Global Market Comments

August 27, 2021

Fiat Lux

Featured Trade:

(AUGUST 25 BIWEEKLY STRATEGY WEBINAR Q&A),

(ROM), (EEM), (FXI), (DIS), (AMZN), (NFLX), (CHPT), (TLT), (TBT),

(AAPL), (GOOG), (WPM), (GOLD), (NEM), (GDX), (X), (SLV), (FCX), (BA), (HOOD), (USO)

|

August 25 Biweekly Strategy Webinar Q&ABelow please find subscribers’ Q&A for the August 25 Mad Hedge Fund Trader Global Strategy Webinar broadcast from The Atlantis Casino Hotel in Reno, NV.

Q: How does a 2X ProShares Ultra Technology ETF (ROM) February 2022 vertical bull call spread on the ROM look? Would you do $110-$115 or $115-$120?

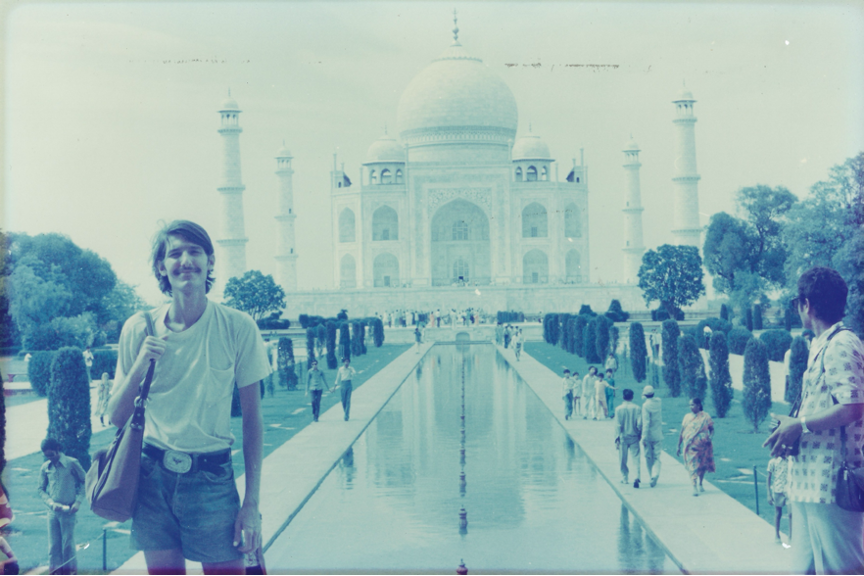

A: I would do nothing here at $112.50 because we’ve just gone up 10 points in a week. I’d wait for some kind of pullback, even just $5 or $10 points, and then I would do the $110-$115. I’m leaning towards more conservative LEAPS these days—bets that the market goes sideways to up small rather than going ballistic, which it has done for the last 18 months. Think at-the-money strikes, not deep out-of-the-money on your LEAPS from here on for the rest of this economic cycle. The potential profits are still enormous. The only problem with (ROM) is that the longest maturities on the options are only six months.

Q: How do you recommend entering your long-term portfolio?

A: I would use the one-third rule: you put on ⅓ now, ⅓ higher or lower later on, and ⅓ higher or lower again. That way you get a good average price. Long term, everything goes up until we hit the next recession, which is probably several years off.

Q: I keep reading that the Delta variant is a market risk, but I don’t think that investors will look through this. Is Delta already priced into the shares?

A: Yes, what is not priced into the shares is the end of Delta, the end of the pandemic—and that will lead to my “everything” rally that I’ve been talking about for a month now. And we have already seen the beginning of that, especially with the price action this week. So yes, Delta in: dead market; Delta out: roaring market.

Q: Do you think there will eventually be a rotation into emerging markets (EEM), or has the virus battered these markets too much to even consider it?

A: Sometime in our future—not yet—the emerging markets will be our core holding. And the trigger for that will be the collapse of the dollar, which is hitting an interim high right now. When the greenback rolls over and dies, you can expect emerging markets, especially China, to take off like a rocket. That’s going to be our next big trade. I don't know if it will be this year or next year but it’s coming, so start doing your emerging market research now, and keep reading my newsletter.

Q: Is the coming tax hike a problem for the stock market?

A: No, I don’t think so. First off, I don’t think they’re going to do a tax bill this year; they don’t want anything to interfere with the 2022 election, so it may be next year’s business. Also, any new taxes are going to be overwhelmingly focused on billionaires, carried interest, offshoring, and large corporations. The middle class, people who make less than $400,000 a year, will not see any tax hike at all, possibly even getting some tax cuts via restored SALT deductions. So, I don't really see it affecting the stock market at all.

Q: What do you think about Chinese stocks (FXI)?

A: Long-term they’re okay, short term possibly more downside. Interestingly, the bigger risk may not be China itself and how the government is beating up its own tech companies, but the SEC. It has indicated they don’t really like these offshore vehicles that have been listed on the New York Stock Exchange, and they may move to ban them. I’m not rushing into China right now, only because there are just so many better opportunities in the US stock market for the time being. I may go back in the future—it’s a case where I’d rather buy them on the way up than trying to catch a falling knife on China right now.

Q: Do you expect any market impact from the Jackson Hole meeting?

A: Yes, whatever J Powell says, even if he says nothing, will have a market impact. And it will have a bigger impact on the bond market than it will on the stock market, which is down a full point this morning. So yes, but not yet. I imagine we’ll hear something very soon.

Q: September and October tend to be volatile; do you see us having a 5% or 10% pullback in those months?

A: I don’t see any more than 5%, with the hyper liquidity that we have in the system now. There just aren’t any events out there that could trigger a pullback of 10%—no geopolitical events, and the economy will be getting stronger, not worse. So yes, an “everything rally” doesn’t give you many long side entry points, so I just don’t see 10% happening.

Q: What about a Walt Disney (DIS) January 2022 $180-$220 LEAPS?

A: I would do the $180-$200. I think you can afford to be tighter on your spread there, take some more risk because I think it’s just going to go nuts to the upside once we get a drop in COVID cases. By the way, Disney parks are only operating at 70% capacity, so if you go back up to 100% that's a near 50% increase in profits for the company. And it’s not just Disney, but Netflix (NFLX), Amazon (AMZN), and everybody else that’s about to have the greatest number of blockbuster movies released of all time. They’re holding back their big-ticket movies for the end of the pandemic when people can go back into theaters. We’ll start seeing those movies come out in the last quarter of this year, and I’m particularly looking forward to the next James Bond movie, a man after my own heart.

Q: Are EV car charging companies like ChargePoint Holdings (CHPT) going to do as well as the car companies?

A: No. They’re low margin business, so it’s not a business model for me. I like high-profit margins, huge barriers to entry, and very wide moats, which pretty much characterizes everything I own. The big profits in EVs are going to be in the cars themselves. Charging the cars is a very capital-intensive, highly regulated, and low-margin business.

Q: Would a Fed taper cause a 10% pullback?

A: Absolutely not; in fact, I think a taper would make the market go up because Jay Powell has been talking it into the market all year. And that’s his goal, is to minimize the impact of a taper so when they finally do it, they say ho-hum and “okay you can take that risk out of the market.” That’s the way these things work.

Q: What is your yearend target for United States Treasury Bond Fund (TLT)?

A: $132. Call it bold, but I'm all about bold. I think the first stop will be at $144, then $138, then bombs away!

Q: What will it take for (TLT) to dip below $130?

A: Another year of hot economic growth, which Congress seems hell-bent on delivering us.

Q: What are your ProShares Ultra Short 20+ Year Treasury ETF (TBT) targets?

A: When we were at 1.76% on the 10-year bond, the (TBT) made it all the way back to 22 ½. Next year we go higher, probably to $25, maybe even $30.

Q: What’s your 10-year view on the (TBT)?

A: $200. That’s when you get interest rates back to 10% in 10 years on the 10-year bond. So yes, that’s a great long-term play.

Q: How long can we hold (TBT)?

A: As long as you want. Ten years would be a good time frame if you want to catch that $17 to $200 move. The (TBT) is an ETF, not an option, therefore it doesn’t expire.

Q: Are you working on an electrification stock list?

A: I am not, because it’s such a fragmented sector. It’s tough to really nail down specific stocks. I think it’s safe to say that the electric power grid is going to change beyond all recognition, but they won’t necessarily be in high margin companies, and I tend to prefer high-profit-margin, large-moat companies which nobody else can get into, like Apple (AAPL) or Google (GOOG).

Q: What about gas pipelines with high yields?

A: They have a high yield for a reason; because they’re very high risk. If you're going to a carbon-free economy, you don’t necessarily want to own pipelines whose main job is moving carbon; it’s another buggy whip-type industry I would avoid. I’ve seen people get wiped out by these things more times than I could count. If you remember Master Limited Partnerships, quite a few of them went bankrupt last year with the oil crash, so I would avoid that area. These tend to be very highly leveraged and poorly managed instruments.

Q: Best play on silver (SLV)?

A: Wheaton Precious Metals (WPM) is the highest leveraged silver play out there, and a great LEAPS candidate. Go out 2 years and triple your money.

Q: Geopolitical oil (USO) risks?

A: No, nobody cares about oil anymore—that’s why we’re giving up on Afghanistan. China is buying 80% of the Persian Gulf oil right now. We don’t really need it at all, so why have our military over there to protect China’s oil supply?

Q: What about Freeport McMoRan (FCX)?

A: I absolutely love it. Any big economic recovery can’t happen without copper, and you have a huge tailwind there from electric cars which need 200 pounds of copper each, as opposed to 20 pounds in conventional cars.

Q: I see AMC Entertainment Holdings (AMC) is up 20% today; should everyone be chasing this stock?

A: No, absolutely not. (AMC) and all the meme stocks aren’t investments, they’re gambling, and there are better ways to gamble.

Q: Should I buy the lumber dip?

A: Yes. I think the slowdown on housing is temporary because it will take 10 years for supply and demand in the housing market to come back into balance because of all the millennials entering the housing market for the first time. So, that would be a yes on lumber and all the other commodities out there that go into housing like copper, steel, and aluminum.

Q: Should I put money into Canadian Junior Gold Miners (GDX)?

A: No, I would rather go out and take a long nap first. These are just so high risk, and they often go bankrupt. The liquidity is terrible, and the dealing spreads are wide. I would stick with the bigger precious metal plays like Newmont Mining (NEM), Barrick Gold (GOLD), and Wheaton Precious Metals (WPM).

Q: Is Boeing (BA) a buy here?

A: Yes, we’re back at the bottom end of the trading range for the stock. It’s just a matter of time before they get things right, and the 737 Max orders are rolling in like crazy now that there’s an airplane shortage.

Q: What do you think about Robinhood (HOOD)?

A: I like it quite a lot; I got flushed out of my long position on Friday with a 10% down move. Of course, 90% of my stop losses end up expiring at their maximum profit points, but I have to do it to keep the volatility of the portfolio down. So yes, I’ll try to buy it again on the next dip. The trouble is it’s kind of a quasi-meme stock in its own right, hence the volatility; so I would say on the next 10% down day, you go into Robinhood, and I probably will too.

Q: How are the wildfires around Tahoe?

A: They’re terrible and there are three of them. I did a hike two days ago there, and out of a parking lot with 100 spaces, I was the only one there. It’s the only time I’d ever seen Tahoe deserted in August. With visibility of 500 yards, it's just terrible. Fortunately, I was able to hike without coughing my guts out—it’s not so thick that you can’t breathe.

Q: What do you think of US Steel (X)?

A: I like it, I think the whole industrial commodity complex rallies like crazy going into the end of the year.

Q: As a new member, where is the best place to start? It’s just kind of like drinking from a fire hose.

A: Wait for the trade alerts; they only happen at sweet spots and you may have to wait a few days or weeks to get one since we only like to enter them at good points. That’s the best place to enter new positions for the first time. In the meantime, keep reading all the research, because when these trade alerts do come out, they’re not surprises because I’m pumping out research on them every day, across multiple fronts. Be patient— we are running a 93% success rate, but only because we take our time on entering good trades. The services that guarantee a trade alert every day lose money hand over fist.

Q: If they do delist Chinese stocks, will US investors be left holding the bag?

A: Yes, and that will be the only reason they don’t delist them, that they don’t want to wipe out all current US investors.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH or TECHNOLOGY LETTER (whichever applies to you), then select WEBINARS and all the webinars from the last ten years are there in all their glory.

Good Luck and Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

|