| Read in Browser | |||||||||||||||||||||||

| � | |||||||||||||||||||||||

| � | |||||||||||||||||||||||

| � | |||||||||||||||||||||||

| � |

| Read in Browser | |||||||||||||||||||||||

| � | |||||||||||||||||||||||

| � | |||||||||||||||||||||||

| � | |||||||||||||||||||||||

| � |

| Good morning. (Was this newsletter forwarded to you? Sign up here.) |

|

| [h=2]A fund manager finds her flock[/h] |

| Cathie Wood, the hottest fund manager on Wall Street, didn’t rise to prominence in the typical way. A common path to success for money managers is to land larger and larger accounts, transitioning from managing billions of dollars from wealthy individuals to handling trillions from pension funds, endowments and sovereign wealth funds. Wood has taken the reverse route, explains The Times’s Matt Phillips in a big new profile of the fund manager. |

| Since leaving the world of traditional money management, Wood’s bold bets on Tesla, Robinhood and cryptocurrency have won her clients and followers among the masses of tech-loving, risk-seeking small investors who dove into the market over the past year or so. Her recent success is as much about her investment acumen as her willingness to go against the grain, an approach that has captured the anti-establishment mood of the markets. Can she keep it up? |

| How she got here: Wood, 65, used to manage money for pension funds at AllianceBernstein. Then, as now, her preferred approach was to take big bets on tech stocks and ride hot investment trends. Managing money for pension funds held Wood back. Former colleagues said she didn’t fit in. Deemed too risky, she struck out on her own, founding Ark Invest in 2014 with a pitch calibrated to attract individual investors. |

| In part, the deeply religious money manager said the motivation to strike out on her own came from an epiphany on a summer day in 2012: “I really feel like that was the Holy Spirit just saying to me, ‘OK, this is the plan,’” she told the “Jesus Calling” podcast last year. Ark now manages $85 billion, up from less than $10 billion at the end of 2019. |

| What she does differently: Wood’s decisions to buy and sell stocks are disclosed daily to any investor who signs up for her email updates, an unheard-of level of transparency. As her public profile grows, these pronouncements often move share prices, creating a self-reinforcing loop. This strategy came into its own last year, with Wood’s Ark Innovation fund gaining an astounding 150 percent. Supporters elevated her to an unlikely cultural icon, putting her face on T-shirts and other merchandise. |

|

| The tide may be turning: Wood’s flagship fund is down 7 percent this year, underperforming the market, a demonstration of her feast-or-famine style of investing. That volatility may not rattle return-chasing retail traders. And Ark’s approach may not convince the risk-averse fund management industry to change its ways. But it raises questions about finding a new balance amid shifting market forces. |

| Wood’s emergence as the standard-bearer for a new movement has also created an opportunity for other investors to bet against her singular vision. Hedge fund managers, including Michael Burry of “The Big Short” fame, have recently been buying put options that pay out if Wood’s highly concentrated fund stumbles. It isn’t the first time that people have thought she was wrong. |

| [h=3]HERE’S WHAT’S HAPPENING[/h] |

| The F.D.A. could give full approval to Pfizer’s coronavirus vaccine today. The expected authorization could lead to more vaccine mandates at companies, universities and hospitals. Polls suggest the “emergency use” approval of vaccines made some people hesitant to get the shots. |

| President Biden may extend the Aug. 31 deadline for removing American troops from Afghanistan. The military has evacuated 28,000 people over the past week, and the Pentagon has enlisted six commercial airlines — American, Atlas Air, Delta, Omni Air, Hawaiian Airlines and United — to help evacuate more Americans and Afghan allies from Kabul. |

| Citadel redeems $500 million it put into Melvin Capital during the meme-stock frenzy. That is part of the $2 billion in emergency liquidity Citadel injected into the fund as it suffered a short squeeze earlier this year. Steven Cohen’s Point72, which made a $750 million infusion, told The Times it’s “staying put.” Melvin is down 41 percent for the year. |

| New York’s economic revival is on hold. The rise of the Delta variant of the coronavirus has dashed the city’s hopes that September would see a return to normal. With return-to-office plans postponed, events canceled and foreign tourism low, Mark Zandi, the chief economist at Moody’s Analytics, said “it’s going to be a long time before New York City gets its economic groove back.” |

| China’s growing corporate crackdown hits dozens of I.P.O.s. The country’s market regulator halted 42 planned listings while it investigated one of China’s biggest law firms, an investment bank and other firms linked to the deals. The carmaker BYD, which hoped to raise about $400 million selling shares in its chip-making unit, was among the firms affected by the move. |

| [h=2]Topps tears up its SPAC deal[/h] |

| Topps pulled the plug on its deal to go public via a SPAC backed by Mudrick Capital on Friday, the day after it learned that its licensing deal to make baseball cards would end after more than 70 years. Major League Baseball and its players’ union said they would not renew their licenses with Topps when they ran out in the next few years. Instead, they would award the licenses exclusively to Fanatics, the fast-growing, Silver Lake-backed collectibles group, which is creating a new card company. |

| Topps was left in the dark about the negotiations. Its co-owner, the former Disney chief Michael Eisner, had a “brief, heated call with M.L.B. commissioner Rob Manfred asking why he hadn’t been given a heads-up or a chance to counter,” The Wall Street Journal reported. |

| Mudrick warned about the risk of losing M.L.B. licenses in its merger documents, given the “substantial portion” of revenue they provided for Topps. But the SPAC sponsor felt confident enough to announce a merger deal in April, presumably relying on the long relationship between Topps and baseball. It may have not taken heed of players’ increasing demands for more of a say over how they earn money from their likenesses. Fanatics will give the union an equity stake and a seat on the board of its new venture. |

| The sports collectibles industry is experiencing a renaissance. Now that Fanatics has taken away the crown jewel in the Topps portfolio, it could do what it did with Majestic after it bought that company’s rights to make major-league uniforms: acquire it. It could also go after Panini or Upper Deck, but the Topps brand remains strong among hobbyists. “Collectors are nostalgic, by nature, so the thought of the Topps brand going away is saddening,” said Chris Ivy, the director of sports auctions for Heritage Auctions. |

| [h=2]“There are some people whose confidence outweighs their knowledge, and they’re happy to say things which are wrong. And then there are other people who probably have all the knowledge but keep quiet because they’re scared of saying things.”[/h] |

| — Helen Jenkins, an infectious disease expert at Boston University, on the problem of communicating scientific uncertainty about the coronavirus to the public. |

| [h=2]The week ahead[/h] |

| Taper talk: Central bankers meet for their annual gathering in Jackson Hole, Wyo., starting on Thursday. The Fed has made important announcements at the event in the past, and many expect Jay Powell, the Fed’s chair, to reveal details about how and when the bank plans to wind down its bond-buying program. |

| British travel restrictions: Britain will update its much-criticized “traffic light” system of pandemic travel rules, which imposes various quarantine and testing requirements on people returning from “green,” “amber” and “red” listed countries. |

| The Paralympics: Tokyo is still grappling with a high level of coronavirus infections and a low rate of vaccination while preparing for the Paralympics to start on Tuesday. As with the Olympics, no spectators will be allowed. |

|

| From The TimesMachine: On Aug. 23, 1995, tech obsessives counted down to midnight for the release of Windows 95, waiting at stores around the world to be among the first to get their hands on a copy of the software. The Times called it the “splashiest, most frenzied, most expensive introduction of a computer product in the industry’s history.” |

| [h=2]The real price of a colonoscopy[/h] |

| In January, a federal rule ordered hospitals to publish the prices they negotiate with private insurers, so patients and employers had the information they needed to shop for the best options. Hospitals, however, have largely ignored the rule, so The Times worked with researchers at the University of Maryland-Baltimore County to create a database showing how much basic medical care costs at 60 major hospitals. The results are eye-opening. |

| Prices vary wildly, and sometimes insured patients pay more than those with no coverage. At the University of Mississippi Medical Center, a colonoscopy costs $2,144 with an Aetna plan, $1,463 with Cigna insurance and $782 with no insurance at all. That’s just one example. Given the scant data available, it’s difficult to know the net costs to employers and employees, beyond that they are seemingly random. |

| Hospitals treat fines as a cost of doing business. Those that post prices use hard-to-use formats designed for data scientists and professional researchers. And the penalty for noncompliance is a maximum of $109,500 per year — N.Y.U. Langone, a system of five inpatient hospitals that have not posted their prices, reported $5 billion in revenue in 2019. |

| The data could invite scrutiny of private health insurance and hospitals. In a sweeping executive order last month, President Biden directed health officials to “support” price transparency efforts. The order also pushed the F.T.C. to review and revise its guidelines for hospital mergers. |

| Want to share The New York Times with your friends and family? Invite them to enjoy unlimited digital access to our journalism with this special offer. |

| [h=3]THE SPEED READ[/h] |

| Deals |

|

| Policy |

|

| Best of the rest |

|

| Anna Schaverien contributed reporting. |

| Thanks for reading! We’ll see you tomorrow. |

| We’d like your feedback. Please email thoughts and suggestions to dealbook@nytimes.com. |

|

|

|

|

|

|

| Andrew Ross Sorkin, Founder/Editor-at-Large, New York @andrewrsorkin |

| Jason Karaian, Editor, London @jkaraian |

| Sarah Kessler, Deputy Editor, Chicago @sarahfkessler |

| Stephen Gandel, News Editor, New York @stephengandel |

| Michael J. de la Merced, Reporter, London @m_delamerced |

| Lauren Hirsch, Reporter, New York @LaurenSHirsch |

| Ephrat Livni, Reporter, Washington D.C. @el72champs |

| Read in Browser | ||||||||||||||||||||||

| � | ||||||||||||||||||||||

| � | ||||||||||||||||||||||

| � |

August 24, 2021 Continue reading the main story |

| Good morning. (Was this newsletter forwarded to you? Sign up here.) |

|

| [h=2]Fully endorsed[/h] |

| The F.D.A. granted full approval to the Pfizer-BioNTech coronavirus shots for people 16 and older yesterday, the fastest vaccine approval in the agency’s history. (Although, perhaps, not fast enough.) President Biden seized on the moment. “If you’re a business leader, a nonprofit leader, a state or local leader, who has been waiting for full F.D.A. approval to require vaccinations, I call on you now to do that,” he said. “Require it.” |

| It gives companies more cover to impose vaccine mandates and industry groups more ground to lobby local authorities. Some states have moved to outlaw vaccine mandates. Arizona’s governor, for example, issued an orderoutlawing coronavirus vaccination as a requirement for employment. Those actions made it difficult for companies with large national footprints to impose blanket mandates. While some have pushed back, like Norwegian Cruise Line in Florida, most have stayed out of the fray. |

| “Many companies have made the decision to mandate vaccines for some or all of their employees, and we applaud their decision,” the Business Roundtable said in a statement. “We also encourage policymakers, including at the state and local levels, to support — not impede — companies’ ability to make such a decision.” |

| [h=3]PAID POST: A MESSAGE FROM DARKTRACE[/h]When Ransomware Strikes, Darktrace Fights Back Autonomous Response is the only technology that takes targeted action to interrupt ransomware, without disrupting business activity. Discover how to protect your organization from machine-speed attacks. LEARN HOW > |

| More public sector employers are introducing mandates, easing the way for private employers to make similar moves. New York City said it would require all 148,000 employees of the city’s Education Department to be vaccinated. The Pentagon is demanding that its 1.4 million service members receive the shot by the middle of next month. |

| Some of the latest corporate mandates: |

|

| Mandates may be the only way to significantly increase vaccination rates, given continued hesitancy about the shot. A recent poll found that three out of 10 unvaccinated people said that they would be more likely to get a fully approved F.D.A. shot, though some experts believe that this figure could be exaggerated. |

| More regulatory action is coming. Moderna’s application for full approval of its vaccine was filed in June, a month after Pfizer. Johnson & Johnson is expected to apply for full approval soon. And the F.D.A. is also weighing whether to authorize booster shots for the fully vaccinated, another twist for corporate vaccine mandates. |

| [h=3]HERE’S WHAT’S HAPPENING[/h] |

| House leaders delay a vote on Biden’s budget priorities. Plans for a vote yesterday on a $3.5 trillion budget blueprint were scrapped, as centrist Democrats demanded that the $1 trillion bipartisan infrastructure plan was approved first. Wall Street analysts are telling clients to prepare for both measures to pass — eventually. |

| Commodity prices are moderating, reducing inflation concerns. The decline in iron, oil, copper and other commodities from recent highs gives the Fed and other policymakers more room to operate. That is helping the Biden administration make the case that its spending plans won’t push inflation higher. |

|

| The S.E.C. issues new requirements for Chinese companies listing in the U.S. Some Chinese companies have reportedly begun receiving requests for more detailed disclosures about their use of offshore vehicles in I.P.O.s. That follows a recent call from Gary Gensler, the S.E.C. chairman, for a “pause” in Chinese listings on U.S. exchanges. |

| Walmart begins delivering goods for other retailers. The new service, Walmart GoLocal, is an effort to leverage the retail giant’s reach and to diversify its revenue streams. It will also make Walmart look more like its biggest online rival, Amazon. |

| A Korean law challenges the White House’s policy on Big Tech. Apple and Google are asking the U.S. government for help fighting a law in South Koreathat the companies say would unfairly harm their app stores. The law, expected to face a crucial vote this week, is a test for the Biden administration, which must balance defending American companies’ interests abroad with its push to rein in their power at home. |

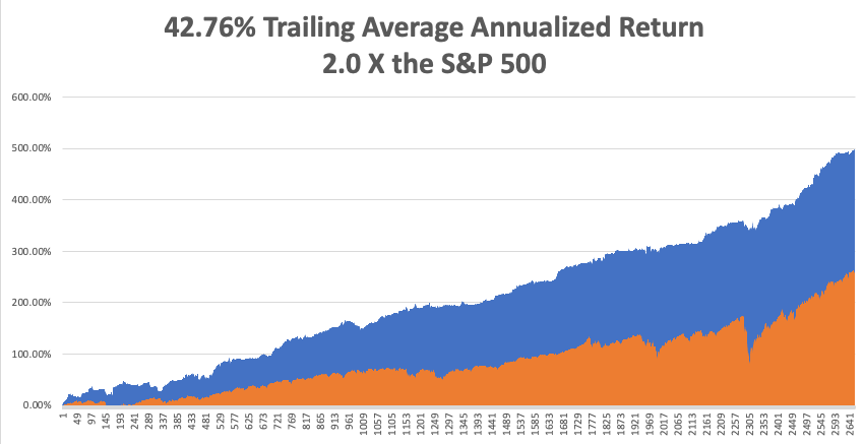

| [h=2]Checking in on hedge fund performance[/h] |

| Hedge funds have trailed the market for many months. Part of the reason is that their favorite stocks, as measured by a Goldman Sachs index of the most heavily owned shares, have risen just 4 percent in the past six months, versus 16 percent for the S&P 500. |

|

| Hedge funds were caught off guard by Beijing’s corporate crackdown.Asian stocks, especially ones exposed to China’s rapidly growing economy, have long been favorites of hedge funds, which search for higher-than-average returns to justify their higher-than-average fees. But Beijing’s recent crackdown on its largest tech companies, particularly those with U.S. listings, has hit those bets hard. |

| Goldman says that about a third of the funds it surveys had an investment in foreign-listed shares of Chinese companies at the end of June, the highest percentage it has ever measured. Alibaba, a top holding of many hedge funds, has slumped nearly 30 percent since the end of June. |

| Hedge funds also doubled-down on pandemic plays, loading up on investments in companies that benefited from pandemic lockdowns but underperformed recently as the economy reopened. |

| For instance, hedge funds collectively own more shares in Amazon than they did a year ago, according to Bank of America. Peloton also recently became one of the stocks most widely held by hedge funds. |

| The outlook: With Covid cases on the rise, however, betting on another pandemic-related slowdown or on a return to more strict social distancing looks smarter by the day. And Chinese shares have fallen so far that bargain hunters are jumping in, lifting stocks from historic lows in recent trading. What’s more, the biggest hedge funds don’t appear to have any trouble raising money as investors keep the faith that their strategies will pay off whatever the prevailing market conditions. |

| [h=2]“There was already a higher bar before Theranos because we don’t fit the pattern. This just makes it that much harder.”[/h] |

| — Falon Fatemi, co-founder of the tech companies Fireside and Node, on how the collapse of Theranos, the blood-testing start-up led by Elizabeth Holmes, has made it harder for firms led by women to attract investors. |

| [h=2]The gig economy hits a glitch[/h] |

| A California judge on Friday ruled that a law in the state classifying many gig workers as independent contractors, known as Prop. 22, was unconstitutional and unenforceable. Here are answers to questions you may have about the decision. (You can find more detailed explanations here.) |

| Why did the judge find Prop. 22 unconstitutional? |

| Prop. 22 carved gig workers out of the pool of employees eligible for compensation in the event of an injury or other workplace incident. But California’s Constitution gives the state legislature authority to create and enforce a workers’ compensation system. The judge wrote in his decision that Prop. 22 “limits the power of a future legislature to define app-based drivers as workers subject to workers’ compensation law” and was therefore unconstitutional. |

| Who intervened to block the proposition? |

| Three ride-hail drivers and one rider are involved in the lawsuit, along with the Service Employees International Union. |

| Who is on the other side? |

| Although the lawsuit focuses on how app-based companies treat their workers, a coalition of drivers and labor groups is suing the state of California and the Department of Industrial Relations, which administers workers’ compensation. The gig economy companies’ coalition, Protect App-Based Drivers and Services, is a respondent in the suit. |

| What’s next? |

| The attorney general of California or Protect App-Based Drivers and Services can file an appeal. Even an expedited appeal could take several months. For now, gig economy companies might be required to begin paying into workers’ compensation funds — but the companies argue that nothing will change until the appeal is resolved. The shares of Lyft and Uber rose yesterday as investors bet that the effect might not be as severe as feared. |

|

| [h=2]Pining for the office[/h] |

| The pandemic has converted many to remote work, and for all the employees who prefer hybrid or fully virtual setups, there are also many who can’t wait to get back to the office full-time. With each delay of return-to-office dates, that group is growing more frustrated. |

| Most people want a workplace outside of their home. Advocates for remote work might be particularly vocal right now, but a national survey of more than 950 workers, conducted in mid-August by Morning Consult on behalf of The Times, found that 45 percent of the employees questioned said that they wanted to be at a workplace or an office full-time. Around 30 percent wanted to work remotely full-time, with the rest preferring a hybrid approach. |

| Who wants to go back? Social butterflies, people with crowded or noisy homes and new hires are among those who yearn for offices to reopen. “If we don’t get a really solid foundation at this company in our first six months, our first year, what foot does that leave us on for the rest of our time at the company?” said David Pantera, whose orientation process at Google will be held online next month. |

| Some are reaching the end of their tether. For many, being forced to set up offices in their kitchens, living rooms or bedrooms has eroded important barriers between work and home life, increased a sense of isolation and led to burnout, said Tsedal Neeley, a Harvard Business School professor who has studied remote work for decades. |

| Want to share The New York Times with your friends and family? Invite them to enjoy unlimited digital access to our journalism with this special offer. |

| [h=3]THE SPEED READ[/h] |

| Deals |

|

| Policy |

|

| Best of the rest |

|

| Anna Schaverien contributed reporting. |

| Thanks for reading! We’ll see you tomorrow. |

| We’d like your feedback. Please email thoughts and suggestions to dealbook@nytimes.com. |

|

|

|

|

|

|

| Andrew Ross Sorkin, Founder/Editor-at-Large, New York @andrewrsorkin |

| Jason Karaian, Editor, London @jkaraian |

| Sarah Kessler, Deputy Editor, Chicago @sarahfkessler |

| Stephen Gandel, News Editor, New York @stephengandel |

| Michael J. de la Merced, Reporter, London @m_delamerced |

| Lauren Hirsch, Reporter, New York @LaurenSHirsch |

| Ephrat Livni, Reporter, Washington D.C. @el72champs |

| State | Rt as of August 21 | Plus, Minus, or Steady | Rising or Falling |

| Alabama | 0.90 | Down | Falling |

| Alaska | 1.03 | Steady | Falling |

| Arizona | 1.00 | Steady | Falling |

| Arkansas | 0.72 | Down Big | Falling |

| California | 1.27 | Up Big | Rising |

| Colorado | 0.99 | Steady | Falling |

| Connecticut | 0.89 | Down | Falling |

| D.C. | 1.30 | Up Big | Falling |

| Delaware | 0.55 | Down Big | Falling |

| Florida | 0.83 | Down Big | Falling |

| Georgia | 1.03 | Steady | Falling |

| Hawaii | 1.01 | Steady | Falling |

| Idaho | 0.91 | Down | Falling |

| Illinois | 1.09 | Up | Falling |

| Indiana | 1.16 | Up Big | Falling |

| Iowa | 1.25 | Up Big | Falling |

| Kansas | 0.69 | Down Big | Falling |

| Kentucky | 1.15 | Up Big | Falling |

| Louisiana | 0.66 | Down Big | Falling |

| Maine | 1.04 | Steady | Falling |

| Maryland | 0.93 | Down | Falling |

| Massachusetts | 1.10 | Up | Steady |

| Michigan | 1.01 | Steady | Falling |

| Minnesota | 1.15 | Up Big | Falling |

| Mississippi | 0.92 | Down | Falling |

| Missouri | 0.79 | Down Big | Falling |

| Montana | 0.98 | Steady | Falling |

| Nebraska | 1.47 | Up Big | Rising |

| Nevada | 0.61 | Down Big | Falling |

| New Hampshire | 1.04 | Steady | Falling |

| New Jersey | 1.19 | Up Big | Peaking |

| New Mexico | 1.06 | Up | Falling |

| New York | 0.98 | Steady | Falling |

| North Carolina | 1.06 | Up | Falling |

| North Dakota | 1.30 | Up Big | Falling |

| Ohio | 1.31 | Up Big | Falling |

| Oklahoma | 0.80 | Down Big | Falling |

| Oregon | 1.17 | Up Big | Falling |

| Pennsylvania | 1.29 | Up Big | Falling |

| Rhode Island | 1.07 | Up | Falling |

| South Carolina | 0.90 | Down | Falling |

| South Dakota | 1.48 | Up Big | Peaking |

| Tennessee | 1.20 | Up Big | Falling |

| Texas | 0.97 | Steady | Falling |

| Utah | 0.91 | Down Big | Falling |

| Vermont | 1.06 | Up | Falling |

| Virginia | 1.05 | Up | Falling |

| Washington | 1.19 | Up Big | Falling |

| West Virginia | 1.50 | Up Big | Rising |

| Wisconsin | 0.88 | Down | Falling |

| Wyoming | 1.16 | Up Big | Falling |

|

| Read in Browser | |||||||||||||||||||||||

| � | |||||||||||||||||||||||

| � | |||||||||||||||||||||||

| � | |||||||||||||||||||||||

| � |

|

| Global Market Comments August 24, 2021 Fiat Lux Featured Trade: (A REFRESHER COURSE AT SHORT SELLING SCHOOL), (SH), (SDS), (PSQ), (DOG), (RWM), (SPXU), (AAPL), (TSLA), (VIX), (VXX), (IPO), (MTUM), (SPHB), (HDGE)

|

| � |

A Refresher Course at Short Selling SchoolGoing into the first Fed taper in eight years, it is possible that the market could get slapped in the face with another 5% correction. If that is the case, it is a good idea to take a quickie refresher case on short selling and all the different ways to add downside protection. While you are all experts in buying stocks, selling them short is another kettle of fish. The stock market is now more overpriced than it has been over the last year. The (SPY) has risen an unprecedented 80% in 14 months. We are also solidly into the high risk, low return time of the year from May to October. Historically, the total return for stocks this time of year for the past 70 years is precisely zero. I, therefore, think it is timely to review how to make money when prices are falling. I call it Short Selling School 101. I don’t think we are going to crash to new lows from here, maybe drop only 10% at worst. So, some of the most aggressive bearish strategies described below won’t be appropriate. If you are long stocks in general a low-risk hedge for you might be to sell short the S&P 500 September 17, 2021 $455 call options for $1.03. If stocks plunge, you have some downside cushion ($1.03 X 100) = $103 in cash. Sell short one-call option for every 100 shares of (SPY) you own. If stocks rise and your stock gets called away 6% higher you will think you died and went to heaven. Just buy them back on the next dip. If the bear move extends you can simply repeat this gesture every month until the cows come home. If you have big positions in single stocks, like Apple (AAPL), you can execute the same kind of strategy. Selling short the Apple September 17, 2021 $155 call option for $1.27 to hedge an existing long in the stock looks like the no-brainer here. You should sell one option contract for every 100 shares you own to bring in ($1.27 X 100) = $127 in cash. There is nothing worse than closing the barn door after the horses have bolted or hedging after markets have crashed. No doubt, you will receive a wealth of short selling and hedging ideas from your other research sources and the media right at the next market bottom. That is always how it seems to play out, great closing the barn doors after the horses have bolted. So I am going to get you out ahead of the curve, putting you through a refresher course on how to best trade falling markets now, while stock prices are still rich. I’m not saying that you should sell short the market right here. But there will come a time when you will need to do so. Watch my Trade Alerts for the best market timing. So here are the best ways to profit from declining stock prices, broken down by security type: Bear ETFs Of course, the granddaddy of them all is the ProShares Short S&P 500 Fund (SH), a non-leveraged bear ETF that is supposed to match the fall in the S&P 500 point for point on the downside. Hence, a 10% decline in the (SPY) is supposed to generate a 10% gain in the (SH). In actual practice, it doesn’t work out like that. The ITF has to pay management operating fees and expenses, which can be substantial. After all, nobody works for free. There is also the “cost of carry,” whereby owners have to pay the price for borrowing and selling short shares. They are also liable for paying the quarterly dividends for the shares they have borrowed, around 2% a year. And then you have to pay the commissions and spread for buying the ETF. Still, individuals can protect themselves from downside exposure in their core portfolios by buying the (SH) against it (click here for the prospectus). Short selling is not cheap. But it’s better than watching your gains of the past seven years go up in smoke. Virtual all equity indexes now have bear ETFs. Some of the favorites include the (PSQ), a short play on the NASDAQ (click here for the prospectus), and the (DOG), which profits from a plunging Dow Average (click here for the prospectus). My favorite is the (RWM) a short play on the Russell 2000, which falls 1.5X faster than the big cap indexes in bear markets (click here for the prospectus). Leveraged Bear ETFs My favorite is the ProShares Ultra Short S&P 500 (SDS), a 2X leveraged ETF (click here for the prospectus). A 10% decline in the (SPY) generates a 20% profit, maybe. Keep in mind that by shorting double the market, you are liable for double the cost of shorting, which can total 5% a year or more. This shows up over time in the tracking error against the underlying index. Therefore, you should date, not marry this ETF, or you might be disappointed.

The 3X bear ETFs, like the UltraPro Short S&P 500 (SPXU), are to be avoided like the plague (click here for the prospectus). First, you have to be pretty good to cover the 8% cost of carry embedded in this fund. They also reset the amount of index they are short at the end of each day, creating an enormous tracking error. Eventually, they all go to zero and have to be periodically redenominated to keep from doing so. Dealing spreads can be very wide, further added to costs. Yes, I know the charts can be tempting. Leave these for the professional hedge fund intraday traders for which they are meant. Buying Put Options For a small amount of capital, you can buy a ton of downside protection. For example, the April (SPY) $182 puts I bought for $4,872 on Thursday allows me to sell short $145,600 worth of large-cap stocks at $182 (8 X 100 X $6.09). Go for distant maturities out several months to minimize time decay and damp down daily price volatility. Your market timing better be good with these because when the market goes against you, put options can go poof and disappear pretty quickly. That’s why you read this newsletter. Selling Call Options One of the lowest risk ways to coin it in a market heading south is to engage in “buy writes.” This involves selling short call options against stock you already own but may not want to sell for tax or other reasons. If the market goes sideways or falls, and the options expire worthless, then the average cost of your shares is effectively lowered. If the shares rise substantially they get called away, but at a higher price so you make more money. Then you just buy them back on the next dip. It is a win-win-win.

This is what the pros do, as futures contracts trade on countless exchanges around the world for every conceivable stock index or commodity. It is easy to hedge out all of the risks for an entire portfolio of shares by simply selling short futures contracts for a stock index. For example, let’s say you have a portfolio of predominantly large-cap stocks worth $100,000. If you sell short 1 September, 2021 contract for the S&P 500 against it, you will eliminate most of the potential losses for your portfolio in a falling market. The margin requirement for one contract is only $5,000. However, if you are short the futures and the market rises, then you have a big problem, and the losses can prove ruinous. But most individuals are not set up to trade futures. The educational, financial, and disclosure requirements are beyond mom-and-pop investing for their retirement fund. Most 401Ks and IRAs don’t permit the inclusion of futures contracts. Only 25% of the readers of this letter trade the futures market. Regulators do whatever they can to keep the uninitiated and untrained away from this instrument. That said, get the futures markets right, and it is the quickest way to make a fortune if your market direction is correct. Buying Volatility Volatility (VIX) is a mathematical construct derived from how much the S&P 500 moves over the next 30 days. You can gain exposure to it through buying the iPath S&P 500 VIX Short-Term Futures ETN (VXX) or buying call and put options on the (VIX) itself. If markets fall, volatility rises, and if markets rise, then volatility falls. You can therefore protect a stock portfolio from losses by buying the (VIX). I have written endlessly about the (VIX) and its implications over the years. For my latest in-depth piece with all the bells and whistles, please read “Buy Flood Insurance With the (VIX)” by clicking here.

Another way to make money in a down market is to sell short recent initial public offerings. These tend to go down much faster than the main market. That’s because many are held by hot hands, known as “flippers,” don’t have a broad institutional shareholder base. Many of the recent ones don’t make money and are based on an, as yet, unproven business model. These are the ones that take the biggest hits. Individual IPO stocks can be tough to follow to sell short. But one ETF has done the heavy lifting for you. This is the Renaissance IPO ETF (click here for the prospectus). As you can tell from the chart below, (IPO) was warning that trouble was headed our way since the beginning of March. So far, a 6% drop in the main indexes has generated a 20% fall in (IPO).

This is another mathematical creation based on the number of rising days over falling days. Rising markets bring increasing momentum while falling markets produce falling momentum. So, selling short momentum produces additional protection during the early stages of a bear market. Blackrock has issued a tailor-made ETF to capture just this kind of move through its iShares MSCI Momentum Factor ETF (MTUM). To learn more, please read the prospectus by clicking here.

Beta, or the magnitude of share price movements, also declines in down markets. So, selling short beta provides yet another form of indirect insurance. The PowerShares S&P 500 High Beta Portfolio ETF (SPHB) is another niche product that captures this relationship. The Index is compiled, maintained, and calculated by Standard & Poor's and consists of the 100 stocks from the (SPX) with the highest sensitivity to market movements, or beta, over the past 12 months. The Fund and the Index are rebalanced and reconstituted quarterly in February, May, August, and November. To learn more, read the prospectus by clicking here.

Another subsector that does well in plunging markets is publicly listed bearish hedge funds. There are a couple of these that are publicly listed and have already started to move. One is the Advisor Shares Active Bear ETF (HDGE) (click here for the prospectus). Keep in mind that this is an actively managed fund, not an index or mathematical relationship, so the volatility could be large.

|

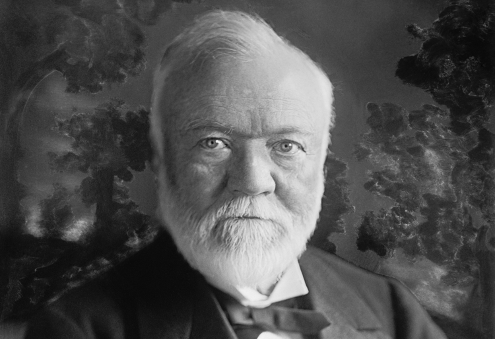

Quote of the Day“If you die a rich person, you’ve failed,” said steel pioneer Andrew Carnegie, who gave away $11 billion during his lifetime, including building a library in every town in the United States.

|

| This is not a solicitation to buy or sell securities The Mad Hedge Fund Trader is not an Investment advisor For full disclosures click here at: http://www.madhedgefundtrader.com/disclosures The "Diary of a Mad Hedge Fund Trader"(TM) and the "Mad Hedge Fund Trader" (TM) are protected by the United States Patent and Trademark Office The "Diary of the Mad Hedge Fund Trader" (C) is protected by the United States Copyright Office |

| Good morning. (Was this newsletter forwarded to you? Sign up here.) |

|

| [h=2]The pandemic credit conundrum[/h] |

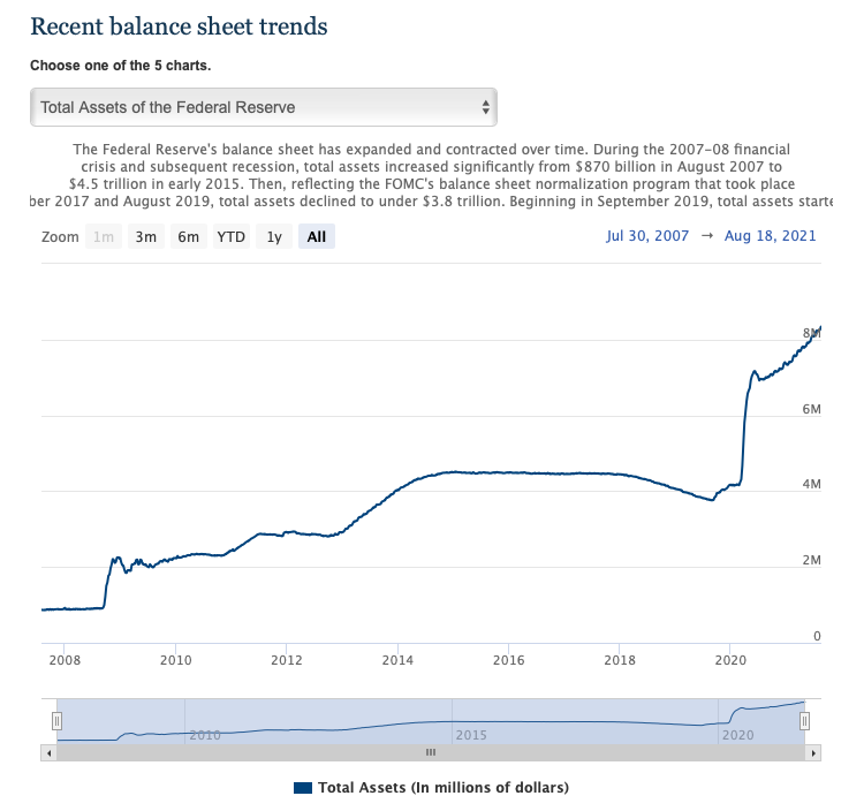

| The job of a banker, an old joke goes, can be summed up by the 3-6-3 rule: Gather deposits at 3 percent, lend them out at 6 percent and be on the golf course by 3 p.m. These days, banks pay next to nothing in interest, yet they are awash in deposits. They also offer loans at rock-bottom rates, yet see little demand from borrowers. What are they doing with the money instead? Bingeing on bonds, The Times’s Matt Phillips reports. |

| (And as for golf? Tee times have been harder to get lately, so that may be the only part of the joke that still has some truth to it.) |

| U.S. banks bought a record $150 billion in Treasury bonds last quarter,hugely expanding their holdings relative to the new loans they have written. When the economy is growing, like now, banks usually have no problem finding borrowers: These loans provide banks with higher returns than parking their money in low-yielding government bonds. But with loan demand remaining sluggish, lenders are reluctantly buying bonds guaranteed to generate skimpy returns. |

|

| The bond-buying spree explains some of the recent quirks in markets: |

|

| Credit trends also raise questions about the economic recovery. Low interest rates didn’t stop lending when the economy was strong before the pandemic. Uncertainty about the effect of the rapidly spreading Delta variant of the coronavirus, which affects supply chains, the labor supply and more, could over time become the primary reason that people and businesses seem so reluctant to borrow, despite conditions that would normally be conducive to doing so. |

| In the latest reading of its U.S. economy recovery tracker, Oxford Economics said that progress had stalled at about 96 percent of prepandemic levels and “gains will be harder to come by as we move past peak growth.” Five of the six components in its weekly index of activity fell, with financial conditions — reflected by stock market gains and low interest rates — the only one sending a different signal than the others. |

| [h=3]HERE’S WHAT’S HAPPENING[/h] |

| Goldman Sachs will require coronavirus vaccination for anyone who enters its U.S. offices. The bank set a deadline of Sept. 7, saying yesterday that anyone who does not get the shot by then must work from home. (The mandate also applies to outside visitors to its offices.) Several universities, including Ohio State, Louisiana State and the University of Minnesota, also announced vaccine mandates for students, faculty and staff, citing the F.D.A.’s full approval of the Pfizer-BioNTech vaccine this week. |

| The House narrowly passes a $3.5 trillion budget blueprint. Progressive and moderate Democrats overcame their differences to pass the framework for a bill (over united Republican opposition) that would pave the way for a vast expansion of social safety net and climate programs. As part of the compromise, House leadership committed to a vote on the $1 trillion bipartisan infrastructure package by Sept. 27. |

| Afghanistan faces an enormous economic shock. The former head of the country’s central bank warned in an opinion article for The Financial Times of an imminent financial and humanitarian crisis after the Taliban takeover. The World Bank halted payments on $800 million in aid committed to Afghanistan this year, after a similar move by the I.M.F. last week. |

| Supply chain issues spell trouble for the food sector. Labor shortages at some of the largest food distributors in the U.S. are causing problems for stores with delivery delays, empty shelves and higher prices for key items. In Britain, truck driver shortages have resulted in some branches of McDonald’s running out of milkshakes and in the chicken-chain Nando’s suffering a shortage of a crucial item: chicken. |

| Kathy Hochul says the buck stops with her. In her first one-on-one interview after becoming New York’s governor, Hochul told The Times that she would adopt a less top-down style than her predecessor Andrew Cuomo. (“It’s consultation with the locals, and then the buck stops with me,” she said.) When asked if she would use her influence on the redistricting process to help get more Democrats elected to the House, she answered directly: “Yes. I am also the leader of the New York State Democratic Party. I embrace that.” |

| [h=2]Warby Parker eyes the public market[/h] |

| The trendy eyewear brand Warby Parker has filed for a direct listing on the N.Y.S.E., disappointing bankers who for years had been chasing the eagerly anticipated I.P.O. The filing comes as a number of other online retail brands, like Allbirds and Fabletics, are preparing market debuts as tech companies and consumer names are in high demand. Warby was last valued at about $3 billion in the private market. |

| Warby Parker is growing quickly — and losing money. It reported revenue of $270 million in the first half of this year, up more than 50 percent from the same period last year, which was dented by store closures during the pandemic. Its first-half loss narrowed to around $7 million, from $10 million last year. Warby said it now generates about half of its sales online and half in its 145 stores. It has plans to open more across the country. |

| More time on Zoom is good for business. In laying out the state of the eyewear market, Warby highlighted the effect that growing screen time has on eye health. “The rising usage of smartphones, tablets, computers and other devices has contributed significantly to increased vision correction needs and consistent new customer growth within the eyewear market,” the company said. |

| It’s registering as a public benefit corporation, a designation granted to companies that take a wide range of stakeholders into account as part of their corporate missions. (In Warby’s rundown of risks for investors, the company warned that “our duty to balance a variety of interests may result in actions that do not maximize stockholder value.”) While some companies that went public with such designations have stumbled, like Etsy, the rising interest in E.S.G. investing has made it increasingly popular. |

| [h=2]“If you really want to make the markets safer, rather than puffing up your chest and posturing to or with Wall Street, talk to small investors about what they want to see and how they want to be communicated with.”[/h] |

| — Mark Cuban, the billionaire investor, takes aim at Gary Gensler, the S.E.C. chairman, on Twitter. Cuban’s tweet was in reply to a general warning from Gensler that his agency, which has unsuccessfully sued Cuban in the past, would go after people who make use of loopholes and legal tricks that violate the spirit of securities laws. |

|

| [h=2]Democracy and deal reviews[/h] |

| Antitrust experts are split over what competition policy can (and should) accomplish. Those who support the status quo view monopoly through a lens of consumer welfare, focusing on price effects. Those who push for change — including the Biden administration — argue that corporate concentration causes many social harms that can’t be measured by prices alone. One of the ill effects is an erosion of democracy, according to a new report. |

| “Corporate concentration and antidemocratic political influence go hand in hand,” wrote Reed Showalter, a fellow at the American Economic Liberties Project, a progressive nonprofit. He told DealBook that he spent two years examining data on three powerful sectors that spend big on lobbying — internet companies, pharmaceutical manufacturers and oil and gas firms — and found that once markets got less competitive, spending on political influence increased. “The more market power a corporation acquires, the more it lobbies,” he wrote. |

| Monopolies have the time and money to spend on influence. A “tentative conclusion” of his research, Showalter said, is that “monopolies seek to acquire political power, whereas competitive businesses focus on competing.” This is data-driven evidence that “competition is important writ large,” Showalter said, suggesting that antitrust officials might consider the effect of potential monopolists on representative democracy when reviewing deals. |

| The report drops some notable names. Showalter’s report begins with an interesting acknowledgment, thanking Tim Wu, a former Columbia law professor who is now a technology and competition policy adviser at the White House. What’s more, Showalter works at the law firm founded by Jonathan Kanter, whom President Biden recently nominated to lead the Justice Department’s antitrust division. Showalter said that Kanter did not discuss the report with him and that his work as a fellow was separate from his day job. But he acknowledged more generally that the expansive approach to antitrust that his report advocated appeared to be ascendant in the halls of power. |

| Want to share The New York Times with your friends and family? Invite them to enjoy unlimited digital access to our journalism with this special offer. |

| [h=3]THE SPEED READ[/h] |

| Deals |

|

| Policy |

|

| Best of the rest |

|

| Anna Schaverien contributed reporting. |

| Thanks for reading! We’ll see you tomorrow. |

| We’d like your feedback. Please email thoughts and suggestions to dealbook@nytimes.com. |

|

|

|

|

|

|

| Andrew Ross Sorkin, Founder/Editor-at-Large, New York @andrewrsorkin |

| Jason Karaian, Editor, London @jkaraian |

| Sarah Kessler, Deputy Editor, Chicago @sarahfkessler |

| Stephen Gandel, News Editor, New York @stephengandel |

| Michael J. de la Merced, Reporter, London @m_delamerced |

| Lauren Hirsch, Reporter, New York @LaurenSHirsch |

| Ephrat Livni, Reporter, Washington D.C. @el72champs |

Interesting info on the covid rates. The south seems to be coming out of it and the NE states about to take a beating.

| Good morning. (Was this newsletter forwarded to you? Sign up here.) |

|

| [h=2]A new twist for vaccine mandates[/h] |

| Delta Air Lines has opened a new front in the push by companies to get employees vaccinated against the coronavirus. Yesterday, Delta said that workers who aren’t vaccinated by Nov. 1 will have to pay an additional $200 per month to remain on the airline’s health plan. More companies are considering imposing such fees on the unvaccinated, following the airline’s lead. |

| The shift from incentives like extra pay or time off to get the shot to financial penalties for choosing not to is a noteworthy change in corporate vaccination initiatives. Companies are taking a tougher stance even if they, like Delta, stop short of mandating that workers get the vaccine or lose their jobs. |

| Recent hospital stays because of Covid have cost Delta about $50,000 per employee, and every one of those workers was not fully vaccinated, Delta’s C.E.O., Ed Bastian, said in a memo to staff. Like most large employers, Delta insures its work force, meaning it pays health costs directly and hires an insurance company to administer its plans. |

| An insurance surcharge is technically complicated. Because employers can’t charge people with pre-existing health conditions higher insurance prices, the surcharges on the unvaccinated are structured as part of “wellness” incentive programs, which are permitted under the Affordable Care Act. These programs must be voluntary but can involve rewards or penalties as large as 30 percent of an employee’s health insurance premium. |

| How to leverage wellness programs to encourage vaccinations has been a preoccupation in boardrooms, with trade groups pushing regulators for clarification of what was allowed. “This is not rocket science, but it is not easy,” said Rob Duston, a lawyer with Saul Ewing Arnstein & Lehr. Employees facing surcharges who don’t want to be vaccinated can simply drop out of the company health plan. (Delta also said that unvaccinated employees would have to wear masks indoors, get a weekly Covid test and forgo payment protections if they missed work because of a Covid infection.) |

| So why not make vaccination mandatory? Companies are on sound legal footing for imposing vaccine mandates for employees. But “every company has to make its own decision for its culture,” Bastian told CNN. “I think these added voluntary steps, short of mandating a vaccine, are going to get us as close to 100 percent as we can.” |

| Geography and politics play a part. Companies balancing the risks of losing employees, altering company culture and facing political blowback can arrive at different conclusions, even within the same industry. United Airlines, which is based in Chicago, was an early mover in mandating vaccination, but its rivals like Delta, which is based in Atlanta, and American and Southwest, which are based in Texas, haven’t required vaccines. Gov. Greg Abbott of Texas issued an executive order yesterday banning coronavirus vaccine mandates, and Gov. Brian Kemp of Georgia has told businesses in the state that they don’t have to comply with local mask or vaccine rules. |

| [h=3]HERE’S WHAT’S HAPPENING[/h] |

| The Biden administration prepares to approve coronavirus vaccine booster shots. The regulatory go-ahead for an additional dose of the Pfizer-BioNTech and Moderna vaccines would reportedly be recommended six months after the previous dose, The Wall Street Journal reports. Vaccine makers have shown that an additional shot increases antibodies against the Delta variant. |

| Economic growth in the U.S. appears to be slipping. The White House’s economic team has lowered its informal internal forecasts for this year, renewing efforts by the administration to get two multitrillion-dollar spending bills through Congress as soon as possible. It also makes paying out already approved pandemic aid more urgent: Nearly 90 percent of a $46.5 billion rental aid program for people facing eviction has yet to be distributed. |

| A new Facebook panel will address election-related issues. Facebook is in the process of recruiting outside experts who will advise the company on political misinformation and how to deal with campaign ads. The fact that the company is likely to recruit and pay the panel itself could raise questions about independence. |

| South Korea raises interest rates, a rare move for a major central bank.Exports are a major driver of growth for the country, as manufacturers around the world deal with a chip shortage. A jump in inflation, particularly in real estate, and large consumer debts led the bank to act, as most of its developed-economy counterparts are likely to keep rates at rock-bottom levels for much longer. |

| Google and Microsoft will invest at least $30 billion to bolster U.S. cybersecurity defenses. The pledges came after 20 executives of major tech companies met for a cybersecurity summit yesterday at the White House. The Biden administration estimates a half-million jobs in the field are currently unfilled, a major challenge to countering hacks and ransomware attacks. |

| [h=2]Why OnlyFans reversed its ban on porn[/h] |

| Yesterday, the online subscription service OnlyFans reversed its ban on explicit content. The ban, instated less than a week ago, was not well received. Even creators who would meet the new guidelines left the site, and critics said OnlyFans was being unfair to legitimate sex workers. |

| If OnlyFans weren’t already associated with adult entertainment, it might be seen as even more dependent on it now. So why did the platform, which is profitable and growing rapidly, take the risk of shunning a big part of its business in the first place? Here are some possibilities: |

|

| [h=2]“Of course there’s a bit of jealousy all the way around. It’s, ‘Why didn’t I think of that?’”[/h] |

| — Brent Crenshaw, a marketing executive from Dallas, on his co-workers’ reaction to his move to Barbados on a yearlong visa. He told The Wall Street Journal he was just as productive as in Texas and even got promoted while working from the Caribbean island. |

| [h=2]Bitcoin E.T.F. backers dare to dream[/h] |

| Cryptocurrency supporters had hoped that the new S.E.C. chair, Gary Gensler, who previously taught a course about blockchain at M.I.T., would make a long-held dream come true: approving a Bitcoin exchange-traded fund in the U.S. Instead, under his watch, the agency has delayed decisions on these long-sought vehicles that would expose a wide range of investors to crypto without having to hold it directly. Gensler has, however, hinted at efforts that may someday pass muster, which is generating a lot of chatter and intrigue in crypto circles. |

| Regulated Bitcoin futures are viewed favorably by regulators. Gensler has said that applications for E.T.F.s that hold Bitcoin futures traded at the C.M.E., a regulated exchange, are particularly welcome. American crypto entrepreneurs with a high risk tolerance have set up exchanges offshore to trade racier, unregulated crypto derivatives, a sharp contrast to the tame world of C.M.E. futures. But the strict investor protection provided by funds subject to federal securities laws on established, heavily regulated exchanges is, naturally, what appeals to watchdogs like the S.E.C. |

| This only raises more questions, Todd Kornfeld of the law firm Troutman Pepper told DealBook. Gensler is suggesting added obligations and limitations for Bitcoin E.T.F. applicants under a rule for mutual funds. This hasn’t applied to existing Bitcoin investment vehicles because Bitcoin is considered a commodity, not a security. Some venture that Gensler’s comments hint at a deeper meaning, stoking debate over the existential question about when a crypto token is a stake in a company versus an asset of independent value. |

| In the meantime, there are workarounds. Until a Bitcoin E.T.F. gets approved — many believe it is only a matter of time — there are alternatives. |

|

| Corporate Subscriptions |

| Want to share The New York Times with everyone at work? Learn more about our corporate digital subscriptions here. |

| [h=3]THE SPEED READ[/h] |

| Deals |

|

| Policy |

|

| Best of the rest |

|

| Anna Schaverien contributed reporting. |

| Thanks for reading! We’ll see you tomorrow. |

| We’d like your feedback. Please email thoughts and suggestions to dealbook@nytimes.com. |

|

|

|

|

|

|

One thing that I said on Monday is that, while the SEC’s argument is not particularly surprising, I had never seen a case like this before, and I pondered a bit what that could mean. I suggested two possibilities: Perhaps people just don’t go around using their companies’ information to trade on comparable companies, or perhaps they do and the SEC just doesn’t go after them. I guessed that the second possibility was more likely but I had no real data. But here are a paper and blog post from last year, by Mihir Mehta, David Reeb and Wanli Zhao, about “Shadow Trading,” which is … this: We examine whether corporate insiders attempt to circumvent insider trading restrictions by facilitating trading in competitors and supply chain partners, an activity we label Shadow Trading. So, yes, the answer is apparently that insiders of one company regularly use corporate information to trade in the stocks of other companies, but the SEC doesn’t usually go after them.To identify situations in which insiders could use their private information to facilitate shadow trading, we use corporate announcements. We focus on announcements that are likely to represent the release of private information held by a firm’s insiders such as earnings announcements, M&A transaction announcements, and announcements about new products. Using multiple proxies of informed trading from the literature to measure shadow trading, we document that immediately before one of these corporate news announcements by a focal firm, competitors and supply chain partners display increased informed trading levels in their stocks. In particular, the magnitude of informed trading is linked to the magnitude of the information shocks. Each news event appears to represent a significant opportunity for profitable trading—a back-of-the-envelope calculation suggests that the average profit from a single shadow trading event ranges from about $140,000 to over $650,000. … Overall, our evidence shows that employees facilitate trading in their firms’ business partners and competitors to circumvent insider trading regulations designed to limit their ability to exploit private information. Should it? I dunno. The Incyte/Medivation case looks pretty bad: The guy allegedly had the paradigmatic most-material-possible inside information (his company was being acquired at a premium) and used it to trade the paradigmatic most-insider-trader-y-possible instruments (short-dated out-of-the-money call options). If you look at those facts, you are going to say “yeah this seems like insider trading.” But in general I am not sure it’s so bad for public-company employees to use things they learn at work to trade in the stocks of other companies in their industry. A story like “Ms. X is an oil-company executive at Company Y, through her job she has come to know a lot about geology and drilling technologies and the personalities in the sector, she met the executives of Company Z at an industry conference and thought that they’re a smart crew, she studies maps and geological reports at her job and thinks Company Z owns some good properties, so she bought some Company Z stock as an investment” — I could see how you might object to that story, but all in all it seems fairly innocuous, more “careful research using expert knowledge” than “insider trading.” The line between “someone who works in an industry uses her specialized knowledge to make smart investments in comparable companies” and “insider trading” is a bit blurry, and perhaps the SEC should only go after people who, you know, buy short-dated out-of-the-money call options on their competitors a couple of days before their company announces a merger. There is one other factor that might have been important in the Medivation/Incyte case. Mehta, Reeb and Zhao write: We also examine whether firms can directly influence shadow trading activity. Firms have incentives to prohibit their employees from engaging in shadow trading because the public revelation of such actions could adversely affect their business relationships. Using a subsample of firms for which we can obtain corporate policy handbooks, we show that shadow trading activity is relatively lower when firms explicitly mandate prohibitions against it in their employee handbooks. Presumably what that looks like is a corporate insider trading policy that says something like “you can’t use what you learn at work to trade our stock or anyone else’s,” as opposed to just “you can’t use what you learn at work to trade our stock.” When companies have policies like that, their employees do in fact do less trading in comparable-company stocks. And in fact Medivation had that sort of policy. From the SEC’s complaint (its emphasis): Panuwat also signed Medivation’s insider trading policy, which prohibited employees from personally profiting from material nonpublic information concerning Medivation by trading in Medivation securities or the securities of another publicly traded company. The policy stated, “During the course of your employment … with the Company, you may receive important information that is not yet publicly disseminated … about the Company. … Because of your access to this information, you may be in a position to profit financially by buying or selling or in some other way dealing in the Company’s securities … or the securities of another publicly traded company, including all significant collaborators, customers, partners, suppliers, or competitors of the Company. … For anyone to use such information to gain personal benefit … is illegal. …” What if it hadn’t said that? What if it had said “don’t use information you get in your job to trade Medivation stock, but do whatever you want to other stocks”? Insider trading, I often say, is not about fairness, but about theft; here the alleged theft was from Medivation. The SEC’s theory here is that the inside information here was material to Incyte but was misappropriated from Medivation, that the insider had a duty to Medivation to keep it confidential and, because he violated that duty, he broke the law. If he had not had an explicit duty to Medivation not to trade on it, could the SEC argue the same thing? Maybe? “You were supposed to use what you learned at work to help your company, not to buy call options on competitors.” (And — as Mehta et al. point out — companies are harmed by this, since it “could adversely affect their business relationships” if their executives are privately profiting from what they learn in negotiations with customers and suppliers, etc.) But it’s a much weaker argument. If Medivation didn’t care that its employees were using inside information to trade on competitors, why should the SEC?

We talked about the case in February when the decision came down. The gist is that Citi was the administrative agent for a syndicated loan to Revlon Inc., and it accidentally paid off the whole loan early when it meant to just make an interest payment. The hedge funds who kept the money had reasons of their own for doing so (involving a dispute over a restructuring of Revlon’s debt), but those reasons are not particularly relevant to judge’s decision. For his purposes, all that matters is that (1) Revlon really owed money to those hedge funds, (2) Citi paid off the amount Revlon owed, and (3) the hedge funds thought, for at least a split second, that Citi might have been intentionally paying off the loan on Revlon’s behalf. This is called the “discharge for value defense” under New York law, the leading case is something called “Banque Worms,” and you can read more about it in the judge’s opinion but honestly it won’t make much more sense if you do. Everyone was surprised by the decision, it makes no sense, it is not how anyone thinks sophisticated financial counterparties operate, and so it is not how sophisticated financial counterparties operate. Basically as soon as the decision came down, bank lawyers starting writing in new syndicated loan documents “also if we send you money by accident you have to send it back, Banque Worms or no Banque Worms.” And lawyers for hedge funds and other syndicated lenders did not push back on these clauses, because obviously if the bank sends them money by accident they have to send it back. These clauses are called “Revlon blockers,” and we discussed them in March, a few weeks after the decision came down. I wrote: This doctrine is dumb and no one in the world of syndicated lending actually meant to sign up for it; “if you send us the wrong money we will keep it” is not a rule that anyone wanted built into their loan documents. It did not occur to anyone to opt out of it—it did not occur to anyone, outside of the small fellowship of Finders Keepers lawyers, that this rule even existed—until it cost Citi $500 million. But now everyone is extremely aware of it, the big banks want to opt out, they have consulted with their own Finders Keepers lawyers, they have put the opt-out language into the contracts, and the other lenders don’t really have a choice. What are they going to do, object? “No, if you send us money by accident, we’d prefer to keep it”? It’s just not a reasonable ask. It’s the law, sure—at least by default—but it’s not reasonable. Anyway here’s a recent paper by Eric Talley of Columbia Law School called “Discharging the Discharge for Value Defense,” which criticizes the Revlon decision and also counts up the Revlon blockers: I document a rapid, precipitous trend towards writing and/or amending debt contracts so as to nullify the Citibank opinion in its entirety, manifested in a variety of “Revlon blocker” provisions that have appeared in hundreds of publicly disclosed contracts. The firms that adopt Revlon blockers are systematically the largest and most sophisticated companies in the public markets, and their rejection of Citibank appears to have met with general market approval. “This analysis underscores the critical role that default rules play in contract law and policy,” writes Talley, “and the high stakes involved in getting them right,” but I am actually not sure the stakes are that high here? I mean, Citi is out $500 million (maybe), so the stakes are high for Citi, though presumably Revlon will eventually pay it back even if it loses on appeal. (I think?) But the fact that this is a bad rule doesn’t matter that much for future cases, because it is a default rule, and syndicated lenders are big and sophisticated and can just change their contracts to opt out of the rule. The funniest part of the paper might be that the judge in the Revlon/Citi case thought the rule was important, and that his decision would cause big good changes in the banking industry. From the paper: The written opinion itself speculated that lending communities and their trade associations would potentially alter their practices, for example by effectuating broad changes to compliance staffing, reforms to industry standards, and enhancements to quality control protocols, so as to further reduce (or in the words of the Court, “eliminate”) the possibility of unanticipated mistakes. And from the opinion: Here, there is no doubt that the party best positioned to avoid the error that occurred was Citibank. The bank took that role seriously in adopting the six-eye approval process for wire transfers of the kind made here. And while that process obviously failed in this instance, the unprecedented nature of the mistake in this case suggests that it has generally been successful. Moreover, banks could — and, perhaps after this case, will — take other relatively costless steps to both minimize the risk of errors and increase the probability of clawing back erroneous payments. For example, banks could, either on their own, or through an industry association like the LSTA, create clear standards governing the content and timing of payment notices. If a payment notice akin to the Calculation Statements here always preceded an actual payment by some specified interval (and banks adopted security procedures, akin to the six-eyes process, to ensure that they did), then the absence of such a notice would indeed raise a red flag that the payment was erroneous. So too, if such notices always unambiguously and explicitly described the size and nature of the payment, the recipient of a payment that deviated from the notice would plainly be on notice of the mistake. For example, one could imagine payment notices that stated something like: “You will shortly receive a wire payment of $X. This payment is for interest only; it does not include any payment of principal. If you receive more than $X, any excess would be the result of an error and you would not be entitled to keep it.” Suffice it to say, had the Calculation Statements in this case included simple and clear language along these lines, this costly litigation would almost surely have been avoided. In short, although the mistake that gave rise to this case may be the proverbial Black Swan event, and the risk of a reoccurrence may therefore be small, the banking industry could — and would be wise to — eliminate the risk altogether by taking these or similarly modest steps. The message here is something like “banks need to be more careful with their money, and to teach them a lesson I won’t let Citi have its money back.” And the banks responded, rationally, by changing their contracts so they don’t have to be more careful.

Anyway one problem with the recent boom in retail trading is that companies are sending more of those 25-cent emails. In part because there are more retail investors, but also because it’s easier for them to buy more stocks. With commission-free trading and fractional shares, you can buy 0.5 shares of 100 stocks almost as easily as you can buy 100 shares of one stock. Also when you sign up for Robinhood you get some free stock. The Wall Street Journal reports: Brokerages like Robinhood are required to deliver proxy materials to a public company’s shareholders ahead of annual meetings. They are then reimbursed by the public company for the cost of distribution. Again, as a non-expert who sends out emails for a living, I cannot resist thinking that the best solution to this problem is something like “you could probably send a bunch of email attachments pretty cheaply,” but I suppose multiple financial regulators adopting rules saying “if a broker gives away free shares to customers it has to eat the six-figure cost of forwarding email attachments to those customers” is also reasonable?[1] I guess? This means that Robinhood’s stock giveaways have saddled some companies with larger bills for delivering proxy statements. Now, the practice is sparking a backlash from companies and scrutiny from market regulators. One company pushing back is Florida-based drugmaker Catalyst Pharmaceuticals Inc., which says Robinhood’s program cost it more than $200,000 last year and could be even more expensive this year. “Catalyst has become aware that Robinhood has been giving away shares of Catalyst’s common stock at no charge as part of its promotional program,” Catalyst Chief Executive Patrick McEnany wrote in a June comment letter to the Securities and Exchange Commission. “Catalyst believes that there are likely numerous companies facing this same issue, and that the costs of distributing materials to small stockholders under these circumstances is onerous and unreasonable.” Following this and other letters, on Aug. 13, the SEC approved a proposed rule change from the New York Stock Exchange that prohibits brokers from seeking reimbursement from companies for delivering proxy materials to investors who received shares from their broker at no cost. The new rule won’t immediately affect Robinhood, which isn’t a member of the NYSE. But companies are now urging the Financial Industry Regulatory Authority, or Finra, which oversees brokers including Robinhood, to pass a similar rule change. … Last fall, Catalyst learned that the number of people who owned its stock had soared over the previous year to 280,000 from 25,000. The 74-employee company received a bill from a Robinhood service provider for $234,000 to cover the costs of sending out proxy materials to investors ahead of its 2020 shareholder meeting, up from $12,500 in 2019.

A basket of so-called meme stocks is surging, fueled by afternoon rallies for GameStop Corp. and AMC Entertainment Holdings Inc. A struggling mall-based video-game retailer was up 28% yesterday on no news.[2] It used to be that when a stock went up 28% in a day you’d be like, well, right, they just announced that they were being acquired. Or at least blow-out earnings. Now it’s like “eh people like options or whatever.” Also GameStop closed at $210.29 per share yesterday? For a market cap of $16.2 billion? And it traded $2.9 billion of volume? Back in February, I wrote about GameStop:The group of 37 retail-trader favorites tracked by Bloomberg soared 10% Tuesday, the most since early June, as trading volumes accelerated. GameStop and AMC, two of the most closely-followed meme stocks, surged 28% and 20% respectively. The afternoon rally caught most analysts by surprise as investors await insights from Federal Reserve Chairman Jerome Powell’s address from Jackson Hole later this week. “I was expecting some calm as we await Jackson Hole, but it looks like ‘Meme Stock Mania’ sees an opportunity here,” said Ed Moya, senior market analyst at Oanda Corp. “It seems this is retail jumping back in on their favorite trades after last Friday’s options expiration.” But I tell you what, if we are still here in a month I will absolutely freak out. Stock prices can get totally disconnected from fundamental value for a while, it’s fine, we all have a good laugh. But if they stay that way forever, if everyone decides that cash flows are irrelevant and that the important factor in any stock is how much fun it is to trade, then … what are we all doing here? People keep reminding me of that line. GameStop closed at $134.14 that day. It was more than six months ago. I am keeping it together, you know, but sure, I’m a little freaked out. Meanwhile at Bloomberg Businessweek, Michael Regan and Vildana Hajric write about how everything is weird: Despite the seemingly endless supply of brainpower and cutting-edge technology that’s put to work in financial markets, at times it feels as if nobody knows anything. I feel like 100 years ago a stock would go up and you’d be like “why” and the answer would be “the people who buy stocks like this stock so they bought it and it went up,” and that was, if not an entirely illuminating explanation, at least the best you were gonna get. And then people invented fundamental analysis and discounted-cash-flow valuation, and companies started disclosing detailed financial information, and stock investing became professionalized, and the importance of institutional investors grew as the influence of individual investors waned, and individuals started investing through funds and eventually index funds and left stock trading to be a highly competitive business done by financial professionals. And it became fashionable to say things like “the price of a stock reflects the present value of its expected future cash flows,” and if a stock went up and you asked why and someone replied “well people decided to buy it” you would think they were being annoying. And then retail trading became free and the pandemic happened and everyone’s brains broke and now GameStop goes up 28% in a day and you ask “why” and the answer is that it’s August and people like the stock. What are we all doing here.That’s perhaps the hardest-to-digest lesson learned—or at least reinforced—from the past year and a half, during which the U.S. stock market doubled at the fastest pace since 1932: The accrued wisdom of Wall Street can be a swiftly depreciating asset. … In past years, the whims of individual investors weren’t considered to be a major influence on the fate of most stocks or the market as a whole. That changed during the pandemic, because of a confluence of events: a price war between brokerages in late 2019 reduced the cost of placing a trade to literally nothing, just in time for lockdowns to create a surplus of time and money for Americans to dabble in the market. The number of shares traded by customers of the main retail brokerages rose from 700 million a day before the pandemic to 2.9 billion earlier this year, to account for as much as a quarter of the market’s volume, according to Bloomberg Intelligence. Retail options trading more than doubled. Fueled by influential voices on Reddit and other social media, the new hordes of day traders often pumped up the shares of companies that were teetering on bankruptcy and had been left for dead by professional money managers.

If you'd like to get Money Stuff in handy email form, right in your inbox, please subscribe at this link. Or you can subscribe to Money Stuff and other great Bloomberg newsletters here. Thanks! [1] I realize that some people get paper proxy statements in the mail, but it does feel like most Robinhood users could be persuaded to opt out of that? Like they are trading on their phones? They are young and tech-savvy and so forth? They do not want to get a proxy statement in the mail for a company where they own $4.17 worth of stock? [2] No news that I saw. One piece of GameStop-adjacent news over the weekend was that Citadel plans to redeem $500 million of its investment in Melvin Capital Management, the hedge fund that became famous (and lost a bunch of money, necessitating the Citadel investment) in January for betting against GameStop. This has absolutely nothing to do with GameStop but you can sort of imagine it as being psychologically connected. Retail traders see the news and are like “hahaha, I remember when we took down Melvin, good times, better buy some GameStop call options.” |

|

| � | |||||||||||||||||

Read in Browser | |||||||||||||||||

| |||||||||||||||||

| |||||||||||||||||

|

|

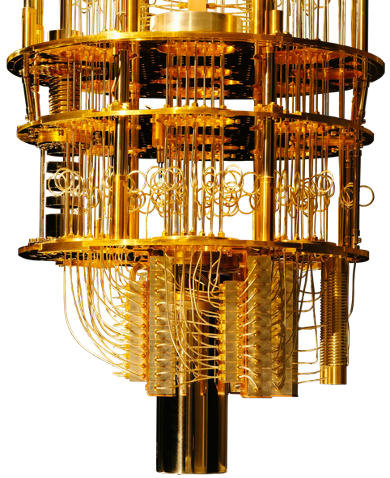

| Global Market Comments August 26, 2021 Fiat Lux Featured Trade: (GOOGLE’S MAJOR BREAKTHROUGH IN QUANTUM COMPUTING), (GOOGL), (IBM)

|

| � |