| |

Top News

Shutterstock

- The S&P (SP500) and Dow (DJI) finished up for the second week in a row. The Nasdaq (COMP.IND) ended the week down as rates steadily gained from Monday to Thursday following mixed inflation data. But they tumbled today after the University of Michigan reported preliminary August sentiment that saw one of the biggest tumbles in 50 years.

- Worries about the COVID Delta variant hit all aspects of the survey. The 10-year Treasury yield slumped 8 basis points to 1.29% Friday, having been as high as nearly 1.38% as the reflation trade gained steam again. For the week, the Dow led the major averages, up 0.9%, while the S&P gained 0.7%. The Nasdaq edged down 0.1%.

| | Economy

Inflation picture far from clear as PPI arrives and yields swing

Inflation data is rivaling nonfarm payrolls in terms of market enthusiasm lately as Wall Street tries to gauge when the Federal Reserve will make its move to curb asset purchases.

Input cost inflation has been plagued by the same large price swings that the Fed has argued are transitory on the retail side, such as a spike in lumber prices, which has subsided, and a shortage of semiconductors, which is still a problem.

And while companies have been announcing price increases through this and the last earnings seasons, there are concerns that more sticker shock is in store for consumers.

Tyson Foods (TSN) CEO Donnie King said on the company's earnings call this week that Tyson has seen "accelerating and unprecedented inflation" and "costs are hitting us faster than we can get pricing at this point."

Ammo for both camps. Yesterday's July CPI numbers showed a cooler-than-expected core rise and moderate price gains in hot sectors, but a headline number still well above 5%.

"Inflation has, at a minimum, paused," Brad McMillan, chief investment officer at Commonwealth Financial Network, told CNBC. "For both the headline and core figures, the monthly and annual numbers were stable or down from last month. Based on that data, inflation is certainly not on an unstoppable increase."

"The inflation data for July moderated somewhat, at least relative to the heady pace of recent months, which should temper market and policymaker concerns a bit, despite the fact that inflation will stay sticky-higher for a while and the risk to inflation from here remains on the high-side," BlackRock's Rick Rieder writes.

David Kelly, chief global strategist at J.P. Morgan Asset Management, said this was "still a very hot report" and that some of the higher prices will stick around for the rest of the expansion.

"We're too obsessed with second derivatives here, we still have a five handle on inflation."

In a Bloomberg column this morning, Mohamed El-Erian, chief economic advisor at Allianz, says the report supports both sides of the debate.

The transitory inflation camp will point to "the retreat of items that have been chief contributors to the surge in inflation, such as used-car prices and airfares," while those who worry about sustained economic damage from persistent inflation will point to higher food prices and the initial stages of wage-push inflation.

Overall, "it would be better to tilt toward what company after company has been saying about cost and price pressures rather than rely on macroeconomic models that inevitably struggle to capture pandemic-related changes," he says.

Whither yields? The Treasury market still remains a bit of a puzzle, with benchmark 10-year yields have risen 20 basis points in 10 days, but still historically very low for the kind of growth and inflation numbers the market is seeing.

Yesterday provided another head-fake as the 10-year failed to take its cue from the CPI. Instead, it reacted much more to the strong demand for the $41B 10-year auction, where bid-to-cover was the highest since May 2020, which Jefferies called "one for the record books."

This morning the 10-year (TBT) (TLT) is down 2 basis points to 1.34%.

The "post-CPI reaction is a fairly classic sign of the market, albeit modestly, pushing back its expectations for when the FOMC may take their ‘foot off the gas’ and begin to taper asset purchases," Michael Brown, senior market analyst at Caxton writes. "I think, however, that such a view may be misplaced, given that yesterday’s inflation print was broadly in line with where the FOMC would’ve expected it to be."

Goldman Sachs cut its 2021 expectations for the 10-year yield this week, now calling for a rise to 1.6%, down from 1.9%.

"In looking ahead, we expect erosion of labor market slack should continue to translate primarily to higher real yields, which we expect to be the main driver in taking yields towards our revised year-end target," Goldman said. "Notably, inflation out the forward curve is broadly priced at levels consistent with core PCE remaining around 2% (or higher), and while the delta variant poses some upside risks to inflation, our economists do expect pressures to subside over the coming quarters."

| | Sponsored By Voyager

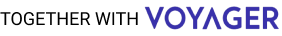

How to use DeFi to diversify your investment portfolio

Decentralized finance is revolutionizing the investment space as we know it. With a vast range of DeFi tokens to choose from, where should you begin? Voyager wants to empower you with the knowledge and education you need to invest intelligently. Check out Voyager's deep dive into popular DeFi assets to see how you can diversify with DeFi.

Decentralized finance is revolutionizing the investment space as we know it. With a vast range of DeFi tokens to choose from, where should you begin? Voyager wants to empower you with the knowledge and education you need to invest intelligently. Check out Voyager's deep dive into popular DeFi assets to see how you can diversify with DeFi.

Read more to find the next big DeFi moonshot.

| | Global

Climate Code Red

The United Nations issued a stark warning on climate change yesterday with a call for immediate large-scale action on cutting emissions. The Intergovernmental Panel on Climate Change's report put the blame "unequivocally" on human activity and U.N. Secretary-General António Guterres said the findings were a "code red for humanity."

Some changes are already locked in, with Greenland's land-ice sheet expected to keep melting, leading to rising sea levels. Heat waves that occurred once in 50 years are now happening every 10 years. Currently, the Dixie Fire in California is now the second-largest wildfire in the state's history and could take weeks to contain. And the harshest heat wave in 30 years is leading to damaging wildfires across Greece and Italy.

There's a general acknowledgment on Wall Street that moving away from fossil fuels, the biggest cause of carbon emissions, will happen. Just look at the performance of Tesla and the EV sector, but environmentally friendly investing hasn't paid off so far in 2021.

Green stocks in the red. Bloomberg's Cormac Mullen notes the weak performance of the S&P Global Clean Energy Index (ICLN) which is down nearly 18% year to date and more than 30% since its peak in early January as President Joe Biden's inauguration approached. The MSCI World Index is up nearly 16% year to date and up more than 13% from ICLN's peak.

Among other clean energy ETFs, the Invesco MSCI Sustainable Future ETF (ERTH) is down more than 10% year to date and nearly 20% off from the post-Biden election peak. The VanEck Vectors Low Carbon Energy ETF (SMOG) and First Trust NASDAQ Clean Edge Green Energy Index ETF (QCLN) are down more than 2% year to date and about 16% off January highs.

Wall Street opportunities: Biden's recent executive order for 50% of cars to be EV by 2030 has received the support of Detroit. And UBS notes that more than 50 large investors with $14T in investments have come together to call on companies to outline "net zero" commitments for 2050.

"The U.S. SEC may propose by year-end that listed firms report climate data and will also look at the criteria for investment funds claiming the sustainability or ESG label," UBS says. UBS says it sees carbon-neutral opportunities in autos, auto parts, batteries, electric and electronic components and green tech.

"With the global race to win the EV market well underway, we expect growth to be exponential rather than linear," it adds. "By 2025, we think around 25% of new cars may be electrified. By 2030, the share may reach 60–70%."

Morgan Stanley says the bipartisan infrastructure bill "could set the stage for a potentially more substantive reconciliation bill - the Administration's first opportunity for meaningful climate legislation."

Yesterday it refreshed its "Decarbonization Playbook" of stocks rated Overweight or Equal Weight with "more direct exposure to legislative support," analyst Devin McDermott writes. Those stocks and themes include: "Air Products (APD) (OW; hydrogen & carbon capture), Archer Daniels Midland (ADM) (EW; carbon capture), Bloom Energy (BE) (EW; hydrogen and potentially carbon capture), CF Industries (CF) (EW; green/blue ammonia/hydrogen & carbon capture), Exelon (EXC) (OW; nuclear), Exxon (XOM) & Chevron (CVX) (OW; carbon capture, renewable fuels and/or hydrogen), Linde (LIN) (OW; hydrogen & carbon capture), New Fortress Energy (NFE) (OW; hydrogen), NextDecade (NEXT) (OW; carbon capture), Nutrien (NTR) (EW; green/blue ammonia/hydrogen & carbon capture), Occidental Petroleum (OXY) (OW; carbon capture), Plug Power (PLUG) (EW; hydrogen), Sunrun (RUN) (OW; solar), and Tesla (TSLA) (OW; EVs)."

| | Trending

Meme Stock Stumble

AMC (AMC) looked to hit all the right notes for its devoted retail investors on the earnings call, but an early pop in shares fizzled, wiping out the gains heading into the report. The stock closed down 6% yesterday and nearly 14% from where shares opened when it looked like another push from the "Ape Army" was on its way.

CEO Adam Aron, known to the Army as Silverback, played to that crowd in the earnings call, floating ideas for a retail audience that cares much more about wild innovation than classic valuation.

Yes, AMC would consider partnering with GameStop (GME). Sure, you will be able to pay for tickets and concessions with bitcoin (BTC-USD) by the end of the year. But Aron did balk at the idea of making a gorilla the official AMC mascot and dismissed a return of drive-in theaters as simply a bad economic idea. You can read the full transcript of the earnings call on Seeking Alpha.

From a more fundamental perspective AMC's results looked good at first blush, beating estimates and noting $2B in liquidity. That led to the initial extended-hours pop in shares. But big concerns about the business model remain.

SA contributor ASB Capital is says that attendance is simply not improving enough. Another SA contributor The Asian Investor notes that the "size of AMC’s losses and the deeply negative cash flow in Q2'21 show that AMC faces numerous business challenges that are so far unaddressed, especially the high cash burn."

Aron is "telling you that the industry will not be back to normal in 2021, probably will not be back to normal in 2022, and the company only 'maybe' has enough cash to survive anything much less than a full recovery in two years." Unsurprisingly, short-seller Jim Chanos, who is betting on AMC to fall, blasted the Apes for trading for "misguided reasons" and not seeing the risks in the company model or the high valuation. "If you keep doing dumb things, if you keep saying, 'I'm a nihilist, I eat crayons, I don't care about this, I don't care about that,' well if you end up losing money, you only have yourself to blame," he said.

Retail interest rising: As AMC devotees prepare to make another stand for the stock at the $30 level, there are few signs of a new big meme name on the cusp of unprecedented gains. EV battery company Microvast (MVST) has recently topped the mentions list for the WallStreetBets subreddit, according to Quiver Quantitative. But its moves, while big, have been choppy rather than straight up.

However, Morgan Stanley notes that retail investing interest is picking up recently, with a bias towards more buying. "Retail participation is currently at 9.4% of the total market volume, which is in the 76th percentile relative to the last 5 years," Morgan Stanley's Quantitative Equity Strategy team writes. "Order imbalance has remained slightly positive. It currently sits at 0.6% or 62nd percentile relative to the last 5 years."

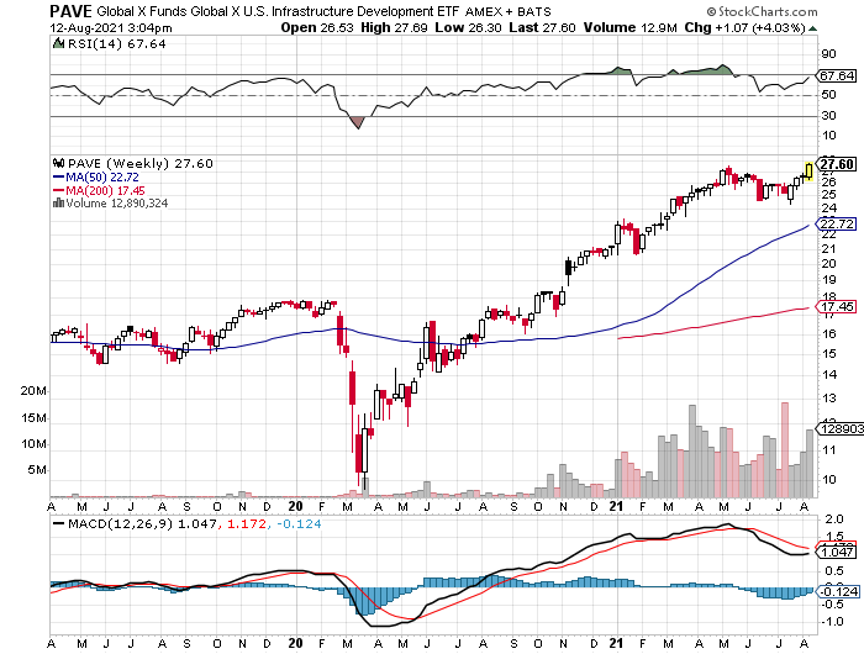

Real Estate (XLRE) and Health Care (XLV) have the biggest positive buy/sell imbalances among retail traders, so the next meme favorite could come from those sectors. Materials (XLB) and Consumer Staples (XLP), also not readily associated with the retail crowd, have positive imbalances as well. Only Energy (XLE) and Industrials (XLI) are negative.

| | Covid

Vaccine Mandate Surge

Dr. Anthony Fauci says he is hopeful full approval of COVID-19 vaccines by the Food and Drug Administration will come in August and also expects that to spur a large number of vaccine mandates by private companies and institutions.

"No one wants to get ahead of the FDA because they're an independent group that makes their decisions and that's good in many respects because there will never be any concerns that we are influencing them, but I hope, I don't predict, but I hope that it will be within the next few weeks," Fauci said on NBC'S "Meet the Press." "I hope that it's within the month of August."

That, in turn, could lead to "a flood" of mandates for vaccines, although not at the federal level, he told USA Today's editorial board in a wide-ranging interview. "Organizations, enterprises, universities, colleges that have been reluctant to mandate at the local level will feel much more confident," Fauci said.

"They can say: 'If you want to come to this college or university, you've got to get vaccinated. If you want to work in this plant, you have to get vaccinated. If you want to work in this enterprise, you've got to get vaccinated. If you want to work in this hospital, you've got to get vaccinated.'"

Fauci adds he does not expect the economy to go into lockdown again. National Institute of Health Director Dr. Francis Collins said on ABC's "This Week" he supported businesses deciding to mandate for vaccines, saying "we ought to use every public health tool that we can when people are dying."

“Unless we vaccinate everyone in 200 plus countries, there will still be new variants,” epidemiologist Dr. Larry Brilliant told CNBC Asia, who predicts COVID could become a "forever virus" like the flu.

What this could mean for stocks: So far, public companies have been proactive with mask mandates in high-infection areas and some companies, like Microsoft (MSFT), are requiring employees to be vaccinated. Norwegian Cruise Line (NCLH) said on Sunday that a judge had temporarily halted a Florida law prohibiting the requirement to show proof of vaccination, paving the way for the company to ask for proof from its travelers.

These moves have been well received by Wall Street, overall, with the S&P and Dow moving back into record territory amid the announcements. Wells Fargo cites the high U.S. vaccination rate as a chief reason that the economy will not face the disruptions it did during the initial outbreak.

"The bottom line is we do not expect the Delta variant to create meaningful headwinds for the economy as was the case in the early stages of the COVID-19 pandemic," strategist Scott Wren wrote in a note, but UBS highlights the risk of more mutations.

"While economic fundamentals remain incredibly positive in most major markets, this will only remain the case so long as populations worldwide reach herd immunity levels before mutations such as the Delta variant compromise the protection offered by current vaccines," it said.

| | Consumer

Spending Slowdown

Shares of Disney (DIS) are climbing in premarket trading after its subscriber numbers topped Wall Street expectations. On its earnings call, the company also highlighted a comeback in the consumer as COVID restrictions ease. Parks were profitable for the first time since the onset of the COVID-19 pandemic. Chief Financial Officer Christine McCarthy noted that per capita spending was up "significantly" vs. 2019 numbers, at both Disney World and Disneyland. And reservations remain strong at both domestic resorts, she said, but a recent credit card survey from BofA Securities indicates that spending is already slowing.

"With the full month of July data, we calculate the seasonally adjusted change from June to July. Total card spending was down 1.3% on a month-over-month seasonally adjusted basis (mom sa)," BofA Economist Michelle Meyer writes in a note. "Slicing the data further, retail sales ex-autos were down a more notable 2.4% mom sa."

There are two main reasons for the decline, Meyer says: A decline in online retail sales due to the timing of Prime Day promotions, which are usually in mid-July. The increase in services spending moderated and was unable to offset the weakening in goods spending.

Higher cases and higher prices: While U.S. shoppers have savings to deploy following the pandemic and little place to find yield, caution in going out and spending the cash remains.

"The biggest deceleration continues to be in spending on airfare which we think reflects concerns over the Delta variant. At the same time, durable goods spending (electronics + furniture + home improvement) weakened, with 2-year growth of 24%," Meyer says. "What’s left? A combination of other services which tend to be less cyclical and nondurable goods spending which continues to run at a trend pace."

“The urban cities, like New York, Chicago and San Francisco, aren’t feeling the same recovery as the Sunbelt states and less populated areas,” Naveen Jaggi, president of retail advisory firm JLL told Forbes. “Combine this with many corporate offices slowing their return to the office. We are going to have a very uneven return to work and we are going to have an even longer return to the shopping habits of yesterday.”

Rising prices in services could add to the reluctance. Tyson Foods (TSN) recently warned that it is racing to pass on the rise on its higher costs to customers, which indicates higher restaurant checks ahead. The July PPI came in hotter than expected, underscoring input cost concerns.

| |

U.S. Indices

Dow +0.8% to 35,209. S&P 500 +0.9% to 4,437. Nasdaq +1.1% to 14,836. Russell 2000 +0.9% to 2,246. CBOE Volatility Index -11.5% to 16.15.

S&P 500 Sectors

Consumer Staples -0.6%. Utilities +2.3%. Financials +3.6%. Telecom +0.8%. Healthcare +0.7%. Industrials +0.2%. Information Technology +0.9%. Materials +0.2%. Energy +0.3%. Consumer Discretionary +0.4%.

World Indices

London +1.3% to 7,123. France +3.1% to 6,817. Germany +1.4% to 15,761. Japan +2.% to 27,820. China +1.8% to 3,458. Hong Kong +0.8% to 26,179. India +3.2% to 54,278.

Commodities and Bonds

Crude Oil WTI -8.2% to $67.89/bbl. Gold -3.% to $1,763.5/oz. Natural Gas +5.7% to 4.135. Ten-Year Treasury Yield -0.4% to 133.95.

Forex and Cryptos

EUR/USD -0.92%. USD/JPY +0.49%. GBP/USD -0.22%. Bitcoin +4.3%. Litecoin +6.1%. Ethereum +15.6%. Ripple +2.1%.

Top Stock Gainers

BeyondSpring (NASDAQ:BYSI) +182%. Score Media and Gaming (NASDAQ:SCR)+113%. Bit Digital (NASDAQ:BTBT) +95%. AeroCentury Corp. (NYSE:ACY) +83%. Kaixin Auto Holdings (NASDAQ:KXIN) +66%.

Top Stock Losers

E-Home Household Service Holdings (NASDAQ:EJH) -81%. Zymergen (NASDAQ:ZY)-65%. Live Ventures (NASDAQ:LIVE) -52%. Moxian (NASDAQ:MOXC) -50%. Sprague Resources (NYSE:SRLP) -48%.

Where will the markets be headed next week? Current trends and ideas? Add your thoughts to the comments section.

| | U.S. Indices

Dow +0.9% to 35,515. S&P 500 +0.7% to 4,468. Nasdaq -0.1% to 14,823. Russell 2000 -1.2% to 2,222. CBOE Volatility Index -4.5% to 15.43.

S&P 500 Sectors

Consumer Staples +2.1%. Utilities +1.5%. Financials +1.9%. Telecom +0.8%. Healthcare +0.5%. Industrials +1.4%. Information Technology +0.1%. Materials +2.7%. Energy -0.8%. Consumer Discretionary +0.%.

World Indices

London +1.3% to 7,219. France +1.2% to 6,896. Germany +1.4% to 15,977. Japan +0.6% to 27,977. China +1.7% to 3,516. Hong Kong +0.8% to 26,392. India +2.1% to 55,437.

Commodities and Bonds

Crude Oil WTI -0.4% to $68.03/bbl. Gold +1.1% to $1,781.6/oz. Natural Gas -7.% to 3.851. Ten-Year Treasury Yield +0.1% to 134.09.

Forex and Cryptos

EUR/USD +0.31%. USD/JPY -0.59%. GBP/USD -0.04%. Bitcoin +6.8%. Litecoin +14.8%. Ethereum +4.2%. Ripple +33.4%.

Top Stock Gainers

Fulcrum Therapeutics (NASDAQ:FULC) +183%. Golden Nugget Online Gaming (NASDAQ:GNOG) +58%. Rani Therapeutics Holdings (NASDAQ:RANI) +58%. Upstart Holdings (NASDAQ:UPST) +54%. Allied Healthcare (NASDAQ:AHPI) +49%.

Top Stock Losers

Katapult Hldgs (NASDAQ:KPLT) -64%. Pharmacyte Biotech (NASDAQ:PMCB) -64%. Medavail Hldg (NASDAQ:MDVL) -60%. Gohealth (NASDAQ:GOCO) -55%. Axsome Thera (NASDAQ:AXSM) -55%.

Where will the markets be headed next week? Current trends and ideas? Add your thoughts to the comments section.

| | �

|

|