| [h=2]Is lending your Bitcoins a security?[/h] |

Oh, sure, yes, absolutely. The rule in the U.S. is that an “investment contract,” meaning “the investment of money in a common enterprise with a reasonable expectation of profits to be derived from the efforts of others,” is a security, and generally can’t be sold to the public without registering it with the Securities and Exchange Commission, delivering a prospectus with audited financial statements, etc. A Bitcoin lending program — in which (1) a bunch of people pool their Bitcoins, (2) some manager or smart contract lends those Bitcoins to borrowers who pay interest, and (3) some or all of the interest is paid back to the people in the pool — is pretty straightforwardly an investment contract and thus a security.

I have been saying this for months, though that’s only because the SEC has also been saying it for months. But I admit that the SEC hasn’t been saying it in a particularly clear way. There’s not an SEC press release saying “FYI crypto lending programs are obviously securities.” And I gather that there are about a lot of crypto lending programs — they’re a staple feature of decentralized finance platforms — and roughly none of them are registered with the SEC. The SEC and state regulators have brought enforcement actions against a few of them — we’ve talked about BitConnect and BlockFi and Blockchain Credit Partners — but I suppose each of those is distinctive in its own way, and there are about a zillion others that haven’t been sued by the SEC.[1] So you could reasonably look around and be like “oh sure we can pool people’s Bitcoins and lend them and pass along the interest, that's not a security that should involve the SEC.” You’d be wrong, but I get where you’re coming from.

Anyway:

Coinbase Global Inc. was warned by the Securities and Exchange Commission against launching a product that would allow consumers to earn interest on their crypto holdings.

The U.S.’s biggest cryptocurrency exchange said it received a Wells notice saying the agency will bring an enforcement action if the company goes ahead with its Lend product. Coinbase expressed surprise at the SEC’s move, in a blog post, adding it plans to delay the launch at least until October.

Here is Coinbase’s defense of its lending program, which sort of halfheartedly argues that it’s not an investment contract:

Coinbase’s Lend program doesn’t qualify as a security — or to use more specific legal terms, it’s not an investment contract or a note. Customers won’t be “investing” in the program, but rather lending the USDC they hold on Coinbase’s platform in connection with their existing relationship. And although Lend customers will earn interest from their participation in the program, we have an obligation to pay this interest regardless of Coinbase’s broader business activities. What’s more, participating customers’ principal is secure and we’re obligated to repay their USDC on request.

I mean, is it “the investment of money in a common enterprise with a reasonable expectation of profits to be derived from the efforts of others”? I think so? I don’t think that the paragraph above says anything different, even though it puts the word “investing” in quotes. Coinbase also complains that the SEC is not being particularly customer-friendly in its regulation of crypto lending:

Despite Coinbase keeping Lend off the market and providing detailed information, the SEC still won’t explain why they see a problem. Rather they have now told us that if we launch Lend they intend to sue. Yet again, we asked if the SEC would share their reasoning with us, and yet again they refused. They have only told us that they are assessing our Lend product through the prism of decades-old Supreme Court cases called Howey and Reves. The SEC won’t share the assessment itself, only the fact that they have done it. These two cases are from 1946 and 1990. Formal guidance from the SEC about how they intend to apply Howey and Reves tests to products like Lend would be a big help to regulating our industry in a responsible way. Instead, last week’s Wells notice tells us that the SEC would rather skip those basic regulatory steps and go right to litigation.

And here is a Twitter thread of similar complaints from Coinbase Chief Executive Officer Brian Armstrong.

Look, I get it. From the perspective of Coinbase, and of its customers, and frankly of most normal people interested in crypto:

- People would like to lend their Bitcoins.

- It doesn’t feel like a security.

- It’s kind of annoying and archaic that a 1946 Supreme Court case says that it is?

But look at it from the SEC’s perspective:

- The SEC really doesn’t like crypto.

- The SEC is a regulatory agency that has a general tendency to want to do more regulating.

- Popular tokens like Bitcoin and Ether are not securities and so not subject to SEC regulation, which leaves the SEC feeling antsy.

- But crypto lending programs are pretty clearly securities subject to SEC regulation.

- So for the SEC to say “crypto lending programs are securities and need to be regulated” serves the dual purposes of (1) expanding SEC jurisdiction over crypto and (2) stopping those programs.

- Also it’s pretty clearly justified by a 1946 Supreme Court case.

None of that is at all satisfying, I suspect, but it is true.

It is particularly unsatisfying because lending is such a normal concept and, in general, not a security. If I lend you a dollar, or a Bitcoin, that’s not a security, even if you promise to pay me interest. What transforms a simple loan (not a security) into the sort of “note” that is a security is a little hazy; there is that pooling of investment for outside management, and the law involves a four-part test asking about the purpose of the loan, whom it was sold to, how it was marketed and whether there is an “alternative regulatory scheme.” If I lend you a Bitcoin, that's not the sort of loan that is a security; if a big company markets a lending program to customers looking to make money, that (probably) is. But it is all a bit vague and muddled. Syndicated loans to companies are not securities. Why are pooled loans to Bitcoin speculators securities?

Still I feel like both sides here are wrong and there is an obvious better analogy. I think this thing is not a stock or bond or “note” or “investment contract” (a security), or a personal IOU or syndicated loan (not a security). Obviously this thing — where you have an account at Coinbase, Coinbase lends your Bitcoins to people it chooses, and you get interest from Coinbase — is a bank account. This is what banks do: They hold your money for you, they use it to fund loans, they pay you interest, they promise to pay you back even if the loans default, the whole thing is seamless to you, etc. It’s just a bank account.

Now a bank account is not a security, but that is not because banks have found some clever loophole to avoid the securities laws that Coinbase can copy. A bank account is not a security because the securities laws, ever since they were written in the 1930s, exempt bank accounts.[2] And the basic reason for that is that banks are subject to banking regulation, which is generally much stricter than securities regulation. You don’t have to file a prospectus, but you do have to meet capital requirements and have bank examiners and all the rest. A bank account is regulated as a bank account, so you don’t have to regulate it as a security.

It must be tempting for Coinbase here to say “look this thing isn’t a security, this is just like a savings account at a bank, and that isn’t a security is it?”[3] Which is quite right! But Coinbase obviously does not want to be regulated as a bank; it does not want to be subject to bank capital requirements (which require essentially 100% equity capital backing Bitcoin positions) or prudential regulation by bank regulators who like crypto about as much as the SEC does but have even more tools to crack down. You think the SEC is being annoying about not issuing formal guidance! A bank examiner could just call you up and say “we don’t think owning Bitcoin is a good idea, get rid of it,” and then where would Coinbase be?

In general the thing that is happening now in the crypto world is that it is rapidly recreating the things that exist in the traditional finance world. “Earn interest on your savings” is a thing that exists in traditional finance, though the interest is quite low these days; it is fairly intuitive and customer-friendly and so of course crypto companies would like to re-create it (but with higher interest). And of course it would be nice, for crypto companies, to re-create banking without bank regulation. But you can see why regulators wouldn’t like it.

If you are a bank, a thing you want is to be able to say “we made $X billion of ESG loans this quarter,” loans tied to environmental, social and governance goals. The way these loans work is that if the borrower hits some targets for stuff “ranging from improved energy efficiency to workforce and boardroom diversity,” it pays a lower interest rate; if it misses the targets it pays a higher interest rate. If you make $X billion of those loans, where X is impressively large, you get to put out a press release about how environmentally friendly you are. When investors run ESG screens to decide what banks to invest in, your commitment to ESG loans will be a positive. When climate-change protesters show up at your office to complain about how you finance coal companies you can say “no no no we are on your side, we made $X billion of ESG loans this quarter.”[4]

Similarly if you are a company and a bank comes to you and is like “let’s do an ESG loan where you pay less for hitting ESG targets and more for missing them” you will be like, sure, I guess, that way I can tell my shareholders and climate protesters that I am doing good ESG stuff.

Will anyone care? I dunno. Abstractly it feels like agency costs all the way down. The bank and the borrower don’t need to care very much about this; they just need something to tell shareholders. The institutional shareholders don’t need to care very much either; they just need some metric where they can tell their clients “we only invest in banks that do good ESG stuff.” The clients might be governments or pension funds that also need to tell some set of constituents about their environmental commitments. The constituents — the taxpayers or employees — might want something along the lines of “someone should tell me to feel good about the environmental impact of my investments” rather than, like, “my investments should actually have a good environmental impact.” I think there is probably a lot of value to be created by telling people soothing things about ESG, and in practice, if someone creates that value, a lot of intermediaries in the chain will capture some of it.

If that is your model — maybe it’s too cynical, but go with it for a minute — then how would you design the ESG loan? Like, specifically, what would the interest-rate reward and penalty be?[5] Well, they could be big numbers. If the borrower hits its targets it saves 2% interest each year; if it misses them it pays an extra 2%. That would be pretty material. The borrower would have a large financial risk tied to its ESG behavior. That is appealing if you care about achieving ESG goals. Companies that failed to reduce emissions might run out of money and have to shut down; reducing emissions would become their top corporate priority. Seems good, for ESG.

It’s not that appealing to the borrower though? If you are the chief financial officer of a company negotiating a bank revolver, your goal is to make sure that you never run out of money. You don't want to go back to your board to be like “good news, we’ll never run out of money as long as we cut our carbon emissions by 30%, but if we don’t we go bankrupt.” Your goal in negotiating a bank loan is not to increase your financial risk.

Similarly if you are the bank, what are your incentives with a loan like that? Surely if banks ended up doing a lot of loans that pay huge interest rates for failing to hit ESG targets, and way-below-market interest rates for hitting those targets, somebody at a bank is going to start making economically rational decisions and buying the ones that will miss their targets (and pay high rates)? Like if you run the ESG Loan Trading Desk at a bank, and ESG loans have wide rate swings based on hitting or missing targets, surely your job is to go find the companies that do the most pollution and buy their ESG loans? Because then you will make more money than the ESG loan desks at other banks who only buy the loans of the companies that will hit their targets? And probably you are rewarded more for making money than for your extremely attenuated environmental impact?[6]

No I mean obviously the logical answer is that the bonus or penalty for hitting or missing ESG targets will be very very small. Bloomberg’s Michael Tobin and Davide Scigliuzzo report:

A Bloomberg analysis of over 70 sustainability-linked revolving credit lines and term loans arranged in the U.S. since 2018 shows that more than a quarter contain similar provisions: no penalty for falling short of stated goals, and only a minuscule discount if targets are met. …

“It’s just disingenuous,” said Peter Schwab, a portfolio manager at Impax Asset Management, one of the largest money managers dedicated to sustainable investments. “There is really no material financial impact. I don’t know why some companies even bother.” …

Sustainability-linked loans have seemingly become a way for companies to tout their ESG bona fides while risking the absolute bare minimum, potentially adding to concerns about so-called greenwashing that have emerged in other areas of sustainable finance and attracted scrutiny from regulators. …

About 40% the borrowers agreed to pay a penalty of five basis points if they failed to meet their targets in exchange for a five basis point discount if they achieved their goals -- a total swing of 10 basis points. … More than a quarter of firms had incentives that amounted to a single basis point if they drew their revolvers, like American Campus Communities did. ...

“Most of the pricing adjustments upward or downward are tiny,” George Serafeim, a professor at Harvard Business School who focuses on corporate performance and social impact, said via email. “It seems to me more a symbolic gesture rather than a serious effort to price and embed in the contract climate risk.”

It strikes me that (1) Serafeim is right that it is mostly a symbolic gesture and (2) it is very hard to imagine a realistic way to price and embed climate risk in a bank loan.

Look, if you are a banker, the main product that you are pitching to corporate clients is risk reduction. Not always, not always; sometimes you will show up to pitch a transformative merger that could easily go wrong and destroy the company but that might pay off big. Every so often a client will like a risky financial bet it is making and want to double down. But mostly you show up and say “hey, you have a risk, I want to smooth it out.” You pitch ways to hedge the client’s interest-rate risk way more often than you pitch ways to add to that risk.

You could tell a story like “climate change is an existential risk to all businesses and ESG loans are a way to hedge that risk,” but of course it isn’t true. If the seas rise, the people paying one basis point less in interest because they hit diversity targets will get flooded just as much as the people paying one basis point more because they missed them. On a societal level “do more good ESG stuff” is some sort of rough mitigant for the risk of bad ESG outcomes, but any particular banker pitching any particular ESG loan obviously isn’t doing it as a hedge to the client’s risk but as a good public-relations move for the bank and the client. The banker just doesn’t want to add to the client's risk. Putting the ESG goals in the loan, but making sure that the risks are immaterial, is the obvious answer.

|

| Sponsored Content

The Moon Pod is a zero gravity beanbag chair that relieves stress and anxiety, mimicking the sensations of flotation therapy. Moon Pod’s zero-gravity technology acts as your personal cushioning system, so you can sit back and relax.

Moon Pod

|

|

| [h=2]Rentech tax settlement[/h] |

The basic rule is that if you buy a stock and it goes up and then you sell it, you have capital gains: The amount you sold it for, minus the amount you paid, is a gain, and you pay taxes on the gain. Most of the time, in the U.S., there is a difference between the tax rates on “short-term capital gains” (you buy the stock and sell it within a year) and “long-term capital gains” (you hold it for longer than a year). Short-term capital gains tend to be taxed at higher rates (usually ordinary-income rates) than long-term capital gains.

This is true, in the U.S., for people, particularly for people with high incomes. It is not particularly true for corporations or banks. A bank does not care about holding its stocks and bonds for more than a year to save on taxes. A rich person does.

If you run a quantitative hedge fund with your and your employees’ money, and your trades turn over frequently, and you are very very very good at running a quantitative hedge fund, you will generate lots of short-term capital gains for yourself and your employees, and you and the employees will have to pay lots of taxes. This will make you sad.

What you want is to put all the short-term trading in a box, and then buy long-term ownership of the box. Then you periodically (but less often than once a year) take your profits out of the box and call them long-term gains. One way to do that might be to give the short-term gains to someone else — preferably a bank (which doesn’t care about short-term versus long-term capital gains)[7] — and have the bank sell you the long-term gains. You do a trade of this form:

- You pick some stocks and the bank buys them, with $100 of its own money, in a special segregated account.

- The bank writes you a derivative saying basically “at the end of three years we’ll give you whatever is in in this account.” You pay the bank $100 in cash, up front, for this derivative, which is roughly the expected value of an account with $100 of stuff in it.[8]

- You “manage” the account on the bank’s behalf: You tell the bank what stocks to buy and sell, in the account, and it does whatever you say.

- You manage it quite actively; every day the bank sells most of the stocks in the account and buys new ones, generating lots of short-term trading and, hopefully, profits.

- Your management is good and the value of the stuff in the account goes up. At the end of three years it is worth, say, $250.

- At the end of the three years the bank gives you whatever stocks happen to be in the account, which you sell for $250. You paid $100 for the derivative so you have a profit of $150.

- That's $150 of long-term capital gains, right? You bought a thing for $100, waited three years, and sold it for $250. What’s the problem?

The Internal Revenue Service doesn’t like this, and if you do it in that simple form above they will stop you. Renaissance Technologies is a hedge fund that (1) mostly manages its employees’ money, (2) does a lot of short-term trading, and (3) is very good at it. It availed itself of a (slightly) more complicated version of this trade, in which it bought a “call option” on the stuff in the box in order to get long-term capital gains treatment (and leverage). (We talked about it here.) The IRS didn’t like it, Congress didn’t like it, and there was a long-running controversy. But then last week:

The founder of quantitative hedge-fund manager Renaissance Technologies and his colleagues will pay billions of dollars in back taxes, interest and penalties to resolve one of the biggest tax disputes in U.S. history, under the terms of a deal reached by the firm and the Internal Revenue Service.

Renaissance Chief Executive Officer Peter Brown disclosed the agreement Thursday in a letter to investors seen by Bloomberg. While it doesn’t say how much money will be paid, U.S. Senate investigators in 2014 pegged potential unpaid taxes in the case at $6.8 billion, before interest and penalties.

Seems right. Still it was an interesting effort.

It’s fun to imagine what the world would be like if instead of being immutable permissionless decentralized code blah blah blah, Bitcoin was a company. It’s a brash disruptive payments startup, its CEO goes around touting its virtues and saying it will eventually displace all of traditional finance, he meets with politicians and philosophizes about how his product should be adopted by countries as legal currency. And then he has a real good meeting with the “hustle bro populist” president of El Salvador and says “you should adopt Bitcoin” and the president says “okay I will.” And then the CEO of Bitcoin is like “Oh. Oh? Oh. Well! Great! That’s super.” And he goes back to his team and says “they’re adopting Bitcoin” and the team says “uh well we didn’t expect that, what does that even mean.” And then they work feverishly to make it happen, and the clock ticks down to Now Bitcoin Is Our Legal Tender Day, and at like 6 p.m. the day before the deadline the CEO of Bitcoin calls the president of El Salvador and is like “look honestly man we are not ready to be a legal tender, I’m really sorry about this, give us another few months.” And everyone is super embarrassed and important lessons are learned.

But here in the actual world Bitcoin is a decentralized blah blah blah, there is no CEO, and:

El Salvador became the first country to adopt the digital token as legal tender on Tuesday, with the government’s Bitcoin wallet Chivo coming pre-loaded with $30 worth of the currency for users who register with a national ID number.

But it almost immediately ran into trouble — the government had to disconnect the wallet to sort out technical glitches. Bitcoin tumbled as much as 17% in a matter of minutes, and other crypto assets and related stocks crumbled too.

El Salvador’s move is “a stunt that will completely clog the transactions for the majority of Bitcoin holders who really just want it to remain a store of value to hold,” said Carsten Sorensen, a researcher with The London School of Economics. “When individual countries seek to overnight make it legal tender, then the network will easily suffer as there already are issues with the transaction rate.”

I feel like that is kind of the cool thing to say about Bitcoin these days, not that it's the transactional currency of the future but that it’s a “store of value to hold,” not spend. If Bitcoin was a company, it would have pivoted its public-relations and commercial focus to getting institutions to buy and hold Bitcoin, rather than the sort of circa-2015 vision of getting people to adopt Bitcoin to pay for pizza. But Bitcoin is decentralized and permissionless and if a country decides to adopt it as a currency and distribute it at ATMs, all the people who think “no no no it’s not for this sort of stunt, it’s for hedge funds to buy and hold” don’t get a say in the matter.

Well, here's a story about a guy who just got sentenced to four years in prison for running a $126 million printer toner fraud scheme. I feel like printer toner is probably a good business to run a scam in, because all of your customers are just wearily expecting to be scammed so they’re not going to complain. “Ah, right, a $126 million bill for one toner cartridge, I guess that’s how toner works now,” they’ll shrug, and pay you without going to the police. Toner is a necessary business expense with an arbitrary price; why not run a scam on it? Anyway there are good quotes:

In announcing the arrest of Mr. Michaels and 20 other people accused of being connected to the scheme in 2016, the Huntington Beach Police Department in California called it “Operation Tone It Down.” The authorities said at the time that Mr. Michaels had previously received court warnings about deceptive telemarketing practices.

TonerNews.com, a website devoted to writing about printing supplies, called Mr. Michaels “the California toner pirate godfather” in a post on Sunday. Mr. Michaels’ lawyer scoffed at the moniker.

If you'd like to get Money Stuff in handy email form, right in your inbox, please subscribe at this link. Or you can subscribe to Money Stuff and other great Bloomberg newsletters here. Thanks!

[1] Why not? I suspect the answer is some combination of “they’re busy” and “it’s hard to find the people running some of these things”; I don’t think “the SEC thinks all the rest of them are okay” is a plausible answer.

[2] For instance Section 3(a)(2) of the Securities Act of 1933 exempts “any security issued or guaranteed by any bank” from the registration requirements. But the four-part Reves test, which I mentioned a couple of paragraphs above, is perhaps more relevant; the Supreme Court found that a “note” is not a security if “some factor such as the existence of another regulatory scheme significantly reduces the risk of the instrument, thereby rendering application of the Securities Acts unnecessary,” with federal banking regulation being the most important such regulatory scheme.

[3] Arguably another, even better analogy is to cash sweep accounts at brokerage firms, but those generally sweep to either (1) money market funds (which are securities, and investment companies) or (2) bank accounts (which are at regulated banks).

[4] When I wrote about this topic previously I expressed some skepticism that banks would care about this stuff. Boy was I wrong! I got a lot of email. These sorts of ESG loans seem to be bank-driven; the banks want to tell their shareholders and regulators and critics and stakeholders that they are doing ESG stuff, and ESG-linked loans seem like an easy category of ESG stuff for banks to do. The borrowers also like to advertise them though.

[5] A simple model for how it works is that the reward and penalty are symmetric around an ordinary non-ESG market rate: The company would usually pay Y% for a loan, but instead it can get an ESG loan where it pays (Y-Z)% if it hits the targets and (Y+Z)% if it misses, with the targets being achievable-but-not-too-easy goals. This seems fairly common. Other possibilities are imaginable. For instance, in the ESG loan you pay Y% if you hit the targets and (Y+2Z)% if you miss them, but the targets are very easy and you’re guaranteed to hit them. Etc.

[6] This is related to Cliff Asness’s point, which I cite a lot, that if the goal of ESG investing is to raise the cost of capital of bad behavior, then people who invest in bad behavior will get higher returns. You can object to the first part of that: There are theories of ESG investing that do *not* rely on the idea that it raises the cost of capital of bad behavior. (Your theory could be “in the long run good ESG will outperform and I am just making a rational bet,” or “I will invest in good and bad companies but use activism to make the bad ones better”; those are not cost-of-capital theories.) But once you are talking about ESG loans that *explicitly adjust their pricing for hitting or missing ESG targets*, you are stuck in a cost-of-capital theory, and it is obvious that people who make ESG loans to borrowers who miss their targets will have higher returns than people who make ESG loans to borrowers who hit their targets.

[7] The deep reason for this is that the bank is not in the business of making short-term *directional* bets. It is a dealer; it is buying and selling stuff over the short term for client service, not to bet on the stuff. Often its bets offset. For instance in the trade I describe below the bank has some gains on the stuff, but it has precisely offsetting losses on the derivative it sells to you. In practice the bank is going to pay taxes on its net income — basically the fee you pay it to do this trade — not on the day-to-day price moves of the underlying stuff. *You* would pay taxes on those moves; the bank won’t.

[8] Or maybe you pay $110, to cover the bank’s fee for doing this. Or more likely you pay $20 up front and then $90 at the end, to get leverage. I am describing this trade schematically; I’ve explained it a touch more realistically here.

|

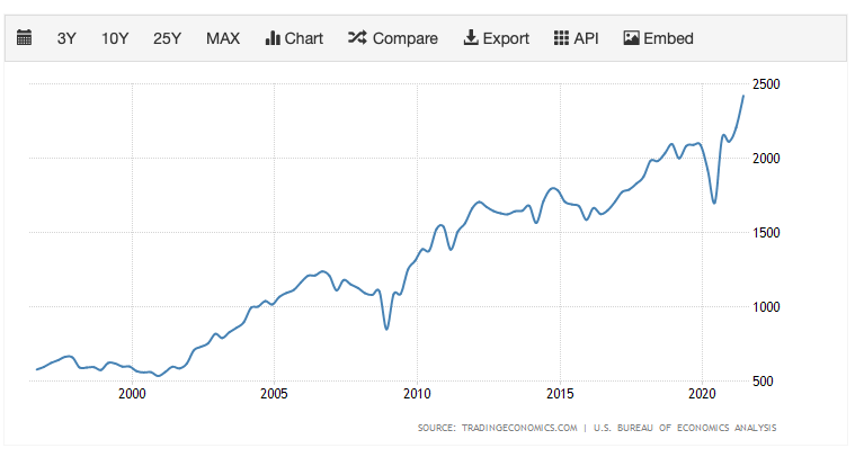

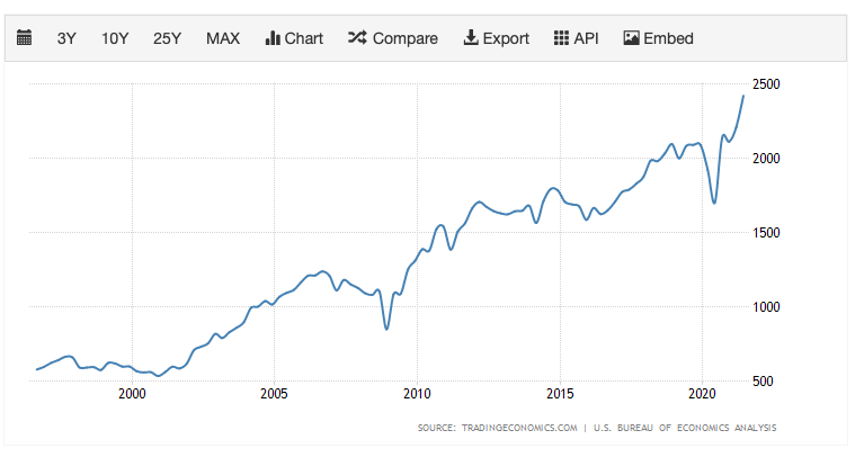

US Corporate Profits

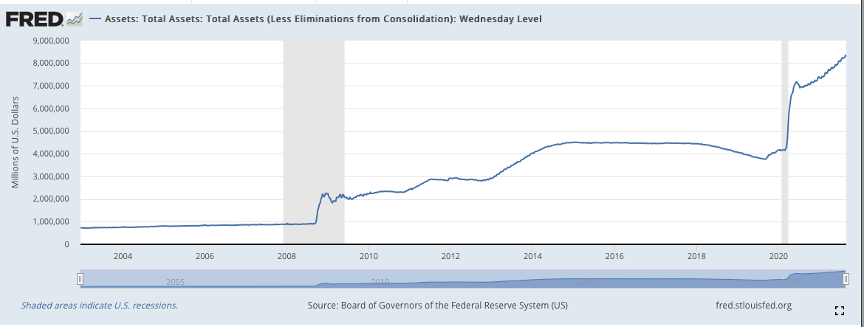

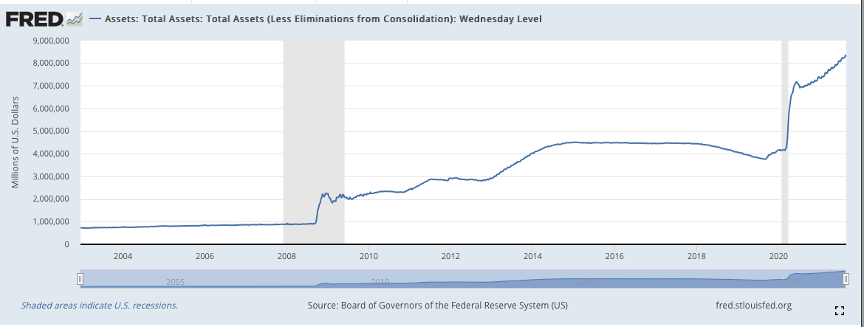

US Corporate Profits Federal Reserve Balance Sheet

Federal Reserve Balance Sheet

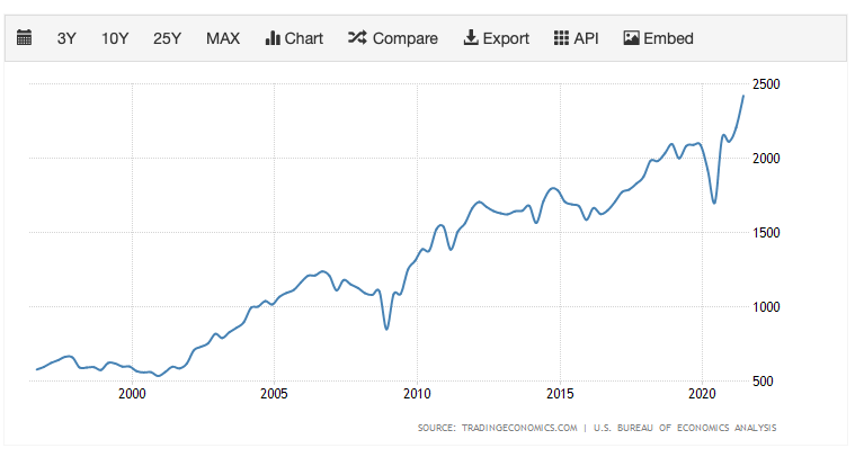

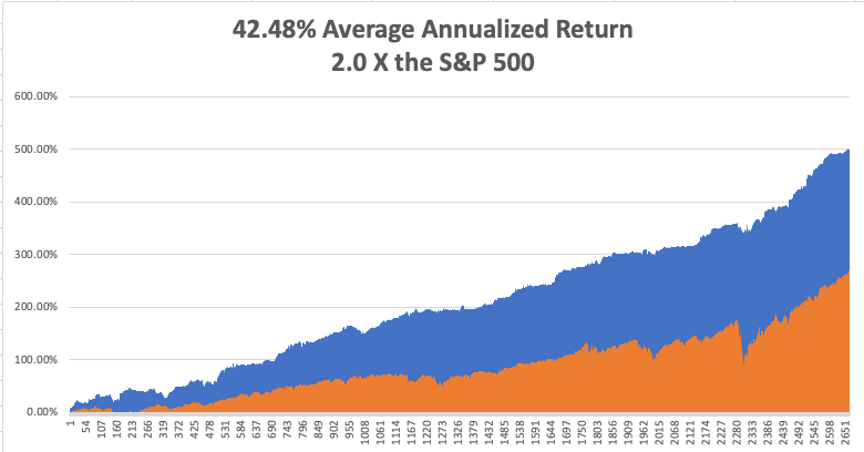

TEGF

TEGF