NYT Dealbook

|

| [h=2]Monopoly matters[/h] |

| For the past three weeks, Apple has been defending itself in federal court against claims brought by Epic Games, the maker of the blockbuster video game Fortnite, that Apple abuses its power by charging app makers unfairly high commissions to appear in its App Store. Judge Yvonne Gonzalez Rogers said she hoped to deliver a verdict in mid-August. |

| The crux of the case is about market definition. Since Epic’s games are played on many non-Apple devices, its complaint about Apple as a monopolist is not clear-cut; a company that relies exclusively on Apple for distribution may have a stronger claim. |

| To that end, this case could be seen as a dress rehearsal for future antitrust cases, even if the judge rules in Apple’s favor. And if the judge finds for Epic, it would probably not force immediate changes to the $100 billion market for iPhone apps, since any ruling is set to be tied up in appeals for years. Regardless, the evidence revealed in the past few weeks is likely to feature in court battles to come. |

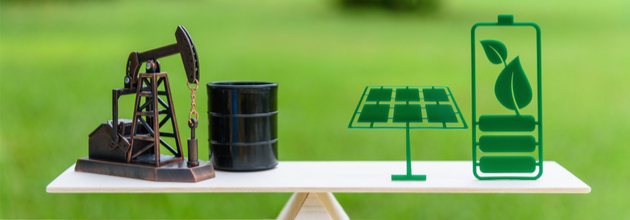

| [h=3]PAID POST: A MESSAGE FROM EXXONMOBIL[/h]An Idea to Help Decarbonize Heavy Industrial Areas ExxonMobil’s idea to capture and store roughly 100 million metric tons of CO2 annually by 2040 would more than double the world’s current carbon capture and storage capacity. That’s equal to taking 20 million cars off the road. It has the potential to effectively decarbonize the entire industrial area around the Houston Ship Channel and help the city of Houston meet its net-zero ambitions by 2050. LEARN MORE AT ENERGYFACTOR.COM |

| After the trial wrapped up yesterday, DealBook spoke with Kellen Browning, a technology reporter for The Times, about the companies’ arguments, what the judge said and how a sometimes-naked banana became a topic of debate in the California courtroom. Here is an edited version of the discussion. |

| Epic has argued that the case is about iPhone apps, while Apple has argued that it’s about gaming. Why is the distinction important? |

| If the case is about iPhone apps in general, then Epic can claim that Apple has a monopoly over distribution. But if the case is just about the distribution of gaming apps or games more narrowly, then Apple has been able to argue that there are many different places that people can get their games. |

| Why was there so much discussion of Apple’s security features and review process? |

| One of Apple’s arguments was that it has really good security and it thoroughly reviews its apps, and it wouldn’t be able to do that as effectively if Epic were allowed to essentially offer its own app store within Apple’s App Store (and bypass Apple’s commission). In response, Epic showed internal emails between Apple executives discussing times when Apple’s review failed to pick up problematic apps. |

| Essentially, Apple said, “You know, sometimes we make mistakes, but overall we’re pretty good.” And — have you heard about Peely? |

| The banana? |

| Yes. Apple responded to Epic’s saying, “Here’s some evidence that the content of your game store may be inappropriate, and we wouldn’t be able to police it.” In that line of argument, they brought up Peely, a character in Fortnite, which is a banana that sometimes wears a tuxedo, and sometimes doesn’t. And so there was this whole back-and-forth over whether it’s appropriate to show the “naked” banana in court. The judge was making Peely jokes for the rest of the trial. |

| Did the judge ask any searching questions? |

| The judge asked Tim Cook at one point whether the decision to reduce Apple’s commission for some smaller developers was because of this sort of scrutiny. He acknowledged that, to some extent, concerns about regulation or scrutiny were in the back of his mind. The judge also talked about how it seemed that Apple hadn’t felt any competitive pressure to lower its 30 percent commission fee, based on other game platforms lowering their fees, which has happened a few times. |

| Read The Times’s full story on the last day of the Epic vs. Apple trial. |

| [h=3]HERE’S WHAT’S HAPPENING[/h] |

| Airlines begin skirting Belarus after it forced down a plane. Carriers said they would avoid the country’s airspace after it compelled a Ryanair flight bound for Lithuania to land in Minsk, the Belarusian capital, to seize a dissident journalist. The detour is likely to be costly for airlines that fly between Europe and Asia. |

| New York City schools eliminate remote learning for the coming school year. All students and staff will be back in buildings full time come September, a milestone for America’s largest school system and a crucial step in reopening the city’s economy — especially for working parents. |

| Companies are favoring carrots over sticks to get workers vaccinated.Businesses are increasingly turning to cash stipends for inoculated employees, though some lawyers worry about the legality of such bonuses. United Airlines has created a sweepstakes for travelers who share their vaccination status, with the chance to win free flights. |

| Senator Elizabeth Warren proposes tripling the I.R.S.’s annual budget. The Massachusetts Democrat unveiled legislation to increase the agency’s funding to $31.5 billion to support President Biden’s plan to help it pursue tax evasion by corporations and the wealthy. |

| Florida will fine social networks that bar political candidates. The new lawis a direct challenge to the suspension of Donald Trump by Facebook and Twitter, and also prevents those platforms from banning some news outlets from posting their content. It’s likely to be challenged on constitutional grounds. |

| [h=2]What’s in Ray Dalio’s wallet?[/h] |

| After a harrowing few days for cryptocurrency investors, many will have taken comfort yesterday when Ray Dalio, the billionaire hedge fund manager, said, “I have some Bitcoin.” The statement generated headlines and attention because Dalio had dwelled on Bitcoin’s limitations last year: “I might be missing something about Bitcoin so I’d love to be corrected,” he said in November. |

| Timing is everything. It’s worth noting that Dalio’s remarks were streamed to attendees of CoinDesk’s Consensus conference yesterday, but had been recorded on May 6. Bitcoin has lost about a third of its value since then. |

| Crypto gets more attractive as the dollar loses its allure, Dalio said. The U.S. dollar may one day lose its position as the global reserve currency, he said, but that wouldn’t necessarily be good for crypto. If governments sense that people would rather “have Bitcoin than a bond,” a crackdown will follow, he suggested. |

| A digital dollar from Uncle Sam could be coming, the Fed governor Lael Brainard said at the conference. “We must explore — and try to anticipate — the extent to which households’ and businesses’ needs and preferences may migrate further to digital payments,” she said. Brainard argued that a central bank digital currency would be safer and more stable than “a predominance of private moneys.” |

| In other crypto news, the Bank of England’s governor, Andrew Bailey, called cryptocurrencies “dangerous,” a group of Bitcoin miners (and Elon Musk) met to discuss the industry’s climate impact, and the volume of chatter about crypto on Reddit now surpasses discussions about meme stocks. |

| [h=2]“A SPAC is more like a Vegas wedding. It just doesn’t have the same level of preparation and vetting like a traditional I.P.O. But here is the point: It is still a legal wedding.”[/h] |

| — Usha Rodrigues, a law professor at the University of Georgia, at a House hearing on the blank-check boom. |

| [h=2]Onward and upward for vertical farming[/h] |

| Bowery Farming, a high-tech vertical farming company that grows greens indoors, has raised $300 million in funding at a valuation of $2.3 billion, it will announce today. The round was led by Fidelity. |

| Not your typical farmer. Irving Fain, Bowery’s founder and C.E.O., began his career in investment banking, directed digital marketing at iHeartMedia and founded CrowdTwist, a brand analytics software company. He started the “smart” farm company, which uses technology to control and monitor growth, in 2014. The company’s farms are built near cities and employ workers with no agricultural experience to work tech-enabled greenhouses. |

|

| Stars are betting on it. Bowery’s latest funding round boasts celebrity investors like the actress Natalie Portman, the chef José Andrés and the singer-songwriter and actor Justin Timberlake. Its greens and herbs are sold in more than 850 stores, and it has recorded sales growth of some 750 percent since the start of 2020. |

| [h=2]E.S.G. risks grow, but myths persist[/h] |

| When it comes to scrutiny of companies’ environmental, social and governance policies, or E.S.G., “there’s so much activity going on,” Jennifer Semko, a partner at the law firm Baker McKenzie in Washington, told DealBook. She cited increased attention on E.S.G. issues from employees, consumers, shareholders, stakeholders and governments around the world. “Companies need to be better prepared,” she said. |

| E.S.G. matters are a growing litigation risk. In a recent Baker McKenzie survey of litigation risks at multinational companies, only the energy and mining sectors were highly attuned to the issues, Semko said. It’s “a little surprising,” she said, given that companies in every sector are facing questions about the environment and much more — everything from ethical sourcing to social justice. |

| Insurers are also looking at E.S.G. as a risk factor, said Paul Schiavone of Allianz. In a new report, his company named E.S.G. as one of the major risk trends to financial service firms, and Schiavone says he believes that as these issues get more attention, good corporate citizens will be rewarded for “friendliness” of all kinds. Companies that pay attention to E.S.G. concerns may face fewer regulatory investigations, lawsuits and other disruptions — all matters of interest to insurers. |

| Investor interest alone isn’t enough to prompt companies to open up about E.S.G., said Allison Herren Lee, an S.E.C. commissioner. Speaking to an accounting trade group yesterday, she dismissed what she called the “most prevalent myth” about E.S.G. reporting issues. Securities laws require that companies disclose material information to investors, but it is “simply not true” that companies reveal much about E.S.G. unless it is specifically mandated, she said. |

| Thank you for your support. Want to share The New York Times? Friends and family can enjoy unlimited digital access to our journalism with this special offer. |

| [h=3]THE SPEED READ[/h] |

| Deals |

|

| Politics and policy |

| Tech |

| Best of the rest |

|

| Thanks for reading! We’ll see you tomorrow. |

| We’d like your feedback! Please email thoughts and suggestions to dealbook@nytimes.com. |

|

|

|

|

|

|

| Andrew Ross Sorkin, Founder/Editor-at-Large, New York @andrewrsorkin |

| Jason Karaian, Editor, London @jkaraian |

| Sarah Kessler, Deputy Editor, Chicago @sarahfkessler |

| Michael J. de la Merced, Reporter, London @m_delamerced |

| Lauren Hirsch, Reporter, New York @LaurenSHirsch |

| Ephrat Livni, Reporter, Washington D.C. @el72champs |

.jpg)

ANOY

ANOY