You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Intersting thoughts

- Thread starter Bozzie

- Start date

to be clear, i enjoy reading his thoughts, an obviously experienced knowledgeable person and I thank Boz for posting his articles . He is categorically incorrect on his statement on tech., analysis , period. Many ways to skin a cat , kudos to him ,wishing him continual success , health

CoachB - are u trading BABA or investing ?

BIGGGGGGGGGGGGGGGGGGGGGG tech earnings out soon. ICONIC : AAPL, FB GOOG, MSFT april 27/28. Could get bumpy

NFLX laid an egg and was punished yesterday, down 7% ish I believe it was

CoachB - are u trading BABA or investing ?

BIGGGGGGGGGGGGGGGGGGGGGG tech earnings out soon. ICONIC : AAPL, FB GOOG, MSFT april 27/28. Could get bumpy

NFLX laid an egg and was punished yesterday, down 7% ish I believe it was

| View in browser|nytimes.com Continue reading the main story |

April 23, 2021 |

| Good morning. (Was this newsletter forwarded to you? Sign up here.) |

|

| [h=2]Closing loopholes[/h] |

| President Biden is expected to unveil a $1.5 trillion “human infrastructure” plan next week that will focus on education, child care and paid leave for workers, among other things. It would be paid for in part by new taxes on the rich, including the end of a tax break that lawmakers have tried to eliminate for years. |

| The White House will propose a major change to capital gains taxes, with people earning more than $1 million per year paying the top marginal tax rate on their investment gains. Mr. Biden wants to raise that rate to 39.6 percent. |

| The carried interest loophole might finally disappear. Profits earned from funds owned by real estate investors and managers of private equity and venture capital firms are taxed as capital gains at about 20 percent, instead of as regular income, which is taxed at more than double that rate when state levies and other taxes are taken into account. |

|

|

| Other changes to the tax code could be in the works, including to the estate tax. Private equity executives are also worried that the Biden administration may limit the tax deductibility of corporate interest payments, which would be another hit to their business model. |

| Stocks fell on news of the potential capital gains tax change, but futures are up today. Some in Washington believe any tax proposals will get watered down, particularly given Democrats’ slim margin of control in Congress. And the potential changes to the capital gains tax would affect only the 0.3 percent of Americans who reported annual incomes of $1 million or more, according to the latest IRS data. |

|

| [h=3]HERE’S WHAT’S HAPPENING[/h] |

| U.S. health officials may soon lift the pause on Johnson & Johnson’s vaccine. A committee of outside experts will meet today to discuss whether to resume giving the shot; they’re expected to vote in favor. But the damage may be done: The Biden administration has reportedly written off the J&J shot’s importance to U.S. vaccination efforts. |

| President Biden sets a new climate goal. At the first day of a climate summit that the U.S. convened, he pledged to cut America’s emissions in half by 2030, compared with 2005 levels, and offered more funding for developing countries to help them meet their targets. Swiss Re estimated that climate change could cost the global economy as much as $23 trillion in the coming decades. |

| Airlines see clearer skies ahead. Carriers expect travel to return almost to normal levels by the summer, with the largest airlines expected to offer as many seats this July as they did in July 2019, by one estimate. The industry plans to call back thousands of employees and hire hundreds of pilots. |

| Scrutiny over a fatal Tesla crash intensifies. Two senators asked regulators to create recommendations for autonomous vehicle software, following the deaths of two men in a Tesla, in which police said no one was behind the wheel. Consumer Reports said it was able to trick Tesla’s Autopilot into operating without anyone in the driver’s seat. |

| AT&T gains ground in the streaming race. The company added 2.7 million subscribers to HBO and HBO Max in the first quarter. Also worth noting: AT&T collects nearly three times more revenue per streaming user than Disney, and trails only Netflix by that measure. |

| [h=2]Proxy-season politics[/h] |

| The riot at the Capitol in January prompted a reckoning on corporate political donations that will be a prominent feature of proxy season, with many shareholder proposals demanding greater disclosure of company spending. |

| “Companies are reading the writing on the wall,” Thomas DiNapoli, New York State’s comptroller and trustee for the state’s public pension fund, told DealBook. “Political and social polarization are bad for their business, and they need to decide if political donations are worth the risk.” |

| “Time will tell if their increased attention to these issues is lip service or if it represents a sincere change in corporate culture,” Mr. DiNapoli said. “At a minimum, investors need disclosure of this spending.” New York’s public pension fund is the third-largest in the U.S. and since 2010 it has filed more than 155 shareholder proposals on political spending, winning more than 40 adoptions or agreements, including from Bank of America, Delta Air Lines and Pepsi. Three of five resolutions it has advanced this year have already been withdrawn, with the companies agreeing to make changes without putting them to a vote. That’s a 60 percent hit rate, and companies that wouldn’t engage before are now at least responsive, a spokesperson for the fund said. |

|

| “Companies are now expected to have core values — almost personalities,” said Bruce Freed, the president of the Center for Political Accountability, a nonprofit that partners with shareholders on proposals. Recent agreements, like the ones brokered by Mr. DiNapoli, are a “strong indication” that corporations are feeling “real pressure,” he said. Nine of 30 companies (including those noted above) have agreed this year to provide more disclosure on political donations. Last year, eight of 40 companies facing similar proposals agreed to act instead of putting the question to shareholders in a vote. The Capitol riot “raised the stakes,” Mr. Freed said, and the pressure on companies has not relented since. |

|

| [h=2]“We clearly misjudged how this deal would be viewed by the wider football community and how it might impact them in the future. We will learn from this.”[/h] |

| — A JPMorgan Chase spokesman, on the bank’s proposed financing of the European Super League. For more on the short-lived plan for a multibillion-dollar continental soccer competition, read this comprehensive account by The Times’s Tariq Panja and Rory Smith. |

| [h=2]Tallying the damage of a global chip shortage[/h] |

| A dearth of computer chips is roiling supply chains around the world. It has especially wreaked havoc on carmakers, many of whom have been forced to shut down plants for lack of chips integral to modern cars. |

|

| The shortage is unlikely to end anytime soon, according to Intel’s C.E.O., Pat Gelsinger: “This will take a while until people can put more capacity in the ground,” he told The Wall Street Journal. |

| [h=2]In the papers[/h] |

| Some of the academic research that caught our eye this week, summarized in one sentence: |

|

| [h=2]Exclusive: Master P to invest in racial equity[/h] |

| Percy Miller, better known to hip-hop fans as Master P, plans to invest $10 million in companies led by or serving people who are Black, Indigenous and people of color, DealBook is first to report. He sees ownership and equity as keys to bridging racial wealth gaps, and wants other investors to follow his lead. |

| “This is all about economic empowerment,” Mr. Miller told DealBook. Early in his career, Mr. Miller opened a record store from which he launched No Limit Records, once one of the largest independent labels. More recent projects have been aimed at social entrepreneurship, like an “Uncle P” line of food products to replace Aunt Jemima and Uncle Ben’s (both have since beenrenamed) that would dedicate a portion of profits to supporting Black communities. |

|

| Mr. Miller wants to invest in an array of industries, with education, including financial literacy, a priority. “I always tell people, product outweighs talent — at the same time, education and wisdom are so important,” he said. “That’s the longevity of my success.” |

|

| Thank you for your support. Want to share The New York Times? Friends and family can enjoy unlimited digital access to our journalism with this special offer. |

| [h=3]THE SPEED READ[/h] |

| Deals |

| Politics and policy |

|

| Tech |

|

| Best of the rest |

| Thanks for reading! We’ll see you tomorrow. |

| We’d like your feedback! Please email thoughts and suggestions to dealbook@nytimes.com. |

|

|

|

|

|

|

| Andrew Ross Sorkin, Founder/Editor-at-Large, New York @andrewrsorkin |

| Jason Karaian, Editor, London @jkaraian |

| Sarah Kessler, Deputy Editor, Chicago @sarahfkessler |

| Michael J. de la Merced, Reporter, London @m_delamerced |

| Lauren Hirsch, Reporter, New York @LaurenSHirsch |

| Ephrat Livni, Reporter, Washington D.C. @el72champs |

I wish I had the time to get into this regularly but things have re ramped up to normal around here.

We're looking at a property today for a very quick summer flip. Things have gone mad here value wise and it still's largely undiscovered.

The Biden tax plan has me nervous in a million ways.

We're looking at a property today for a very quick summer flip. Things have gone mad here value wise and it still's largely undiscovered.

The Biden tax plan has me nervous in a million ways.

|

You're going to crush it my man..

Maybe..time is the problem with the amount of work I have around here.

I'd like to do a flip or two down the road....if (or when) the market settles back down. Right now there's no real deals to be had. I see a lot of homes that are being flipped, but I think those are people who have an inside connection w/ a broker and they're find deals (on places that are real dumps). On realtor.com you can see when the house was last sold, and I'm seeing "last sold in 2020 for $150,000"...and it's listed for $425k w/ builder grade renovations. It's unbelievable. I know the flipper is putting in the work, but they're making $100k or more off of a 3/2 1300sf type house. We're seriously considering renting for a year or so to see if the market settles down. I read an article yesterday saying nationwide home prices are 5.5% over valued, but in specific markets they are 20% or more over valued. Florida is going crazy w/ overinflated prices.

[h=1]Is the U.S. housing market heading for a crash? Here’s what the experts say[/h]

https://www.marketwatch.com/story/i...hat-the-experts-say-11619023745?siteid=yhoof2

Home prices in Idaho (30%-34%) and Nevada (25%-29%) are “becoming more unsustainably inflated while Texas (15%-19%) has become frothier over the last year. “What’s more, markets like Rhode Island and Washington (both 10%-14% overvalued) that have traditionally experienced more sustainable house-price increases “are now seeing similar disconnects between home price growth and economic fundamentals in place to support the rate of growth,”

I'd like to do a flip or two down the road....if (or when) the market settles back down. Right now there's no real deals to be had. I see a lot of homes that are being flipped, but I think those are people who have an inside connection w/ a broker and they're find deals (on places that are real dumps). On realtor.com you can see when the house was last sold, and I'm seeing "last sold in 2020 for $150,000"...and it's listed for $425k w/ builder grade renovations. It's unbelievable. I know the flipper is putting in the work, but they're making $100k or more off of a 3/2 1300sf type house. We're seriously considering renting for a year or so to see if the market settles down. I read an article yesterday saying nationwide home prices are 5.5% over valued, but in specific markets they are 20% or more over valued. Florida is going crazy w/ overinflated prices.

Is the U.S. housing market heading for a crash? Here’s what the experts say

https://www.marketwatch.com/story/i...hat-the-experts-say-11619023745?siteid=yhoof2

Home prices in Idaho (30%-34%) and Nevada (25%-29%) are “becoming more unsustainably inflated while Texas (15%-19%) has become frothier over the last year. “What’s more, markets like Rhode Island and Washington (both 10%-14% overvalued) that have traditionally experienced more sustainable house-price increases “are now seeing similar disconnects between home price growth and economic fundamentals in place to support the rate of growth,”

The market is on fire..we looked at a place yesterday that we'll pass on because of price and the shape it's in.... our realitor says he could see a 20% drop this year in some markets.

If you're gonna do a flip look for a fairy dust flip to start....Paint, floors, new carpets, yards or other thing you can easily sub out ..Like a bad roof.

I did a 120 YO victorian house in LA..I took years because of code upgrades and it was broken beyond the beyond.... bought in 2008 for 425.000 sold 12 years later for X3 .. I had renters for 8 years..I'd never bite off a project like that again.

I was ready to sell in 2012 but market in my area took a bit to catch on fire...short is you can do well with smaller properties without huge a capital outlay if you pick the right house....

If you're interested I have two books that are essential reference for fix it projects with up to date codes..I don't do much without them.

Hopefully you find a deal in Florida CB and have a good weekend.

The market is on fire..we looked at a place yesterday that we'll pass on because of price and the shape it's in.... our realitor says he could see a 20% drop this year in some markets.

If you're gonna do a flip look for a fairy dust flip to start....Paint, floors, new carpets, yards or other thing you can easily sub out ..Like a bad roof.

I did a 120 YO victorian house in LA..I took years because of code upgrades and it was broken beyond the beyond.... bought in 2008 for 425.000 sold 12 years later for X3 .. I had renters for 8 years..I'd never bite off a project like that again.

I was ready to sell in 2012 but market in my area took a bit to catch on fire...short is you can do well with smaller properties without huge a capital outlay if you pick the right house....

If you're interested I have two books that are essential reference for fix it projects with up to date codes..I don't do much without them.

Hopefully you find a deal in Florida CB and have a good weekend.

That was a nice turnaround on the Victorian! If we ever do it, we'd likely buy homes that we could sell for ~$300k (so ideally we'd get it for under $200k). I've flipped on property, back in 2005 before the crash. I'd be interested in the books you mentioned.

It's nice here in DC today. Hope you have a good weekend.

copy and pasting;

GREED

In Oliver Stone’s classic movie, Wall Street, the protagonist and iconic character, Gordon Gekko, famously declared “greed, for lack of a better word, is good. Greed is right. Greed works”, while providing an impassioned monologue on the merits of capitalism.

We’re all susceptible to greed in some form or degree. If greed pushes us to study and work harder, save more and gives us drive, then it can be a good thing. But as the saying goes, “too much of a good thing” can lead to disaster and financial ruin.

Well, we’ve seen yet another example on Wall Street of extreme greed that brought down a billionaire hedge fund manager in a matter of days. Bloomberg wrote a big piece on this individual perfectly titled “How to Lose $20 billion in 2 days”.

Today I’m going to discuss the story of hedge fund manager, Bill Hwang, and how his greed and avarice led to him blowing up and wiping away billions of dollars of capital in a matter of days.

Mr. Hwang started his investing career as a stock salesman in the 1990s but then moved up to be an investment analyst working for a well-known and well-respected hedge fund manager Julian Robertson, who ran a fund called Tiger Management.

Bill and a number of other analysts (notably Catherine Wood of Ark Funds) learned the tricks of successful stock investing and ultimately went out on his own to start the hedge fund company, Tiger Asset Management. There he made billions based on his aggressive stock trading strategies, but at an expense, when Mr. Hwang was caught up in some shady insider trading stuff that led to him getting fined for insider trading and being banned from trading Hong Kong stocks for a number of years.

Following this misadventure he changed Tiger Asia Management into a ‘family office’ investment shop (what many hedge fund managers do after getting caught doing something illegal), called Archegos Capital Management. This is when things went sideways.

Initially he was very successful, quietly amassing an incredible net worth of over US$10 billion dollars. Apparently, this wasn’t enough for him as he then leveraged up this capital, multiple times over, amassing a stock portfolio estimated at over US$100 billion dollars.

Below is one of the stocks that he bet on huge, with Viacom surging from a low of $11/share last March to a peak of $100 by March of this year. According to Bloomberg and other news outlets, he used margin to leverage up his bets on Viacom and other stocks, while also using a derivative product called a total return swap. With total return swaps you don’t own the underlying stock, but make or lose money based on the daily price changes of the stock. If the stock is down on the day, then Bill would need to cover this decline with his broker.

Leverage can help goose stock returns but just as easy it can compound losses as Bill borrowed more and more from his prime brokers, while also obfuscating his massive concentrated stock exposures, through these swap contracts.

This was working just fine until Viacom announced a big stock sale, taking advantage of the big move in the stock price, and the shares dropped like a stone taking Bill and his portfolio along with it. As the stocks fell further and further his brokers (Morgan Stanley, Goldman Sachs and many more) then forced him to cover the loans, which he could not do, leading him to default and in ruin.

And the losses keep piling up across Wall Street with Morgan Stanley, Credit Suisse and many other banks taking huge losses in the quarter as they unwound their positions and closed out the risk. Credit Suisse, once again is knee deep in it with losses so far totaling US$5 billion, but the pain is wide spread across the banking sector.

What is the point of this story?

Control your greed and risk taking! First, excessive greed is generally an unattractive human trait in my opinion. Second, it can cause you to make mistakes, taking on way more risk than you realize or is appropriate, all potentially leading to downfall and tears.

....................................................

kinda amazing the banks expose themselves to that much risk, surely they knew how levered he was

GREED

In Oliver Stone’s classic movie, Wall Street, the protagonist and iconic character, Gordon Gekko, famously declared “greed, for lack of a better word, is good. Greed is right. Greed works”, while providing an impassioned monologue on the merits of capitalism.

We’re all susceptible to greed in some form or degree. If greed pushes us to study and work harder, save more and gives us drive, then it can be a good thing. But as the saying goes, “too much of a good thing” can lead to disaster and financial ruin.

Well, we’ve seen yet another example on Wall Street of extreme greed that brought down a billionaire hedge fund manager in a matter of days. Bloomberg wrote a big piece on this individual perfectly titled “How to Lose $20 billion in 2 days”.

Today I’m going to discuss the story of hedge fund manager, Bill Hwang, and how his greed and avarice led to him blowing up and wiping away billions of dollars of capital in a matter of days.

Mr. Hwang started his investing career as a stock salesman in the 1990s but then moved up to be an investment analyst working for a well-known and well-respected hedge fund manager Julian Robertson, who ran a fund called Tiger Management.

Bill and a number of other analysts (notably Catherine Wood of Ark Funds) learned the tricks of successful stock investing and ultimately went out on his own to start the hedge fund company, Tiger Asset Management. There he made billions based on his aggressive stock trading strategies, but at an expense, when Mr. Hwang was caught up in some shady insider trading stuff that led to him getting fined for insider trading and being banned from trading Hong Kong stocks for a number of years.

Following this misadventure he changed Tiger Asia Management into a ‘family office’ investment shop (what many hedge fund managers do after getting caught doing something illegal), called Archegos Capital Management. This is when things went sideways.

Initially he was very successful, quietly amassing an incredible net worth of over US$10 billion dollars. Apparently, this wasn’t enough for him as he then leveraged up this capital, multiple times over, amassing a stock portfolio estimated at over US$100 billion dollars.

Below is one of the stocks that he bet on huge, with Viacom surging from a low of $11/share last March to a peak of $100 by March of this year. According to Bloomberg and other news outlets, he used margin to leverage up his bets on Viacom and other stocks, while also using a derivative product called a total return swap. With total return swaps you don’t own the underlying stock, but make or lose money based on the daily price changes of the stock. If the stock is down on the day, then Bill would need to cover this decline with his broker.

Leverage can help goose stock returns but just as easy it can compound losses as Bill borrowed more and more from his prime brokers, while also obfuscating his massive concentrated stock exposures, through these swap contracts.

This was working just fine until Viacom announced a big stock sale, taking advantage of the big move in the stock price, and the shares dropped like a stone taking Bill and his portfolio along with it. As the stocks fell further and further his brokers (Morgan Stanley, Goldman Sachs and many more) then forced him to cover the loans, which he could not do, leading him to default and in ruin.

And the losses keep piling up across Wall Street with Morgan Stanley, Credit Suisse and many other banks taking huge losses in the quarter as they unwound their positions and closed out the risk. Credit Suisse, once again is knee deep in it with losses so far totaling US$5 billion, but the pain is wide spread across the banking sector.

What is the point of this story?

Control your greed and risk taking! First, excessive greed is generally an unattractive human trait in my opinion. Second, it can cause you to make mistakes, taking on way more risk than you realize or is appropriate, all potentially leading to downfall and tears.

....................................................

kinda amazing the banks expose themselves to that much risk, surely they knew how levered he was

money talks i guess , i never pity the banks .

Hwang is a smart dude - economics degree from UCLA, MBA at Carnegie Mellon and it appears was quite charitable. HOW can a guy of this intellect/experience have such a concentrated , levered postion before an earnings date? Can't wrap my head around this . He blocked out the risks? Its fuckin nuts-- way past greed into hubris ?

Hwang is a smart dude - economics degree from UCLA, MBA at Carnegie Mellon and it appears was quite charitable. HOW can a guy of this intellect/experience have such a concentrated , levered postion before an earnings date? Can't wrap my head around this . He blocked out the risks? Its fuckin nuts-- way past greed into hubris ?

I got a margin call during the dot com bubble..managed to turn 10K into 300k than back to 10k quickly while making hundreds of trades with the help of an nutball broker...youth but mainly greed was my downfall...Hard lesson.

|

I'd sorta blocked this out..crazy days in the market the run up was unreal and the drop..wow...I thought I was going to retire way early..ummm, NO.

https://www.warriortrading.com/dotcom-bubble/

https://www.warriortrading.com/dotcom-bubble/

|

|

| Global Market Comments April 26, 2021 Fiat Lux Featured Trade: (MARKET OUTLOOK FOR THE WEEK AHEAD, or THE CORRECTION IS OVER) (PAVE), (NFLX), (AAPL), (AMD), (NVDA), (ROKU), (AAPL), (AMZN), (MSFT), (FB), (GOOGL), (TSLA), (KSU), (CP), (GS), (UNP) (LEN), (KBH), (PHM)

|

| � |

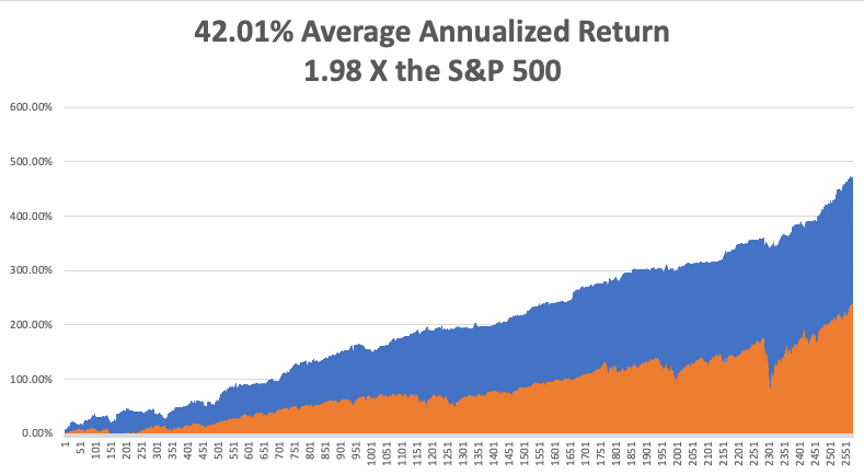

The Market Outlook for the Week Ahead, or The Correction is OverThis is a classic example of if it looks like a duck and quacks like a duck, it’s definitely not a duck….it’s a giraffe. In stock market parlance, that means we have just suffered an eight-month correction which is now over. Look at the charts and a correction is nowhere to be found. The largest pullback we have seen in the past year has been a scant 12% dip right before the presidential election. If that’s all the pain we have to suffer to be rewarded with an 80% gain, I’ll take that all day long. Instead, what we have seen has been a series of sector-specific rolling corrections that were masked by the indexes that were steadily grinding up. During this time, the best quality stocks endured pretty dramatic hits, like Netflix (NFLX) (-21%), Apple (AAPL) (-26%), Advanced Micro Devices (AMD) (-25%), NVIDIA (NVDA) (-28%), and Roku (ROKU) (-40%). Stocks sold off hard after Q1 earnings. They are doing the same now with Q2 earnings. That ends on Tuesday after the close when the 800-pound gorilla of them all announces on Wednesday, April 28. After that, we could be in for another leg in the bull market that could take us up by 10% by the summer. Some 85% of all companies are now beating forecasts handily. But half are seeing shares fall after the announcement. That shows how professional the market is getting. So, if you eliminate the earnings announcement, you eliminate the share falls? This is all in the face of economic growth predictions of lifetime proportions. Analysts are now looking for 43% earnings growth in Q2, 55% in Q3, and 75% in Q4. These are WWII-type numbers. And the Fed put is still good at the bank. Jerome Powell is promising no rate rises until 2023 on an almost daily basis. It all sets up a continuing pattern of sideways “time” corrections like we’ve just seen followed by frenetic legs up to new highs. This could go on for years. It worked last time. The coming week should be quite a blockbuster. It is only the fifth time in history that the five largest stocks in the S&P 500 accounting for 25% of the market cap all report in the same week. These are Apple (AAPL), Amazon (AMZN), Microsoft (MSFT), Facebook (FB), and Alphabet (GOOGL). That’s going to leave a mark! Biden’s rumored proposal that high-end earners will see doubled capital gains taxes knocked 500 points of the Dow in seconds. The new tax would apply to Americans earning a net income of $1 million or more. Never mind that congress would have to approve the move first, as Trump found out to his chagrin. It’s a trial balloon that was shot down immediately. Trump had planned to cut capital gains to a 15% rate and run a bigger deficit. It would only apply to Americans who own stocks and never sell. Guess why? To avoid taxes, dummy! US Stock Funds take in a record $157 billion in March. That beats the record $144 billion that came in during February. Warning: these massive cash flows are consistent with short-term market tops. Vanguard and iShares index funds took in far and away the most money. The Global X US Infrastructure Fund (PAVE) was one of the most popular directed funds. The labor shortage is on, with companies engaging in mass hiring and paying signing bonuses for low-end jobs. I was awoken by workers putting up a fence next door on a Saturday morning. They’re working weekends to pay back the debts they ran up last year to keep eating. If you are planning any jobs this year, buy the materials now. The country will be out of everything in three months, with current quarter GDP topping a historic 10%. SPACS have crashed, with the average SPAC down 23% since the February top, and some like Virgin Galactic Holdings off by 50%. Don’t touch these things with a ten-foot pole, as 80% will go under or shut down with no investments. It reminds me of five online pet food companies at the Dotcom Bubble top. It's all a symptom of too much cash flooding the financial system. Takeover battle for Kansas City Southern (KSU) ensues, with Canadian Nation making a sweeter $33.7 billion offer than Canadian Pacific’s (CP) $30 billion bid. It just shows how valuable railroads really are in a booming economy that urgently needs to move a lot of stuff. Good thing I’m long (UNP). Is the Reading Railroad still available? How about the B&O or the Short Line? Yellen sets Zero Emissions Target for 2035. That sets up one of the biggest investment opportunities of the century. The trick is to find companies that have viable technologies that can make a stand-alone profit that haven’t already gone up ten times, like Tesla (TSLA). Most of the new EV IPOs aren’t going to make it. This will be a major focus of Mad Hedge research going forward. I hope I live that long! Existing Home Sales down 12.3% YOY, down 3.7% in March, to 6.03 million units. Prices are up 17.02% YOY, the highest on record. Sales of homes over $1 million are up 108%. Inventory is still the issue, down to only 1.07 million units, off 28% in a year. Truly stunning numbers. New Home Sales up a ballistic 20.7% YOY in March on a signed contracts basis. This is in the face of rising home mortgage interest rates. The flight to the suburbs continues. Homebuilder stocks took off like a scalded chimp. Buy (LEN), (KBH), and (PHM) on dips. When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% to 120,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 120,000 here we come! My Mad Hedge Global Trading Dispatch profit reached 9.48% gain during the first half of April on the heels of a spectacular 20.60% profit in March. I used the dip early in the week to add two more positions in Goldman Sachs (GS) and Union Pacific (UNP). I suffered a day of buyer’s remorse on Thursday when Biden floated his capital gains plan and tanked the Dow by 500 points. Then everything took off like a rocket to new highs on Friday. That leaves me 80% invested and 20% in cash. The markets went up too fast to get the last match of money in the market. My 2021 year-to-date performance soared to 53.57%. The Dow Average is up 12.3% so far in 2021. That brings my 11-year total return to 476.12%, some 2.00 times the S&P 500 (SPX) over the same period. My 11-year average annualized return now stands at an unbelievable 42.01%, the highest in the industry. My trailing one-year return exploded to positively eye-popping 132.09%. I truly have to pinch myself when I see numbers like this. I bet many of you are making the biggest money of your long lives. We need to keep an eye on the number of US Coronavirus cases at 31.9million and deaths topping 570,000, which you can find here. The coming week will be big on the data front, with a couple of historic numbers expected. On Monday, April 26, at 8:30 AM, US Durable Goods for March are out. Earnings for Tesla (TSLA) and NXP Semiconductors (NXP) are out. On Tuesday, April 27, at 9:00 AM, we learn the S&P Case Shiller National Home Price Index for February. We also get earnings for Alphabet (GOOGL), Microsoft (MSFT), and Visa (V). On Wednesday, April 28 at 2:00 PM, The Fed Open Market Committee releases its Interest Rates Decision. The following press conference is more important. Apple (AAPL), Boeing (BA), and QUALCOMM (QCOM) earnings are out. On Thursday, April 29 at 8:30 AM, the Weekly Jobless Claims are printed. We also obtain the blockbuster US GDP for Q1. Amazon (AMZN), Caterpillar (CAT, and Merck (MRK) release earnings. On Friday, April 30 at 8:30 AM, we get US Personal Income and Spending for March. Exxon Mobile (XOM) and Chevron (CVX) release earnings. Berkshire Hathaway (BRK/B) announces the next day. At 2:00 PM, we learn the Baker-Hughes Rig Count. As for me, after telling you last week why I walked so funny, let me tell you the other reason. In 1987, to celebrate obtaining my British commercial pilot’s license, I decided to fly a tiny single-engine Grumman Tiger from London to Malta and back. It turned out to be a one-way trip. Flying over the many French medieval castles was divine. Flying the length of the Italian coast at 500 feet was fabulous, except for the engine failure over the American airbase at Naples. But I was a US citizen, wore a New York Yankees baseball cap, and seemed an alright guy, so the Air Force fixed me up for free and sent me on my way. Fortunately, I spotted the heavy cable connecting Sicily with the mainland well in advance. I had trouble finding Malta and was running low on fuel. So I tuned into a local radio station and homed in on that. It was on the way home that the trouble started. I stopped by Palermo in Sicily to see where my grandfather came from and to search for the caves where my great-grandmother lived during the waning days of WWII. Little did I know that Palermo was the worst wind shear airport in Europe. My next leg home took me over 200 miles of the Mediterranean to Sardinia. I got about 50 feet into the air when a 70-knot gust of wind flipped me on my side perpendicular to the runway and aimed me right at an Alitalia passenger jet with 100 passengers awaiting takeoff. I managed to level the plane right before I hit the ground. I heard the British pilot say on the air “Well, that was interesting.” Giant fire engines descended upon me, but I was fine, sitting on my cockpit, admiring the tree that had suddenly sprouted through my port wing. Then the Carabinieri arrested me for endangering the lives of 100 Italian tourists. Two days later, the Ente Nazionale per l’Avizione Civile held a hearing and found me innocent, as the wind shear could not be foreseen. I think they really liked my hat, as most probably had distant relatives in New York. As for the plane, the wreckage was sent back to England by insurance syndicate Lloyds of London, where it was disassembled. Inside the starboard wing tank, they found a rag which the American mechanics in Naples had left by accident. If I had continued my flight, the rag would have settled over my fuel intake vavle, cut off my gas supply, and I would have crashed into the sea and disappeared forever. Ironically, it would have been close to where French author Antoine de St.-Exupery (The Little Prince) crashed in 1945. In the end, the crash only cost me a disk in my back, which I had removed in London and led to my funny walk. Sometimes, it is better to be lucky than smart. Stay healthy. John Thomas CEO & Publisher The Diary of a Mad Hedge Fund Trader

|

Quote of the Day“Of course, you never go broke taking a profit, but you never get rich either, because a good portion of what you make goes to taxes,” said legendary value investor Ron Baron.

|

|

|---|

April 27, 2021 Continue reading the main story |

| Good morning. (Was this newsletter forwarded to you? Sign up here.) |

|

| [h=2]Tesla, the emission credits and crypto company[/h] |

| The electric carmaker posted record quarterly earnings yesterday, beating Wall Street forecasts. But a closer look shows that its core business — you know, making vehicles — wasn’t the only story, and that might be why the company’s stock fell in aftermarket trading. |

|

| Tesla reported a quarterly profit of $438 million, its highest ever. But financial maneuvers flattered this number: |

|

|

| The business of selling cars is headed in the right direction, but faces supply problems. Vehicle deliveries came to 184,000, ahead of expectations, even as sales of Model S and X cars fell ahead of lineup revamps. But Elon Musk, Tesla’s C.E.O. (or, fine, “Technoking,” if we must), conceded that problems in sourcing components — notably, the global shortage of computer chips — had led to “some of the most difficult supply-chain challenges that we’ve ever experienced.” The real pinch may come in the second quarter, so it’s a good thing that Tesla has so many other businesses to fall back on. |

| Safety issues could be a bigger, long-term risk. Tesla is still dealing with an investigation into a fatal crash in Texas this month involving one of its vehicles, in which the police say no one was behind the wheel. Tesla’s chief engineer cited new evidence yesterday that potentially contradicts that claim. And the company is trying to put out a P.R. crisis in China, after the state news media accused it of “being arrogant” in its handling of a customer’s complaints about her car’s brakes. |

| [h=3]PAID POST: A MESSAGE FROM DARKTRACE[/h]Cybersecurity: Not a Human-Scale Problem With the World Economic Forum warning of ‘’A.I.-enabled threats,” humans are struggling to keep pace. Autonomous Cyber AI interrupts in-progress cyberattacks in seconds – wherever they strike. LEARN HOW > |

|

| [h=3]HERE’S WHAT’S HAPPENING[/h] |

| The U.S. will donate AstraZeneca vaccine doses to India. President Biden will send up to 60 million doses to help India quell its Covid-19 crisis, though only after U.S. officials test them for safety. Tech giants — including Google and Microsoft, both led by Indian-born executives — will also send supplies and funds to help. |

| U.S. population growth has slowed substantially. New Census Bureau datashowed the second-slowest rate since 1790, as birthrates and immigration declined. The bureau also reported big changes to the political map, with the South and West gaining seats in Congress and New York, California and the Midwest losing representation. |

| The I.R.S. may get more money to go after tax evasion. Mr. Biden will propose giving the agency an extra $80 billion and additional authority to catch cheating by the wealthy and big corporations, The Times’s Jim Tankersley reports. Administration officials believe that could help raise $700 billion, which would assist in financing Mr. Biden’s infrastructure plans. |

| Et tu, UBS? The Swiss banking giant said it had lost $774 million from its exposure to Archegos, becoming yet another financial giant to be hurt by the investment fund’s meltdown. Nomura calculated its total hit from Archegos to be $2.3 billion and said it had mostly closed out its trading positions related to the firm. |

| Apple will build a $1 billion base in North Carolina. The iPhone maker said its new campus would have 3,000 employees, including software engineers. It’s the latest outpost for Apple outside California: The company is also opening a campus in Austin, Texas, next year. |

| [h=2]Peculiar alliances for divided times[/h] |

| A Supreme Court case argued yesterday has created strange bedfellows, which did not escape the attention of the justices. The matter pits charities against the state of California over donor disclosure requirements, and it’s a dispute over a seemingly small technical issue which some say has serious implications for political donations. It has turned groups that are often on opposite sides of political fights into — tentative — allies. |

| Nonprofits “across the ideological spectrum” filed briefs supporting the petitioners, the Koch-backed charity Americans for Prosperity Foundation, Justice Brett Kavanaugh noted. The foundation argues that California violates the constitutionally protected right to anonymous association by collecting major donor data and failing to protect it (the state’s website has experienced security breaches). Justice Kavanaugh cited a filing from the A.C.L.U., the N.A.A.C.P. Legal Defense and Education Fund and others who all agreed that “a critical corollary of the freedom to associate is the right to maintain the confidentiality of one’s associations.” |

| “Certainly, we don’t see eye to eye with the petitioners in this case on every issue,” Brian Hauss of the A.C.L.U. said at a news conference after arguments at the court. In this case, it’s standing with the Americans for Prosperity Foundation because of what it calls California’s “systemic incompetence” in failing to protect nonpublic data. Legally speaking, however, it recognized a distinction between public disclosure and nonpublic disclosure. In other words, the brief didn’t argue for a general extension of anonymity. |

| Opponents say this is a case about “dark money.” Democratic senators argued in an amicus brief that the foundation is advancing the matter as a way to make it easier for special interests to influence politics with untraceable money. “This case is really a stalking horse for campaign finance disclosure laws,” Justice Stephen Breyer said. A ruling is expected in June. |

| [h=2]“Facebook isn’t in control of its own destiny.”[/h] |

| — Brian Wieser, president of business intelligence at GroupM, on the leverage that Apple has over Facebook. Apple’s Tim Cook and Facebook’s Mark Zuckerberg have increasingly been at odds, most recently over a new privacy feature Apple launched this week that gives users more control over how apps (like Facebook’s) can track them. |

| [h=2]Blockchain for the long term[/h] |

| Amid the recent cryptocurrency frenzy, many people wonder whether it’s time to buy Bitcoin or mint an NFT and whether it’s too late to get rich quick. The Ethiopian government is also getting into blockchain in a big way — but it’s thinking longer term. Today, along with the software company IOHK, it launched the world’s biggest blockchain deployment to date, the partners say, involving five million students. |

| “We believe blockchain offers a key opportunity to end digital exclusionand widen access to higher education and employment,” Getahun Mekuria, Ethiopia’s education minister, said in a statement about the project hosted on the IOHK-backed, open-source Cardano platform. The project, which DealBook is first to report, will give students tools, identifications and access to a unified records system that allows rural and indigent young people to have the same system as others. |

| What’s Cardano? Charles Hoskinson, IOHK’s co-founder, is among the founders of Ethereum, the second-most valuable cryptocurrency after Bitcoin. He left in 2014 with a mission to bolster crypto’s intellectual underpinnings and advance blockchain’s reach around the world, emphasizing things like security and governance. IOHK does work for institutions, backs academic research on blockchain and supports the Cardano platform, the issuer of the sixth-most valuable cryptocurrency, ADA. Cardano’s critics say the platform’s valuation is mystifying because development has been sluggish. Hoskinson described his approach to DealBook by citing the axiom “To go fast, go slow.” |

| [h=2]The resistance to the resistance[/h] |

| Basecamp, a company that makes productivity software, said yesterday that it had “made some internal changes,” including a ban on talking about politics at work. “Every discussion remotely related to politics, advocacy or society at large quickly spins away from pleasant,” Jason Fried, Basecamp’s C.E.O., wrote in a blog post. “You shouldn’t have to wonder if staying out of it means you’re complicit, or wading into it means you’re a target.” |

| Basecamp’s move echoes a ban on talking politics at Coinbase, which Brian Armstrong, the C.E.O. of Coinbase, enacted in September, prompting dozens of employees to leave the company. Surveys suggest that a large portion of employees believe that the companies they work for should speak up on social issues. Basecamp’s new policy is one of the least hedged signals yet that the feeling is not always mutual. |

| Both C.E.O.s framed it as removing distractions but carved out exceptions for issues they consider relevant to their businesses. “If there is a bill introduced around crypto, we may engage here,” Mr. Armstrong wrote last year, while Basecamp’s co-founder David Hansson wrote yesterday that the company might engage on “topics like antitrust, privacy, employee surveillance.” Both moves were immediately met with a mix of admiration and criticism, with supporters saying the policies are good for business and detractors arguing that choosing to abstain from politics is inherently political and probably impossible to enforce. |

| The timing of these announcements is probably no accident, following a surge of employee activism and corporate action on social issues. Basecamp’s move — notable because its founders have long evangelized the company’s worker-friendly culture in books and blog posts — is the latest sign that some companies may want to pull the pendulum back. |

|

| Thank you for your support. Want to share The New York Times? Friends and family can enjoy unlimited digital access to our journalism with this special offer. |

| [h=3]THE SPEED READ[/h] |

| Deals |

|

|

| Politics and policy |

|

| Tech |

|

| Best of the rest |

|

| Thanks for reading! We’ll see you tomorrow. |

| We’d like your feedback! Please email thoughts and suggestions to dealbook@nytimes.com. |

|

|

|

|

|

|

| Andrew Ross Sorkin, Founder/Editor-at-Large, New York @andrewrsorkin |

| Jason Karaian, Editor, London @jkaraian |

| Sarah Kessler, Deputy Editor, Chicago @sarahfkessler |

| Michael J. de la Merced, Reporter, London @m_delamerced |

| Lauren Hirsch, Reporter, New York @LaurenSHirsch |

| Ephrat Livni, Reporter, Washington D.C. @el72champs |

| � |

Global Market Comments

April 27, 2021

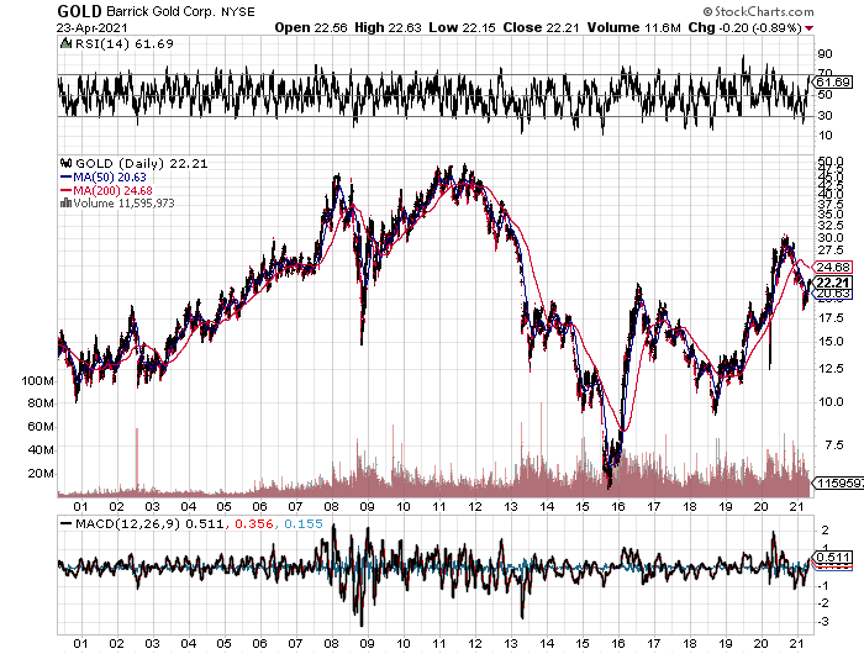

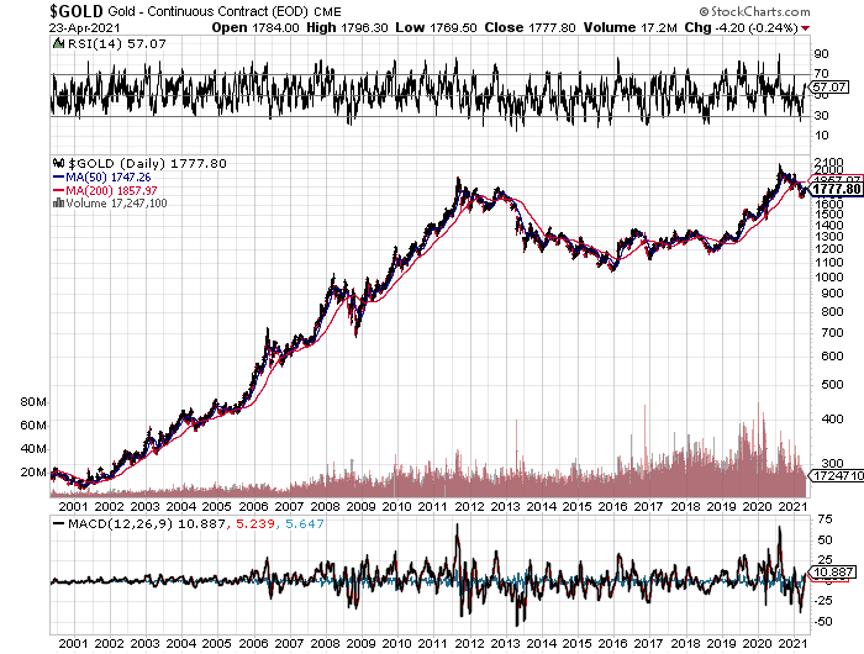

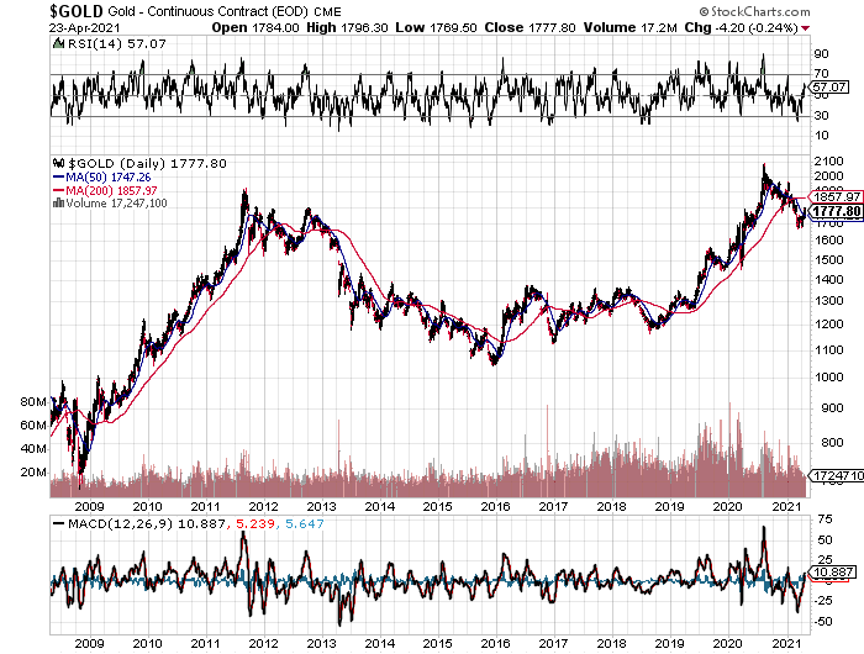

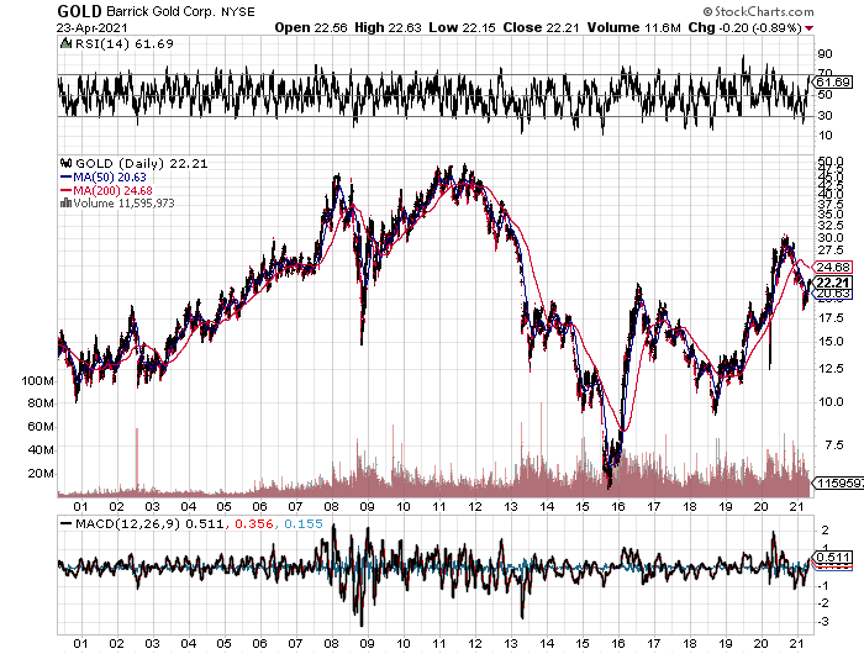

Fiat LuxFeatured Trade:(THE SECRET FED PLAN TO BUY GOLD),

(GLD), (GDX), (PALL), (PPLT),

(TESTIMONIAL)

April 27, 2021

Fiat LuxFeatured Trade:(THE SECRET FED PLAN TO BUY GOLD),

(GLD), (GDX), (PALL), (PPLT),

(TESTIMONIAL)

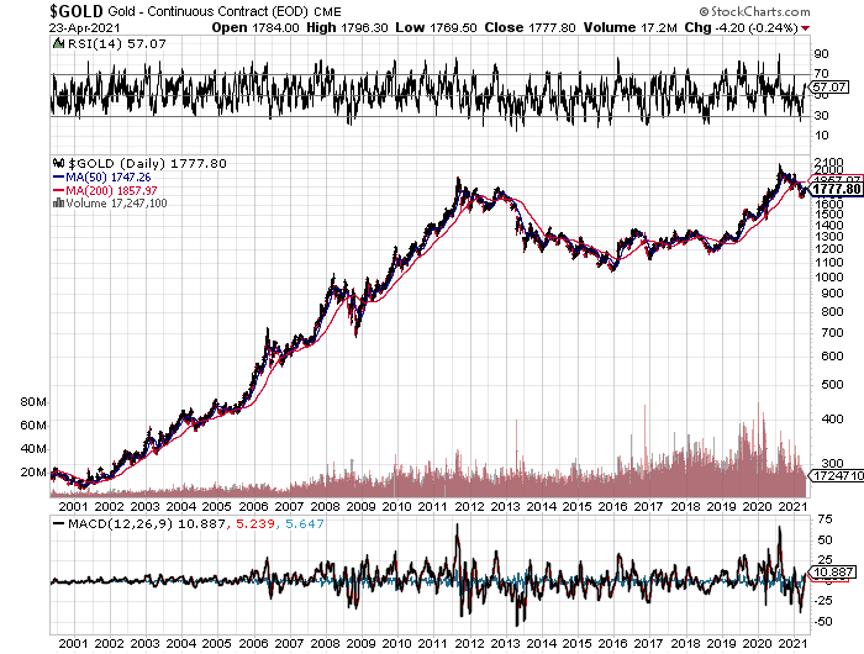

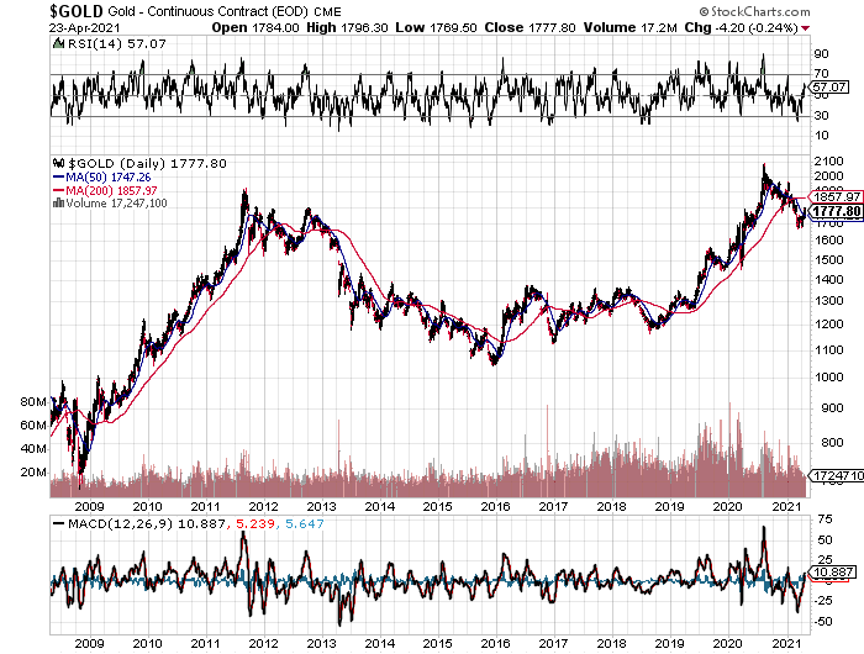

The Secret Fed Plan to Buy GoldWith the latest effort to expand quantitative easing through the Fed purchase of individual corporate bonds, we must consider what else our central bank has up its sleeve.

With American interest rates already near zero, the markets will take the rates for all interest-bearing securities well into negative numbers. This has already happened in Japan and Germany.

At that point, our central bank’s primary tool for stimulating US businesses will become utterly useless, ineffective, and impotent.

What else is in the tool bag?

How about large-scale purchases of Gold (GLD)?

You are probably as shocked as I am with this possibility. But there is a rock-solid logic to the plan. As solid as the vault at Fort Knox.

This theory gained credence when my old friend, Judy Shelton, was appointed to the federal reserve, a noted gold bug.

The idea is to create asset price inflation that will spread to the rest of the economy. It already did this with great success from 2009-2014 with quantitative easing, whereby almost every class of debt securities were hoovered up by the government.

“QE on steroids”, to be implemented only after overnight rates go negative, would involve large-scale purchases of not only gold, but stocks, government bonds, and exchange-traded funds as well. Corporate bond purchases are simply a step in that direction.

If you think I’ve been smoking California’s largest cash export (it’s not the raisins) you would be in error. I should point out that the Japanese government is already pursuing QE to this extent, at least in terms of equity-type investments and ETFs, and already owns a substantial part of the Japanese stock market.

And, as the history buff that I am, I can tell you that it has been done in the US as well, with tremendous results.

If you thought that President Obama had it rough when he came into office in 2009 with the Great Recession on, it was nothing compared to what Franklin Delano Roosevelt inherited.

The country was in its fourth year of the Great Depression. US GDP had cratered by 43%, consumer prices crashed by 24%, the unemployment rate was 25%, and stock prices vaporized by 90%. Mass starvation loomed.

Drastic measures were called for.

FDR issued Executive Order 6102 banning private ownership of gold, ordering them to sell their holdings to the US Treasury at a lowly $20.67 an ounce.

He then urged Congress to pass the Gold Reserve Act of 1934, which instantly revalued the government’s holdings at $35.00, an increase of 69.32%. These and other measures caused the value of America’s gold holdings to leap from $4 to $12 billion. That’s a lot of money in 1934 dollars, about $208 billion in today’s money.

Since the US was still on the gold standard back then, this triggered an instant dollar devaluation of more than 50%. The high gold price sucked in massive amounts of the yellow metal from abroad creating, you guessed it, inflation.

The government then borrowed massively against this artificially created wealth to fund the landscape-altering infrastructure projects of the New Deal.

It worked.

During the following three years, the GDP skyrocketed by 48%, inflation eked out a 2% gain, the unemployment rate dropped to 18%, and stocks jumped by 80%. Happy days were here again.

Monetary conditions are remarkably similar today to those that prevailed during the last government gold buying binge.

There has been a de facto currency war underway since 2009. The Fed started when it launched QE, and Japan, Europe, and China have followed. Blue-collar unemployment and underpayment are at a decades high. The need for a national infrastructure program is overwhelming.

However, in the 21[SUP]st[/SUP] century version of such a gold policy, it is highly unlikely that we would see another gold ownership ban.

Instead, the Fed would most likely move into the physical gold market, sitting on the bid for years, much like it recently did in the Treasury bond market for five years. Gold prices would increase by a multiple of current levels.

It would then borrow against its new gold holdings, plus the 4,176 metric tonnes worth $200 billion at today’s market prices already sitting in Fort Knox, to fund a multi trillion-dollar infrastructure spending program.

Heaven knows we need it. Millions of blue-collar jobs would be created, and inflation would come back from the dead.

Yes, this all sounds like a fantasy. But negative interest rates were considered an impossibility only years ago.

The Fed’s move on gold would be only one aspect of a multi-faceted package of desperate last-ditch measures to extend economic growth into the future which I outlined in a previous research piece (click here for “What Happens When QE Fails” by clicking here).

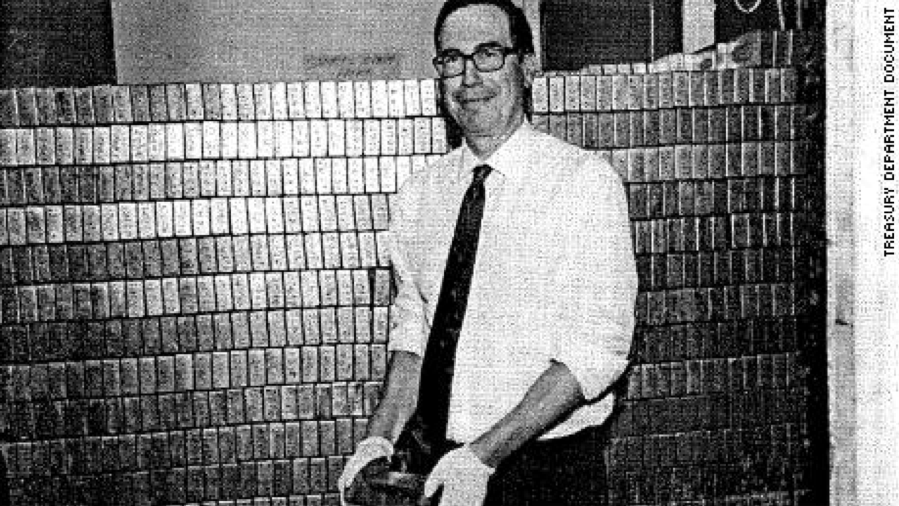

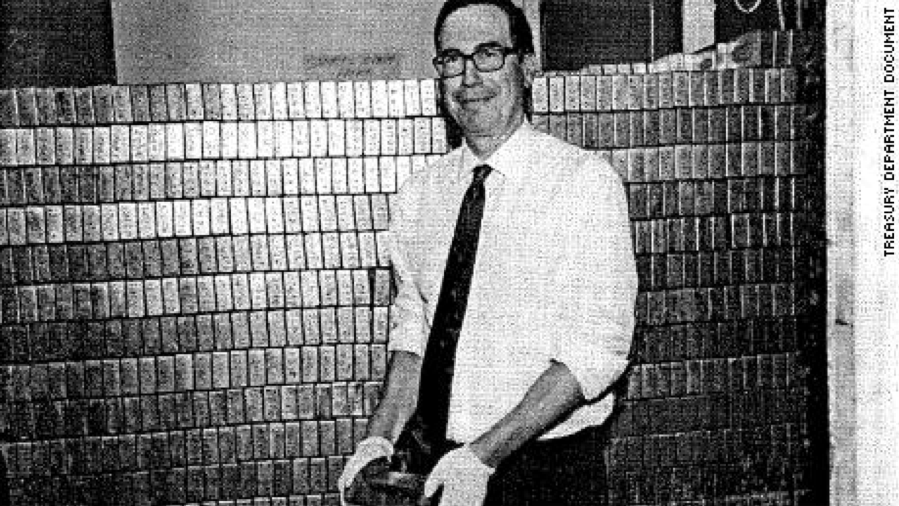

That’s assuming that the gold is still there. Treasury Secretary Stephen Mnuchin says he saw the gold himself during an inspection that took place on the last solar eclipse over Fort Knox in 2018. The door to the vault at Fort Knox had not been opened since September 23, 1974.

But then Steve Mnuchin says a lot of things. Persistent urban legends and internet rumors claim that the vault is actually empty or filled with fake steel bars painted gold.

But is it Really Gold?

But is it Really Gold?

[h=2]

[/h]

[/h]

With American interest rates already near zero, the markets will take the rates for all interest-bearing securities well into negative numbers. This has already happened in Japan and Germany.

At that point, our central bank’s primary tool for stimulating US businesses will become utterly useless, ineffective, and impotent.

What else is in the tool bag?

How about large-scale purchases of Gold (GLD)?

You are probably as shocked as I am with this possibility. But there is a rock-solid logic to the plan. As solid as the vault at Fort Knox.

This theory gained credence when my old friend, Judy Shelton, was appointed to the federal reserve, a noted gold bug.

The idea is to create asset price inflation that will spread to the rest of the economy. It already did this with great success from 2009-2014 with quantitative easing, whereby almost every class of debt securities were hoovered up by the government.

“QE on steroids”, to be implemented only after overnight rates go negative, would involve large-scale purchases of not only gold, but stocks, government bonds, and exchange-traded funds as well. Corporate bond purchases are simply a step in that direction.

If you think I’ve been smoking California’s largest cash export (it’s not the raisins) you would be in error. I should point out that the Japanese government is already pursuing QE to this extent, at least in terms of equity-type investments and ETFs, and already owns a substantial part of the Japanese stock market.

And, as the history buff that I am, I can tell you that it has been done in the US as well, with tremendous results.

If you thought that President Obama had it rough when he came into office in 2009 with the Great Recession on, it was nothing compared to what Franklin Delano Roosevelt inherited.

The country was in its fourth year of the Great Depression. US GDP had cratered by 43%, consumer prices crashed by 24%, the unemployment rate was 25%, and stock prices vaporized by 90%. Mass starvation loomed.

Drastic measures were called for.

FDR issued Executive Order 6102 banning private ownership of gold, ordering them to sell their holdings to the US Treasury at a lowly $20.67 an ounce.

He then urged Congress to pass the Gold Reserve Act of 1934, which instantly revalued the government’s holdings at $35.00, an increase of 69.32%. These and other measures caused the value of America’s gold holdings to leap from $4 to $12 billion. That’s a lot of money in 1934 dollars, about $208 billion in today’s money.

Since the US was still on the gold standard back then, this triggered an instant dollar devaluation of more than 50%. The high gold price sucked in massive amounts of the yellow metal from abroad creating, you guessed it, inflation.

The government then borrowed massively against this artificially created wealth to fund the landscape-altering infrastructure projects of the New Deal.

It worked.

During the following three years, the GDP skyrocketed by 48%, inflation eked out a 2% gain, the unemployment rate dropped to 18%, and stocks jumped by 80%. Happy days were here again.

Monetary conditions are remarkably similar today to those that prevailed during the last government gold buying binge.

There has been a de facto currency war underway since 2009. The Fed started when it launched QE, and Japan, Europe, and China have followed. Blue-collar unemployment and underpayment are at a decades high. The need for a national infrastructure program is overwhelming.

However, in the 21[SUP]st[/SUP] century version of such a gold policy, it is highly unlikely that we would see another gold ownership ban.

Instead, the Fed would most likely move into the physical gold market, sitting on the bid for years, much like it recently did in the Treasury bond market for five years. Gold prices would increase by a multiple of current levels.

It would then borrow against its new gold holdings, plus the 4,176 metric tonnes worth $200 billion at today’s market prices already sitting in Fort Knox, to fund a multi trillion-dollar infrastructure spending program.

Heaven knows we need it. Millions of blue-collar jobs would be created, and inflation would come back from the dead.

Yes, this all sounds like a fantasy. But negative interest rates were considered an impossibility only years ago.

The Fed’s move on gold would be only one aspect of a multi-faceted package of desperate last-ditch measures to extend economic growth into the future which I outlined in a previous research piece (click here for “What Happens When QE Fails” by clicking here).

That’s assuming that the gold is still there. Treasury Secretary Stephen Mnuchin says he saw the gold himself during an inspection that took place on the last solar eclipse over Fort Knox in 2018. The door to the vault at Fort Knox had not been opened since September 23, 1974.

But then Steve Mnuchin says a lot of things. Persistent urban legends and internet rumors claim that the vault is actually empty or filled with fake steel bars painted gold.

You Can See the Upside Breakout Coming Clear as Day

TestimonialThanks for all your help with my trading. Your service is very effective.

As you know I went heavily into some LEAPS two days ago including United Airlines, (UAL), Delta Airlines (DAL), Wynn Resorts (WYNN), MGM Resorts International (MGM), and Simon Property Group (SPG) that have returned as much as a 25% ROI over that short period.

I know two days does not prove anything, but it is a great way to begin a trade.

Thanks again,

John

Seattle, WA

As you know I went heavily into some LEAPS two days ago including United Airlines, (UAL), Delta Airlines (DAL), Wynn Resorts (WYNN), MGM Resorts International (MGM), and Simon Property Group (SPG) that have returned as much as a 25% ROI over that short period.

I know two days does not prove anything, but it is a great way to begin a trade.

Thanks again,

John

Seattle, WA

Quote of the Day"Freedom of the press is only true if you own a press," said A.J. Liebling, a famed journalist for the New Yorker.

This is not a solicitation to buy or sell securities

The Mad Hedge Fund Trader is not an Investment advisor

For full disclosures click here at:

http://www.madhedgefundtrader.com/disclosures

The "Diary of a Mad Hedge Fund Trader"(TM)

and the "Mad Hedge Fund Trader" (TM)

are protected by the United States Patent and Trademark Office

The "Diary of the Mad Hedge Fund Trader" (C)

is protected by the United States Copyright Office

Futures trading involves a high degree of risk and may not be suitable for everyone.