You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Intersting thoughts

- Thread starter Bozzie

- Start date

FOMC tomorrow, event risk. Powell has a history of not pleasing the market , we shall see. If he hints of taking the foot off the pedal? I think it will be a sea of red..

Choose words wisely

Sound like rates stay pinned, but who knows.

How about the Fed buying gold..$ I don't know how accurate he'll be with this but it's interesting, owning the bid w/ the 200 Billion in reserve make's sense.

"Instead, the Fed would most likely move into the physical gold market, sitting on the bid for years, much like it recently did in the Treasury bond market for five years. Gold prices would increase by a multiple of current levels.

It would then borrow against its new gold holdings, plus the 4,176 metric tonnes worth $200 billion at today’s market prices already sitting in Fort Knox, to fund a multi trillion-dollar infrastructure spending program".

wow, 'free' markets doing its thing ....

futures ;

NS - double top , today with a red candle (the day is not done) , lower low, lower high. Despite GOOG crushing it

ES- doji yesterday indecision, ..today, inside candle with a very very tight range

clearly the market is waiting on Powel

2 pm -statement read , algos likely to spike immediately ,..then a chat after (will Powell , yet AGAIN, put his foot in his mouth?), so that initial reaction may not last/and or gain steam . Could , of course, be a nothing burger

Mr Powel the floor is yours ....

FB, AAPL after the close

futures ;

NS - double top , today with a red candle (the day is not done) , lower low, lower high. Despite GOOG crushing it

ES- doji yesterday indecision, ..today, inside candle with a very very tight range

clearly the market is waiting on Powel

2 pm -statement read , algos likely to spike immediately ,..then a chat after (will Powell , yet AGAIN, put his foot in his mouth?), so that initial reaction may not last/and or gain steam . Could , of course, be a nothing burger

Mr Powel the floor is yours ....

FB, AAPL after the close

|

|---|

April 28, 2021 Continue reading the main story |

| Good morning. We have two scoops in the newsletter today, both about consumer-facing brands — Allbirds and Panera — looking to cash in on investor interest in business models pitched for a shift in postpandemic habits. (Was this newsletter forwarded to you? Sign up here.) |

|

| [h=2]Exclusive: Allbirds is interviewing banks for an I.P.O.[/h] |

| Silicon Valley’s favorite shoe brand is headed to Wall Street. Allbirds is interviewing banks over the next few weeks to help it make a market debut, DealBook hears. The direct-to-consumer company was last valued at around $1.7 billion. |

| “It’s the materials.” Allbirds was founded by the New Zealand soccer star Tim Brown and Joey Zwillinger, a renewables expert. Its mantra is to “create better things in a better way,” and the company advertises that the merino wool in its shoes uses 60 percent less energy than typical synthetic materials. “One of the worst offenders of the environment from a consumer product standpoint is shoes,” Zwillinger told The Times in 2017. “It’s not the making; it’s the materials.” The brand’s flashy-but-logo-free shoes are popular among techies, celebrities (Leonardo DiCaprio is an investor) and Barack Obama. The company has raised more than $200 million since 2016. |

| The I.P.O. would jump into a hot market. Consumer brands that were founded with a heavy (if not exclusive) internet presence, including Honest Company and Warby Parker, are taking advantage of a pandemic-driven boom in online shopping to see if investor enthusiasm for tech I.P.O.s extends to them as well. Many of those companies, including Allbirds, have since opened some retail stores, which has proved an easier transition than the legacy retailers trying to build digital operations after making their names in the offline world. |

| [h=3]PAID POST: A MESSAGE FROM DARKTRACE[/h]Cybersecurity: Not a Human-Scale Problem With the World Economic Forum warning of ‘’A.I.-enabled threats,” humans are struggling to keep pace. Autonomous Cyber AI interrupts in-progress cyberattacks in seconds – wherever they strike. LEARN HOW > |

| Business for good? Allbirds is a certified B Corp, a certification earned by focusing on social good as well as profit. (Zwillinger joined a DealBook Debrief call last year to talk about the purpose of business.) Wall Street hasn’t always taken kindly to such companies: Etsy had to drop the status after taking a beating from the public markets following its I.P.O. Allbirds, though, said the $100 million funding round it announced last September was “indication of investors’ continued enthusiasm for its stakeholder-centric business model.” |

|

| [h=3]HERE’S WHAT’S HAPPENING[/h] |

| President Biden prepares for his first joint address to Congress. In a locked-down Capitol, before a far smaller audience than usual, he is expected to argue for his expansive infrastructure bill and unveil a sweeping plan for nearly universal children’s education programs. Polls suggest that Americans supportBiden’s big spending proposals. Follow the lead-up to the speech in our live briefing. |

| Vaccinated Americans can go maskless outside. The C.D.C. revised its social-distancing guidelines, allowing people who have received their shots to forgo masks outdoors except in crowded venues like stadiums. Meanwhile, Pfizer’s C.E.O., Albert Bourla, said the drug maker might roll out an oral treatment for Covid-19 by year end. |

| Deutsche Bank dodges a bullet. The German bank reported $1.1 billion in quarterly profit, its best performance in seven years, as its traders outperformed rivals on Wall Street. Just as notably, the bank said that unlike many of its competitors, it had suffered no losses from exposure to Archegos. |

| The cloud powers tech giants’ stellar earnings. Alphabet, Google’s parent company, said profit had more than doubled in the first quarter as online advertising and cloud services remained strong during the pandemic. Microsoft said its first-quarter earnings had jumped 44 percent, thanks to cloud and Office 365 workplace software. All eyes are now on Apple and Facebook, which report earnings after markets close today. |

| JPMorgan Chase will open its U.S. offices to all employees next month.The bank told its American workers that they can return on May 17, subject to a 50 percent occupancy cap, with a formal return to the office for all in July. Separately, HSBC plans to cut its office space 20 percent this year as it adopts more flexible working arrangements. |

| [h=2]After refinancing, Panera’s owners eye public market return[/h] |

| JAB, the sprawling conglomerate that owns Keurig, Krispy Kreme, Snapple and many other brands, completed an $800 million refinancing deal this month for its restaurant chain Panera Bread, DealBook is first to report. The deal could pave the way for JAB to bring the company back to the public markets after taking the chain private in 2017. As always with these things, no plans are final. JAB and Panera declined to comment. |

| A public listing could take place with or without an I.P.O. JAB has taken its investments public in a variety of ways, often while retaining a large stake. In 2018, it merged Green Mountain, which was private at the time, with Dr Pepper Snapple Group, and last year it took the coffee chain JDE Peets public through a traditional I.P.O. SPACs are sitting on more than $100 billion in cash as they look for companies to buy and take public. |

| The restaurant industry shifted online during the pandemic. The best-performing chains have been those that were already focused on takeout and delivery before lockdown orders — like Dunkin Brands. Panera’s online ordering business was part of its appeal to JAB back in 2017. During the pandemic, the chain added tech-enabled curbside delivery and started selling groceries. About 85 percent of Panera customers now get carryout or delivery, compared with 40 percent before the pandemic, the company’s chief executive, Niren Chaudhary, told The Associated Press. |

|

| [h=2]“I’ve turned down a million dollars’ worth of work in the last two weeks.”[/h] |

| — Matt Guse, the owner of the industrial company MRS Machining, on the unexpected resurgence in manufacturing and a dearth in factory workers to keep up with demand. |

| [h=2]Seeing red over a green bank[/h] |

| A Senate subcommittee hearing on the environment yesterday mulled legislation to support green investment, one aspect of the White House’s push to make fighting climate change a part of all of its policies. Inevitably, this exposed deep political divides, clouding the prospects for this and related initiatives important to the “climate administration.” |

| The National Climate Bank Act would provide $100 billion for a nonprofit investment accelerator to attract private capital and create jobs while cutting emissions, said the committee chair Edward Markey, Democrat of Massachusetts. (He first introduced the idea in 2009.) President Biden’s infrastructure plan recommends such an accelerator, and more than 200 groups recently urged Congress to incorporate the act into an infrastructure bill. |

| “We don’t agree on anything, but I love him,” quipped the Oklahoma Republican Jim Inhofe before critiquing Markey’s plan at the hearing. The bank would create “a slush fund for green billionaires” like Elon Musk to collect government subsidies while taxpayers foot the bill for “charging stations of residents of coastal states,” Inhofe said. “We don’t need to pick winners and losers,” said Cynthia Lummis, Republican of Wyoming. Instead of eliminating fossil fuels, encouraging innovations like Wyoming’s carbon-capture experiments could also reduce emissions, she said. |

| “This is an approach that has been embraced by Republicans and Democrats alike in states across the nation,” Senator Chris Van Hollen, Democrat of Maryland, told DealBook after the hearing. He refuted claims that the fund would lack oversight and lead to higher energy prices. Reed Hundt of the Coalition for Green Capital, a nonprofit that helps create green banks, testified that there are projects underway in 37 states, and “we’re not talking about billionaires who want to go to Mars.” |

|

| [h=2]A slow roll to federal marijuana legalization[/h] |

| For marijuana sector investors, things have never been better. States are reaping revenue from legalization and resistance at the federal level seems futile. “The shift in the political climate in D.C. has created tailwinds for the industry,” Matt Sweeney of the cannabis investment group Entourage Effect Capital told DealBook. |

| Uncle Sam isn’t totally sold. The House last week passed the Safe Banking Act(again), which would bar federal regulators from penalizing banks working with legal cannabis businesses. But although the Senate Banking Committee chair, Sherrod Brown of Ohio, said he would look at it “seriously,” he also said he was “not ready to move.” That means the Senate won’t vote on it soon, if at all. |

| More time might be good for industry insiders, Sweeney said. Full federal legalization would bring Wall Street investors and tobacco and alcohol giants looking to cash in, he said, and cannabis companies could use the time to scale up. From his perspective, the next important step is passing legislation that safeguards states’ marijuana laws. |

|

| Legalization is paying off for some states. In Illinois, tax revenue on sales of marijuana recently surpassed levies collected on alcohol. According to estimates from the independent policy nonprofit the Tax Foundation, the scope for tax revenue on recreational marijuana sales runs to the tens of millions of dollars per year for many states, if not more. |

| Thank you for your support. Want to share The New York Times? Friends and family can enjoy unlimited digital access to our journalism with this special offer. |

| [h=3]THE SPEED READ[/h] |

| Deals |

|

| Politics and policy |

|

| Tech |

|

| Best of the rest |

|

| Thanks for reading! We’ll see you tomorrow. |

| We’d like your feedback! Please email thoughts and suggestions to dealbook@nytimes.com. |

|

|

|

|

|

|

| Andrew Ross Sorkin, Founder/Editor-at-Large, New York @andrewrsorkin |

| Jason Karaian, Editor, London @jkaraian |

| Sarah Kessler, Deputy Editor, Chicago @sarahfkessler |

| Michael J. de la Merced, Reporter, London @m_delamerced |

| Lauren Hirsch, Reporter, New York @LaurenSHirsch |

| Ephrat Livni, Reporter, Washington D.C. @el72champs |

| � |

yesterdays MH

Today

|

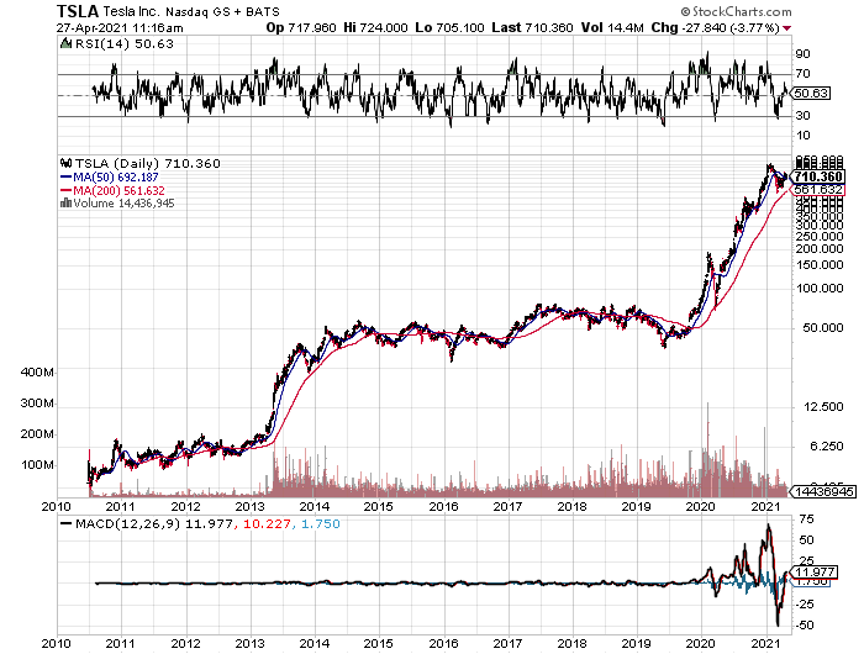

| Global Market Comments April 28, 2021 Fiat Lux Featured Trade: (WHY TESLA IS TAKING OVER THE WORLD), (TSLA), (GM), (TM), (TESTIMONIAL)

|

| � |

Why Tesla is Taking Over the WorldIt was another typical Elon Musk earnings call. Tesla is evolving into the world’s preeminent robotics and AI company. It is building the largest neural network in history, which all the Teslas ever made talking to each other, some two million by the end of this year. When the US goes all-electric in a decade, the size of the power grid is going to triple (buy copper), or else brownouts and outages will become constant. Every home in the country is going to need solar roofs to meet the demand. Demand for cars is the greatest Tesla has ever seen, far beyond their ability to produce them, and Q1 is the slow quarter for the auto industry. Oh, and the company made $100 million trading Bitcoin in Q1, about a quarter of its total profits. Elon never fails to amaze. As for the stock, I think we are stuck in a prolonged sideways trading range from $550-$750. Once all the short sellers and naysayers are reestablished, the stock will ramp up to new all-time highs above $904. That’s the way Tesla has always traded. My decade target is still $10,000 per share. I’ll never forget my first tour of the Fremont factory in 2010, right after they bought it for stock from Toyota (TM) out of the General Motors (GM) bankruptcy (Toyota owned half). It then occupied only a tiny corner of the gigantic 50,000 square foot space. But you know what? There were virtually no humans on the assembly line, just a long row of red German-made robots. There was just the occasional guy shooting oil into automatic joints. It was a vision into the future. I knew I was on the right track when the salesman told me that the customer who just preceded me for a Tesla Model X 90D SUV was the Golden Bay Warriors star basketball player, Steph Currie. Well, if it’s good enough for Steph, then it’s good enough for me. So, when I received a call from Elon Musk’s office to test the company’s self-driving technology embedded in their new vehicles for readers of the Diary of a Mad Hedge Fund Trader. I did, and prepare to have your mind blown! I was driving at 80 MPH on CA-24, a windy eight-lane freeway that snakes its way through the East San Francisco Bay Area mountains. Suddenly the salesman reached over a flicked a lever on the left side of the driving column. The car took over! There it was, winding and turning along every curve, perfectly centered in the lane. As much as I hated to admit it, the car drove better than I ever could. It does especially well at night or in fog, a valuable asset for senior citizens whose night vision is fading fast. All that was required was for me to touch the steering wheel every minute to prove that I was not sleeping. The cars do especially well in rush hour driving, as it is adept at stop and go traffic. You can just sit there and work on your laptop, read a book, call some customers, or watch a movie on the built-in 5G WIFI HD TV. When we returned to the garage the car really showed off. When we passed a parking space, another button was pushed, and we perfectly backed 90 degrees into a parking space, measuring and calculating all the way. The range is 300 miles, which I can recharge at home at night from a standard 220-volt socket in my garage in seven hours. When driving to Lake Tahoe, I can stop halfway to get a full charge in 30 minutes at a Tesla supercharging station. The new chargers operate at a blazing 400 miles per hour. That’s enough time to walk to the subway next door and get a couple of sandwiches. The chassis can rise as high as eight inches off the ground so it can function as a true SUV. The “ludicrous mode,” a $10,000 option, takes you from 0 to 60 mph in 2.9. However, even a standard Tesla can accelerate so fast that it will make the average passenger car sick. Here’s the buzzkill. Tesla absolutely charges through the nose for extras. The 22-inch wheels, the third row of seats to get you to seven passengers, the premium sound, the leather seats, and the self-driving software can easily run you $30,000-$40,000. A $750 tow hitch will accommodate a ski or back rack on the back. There is a $1,000 delivery charge, even if you pick it up at the Fremont factory. It’s easy to see how you can jump from an $84,990 base price to a total cost of $162,500, including taxes, for the ultra-luxury Performance model, as I did. As for “drop dead’ curb appeal, nothing beats the Model X. When I first started driving Teslas ,I used to get applause at stoplights. It took a while to realize they were cheering the car, not me. Even after driving one of these for 11 years, I still get notes with phone numbers from young women asking for rides. And they don’t even offer that as an option! Buy the stock on every 20% dip. My original split-adjusted cost is $3.30. It’s still true that if you buy the shares, you get the car for free.

|

TestimonialGoing to renew my membership today because you provide great ideas. I think you have a lot of integrity in your messages. We may not agree politically, but you have nailed many of the concepts you shepherd. I have become a fan and look forward to your writing every day. Don, Cleveland, Ohio

|

Quote of the Day"I know not with what weapons World War III will be fought, but World War IV will be fought with sticks and stones," said Nobel Prize winner Albert Einstein.

|

| This is not a solicitation to buy or sell securities The Mad Hedge Fund Trader is not an Investment advisor For full disclosures click here at: http://www.madhedgefundtrader.com/disclosures The "Diary of a Mad Hedge Fund Trader"(TM) and the "Mad Hedge Fund Trader" (TM) are protected by the United States Patent and Trademark Office The "Diary of the Mad Hedge Fund Trader" (C) is protected by the United States Copyright Office Futures trading involves a high degree of risk and may not be suitable for everyone. |

Today

|

April 29, 2021 Continue reading the main story |

| Good morning. (Was this newsletter forwarded to you? Sign up here.) |

|

| [h=2]The next 100 days[/h] |

| Today is President Biden’s 100th day in office, and yesterday he delivered his first address to a joint session of Congress. In his speech, he laid out an agenda that, The Times’s Peter Baker writes, represents “a fundamental reorientation of the role of government not seen since the days of Lyndon B. Johnson’s Great Society and Roosevelt’s New Deal.” The centerpiece of his address was a plan for some $4 trillion in spending, split into two bills, on top of the $1.9 billion in economic aid already passed earlier in his term. |

| “Doing nothing is not an option. Look, we can’t be so busy competing with one another that we forget the competition that we have with the rest of the world.” |

| Although the Democrats’ narrow control of Congress means that they can pass spending bills without Republican support, they also need to keep their own group united. Even before the speech, Biden faced a skeptic in Senator Joe Manchin, the moderate West Virginia Democrat who is a key vote in the upper chamber. The cost of the president’s plans “makes me uncomfortable,” Manchin said. Senator Mark Kelly, the recently elected Democrat from Arizona, added, “We’ve got to get back to managing the size of our debt compared to the size of our economy.” |

| [h=3]PAID POST: A MESSAGE FROM DARKTRACE[/h]Cybersecurity: Not a Human-Scale Problem With the World Economic Forum warning of ‘’A.I.-enabled threats,” humans are struggling to keep pace. Autonomous Cyber AI interrupts in-progress cyberattacks in seconds – wherever they strike. LEARN HOW > |

|

| “There is simply no reason why the blades for wind turbines can’t be built in Pittsburgh instead of Beijing.” |

| Biden said that bolstering America’s international competitiveness is a major reason for his ambitious spending plans, invoking China specifically as the country’s biggest rival. In a hawkish tone, he dismissed the belief that he ascribed to President Xi Jinping that “democracy can’t compete in the 21st century with autocracies, because it takes too long to get consensus.” And by calling out green infrastructure as crucial to competing with China, he also made a patriotic pitch for climate-linked spending as a way to “buy American products, made in America, to create American jobs” in fast-growing sectors like electric vehicles, batteries and renewable energy. |

| “I think you should be able to become a billionaire or a millionaire. But pay your fair share.” |

| Biden made clear he wants to pay for his ambitious plans by taxing the wealthy, including through higher income and capital gains levies. But this met with a mixed reaction even from fellow Democrats: Manchin called the proposed capital gains hike “a heavy lift,” while others, like Senator Jon Tester of Montana, suggested a mix of higher taxes and deficit spending. |

|

|

| Here’s how to spend $4 trillion: The Upshot team compiled a handy pie chartthat shows the scale of all the initiatives in Biden’s proposed spending plans, from tax credits to universal prekindergarten, airport upgrades and broadband rollouts. (Be sure to follow the link to see the graphic in its full glory.) As lawmakers pick this over in the next 100 days and beyond, the resulting pie is likely to look a lot different than it does today. |

| Read the full transcript of Biden’s speech, and The Times’s fact check and analysis. |

| [h=3]HERE’S WHAT’S HAPPENING[/h] |

| The Fed leaves interest rates unchanged as the economy begins to heal.The central bank’s chairman, Jay Powell, said he wanted to see more progressbefore he thinks about lifting interest rates and slowing repurchases of government bonds. |

| Apple and Facebook join the parade of stellar tech earnings reports. Applemore than doubled its first-quarter profits, as iPhone sales boomed. And Facebook reported similar gains as its online ad business grew during the pandemic, while its user base grew to 3.5 billion. (Facebook’s ad sales may suffer from new privacy features rolled out by Apple, however.) Amazon rounds out the Big Tech earnings bonanza later today. |

| The S.E.C.’s new enforcement chief resigns unexpectedly. Days into her new job, Alex Oh, a former partner at Paul, Weiss, stepped down after a federal court ruling involving one of her former clients, Exxon Mobil. In a case involving claims of human rights abuses in Indonesia, the presiding judge rebuked Exxon’s legal team for derogatory comments about opposing counsel. |

| Endeavor will finally go public. The entertainment giant co-founded by Ari Emanuel, which owns the WME talent agency and the UFC mixed martial arts league, raised $511 million in its I.P.O. at a $10 billion valuation, the top of its expected price range. Its successful offering comes two years after it called off an I.P.O. amid a lukewarm reception from investors. |

| Verizon considers selling its old-guard internet media business. The telecom giant is exploring the sale of assets like AOL and Yahoo, according to The Wall Street Journal. Potential buyers include Apollo Global Management, and the WSJ reports that a deal could be valued at up to $5 billion. Verizon spent $9 billion buying the once-dominant web giants. |

| [h=2]A Bitcoin E.T.F. dream deferred[/h] |

| For many cryptocurrency supporters and investors, U.S. regulatory approval of a Bitcoin exchange-traded fund represents the holy grail. It would allow the crypto-curious to get exposure to Bitcoin without having to buy the tokens themselves, signifying that digital assets are really, truly mainstream. But it’s not meant to be — yet. Yesterday, the S.E.C. delayed a decision on a Bitcoin E.T.F. proposal from the investment manager VanEck, saying it needs more time but offering no other explanation. |

| Delay is not denial, and it may be a good sign, Todd Cipperman, the founder of the compliance services firm CCS, told DealBook. When considering the concept of a crypto E.T.F. in 2018, the S.E.C. raised questions about investor protection issues and put a “wet blanket on the whole idea,” he said. Now crypto is much bigger, and Gary Gensler, who taught courses about blockchain technology at M.I.T., is chair of the S.E.C. His expertise doesn’t guarantee success for crypto E.T.F.s, but it will be easier for an expert in the field to approve them, Cipperman suggested. |

| The deadline can be extended again. The S.E.C. gave itself until mid-June, with the option to take more time, but it must decide before year’s end. The regulator has rejected every proposal to date, starting with the first Bitcoin E.T.F. pitch in 2013, presented by the Winklevoss twins, which was eventually rejected in 2017 (and again in 2018). There are several E.T.F. proposals on the table now, including one from the traditional finance giant Fidelity. |

| Canada, meanwhile, is approving all kinds of crypto E.T.F.s, after allowing its first Bitcoin E.T.F. in February. Hester Peirce, an S.E.C. commissioner and vocal crypto champion, told DealBook earlier this month that she has been “mystified” by her agency’s response to some prior applications, which met the standards in her view. With more players now engaging in the process, approval could be looming — eventually. |

| [h=2]“This isn’t an opportunistic profit-taking by companies; this is a reset of the market.”[/h] |

| — Greg Portell, a partner at the consulting firm Kearney, on the coming price hikes for a range of products, from diapers to cereal to toilet paper. |

| [h=2]Watch this space[/h] |

| Michael Lynton, the chairman of Snap and Warner Music (and former C.E.O. of Sony Entertainment), quietly put together a venture capital firm, 25madison, that has largely remained under the radar for the past three years. However, today it is likely to start getting a lot more attention: Apollo Global Management and the entertainment giant Endeavor will back the firm with new funding. |

| Lynton created the firm with Steven Price, a longtime private equity investor in media; Matt Fremont-Smith, a former Goldman Sachs partner; and Gary Ginsburg, the former head of communications for SoftBank, Time Warner and News Corp., among others. |

| Given their connections and track record, we expect to be hearing more from them soon. |

| [h=2]A diversity and inclusion “crisis” at companies[/h] |

| Money can’t buy happiness, but pay and promotion disparities can make employees dissatisfied and give them a negative view of company culture. That is why Andrew Chamberlain, the chief economist at the job website Glassdoor, will argue today at a Congressional hearing on pay equity that businesses can’t improve their workplace cultures, especially when it comes to diversity and inclusion, while ignoring the economics. |

| The state of companies’ efforts to be more inclusive depends on who you ask, according to a Glassdoor survey released today. In the poll of more than 12,000 employees across industries, Black workers rated their companies well below the overall average on diversity and inclusion efforts, signifying perhaps that talk is cheap and that perceptions reflect the realities of racial pay gaps. |

| “This study is a flashing warning light,” Chamberlain said in a statement to DealBook. Disagreement among employees about company culture signifies a “crisis” in workplace inclusivity, he added. “These gaps in workplace culture are related to pay gaps.” |

| Thank you for your support. Want to share The New York Times? Friends and family can enjoy unlimited digital access to our journalism with this special offer. |

| [h=3]THE SPEED READ[/h] |

| Deals |

| Politics and policy |

|

| Tech |

|

| Best of the rest |

| Thanks for reading! We’ll see you tomorrow. |

| We’d like your feedback! Please email thoughts and suggestions to dealbook@nytimes.com. |

|

|

|

|

|

|

| Andrew Ross Sorkin, Founder/Editor-at-Large, New York @andrewrsorkin |

| Jason Karaian, Editor, London @jkaraian |

| Sarah Kessler, Deputy Editor, Chicago @sarahfkessler |

| Michael J. de la Merced, Reporter, London @m_delamerced |

| Lauren Hirsch, Reporter, New York @LaurenSHirsch |

| Ephrat Livni, Reporter, Washington D.C. @el72champs |

I don't understand why APPL isn't moving today. It moved after hours yesterday and it's sitting around even today (it was slightly down for a while).

They crushed it...it's weird.

I was reading today guys who install pools are booked out till next year..200K pool installed this year.

I sorta love this weird play...29.75 @ the close today

https://finance.yahoo.com/quote/LESL/

Global Market Comments

April 29, 2021

Fiat LuxFeatured Trade:(THEY’RE NOT MAKING AMERICANS ANYMORE)

April 29, 2021

Fiat LuxFeatured Trade:(THEY’RE NOT MAKING AMERICANS ANYMORE)

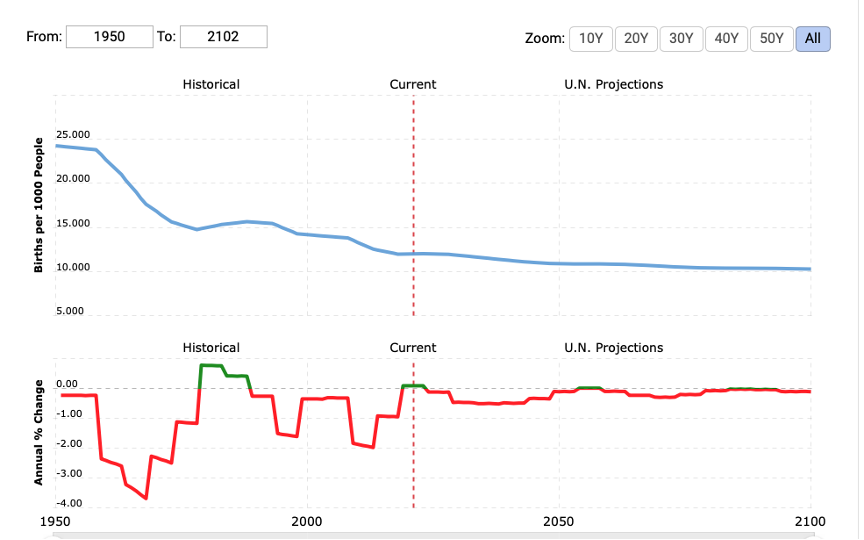

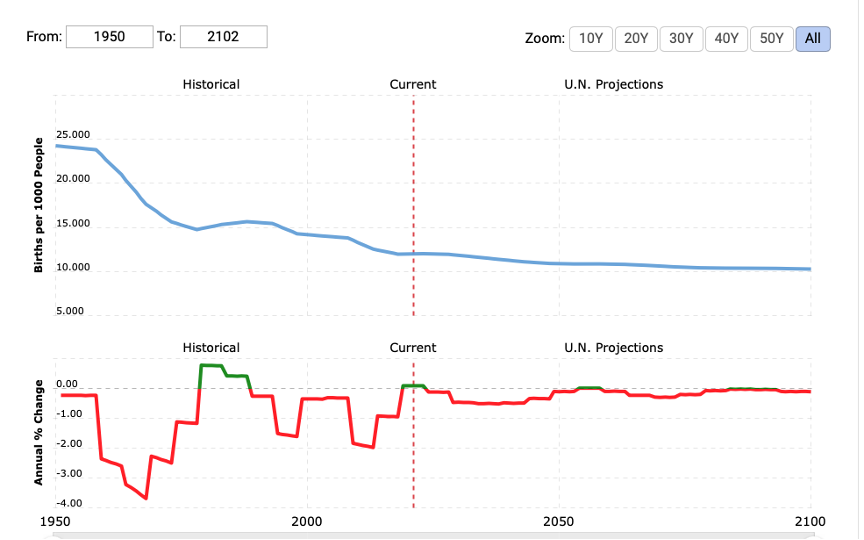

They're Not Making Americans AnymoreYou can count on a bear market hitting some time in 2038, one falling by at least 25%.

Worse, there is almost a guarantee that a financial crisis, severe bear market, and possibly another Great Depression will take place no later than 2058 that would take the major indexes down by 50% or more.

No, I have not taken to using an Ouija board, reading tea leaves, nor examine animal entrails in order to predict the future. It’s much easier than that.

I simply read the data just released from the National Center for Health Statistics, a subsidiary of the federal Centers for Disease Control and Prevention (click here for their link).

The government agency reported that the US birth rate fell to a new all-time low for the third year in a row, to 11.99 births per 1,000 women of child bearing age. A birth rate of 12.5 per 1,000 is necessary for a population to break even. The absolute number of births is the lowest since 1987. In 2017, women had 500,000 fewer babies than in 2007.

These are the lowest number since WWII when 17 million men were away in the military, a crucial part of the equation.

Babies grow up, at least most of them. In 20 years, they become consumers, earning wages, buying things, paying taxes, and generally contributing to economic growth.

In 45 years, they do so quite substantially, becoming the major drivers of the economy. When these numbers fall, recessions and bear markets occur with absolute certainty.

You have long heard me talk about the coming “Golden Age” of the 2020s. That’s when a two-decade-long demographic tailwind ensues because the number of “peak spenders’ in the economy starts to balloon to generational highs. The last time this happened during the 1980s and 1990s, stocks rose 20-fold.

Right now, we are just coming out of two decades of demographic headwind when the number of big spenders in the economy reached a low ebb. This was the cause of the Great Recession, the stock market crash and the anemic 2% annual growth since then.

The reasons for the maternity ward slowdown are many. The great recession certainly blew a hole in the family plans of many Millennials. Falling incomes always lead to lower birth rates, with many Millennial couples delaying children by five years or more. Millennial mothers are now having children later than at any time in history.

Burgeoning student debt, which just topped $1.5 trillion, is another. Many prospective mothers would rather get out from under substantial debt before they add to the population.

The rising education of women is another drag on childbearing and is a global trend. When spouses become serious wage earners, families inevitably shrink. Husbands would rather take the money and improve their lifestyles than have more kids to feed.

Women are also delaying having children to postpone the “pay gaps” that always kick in after they take maternity leave. Many are pegging income targets before they entertain starting families.

As a result of these trends, one in five children last year were born to women over the age of 35, a new high.

This is how Latin Americans moved from eight to two-child families in only one generation. The same is about to take place in Africa, where standards of living are rising rapidly, thanks to the eradication of several serious diseases.

The sharpest falls in the US have been with minorities. Since 2017, the birthrates for Hispanics has dropped by 27% from a very high level, African Americans 11%, whites 5%, and Asian 4%.

Europe has long had the same problem with plunging growth rates but only much worse. Historically, the US has made up for the shortfall with immigration, but that is now falling, thanks to the current administration policies. Restricting immigration now is a guaranty of slowing economic growth in the future. It’s just a numbers game.

So watch that growth rate. When it starts to tick up again, it’s time to buy….in about 20 years. I’ll be there to remind you with this newsletter.

As for me, I’ve been doing my part. I have five kids aged 15-36, and my life is only half over.

Where did you say they keep the Pampers?

[h=2]I'm Doing My Part[/h]

[h=2]I'm Doing My Part[/h]

Worse, there is almost a guarantee that a financial crisis, severe bear market, and possibly another Great Depression will take place no later than 2058 that would take the major indexes down by 50% or more.

No, I have not taken to using an Ouija board, reading tea leaves, nor examine animal entrails in order to predict the future. It’s much easier than that.

I simply read the data just released from the National Center for Health Statistics, a subsidiary of the federal Centers for Disease Control and Prevention (click here for their link).

The government agency reported that the US birth rate fell to a new all-time low for the third year in a row, to 11.99 births per 1,000 women of child bearing age. A birth rate of 12.5 per 1,000 is necessary for a population to break even. The absolute number of births is the lowest since 1987. In 2017, women had 500,000 fewer babies than in 2007.

These are the lowest number since WWII when 17 million men were away in the military, a crucial part of the equation.

Babies grow up, at least most of them. In 20 years, they become consumers, earning wages, buying things, paying taxes, and generally contributing to economic growth.

In 45 years, they do so quite substantially, becoming the major drivers of the economy. When these numbers fall, recessions and bear markets occur with absolute certainty.

You have long heard me talk about the coming “Golden Age” of the 2020s. That’s when a two-decade-long demographic tailwind ensues because the number of “peak spenders’ in the economy starts to balloon to generational highs. The last time this happened during the 1980s and 1990s, stocks rose 20-fold.

Right now, we are just coming out of two decades of demographic headwind when the number of big spenders in the economy reached a low ebb. This was the cause of the Great Recession, the stock market crash and the anemic 2% annual growth since then.

The reasons for the maternity ward slowdown are many. The great recession certainly blew a hole in the family plans of many Millennials. Falling incomes always lead to lower birth rates, with many Millennial couples delaying children by five years or more. Millennial mothers are now having children later than at any time in history.

Burgeoning student debt, which just topped $1.5 trillion, is another. Many prospective mothers would rather get out from under substantial debt before they add to the population.

The rising education of women is another drag on childbearing and is a global trend. When spouses become serious wage earners, families inevitably shrink. Husbands would rather take the money and improve their lifestyles than have more kids to feed.

Women are also delaying having children to postpone the “pay gaps” that always kick in after they take maternity leave. Many are pegging income targets before they entertain starting families.

As a result of these trends, one in five children last year were born to women over the age of 35, a new high.

This is how Latin Americans moved from eight to two-child families in only one generation. The same is about to take place in Africa, where standards of living are rising rapidly, thanks to the eradication of several serious diseases.

The sharpest falls in the US have been with minorities. Since 2017, the birthrates for Hispanics has dropped by 27% from a very high level, African Americans 11%, whites 5%, and Asian 4%.

Europe has long had the same problem with plunging growth rates but only much worse. Historically, the US has made up for the shortfall with immigration, but that is now falling, thanks to the current administration policies. Restricting immigration now is a guaranty of slowing economic growth in the future. It’s just a numbers game.

So watch that growth rate. When it starts to tick up again, it’s time to buy….in about 20 years. I’ll be there to remind you with this newsletter.

As for me, I’ve been doing my part. I have five kids aged 15-36, and my life is only half over.

Where did you say they keep the Pampers?

Quote of the Day“It’s easier to get out of Cuba than to get out of Facebook,” said a market analyst.

This is not a solicitation to buy or sell securities

|

|---|

|

| [h=2]Berkshire bucks the trend[/h] |

| Tomorrow is Berkshire Hathaway’s annual shareholder meeting, the gathering known as “Woodstock for capitalists.” Like last year, the company is bowing to the times by holding the meeting virtually. But another aspect of the discussion may show that Warren Buffett is increasingly out of step with the times, DealBook’s Michael de la Merced reports. |

| Investors are pressing Berkshire to disclose more about climate change and work-force diversity. Shareholders, including the Calpers public pension fund, argue that Buffett’s conglomerate isn’t doing enough to disclose its portfolio companies’ progress in addressing those issues. Buffett opposed these initiatives ahead of the meeting, arguing that they cut against Berkshire’s philosophy of letting its subsidiaries operate largely independently. “I don’t believe in imposing my political opinions on the activities of our businesses,” he said at Berkshire’s 2018 annual meeting. |

| Buffett is expected to get his way, for now. He controls over a third of Berkshire’s voting power and holds sway over faithful retail investors, virtually guaranteeing that the proposals will fail to pass. |

|

| The big question is whether this will tarnish Berkshire’s golden reputation. Corporate America is increasingly heeding investor demands — including from BlackRock, a major Berkshire shareholder — to do more to fight climate change and racial inequity. Berkshire does not dispute the importance of climate change and diversity, but Buffett’s pushback here risks denting his standing as perhaps the world’s most admired investor. “I don’t think at the moment there’s been a slip in the gold standard,” said Lawrence Cunningham, a professor at George Washington University and a Berkshire shareholder, “but if it’s not tended to, there might be.” |

| [h=3]HERE’S WHAT’S HAPPENING[/h] |

| Big Tech finishes earnings season on a strong note. Amazon’s first-quarter earnings more than tripled — yes, tripled — to $8 billion, surpassing expectations. As our colleague Shira Ovide writes, the quarter showed that tech giants are “unquestioned winners of the pandemic economy.” |

| Europe’s antitrust chief accuses Apple of unfairly squeezing Spotify.Margrethe Vestager announced today that an E.U. investigation found that the iPhone maker abused its control over its App Store to charge its music-streaming rival more in fees. |

| A big day in New York City: July 1. Mayor Bill de Blasio said the city would fully reopen by that day. But officials concede that tourism won’t fully return to prepandemic levels for years, and employers have been largely targeting the fall for bringing workers back to offices. |

| The head of the Credit Suisse board’s risk committee steps down. Andreas Gottschling won’t stand for re-election. He is the latest official at the Swiss bank to exit following scandals at Greensill and Archegos. |

| Good and bad news for AstraZeneca. The drug maker beat expectations for earnings and sales growth, but it is struggling to compile the data requested by U.S. officials to have its Covid-19 vaccine approved by the F.D.A., The Wall Street Journal reported. |

| [h=2]Ari Emanuel’s I.P.O. second act[/h] |

| Endeavor, the entertainment conglomerate run by the Hollywood mogul Ari Emanuel, pulled its I.P.O. at the last minute in 2019 amid lukewarm interest from investors. Although the pandemic hurt its live events business as well as its talent representation division, yesterday Endeavor made its market debut, closing the day with a market cap of more than $10 billion. Emanuel spoke with DealBook about what changed — and what comes next. |

| On why the I.P.O. went ahead this time |

| “There was confusion with regard to the U.F.C., so we cleaned that up,” Emanuel said about the mixed-martial arts league that Endeavor is acquiring full control of with proceeds from the offering. Debt was also a worry before, and leverage will be reduced with help from a $1.7 billion private placement, with Third Point and Elliot Management among the investors. |

| Endeavor also used the pandemic period to restructure and consolidate, shifting further away from its talent agency roots. Endeavor’s businesses will help feed a demand for content and events after the pandemic, he said: “We’re the story about coming out.” |

| On Endeavor’s role in the streaming wars |

| “We’re platform agnostic, and we serve all parties,” Emanuel said. The broadcasters are spending “huge” amounts to build out their streaming platforms. “I don’t have to do that,” Emanuel said. “I just have to supply it.” |

| On how he met Elon Musk, who is joining Endeavor’s board |

| “I definitely cold called. That’s kind of in my nature,” Emanuel said. “We’ve represented him in some of his endeavors. And then over time, he and I became friendly.” |

| “He’s also a great entrepreneur, meaning he knows how hard it is to build and run a company,” he added, noting that they often call each other for advice. |

| On whether he has any concerns about putting Musk on the board given the Tesla chief’s history with the S.E.C. |

| “No.” |

| [h=2]“The days of the bullpen, the trading floors — that’s over.”[/h] |

| — Whitley Collins of CBRE on how the pandemic has upended the commercial real estate market, reversing the trend of “more and more dense” office spaces. |

| [h=2]A warning on gig workers[/h] |

| Marty Walsh, the labor secretary, said yesterday that most gig workers in the U.S. should be classified as employees, not independent contractors. “In some cases they are treated respectfully and in some cases they are not, and I think it has to be consistent across the board,” he told Reuters. Shares of Uber, Lyft, Fiverr and DoorDash fell on the news. |

| But how much control does Walsh have over how companies classify their employees? |

| There’s no single law that makes workers employees or contractors. The Labor Department can enforce the Fair Labor Standards Act, which establishes the federal minimum wage and overtime pay. This only applies to employees, and who should fall into that category has been the subject of a long-running debate. |

|

| New guidance wouldn’t change the law. But it could change how the Labor Department decides whether to bring lawsuits against gig economy companies. “It’s implicitly a sign to employers that you should comply with this interpretation or there’s a risk of enforcement,” Brian Chen, a staff attorney at the National Employment Law Project, told DealBook. The guidance is nonbinding, but Benjamin Sachs, a professor at Harvard Law School, said courts “tend to give it deference” when making decisions. “I wouldn’t be surprised if we saw specific action coming from the department sometime this year,” said William Gould, a Stanford law professor and the former chairman of the National Labor Relations Board. |

| [h=2]An unequal recovery[/h] |

| Alisha Haridasani Gupta, a gender reporter for the In Her Words newsletter, explains why promising G.D.P. numbers aren’t the end of the story. |

| “A boom-like year” is how one economist described what the U.S. economy might look like in 2021. The latest data, published yesterday, showed that G.D.P. grew at a robust 6.4 percent annualized rate in the first quarter. |

| While the headline numbers may at first glance suggest that America’s economic health is on track for a full recovery, a closer look reveals an economy that is “profoundly unequal across sectors, unbalanced in ways that have enormous long-term implications,” as The Times’s Neil Irwin put it. |

| Growth has been fueled by consumer spending on goods, while the services sector has yet to recover. Services account for more than 95 percent of the jobs held by women, according to Michael Madowitz, an economist at the Center for American Progress. |

| “I’m a little worried we’re too confident the service job losses are just going to spring back to life,” Madowitz said. “If nobody closed a business that might be fine, but that seems unlikely.” |

| Roughly two million women have left the work force since last February. G.D.P. does not account for their lost productivity and earnings, nor for the hours of work at home that women shouldered in the past year, uncompensated. |

|

| [h=2]Weekend reading: The soul of a C.E.O.[/h] |

| Hubert Joly, the former C.E.O. of Best Buy, has written the kind of book he would not have read early in his career, with new-age formulations he might have once found laughable, like “human magic.” But now he sees business as a philosophical quest, and Best Buy’s transformation from a sinking ship to a success proves that putting purpose first is good for profits. Joly spoke to DealBook about “The Heart of Business,” which is out next week. |

| Why did you write a book? |

| So much of what I learned in business school is either wrong, dated or incomplete. We urgently need a new philosophy of business and capitalism, a refoundation around purpose and humanity. There’s no going back after the pandemic. We’ve seen each others’ homes and vulnerability. We need to make a declaration of interdependence. |

| Isn’t pursuing profits the point? |

| Milton Friedman is on my “most wanted” list. People who oppose stakeholder capitalism are mistaken. We can create better economic outcomes by connecting with employees, customers, communities and the planet. People should refuse zero-sum games. The book is a practical guide for leaders who are eager to abandon the old way. |

| And it’s also spiritual? |

| Yes. Because work is fundamental. We should ask ourselves why we work, what drives us. At Best Buy, before the holiday season, we’d gather — even though it’s a very busy time — to talk about what gives people energy, what matters. Magic happens when work is connected to meaning and individual genius, to the thing that’s good or beautiful in each of us. |

| How does this “magic” manifest itself? |

| Two Best Buy employees performed pretend “surgery” on a broken dinosaur toy behind the counter and gave a boy back a new item, saying his baby dino recovered. That had to come from the heart. They could have just sent his mother to the shelf. Leaders need to use their heads and hearts and see and hear employees and give people the freedom to make work meaningful. |

| Thank you for your support. Want to share The New York Times? Friends and family can enjoy unlimited digital access to our journalism with this special offer. |

| [h=3]THE SPEED READ[/h] |

| Deals |

|

|

| Politics and policy |

|

| Tech |

| Best of the rest |

|

| Thanks for reading! We’ll see you tomorrow. |

Global Market Comments

April 30, 2021

Fiat LuxFeatured Trade:(APRIL 28 BIWEEKLY STRATEGY WEBINAR Q&A),

(PFE), (MRNA), (USO), (DAL), (TSLA), (CRSP), (ROM), (QQQ), (T),

(NTLA), (EDIT), (FARO), (PYPL), (COPX), (FCX), (IWM), (GOOG), (MSFT), (AMZN)

April 30, 2021

Fiat LuxFeatured Trade:(APRIL 28 BIWEEKLY STRATEGY WEBINAR Q&A),

(PFE), (MRNA), (USO), (DAL), (TSLA), (CRSP), (ROM), (QQQ), (T),

(NTLA), (EDIT), (FARO), (PYPL), (COPX), (FCX), (IWM), (GOOG), (MSFT), (AMZN)

April 28 Biweekly Strategy Webinar Q&ABelow please find subscribers’ Q&A for the April 28 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Silicon Valley, CA.

Q: There is talk of digital currencies being launched in the US. Is there any truth to that? How would that affect the dollar?

A: There is no truth to that; there is not even any serious discussion of digital currency at the US Treasury. My theory has always been that once Bitcoin works and is made theft-proof, the government will take it over and make that the digital US dollar. So far, Bitcoin has existed regulation-free; in fact, the IRS is counting on a trillion dollars in capital gains being taxed going forward in helping to address the budget deficit.

Q: If you have a choice, what’s the best vaccine to get?

A: The best vaccine is the one you can get the fastest. I know you’re a little slow on the rollout in Canada. Go for Pfizer (PFE) if you’re able to choose. You should avoid Moderna (MRNA) because 15% of people getting second shots have one-day symptoms after the second shot. But basically, you don’t get to choose, only kids get to choose because only Pfizer has done trials on people under the age of 21. So, if you take your kids in, they will all get Pfizer for sure.

Q: Should I buy Freeport McMoRan (FCX) here or wait for a bigger dip?

A: Freeport has just had a 25% move up in a week. I wouldn’t touch that. We put out the trade alert when it was in the mid $30s, and it's essentially at its maximum profit point now. So, you don't need to chase—wait for a bigger dip or a long sideways move before you get in.

Q: How do I trade copper if I don't do futures?

A: Buy (FCX), the largest copper producer in the US, and they have call options and LEAPS. By the way, if we do get another $5 dip in Freeport, which we just had, I would really do something like the (FCX) $45-$50 2023 LEAP. You can get 5 times your money on that.

Q: Time to buy oil stocks (USO) for the summer?

A: No, the big driver of oil right now is the pandemic in India. They are one of the world's largest consumers—you find out that most poor countries are using oil right now as they can’t afford the more expensive alternative sources of power. And when your biggest customer is looking at a billion corona cases, that’s bad for business. Remember, when you trade oil, you’re trading against a long-term bear trend.

Q: Would you buy Delta Airlines (DAL) at today’s prices?

A: Yes, I’m probably going to go run the numbers on today's call spread; I actually have 20% of cash left that I could spend. So that looks like a good choice—summer will be incredible for the entire airline industry now that they have all staved off bankruptcy. Ticket prices are going to start rising sharply with an impending severe aircraft shortage.

Q: What are your thoughts on the Buffet index which shows that stocks are more stretched vs GDP at any time vs 2000?

A: The trouble with those indicators is that they never anticipated A) the Fed buying $120 billion a month in US Treasury bonds, B) the Fed promising to keep interest rates at zero for three years, and C) an enormous bounce back from a once-in-a-hundred-year pandemic. That's why not just the Buffet Index but virtually all technical indicators have been worthless this year because they have shown that the market has been overbought for the last six months. And if you paid attention to your indicators, you were either left behind or you went short and lost your shirt. So, at a certain point, you have to ignore your technical indicators and your charts and just buy the damn market. The people who use that philosophy (and know when to use it, and it’s not always) are up 56% on the year.

Q: What trade categories are getting fantastic returns? It’s certainly not tech.

A: Well, we actually rotated out of tech last September and went into banks, industrial plays, and domestic recovery plays. And you can see in the stocks I just showed you in our model portfolio which one we’re getting the numbers from. Certainly, it was not tech; tech has only performed for the last four weeks and we jumped right back in that one also with positions in Microsoft (MSFT). So yes, it’s a constantly changing game; we’re getting rotations almost daily right now between major groups of stocks. The only way to play this kind of market is to listen to someone who’s been practicing for 52 years.

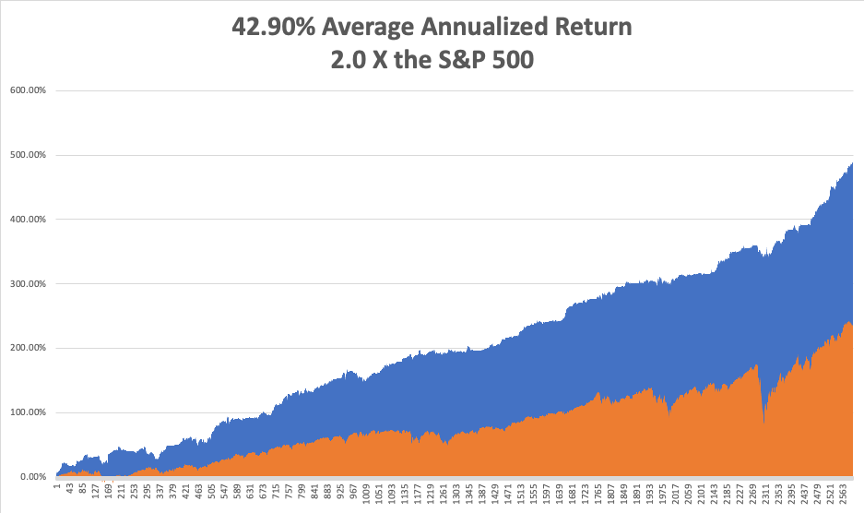

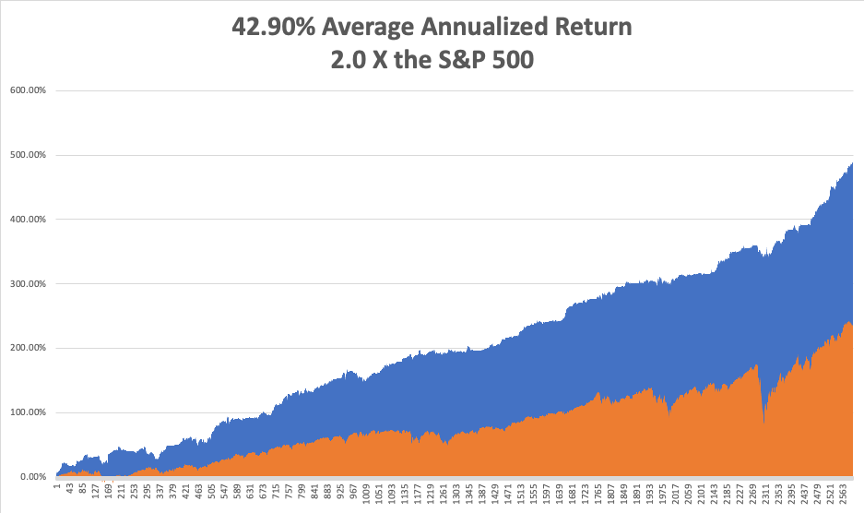

Q: I am 83 years old and have four grandchildren. I want to invest around $20,000 with each child. I was thinking of your bullish view on Tesla (TSLA) on a long-term investment. Do you agree?

A: If those were my grandchildren, I would give them each $20,000 worth of the ProShares Ultra Technology Fund (ROM), the 2x long technology ETF. Unless tech drops 50% from here, that stock will keep increasing at twice the rate of the fastest-growing sector in the market. I did something similar with my kids about 20 years ago and as a result, their college and retirement funds for their kids have risen 20 times. So that’s what I would do; I would never bet everything on a single stock, I would go for a basket of high-tech stocks, or the Invesco QQQ NASDAQ Trust (QQQ) if you don’t want the leverage.

Q: Do you like Amazon (AMZN) splitting?

A: I don’t think they’ll ever split. Jeff Bezos worked on Wall Street (with me at Morgan Stanley) and sees splits as nothing more than a paper shuffle, which it is. It’s more likely that he’ll break up the company into different segments because when they get to a $5 trillion market cap, it will just become too big to manage. Also, by breaking Amazon up into five companies—AWS, the store, healthcare, distribution, etc., —you’re getting a premium for those individual pieces, which would double the value of your existing holdings. So, if you hold Amazon stock, you want it to face an antitrust breakup because the flotation will double the value of your total holdings. That has happened several times in the past with other companies, like AT&T (T), which I also worked on.

Q: When is Tesla going to move and why is it going up with earnings up 74%?

A: Well, the stock moved up a healthy 46% going into the earnings; it’s a classic sell the news market. Most stocks are doing that this quarter and they did so last quarter as well. And Tesla also tends to move sideways for years and then have these explosive moves up. I think the next double or triple will come when they announce mass production of their solid-state batteries, which will be anywhere from 2 to 5 years off.

Q: How can I renew my subscription?

A: You can call customer support at 347-480-1034 or email support@madhedgefundtrader.com and I guarantee you someone will get back to you.

Q: Top gene-editing stock after CRISPR Therapeutics (CRSP)?

A: There are two of them: one is Intellia (NTLA); it’s actually done better than CRISPR lately. The second is Editas (EDIT) and you’ll find out that the same professionals, including the Nobel prize winner Jennifer Doudna here at Berkeley, rotate among all three of these, and the people who run them all know each other. They were all involved in the late 2000's fundamental research on CRISPR, and they’re all frenemies. So yes, it's a three-company industry, kind of like the cybersecurity industry.

Q: What about ****** (PYPL)?

A: I would wait for the earnings since so many companies are selling off on their announcements. See if they sell off 3-5%, then you buy it for the next leg up. That is the game now.

Q: Do you like any 3D printing stocks like Faro Technologies (FARO)?

A: No, that’s too much of a niche area for me, I’m staying away. And that's becoming a commodity industry. When they were brand new years ago, they were red hot, now not so much.

Q: Do you see the chip companies continuing their bull run for the next few months?

A: I do. If anything, the chip shortage will get worse. Each EV uses about 100 chips, and they’re mostly the low-end $10 chips. Ford (F) said production of a million cars will be lost due to the chip shortage. Ford itself has 22,000 cars sitting in a lot that are fully assembled awaiting the chips. Tesla alone has $300 worth of chips just in its inverters, and there are two inverters in every car. So, when you go from production of 500,000 cars to a million in one year, that's literally billions of chips.

Q: The airlines are packed; what are your thoughts?

A: Yes, one of the best ways to invest is to invest in what you see. If you see airlines are packed, buy airline stocks. If you can’t hire anyone, you know the economy is booming.

Q: What about the Russel 2000 (IWM)?

A: We covered it; it looks like it wants to break out to new highs from here. By the way, there are only 1,500 stocks left in the Russell 2000 after the pandemic, mergers, and bankruptcies.

Q: Are there other ways to play copper out there like (FCX)?

A: Yes; one is the (COPX)— a pure copper futures ETF. However, be careful with pure metal ETFs of any kind because they have huge contangos and you could get a 50% move up in your commodity while your ETF goes down 50% over the same time. This happens all the time in oil and natural gas, and to a lesser degree in the metals, so be careful about that. Before you get into any of these alternative ETFs, look at the tracking history going back and I think you'll see you're much better off just buying (FCX).

Q: How long do you typically hold onto your 2-year LEAPS? Based on my research, the time decay starts to accelerate after about 3 months to one year on LEAPS.

A: Actually, with LEAPS, the reason I go out to two years is that the second year is almost free, there's almost no extra cost. And it gives you more breathing room for this thing to work. Usually, if I get my timing right, my LEAP stocks make big moves within the first three months; by then, the LEAP has doubled in value, and then you have to think about whether you should keep it or whether there are better LEAPS out there (which there almost always are). So, you sell it on a double, which only took a 30% move in the stock, or you may be committed to the company for the long term, like a Microsoft or an Amazon. And then you just run it through the expiration to get a 400% or 500% profit in two years. That is how you play the LEAP game.

Q: Are these recorded?

A: Yes, we record these and we post them on the website after about 2 hours. Just log into the site, go to “my account”, then select your subscription type (Global Trading Dispatch or Technology Letter), and “webinars” will be one of the button choices.

Q: Can you also sell calls on LEAPS?

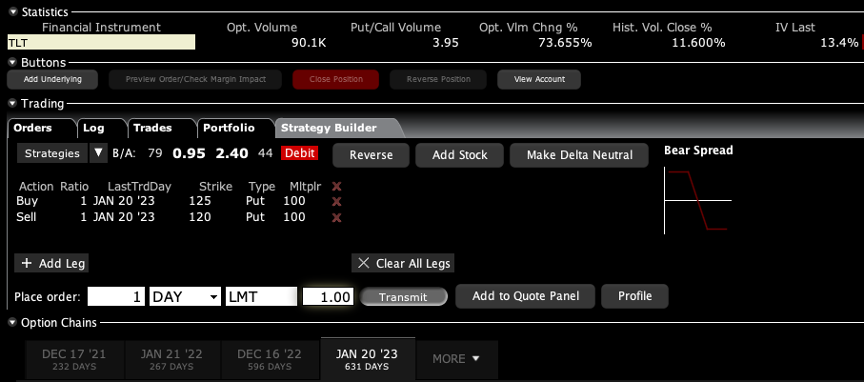

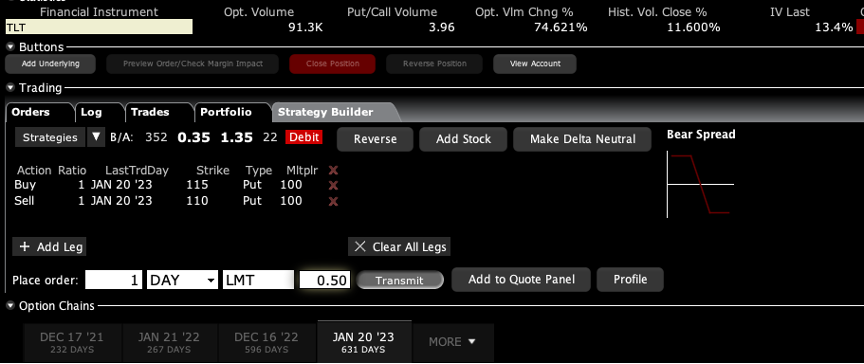

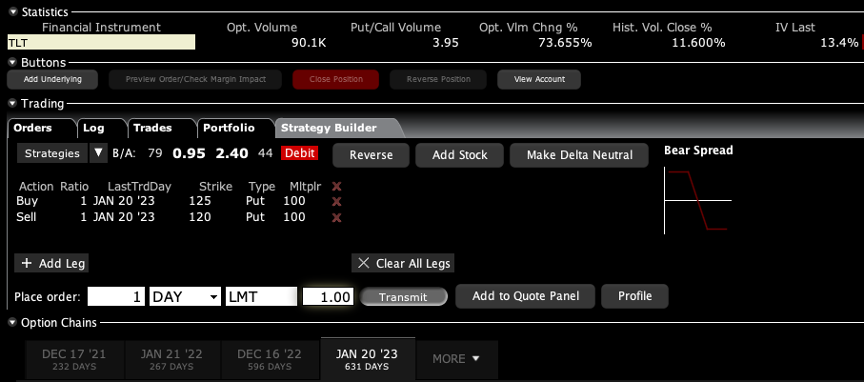

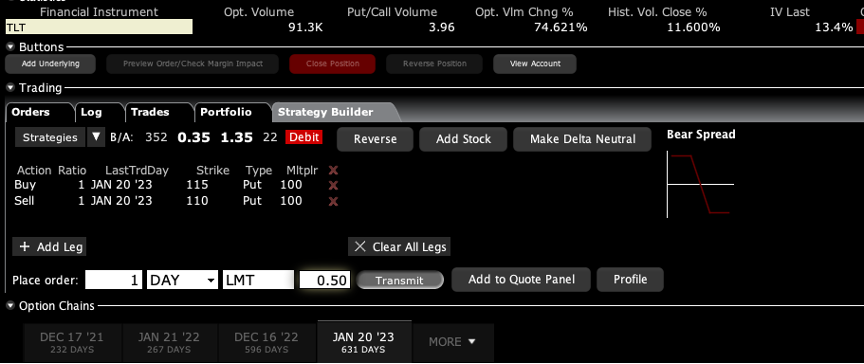

A: Yes and the only place to do that is the US Treasury market (TLT). There you either want to be short calls far above the market, out two years, or you want to be long puts. And by the way, if you did something like a $120-$125 put spread out to January 2023, then you’re looking at making about a 400% gain. That is a bet that 20-year interest rates only go up a little bit more, to 2.00%. If you really want to bet the ranch, do something like a $120-$122 and you might get a 1000% return.

Q: What is the best LEAP to trade for Microsoft (MSFT)?

Q: What is the best LEAP to trade for Microsoft (MSFT)?

A: If you want to go out two years, I would do something like a June 2023 $290-$300 vertical bull call spread. There is an easy 67% profit in that one on only a 20% rise in the stock. I do front monthlies for the trade alert service, so we always have at least 10 or 20 trade alerts going out every month. And the one I currently have for is a deep in the money May $230-$240 vertical bull call spread which expires in 12 days.

Q: What is the best way to play Google (GOOG)?

Q: What is the best way to play Google (GOOG)?

A: Go 20% out of the money and buy a January 2023 $2,900-$3,000 vertical bull call spread for $20—that should make about 400%. If you want more specific advice on LEAPS, we have an opening for the Mad Hedge Concierge Service so send an email to support@madhedgefundtrader.com with subject line “concierge,” and we will reach out to you.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH or TECHNOLOGY LETTER, then WEBINARS, and all the webinars from the last ten years are there in all their glory.

Good Luck and Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

I Think I See Another Winner

I Think I See Another Winner

Q: There is talk of digital currencies being launched in the US. Is there any truth to that? How would that affect the dollar?

A: There is no truth to that; there is not even any serious discussion of digital currency at the US Treasury. My theory has always been that once Bitcoin works and is made theft-proof, the government will take it over and make that the digital US dollar. So far, Bitcoin has existed regulation-free; in fact, the IRS is counting on a trillion dollars in capital gains being taxed going forward in helping to address the budget deficit.

Q: If you have a choice, what’s the best vaccine to get?

A: The best vaccine is the one you can get the fastest. I know you’re a little slow on the rollout in Canada. Go for Pfizer (PFE) if you’re able to choose. You should avoid Moderna (MRNA) because 15% of people getting second shots have one-day symptoms after the second shot. But basically, you don’t get to choose, only kids get to choose because only Pfizer has done trials on people under the age of 21. So, if you take your kids in, they will all get Pfizer for sure.

Q: Should I buy Freeport McMoRan (FCX) here or wait for a bigger dip?

A: Freeport has just had a 25% move up in a week. I wouldn’t touch that. We put out the trade alert when it was in the mid $30s, and it's essentially at its maximum profit point now. So, you don't need to chase—wait for a bigger dip or a long sideways move before you get in.

Q: How do I trade copper if I don't do futures?

A: Buy (FCX), the largest copper producer in the US, and they have call options and LEAPS. By the way, if we do get another $5 dip in Freeport, which we just had, I would really do something like the (FCX) $45-$50 2023 LEAP. You can get 5 times your money on that.

Q: Time to buy oil stocks (USO) for the summer?

A: No, the big driver of oil right now is the pandemic in India. They are one of the world's largest consumers—you find out that most poor countries are using oil right now as they can’t afford the more expensive alternative sources of power. And when your biggest customer is looking at a billion corona cases, that’s bad for business. Remember, when you trade oil, you’re trading against a long-term bear trend.

Q: Would you buy Delta Airlines (DAL) at today’s prices?

A: Yes, I’m probably going to go run the numbers on today's call spread; I actually have 20% of cash left that I could spend. So that looks like a good choice—summer will be incredible for the entire airline industry now that they have all staved off bankruptcy. Ticket prices are going to start rising sharply with an impending severe aircraft shortage.

Q: What are your thoughts on the Buffet index which shows that stocks are more stretched vs GDP at any time vs 2000?

A: The trouble with those indicators is that they never anticipated A) the Fed buying $120 billion a month in US Treasury bonds, B) the Fed promising to keep interest rates at zero for three years, and C) an enormous bounce back from a once-in-a-hundred-year pandemic. That's why not just the Buffet Index but virtually all technical indicators have been worthless this year because they have shown that the market has been overbought for the last six months. And if you paid attention to your indicators, you were either left behind or you went short and lost your shirt. So, at a certain point, you have to ignore your technical indicators and your charts and just buy the damn market. The people who use that philosophy (and know when to use it, and it’s not always) are up 56% on the year.

Q: What trade categories are getting fantastic returns? It’s certainly not tech.

A: Well, we actually rotated out of tech last September and went into banks, industrial plays, and domestic recovery plays. And you can see in the stocks I just showed you in our model portfolio which one we’re getting the numbers from. Certainly, it was not tech; tech has only performed for the last four weeks and we jumped right back in that one also with positions in Microsoft (MSFT). So yes, it’s a constantly changing game; we’re getting rotations almost daily right now between major groups of stocks. The only way to play this kind of market is to listen to someone who’s been practicing for 52 years.

Q: I am 83 years old and have four grandchildren. I want to invest around $20,000 with each child. I was thinking of your bullish view on Tesla (TSLA) on a long-term investment. Do you agree?

A: If those were my grandchildren, I would give them each $20,000 worth of the ProShares Ultra Technology Fund (ROM), the 2x long technology ETF. Unless tech drops 50% from here, that stock will keep increasing at twice the rate of the fastest-growing sector in the market. I did something similar with my kids about 20 years ago and as a result, their college and retirement funds for their kids have risen 20 times. So that’s what I would do; I would never bet everything on a single stock, I would go for a basket of high-tech stocks, or the Invesco QQQ NASDAQ Trust (QQQ) if you don’t want the leverage.

Q: Do you like Amazon (AMZN) splitting?

A: I don’t think they’ll ever split. Jeff Bezos worked on Wall Street (with me at Morgan Stanley) and sees splits as nothing more than a paper shuffle, which it is. It’s more likely that he’ll break up the company into different segments because when they get to a $5 trillion market cap, it will just become too big to manage. Also, by breaking Amazon up into five companies—AWS, the store, healthcare, distribution, etc., —you’re getting a premium for those individual pieces, which would double the value of your existing holdings. So, if you hold Amazon stock, you want it to face an antitrust breakup because the flotation will double the value of your total holdings. That has happened several times in the past with other companies, like AT&T (T), which I also worked on.

Q: When is Tesla going to move and why is it going up with earnings up 74%?

A: Well, the stock moved up a healthy 46% going into the earnings; it’s a classic sell the news market. Most stocks are doing that this quarter and they did so last quarter as well. And Tesla also tends to move sideways for years and then have these explosive moves up. I think the next double or triple will come when they announce mass production of their solid-state batteries, which will be anywhere from 2 to 5 years off.

Q: How can I renew my subscription?

A: You can call customer support at 347-480-1034 or email support@madhedgefundtrader.com and I guarantee you someone will get back to you.

Q: Top gene-editing stock after CRISPR Therapeutics (CRSP)?

A: There are two of them: one is Intellia (NTLA); it’s actually done better than CRISPR lately. The second is Editas (EDIT) and you’ll find out that the same professionals, including the Nobel prize winner Jennifer Doudna here at Berkeley, rotate among all three of these, and the people who run them all know each other. They were all involved in the late 2000's fundamental research on CRISPR, and they’re all frenemies. So yes, it's a three-company industry, kind of like the cybersecurity industry.

Q: What about ****** (PYPL)?

A: I would wait for the earnings since so many companies are selling off on their announcements. See if they sell off 3-5%, then you buy it for the next leg up. That is the game now.

Q: Do you like any 3D printing stocks like Faro Technologies (FARO)?

A: No, that’s too much of a niche area for me, I’m staying away. And that's becoming a commodity industry. When they were brand new years ago, they were red hot, now not so much.

Q: Do you see the chip companies continuing their bull run for the next few months?

A: I do. If anything, the chip shortage will get worse. Each EV uses about 100 chips, and they’re mostly the low-end $10 chips. Ford (F) said production of a million cars will be lost due to the chip shortage. Ford itself has 22,000 cars sitting in a lot that are fully assembled awaiting the chips. Tesla alone has $300 worth of chips just in its inverters, and there are two inverters in every car. So, when you go from production of 500,000 cars to a million in one year, that's literally billions of chips.

Q: The airlines are packed; what are your thoughts?

A: Yes, one of the best ways to invest is to invest in what you see. If you see airlines are packed, buy airline stocks. If you can’t hire anyone, you know the economy is booming.

Q: What about the Russel 2000 (IWM)?

A: We covered it; it looks like it wants to break out to new highs from here. By the way, there are only 1,500 stocks left in the Russell 2000 after the pandemic, mergers, and bankruptcies.

Q: Are there other ways to play copper out there like (FCX)?

A: Yes; one is the (COPX)— a pure copper futures ETF. However, be careful with pure metal ETFs of any kind because they have huge contangos and you could get a 50% move up in your commodity while your ETF goes down 50% over the same time. This happens all the time in oil and natural gas, and to a lesser degree in the metals, so be careful about that. Before you get into any of these alternative ETFs, look at the tracking history going back and I think you'll see you're much better off just buying (FCX).

Q: How long do you typically hold onto your 2-year LEAPS? Based on my research, the time decay starts to accelerate after about 3 months to one year on LEAPS.

A: Actually, with LEAPS, the reason I go out to two years is that the second year is almost free, there's almost no extra cost. And it gives you more breathing room for this thing to work. Usually, if I get my timing right, my LEAP stocks make big moves within the first three months; by then, the LEAP has doubled in value, and then you have to think about whether you should keep it or whether there are better LEAPS out there (which there almost always are). So, you sell it on a double, which only took a 30% move in the stock, or you may be committed to the company for the long term, like a Microsoft or an Amazon. And then you just run it through the expiration to get a 400% or 500% profit in two years. That is how you play the LEAP game.

Q: Are these recorded?

A: Yes, we record these and we post them on the website after about 2 hours. Just log into the site, go to “my account”, then select your subscription type (Global Trading Dispatch or Technology Letter), and “webinars” will be one of the button choices.

Q: Can you also sell calls on LEAPS?

A: Yes and the only place to do that is the US Treasury market (TLT). There you either want to be short calls far above the market, out two years, or you want to be long puts. And by the way, if you did something like a $120-$125 put spread out to January 2023, then you’re looking at making about a 400% gain. That is a bet that 20-year interest rates only go up a little bit more, to 2.00%. If you really want to bet the ranch, do something like a $120-$122 and you might get a 1000% return.

A: If you want to go out two years, I would do something like a June 2023 $290-$300 vertical bull call spread. There is an easy 67% profit in that one on only a 20% rise in the stock. I do front monthlies for the trade alert service, so we always have at least 10 or 20 trade alerts going out every month. And the one I currently have for is a deep in the money May $230-$240 vertical bull call spread which expires in 12 days.

A: Go 20% out of the money and buy a January 2023 $2,900-$3,000 vertical bull call spread for $20—that should make about 400%. If you want more specific advice on LEAPS, we have an opening for the Mad Hedge Concierge Service so send an email to support@madhedgefundtrader.com with subject line “concierge,” and we will reach out to you.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH or TECHNOLOGY LETTER, then WEBINARS, and all the webinars from the last ten years are there in all their glory.

Good Luck and Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Quote of the Day"When it comes down to data or anecdotes when making a management decision, the anecdotes are usually right," said Jeff Bezos, the founder of Amazon.

|

this is the one I've been waiting on for years...This will be a lot like the TWST ride IMO

Ginko bioworks...Going public via a SPAC.

I'll buy double fisted... worth watching long.

https://investmentu.com/ginkgo-bioworks-ipo-stock/

Hope everyone is doing swell around here.

Ginko bioworks...Going public via a SPAC.

I'll buy double fisted... worth watching long.

https://investmentu.com/ginkgo-bioworks-ipo-stock/

Hope everyone is doing swell around here.

:toast:Welcome back Bozzie!!

Global Market Comments

May 24, 2021

Fiat LuxFeatured Trade:(MARKET OUTLOOK FOR THE WEEK AHEAD, or IT'S ALL ABOUT THE NUMBERS),

(TLT), (SPY), (FCX), (QQQ), (VIX), (UUP), (AMAT), (CRM), (GOOG), (AMZN), (AAPL), (FB)

May 24, 2021

Fiat LuxFeatured Trade:(MARKET OUTLOOK FOR THE WEEK AHEAD, or IT'S ALL ABOUT THE NUMBERS),

(TLT), (SPY), (FCX), (QQQ), (VIX), (UUP), (AMAT), (CRM), (GOOG), (AMZN), (AAPL), (FB)

The Market Outlook for the Week Ahead, or It’s All About the NumbersI know that not all of you are mathematicians, nor blessed with math degrees from UCLA, as I am. However, the future of your retirement funds relies on a few simple numbers. So, I will try to be gentle.

S&P tech stocks are trading at a 27 price earnings multiple. The S&P 500 Index, as a whole, trades at a 21 multiple. S&P value stocks, financials, and old-line recovery stocks like industrials and materials are trading at a 17 multiple.

Historically, companies with double the earnings power of the index trade at a 5-point premium to the main market. As long as this disparity exists, tech stocks will go down and value with go up.

However, we are getting close to a reversal. Allowing for market noise, I don’t see tech dropping more than 10% from here over the coming months. Then we will see the mother of all Q4 rallies taking it to new highs.

That explains why investors have been nibbling on tech lately, especially the best ones like NVIDIA (NVDA), Applied Materials (AMAT), and Salesforce (CRM). You also want to pick up big cap money machines like Alphabet (GOOG), Amazon (AMZN), Apple (AAPL), and Facebook (FB). Their LEAPS are begging for attention.

That means the downside from here is limited. Sorry Cassandras, no crashes here.

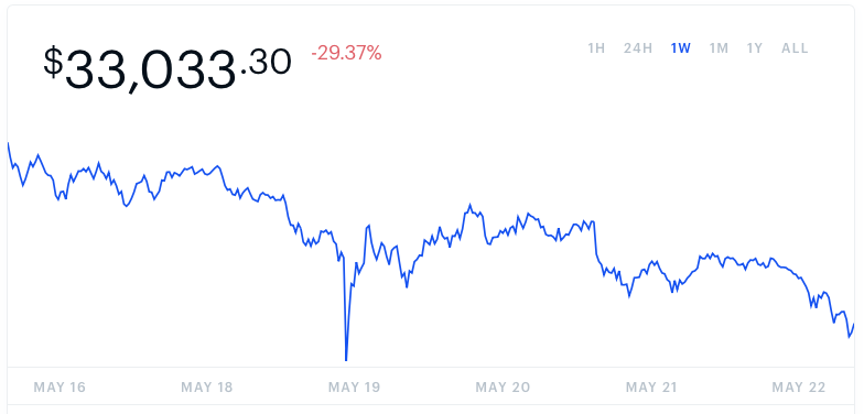

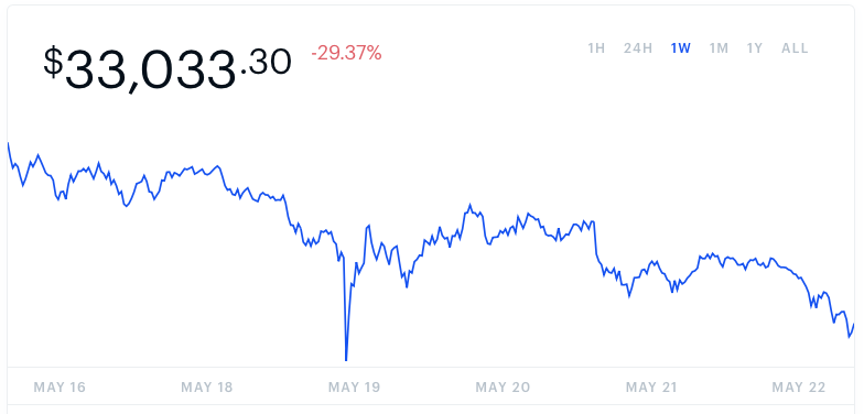

I am more convinced of this outcome than ever, given the substantial number of crashes and disasters, markets have weathered this year. These are truly Teflon markets. Last week, Bitcoin collapsed an amazing 55% in six weeks, wiping $1 trillion off the value of that market.

The fear had been that a crypto crash of this size would ignite a system contagion that would take everything down. A few years ago, it would have. But with massive Fed liquidity and unprecedented deficit spending, all we got was down 600 points one day and 600 up the next.

No crash here.

We’ve also had smaller crashes in sectors that were the most egregiously overpriced in February, like SPACS, meme stocks, and shares trading at 100 times sales with no earnings. Again, no harm no foul. It was a comeuppance that was well earned.

The big tell that I am right came screaming loud and clear last week from the US dollar, which hit a new 2021 low. A cheaper greenback means cheaper US stocks for foreign investors, which means they buy more of them. A weak buck also means that interest rates will stay lower for longer, which is great news for stocks, especially tech.

So, take it easy for the next few months. Keep positions small and rejoin the human race.

It seems odd going out into civilization and seeing live people walking around without masks. All the batteries on my watches are dead, as they have not been used for nearly two years, so they are getting replaced. I walked into my closet, and it was like adventuring into an archeological dig, with dozens of Turnbull & Asser shirts untouched by human hands. I’ve been living in Marine Corps sweats since 2019.