|

| Global Market Comments June 11, 2021 Fiat Lux Featured Trade: (HOW TO FIND A GREAT OPTIONS TRADE)

|

| � |

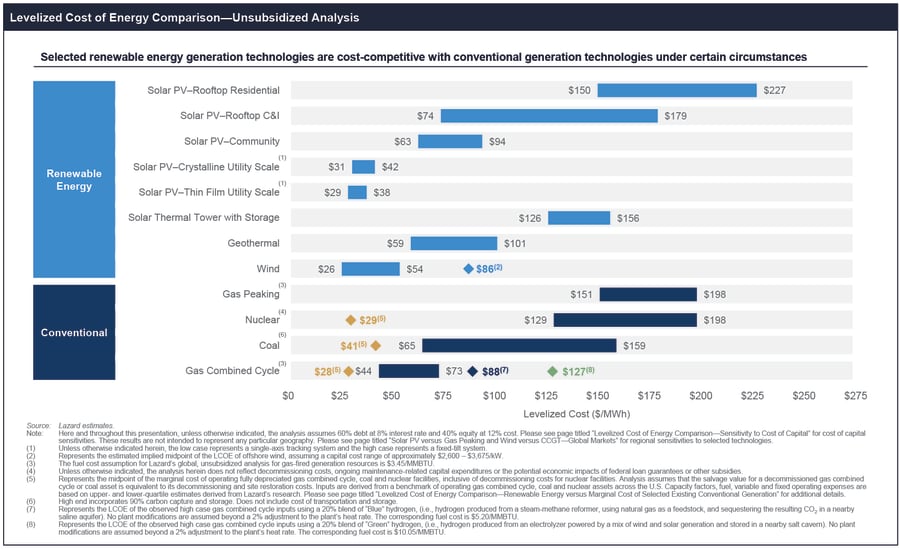

How to Find a Great Options TradeYou’ve spent vast amounts of time, money, and effort to become an options trading expert. You know the difference between bids and offers, puts and calls, exercise prices, and expiration days. And you still can’t make any money. Now what? Where do you apply your newfound expertise? How do you maximize your reward while minimizing your risk? It is all very simple. Stick to five basic disciplines and you will suddenly find that the number of your new trades that are winners takes a quantum leap, and money will start pouring into your trading account. It’s really not all that hard to do. So here we go! 1) Know the Macro Picture If you have a handle on whether the economy is growing or shrinking, you have a major advantage in the options market. In a growing economy, you only want to employ bullish strategies, like calls, call spreads, and short volatility plays. In a shrinking economy, you want to execute bearish plays, like puts, put spreads, and long volatility plays. Remember, the only thing that is useful for your options trading is a view on what the economy is going to do NEXT. The government only publishes historical economic data, which is for the most part useless in predicting what is going to happen in the future. The options market is all about discounting what is going to happen next. And how do you find that out? Well, you could hire your own in-house staff economist. Or you could rely on economic research from the largest brokerage houses. Even the Federal Reserve puts out its own forecasts for economic growth prospects. However, all of these sources have notoriously poor track records. Listening to them and placing bets on their advice CAN get you into a world of trouble. For the best possible read on the future of the US and the global economy, there is no better place to go than Global Trading Dispatch, published by me, John Thomas, the Mad Hedge Fund Trader. This is where the largest hedge funds and brokers go to find out what really is going to happen to the economy. Do you want to give yourself another valuable edge? There are over 100 different industries listed on US stock markets. However, only about 5 or 10 are really growing decisively at any particular time. The rest are either going nowhere or are shrinking. In fact, you can find a handful of sectors that are booming, while others are in outright recession. If you are a major hedge fund, institution, or government, you may want to cover all 100 of those industries. Good luck with that. If you are a small hedge fund, or an individual working from home, you will want to conserve your time and resources, skip most of US industry, and only focus on a handful. Some traders take this a step further and only concentrate on a single high growing, volatile industry, like technology or biotech, or even a single name, like Netflix (NFLX), Tesla (TSLA), or Amazon (AMZN). How do you decide which industry to trade? Brokerage houses pump out more free research than you could ever read in a lifetime. Government reports tend to be stodgy, boring, and out of date. Big hedge funds keep their in-house research confidential (although some of it leaks out to me). The Mad Hedge Fund Trader solves this problem for you by limiting its scope to a small number of benchmark, pathfinder industries, like technology, banks, energy, consumer cyclical, biotech, and cybersecurity. In this way, we gain a handle on what is happening in the economy as a whole, while lining up rifle shots on the best options trades out there. We want to direct you where the action is, and where we have a good handle on future earnings prospects. It doesn’t hurt that we live on the edge of Silicon Valley and get invited to test out many new technologies before they are made public. My Tesla Model S1 is a perfect example. That encourages me to recommend Tesla stock at $16 before it began its historic run to $295. It was the best short squeeze ever. 2) The Micro Picture is Ideal Once you have a handle on the economy and the best industries, it’s time to zero in on the best company to trade in, or the “MICRO” selection. It’s always great to find a good target to trade in because positions in single companies can deliver double or even triple the returns compared to stock indexes. That's because the market will pay a far higher implied volatility for a single company than a large basket of companies. Remember also that you are taking greater risks in trading individual companies. The options market will pay you for that extra risk. If the earnings come through as expected, everything is hunky-dory. If they don’t, the shares can drop by half in a heartbeat. Large indexes buffer this effect, which is why they have far lower volatility. Of course, there are gobs of market research about individual companies out there from brokers. Some of it is right, some of it is wrong, but all of it is conflicted. Recommendations are either “BUY” or “HOLD”. Brokers are loath to issue a “SELL” recommendation for a stock because it will eliminate any chance of that firm obtaining new issue business. Who wants to hire a broker to sell new stock when their analyst has already dissed the company? And brokerage firms don’t make their bread and butter on those piddling little discount commissions you have been paying them. They make it on highly lucrative new issues business. In fact, a new issue can earn as much as $100 million for one firm. I know because I’ve done it. I have been following about 100 companies in the leading market sectors for nearly half a century. Some of the management of these firms have become close friends over the decades. So, I get some really first-class information. When markets rotate to sectors and companies that I already know, I have a huge advantage. Needless to say, this gives me a massive head start when selecting individual names for options Trade Alerts. 3) The Technicals Line Up I have never been a huge fan of technical analysis. Most technical advice boils down to “if it’s gone up, it will go up more” or “If it’s gone down, it will go down more.” Over time, the recommendations are accurate 50% of the time or is about equal with a coin toss. However, the shorter the time frame, the more useful technical analysis becomes. If you analyze intraday trading, almost all very short-term movements can be explained in technical terms. This is entirely how day traders make their livings. It’s a classic case of if enough people believe something, it becomes true, no matter how dubious the underling facts may be. So it does behoove us to pay some attention to the charts when executing your trades. Talk to old-time investors and you will fund that they use fundamentals for long-term stock selection and technicals for short-term order execution. Talk to them some more and you find the best fundamentalists sound like technicians, while savvy technicians refer to underlying fundamentals. Get the technicals right, and you can provide one additional reason for your trade to work. 4) The Calendar is Favorable There is one more means of assuring your trades turn into winners. I am a big fan of buying straw hats in the dead of winter and umbrellas in the sizzling heat of the summer. There IS a method to my madness. Have you heard of “Sell in May and go away?” According to the Stock Trader’s Almanac, $10,000 invested at the beginning of May and sold at the end of October every year since 1950 would be showing a loss today. This is despite the fact that the Dow Average rocketed from $409 to $18,300 during the same time period, a gain of 44.74 times! Amazingly, $10,000 invested every November and sold at the end of April would today be worth $702,000, giving you a compound annual return of 7.10%. It gets better. Of the 62 years under study, the market was down in 25 of the May to October periods, but negative in only 13 of the November to April periods. What’s more, the market has been down only three times during the November to April in the last 20 years! There have been just three times when the "good 6 months" have lost more than 10% (1969, 1973, and 2008), but with the "bad six months" time period, there have been 11 losing losses of 10% or more. So it’s clear that trading according to the calendar can have a significant impact on your profitability. Being a long-time student of the American, and indeed, the global economy, I have long had a theory behind the regularity of this cycle. It’s enough to base a pagan religion around, like the ones practicing Druids at Stonehenge. Up until the 1920s, we had an overwhelmingly agricultural economy. Farmers were always at maximum financial distress in the fall when their outlays for seed, fertilizer, and labor were the greatest, but they had yet to earn any income from the sale of their crops. So they had to borrow all at once, placing a large cash call on the financial system as a whole. This is why we have seen so many stock market crashes in October. Once the system swallows this lump, it’s nothing but green lights for six months. After the cycle was set and was easily identifiable by computer algorithms, the trend became a self-fulfilling prophecy. Yes, it may be disturbing to learn that we ardent stock market practitioners might in fact be the high priests of a strange set of beliefs. But hey, some people will do anything to outperform the market. It is important to remember that this cyclicality is not 100% accurate, and you know the one time you bet the ranch, it won’t work. Benefits of the Tailwinds So there we have it. Adopt these five simple disciplines and you will find your success rate on trades jumps from a mere coin toss to 70%, 80%, or even 90%. In other words, you convert your trading from an endless series of frustrations to a reliable source of income. If a potential trade meets only four of these five criteria, please do it with your money and not mine. Your chances of making money have just declined. And I bet a lot of you poor souls execute trades all the time that meet NONE of these criteria. No wonder you’re losing money hand over fist! Get the tailwinds of the economy, your industrial call, your company pick, the market technicals, and the calendar working for you, and all of a sudden you’re a trading genius. It only took me half a century to pull all this together. Hopefully, you can learn a little bit faster than me. I hope it all works for you.

|

Quote of the Day“In a social democracy with a fiat currency, all roads lead to inflation,” said legendary hedge fund manager Bill Fleckenstein.

|

| This is not a solicitation to buy or sell securities The Mad Hedge Fund Trader is not an Investment advisor For full disclosures click here at: http://www.madhedgefundtrader.com/disclosures The "Diary of a Mad Hedge Fund Trader"(TM) and the "Mad Hedge Fund Trader" (TM) are protected by the United States Patent and Trademark Office The "Diary of the Mad Hedge Fund Trader" (C) is protected by the United States Copyright Office |