You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Intersting thoughts

- Thread starter Bozzie

- Start date

Wife and I went to the movies last night for the first time in a year +, saw Quiet Place 2. Pretty good, not great - first one was better.

Nice we just went out for dinner..Packed restaurant

,

|

| Global Market Comments June 2, 2021 Fiat Lux Featured Trade: (HOW TO EXECUTE A VERTICAL BULL CALL SPREAD), (AAPL)

|

| � |

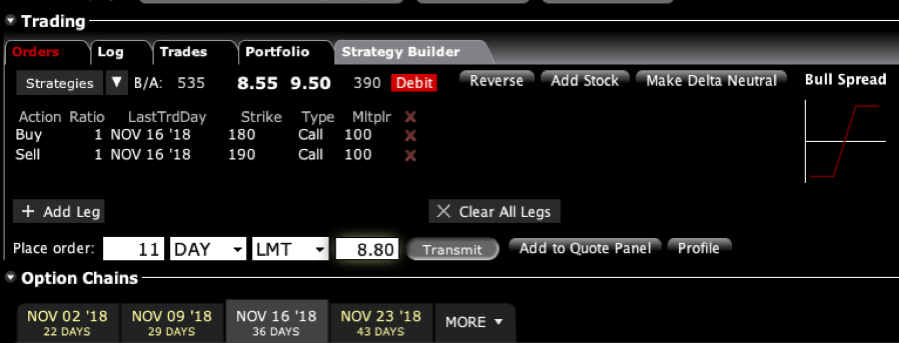

How to Execute a Vertical Bull Call SpreadWe have recently had a large influx of new subscribers. I have no idea why. Maybe it’s my sterling personality and rapier-like wit. For whatever reason, I am going to update several educational pieces that are core to understanding the Mad Hedge trading strategy. Most investors make the mistake of investing in positions that have only a 50/50 chance of success, or less. They’d do better with a coin toss. The most experienced hedge fund traders find positions that have a 99% chance of success and then leverage up on those trades. Stop out of the losers quickly and you have an approach that will make you well into double digits, year in and year out, whether markets go up, down, or sideways. For those readers looking to improve their trading results and create the unfair advantage they deserve, I have posted a training video on How to Execute a Vertical Bull Call Spread. This is a matched pair of positions in the options market that will be profitable when the underlying security goes up, sideways, or down in price over a defined limited period of time. It is the perfect position to have onboard during markets that have declining or low volatility, much like we have experienced for most of the last several years, and will almost certainly see again. I have strapped on quite a few of these babies across many asset classes this year, and they are a major reason why I am up so much last year. To understand this trade, I will use the example of Apple trade, which most people own and know well. On October 8, 2018, I sent out a Trade Alert by text message and email that said the following: BUY the Apple (AAPL) November 2018 $180-$190 in-the-money vertical BULL CALL spread at $8.80 or best At the time, Apple shares were trading at $216.17. To accomplish this, they had to execute the following trades: Buy 11 November 2018 (AAPL) $180 calls at….…....……$38.00 Sell short 11 November 2018 (AAPL) $190 calls at.....….$29.20 Net Cost:…………………….………..………….…..................$8.80 A screenshot of my own trading platform is below:

The vertical part of the description of this trade refers to the fact that both options have the same underlying security (AAPL), the same expiration date (November 16, 2018), and only different strike prices ($180 and $190). The maximum potential profit can be calculated as follows: +$190.00 Upper strike price -$180.00 Lower strike price +$10.00 Maximum Potential Profit Another way of explaining this is that the call spread you bought for $8.80 is worth $10.00 at expiration on November 16, giving you a total return of 13.63% in 27 trading days. Not bad! The great thing about these positions is that your risk is defined. You can’t lose any more than the $9,680 you put up. If Apple goes bankrupt, we get a flash crash or suffer another 9/11 type event, you will never get a margin call from your broker in the middle of the night asking for more money. This is why hedge funds like vertical bull call spreads so much. As long as Apple traded at or above $190 on the November 16 expiration date, you will make a profit on this trade. As it turns out, my take on Apple shares proved dead-on, and the shares rose to $222.22, or a healthy $32 above my upper strike. The total profit on the trade came to: ($10.00 expiration - $8.80 cost) = $1.20 ($1.20 profit X 100 shares per contract X 11 contracts) = $1,320. To summarize all of this, you buy low and sell high. Everyone talks about it but very few actually do it. Occasionally, Vertical Bull Call Spreads don’t work and the wheels fall off. As hard as it may be to believe, I am not infallible. So if I’m wrong and I tell you to buy a vertical bull call spread, and the shares fall not a little, but a LOT, you will lose money. In those rare cases when that happens, I’ll shoot out a Trade Alert to you with stop-loss instructions before the damage gets out of control. I start looking at a stop loss when the deficit hit 10% of the size of the position or 1% or the total capital in my trading account. To watch the video edition of How to Execute a Vertical Bull Call Spread complete with more detailed instructions on how to execute the position with your own online platform, please click here. Good luck and good trading.

|

Quote of the Day“Semiconductors are the new industrials,” said Josh Brown of Ritholtz Wealth Management. |

| This is not a solicitation to buy or sell securities The Mad Hedge Fund Trader is not an Investment advisor For full disclosures click here at: http://www.madhedgefundtrader.com/disclosures The "Diary of a Mad Hedge Fund Trader"(TM) and the "Mad Hedge Fund Trader" (TM) are protected by the United States Patent and Trademark Office The "Diary of the Mad Hedge Fund Trader" (C) is protected by the United States Copyright Office Futures trading involves a high degree of risk and may not be suitable for everyone.[FONT="][/FONT] |

| Good morning. (Was this newsletter forwarded to you? Sign up here.) |

|

| [h=2]What is anything worth?[/h] |

| Remember GameStop? The original meme stock, which surged in January as retail traders banded together to buy it, now seems like ancient history. These days, it’s all about AMC, the movie theater chain whose value has soared far higher and faster than GameStop and other meme stocks. AMC’s stock nearly doubled yesterday alone; it’s now worth nearly eight times its prepandemic high, a heady valuation for a business that was flirting with bankruptcy not long ago. |

|

| By the numbers. AMC is now as valuable as Delta Air Lines. AMC says that more than three million retail investors now hold about 80 percent of its shares; most big companies’ share registers are dominated by institutions. This “atypical” retail interest, AMC said in a recent filing, could lead to “rapid and substantial increases or decreases unrelated to our operating performance or prospects, or macro or industry fundamentals.” But the well-organized groups of retail traders who encourage each other to buy and hold in forums like Reddit and elsewhere on social media proved that the January frenzy was not a one-off event, and could become a more typical feature of stock markets. |

| AMC is embracing the retail crowd, offering free popcorn and other perks to shareholders and, more important, raising much-needed cash by issuing more of its suddenly turbocharged shares. Today, it authorized the issue of a big chunk of new shares, worth more than $700 million at prevailing prices, which were down only a little in premarket trading. On Tuesday, it sold $230 million of stock to Mudrick Capital, which promptly sold the shares at a quick profit. This is not how these things usually work. |

|

| What does it mean? When stock prices are divorced from fundamentals, it cements the public perception that markets can be manipulated — by a small group of insiders or a large group of determined traders — and therefore can’t be trusted. That could have long-term implications beyond what happens with AMC, GameStop or any other stock in the headlines. |

|

| [h=3]HERE’S WHAT’S HAPPENING[/h] |

| The Fed will sell off its Covid-era corporate debt holdings. The plan will wind down a program launched last March to stabilize the bond markets in the early days of the pandemic. It’s the latest sign of the burgeoning economic recovery. |

| The F.B.I. names a suspect in the JBS ransomware attack. Federal authorities said REvil, a prominent Russian cybercriminal gang, was behind the hack that disrupted the world’s biggest meat processor. REvil is considered one of the biggest perpetrators of “ransomware as a service,” selling its software to other criminals. |

| Exxon Mobil loses a third board seat to an activist investor. Exxon said that Engine No. 1, the tiny investment firm that sought to shake up the oil giant on environmental grounds, had claimed another director position. In other shareholder activism news, Elliott Management has taken a roughly 10 percent stake in the data storage company Dropbox, DealBook has confirmed. |

| Anheuser-Busch InBev offers free beer to promote vaccinations. The brewing giant said it would “buy America’s next round” of beer, seltzer or a nonalcoholic drink if 70 percent of American adults receive at least one dose of vaccine by July 4. (The country is currently at 63 percent.) |

| Dogecoin roars back. The price of the joke cryptocurrency has surged since Tuesday, as Coinbase added it to its pro trading platform. It has gained more than 30 percent since then, but remains well below its highs set last month. |

| [h=2]New York may change how America does antitrust[/h] |

| The New York State legislature is in session for another week and competition law is on the docket. State Senator Michael Gianaris told DealBook that he’s confident there will be action on “The 21st Century Anti-Trust Act,” legislation he sponsored that would dramatically alter current standards. The revamp is necessary, Gianaris said, because “now we have digital and tech economies that have upended everything.” |

| The act’s passage would put New York at the “vanguard” of a national movement, 15 state and national labor and policy groups wrote in a letter to legislators that DealBook is first to report. The organizations argue that the lawwould “rein in many abusive tactics corporations use against other firms and workers that are difficult to challenge under current antitrust law and precedent.” |

| Market dominance would be presumed with 40 percent market share.Currently, companies qualify as dominant if they have 70 to 90 percent of a market. “It’s not illegal to be dominant,” said Pat Garofalo of the American Economic Liberties Project, one of the groups that signed the letter. “It’s just illegal to block others from the market unfairly.” In the act, an “abuse of dominance” standard would replace the current “consumer welfare” standard. |

|

| “The proposed legislation adopts a European standard for defining a monopoly,” said Kathryn Wylde, the head of the Partnership for New York City, a group that represents the city’s C.E.O.s. “It may be a political win to take on the big tech companies,” but developing a new regulatory regime is best left to the federal government, she said. |

|

| [h=2]Yellen takes on a tax ‘race to the bottom’[/h] |

| Treasury Secretary Janet Yellen is at the Group of 7 finance ministers meeting in Britain, which starts tomorrow, with a mission: convince her global counterparts to embrace a global minimum tax and eliminate tax havens. It won’t be easy. |

| Yellen wants to end a “race to the bottom,” in which countries slash their tax rates to entice companies to move their headquarters and shift profits. This is tied to the Biden administration’s effort to raise the U.S. corporate tax rate, which would be more effective if there were fewer low-tax jurisdictions competing to lure companies away. |

| The U.S. is also applying pressure. The Biden administration unveiled 25 percent levies on some $2.1 billion worth of goods as a response to other countries’ efforts to tax American digital giants. The tariffs, however, were suspended — for 180 days — while the U.S. negotiates with other countries. |

| Proponents of a global minimum tax see the possibility of a deal by October. “There’s been a 180-degree change on taxes by the United States that makes us think there will be a deal,” said Ángel Gurría of the O.E.C.D. |

|

| In other economic news: The U.S. is enjoying sustained wage growth, but experts worry about a slowdown or a rise in inflation. Here are the charts to watch to see which way things are headed. |

|

| [h=2]Will supersonic business travel make a comeback?[/h] |

| Maybe, in about a decade. United Airlines announced today a deal to buy 15 jets that can travel faster than the speed of sound from Boom Supersonic, a Denver-based start-up. United said it has an option to increase its order by up to 35 planes. |

| United has been positioning itself as an innovative risk taker. It announced a $20 million investment in an electric air taxi start-up, Archer, in February. “Aerospace takes a long time to innovate,” said Michael Leskinen, who heads corporate development at United. “If you don’t start setting these opportunities out now, you will have missed them.” |

|

| Barriers beyond sound. The Concorde flew its final trip between New York and London in 2003. That service was plagued by high costs, safety concerns and flagging demand. In recent years, people have also grown increasingly concerned about air travel’s contribution to climate change. Boom says its new engines are more efficient than their gas-guzzling supersonic predecessors, and that they would run on “sustainable aviation fuel,” making them better for the environment. |

| Will business buy in? United is not yet saying how much a ticket would cost, though it notes that the Overture would run at a quarter of the operating costs of a Concorde. Pitched at business travelers, who got used to fewer in-person meetings during the pandemic, the new service would test whether corporate travel managers think cutting travel time is worth adding to costs, said Henry Harteveldt, a travel industry analyst. |

| Thank you for your support. Want to share The New York Times? Friends and family can enjoy unlimited digital access to our journalism with this special offer. |

| [h=3]THE SPEED READ[/h] |

| Deals |

|

| Politics and policy |

| Tech |

|

| Best of the rest |

|

| Thanks for reading! We’ll see you tomorrow. |

| We’d like your feedback! Please email thoughts and suggestions to dealbook@nytimes.com. |

|

|

|

|

|

|

| Andrew Ross Sorkin, Founder/Editor-at-Large, New York @andrewrsorkin |

| Jason Karaian, Editor, London @jkaraian |

| Sarah Kessler, Deputy Editor, Chicago @sarahfkessler |

| Michael J. de la Merced, Reporter, London @m_delamerced |

| Lauren Hirsch, Reporter, New York @LaurenSHirsch |

| Ephrat Livni, Reporter, Washington D.C. @el72champs |

| Good morning. (Was this newsletter forwarded to you? Sign up here.) |

|

| [h=2]A SPAC deal like no other[/h] |

| Bill Ackman’s jumbo-sized SPAC has finally found its big deal: It is closing in on an agreement to buy a 10 percent stake in Universal Music Group, the home of artists like Taylor Swift, at a $42 billion valuation. If completed, the transaction would be the biggest involving a SPAC to date — and it would certainly be among the most complex. |

| Here’s how it would work — buckle up, because this is complicated: |

|

| What’s the point of all this financial engineering? This complex transaction is unlike any other SPAC deal, and in many ways doesn’t resemble a SPAC at all. Vivendi is a clear winner, since it would get another major investor for Universal at a higher valuation than Tencent had given the music label earlier this year. The outcome for Pershing Square Tontine’s various investors is more complicated, since it won’t work like a traditional SPAC: |

|

|

| Investors appear wary of the deal. Shares in Ackman’s SPAC plunged 14 percent in after-hours trading after news reports about the Universal transaction emerged, but at the time of writing were down 7 percent. They remain above the blank-check firm’s $20 I.P.O. price, but down from a high of more than $30 a few months ago. |

| [h=3]HERE’S WHAT’S HAPPENING[/h] |

| Has the job market bounced back? The Labor Department is set to publish May jobs data at 8:30 a.m. Eastern, and a lot is at stake given the previous month’s shockingly low numbers. Economists expect to see a sharp rebound in hiring, but another weak showing might aid arguments that overly generous unemployment benefits are deterring people from seeking work. |

| President Biden offers more cuts to his infrastructure plan to win bipartisan support. In proposing to further limit spending and delay some tax increases, the president is hoping to win over moderate Republican senators. The gambit appeared to generate little support, however, and progressive Democrats are pushing him to pass the bill along party lines. |

| The E.U. and U.K. open their first formal antitrust investigation into Facebook. The inquiry will examine whether Facebook improperly uses data gathered from advertisers to compete against them in classified ads. It is a similar investigation to the one being pursued against Amazon. |

| More sponsors of the Tokyo Olympics call for a delay. Several corporate backers are privately encouraging organizers to push the games back by several months to allow more spectators to safely attend, The Financial Times reports. |

| The White House urges companies to shore up defenses against ransomware. Federal cybersecurity officials called on corporate America to adopt the same protective measures that the government and contractors use. It’s part of a rushed effort to protect critical infrastructure in the wake of two hacks that crippled a vital oil pipeline and a giant meat processor. |

| [h=2]The U.S. economy is 93.03 percent recovered[/h] |

| At least, that’s according to the latest reading of the “recovery tracker” compiled by Oxford Economics. The index combines a range of high-frequency statistics — Covid cases, hotel stays, job postings, mortgage applications and the like — to gauge economic activity in relation to late January, before the pandemic turned everything upside down. |

|

| The gains are not evenly shared. Like so many other aspects of the recovery, the effects are unequal. In the latest weekly reading, just under half of states improved and the rest were flat or down. |

| [h=2]“The shareholders should authorize more shares.”[/h] |

| — Adam Aron, AMC’s C.E.O., making the case for more stock sales in an hourlong interview on the “Trey’s Trades” YouTube channel. On Thursday morning, AMC said it would issue more than 11 million shares “from time to time,” and then a few hours later said it had sold the lot for nearly $590 million. The meme-stock darling has raised some $1.6 billion this way so far this year, taking advantage of its surging price to build up a large cash cushion. It doesn’t have many shares left it can sell, so it will ask shareholders at its upcoming meeting for permission to issue more. |

| [h=2]Calling B.S. on a theory about pointless jobs[/h] |

| The anthropologist David Graeber popularized the notion that, as he saw it, many workers waste their lives on meaningless tasks that they know have little social value. The theory, which used a barnyard epithet to describe socially useless jobs, struck a chord and was embraced by some academics and politicians to criticize the modern economy. But the theory itself might be B.S., according to a new empirical study that questions Graeber’s methods. |

| Very few jobs are “intrinsically and objectively” B.S., the lead researcher, Magdalena Soffia of Cambridge University, told DealBook. Graeber said that people are increasingly driven to useless jobs in fields like engineering, law and finance by student debt and “managerial feudalism.” Valuable and fulfilling work includes manual labor, public service and the arts, he posited, but these don’t pay well. The new analysis, which tested five of his hypotheses against extensive data sets from the E.U., showed workers did not feel nearly as bad about their jobs as Graeber believed, whatever they did for a living, and that the share of people who said their work was useless was “low and declining” over time. |

| Hedge fund managers and corporate lawyers topped Graeber’s B.S. jobs list. (He was, after all, “the house theorist of Occupy Wall Street,” The Times wrote in 2011). But few people in the new study felt the futility he described. Ultimately, only about one in 20 felt they had a B.S. job, even though all experienced some frustrations. For those, there are fixes, Soffia said: “We are not doomed. There is a lot that can be done to improve the quality of existing employment.” |

| “Empiricism always wins,” said Louis Hyman, the director of the Institute for Workplace Studies at Cornell. He calls the research, which he was not involved in, a “meaningful contribution.” Graeber’s theory was catchy, Hyman said, but it distracted from more important questions about work: Are people paid enough and do they have power? Do they feel like a machine or a person? Can work provide a stable life? As businesses and lawmakers puzzle over a labor shortage, those issues are especially pressing. It’s not work itself that’s B.S., but certain conditions can be, Hyman said. |

| Thank you for your support. Want to share The New York Times? Friends and family can enjoy unlimited digital access to our journalism with this special offer. |

| [h=3]THE SPEED READ[/h] |

| Deals |

|

|

| Politics and policy |

|

| Tech |

|

| Best of the rest |

|

| Thanks for reading! We’ll see you tomorrow. |

| We’d like your feedback! Please email thoughts and suggestions to dealbook@nytimes.com. |

|

|

|

|

|

|

| Andrew Ross Sorkin, Founder/Editor-at-Large, New York @andrewrsorkin |

| Jason Karaian, Editor, London @jkaraian |

| Sarah Kessler, Deputy Editor, Chicago @sarahfkessler |

| Michael J. de la Merced, Reporter, London @m_delamerced |

| Lauren Hirsch, Reporter, New York @LaurenSHirsch |

| Ephrat Livni, Reporter, Washington D.C. @el72champs |

| � |

I feel the same way actually.If Endeavor goes public I'll be first in line to short the shit outa it...They represented me for a long while Ari is a joker and semi con man

Hope it does happen at some point.

_____________________________

Marius from Cargolution

I feel the same way actually.

Hope it does happen at some point.

_____________________________

Marius from Cargolution

The biz is a bit of a con and the way up and down the line...I don't miss it at all.

Matter of fact I pulled outa a job after flying to CA for a negotiation booking a place and amassing a crew last month.

It took two weeks to untangle the mess..made me miss ARI..joking

I don't have the heart for the biz any longer turns out but it was a hell of a fun ride.

This is the one I love.....

https://www.businessinsider.com/gin...-billion-spac-deal-investor-skepticism-2021-6

|

|---|

|

|

| Global Market Comments June 4, 2021 Fiat Lux Featured Trade: (HOW TO EXECUTE A MAD HEDGE TRADE ALERT) (TBT)

|

| � |

How to Execute a Mad Hedge Trade AlertToday, I’m going to teach you how to execute one of my market-beating Trade Alerts. Pay attention because if you have subscribed to Global Trading Dispatchor Mad Hedge Fund Trader Pro, you will receive about 200 of these a year. The alerts will bunch up at market tops and bottoms. After that, we may see weeks of no action. Ideal entry points don’t happen every day of the year. Following them is your path to understanding global financial markets. You will also make a lot of money. Most important is for you to add my email address to your address book. Otherwise, all my trade alerts will go into your spam folder where they will disappear forever. So please add alert@madhedgefundtrader.com right now to your email address book. To sign up for the Trade Alert Service so you can get alerts five seconds after they are issued,please email Filomena at support@madhedgefundtrader.com. Be sure to put “Text Alert Sign Up” in the subject line. Let me show you a real-world example of how to do a round trip on a trade that I issued a few years ago. Holy smokes! What’s that? That pinging sound from your cell phone tells you the Mad Hedge Fund Trader has just sent out a Trade Alert! The urgent text alert says: MHFT ALERT- Buy ETF (TBT) at $57.06 or best, Opening Trade 9-8-2014, wgt: 10% =174 shares, SEE EMAIL A few minutes later, you receive the following email: Sender: Mad Hedge Fund Trader Subject: Trade Alert - (TBT) September 9, 2014 Trade Alert - (TBT) Buy the ProShares Ultra Short 20+ Treasury ETF (TBT) at $57.06 or best 9-8-2014 –2:00 PM EST Opening Trade Portfolio weighting: 10% Number of Shares: 174 You can buy this in a $57-$58 range and have a reasonable expectation of making money on this trade. Logic to follow. Here is the specific trade you need to execute this position: Buy 174 shares of the (TBT) at……………$57.06 (174 shares X $57.56 = $10,015.44)

You now own 174 shares of the (TBT). That is a bet that bond prices will rise and interest rates will rise. So let’s see how that position worked out over the next several days. Did it work? Did you make money? Let’s see what transpired in the weeks after this trade alert was issued. It turned out that the TBT was the perfect position to take at that time. Bond prices fell pretty fast, and interest rates spiked up nicely causing the (TBT) to jump by $2.91 in the following nine days. That works out to a nice little gain of 5%. By the way, you can pull up these charts anytime you want for free by just going to www.stockcharts.com What’s that? Here comes another text message from the Mad Hedge Fund Trader! Better check it out.

The following email says: Sender: Mad Hedge Fund Trader Subject: Trade Alert - (TBT) September 17, 2014 Trade Alert - (TBT) Sell the ProShares Ultra Short 20+ Treasury ETF (TBT) at $59.97 or best 9-17-2014 –2:00 PM EST Closing Trade Portfolio weighting: 10% Number of Shares: 174 Here is the specific trade you need to exit this position: Sell 174 shares of the August, 2014 (TBT) at……………$59.97 Profit: $59.97 - $57.06 = $2.91 174 shares X $2.91 = $506.34, or 0.51% for the notional $100,000 model portfolio. So there, you’ve just made $506 in just 9 days, which works out to 0.51% per $100,000. You did this never risking more than 10% of your cash at any time. Annualize that, and it works out to 206% a year. That’s how it’s done. This is how the big boys do it. This is how I do it. Of course, not every trade is a winner, and not all do this well so quickly. Sometimes, it requires the patience of Job to see a trade through to profitability. Last year, slightly less than 90% of my trades made money. The rest I stopped out of for small losses. That’s because it’s easier to dig yourself out of a small hole than a big one. But one thing is for sure. You win more games hitting lots of singles. Beginners stand out by swinging for the fences and striking out almost every time. So, watch your text message service for the next Trade Alert. Watch your email. And you can follow me on your way to successful trading, and to riches.

|

Quote of the Day"In the US you had ten bad years in a row (during the Great Depression) and it still turned out to be a pretty good century," said Lloyd Blankfein, CEO of Goldman Sachs.

|

| This is not a solicitation to buy or sell securities The Mad Hedge Fund Trader is not an Investment advisor For full disclosures click here at: http://www.madhedgefundtrader.com/disclosures The "Diary of a Mad Hedge Fund Trader"(TM) and the "Mad Hedge Fund Trader" (TM) are protected by the United States Patent and Trademark Office The "Diary of the Mad Hedge Fund Trader" (C) is protected by the United States Copyright Office |

|

Ginkgo Bioworks investors day June 24th sign up.

https://www.ginkgobioworks.com/investors/

https://eagleequityptnrs.com

I'll be a buyer at some point after the offering

https://www.ginkgobioworks.com/investors/

https://eagleequityptnrs.com

I'll be a buyer at some point after the offering

|

June 7, 2021 Continue reading the main story | |

| Good morning. |

| Breaking: Jeff Bezos said this morning that he’ll be a passenger on a July 20 manned space flight by his company, Blue Origin. Coming two weeks after he steps down as Amazon’s C.E.O., it would make him the first billionaire space entrepreneur to reach space, beating Richard Branson and Elon Musk. It also raises questions about the risks to Amazon, with its founder, executive chairman and major shareholder strapped into a capsule rocketing 60 miles above Earth. |

| (Was this newsletter forwarded to you? Sign up here.) |

|

| [h=2]End of the beginning on a global tax deal[/h] |

| The Group of 7 finance chiefs sealed what they called a “historic global tax agreement” at a summit meeting in Britain this weekend. It was a diplomatic victory in particular for Treasury Secretary Janet Yellen, who is leading the Biden administration’s push to collect trillions more in taxes from corporations and wealthy Americans to pay for its expansive spending proposals. |

| There are two “pillars” to the deal. The first would tax companies based on where they operate, and not just the location of their headquarters. This is important for big European countries, which have sparked trade tensions by imposing special digital taxes on American tech giants. The second would impose a 15 percent minimum global tax rate on companies — a major priority for the U.S. — which would generate more revenue from taxes on American multinationals that use offshore havens to reduce their tax bills. |

| [h=3]PAID POST: A MESSAGE FROM DARKTRACE[/h]Cybersecurity: Not a Human-Scale Problem With the World Economic Forum warning of ‘’A.I.-enabled threats,” humans are struggling to keep pace. Autonomous Cyber AI interrupts in-progress cyberattacks in seconds – wherever they strike. LEARN HOW > |

| There are many details left to be worked out. The location-based tax pillar would apply to companies with at least a 10 percent profit margin, which some say wouldn’t cover Amazon. The global minimum rate pillar would be most effective if applied to corporate profits broken down on a country-by-country basis, instead of pooled and averaged across different tax regimes. |

|

| What happens next: The proposal will go before the Group of 20, which meets in Italy next month, and then an O.E.C.D.-led group of around 140 countries negotiating tax policy. National governments would have to pass legislation to enact any changes to their tax laws, which means it could take years before this weekend’s agreement has a real-world impact. |

| What they’re saying: |

|

| [h=3]HERE’S WHAT’S HAPPENING[/h] |

| President Biden distances himself from enhanced unemployment benefits. Following Friday’s solid but unexceptional jobs report, Biden said he wouldn’t extend the $300-a-week payments, which expire in September. Many Republicans say the benefits deter people from seeking work; economists say the evidence is less clear. |

| AMC executives cash in on meme-stock mania. Leaders of the movie theater chain sold $8 million worth of shares late last week as the company’s stock soared. In other meme-stock news, GameStop’s most ardent fans think the video game retailer has a bright future ahead, despite its volatile trading performance. |

| U.S. vaccination rates continue to drop. America is now averaging fewer than one million shots per day, even though everyone 12 and older is eligible. That is putting Biden’s goal of 70 percent of adults being vaccinated by July 4 increasingly out of reach. (Separately, here’s a creative effort by The Washington Post to track progress toward that goal.) |

| The global semiconductor shortage may last longer than expected. Flex, one of the world’s biggest chip makers, warned that the short supply — which has disrupted industries like automaking and consumer electronics — may persist until next summer. That could speed up efforts by countries and companies to rethink their supply chains. |

| Apple employees push back against the company’s hybrid-working plans.Workers wrote in a letter to management that a mandate to work three days a week in the office is too inflexible. |

| [h=2]Back to the future for buyouts[/h] |

| A group of investors, including Blackstone and Carlyle, have agreed to buy the medical supplies provider Medline for more than $30 billion. It’s the biggest leveraged buyout since the 2008 financial crisis — and a sign that private equity firms are ready to open their wallets for more (and bigger) deals. |

| Buyout firms are now sitting on $1.6 trillion in so-called dry powder,according to Preqin, and have also continued fund-raising at a healthy pace. That has filled their war chests with cash that they’re increasingly under pressure to spend — or risk the ire of investors who don’t want their money just sitting around. And as The Wall Street Journal notes, some of those investors also want to invest directly in those deals alongside the private equity firms. |

| That has led to a revival of pre-crisis strategies. Beyond the growing size of L.B.O.s, private equity shops are teaming up to buy targets, a practice that had fallen out of favor (and ran into concerns about potential antitrust violations). That said, the Medline megadeal isn’t exactly like the club deals of before: It involves less debt than previous buyouts, and the private equity buyers are keeping the current management. |

|

| [h=2]“I’m here to tell all the haters and all the doubters that this is not a moment, this is a movement.”[/h] |

| — Francis Suarez, the mayor of Miami, at the city’s huge Bitcoin conference this weekend. Tens of thousands flocked to the city for the event, a “raging fireball of finance, technology and joyful anarchy, of unfathomable wealth and desperate striving,” writes The Times’s Erin Griffith, who had a photographer in tow to capture the mood among crypto’s most ardent supporters. |

| [h=2]Mark Cuban-backed banking app is going public via SPAC[/h] |

| Dave, the banking app, is going public via a SPAC that values the company at about $4 billion. The deal, with VPC Impact Acquisition Holdings III, includes a $210 million investment led by Tiger Global Management. Mark Cuban is a lead investor and board member at Dave, which has about $122 million in annual revenue and has been profitable since 2018. |

| Dave is one of many fintech upstarts taking aim at overdraft fees. Those fees, which tend to hit those who can least afford them, have also attracted the ire of regulators. Dave says that unlike others tackling overdraft fees by cutting off spending when an account drops to zero, it offers up to $100 in no-interest cash so customers can still pay for daily essentials. Dave collects revenue through $1 monthly membership fees and the tips it asks members to pay, instead of charging them interest. It also has a “side hustle” service in which customers can apply for gig economy jobs at companies like Uber to make money in advance of upcoming bills. |

|

| “It is challenging out there right now,” Jason Wilk, Dave’s chief executive, said of the SPAC landscape. But the blank-check firm run by Victory Park Capital gave Dave the chance to go public quicker than with a traditional I.P.O., he said. The extra investments by Victory Park and Tiger Global also helped. “If we didn’t have the $30 million support from Victory Park and another $50 million from Tiger ahead of going through with the transaction, I don’t know that we would have chosen the SPAC route right now,” he said. |

|

| Thank you for your support. Want to share The New York Times? Friends and family can enjoy unlimited digital access to our journalism with this special offer. |

| [h=3]THE SPEED READ[/h] |

| Deals |

|

| Politics and policy |

| Tech |

|

| Best of the rest |

| On Friday, we described the complex mechanics of the transaction between Bill Ackman’s SPAC and Universal Music Group. It’s even more complicated than we first suggested, between the purchase of a stake in Universal, the money left over in the SPAC (which would no longer be considered a SPAC) to pursue another acquisition and the creation of a new type of takeover vehicle called a SPARC. Our original report has been expanded to explain these details. |

| Thanks for reading! We’ll see you tomorrow. |

| We’d like your feedback! Please email thoughts and suggestions to dealbook@nytimes.com. |

|

|

|

|

|

|

| Andrew Ross Sorkin, Founder/Editor-at-Large, New York @andrewrsorkin |

| Jason Karaian, Editor, London @jkaraian |

| Sarah Kessler, Deputy Editor, Chicago @sarahfkessler |

| Michael J. de la Merced, Reporter, London @m_delamerced |

| Lauren Hirsch, Reporter, New York @LaurenSHirsch |

| Ephrat Livni, Reporter, Washington D.C. @el72champs |

Boz - we are under contract on a house in Gulfport, FL (in Pinellas County, same county as St. Petersburg). We're supposed to close July 2nd. 3/2, 1700sf. $442k. It's probably 10% overpriced, but we got it for $26k under ask. Fully renovated, and they did a pretty good job w/ the reno. We plan to add a pool and a pool house w/ a storage/shed/garage space. I'm going to have to fly up to DC once a month, which sucks, but I'm happy to keep the job. I plan to retire in June of 2026 (just under 5 years). I'll probably move down there in August or September after we sell the Arlington house. The cabin sold yesterday - a little bitter sweet. I put A LOT of hard work into that place, it was a wooded 3 acre lot when I bought it.

Boz - we are under contract on a house in Gulfport, FL (in Pinellas County, same county as St. Petersburg). We're supposed to close July 2nd. 3/2, 1700sf. $442k. It's probably 10% overpriced, but we got it for $26k under ask. Fully renovated, and they did a pretty good job w/ the reno. We plan to add a pool and a pool house w/ a storage/shed/garage space. I'm going to have to fly up to DC once a month, which sucks, but I'm happy to keep the job. I plan to retire in June of 2026 (just under 5 years). I'll probably move down there in August or September after we sell the Arlington house. The cabin sold yesterday - a little bitter sweet. I put A LOT of hard work into that place, it was a wooded 3 acre lot when I bought it.

Dude..so good congratulations ..

Man ....what a journey ..I'm super happy for you.

Great news my friend.....

|

|---|

|

| Global Market Comments June 9, 2021 Fiat Lux Featured Trade: (MEET THE ITALIAN LEONARDO FIBONACCI)

|

| � |

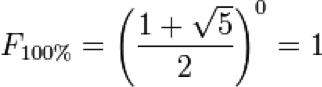

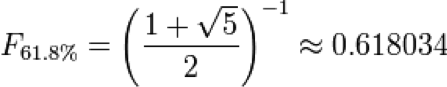

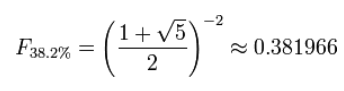

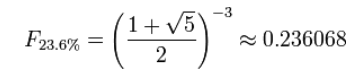

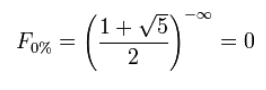

Meet the Italian Leonardo FibonacciI remember the 12[SUP]th[/SUP] century like it was yesterday. In those days, the leading intellectuals used to get together and drink wine by the gallon, which then was really little more than rotten grape juice. The problem was that we all used to pass out before anybody came up with a great idea. Then someone started importing coffee from the Middle East, and thinkers stayed awake long enough to produce great thoughts. Enter the Renaissance. One of the guys I used to hang out with then was named Leonardo Fibonacci. Good old Leo was a man after my own heart, a world-class nerd and geek, with a penchant for mathematics. His dad was a diplomat from the Court at Pisa to the Algiers sultanate who had a nice little import/export business on the side. It is safe to say that there was probably as little action in Algiers then as there is today. I know because I’ve been there. Instead of camping out in his dad’s basement and staying depressed like a lot of young men these days, Leo killed time trolling the local bazaars for interesting used books he could buy on the cheap. Remember, this was before texting. That was not hard to do since most people couldn’t read. He took the trouble to learn Arabic and translated them back into Latin. Ancient math books were his specialty. It didn’t take Leo long to figure out that the Arabs had developed a numbering system vastly superior to the Roman numerals then in use in Europe. Most importantly, they mastered the concept of zero and the placement of digits in addition and subtraction. The Arabs themselves, in fact, lifted these concepts from archaic Indian mathematicians as far back as the 6[SUP]th[/SUP]century. If you don’t believe me about the significance of this discovery, try multiplying CCVII by XXXIV. (The answer is VIIXXXVIII, or 7,038). Good luck designing a house, a bridge, or a computer software program with such a cumbersome numbering system. Leo didn’t just stop there. He also discovered a series of numbers, which seemed to have magical predictive powers. The formula is extremely simple. Start with zero, add the next number, and you have the next number in the series. Continue the progression and you get 0,1,1,2,3,5,8,13,21,34,55…. and so on. It’s no surprise that the sequence became known as the “Fibonacci Sequence”. The great thing about this series is that if you divide any number in it by the next one, you get a product that has become known as the “Golden Ratio”. This number is 1:1.618, or 0.618 to one. Fibonacci’s original application for this number was to predict the growth rate of a population of breeding rabbits. Then some other mathematicians started poking around with it. It turns out the Great Pyramid in Egypt was built to the specification of a Fibonacci ratio. So is the rate of change of the curvature in a seashell, or a human ear. So is the ratio of the length of your arms to your legs. Upon closer inspection, the Fibonacci formula turned out to be absolutely everywhere, from the structure of the tiniest cell to the swirl of the largest galaxies in the universe. Fibonacci introduced his findings in a book entitled “Liber Abaci”, or “Free Abacus” in English, which he published in 1202. In it, he proposed the 0-9 numbering system, place values, lattice multiplication, fractions, bookkeeping, commercial weights and measures, and the calculation of interest. It included everything we would recognize as modern mathematics. The book launched the scientific revolution in Europe that led us to where we are today and was a major bestseller. In fact, you can still buy it on Amazon, making it the longest continuously published book in history. Enter the stock market. By the end of the 19[SUP]th[/SUP]century, some observers noticed that share prices tended to move in predictable patterns on charts. In particular, they always seemed to advance and pull back around the numbers forecast by my friend, Fibonacci, seven hundred years earlier. These people came to be known as “technical analysts,” as opposed to fundamental analysts, who look at the underlying business behind each company. By the 1930s, Fibonacci numbers had worked their way into mainstream technical analytical theories, such as Elliot Wave. Today, most market tracking software and data systems, like Bloomberg, will automatically throw up Fibonacci support and resistance numbers on every stock chart. Why am I talking about this? Because I am frequently asked how I pick the precise strike prices for options in my own Trade Alert Service. I use a combination of moving averages, moving average convergence-divergence (MACD) indicators, Bollinger bands, Fibonacci numbers, and a mumbling chant taught to me by an old Yaqui Indian shaman. And I do all of this only after going over the underlying fundamentals of the stock or index with a fine-tooth comb. I can’t be any clearer than that. Enter the high-frequency traders. Knowing that the bulk of us rely on Fibonacci numbers for our short-term trading calls, they have developed algorithms that seek to exploit that preference. They enter a large number of stop-loss orders to sell just below a “Fibo” support level, then put up fake, but extremely large offers just above it which are usually cancelled. Only 1% of these orders ever get executed. When conventional traders see these huge offers to sell, they panic, dump their stocks, and trigger the stop losses. The HFTs then jump in and cover their own shorts for a quick profit, sometimes only for a fraction of a penny. The net effect of these shenanigans is to make Fibo numbers less effective. Fibo support is just not as rock-solid as it used to be, nor is resistance. This is why the performance of several leading technical analysts has seriously deteriorated in recent years. Although their importance is now somewhat diluted, I still enjoy Fibonacci numbers as I see them in nature all around me. They occasionally have other uses such as in cryptography. When I watched The Da Vinci Code sequel, “Angels & Demons,” and listened to the clues, I recognized the handiwork of my old friend Leo. The rest of the audience sat there clueless, except for the group in the next row wearing “UC BERKELEY” hoodies. For the fellow geeks and nerds among you, here are the precise Fibonacci numbers indicating support and resistance, which you will find on a stock chart. Fibonacci Ratios Fibonacci ratios are mathematical relationships, expressed as ratios, derived from the Fibonacci sequence. The key Fibonacci ratios are 0%, 23.6%, 38.2%, and 100%.

The key Fibonacci ratio of 0.618 is derived by dividing any number in the sequence by the number that immediately follows it. For example: 8/13 is approximately 0.6154, and 55/89 is approximately 0.6180.

The 0.382 ratio is found by dividing any number in the sequence by the number that is found two places to the right. For example: 34/89 is approximately 0.3820.

The 0.236 ratio is found by dividing any number in the sequence by the number that is three places to the right. For example: 55/233 is approximately 0.2361.

The 0 ratio is :

|

Quote of the Day When asked how he manages the time to be chairman of Microsoft, run the world's largest charity, and raise three kids, Bill Gates answered, "I don't mow the lawn."

|

| This is not a solicitation to buy or sell securities The Mad Hedge Fund Trader is not an Investment advisor For full disclosures click here at: http://www.madhedgefundtrader.com/disclosures The "Diary of a Mad Hedge Fund Trader"(TM) and the "Mad Hedge Fund Trader" (TM) are protected by the United States Patent and Trademark Office The "Diary of the Mad Hedge Fund Trader" (C) is protected by the United States Copyright Office Futures trading involves a high degree of risk and may not be suitable for everyone.[FONT="][/FONT] |

Despicable Tax shelters

| View in browser|nytimes.com Continue reading the main story |

June 9, 2021 |

| Good morning. (Was this newsletter forwarded to you? Sign up here.) |

|

| [h=2]Tax and the .001 percent[/h] |

| The fallout from ProPublica’s bombshell report about billionaires’ tax bills is just beginning. The news outlet obtained tax records for the nation’s 25 richest people, which show that they paid $13.6 billion in federal income taxes between 2014 and 2018, or about 16 percent of their reported income over that period — and a very, very small sliver of their wealth. |

| What’s revelatory about the scoop is that it provides never-before-seen details of specific billionaires’ tax bills, or lack thereof. Some of the jaw-droppers in the report: |

|

| Something to keep in mind about the numbers, as presented by ProPublica, is that comparing the billionaires’ tax bills with estimates of their wealth isn’t how the U.S. tax system works. (That is, in the absence of a wealth tax, proposed by Senators Elizabeth Warren and Bernie Sanders.) More pertinent to a public policy debate is to look at all the deductions against the billionaires’ incomes that reduce their tax liabilities to, in some cases, zero. The push to raise income tax rates, as President Biden has proposed, would not have a big effect on these fortunes, which generate large amounts of wealth but relatively modest amounts of income. |

| What can be done? There are changes to the tax code that could arguably capture a larger share of taxes from the ultrarich than a wealth tax, as DealBook has argued. These include: |

|

| The publication of personal tax records also poses a conundrum. Biden administration officials said they were investigating whether the disclosure of individuals’ tax information constituted a crime; Senator Ron Wyden, Democrat of Oregon, worried about the privacy implications even as he called for changes to the tax code. (A spokesman for Mike Bloomberg told ProPublica that he would “use all legal means” to find and punish those responsible for the leak.) |

|

| What others have to say: For billionaires, the federal income tax “has become a voluntary tax,” the economist Gabriel Zucman told David Leonhardt of our sister newsletter, The Morning. “The Real Tax Scandal Is What’s Legal,” reads the headline of a Times editorial. But Megan McArdle, a columnist at The Washington Post, was disappointed: “I genuinely thought the tax avoidance strategies would be something more than unrealized capital gains.” |

| [h=3]HERE’S WHAT’S HAPPENING[/h] |

| President Biden breaks off infrastructure talks with Senate Republicans. The end of a weekslong effort to forge a bipartisan compromise came as G.O.P. lawmakers refused to make concessions on spending and taxation plans. The president will try to revive bipartisan talks with a different set of Republicans while Senate Democrats will explore passing portions of Biden’s plan along party lines. |

| The Senate approves hundreds of billions in spending to compete with China on tech. The 68-32 vote reflects broad support for bolstering research and development to beat Beijing in the race to lead in chip-making and in emerging technologies, like artificial intelligence and quantum computing. |

| China tries to tame rising inflation. The country said today that prices charged by factories, farmers and other producers in May had risen 9 percentyear on year, the biggest increase since September 2008. That portends price increases in goods around the world. |

| Lordstown warns that it’s low on cash. The electric truck maker said it couldn’t begin commercial production without raising more money. The news may increase concerns about start-ups that have recently gone public via blank-check firms known as SPACs. |

| Speaking of SPACs, Clover Health is the newest darling of internet traders. Shares in the health insurer, which went public by merging with one of Chamath Palihapitiya’s SPACs, nearly doubled yesterday after it drew the attention of Reddit trading forums. One theory is that traders are forcing up its price to squeeze short sellers like Hindenburg Research that have accused the company of misleading investors. |

| [h=2]Where are the workers?[/h] |

| American employers had 9.3 million jobs available at the end of April, the most in at least two decades, according to the latest stats released yesterday. Hiring rose, too, but not by nearly as much; workers have been emboldened to seek new opportunities, and nearly four million voluntarily quit their jobs in April, the most on record. |

|

| In short, workers have the upper hand as employers struggle to hire and retain them while the economy recovers from the pandemic. That is leading to higher pay for employees who have kept their jobs. It has also brought more generous offers for job seekers in sectors that are hiring rapidly to match pent-up demand unleashed after lockdowns. |

| Companies are getting creative. “The result is a cornucopia of new benefits as human resources officers and employees alike rethink what makes for a compelling compensation package,” writes The Times’s Nelson Schwartz. It’s not just about pay, but also: |

|

| [h=2]“It was a complicated password, I want to be clear on that. It was not a ‘Colonial123’-type password.”[/h] |

| — Joseph Blount, the C.E.O. of Colonial Pipeline, explained at a congressional hearing how hackers infiltrated its systems with a single password, installing ransomware that crippled the East Coast’s fuel supplies for days. |

| [h=2]Small-business owners are worried, but hopeful[/h] |

| Small-business owners were hit hard by the pandemic. But according to a new survey of 10,000 businesses, conducted by Goldman Sachs and reported first by DealBook, they’re feeling pretty optimistic. That’s even as they stare down three big concerns: |

|

| Even with those worries, 67 percent of business owners think things are moving in the right direction. “People aren’t wearing their masks,” Wall said, a sign that vaccinations have helped business conditions improve, especially compared with this time last year. “So I think there’s a reason for them to be optimistic.” |

| Thank you for your support. Want to share The New York Times? Friends and family can enjoy unlimited digital access to our journalism with this special offer. |

| [h=3]THE SPEED READ[/h] |

| Deals |

|

| Politics and policy |

|

| Tech |

| Best of the rest |

|

| Thanks for reading! We’ll see you tomorrow. |

| We’d like your feedback! Please email thoughts and suggestions to dealbook@nytimes.com. |

|

|

|

|

|

|

| Andrew Ross Sorkin, Founder/Editor-at-Large, New York @andrewrsorkin |

| Jason Karaian, Editor, London @jkaraian |

| Sarah Kessler, Deputy Editor, Chicago @sarahfkessler |

| Michael J. de la Merced, Reporter, London @m_delamerced |

| Lauren Hirsch, Reporter, New York @LaurenSHirsch |

| Ephrat Livni, Reporter, Washington D.C. @el72champs |

| Need help? Review our newsletter help page or contact us for assistance. You received this email because you signed up for DealBook from The New York Times. To stop receiving these emails, unsubscribe or manage your email preferences. |

| � |

| Good morning. (Was this newsletter forwarded to you? Sign up here.) |

|

| [h=2]The cost of everything is up[/h] |

| Prices are rising for airfares, used cars, burritos and much more. New data due later today will provide a crucial signal as to whether these increases are temporary — or something investors and policymakers should worry about, writes The Times’s Jeanna Smialek. |

| Economists expect a big number, with the Consumer Price Index for May predicted to have risen 4.7 percent in May versus the previous year, which would be the biggest jump since 2008. “It’s going to be another shocking report,” said Laura Rosner-Warburton, a founding partner at MacroPolicy Perspectives. |

| In part, this is because of technical factors, since last May’s price level was particularly depressed by pandemic lockdowns. The Times’s Ella Koeze made an excellent chart to explain how these “base effects” work: |

|

| Whatever the latest number, the debate about inflation won’t die down. A sharp increase in April was enough to make many anxious about how long a period of elevated inflation will last. Short-lived bursts of inflation that are tied to supply chain bottlenecks, as in the case of cars, or stimulus-check spending wouldn’t do lasting damage to the economy. But entrenched price rises, which would show up in things like rent, could force the Fed to cut its support of the economy sooner than expected and crimp the White House’s expansive spending plans. |

| [h=3]HERE’S WHAT’S HAPPENING[/h] |

| Lawmakers weigh tax changes in the wake of the ProPublica report. Democrats and Republicans alike suggested that the scoop — which revealed how billionaires like Elon Musk drastically lower their tax bills — should lead to changes in the tax code. Separately, Attorney General Merrick Garland said investigating the leak of private tax data “will be at the top of my list” of priorities. |

| The U.S. and Europe close in on a tariff truce. The two sides are working to end disputes over aircraft subsidies and metals tariffs that led to a trade war under Donald Trump, aiming to reach a deal by mid-July. |

| The U.S. will send 500 million Pfizer-BioNTech vaccine doses abroad. The Biden administration will buy the shots at a not-for-profit price and donate them to about 100 countries over the next year. (It’s in talks with Moderna over a similar deal.) Skeptics say the U.S. must also help other countries manufacture vaccines. |

| JBS concedes it paid a ransom to end a hacking attack. The meat processor said it transferred $11 million worth of Bitcoin to criminals who disrupted several of its plants. But the revelation that the F.B.I. had recovered most of the Bitcoin ransom paid by Colonial Pipeline showed that, contrary to popular belief, crypto can be tracked. |

| The Keystone XL pipeline is officially dead. The pipeline, which would have stretched from Canada to the Gulf Coast, was formally terminated yesterday by its owner, TC Energy. It was at the center of years of political controversy, but its days had been numbered since President Biden took office and rescinded a key construction permit. |

| [h=2]GameStop shops at Amazon[/h] |

| You can get just about anything at Amazon these days, including, in the case of GameStop, a new set of executives. The latest overhaul at the video-game retailer comes amid the windfall of becoming one of the most popular “meme stocks.” |

| Will the Amazon playbook revive the struggling retailer? GameStop’s new C.E.O., Matt Furlong, and C.F.O., Mike Recupero, who are both Amazon veterans, join an executive committee that also includes ex-Amazon staffers as C.O.O. (Jenna Owens), chief technology officer (Matt Francis) and chief growth officer (Elliott Wilke). It helps that GameStop’s tricky shift to e-commerce from bricks-and-mortar stores will be bolstered by money raised from selling its turbocharged stock, which is up some 1,600 percent this year. The company said yesterday that it plans to sell 5 million more shares. |

|

| Will regulators put a stop to meme-stock mania? GameStop disclosed in a filing that the S.E.C. had asked it to volunteer documents and information about “trading activity in our securities and the securities of other companies,” though it didn’t believe the inquiry would “adversely impact” its business. |

|

| [h=2]“We know firsthand the challenge dedicated I.R.S. employees face each day as they work to administer tax laws while hamstrung by inadequate funding and support.”[/h] |

| — Five former Treasury secretaries (Tim Geithner, Jacob Lew, Hank Paulson, Bob Rubin and Larry Summers) in a joint essay for Times Opinion about how to stop tax evasion. |

| [h=2]Easing up on TikTok, not China[/h] |

| President Biden revoked a Trump-era executive order that sought to ban TikTok and WeChat in the U.S., which could have led to the forced sale of TikTok to an Oracle-Walmart consortium. But that doesn’t mean the White House is taking the pressure off Chinese tech giants. |

| Biden administration officials are planning a broader directive, aimed at creating “clear intelligible criteria” for reviewing the national security implications of tech tied to foreign governments. (The Trump ban, they said, hadn’t been carried out “in the soundest fashion,” and had been dealt numerous legal setbacks.) |

| China remains squarely in Washington’s sights. The TikTok announcement came after lawmakers overwhelmingly passed a bill allocating $250 billion for research into emerging technologies in which the U.S. competes with China. And last week, the White House expanded a Trump-era order barring Americans from investing in Chinese businesses with links to that country’s military. The president is also working with Britain and other countries on other ways to counter China. |

| [h=2]Goldman asks bankers if they’ve been vaccinated[/h] |

| Goldman Sachs wants to know how many of its bankers have gotten a Covid shot. The bank sent a memo this week informing employees in the U.S. that they must report their vaccination status by noon today. “Registering your vaccination status allows us to plan for a safer return to the office for all of our people as we continue to abide by local public health measures,” said a section of the memo, sent to employees who have not yet reported their status, which was obtained by DealBook. |

| Disclosing vaccination status has been optional until now. In May, Goldman told employees that they could go maskless in the Manhattan office if they reported their vaccination status. Now, all U.S. employees, regardless of whether they are in the office or choose to wear a mask while there, will need to log their status in the bank’s system. Bankers do not need to show proof of vaccination, but will be asked to record the date they received their shots and the maker of their vaccine. (The E.E.O.C made clear this month that asking employees for their vaccination status is legal, so long as the data is kept confidential.) |

| Companies are trying to find out how many workers are vaccinated ahead of full office reopenings. They’re doing it by conducting surveys, giving out cash rewards upon proof of vaccination or making reporting compulsory, as with Goldman. That data can inform the need for new incentives to get more people vaccinated or potentially to impose a mandate. (Goldman, for its part, said in the memo it “strongly encourages” vaccination, though the choice “is a personal one.”) The Wall Street firm, which began to bring more workers back into the office this month, has been offering bankers paid time off to get the shots. |

| [h=2]Your questions about the post-Covid workplace, answered[/h] |

| Cubicles. Cafeterias. Meeting rooms. Awkward elevator moments. |

| Remember when the office was still the office? |

| More than a year into the pandemic, the rules of office life have fundamentally changed. |

| As companies try to get back to normal by calling employees back to the office, that’s raising a lot of questions: Are hybrid offices here to stay? If you work remotely, can you still get promoted? How do you speak up in a meeting when you’re the only one on Zoom? |

| We want to hear what’s on your mind as offices open up. DealBook and the In Her Words newsletter are teaming up to answer your questions in an upcoming special report. Submit them using this form. |

| Thank you for your support. Want to share The New York Times? Friends and family can enjoy unlimited digital access to our journalism with this special offer. |

| [h=3]THE SPEED READ[/h] |

| Deals |

|

| Politics and policy |

|

| Tech |

| Best of the rest |

|

| Correction: In yesterday’s newsletter, we conflated real-estate tax loopholes. The “like-kind exchange” allows taxpayers to perpetually defer capital gains by trading one property for another. A different loophole allows property owners to depreciate the value of their investments for tax purposes even when the actual value of a property appreciates. Both practices could use more scrutiny. |

| Thanks for reading! We’ll see you tomorrow. |

| We’d like your feedback! Please email thoughts and suggestions to dealbook@nytimes.com. |

|

|

|

|

|

|

| Andrew Ross Sorkin, Founder/Editor-at-Large, New York @andrewrsorkin |

| Jason Karaian, Editor, London @jkaraian |

| Sarah Kessler, Deputy Editor, Chicago @sarahfkessler |

| Michael J. de la Merced, Reporter, London @m_delamerced |

| Lauren Hirsch, Reporter, New York @LaurenSHirsch |

| Ephrat Livni, Reporter, Washington D.C. @el72champs |

|

|

| Global Market Comments June 10, 2021 Fiat Lux Featured Trade: (A NOTE ON OPTIONS CALLED AWAY), (MSFT), (TLT), (BA), (GOOGL), (SPY)

|

| � |

A Note on Assigned Options, or Options Called AwayIn the run-up to every options expiration, which is the third Friday of every month, there is a possibility that any short options position you have may get assigned or called away. If it happens, there is only one thing to do: fall down on your knees and thank your lucky stars. You have just made the maximum possible profit for your position instantly. Most of you have short option positions, although you may not realize it. For when you buy an in-the-money vertical option spread, it contains two elements: a long option and a short option. The short options can get “assigned,” or “called away” at any time as it is owned by a third party, the one you initially sold the put option to when you initiated the position. You have to be careful here because the inexperienced can blow their newfound windfall if they take the wrong action, so here’s how to handle it correctly. Let’s say you get an email from your broker telling you that your call options have been assigned away. I’ll use the example of the Microsoft (MSFT) December 2019 $134-$137 in-the-money vertical BULL CALL spread. For what the broker had done in effect is allow you to get out of your call spread position at the maximum profit point 8 days before the December 20 expiration date. In other words, what you bought for $4.50 last week is now at $5.00! All you have to do is call your broker and instruct them to exercise your long position in your (MSFT) December 134 calls to close out your short position in the (MSFT) December $137 calls. This is a perfectly hedged position, with both options having the same expiration date, so there is no risk. The name, number of shares, and number of contracts are all identical, so you have no exposure at all. Calls are a right to buy shares at a fixed price before a fixed date, and one options contract is exercisable into 100 shares. To say it another way, you bought the (MSFT) at $134 and sold it at $137, paid $2.60 for the right to do so, so your profit is 40 cents, or ($0.40 X 100 shares X 38 contracts) = $1,520. Not bad for an 18-day limited risk play. Sounds like a good trade to me. Weird stuff like this happens in the run-up to options expirations. A call owner may need to buy a long (MSFT) position after the close, and exercising his long December $134 call is the only way to execute it. Adequate shares may not be available in the market, or maybe a limit order didn’t get done by the market close. There are thousands of algorithms out there that may arrive at some twisted logic that the puts need to be exercised. Many require a rebalancing of hedges at the close every day which can be achieved through option exercises. And yes, options even get exercised by accident. There are still a few humans left in this market to blow it by writing shoddy algorithms. And here’s another possible outcome in this process. Your broker will call you to notify you of an option called away, and then give you the wrong advice on what to do about it. They’ll tell you to take delivery of your long stock and then most additional margin to cover the risk. Either that or you can just sell your shares on the following Monday and take on a ton of risk over the weekend. This generates a ton of commission for the brokers but impoverishes you. There may not even be an evil motive behind the bad advice. Brokers are not investing a lot in training staff these days. In fact, I think I’m the last one they really did train. Avarice could have been an explanation here but I think stupidity and poor training and low wages are much more likely. Brokers have so many ways to steal money legally that they don’t need to resort to the illegal kind. This exercise process is now fully automated at most brokers but it never hurts to follow up with a phone call if you get an exercise notice. Mistakes do happen. Some may also send you a link to a video of what to do about all this. If any of you are the slightest bit worried or confused by all of this, come out of your position IMMEDIATELY at a small profit! You should never be worried or confused about any position tying up YOUR money. Professionals do these things all day long and exercises become second nature, just another cost of doing business. If you do this long enough, eventually you get hit. I bet you don’t.

|

Quote of the Day"Artificial Intelligence is potentially more dangerous than nukes," said Andrew McAfee of the MIT Center for Digital Business.

|

| This is not a solicitation to buy or sell securities The Mad Hedge Fund Trader is not an Investment advisor For full disclosures click here at: http://www.madhedgefundtrader.com/disclosures The "Diary of a Mad Hedge Fund Trader"(TM) and the "Mad Hedge Fund Trader" (TM) are protected by the United States Patent and Trademark Office The "Diary of the Mad Hedge Fund Trader" (C) is protected by the United States Copyright Office |

| View in browser|nytimes.com Continue reading the main story |

June 11, 2021 |

| Good morning. (Was this newsletter forwarded to you? Sign up here.) |

|

| [h=2]Paying (a lot) for performance[/h] |

| Six of the 10 largest executive pay packages of all time were awarded last year. This and other findings come from a new survey of the 200 highest paid C.E.O.s at public companies conducted for The Times by Equilar, a consulting firm. “Even in a gilded age for executive pay, 2020 was a blowout year,” writes The Times’s Peter Eavis. |

| The spike is due in large part to linking C.E.O.s’ pay to stock prices. This “pay-for-performance” structure is intended to align managers’ incentives with those of the company’s owners, the shareholders. But it also raises questions about how much credit executives deserve for rising stock prices, and whether the performance conditions attached to stock awards are suitably tough. C.E.O. pay jumped 14.1 percent last year, while the median worker got a 1.9 percent raise. |

|

|

| “Say on pay” votes give shareholders a way to weigh in on compensation. Only around 2 percent of these nonbinding votes have historically gone against management, with recent high-profile rebukes coming at Starbucks and G.E. So far this year, votes against pay packages are on the rise, although these still tend to come in well below 50 percent disapproval. |

|

| Eight C.E.O.s received pay packages last year worth more than $100 million. In 2019, only one chief executive’s pay package crossed that threshold. The top three earners all oversaw companies that went public last year. They are: |

|

| For more charts and details about executive pay packages, read the full article. |

| [h=3]HERE’S WHAT’S HAPPENING[/h] |

| A bipartisan group of senators announced a compromise infrastructure deal. Five Democrats and five Republicans put together a package worth $1.2 trillion over eight years. It would address a narrower range of physical infrastructure than the plan proposed by the White House, and avoid raising taxes to pay for it (though details on this point are scarce). |

| The F.D.A. extends the shelf life of J.&J.’s vaccine. The regulator gave the company six more weeks to use up its supply, before millions of doses were set to possibly go to waste. State officials said the federal decision to pause its use in April on concerns about rare blood clots led to sagging demand for the single-dose vaccine. |

| Investors shrug off high inflation numbers. Consumer prices rose at their fastest pace since 2008, more than economists expected. But one-third of the increase in the latest data, for May, was due to a surge in prices for used cars, a sign that the spike in inflation may be a result of supply chain bottlenecks and other temporary factors. The S&P 500 closed at a record high and bonds showed few signs of distress. Stock futures are up again today. |

| The F.B.I. urges companies not to pay ransoms to hackers. Christopher Wray, the F.B.I.’s director, said at a congressional hearing that companies infected with ransomware should quickly contact law enforcement to find other ways to respond. Victims paid nearly $350 million in ransoms last year, emboldening hackers to take on more high-profile targets this year, like the meat producer JBS and the Colonial Pipeline operator. |

| Regulators weigh the risk of banks holding Bitcoin. In both good and bad news for supporters of cryptocurrency, the Basel Committee on Banking Supervision proposed a risk-management framework for crypto assets on bank balance sheets. That establishes digital tokens as a recognized asset class, bringing them more into the mainstream, but the suggested risk weight, 1,250 percent, would make capital requirements for holding crypto onerous. |

| [h=2]Didi Chuxing unveils its I.P.O.[/h] |

| The Chinese ride-hailing giant Didi Chuxing published its I.P.O. documentsyesterday, giving the first peek inside a company valued at $56 billion a few years ago. The planned New York listing could be the world’s biggest I.P.O. this year, with sources telling Reuters that the company may raise $10 billion at a valuation of $100 billion. The offering comes as many city dwellers emerge from pandemic lockdowns and return to their ride-hailing ways. |

| Sales and profit fell last year. Didi’s revenue fell 8 percent last year, to $21.6 billion, as passenger numbers slid during the pandemic. It lost $1.6 billion for the year, and like most ride-hailing companies, Didi has historically been unprofitable even during better economic times. It reported a profit of $30 million in the first quarter of this year, although some of that came from gains on spinoffs and divestitures. |

| It wants to grow globally. Didi operates in 15 countries, including Brazil and Mexico, and has built a dominant position in China, where it bought Uber’s operations after a few years of competing with it. “What we have learned and built is relevant across the globe — in Latin America, Russia, South Africa or anywhere where affordable, safe and convenient mobility is valuable,” Didi wrote in its prospectus. |

| [h=2]“I don’t feel like a guinea pig. I feel like a pioneer.”[/h] |

| — Michelle Lewis of Orange County, Calif., on her honeymoon aboard the first cruise ship to set sail from a North American port since the pandemic began. |

| Though it was billed as the continent’s first fully vaccinated cruise, two passengers on the Royal Caribbean ship nonetheless tested positive for the coronavirus yesterday. They are asymptomatic and in isolation, with the seven-day cruise set to return to St. Maarten tomorrow. Cruise lines are preparing to restart operations from U.S. ports this summer. |

|

| [h=2]These precedented times[/h] |

| Dealing with the fallout from a deadly, destabilizing pandemic left many executives struggling for words. When they tried to describe the challenge to investors, especially during the early days of the outbreak, they often turned to the same descriptor: “unprecedented.” |

| As economies reopen and conditions become more, well, precedented, the chatter among executives, analysts and investors is changing as well. Mentions of “unprecedented” events are less prevalent than they were a year ago and are often references to something in the past. “We’re now comparing to the unprecedented growth we saw a year ago,” said Jim Jaye of Sherwin-Williams at an investor event this week. |

|

| Thank you for your support. Want to share The New York Times? Friends and family can enjoy unlimited digital access to our journalism with this special offer. |

| [h=3]THE SPEED READ[/h] |

| Deals |

|

| Politics and policy |

|

| Tech |

| Best of the rest |

| Thanks for reading! We’ll see you tomorrow. |

| We’d like your feedback! Please email thoughts and suggestions to dealbook@nytimes.com. |

|

|

|

|

|

|

| Andrew Ross Sorkin, Founder/Editor-at-Large, New York @andrewrsorkin |

| Jason Karaian, Editor, London @jkaraian |

| Sarah Kessler, Deputy Editor, Chicago @sarahfkessler |

| Michael J. de la Merced, Reporter, London @m_delamerced |

| Lauren Hirsch, Reporter, New York @LaurenSHirsch |

| Ephrat Livni, Reporter, Washington D.C. @el72champs |