The Market Outlook for the Week Ahead, or Lie Back and Think of EnglandIf you have to ask what this classic phrase from Britain’s colonial past means, you are too young to know.

The stock market equivalent is that there is nothing to do. Just sit back and relax, watching the value of your stocks go up every day. Let the greatest monetary and fiscal stimulus work its inevitable magic.

When I said last week that stocks might go up every day in April, I wasn’t kidding. NASDAQ (QQQ) has gone up every day this month except one. The S&P 500 has seen only two down days when it was virtually unchanged.

And the best may be yet to come.

The mere prospect of a $2.3 infrastructure trillion budget is enough to keep stocks powering upward for the foreseeable future. Biden may have to negotiate the total down to get it through congress and that may be the cause of the next correction…in about three months.

What really had the phones buzzing on Thursday was the bizarre move in the bond market. After seeing spectacularly positive data, the Weekly Jobless Claims plunging by 200,000 and Retail Sales coming in at a prolific 9.8%, bonds should have crashed.

Instead, the (TLT) jumped by $2.60. That took interest rate and inflation fears packing and sent the indexes soaring to all-time highs once again.

It’s proof yet again that inflation is the boogie man that will never show. Despite the incredible strength of the economy, any time anyone tries to raise prices, another company comes along with a better product or service at half the price. Such is the relentless tide of technology.

In the meantime, Goldilocks has moved in, unpacked her bags, gotten comfortable, and has settled in for the duration. I have been so aggressive in trading the market for the last six months it is wearing me out.

So, I took a rare Saturday off, weeding the garden, setting up a new computer, and generally fixing things that I haven’t had time to attend to since last year. I lived almost normally….for a day.

One of the best Earnings Seasons in history started last week, with 25% growth expected at 81% beating forecasts. JP Morgan (JPM) and Bank of America (BAC) kicks off on Wednesday, with the big kahuna, Apple (AAPL) reporting on April 28. Expect stocks to rally until then. It may give us the first hint of the massive stimulus on the economy to come. Q2 and Q3 will be the monster quarters.

Equity Funds pick up a half trillion dollars in five months, more than they attracted over the last 12 years. It’s all rocket fuel for the ongoing market melt-up. With the Volatility Index (VIX) at a one-year low at $17, the best may be yet to come. Equity investors are the most bullish in years.

Tesla is upgraded to $1,071 per share by research firm Canaccord Genuity. The company is transitioning from low-volume high-priced cars to high-volume low-priced cars, as seen in the 47% leaps in sales during Q1. The stationary battery business is booming, thanks to a new generation of technology. Tesla is developing an Apple-type brand value in the energy market, which is worth a big premium, which competitors can’t match. Tesla has brought a machine gun to a knife fight. Global chip shortages are a risk. The stock jumped $25 on the news.

Consumer Price Index comes in muted at 0.6% in April and 2.6% YOY. The market had been fearing worse, sparking another leg up in technology stocks. Much of the gain was from a jump in gasoline prices, which are now falling. Food prices are also rising.

JP Morgan pops on upside earnings surprise, with Q1 profits soaring from $2.9 billion a year ago to an eye-popping $14.5 billion. Revenues were up 14% to $33.1 billion. Loan demand is weakening because so many people are getting government money for free. Credit card debts are being paid down.

Retail Sales explode in March, up a staggering 9.8%. New spending at bars and restaurants was a major factor, and we haven’t even started yet! Stocks soar to new highs, and the bond market takes off like a scalded chimp, taking ten-year US Treasury yields below 1.57%. It confirms my thesis that when we see actual real numbers of an unprecedented recovery, we get another new leg in the bull market.

Weekly Jobless Claims collapse to 576,000, the lowest of 2021. That's down a massive 193,000 jobs from the previous week. Herd immunity is here! Keep getting those shots!

China’s (FXI) GDP grew by a staggering record of 18.3% in Q1 at an annualized rate YOY. Strong industrial production and exports were the leaders. It presages a similar explosive growth rate for the US in Q2. We won’t know until the end of July. Having your largest customers breaking growth records is great for your business too. Buy everything on dips.

Hedge funds nailed the Bond Crash, selling short some $100 billion in paper since January. It will be more than enough to cover their losses in equity shorts.

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% to 120,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 120,000 here we come!

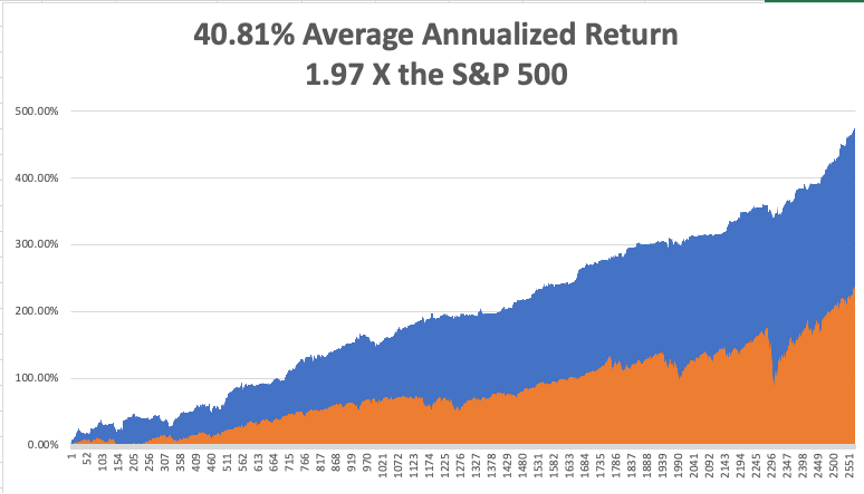

My Mad Hedge Global Trading Dispatch profit reached 7.17% gain during the first half of April on the heels of a spectacular 20.60% profit in March.

It was a very busy week for trade alerts, with five positions expiring at their maximum profit points in (TSLA) and the (TLT). It’s been so long since I’ve had a loss, I forgot what they looked like.

I used a puzzling $2.60 spike in the (TLT) to add to my already substantial short position in bonds (TLT) with a distant May expiration. Ten-year US Treasury yields fell all the way to 1.51%.

My 2021 year-to-date performance soared to 51.26%. The Dow Average is up 12.9% so far in 2021.

That brings my 11-year total return to 473.81%, some 2.00 times the S&P 500 (SPX) over the same period. My 11-year average annualized return now stands at an unbelievable 40.81%, the highest in the industry.

My trailing one-year return exploded to positively eye-popping 129.19%. I truly have to pinch myself when I see numbers like this. I bet many of you are making the biggest money of your long lives. Every time I think these numbers can’t be topped, they increase by another 10% during the following two weeks.

We need to keep an eye on the number of US Corona virus cases at 31.6million and deaths topping 567,000, which you can find here.

The coming week will be dull on the data front.

On Monday, April 19 at 11:00 AM, earnings for (IBM), Coka-Cola (KO), and United Airlines (UAL) are released.

On Tuesday, April 20, at 4:30 PM, API Crude Stocks are published. We also get earnings for Johnson & John (JNJ) and Netflix (NFLX).

On Wednesday, April 21 at 1:00 PM, there is a big 20-year US Treasury bond auction. Chipotle (CMG) and Verizon (VZ) earnings are out.

On Thursday, April 22 at 8:30 AM, the Weekly Jobless Claims are printed. At 10:00 AM Existing Home Sales for March are announced. Snap (SNAP) and Intel (INTC) announce earnings.

On Friday, April 23 at 10:00 AM, we get the New Home Sales for March. American Express (AXP) and Honeywell (HON) release earnings. At 2:00 PM, we learn the Baker-Hughes Rig Count.

As for me, someone commented that I walk kind of funny the other day, and the memories flooded back.

In 1975, The Economist magazine in London heard rumors that a large part of the population was getting slaughtered in Cambodia. We expected this to happen after the fall of Vietnam, but not in the Land of the Khmers. So my editor, Peter Martin, sent me to check it out.

Hooking up with a right-wing guerrilla group financed by the CIA was the easy part. Humping 100 miles in 100-degree heat wasn’t.

We eventually came to a large village that was completely deserted. Then my guide said, “Over here.” He took me to a nearby cave containing the bodies of over 1,000 women, children, and old men that had been there for months.

I’ll never forget that smell.

With the evidence and plenty of pictures in hand, we started the trek back. Suddenly, there was a large explosion and the man 20 yards in front of me disappeared. He had stepped on a land mine. Then the machine-gun fire opened up. It was an ambush.

I picked up an M-16 to return fire, but it was bent, bloody, and unusable. I picked up a second rifle and fired until it was empty. Then everything suddenly went black.

I woke up days chained to a palm tree, covered in shrapnel wounds, a prisoner of the Khmer Rouge. Maggots infested my wounds, but I remembered from my Tropical Diseases class at UCLA that I should leave them alone because they only ate dead flesh and would prevent gang green. That class saved my life. Good thing I got an “A”.

I was given a bowl of rice a day to eat, which I had to gum because it was full of small pebbles and might break my teeth. Farmers loaded their crops with these so the greater weight could increase their income. I spent my time pulling shrapnel out of my legs with a crude pair of plyers.

Two weeks later, the American who set up the trip for me showed up with cases of claymore mines, rifles, ammunition, and antibiotics. My chains we cut and I began the long walk back to Thailand.

It’s nice to learn your true value.

Back in Bangkok, I saw a doctor who attended to the 50 caliber bullet that grazed my right hip. It was too old to sew up so he decided to clean it instead. “This won’t hurt a bit,” he said as he poured in hydrogen peroxide and scrubbed it with a stiff plastic brush.

It was the greatest pain of my life. Tears rolled down my face.

But you know what? The Economist got their story and the world found out about the Great Cambodian Genocide, where 3 million died. There is a museum in Phnom Penh devoted to it today.

So, if you want to know why I walk funny, be prepared for a long story. I still set off metal detectors.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Doing Research

|