You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Intersting thoughts

- Thread starter Bozzie

- Start date

|

| Global Market Comments April 13, 2021 Fiat Lux Featured Trade: (REVISITING THE ROM) (ROM) (BRING BACK THE UPTICK RULE!)

|

| � |

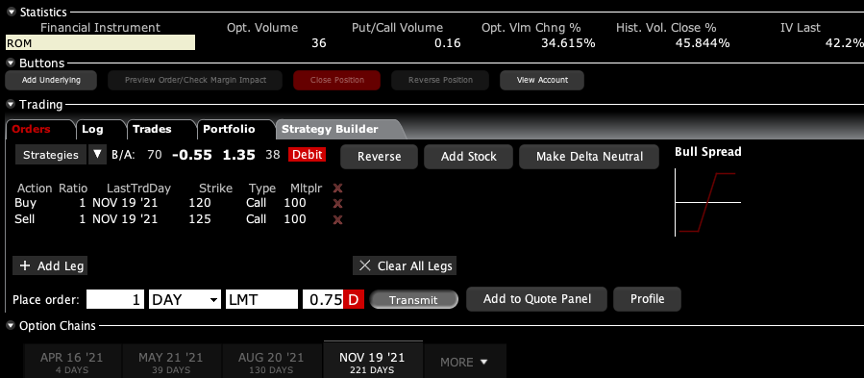

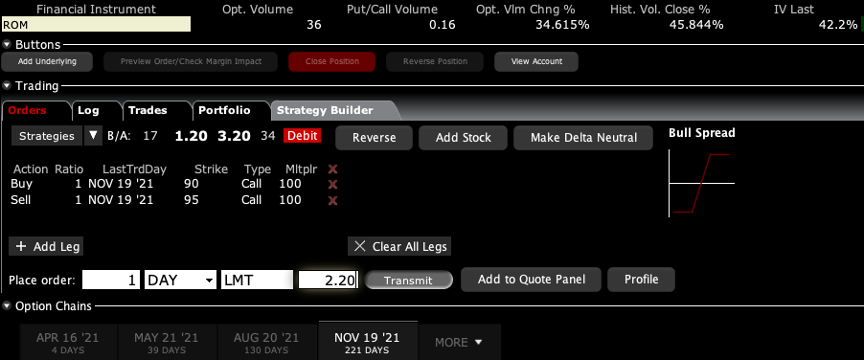

Revisiting the ROM Now that technology stocks have returned from the grave, it is time to increase our exposure to the sector. After all, we are two weeks into a rally that could last until the rest of the year.It was the stabilization of interest rates that did the trick. While ten-year US Treasury yields (TLT) were soaring from 0.89% to 1.76%, tech stocks smelled like three-day-old sushi left in the sun. Now that rates have fallen back to 1.64%, tech stocks have caught on fire. Rates didn’t really have to go down, just stop going up at 100 miles per hour. Markets are now pricing in the end of the pandemic. So, I have been dusting off some of my favorite trades for a decade ago, when we were dealing with similar levels of panic, despair, and desperation. Suddenly, the (ROM) came to mind. The (ROM) is the ProShares Ultra Technology ETF, a 2X long in the top technology shares. It holds the fastest growing, cream of the cream of corporate America which you want to hide behind the radiator and keep forever. Quality is on sale now and here is where you want to be loading the boat. The $683 million market cap (ROM) even pays a modest 0.17% dividend. (ROM)’s ten largest holdings include: Microsoft (MSFT) Apple (AAPL) Facebook (FB) Alphabet (GOOGL) Intel (INTC) Cisco (CSCO) Adobe (ADBE) NVIDIA (NVDA) Salesforce (CRM) Oracle (ORCL) The major (ROM) holdings, like Apple, Amazon, and Facebook (FB) have gone virtually nowhere for eight months. Yet, their earnings have continued to grow at a feverish 20% annual rate. The stocks were just exhausted and needed a time-out. The great thing about the (ROM) is that it is one of the most volatile ETFs in the market. Over the past two weeks, the (ROM) has rocketed 20%. From the March 2020 bottom, it has rocketed from $20 to $86. I’d like a piece of that! It gets better. The (ROM) HAS OPTIONS. That effectively increases your technology leverage from 2:1 to 20:1 with defined limited risk (you can’t lose any more than you put in). I’ll give you an example. The longest expiration for which (ROM) options are currently trading is November 19, 2021, or six months out. (ROM) is currently trading at $85.03. You can buy the (ROM) November 19 $120-$125 call spread for $0.75. If tech stocks rise by 23% by November and the (ROM) soars by 47%, then the value of your call spread increases from $0.75 to $5.00, or 466%.

For example, the (ROM) November $90-$95 vertical bull call spreads cost $2.20 and requires only a 5.9% rise in tech stocks, or an 11.8% increase in the (ROM) to appreciate to $5.00 for a gain of 127% in six months.

It has since done exactly that. The harder I work, the luckier I get To learn more about (ROM), please click here for their website.

|

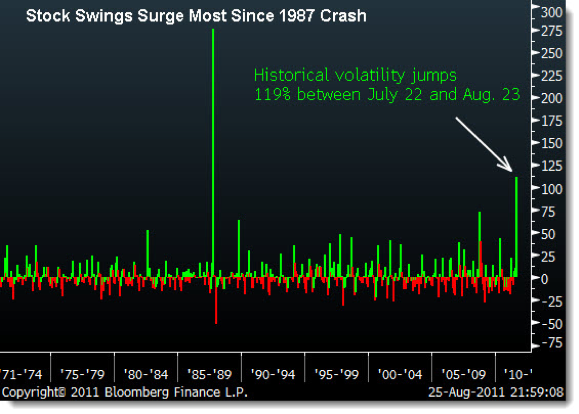

Bring Back the Uptick Rule!When the Dow crashed 514 points in a single day a few years ago, the market lost a staggering $850 billion in market capitalization. High frequency traders were possibly responsible for half of this move, but generated a mere $65 million in profits, some 7/1,000’s of a percent of the total loss. Are market authorities and regulators being penny-wise but pound-foolish? The carnage the HF traders are causing is triggering a rising cry from market participants to ban the despised strategy. Many are calling for the return of the “short sale test tick rule”, or SEC Rule 17 CFR 240.10a-1, otherwise known as the “uptick rule”, which permits traders to execute short sales only if the previous trade caused an uptick in prices. The rule was created eons ago to prevent the sort of cascading, snowballing selling that we are seeing today. It was repealed on July 6, 2007. Check out a chart of the volatility that ensued and it will make your hair on the back of your neck raise. Those unfamiliar with how algorithmic trading works, see it as something akin to illegal front running. “Co-location” of mainframes with exchange computers, or having them in adjacent rooms, gives them another head start over the rest of us. Much of the trading sees HF traders battling each other and involves what used to be called “spoofing”, the placing of large, out-of-the-market orders with no intention of execution. Needless to say, if you or I tried any of these shenanigans, the SEC would lock us up in the can so fast it would make your head spin. Many accuse exchange authorities of a conflict of interest, allowing members to reap sizeable custody fees from HF traders, while the rest of us get taken to the cleaners. Co-location fees run in the hundreds of thousands of dollars per customer per month. This is happening while traditional revenue sources, like proprietary trading, are disappearing, thanks to Dodd-Frank. There is no doubt that the volatility is driving the retail investor from the market. In fact, HF trading has been around since the nineties, back when the uptick rule was still in place and co-location was a term out of Star Trek. But it was small potatoes then, confined to a few niche players like Renaissance, and certainly lacked the firepower to engineer 500-point market swings. The big problem with this solution is that HF trading now accounts for up to 70% of the daily trading volume. Ban them, and the market volatility will shrink back to double-digit trading ranges that will put us all asleep. The diminished liquidity might make it difficult for the 800-pound gorillas of the market, like Fidelity and CalPERS, to execute trades, further frightening end investors from equities. It is possible that we have become so addicted to the crack cocaine that HF traders provide us that we can’t live without it?

|

Quote of the Day“Any sufficiently advanced technology is indistinguishable for magic, said Arthur C. Clark, futurologist and author of 2001: A Space Odyssey.\ [FONT=Arial, Helvetica, sans-serif]

[FONT=Arial, Helvetica, sans-serif][/FONT] |

| This is not a solicitation to buy or sell securities The Mad Hedge Fund Trader is not an Investment advisor For full disclosures click here at: http://www.madhedgefundtrader.com/disclosures The "Diary of a Mad Hedge Fund Trader"(TM) and the "Mad Hedge Fund Trader" (TM) are protected by the United States Patent and Trademark Office The "Diary of the Mad Hedge Fund Trader" (C) is protected by the United States Copyright Office |

|

| Good morning. (Was this newsletter forwarded to you? Sign up here.) |

|

| [h=2]Coinbase leads the way[/h] |

| Heavy trading volume greeted the highly anticipated market debut of Coinbase, which ended the day worth some $86 billion. The cryptocurrency company’s coming-out party made some insiders very rich, opened up new possibilities for cementing its position in the blockchain economy and blazed a trail for other crypto companies to follow its lead onto the public markets. |

| Meet the latest crypto billionaires. The stake held by Brian Armstrong, Coinbase’s co-founder and C.E.O., is now worth roughly $13 billion. Shares held by its other co-founder, Fred Ehrsam, are worth about $6.7 billion. (Andreessen Horowitz’s stake is worth $11.2 billion, while Union Square Ventures’ is worth $5.3 billion.) |

| What’s next for Coinbase? “We want to be able to have a public mark on our stock price because it helps us do more and more M.&A.,” Emilie Choi, the company’s C.O.O., told Protocol yesterday. “There’s so much innovation happening in the crypto ecosystem, and we can’t possibly do it all in-house.” |

|

| Who will be the next publicly traded crypto giant? The tech investor Ron Conway called Coinbase “the Google for the crypto economy.” As crypto goes mainstream, others with similarly big ambitions may follow Coinbase onto the public markets, including: |

|

| Just for fun: Here’s Mr. Armstrong’s original Hacker News post from March 2012 looking for a co-founder for his crypto venture, which drew dismissive comments like, “Because bitcoin worked out so well. Have fun with that, dude.” Bitcoin was worth about $5 then; it’s more than $60,000 now. |

| [h=3]HERE’S WHAT’S HAPPENING[/h] |

| The Senate confirms Gary Gensler as S.E.C. chairman. The former Goldman Sachs executive and Obama administration financial regulator passed 53-45. He is expected to take a more aggressive approach to enforcement than his predecessor, Jay Clayton, and — based on what he taught as an M.I.T. professor — will make fintech and blockchain among his focuses. |

| Dell will finally spin out its majority stake in VMware. Under the terms of the long-anticipated deal, Dell will distribute its holdings in the business software maker to its shareholders, while collecting a roughly $12 billion special dividend. Investors have pushed for such a move to boost valuations of both Dell and VMware. |

| The C.D.C. prolongs the pause on Johnson & Johnson’s vaccine. An advisory committee for the health agency said it needed more time to assess the Covid-19 shot’s safety; it won’t vote on a recommendation for at least a week. Separately, concerns about the J&J and AstraZeneca vaccines mean the E.U. will increasingly rely on the Pfizer-BioNTech shot for its inoculation plans. |

| Bank of America continues a bumper bank earnings season. It reported a doubling of first-quarter profit from a year ago, following a similar pattern to the huge gains in earnings released yesterday by JPMorgan and Goldman Sachs. For big banks, a rebound in core Wall Street businesses has combined with the release of billions in reserves to cover loan losses, a sign of bullishness on post-pandemic economic life. |

| Banks address Wall Street burnout. Goldman Sachs’s C.E.O., David Solomon, said yesterday the firm is “a place where we work very hard to serve our clients” but also needs to be “thoughtful about personal resilience and well-being.” Houlihan Lokey said it’s offering some workers all-expenses-paid vacations and generally won’t let them work past midnight. |

| [h=2]A gran apuesta (big bet) on streaming[/h] |

| Televisa and Univision dominate two of the biggest Spanish-language broadcasting markets, the U.S. and Mexico. In striking a $4.8 billion deal to combine their media, content, and production assets, they are adapting to a future where streaming is king, their leaders told DealBook. |

| “We’re creating the first and really only truly global Spanish-language television business,” Wade Davis, Univision’s chief, said, noting that the companies have been largely regional and, until recently, focused on broadcast TV. That might be OK for now — Univision’s ratings went up last year, Mr. Davis said — but the real opportunity is in the nascent market for Spanish-language streaming, with just 10 percent of the world’s 600 million Spanish speakers subscribing to a service. |

|

| Investors appear to like the deal, with shares in Televisa jumping 23 percent on the news. The big question is whether Televisa-Univision, as the combined business will be called, can compete with behemoths like Netflix that are also betting on global markets and non-English programming. Mr. Davis argued Televisa-Univision’s greatest advantage is that it’s exclusively focused on the Spanish-language market — but it’s still much smaller than its streaming rivals, and it’s coming late to the game. |

| [h=2]“Every aspect of human existence is going online, and every aspect of that is running on semiconductors. People are begging us for more.”[/h] |

| — Pat Gelsinger, the C.E.O. of Intel, on the global chip shortage sending shock waves through the economy. |

|

| [h=2]How big can a SPAC get?[/h] |

| The answer, in short, is as big as a financier can dream. This week, a blank-check firm that raised $500 million in its I.P.O. got $4 billion in additional funding from private investors to merge with Grab in a deal worth $40 billion. That’s a difference of nearly 8,000 percent between the cash in the SPAC and the value of the company that will take over its listing. It’s the largest ratio on record, according to data from SPAC Research. |

| The size of a SPAC is only loosely related to that of the target it seeks.Additional funding these companies arrange alongside a merger allows them to take on bigger targets, and the bigger the target, the less dilutive the SPACsponsor’s stake in the combined entity, making it more attractive to other shareholders. So far this year, the value of announced SPAC mergers has been more than 800 percent larger, on average, than the cash in the SPACs; that’s up from roughly 600 percent last year and 400 percent in 2019. |

|

| [h=2]The new media barbell[/h] |

| Jon Kelly, a former Vanity Fair editor, plans to launch a new media company with an unusual business model, Ed Lee and DealBook’s Lauren Hirsch report for The Times. The venture has raised about $7 million from investors, including the private equity firm TPG. Notably, it will pay its yet-to-be-named writers a portion of the subscription fees they personally generate, creating a compromise between the dominant business models of old and new media companies. |

| Upstart media brands are betting on star power to drive subscriptions. Mr. Kelly’s new venture, which may be called Puck, the name of an American humor magazine of the late 1800s and early 1900s, plans to use its revenue-sharing model to attract big-name writers. The push to “monetize individuality” has attracted increasingly high-profile figures to new platforms: Substack offers lucrative contracts to select writers who use it to launch newsletters. |

| Established companies rely more on prestige, breadth and experience. The largest media companies lean on their brands to attract both talent and subscribers. |

| It gets murky in the middle. Digital media players like BuzzFeed, Vice, Vox Media and Group Nine rely more on ads than subscriptions, and they’ve stumbled as the pandemic has ravaged that industry. In an increasingly crowded, differentiated field, they’re trying to bulk up via mergers or go publicto raise funds and satisfy early investors. |

| [h=2]Bernie Madoff’s legacy[/h] |

| Bernie Madoff, architect of the largest Ponzi scheme ever, died in a federal prison hospital yesterday at the age of 82, while serving a 150-year prison sentence. Here’s what he left behind: |

|

| Thank you for your support. Want to share The New York Times? Friends and family can enjoy unlimited digital access to our journalism with this special offer. |

| [h=3]THE SPEED READ[/h] |

| Deals |

|

| Politics and policy |

|

| Tech |

| Best of the rest |

|

| Thanks for reading! We’ll see you tomorrow. |

| Tonight, at 7 p.m. Eastern, David Leonhardt hosts a special live edition of The Morning newsletter, exclusively for subscribers of The Times. Join him as the Games team solves the Spelling Bee with actor William Jackson Harper, Rupi Kaur celebrates the power of poetry and more. R.S.V.P. here to attend. |

| We’d like your feedback! Please email thoughts and suggestions to dealbook@nytimes.com. |

|

Nuts... Good news is they are working on their "relationship" and will stay together for now ( 400 million reasons for Alex to make it work)......Spectral update. Nothing new, the trial is moving at a snails pace but I'm more in the pump$$$ camp.

I'd love to see more options exercised or that Canadian approval for home use.

Hope you're well CB.

It's over CB..400 million Tears

https://www.cnn.com/2021/04/15/ente...-alex-rodriguez-break-up-statement/index.html

Check check on that spectral list..Both done.

It's over CB..400 million Tears

https://www.cnn.com/2021/04/15/ente...-alex-rodriguez-break-up-statement/index.html

Check check on that spectral list..Both done.

They'll both be fine. I bet ARod's net worth explodes over the next decade.

| View in browser|nytimes.com Continue reading the main story |

April 16, 2021 |

| Good morning. (Was this newsletter forwarded to you? Sign up here.) |

|

| [h=2]A change of messenger at Goldman Sachs[/h] |

| For nearly a decade, Jake Siewert led Goldman Sachs’s post-crisis efforts to shed its image as one of Wall Street’s most mysterious, and maligned, money machines. We’re the first to report that he plans to announce his departure later today. |

| Mr. Siewert joined Goldman as its communications chief in 2012, bringing both political connections — he was a top aide to Tim Geithner when he was Treasury secretary, and spent eight years in the Clinton administration, including as White House press secretary — and experience as a senior executive at Alcoa. (Mr. Siewert’s wife, Christine Anderson, is the global head of external relations at Blackstone.) |

|

| His primary task was erasing Goldman’s reputation as a “great vampire squid.” That meant demystifying the firm, putting its executives more in the public eye and repairing relationships with policymakers and the media. Mr. Siewert helped push Goldman into podcasting and social media at a time when neither was common practice at a Wall Street bank. More recently, he was involved in the launch of Marcus, the online retail banking division that has become a key source of growth for the firm. Surveys suggest that Goldman’s public reputation has improved markedly since the financial crisis. |

| Now, Mr. Siewert is headed to Warburg Pincus to effectively become a political and policy adviser. The role — which will take him away from P.R. and see him working for both the firm and its portfolio companies — reunites him with Mr. Geithner, who has been Warburg’s president since 2014. Mr. Siewert’s departure is amicable, according to people with knowledge of the matter, though he was considered closer personally to Lloyd Blankfein, the Goldman C.E.O. who hired him, than the current chief, David Solomon. |

|

| [h=3]HERE’S WHAT’S HAPPENING[/h] |

| China’s economy booms, but not everyone is sharing in it. The country’s G.D.P. grew a jaw-dropping 18.3 percent in the first quarter compared with the same time last year — though that partly reflects the pandemic shutdown of 2020. The surge was tied to exports and infrastructure spending, but Beijing’s big challenge remains persuading consumers to spend more. (The latest U.S. data suggest Americans are doing that with gusto.) |

|

| Voters like President Biden’s $2.3 trillion infrastructure plan. A new poll for The Times showed that two-thirds of Americans (and nearly three-quarters of independent voters) backed the proposal. No Republican lawmakers have publicly supported the proposal, and they hope to spur opposition by focusing on likely increases in corporate taxes, though some corporate leaders have tentatively backed higher rates. |

| The White House threatens to cut Russia’s ties to the global financial system. The Biden administration barred American banks from buying newly issued Russian government debt, part of sanctions imposed in retaliation for the Solar Winds hack. The short-term impact is likely small, but experts say it is a symbolic step that signals a willingness to isolate Moscow. |

| Vaccinated people may need a third booster shot. The additional dose of a Covid-19 vaccine would come at least six months after their second, Pfizer’s C.E.O., Albert Bourla, said yesterday. Longer term, annual boosters may be required to guard against new virus strains; already, parts of London are seeing an uptick in cases involving the South African variant, including in some people who received at least one dose of vaccine. |

| Elliott may start a fight at GlaxoSmithKline. The big activist hedge fund has taken a multibillion-pound stake in the British medical and consumer products giant, DealBook has learned. The Financial Times, which first reported the news, said it came as other investors expressed worries that the company was underperforming, particularly in its drug pipeline. |

| [h=2]Jeff Bezos lays out his legacy[/h] |

| Amazon published its founder’s latest letter to shareholders yesterday. It is likely the last such letter written by Jeff Bezos as C.E.O., since he plans to step down later this year and become executive chairman. In the letter, Mr. Bezos, the richest man in the world, laid out his view of Amazon’s impact during his 27-year tenure. |

| Mr. Bezos calculated the value he thinks Amazon creates for society. The total came to $301 billion last year, he said, with more than half going to customers (via time savings and the cost improvements of cloud computing), followed by employees (via compensation), third-party sellers (via profits from selling on Amazon) and finally shareholders (via the company’s net income). “Draw the box big around all of society, and you’ll find that invention is the root of all real value creation,” Mr. Bezos wrote. “And value created is best thought of as a metric for innovation.” |

|

| Mr. Bezos said that Amazon’s goal is to become “Earth’s Best Employer and Earth’s Safest Place to Work.” He disputed the characterization of Amazon warehouse employees as “being treated as robots” (the jobs have been criticized over workplace safety measures during the pandemic, algorithmic management and productivity quotas), and highlighted Amazon’s $15 minimum hourly wage, which one study suggested led to increased wages at other businesses nearby. |

|

| The letter ended on a philosophical note. “We all know that distinctiveness — originality — is valuable,” Mr. Bezos wrote. “We are all taught to ‘be yourself.’ What I’m really asking you to do is to embrace and be realistic about how much energy it takes to maintain that distinctiveness. The world wants you to be typical — in a thousand ways, it pulls at you. Don’t let it happen.” |

| [h=2]“This is the healthiest we have seen the consumer emerge from a crisis in recent history.”[/h] |

| — Jane Fraser, the C.E.O. of Citigroup, reporting a tripling of profit in its latest quarter. |

| [h=2]David Einhorn has thoughts[/h] |

| Greenlight Capital’s quarterly report is out and the hedge fund’s founder, David Einhorn, has a lot to say. |

|

|

| He’s not a fan of payment for order flow, which is how Robinhood makes money on free trading. It’s “just disguised commission,” Mr. Einhorn said. |

| A New Jersey deli worth $100 million on the stock market is a warning sign, he said of the peculiar penny stock. “The pastrami must be amazing,” he wrote. “Small investors who get sucked into these situations are likely to be harmed eventually, yet the regulators — who are supposed to be protecting investors — appear to be neither present nor curious.” |

|

| [h=2]IBM’s post-pandemic guide to working in an office[/h] |

| Wondering what the office will be like when you go back? So are millions of other workers, and employers are trying to prepare them for it. IBM has designed a “reorientation” program to help its employees adjust when they return to a familiar setting and find a host of unfamiliar new procedures. DealBook spoke with Joanna Daly, the company’s vice president of talent, about it. |

| IBM made a “day in the life” video to show employees what to expect. One version of the 11-minute-long video seen by DealBook starts with “Paul” taking his temperature before going to the office, where he experiences all the new Covid precautions, like one person allowed in the bathroom at a time, one-way staircases and masking requirements. IBM is also distributing an 18-page presentation depicting “Sonia’s’’ return to the workplace (that’s her above chatting with colleagues), a back-to-work manual of sorts. |

| “It’s sort of like the first day of school,” Ms. Daly said. “A day early, kids go and get to see the classroom or see how things work.” It’s needed, she said, because “this is not simply returning to the workplace as it existed before or the ways of working as it existed before.” The company, which has 346,000 employees, hasn’t set a strict timeline for when its U.S. workers will return to the office. IBM’s chief executive, Arvind Krishna, has said he expects 80 percent of them will work in a hybrid fashion when they do. |

| Thank you for your support. Want to share The New York Times? Friends and family can enjoy unlimited digital access to our journalism with this special offer. |

| [h=3]THE SPEED READ[/h] |

| Deals |

|

| Politics and policy |

|

| Tech |

| Best of the rest |

|

|

| Global Market Comments April 15, 2021 Fiat Lux Featured Trade: (CYBERSECURITY IS ONLY JUST GETTING STARTED), (PANW), (HACK), (FEYE), (CSCO), (FTNT), (JNPR), (CYBR)

|

| � |

Cybersecurity is Only Just Getting Started One of the unfortunate aspects of the pandemic has been a tenfold increase in online fraud. I get a dozen phishing attacks a day pretending to be Wal-Mart, the Bank of America, and Amazon. And I never click on anything from Apple asking me to change my ID and password. The crooks are just getting too good. However, where there are criminals there is investment gold. The cybersecurity sector has been spurred upward with the rest of technology in recent months, creating a rare entry point on the cheap side of the longer-term charts. The near-destruction of Sony (SNE) by North Korean hackers years ago has certainly put the fear of God into corporate America. Apparently, they have no sense of humor whatsoever north of the 38th parallel. As a result, there is a generational upgrade in cybersecurity underway, with many potential targets boosting spending by multiples. It’s not often that I get a stock recommendation from an army general. That is exactly what happened the other day when I was speaking to a three-star about the long-term implications of the escalating trade war. He argued persuasively that the world will probably never again see large-scale armies fielded by major industrial nations. Wars of the future will be fought online, as they have been silently and invisibly over the past 20 years. All of those trillions of dollars spent on big ticket, heavy metal weapons systems, like submarines and F-35 fighters ($122 million each) are pure pork designed by politicians to buy voters in marginal swing states. The money would be far better spent where it is most needed, on the cyber warfare front. Needless to say, my friend shall remain anonymous. The problem is that when wars become cheaper, you fight more of them, as is the case with online combat. You probably don’t know this, but during the Bush administration, the Chinese military downloaded the entire contents of the Pentagon’s mainframe computers at least seven times. This was a neat trick because these computers were in stand-alone, siloed, electromagnetically shielded facilities not connected to the Internet in any way. Here are essentially no secrets about anything anymore. In the process, they obtained the designs of all of our most advanced weapons systems, including our best smart nukes. What have they done with this top-secret information? Absolutely nothing. Like many in senior levels of the US military, the Chinese have concluded that these weapons are a useless waste of valuable resources. Far better value for money are more hackers, coders, and servers, which the Chinese have pursued with a vengeance. You have seen this in the substantial tightening up of the Chinese Internet through the deployment of the Great Firewall, which blocks local access to most foreign websites, including Wikipedia. Try sending an email to someone in the middle Kingdom with a Gmail address. It is almost impossible. This is why Google (GOOG) closed their offices there years ago. I know of these because several Chinese readers are complaining that they are unable to open my own Mad Hedge Trade Alerts, or access their foreign online brokerage accounts. As a member of the Joint Chiefs of Staff recently told me, “The greatest threat to national defense is wasting money on national defense.” Although my brass-hatted friend didn’t mention the company by name, the implication is that I need to go out and buy Palo Alto Networks (PANW) right now. Palo Alto Networks, Inc. is an American network security company based in Santa Clara, California just across the water from my Bay area office. The company’s core products are advanced firewalls designed to provide network security, visibility and granular control of network activity based on application, user, and content identification. To visit their website please click here. Palo Alto Networks competes in the unified threat management and network security industry against Cisco (CSCO), FireEye (FEYE), Fortinet (FTNT), Check Point (CHKP), Juniper Networks (JNPR), and Cyberoam, among others. The really interesting thing about this industry is that there really are no losers. That’s because companies are taking a layered approach to cybersecurity, parceling out contracts to many of the leading firms at once, looking to hedge their bets. To say that top management has no idea what these products really do would be a huge understatement. Therefore, they buy all of them. This makes a basket approach to the industry more feasible than usual. You can do this by buying the $435 million capitalized Pure Funds ISE Cyber Security ETF (HACK), which boasts CyberArk Software (CYBR and FireEye (FEYE) as its largest positions. (HACK) has been a hedge fund favorite since the Sony attack. For more information about (HACK), please click here. And don’t forget to change your password.

|

Quote of the Day"Technology has outrun the ability of the market to handle it. When the next bear market comes, there could be a messy affair," said my friend and client Leon Cooperman of hedge fund Omega Advisors.

|

|

|---|

Global Market Comments

April 16, 2021

Fiat LuxFeatured Trade:(APRIL 14 BIWEEKLY STRATEGY WEBINAR Q&A),

(TSLA), (JPM), (ROM), (AAPL), (MSFT), (FB) (CRSP), (TLT), (VIX), (DIS), (NVDA), (MU), (AMD), (AMAT) (PLTR), (WYNN), (MGM)

April 16, 2021

Fiat LuxFeatured Trade:(APRIL 14 BIWEEKLY STRATEGY WEBINAR Q&A),

(TSLA), (JPM), (ROM), (AAPL), (MSFT), (FB) (CRSP), (TLT), (VIX), (DIS), (NVDA), (MU), (AMD), (AMAT) (PLTR), (WYNN), (MGM)

April 14 Biweekly Strategy Webinar Q&ABelow please find subscribers’ Q&A for the April 14 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Silicon Valley, CA.

Q: How do you choose your buy areas?

A: It’s very simple; I read the Diary of a Mad Hedge Fund Trader. Beyond that, there are two main themes in the market right now: domestic recovery and tech; and I try to own both of those 50/50. It's impossible to know which one will be active and which one will be dead, and some of that rotation will happen on a day-by-day basis. As for single names, I tend to pick the ones I have been following the longest.

Q: In my 401k, should I continue placing my money in growth or move to something like emerging markets or value?

A: It depends on your age. The younger you are, the more aggressive you should be and the more tech stocks you should own. Because if you’re young, you still have time to earn the money back if you lose it. If you’re old like me, you basically only want to be in value stocks because if you lose all the money or we have a recession, there's not enough time to go earn the money back; you’re in spending mode. That is classic financial advisor advice.

Q: When you say “Buy on dips”, what percentage do you mean? 5% or 10%

A: It depends on the volatility of the stock. For highly volatile stocks, 10% is a piece of cake. Some of the more boring ones with lower volatility you may have to buy after only a 2% correction; a classic example of that is the banks, like JP Morgan (JPM).

Q: Even though you’re not a fan of cryptocurrency, what do you think of Coinbase?

A: It’ll come out vastly overvalued because of the IPO push. Eventually, it may fall to a lower level. And Coinbase isn’t necessarily a business model dependent on bitcoin; it is a business model based on other people believing in bitcoin, and as long as there’s enough of those creating two-way transactions, they will make money. But all of these things these days are coming out super hyped; and you never want to touch an IPO—wait for it to drop 50%, as I once did with Tesla (TSLA).

Q: Please explain the barbell portfolio.

A: The barbell works when you have half tech, half domestic recovery. That way you always have something going up, because the market tends to rotate back and forth between the two sectors. But over the long term everything goes up, and that is exactly what has been happening.

Q: Is the ProShares Ultra Technology Fund (ROM) an ETF?

A: Yes, it is an ETF issuer with $53 billion worth of funds based in Bethesda, MD. (ROM) is a 2x long technology ETF, and their largest holdings include all the biggest tech stocks like Apple (AAPL), Microsoft (MSFT), Facebook (FB), and so on.

Q: Will all this government spending affect the market?

A: Yes, it will make it go up. All we’re waiting to see now is how fast the government can spend the money.

Q: What is the target for ROM?

A: $150 this year, and a lot more on the bull call spread. The only shortcoming of (ROM) is you can only go out six months on the expiration. Even then, you have a good shot at making a 500% return on the farthest out of the money LEAPS, the November $130-$135 vertical bull call spread. That's because market makers just don’t want to take the risk being short technology two years out. It’s just too difficult to hedge.

Q: There have been many comments about hyperinflation around the corner. Will we be seeing hyperinflation?

A: No, the people who have been predicting hyperinflation have been predicting it for at least 20 years, and instead we got deflation, so don’t pay attention to those people. My view is that technology is accelerating so fast, thanks to the pandemic, that we will see either zero inflation or we will see deflation. That has been the pattern for the last 40 years and I like betting on 40-year trends.

Q: When we get called away on our short options, is it easier to close the trade than to exercise your option?

A: No, any action you take in the market costs money, costs commissions, costs dealing spreads. And it's much easier just to exercise the option if you have to cover your short, which is either free or will cost you $15.

Q: Are you worried about overspending?

A: No, the proof in that is we have a 1.53% ten-year US Treasury yield, and $20 trillion in QE and government spending is already known, it’s already baked in the price. So don’t listen to me, listen to Mr. Market; and it says we haven't come close to reaching the limit yet on borrowing. Look at the markets, they're the ones who have the knowledge.

Q: My Walt Disney (DIS) LEAPs are getting killed. I don't understand why my LEAPS go down even on green days for the stock.

A: The answer is that the Volatility Index (VIX) has been going down as well. Remember, if you’re long volatility through LEAPS, and volatility goes down, you take a hit. That said, we’re getting close to the lows of the year for volatility here, so any further stock gains and your LEAPS should really take off. And remember when you buy LEAPS, you’re doing multiple bets; one is that volatility stays high and goes higher, and one is that your stock is high and goes higher. If both those things don’t happen, and you can lose money.

Q: How do you best short the (TLT)?

A: If you can do the futures market, Treasury bonds are always your best short there because you have 10 to 1 leverage.

Q: How would you do a spread on Crisper Technology (CRSP)?

A: We have a recommendation in the Mad Hedge Biotech & Healthcareservice to be long the two-year LEAP on Crisper, the $160-$170 vertical bull call spread.

Q: When do you see the largest dip this year?

A: Probably over the summer, but it likely won’t be over 10%. Too much cash in the market, too much government spending, too much QE. People will be in “buy the dips” mode for years.

Q: Is the SPAC mania running out of steam?

A: Yes, you can only get so many SPACS promising to buy the same theme at a discount. I think eventually, 80% of these SPACS go out of business or return the money to investors uninvested because they are promising to buy things at great bargains in one of the most expensive markets in history, which can’t be done.

Q: What do you think about Joe Biden’s attempt to tame the semiconductor chip shortage?

A: Most people don't know that all chips for military weapons systems are already made in the US by chip factories owned by the military. And the pandemic showed that a just-in-time model is high risk because all of a sudden when the planes stop flying, you couldn't get chips from China anymore. Instead, they had to come by ship which takes six weeks, or never. So a lot of companies are moving production back to the US anyway because it is a good risk control measure. And of course, doing that in the midst of the worst semiconductor shortage in history shows the importance of this. Even Tesla has had to delay their semi truck because of chip shortages. Keep buying NVIDIA (NVDA), Micron Technology (MU), Advanced Micro Devices (AMD), and Applied Materials (AMAT) on dips.

Q: Do you see a sell the news type of event for upcoming earnings?

A: Yes, but not by much. We got that in the first quarter, and stocks sold off a little bit after they announced great earnings, and then raced back up to new highs. You could get a repeat of that, as people are just sitting on monster profits these days and you can’t blame them for wanting to pull out a little bit of money to spend on their summer vacation.

Q: Has the stock market gotten complacent about COVID risk?

A: No, I would say COVID is actually disappearing. Some 100 million Americans have been vaccinated, 5 million more a day getting vaccinated, this thing does actually go away by June. So after that, you only have to worry about the anti-vaxxers infecting the rest of the population before they die.

Q: Do you see any imminent foreign policy disasters in Asia, the Middle East, or Europe that could derail the stock market?

A: I don’t, but then you never see these things coming. They always come out of the blue, they're always black swans, and for the last 40 years, they have been buying opportunities. So pray for a geopolitical disaster of some sort, take the 5-10% selloff and buy because at the end of the day, American stockholders really don't care what’s going on in the rest of the world. They do care, however, about increasing their positions in long-term bull markets. I don't worry about politics at all; I don’t say that lightly because it’s taking 50 years of my own geopolitical experience and throwing it down the toilet because nobody cares.

Q: Would you buy Coinbase?

A: Absolutely not, not even with your money. These things always come out overpriced. If you do want to get in, wait for the 50% selloff first.

Q: Is Canada a play on the dollar?

A: Absolutely yes. If they get a weaker dollar, it increases Canadian pricing power and is good for their economy. Canada is also a great commodities play.

Q: The IRS is using Palantir (PLTR) software to find US citizens avoiding taxes with Bitcoin.

A: Yes, absolutely they are. Anybody who thinks this is tax-free money is delusional. And this is one reason to buy Palantir; they’re involved in all sorts of these government black ops type things and we have a very strong buy recommendation on Palantir and their 2-year LEAPS.

Q: Are NFTs, or Non-Fundable Tokens, another Ponzi scheme?

A: Absolutely, if you want to pay millions of dollars for Paris Hilton’s music collection, go ahead; I'd rather buy more Tesla.

Q: When do you think you can go to Guadalcanal again?

A: Well, I’m kind of thinking next winter. Guadalcanal is one of the only places you can go and get more diseases than you can here in the US. Last year, I went there and picked up a bunch of dog tags from marines who died in the 1942 battle there, sent them back to Washington DC, and had them traced and returned to the families. And I happen to know where there are literally hundreds of more dog tags I can do this with. It’s not an easy place to visit and it’s very far away though. Watch out for malaria. My dad got it there.

Q: Walt Disney is already above the pre-pandemic price. Do you suggest any other hotel company name at this time?

A: Go with the Las Vegas casinos, Wynn (WYNN) and MGM (MGM) would be really good ones. Las Vegas is absolutely exploding right now, and we haven't seen that yet in the earnings yet, so buy Las Vegas for sure.

Q: Is the upcoming Roaring Twenties priced into the stock market already?

A: Absolutely not. You didn't want to sell the last Roaring Twenties in 1921 as it still had another eight years to go. You could easily have eight years on this bull market as well. We have historic amounts of money set up to spend, but none of it has been actually spent yet. That didn’t exist in 1921. I think that when they do start hitting the economy with that money, that we get multiple legs up in stock prices.

To watch a replay of this webinar just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last ten years are there in all their glory.

Good Luck and Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Q: How do you choose your buy areas?

A: It’s very simple; I read the Diary of a Mad Hedge Fund Trader. Beyond that, there are two main themes in the market right now: domestic recovery and tech; and I try to own both of those 50/50. It's impossible to know which one will be active and which one will be dead, and some of that rotation will happen on a day-by-day basis. As for single names, I tend to pick the ones I have been following the longest.

Q: In my 401k, should I continue placing my money in growth or move to something like emerging markets or value?

A: It depends on your age. The younger you are, the more aggressive you should be and the more tech stocks you should own. Because if you’re young, you still have time to earn the money back if you lose it. If you’re old like me, you basically only want to be in value stocks because if you lose all the money or we have a recession, there's not enough time to go earn the money back; you’re in spending mode. That is classic financial advisor advice.

Q: When you say “Buy on dips”, what percentage do you mean? 5% or 10%

A: It depends on the volatility of the stock. For highly volatile stocks, 10% is a piece of cake. Some of the more boring ones with lower volatility you may have to buy after only a 2% correction; a classic example of that is the banks, like JP Morgan (JPM).

Q: Even though you’re not a fan of cryptocurrency, what do you think of Coinbase?

A: It’ll come out vastly overvalued because of the IPO push. Eventually, it may fall to a lower level. And Coinbase isn’t necessarily a business model dependent on bitcoin; it is a business model based on other people believing in bitcoin, and as long as there’s enough of those creating two-way transactions, they will make money. But all of these things these days are coming out super hyped; and you never want to touch an IPO—wait for it to drop 50%, as I once did with Tesla (TSLA).

Q: Please explain the barbell portfolio.

A: The barbell works when you have half tech, half domestic recovery. That way you always have something going up, because the market tends to rotate back and forth between the two sectors. But over the long term everything goes up, and that is exactly what has been happening.

Q: Is the ProShares Ultra Technology Fund (ROM) an ETF?

A: Yes, it is an ETF issuer with $53 billion worth of funds based in Bethesda, MD. (ROM) is a 2x long technology ETF, and their largest holdings include all the biggest tech stocks like Apple (AAPL), Microsoft (MSFT), Facebook (FB), and so on.

Q: Will all this government spending affect the market?

A: Yes, it will make it go up. All we’re waiting to see now is how fast the government can spend the money.

Q: What is the target for ROM?

A: $150 this year, and a lot more on the bull call spread. The only shortcoming of (ROM) is you can only go out six months on the expiration. Even then, you have a good shot at making a 500% return on the farthest out of the money LEAPS, the November $130-$135 vertical bull call spread. That's because market makers just don’t want to take the risk being short technology two years out. It’s just too difficult to hedge.

Q: There have been many comments about hyperinflation around the corner. Will we be seeing hyperinflation?

A: No, the people who have been predicting hyperinflation have been predicting it for at least 20 years, and instead we got deflation, so don’t pay attention to those people. My view is that technology is accelerating so fast, thanks to the pandemic, that we will see either zero inflation or we will see deflation. That has been the pattern for the last 40 years and I like betting on 40-year trends.

Q: When we get called away on our short options, is it easier to close the trade than to exercise your option?

A: No, any action you take in the market costs money, costs commissions, costs dealing spreads. And it's much easier just to exercise the option if you have to cover your short, which is either free or will cost you $15.

Q: Are you worried about overspending?

A: No, the proof in that is we have a 1.53% ten-year US Treasury yield, and $20 trillion in QE and government spending is already known, it’s already baked in the price. So don’t listen to me, listen to Mr. Market; and it says we haven't come close to reaching the limit yet on borrowing. Look at the markets, they're the ones who have the knowledge.

Q: My Walt Disney (DIS) LEAPs are getting killed. I don't understand why my LEAPS go down even on green days for the stock.

A: The answer is that the Volatility Index (VIX) has been going down as well. Remember, if you’re long volatility through LEAPS, and volatility goes down, you take a hit. That said, we’re getting close to the lows of the year for volatility here, so any further stock gains and your LEAPS should really take off. And remember when you buy LEAPS, you’re doing multiple bets; one is that volatility stays high and goes higher, and one is that your stock is high and goes higher. If both those things don’t happen, and you can lose money.

Q: How do you best short the (TLT)?

A: If you can do the futures market, Treasury bonds are always your best short there because you have 10 to 1 leverage.

Q: How would you do a spread on Crisper Technology (CRSP)?

A: We have a recommendation in the Mad Hedge Biotech & Healthcareservice to be long the two-year LEAP on Crisper, the $160-$170 vertical bull call spread.

Q: When do you see the largest dip this year?

A: Probably over the summer, but it likely won’t be over 10%. Too much cash in the market, too much government spending, too much QE. People will be in “buy the dips” mode for years.

Q: Is the SPAC mania running out of steam?

A: Yes, you can only get so many SPACS promising to buy the same theme at a discount. I think eventually, 80% of these SPACS go out of business or return the money to investors uninvested because they are promising to buy things at great bargains in one of the most expensive markets in history, which can’t be done.

Q: What do you think about Joe Biden’s attempt to tame the semiconductor chip shortage?

A: Most people don't know that all chips for military weapons systems are already made in the US by chip factories owned by the military. And the pandemic showed that a just-in-time model is high risk because all of a sudden when the planes stop flying, you couldn't get chips from China anymore. Instead, they had to come by ship which takes six weeks, or never. So a lot of companies are moving production back to the US anyway because it is a good risk control measure. And of course, doing that in the midst of the worst semiconductor shortage in history shows the importance of this. Even Tesla has had to delay their semi truck because of chip shortages. Keep buying NVIDIA (NVDA), Micron Technology (MU), Advanced Micro Devices (AMD), and Applied Materials (AMAT) on dips.

Q: Do you see a sell the news type of event for upcoming earnings?

A: Yes, but not by much. We got that in the first quarter, and stocks sold off a little bit after they announced great earnings, and then raced back up to new highs. You could get a repeat of that, as people are just sitting on monster profits these days and you can’t blame them for wanting to pull out a little bit of money to spend on their summer vacation.

Q: Has the stock market gotten complacent about COVID risk?

A: No, I would say COVID is actually disappearing. Some 100 million Americans have been vaccinated, 5 million more a day getting vaccinated, this thing does actually go away by June. So after that, you only have to worry about the anti-vaxxers infecting the rest of the population before they die.

Q: Do you see any imminent foreign policy disasters in Asia, the Middle East, or Europe that could derail the stock market?

A: I don’t, but then you never see these things coming. They always come out of the blue, they're always black swans, and for the last 40 years, they have been buying opportunities. So pray for a geopolitical disaster of some sort, take the 5-10% selloff and buy because at the end of the day, American stockholders really don't care what’s going on in the rest of the world. They do care, however, about increasing their positions in long-term bull markets. I don't worry about politics at all; I don’t say that lightly because it’s taking 50 years of my own geopolitical experience and throwing it down the toilet because nobody cares.

Q: Would you buy Coinbase?

A: Absolutely not, not even with your money. These things always come out overpriced. If you do want to get in, wait for the 50% selloff first.

Q: Is Canada a play on the dollar?

A: Absolutely yes. If they get a weaker dollar, it increases Canadian pricing power and is good for their economy. Canada is also a great commodities play.

Q: The IRS is using Palantir (PLTR) software to find US citizens avoiding taxes with Bitcoin.

A: Yes, absolutely they are. Anybody who thinks this is tax-free money is delusional. And this is one reason to buy Palantir; they’re involved in all sorts of these government black ops type things and we have a very strong buy recommendation on Palantir and their 2-year LEAPS.

Q: Are NFTs, or Non-Fundable Tokens, another Ponzi scheme?

A: Absolutely, if you want to pay millions of dollars for Paris Hilton’s music collection, go ahead; I'd rather buy more Tesla.

Q: When do you think you can go to Guadalcanal again?

A: Well, I’m kind of thinking next winter. Guadalcanal is one of the only places you can go and get more diseases than you can here in the US. Last year, I went there and picked up a bunch of dog tags from marines who died in the 1942 battle there, sent them back to Washington DC, and had them traced and returned to the families. And I happen to know where there are literally hundreds of more dog tags I can do this with. It’s not an easy place to visit and it’s very far away though. Watch out for malaria. My dad got it there.

Q: Walt Disney is already above the pre-pandemic price. Do you suggest any other hotel company name at this time?

A: Go with the Las Vegas casinos, Wynn (WYNN) and MGM (MGM) would be really good ones. Las Vegas is absolutely exploding right now, and we haven't seen that yet in the earnings yet, so buy Las Vegas for sure.

Q: Is the upcoming Roaring Twenties priced into the stock market already?

A: Absolutely not. You didn't want to sell the last Roaring Twenties in 1921 as it still had another eight years to go. You could easily have eight years on this bull market as well. We have historic amounts of money set up to spend, but none of it has been actually spent yet. That didn’t exist in 1921. I think that when they do start hitting the economy with that money, that we get multiple legs up in stock prices.

To watch a replay of this webinar just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last ten years are there in all their glory.

Good Luck and Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Quote of the Day“What the Fed has done is pulled forward several years of stock appreciation into just a couple of months. I think stock prices are too high,” said Jonathan Golub, chief US equity strategist of Credit Suisse.

|

BABA has a run coming.

Shares of Alibaba (BABA) are up more than 5% this week after China's decision to fine the company 4% of 2019 revenue allowed it to move forward. The State Administration for Market Regulation (SAMR) said Saturday that it had determined that Alibaba had been abusing market dominance since 2015 by forbidding its merchants from using other online e-commerce platforms. Alibaba said in a statement that it accepts the penalty and “will ensure its compliance with determination”.

The $2.75B fine was the highest ever antitrust penalty imposed by China.

But investors are bidding the stock higher, with the fine not material to the company's finances and the cloud of regulatory action removed. "Despite the record fine amount, we think this should lift a major overhang on BABA and shift the market’s focus back to fundamentals,” Morgan Stanley wrote in a note on Sunday. "The final ruling leans significantly towards what investors had been considering the best case outcome," Macquarie says.

U.S. megacap tech companies are also facing investigations into their practices DataTrek Research listed tech regulation as one of five scenarios that could be the catalyst for a bear market. It noted that Alibaba and Tencent (TCEHY) haven't really underperformed the broader Chinese market, but rather "the Chinese government’s sudden increase in tech sector regulatory scrutiny is hitting overall investor confidence."

The relatively benign outcome for Alibaba could increase confidence for U.S. Big Tech to weather any political storm from Washington.

Shares of Alibaba (BABA) are up more than 5% this week after China's decision to fine the company 4% of 2019 revenue allowed it to move forward. The State Administration for Market Regulation (SAMR) said Saturday that it had determined that Alibaba had been abusing market dominance since 2015 by forbidding its merchants from using other online e-commerce platforms. Alibaba said in a statement that it accepts the penalty and “will ensure its compliance with determination”.

The $2.75B fine was the highest ever antitrust penalty imposed by China.

But investors are bidding the stock higher, with the fine not material to the company's finances and the cloud of regulatory action removed. "Despite the record fine amount, we think this should lift a major overhang on BABA and shift the market’s focus back to fundamentals,” Morgan Stanley wrote in a note on Sunday. "The final ruling leans significantly towards what investors had been considering the best case outcome," Macquarie says.

U.S. megacap tech companies are also facing investigations into their practices DataTrek Research listed tech regulation as one of five scenarios that could be the catalyst for a bear market. It noted that Alibaba and Tencent (TCEHY) haven't really underperformed the broader Chinese market, but rather "the Chinese government’s sudden increase in tech sector regulatory scrutiny is hitting overall investor confidence."

The relatively benign outcome for Alibaba could increase confidence for U.S. Big Tech to weather any political storm from Washington.

We need BABA to go on a run. It's been dropping or stagnant for 6 months now.

CCP's been rough..JD and mainly TENCENT are next looks like.

|

The ARK funds haven't been doing so well. I wonder if the shine is wearing off on Cathie Woods. She made a big play on TSLA and now COIN - I'll be watching to see how that goes. I sold off the few shares of TSLA I had last month for a small gain...and it's up quite a bit since I sold in this mid-$600 range.

The ARK funds haven't been doing so well. I wonder if the shine is wearing off on Cathie Woods. She made a big play on TSLA and now COIN - I'll be watching to see how that goes. I sold off the few shares of TSLA I had last month for a small gain...and it's up quite a bit since I sold in this mid-$600 range.

Nice..yea I saw the buy in the ARK innovation ....I'm watching Coin...It's more or less tracking confidence In bitcoin.

Madhedge this week

Q: Even though you’re not a fan of cryptocurrency, what do you think of Coinbase?

A: It’ll come out vastly overvalued because of the IPO push. Eventually, it may fall to a lower level. And Coinbase isn’t necessarily a business model dependent on bitcoin; it is a business model based on other people believing in bitcoin, and as long as there’s enough of those creating two-way transactions, they will make money. But all of these things these days are coming out super hyped; and you never want to touch an IPO—wait for it to drop 50%, as I once did with Tesla

YNDF

YNDF