You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Intersting thoughts

- Thread starter Bozzie

- Start date

|

| Global Market Comments April 5, 2021 Fiat Lux Featured Trade: (MARKET OUTLOOK FOR THE WEEK AHEAD, or A SUPERCHARGED ECONOMY IS SUPERCHARGING THE STOCK MARKET), (SPX), (LRCX), (AMAT), (VIX), (BA), (LUV), (AKL), (TSLA), (DAL)

|

| � |

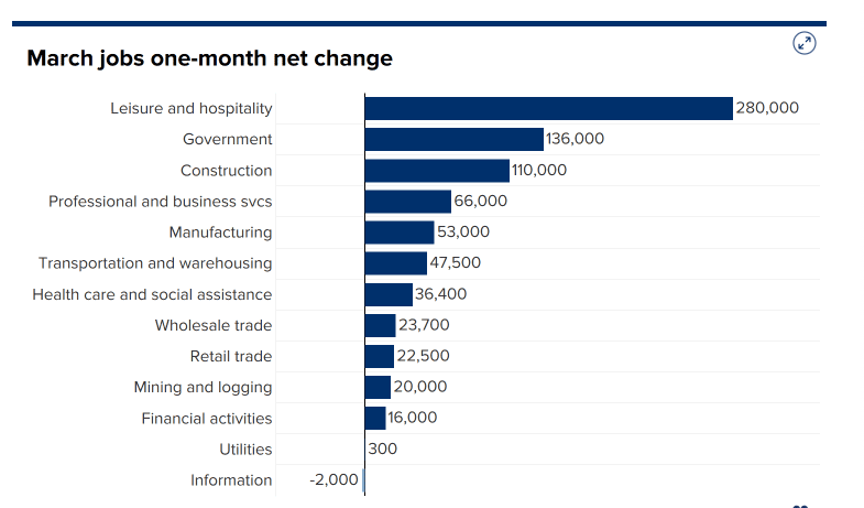

The Market Outlook for the Week Ahead, or A Supercharged Economy is Supercharging the Stock MarketStocks have risen at an annualized rate of 40% so far in 2021. If that sounds too good to be true, it is. But then, we have the greatest economic and monetary stimulus of all time rolling out also. Of the $10 trillion in government spending that has or is about to be approved, virtually none of it has been spent. There hasn’t been enough time. It turns out that it is quite hard to spend a trillion dollars. Corporate America and its investors are salivating. The best guess is that the new spending will create five million jobs for the economy over eight years, taking the headline Unemployment Rate down to a full employment 3-4%. The clever thing about the proposal is that it is financed over 15 years, which takes advantage of the current century's low interest rates. That is something many strategists have been begging the US Treasury to do for years. Take the free money while it is on offer. There is something Rooseveltean about all this, with great plans and huge amounts of money, like 10% of GDP on the table. But then we did just come out of a Great Depression, with unemployment peaking at 25 million, the same as in 1933. The package is so complex that it is unlikely to pass by summer. Until then, stocks will probably continue to rally on the prospect. It makes my own forecast of a 30% gain in stocks and a Dow Average of 40,000 for 2021 look overly cautious, conservative, and feeble (click here). But then, you have to trade the market you have, not the one you want. And here is the really fun part. After a grinding seven-month-long correction, technology stocks have suddenly returned from the dead. All the best names gained 10% or more in the previous four-day holiday-shortened week. Clearly, investors have itchy trigger fingers with tech stocks at these levels. In the meantime, technology stock prices have fallen 20-50% while earnings have jumped by 20% to 40%. What was expensive became cheap. It was a setup that was begging to happen. This is great news because technology stocks are the core to all non-indexed retirement funds. The S&P 500 (SPX) blasted through 4,000, a new all-time high, off the back of one of the largest infrastructure spends in history. Job creation over the next eight years is estimated at 5 million. Corporate earnings will go through the roof. Tech is back from the dead. Leaders were semiconductor equipment makers like my old favorites, Applied Materials (AMAT) and Lam Research (LRCX). The Volatility Index (VIX) sees the $17 handle, hinting at much higher to come. The next leg up for the Roaring Twenties has begun! Biden Infrastructure Bill Tops $2.3 Trillion. Of course, some of it isn’t infrastructure but other laudable programs that starved under the Trump administration, like spending on seniors (I’m all for that!). Still, spending is spending, and this will turbocharge the economy all the way out to say….2024. The impact on interest rates will be minimal as long as the Fed keeps overnight rates near zero, as they have promised to do for nearly three years. Making the power grid carbon-free by 2035 is a goal and would require a 50% increase in solar national installations. Infrastructure spending is always a win-win because the new tax revenues it generates always pay for it in the end. March Nonfarm Payroll Report exploded to the upside, adding a near record 917,000 jobs, and taking the headline Unemployment Rate down to 6.0%. Employers are front running Biden’s infrastructure plans, hiring essential workers while they are still available. Look for labor shortages by summer, especially in high paying tech. Leisure & Hospitality was the overwhelming leader at a staggering 280,000, followed by Government at 136,000 and Construction at 110,000.

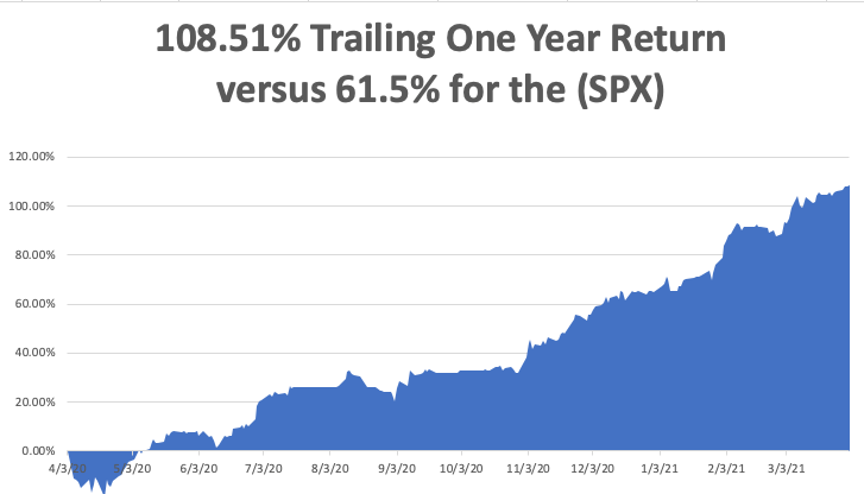

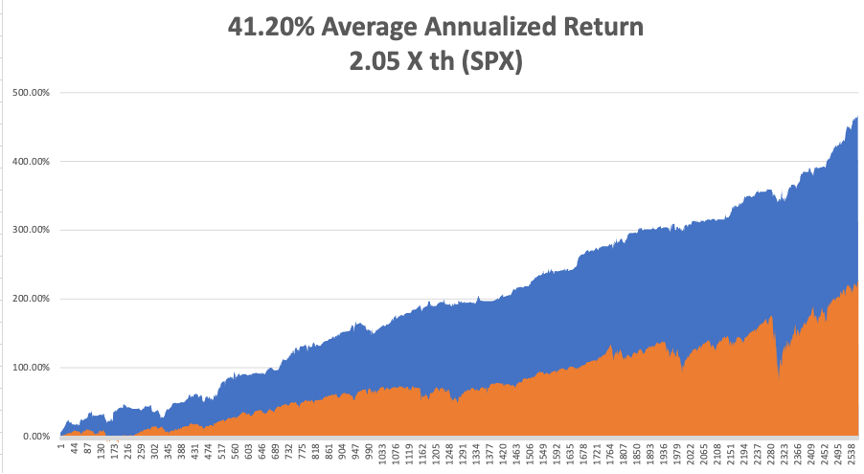

Consumer Confidence soared, up 19.3 points to 109 in February, according to the Conference Board. It’s the second-biggest move on record. A doubling of the value of your home AND your stock portfolio in a year is making people feel positively ebullient. Oh, and free money from the government is in the mail. The Suez Canal reopened, allowing 10% of international trade to resume. A massive salvage effort that freed the 200,000 ton Ever Given. The ship will be grounded for weeks pending multiple inspections. Somebody’s insurance rates are about to rachet up. It all shows how fragile is the international trading system. Deliveries to Europe will still be disrupted for months. It puts a new spotlight on the Arctic route from Asia to Europe, which is 4,000 nm shorter. Boeing (BA) won a massive order, some 100 planes from Southwest Air (LUV), practically the only airline to use the pandemic to expand. Boeing can fill the order almost immediately from 2020 cancelled orders for the $50 million 737 MAX. Keep buying both (BA), (LUV), and (AKL) on dips. Tesla blows away Q1 deliveries, with a 184,400 print, or 47.5% high than the 2021 rate. That is without any of the new Biden EV subsidies yet to kick in. Lower priced Model 3 sedans and Model Y SUVs accounted for virtually all of the report. The Shanghai factory is kicking in as a major supplier to high Chinese demand. The one million target for 2021 is within easy reach. Traders saw this coming (including me) and ramped the stock up $100. Buy (TSLA) on dips. My long-term target is $10,000. United Airlines hires 300 pilots to front-run expected exposure summer travel. CEO Scott Kirby says domestic vacation travel has almost completely recovered. Keep buying (LUV), (AKL), and (DAL) on dips. When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% to 120,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 120,000 here we come! My Mad Hedge Global Trading Dispatch profit reached 0.38% gain during the first two days of April on the heels of a spectacular 20.60% profit in March. I used the Monday low to double up my long in Tesla. After that, it was off to the races for all of tech. I caught a $100 move on the week. My new large Tesla (TSLA) long expires in 9 trading days. That leaves me with 50% cash and a barrel full of dry powder. My 2021 year-to-date performance soared to 44.47%. The Dow Average is up 9.40% so far in 2021. That brings my 11-year total return to 467.02%, some 2.08 times the S&P 500 (SPX) over the same period. My 11-year average annualized return now stands at an unbelievable 41.20%, the highest in the industry. My trailing one-year return exploded to positively eye-popping 108.51%. I truly have to pinch myself when I see numbers like this. I bet many of you are making the biggest money of your long lives. We need to keep an eye on the number of US Coronavirus cases at 30.6million and deaths topping 555,000, which you can find here. The coming week will be dull on the data front. On Monday, April 5, at 10:00 AM, the ISM Non-Manufacturing Index for March is released. On Tuesday, April 6, at 10:00 AM, US Consumer Inflation Expectations for March are published. On Wednesday, April 7 at 2:00 PM, the minutes of the last Federal Open Market Committee Meeting are published. On Thursday, April 8 at 8:30 AM, the Weekly Jobless Claims are printed. On Friday, April 9 at 8:30 AM we get the Producer Price Index for March. At 2:00 PM, we learn the Baker-Hughes Rig Count. As for me, I recently turned 69, so I used a nice day to climb up to the Lake Tahoe High Sierra rim at 9,000 feet, found a nice granite boulder sit on to keep dry, and tried to figure out what it was all about. I’ve been very lucky. I had a hell of a life that I wouldn’t trade for anything. I wouldn’t change a bit (well, maybe I would have bought more Apple shares at a split-adjusted 30 cents in 1998. I knew Steve was going to make it). Since I’ve always loved what I did, journalist, trader, combat pilot, hedge fund manager, writer, I don’t think I have “worked” a day in my life. I fought for things I believed in passionately and won, and kept on winning. It’s good to be on the right side of history. I have loved and lost and loved again and lost again, and in the end outlived everyone, even my younger brother, who died of Covid-19 a year ago. The rule here is that it is always the other guy who dies. My legacy is five of the smartest kids you ever ran into. They’re great traders as well. So I’ll call it a win. I visited my orthopedic surgeon the other day to get a stem cell top-up for my knees and she asked how long I planned to keep coming back. I told her 30 years, and I meant it. There’s nothing left for me to do but to make you all savvy in the markets and rich, something I leap out of bed every morning at 5:00 AM to accomplish. Enjoy your weekend. Stay healthy. John Thomas CEO & Publisher The Diary of a Mad Hedge Fund Trader

The Way Forward is Clear

|

Quote of the DayThe 40-year bull market in bonds is over,” said Dr. Jeremy Siegal of the Wharton School of Business. I agree heartily.

|

|

These lefty companies are going to regret going "woke". MLB is going to get crushed. I'm personally sick of it.

I don't really care much about the all star game I don't drink coke or fly delta much...I think MLB with be fine, basketball did the same thing in NC a few years ago, people were pissed now it's a distance memory.

I love baseball and I'll still be a huge fan... I don't like the politics in sports but I guess it's part of sports like every thing else theses days.. politics seems to rule the discord now.

Be well buddy

April 7, 2021 Continue reading the main story |

| Good morning. (Was this newsletter forwarded to you? Sign up here.) |

|

| [h=2]Dear shareholders …[/h] |

| The annual letter to shareholders by JPMorgan Chase’s chief Jamie Dimon was just published. The widely read letter is not just an overview of the bank’s business but also covers Mr. Dimon’s thoughts on everything from leadership lessons to public policy prescriptions. |

| “The U.S. economy will likely boom.” A combination of excess savings, deficit spending, a potential infrastructure bill, vaccinations and “euphoria around the end of the pandemic,” Mr. Dimon wrote, may create a boom that “could easily run into 2023.” That could justify high equity valuations, but not the price of U.S. debt, given the “huge supply” soon to hit the market. There is a chance that a rise in inflation would be “more than temporary,” he wrote, forcing the Fed to raise interest rates aggressively. “Rapidly raising rates to offset an overheating economy is a typical cause of a recession,” he wrote, but he hopes for “the Goldilocks scenario” of fast growth, gently increasing inflation and a measured rise in interest rates. |

| “Banks are playing an increasingly smaller role in the financial system.” Mr. Dimon cited competition from an already large shadow banking system and fintech companies, as well as “Amazon, Apple, Facebook, Google and now Walmart.” He argued those nonbank competitors should be more strictly regulated; their growth has “partially been made possible” by avoiding banking rules, he wrote. And when it comes to tougher regulation of big banks, he wrote, “the cost to the economy of having fail-safe banks may not be worth it.” |

| [h=3]PAID POST: A MESSAGE FROM DARKTRACE[/h]Cybersecurity: Not a Human-Scale Problem With the World Economic Forum warning of ‘’A.I.-enabled threats,” humans are struggling to keep pace. Autonomous Cyber AI interrupts in-progress cyberattacks in seconds – wherever they strike. LEARN HOW > |

| “China’s leaders believe that America is in decline.” While the U.S. has faced tough times before, today “the Chinese see an America that is losing ground in technology, infrastructure and education — a nation torn and crippled by politics, as well as racial and income inequality — and a country unable to coordinate government policies (fiscal, monetary, industrial, regulatory) in any coherent way to accomplish national goals,” he wrote. “Unfortunately, recently, there is a lot of truth to this.” |

| “The solution is not as simple as walking away from fossil fuels.” Addressing climate change doesn’t mean “abandoning” companies that produce and use fossil fuels, Mr. Dimon wrote, but working with them to reduce their environmental impact. He sees “huge opportunity in sustainable and low-carbon technologies and businesses” and plans to evaluate clients’ progress according to reductions in carbon intensity — emissions per unit of output — which adjusts for factors like size. |

| Other notable news (and views) from the letter: |

|

| Some meta-analysis: This was Mr. Dimon’s longest letter yet, at 35,000 words over 66 pages. The steadily expanding letters — aside from a shorter edition last year, weeks after Mr. Dimon had emergency heart surgery — could be seen as a reflection of the range of issues top executives are now expected, or compelled, to address. |

|

| [h=3]HERE’S WHAT’S HAPPENING[/h] |

| Toshiba considers a $20 billion takeover bid. The Japanese tech company said it had received a leveraged buyout offer from the private equity firm CVC Capital, sending its shares to a four-year high. Toshiba has had a series of scandals, and faces pressure from activist investors. |

| Amazon, a notable tax avoider, backs higher corporate taxes. Jeff Bezos said that he supported raising the corporate rate to help pay for President Biden’s infrastructure plans — though he didn’t mention the White House’s proposed rate, 28 percent. Other corporate chiefs are privately criticizing the potential tax rise. |

| The company behind the Johnson & Johnson vaccine mix-up has a history of errors. Emergent BioSolutions, which the U.S. relied on to produce doses by J.&J. and AstraZeneca, had a made manufacturing errors before. Experts worry this may leave some Americans more wary of getting vaccinated, even as Mr. Biden has moved up the eligibility deadline for U.S. inoculations. |

| An electric aircraft maker sues a rival for intellectual property theft. Wisk, which is backed by Boeing and the Google founder Larry Page, said that former employees downloaded confidential information before joining Archer, a competitor. Archer, which is going public by merging with a SPAC run by Moelis & Company and which counts United Airlines as an investor, denied wrongdoing and said it was cooperating with a government investigation. |

| A blistering start for venture capital in 2021. Start-ups set a fund-raising quarterly record in the first three months of the year, raising more than $62 billion, according to the MoneyTree report from PwC and CB Insights. That’s more than twice the total a year earlier and represents nearly half of what start-ups raised in all of 2020. |

| [h=2]Why is the Amazon union vote taking so long?[/h] |

| Voting in the union election at an Amazon warehouse in Bessemer, Ala., ended on March 29, and counting began the next day, but the outcome is still unknown. What’s going on? It’s less about the number of ballots than how they’re counted. |

| The stakes are high, for both Amazon and the labor movement. Progressive leaders like Bernie Sanders have argued a victory for the union, the first at an Amazon facility in the U.S., could inspire workers elsewhere to unionize. And Amazon is facing increased scrutiny for its market power and labor practices. |

| Despite the significance, only a tiny portion of Amazon’s work force was eligible to vote. About 5,800 workers mailed their ballots to the Birmingham office of the National Labor Relations Board. Counting each vote involves two envelopes: one giving the worker’s name and, inside that, another sealed envelope containing an anonymous ballot. Handling them has been a painstaking process: |

|

|

|

| [h=2]“Economic fortunes within countries and across countries are diverging dangerously.”[/h] |

| — Kristalina Georgieva, the managing director of the I.M.F., on how the uneven rollout of vaccines poses a threat to the global economic recovery. |

| [h=2]Credit Suisse’s expensive mistakes[/h] |

| After the 2008 financial crisis, Credit Suisse emerged battered by high-risk bets and promised to do better. A series of recent scandals suggests it hasn’t, The Times’s Jack Ewing writes. |

| A recap of the Swiss bank’s troubles over the past year or so: |

|

|

| It could have been worse. Rules requiring banks to hold more capital helped prevent the Archegos meltdown from posing a systemic threat. Still, Credit Suisse is paying dearly for it, replacing a half-dozen top executives, forgoing executive bonuses and halting stock buybacks. Its current chief, Thomas Gottstein, is facing closer scrutiny as well. |

| Credit Suisse’s troubles show that regulators must stay vigilant, critics say, as lenders chase profits in increasingly risky ways. The Swiss bank is “a straw in the wind that suggests there is a relaxation of risk management within banks because it is so difficult to make money on interest margins,” said Nicolas Véron of the Peterson Institute for International Economics. |

|

| [h=2]Who’s behind that corporate veil?[/h] |

| The Treasury Department is introducing new rules on corporate transparency and it wants input. This week, it began a 30-day comment period on to-be-drafted regulations that would make it harder to obscure who controls a company. Among the details to be worked out are what entities should report and when; how to collect, protect and update information for a database; and the criteria for sharing with law enforcement. |

| “We could not be more excited,” Kenneth Blanco, the director of the Treasury’s Financial Criminal Enforcement Network (FinCEN), told bankers recently. The U.S. has been under pressure to address its vulnerability to money laundering and financial crimes: |

|

| New rules could make forming small businesses, special purpose vehicles and other closely held entities “significantly” more burdensome, said Steve Ganis of Mintz, an expert in anti-money laundering regulation. “FinCEN’s new regime will make things much more complicated for start-ups, where control and ownership are highly fluid,” he said. Public companies and many larger businesses would be exempt because they already face stricter scrutiny. |

| Thank you for your support. Want to share The New York Times? Friends and family can enjoy unlimited digital access to our journalism with this special offer. |

| [h=3]THE SPEED READ[/h] |

| Deals |

|

| Politics and policy |

|

| Tech |

|

| Best of the rest |

|

| � |

Global Market Comments

April 6, 2021

Fiat LuxFeatured Trade:(THE IRS LETTER YOU SHOULD DREAD),

(PANW), (CSCO), (FEYE),

(CYBR), (CHKP), (HACK), (SNE)

(FB), (AAPL), (NFLX), (GOOGL), (MSFT), (TSLA), (VIX)

(TESTIMONIAL)

April 6, 2021

Fiat LuxFeatured Trade:(THE IRS LETTER YOU SHOULD DREAD),

(PANW), (CSCO), (FEYE),

(CYBR), (CHKP), (HACK), (SNE)

(FB), (AAPL), (NFLX), (GOOGL), (MSFT), (TSLA), (VIX)

(TESTIMONIAL)

The IRS Letter You Should DreadI knew the letter from the IRS sitting in my mailbox was bad news just from the color of the paper.

It was not light green, the color of a refund check from the United States Treasury. Instead, it was white, warning that it contained some sort of demand, audit notice, or threatened legal action.

In fact, it was far worse than that.

In the most stilted, bureaucratic language possible, I was informed that my $100,000 tax refund for 2019 had been already been paid out to someone else.

Another party using my name and social security number, but a different address, had already filed a 2019 return for me.

In order to get my money back, I would have to file a new return and include hard copies of every single piece of supporting documentation. It was in effect a full paper audit. Then, I would have to wait 60 days.

This was three months ago.

I informed my accountant immediately. I heard him shout across the room to his partner, “Hey Joe, I’ve got another one.”

He told me that half of his clients had had their refund checks stolen this year, and as a result, the IRS was now demanding automatic audits on all refund requests of $10,000 or more.

It gets worse. Budget cuts at the despised government agency mean that huge delays are occurring in almost all interactions. Even routine requests can sit on a bureaucrat’s desk for two years. The number of standard audits has fallen substantially.

Of the more than 245 million tax returns the IRS processed in 2017, only 1 in 160 individual returns -- 0.6 percent -- were audited. That marks a sixth consecutive annual decline in audits and amounts to the lowest level in 15 years. About 934,000 returns were audited in 2017, the lowest number since 2003, according to agency data.

The ones that take place are just a quick pass over, often conducted by mail, rather than the in-person, full proctologic examinations of the past.

Furthermore, the government didn’t have the money to pay for the latest upgrade of QuickBooks Pro.

This means I was unable to use the online accounting service’s spreadsheets during audits when the taxpayer’s accountant has upgraded, greatly increasing the time required for each audit while decreasing its effectiveness.

As a result, QuickBooks is seeing the fastest and most widespread adoption of its latest software version in history.

You can’t make this stuff up.

I asked my accountant how long it would really take for me to collect my 2018 refund. “Better count on a year,” he said.

Then the news flash came out that the hacker has stolen the tax returns of 100,000 individuals, including their personal information. I was clearly one of those victims.

Not only did the crooks discover my name and social security number, they also knew that my high school team name was the “Apaches,” my first car was a “Volkswagen,” and that I was married in “Tokyo.”

I bet they know my inside leg measurement as well (I’m not telling!).

It all reminds me that it is once again time to revisit Palo Alto Networks (PANW) and FireEye (FEYE). I have been recommending these two cybersecurity names for the past three years, issuing Trade Alerts on each opportunistic dip.

The near-destruction of Sony (SNE) by North Korean hackers has certainly put the fear of God into corporate America.

Apparently, they have no sense of humor whatsoever north of the 38th parallel.

I saw The Interview the other day on a plane, the film making fun of Supreme Leader Kim Jong-un that so pissed them off, and it totally sucked.

As a result, there is a generational upgrade in cybersecurity underway, with many potential targets boosting spending by multiples.

It’s not often that I get a stock recommendation from an army general. That is exactly what happened the other day when I was speaking to a three-star about the long-term implications of the Iran peace deal.

He argued persuasively that the world will probably never again see large-scale armies fielded by major industrial nations. Wars of the future will be fought online, as they have been silently and invisibly over the past 15 years.

All of those trillions of dollars spent on big-ticket, heavy metal weapons systems are pure pork designed by politicians to buy voters in marginal swing states.

The money would be far better spent where it is most needed, on the cyber warfare front. Needless to say, my friend shall remain anonymous.

The problem is that when wars become cheaper, you fight more of them, as is the case with online combat. Cyberwars are now happening every day, all the time, 24/7, and everywhere.

You probably don’t know this, but during the Bush administration, the Chinese military downloaded the entire contents of the Pentagon’s mainframe computers at least seven times.

This was a neat trick because these computers were in stand-alone, siloed, electromagnetically shielded facilities not connected to the Internet in any way.

In the process, they obtained the designs of all of our most advanced weapons systems, including our best nukes. What have they done with this top-secret information?

Absolutely nothing.

Like many in senior levels of the US military, the Chinese have concluded that nuclear weapons are a useless waste of valuable resources.

Far better value for money is more hackers, coders, and servers, which the Chinese have pursued with a vengeance.

You have seen this in the substantial tightening up of the Chinese Internet through the deployment of the Great Firewall, which blocks local access to most foreign websites.

Some Mad Hedge Fund Trader subscribers in the Middle Kingdom have told me they can no longer access their US-based online brokerage accounts, which are blocked by mainland “porn” filters.

“Porn” is defined as anything the Chinese government doesn’t agree with.

Try sending an email to someone in the Middle Kingdom with a Gmail address. It is almost impossible. This is why Google (GOOG) closed its offices five years ago.

As a member of the Joint Chiefs of Staff recently told me, “The greatest threat to national defense is wasting money on national defense.”

Although my brass-hatted friend didn’t mention the company by name, the implication is that I need to go out and buy Palo Alto Networks (PANW) right now.

Palo Alto Networks, Inc. is an American network security company based in Santa Clara, California, just across the water from my Bay area office.

The company’s core products are advanced firewalls designed to provide network security, visibility, and granular control of network activity based on application, user, and content identification.

Palo Alto Networks competes in the unified threat management and network security industry against Cisco (CSCO), FireEye (FEYE), Fortinet (FTNT), Check Point (CHKP), Juniper Networks (JNPR), and Cyberoam, among others.

The really interesting thing about this industry is that there are no losers.

That’s because companies are taking a layered approach to cybersecurity, parceling out contracts to many of the leading firms at once, looking to hedge their bets.

To say that top management has no idea what these products really do would be a huge understatement. Therefore, they buy all of them.

This makes a basket approach to the industry more feasible than usual.

You can do this by buying the $070 million capitalized PureFunds ISE Cyber Security ETF (HACK), which boasts Cyberark Software (CYBR), Infoblox (BLOX), and Fireye (FEYE) as its three largest positions. (HACK) has been a hedge fund favorite since the Sony attack.

For more information about (HACK), please click here.

As for my tax refund, I am still waiting.

It was not light green, the color of a refund check from the United States Treasury. Instead, it was white, warning that it contained some sort of demand, audit notice, or threatened legal action.

In fact, it was far worse than that.

In the most stilted, bureaucratic language possible, I was informed that my $100,000 tax refund for 2019 had been already been paid out to someone else.

Another party using my name and social security number, but a different address, had already filed a 2019 return for me.

In order to get my money back, I would have to file a new return and include hard copies of every single piece of supporting documentation. It was in effect a full paper audit. Then, I would have to wait 60 days.

This was three months ago.

I informed my accountant immediately. I heard him shout across the room to his partner, “Hey Joe, I’ve got another one.”

He told me that half of his clients had had their refund checks stolen this year, and as a result, the IRS was now demanding automatic audits on all refund requests of $10,000 or more.

It gets worse. Budget cuts at the despised government agency mean that huge delays are occurring in almost all interactions. Even routine requests can sit on a bureaucrat’s desk for two years. The number of standard audits has fallen substantially.

Of the more than 245 million tax returns the IRS processed in 2017, only 1 in 160 individual returns -- 0.6 percent -- were audited. That marks a sixth consecutive annual decline in audits and amounts to the lowest level in 15 years. About 934,000 returns were audited in 2017, the lowest number since 2003, according to agency data.

The ones that take place are just a quick pass over, often conducted by mail, rather than the in-person, full proctologic examinations of the past.

Furthermore, the government didn’t have the money to pay for the latest upgrade of QuickBooks Pro.

This means I was unable to use the online accounting service’s spreadsheets during audits when the taxpayer’s accountant has upgraded, greatly increasing the time required for each audit while decreasing its effectiveness.

As a result, QuickBooks is seeing the fastest and most widespread adoption of its latest software version in history.

You can’t make this stuff up.

I asked my accountant how long it would really take for me to collect my 2018 refund. “Better count on a year,” he said.

Then the news flash came out that the hacker has stolen the tax returns of 100,000 individuals, including their personal information. I was clearly one of those victims.

Not only did the crooks discover my name and social security number, they also knew that my high school team name was the “Apaches,” my first car was a “Volkswagen,” and that I was married in “Tokyo.”

I bet they know my inside leg measurement as well (I’m not telling!).

It all reminds me that it is once again time to revisit Palo Alto Networks (PANW) and FireEye (FEYE). I have been recommending these two cybersecurity names for the past three years, issuing Trade Alerts on each opportunistic dip.

The near-destruction of Sony (SNE) by North Korean hackers has certainly put the fear of God into corporate America.

Apparently, they have no sense of humor whatsoever north of the 38th parallel.

I saw The Interview the other day on a plane, the film making fun of Supreme Leader Kim Jong-un that so pissed them off, and it totally sucked.

As a result, there is a generational upgrade in cybersecurity underway, with many potential targets boosting spending by multiples.

It’s not often that I get a stock recommendation from an army general. That is exactly what happened the other day when I was speaking to a three-star about the long-term implications of the Iran peace deal.

He argued persuasively that the world will probably never again see large-scale armies fielded by major industrial nations. Wars of the future will be fought online, as they have been silently and invisibly over the past 15 years.

All of those trillions of dollars spent on big-ticket, heavy metal weapons systems are pure pork designed by politicians to buy voters in marginal swing states.

The money would be far better spent where it is most needed, on the cyber warfare front. Needless to say, my friend shall remain anonymous.

The problem is that when wars become cheaper, you fight more of them, as is the case with online combat. Cyberwars are now happening every day, all the time, 24/7, and everywhere.

You probably don’t know this, but during the Bush administration, the Chinese military downloaded the entire contents of the Pentagon’s mainframe computers at least seven times.

This was a neat trick because these computers were in stand-alone, siloed, electromagnetically shielded facilities not connected to the Internet in any way.

In the process, they obtained the designs of all of our most advanced weapons systems, including our best nukes. What have they done with this top-secret information?

Absolutely nothing.

Like many in senior levels of the US military, the Chinese have concluded that nuclear weapons are a useless waste of valuable resources.

Far better value for money is more hackers, coders, and servers, which the Chinese have pursued with a vengeance.

You have seen this in the substantial tightening up of the Chinese Internet through the deployment of the Great Firewall, which blocks local access to most foreign websites.

Some Mad Hedge Fund Trader subscribers in the Middle Kingdom have told me they can no longer access their US-based online brokerage accounts, which are blocked by mainland “porn” filters.

“Porn” is defined as anything the Chinese government doesn’t agree with.

Try sending an email to someone in the Middle Kingdom with a Gmail address. It is almost impossible. This is why Google (GOOG) closed its offices five years ago.

As a member of the Joint Chiefs of Staff recently told me, “The greatest threat to national defense is wasting money on national defense.”

Although my brass-hatted friend didn’t mention the company by name, the implication is that I need to go out and buy Palo Alto Networks (PANW) right now.

Palo Alto Networks, Inc. is an American network security company based in Santa Clara, California, just across the water from my Bay area office.

The company’s core products are advanced firewalls designed to provide network security, visibility, and granular control of network activity based on application, user, and content identification.

Palo Alto Networks competes in the unified threat management and network security industry against Cisco (CSCO), FireEye (FEYE), Fortinet (FTNT), Check Point (CHKP), Juniper Networks (JNPR), and Cyberoam, among others.

The really interesting thing about this industry is that there are no losers.

That’s because companies are taking a layered approach to cybersecurity, parceling out contracts to many of the leading firms at once, looking to hedge their bets.

To say that top management has no idea what these products really do would be a huge understatement. Therefore, they buy all of them.

This makes a basket approach to the industry more feasible than usual.

You can do this by buying the $070 million capitalized PureFunds ISE Cyber Security ETF (HACK), which boasts Cyberark Software (CYBR), Infoblox (BLOX), and Fireye (FEYE) as its three largest positions. (HACK) has been a hedge fund favorite since the Sony attack.

For more information about (HACK), please click here.

As for my tax refund, I am still waiting.

Huge..mind blowing trade by volume.

Prosus sells 2% of Tencent for $14.7 billion in world's largest block trade

By Scott Murdoch, Toby Sterling

3 MIN READ

(Reuters) -Holland-based technology investor Prosus NV has sold 2% of Tencent Holdings Ltd 0700.HK for $14.7 billion, the Chinese gaming and social media giant said on Thursday, in the world's largest-ever block trade.

FILE PHOTO: A Tencent logo is seen at its booth at the 2020 China International Fair for Trade in Services (CIFTIS) in Beijing, China September 4, 2020. REUTERS/Tingshu Wang

Tencent, in a Hong Kong Stock Exchange filing, said Prosus sold 191.89 million shares for HK$114.1 billion ($14.67 billion), reducing its stake to 28.9%.

That works out as HK$595 per share, confirming Reuters’ earlier report in which sources said Prosus sold the stock at the top of an indicative range of HK$575 to $HK595.

The price was a 5.5% discount to Tencent’s Wednesday close of $HK629.50. The stock, which is up 10% so far this year, opened down 2.5% in Hong Kong following the news on Thursday.

Prosus, majority controlled by Naspers Ltd, did not respond to a request for comment on the pricing.

The block trade - or the usually private, single trade of a large amount of securities - surpassed the previous record set in 2018 when Naspers also sold 2% of Tencent for $9.8 billion, Refinitiv data showed.

“The proceeds of the sale will increase our financial flexibility, enabling us to invest in the significant growth potential we see across the group, as well as in our own stock,” Prosus Chief Executive Bob van Dijk said in a statement.

Prosus also invests in online food delivery platforms, classified marketplaces and digital payments businesses.

For the half-year ended Sept. 30, it reported a 29% increase in core earnings at $2.2 billion, as proceeds from its Tencent stake offset losses at other online interests.

“We expect the news to viewed cautiously until there is more clarity on how the funds will be redeployed,” analysts at Renaissance Capital said in a client note.

The sale is unlikely to lead to any short-term reduction in the gap between the market value of Prosus at 160 billion euros ($189.92 billion) and that of its Tencent stake at 200 billion euros as of Wednesday, the analysts said.

Citigroup Inc , Morgan Stanley and Goldman Sachs Group Inc were joint global coordinators for the sale.

($1 = 0.8425 euros)

($1 = 7.7849 Hong Kong dollars)

Reporting by Scott Murdoch in Hong Kong, Toby Sterling in Amsterdam and Abhinav Ramnarayan in London; Editing by Jane Merriman and Christopher Cushing

Our Standards: The Thomson Reuters Trust Principles.

Prosus sells 2% of Tencent for $14.7 billion in world's largest block trade

By Scott Murdoch, Toby Sterling

3 MIN READ

(Reuters) -Holland-based technology investor Prosus NV has sold 2% of Tencent Holdings Ltd 0700.HK for $14.7 billion, the Chinese gaming and social media giant said on Thursday, in the world's largest-ever block trade.

FILE PHOTO: A Tencent logo is seen at its booth at the 2020 China International Fair for Trade in Services (CIFTIS) in Beijing, China September 4, 2020. REUTERS/Tingshu Wang

Tencent, in a Hong Kong Stock Exchange filing, said Prosus sold 191.89 million shares for HK$114.1 billion ($14.67 billion), reducing its stake to 28.9%.

That works out as HK$595 per share, confirming Reuters’ earlier report in which sources said Prosus sold the stock at the top of an indicative range of HK$575 to $HK595.

The price was a 5.5% discount to Tencent’s Wednesday close of $HK629.50. The stock, which is up 10% so far this year, opened down 2.5% in Hong Kong following the news on Thursday.

Prosus, majority controlled by Naspers Ltd, did not respond to a request for comment on the pricing.

The block trade - or the usually private, single trade of a large amount of securities - surpassed the previous record set in 2018 when Naspers also sold 2% of Tencent for $9.8 billion, Refinitiv data showed.

“The proceeds of the sale will increase our financial flexibility, enabling us to invest in the significant growth potential we see across the group, as well as in our own stock,” Prosus Chief Executive Bob van Dijk said in a statement.

Prosus also invests in online food delivery platforms, classified marketplaces and digital payments businesses.

For the half-year ended Sept. 30, it reported a 29% increase in core earnings at $2.2 billion, as proceeds from its Tencent stake offset losses at other online interests.

“We expect the news to viewed cautiously until there is more clarity on how the funds will be redeployed,” analysts at Renaissance Capital said in a client note.

The sale is unlikely to lead to any short-term reduction in the gap between the market value of Prosus at 160 billion euros ($189.92 billion) and that of its Tencent stake at 200 billion euros as of Wednesday, the analysts said.

Citigroup Inc , Morgan Stanley and Goldman Sachs Group Inc were joint global coordinators for the sale.

($1 = 0.8425 euros)

($1 = 7.7849 Hong Kong dollars)

Reporting by Scott Murdoch in Hong Kong, Toby Sterling in Amsterdam and Abhinav Ramnarayan in London; Editing by Jane Merriman and Christopher Cushing

Our Standards: The Thomson Reuters Trust Principles.

| View in browser|nytimes.com Continue reading the main story |

April 8, 2021 |

| Good morning. (Was this newsletter forwarded to you? Sign up here.) |

|

| [h=2]Let the haggling begin[/h] |

| The Biden administration has unveiled its corporate tax overhaul, intended to raise $2.5 trillion over 15 years to pay for an infrastructure program. “Debate is welcome. Compromise is inevitable. Changes are certain,” President Biden said, but he stressed that “inaction is not an option.” |

| “America’s corporate tax system has long been broken,” the Treasury secretary Janet Yellen wrote in a Wall Street Journal op-ed coinciding with the plan’s release. In addition to raising the headline corporate tax rate, the administration’s proposal takes aim at companies that shift profits abroad, especially to low-tax havens like Bermuda or Ireland. Some of the changes could be enacted by regulation, but things like raising the corporate tax rate will need the approval of Congress. |

| What’s in the plan? Here are the main provisions: |

|

|

|

|

| What effect would it have? A Wharton School budget model concluded that the corporate tax rate increase would “not meaningfully affect the normal return on investment,” but when combined with the proposed minimum tax on book income, business investment would fall somewhat. All told, by 2050 the tax provisions would reduce government debt by more than 11 percent from the current baseline, but also reduce G.D.P. by 0.5 percent over that period. |

| Business groups aren’t happy about it. The Chamber of Commerce said the plan would “hurt American businesses and cost American jobs.” The Business Roundtable said it “threatens to subject the U.S. to a major competitive disadvantage.” Republican lawmakers have also argued that it’s bad for business, but the White House was quick to note that the former Trump economic adviser Gary Cohn, a key player in the 2017 tax cut, said last June that “I’m actually OK at 28 percent.” |

|

| For more on this, see our sister newsletter, The Morning: “Corporate Taxes Are Wealth Taxes” |

| [h=3]HERE’S WHAT’S HAPPENING[/h] |

| The counting of votes in the Amazon union drive begins soon. The union seeking to represent workers at a warehouse in Alabama said that 3,215 ballots were cast, representing 55 percent of eligible workers. The hand count of the ballots will begin either later today or tomorrow. |

| Britain curbs the use of AstraZeneca’s vaccine for people under 30. The decision came as regulators increasingly suspect a link between the shot and rare blood clots. While Britain has enough vaccines from other makers to avoid a slowdown in its inoculation efforts, the concerns may dent vaccination efforts in developing countries. |

| Senator Mitch McConnell walks back his comments on companies and politics, sort of. The minority leader conceded that his criticism of companies for speaking out against voting restrictions was not spoken “artfully.”(Democrats noted that Republicans have benefited from corporate donations.) “They are certainly entitled to be involved in politics,” Mr. McConnell said. |

| Tencent’s biggest shareholder sells a slice of its holdings for $14.7 billion.Prosus, the Europe-based tech investor, sold 2 percent of its stake in the Chinese tech giant in the biggest-ever block trade (breaking its own record). Prosus still owns a 29 percent stake in the company. |

| The N.R.A.’s chief concedes that he hid the group’s Chapter 11 plans.Wayne LaPierre said at a bankruptcy court hearing that he hadn’t told top executives or his board of the arrangement. He is accused of having the gun-rights group file for Chapter 11 to stymie an investigation by New York State’s attorney general. |

| [h=2]Acres of empty desks[/h] |

| Many parts of the economy have held up during the pandemic — but corporate real estate isn’t one of them. Landlords and cities are worried that remote working will irreversibly sap demand for office space, The Times’s Peter Eavis and Matthew Haag report. |

| The numbers are grim for landlords. The national office vacancy rate in city centers has hit 16.4 percent, according to Cushman & Wakefield, a decade-long high. In Manhattan alone, over 17 percent of all office space is available, the most in over 30 years. And rents on existing space could also face pressure from new buildings coming online, representing 124 million square feet. |

| Some are staying hopeful. Landlords like Boston Properties and SL Green haven’t suffered big financial losses from the pandemic, thanks to many tenants being locked into long leases. They’re also betting many companies want their workers to meet in person to better collaborate and train younger employees. |

| The final damage won’t be known for some time. Companies are still trying to figure out their real estate needs, based on their work policies: While Amazon expects a return to an “office-centric culture,” JPMorgan Chase’s Jamie Dimon said that the bank may need only 60 seats for every 100 employees after the pandemic. |

|

| [h=2]“Even though I’m sort of a pro-crypto, pro-Bitcoin maximalist person, I do wonder whether at this point Bitcoin should also be thought in part of as a Chinese financial weapon against the U.S.”[/h] |

| — Peter Thiel, the tech investor, on how cryptocurrency threatens the U.S. dollar. “China wants to do things to weaken it, so China’s long Bitcoin,” he added. |

| [h=2]Doing vaccine passports right[/h] |

| New York recently became the first U.S. state to offer Covid-19 “vaccine passports,” while the governors of Florida and Texas banned them. Airlines, universities, event venues and other businesses are also testing various methods of vaccine verification. The starkly different approaches reflect a wider national and global debate on proof of health in the pandemic era. |

| “There are a lot of ways it could be done badly,” Jay Stanley of the American Civil Liberties Union told DealBook, but he suggested a “narrow path” to a certification system that could work. The ideal system would be paper-based with a digital supplement, Mr. Stanley argues, so that people who lack access to technology aren’t disadvantaged. Encrypted data would be stored on a decentralized network, protected with a public key for vaccine providers and private keys for users to ensure privacy. Fairness also demands a standardized approach, rather than the current variety of systems, which could result in “a mess for civil liberties, equity and privacy,” he said. |

| The Biden administration has said it won’t mandate vaccine passports, a point it reiterated this week, but it is working on standards the private sector can adopt. New York partnered with IBM on the state’s opt-in Excelsior Pass, which allows access to restricted activities and venues. |

| The certificates can raise a slew of social and legal issues, depending on who is asking for proof of vaccination and why, according to Stanford law professor David Studdert. Government mandates trigger more concerns than opt-in programs, he noted, and companies will have different considerations if they seek certification from customers or workers. Given all the variations, he said, “within reason” the market should decide what works, and officials should avoid both mandates and bans: “Different communities and employers have a different tolerance for risk.” |

| More on vaccine passports: |

|

| Thank you for your support. Want to share The New York Times? Friends and family can enjoy unlimited digital access to our journalism with this special offer. |

| [h=3]THE SPEED READ[/h] |

| Deals |

|

| Politics and policy |

|

| Tech |

|

| Best of the rest |

|

| � |

| ||||||

| Global Market Comments April 8, 2021 Fiat Lux Featured Trade: (A NOTE ON ASSIGNED OPTIONS, OR OPTIONS CALLED AWAY), (BAC)

| ||||||

| � | ||||||

A Note on Assigned Options, or Options Called Away I know all of this may sound confusing at first. But once you get the hang of it, this is the greatest way to make money since sliced bread.I still have a record five positions left in my model trading portfolio, they are all deep in-the-money, and about to expire in six trading days. That opens up a set of risks unique to these positions. I call it the “Screw up risk.” As long as the markets maintain current levels, ALL of these positions will expire at their maximum profit values. They include:

With the April 16 options expirations upon us, there is a heightened probability that your short position in the options gets called away. If it happens, there is only one thing to do: fall down on your knees and thank your lucky stars. You have just made the maximum possible profit for your position instantly. Most of you have short option positions, although you may not realize it. For when you buy an in-the-money vertical option spread, it contains two elements: a long option and a short option. The short options can get “assigned,” or “called away” at any time, as it is owned by a third party, the one you initially sold the put option to when you initiated the position. You have to be careful here because the inexperienced can blow their newfound windfall if they take the wrong action, so here’s how to handle it correctly. Let’s say you get an email from your broker telling you that your call options have been assigned away. I’ll use the example of the Tesla (TSLA) call spread. For what the broker had done in effect is allow you to get out of your call spread position at the maximum profit point the day before the April 16 expiration date. In other words, what you bought for $44.00 on March 19 is now worth $50.00, giving you a near-instant profit of 13.63%! In the case of the Tesla (TSLA) April $450-%500 in-the-money vertical Bull Call spread all have to do is call your broker and instruct them to “exercise your long position in your (Tesla) April 16 $450 calls to close out your short position in the (Tesla) April 16 $500 calls.” This is a perfectly hedged position, with both options having the same name and the same expiration date, so there is no risk. The name, number of shares, and number of contracts are all identical, so you have no exposure at all. Calls are a right to buy shares at a fixed price before a fixed date, and one options contract is exercisable into 100 shares. To say it another way, you bought Tesla at $450 and sold it at $500, paid $44.00 for the right to do so, so your profit is $6.00, or ($6.00 X 100 shares X 2 contracts) = $1,200. Not bad for a 20-day limited risk play. Sounds like a good trade to me. Short positions usually only get called away for dividend-paying stocks or interest-paying ETFs like the (TLT). There are strategies out here that try to capture dividends the day before they are payable. Exercising an option is one way to do that. Weird stuff like this happens in the run-up to options expirations like we have coming. A call owner may need to buy a long (TSLA) position after the close, and exercising his long (TSLA) $500 call is the only way to execute it. Adequate shares may not be available in the market, or maybe a limit order didn’t get done by the market close. There are thousands of algorithms out there which may arrive at some twisted logic that the puts need to be exercised. Many require a rebalancing of hedges at the close every day which can be achieved through option exercises. And yes, options even get exercised by accident. There are still a few humans left in this market to blow it by writing shoddy algorithms. And here’s another possible outcome in this process. Your broker will call you to notify you of an option called away, and then give you the wrong advice on what to do about it. This generates tons of commissions for the broker but is a terrible thing for the trader to do from a risk point of view, such as generating a loss by the time everything is closed and netted out. There may not even be an evil motive behind the bad advice. Brokers are not investing a lot in training staff these days. In fact, I think I’m the last one they really did train. Avarice could have been an explanation here but I think stupidity and poor training and low wages are much more likely. Brokers have so many ways to steal money legally that they don’t need to resort to the illegal kind. This exercise process is now fully automated at most brokers but it never hurts to follow up with a phone call if you get an exercise notice. Mistakes do happen. Some may also send you a link to a video of what to do about all this. If any of you are the slightest bit worried or confused by all of this, come out of your position RIGHT NOW at a small profit! You should never be worried or confused about any position tying up YOUR money. Professionals do these things all day long and exercises become second nature, just another cost of doing business. If you do this long enough, eventually you get hit. I bet you don’t.

| ||||||

Quote of the Day“Stock prices have reached what looks like a permanently high plateau,” said economist Irving Fisher….just before the 1929 stock market crash.

| ||||||

| Good morning. (Was this newsletter forwarded to you? Sign up here.) |

|

| [h=2]A new clothing unicorn takes shape[/h] |

| Pandemic lockdowns that consigned form-fitting clothing to the back of many closets would seem disastrous to Skims, the start-up that made its name with shapewear. But the brand has helped make Kim Kardashian West, its co-founder, a billionaire, DealBook’s Michael de la Merced reports. |

| Skims has raised $154 million at a $1.6 billion valuation, Michael is the first to report. The round was led by Thrive Capital, the venture firm that has backed the likes of Warby Parker and Glossier, and it included the existing investor Imaginary Ventures. |

| The deal cements Ms. Kardashian West’s status as a billionaire, after Forbes anointed her as such this week, based on a far lower valuation for Skims. She will remain the single biggest shareholder after the fundraising round, and with her business partner, Jens Grede, will control a majority stake. |

| But how will shapewear fare after the pandemic? Skims is betting on renewed interest in going-out clothing, with Mr. Grede expecting a “rebalancing” of sales across the company’s categories (read: an uptick in body-hugging fashions). A well-timed introduction of loungewear helped Skims offset the 30 percent drop in shapewear across the industry last year, according to NPD. |

|

| Ms. Kardashian West isn’t ruling out a sale down the road, so long as she still has a big role in operations. “I think I’m open to the conversation, for sure,” she said. But “I would never want to give up my process. I would hope that whoever we partner with in a sale one day would believe in that, too.” |

| [h=3]HERE’S WHAT’S HAPPENING[/h] |

| The union push at Amazon appears to be faltering. With about half of the ballots counted in a unionization vote at an Alabama warehouse, the “no” votes had a more than 2-to-1 advantage, putting Amazon on the cusp of defeating the most serious organized-labor threat in the company’s history. Counting resumes today. |

| More banks announce policies and perks to help junior workers. As the industry grapples with burnout in the ranks, Bank of America said it would raise pay and Barclays said junior bankers shouldn’t work on Saturdays and should take all their vacation time. |

| A chip shortage leads General Motors to slow production. It will reduce output or pause operations at several North American factories, and extend factory closures it announced previously until May 10. The industry is grappling with a lack of key components of modern vehicles. |

| Sony signs a five-year deal with Netflix. It gives the streaming giant exclusive U.S. rights to Sony’s films, but only once they leave theaters. WarnerMedia’s chief also said it would go back to releasing films in theaters first next year, instead of making them available simultaneously to stream. |

| Chewy’s co-founder is set to become GameStop’s chairman. Ryan Cohen’s investment in GameStop last year was one of the factors driving its torrid run as the “meme stock” of choice. Mr. Cohen and several others with connections to the online pet retailer are expected to be elected to GameStop’s board in June, pledging to turn GameStop retailer into the “Chewy of gaming.” |

| [h=2]The S.E.C. says ‘it may be time to revisit’ the rules on SPACs[/h] |

| John Coates, the acting director of the corporate finance division at the S.E.C., issued a lengthy statement yesterday about how securities laws apply to blank-check firms. In particular, he is interested in a crucial (and controversial) difference between SPACs and traditional I.P.O.s: blank-check firms are allowed to publish often-rosy financial forecasts when merging with an acquisition target, while companies going public in an I.P.O. are not. |

| “With the unprecedented surge has come unprecedented scrutiny,” Mr. Coates wrote of the recent boom in blank-check deals. Investors raise money for SPACs via an I.P.O., and those funds are used to merge with an unspecified company in the future, thereby taking it public. Because the so-called “de-SPAC” deal is technically a merger, it’s given the same “safe harbor” legal protections for its financial forecasts as a typical M.&A. deal. With traditional I.P.O.s, companies can’t issue such projections to prospective investors, because regulators consider it too risky for firms as yet untested by the public markets. |

| The S.E.C. thinks financial forecasts for SPACs might be a problem. They can be “untested, speculative, misleading or even fraudulent,” Mr. Coates wrote. At the end of his statement, he suggested a major rethink of how the “full panoply” of securities laws apply to SPACs, which could upend the blank-check business model: |

| If we do not treat the de-SPAC transaction as the “real I.P.O.,” our attention may be focused on the wrong place, and potentially problematic forward-looking information may be disseminated without appropriate safeguards. |

| The letter serves as a warning. Unless the S.E.C. issues new rules (as it did for penny stocks) or Congress passes legislation, SPAC projections will continue. But this strongly worded statement could moderate or even mute them. “The S.E.C has now put them on notice,” Lynn Turner, a former chief accountant of the agency, said. |

| [h=2]A new twist in Leon Black’s departure from Apollo[/h] |

| Leon Black’s announcement that he was stepping down from Apollo sooner than expected came just days after directors learned of sexual harassment allegations against him, The New York Post reports. Mr. Black denied the claims, which the woman, Guzel Ganieva, tweeted about in mid-March. |

| Mr. Black told The Post the two had a consensual affair, which was not the cause of his departure. “I foolishly had a consensual affair with Ms. Ganieva that ended more than seven years ago,” he said. “Any allegation of harassment or any other inappropriate behavior towards her is completely fabricated.” He said he believes he is being extorted, having made payments to her to keep the relationship a secret. |

| Apollo has shaken up its board after the fallout from Mr. Black’s ties to Jeffrey Epstein. After investigating Mr. Black’s financial relationship with Mr. Epstein, Apollo said Mr. Black would step back from the company and announced a number of corporate governance changes. |

| [h=2]In the papers[/h] |

| Some of the academic research that caught our eye this week, summarized in one sentence: |

|

| [h=2]Approaching the endgame in a big battery battle[/h] |

| Sunday is the official deadline for Katherine Tai, the U.S. trade representative, to decide whether to reverse an International Trade Commission ruling in a trade secrets dispute between two South Korean electric vehicle battery manufacturers. Both companies — LG Chem and SK Innovation — are building plants in the U.S., and the ruling threatens SK with a ban on supplying batteries in the country, putting its facility under construction in Georgia at risk. |

| Senator Jon Ossoff of Georgia has been working “intensely” on getting the companies to negotiate a settlement, his spokesperson told DealBook, suggesting that the complex saga could continue past the weekend. Mr. Ossoff has been stressing the urgency of saving SK’s plant — in terms of creating jobs and bolstering the domestic battery supply — and returned to Washington while the Senate was out of session for meetings, his spokesperson said. |

| The U.S.T.R. doesn’t necessarily have to announce a decision; a representative declined to comment on Ms. Tai’s plans. But people will want some guidance on the government’s thinking, given the high profile of the case. Last week, in a separate I.T.C. case between LG and SK over battery patents, a judge ruled against LG. SK says this recent win supports its call for a veto in the other case. |

|

| [h=2]Weekend reading: What’s mine is yours?[/h] |

| Anyone in business thinks a lot about ownership — who gets what, why and whether it’s worth what’s being paid. But few realize how deeply these concepts dictate the way we navigate time, space, nature and relationships, say the law professors Michael Heller and James Salzman. Not even they fully understood the extent of our possession obsession until they wrote their new book, “Mine! How the Hidden Rules of Ownership Control Our Lives.” |

| In the beginning, there was property. The biblical account of Adam and Eve in the Garden of Eden, seen through the professors’ prism, is about real estate. A landowner with a tree asked humans to avoid its fruits and exercised his right to exclude them when they disobeyed. It was all God’s property — the land, the tree, the fruit. Possession and exclusion have traditionally been the primary privileges of ownership. |

| “In the 21st century, property has become dematerialized,” Mr. Heller told DealBook. The digital realm employs traditional concepts of property but offers less to possess. For example, Amazon can technically delete e-books from Kindle readers, but no physical bookseller would dream of reserving the right to enter your house, take a book from the shelf and keep the money you paid for it. The NFT craze takes the abstraction even further, he said, creating a new kind of property with no typical right of possession or exclusion, just “a stream of ones and zeros” on a blockchain. |

| “The world looks different if you start focusing on ownership,” Mr. Salzman explained. He now notices a constant flow of negotiations and conflicts, spoken and silent, all around him. Why, he wonders, does having a thing first or holding it in a given moment validate claims to title in some contexts but not others, while the concept of ownership itself seems universal? “Once you’ve seen it, you can’t unsee it,” Mr. Heller said. |

| Thank you for your support. Want to share The New York Times? Friends and family can enjoy unlimited digital access to our journalism with this special offer. |

| [h=3]THE SPEED READ[/h] |

| Deals |

| Politics and policy |

| Tech |

| Best of the rest |

| � |

Esports GMBL 15.39 .. Two reports...Noble and Singular

I had a third, Citron Research but they may have taken it down... it mentioned Esports as a potential Gamestop buyout target.

Gamestop needs to capitalize on the stock price and start an online gaming portal.

GMBL reports

On the drive

https://drive.google.com/drive/folders/1yZSUZgs3Ygy4x8i73JjzbDRciRpMh5TJ

Pretty attractive company

I had a third, Citron Research but they may have taken it down... it mentioned Esports as a potential Gamestop buyout target.

Gamestop needs to capitalize on the stock price and start an online gaming portal.

GMBL reports

On the drive

https://drive.google.com/drive/folders/1yZSUZgs3Ygy4x8i73JjzbDRciRpMh5TJ

Pretty attractive company

|

I just listened to the call. Certainly worth a shot.

I have to open another account to trade OTC stocks. All my trades are inside my RRSP, which doesn't allow this.

funds will need to settle in mine before I buy

|

|

SRLF

SRLF