You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Intersting thoughts

- Thread starter Bozzie

- Start date

Just a bit.

Last week bought and sold SAVE $14_$23. It fell below $22 then back to $25, and ATM $22.77. So I feel like i got in and out well enough.

Continue to add to TMFC.

Bought some KARS today (electric car fund basically).

Those 2 are long term holds with holdings related to AI and such.

I'm not smart enough to pick a ton of specific stocks, so I select certain sectors.

I'm always open to suggestions if you have any.

Last week bought and sold SAVE $14_$23. It fell below $22 then back to $25, and ATM $22.77. So I feel like i got in and out well enough.

Continue to add to TMFC.

Bought some KARS today (electric car fund basically).

Those 2 are long term holds with holdings related to AI and such.

I'm not smart enough to pick a ton of specific stocks, so I select certain sectors.

I'm always open to suggestions if you have any.

I don't right now.. I took a good amount out of my trading account...if we see a decent dip I'll up a few positions or I've been thinking about a small long short.

I have a plan but till then I'm holding and sitting.

Good luck with your plays

I have a plan but till then I'm holding and sitting.

Good luck with your plays

|

Global Market Comments June 9, 2020 Fiat Lux Featured Trade: (HOW TO EXECUTE A VERTICAL BULL CALL SPREAD) (AAPL) (THE NEW CODER BOOM)

|

| � |

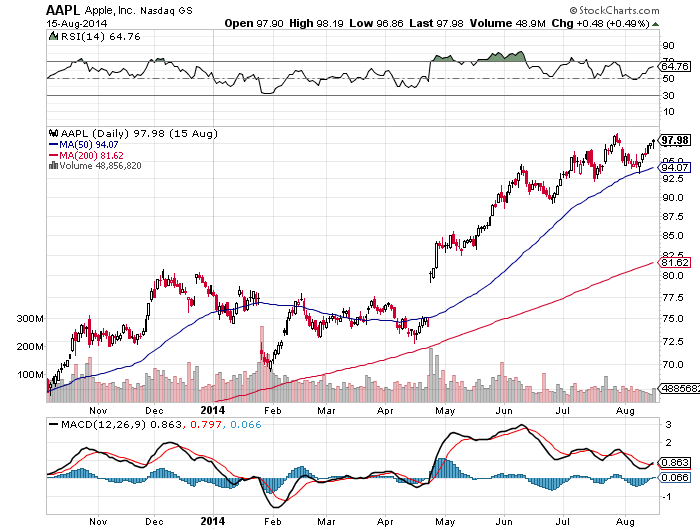

How to Execute a Vertical Bull Call Spread Since we have a lot of new subscribers, I am going to go over this one more time. For those readers looking to improve their trading results and create the unfair advantage they deserve, I have posted a training video on How to Execute a Vertical Bull Call Spread. This is a matched pair of positions in the options market that will be profitable when the underlying security goes up, sideways, or down a small amount in price over a defined limited period of time. It is the perfect position to have onboard during markets that have declining or low volatility, much like we experienced in 2014, and will almost certainly see again.I have strapped on quite a few of these across many asset classes this year, and they are a major reason why I am showing positive performance numbers for 2016. To understand this trade, I will use the example of an Apple trade, which I executed on July 10, 2014. I then felt very strongly that Apple shares would rally into the release of its new iPhone 6 on September 9, 2014. The same play has just started to kick in for the iPhone 7 released September of that year. So followers of my Trade Alert service received text messages and emails to add the following position: Buy the Apple (AAPL) August 2014 $85-$90 in-the-money bull call spread at $4.00 or best To accomplish this, they had to execute the following trades: Buy 25 August 2014 (AAPL) $85 calls at...............$9.60 Sell short 25 August 2014 (AAPL) $90 calls at......$5.60 Net Cost:...................................................................$4.00 This gets traders into the position at $4.00, which cost them $10,000 ($4.00 per option X 100 shares per option contract X 25 contracts). The vertical part of the description of this trade refers to the fact that both options have the same underlying security (AAPL), the same expiration date (August 15, 2014) and only different strike prices ($85 and $90). The breakeven point can be calculated as follows: $85.00 - Lower strike price +$4.00 - Price paid for the vertical call spread $89.00 - Break even Apple share price Another way of explaining this is that the call spread you bought for $4.00 is worth $5.00 at expiration on August 15, giving you a total return of 25% in 26 trading days. Not bad! The great thing about these positions is that your risk is defined. You can't lose any more than the amount of capital you put up, in this case, $10,000. If Apple goes bankrupt, we get a flash crash or suffer another 9/11 type event, you will never get a margin call from your broker in the middle of the night asking for more money. This is why hedge funds like spreads so much. As long as Apple traded at or above $89 on the August 14 expiration date, you would have made a profit on this trade. As it turns out, my read on Apple shares proved dead-on, and the shares closed at $97.98 on expiration day or a healthy $8.98 above my breakeven point. The total profit on the trade came to: ($1.00 profit X 100 shares X 25 contracts) = $2,500 This means that the position earned a 25% profit on your $10,000 investment in a little more than a month. Now you know why I like Vertical Bull Call Spreads so much. So do my followers. Occasionally, these things don't work and wheels fall off. As hard as it may be to believe, I am not infallible. So, if I'm wrong and I tell you to buy a vertical bull call spread, and the shares fall not a little, but a lot, you will lose money. On those rare occasions when that happens, I'll shoot out a Trade Alert to you with stop-loss instructions before the damage gets out of control. That stop loss is usually at the lower strike price when there is still a lot of time to run to expiration, as the position still has a lot of time value remaining, and the upper strike price when there are only a few days left until expiration. To watch the video edition of How to Execute a Vertical Bull Call Spread, complete with more detailed instructions on how to execute the position with your own online platform, please click here.

|

The Coder Boom There is a new boom going on in Northern California. It is not another gold rush, even though this winter’s heavy rains have flushed out a new supply of the yellow metal in High Sierra rivers and streams.And I am not referring to the marijuana boom triggered by the recent legalization of the evil weed in the November election. No, I am talking about the coder boom, the stampede by young job seekers to cash in on the overwhelming demand for computer programmers. I’m hearing about this everywhere. Kids are quitting their jobs driving trucks, running farms, or working as baristas at Starbucks. They blow their entire life savings on a three-month crash course at a coding school. The schools then promise them dream jobs on graduation. Schools like this are popping up like mushrooms on the green California hills in winter, charging up to $20,000 per course. Don’t think you’ll just walk into these places either. All of these schools have waiting lists and only the most qualified and ambitious get in. They’re almost as hard to get into as my….tennis club. It’s worth it because it sets you up to move into a six-figure job almost immediately. At least, it’s supposed to. There is no doubt that there is an absolutely mammoth demand for computer programmers right now. There is NO part of the US economy that isn’t attempting to grow its online presence as rapidly as possible. Salaries are through the roof as can be seen by the interactive map of current programming jobs around the country published by Cyber Coders, please click here. Headhunter Robert Half (click here) wants to charge you 30% of a first year’s salary for their service in finding developers. Ouch!! Click here for a map from the Bureau of Labor Statistics on where all the developer jobs are going at. The problem is that as soon as a coder gets good, they go freelance, charging up to $200 an hour. Who can blame them? Raking the money in while working anywhere, anytime sounds like a great gig to me. Hiring a developer can be the most challenging task for a small rapidly growing business. Stories are rife of dummy developers wiping out business overnight because of incompetent coding. And heaven help you if you thought you could save money and outsource this job to India. Marquee names like Google and Apple soak up the few out there with actual college degrees in computer science, leaving the rest of use to hire hobbyists who went full time. Sounds familiar. Coder Camp (www.codercamp.com) invites you to “Reprogram your Career” with a series of immersive camps on Java, JavaScript, and Ruby on Rails for $14,200 each. Udemy (www.udemy.com) offers dozens of courses ranging from $49 on up for online tutorials on every programming topic under the sun. They boast 20,000 online instructors and 10 million hungry students in 190 countries. Learning Tree International (https://www.learningtree.com), the veteran in the space has a four-course training passport for $6,790. Dev Bootcamp (http://devbootcamp.com/) pioneered the short-term immersive “web development boot camp,” a model that transforms beginners into full-stack web developers. Their 19-week $13,900 program offers three-year low-interest financing. Hack Reactor (http://www.hackreactor.com) is the high-end Cadillac operation and promises a 99% job placement rate with a $105,000 initial salary. I hear that production-grade iPhone apps are the hot skill to learn. And if you are able to learn anything about cybersecurity you can write your own ticket. As is so often the case with these Internet schemes, the hype may exceed actual results (mine excluded). Developer friends tell me that it takes a year of full-time study before you can land an actual regular job. It really takes as much time to learn coding as it does to speak a new foreign language fluently. Many new coders start with limited part-time assignments and work their way up from there as their skills build. If you are good at math, you have a definite advantage as much of good coding involves problem-solving of a mathematical nature. Still, you can’t argue with people abandoning old economy jobs and training for new economy ones, whatever the cost. I’m told there has been a recent influx of new students freshly laid off in the oil patch. If you still have a Millennial living in the basement awaiting their calling, this is a big chance to turf them out. All you need is a cheap computer, broadband, and motivation. Oh, and by the way, the Mad Hedge Fund Trader is looking to hire a developer with a specialty in API and Infusionsoft, click here for their link. Thanks to last year’s blowout double-digit performance numbers, my firm has entered hyper-growth mode, and everyone is working pedal to the metal. Please send your resume to support@madhedgefundtrader.com and specify “DEVELOPER” in the subject line.

So What is This "DEL" Key For Anyway? |

Quote of the Day “I have lived through many unique events over the past five decades on Wall Street, but this market seems to defy all logic based on historical experience and data,” said Michael Schwartz chief options strategist at Oppenheimer & Co.

|

| This is not a solicitation to buy or sell securities The Mad Hedge Fund Trader is not an Investment advisor For full disclosures click here at: http://www.madhedgefundtrader.com/disclosures The "Diary of a Mad Hedge Fund Trader"(TM) and the "Mad Hedge Fund Trader" (TM) are protected by the United States Patent and Trademark Office The "Diary of the Mad Hedge Fund Trader" (C) is protected by the United States Copyright Office Futures trading involves a high degree of risk and may not be suitable for everyone.[FONT="][/FONT] |

Keynesian Economics

www.investopedia.com/terms/k/keynesianeconomics.asp

I was remembering this from college Econ.I had a prof who was way into Keynesian Theory.

Amazing the way this theory is being implemented today still.

That was an extremely good read, Thank you

Pretty amazing...Dow down this AM.

Who shows up on CNBC at the opening?

Steve Mnuchin...talking about another trillion being infused.

If it isn't vaccine a hope, cooked unemployment numbers, the promise of more stimulus and now SM soothing investors this AM...

At some point the rhetoric and reality will collide.

Who shows up on CNBC at the opening?

Steve Mnuchin...talking about another trillion being infused.

If it isn't vaccine a hope, cooked unemployment numbers, the promise of more stimulus and now SM soothing investors this AM...

At some point the rhetoric and reality will collide.

Global Market Comments

June 10, 2020

Fiat LuxFeatured Trade:(THE MAD HEDGE JUNE 4 TRADERS & INVESTORS SUMMIT RECORDING IS UP),

(HOW TO HANDLE THE FRIDAY, JUNE 19 OPTIONS EXPIRATION),

(TLT), (TBT)

June 10, 2020

Fiat LuxFeatured Trade:(THE MAD HEDGE JUNE 4 TRADERS & INVESTORS SUMMIT RECORDING IS UP),

(HOW TO HANDLE THE FRIDAY, JUNE 19 OPTIONS EXPIRATION),

(TLT), (TBT)

The Mad Hedge June 4 Traders & Investors Summit Recording is Up

For those who missed the June 4 Mad Hedge Traders & Investors Summit, I have posted all 9:15 hours of recordings of every speaker. To find it, please click here.

This is a collection of some of the best traders and investors I have stumbled across over the past five decades. They include:

8:45 Meet John Thomas, the Mad Hedge Fund Trader- Summit Welcome and Opening Comments

9:00 Andrew Pancholi - Market Timing Report

“Learn How Markets Repeat with Absolute Precision”

10:00 - Fausto Pugliese – Cyber Trading University

“The Most important Tape Reading Tactics Every Trader Should Know”

11:00 - Adam Mesh - Adam Mesh Trading

“Options Made Easy”

12:00 - Hubert Senters - Trade Thirsty

"Investors Miss 95% of Tech Stock Gains -- Here's How You Can Get Them"

1:00 - Charles Hughes – Hughes’ Optioneering -

“Simple, Shockingly Successful PowerTrend® Spread Strategy to be Revealed”

2:00 - Steve Reitmeister - Stock News

“2020 Stock Market Outlook”

3:00 - Hillary Kramer – Eagle Financial Publications

“Accelerated Profit Path: How to Make Money in A Whipsaw Market”

4:00 - Doc Severson – READY SET TRADE

“REVISED 2020 Stock Market Outlook”

5:00 Tom Sosnoff- Tastyworks

“Tastyworks Platform Demo”

I’m sure you will find these speakers educational, if not entertaining.

John Thomas

CEO & Publisher

Mad Hedge Traders & Investors Summit

[h=2]Hooking People Up[/h]

[h=2]Hooking People Up[/h]

For those who missed the June 4 Mad Hedge Traders & Investors Summit, I have posted all 9:15 hours of recordings of every speaker. To find it, please click here.

This is a collection of some of the best traders and investors I have stumbled across over the past five decades. They include:

8:45 Meet John Thomas, the Mad Hedge Fund Trader- Summit Welcome and Opening Comments

9:00 Andrew Pancholi - Market Timing Report

“Learn How Markets Repeat with Absolute Precision”

10:00 - Fausto Pugliese – Cyber Trading University

“The Most important Tape Reading Tactics Every Trader Should Know”

11:00 - Adam Mesh - Adam Mesh Trading

“Options Made Easy”

12:00 - Hubert Senters - Trade Thirsty

"Investors Miss 95% of Tech Stock Gains -- Here's How You Can Get Them"

1:00 - Charles Hughes – Hughes’ Optioneering -

“Simple, Shockingly Successful PowerTrend® Spread Strategy to be Revealed”

2:00 - Steve Reitmeister - Stock News

“2020 Stock Market Outlook”

3:00 - Hillary Kramer – Eagle Financial Publications

“Accelerated Profit Path: How to Make Money in A Whipsaw Market”

4:00 - Doc Severson – READY SET TRADE

“REVISED 2020 Stock Market Outlook”

5:00 Tom Sosnoff- Tastyworks

“Tastyworks Platform Demo”

I’m sure you will find these speakers educational, if not entertaining.

John Thomas

CEO & Publisher

Mad Hedge Traders & Investors Summit

How to Handle the Friday June 19 Options Expiration

Followers of the Mad Hedge Fund Trader alert service have the good fortune to own a deep in-the-money options positions that expire on Friday, June 19, and I just want to explain to the newbies how to best maximize their profits.

This involves the:

the iShares Barclays 20+ Year Treasury Bond Fund (TLT) June 2020 $175-$180 in-the-money vertical Bear Put spread

the S&P 500 (SPY) June 2020 $235-$245 in-the-money vertical BULL CALL spread

Provided that we don’t have another 3,000-point move down in the market by next week, these positions should expire at their maximum profit points.

So far, so good.

I’ll do the math for you on our oldest iShares Barclays 20+ Year Treasury Bond Fund (TLT) position. Your profit can be calculated as follows:

Profit: $5.00 expiration value - $4.10 cost = $0.90 net profit

(24 contracts X 100 contracts per option X $0.90 profit per options)

= $2,160 or 21.95% in 34 trading days.

Many of you have already emailed me asking what to do with these winning positions.

The answer is very simple. You take your left hand, grab your right wrist, pull it behind your neck, and pat yourself on the back for a job well done.

You don’t have to do anything.

Your broker (are they still called that?) will automatically use your long position to cover your short position, canceling out the total holdings.

The entire profit will be credited to your account on Monday morning June 22 and the margin freed up.

Some firms charge you a modest $10 or $15 fee for performing this service.

If you don’t see the cash show up in your account on Monday, get on the blower immediately and find it.

Although the expiration process is now supposed to be fully automated, occasionally machines do make mistakes. Better to sort out any confusion before losses ensue.

If you want to wimp out and close the position before the expiration, it may be expensive to do so. You can probably unload them pennies below their maximum expiration value.

Keep in mind that the liquidity in the options market understandably disappears, and the spreads substantially widen, when a security has only hours, or minutes until expiration on Friday. So, if you plan to exit, do so well before the final expiration at the Friday market close.

This is known in the trade as the “expiration risk.”

One way or the other, I’m sure you’ll do OK, as long as I am looking over your shoulder, as I will be, always. Think of me as your trading guardian angel.

I am going to hang back and wait for good entry points before jumping back in. It’s all about keeping that “Buy low, sell high” thing going.

I’m looking to cherry-pick my new positions going into the next quarter-end.

Take your winnings and go out and buy yourself a well-earned dinner. Just make sure it’s take-out. I want you to stick around.

Well done, and on to the next trade.

You Can’t Do Enough Research

Followers of the Mad Hedge Fund Trader alert service have the good fortune to own a deep in-the-money options positions that expire on Friday, June 19, and I just want to explain to the newbies how to best maximize their profits.

This involves the:

the iShares Barclays 20+ Year Treasury Bond Fund (TLT) June 2020 $175-$180 in-the-money vertical Bear Put spread

the S&P 500 (SPY) June 2020 $235-$245 in-the-money vertical BULL CALL spread

Provided that we don’t have another 3,000-point move down in the market by next week, these positions should expire at their maximum profit points.

So far, so good.

I’ll do the math for you on our oldest iShares Barclays 20+ Year Treasury Bond Fund (TLT) position. Your profit can be calculated as follows:

Profit: $5.00 expiration value - $4.10 cost = $0.90 net profit

(24 contracts X 100 contracts per option X $0.90 profit per options)

= $2,160 or 21.95% in 34 trading days.

Many of you have already emailed me asking what to do with these winning positions.

The answer is very simple. You take your left hand, grab your right wrist, pull it behind your neck, and pat yourself on the back for a job well done.

You don’t have to do anything.

Your broker (are they still called that?) will automatically use your long position to cover your short position, canceling out the total holdings.

The entire profit will be credited to your account on Monday morning June 22 and the margin freed up.

Some firms charge you a modest $10 or $15 fee for performing this service.

If you don’t see the cash show up in your account on Monday, get on the blower immediately and find it.

Although the expiration process is now supposed to be fully automated, occasionally machines do make mistakes. Better to sort out any confusion before losses ensue.

If you want to wimp out and close the position before the expiration, it may be expensive to do so. You can probably unload them pennies below their maximum expiration value.

Keep in mind that the liquidity in the options market understandably disappears, and the spreads substantially widen, when a security has only hours, or minutes until expiration on Friday. So, if you plan to exit, do so well before the final expiration at the Friday market close.

This is known in the trade as the “expiration risk.”

One way or the other, I’m sure you’ll do OK, as long as I am looking over your shoulder, as I will be, always. Think of me as your trading guardian angel.

I am going to hang back and wait for good entry points before jumping back in. It’s all about keeping that “Buy low, sell high” thing going.

I’m looking to cherry-pick my new positions going into the next quarter-end.

Take your winnings and go out and buy yourself a well-earned dinner. Just make sure it’s take-out. I want you to stick around.

Well done, and on to the next trade.

You Can’t Do Enough Research

Quote of the Day

“Of course, you never go broke taking a profit, but you never get rich either, because a good portion of what you make goes to taxes,” said legendary value investor Ron Baron.

Nobody should be surprised today at the big selloff in the markets.

I mean really-the Nasdaq at all time highs and Dow within striking distance, so many unemployed, multiple bankruptcies, the Virus

still doing its thing, the protests, riots and in general the horrible state of the country.

Imo using the Dow as a standard and taking into account the overall prospects for the next 6-12 months,

imo the Dow deserves to be in around the 23,000 range and certainly not the 27,000 plus a day or two ago and

within a few thousand points of its all time high.

That is simply not reality!!

I mean really-the Nasdaq at all time highs and Dow within striking distance, so many unemployed, multiple bankruptcies, the Virus

still doing its thing, the protests, riots and in general the horrible state of the country.

Imo using the Dow as a standard and taking into account the overall prospects for the next 6-12 months,

imo the Dow deserves to be in around the 23,000 range and certainly not the 27,000 plus a day or two ago and

within a few thousand points of its all time high.

That is simply not reality!!

Normal profit taking..with the run why not take some $$$ off the table.

Eventually things will either go flat or down.. I can't see new new "Highs" but who knows.

Of course there is profit taking-I took some myself over the last few days, and hopefully you and others did also.

However, as stated in previous post, despite Trump's irrational exuberance about the market, imo there is very little to get excited about, and

in fact a lot to worry about!

Of course there is profit taking-I took some myself over the last few days, and hopefully you and others did also.

However, as stated in previous post, despite Trump's irrational exuberance about the market, imo there is very little to get excited about, and

in fact a lot to worry about!

yeah.. the economy... it's tough to understand these days the stock market is betting on the future and I understand that.

Infusing a trillion more dollars as SM said this AM on CNBC...Yesterday the Fed chairman said interest rates would remain low into 2022 and that didn't do much either...

weirdly the market said fuck off and went down another 400 points this AM after SM spoke.

Here may be some solid reasons why market is down big:

https://www.msn.com/en-us/money/mar...ilers-drop/ar-BB15amBi?ocid=anaheim-ntp-feeds

https://www.msn.com/en-us/money/mar...ilers-drop/ar-BB15amBi?ocid=anaheim-ntp-feeds

What is occurring in the market has happened before and will occur again, namely building up momentum and steam relatively slowly over a period

of time with nice overall gains, and then collapsing like a deck of cards suddenly in one or two days and giving a lot of it back.

As they say, that's show biz!

of time with nice overall gains, and then collapsing like a deck of cards suddenly in one or two days and giving a lot of it back.

As they say, that's show biz!

|

Global Market Comments June 12, 2020 Fiat Lux Featured Trade: (WHEN THE BILL COMES DUE) (SPY), (TLT), (GD), (USO), (HTZ), (JCP)

|

| � |

When the Bill Comes Due This was a top you could see coming a mile off. Now, the correction for the greatest rally in stock market history has begun. Will it be the greatest correction in history?It could be. It was the awful news that the Coronavirus is starting to run away again that started the panic. New cases in Texas and Arizona are growing so fast that the local hospital systems are getting overwhelmed once again. The Armageddon scenario is back on the table once again. You knew we were in trouble when the stocks of bankrupt companies, like Hertz (HTZ) and JC Penny (JCP) started doubling in a day, even though they have no equity value whatsoever. They were bid up simply because they had low single-digit prices, as bankrupt companies always do. They were bid up by greater fools and the market just ran out of them. It wasn’t just equities that got slammed. Oil (USO) suffered a horrific day, down 8.2%. because of burgeoning inventories leftover from a dead-in-the water economy. Bonds rocketed three points and are up an eye-popping 11 points from last week. Even gold (GLD) failed to move, held back by widespread margin calls. It seems we have returned to the terrors of February-March, the down 2,000 points a day kind. There was barely a rally all day. It basically went straight down. How much more is there to go? Let’s look at the obvious targets in the S&P 500 (SPY) and the distance from the Monday top. $299 – Down 7.7% from the top – the 200-day moving average and top of the April - May double top $288.74 – Down 10.9% - The 50-day moving average $272 – Down 15% - bottom of the April - May double bottom $262 – Dow 19.4% - Top of the initial rally off the March 23 bottom and the level where a new bear market is declared. Two bear markets in two quarters? $219 – Down 32.6% - the March 23 low gets retested. There is quite a lot to chew on here. In the end, it will depend on how much the first Corona wave ramps up after a far too early re-opening. Even if there are no further shutdowns of the economy, a world where consumers are too afraid to leave their homes doesn’t generate a lot of growth or earnings. When the president says things are great, but you see 5% of normal traffic in the local shopping mall, you want to run a mile. Forget about the second wave, we haven’t even gotten out of the first wave yet. Corona deaths topped 114,000 today. We could hit 250,000 by August, not a great mall traffic generator. If the selloff continues, and it probably will until the Q2 earnings are published starting in mid-July, then this is the dip you want to buy. For if the lows hold, we will be at the beginning of a 400% move in the main indexes over the next decade. To get the depth of the argument why this will happen, please read about the coming Roaring Twenties and the next American Golden Age by clicking here. Here is what you want to do on this move down: *Stocks - buy big dips *Bonds – sell rallies aggressively *Commodities - buy dips *Currencies - sell US dollar rallies *Precious Metals – buy dips *Energy – stand aside *Volatility - sell short over $50 *Real Estate – buy dips And buy LEAPS (Long Term Equity Anticipation Securities), lots of LEAPS. This is where traders have been picking up 500%-1,000% returns this year. Stay Healthy, John Thomas CEO & Publisher The Diary of a Mad Hedge Fund Trader

|

Quote of the Day "Technology has outrun the ability of the market to handle it. When the next bear market comes, there could be a messy affair," said my friend and client Leon Cooperman of hedge fund Omega Advisors.

|

Imo and as stated and/or implied earlier, until we some sustained and consistent improvement in the economy, jobs(not just one month's numbers)

at least some sign the Virus is over and/or some vaccine or proven treatment, imo at 23,000 or so for the Dow, it is fairly valued at this juncture.

I disagree I make a strong distinction between economy and the stock market, to me they are two different animals. The world is taking its rightful course , the very rich and the poor. We need to purge off the poor, they are dragging down the rich and the stock market.

I disagree I make a strong distinction between economy and the stock market, to me they are two different animals. The world is taking its rightful course , the very rich and the poor. We need to purge off the poor, they are dragging down the rich and the stock market.

I am not quite sure I understand what you are saying exactly in your post-could you please clarify?

My point in essence is saying that I believe that at this juncture based on the current situation with jobs/unemployed, the Virus, etc. and the overall

of what I believe the overall perception reality over the six months or so(which is about how far generally speaking the market looks ahead),

a Dow within a couple of hundred of points BEFORE the Virus took hold is simply not justified/warranted at the moment.

Until/if/when we see some clear indication that overall things have turned dramatically better, imo Dow is fairly valued at 23,000 tops.

If there is a sustained surge in Round Two of the Virus, a return to around Dow 20,000 or possibly even lower would

not be that shocking because of the major impacts and ripple effect it would have on the economy, jobs, etc.