You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Intersting thoughts

- Thread starter Bozzie

- Start date

This guy is short in the market so take this with a grain or two.

U.S. Equity Crash Risks Rising

Jun. 12, 2020 2:23 PM ET |

Includes: NDX, SP500

Stuart Allsopp

Long/short equity, research analyst, macro, portfolio strategy

Summary

U.S. equity markets are showing signs of a major top as a number of important bearish divergences appear within and across markets.

We expect the March lows to be tested, and ultimately broken, over the coming months.

Valuations are even more extreme in absolute terms and relative to the rest of the world compared to February, while the fundamental outlook is even more uncertain.

Investors have historically required a significantly higher risk premium to compensate for the exact kinds of risks we see today.

The current selloff was a stark reminder of what can happen when speculators chase returns at record valuations amid waning market breadth and deteriorating fundamentals with the belief that policymakers will prevent a selloff. While we have only seen a modest correction so far, the current setup has the hallmarks of the kind of major market tops that give way to substantial declines. We expect the March lows to be tested, and ultimately broken, over the coming months.

We wrote in late-February about how U.S. equity markets showed signs of a major top owing to a number of important bearish divergences across different measures of risk appetite. We are seeing a similar set up currently as we saw four months ago. Furthermore, valuations are even more extreme in absolute terms and relative to the rest of the world, while the fundamental outlook is even more uncertain suggesting a much higher equity risk premium is warranted.

Divergences Abound

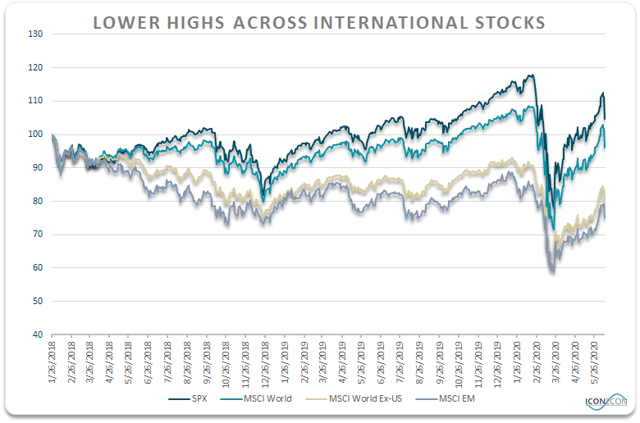

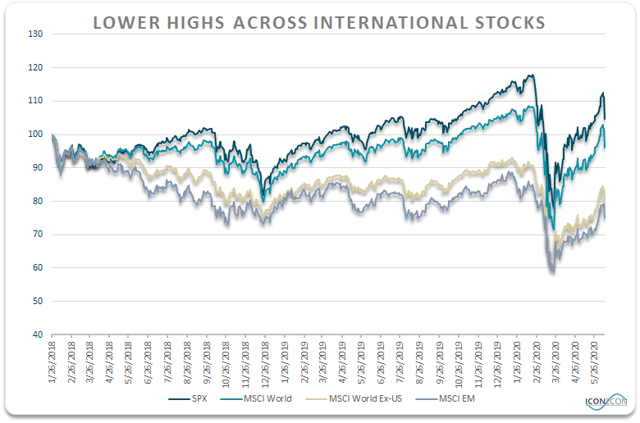

The chart below shows the performance of the SP500 alongside the MSCI World, the MSCI World Ex-U.S. and the MSCI EM Index. While the rally has been broad-based since the March low, the series of lower lows across international stocks remains intact. Even after the recent rally the MSCI World remains below its 2018 peak owing to international weakness.

Source: Bloomberg

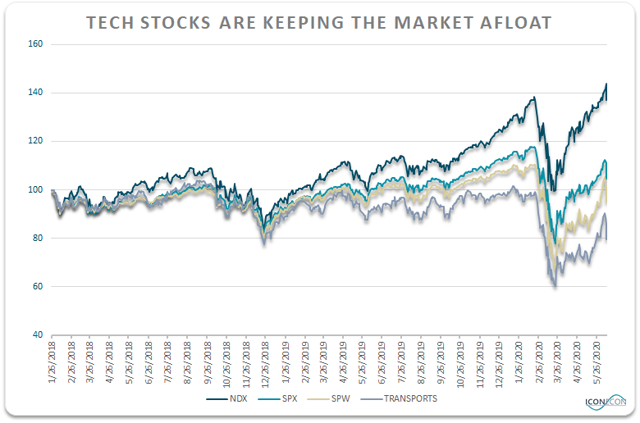

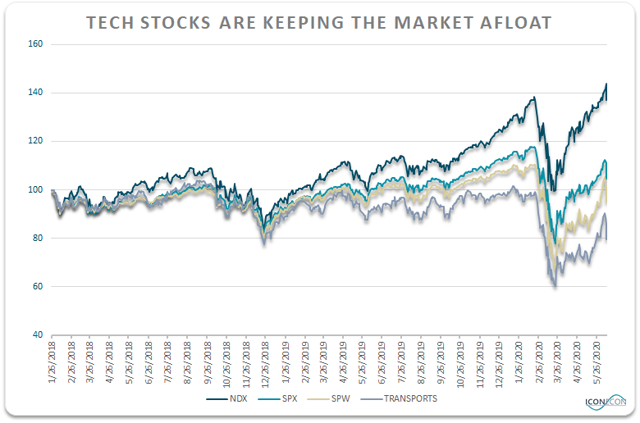

Even within the U.S. it is the large cap tech stocks which are driving the overall market's advance, which has become increasingly narrow. The average SP500 stocks remains below its 2018 peak while Transports remain 20% off their highs. Retail investors appear to have been a key driver of the surge in stocks over the past month with retail trading account openings bursting higher amid a knee-jerk reaction to the Fed's stimulus measures. These are not the kind of holders who are likely to withstand double-digit corrections.

Source: Bloomberg

Similarities To The 2007 Peak

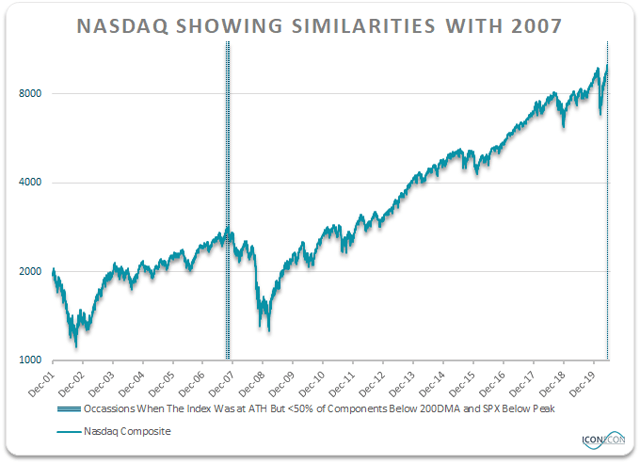

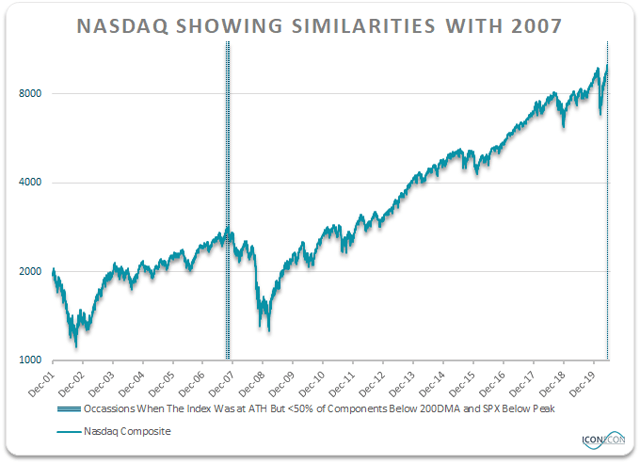

The Nasdaq Composite's rise has been particularly narrow in nature with the index breaking to new highs on June 10 despite only 3.5% of individual components hitting new annual highs and just 47% of the index's components trading above their 200-day moving average. The last time we saw the Nasdaq Composite at all-time highs while fewer than half of its components were above their 200-dmas and the S&P500 was below its peak, as was the case on Wednesday, was on October 31, 2007. As shown below, this market the exact peak of the 2000s bull market.

Source: Bloomberg, author's calculations

U.S. Valuation Premium Has Risen Further...

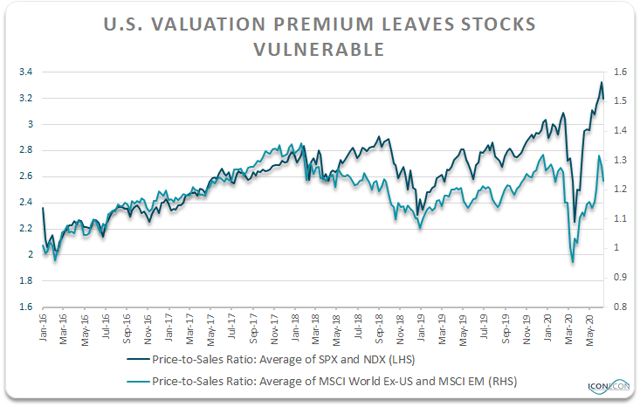

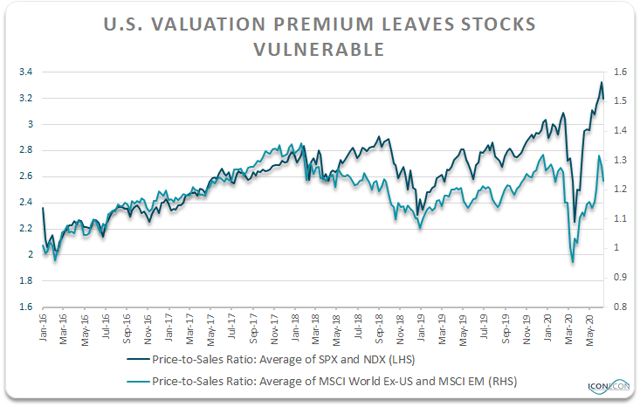

While the technical picture is similar to that seen in February, valuations are even more extreme now compared to then. As we argued here the U.S. market capitalization ratio to GDP is at new all-time-highs. Meanwhile, the U.S.'s valuation premium to the rest of the world has also risen. The following chart shows the average forward price-to-sales ratio of the Nasdaq 100 and the SP500 relative to the average of the MSCI World Ex-U.S. and MSCI Emerging Market Index. As we have highlighted previously we see the U.S. dramatically underperforming international stocks over the coming years owing largely to the extreme valuation differentials. While extreme valuations on their own do not tend to matter much for short-term equity performance, they are yet another example of long-term equity headwinds which are currently blowing.

Source: Bloomberg

...Despite The Fundamental Deterioration

The rise in the U.S. valuation premium comes at a time of heightened uncertainty over the country's fundamental outlook. At the start of the year our fundamental concerns were based on the country's declining long-term growth rate owing to loose monetary and fiscal policy combined with record levels of corporate, government, and external debt. Today, monetary and fiscal policy have been pushed to new extremes raising the threat of stagflation, while our economic growth concerns have been heightened to say the least as a result of the mass hysteria surrounding Covid-19 and the ongoing protests.

Equities Require A Risk Premium For Times Like These

Investors have historically required a high returns on stocks regardless of bond yields because equities are risky assets (see 'SP500: Low Bond Yields Do Not Justify High Equity Valuations'). Specifically, they decline at the worst possible time. When the economy heads to recession investors do not want to suffer from a decline in equity prices at the same time as they are suffering from a decline in dividend income and potentially employment. Given the fundamental outlook facing the U.S. economy and political environment we think U.S. equities should be offering a significantly higher risk premium.

U.S. Equity Crash Risks Rising

Jun. 12, 2020 2:23 PM ET |

Includes: NDX, SP500

Stuart Allsopp

Long/short equity, research analyst, macro, portfolio strategy

(403 followers)

Summary

U.S. equity markets are showing signs of a major top as a number of important bearish divergences appear within and across markets.

We expect the March lows to be tested, and ultimately broken, over the coming months.

Valuations are even more extreme in absolute terms and relative to the rest of the world compared to February, while the fundamental outlook is even more uncertain.

Investors have historically required a significantly higher risk premium to compensate for the exact kinds of risks we see today.

The current selloff was a stark reminder of what can happen when speculators chase returns at record valuations amid waning market breadth and deteriorating fundamentals with the belief that policymakers will prevent a selloff. While we have only seen a modest correction so far, the current setup has the hallmarks of the kind of major market tops that give way to substantial declines. We expect the March lows to be tested, and ultimately broken, over the coming months.

We wrote in late-February about how U.S. equity markets showed signs of a major top owing to a number of important bearish divergences across different measures of risk appetite. We are seeing a similar set up currently as we saw four months ago. Furthermore, valuations are even more extreme in absolute terms and relative to the rest of the world, while the fundamental outlook is even more uncertain suggesting a much higher equity risk premium is warranted.

Divergences Abound

The chart below shows the performance of the SP500 alongside the MSCI World, the MSCI World Ex-U.S. and the MSCI EM Index. While the rally has been broad-based since the March low, the series of lower lows across international stocks remains intact. Even after the recent rally the MSCI World remains below its 2018 peak owing to international weakness.

Source: Bloomberg

Even within the U.S. it is the large cap tech stocks which are driving the overall market's advance, which has become increasingly narrow. The average SP500 stocks remains below its 2018 peak while Transports remain 20% off their highs. Retail investors appear to have been a key driver of the surge in stocks over the past month with retail trading account openings bursting higher amid a knee-jerk reaction to the Fed's stimulus measures. These are not the kind of holders who are likely to withstand double-digit corrections.

Source: Bloomberg

Similarities To The 2007 Peak

The Nasdaq Composite's rise has been particularly narrow in nature with the index breaking to new highs on June 10 despite only 3.5% of individual components hitting new annual highs and just 47% of the index's components trading above their 200-day moving average. The last time we saw the Nasdaq Composite at all-time highs while fewer than half of its components were above their 200-dmas and the S&P500 was below its peak, as was the case on Wednesday, was on October 31, 2007. As shown below, this market the exact peak of the 2000s bull market.

Source: Bloomberg, author's calculations

U.S. Valuation Premium Has Risen Further...

While the technical picture is similar to that seen in February, valuations are even more extreme now compared to then. As we argued here the U.S. market capitalization ratio to GDP is at new all-time-highs. Meanwhile, the U.S.'s valuation premium to the rest of the world has also risen. The following chart shows the average forward price-to-sales ratio of the Nasdaq 100 and the SP500 relative to the average of the MSCI World Ex-U.S. and MSCI Emerging Market Index. As we have highlighted previously we see the U.S. dramatically underperforming international stocks over the coming years owing largely to the extreme valuation differentials. While extreme valuations on their own do not tend to matter much for short-term equity performance, they are yet another example of long-term equity headwinds which are currently blowing.

Source: Bloomberg

...Despite The Fundamental Deterioration

The rise in the U.S. valuation premium comes at a time of heightened uncertainty over the country's fundamental outlook. At the start of the year our fundamental concerns were based on the country's declining long-term growth rate owing to loose monetary and fiscal policy combined with record levels of corporate, government, and external debt. Today, monetary and fiscal policy have been pushed to new extremes raising the threat of stagflation, while our economic growth concerns have been heightened to say the least as a result of the mass hysteria surrounding Covid-19 and the ongoing protests.

Equities Require A Risk Premium For Times Like These

Investors have historically required a high returns on stocks regardless of bond yields because equities are risky assets (see 'SP500: Low Bond Yields Do Not Justify High Equity Valuations'). Specifically, they decline at the worst possible time. When the economy heads to recession investors do not want to suffer from a decline in equity prices at the same time as they are suffering from a decline in dividend income and potentially employment. Given the fundamental outlook facing the U.S. economy and political environment we think U.S. equities should be offering a significantly higher risk premium.

Re: the article, lets just say that imo there is a better chance of Dow testing March lows than there is of breaking through the all time high of the Dow.

To be clear, this doesn't mean that for sure we are going to test the March lows, but rather to focus /emphasize to state on

how overbought imo the market was at 27,000 level or to a lesser extent at present 25,345.

To be clear, this doesn't mean that for sure we are going to test the March lows, but rather to focus /emphasize to state on

how overbought imo the market was at 27,000 level or to a lesser extent at present 25,345.

|

| Global Market Comments June 15, 2020 Fiat Lux Featured Trade: (MARKET OUTLOOK FOR THE WEEK AHEAD, or WAITING FOR MY SUGAR CUBE), (SPY), (INDU), (UUP), (GLD), (TLT), (HTZ), (TSLA)

|

| � |

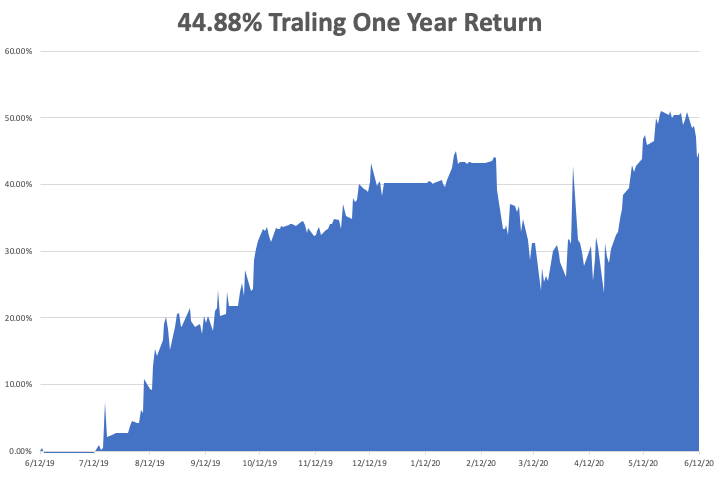

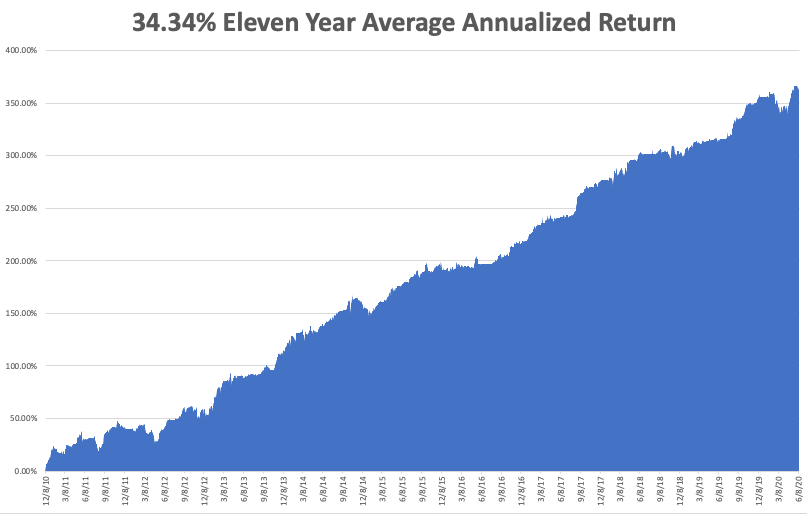

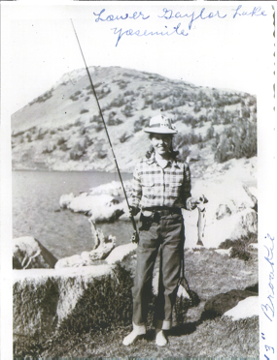

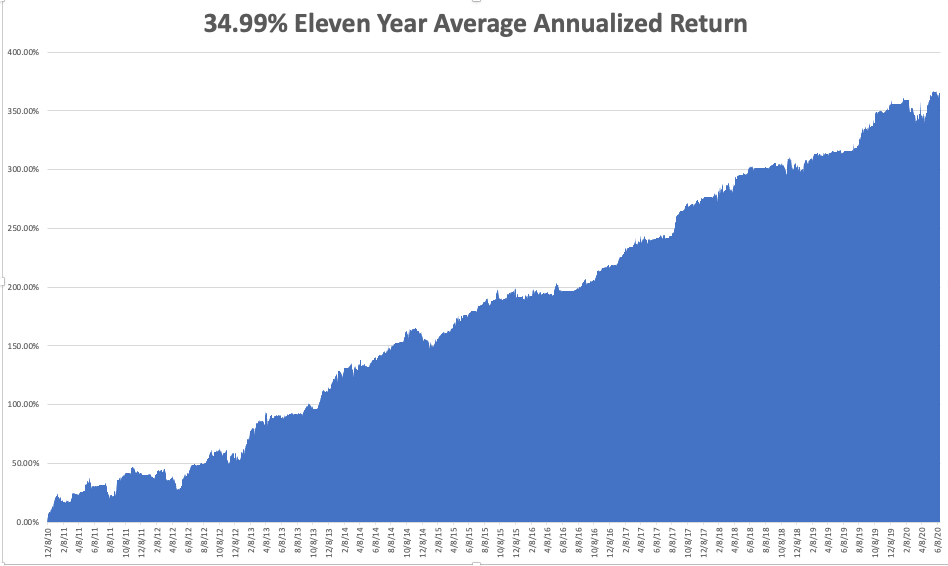

The Market Outlook for the Week Ahead, or Waiting for My Sugar Cube I was born in the middle of a pandemic.It was polio, and in the early 1950s, it was claiming 150,000 kids a year just in the US. You know polio. You’ve seen the pictures of the kids with withered legs or living in iron lungs, the ventilators of their day. My mom contracted polio in the 1930s and spent a year in quarantine. They didn’t understand then that the virus was in the drinking water. She lost the use of her legs for a time. My grandfather’s cure was to take her hiking in the High Sierras every weekend to rebuild her muscles. During WWII, he had to buy gas coupons on the black market to make the round trip from LA to Yosemite. It worked well enough for mom to earn a scholarship to USC where she met my dad, a varsity football player. By the time I came along, Jonas Salk discovered a vaccine, which was infused into a sugar cube and given to me at the Santa Anita Racetrack along with tens of thousands of others. It was one of the big events of American history. Some 70 years later, I am maintaining the family tradition, forcing my kids out on backpacks a couple of times a week, they're moaning and complaining all the way. It looks like the first wave of the Corona pandemic isn’t even over yet. That’s why the Dow Average managed to puke out some 10% in days. So, here is the conundrum: How much can we take the market down in the face of the greatest monetary and fiscal stimulus in history. Some $9 trillion has already been spent and there is at least another $5 trillion behind it. My bet is a few more thousand points down to 24,000 but not much more than that. If this turns into a rout and a retest of the lows, the Fed will simply turn on the presses and print more money. After all, the marching orders from the top are to keep stocks high into the election, whatever the cost. One of the reasons we are seeing such wild swings in the market is that the market itself doesn’t know what it’s worth. That’s because this is the most artificially manipulated market in history, thanks to the government stimulus, 20 times what we saw in 2008-2009. Stocks can’t figure out if they are worthless, or worth infinity, and we are wildly whipsawing back and forth between two extremes. Take that stimulus away and the Dow Average would be worth 14,000 or less. Stimulus will go away someday, and when it goes away, there will be a big hit to the market. It’s anyone’s guess as to timing. Ask the Covid-19 virus. We have seen countless market gurus being wrong about this market, many of whom are old friends of mine. That’s because they, like I, see the long-term damage being wrought to the economy. Recovering 80% of what we lost will be easy. The last 20% will be a struggle. That alone amounts to one of the worst recessions we have ever seen. This is going to be a loooong recovery. Some forecasters don’t expect US GDP to recover to the 2019 level of $21.43 trillion until 2025. In the meantime, the national debt is soaring, now at $26 trillion, and will soon become a major drag on the economy. The budget deficit alone this year is now pegged at an eye-popping $3 trillion, the largest in history. The S&P 500 turned positive on the year for a whole day. It’s been an amazing move, the largest in history in the shortest time, some 47% in ten weeks. NASDAQ hit my year-end target of $10,000, then immediately gave back 10%. The problem now is that stocks are still the most overbought in history and risk is the highest since January. Much trading is now dominated by newly minted day traders chasing bankrupt stocks like Hertz (HTZ) with their $1,200 stimulus check. Far and away, the better trade is to sell short bonds. After that, buy gold (GLD) and sell short the US Dollar (UUP). Stocks then dove 7.4% on second wave fears as US cases top 2 million and deaths exceeded 114,000. Jay Powell says he won’t raise interest rates until 2023 at the earliest. The “reopening” stocks of airlines, hotels, and cruise lines are leading the downturn from crazy overbought levels. Houston may have to close down again, in the wake of soaring Corona cases after a too early reopening. Other cities will follow. Cases in Arizona are also hitting new highs. It’s not what the market wanted to hear. Weekly Jobless Claims hit 1.54 million, at a falling rate, but still at horrendous absolute levels. That’s better than last week’s 1.9 million. Some 20.9 million are still receiving state unemployment benefits, or 13.1% or the total workforce. These numbers certainly don’t justify a stock market near an all-time high. The Fed expects Unemployment to remain stubbornly high, not falling to 9.3% by yearend. I think that’s highly optimistic. Some 20% of the 43 million lost jobs are never coming back, giving you an embedded U-6 rate of over 10%. It is easier and faster to fire people than to hire them back. Election Poll numbers are starting to affect the market. Polls showing Trump 10%-14% points behind Joe Biden in the November presidential election opened stocks down 400 points on Monday. The betting polls in London are confirming these numbers. The Republican leadership is jumping ship. A Biden win will bring higher corporate taxes, balanced budgets, less liquidity for the stock market, fewer Tweets, and clipped wings for the top 1%. Is this a trigger for the next market correction? We’ll find out in five months. When will stocks notice that? Bond King Jeffrey Gundlach absolutely hates stocks, predicting we could take out the March lows. He believes the monster rally in big tech is unsustainable. The better trades are to sell short the US dollar (UUP) and to buy gold (GLD). I agree with much of this, but Geoff’s calls can take 6-12 months to come true, so don’t hold your breath, or bet the ranch. Tesla hit a new all-time high, as I expected, ticking at $1,220. An 11% price cut is boosting sales and market share, while (GM) and (F) are dying. The Model Y, which looks like the love child of a Model X and Tesla 3, is expected to be their biggest seller ever. This is one bubble stock that ISworth chasing. Buy (TSLA) dips up to $2,500. No kidding! New Zealand became the first Corona-free country, with zero cases, so it can be done. An island country with all international flights grounded, aggressive social distancing restrictions, and an ambitious contract tracing, the land of kiwis had everything going for it. Most importantly, they had the right leadership that listened to scientists, which the worst-hit countries of Sweden, Brazil, and the US are sadly lacking. The Mad Hedge June 4 Traders & Investors Summit recording is up. For those who missed it, I have posted all 9:15 hours of recordings of every speaker. This is a collection of some of the best traders and investors I have stumbled across over the past five decades. To find it please click here. When we come out on the other side of this, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil at a cheap $34 a barrel, there will be no reason not to. The Dow Average will rise by 400% or more in the coming decade. My Global Trading Dispatch performance took it on the nose last week. I got stopped out of my shorts at the market top, then took a hit on my bonds shorts. My 11-year performance stands at 360.61%. That takes my 2020 YTD return up to a more modest +4.70%. This compares to a loss for the Dow Average of -12.2%, up from -37%. My trailing one-year return retreated to 44.88%. My eleven-year average annualized profit backed off to +34.34%. The only numbers that count for the market are the number of US Coronavirus cases and deaths, which you can find here. On Monday, June 15 at 12:00 PM EST, the June New York State Manufacturing Index is out. On Tuesday, June 16 at 12:30 PM EST, US Retail Sales for May are released. On Wednesday, June 17 at 8:15 AM EST, Housing Starts for May are announced. At 10:30 AM EST, the EIA Cushing Crude Oil Stocks are published. On Thursday, June 18 at 8:30 AM EST, Weekly Jobless Claims are announced. On Friday, June 19 at 2:00 PM EST, the Baker Hughes Rig Count is out. As for me, I am waiting for my sugar cube. In the meantime, I will spend the weekend carefully researching the recreational vehicle market. If everything goes perfectly, a Covid-19 vaccine will be not available to the general public for at least two years. Until then, my travel will be limited to the distance I can drive. Travel while social distancing with my own three-man “quaranteam” will be the only safe way to go. When the New York Times highlights it, as they did this weekend, it’s got to be a major new thing. Stay healthy. John Thomas CEO & Publisher The Diary of a Mad Hedge Fund Trader

|

Quote of the Day "In investment management, the progression is from the innovators to the imitators, to the swarming incompetents," said Oracle of Omaha, Warren Buffett.

|

Global Market Comments

June 16, 2020

Fiat LuxFeatured Trade:(THE IDIOT’S GUIDE TO INVESTING),

(TSLA), (BYND), (JPM)

(TESTIMONIAL)

June 16, 2020

Fiat LuxFeatured Trade:(THE IDIOT’S GUIDE TO INVESTING),

(TSLA), (BYND), (JPM)

(TESTIMONIAL)

The Idiot’s Guide to Investing

Three months into my enforced home quarantine, I am resorting to some oldies but goodies for home entertainment. They’re not making movies anymore, so oldies are all we get.I just finished watching Von Ryan’s Express (1965), and Frank Sinatra got shot in the back. It was a timely movie for me to revisit because I rode the exact Italian Alpine rail lines used in the film only two last year and recognized some of the precise scenery and rail junctions used by the filmmakers.

What would you do if I recommended an investment strategy that would cause your accountant to disown you, your inheritance-anticipating children to sue you, and your wife to file for divorce?

Chances are you would designate all my future mailings as SPAM, unfriend me on Facebook, and tear my card out of your Rolodex.

Well, here it is anyway. I’ll call it my “Ignore All Risk” portfolio. It’s really quite simple. This is all you have to do:

1) Buy stocks that have already gone up the most, boast the highest year-to-date performance and have momentum overwhelmingly on their side. Only do what everyone else is doing. Go for the easy trade. Bankrupt companies like Hertz (HTZ) are preferred which at one point was up 690% last week.

2) Buy stocks with the highest price-earnings multiples. I’m talking mid to high double digits.

3) Lean towards stocks with the highest short interest, such as Tesla at 30%

(TSLA) and Beyond Meat (BYND) at 20%.

4) Avoid all cryptocurrency bets, like Bitcoin. In fact, avoid all financials, period.

5) Ignore all valuations and fundamentals. Don’t waste a minute reading a single page of research, especially from an old-line legacy broker. Seeking Alpha, where none of the information is independently verified, is a far better source of information than JP Morgan (JPM).

6) Big institutions should allocate all of their assets only to their youngest traders and portfolio managers. Old farts, or anyone with any memory or experience whatsoever, should be completely ignored. A person who’s never seen a stock go down is now your best friend.

7) Oh, and there is one more thing. Go hugely overweight bonds over equities in the face of unprecedented and massive government borrowing at all-time low-interest rates.

Any professional manager pursuing an approach like this would surely get fired, lose all of their securities registrations and licenses, and get banned from the industry for life.

But there is one big offset to these career-ending consequences. They would also be the top-performing money manager of the year, beating the pants off of all competitors. Every investment they made this year worked.

They would be regarded as a trading genius on par with my friends Paul Tudor Jones and Appaloosa’s David Tepper. If they invested their own money using this strategy, they would be so filthy rich they wouldn’t care what happened to themselves.

We are now in an environment where EVERY trade is crowded, be they in equities, fixed income, or foreign exchange. The metaphors coming to mind are legion. There are too many passengers on one side of the canoe. The lemmings are mindlessly stampeding towards a giant cliff. I could go on.

Of course, incredible excess liquidity is to blame. That is the only time both stocks AND bonds go up at the same time. The world’s central banks have been flooding the globe with cash for over a decade now, and the pandemic has given them license to increase these efforts vastly.

The end result has been to undervalue all asset classes, be they paper or hard. Cash is trash, especially in Japan and Europe where you have to PAY banks to take your money.

The fact is that shares with the fastest price appreciation over the past 12 months are trading at valuations that are almost 25% higher than normal.

I have traded and invested through all of this before; the Nifty Fifty of the early 1970s, the Great Japan Bubble of the 1980s, the Dotcom Bubble of the 1990s, and of course the 2007 bubble top. And there is one thing all of these market apexes have in common. They inflated a lot longer than anyone expected, sometimes FOR YEARS!

You could be conservative, go into 100% cash, and just stay on the sidelines until mass groupthink, hysteria, and insanity leave the market. But that could be a very long time.

And after more than a half-century in this business, there is one thing I know for sure. Traders who don’t trade, investors who don’t invest, and newsletters that don’t recommend all have one thing in common. THEY GET FIRED. Just because investing gets hard is no reason to quit the market.

The Japanese have a great expression for this: “When the fool is dancing, the greater fool is watching.” So, I’m going to start dancing away. What will it be? The cha cha, the limbo, or the Watusi?

Hmmmm. Let me see. Let me Google what everyone else is doing.

Three months into my enforced home quarantine, I am resorting to some oldies but goodies for home entertainment. They’re not making movies anymore, so oldies are all we get.I just finished watching Von Ryan’s Express (1965), and Frank Sinatra got shot in the back. It was a timely movie for me to revisit because I rode the exact Italian Alpine rail lines used in the film only two last year and recognized some of the precise scenery and rail junctions used by the filmmakers.

What would you do if I recommended an investment strategy that would cause your accountant to disown you, your inheritance-anticipating children to sue you, and your wife to file for divorce?

Chances are you would designate all my future mailings as SPAM, unfriend me on Facebook, and tear my card out of your Rolodex.

Well, here it is anyway. I’ll call it my “Ignore All Risk” portfolio. It’s really quite simple. This is all you have to do:

1) Buy stocks that have already gone up the most, boast the highest year-to-date performance and have momentum overwhelmingly on their side. Only do what everyone else is doing. Go for the easy trade. Bankrupt companies like Hertz (HTZ) are preferred which at one point was up 690% last week.

2) Buy stocks with the highest price-earnings multiples. I’m talking mid to high double digits.

3) Lean towards stocks with the highest short interest, such as Tesla at 30%

(TSLA) and Beyond Meat (BYND) at 20%.

4) Avoid all cryptocurrency bets, like Bitcoin. In fact, avoid all financials, period.

5) Ignore all valuations and fundamentals. Don’t waste a minute reading a single page of research, especially from an old-line legacy broker. Seeking Alpha, where none of the information is independently verified, is a far better source of information than JP Morgan (JPM).

6) Big institutions should allocate all of their assets only to their youngest traders and portfolio managers. Old farts, or anyone with any memory or experience whatsoever, should be completely ignored. A person who’s never seen a stock go down is now your best friend.

7) Oh, and there is one more thing. Go hugely overweight bonds over equities in the face of unprecedented and massive government borrowing at all-time low-interest rates.

Any professional manager pursuing an approach like this would surely get fired, lose all of their securities registrations and licenses, and get banned from the industry for life.

But there is one big offset to these career-ending consequences. They would also be the top-performing money manager of the year, beating the pants off of all competitors. Every investment they made this year worked.

They would be regarded as a trading genius on par with my friends Paul Tudor Jones and Appaloosa’s David Tepper. If they invested their own money using this strategy, they would be so filthy rich they wouldn’t care what happened to themselves.

We are now in an environment where EVERY trade is crowded, be they in equities, fixed income, or foreign exchange. The metaphors coming to mind are legion. There are too many passengers on one side of the canoe. The lemmings are mindlessly stampeding towards a giant cliff. I could go on.

Of course, incredible excess liquidity is to blame. That is the only time both stocks AND bonds go up at the same time. The world’s central banks have been flooding the globe with cash for over a decade now, and the pandemic has given them license to increase these efforts vastly.

The end result has been to undervalue all asset classes, be they paper or hard. Cash is trash, especially in Japan and Europe where you have to PAY banks to take your money.

The fact is that shares with the fastest price appreciation over the past 12 months are trading at valuations that are almost 25% higher than normal.

I have traded and invested through all of this before; the Nifty Fifty of the early 1970s, the Great Japan Bubble of the 1980s, the Dotcom Bubble of the 1990s, and of course the 2007 bubble top. And there is one thing all of these market apexes have in common. They inflated a lot longer than anyone expected, sometimes FOR YEARS!

You could be conservative, go into 100% cash, and just stay on the sidelines until mass groupthink, hysteria, and insanity leave the market. But that could be a very long time.

And after more than a half-century in this business, there is one thing I know for sure. Traders who don’t trade, investors who don’t invest, and newsletters that don’t recommend all have one thing in common. THEY GET FIRED. Just because investing gets hard is no reason to quit the market.

The Japanese have a great expression for this: “When the fool is dancing, the greater fool is watching.” So, I’m going to start dancing away. What will it be? The cha cha, the limbo, or the Watusi?

Hmmmm. Let me see. Let me Google what everyone else is doing.

Testimonial

I would like to say a big Thank You for presenting such an amazing event, the Mad Hedge Traders & Investment Summit.

I really enjoyed it and learned a lot of amazing insights that I never knew were possible.

I do not know if you guys have sent out the recorded copies or if these are still in the works so let me know.

Can you please send me a copy or let me know how the process of this is going as I would really like to hear some of these speakers again.

Absolute Appreciation and Wishing You All Prospering Success!

Best Regards,

Troy

Note: the link to the Summit replay is found here.

I would like to say a big Thank You for presenting such an amazing event, the Mad Hedge Traders & Investment Summit.

I really enjoyed it and learned a lot of amazing insights that I never knew were possible.

I do not know if you guys have sent out the recorded copies or if these are still in the works so let me know.

Can you please send me a copy or let me know how the process of this is going as I would really like to hear some of these speakers again.

Absolute Appreciation and Wishing You All Prospering Success!

Best Regards,

Troy

Note: the link to the Summit replay is found here.

Quote of the Day

"Everything is expensive now. Worries about the future can cause safe assets to become highly priced ... I call it the 'Titanic Effect.' When the Titanic was going down, people would pay a fortune for anything that floats. We may be in a Titanic situation now," said my buddy, Nobel Prize winner Robert Shiller.

|

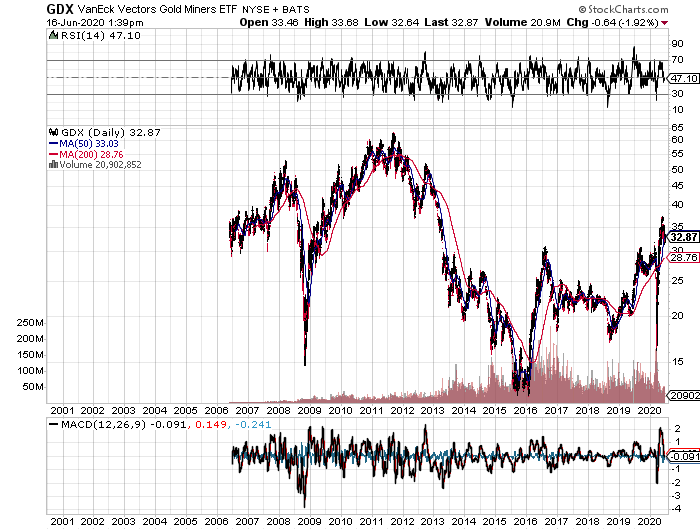

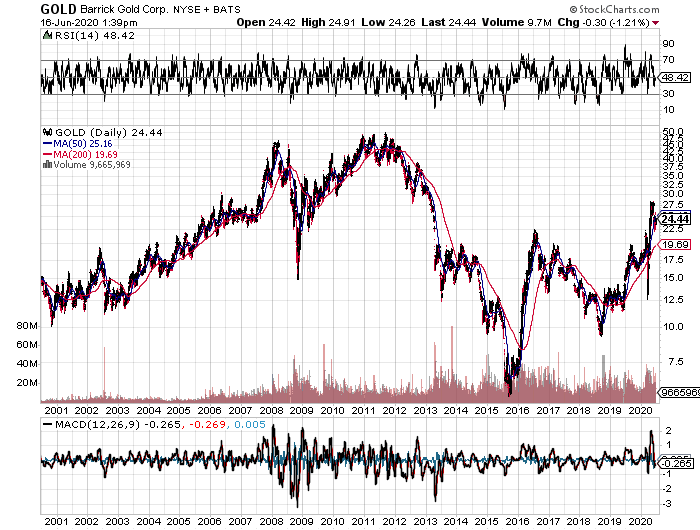

| Global Market Comments June 17, 2020 Fiat Lux Featured Trade: (THE SECRET FED PLAN TO BUY GOLD), (GLD), (GDX), (PALL), (PPLT), (TESTIMONIAL)

|

| � |

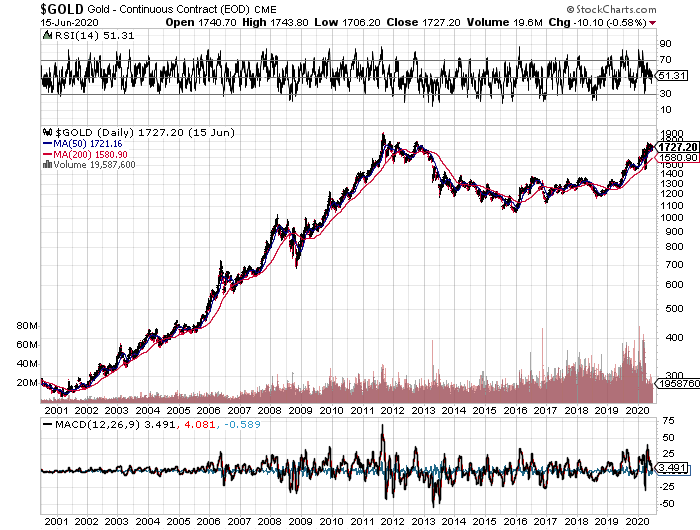

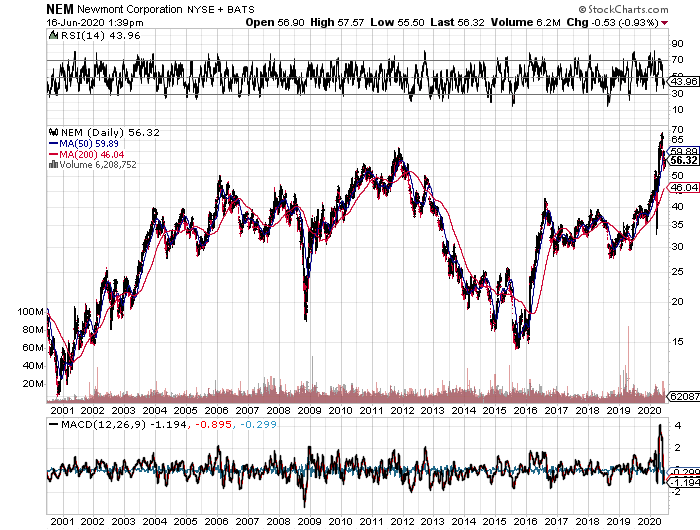

The Secret Fed Plan to Buy Gold With the latest effort to expand quantitative easing through the Fed purchase of individual corporate bonds, we must consider what else our central bank has up its sleeve.With American interest rates already near zero, the markets will take the rates for all interest-bearing securities well into negative numbers. This has already happened in Japan and Germany. At that point, our central bank’s primary tool for stimulating US businesses will become utterly useless, ineffective, and impotent. What else is in the tool bag? How about large-scale purchases of Gold (GLD)? You are probably as shocked as I am with this possibility. But there is a rock-solid logic to the plan, as solid as the vault at Fort Knox. This theory gained credence when my old friend, Judy Shelton, was appointed to the federal reserve, a noted gold bug. The idea is to create asset price inflation that will spread to the rest of the economy. It already did this with great success from 2009-2014 with quantitative easing, whereby almost every class of debt securities were Hoovered up by the government. “QE on steroids”, to be implemented only after overnight rates go negative, would involve large scale purchases of not only gold, but stocks, government bonds, and exchange-traded funds as well. Corporate bond purchases are simply a step in that direction. If you think I’ve been smoking California’s largest cash export (it’s not the raisins), you would be in error. I should point out that the Japanese government is already pursuing QE to this extent, at least in terms of equity-type investments and ETFs, and already owns a substantial part of the Japanese stock market. And, as the history buff that I am, I can tell you that it has been done in the US as well, with tremendous results. If you thought that President Obama had it rough when he came into office in 2009 with the Great Recession on, it was nothing compared to what Franklin Delano Roosevelt inherited. The country was in its fourth year of the Great Depression. US GDP had cratered by 43%, consumer prices crashed by 24%, the unemployment rate was 25%, and stock prices vaporized by 90%. Mass starvation loomed. Drastic measures were called for. FDR issued Executive Order 6102 banning private ownership of gold, ordering them to sell their holdings to the US Treasury at a lowly $20.67 an ounce. He then urged Congress to pass the Gold Reserve Act of 1934, which instantly revalued the government’s holdings at $35.00, an increase of 69.32%. These and other measures caused the value of America’s gold holdings to leap from $4 to $12 billion. That’s a lot of money in 1934 dollars, about $208 billion in today’s money. Since the US was still on the gold standard back then, this triggered an instant dollar devaluation of more than 50%. The high gold price sucked in massive amounts of the yellow metal from abroad creating, you guessed it, inflation. The government then borrowed massively against this artificially created wealth to fund the landscape-altering infrastructure projects of the New Deal. It worked. During the following three years, the GDP skyrocketed by 48%, inflation eked out a 2% gain, the unemployment rate dropped to 18%, and stocks jumped by 80%. Happy days were here again. Monetary conditions are remarkably similar today to those that prevailed during the last government gold-buying binge. There has been a de facto currency war underway since 2009. The Fed started when it launched QE, and Japan, Europe, and China have followed. Blue-collar unemployment and underpayment are at a decades high. The need for a national infrastructure program is overwhelming. However, in the 21[SUP]st[/SUP] century version of such a gold policy, it is highly unlikely that we would see another gold ownership ban. Instead, the Feds would most likely move into the physical gold market, sitting on the bid for years, much like it recently did in the Treasury bond market for five years. Gold prices would increase by a multiple of current levels. It would then borrow against its new gold holdings, plus the 4,176 metric tonnes worth $200 billion at today’s market prices already sitting in Fort Knox, to fund a multi-trillion-dollar infrastructure-spending program. Heaven knows we need it. Millions of blue-collar jobs would be created and inflation would come back from the dead. Yes, this all sounds like a fantasy. But negative interest rates were considered an impossibility only years ago. The Fed’s move on gold would be only one aspect of a multi-faceted package of desperate last-ditch measures to extend economic growth into the future which I outlined in a previous research piece (click here for “What Happens When QE Fails”. That’s assuming that the gold is still there. Treasury Secretary Stephen Mnuchin says he saw the gold himself during an inspection that took place during the last solar eclipse over Fort Knox in 2018. The door to the vault at Fort Knox had not been opened since September 23, 1974. But then Steve Mnuchin says a lot of things. Persistent urban legends and internet rumors claim that the vault is actually empty or filled with fake steel bars painted gold.

You Can See the Upside Breakout Coming Clear as Day [h=2] [/h][h=2]

|

Testimonial Thanks for all your help with my trading. Your service is very effective.As you know, I went heavily into some LEAPS two days ago including United Airlines, (UAL), Delta Airlines (DAL), Wynn Resorts (WYNN), MGM Resorts International (MGM), and Simon Property Group (SPG) that have returned as much as a 25% ROI over that short period. I know two days does not prove anything, but it is a great way to begin a trade. Thanks again, John Seattle, WA

|

Quote of the Day "Freedom of the press is only true if you own a press," said A.J. Liebling, a famed journalist for the New Yorker.

|

|

Global Market Comments June 18, 2020 Fiat Lux Featured Trade: (TESTING TESLA’S SELF-DRIVING TECHNOLOGY), (TSLA) (TESTIMONIAL)

|

| � |

Testing Tesla's Self-Driving Technology I knew I was on the right track when the salesman told me that the customer who just preceded me for a Tesla Model X 90D SUV was the Golden Bay Warriors star basketball player, Steph Currie.Well, if it’s good enough for Steph, then it’s good enough for me. Last week, I received a call from Elon Musk’s office to test the company’s self-driving technology embedded in their new vehicles for readers of the Diary of a Mad Hedge Fund Trader. I did, and prepare to have your mind blown! I was driving at 80 MPH on CA-24, a windy eight-lane freeway that snakes its way through the East San Francisco Bay Area mountains. Suddenly the salesman reached over a flicked a lever on the left side of the driving column. The car took over! There it was, winding and turning along every curve, perfectly centered in the lane. As much as I hated to admit it, the car drove better than I ever could. It does especially well at night or in fog, a valuable asset for senior citizens whose night vision is fading fast. All that was required was for me to touch the steering wheel every two minutes to prove that I was not sleeping. The cars do especially well in rush hour driving, as it is adept at stop and go traffic. You can just sit there and work on your laptop, read a book, or watch a movie on the built in 4G WIFI HD TV. When we returned to the garage, the car really showed off. When we passed a parking space, another button was pushed, and we perfectly backed 90 degrees into a parking space, measuring and calculating all the way. The range is 290 miles, which I can recharge at home at night from a standard 220-volt socket in my garage in seven hours. When driving to Lake Tahoe, I can stop half way at get a full charge in 30 minutes. The new chargers operate at a blazing 400 miles per hour. The chassis can rise as high as eight inches off the ground so it can function as a true SUV. The “ludicrous mode,” a $10,000 option, takes you from 0 to 60 mph in 2.9 seconds. However, even a standard Tesla can accelerate so fast that it will make the average passenger carsick. Here’s the buzzkill. Tesla absolutely charges through the nose for extras. The 22-inch wheels, the third row of seats to get you to seven passengers, the premium sound, the leather seats, and the self-driving software can easily run you $30,000-$40,000. A $750 tow hitch will accommodate a ski or back rack. There is a $1,000 delivery charge, even if you pick it up at the Fremont factory. It’s easy to see how you can jump from an $84,990 base price to a total cost of $162,500, including taxes, for the ultra-luxury Performance model, as I did. My company will be purchasing the car under Section 179 of the International Revenue Code. The car qualifies because it weighs over 6,000 pounds and is therefore a truck under the new tax law. This allows me to deduct the entire $162,500 cost of the vehicle upfront, plus the maintenance and insurance costs for the entire life of the car. However, I will have to maintain a mileage log as a hedge against any future IRS audits. Ironically, Section 179 was enacted as a subsidy for consumer purchases of the eight mile per gallon Hummer, which was originally built by AM General and owned by General Motors (GM). After several attempts to sell, the division failed, production was permanently shut down. However, the tax subsidies live on for any like designed vehicle. It looks like I’ll have to buy two Teslas this year. As for “drop dead’ curb appeal, nothing beats the Model X. Buy the stock on every 20% dip. My original cost is $16.50 a share and it topped $1,000 last week. It’s another way of saying “buy the shares and you get the car for free.”

|

Testimonial Going to renew my membership today because you provide great ideas. I think you have a lot of integrity in your messages. We may not agree politically, but you have nailed many of the concepts you shepherd. I have become a fan and look forward to your writing every day. Don, Cleveland, Ohio

|

Quote of the Day "I know not with what weapons World War III will be fought, but World War IV will be fought with sticks and stones," said Nobel Prize winner Albert Einstein.

|

|

| Global Market Comments June 19, 2020 Fiat Lux Featured Trade: (JUNE 17 BIWEEKLY STRATEGY WEBINAR Q&A), (SPY), (AAPL), (FXE), (FXA), (BA), (UAL), (AAPL), (MSFT), (BIIB), (PFE), (OXY), (SPCE), (WMT), (CSCO), (TGT)

|

| � |

June 17 Biweekly Strategy Webinar Q&A Below please find subscribers’ Q&A for the June 17 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Silicon Valley, CA with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!Q: What is the best way to buy long term LEAPS for unlimited profits? A: There is no such thing as unlimited profits on LEAPS; they are specifically limited to about 500% or 1,000%. Most people will take that. The answer is to wait for crash day. That’s when you dive into LEAPS, or during very prolonged sell-offs like we had in February or March. That’s where you get the bang per buck. On a capitulation day, you can pick up these things for pennies. Q: How do you explain that all the cities and states that had major COVID-19 outbreaks and deaths are controlled by Democrats? A: That’s like asking why you don’t get foot and mouth disease in New York City. The majority of US cities are Democratic, while the rural areas tend towards Republicans and the suburbs that flip back and forth. So, you will always get these big hotspots in cities where the population density is highest and there is a lot of crowding because that’s where the people are. Covid-19 is a disease that relies on within six-foot transmission. You are not going to get these big outbreaks in rural places because there are few people. Horse, cow, and pig diseases are another story. That is one reason the disease has become so politicized by the president. Q: What is the time horizon for your picks? A: It’s really a price function rather than a time horizon. Sometimes, a trade works in a day, other times it’s a month. I try to send out a large number of trade alerts because we have new subscribers coming in every day and the first thing they want is a trade alert. Occasionally, I’ll make 10% in a day and I take that immediately. Q: I’m a new investor; trading in a pandemic is one thing, but what about other risks like volcanic eruptions, major solar flares, or global war? How do I prepare for one of three of these things in the next 25 years? A: I’m actually worried about all three of those happening this year. If you lived through 1968, everything bad tends to happen in one year, and bad things tend to happen in threes. This is a year where we’re kind of making it up as we go along because there is no precedent. The playbook has been thrown out. Those who always relied on trading stocks and securities predictable ranges got wiped out. Q: Beijing has quarantined its population again and canceled flights; is this going to cause the Chinese government to ramp up the blame game with the US? A: Absolutely, the US is the number one Corona incubator in the world by far. We have 120,000 deaths—China had 4,000 deaths with four times the population. Many countries are blaming us for keeping this pandemic alive and spreading it further. But I don’t think foreign relations are a high priority right now with our current government. That said, it is easier for a dictatorship to control an epidemic than a democracy. In China, they were welding people’s doors shut who had the disease. Q: Do you think taking away the $600 or $1200 stipend for the unemployed is going to crush the chances for many trying to get back to work? A: It will. A lot of the stimulus measures only delay collapse by a couple of months. The PPP money was only for 2 months; I know a lot of companies are counting on that to stay in business. Some state unemployment benefits run out soon. Either you’re going to have to start forking up $3 trillion every other month, or you’re going to get another sharp downturn in the economy. Cities are bracing themselves for the worst eviction onslaught ever. Mass starvation among the poor is a possibility. Q: Where do you place stops on vertical spreads? A: Since vertical spreads don’t lend themselves to technical analysis, you have to draw a line in the sand—for me, it’s 2%. If I lose 2% of my total capital, or 20% on the total position, then I get the heck out of there and go look for another trade. That’s easy for me to do because I know that 90% of the time my next trade is a winner. Q: Why did you sell your S&P 500 (SPY) July $330/$320 put spread at absolutely the worst moment? A: The market broke my lower strike price, which is always a benchmark for getting out of a losing trade. When you go out-of-the-money on these spreads, the leverage works against you dramatically. This market isn’t lending itself to any kind of conventional historic analysis. The market went higher than it ever should have based on any kind of indicator you’re using. When the market delivers once in 100 year moves like we had off the March 23 bottom, you are going to be wrong. However, we immediately made the money back by putting on a (SPY) July $335/$340 put spread with a shorter maturity, and a (SPY) July $260-$$270 call spread. If you’re in this business, you’re going to take losses and be made to look like a perfect idiot, like I did twice last week. Q: Who is getting involved down 10%? A: I would say you’re getting both institutions and individuals involved down 10%. You keep hearing about $5 trillion in cash on the sidelines, and that’s how it’s coming to work. Plus, we have 13 million new day traders gambling away their stimulus checks. Q: Why have you not put on a currency trade this year? A: With the incredible volatility of the stock market, there were always better fish to fry. Currencies haven’t moved that much, and you want stocks that are dropping by 80% in two months and gapping up 200% the next two months. So, in terms of trading opportunities, currencies are number three on that list. Would you rather buy Apple (AAPL) for a 75% move, or the Euro (FXE) for a 6% move? My favorite has been the Aussie (FXA) and it has only gone up 20%. Q: Do you issue trade alerts on LEAPS? A: I don’t; most trade alerts are short term trades in the next month or two because we have to generate a large number of them. However, in February, March, and April, we started sending out lists of LEAPS. We sent out about 25 LEAPS recommendations. We did ten for Global Trading Dispatch (BA), (UAL), (DAL), ten for the Mad Hedge Technology Letter(AAPL), (MSFT), and five for the Mad Hedge Biotech & Health Care Letter (BIIB), (PFE). Even if you got just one or two of these, you got a massive impact on your performance because they did go up 500% to 1,000% in 2 months, which is normally the kind of return you see in two years. So, getting people to buy all those LEAPS was probably the greatest call in the 13-year history of this letter. I know subscribers who made many millions of dollars. Q: I am new to trading; other than placing a trade, what do you recommend I get a handle on in the learning process? A: We do have two services for sale. We have “Options for the Beginner,” and that I would highly recommend, and I’ll make sure that’s posted in the store. You can’t read or study enough. If you really want to go back to basics, read the 1948 edition of Graham and Dodd, where Warren Buffet got his education actually working for Benjamin Graham in the ’40s. Q: Will Occidental Petroleum (OXY) go bankrupt? A: No, they have the strongest balance sheet of any of the oil majors, so I would bet they would hang around for some time. They also have no offshore oil, which is the highest cost source of oil. But it’s going to be a volatile time for a while. Q: Usually the selling is telling me to go away. With this market, the amount of money on the sidelines, is it going to be a stock picker’s market? A: Yes, like I said the playbook is out the window. Normally, you get a month’s worth of trading in a month, now you get a month's worth in a day or two. So, we’re on fast forward, Corona is the principal driver of the market and no one knows what it’s going to do. The teens were a great index play. The coming Roaring Twenties will be a stock picker’s market because half of the companies will go out of business, while many will rise tenfold. You want to be in the latter, not the former. And index gets you the wheat AND the chaff. Q: Will there be another opportunity to buy LEAPS? A: Yes, especially if we get a second corona wave and it slaps the market down to new lows again. There’s a 50/50 chance of that happening. The rate of Corona cases is now increasing exponentially. We had 4,000 new cases in California yesterday. Q: How do you see Main Street two years from now? Will the battered middle class ever recover? They will if they move online. I think main street will be empty in two years. Only the largest companies are surviving because they have the cash reserve to do so. And they seem to be able to get government bailout money far better than the local nail salon or dry cleaner. Again, this was a trend that had been in place for decades but was greatly accelerated by the pandemic. I was in Napa, CA yesterday and half of the storefront shops had gone out of business. Q: What are your thoughts on the spacecraft company Virgin Galactic (SPCE)? A: Great for day traders, great for newbies, but not real investment material here. I don’t think the company will ever make money. It was just part of the temporary space had. Better to read about it in the papers and have a laugh than risk your own hard-earned money. Elon Musk’s Space X though is a completely different story. Q: Which is the better buy now: Walmart (WMT), Costco (CSCO), or Target (TGT)? A: I’d probably go for Target because they have been the fastest to move to the new online order and curb pickup universe. But Costco is also a great play. Q: When should I buy Tesla? A: On the next meltdown or down 30% from here, if and whenever we get that. It’s going to $2,500, then $5,000. Q: With QE infinity, it doesn’t sound like we’ll get to LEAPS country. Do you agree? A: No, I wouldn’t agree because at some point, the government might run out of money, the bond market won’t let them borrow anymore, and the money that gets approved doesn’t actually get spent because the works are so gummed up. Plus, Corona is in the driver's seat now. What if we’re wrong and we don’t get 250,000 cases by August, but 500,000 cases? 20 million? There are 100 things that could go wrong and get us back down to lows and only one that can go right and that is a Covid-19 vaccine. We’ve essentially been on nonstop QEs for the last 10 years already and the market has managed many 20% selloffs during that time. If we pursue a Japanese monetary policy, we will get a Japanese result, near-zero growth for 30 years. Good Luck and Stay Healthy. John Thomas CEO & Publisher The Diary of a Mad Hedge Fund Trader

|

Quote of the Day "When it comes down to data or anecdotes when making a management decision, the anecdotes are usually right," said Jeff Bezos, the founder of Amazon.

|

Bozzie thank you for something to read to kill time till 359, and ist time to buy some MSFT

Bozzie thank you for something to read to kill time till 359, and ist time to buy some MSFT

Sure Smart...he's done well but was too conservative in his view of the speed of the market recovery.

IA based Cloud security for government and large telecommuting companies ..I'll hold it for a bit.

Bought Crowdstrike (CRWD) this AM @ 102.50

|

| Global Market Comments June 22, 2020 Fiat Lux Featured Trade: (MARKET OUTLOOK FOR THE WEEK AHEAD, OR THE FED RIDES AGAIN), (TLT), (SPY), (TSLA), (IBB), (AMGN), (GILD), (ILMN)th="400" height="216" />

|

| � |

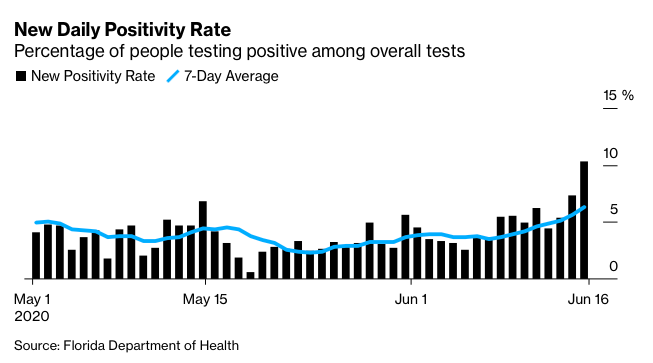

The Market Outlook for the Week Ahead, or The Fed Rides Again The free Fed put was tested once again last week, and once again it held. It seems that the line in the sand is $300 for the (SPY), and if that doesn’t hold, $270 will do. At least, for a month.How long this game will last is anyone’s guess. $14 trillion is a lot of money to throw at the problem. But then so are US Covid-19 deaths approaching 1,000 a day. Who knows what Jay Powell has up his sleeve? Probably quite a lot. A large chunk of the US economy has gone missing and is never coming back, especially the portion represented by small companies. Whether stock investors will notice this will be the big bet for the remainder of 2020. My bet is they will if the spread of the epidemic can’t be stopped. I give it a 50/50 chance. If the worst-case scenario happens, get ready to load the boat of LEAPS once again, for we have a Roaring Twenties and second American Golden Age ahead of us, if you can live to see it. We are one wonder drug discovery away from that starting tomorrow morning at 9:00 AM. We got encouraging news last week with the commonplace steroid dexamethasone, which reduces deaths by 30%. Publishing the Mad Hedge Biotechnology & Health Care Letter, I can tell you there are hundreds more drugs like this under rapid development. Click here. There is no doubt that biotech stocks (IBB) are breaking out to the upside. Take a look at the ten largest components of the iShares NASDAQ Biotechnology ETF and you’ll see they all have virtually the same chart (click here), stocks like Amgen (AMGN), Gilead Sciences (GILD), and Illumina (ILMN) The trillions of dollars pouring into Covid-19 research is a big driver. In the meantime, past headaches have magically gone away, like the threat of a nationalization and drug price controls. No one feels like regulating drug companies in this environment. Almost all impediments to research have been tossed away. Relative to the rest of the superheated stock market, biotech shares are still cheap. The Fed is to starting to buy individual bonds, in another unprecedented expansion of quantitative easing. They are clearly worried about exploding Corona cases, as I am. US Treasury bonds (TLT) dove two points on the news as this may represent a diversion of Fed buying from that market. Stocks soared 1,000 points. The big message is more QE to come. Another election play? It is called “QE Infinity” for a reason. It’s a great level to trade against. I hope you loaded up on tech LEAPS at the bottom, as I begged you to do. The Fed balance sheet soars, from $4 trillion to $7 trillion this year, says Fed governor Jay Powell. It is the fastest debt blow up in history. That’s $18,750 per taxpayer in four months. It could be $10 trillion by yearend. If you received less than this stimulus money, you got screwed. This always ends in stagflation….high inflation and slow growth, like we saw after the Vietnam War. Your grandkids are going to have to take side jobs driving for Uber to pay off this bill. Reopening states see corona cases explode, tossing the “V” shaped economic recovery out the window. Some 25 states are seeing a rapid rise in new cases. Is this the second wave or an extension of the first? The green shoots have been squashed. Stocks won’t like it. The free pass is over. Stocks pop on miracle steroid drug that reduces Covid-19 death rates. Dexamethasone is the drug in question, normally used for arthritis treatments. It’s just in time as Beijing is closing down schools again in the wake of a second wave. A US dollar crash is a sure thing, says my old Morgan Stanley colleague, Steven Roach. I couldn’t agree more. Steve is expecting a 35% swan dive for Uncle Buck. A negative savings rate combined with a retreat from Globalization is a toxic combo. A 1970s type stagflation could ensue. Weekly Jobless Claims are still sky-high, at 1.51 million, far above estimates. The Dow gave up 300 points at the opening, then quickly clawed it back. Walk down Main Street these days and they are still filled with empty storefronts. Many companies are simply running out of money, unable to wait for a recovery. In the meantime, Corona cases are hitting new records every day. Florida cases are off the charts. Things will get worse before they get better. Retail Sales posted record pop, up 17.7% in May. You are going to see a lot of these record data points because we are coming off a near-zero base. It will actually take years to get to January business levels. I’m sorry, but the higher the free Fed put drives the stock market, the worse the long-term outlook for the economy is going to be. Homebuilder Confidence is off the charts, with Sales Expectationsjumping 22 points to 68. It’s a positive perfect storm, with record-low 2.90% 30-year fixed rate mortgage, Fed buying of mortgage securities and a massive Millennial tailwind that I have been calling for years. A sudden Corona-driven urban flight is sending customers into the arms of suburban builders. Get into Lennar Homes (LEN), KB Homes (KBH), and Pulte Homes (PHM) on dips if you can. Tesla (TSLA) to open the second US factory this year, somewhere in the southwest as demand overwhelms supply for electric vehicles, exacerbated by the two-month Corona shutdown. The tax break bidding war has already begun, with Texas and Oklahoma slugging it out. The factory comes with 5,000 jobs. Tesla got its first factory for free, giving stock to Toyota for $10 a share. It was the best investment Toyota ever made. The Mad Hedge June 4 Traders & Investors Summit recording is up. For those who missed it, I have posted all 9:15 hours of recordings of every speaker. This is a collection of some of the best traders and investors I have stumbled across over the past five decades. To find it, please click here. When we come out on the other side of this, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% or more in the coming decade. My Global Trading Dispatch performance nicely recouped the pasting we took last week, taking in a nice 7%, bringing June in at +1.21%. With the June options expiration, we managed to cash in on the accelerated time decay in seven positions for Global Trading Dispatch and another three for the Mad Hedge Technology Letter. My eleven-year performance stands at a new all-time high of 367.44%. That takes my 2020 YTD return up to a more robust +11.53%. This compares to a loss for the Dow Average of -9.2%, up from -37% on March 23. My trailing one-year return popped back up to 51.92%. My eleven-year average annualized profit recovered to +34.99%. The only numbers that count for the market are the number of US Coronavirus cases and deaths, which you can find here. On the economic front, some low-grade inflation numbers are published. On Monday, June 22 at 11:00 AM EST, the May Existing Home Sales are out. On Tuesday, June 23 at 11:00 AM EST, May New Home Sales are published. On Wednesday, June 24, at 8:15 AM EST, the National Home Price Indexis printed. At 10:30 AM EST, the EIA Cushing Crude Oil Stocks are published. On Thursday, June 25 at 8:30 AM EST, Weekly Jobless Claims are announced. Also out it the final figure for Q1 GDP. On Friday, June 26, at 10:00 AM EST, the Baker Hughes Rig Count is out. At 11:00, we get the University of Michigan Inflation Expectations. As for me, I’ll spend the weekend modernizing my camping equipment, some pieces of which are WWII surplus, or are at least 50 years old. Since all of the Boy Scout summer camps for the year have been cancelled, such a Philmont and Catalina Island, I’m creating my own. We’re going on a 50-mile hike around California’s High Sierra Desolation Wilderness, a part of Northern California my family has been fishing at for a hundred years. We’ll be trekking on the Pacific Crest Trail featured in the film Wild. I’ll try to regale you with pictures on my return and wild fish stories. It’s easier said than done, for there is a national camping boom going on. It can be difficult to get simple things, like maps, without an August delivery date. Some of my WWII stuff may have to suffice after all. Stay healthy. John Thomas CEO & Publisher The Diary of a Mad Hedge Fund Trader

|

Quote of the Day “The real back swan wasn’t the virus, it was the lockdown, which caused very serious damage to the economy, especially small companies,” said Jason Trennert of Strategas Research Services.

|

Interesting JD article ... Seeking alpha..

https://seekingalpha.com/article/4354959-jd-coms-spectacular-transformation-deserves-your-relook

https://seekingalpha.com/article/4354959-jd-coms-spectacular-transformation-deserves-your-relook

I also bought CRWD but paid $103.

Cloud..it's all about the cloud

https://fortune.com/2020/06/22/stock-market-cloud-computing-nasdaq/

Bozzie thank you for something to read to kill time till 359, and ist time to buy some MSFT

I agree with you Bozzie , but MSFT is my cloud play. The more valuable the information you store, the more threats you deal with , you need to stay one step ahead of technology and keep investing in inferstructure , and then you are still not safe from them hacking a person. When it comes to cloud and profits i like to make sure I'm getting a piece of freshly printed digital money like the JEDI contract 10 billion payday.

I got in Friday at 3:58 and was down 5k when the after market closed, I overslept today and got lucky. I really like this stock if Trump is re elected.

I agree with you Bozzie , but MSFT is my cloud play. The more valuable the information you store, the more threats you deal with , you need to stay one step ahead of technology and keep investing in inferstructure , and then you are still not safe from them hacking a person. When it comes to cloud and profits i like to make sure I'm getting a piece of freshly printed digital money like the JEDI contract 10 billion payday.

Yeah I love your MSFT play.

|

| Global Market Comments June 23, 2020 Fiat Lux Featured Trade: (HERE ARE THE FOUR BEST PANDEMIC-INSPIRED TECHNOLOGY TRENDS), (AMZN), (CHWY), (EBAY), NFLX), (SPOT), (TMUS), (ATVI), (V), (PYPL), (AAPL), (MA), (TDOC), (ISRG), (TMDI)

|

| � |

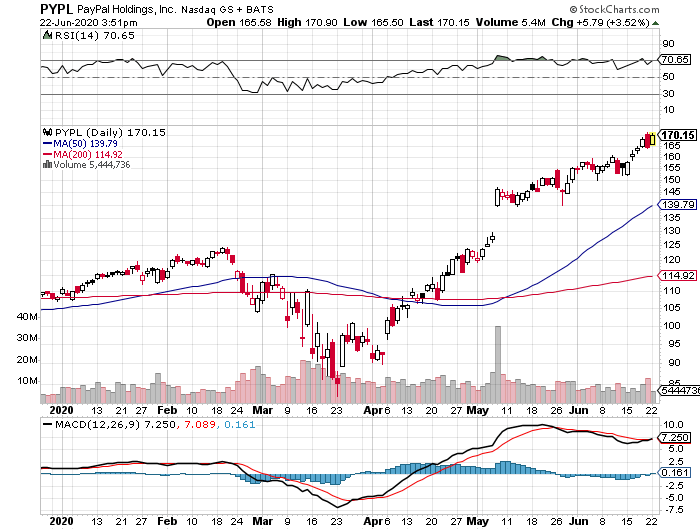

Here the Four Best Pandemic-Inspired Technology Trends By now, we have all figured out that the pandemic has irrevocably changed the course of technology investment. Some sectors are enjoying incredible windfalls, while others are getting wiped out.The digitization of the economy has just received a turbocharger. It has become a stock pickers market en extemus. The good news is that we are still on the ground floor of trends that have a decade to run, like working from home, more online food purchases, and a rise in touchless payments. This means there's a huge upside for investors willing to make big bets on what’s expected to become some of the most important technologies in the years ahead. Covid-19 is a wake-up call to accelerate trends that have been around for years and are now greatly speeding up. The pandemic seems to have triggered a new survival instinct: innovate fast or die. Let me list some of the frontrunners. 1. E-commerce E-commerce is the No. 1 shelter-in-place beneficiary by miles, as a combination of stay-at-home orders, reduced spending on dining, and government stimulus have sent Americans in search of other ways to spend their money. Even though Covid-19 restrictions are now being eased, the e-commerce industry should still see about 25% growth across all of 2020. The estimated $60 billion spent by consumers from their stimulus checks has also been a tailwind. While the world is now re-opening, we expect these buckets of available dollars to remain e-commerce tailwinds for the foreseeable future as we expect adjusted retail and travel spend to decline an aggregate of 18% in and for as much as half of all small retail stores to potentially close this year. When Amazon shares were at $1,000, I wrote a report calculating that its breakup value was at least $3,000 a share. It looks like Amazon may hit that target before yearend….without the breakup. Want to know the winners? Try Amazon (AMZN), Chewy (CHWY), and eBay (EBAY). 2. Digital Entertainment The Covid-19 pandemic has also left more Americans in search of digital, at-home entertainment, a trend that’s delivered a huge push for companies like Activision Blizzard that develop online games. New users, time spend gaming and in-game purchases are only accelerating and spell even more lasting benefit for game developers. Content names like video streaming site Netflix (NFLX), as well as bandwidth and connectivity companies including Comcast (CMCSA) and T-Mobile (TMUS), are names to focus on. This increased use of high bandwidth applications is likely to continue post-COVID-19 and has the impact of similarly increasing the demand for bandwidth and connectivity. This increases the value of upstream assets in the infrastructure sectors like fiber-based wireline broadband networks and nascent 5G build-outs. Names to play the space: Netflix (NFLX), Spotify (SPOT), T-Mobile (TMUS), Activision Blizzard (ATVI). 3. Touchless payments Another trend the stock market still underappreciated is a generational surge in contactless payments, which has recently seen a jump higher amid Covid-19 fears and efforts to minimize physical contact. Companies like Visa (V), Mastercard (MA), and ****** (PYPL), already integral to the payments world, should be major beneficiaries in the years ahead. The market assumes that COVID-19 related adoption of digital payments is a near-term benefit for payment service providers, offsetting some of the consumer spending headwinds. However, digitization of payments is part of a multi-year secular growth driver, with COVID-19 as just the latest accelerator. Names to play the space: Visa (V), ****** (PYPL), Apple (AAPL), and Mastercard (MA). 4. Telemedicine Healthcare is one of the most inefficient industries left in the United States. I call it a 19[SUP]th[/SUP] century industry operating with 21[SUP]st[/SUP] century technology. While progress has been made, those massive stacks of paper records are finally disappearing, there still is a long way to go. These days, even doctors don’t want to see patients in person, as they may contract the Coronavirus. Far better to see them online, which could address 90% of most patients. Teledoc (TDOC) does exactly that (click here for my full report). So does Intuitive Surgical (ISRG), maker of DaVinci Surgical Systems, which enables remote operations for a whole host of maladies. Titan Medical (TMDI) is another name to look at here. Names to play the space: (TDOC), (ISRG), (TMDI).

|

Quote of the Day “Everyone is now Cinderella at the ball, and there is no clock on the wall to tell you what time it is,” said the Oracle of Omaha Warren Buffet about the present rich pricing of stocks.

|