Global Market Comments

July 30, 2021

Fiat Lux

Featured Trade:

(JULY 28 BIWEEKLY STRATEGY WEBINAR Q&A),

(SPY), (CRSP), (TLT), (TBT), (BABA), (BIDU), (FXI), (RAD), (TSLA), (NASD), (NKLA), (NIO), (INTC), (MU), (NVDA), (AMD), (TSM), (VXX), (XVZ), (SVXY), (FCX), (ROM), (SPG)

|

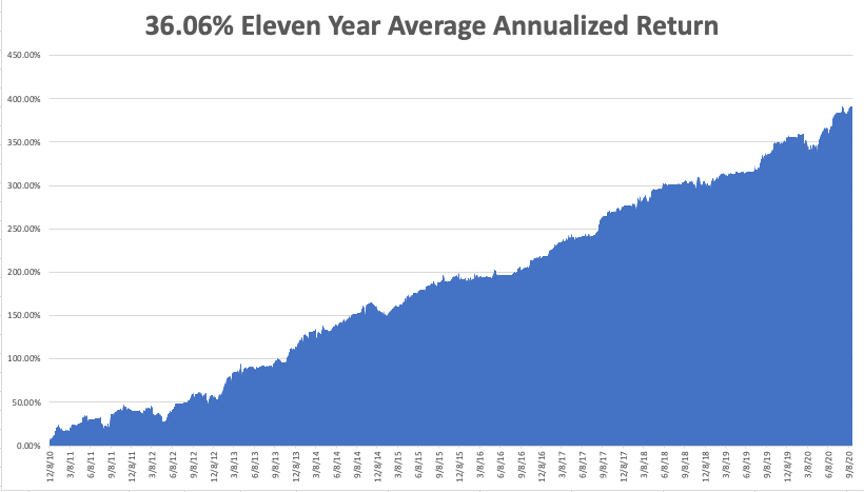

July 28 Biweekly Strategy Webinar Q&ABelow please find subscribers’ Q&A for the July 28 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Lake Tahoe, NV.

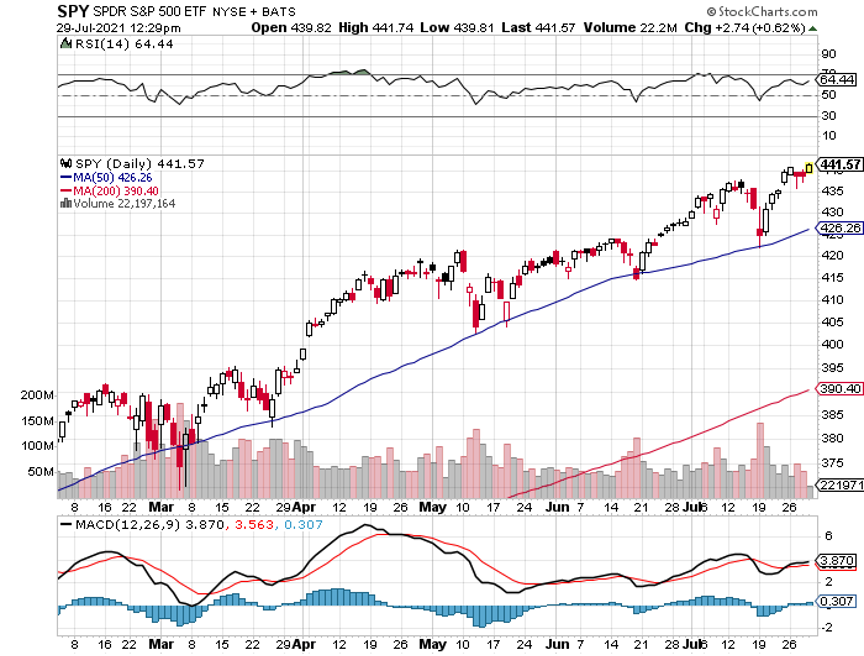

Q: What is your plan with the (SPY) $443-$448 and the $445/450 vertical bear put spreads?

A: I’m going to keep those until we hit the lower strike price on either one and then I’ll just stop out. If the market doesn’t go down in August, then we are going straight up for the rest of the year as the earnings power of big tech is now so overwhelming. Sorry, that’s my discipline and I’m sticking to it. Usually, what happens 90% of the time when we go through the strike, and then go back down again by expiration for a max profit. But the only way to guarantee that you'll keep your losses small is by stopping out of these things quickly. That’s easy to do when you know that 95% of the time the next trade alert you’ll get is a winner.

Q: Are you still expecting a 5% correction?

A: I am. I think once we get all these great earnings reports out of the way this week, we’re going to be in for a beating. I just don't see stocks going straight up all the way through August, so that’s another reason why I'm hanging on to my short positions in the S&P 500 (SPY).

Q: What’s the best way to play CRISPR Therapeutics (CRSP) right now?

A: That is with the $125-$130 vertical bull call spread LEAPS with any maturity in 2022. We had a run in (CRSP) from $100 up to $170 and I didn’t take the damn profit! And now we’ve gone all the way back down to $118 again. Welcome to the biotech space. You always take the ballistic moves. Someday I should read my own research and find out why I should be doing this. For those who missed (CRSP) the last time, we are one proprietary drug announcement, one joint venture announcement, or one more miracle cure away from another run to $170. So that will probably happen in the next year, you get the $125-$130 call spread, and you will double your money easily on that.

Q: I’m down 40% on the United States Treasury Bond Fund (TLT) January $130-$135 vertical bear put spread LEAPS. What would you do?

A: Number one, if you have any more cash I would double up. Number two, I would wait, because I would think that starting from the Fall, the Fed will start to taper; even if they do it just a little bit, that means we have a new trend, the end of the free lunch is upon us, and the (TLT) will drop from $150 down to $132 where it was in March so fast it will make your head spin. I'm hanging onto my own short position in (TLT). If you are new to the (TLT) space and you want some free money, put on the January 2020 $150-$155 vertical bear put spread now will generate about a 75% return by the January 21, 2022 options expiration. I just didn't figure on a 6.5% GDP growth rate generating a 1.1% bond yield, but that’s what we have. I'm sorry, it’s just not in the playbook. Historically, bonds yield exactly what the nominal GDP growth rate is; that means bonds should be yielding 6.50% now, instead of 1.1%. They will yield 6.5% in the future, but not right now. And that's the great thing about LEAPS—you have a whole year or 6 months for your thesis to play out and become right, so hang on to those bond shorts.

Q: Do you have any ideas about the target for Facebook (FB) by the end of the year?

A: I would say up about 20% from current levels. Not only from Facebook but all the other big tech FANGS too. Analysts are wildly underestimating the growth of these companies in the new post-pandemic world.

Q: Do you think the worst of the pandemic will be over by September?

A: Yes, we will be back on a downtrend by September at the latest and that will trigger the next leg up in the bull market. Delta with its great infectious and fatality rates is panicking people into getting shots. The US government is about to require vaccinations for all federal employees and that will get another 5 million vaccinated. Americans have the freedom to do whatever they want but they don’t have the freedom to kill their neighbors with fatal infections.

Q: What should I do with my China (BABA), (BIDU), (FXI) position? Should I be doubling down?

A: Not yet, and there’s no point in selling your positions now because you’ve already taken a big hit, and all the big names are down 50% from the February high. I wouldn't double down yet because you don’t know what's happening in China, nobody does, not even the Chinese. This is their way of addressing the concentration of the wealth in the top 1% as has happened here in the US as well. They’re targeting all the billionaire stocks and crushing them by restricting overseas flotations and so on, so it ends when it ends, and when that happens all the China stocks will double; but I have absolutely no idea when that's going to happen. That being said, I have been getting phone calls from hedge funds who aren’t in China asking if it's time to get in, so that's always an interesting precursor.

Q: What happened to the flu?

A: It got wiped out by all the Covid measures we took; all the mask-wearing, social distancing, all that stuff also eliminates transmission of flu viruses. Viruses are viruses, they’re all transmitted the same way, and we saw this in the Rite Aid (RAD) earnings and the 55% drop in its stock, which were down enormously because their sales of flu medicines went to zero, and that was a big part of their business. I didn’t get the flu last year either because I didn’t get Covid; I was extremely vigilant on defensive measures in the pandemic, all of which worked.

Q: Why would the Fed taper or do much of anything when Powell wants to be reappointed in February 2022?

A: I don’t think he is going to get reappointed when his four-year term is up in early 2022. His policies have been excellent, but never underestimate the desire of a president to have his own man in the office. I think Powell will go his way after doing an outstanding job, and they will appoint another hyper dove to the position when his job is up.

Q: What are your thoughts on the Chinese electric auto company Nio competing here in the U.S.?

A: They will never compete here in the U.S. China has actually been making electric cars longer than Tesla (TSLA) has but has never been able to get the quality up to U.S. standards. Look what happened to Nikola (NKLA) who’s founder was just indicted. Avoid (NIO) and all the other alternative startup electric car companies—they will never catch up with Tesla, and you will lose all your money. Can I be any clearer than that?

Q: You recently raised the ten-year price target up for the Dow Average from 120,000 to 240,000. What is Nasdaq's target 10 years out?

A: I would say they’re even higher. I think Nasdaq (NASD) could go up 10X in 10 years, from 14,000 to 140,000 because they are accounting for 50% of all earnings in the U.S. now, and that will increase going forward, so the stocks have to go ballistic.

Q: What do you think of Intel (INTC)?

A: I don’t like it. They had a huge rally when they fired their old CEO and brought in a new one. There was a lot of talk on reforming and restructuring the company and the stock rallied. Since then, the market has started insisting on performance which hasn’t happened yet so the stock gave up its gains. When it does happen, you’ll get a rally in the stock, not until then, and that could be years off. So I'd much rather own the companies that have wiped out Intel: (MU), (NVDA), (AMD), and (TSM).

Q: When you do recommend buying the Volatility Index (VIX), do you recommend buying the (VIX) or the (VXX)?

A: You can only buy the VIX in the futures market or through ETFs and ETNs, like the (VXX), the (XVZ), and the (SVXY), or options on these. I would be very careful in buying that because time decay is an absolute killer in that security, and that's why all the professionals only play it from the short side. That's also why these spikes in prices literally last only hours because you have professionals hammering (VIX). Somebody told me once that 50% of all the professional traders in the CME make their living shorting the (VIX) and the (VXX). So, if you think you’re better than the professionals, go for it. My guess is that you’re not and there are much better ways to make money like buying 6-to-12-month LEAPS on big tech stocks.

Q: Can the Delta variant get a bigger pullback?

A: Yes. I expect one in August, about 5%. But if Delta gets worse, the selloff gets worse. You saw what it did last year, down 40% in the (SPY) in only two months, so yes, it all depends on the Delta virus. I'm not really worrying about Delta, it's the next one, Epsilon or Lambda, which could be the real killer. That's when the fatality rate goes from 2% to 50%, and if you think I'm crazy, that's exactly what happened in 1919. Go read The Great Influenza book by John Barry that came out 20 years ago, which instantly became a best seller last year for some reason.

Q: Does the Matterhorn have enough flat space on the top to stand on it?

A: Actually, there is a 6’x6’ sort of level rock to stand on top of the Matterhorn. If you slip, it’s a 5000’ fall straight down on any side, and on a good weather day in the summer, there are 200 people climbing the Matterhorn. There's sometimes a one-hour line just to take your turn to get to the top to take your pictures, and then get down again to make space for the next person. So that's what it's like climbing the Matterhorn, it's kind of like climbing Mount Everest, but I still like to do it every year just to make sure I can do it, and one year I hope to win the prize for the oldest climber of the year to climb the Matterhorn. Every year this German guy beats me; he’s two years older than me.

Q: When will Freeport McMoRan (FCX) start going up? I have the 2023 LEAPS

A: Good thing you have the two-year LEAPS because that gives you two years for inflation to show its ugly face once again. You just have to be patient with these. I think we’ll get a rally in the Fall along with all the other interest rate plays like banks, industrials, money management companies, and so on. (FCX) will certainly participate in that. In the meantime, if we get all the way down to $30 in Freeport McMoRan, I would double up your position.

Q: Why is oil (USO) not a buy? Oil is the ultimate inflation hedge.

A: Yes, unless all of the cars in the United States become electric in the next 15 years, which they will, wiping out half of all demand from the largest oil consumer. The United States consumes about 20 million barrels of oil a day, half of that is for cars, and if you take that out of the demand picture you dump 10 million barrels a day on the market and oil goes back to negative numbers like we saw last year. Never do counter-trend trades unless you’re a professional in from of a screen 24 hours a day.

Q: Should I take profits on my ProShares Ultra Technology ETF (ROM) November $90-$95 vertical bull spread and then enter a new spread when tech sells off?

A: Absolutely! When you have that much leverage and you get these price spikes, you sell! The leverage on this position is 2X on the ETF and 10X on the options for a total of 20X! Well done, nice trade and nice profit, go out and buy yourself a new Tesla and wait for the next dip in tech, which may have already started, and which could power on for the rest of August.

Q: What’s the next move for REITs?

A: REITs came off of historic lows last year; a lot of people thought they were going to go bankrupt, and for companies like (SPG) it was a close-run thing. I would be inclined to take profits on REITs here. The next thing to happen is for interest rates to go up and REITs don’t do that great in a rising rate environment.

Q: When is the off-season in Incline Village?

A: It’s the Spring and the Fall, in between ski season and the summer season. That means there are four months a year here, May/June and September/October, where I’m the only one here and the parking lots are empty. There is no one on the trails, the weather is perfect, the leaves are changing colors, and the roads aren’t crowded, so that is the time to be here. It’s a mob scene in the winter and a worse mob scene in the summer!

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last ten years are there in all their glory.

Good Luck and Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

|