| Read in Browser | |||||||||||||||||||

| � | |||||||||||||||||||

| � | |||||||||||||||||||

| LISTEN TO TODAY'S PODCAST AVAILABLE AT 8AM ON:

| � | |||||||||||||||||||

| � | |||||||||||||||||||

| � |

| Read in Browser | |||||||||||||||||||

| � | |||||||||||||||||||

| � | |||||||||||||||||||

| LISTEN TO TODAY'S PODCAST AVAILABLE AT 8AM ON:

| � | |||||||||||||||||||

| � | |||||||||||||||||||

| � |

Boz, I've been offline for a few days....got moved into the new Florida house. What a pain in the ass! The drive on Friday from Arlington, VA to Richmond Hill, GA (Savannah area) took almost 12 hours (it rained the entire way, plus holiday traffic), I can usually get from DC to Jacksonville in less than 11 hours (Richmond Hill is about 2 hours north of Jax). I head back to DC, leaving the wife here to get the new house in order. I'm putting the Arlington house up for sale next Friday. We're getting the interior painted, cleaned, and staged. Also doing some mild landscaping outside (total of about $8k worth of work) - we're hoping to get at least $700k.

I haven't been paying much attention to the news or stocks. I'll get back to normal by mid next week. Hope the farm is coming along! We got a hotel the night of the 4th, since the new house is still a wreck w/ boxes everywhere. It was nice, right on the water in Tierra Verde.

| Good morning. (Was this newsletter forwarded to you? Sign up here.) |

|

| Beijing’s latest shots in the tech cold war |

| Tensions are growing between China and tech companies inside — and outside — its borders. |

| China is cracking down on domestic tech giants with U.S. ties. On Sunday, Beijing officials ordered Didi, the ride-hailing app, to be removed from the country’s app stores over concerns about the handling of customer data, days after the company completed a blockbuster U.S. I.P.O. Yesterday, they suspended new user registrations for platforms run by two other Chinese companies that recently listed shares in New York, citing the need for cybersecurity reviews. Didi’s shares fell nearly 30 percent in premarket trading, below their I.P.O. price. |

| Meanwhile, U.S. tech firms are making threats about their businesses in Hong Kong. Amazon, Apple, Facebook, Google and other American tech groups have threatened to pull out of the territory if the government doesn’t roll back efforts to control online speech there. The threat was made in a letter sent last month by an American trade group representing Big Tech in Asia. |

| A trans-Pacific tech breakup would be messy. Many large U.S. tech companies, notably Apple, have spent billions of dollars building their presences in China, both by moving manufacturing there and by courting local customers. An investigation by The Times showed the lengths Apple has gone to keep Chinese regulators happy, even breaking some of the privacy pledges the company has made to customers. |

|

| Further reading: A look at the $150 million semiconductor chip-making machine produced by a Dutch company that has become a key lever in the tech cold war between China and the U.S. |

| HERE’S WHAT’S HAPPENING |

| Oil prices rise as OPEC fails to reach a deal on production. Brent crude traded at multiyear highs after the alliance of oil producers was unable to agreeon how much more oil to produce. Behind the summit’s collapse was the United Arab Emirates, which refused to back quotas pushed by Saudi Arabia. |

| The search for victims of the Miami condo collapse resumes. Four more bodies were pulled from the ruins yesterday, bringing the death toll to 28, with more than 100 people still missing. What remained of the high-rise building was demolished on Sunday, and evidence suggests that despite Florida’s strict building regulations, local enforcement was lax. |

| England prepares to lift most pandemic restrictions. Prime Minister Boris Johnson said social distancing rules would likely expire on July 19, making masks optional in crowded public spaces and allowing venues like nightclubs to reopen at full capacity. Scientists criticized the move amid an outbreak of Covid-19 cases linked to the Delta variant. |

| Nextdoor, the neighborhood-focused social network, is going public. The company, which covers 275,000 neighborhoods in 11 countries, is merging with a SPAC to gain a Nasdaq stock listing. The move, which values Nextdoor at $4.3 billion, comes as the company has tried to clean up its reputation as a haven for racism and targeted online harassment. (Its expected ticker is “KIND.”) |

| Tech and media moguls are headed to Sun Valley. The high-powered Allen & Company gathering in Idaho is back this week after being canceled last year, with off-the-record discussions of topics like media takeovers. Expected attendees, according to The Wall Street Journal, include Warren Buffett, Bill Gates, the new Amazon C.E.O., Andy Jassy and — perhaps awkwardly — Discovery’s David Zaslav and his soon-to-be employee, WarnerMedia’s Jason Kilar. |

| A global ransomware assault |

| Hundreds of companies around the world are reeling after a software provider to small- and medium-sized businesses was hit by a major cyberattack. Russian cybercriminals are suspected of orchestrating what some experts are calling a “global supply chain hack.” |

| The damage is widespread. The Swedish grocery chain Coop had to close at least 800 stores on Saturday, while a pharmacy chain and 11 schools in New Zealand were also affected. Linking all of them was Kaseya, which makes systems management software that was in the middle of performing updates to guard against such an attack. Although Kaseya said that fewer than 40 customers had been affected, that group serviced hundreds of others, amplifying the effect. |

|

| The authorities suspect a well-known Russian group. REvil, which was accused of orchestrating an attack on the meat processor JBS in May, was identified as a likely culprit. While President Biden confronted Vladimir Putin last month over Moscow’s ties to cybercrime, Biden said over the weekend, “The initial thinking was it was not the Russian government, but we’re not sure yet.” |

| “This monitoring system is fundamentally weak, because it’s easy to cheat and doesn’t monitor very consistently.” |

| —Raj Rajkumar, a Carnegie Mellon professor, on how Tesla’s Autopilot system tracks drivers’ alertness. The National Highway Traffic Safety Administration has about two dozen active investigations into crashes involving Autopilot. The accidents “could call into question the development of similar systems used by rival carmakers,” The Times’s Neal Boudette writes. |

| Regulators beg to differ on E.S.G. |

| Investors are demanding more information from companies about environmental, social and governance, or E.S.G., issues. Regulators are taking notice but aren’t coming to the same conclusions on what to do about it. |

| “We are clearly at a tipping point,” said Michael Passoff, the head of Proxy Impact, a shareholder services firm. He told DealBook that in 25 years of working in sustainable investing, the enthusiasm among shareholders for E.S.G. resolutions this year was “unprecedented.” So far, 34 such proposals at public companies have gained a majority vote, surpassing last year’s record-setting total of 21. Half of the successful shareholder votes on such proposals in the past decade have occurred in the past two years. |

| “You cannot direct the wind, but you can adjust your sails,” said Allison Herren Lee, an S.E.C. commissioner, in remarks to the Society for Corporate Governance. Lee, who has made E.S.G. a focus of her recent work, urged corporate board members to recognize the movement’s momentum. “This proxy season is just the latest affirmation of a sea change on climate and E.S.G.,” she said, adding that the S.E.C.’s disclosure rules should “provide investors with adequate information to test public pledges” that companies make on these issues. |

| “What if the sustainability standards turn out to be flawed?” asked Hester Peirce, another S.E.C. commissioner, in a letter to an accounting standards-setting body, whose “gaze has drifted to sustainability reporting,” she said. “We must be careful not to compromise accounting standard-setting in an effort to achieve objectives other than high-quality financial reporting, no matter how noble those objectives may be.” She will detail what role she thinks the S.E.C. should play in E.S.G. at a Brookings Institution event this month. |

| In other news: As E.S.G. investing becomes more popular, it is increasingly difficult for these strategies to outperform the market, according to recent research. |

| Want to share The New York Times with your friends and family? Invite them to enjoy unlimited digital access to our journalism with this special offer. |

| THE SPEED READ |

| Deals |

|

| Politics and policy |

| Tech |

|

| Best of the rest |

| � |

|

| Global Market Comments July 7, 2021 Fiat Lux Featured Trade: (JUNE 30 BIWEEKLY STRATEGY WEBINAR Q&A), (QQQ), (BRKB), (GOOG), (NVDA), (FB), (TSLA), (JPM), (BAC), (C), (GS), (MS), (NASD), ((X), (FCX), (AMZN), (MSFT), (AAPL), (FCX)

|

| � |

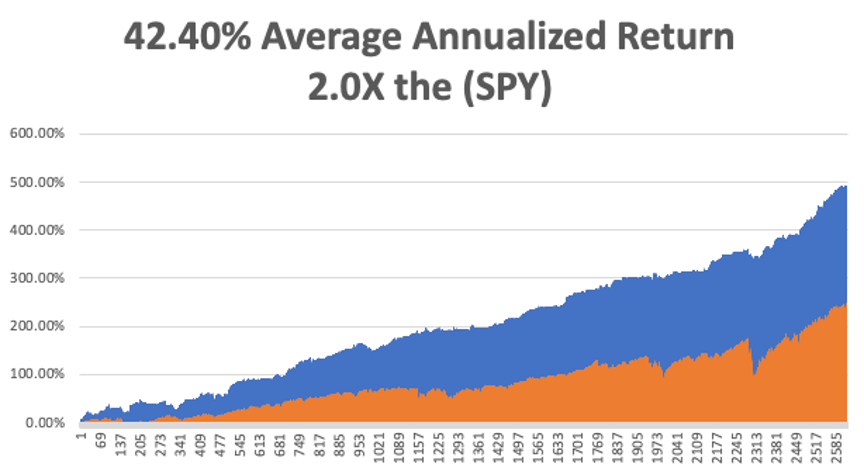

June 30 Biweekly Strategy Webinar Q&ABelow please find subscribers’ Q&A for the June 30 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Lake Tahoe, NV. Q: How long will the tech rally last (QQQ)? A: Short term we are overheated, but long term it’s still a buy. I think tech will lead for the next several years. Look for the next 10% correction, load the boat again with at-the-money LEAPS, and you’ll get almost as rich as I am, because I've been doing that for years. Q: What is driving tech? Why is it suffering when interest rates rise, and they have such big cash balances? A: I agree with you; that makes absolutely no sense for tech to fall when rates rise. Big tech actually makes more money when interest rates go up, because they’re all sitting on cash balances of up to $250 billion, as is the case with Apple (AAPL). The answer is that the modeling that stock analysts use is highly sensitive to interest rates and affects companies the most with the highest growth rates. That would be big tech which is averaging about 40% of growth right now. Industrials are less affected because they are slower growers, if at all. This is strictly a modeling question; I think long-term the market figures this out. And in fact, the recent price action has been immune to interest rate moves. Q: Are you worried about the Tesla (TSLA) recall? A: No. In fact, they did the recall like they do all the recalls; it happens overnight when you’re asleep. The software upgrade does it all and you end up with a new car in the morning with a lot more functionality. That just means you have to figure out how to use your new car about once a month. But that’s how they did it, and the fact is that Tesla is so much farther ahead in technology than all of their Chinese competitors, that Chinese electric companies will never grow outside of China, whereas Tesla takes over the world. Q: What LEAP would you buy on Tesla? A: I would buy the June 2023 $750/$800 vertical bull call spread for $18, and as long as Tesla shares are over $800 in two years, that will be worth $50 dollars giving you a return of 177% profit. If that’s not enough profit for you in two years, you are in the wrong business and should consider becoming a rock singer, drug dealer, or Bitcoin miner—one of these other really high return alleged professions. Q: What’s happening with mergers and acquisitions? As a stock driver do you expect it to speed up or slow down? A: Well I expect M&A to slow down because prices are so high. And notice that Warren Buffet has done virtually nothing in a year because in his world nothing really got cheap, even at last year’s lows. He’s been buying his own shares instead in (BRKB). But you still have backdoor M&A as I call it, and that’s share buybacks, which are returning with a vengeance. Last week, all the banks in financials were allowed to start their own buybacks for the first time in a year and four months, so that makes all of them buys. And I'm talking about JP Morgan (JPM), Bank of America (BAC), Citibank (C), Goldman Sachs (GS), and Morgan Stanley (MS) (where they’re also doubling dividends). Corporate buybacks I expect to top the previous record of $1.2 trillion, which we set right before the pandemic. Q: I have a number of tech mutual funds with heavy weighting in (AMZN), (FB), (MSFT), (GOOG), and (NVDA) for my basic portfolio which I bought on your advice. Should I be cute and sell for the waiting 10% pullback or maintain a buy and hold? A: The answer 99% of the time is just hold. We think tech goes up for ten more years. With mutual funds and ETFs you have no expiration dates like you do with options. And if you’re one of these guys that sits in front of a screen 24 hours a day with 30 years of experience, you can sell now and buy them back cheaper. But most people don’t have the training or discipline to pull that off. And the retail individuals who try this actually end up buying high and selling lower. I would say if you’re happy with your ETF tech funds, just keep them. Q: I don’t trade options spreads—how much am I killing my returns? I’m having trouble with options trading. A: Actually, over the long term, it’s the equity owners who make the most money. On an aggressive front month trading strategy in options, you’re only making 1% or 2% a month per position; whereas over time, the equities we’re picking are going up anywhere from 100% to 1,000% (295X for Tesla). I refer you to the Mad Hedge Hall of Fame list of ten baggers, of which we probably have over 30 now. The only people who would beat outright stock ownership are LEAPS players where you can regularly make 100% every 6 months if you have the right setup, the right timing, and so on. We’ve actually never lost money on LEAPS. Someone asked earlier whether I could tell you how to take profits on LEAPS, and the answer is no, you don’t have to do anything because they expire at max profit and you make a ton of money. So, LEAPS are the only area you’re missing out on. I recommend learning how to do LEAPS and I would be happy to teach you. Q: When do you update your long-term portfolio? A: Twice a year. I did it in January, so I guess I'm due for July. Q: Is it time to buy LEAPS on Skyworks? A: No, wait for a 10% correction. LEAPS are something you do at short term bottoms, not short-term tops; otherwise, it will cost you some money and you’ll miss the other 100% profit. Q: I’m looking at ESG stocks (environmental, social & governance). Are they legit? A: Yes, they attracted $2 trillion in asset allocations last year; however, a lot of them went ballistic discounting a Biden presidency, which happened, and they’re now up close to 400% year on year. I wouldn't chase them too much here, especially the ones that don’t have earnings yet. They became a mania at one point. So, I would wait for some decent pullback to get involved in any of the ESG plays. Q: When will you deploy your cash? A: I’m kind of waiting for my own market timing index to get back into the 20s, if we can get that; and we might sometime in July. But if we don’t, I’ll have to go back into the market in August, because then you’re front running very positive seasonals from October onwards, and August is usually our biggest month of the year. Q: Is Amazon a good spot to load up on some more LEAPS, or should we wait? A: The time to do this was when I sent out the LEAPS recommendation three weeks ago. Since then, we gave gained 25%. I would wait; don’t chase marginal trades ever, especially when you’re up 60% on the year—I would wait for a pullback, and I would run what you already own. Buy the pullbacks elsewhere, like in banks, financials, industrials, US steel (X), Freeport McMoRan (FCX), commodity plays, etc. Buy low, sell high; it’s a revolutionary new concept that I’ve invented. Q: Why is oil (USO) at $74? A: Global economic recovery. It’s a short-term move; eventually, we’re going back to zero in oil, but with the US growing at a 10% annual rate, the world's largest oil consumer, anything the US uses goes up. Any plays in oil will be short-term, and if you have things like NVIDIA going up 80% in two months, why the heck are you even looking in oil? Don’t make excuses to go into these really long-term downtrends—unless you work in the industry and I know a lot of you do. Q: What is the NASDAQ (NASD) year-end target? A: I’m looking at 18,000, or about 23% higher than here. That would give you a full-year return of about 39%. Q: I'm a subscriber to Global Trading Dispatch, but don’t get trade alerts for LEAPS. A: Well actually you do—three weeks ago I did send out a newsletter giving you 3 LEAPS in Amazon (AMZN), Microsoft (MSFT) and Apple (AAPL) and told you to buy all the LEAPS down there. Those are up anywhere from 10% to 30% since then. We do send those out occasionally to Global Trading Dispatch members just to show you what is doable. The way to get more constant LEAPS alerts is signing up for the Mad Hedge Concierge Service, which is by application only. Q: Are you bullish on Bitcoin even though the Chinese government is against it? A: Yes, but this is a pure technical play and I’m not really sure what I'm buying, so I'm only going to get in at my price which will be at $10,000 or $20,000. A big chunk of the mining industry literally moved over a weekend from China to the US or other unregulated domiciles like Kazakhstan. And how much confidence do you want to have on a monetary instrument based in Kazakhstan? Not much. Q: What are the economic conditions that would trigger the expected 10% pullback? A: There are none, because I expect the superheated growth in the economy to continue for two more years, and the only short-term pullbacks we’re getting are triggered by rises in interest rates. Interest rates will fluctuate, but just buy every dip and keep loading the boat on your equity longs and our favorite sectors and you will be glad that you heard of Mad Hedge Fund Trader. Q: Is it worth looking at electric grid stocks? A: Excellent question, and I promise to do more work on that. Yes, absolutely, because the grid has to triple in size in order to accommodate the move to a green economy and that means we have to build 200,000 miles of aluminum long-distance transmission lines. The copper going into a new car will jump from 20 pounds for the old internal combustion engines to 400 pounds. So that's why I say, Freeport McMoRan (FCX)—it’s not a question of if or when you get in; they are seeing a generational upgrade in demand for copper. Same is true for electric cars. To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com , go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last ten years are there in all their glory. Good Luck and Stay Healthy. John Thomas CEO & Publisher The Diary of a Mad Hedge Fund Trader

|

Quote of the Day“At the tail end of a momentum-driven melt-up, weird things start to happen,” said Chris Harvey, chief equity strategist at Wells Fargo.

|

| This is not a solicitation to buy or sell securities The Mad Hedge Fund Trader is not an Investment advisor For full disclosures click here at: http://www.madhedgefundtrader.com/disclosures The "Diary of a Mad Hedge Fund Trader"(TM) and the "Mad Hedge Fund Trader" (TM) are protected by the United States Patent and Trademark Office The "Diary of the Mad Hedge Fund Trader" (C) is protected by the United States Copyright Office |

| Good morning. (Was this newsletter forwarded to you? Sign up here.) |

|

| [h=2]Ireland against the world[/h] |

| Friday kicks off a two-day summit in Venice of ministers from the Group of 20 major economies. The main agenda item: negotiating a global minimum corporate income tax. The proposed rate is 15 percent. |

| A global minimum tax is a major threat to havens like Ireland, The Times’s Liz Alderman reports. Ireland levies a 12.5 percent corporate rate, among other breaks for multinational companies. Over 800 U.S. companies have put their European base in Ireland, which helps many avoid paying taxes in countries where they make profits. Ireland was among the holdouts, along with Barbados, Hungary and a smattering of others, to a sweeping framework agreement that recently set the stage for a global accord. |

| The momentum has been building: |

|

| Ireland stands to lose up to a quarter of its corporate tax haul, and at the G20 meeting it will push for terms that would allow it and other small countries to make up for the loss. Accounting and law firms, which are major beneficiaries of the global tax shifting game, are lobbying Ireland behind the scenes to hold its ground. |

| Even inside Ireland, the will to remain a tax haven may be fading: |

|

| A G20 deal would not mean the end of all tax havens. Ireland and others could still offer targeted tax cuts and income exemptions under the deal. Economists estimate that tax havens cost governments up to $600 billion a year; a global 15 percent minimum tax would bring in $150 billion. |

| And given Ireland’s long history as a base for multinationals — with a broad tech industry, extensive pharma research facilities and an English-speaking work force — it could raise its tax rate and collect more income without scaring away many companies. Havens where lower taxes are the only draw may find it harder to maintain their status. |

| [h=3]HERE’S WHAT’S HAPPENING[/h] |

| Bill Gates can remove Melinda French Gates from their foundation in two years. News that the $50 billion nonprofit had raised an additional $15 billion was overshadowed by the revelation that Mr. Gates could assume sole control if the divorcing couple can’t find a way to work together. Should Ms. French Gates resign, she would receive new money for her own philanthropy. |

| Dozens of states sue Google over its Android app store. Thirty-six states and the District of Columbia accused the tech giant of abusing its control over apps on phones with its operating system and imposing onerous terms on developers. The suit raises the possibility of similar action against Apple. |

| A persistent divide at the Fed over inflation. Minutes from the central bank’s top policymaking committee last month showed that while officials agreed that economic growth looked strong, they disagreed on whether the risk of overheating was “transitory.” Also worried about inflation is the I.M.F.; less concerned is the European Commission. |

| The Olympics may go ahead without fans. A spike in coronavirus cases in Tokyo led the government to declare a state of emergency, which could spell the end for organizers’ plans to allow domestic spectators to attend the events. |

| Donald Trump sues social media platforms, and raises money off it. The former president accused Facebook, Google and Twitter of “unconstitutional” censorship, an argument legal experts say has no merit. In a sign of what may be another reason for the move, a Trump political action committee immediately reached out to donors. |

| [h=2]Can Amazon block Lina Khan?[/h] |

| Last week, Amazon fired a pre-emptive shot at the new F.T.C. chair, Lina Khan, using a common line of attack on policymakers with an opinionated past: trying to disqualify them for alleged bias. |

| Khan made her name with a forceful view on Amazon and antitrust, arguing that the sprawling tech giant showed how competition law was “unequipped” for the digital age. This, among other things, disqualifies Khan from participating in F.T.C. actions against Amazon, the company said. Amazon is a subject of the F.T.C.’s inquiry into Big Tech’s acquisitions of smaller rivals, and the agency is separately reviewing its proposed purchase of MGM. |

| So, does Amazon have a chance? |

| Disqualifying a commissioner isn’t easy. At her Senate confirmation hearing, Khan rejected the idea of a blanket disqualification from Big Tech investigations, saying she would consider such requests on a case-by-case basis and consult with F.T.C. counsel. Simply voicing opinions critical of companies is rarely cause for recusal, and most disqualification attempts fail. |

|

| Amazon’s filing may be “a warning shot,” said Bruce Hoffman, a partner at Cleary Gottlieb and the former director of the F.T.C.’s competition bureau. Because it isn’t attached to a case and aims to recuse Khan broadly, it essentially serves as a notice to the agency. It could be Amazon’s way of saying, “if you participate, this could haunt you,” he said. |

| Commissioners are chosen for their policy views, as well as their expertise, so many would be disqualified if having opinions was disqualifying, said Khan’s former colleague at Columbia, the antitrust law scholar Eleanor Fox. Asked whether Amazon’s motion would succeed in blocking Khan, she replied: “Oh, I don’t think so.” |

| [h=2]“The crypto bros around the world have read the writing on the wall and realize Singapore Inc. is embracing the asset class.”[/h] |

| — The founder of a cryptocurrency start-up on why the island nation has become the industry’s new hub. |

| [h=2]The sidelining of Sheryl Sandberg[/h] |

| The partnership between Mark Zuckerberg and Sheryl Sandberg is one of the most storied in Silicon Valley. When the executives met in 2007, Sandberg was a vice president at Google with many qualities that the 23-year-old Zuckerberg lacked: polish, experience, and an interest in running aspects of a growing business that Zuckerberg found boring. |

| In Valley-speak, Sandberg was the “adult supervision” to Zuckerberg’s founder vision, and she quickly became the archetype for this role. “Every company we work with wants ‘a Sheryl,’” said Marc Andreessen, the venture capitalist who sits on Facebook’s board. |

| Now, more than a decade into Sandberg’s tenure as Facebook’s C.O.O., there are signs that her influence has waned, according to a forthcoming book, “An Ugly Truth: Inside Facebook’s Battle for Domination,” by Sheera Frenkel and Cecilia Kang, both reporters for The Times. |

| In an excerpt published today, Frenkel and Kang write that Zuckerberg and Sandberg’s working relationship weakened during the Trump presidency, a period in which the company faced controversies over its role in the spread of misinformation, Russian election interference, and the Capitol riots. Zuckerberg has elevated other key executives, while Sandberg’s influence in Washington, a key part of her role at Facebook, has faded. |

| Facebook is no longer led by a No. 1 and No. 2, but a No. 1 and many,insiders told the authors. |

| Sandberg was disappointed with the 2016 election result, and her Democratic connections were less useful with Republicans in the White House. Zuckerberg, meanwhile, formed a friendly relationship with President Trump and began representing Facebook in Washington. Zuckerberg also took the lead on important content decisions. In 2019, after he made a speech defending Facebook’s stance against policing political speech, including a policy to not moderate politicians’ speech or fact-check their political ads, Sandberg said there was little she could do to change his mind, according to sources close to her. |

| Facebook’s founder may be outsourcing less of the business to his adult supervision these days, but the public reckoning over the company’s role in society doesn’t seem to have strained its finances, even as it has strained this partnership. Last month, Facebook’s market capitalization rose above $1 trillion for the first time. |

| Want to share The New York Times with your friends and family? Invite them to enjoy unlimited digital access to our journalism with this special offer. |

| [h=3]THE SPEED READ[/h] |

| Deals |

|

| Policy |

|

| Best of the rest |

| Thanks for reading! We’ll see you tomorrow. |

| We’d like your feedback. Please email thoughts and suggestions to dealbook@nytimes.com. |

|

|

|

|

|

|

|

|

| Global Market Comments July 8, 2021 Fiat Lux Featured Trade: (TESTIMONIAL) (A BUY-WRITE PRIMER) (AAPL)

|

| � |

TestimonialJohn, I couldn’t be happier with your service, and the way you operate your business. I love it! And I recommend you to my relatives and my good friends when appropriate. I feel very grateful and blessed to have been introduced to your information and your person even though not in person. I’m in Tesla (TSLA), Advanced Micro Devices (AMD), NVIDIA (NVDA), Boeing Aircraft (BA), and Apple (AAPL). I paid $500,000 down for a million-dollar home in Anthem, CA with my profits and it is now worth $1.5 million. We have remodeled it into our dream home, and I have my own golf cart in the garage. I couldn’t feel more fortunate to have come across you. I read your Mad Hedge Hot Tips and diary every day and I feel you keep me in the know with how the market is moving. I took the opportunity when it came last year and went all-in under your guidance. It has changed my and my wife and five children’s lives for the better. Here is a pic of our Model Y and Tesla solar on our new 4,000’ Executive home. Peace and all the best, and best of luck with your daughters and Boy Scouts. Greg Anthem, CA

|

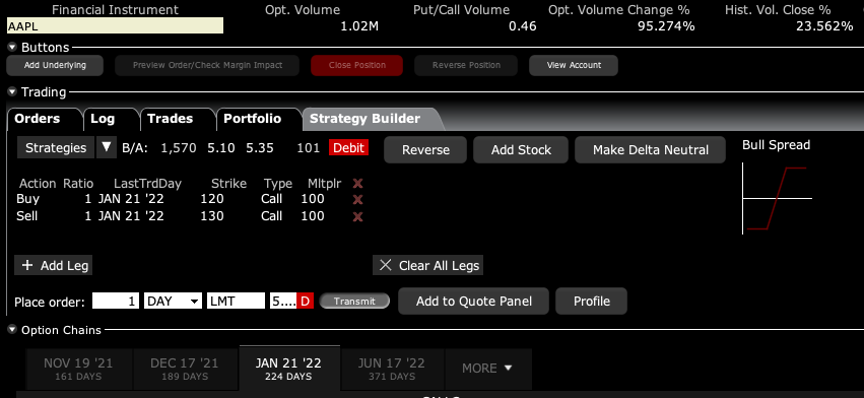

A Buy-Write PrimerAll good things must come to an end. From the March 2020 bottom, the Dow Average gained 67% by the end of the year. My forecast for end of 2021 is another 30%. 2022 may be a more subdued affair, with the Dow gaining a modest 15%. The average annualized return for the last ten years is 13.9%, including dividends. And that’s the way markets work. It’s like watching a bouncing ball, with each successive bounce shorter than the previous one. Thank Leonardo Fibonacci for this discovery (click here for details.) Which means a change in trading strategy is on order. The free lunch is over. It’s finally time to start working for your money. When you’re trading off a decade low, its pedal to the metal, full firewall forward, full speed ahead, damn the torpedoes. Your positions are so aggressive and leveraged that you can’t sleep at night. Some 16 months into the bull market, not so much. It’s time to adjust your trades for a new type of market that continues to appreciate, but at a slower rate and not as much. Enter the Buy-Write. A buy-write is combination of positions where you buy a stock and also sell short options on the same stock against the shares at a higher price, usually on a one-to-one basis. “Writing” is another term for selling short in the options world because you are in effect entering into a binding contract. When you sell short an option, you are paid the premium the buyer pays and the cash sits in your brokerage account accruing interest. If the stock rallies, remains the same price, or rises just short of the strike price you sold short, you get to keep the entire premium. Most buy-writes take place in front month options and the strike prices are 5% or 10% above the current share price. I’ll give you an example. Let’s say you own 100 shares of Apple (AAPL) at $140. You can sell short one August 2021 $150 call for $1.47. You will receive the premium of $147.00 ($1.47 X 100 shares per option). Remember, one option contract is exercisable into 100 shares. As long as Apple shares close under $150 at the August 20 option expiration, you get to keep the entire premium. If Apple closes over $150, you automatically become short 100 Apple shares. Then you simply instruct your broker to cover your short in the shares with the 100 Apple shares you already have in your account. Buy-writes accomplish several things. They reduce your risk, pare back the volatility of your portfolio, and bring in extra income. Do these right and it will enhance the overall performance of your portfolio. Knowing when to strap these babies on is key. If the market is going straight up, you don’t want to touch buy-writes with a ten-foot pole as your stock will be called away and you will miss substantial upside. It’s preferable to skip dividend paying months, usually March, June, September, and December to avoid your short option getting called away mid-month by a hedge fund trying to get the dividend on the cheap. You don’t want to engage in buy-writes in bear markets. What ever you take in with option premium, it will be more than offset by losses on your long stock position. You’re better off just dumping the stock instead. Now comes the fun part. As usual, the are many ways to skin a cat. Let’s say that you are a cautious sort. Instead of selling short the $150 strike, you can sell the $155 strike for less money. That would bring in $79 per option. But your risk of a call-away drops too. You can also go much further out in your expiration date to bring in more money. If you go out to the January 18, 2022 expiration, you will take in a hefty $6.67 in option premium, or $667 per option. However, the likelihood of Apple rising above $150 and triggering a call-away by then is far greater. Let’s say you are a particularly aggressive trader. You can double your buy-write income by doubling your option short sales at the ration of 2:1. However, if Apple closes above $150 by expiration day, you will be naked short 100 shares of Apple. It is likely you won’t have enough cash in your account to meet the margin call for selling short 100 shares of Apple so you will have to buy the shares in the market immediately. It's something better left to professionals. How about if you are a hedge fund trader, have a 24-hour trading desk, a good in-house research department, and serious risk control? Then you can entertain “at-the-money buy writes.” In the case of Apple, you could buy shares and sell short the August 20 $140 calls against them for $4.45 and potentially take in $4.45 for each 100 Apple shares you own. Then you make a decent profit if Apple remains unchanged or goes up less than $4.45. That amounts to a $3.18% return in 34 trading days and annualizes out at 26%. In bull markets, hedge funds execute these all day long, but they have the infrastructure to manage the position. It’s better than a poke in the eye with a sharp stick. There are other ways to set up buy-writes. Instead of buying stock, you can establish your long position with another call option. These are called “vertical bull call debit spreads” and are a regular feature of the Mad Hedge Trade Alert Service. “The “vertical” refers to strike prices lined up above each other. The “debit” means you have to pay cash for the position instead of getting paid for it. How about if you are a cheapskate and want to get into a position for free? Buy one call option and sell short two call options against it for no cost. The downside is that you go naked short if the strike rises above the short strike price, again triggering a margin call. Here is my favorite, which I regularly execute in my own personal trading account. Buy long-term LEAPS (Long Term Equity Anticipation Securities) spreads like I recommended three weeks ago with the (AAPL) January 21 $120-$130 vertical bull call spread for $5.20. On Friday, it closed at $7.21, up 38.65%. This is a bet that one of the world’s fastest growing companies will see its share unchanged or higher in seven months. In Q1, Apple’s earnings grew at an astonishing 35% to $23.6 billion. Sounds like a total no-brainer, right? If I run this position all the way to expiration, and I probably will, the total return will be ($10.00 - $5.20 = $4.80), or ($4.80/$5.20 = 92.31%) by the January 21, 2022 option expiration. This particular expiration benefits from the year-end window dressing surge, and the New Year asset allocation into equities.

Keep in mind that the deltas on LEAPS are very low, usually around 10% because they are so long-dated. That means your front month short should only be 10% of the number of shares owned through your LEAPS in order to set delta neutral. Otherwise, you might get hit with a margin call you can’t meet. After doing this for 53 years, it is my experience that this is the best risk/reward options positions available in the market. To make more than 92.31% in seven months, you have to take insane amounts of risk, or engage in another profession, like becoming a rock star, drug dealer, or Bitcoin miner. I’m sure you’d rather stick to options trading, so good luck with LEAPS.

|

Quote of the Day"It is fine to have the longest view in the room, as long as the thing at the end of the vista is a gigantic hill of money," said John Lanchester of The New Yorker magazine.

|

| This is not a solicitation to buy or sell securities The Mad Hedge Fund Trader is not an Investment advisor For full disclosures click here at: http://www.madhedgefundtrader.com/disclosures The "Diary of a Mad Hedge Fund Trader"(TM) and the "Mad Hedge Fund Trader" (TM) are protected by the United States Patent and Trademark Office The "Diary of the Mad Hedge Fund Trader" (C) is protected by the United States Copyright Office Futures trading involves a high degree of risk and may not be suitable for everyone.[FONT="][/FONT] |

| Read in Browser | ||||||||||||||||||

| ||||||||||||||||||

| ||||||||||||||||||

| LISTEN TO TODAY'S PODCAST AVAILABLE AT 8AM ON:

| ||||||||||||||||||

|

| Good morning. (Was this newsletter forwarded to you? Sign up here.) |

|

| Branson and Bezos launch a space race for insurers, too |

| Richard Branson is scheduled to fly into suborbital space this Sunday, nine days ahead of a similar journey by a fellow billionaire, Jeff Bezos. These first flights for the space moguls will also launch without liability insurance. |

| Brokers say that neither Virgin Galactic nor Branson appears to have purchased coverage should the British business mogul be hurt, or worse. (The craft is likely covered.) The same goes for Bezos and his company Blue Origin. Virgin, Branson and Blue Origin declined or did not respond to requests for comment. |

| Liability coverage is required on international flights. But Virgin’s craft, the V.S.S. Unity, launches and lands in the same place. As such, Branson’s flight, despite rocketing 2,400 miles an hour to the edge of space, is technically considered domestic travel. Virgin has said passengers will eventually be required to sign a contract agreeing to be fully liable for their own safety, but American law makes it nearly impossible to transfer all liability in the case of personal injury or loss of life. |

| Insurance providers say it’s very likely that regulators will soon require liability policies. There aren’t currently a lot of options for casual space travelers, but some insurers are interested in developing such policies. The Swiss insurance giant Allianz first began designing space tourism policies in 2012, though there is no evidence one has been sold. (Allianz did not return a request for comment.) And while space tourism is new, insurance experts say there is now more than enough data on rocket launches to know how to price these policies. |

|

| Space tourism could create a much larger demand for coverage. “The big question for the insurance industry is whether this is more like aviation insurance or more like current space policies,” said Neil Stevens, a senior vice president of space products at the insurance broker Marsh. “There hasn’t been a situation where insurance markets haven’t stepped up.” |

| But for now, space travel is launching without an insurance net for passengers. Developing those policies is one more small step that is likely needed before space travel can leap into a fully functioning tourism market. |

| HERE’S WHAT’S HAPPENING |

| Markets tumble amid investor fears about the economic recovery. The S&P 500 fell as much as 1.6 percent and the yield on 10-year Treasury bonds dropped after weekly unemployment claims came in higher than expected. Supporters of the Biden administration’s economic plan argued that was a reason to keep pandemic-era government support in place. |

| Pfizer pushes for Covid-19 booster shots. The company said that it planned to ask the F.D.A. for emergency approval for a third dose of its vaccine, and that it was working on a shot that offered more protection against the Delta variant. Shortly after Pfizer’s announcement, however, the F.D.A. and the C.D.C. said fully vaccinated people generally did not need boosters — yet. |

| The fallout from China’s tech crackdown grows. As Beijing tightens its scrutiny of Chinese tech giants with overseas stock listings — including appointing a powerful new overseer for the effort — an index of U.S.-listed Chinese stocks plunged. And the Chinese medical data company LinkDoc has reportedly halted its plans to go public on the Nasdaq. |

| The F.D.A. restricts access to a pricey new Alzheimer’s drug. The agency will limit the use of Aduhelm to patients with early-stage symptoms of the disease, drastically narrowing who can receive the $56,000-per-year treatment. The move will save Medicare billions and came after the F.D.A. was criticized for initially approving Aduhelm for all Alzheimer’s patients. |

| Toyota halts donations to Republicans who objected to President Biden’s win. The move came after criticism, most recently from an ad campaign by the Lincoln Project. While Toyota had previously defended those donations, it said yesterday that its support of the election objectors had “troubled some stakeholders.” |

| Biden takes on competition in … everything |

| President Biden will sign a wide-ranging executive order today targeting the power of big companies. It’s the latest move to promote competition that, his administration argues, is hampered by corporate giants and dealmaking. The order itself will not create immediate change — that will largely be left to the regulators — but it sets activity in motion across a host of industries. |

| The order takes aim at Big Tech: |

|

| It also targets monopoly risks in other areas: |

|

| The trustbusters have their marching orders. Biden’s executive order leans heavily on the F.T.C. and the Justice Department to “vigorously” enforce antitrust laws. But the top antitrust enforcement spot at the Justice Department remains vacant, reportedly because of opposition to the proposed contenders. Still, the division isn’t exactly inactive: It just sued to block the merger of the insurance giants Aon and Willis Towers Watson. And Lina Khan, a Big Tech foe, was just made chair of the F.T.C., where she is already expanding the commission’s competition oversight. The F.T.C. is also challenging the vertical merger of the biotech companies Illumina and Grail, which antitrust lawyers see as yet another sign that dealmakers will face difficulties in the years ahead. |

| “The harms to consumers as a result of this under-regulated market are real and continue to proliferate in the absence of effective S.E.C. regulations.” |

| —Senator Elizabeth Warren, arguing for stricter oversight of cryptocurrency exchanges in a letter to the S.E.C. chair, Gary Gensler. |

|

| A showdown with Martin Shkreli |

| Despite having been behind bars for years, Martin Shkreli — of price-hiking “Pharma Bro” infamy — is still exerting influence at the drugmaker he once ran, now known as Phoenixus. But a group of investors, including a former ally, is seeking to wrest control, DealBook’s Michael de la Merced reports in The Times. |

| Shkreli is still making his voice heard. He was reprimanded after the revelation that he had used a contraband cellphone while in prison to conduct business. But even now, while incarcerated in a Pennsylvania prison, he continues to reach out by making collect calls, and federal authorities accuse him of using associates to relay his wishes. |

| Shareholders will vote Monday on whether to oust the board. A group of activist investors, including Kevin Mulleady, a former Shkreli ally, is urging shareholders to cut the company’s ties to Shkreli. |

|

| The company’s board disputes the allegations. In a letter to investors, the current directors said that Shkreli’s only influence was in his 44 percent stake in the company, and that he had no other say in how the drugmaker was run. They took aim in particular at Mulleady, who previously served on Phoenixus’s board and as C.E.O. until being ousted in December (at Shkreli’s urging). Mulleady is a co-defendant with Shkreli in several lawsuits, including an antitrust case filed by the F.T.C. and New York State. |

|

| Shkreli’s days at Phoenixus may be numbered, regardless. The judge overseeing a creditor’s lawsuit against Shkreli last week granted a request to appoint a receiver to take his shares, with the aim of selling them to pay off debts. So even if the activist group loses Monday’s vote, Shkreli may lose his influence at the company all the same, Mulleady said: “Martin’s kind of high and dry here.” |

| Want to share The New York Times with your friends and family? Invite them to enjoy unlimited digital access to our journalism with this special offer. |

| THE SPEED READ |

| Deals |

|

| Policy |

| Best of the rest |

|

| Thanks for reading! We’ll see you tomorrow. |

| We’d like your feedback! Please email thoughts and suggestions to dealbook@nytimes.com. |

Read in Browser

Read in Browser

LISTEN TO TODAY'S PODCAST AVAILABLE AT 8AM ON:

LISTEN TO TODAY'S PODCAST AVAILABLE AT 8AM ON:

|

|

| Global Market Comments July 9, 2021 Fiat Lux Featured Trade: (SOME BASIC TRICKS FOR TRADING OPTIONS)

|

| � |

Some Basic Tricks for Trading OptionsI have spent the past 14 years teaching investors how to trade options. This is more important than ever, now that the hedging of options accounts for more than 50% of all stock market daily volume. See yesterday’s research piece was about Buy-Writes. Those who get it make millions, and this year, in particular, seems to have produced a bumper crop of new fortunes. It’s really not all that hard, as I know many who are complete dummies on all other matters but earn a decent living trading options. All they need is to follow a few valuable rules that have stood the test of time. I could add to this list as I possess additional skills and experience that other options traders lack, but the ten tips below are a great start. After practicing for 53 years, it starts to get easy. Needless to say, following the Mad Hedge Fund Trader is crucial in best obtaining the correct timing in implementing these rules. 1) Have an investment thesis. Know why you are doing what you are about to do. Focus on events like earnings reports or product launches and try to figure out how the underlying stock might react. Aim not where the puck is, but where it is about to go. 2) Use your research on the stock to decide whether you will buy or sell a call or put option. Don’t delude yourself into thinking you have an educated view of options contracts until you have traded for a while and understand how the stock and options markets work with each other. 3) Focus on options that expire in three months or less. The sweet spot for many investors is about 30 to 45 days, which is enough time to benefit from accelerated time decay (more on that later) and for your stock thesis to work itself out without paying top dollar. 4) Before you buy or sell options, divide the contract’s implied volatility by 16. This will tell you what the options market thinks the stock will do each day through expiration. If the call has an 80% volatility, the call is priced as if the stock will move 5% each day until expiration. If you think the stock will move more, buy the contract, If, you think it will move less, sell the contract. The Rule of 16 is a powerful tool. 5) Good trading is about understanding events and how they are packed into your expiration. Understand everything that could happen to move the stock during your chosen expiration cycle, such as earnings reports, and anything that could move the entire market, like Federal Reserve meetings, elections, and economic reports. 6) Options contracts lose a little value each day. Time decay, or “theta,” is a powerful force that can be monetized by options sales. It’s also the reason that many investors try to trade options that expire in under a month. No one wants to pay a time premium, which you can think of as the inventory carrying cost for owning options. Get time decay right and it’s like having a rich uncle write you a check every day. 7) If you are thematically confident on a stock but unsure on the timeline, many institutions buy options that expire in a year or more to rent exposure to the stock, otherwise known as LEAPS (Long-Term Equity Anticipation Securities). If the stock goes up, the call goes up. If the trade fails, options always cost less than the associated stock, which means that options, when well used, help investors limit risk and enhance returns. 8) Don’t be a pig. If you make 50% or more on your initial trades, take profits. If you make 100% or more, definitely take profits. If you are so convinced that the market is wrong and you are right, take out your initial invested capital so you are playing with house money. 9) Be afraid of excess leverage. One options contracts represent 100 shares of stock. Don’t trade 10 contracts if you cannot afford to cover 1,000 shares of stock. All beginners should trade one contract at a time until they develop some mastery of basic trading rules. Never trade “naked” contracts that aren’t covered by cash or stock. 10) Simplicity is everything. Avoid strategies with many moving parts. Many seasoned options traders focus on hitting singles and doubles, creating significant income for themselves. Master buying a call and put and selling a call and put, and then consider spread strategies. Complicated strategies like iron condors and butterflies sound great, but usually make more money for the brokers than you. When in doubt, remember: Bad investors think of ways to make money. Good investors think of ways to not lose money. The goal is to pay for your own yacht, not your broker’s.

|

Quote of the Day[FONT=Arial, Helvetica, sans-serif]“It’s not always the troops that storm the beaches who are the right ones to set up the government,” said Steve Vassallo from Foundation Capital about the resignation of founder Travis Kalanick from Uber.[/FONT] [FONT=Arial, Helvetica, sans-serif][/FONT][FONT=Arial, Helvetica, sans-serif]

|

| Read in Browser | ||||||||||||||||||

| � | ||||||||||||||||||

| � | ||||||||||||||||||

| LISTEN TO TODAY'S PODCAST AVAILABLE AT 8AM ON:

| � | ||||||||||||||||||

| � |

| Good morning. In today’s newsletter, we look at President Biden’s plan to make community college free — and what happened when Tennessee introduced similar programs. |

| (Was this newsletter forwarded to you? Sign up here.) |

|

| [h=2]Does free college work?[/h] |

| By Jenny Gross Reporter, Express |

| President Biden’s plan to make community colleges free for all students comes at a critical time: The pandemic led to a steep decline in college enrollment, particularly for low-income and minority students. And businesses have struggled to fill vacancies, as the economy adds jobs at a rapid rate. |

| Proponents of the proposal, which would cost $109 billion over 10 years and is part of Mr. Biden’s American Families Plan, argue that community colleges can help solve both of these problems while also boosting local economies. In addition to paying for tuition, the plan would allocate resources for community colleges to build programs that addressed skills shortages. And a number of economic studies have suggested that increasing the percentage of college graduates benefits everyone, not just the students who received grants to go to college. |

| “There is a spillover effect,” said Timothy Bartik, a senior economist at the W.E. Upjohn Institute for Employment Research, who has studied programs that subsidize education and job skills. “The fact that your neighbor’s kids get an education makes the local economy more productive.” |

| Still, most Americans have doubts about the effectiveness of community colleges, with only 12 percent believing community college degrees prepare people “very well” for the work force, according to a 2019 Pew Research Center survey. Mr. Biden’s plan, which if passed would be funded through tax increases on the wealthy, faces resistance from Republican politicians who say community colleges consistently underperform, with only about a third of students graduating. |

| The debate is muddled by insufficient data. Few detailed studies have looked at how community colleges affect students’ earnings in the long term, and while 15 states have programs that offer tuition-free community college to anyone, regardless of high school grades or income, most of these programs are too new to have shown meaningful results. |

| One exception is Tennessee, a Republican-run state, whose statewide program was inspired by a county-level program started in 2008. Looking closely at Tennessee’s program, which goes further in offering tuition-free community college than programs in almost any other state, suggests both what free community college can accomplish — and some factors that may be important for doing so. |

| [h=2]Bringing a better work force to Knoxville[/h] |

| In 2008, small businesses in Knox County, in eastern Tennessee, could not find enough skilled workers — particularly nurses, computer technicians, welders and pipe fitters. In response, the county started a program, funded by local businesses and leaders, that offered tuition-free community college to all high school graduates. The program’s founders framed it as a way to create a sustainable work force. |

| “Yes, we believe that all students have the potential to earn a college credential, but it was about bringing a world-class work force to Knoxville and Knox County so that we could attract business and industry to the area,” said Krissy DeAlejandro, an executive director and one of the founders of the program. |

| More than a decade later, the results are encouraging. |

|

|

| In 2014, Tennessee started a statewide program offering tuition-free community college or technical school. (The program is funded by the state, and private donors fund a nonprofit organization offering student-success initiatives, including mentorship.) In the years since, a significantly higher percentage of high school graduates have enrolled in college within a year, and more have earned degrees or work force certificates, according to the Lumina Foundation, an independent, private foundation in Indianapolis focused on the accessibility of higher education. |

| [h=2]What Tennessee got right[/h] |

| Celeste Carruthers, a professor at the University of Tennessee’s Haslam College of Business who has extensively researched the state’s tuition-free programs, said Tennessee had done several things right. The first was keeping the program simple. |

| “The crystal-clear message that college is free if you follow these steps and go to these places cuts through a lot of the clutter and opaqueness,” Dr. Carruthers said. Need-based and merit-based programs in other states, she said, had less success attracting low-income students, some of whom have struggled to navigate the complicated college financial aid process. |

| Another aspect of Tennessee’s success was its focus on mentorship for students. One point that conversations about low graduation rates often overlook is that community colleges take all students, regardless of grades and test scores, said Juan Salgado, the chancellor of Chicago’s community college system. Many are first-generation college students, and some are struggling with homelessness, hunger or other family problems. |

| That may mean students need more help meeting deadlines, completing coursework and finding jobs. Studies of a program that City University of New York developed to provide mentorship and other support services for students showed impressive increases in graduation rates for low-income students when three community colleges in Ohio replicated it, but results were less encouraging in Detroit. |

| “Evidence shows that with the right support, financial included, our students can do extremely well despite their circumstances,” Mr. Salgado said. |

| He said mentorship and apprenticeship programs, like ones that Chicago community colleges have with Aon, one of the world’s largest insurance brokerages, enabled students to begin building a professional network for guidance on interviews, career goals and even office attire. A first-generation college student himself, Mr. Salgado said he remembered not having anyone to go to for advice about what to wear to work. He said he had felt humiliated on his first day on the job when he realized his outfit stood out. |

| “It hurt me, from a self-esteem standpoint,” he said. “I didn’t have exposure to a network of professionals.” |

| Ms. DeAlejandro, too, knew from her own experience as a first-generation college student that free tuition alone was not enough for programs to succeed. The Knox Country program recruited volunteer mentors from local businesses to help students through their senior year of high school and the first semester of college. |

| “That’s the magic of what we do,” Ms. DeAlejandro said. “All the different pieces make a student feel seen.” |

| Johari Hamilton, who graduated last month from Southwest Tennessee Community College in Memphis in the top of her class, said the tutoring, mental health counseling and encouragement had helped her stay focused and engaged. |

| “It was absolutely necessary for me to achieve that level of success,” said Ms. Hamilton, 48, a single parent who raised three children and went back to school after struggling to find a job. In the fall, she plans to transfer to Middle Tennessee State University to pursue a bachelor’s degree in public relations. |

| [h=2]Lessons for the Biden plan[/h] |

| Carmel Martin, an adviser to Mr. Biden who helped design the national proposal, said Tennessee’s program was among those that White House officials studied. |

| “Some good studies show positive outcomes from Tennessee,” Ms. Martin said. “There’s various components that were very smart.” |

| Like the Tennessee program, the Biden plan includes a mentorship program, opportunities for people who want work force credentials but not a four-year degree, and investment in programs tailored to the skills that local employers need. For example, if aviation engineering skills are in high demand, funds could go for equipment or labs to offer certificates in that space. |

| But while increasing access to community college is appealing to lawmakers in both parties, there are disagreements on how to go about it. Representative Tim Burchett, a Tennessee Republican, said the federal government should not funnel billions of dollars of taxpayer money into schools without a track record. |

| “Every dollar you give to a university ought to have a string attached to it,” he said, adding that too many schools are educating students in areas where no jobs are available. |

| There is a political risk that some of the aspects that made the Tennessee program a success may not get congressional approval — and that’s if the community college provision of the plan is approved at all. |

| Dr. Miller-Adams, author of “The Path to Free College: In Pursuit of Access, Equity, and Prosperity,” said the lack of research was all the more remarkable given the huge numbers of students enrolled in community colleges. An analysis by Columbia University’s Teachers College showed that 44 percent of undergraduates, mostly from low-income families and minority groups, attended public two-year colleges. |

| “There are huge amounts of money being committed without really strong evidence,” Dr. Miller-Adams said. |

| Bruce Sacerdote, an economics professor at Dartmouth College, said that while the Biden program would undoubtedly raise the number of college graduates, more needed to be done to combat wealth inequality. “This thing is not a silver bullet,” he said. |

| WEEKEND READING Stories from the Sunday business section |

| Want to share The New York Times with your friends and family? Invite them to enjoy unlimited digital access to our journalism with this special offer. |

| What do you think? Would free community college boost the economy? Is there a better way to promote education or build skills? Let us know: dealbook@nytimes.com. |

|

|

|

|

|

|

| Andrew Ross Sorkin, Founder/Editor-at-Large, New York @andrewrsorkin |

| Jason Karaian, Editor, London @jkaraian |

| Sarah Kessler, Deputy Editor, Chicago @sarahfkessler |

| Michael J. de la Merced, Reporter, London @m_delamerced |

| Lauren Hirsch, Reporter, New York @LaurenSHirsch |

| Ephrat Livni, Reporter, Washington D.C. @el72champs |

| Read in Browser | ||||||||||||||||||||

| � | ||||||||||||||||||||

| � | ||||||||||||||||||||

| LISTEN TO TODAY'S PODCAST AVAILABLE AT 8AM ON:

| � | ||||||||||||||||||||

| � |

| Good morning. (Was this newsletter forwarded to you? Sign up here.) |

|

| Optimism blooms in earnings season |

| After closing the books on the second quarter, executives are the most positive they have ever been about the profits their companies are generating, according to data from FactSet. And that might be a good sign that bottom-line growth will continue even after the expected rebound from the pandemic economic plunge. |

| Companies begin reporting their second quarter profits this week. Things really kick off tomorrow, when Goldman Sachs, JPMorgan Chase and PepsiCo publish their earnings before the market opens. The big banks, in particular, are likely to reveal bumper profits, The Times’s Lananh Nguyen reports. |

| Profits are soaring, for now. Analysts predict that earnings for companies in the S&P 500 rose more than 60 percent in the second quarter compared with last year. That would be the strongest growth in more than 10 years, but it’s less impressive than it sounds. Almost all of the growth is a result of the reopening of the economy as well as the fact that the same period a year ago was the depth of pandemic lockdowns. |

|

|

| Will earnings continue to rise after the initial reopening? Some soft economic data recently spooked the market, and analysts expect corporate profits to moderate in the coming quarters. Still, the jump in S&P 500 earnings for the full year is expected to rival the strongest in recent history. And business leaders seem confident that their companies are coming out of the pandemic in much better shape than expected (although they tend to be a glass-half-full bunch). |

|

| HERE’S WHAT’S HAPPENING |

| The G20 signs on to a global tax overhaul. Finance ministers from the group backed efforts to create a global minimum tax rate of 15 percent and impose new levies on multinationals. But there’s a long road ahead, as lawmakers in the U.S. and elsewhere debate the specifics. |

| Worldwide concern grows about coronavirus variants. New strains like Delta, which are continuing to spread quickly, could threaten the global economic recovery, G20 officials said. In positive news, researchers are increasingly encouraged by breath tests that can detect Covid-19. |

| China’s I.P.O. crackdown freezes the plans of TikTok’s parent company.ByteDance reportedly halted efforts to list its shares abroad earlier this year as Beijing officials tightened their focus on cybersecurity, The Wall Street Journal reports. (Didi went ahead with a U.S. listing, then quickly landed in hot water.) Over the weekend, the Chinese government proposed new data requirementsfor companies looking to list shares overseas. |

| Texas Republicans advance new voting restrictions. Lawmakers moved forward with an overhaul of the state’s voting laws at a special legislative session. Democrats, who have criticized the proposals as efforts to disenfranchise minority voters, are preparing to fight but have limited options; all eyes are on Texas-based companies to see if they will make statements about the measures. |

| Goldman Sachs wrestles with whether to raise pay for junior bankers.Executives at the Wall Street giant are debating the wisdom of increasing compensation to address complaints about burnout, The Financial Times reports, even as rivals have raised salaries. The argument against: It would set a “dangerous precedent” and erode the idea of paying for performance. |

| Larry Fink’s new idea for fighting climate change |

| After years of cajoling corporations to do more to fight climate change, Larry Fink has new targets in his quest to make the economy more sustainable. The BlackRock chief, who spoke on Sunday at the G20 summit, said the World Bank and the International Monetary Fund needed to “rethink their roles.” |

|

| The World Bank and I.M.F. should act more like Fannie Mae and Freddie Mac, Fink said, and less like traditional lenders. Guarantees by the institutions could lead to huge additional investments in green technologies in emerging markets. For example, the U.S. government guarantee of mortgage insurers led to a $11 trillion market for home loans. |

| It’s a very big idea. Critics will say that the primary beneficiaries of the proposal would be large investors like BlackRock that would shield themselves from losses. (For the idea to fly, investors would also have to share some of their investment gains with the institutions.) Fink sometimes gets called out as being too incremental in his approach, but what he suggested would fundamentally change the function of the World Bank and the I.M.F., as well as reshape the role of governments in combating climate change. |

| Companies can’t do this alone. Fink has long pushed for the corporate sector to take the lead on climate initiatives, doing more than most to put the environment on boardroom agendas. Now that he is criticizing governments and other official institutions as not pulling their weight when it comes to climate change, saying that even the world’s largest multinationals and investment firms can’t tackle this on their own, it warrants watching. |

|

| The dawning of space tourism |

| The race is on for companies to take paying customers to the stars, now that Richard Branson can call himself an astronaut. |

| “The whole thing was magical,” Branson said after his flight to the edge of space yesterday aboard a Virgin Galactic rocket plane. On hand to cheer him on at the New Mexico spaceport was fellow space-minded billionaire Elon Musk. Blue Origin’s Jeff Bezos, who is set to ride in his own company’s rocket next week, had wished Branson “a successful and safe flight.” (Blue Origin also cheekily noted that its passengers, unlike Virgin Galactic’s, would fly above the internationally accepted boundary of space.) |

| The business of leisure spaceflight is still a ways off. While Virgin Galactic’s craft demonstrated its safety, more tests are needed before the company formally opens for business — at a cost of $250,000 per ticket. It’s not clear when Blue Origin will take on paying customers, beyond the person who bid $28 million to fly with Bezos on July 20. |

| “Mr. Bezos is worth $200 billion and now he wants to get a spaceship. That’s very nice. That’s what this legislation is about, Maureen.” |

| — Senator Bernie Sanders, in an interview with the Times Opinion columnist Maureen Dowd about his priorities for addressing inequality. “You have the richest guys in the world who are not particularly worried about earth anymore,” he added. |

|

| A new type of bond could revive ailing medical science |

| Scientists translating basic research into treatments for disease increasingly have to think like venture capitalists, or risk their ideas languishing in what’s called the “valley of death.” They may soon have a new way to finance the journey from initial discoveries to clinical trials with BioBonds, DealBook’s Ephrat Livni reports for The Times. |

| BioBonds would create low-interest, government-backed loans for “translational” research. These would be packaged into a bond and sold on the secondary market for risk-averse institutional investors like pension funds. In May, Representatives Bobby Rush, Democrat of Illinois, and Brian Fitzpatrick, Republican of Pennsylvania, introduced legislation that would create $30 billion worth of these loans over three years, helping to fund F.D.A.-approved clinical trials. |

| The pandemic dug the research funding hole “a whole lot deeper,” said Karen Petrou, a co-founder and managing partner of Federal Financial Analytics, a consulting firm in Washington that devised BioBonds. Last year, clinical trials were halted, resources were diverted from labs, attention was focused on immediate needs and a lot of funding dried up. But without the initial efforts of academic labs, it would have been impossible for pharmaceutical companies to fast-track Covid vaccine development. |

| “We needed an American model,” Petrou said. Many countries support private-sector funding for biomedical research, and each does it differently. Petrou, who suffers from retinal degeneration and became blind in her 40s, discovered the funding struggles for researchers in 2013 while trying to raise money for studies on her condition. Potential investors said such projects were too speculative. She refused to accept that as a final answer. |

| Green bonds are the inspiration, having created a $750 billion private market in sustainability projects via publicly backed loans. BioBonds offer a “lifeline” for medical research, said Dr. Attila Seyhan, the director of translational oncology operations at Brown University and a former Pfizer scientist. While the loans must be repaid, he believes that university business units, which are already working with scientists on commercializing projects, will find creative ways to make them work. Even if only 1 percent of bets pay off, he said, it’s still worthwhile: “This is how drug development works.” |

| Want to share The New York Times with your friends and family? Invite them to enjoy unlimited digital access to our journalism with this special offer. |

| THE SPEED READ |

| Deals |

|

| Policy |

|

| Best of the rest |

|

| Thanks for reading! We’ll see you tomorrow. |

| We’d like your feedback. Please email thoughts and suggestions to dealbook@nytimes.com. |

|

|

|

|

|

|

| Andrew Ross Sorkin, Founder/Editor-at-Large, New York @andrewrsorkin |

| Jason Karaian, Editor, London @jkaraian |

| Sarah Kessler, Deputy Editor, Chicago @sarahfkessler |

| Michael J. de la Merced, Reporter, London @m_delamerced |

| Lauren Hirsch, Reporter, New York @LaurenSHirsch |

| Ephrat Livni, Reporter, Washington D.C. @el72champs |

| � | |||||||||||||||||||

| |||||||||||||||||||

| |||||||||||||||||||

| LISTEN TO TODAY'S PODCAST AVAILABLE AT 8AM ON:

| |||||||||||||||||||

| |||||||||||||||||||

Just got back to DC today. House goes on the market Thursday....hoping for the best.

Why is BABA in the tank. I hadn't logged into my accounts in a few days and saw BABA at $205. WTF??

|

| Global Market Comments July 13, 2021 Fiat Lux Featured Trade: (WHY SOLID-STATE BATTERIES ARE THE “NEXT BIG THING”) (TSLA), (QS)

|

| � |

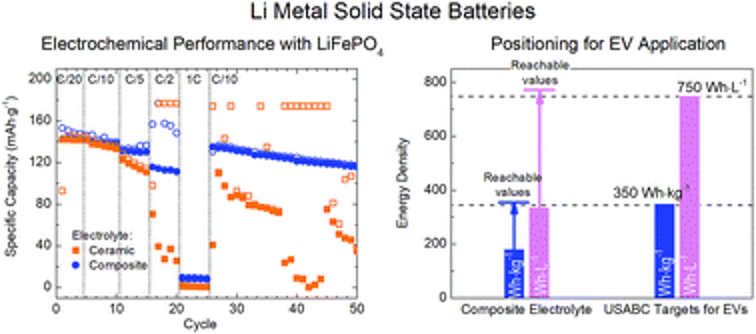

Why Solid-State Batteries are the “Next Big Thing”Tesla shares have recently gotten their mojo back, rising by 25% in two months, and that can only mean one thing: mass production of solid-state batteries is fast approaching. For the last 30 years, the cutting edge of battery design has been trapped in lithium-ion liquid or gel states. This originally Japanese technology took us from the first generation of smartphones in the early 1990s to the 1,200-pound, 405-mile range behemoths of today. Now it’s time for the next big thing. Solid-state batteries, made of oxide, sulfide, and phosphate ceramics, have existed in labs for decades and are currently used in pacemakers and other small devices. But economic mass production has remained elusive. That may be about to change. Bill Gates-backed QuantumScape gained a listing on the New York Stock Exchange via a SPAC (special purpose acquisition corporation) with Kensington Capital Acquisition Corp. (click here for the link). The deal valued the company at $3.3 billion, a high figure for a firm with no salable product. QuantumScape is a decade-old San Jose, CA-based startup which has been pioneering solid-state battery technology. It obtained a $100 million investment from Volkswagen in 2018. QuantumScape’s goal is to supply the batteries for an all-electric VW Golf by 2025. And here is the big deal about solid state. It offers energy densities 2.5 greater than existing lithium-ion batteries. It also presents far less risk of catching fire when punctured, as we have seen dramatically on TV a few times over the last couple of years with unfortunate Tesla’s. With such technology, Tesla can cut battery sizes from 1,200 pounds to 500 pounds, chop $6,000 off the cost of production of each car, and further extend ranges because of less weight. That would enable Tesla to enter the mass market with a $36,000 entry-level Tesla 3 or small SUV Model Y with minimal fuel cost and maintenance for the life of the car. This is how Tesla boosts production from last year’s 500,000 units to 5 million units annually by 2025. This is what the recent $700 Tesla share price is all about. There are even more advanced battery technologies on the horizon. Samsung is working on graphene technology for its smartphones. The University of Chicago has developed a lithium dioxide battery seven times more powerful than those currently available. Silicon nanowire technology will become viable in three years that offer a further multiplication of ranges. In the end, Elon Musk may surprise us all. In 2019, Tesla bought Maywell Technologies and their dry battery technology which can produce batteries at 16 times greater energy density at 20% less cost, giving a 20-fold improvement in battery performance. That is a greater leap in energy densities that we have seen over the past decade when costs dropped by 80%. As a long-time Tesla owner (chassis no. 125 of the assembly line), I can tell you that it has been a battle to keep up with Tesla’s rapidly emerging technology. As soon as I bought a Model X three years ago with a 275-mile range, a new 351-mile range was announced. I did get a great deal on the car though and I’ll never drive another vehicle. As an old venture capitalist once told me, “When you’re in tech, you’re in the bakery business. You have to sell whatever you have in three days before it goes stale.” For a YouTube video of Bill Gates explaining his involvement in QuantumScape, please click here.

|

Quote of the Day“Without new profits, the market can’t go anywhere,” said independent research consultant David Darst.

|

| This is not a solicitation to buy or sell securities The Mad Hedge Fund Trader is not an Investment advisor For full disclosures click here at: http://www.madhedgefundtrader.com/disclosures The "Diary of a Mad Hedge Fund Trader"(TM) and the "Mad Hedge Fund Trader" (TM) are protected by the United States Patent and Trademark Office The "Diary of the Mad Hedge Fund Trader" (C) is protected by the United States Copyright Office Futures trading involves a high degree of risk and may not be suitable for everyone.[FONT="][/FONT] |