You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Intersting thoughts

- Thread starter Bozzie

- Start date

EDTX is pissing me off!

Orders at the close for .44 no matter the price...very strange.

I still love it.

|

| Global Market Comments June 22, 2021 Fiat Lux Featured Trade: (THE LAZY MAN’S GUIDE TO TRADING) (ROM), (UXI), (BIB), (UYG) (TESTIMONIAL)

|

| � |

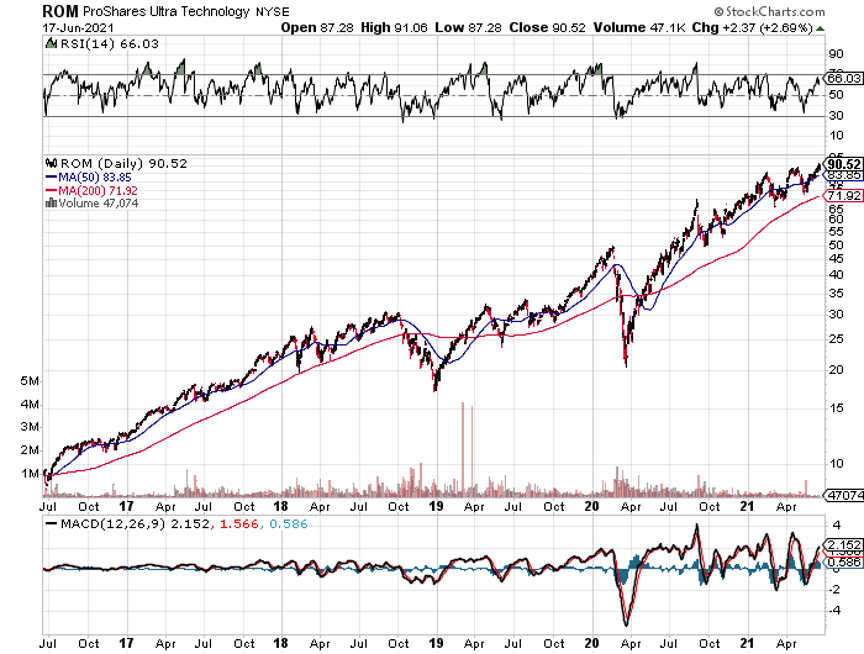

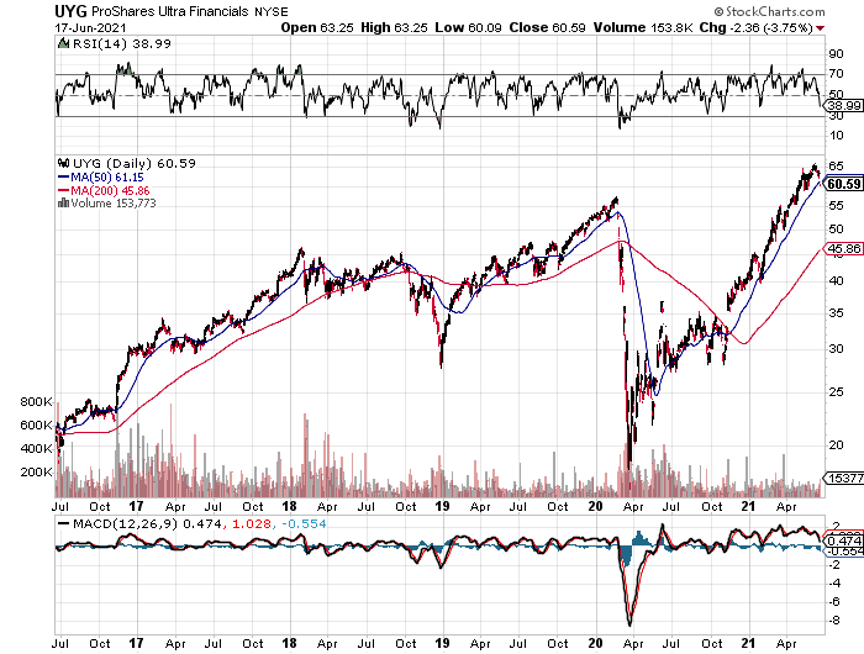

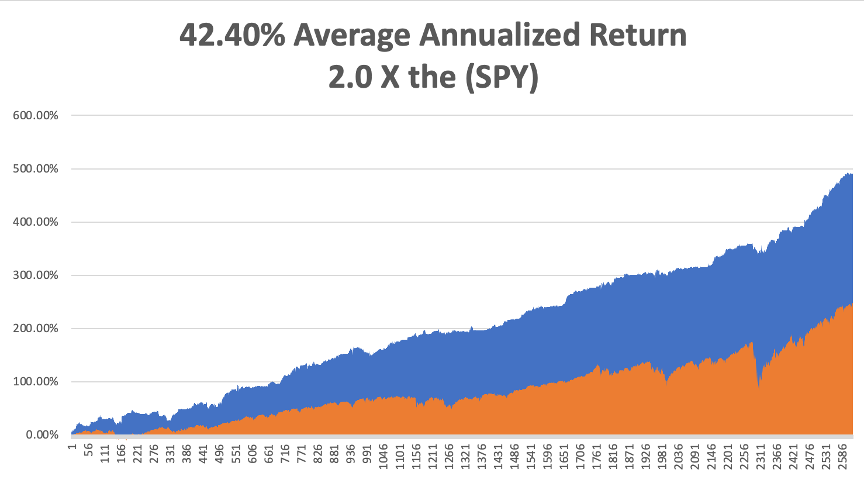

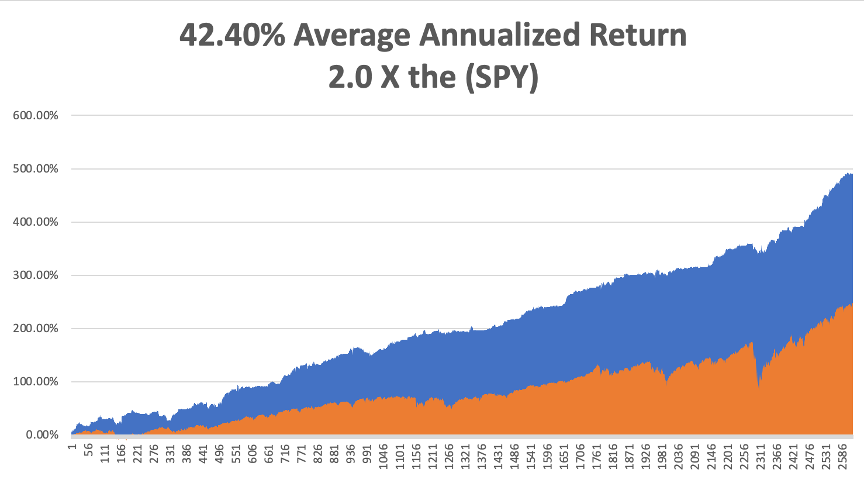

The Lazy Man’s Guide to TradingI like to start out my day at 5:00 AM by calling readers on the US east coast and Europe, asking how they like the service, are there any ways I can improve it, and what topics would they like me to write about. After all, at 5:00 AM Pacific time, they are the only ones around. You’d be amazed at how many great ideas I pick up this way, especially when I speak to industry specialists, other hedge fund managers, and generally smart people. Even the 25-year-old day trader operating out of his mother’s garage has been known to educate me about something. So when I talked with a gentleman for Tennessee this morning, I heard a common complaint. Naturally, I was reminded of my former girlfriend, Cybil, who owns a mansion on top of the levee in nearby Memphis overlooking the great Mississippi River. As much as he loved the service, he didn’t have the time or the inclination to execute my market-beating Trade Alerts. I said, “Don’t worry. There is an easier way to do this.” Only about a quarter of my followers actually execute my Trade Alerts, largely what I think of as “semi-professionals.” The rest rely on my research to correctly guide them in the management of the IRA’s 401ks, pension funds, or other retirement assets. There is also another, easier way to use the Trade Alert service. Think of it as “Trade Alert light.” Do the following. 1) Only focus on the four best of the S&P 500’s 101 sectors. I have listed the ticker symbols below. 2) Wait for the chart technicals to line up. Bullish long-term “Golden crosses” are setting up for several sectors. 3) Use a macroeconomic tailwind, like the ramp-up from a -33% GDP growth rate to +32% we are currently seeing, the biggest in history. 4) Shoot for a microeconomic sweet spot, companies, and sectors that enjoy special attention. 5) Increase risk when the calendar is in your favor, such as during November to May. 6) Use a modest amount of leverage in the lowest risk bets, but not much. 2:1 will do. 7) Scale in, buying a few shares every day on down days. Don’t hold out for an absolute bottom. You will never get it. That only happens in the movies. The goal of this exercise is to focus your exposure on a small part of the market with the greatest probability of earning a profit at the best time of the year. This is what grown-up hedge funds do all day long. Sounds like a plan. Now, what do we buy? (ROM) – ProShares Ultra Technology 2X Fund – Gives you a double exposure to what will be the top-performing sector of the market for the rest of your life. Click here for details and largest holdings. (UXI) – ProShares Ultra Industrial Fund 2X – Is finally rebounding off a decade low. Onshoring and incredibly cheap valuations are other big tailwinds here. For details and largest holdings, click here, (BIB) – ProShares Ultra NASDAQ Biotechnology 2X Fund – With a biotechnology Golden Age just beginning and Covid-19 providing a gale force tailwind, this will be the other hyper-growth sector in the stock market for the next 20 years. How much is a cancer cure worth to stock valuations? Oh, about $2 trillion. A basket approach favors this notoriously volatile sector by rotating in new winners to replace losers. (UYG) – ProShares Ultra Financials 2X Fund – Yes, after ten years of false starts, interest rates are finally going up. My friend, Treasury Secretary Professor Janet, is handing out her Christmas presents early this year. This instantly feeds into wider profit margins for financials of every stripe. For details and largest holdings, click here. Of course, you’ll need to keep reading my letter to confirm that the financial markets are proceeding according to the script. We all know that sectors can rotate rapidly. You will also have to read the Trade Alerts, as we include a ton of deep research in the Updates. You can then unload your quasi-trading book with hefty profits in the spring, just when markets are peaking out. “Sell in May and Go Away?” I bet it works better than ever in 2021.

|

TestimonialTwo years ago, I put my wife’s entire 401k into your “Lazy Man’s” portfolio. Then I forgot about it. Yesterday, I opened it up to take a look at it and I almost fell out of my chair. It was up 50%! In only two years! Thank you for under-promising and over-delivering. My wife thanks you even more for setting up a more comfortable retirement for the both of us. Next time you’re in town, we would love to take you out to Billy Bob’s for dinner and we’ll buy you the biggest steak you have ever seen. They have a stock ring INSIDE the restaurant. Thanks a “million”! George Fort Worth, Texas

|

Quote of the Day“Half the world’s job will be wiped out over the next 30 years, and the middle class will be completely wiped out,” said technology guru Mosh Varde.

|

| This is not a solicitation to buy or sell securities The Mad Hedge Fund Trader is not an Investment advisor For full disclosures click here at: http://www.madhedgefundtrader.com/disclosures |

| Good morning. (Was this newsletter forwarded to you? Sign up here.) |

|

| [h=2]What changed after Brexit[/h] |

| Five years ago today, on June 23, 2016, Britain voted to leave the European Union. The separation has hardly been smooth, and in some ways the effects have yet to appear, Eshe Nelson, The Times’s London-based business reporter, writes for DealBook. |

| The Brexit vote upended Britain’s politics, divided its people and fundamentally altered its business environment. |

| Some of the fallout was immediate. The day after the referendum, the value of the British pound plunged the most in its history, setting off a period of rising inflation. |

| Other effects have emerged more slowly. In the past six months — after Britain formally left the bloc’s single market and customs union — the impact has been harder to discern through the turmoil of the pandemic. |

| After the vote, business investment stalled. Companies were too unsure about Britain’s major trading relationships to make big decisions. By the time there was any certainty, the coronavirus had hit British shores. Now, the government is planning a “super deduction” tax break to bolster investment. That could spur spending, but the underlying pace of growth is unlikely to return to its pre-referendum level. |

|

| It’s too soon to unpick the overall impact on trade, especially for more than 180,000 British businesses whose only experience of international trade was with the E.U. New customs checks, veterinary requirements and other regulations have already restricted the movement of goods, and new agreements with far-flung countries aren’t expected to replace the deal Britain had with its nearest neighbors as a member of the E.U. By the government’s own estimates, its new trade deal with Australia will increase G.D.P. by as much as 500 million pounds (about $700 million) over 15 years, or 0.02 percent of output. |

| The financial services industry, one of Britain’s most prosperous sectors, resigned itself early to diminished status in Europe. This year, European shares and derivatives trading has shifted out of London, and banks are still moving employees to other European capitals. In response, the British government is trying to revive London’s reputation as a finance hub by overhauling rules on listings — welcoming SPACs, among other things — and loosening regulations for start-ups. |

| For many, Brexit was never about the economy, it was about immigration. Industries that relied heavily on European workers warned from the start about a looming labor crisis as it became harder for E.U. citizens to move to Britain. As the country recovers from the pandemic, that crisis has arrived. |

| Restaurants and hotels have been thwarted by staff shortages. There are warnings that there aren’t enough food production workers or truck drivers. Pandemic restrictions were a factor in foreign workers leaving the country, and industry groups are lobbying the government for exceptions to visa rules so that more chefs, truck drivers and butchers can be hired from the E.U., as they don’t expect those workers to easily return (or enough locals to step into the roles). |

| Britain’s last year in the bloc coincided with its worst recession in three centuries because of the pandemic. Recovering from Covid won’t be easy for any country, but businesses in Britain are also contending with the end of a four-decade economic union. It could be another five years, or more, before we know the true shape of Britain’s post-Brexit economy. |

| [h=3]HERE’S WHAT’S HAPPENING[/h] |

| Eric Adams is leading the race for New York City mayor. The Brooklyn borough president fell short of outright victory in the Democratic primary, meaning that a winner will likely be decided under the new ranked-choice voting system. Andrew Yang, who is running fourth, conceded; the former Citigroup executive Ray McGuire is much further behind. In the primary contest for Manhattan district attorney, Alvin Bragg is narrowly leading Tali Farhadian Weinstein. |

| A pro-democracy newspaper in Hong Kong will shut down. The publisher of Apple Daily said the 26-year-old publication would cease operations on Saturday. Its financial accounts were frozen and its owner, the media mogul Jimmy Lai, and top editors were arrested amid a crackdown by Beijing-allied authorities in the territory. |

| The U.S. will miss its July 4 vaccination goal. President Biden doesn’t expect to meet his target — 70 percent of U.S. adults receiving at least one shot — by that date, amid a slowing inoculation rate among younger adults. Separately, several countries that relied on Chinese-made vaccines are battling new Covid-19 outbreaks, raising questions about the shots’ efficacy. |

| More signs of a rebound in housing. Existing home sales fell for a fourth straight month, because increased demand has outstripped the available supply. (Sales are up nearly 45 percent versus a year ago.) Meanwhile, the Blackstone Group re-entered the business of single-family home rentals by buying Home Partners of America for $6 billion. |

| Microsoft joins the $2 trillion club. The tech giant became only the third publicly traded company to reach a $2 trillion market cap — after Apple and, briefly, Saudi Aramco — as shares in tech giants continue to outpace other stocks. Unlike its peers, however, Microsoft has largely avoided the heightened antitrust scrutiny now facing Big Tech, potentially setting it up for greater gains. |

| [h=2]Morgan Stanley mandates vaccines — for everyone[/h] |

| Morgan Stanley will require employees to be vaccinated against Covid-19 in order to return to its New York offices next month, The Times has confirmed. That goes further than many other big companies, and what’s more, the bank will also require contingent workers, clients and visitors entering Morgan Stanley’s buildings in New York City and Westchester to be vaccinated. |

| The bank won’t require proof of vaccination, but staff members who don’t report that they are fully vaccinated by July 12 will be required to work remotely. Some of Morgan Stanley’s institutional securities, investment and wealth management divisions already allow only those who say they have been vaccinated to work in the bank’s offices. |

| Companies across the U.S. are grappling with their vaccine policies. The Equal Employment Opportunity Commission said last month that it was legal for companies to ask employees about their vaccination status, and that companies could require workers to be vaccinated to come to the office. Still, many senior executives worry about pushback from employees, with few companies mandating vaccines. |

| Wall Street firms have taken a variety of approaches. This month, Goldman Sachs required its employees in the United States to report their vaccination status. Other big banks, including JPMorgan and Bank of America, are encouraging workers to disclose their vaccination status voluntarily. BlackRock will reportedly allow only vaccinated staff members to return to the office beginning next month. |

| [h=2]“Amazon is changing the nature of work in our country and touches many core Teamster industries and employers.”[/h] |

| — A resolution from the International Brotherhood of Teamsters, which will be put to a vote at the union’s convention tomorrow, would make it a priority to organize Amazon workers and help them win a union contract. The Teamsters would “supply all resources necessary” to the effort, the resolution reads, and would create a dedicated Amazon division at the union. |

| [h=2]Exclusive: M.L.B.’s newest player is a crypto exchange[/h] |

| As cryptocurrency becomes more mainstream, the industry’s businesses are trying to raise brand awareness. To that end, the global crypto exchange F.T.X. is launching a five-year international partnership with Major League Baseball today, DealBook is first to report. It is the first such deal between a pro sports league and a crypto exchange, the partners say. |

| Sports and crypto increasingly mix. M.L.B. is already in the blockchain business via non-fungible tokens, and F.T.X. recently inked a deal for naming rights to the N.B.A.’s Miami Heat arena. Baseball’s fan base is “huge” and overlaps with crypto enthusiasts, said Sam Bankman-Fried, the exchange’s founder and chief executive, a Californian who works out of Hong Kong. The parties did not disclose the financial terms of the deal, which includes worldwide marketing rights and the use of game highlights in F.T.X. content. |

| The crypto exchange will become the first company to sponsor a patch on umpire’s uniforms, starting with the All-Star game in July. “Umpires represent trust, integrity and accountability,” said Noah Garden, the M.L.B.’s chief revenue officer, noting that F.T.X. “embodies the same principles.” From the exchange’s perspective, Bankman-Fried said, the patch is distinct and puts F.T.X.’s name right in the game. |

| “We are here to stay,” Bankman-Fried said about the message F.T.X. is trying to send with the sponsorship. Crypto markets have taken a beating recently, but he is confident in the industry’s long-term prospects. One of the industry’s biggest growing pains, he said, was American officials’ “slow roll” approach to establishing a comprehensive framework for crypto regulation. |

| Want to share The New York Times with your friends and family? Invite them to enjoy unlimited digital access to our journalism with this special offer. |

| [h=3]THE SPEED READ[/h] |

| Deals |

|

| Politics and policy |

|

| Tech |

|

| Best of the rest |

|

| What is different when women lead? Join Hillary Clinton, Greta Thunberg and others for a discussion of women’s role in shaping the future. Exclusive to subscribers of The Times, the online event on Thursday begins at 1 p.m. Eastern. R.S.V.P. here. |

| Thanks for reading! We’ll see you tomorrow. |

| Read in Browser | ||||||||||||||||||

| � | ||||||||||||||||||

| � | ||||||||||||||||||

| LISTEN TO TODAY'S PODCAST AVAILABLE AT 8AM ON:

| � | ||||||||||||||||||

| � |

|

| Global Market Comments June 23, 2021 Fiat Lux Featured Trade: (WHY YOU MISSED THE TECHNOLOGY BOOM AND WHAT TO DO ABOUT IT NOW), (AAPL), (AMZN), (MSFT), (NVDA), (TSLA), (WFC), (FB)

|

| � |

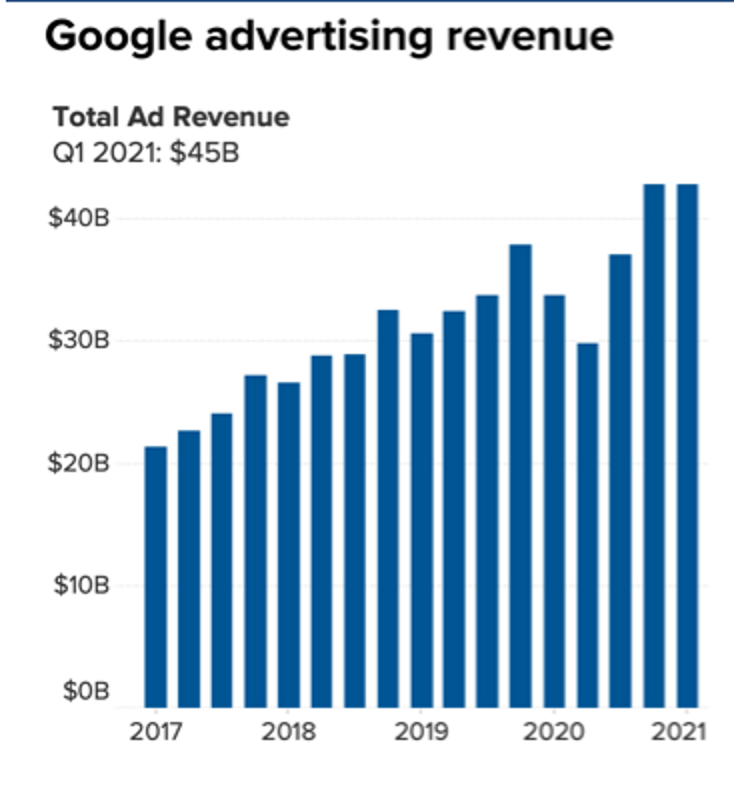

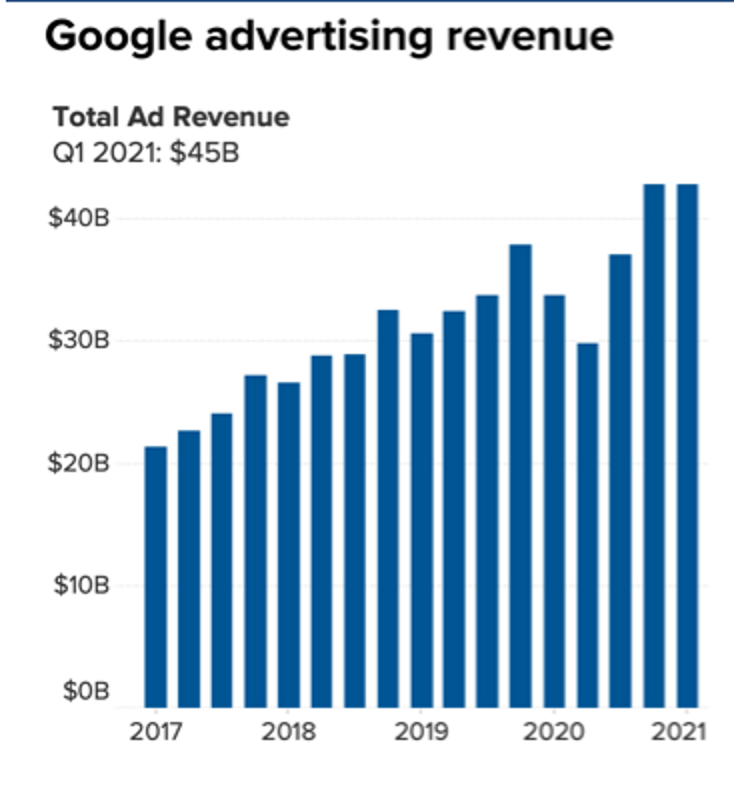

Why You Missed the Technology Boom and What to Do About it NowI often review the portfolios of new concierge subscribers looking for fundamental flaws in their investment approach and it is not unusual for me to find some real disasters. The Armageddon scenario was quite popular a decade ago. You know, the philosophy that said that the Dow ($INDU) was plunging to 3,000, the US government would default on its debt (TLT), and gold (GLD) was rocketing to $50,000 an ounce? Those who stuck with the deeply flawed analysis that led to those flawed conclusions saw their retirement funds turn to ashes. Traditional value investors also fell into a trap. By focusing only on stocks with bargain basement earnings multiples, low price to book values, and high visible cash flows, they shut themselves out of technology stocks, far and away the fastest-growing sector of the economy. If they are lucky, they picked up shares in Apple a few years ago when the earnings multiple was still down at ten. But even the Giant of Cupertino hasn’t been that cheap for years. And here is the problem. Tech stocks defy analysis because traditional valuation measures don’t apply to them. Let’s start with the easiest metric of all, that of sales. How do you measure the value of sales when a company gives away most of its services for free? Take Google (GOOG) for example. I bet you all use it. How many of you have actually paid money to Google to use their search function? I would venture none. What would you pay Google for search if you had to? What is it worth to you to have an instant global search function? Probably at least $100 a year. I would pay $10,000 as I use it all day long. With 92.05% of the global search market comprising 2 billion users, that means $200 billion a year of potential Google revenues are invisible. Yes, the company makes a chunk of this back by charging advertisers access to these search users, generating some $55.31 Billion in revenues and $17.93 billion in net income in the most recent quarter. But much of the increased value of this company is passed on to shareholders not through rising profits or dividend payments but through an ever-rising share price. If you’re looking for dividends, Google doesn’t exist. It is also very convenient that unrealized capital gains are tax-free until the shares are sold, which may be never. I’ll tell you another valuation measure that investors have completely missed, that of community. The most successful companies don’t have just customers who buy stuff, they have a community of members who actively participate in a common vision, which is then monetized. There are countless communities out there now making fortunes, you just have to know how to spot them. Facebook (FB) has created the largest community of people who are willing to share personal information. This permits the creation of affinity groups centered around specific interests, from your local kids’ school activities to municipality emergency alerts, to your preferred political party. This creates a gigantic network effect that increases the value of Facebook. Each person who joins (FB) makes it worth more, raising the value of the shares, even though they haven’t paid it a penny. Again, it’s advertisers who are footing your tab. Tesla (TSLA) has one million customers willing to lend it $400 billion for free in the form of deposits on future car purchases because they also share in the vision of a carbon-free economy. When you add together the costs of initial purchase, fuel, and maintenance savings, a new Tesla Model 3 is now cheaper than a conventional gasoline-powered car over its entire life. REI, a privately held company, actively cultivates buyers of outdoor equipment, teaches them how to use it, then organizes trips. It will then pursue you to the ends of the earth with seasonal discount sales. Whole Foods (WFC), now owned by Amazon (AMZN), does the same in the healthy eating field. If you spend a lot of your free time in these two stores, as I do, The United States is composed entirely of healthy, athletic, good-looking, and long-lived, intelligent people. There is another company you know well that has grown mightily thanks to the community effect. That would be the Diary of a Mad Hedge Fund Trader, one of the fastest-growing online financial services firms of the past decade. What is the value of our community? To give you a hint, the price of my Global Trading Dispatch has soared from $29 a month to $3,000 a year. We have succeeded not because we are good at selling newsletters, but because we have built a global community of like-minded investors with a common shared vision around the world, that of making money through astute trading and investment. We produce daily research services covering global financial markets, like Global Trading Dispatch, the Mad Hedge Technology Letter, and theMad Hedge Biotech & Healthcare Letter. We teach you how to monetize this information with our books like Stocks to Buy for the Coming Roaring Twenties and the Mad Hedge Options Training Course. We then urge you to action with our Trade Alerts. If you want more hands-on support, you can upgrade to the Concierge Service. You can also meet me in person to discuss your personal portfolios and my Global Strategy Luncheons. The luncheons are great because long-term Mad Hedge veterans trade notes on how best to use the service and inform me on where to make improvements. It’s a blast. The letter is self-correcting. When we make a mistake, readers let us know in 60 seconds and we can shoot out a correction immediately. The services evolve on a daily basis. It all comes together to enable customers to make up to 20% to 100% a year on their retirement funds. And guess what? The more money they make, the more products and services they buy from me. This is why I have so many followers who have been with me for a decade or more. And some of my best ideas come from my own subscribers. So, if you missed technology now what should you do about it? Recognize what the new game is and get involved. Microsoft (MSFT) with the fastest-growing cloud business offers good value here. Amazon looks like it will eventually hit my $5,000 target. You want to be buying graphics card and AI company NVIDIA (NVDA) on every 10% dip. It’s going to $1,000. You can buy the breakouts now to get involved or patiently wait until the 10% selloff that usually follows blowout quarterly earnings. My guess is that tech stocks still have to double in value before their market capitalization of 26% matches their 50% share of US profits. And the technologies are ever hyper-accelerating. That leaves a lot of upside even for the new entrants.

|

Quote of the Day“The stock market is one of those things that looks better the more expensive it gets,” said Barbara Marcin, portfolio manager of the Gabelli Dividend Growth Fund.

|

|

| Global Market Comments June 23, 2021 Fiat Lux Featured Trade: (WHY YOU MISSED THE TECHNOLOGY BOOM AND WHAT TO DO ABOUT IT NOW), (AAPL), (AMZN), (MSFT), (NVDA), (TSLA), (WFC), (FB)

|

| � |

Why You Missed the Technology Boom and What to Do About it NowI often review the portfolios of new concierge subscribers looking for fundamental flaws in their investment approach and it is not unusual for me to find some real disasters. The Armageddon scenario was quite popular a decade ago. You know, the philosophy that said that the Dow ($INDU) was plunging to 3,000, the US government would default on its debt (TLT), and gold (GLD) was rocketing to $50,000 an ounce? Those who stuck with the deeply flawed analysis that led to those flawed conclusions saw their retirement funds turn to ashes. Traditional value investors also fell into a trap. By focusing only on stocks with bargain basement earnings multiples, low price to book values, and high visible cash flows, they shut themselves out of technology stocks, far and away the fastest-growing sector of the economy. If they are lucky, they picked up shares in Apple a few years ago when the earnings multiple was still down at ten. But even the Giant of Cupertino hasn’t been that cheap for years. And here is the problem. Tech stocks defy analysis because traditional valuation measures don’t apply to them. Let’s start with the easiest metric of all, that of sales. How do you measure the value of sales when a company gives away most of its services for free? Take Google (GOOG) for example. I bet you all use it. How many of you have actually paid money to Google to use their search function? I would venture none. What would you pay Google for search if you had to? What is it worth to you to have an instant global search function? Probably at least $100 a year. I would pay $10,000 as I use it all day long. With 92.05% of the global search market comprising 2 billion users, that means $200 billion a year of potential Google revenues are invisible. Yes, the company makes a chunk of this back by charging advertisers access to these search users, generating some $55.31 Billion in revenues and $17.93 billion in net income in the most recent quarter. But much of the increased value of this company is passed on to shareholders not through rising profits or dividend payments but through an ever-rising share price. If you’re looking for dividends, Google doesn’t exist. It is also very convenient that unrealized capital gains are tax-free until the shares are sold, which may be never. I’ll tell you another valuation measure that investors have completely missed, that of community. The most successful companies don’t have just customers who buy stuff, they have a community of members who actively participate in a common vision, which is then monetized. There are countless communities out there now making fortunes, you just have to know how to spot them. Facebook (FB) has created the largest community of people who are willing to share personal information. This permits the creation of affinity groups centered around specific interests, from your local kids’ school activities to municipality emergency alerts, to your preferred political party. This creates a gigantic network effect that increases the value of Facebook. Each person who joins (FB) makes it worth more, raising the value of the shares, even though they haven’t paid it a penny. Again, it’s advertisers who are footing your tab. Tesla (TSLA) has one million customers willing to lend it $400 billion for free in the form of deposits on future car purchases because they also share in the vision of a carbon-free economy. When you add together the costs of initial purchase, fuel, and maintenance savings, a new Tesla Model 3 is now cheaper than a conventional gasoline-powered car over its entire life. REI, a privately held company, actively cultivates buyers of outdoor equipment, teaches them how to use it, then organizes trips. It will then pursue you to the ends of the earth with seasonal discount sales. Whole Foods (WFC), now owned by Amazon (AMZN), does the same in the healthy eating field. If you spend a lot of your free time in these two stores, as I do, The United States is composed entirely of healthy, athletic, good-looking, and long-lived, intelligent people. There is another company you know well that has grown mightily thanks to the community effect. That would be the Diary of a Mad Hedge Fund Trader, one of the fastest-growing online financial services firms of the past decade. What is the value of our community? To give you a hint, the price of my Global Trading Dispatch has soared from $29 a month to $3,000 a year. We have succeeded not because we are good at selling newsletters, but because we have built a global community of like-minded investors with a common shared vision around the world, that of making money through astute trading and investment. We produce daily research services covering global financial markets, like Global Trading Dispatch, the Mad Hedge Technology Letter, and theMad Hedge Biotech & Healthcare Letter. We teach you how to monetize this information with our books like Stocks to Buy for the Coming Roaring Twenties and the Mad Hedge Options Training Course. We then urge you to action with our Trade Alerts. If you want more hands-on support, you can upgrade to the Concierge Service. You can also meet me in person to discuss your personal portfolios and my Global Strategy Luncheons. The luncheons are great because long-term Mad Hedge veterans trade notes on how best to use the service and inform me on where to make improvements. It’s a blast. The letter is self-correcting. When we make a mistake, readers let us know in 60 seconds and we can shoot out a correction immediately. The services evolve on a daily basis. It all comes together to enable customers to make up to 20% to 100% a year on their retirement funds. And guess what? The more money they make, the more products and services they buy from me. This is why I have so many followers who have been with me for a decade or more. And some of my best ideas come from my own subscribers. So, if you missed technology now what should you do about it? Recognize what the new game is and get involved. Microsoft (MSFT) with the fastest-growing cloud business offers good value here. Amazon looks like it will eventually hit my $5,000 target. You want to be buying graphics card and AI company NVIDIA (NVDA) on every 10% dip. It’s going to $1,000. You can buy the breakouts now to get involved or patiently wait until the 10% selloff that usually follows blowout quarterly earnings. My guess is that tech stocks still have to double in value before their market capitalization of 26% matches their 50% share of US profits. And the technologies are ever hyper-accelerating. That leaves a lot of upside even for the new entrants.

|

Quote of the Day“The stock market is one of those things that looks better the more expensive it gets,” said Barbara Marcin, portfolio manager of the Gabelli Dividend Growth Fund.

|

| Good morning. (Was this newsletter forwarded to you? Sign up here.) |

|

| [h=2]Billionaires’ giving goes under the spotlight[/h] |

| News yesterday that Warren Buffett had resigned from the Bill and Melinda Gates Foundation has raised questions about the foundation’s future after the impending divorce of its namesake founders. Buffett’s resignation announcement also attracted new attention to the billions the wealthy give to charity — and the tax breaks they get for doing so. |

| Buffett says that he has given more than $41 billion to charity over the years. He announced $4.1 billion in donations yesterday. This comes weeks after a ProPublica exposé based on confidential I.R.S. data revealed how much the richest Americans paid in taxes. The article noted that Buffett paid $23.7 million in taxes from 2014 to 2018, a period when his wealth grew by an estimated $24 billion. |

| Billionaire giving has become a hot topic of debate. Polling by Recode this year suggested that Americans believed higher taxes on the wealthy would be more beneficial to society than more donations from the wealthy. Democratic and Republican lawmakers alike have questioned whether billionaires’ donations are reaching their intended recipients quickly enough — or at all. Two years ago, Andrew cited Buffett’s donations of stock as an example of a loophole in the tax code. |

| Buffett says that philanthropy can be a powerful tax shield, if donors want it to be. Buffett’s donations, he said yesterday, resulted in only 40 cents in tax savings per $1,000 given. The reason his tax bill is so low, he said, was because he earns relatively little in wages, amassing most of his wealth from his holdings of Berkshire Hathaway stock, which isn’t taxed until it’s sold. |

|

| What do you think? Should the tax treatment of philanthropy change? If so, how? Let us know: dealbook@nytimes.com. Include your name and location, and we may feature your response in a future newsletter. |

| [h=3]HERE’S WHAT’S HAPPENING[/h] |

| House lawmakers advance sweeping bills to curtail Big Tech’s power.After hours of sometimes contentious debate, the House Judiciary Committee approved efforts to rein in Silicon Valley’s giants. One would block the biggest tech companies from buying rivals; another, which would make it easier to break them up, is still under consideration. |

| A potential compromise emerges on infrastructure spending. President Biden is set to be briefed today on a $600 billion package for investing in areas like roads and broadband, brokered last night by White House officials and a bipartisan group of lawmakers. It would essentially serve as the first step in the president’s $4 trillion infrastructure ambitions. |

| John McAfee dies in a Spanish prison. The antivirus software pioneer, 75, died after a Spanish court said he could be extradited to the U.S. on tax-evasion charges. After severing ties to the McAfee company in 1994, he led a globe-trotting life full of controversy, including accusations of drug-dealing, drunken driving, illegally entering Guatemala … and running for president. |

| JPMorgan Chase weighs mandatory vaccinations for workers. The bank, which plans to bring its employees back to the office next month, may become the latest Wall Street giant to require some level of inoculation of its work force, according to a memo sent to staff. |

| You won’t believe how BuzzFeed plans to go public. The digital publisher that made its name with listicles and clicky headlines (and won its first Pulitzer this year) is nearing a deal to merge with a SPAC, and may also raise additional money to buy up rivals. |

| [h=2]Brunswick sells a stake to Warren Buffett’s favorite banker[/h] |

| For decades, Brunswick Group made its name, and money, by advising companies on matters like mergers. Now it has struck a deal of its own: selling a minority stake to BDT Capital Partners, the merchant bank run by Byron Trott, a former Goldman Sachs banker and a Warren Buffett favorite. |

| BDT will invest in Brunswick at a £500 million ($698 million) valuation,we’re told. The deal, which came together after Brunswick explored financial options for more than a year, is meant to help Brunswick expand — it currently has 27 offices worldwide — and, perhaps more important, to fund £140 million in payouts to its 200 equity partners. (Half of which will go to Sir Alan Parker, the firm’s chairman and biggest shareholder.) Changes to Brunswick’s corporate structure will also give younger partners a stake in the firm. The Financial Times first reported the deal. |

|

| It’s the latest deal in the P.R. industry, as investment firms have bet on growing client demand. CVC Capital Partners bought a majority stake in Teneo two years ago, while Golden Gate Capital bought a 40 percent stake in Sard Verbinnen in 2016. BDT tends to buy into founder-led private companies, with an aim for holding its investments longer than most private equity firms. “Our minority, long-term investment will continue to support their efforts to remain an independent and partner-controlled business,” Trott told DealBook in a statement. |

| [h=2]“All I want is to own my money.”[/h] |

| — Britney Spears, in a rare public appearance, asking a judge to end her father’s legal control of her life. She said she had been drugged and compelled to perform, and she blamed her father for controlling her against her will. “I would honestly like to be able to sue my family,” she said. |

| [h=2]Larry Fink’s pandemic ‘project’[/h] |

| When the going gets tough, call Larry Fink. BlackRock’s chief was in frequent touch with Treasury Secretary Steven Mnuchin and the Fed chair, Jay Powell, in the days before and after many of the Fed’s emergency rescue programs were announced in late March 2020, The Times’s Jeanna Smialek reports. In one email obtained by The Times, the asset management firm referred to parts of the rescue programs as “the project” that Fink and the Fed were “working on together.” |

|

| The weekend before the Fed’s policy package was released, Mnuchin spoke to Fink more than anyone other than the Fed chair. The New York Fed later hired the firm’s advisory arm, which operates separately from its asset-management business, to carry out the Fed’s purchases of commercial mortgage-backed securities and corporate bonds. (BlackRock also helped with the Fed’s crisis response during the 2008 financial meltdown.) |

|

| Read Jeanna’s full article, including the emails obtained by The Times, about BlackRock’s role in the pandemic crisis response. |

|

| [h=2]Housing policy is set for remodeling[/h] |

| The Supreme Court yesterday saved the imperiled Federal Housing Finance Agency, which has overseen Fannie Mae and Freddie Mac since their government bailouts, but put the agency’s director on the chopping block. The Biden administration quickly took the opportunity to remodel. |

| The case stems from the 2008 financial crisis. Shareholders in Fannie and Freddie sued to recover $124 billion in payments the lenders were required to make after their bailouts. The shareholders said the F.H.F.A.’s unconstitutional structure invalidated these collections. The statute creating the agency, written by Congress, limited the president’s power to dismiss its director, which shareholders said violated separation of powers principles. Justices agreed that the clause was flawed, but they declined to dismantle the agency or invalidate its past actions. They sent shareholders back to lower courts and said the agency’s director could be removed with or without cause. |

|

| The White House removed the F.H.F.A. director hours after the decision. Mark Calabria, a libertarian economist appointed by Donald Trump in 2019 to lead the F.H.F.A., was working on a plan to release Fannie and Freddie from conservatorship. Calabria issued a parting shot in a statement, saying, “When the housing markets experience a significant downturn, Fannie Mae and Freddie Mac will fail at their current capital levels.” |

| “Having a privately owned, too-big-to-fail duopoly in control of the housing market was a terrible idea,” said Jim Parrott, a former housing adviser in the Obama administration now at the Urban Institute. There was once widespread agreement on that, Parrott told DealBook, but getting Fannie and Freddie back in private hands was Calabria’s top priority, and it informed all of his policy decisions. He expects the next director to focus on “questions of how best to help support the housing needs of a nation.” For now, that is Sandra Thompson, who has been at the agency since 2013 and was appointed acting director last night. |

| Want to share The New York Times with your friends and family? Invite them to enjoy unlimited digital access to our journalism with this special offer. |

| [h=3]THE SPEED READ[/h] |

| Deals |

|

| Politics and policy |

|

| Tech |

| Best of the rest |

|

| Thanks for reading! We’ll see you tomorrow. |

| We’d like your feedback! Please email thoughts and suggestions to dealbook@nytimes.com. |

|

|

|

|

|

|

I want to punch Buffet every time he says that the tax code needs to be re-written. "The rich" pay PLENTY of taxes and MORE than their "fair share". But the one that gets me is the Angry Liz Warren push for a "wealth tax". That is the biggest load of bullsh*t I've ever seen! A 'wealth tax'!! So, let's tax people on money they've already earned and have already paid taxes on. smh - Now Biden wants to lower the inheritance tax to $1.3 million. Let's first talk about the idea of an "inheritance tax" - again, money that has already been earned and taxed....so they want to tax it AGAIN? And at 50+%??? They left has never met a tax they didn't love!

I want to punch Buffet every time he says that the tax code needs to be re-written. "The rich" pay PLENTY of taxes and MORE than their "fair share". But the one that gets me is the Angry Liz Warren push for a "wealth tax". That is the biggest load of bullsh*t I've ever seen! A 'wealth tax'!! So, let's tax people on money they've already earned and have already paid taxes on. smh - Now Biden wants to lower the inheritance tax to $1.3 million. Let's first talk about the idea of an "inheritance tax" - again, money that has already been earned and taxed....so they want to tax it AGAIN? And at 50+%??? They left has never met a tax they didn't love!

I paid 64k in taxes this year and I'm not rich in the big picture...I got an audit recently for 2018 and they still want more.

It's fuked up.

| Read in Browser | ||||||||||||||||||

| ||||||||||||||||||

| LISTEN TO TODAY'S PODCAST AVAILABLE AT 8AM ON:

| ||||||||||||||||||

|

| Read in Browser | |||||||||||||||||

| |||||||||||||||||

| LISTEN TO TODAY'S PODCAST AVAILABLE AT 8AM ON:

| |||||||||||||||||

|

| Read in Browser | ||||||||||||||||||

| ||||||||||||||||||

| LISTEN TO TODAY'S PODCAST AVAILABLE AT 8AM ON:

| ||||||||||||||||||

|

|

| Global Market Comments June 24, 2021 Fiat Lux Featured Trade: (WHY DOCTORS, PILOTS, AND ENGINEERS MAKE TERRIBLE TRADERS)

|

| � |

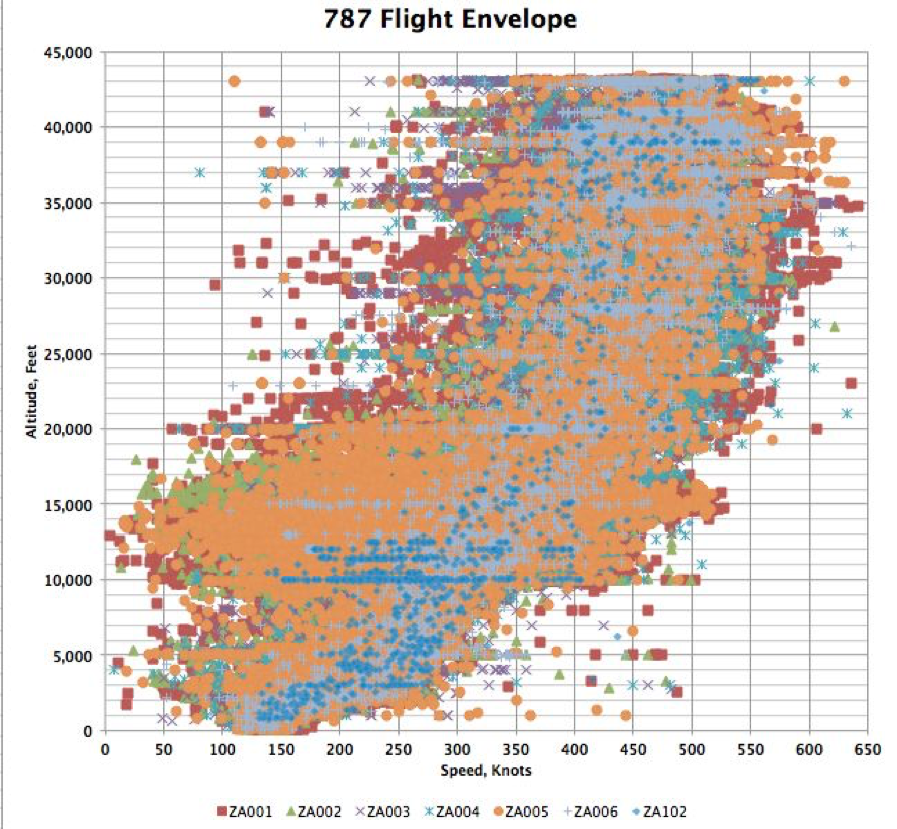

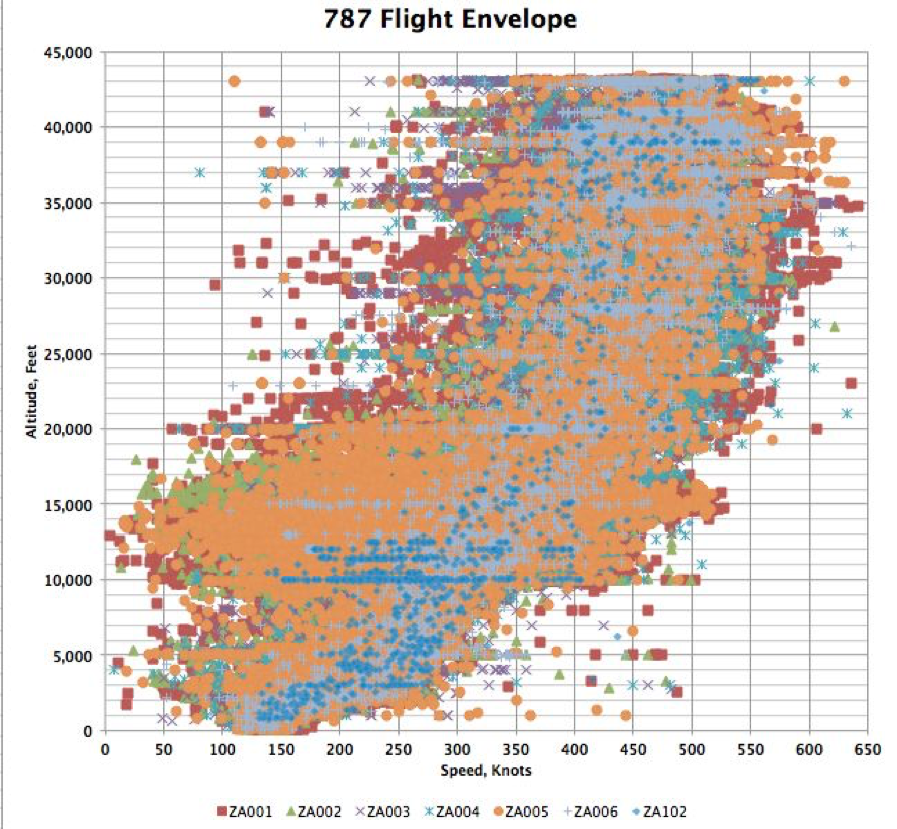

Why Doctors, Pilots, and Engineers Make Terrible TradersAt my last Global Strategy Luncheon, I had the pleasure of sitting next to an anesthesiologist who was a long-time reader of my stock market research. As much as he loved my service, he confided in me that his trading results were awful. I told him I knew why. Doctors, scientists, aircraft pilots, and even anesthesiologists all share the same problem. As smart as they are to plow through 12 years of college studying subjects of mind-numbing difficulty, obtaining MDs, PhDs, and ATPL licenses, they are terrible when it comes to trading their own stock portfolios. A doctor friend once confessed to me that as fast as he was taking money in at his seven-digit-a-year private practice, he was shoveling it out the door in trading and investment losses. And if he got mad at it, or grew stubborn, the losses then compounded. He considered it a disease, or a gambling addiction. I have to admit that I once suffered from the same malady, as I was originally trained as a scientist and mathematician. That is until I identified the problem and dealt with it. And here is the dilemma. Science, medicine, and flying high-performance aircraft all require tremendous degrees of precision. The practitioners have to be exactly right about everything all the time. If they aren’t, people die. Let me give you some examples. I happen to know that the daily dosage for the heart drug Digitalis is 0.25 mg per day. If you accidentally raise that to 0.50 mg, you die, especially if you have small body weight. I also happen to know that the stall speed of a Boeing 787 Dreamliner is 125 miles per hour. At 126 miles per hour, everything is fine. But at 124 miles per hour, you risk stalling on approach, crashing, and killing everyone aboard, especially if it is hot and humid, wind shear is present, and you are overweight. So as far as doctors are concerned, the premium is on precision. This absolutely does NOT work in the stock market. For precision means buying stocks at their perfect absolute lows and selling them at the perfect top ticky highs. The problem is that this is impossible. I have been trading stocks for almost 50 years and can think of only a handful of times when I nailed the perfect highs and lows. When I did, it was purely because of random chance, by accident. By insisting on perfection in his stock execution, doctors miss every trade. They then get frustrated and chase the market, throwing all discipline out the window. This is where the losses ensue. I can almost see the knowing nods of agreement out there. It gets worse. Doctors are used to working with a perfect set of facts, a lab report, a pulse rate, a temperature, or an MRI scan. In the stock market, you have to deal with the fog of war. The facts you have at hand may or may not be true. New, contradictory information is getting dumped on you all day long. And the guy on TV is usually telling you the exact opposite of what you should be doing. Most talking heads on the boob tube are in fact failed traders. After a couple of decades, you get used to operating in a world of uncertainty. You learn which information sources to trust and which ones to ignore when the fur starts to fly. After much practice, you learn how to make the right decision when push comes to shove. Unless doctors work in an emergency room or in combat with the military, they don’t get to learn how to make decisions in the fog of war. To them, markets all seem like a mass of confusing and conflicting information. For the perfectionist, it’s their worst nightmare. No wonder they lose money. So doctors have three choices when it comes to their investment portfolio. They can index, balance stocks against bonds, and get used to subpar returns. They can hand it over to a professional financial advisor, out of harm’s way. Or they can learn the tricks of the trade that I have, which is the purpose of this newsletter. If you learned from my own half-century accumulation of mistakes, you don’t have to repeat them yourself. Your portfolio will love it! Now that I have your attention, I have this pain in my back that keeps bothering me….

|

Quote of the Day"Only losers average losers," said my friend and former client, trading legend Paul Tudor Jones.

|

| This is not a solicitation to buy or sell securities |

|

| Global Market Comments June 24, 2021 Fiat Lux Featured Trade: (WHY DOCTORS, PILOTS, AND ENGINEERS MAKE TERRIBLE TRADERS)

|

| � |

Why Doctors, Pilots, and Engineers Make Terrible TradersAt my last Global Strategy Luncheon, I had the pleasure of sitting next to an anesthesiologist who was a long-time reader of my stock market research. As much as he loved my service, he confided in me that his trading results were awful. I told him I knew why. Doctors, scientists, aircraft pilots, and even anesthesiologists all share the same problem. As smart as they are to plow through 12 years of college studying subjects of mind-numbing difficulty, obtaining MDs, PhDs, and ATPL licenses, they are terrible when it comes to trading their own stock portfolios. A doctor friend once confessed to me that as fast as he was taking money in at his seven-digit-a-year private practice, he was shoveling it out the door in trading and investment losses. And if he got mad at it, or grew stubborn, the losses then compounded. He considered it a disease, or a gambling addiction. I have to admit that I once suffered from the same malady, as I was originally trained as a scientist and mathematician. That is until I identified the problem and dealt with it. And here is the dilemma. Science, medicine, and flying high-performance aircraft all require tremendous degrees of precision. The practitioners have to be exactly right about everything all the time. If they aren’t, people die. Let me give you some examples. I happen to know that the daily dosage for the heart drug Digitalis is 0.25 mg per day. If you accidentally raise that to 0.50 mg, you die, especially if you have small body weight. I also happen to know that the stall speed of a Boeing 787 Dreamliner is 125 miles per hour. At 126 miles per hour, everything is fine. But at 124 miles per hour, you risk stalling on approach, crashing, and killing everyone aboard, especially if it is hot and humid, wind shear is present, and you are overweight. So as far as doctors are concerned, the premium is on precision. This absolutely does NOT work in the stock market. For precision means buying stocks at their perfect absolute lows and selling them at the perfect top ticky highs. The problem is that this is impossible. I have been trading stocks for almost 50 years and can think of only a handful of times when I nailed the perfect highs and lows. When I did, it was purely because of random chance, by accident. By insisting on perfection in his stock execution, doctors miss every trade. They then get frustrated and chase the market, throwing all discipline out the window. This is where the losses ensue. I can almost see the knowing nods of agreement out there. It gets worse. Doctors are used to working with a perfect set of facts, a lab report, a pulse rate, a temperature, or an MRI scan. In the stock market, you have to deal with the fog of war. The facts you have at hand may or may not be true. New, contradictory information is getting dumped on you all day long. And the guy on TV is usually telling you the exact opposite of what you should be doing. Most talking heads on the boob tube are in fact failed traders. After a couple of decades, you get used to operating in a world of uncertainty. You learn which information sources to trust and which ones to ignore when the fur starts to fly. After much practice, you learn how to make the right decision when push comes to shove. Unless doctors work in an emergency room or in combat with the military, they don’t get to learn how to make decisions in the fog of war. To them, markets all seem like a mass of confusing and conflicting information. For the perfectionist, it’s their worst nightmare. No wonder they lose money. So doctors have three choices when it comes to their investment portfolio. They can index, balance stocks against bonds, and get used to subpar returns. They can hand it over to a professional financial advisor, out of harm’s way. Or they can learn the tricks of the trade that I have, which is the purpose of this newsletter. If you learned from my own half-century accumulation of mistakes, you don’t have to repeat them yourself. Your portfolio will love it! Now that I have your attention, I have this pain in my back that keeps bothering me….

|

Quote of the Day"Only losers average losers," said my friend and former client, trading legend Paul Tudor Jones.

|

| This is not a solicitation to buy or sell securities |

Wow! You beat me! I paid $59k in federal income taxes this year (2020), the most - by far - I've ever paid! It was a kick in the nuts! I'm probably going to take it in the ass again next year after selling two properties this year (although one was a primary residence so I hope it's not that bad).

Wow! You beat me! I paid $59k in federal income taxes this year (2020), the most - by far - I've ever paid! It was a kick in the nuts! I'm probably going to take it in the ass again next year after selling two properties this year (although one was a primary residence so I hope it's not that bad).

Jesus ..I had some capital gains on a property and stocks as well as regular income taxes....man, 59k is a load on income CB. I wanna say well done!

| View in browser|nytimes.com Continue reading the main story |

June 25, 2021 |

| Good morning. (Was this newsletter forwarded to you? Sign up here.) |

|

| [h=2]Banks capitalize on their healthy pandemic[/h] |

| Nearly two dozen of the nation’s largest lenders, including Bank of America and JPMorgan Chase, yesterday passed the Fed’s annual test of whether they could survive a severe economic downturn. Last year, during the height of the pandemic, Wall Street’s six largest banks earned a collective $81 billion. They can clearly survive, and thrive, through some pretty significant stress. That is good news — but the risk is that it leads to lenders and policymakers letting their guards down as conditions improve. |

| The main reason the biggest banks fared so well during the pandemic was the financial crisis. Back in 2009, the first year the Fed ran its stress tests, four of those six banks failed, falling $55 billion short of what regulators said the lenders would need to survive another severe recession. Now, after more than a decade of rule changes, cajoling and public shaming, those same six banks have $500 billion more than is required to cover bad loans, negative trades or other losses. The hard lesson learned after Lehman Brothers failed was that the best way to avoid another crisis like the subprime meltdown was to be prepared for one. |

| That lesson may be slipping away. Fearing the effects of the pandemic, last year regulators told banks to preserve capital by suspending dividends and stock buybacks. Now that the banks have weathered the pandemic and passed this year’s stress test, these restrictions will be removed. Next week, lenders will begin submitting their capital plans for approval. An analyst at Barclays predicts that banks will pay out as much as $200 billion to shareholders in the next year. |

|

| The ire of the public and politicians these days is just as likely to be focused on Big Tech as on Wall Street. Billionaire tax avoidance now overshadows banker bonuses as the source of America’s inequality. It took aggressive efforts from policymakers to steady the markets and bolster the economy during the worst of the pandemic, but banks were not at the center of the crisis, like they were during the previous meltdown. And so, if the seeds of the next crisis are sowed in the current one, when it comes to the financial system the soil is fertile right now. |

| [h=3]HERE’S WHAT’S HAPPENING[/h] |

| Antitrust bills targeting Big Tech pass their first test. The House Judiciary Committee approved all six proposals to rein in Silicon Valley, including the so-called breakup bill that could force tech titans to shed some of their businesses. But the hard part comes next, including winning passage from the full House and, more important, the Senate. |

| Shareholders oust Toshiba’s chairman. The rejection of Osamu Nagayama, after revelations that the Japanese industrial giant colluded with the government to inappropriately pressure investors, is a landmark in Japanese corporate governance and a big win for foreign activist funds. |

| Teamsters approve a plan to help organize workers at Amazon. Union delegates overwhelmingly voted to “supply all resources necessary” to help unionization campaigns at the e-commerce giant, and eventually create a special team for the effort. The Teamsters didn’t elaborate on how much money it would spend, nor a timeline for the plan. |

| Google delays a key software privacy change. The company said it would begin blocking the tracking software known as cookies from its Chrome browser in 2023, a year later than expected. The move follows concerns by rivals and regulators that Google was removing a tool used by competing ad companies — though other web browsers have taken a similar step. |

| SPACs take another step into the mainstream. When the Russell 3000 stock index is overhauled today, a number of new entrants will include companies that went public by merging with blank-check funds, like DraftKings, Lordstown and Nikola. |

| [h=2]Biden’s big infrastructure compromise[/h] |

| President Biden yesterday celebrated an agreement on infrastructure spending with a bipartisan group of senators. The hope is that the deal will result in a bill more palatable to members of Congress who balked at Biden’s more expansive spending agenda. |

| “We have a deal,” Biden said about the agreement on $579 billion in new spending on construction, repairs and infrastructure upgrades. “I think it’s really important we’ve all agreed that none of us got all that we wanted.” The deal still faces hurdles, but the basics are sorted. Phased in over eight years, the proposed legislation, which would be paid for by repurposing previously borrowed funds and stepped-up tax collection, will include: |

|

|

| A bunch of stuff was cut. The agreement left out some of Democrats’ prized proposals, which means Biden won’t be able to make good on some campaign promises. The deal does not include: |

|

| There’s a giant caveat. Biden said a bipartisan bill on infrastructure, which would need support from at least 60 senators, could advance only in tandem with a much larger bill that covers the things cut out of the compromise proposal. With little support from Republicans for the bigger bill, it would likely need to pass via reconciliation, a process in which all 50 Democratic senators (if they remain united) could overcome a filibuster. Democratic leaders hope for this all to come together by the fall. |

| “We’re bullish on the package itself,” a Chamber of Commerce spokesperson told DealBook, although the trade association resists linking the infrastructure bill to the bigger proposal with more of Biden’s wish list. Regardless, businesses appear to be gearing up for an influx of projects: Shares of Caterpillar, U.S. Steel and others jumped yesterday on news of the compromise deal, however uncertain its final form. |

| For more on the prospects for infrastructure spending, see today’s edition of our sister newsletter, The Morning. |

| [h=2]“I bet you, I promise you: 50 percent of it can go away if people have the courage.”[/h] |

| — Tsedal Neeley of Harvard Business School on the modern glut of meetings, and what to do about it. |

| [h=2]In the papers[/h] |

| Some of the academic research that caught our eye this week, summarized in one sentence: |

|

|

| [h=2]Exclusive: A Spanx deal takes shape[/h] |

| Just as people are beginning to squeeze into form-fitting clothes again, shapewear brand Spanx has tapped Goldman Sachs to explore options including a sale, DealBook hears from multiple sources familiar with the situation. Any deal would likely value the brand at $1 billion or more and could allow Sara Blakely, Spanx’s founder, to keep some of her ownership in the company. Spanx generated between $300 million and $400 million in revenue over the past year, and between $50 million and $80 million in operating earnings. Spanx did not respond to multiple requests for comment. |

| People are ready to dress up again. Sales of women’s dresses were up 50 percent the week before Easter compared with the same week in 2019, according to NPD, which could signal a need for shapewear. But key to shapewear’s post-pandemic success will be products that maintain a level of comfort many have gotten used to while working in loose-fitting clothes over the past year and a half. And post-pandemic style trends are hard to predict, with even professional forecasters conceding befuddlement. |

| Like Kleenex with tissue, Spanx has become synonymous with the product it sells. But it has also spawned copycats such as Kim Kardashian’s Skims, recently valued at $1.6 billion, which distinguishes itself with modern cuts and a broader color assortment. Spanx, which was founded more than 20 years ago, has faced pushback recently for maintaining its restrictive ways amid new focus on body neutrality and rejection of the “culture of perfection.” Seeking new growth, Spanx has expanded beyond undergarments into denim, swimsuits and undershirts for men. |

| Spanx’s founder has long resisted selling or taking it public. But with private equity firms eager to spend idle capital and valuations on the rise, consumer brands are eyeing lofty paydays. The online fashion retailer Ssense announced the first fund-raising in its 18-year history earlier this month, which valued the company at more than 5 billion Canadian dollars ($4 billion). A slew of other brands — including Allbirds and Warby Parker — are planning I.P.O.s. As for potential buyers for Spanx, we hear a number of private equity firms are circling, including Carlyle, whose past investments in brands include Beautycounter, OGX and Supreme, and TPG, which has investments like Anastasia Beverly Hills under its belt. |

| Want to share The New York Times with your friends and family? Invite them to enjoy unlimited digital access to our journalism with this special offer. |

| [h=3]THE SPEED READ[/h] |

| Deals |

|

| Politics and policy |

| Tech |

| Best of the rest |

|

| Thanks for reading! We’ll see you tomorrow. |

| We’d like your feedback! Please email thoughts and suggestions to dealbook@nytimes.com. |

|

|

|

|

|

|

|

| Global Market Comments June 25, 2021 Fiat Lux Featured Trade: (BACK FROM MY 50-MILE HIKE)

|

| � |

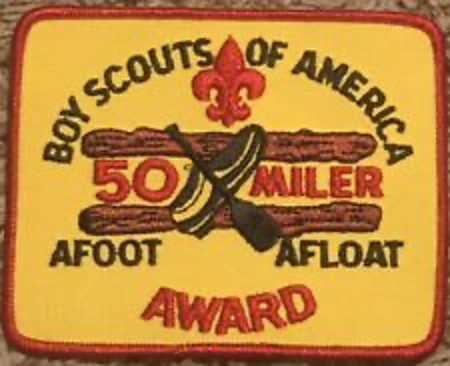

Back From My 50-Mile HikeI realized that perhaps I had bitten off too much taking the Boy Scouts on a 50-mile hike one minute into the adventure. Cutting everything to the bone, I was only able to trim my pack down to 50 pounds. That was with chopping my food ration in half, leaving an extra cell phone battery behind, and bringing only one set of clothes. However, I had to bring a five-pound first aid kit to care for the 14 scouts, my own tent, and all the maps needed to keep us on course. Then at the last minute, another five pounds of medical releases, a satellite phone, and an electronic thermometer were dumped on me by worried parents, taking my load up to a bone-breaking 55 pounds. That’s a lot for a 68-year-old. That’s a lot for anyone. But then the Desolation Wilderness, the roof of the High Sierras, is one of the most stunningly beautiful places on the planet. All other outdoor trips for the Boy Scouts this year had been cancelled, thanks to the pandemic. And at my age, who knows how many 50-mile hikes I have ahead of me? It was now, or maybe never. But then the Desolation Wilderness, the roof of the High Sierras, is one of the most stunningly beautiful places on the planet. All other outdoor trips for the Boy Scouts this year had been cancelled thanks to the pandemic. And at my age, who knows how many 50-miles hikes I have ahead of me? It was now, or maybe never. We took temperatures every morning. All 50 miles were hiked with masks, as did every other group we ran into. Carpooling was banned and every parent had to bring up their own kid to Lake Tahoe. It all worked as no one got sick. We didn’t do just any 50-mile hike. We attacked one of the toughest in the United States. The first two days demanded a 3,200-vertical climb, from Meeks Bay to Phipps Pass, from 6,200 to 9,400 feet. The kids barely noticed the altitude. The adults did. The Desolation Wilderness (click here for permits at https://www.recreation.gov/permits/233261 ) is a 50-mile by 30-mile slab of granite left behind by the last ice age. It is graced with 100 brilliant blue lakes. It looks like a giant’s playground, with enormous boulders and huge fallen trees scattered about the landscape. Black bears were an ever-present danger, as the area was undergoing an unprecedented “bear bloom.” Other hikers reported being harassed all night by the ursine creatures, one even invading a tent in search of food. A Cliff Bar beats clawing termites out of a dead log any day. However, we observed the strictest of bear practices, bagging our food every night and hanging it from tall trees. It became our nightly entertainment, to see who could do the best bear bag hang. Of course, getting it down the next morning was another story. The area had changed a lot since my grandfather brought me up to Desolation 60 years ago with a horse, a mule, a Winchester, and all the fishing gear we could carry. Then wilderness survival meant bringing in plenty of canned food and a nice 16-inch iron skillet, not the tasteless freeze-dried versions of today. You never saw a single soul for a week. You caught your full limit of ten rainbow and brook trout as fast as you could bait the hooks. For fun, we would rummage through old log cabins outfitted with potbellied stoves for 100-year-old supplies left behind by the 19[SUP]th[/SUP] century California gold rush. Once, we even found a crashed airplane that had been missing since the 1930s. Nobody ever went up there. This time around, we passed other hikers once an hour. Every lake was completely fished out. In fact, the park saw record crowds with people flocking to the safety of the great outdoors to flee the epidemic at home. Inexperienced with the outdoors, they attracted even more hungry bears. The scouts developed a daily routine of cooking breakfast, breaking camp, hiking ten miles, searching for the ideal camping spot, setting up tents, and cooking dinner. In the process, they learned organization, self-sufficiency, responsibility, and survival skills. They don’t teach these in schools anymore. Free time was spent playing cards for food. Winners accumulated highly sought-after beef stroganoff. The losers ended up with the despised chicken tetrazzini. I stuck to my granola bars. On the last day, we straggled back to Meeks Bay worn, bleeding, exhausted, but exhilarated. Every morning, we woke up to a Christmas calendar view. The parents couldn’t believe we finished the entire challenging 50 miles without a major injury. I was especially proud of my own 15- and 16-year old daughters, who are probably the first girls to ever complete a 50 miler in a Boy Scout event. The apples don’t fall far from the tree. Everyone became eligible for the elite Boy Scout 50-Mile Patch, which few in the scouting movement ever achieve. During much of the week, scouts were carping about the difficulty of the trail, the mosquitoes, and the sparse offerings of food. They fantasized about the first thing they would eat on return to civilization (banana split, pancakes with whipped cream, a Big Mac, or all three). By the end of the week, they were talking about the next 50-mile hike. With their 2021 spring break trip to the Boy Scout Florida Sea Base cancelled, suddenly California’s Lost Coast looks very inviting. That is, providing we can deal with the bears and the mosquitoes.

|

Quote of the Day “The three most harmful addictions are heroin, carbohydrates, and a monthly salary,” said my friend Nassim Taleb, author of Antifragile: Things That Gain from Disorder.”

|

|

| Global Market Comments June 25, 2021 Fiat Lux Featured Trade: (BACK FROM MY 50-MILE HIKE)

|

| � |

Back From My 50-Mile HikeI realized that perhaps I had bitten off too much taking the Boy Scouts on a 50-mile hike one minute into the adventure. Cutting everything to the bone, I was only able to trim my pack down to 50 pounds. That was with chopping my food ration in half, leaving an extra cell phone battery behind, and bringing only one set of clothes. However, I had to bring a five-pound first aid kit to care for the 14 scouts, my own tent, and all the maps needed to keep us on course. Then at the last minute, another five pounds of medical releases, a satellite phone, and an electronic thermometer were dumped on me by worried parents, taking my load up to a bone-breaking 55 pounds. That’s a lot for a 68-year-old. That’s a lot for anyone. But then the Desolation Wilderness, the roof of the High Sierras, is one of the most stunningly beautiful places on the planet. All other outdoor trips for the Boy Scouts this year had been cancelled, thanks to the pandemic. And at my age, who knows how many 50-mile hikes I have ahead of me? It was now, or maybe never. But then the Desolation Wilderness, the roof of the High Sierras, is one of the most stunningly beautiful places on the planet. All other outdoor trips for the Boy Scouts this year had been cancelled thanks to the pandemic. And at my age, who knows how many 50-miles hikes I have ahead of me? It was now, or maybe never. We took temperatures every morning. All 50 miles were hiked with masks, as did every other group we ran into. Carpooling was banned and every parent had to bring up their own kid to Lake Tahoe. It all worked as no one got sick. We didn’t do just any 50-mile hike. We attacked one of the toughest in the United States. The first two days demanded a 3,200-vertical climb, from Meeks Bay to Phipps Pass, from 6,200 to 9,400 feet. The kids barely noticed the altitude. The adults did. The Desolation Wilderness (click here for permits at https://www.recreation.gov/permits/233261 ) is a 50-mile by 30-mile slab of granite left behind by the last ice age. It is graced with 100 brilliant blue lakes. It looks like a giant’s playground, with enormous boulders and huge fallen trees scattered about the landscape. Black bears were an ever-present danger, as the area was undergoing an unprecedented “bear bloom.” Other hikers reported being harassed all night by the ursine creatures, one even invading a tent in search of food. A Cliff Bar beats clawing termites out of a dead log any day. However, we observed the strictest of bear practices, bagging our food every night and hanging it from tall trees. It became our nightly entertainment, to see who could do the best bear bag hang. Of course, getting it down the next morning was another story. The area had changed a lot since my grandfather brought me up to Desolation 60 years ago with a horse, a mule, a Winchester, and all the fishing gear we could carry. Then wilderness survival meant bringing in plenty of canned food and a nice 16-inch iron skillet, not the tasteless freeze-dried versions of today. You never saw a single soul for a week. You caught your full limit of ten rainbow and brook trout as fast as you could bait the hooks. For fun, we would rummage through old log cabins outfitted with potbellied stoves for 100-year-old supplies left behind by the 19[SUP]th[/SUP] century California gold rush. Once, we even found a crashed airplane that had been missing since the 1930s. Nobody ever went up there. This time around, we passed other hikers once an hour. Every lake was completely fished out. In fact, the park saw record crowds with people flocking to the safety of the great outdoors to flee the epidemic at home. Inexperienced with the outdoors, they attracted even more hungry bears. The scouts developed a daily routine of cooking breakfast, breaking camp, hiking ten miles, searching for the ideal camping spot, setting up tents, and cooking dinner. In the process, they learned organization, self-sufficiency, responsibility, and survival skills. They don’t teach these in schools anymore. Free time was spent playing cards for food. Winners accumulated highly sought-after beef stroganoff. The losers ended up with the despised chicken tetrazzini. I stuck to my granola bars. On the last day, we straggled back to Meeks Bay worn, bleeding, exhausted, but exhilarated. Every morning, we woke up to a Christmas calendar view. The parents couldn’t believe we finished the entire challenging 50 miles without a major injury. I was especially proud of my own 15- and 16-year old daughters, who are probably the first girls to ever complete a 50 miler in a Boy Scout event. The apples don’t fall far from the tree. Everyone became eligible for the elite Boy Scout 50-Mile Patch, which few in the scouting movement ever achieve. During much of the week, scouts were carping about the difficulty of the trail, the mosquitoes, and the sparse offerings of food. They fantasized about the first thing they would eat on return to civilization (banana split, pancakes with whipped cream, a Big Mac, or all three). By the end of the week, they were talking about the next 50-mile hike. With their 2021 spring break trip to the Boy Scout Florida Sea Base cancelled, suddenly California’s Lost Coast looks very inviting. That is, providing we can deal with the bears and the mosquitoes.

|

Quote of the Day “The three most harmful addictions are heroin, carbohydrates, and a monthly salary,” said my friend Nassim Taleb, author of Antifragile: Things That Gain from Disorder.”

|

The Lake Tahoe area has some fantastic hiking!

Thanks yiunleaded...

Yeah we love Tahoe CB ..hopefully next season the snow is good enough to go back..2 years running with pretty bad season totals.

Already thinking about skiing ..ha

| Good morning. This week, Andreessen Horowitz launched a $2.2 billion crypto fund, the largest in the world. In today’s newsletter, Andrew and Ephrat talk with Katie Haun, its co-chair, about the future of crypto and its current challenges. |

| (Was this newsletter forwarded to you? Sign up here.) |

|

| Katie Haun is playing the long game |

| By Andrew Ross Sorkin and Ephrat Livni |

| A top crypto cop turned venture capitalist is now one of the most powerful women in Silicon Valley, with more than $2 billion at her fingertips. |

| Katie Haun, who created the first federal cryptocurrency task force as a prosecutor in the Justice Department, will co-chair a $2.2 billion crypto fundAndreessen Horowitz announced this week. She is a general partner at the venture capital fund and an independent director at the crypto exchange Coinbase. Chris Dixon, also a general partner at Andreessen, will be the fund’s other co-chair. |

| This is Andreessen’s third crypto fund. Haun joined the firm in 2018 to co-lead its first dedicated crypto fund, a $300 million commitment. She also co-led Andreessen’s second fund, which launched in 2020 with $515 million. With the latest blockbuster fund, she’ll have a significant hand in shaping the crypto space just as it seems to be going mainstream. |

| But it’s also a time of uncertainty for crypto. A Chinese regulatory crackdown on Bitcoin is battering prices and raising questions about the value and future regulatory landscape of crypto. She spoke to Andrew and Ephrat about the outlook for the burgeoning industry, the geopolitics of blockchain, risk, regulation and the fund’s focus. The interview has been edited and condensed for clarity. |

| DealBook: Have we ever seen a government as large as China take the steps that it has taken? |

| Katie Haun: Actually, China has made a similar move before, in 2017. It outlawed trading of Bitcoin on exchanges that were based in China. The price of Bitcoin at that time had been hovering around $4,000, but on that news, it took a downward price turn. I’m surprised it didn’t happen sooner. Xi Jinping and China have made no secret of the fact that they consider crypto and blockchain a top-five national priority for China in the next decade. They’ve publicly stated this, and they are developing their own version of cryptocurrency, a digital renminbi. We know that they plan to export this, to tie trade to it, to incentivize people around the world, not just in China, to use it. |

| What happens if Bitcoin is shut down in China completely? Is that market for Bitcoin off the table? |

| The best analog for this is the Great Firewall of China, with the internet. Of course, this will be harder for China to just completely ban. They can do things like control on and off ramps, which they’ve done before. If you look back to that 2017 news, it actually shows the tremendous staying power of a decentralized, open system like Bitcoin. |

| Peter Thiel has argued that China would love to see bitcoin and other cryptocurrencies rise as a strategic effort to destabilize the U.S. dollar. Do you agree? |

| I don’t agree with that. I think China would like to keep control over its version of a digital yuan. And I think that they are developing what is effectively a closed permission system. Fundamentally they want control and surveillance over everything. I do agree that they would very much like to see the U.S. dollar upset as the global reserve currency. I just disagree in the way in which they would go about doing it. It’s far more likely we would see them export their version, by tying incentives to their digital currency to get individuals around the world to use it. |

| Back here in the U.S., do you think crypto will be regulated? |

| There’s this myth that crypto founders want the Wild West. They’re really kind of desperate for regulators to say what the rules are. It takes so much time, money and resources — specialty resources — to figure out how to navigate the morass of agencies ranging from the C.F.T.C. to Treasury, let alone the regulators in 50 different states. |

| S.E.C. Commissioner Hester Peirce has called for a regulatory sandbox, but I’m not sure that goes far enough because it only solves issues for projects that are clearly securities. What I would like to see is at a federal level in the U.S., a regulatory sandbox that has federal pre-emption. And in order to do that, you need legislation. |

| How would that work? |

| It would allow projects to launch with some rules, but it would provide an important test ground to see how they behave in the wild. And at the same time, it would serve a really important function to regulators and to people in the government by helping to train them on these new technologies. There is really no easy way to keep up. I’m full-time in the industry with experts all around, and I can’t keep up with the pace of this technology that’s changing so fast. |

| But how do you protect consumers — the broader public is clearly not being sandboxed or protected while this is taking place? |

| Consumer protection is really important. However, people want access to these products and services. And just saying, well, we’re not going to allow them in the U.S. is not the answer because anyone today with an internet connection and a VPN can pretty easily go access products and services that are offered in other countries. It’s incredibly hard, if not almost impossible, for the U.S. to police what’s happening overseas on offshore platforms. |

| As a former prosecutor, how do you think about crypto being used in so many ransomware attacks like the one on Colonial Pipeline? Why do criminals love Bitcoin so much? |

| Criminals are early adopters and in some ways they make great beta testers for new technology. They’re always looking for a way around the system. Frankly, law enforcement officials actually really like when payment is made in Bitcoin as opposed to fiat. I think it’s funny because as a former prosecutor, I take this for granted. There’s a real false sense of security where wires are used or traditional financial services are used. People think, “Oh, we know everything about that. So we’ll just go subpoena. The bank will give us these records and we’ll just go get the money.” That is just so far from the reality of the situation. |

| So you don’t believe that these ransomware attacks are a function of crypto? |

| I think you are asking if crypto is the cause of ransomware, and it’s absolutely not. I prosecuted many of the Justice Department’s largest online money laundering schemes. In fiat systems, 99.9 percent of money laundering claims succeed. Actually, the thing that really stands out about the ransomware attacks — the Colonial Pipeline is a great example of this. It is unprecedented that the Justice Department would be able to recover the proceeds from international criminal activity so quickly. That timeline is usually years, if ever. |

| When you think about risks in crypto, how much leverage do you think is in the crypto system? |