|

|---|

|

|---|

|

Top News

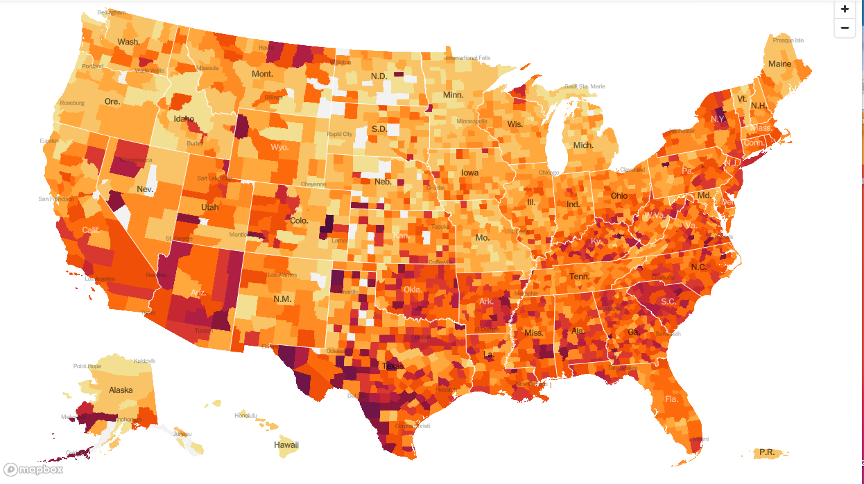

Shutterstock A deep freeze enveloping large swathes of the U.S. has resulted in rolling blackouts for at least 5M people from the upper Midwest to Houston. More than a million barrels a day of oil and 10B cubic feet of gas production have also gone offline, sending U.S. crude prices above $60 a barrel for the first time in more than year and natural gas prices up 6%. Pipelines have also declared force majeure, while massive refineries owned by Exxon Mobil (NYSE: XOM) and Marathon Petroleum (NYSE: MPC) have halted production, threatening to reduce supplies of gasoline and diesel across the country.

The energy crisis is not the only problem, with the frigid weather expected to remain through Wednesday. All air travel in and out of Houston was shut, and COVID vaccination efforts faced potential disruption, with city officials racing to administer doses before they go bad. The National Guard was also mobilized to get the elderly into warming shelters, while the power disruption spilled over into neighboring Mexico.

Backdrop: The cold snap is testing Texas's highly decentralized electricity model. Power plants don't have incentive to build reserve capacity, but are rather paid for the energy that they sell. On Monday, wholesale prices for electricity on the Texas grid even reached the price cap of $9,000 per megawatt hour (the average price is $25). Unlike utility monopolies in other states, electricity retailers in Texas compete fiercely for customer business and often tie prices to market conditions, but this has left generators worried about sending out skyrocketing bills.

Thought bubble: Storage and backup power will need to be addressed as grids across the U.S. change over from fossil fuels to cleaner energy. Competition from heavily subsidized wind power and cheaper natural gas, combined with stricter emissions regulation, has seen coal's share of Texas's electricity fall by more than half in the last decade to 18%. Meanwhile, wind's share has tripled to about 25% since 2010 and accounted for 42% of power last week, but those turbines froze yesterday as the cold weather set in. The Texas grid has also been designed for hot summers, not freezing winters. ( 34 comments)

| |

|---|

Regulation

Janet Yellen is looking to appoint someone to monitor the risks that climate change poses to the financial system as part of a new climate "hub" at the Treasury Department, according to the WSJ. She is reportedly eyeing Sarah Bloom Raskin, former deputy Treasury Secretary during the Obama administration, who worked alongside Yellen on the Federal Reserve Board. Raskin has warned in many speeches and interviews that U.S. regulators must do more to strengthen the financial system's resilience to climate risks.

The appointment would be part of a broader climate action plan being implemented across many government agencies. The Biden administration has already rejoined the Paris climate accord and suspended new oil and gas leases on federal land. It is also preparing a $2T infrastructure proposal, which would double as an aggressive effort to combat climate change.

Quote: "Both the impact of climate change itself and policies to address it could have major impacts, creating stranded assets, generating large changes in asset prices, credit risks and so forth that could affect the financial system," Yellen declared at her Senate confirmation hearing last month. "These are very real risks," she added, calling climate change an "existential threat" to the U.S. economy.

What's on the agenda? Yellen wants to assess the potential harm of more frequent severe weather events like flooding, wildfires or hurricanes on assets underpinning bank loans and mortgages. Shifts might also be seen in banks' business due to declining fossil fuel demand. That could reduce the value of assets owned by oil and power companies and increase the riskiness of loans to those firms. Another area to explore is tax incentives to the energy industry, which is expected to reduce overall carbon emissions. ( 154 comments)

| |

|---|

Sponsored By Yieldstreet

Hedge Funds shouldn’t be the only ones having all the fun in alternative investments. Access alternative investment opportunities vetted by Yieldstreet’s experts across numerous asset classes such as Art, Commercial, Legal, Real Estate, and more. In 2020, 4% of opportunities reviewed passed our selective process to make it to the platform. Imagine what a passive income portfolio could do for you. Investments start at just $1k. Get your piece of the action today. | |

|---|

Stocks

The major averages could hit fresh record highs in their first trading session after Presidents' Day, with U.S. stock index futures pointing to gains of 0.5% at the open. The end of Trump's Senate impeachment trial is set to make room for President Biden's economic priorities, and in turn some catalysts for market momentum. Biden is eager to pass a $1.9T coronavirus relief bill, which would include $1,400 checks for many Americans, extra funding for unemployment benefits, child tax credit increases and aid to state and local governments.

In fact, Biden will take his first official trip outside of Washington, D.C. - since being inaugurated president on January 20 - to make his case. He's heading to Milwaukee tonight to participate in a CNN Town Hall at 9 p.m. ET, after struggling to gain support for his plan from Republicans on Capitol Hill, who have taken issue with its price tag. Biden made Wisconsin a focus for his campaign in 2020, visiting the state three times, and ultimately flipped the state back from red to blue.

Bigger picture: Some are also citing a fall in the CBOE Volatility Index, widely viewed as Wall Street's best fear gauge, for the recent market optimism. "Receding fear is followed by systematic and quant funds adding 'leverage' in other words, this is a set-up to see a rally," said Fundstrat founder Tom Lee. The sentiment is extending to all areas of the market, and even the crypto world, with Bitcoin within a whisker of the $50,000 milestone.

Go deeper: Don't forget the expanded COVID vaccine rollout and economic reopenings. The U.S. government has begun shipping 1M coronavirus vaccines to retail chains like CVS ( CVS), Walgreens ( WBA), Walmart ( WMT) and Kroger ( KR) as part of its Federal Retail Pharmacy Program. Earnings season is also continuing, with CVS and Palantir ( PLTR) set to report results before the market opens, while AIG ( AIG) and Occidental Petroleum ( OXY) release figures after the close. "All the earnings being reported are generally a lot higher than most estimates," said Charles Hepworth, a director at GAM Investments.

| |

|---|

Tech

Parler, the social network popular with conservatives, has resurfaced after going dark for a month, though the app is still not available in the Apple (NASDAQ: AAPL) or Google Play ( GOOG, GOOGL) stores. The tech giants, along with Amazon (NASDAQ: AMZN), had kicked the platform off its services following the deadly storming the U.S. Capitol on January 6. Parler said its service has grown to over 20M users and will be hosted by SkySilk Inc., which operates out of a Los Angeles-area data center.

Quote: "Skysilk does not advocate nor condone hate, rather, it advocates the right to private judgment and rejects the role of being the judge, jury, and executioner. Unfortunately, too many of our fellow technology providers seem to differ in their position on this subject. SkySilk truly believes and supports the freedom of speech and more specifically the rights afforded to us in the First Amendment. This is a non-negotiable issue for us. And while we may disagree with some of the sentiment found on the Parler platform, we cannot allow first amendment rights to be hampered or restricted by anyone or any organization."

While old Parler user accounts have been restored, past "parleys" - the site's term for posts - don't appear to have carried over. The site will start accepting new signups next week, and some high-profile users, like Fox News host Sean Hannity, have already begun posting. The new Parler operation is being overseen by interim CEO Mark Meckler, co-founder of the Tea Party Patriots, following the ouster of John Matze by the board.

Outlook: Some have pointed to Parler as a free speech-focused alternative to the giants of Silicon Valley. The service leaves virtually all moderation decisions up to individuals, collects almost no data about its users and doesn't use content recommendation algorithms (it shows users all the posts from everyone they follow, in reverse chronological order). However, many that have emigrated to the platform have continued posting on Twitter (NYSE: TWTR), raising questions of whether Parler will eventually fizzle, complement or replace larger platforms with much bigger audiences. ( 23 comments)

| |

|---|

Sponsored By Yieldstreet

| |

|---|

Commodities

Beijing is exploring whether it can hurt U.S. defense contractors by limiting the export of rare earth minerals that are crucial for the manufacture of Lockheed Martin's (NYSE: LMT) F-35 and other sophisticated weaponry, according to the FT. The Ministry of Industry and Information Technology has proposed draft controls on the production and export of rare earth minerals from China, which controls about 80% of global supply. Industry executives say government officials have even asked them how badly companies in the U.S. and Europe, including defense contractors, would be affected if China restricted the exports.

Backdrop: The decision follows deteriorating ties between the U.S. and China. What started as a trade war has morphed into a technology war, and at times, possibly a currency war. The latest move suggests rare earths may be the next front, or could be used as leverage in some of those battles. The Biden administration has indicated it would maintain pressure on China (no quick lift for tariffs) but take a more multilateral approach. China's Foreign Ministry also said last year it would also sanction Lockheed Martin, Boeing (NYSE: BA) and Raytheon (NYSE: RTX) for selling arms to Taiwan, the self-ruled island which Beijing claims as its sovereign territory.

What are rare earths? The minerals are a group of 17 chemical elements used in everything from high-tech consumer electronics like smartphones to military equipment. Despite the name, there are deposits of some of them all over the world, but it is unusual to find them in a pure form or in concentrated quantities, hence the title "rare." The U.S. is highly dependent on them for its defense capabilities (i.e., a recent Congressional Research Service report found that each F-35 required 920 pounds of rare earth materials).

Outlook: Hopes of U.S. companies that looked to break into the industry have been dashed in the past due to strict environmental regulations on extracting and processing. China also undercut world prices in the 1990s, leading to additional barriers to entry. There is currently no refining capacity in the U.S. (ore mined here must even be sent to China), but that may be changing. The Pentagon recently signed contracts with American and Australian miners to boost their onshore refining capacity, awarding contracts to MP Materials (NYSE: MP) and Lynas Rare Earths ( OTCPK:LYSCF) for facilities in California and Texas. ( 15 comments)

| |

|---|

What else is happening...

| |

|---|

Today's Markets

In Asia, Japan +1.3%. Hong Kong +1.9%. China closed. India -0.1%.

In Europe, at midday, London flat. Paris flat. Frankfurt flat.

Futures at 6:20, Dow +0.6%. S&P +0.6%. Nasdaq +0.5%. Crude +0.9% to $60.12. Gold -0.2% at $1819.40. Bitcoin +2.4% to $49028.

Ten-year Treasury Yield +6 bps 1.26%

Today's Economic Calendar

| |

|---|

|

|---|

| |

|---|

|

|

...if i do ill try to post.

...if i do ill try to post.