You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Intersting thoughts

- Thread starter Bozzie

- Start date

dont have many holdings in my trading account anymore , lol. Been taking profits .Still own some kweb (dumped some more today, fuckin chart is near vertical , crazy ) and qqq's . Out of MJ, ICLN, ARKK, ARKF, very grateful for the gains. . Could get stopped this week on both qqq, kweb will see.

Price is price , adn the charts on the major indices have not turned , not even close . I plan to get back into any of those 4 etfs if opportunity presents...breakout for XLE (fossil fuel energy) whoa!!!

ES

https://www.investing.com/indices/us-spx-500-futures-streaming-chart

cick 1D then the furthest button on that line 'widescreen'

the ES (spy) was playing in a box ; top of the box 3855ish, bottom of the box 3675 ish. It broke the top of the box and ran to 3957, a +2.6% run . If it pulls back , it needs to HOLD this level ; 3855ish zone is now support. If it was to lose it? the bottom of the box is at play, 3675, that's a 7% fall from the alltime high 3957 (not saying it will go there, but it can , lots of support there).

approx 70% of stock price action just follows the index, if the index pulls back, most stocks will as well. Keep an eye on these levels, esp 3855ish. Stocks /etfs with higher beta numbers will move dramatically faster to the downside than the SPY

again from the charts, NOTHING has been breached , no danger . AND not seeing any massive dark pool prints on the major indices, no big players gettin' atta dodge!...if i do ill try to post.

GL Boz, guys

...

levels are levels.

And of course , when the market retraces etfs/stocks with high beta can violently turn the other way. ARKK a great example of that today, it also showed how powerful its retail investor following is-- as it tanked real early 10% !!!! before buyers came in. Folks panic selling

the NS is at a support (as is aapl )-- it must must hold. it is so far AND its showing a bullish negative divergence . the qqq's had a beautiful bullish pin bar at about 10:30 am, that fell apart...lets see the close .

have my eye on a whole bunch of shit!! ha!!!!!!

|

I'm tempted to buy more BABA, but I want to keep some cash on hand (I'm about 75% invested, 25% cash - I'd like to get to 67%/33%)....but alas, I bought more AAPL today as it was down 2+%. I'm at 125 shares of AAPL now, my biggest holding.

I also added a few ARK's (1 or 2 shares of each).

I am too, BABAs going to uncork eventually..I've been seeing 450.00 targets long.

Can you lose buying Apple and holding...?

AVDL should announce results soon...I've been slowly buying little odd lots went it dips.

I like those IA funds CB..

We take possess of this farm on the 28th, only 2 miles inland from the coast but 20 degrees warmer in the summer, meeting with the owner tomorrow to go over the cows and chickens/ and equipment we bought.

My goal is to wrap up a few other work obligations I have going this year and build a pole barn alone/with friends over the following year..I'd sub out the foundation pour.

Building stuff is what I like to do more than anything..I'm itching hard to get started.

https://www.youtube.com/watch?v=FclK5_dfwWg

Damn, that will be a fun project! Congrats!

I have a small cabin (I'm sure I've mentioned it). My cousin is a builder and he was the builder (I was his helper). I paid cash for it and it took about 2 years to build. We're going to sell it soon, as we are planning our move back to Florida. It was a long process, but I love that place. It's 30x24, w/ 2 bedrooms, a loft (with 2 queen beds), 1.5 baths (plus an outdoor shower) and a 200sf shed on the property. We rent it out on airbnb (made over $20k last year). It's going to be sad selling it, but my plan is to buy a lake lot in central Florida eventually and do a similar project. I love getting away to that place!

I have a small cabin (I'm sure I've mentioned it). My cousin is a builder and he was the builder (I was his helper). I paid cash for it and it took about 2 years to build. We're going to sell it soon, as we are planning our move back to Florida. It was a long process, but I love that place. It's 30x24, w/ 2 bedrooms, a loft (with 2 queen beds), 1.5 baths (plus an outdoor shower) and a 200sf shed on the property. We rent it out on airbnb (made over $20k last year). It's going to be sad selling it, but my plan is to buy a lake lot in central Florida eventually and do a similar project. I love getting away to that place!

Man..that sounds like good fun and congrats on Florida..You've said that's the goal...Getting back to Florida. I'm sure the DC area hasn't been great over the past few months.

With those skills hopefully you make it out to Oregon during the build CB..ha.

I'm just an un-talented laborer! I did a lot of the painting, nailing, trim work, floors, etc. He did all the framing, electrical work, carpentry, etc. We used log siding, so it looks like a log cabin. I just re-stained it last summer (two sides). I've got about $140K into it and hoping we can get $190k+ (property out there is pretty cheap and the square footage is low). It's on 3-acres, which is nice. We do a lot of shooting...and whiskey drinking!

I love a good Bourbon.

I think you'll be shocked with what you get Cabins with land have been going through the roof at least in the westerner half of the country.

This house we bought just before C19 on the water has skyrocketed...Up like 300k this year or 30%, I've never seen anything like it.

Always, I hope you guys crush it and bet you will.

I think you'll be shocked with what you get Cabins with land have been going through the roof at least in the westerner half of the country.

This house we bought just before C19 on the water has skyrocketed...Up like 300k this year or 30%, I've never seen anything like it.

Always, I hope you guys crush it and bet you will.

Damn, that will be a fun project! Congrats!

I have a small cabin (I'm sure I've mentioned it). My cousin is a builder and he was the builder (I was his helper). I paid cash for it and it took about 2 years to build. We're going to sell it soon, as we are planning our move back to Florida. It was a long process, but I love that place. It's 30x24, w/ 2 bedrooms, a loft (with 2 queen beds), 1.5 baths (plus an outdoor shower) and a 200sf shed on the property. We rent it out on airbnb (made over $20k last year). It's going to be sad selling it, but my plan is to buy a lake lot in central Florida eventually and do a similar project. I love getting away to that place!

Hey Coach if you can move into that property and live in it as your primary residence for two years and then sell then I believe you wont have to pay capital gains on that property. That would probably be a significant tax savings. Worth considering. Since you built it and your cost basis is low and you are probably depreciating it on your taxes....that check to uncle sam would be significant. God knows we need more taxes.....but you would probably prefer it to be someone elses.

Hey Coach if you can move into that property and live in it as your primary residence for two years and then sell then I believe you wont have to pay capital gains on that property. That would probably be a significant tax savings. Worth considering. Since you built it and your cost basis is low and you are probably depreciating it on your taxes....that check to uncle sam would be significant. God knows we need more taxes.....but you would probably prefer it to be someone elses.

Yes, I've thought about that...but I'm selling my primary home at about the same time (both in Virginia). I hope to show that it cost me over $175k to build, update, etc. So I'm hoping I only have to pay taxes on about $25k-$40k of it.

|

|

| Global Market Comments February 25, 2021 Fiat Lux Featured Trade: (TAKING A LOOK AT THE ROM) (ROM) (BRING BACK THE UPTICK RULE!)

|

| � |

Taking a Look at the ROM If you have a Great Recession type of stock market, you have to employ a Great Recession type trading strategy.Markets are now pricing in the end of the pandemic. Fear has outrun the facts of the epidemic by 1,000 to one. The result has been a classic rip-your-face-off rally worth 14,000 Dow points. So, I have been dusting off some of my favorite trades for a decade ago, when we were dealing with similar levels of panic, despair, and desperation. Suddenly, the (ROM) came to mind. The (ROM) is the ProShares Ultra Technology ETF, a 2X long in the top technology shares. It holds the fastest growing, cream of the cream of corporate America which you want to hide behind the radiator and keep forever. Quality is on sale now and here is where you want to be loading the boat. (ROM) even pays a modest 0.17% dividend. (ROM)’s ten largest holdings include: Microsoft (MSFT) Apple (AAPL) Facebook (FB) Alphabet (GOOGL) Intel (INTC) Cisco (CSCO) Adobe (ADBE) NVIDIA (NVDA) Salesforce (CRM) Oracle (ORCL) The major (ROM) holdings, like Apple, Amazon, and Facebook (FB) have gone virtually nowhere for six months. Yet, their earnings have continued to grow at a feverish 20% annual rate. These stocks were just exhausted and needed a time-out. Since last week, the (ROM) suffered a nearly 10% selloff. So, there’s your entry point. It gets better. The (ROM) HAS OPTIONS. That means you can lay on out-of-the-money LEAPS on the (ROM). I’ll give you an example. A year ago, you could buy the (ROM) August 2021 $30-$32 LEAP for $0.91. If the (ROM) recovered from the then-current $25 to $32 by August 2021 expiration you could earn a profit of 120%. That means a 28% gain in the stock brought you a 120% profit in the LEAP, implying a limited risk return (you can’t lose any more than you put in) of 428%. Remember too that a 2X ETF can cover a lot of ground in a very short time in a new bull market. It has since done exactly that. The harder I work, the luckier I get. To learn more about (ROM), please click here for their website.

|

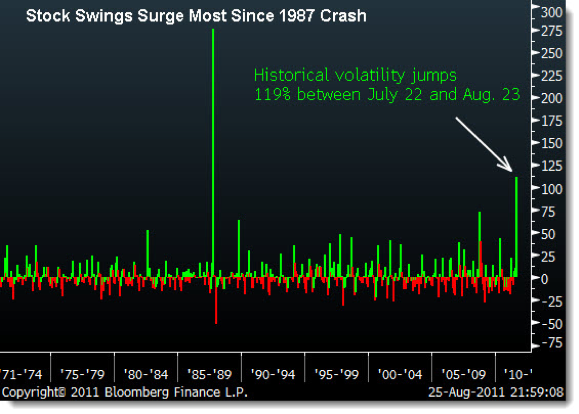

Bring Back the Uptick Rule!When the Dow crashed 514 points in a single day a few years ago, the market lost a staggering $850 billion in market capitalization. High frequency traders were possibly responsible for half of this move, but generated a mere $65 million in profits, some 7/1,000’s of a percent of the total loss. Are market authorities and regulators being penny-wise but pound-foolish? The carnage the HF traders are causing is triggering a rising cry from market participants to ban the despised strategy. Many are calling for the return of the “short sale test tick rule”, or SEC Rule 17 CFR 240.10a-1, otherwise known as the “uptick rule”, which permits traders to execute short sales only if the previous trade caused an uptick in prices. The rule was created eons ago to prevent the sort of cascading, snowballing selling that we are seeing today. It was repealed on July 6, 2007. Check out a chart of the volatility that ensued and it will make your hair on the back of your neck raise. Those unfamiliar with how algorithmic trading works, see it as something akin to illegal front running. “Co-location” of mainframes with exchange computers, or having them in adjacent rooms, gives them another head start over the rest of us. Much of the trading sees HF traders battling each other and involves what used to be called “spoofing”, the placing of large, out-of-the-market orders with no intention of execution. Needless to say, if you or I tried any of these shenanigans, the SEC would lock us up in the can so fast it would make your head spin. Many accuse exchange authorities of a conflict of interest, allowing members to reap sizeable custody fees from HF traders, while the rest of us get taken to the cleaners. Co-location fees run in the hundreds of thousands of dollars per customer per month. This is happening while traditional revenue sources, like proprietary trading, are disappearing, thanks to Dodd-Frank. There is no doubt that the volatility is driving the retail investor from the market. In fact, HF trading has been around since the nineties, back when the uptick rule was still in place and co-location was a term out of Star Trek. But it was small potatoes then, confined to a few niche players like Renaissance, and certainly lacked the firepower to engineer 500-point market swings. The big problem with this solution is that HF trading now accounts for up to 70% of the daily trading volume. Ban them, and the market volatility will shrink back to double-digit trading ranges that will put us all asleep. The diminished liquidity might make it difficult for the 800-pound gorillas of the market, like Fidelity and CalPERS, to execute trades, further frightening end investors from equities. It is possible that we have become so addicted to the crack cocaine that HF traders provide us that we can’t live without it?

|

Quote of the Day[FONT=Arial, Helvetica, sans-serif]“Any sufficiently advanced technology is indistinguishable for magic, said Arthur C. Clark, futurologist and author of 2001: A Space Odyssey.[/FONT] [FONT=Arial, Helvetica, sans-serif][/FONT][FONT=Arial, Helvetica, sans-serif]

|

Dont have to tell you that means we should all be buying. Unfortunately I like what I have so I dont have cash on hand.

Would be smashing Mara at $29 this morning.

I hear ya. I don't have a lot of cash on hand and I bought a couple of stocks a few days back when I thought the market had dipped enough. I like them all and they will come back. Always do. Just have to be patient.