You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Intersting thoughts

- Thread starter Bozzie

- Start date

The SUBZ ETF looks interesting.

Streaming world no doubt CB...

Good read on the SB

|

The market had a hell of a day today. I think I had my best single day ever in the market (I have to look through some spreadsheets, but I think it may be my best single day). Some big run ups in a few "risky" stocks I have. I'm considering liquidating a little this week.

I had one or two of those days last week.

I cut out ATOS last week and bought CVM at the close on Friday but not as much as I want...I still think CVM has a dip in it ...More risk for risk in this trade.

I've been watching the pennies a few guys have been posting ( WELL DONE FELLAS ! ) ..I like it but I'm deep in the penny department already and the risk is real.

|

Global Market Comments

February 9, 2021

Fiat LuxFeatured Trade:(ON EXECUTING MY TRADE ALERTS),

(TEN REASONS WHY STOCKS CAN’T SELL OFF BIG TIME),

(SPY), (INDU), ($COMPQ), (IWM), (TLT), (GME)

February 9, 2021

Fiat LuxFeatured Trade:(ON EXECUTING MY TRADE ALERTS),

(TEN REASONS WHY STOCKS CAN’T SELL OFF BIG TIME),

(SPY), (INDU), ($COMPQ), (IWM), (TLT), (GME)

On Executing Trade AlertsFrom time to time, I receive an email from a subscriber telling me that they are unable to get executions on trade alerts that are as good as the ones I get.

There are several possible reasons for this:

1) Markets move, sometimes quite dramatically so. That’s why I include a screenshot of my personal trading account with every trade alert to reliably source the price for the readers.

2) Your Trade Alert email was hung up on your local provider’s server, getting it to you late. This is a function of your local provider’s lack of adequate capital investment and is totally outside our control.

3) The spreads on deep-in-the-money options spreads can be quite wide. This is why I recommend readers only place limit orders to work in the middle market. Make the market come to you. Never buy at market or pay the offered side of the market unless you are in a stop-loss situation.

4) Hundreds of market makers read Global Trading Dispatch and many have attached algorithms to my service. The second they see one of my Trade Alerts, they adjust their markets accordingly.

This is especially true for deep-in-the-money options. A spread can go from totally ignored to a hot item in seconds. I have seen daily volume soar from 10 contracts to 10,000 in the wake of my Trade Alerts.

On the one hand, this is good news, as my Trade Alerts have earned such credibility in the marketplace, with a 95% success rate. On the other hand, it is a problem for readers to encounter sharp elbows when attempting executions in competition with market makers.

5) Occasionally, emails just disappear into thin air. We use cutting-edge technology, and sometimes it just plain doesn’t work.

This is why I strongly recommend that readers sign up for my free Text Alert Service as a backup. Trade Alerts are also always posted on the website as a secondary backup and show up in the daily P&L as a third. So, we have triple redundancy here. To sign up for the text alert service, please email support@madhedgefundtrader.com indicating your mobile phone number and put Text Alert Service in the subject line.

The bottom line for all of this is that the prices quoted in my Trade Alertsare just ballpark ones with the intention of giving traders some name picking and directional guidance. I pick the name and the direction and that is the heavy lifting when picking winning trades.

You have to exercise your own judgment as to whether the risk/reward is sufficient with the prices you are able to execute yourself.

Sometimes it is better to pay up by a few cents rather than miss the big trend. The market rarely gives you second chances.

Good luck and good trading.

John Thomas

There are several possible reasons for this:

1) Markets move, sometimes quite dramatically so. That’s why I include a screenshot of my personal trading account with every trade alert to reliably source the price for the readers.

2) Your Trade Alert email was hung up on your local provider’s server, getting it to you late. This is a function of your local provider’s lack of adequate capital investment and is totally outside our control.

3) The spreads on deep-in-the-money options spreads can be quite wide. This is why I recommend readers only place limit orders to work in the middle market. Make the market come to you. Never buy at market or pay the offered side of the market unless you are in a stop-loss situation.

4) Hundreds of market makers read Global Trading Dispatch and many have attached algorithms to my service. The second they see one of my Trade Alerts, they adjust their markets accordingly.

This is especially true for deep-in-the-money options. A spread can go from totally ignored to a hot item in seconds. I have seen daily volume soar from 10 contracts to 10,000 in the wake of my Trade Alerts.

On the one hand, this is good news, as my Trade Alerts have earned such credibility in the marketplace, with a 95% success rate. On the other hand, it is a problem for readers to encounter sharp elbows when attempting executions in competition with market makers.

5) Occasionally, emails just disappear into thin air. We use cutting-edge technology, and sometimes it just plain doesn’t work.

This is why I strongly recommend that readers sign up for my free Text Alert Service as a backup. Trade Alerts are also always posted on the website as a secondary backup and show up in the daily P&L as a third. So, we have triple redundancy here. To sign up for the text alert service, please email support@madhedgefundtrader.com indicating your mobile phone number and put Text Alert Service in the subject line.

The bottom line for all of this is that the prices quoted in my Trade Alertsare just ballpark ones with the intention of giving traders some name picking and directional guidance. I pick the name and the direction and that is the heavy lifting when picking winning trades.

You have to exercise your own judgment as to whether the risk/reward is sufficient with the prices you are able to execute yourself.

Sometimes it is better to pay up by a few cents rather than miss the big trend. The market rarely gives you second chances.

Good luck and good trading.

John Thomas

Ten Reasons Why Stocks Can’t Sell Off Big Time

While driving back from Lake Tahoe last weekend, I received a call from a dear friend who was in a very foul mood.Following the advice of another newsletter whose name I won’t mention, he bailed out of all his stocks during the March 2020 meltdown. He was promised that Armageddon was coming, and the Dow would collapse all the way down to 3,000.

With the Federal Reserve now flooding the markets with QE and the government about to unleash untold numbers of stimulus packages, here we are with all the major stock indexes at all-time highs, the (INDU), ($COMPQ), and the (IWM). Higher summits beckon.

Why the hell are stocks still going up?

I paused for a moment as a kid driving a souped-up Honda weaved into my lane of Interstate 80, cutting me off. My Tesla Model X on autopilot suddenly broke sharply. Then I gave my friend my response, which I summarize below:

1) There is nothing else to buy. Complain all you want, but US equities are now one of the world’s highest-yielding securities, with a lofty 1.8% dividend.

A staggering 50% of S&P 500 stocks now yield more than US Treasury bonds (TLT). That compares to two-thirds of all developed world debt offering negative rates and US Treasuries at a parsimonious 1.51%.

2) Oil remains historically low, and the windfall cost savings are only just being felt around the world. $50 a barrel is a hell of a lot cheaper than $150.

3) Obscured by the GameStop (GME) fiasco was the fact that technology stocks continue to report absolutely blockbuster earnings. This will continue for another decade. Buy them before they go up ten times….again.

4) What follows a collapse in European economic growth? A European recovery. European quantitative easing is working just as well as it is here.

5) What follows a Japanese economic collapse? A recovery there too, as hyper-accelerating QE feeds into the main economy. Japanese stocks are now among the world’s cheapest.

6) While the next move in interest rates will certainly be up, it is not going to move the needle on corporate P&L’s for a very long time. We might see at most two 25 basis point cuts by the end of this cycle, and that probably won’t happen until the second half of 2020. In a deflationary world, there is no room for more.

This will make absolutely no difference to the large number of high growth corporates, like technology firms, that don’t borrow at all because they have enormous cash internal flows. That will be most of the stocks you own if you don’t index. Probably half of all listed stocks have no net borrowing.

7) Technology everywhere is accelerating at an immeasurable pace causing profits to do likewise. You see this in the FANG stocks, where blockbuster earnings reports are becoming as reliable as free upgrades.

Biotech has been on a tear as well.

See the new Alzheimer’s cure? It involves extracting the cells from the brains of alert 95-year old’s, cloning them, and then injecting them into early stage Alzheimer’s patients. I’ve already put myself on the waiting list.

The success rate has been 70%. That one alone could be worth $5 billion a year. I might be a user of this cure myself someday.

8) US companies are still massive buyers of their own stock, some $1 trillion worth this year. Banks are back in the game for the first time in a year, forced to conserve capital during the crash.

This has created a free put option for investors for the most aggressive companies, like Apple (AAPL), Cisco Systems (CSCO), Microsoft (MSFT), IBM (IBM), and Intel (INTC), the top five share repurchasers.

They have nothing else to buy either. (AIG) has mandated the repurchase of an amazing 25% of its outstanding float.

They are jacking up dividend payouts at a frenetic pace as well and are expected to return more than $700 billion in payouts this year.

9) Ignore this at your peril, but China is stimulating their economy like crazy, and it is just a matter of time before that growth spills over to the US. The Coronavirus scare has prompted them to increase their quantitative easing efforts by a multiple. Biden will end the trade wars allowing a resumption of international trade the previous highs.

10) Ditto for the banks, which were dragged down by falling interest rates for most of the last decade. Reverse that trade this year, and you have another major impetus to drive stock indexes higher. Financials are looking like the top performing sector of 2021.

My friend was somewhat set back, dazzled, and non-plussed by my out-of-consensus comments.

With that, I told my friend I had to hang up as another kid driving a souped-up Shelby Cobra GT 500, obviously stolen, was weaving back and forth in front of me requiring my attention.

Where is a cop when you need them? Are they ALL afraid to catch Covid-19?

While driving back from Lake Tahoe last weekend, I received a call from a dear friend who was in a very foul mood.Following the advice of another newsletter whose name I won’t mention, he bailed out of all his stocks during the March 2020 meltdown. He was promised that Armageddon was coming, and the Dow would collapse all the way down to 3,000.

With the Federal Reserve now flooding the markets with QE and the government about to unleash untold numbers of stimulus packages, here we are with all the major stock indexes at all-time highs, the (INDU), ($COMPQ), and the (IWM). Higher summits beckon.

Why the hell are stocks still going up?

I paused for a moment as a kid driving a souped-up Honda weaved into my lane of Interstate 80, cutting me off. My Tesla Model X on autopilot suddenly broke sharply. Then I gave my friend my response, which I summarize below:

1) There is nothing else to buy. Complain all you want, but US equities are now one of the world’s highest-yielding securities, with a lofty 1.8% dividend.

A staggering 50% of S&P 500 stocks now yield more than US Treasury bonds (TLT). That compares to two-thirds of all developed world debt offering negative rates and US Treasuries at a parsimonious 1.51%.

2) Oil remains historically low, and the windfall cost savings are only just being felt around the world. $50 a barrel is a hell of a lot cheaper than $150.

3) Obscured by the GameStop (GME) fiasco was the fact that technology stocks continue to report absolutely blockbuster earnings. This will continue for another decade. Buy them before they go up ten times….again.

4) What follows a collapse in European economic growth? A European recovery. European quantitative easing is working just as well as it is here.

5) What follows a Japanese economic collapse? A recovery there too, as hyper-accelerating QE feeds into the main economy. Japanese stocks are now among the world’s cheapest.

6) While the next move in interest rates will certainly be up, it is not going to move the needle on corporate P&L’s for a very long time. We might see at most two 25 basis point cuts by the end of this cycle, and that probably won’t happen until the second half of 2020. In a deflationary world, there is no room for more.

This will make absolutely no difference to the large number of high growth corporates, like technology firms, that don’t borrow at all because they have enormous cash internal flows. That will be most of the stocks you own if you don’t index. Probably half of all listed stocks have no net borrowing.

7) Technology everywhere is accelerating at an immeasurable pace causing profits to do likewise. You see this in the FANG stocks, where blockbuster earnings reports are becoming as reliable as free upgrades.

Biotech has been on a tear as well.

See the new Alzheimer’s cure? It involves extracting the cells from the brains of alert 95-year old’s, cloning them, and then injecting them into early stage Alzheimer’s patients. I’ve already put myself on the waiting list.

The success rate has been 70%. That one alone could be worth $5 billion a year. I might be a user of this cure myself someday.

8) US companies are still massive buyers of their own stock, some $1 trillion worth this year. Banks are back in the game for the first time in a year, forced to conserve capital during the crash.

This has created a free put option for investors for the most aggressive companies, like Apple (AAPL), Cisco Systems (CSCO), Microsoft (MSFT), IBM (IBM), and Intel (INTC), the top five share repurchasers.

They have nothing else to buy either. (AIG) has mandated the repurchase of an amazing 25% of its outstanding float.

They are jacking up dividend payouts at a frenetic pace as well and are expected to return more than $700 billion in payouts this year.

9) Ignore this at your peril, but China is stimulating their economy like crazy, and it is just a matter of time before that growth spills over to the US. The Coronavirus scare has prompted them to increase their quantitative easing efforts by a multiple. Biden will end the trade wars allowing a resumption of international trade the previous highs.

10) Ditto for the banks, which were dragged down by falling interest rates for most of the last decade. Reverse that trade this year, and you have another major impetus to drive stock indexes higher. Financials are looking like the top performing sector of 2021.

My friend was somewhat set back, dazzled, and non-plussed by my out-of-consensus comments.

With that, I told my friend I had to hang up as another kid driving a souped-up Shelby Cobra GT 500, obviously stolen, was weaving back and forth in front of me requiring my attention.

Where is a cop when you need them? Are they ALL afraid to catch Covid-19?

Quote of the Day

“We have the intelligence of a moss growing on a rock compared to nature as a whole…Don’t get hung up on your views of how things should be because you’ll miss out on learning how they really are,” said hedge fund legend Ray Dalio.

SPAC’s are over done when Kaepernick can fund a $200M+. NO.

|

Sold AVDL, needed some cash. Got out at 9.01

Thanks for the advice on this one!

Sweet...above 9 is great.

|

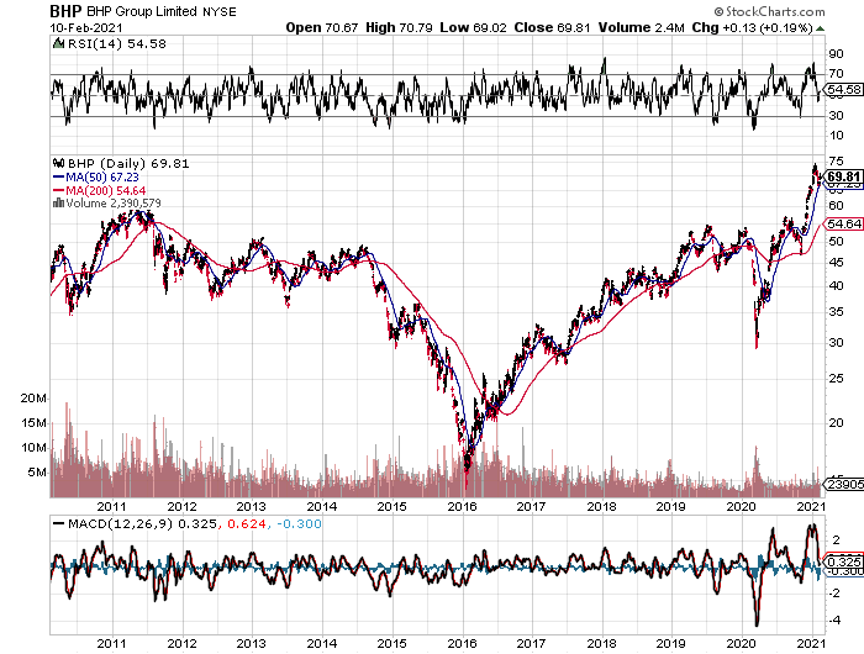

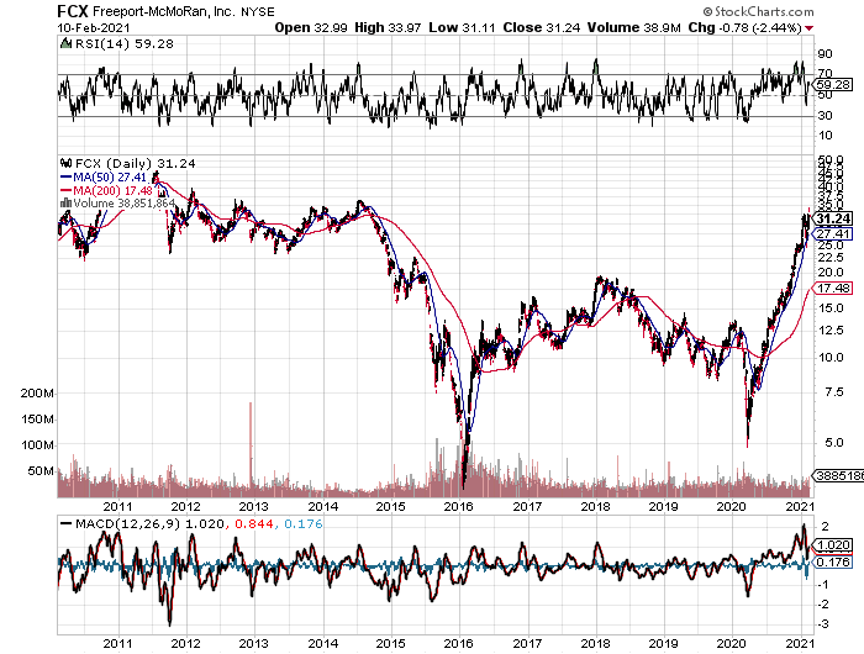

| Global Market Comments February 11, 2021 Fiat Lux Featured Trade: (THE NEXT COMMODITY SUPER CYCLE HAS ALREADY STARTED), (COPX), (GLD), (FCX), (BHP), (RIO), (SIL), (PPLT), (PALL), (GOLD), (ECH), (EWZ), (IDX)

|

| � |

The Next Commodity Supercycle Has Already StartedWhen I closed out my position in Freeport McMoRan (FCX) near its max profit, I received a hurried email from a reader if he should still keep the stock. I replied very quickly: “Hell, yes!” When I toured Australia a couple of years ago, I couldn’t help but notice a surprising number of fresh-faced young people driving luxury Ferraris, Lamborghinis, and Porsches. I remarked to my Aussie friend that there must be a lot of indulgent parents in The Lucky Country these days. “It’s not the parents who are buying these cars,” he remarked, “It’s the kids.” He went on to explain that the mining boom had driven wages for skilled labor to spectacular levels. Workers in their early twenties could earn as much as $200,000 a year, with generous benefits. The big resource companies flew them by private jet a thousand miles to remote locations where they toiled at four-week on, four-week off schedules. This was creating social problems, as it is tough for parents to manage offsprings who make far more than they do. The Great Commodity Boom has started, and in fact, we are already two years into a prolonged supercycle. China, the world’s largest consumer of commodities, is currently stimulating its economy on multiple fronts, including generous corporate tax breaks and relaxed reserve requirements. Get a trigger like the impending settlement of its trade war with the US and it will be off to the races once more for the entire sector. The last bear market in commodities was certainly punishing. From the 2011 peaks, copper (COPX) shed 65%, gold (GLD) gave back 47%, and iron ore was cut by 78%. One research house estimated that some $150 billion in resource projects in Australia were suspended or cancelled. Budgeted capital spending during 2012-2015 was slashed by a blood curdling 30%. Contract negotiations for price breaks demanded by end consumers broke out like a bad case of chickenpox. The shellacking was reflected in the major producer shares, like BHP Billiton (BHP), Freeport McMoRan (FCX), and Rio Tinto (RIO), with prices down by half or more. Write-downs of asset values became epidemic at many of these firms. The selloff was especially punishing for the gold miners, with lead firm, Barrick Gold (GOLD), seeing its stock down by nearly 80% at one point, lower than the darkest days of the 2008-2009 stock market crash. You also saw the bloodshed in the currencies of commodity-producing countries. The Australian dollar led the retreat, falling 30%. The South African Rand has also taken it on the nose, off 30%. In Canada, the Loonie got cooked. The impact of China cannot be underestimated. In 2012, it consumed 11.7% of the planet’s oil, 40% of its copper, 46% of its iron ore, 46% of its aluminum, and 50% of its coal. It is much smaller than that today, with its annual growth rate dropping by more than half, from 13.7% to 2.3% in 2020. What happens to commodity prices when China recovers the heady growth rates of yore? It boggles the mind. The rise of emerging market standards of living will also provide a boost to hard asset prices. As China goes, so does its satellite trading partners, who rely on the Middle Kingdom as their largest customer. Many who are also major commodity exporters themselves, like Chile (ECH), Brazil (EWZ), and Indonesia (IDX), are looking to come back big time. As a result, western hedge funds will soon be moving money out of paper assets, like stocks and bonds, into hard ones, such as gold, silver (SIL), palladium (PALL), platinum (PPLT), and copper. A massive US stock market rally has sent managers in search of any investment that can’t be created with a printing press. Look at the best performing sectors this year and they are dominated by the commodity space. The bulls may be right for as long as a decade, thanks to the cruel arithmetic of the commodities cycle. These are your classic textbook inelastic markets. Mines often take 10-15 years to progress from conception to production. Deposits need to be mapped, plans drafted, permits obtained, infrastructure built, capital raised, and bribes paid in certain countries. By the time they come online, prices have peaked, drowning investors in red ink. So a 1% rise in demand can trigger a price rise of 50% or more. There are not a lot of substitutes for iron ore. Hedge funds then throw gasoline on the fire with excess leverage and high frequency trading. That gives us higher highs, to be followed by lower lows. I am old enough to have lived through a couple of these cycles now, so it is all old news to me. The previous bull legs of supercycles ran from 1870-1913 and 1945-1973. The current one started for the whole range of commodities in 2016. Before that, it was down from seven years. While the present one is short in terms of years, no one can deny how business cycles will be greatly accelerated by the end of the pandemic. Some new factors are weighing on miners that didn’t plague them in the past. Reregulation of the US banking system has forced several large players, like JP Morgan (JPM) and Goldman Sachs (GS) to pull out of the industry completely. That impairs trading liquidity and widens spreads— developments that can only accelerate upside price moves. The prospect of flat US interest rates is also attracting capital. That reduces the opportunity cost of staying in raw metals, which pay neither interest nor dividends. The future is bright for the resource industry. While the gains in Chinese demand are smaller than they have been in the past, they are off of a much larger base. In 20 years, Chinese GDP has soared from $1 trillion to $14.5 trillion. Some 20 million people a year are still moving from the countryside to the coastal cities in search of a better standard of living and improved prospects for their children. That is the good news. The bad news is that it looks like the headaches of Australian parents of juvenile high earners may persist for a lot longer than they wish. Buy all commodities on dips for the next several years.

|

Quote of the Day"If horses could have voted, there never would have been cars," said my friend, Tom Friedman, a columnist at the New York Times.

|

ADVL is up .32 pre-market. FML!

I think it's getting close to announcing results If they aren't good you made the right choice..

You see LLNW? when they started talking about becoming a security company I knew it was trouble.

I sold half at almost even but still have a bunch I'm going to have to hold for at least a few quarters if not longer.

|

ADVL is up .32 pre-market. FML!

Made me laugh. It is down from where you sold now....if your like me at all.....now you feel better about your sale.

TLRY was like that for me. Sold and made money and then mad it went back up. Next day dropped like a rock and I was glad I sold.

It is nearly impossible for the average Joe or for that matter pros to sell at the top and buy at the bottom.....so you just have to accept that.....although I have nearly perfected buying high and selling low....not everyone has this skill.