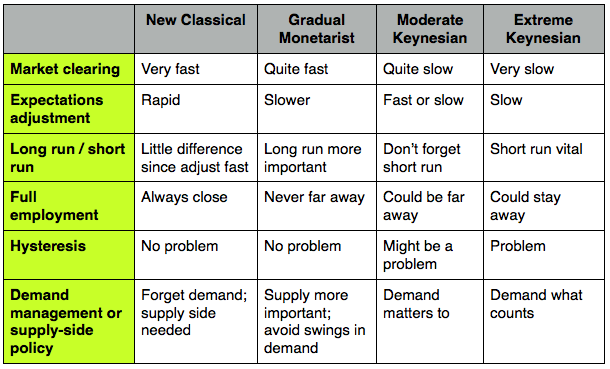

In papers and at forums, fund officials and outside experts said it was clear that government belt-tightening was taking a deeper toll on growth, especially in struggling Eurozone economies, than many of them previously thought.

Moreover, academic economists offered new evidence that cast doubt on a pro-austerity view that countries crossing certain debt-burden thresholds would see negative economic output.

These reports and statements were accompanied by an updated IMF forecast that downgraded the growth outlook for Britain and the United States and projected another year of recession for the 17-nation single-currency union.

In media interviews, some of the toughest criticisms were directed at Britain, which has not budged on its austerity drive.

It's "playing with fire," said the IMF's chief economist, Olivier Blanchard.

IMF Managing Director Christine Lagarde has taken more of a middle ground: She called for countries to reassess budget cuts that are too deep and too rapidly undertaken, but she also spoke about the continued need for balanced budgets, structural reforms and the importance of reducing debt.

"We need growth, first and foremost," Lagarde said Thursday. "Should growth abate … there should be consideration for adjusting the pace" of fiscal consolidation.

http://articles.latimes.com/2013/apr/19/business/la-fi-economy-imf-20130419