I hear ya. I don't have a lot of cash on hand and I bought a couple of stocks a few days back when I thought the market had dipped enough. I like them all and they will come back. Always do. Just have to be patient.

|

I hear ya. I don't have a lot of cash on hand and I bought a couple of stocks a few days back when I thought the market had dipped enough. I like them all and they will come back. Always do. Just have to be patient.

|

| Good morning. (Was this newsletter forwarded to you? Sign up here.) |

|

| [h=2]The bond market gets fussy[/h] |

| The S&P 500 suffered its worst single-day drop in a month yesterday, with tech stocks hard hit. But the big story is in bonds, where yields surged (and prices fell) as investors worried that the Fed wasn’t, well, worried enough. |

| Is this another “taper tantrum”? The sharp rise in government bond yields in recent days, particularly in the longer-dated maturities used as benchmarks for consumer loans and mortgages, reminded many of the 2013 “taper tantrum.” Then, a jump in yields followed comments from Ben Bernanke, the Fed chairman at the time, that he would taper off the central bank’s emergency bond-buying program, which was propping up markets after the financial crisis. |

|

| This time, the Fed isn’t suggesting anything like that. Instead, it’s the central bank’s calm despite a potential surge in post-pandemic economic growth that seemingly spooks investors. They fear that keeping rates low and stimulus flowing freely will stoke inflation, which would require raising rates and withdrawing stimulus sooner than expected. |

| Cue the toddler metaphors. As every parent knows, there are several stages that a child goes through before hitting a full-blown tantrum: |

|

| But what if the tantrum is for real? A truly serious bond sell-off often leads to “contagion, illiquidity, busts, bankruptcies” and other ills, across all assets, analysts at Bank of America noted. That said, the 2013 tantrum faded relatively quickly and markets regained their footing. Now, the “only reason to be bearish is there is no reason to be bearish,” the analysts wrote (as good a reason as any for most tantrums). |

|

| [h=3]HERE’S WHAT’S HAPPENING[/h] |

| A minimum wage lift is blocked from the stimulus bill. The Senate’s parliamentarian ruled that the proposal to raise the federal minimum rate to $15 an hour couldn’t be included in President Biden’s $1.9 trillion plan. Democratic senators are studying ways to raise taxes on companies that don’tpay that rate as a workaround. (Costco won’t be one of them: It plans to raise its minimum wage to $16 an hour.) |

| The White House enlists corporate America in the pandemic fight. Major trade groups like the Chamber of Commerce and companies like Ford, the Gap and Uber will announce measures to join Mr. Biden’s call for a “wartime” mobilization, The Morning newsletter’s David Leonhardt reports. Steps will include donating face masks and giving people free rides and paid time off to get vaccinated. |

| The finance firm TIAA hires a top JPMorgan Chase executive as its next C.E.O. Thasunda Brown Duckett, the head of Chase Consumer Banking, will become one of only a few Black C.E.O.s in the Fortune 500 when she succeeds Roger Ferguson. (TIAA is also the first Fortune 500 company to have two Black C.E.O.s in a row.) |

| States are beginning to ease pandemic lockdowns. Governors across the U.S. are relaxing restrictions as infection rates decline and vaccinations increase. But Republicans are moving more quickly than Democratic counterparts. |

| Coinbase draws back the curtain as it prepares to go public. The cryptocurrency exchange disclosed its finances in its public filing for a direct listing yesterday, revealing that it made a $322 million profit, on $1.3 billion in revenue, last year. It warned that its fortunes were tied to the volatile nature of the crypto market. |

| [h=2]AT&T unloads DirecTV, kind of[/h] |

| AT&T is spinning off its television businesses — DirecTV, AT&T TV and U-verse — into a unit that will have the private equity group TPG as a minority shareholder. The deal values the brands at $16.25 billion, or about a quarter of the $67 billion value AT&T placed on DirecTV when it bought it in 2015. |

| “We certainly didn’t expect this outcome when we closed the DirecTV transaction in 2015, but it’s the right decision to move the business forward,” John Stankey, AT&T’s chief, told analysts. Streaming businesses have eaten into the earnings of broadcast companies like DirecTV: Over the past year, the unit lost more than three million subscribers. But despite falling sales and profits, it generates more than $4 billion in annual cash flow. |

| AT&T wants to focus on telecom and streaming. The company’s biggest forays beyond its wireless business — the DirecTV deal and the $85 billion purchase of Time Warner in 2018 — contributed to its $157 billion in debt. (It also bid $23 billion this week on 5G spectrum licenses.) The company will continue to consider selling noncore assets to pay down that debt, sources told DealBook. |

|

| [h=2]In the papers[/h] |

| Some of the academic research that caught our eye this week, summarized in one sentence: |

|

|

| [h=2]The S.E.C. fires a climate ‘warning flare’[/h] |

| This week, the regulator announced that it would “enhance its focus on climate-related disclosure in public company filings,” eventually updating guidelines issued in 2010. The timing of the announcement comes just days before the Senate confirmation hearings for Gary Gensler, President Biden’s pick to lead the commission. It puts the issue “front and center,” said the securities law partner Joseph Hall of Davis Polk. |

| The S.E.C. “is setting the stage, sending a signal that we are no longer in an administration where ‘climate change’ is a forbidden term,” Mr. Hall said. “It’s a warning flare to let people know new disclosure rules are coming down the pike.” He said he expected Democrats to push Mr. Gensler on adopting specific disclosure requirements, while Republicans will probably lobby for a more vague, principles-based system that gives companies extra leeway. |

| “It’s a significant statement and one companies can see as an opportunity,” according to Wes Bricker of PwC, a former chief accountant at the S.E.C. Mr. Bricker said he thought that many companies had already moved beyond what’s required under the old framework, responding to the market’s increasing demands for transparency on their environmental impact. For companies that are not there yet, the S.E.C.’s announcement is a reminder of the direction things are heading. |

| [h=2]The business of pain[/h] |

| In “Crisis,” a new movie about the opioid-addiction disaster by the writer and director Nicholas Jarecki, three interwoven stories offer radically different perspectives. Together, they show how fundamentally decent people — doctors, police officers, academics, government scientists, parents, children, people in pain and pharma executives — can make bad decisions in a subtly corrupting system. DealBook spoke with Mr. Jarecki about the film, out in theaters today and streaming next Friday. (The interview was edited and condensed for clarity). |

| Why this topic? |

| I had a friend who got involved with opioids many years ago and died. It was perplexing. No one understood. How did this happen? It turns out that opioids affect people very differently and that pills were far more addictive than drug makers admitted. Meanwhile, doctors were overprescribing, encouraged by pharmaceutical companies. We’re used to demonizing addicts, though in the last 10 years awareness of these problems has increased. Still, people are dying as we speak. |

| Gary Oldman plays a professor who accidentally discovers the truth. Is he a good guy? |

| He is compromised. I like characters who are conflicted because life is really more in the gray areas. Gary’s character is almost a rubber-stamp guy for a pharmaceutical company because I found in my research that doing routine lab work for corporations can bring a lot of money into schools, which suggests an inherent conflict. The professor gets caught in that. His boss is saying, “Do we really want to rock the boat?” He’s not sure. But his actions, his dealings with the university and government and drug company, have ramifications for other characters. |

| Do you blame corporations? |

| There’s no villain in this film sitting in a corporate boardroom thinking of how to kill people. But I do like to look at institutional dysfunction and systemic corruption. I’m fascinated by the role of money in American society, how well-meaning people can be perverted by financial incentives. The question then is whether there are adequate safeguards and regulations and how much responsibility we have to change things. |

| Can you talk about professionalism, how the concept shifts for characters? |

| There’s a scene where an undercover officer is seething over police bureaucracy and his boss warns him to be professional. She can sense he wants to break the rules. She’s telling him, “We’re here to serve a specific role, a certain function.” She wants him to stay in his lane, but maybe to do the right thing you have to do the wrong thing sometimes. Maybe we shouldn’t always stay in our lanes. |

| If you’ve found this newsletter helpful, please consider subscribing to The New York Times. Your support makes our work possible. |

| [h=3]THE SPEED READ[/h] |

| Deals |

|

| Politics and policy |

|

| Tech |

| Best of the rest |

|

| � |

good read, from the article;

The low rates also encouraged many homeowners who bought a new home not to sell their previous one, but to treat it as an investment property instead.

“Right now it’s a screaming good deal to have two properties: When my mortgage rate is 2.7 percent, why not have two of them?” said Michael Simonsen, the C.E.O. of Altos Research. “It took a long time, I think, to realize that that’s what was going on.”

2.7% ? even lower than that!

So buy two properties cause rates are low, lol, and only need 5% down...what a mess.Risk certainly is there ; waht if rates go up (which they will , the bond market is telling us that) and what if real estate FOMO subsides? what if govt imposes policy that is anti- real estate just as New Zealand has? (its policies take effect May 2021 as its govt has had enough,)

its insane Boz, what kinda future do young kids have in N America? cost of education is high (esp in your country), cost of real estate is stupid

a neighbor and good friend sold down the street for $1,400,000. He had a modest house. And bought in cottage country, in Wasaga Beach for $1,600,000-- a custom built spectacular house, I was there over the weekend. Wasaga Beach has a mixture of newly built nice brick homes and tiny old houses, all within walking distance. Folks buying the old little houses, and re-building .Empty lots are going for $350,000 to $400,000 !! A teacher friend is a real estate nutter and he bought two lots that were side by side in June for $200,000 and $250,000. He's getting cold calls for offers!! $750,000 for the 2. INSANE.

good read, from the article;

The low rates also encouraged many homeowners who bought a new home not to sell their previous one, but to treat it as an investment property instead.

“Right now it’s a screaming good deal to have two properties: When my mortgage rate is 2.7 percent, why not have two of them?” said Michael Simonsen, the C.E.O. of Altos Research. “It took a long time, I think, to realize that that’s what was going on.”

2.7% ? even lower than that!

So buy two properties cause rates are low, lol, and only need 5% down...what a mess.Risk certainly is there ; waht if rates go up (which they will , the bond market is telling us that) and what if real estate FOMO subsides? what if govt imposes policy that is anti- real estate just as New Zealand has? (its policies take effect May 2021 as its govt has had enough,)

its insane Boz, what kinda future do young kids have in N America? cost of education is high (esp in your country), cost of real estate is stupid

a neighbor and good friend sold down the street for $1,400,000. He had a modest house. And bought in cottage country, in Wasaga Beach for $1,600,000-- a custom built spectacular house, I was there over the weekend. Wasaga Beach has a mixture of newly built nice brick homes and tiny old houses, all within walking distance. Folks buying the old little houses, and re-building .Empty lots are going for $350,000 to $400,000 !! A teacher friend is a real estate nutter and he bought two lots that were side by side in June for $200,000 and $250,000. He's getting cold calls for offers!! $750,000 for the 2. INSANE.

With decent credit u can get 1.5% mortgage rate in Ontario.

I've been saying this for almost two years now, but there's a 'correction' coming in RE (I say "correction" because I don't think it's going to be 'crash', like we saw in 2007-2009). I'm looking to sell both properties here in Virginia to move back to Florida soon. We aren't sure if we're going to rent or buy something that we could use as a rental property after the "correction" happens and we buy our more permanent (nicer, more expensive) home. It's out of control right now and these low interest rates are irresponsible. IMO, the Covid response (stimulus packages) have extended this RE run (I think we would have already seen a correction if Covid hadn't happened). Now there's foreclosure protections and renter/eviction protections. So, once they pass this next stimulus it's going to extend it even further.

I do love Canada..Some of the cities home prices are disturbing, Vancouver and Toronto are insane.

I have work friends in Vancouver who make Great money by any standard and have no shot in hell at buying nice home in a good hood but its been that way for a while up there...Right?

Correct. I live just outside of Toronto (GTA). Housing prices have doubled every 10 years for the last 50 years. I keep hearing about this bubble blah blah blah.

Bought my place for 235 in 2003. House next door sold for $1,035,000. And it needs work lol.

There hasn't been a bubble in Toronto....ever. Small 10-15% corrections at most.

I couldn't afford to live here if I bought now.

Wow, great timingIt's nuts..This house we bought (dumb luck) the timing has been unreal..We bought another place.. cash offers moved to the front of the line and the place had 11 offers...I wish I could have financed at 2.7 instead.

Same thing is happening here with lots and now there is no inventory ..I look at houses everyday online.

We bought this place for 620,000 and lot next door for 200,000..A similar lot sold for 420K a few months ago and the comps on the house are over a million how...You can feel the population increasing here and large scale development is ramping up unfortunately ..we like the fact no-one lives here..yet.

If I was going to go to the end of the earth around here for deals it would be Joseph OR.... The highways dead end and its spectacular.

https://greattowns.com/oregon/joseph/index.html

I often tell my wife, "How do people do it?!?" I don't get it. Not everyone makes big money - or is a high income earner. Not every house is a doctor, lawyer, big money sales rep, business owner, etc. Not everyone gets family money. I know a lot of people live over their means. But it's ridiculous!

I make over $200K (I'll top $250K in 2021...hopefully) and have made over $120K since at least 2007. I have no debt other than my mortgage and whatever I spend on my credit card each month (I pay it off every month). I can't afford a million $$ home. No way. Especially the costs of maintaining a million $$ home - property taxes, insurance, usually larger utility bills, etc.

Where the F&CK are people getting the money??

Wow, great timing

I agree with Coach , current mortgage rates r largely to blame and irresponsible.

I see this shit as sad , not a chance the younger generation has it easier .

|

| Global Market Comments February 26, 2021 Fiat Lux Featured Trade: (REVISITING THE GREAT DEPRESSION) (EXPLORING MY NEW YORK ROOTS)

|

| � |

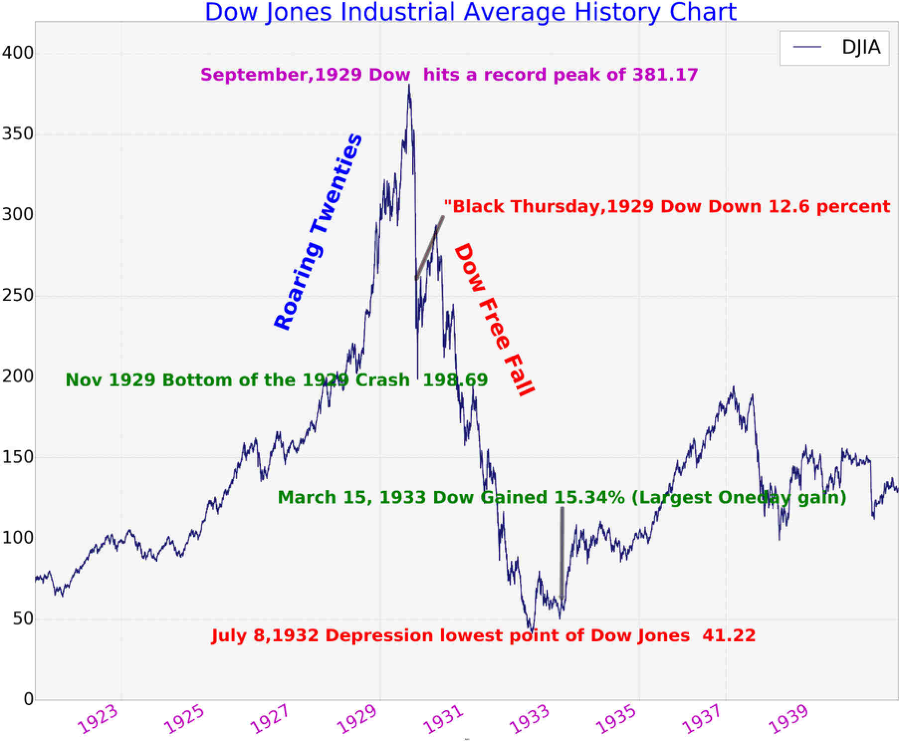

Revisiting the Great DepressionWhen I first arrived on Wall Street during the early 1980s, some of the old veterans who worked through the 1929 stock market crash were just retiring and passed their stories on to me before they left. One was my old friend, Sir John Templeton, founder of the Templeton funds, who often hosted me for dinner at his antebellum-style mansion in the Bahamas. John told me he was really excited when hired in ‘29 to handle the surge of brokerage business. After that, things got really boring for a decade. The downturn we are experiencing now has many similarities to that epic event. In some ways, it's far worse. The 1929 downturn was spread over 34 months. Ours happened almost instantly, in a mere four weeks. We all know about the Roaring Twenties, with flappers, bathtub gin, and a soaring stock market. Then, individuals could buy on ten to one margin. The high-flying tech stocks of the day, like RCA Radio and General Motors (GM), and Ford (F) soared. From 1921 to 1929, the Dow Average rocketed six-fold. The working class was sucked in. Industry followed suit, taking the sign of rising stocks as proof of an economic boom. They massively boosted production in all sectors. That meant they went into the Great Depression loaded to the gills with inventory. The Dow peaked on September 3, 1929 at 381. A slow burn of profit-taking ensued. Suddenly, a cascading waterfall of SELL orders hugely accelerated on “Black Monday” when the Dow plunged by 13%. It was followed by “Black Tuesday” when stocks lost another 13%. Margin calls triggered a run on the banks as investors tried to withdraw cash to cover margin calls. This spawned a financial crisis where eventually 4,000 banks went under. By November, the Dow had fallen by 48% to 198. JP Morgan stepped in to stabilize the market, prompting a short-term rally. It was to no avail. The market continued its slide, eventually hitting bottom at 41, or down an astonishing 89% from the top by July 8, 1932. The market then moved sideways in a wide 150-point range until the outbreak of WWII. It didn’t recover its 1929 peak until 1959. A few years ago, I had lunch with the former governor of the Federal Reserve (click here), who did his PhD dissertation on the causes of the Great Depression. The big mistake the Fed made then was to raise interest rates to damp down stock speculation. They ended up destroying the economy, inadvertently making the depression deeper and longer. The world has learned a lot about central banking since those dark days. For a start, the theory of Keynesianism has been adopted whereby governments borrow and spend during economic downturns and run balanced budgets or surpluses during good times. With QE Infinity in progress, the modern Fed won’t be making the same mistake twice. The Fed almost immediately took interest rates down to zero. Our central bank has also responded with monetary stimulus that is a large multiple of what we saw in 2008-09, essentially buying everything that is out there in fixed income land, some $120 billion a month. The money supply, M2, is growing at an unprecedented 26% a year. The Senate is about to pass a $1.9 trillion bailout bill. Add it all up and the amount of QE outstanding everywhere in the world over the last decade is about to rise by double in the coming months. It’s important that you don’t use selloffs to resort back to last year’s playbook. Cyclical recovery stocks are the play here, the sectors no one owns that haven’t moved in a decade. Save a return to tech for the future. My grandfather never participated in the stock boom of the 1920s. When the market crashed, he had to finish his basement in Brooklyn, New York so that several relatives who had lost homes could move in. We lost many equity investors for good in the 2018-09 crash. No doubt we will lose many more in this cycle. What did grandpa do with his money? He poured it all into real estate, including the land on which the Bellagio Hotel was eventually built, which he picked up in 1945 for $500 an acre. His estate sold it in 1978 for $10 million creating one heck of a family ruckus. He never bought a stock during his entire life.

|

Exploring my New York RootsWhile in New York waiting to board Cunard’s Queen Mary II to sail for Southampton, England, I decided to check out the Bay Ridge address near the Verrazano Bridge where my father grew up. I took a limo over to Brooklyn and knocked on the front door. I told the owner about my family history with the property, but I could see from the expression on his face that he didn’t believe a single word. Then I told him about the relatives moving into the basement during the Great Depression. He immediately let me in and gave me a tour of the house. He told me that he had just purchased the home and had extensively refurbished it. When they tore out the walls in the basement, he discovered that the insulation was composed of crumpled up newspapers from the 1930s, so he knew I was telling the truth. I told him that grandpa would be glad that the house was still in Italian hands. Could I enquire what he had paid for the house that sold in 1923 for $3,000? He said he bought it as a broken-down fixer-upper for a mere $775,000. As I passed under the Verrazano Bridge on the Queen Mary II later that day, I contemplated how much smarter grandpa became the older I got. I hope the same is true with my kids.

|

Quote of the Day“Lower yields, for longer, and lingering. I don’t think we’re going to get to an end for some period of time. The money that has been pumped into the system is going to keep equities high,” said Mark Grant, managing director of Hilltop Securities. [FONT=Arial, Helvetica, sans-serif][/FONT][FONT=Arial, Helvetica, sans-serif]

|

Someone should write a story proactively with a few SPAC disaster stories.. conversely the ballooning blank check wild card in the world of M&A...I like that part and it's the attraction for many.

Pretty interesting the players across politics and media...Worth the read...SPACs scare the shit outa me...Zero transparency with most.

https://www.nytimes.com/2021/02/27/style/SPACS-celebrity-craze.html?action=click&module=Features&pgtype=Homepage