The Greeks – Greek alphabet letters that refer to option valuation components, such as delta, theta, gamma, and vega , this is where the big money is, very complicated but very profitable.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Intersting thoughts

- Thread starter Bozzie

- Start date

As far as a BLUF goes.

This market is nuts and should be approached carefully if you're inexperienced.

I have the feeling the market is going to show "New retail " investors not to touch a hot stove.

I'm Bearish right now.. it bums me out as I'm sitting on cash but I'm waiting till things unwind a bit.

As an investor you won't not make as much but the down side can also be lessened.

This is a great experiment.. Nobody really knows how this is going to go...... So much debt is being created on every level.. it's mind boggling.

Quote of the Day

“In a social democracy with a fiat currency, all roads lead to inflation,” said legendary hedge fund manager Bill Fleckenstein.

This market is nuts and should be approached carefully if you're inexperienced.

I have the feeling the market is going to show "New retail " investors not to touch a hot stove.

I'm Bearish right now.. it bums me out as I'm sitting on cash but I'm waiting till things unwind a bit.

As an investor you won't not make as much but the down side can also be lessened.

This is a great experiment.. Nobody really knows how this is going to go...... So much debt is being created on every level.. it's mind boggling.

Global Market Comments

April 23, 2020

Fiat LuxFeatured Trade:(HOW TO FIND A GREAT OPTIONS TRADE)

April 23, 2020

Fiat LuxFeatured Trade:(HOW TO FIND A GREAT OPTIONS TRADE)

How to Find a Great Options Trade

You’ve spent vast amounts of time, money, and effort to become an options trading expert.

You know the difference between bids and offers, puts and calls, exercise prices and expiration days.

And you still can’t make any money.

Now What?

Where do you apply your newfound expertise? How do you maximize your reward while minimizing your risk?

It is all very simple.

Stick to five basic disciplines and you will suddenly find that the number of your new trades that are winners takes a quantum leap and money will start pouring into your trading account.

It’s really not all that hard to do. So here we go!

1) Know the Macro Picture

If you have a handle on whether the economy is growing or shrinking, you have a major advantage in the options market.

In a growing economy, you only want to employ bullish strategies, like calls, call spreads, and short volatility plays.

In a shrinking economy, you want to execute bearish plays, like puts, put spreads, and long volatility plays.

Remember, the only thing that is useful for your options trading is a view on what the economy is going to do NEXT.

The government only publishes historical economic data, which for the most part is useless in predicting what is going to happen in the future.

The options market is all about discounting what is going to happen next.

And how do you find that out?

Well, you could hire your own in-house staff economist. Or, you could rely on economic research from the largest brokerage houses.

Even the Federal Reserve puts out its own forecasts for economic growth prospects.

However, all of these sources have notoriously poor track records. Listening to them and placing bets on their advice CAN get you into a world of trouble.

For the best possible read on the future of the US and the global economy, there is no better place to go than Global Trading Dispatch, published by me, John Thomas, the Mad Hedge Fund Trader.

This is where the largest hedge funds and brokers go to find out what really is going to happen to the economy.

2) Looking for Great Industry Fundamentals

Do you want to give yourself another valuable edge?

There are over 100 different industries listed on US stock markets. However, only about 5 or 10 are really growing decisively at any particular time. The rest are either going nowhere or are shrinking.

In fact, you can find a handful of sectors that are booming, while others are in outright recession.

If you are a major hedge fund, institution, or government, you may want to cover all 100 of those industries. Good luck with that.

If you are a small hedge fund, or an individual working from home, you will want to conserve your time and resources, skip most of US industry and only focus on a handful.

Some traders take this a step further and only concentrate on a single high-growing, volatile industry like technology or biotech, or an even single name like Netflix (NFLX), Tesla (TSLA), or Amazon (AMZN).

How do you decide which industry to trade?

Brokerage houses pump out more free research than you could ever read in a lifetime. Government reports tend to be stodgy, boring, and out of date. Big hedge funds keep their in-house research confidential (although some of it leaks out to me).

The Mad Hedge Fund Trader solves this problem for you by limiting its scope to a small number of benchmark, pathfinder industries like technology, banks, energy, consumer cyclical, biotech, and cybersecurity.

In this way, we gain a handle on what is happening in the economy as a whole while lining up rifle shots on the best options trades out there.

We want to direct you where the action is and where we have a good handle on future earnings prospects.

It doesn’t hurt that we live on the edge of Silicon Valley and get invited to test out many new technologies before they are made public. My Tesla Model S1 is a perfect example.

That encourages me to recommend Tesla stock at $16 before it began its historic run to $295. It was the best short squeeze eve.

3) The Micro Picture is Ideal

Once you have a handle on the economy and the best industries, it’s time to zero in on the best company to trade in, or the “MICRO” selection.

It’s always great to find a good target to trade in because positions in single companies can deliver double or even triple returns compared to stock indexes.

That's because the market will pay a far higher implied volatility for a single company than a large basket of companies.

Remember also that you are taking greater risk in trading individual companies. The options market will pay you for that extra risk.

If the earnings come through as expected, everything is hunky-dory. If they don’t, the shares can drop by half in a heartbeat. Large indexes buffer this effect, which is why they have far lower volatility.

Of course, there are gobs of market research about individual companies out there from brokers. Some of it is right, some of it is wrong, but all of it is conflicted. Recommendations are either “BUY” or “HOLD”.

Brokers are loath to issue a “SELL” recommendation for a stock because it will eliminate any chance of that firm obtaining new issue business. Who wants to hire a broker to sell new stock when their analyst has already dissed the company?

And brokerage firms don’t make their bread and butter on those piddling little discount commissions you have been paying them. They make it on new highly lucrative new issues business. In fact, a new issue can earn as much as $100 million from one firm. I know because I’ve done it.

I have been following about 100 companies in the leading market sectors for nearly half a century. Some of the management of these firms have become close friends over the decades. So, I get some really first-class information.

When markets rotate to sectors and companies that I already know, I have a huge advantage. Needless to say, this gives me a massive head start when selecting individual names for options Trade Alerts.

4) The Technicals Line Up

I have never been a huge fan of technical analysis.

Most technical advice boils down to “if it’s gone up, it will go up more” or “If it’s gone down, it will go down more.”

Over time, the recommendations are accurate 50% of the time or about equal with a coin toss.

However, the shorter the time frame, the more useful technical analysis becomes.

If you analyze intraday trading, almost all very short-term movements can be explained in technical terms. This is entirely how day traders make their livings.

It’s a classic case of if enough people believe something, it becomes true no matter how dubious the underlying facts may be.

So it does behoove us to pay some attention to the charts when executing your trades.

Talk to old-time investors and you will find that they use fundamentals for long term stock selection and technicals for short-term order execution.

Talk to them some more and you find out that the best fundamentalists sound like technicians, while savvy technicians refer to underlying fundamentals.

Get the technicals right and you can provide one additional reason for your trade to work.

5) The Calendar is Favorable

There is one more means of assuring your trades turn into winners.

I am a big fan of buying straw hats in the dead of winter and umbrellas in the sizzling heat of the summer.

There IS a method to my madness.

Have you heard of “Sell in May and go away?”

According to the Stock Trader’s Almanac, $10,000 invested at the beginning of May and sold at the end of October every year since 1950 would be showing a loss today.

This is despite the fact that the Dow Average rocketed from $409 to $18,300 during the same time period, a gain of 44.74 times!

Amazingly, $10,000 invested on every November and sold at the end of April would today be worth $702,000, giving you a compound annual return of 7.10%.

It gets better.

Of the 62 years under study, the market was down in 25 of the May to October periods, but negative in only 13 of the November to April periods.

What’s more, the market has been down only three times during the November to April periods in the last 20 years!

There have been just three times when the "good 6 months" have lost more than 10% (1969, 1973 and 2008), but with the "bad six months" time period, there have been 11 losses of 10% or more.

So it’s clear that trading according to the calendar can have a significant impact on your profitability.

Being a long-time student of the American, and indeed, the global economy, I have long had a theory behind the regularity of this cycle. It’s enough to base a pagan religion around, like the once practicing Druids at Stonehenge.

Up until the 1920s, we had an overwhelmingly agricultural economy. Farmers were always at maximum financial distress in the fall when their outlays for seed, fertilizer, and labor were the greatest, but they had yet to earn any income from the sale of their crops.

So they had to borrow all at once, placing a large cash call on the financial system as a whole. This is why we have seen so many stock market crashes in October.

Once the system swallows this lump, it’s nothing but green lights for six months.

After the cycle was set and was easily identifiable by computer algorithms, the trend became a self-fulfilling prophecy.

Yes, it may be disturbing to learn that we ardent stock market practitioners might, in fact, be the high priests of a strange set of beliefs. But hey, some people will do anything to outperform the market.

It is important to remember that this cyclicality is not 100% accurate, and you know the one time you bet the ranch, it won’t work.

So there we have it.

Adopt these five simple disciplines and you will find your success rate on trades jumps from a mere coin toss to 70%, 80%, or even 90%.

In other words, you convert your trading from an endless series of frustrations to a reliable source of income.

If a potential trade meets only four of these five criteria, please do it with your money and not mine. Your chances of making money have just declined.

And I bet a lot of you poor souls execute trades all the time that meet NONE of these criteria. No wonder you’re losing money hand over fist!

Get the tailwinds of the economy, your industrial call, your company pick, the market technicals, and the calendar working for you, and all of a sudden you’re a trading genius.

It only took me a half a century to pull all this together. Hopefully, you can learn a little bit faster than me.

I hope it all works for you.

Your Guide to Winning Trades

Your Guide to Winning Trades

You’ve spent vast amounts of time, money, and effort to become an options trading expert.

You know the difference between bids and offers, puts and calls, exercise prices and expiration days.

And you still can’t make any money.

Now What?

Where do you apply your newfound expertise? How do you maximize your reward while minimizing your risk?

It is all very simple.

Stick to five basic disciplines and you will suddenly find that the number of your new trades that are winners takes a quantum leap and money will start pouring into your trading account.

It’s really not all that hard to do. So here we go!

1) Know the Macro Picture

If you have a handle on whether the economy is growing or shrinking, you have a major advantage in the options market.

In a growing economy, you only want to employ bullish strategies, like calls, call spreads, and short volatility plays.

In a shrinking economy, you want to execute bearish plays, like puts, put spreads, and long volatility plays.

Remember, the only thing that is useful for your options trading is a view on what the economy is going to do NEXT.

The government only publishes historical economic data, which for the most part is useless in predicting what is going to happen in the future.

The options market is all about discounting what is going to happen next.

And how do you find that out?

Well, you could hire your own in-house staff economist. Or, you could rely on economic research from the largest brokerage houses.

Even the Federal Reserve puts out its own forecasts for economic growth prospects.

However, all of these sources have notoriously poor track records. Listening to them and placing bets on their advice CAN get you into a world of trouble.

For the best possible read on the future of the US and the global economy, there is no better place to go than Global Trading Dispatch, published by me, John Thomas, the Mad Hedge Fund Trader.

This is where the largest hedge funds and brokers go to find out what really is going to happen to the economy.

2) Looking for Great Industry Fundamentals

Do you want to give yourself another valuable edge?

There are over 100 different industries listed on US stock markets. However, only about 5 or 10 are really growing decisively at any particular time. The rest are either going nowhere or are shrinking.

In fact, you can find a handful of sectors that are booming, while others are in outright recession.

If you are a major hedge fund, institution, or government, you may want to cover all 100 of those industries. Good luck with that.

If you are a small hedge fund, or an individual working from home, you will want to conserve your time and resources, skip most of US industry and only focus on a handful.

Some traders take this a step further and only concentrate on a single high-growing, volatile industry like technology or biotech, or an even single name like Netflix (NFLX), Tesla (TSLA), or Amazon (AMZN).

How do you decide which industry to trade?

Brokerage houses pump out more free research than you could ever read in a lifetime. Government reports tend to be stodgy, boring, and out of date. Big hedge funds keep their in-house research confidential (although some of it leaks out to me).

The Mad Hedge Fund Trader solves this problem for you by limiting its scope to a small number of benchmark, pathfinder industries like technology, banks, energy, consumer cyclical, biotech, and cybersecurity.

In this way, we gain a handle on what is happening in the economy as a whole while lining up rifle shots on the best options trades out there.

We want to direct you where the action is and where we have a good handle on future earnings prospects.

It doesn’t hurt that we live on the edge of Silicon Valley and get invited to test out many new technologies before they are made public. My Tesla Model S1 is a perfect example.

That encourages me to recommend Tesla stock at $16 before it began its historic run to $295. It was the best short squeeze eve.

3) The Micro Picture is Ideal

Once you have a handle on the economy and the best industries, it’s time to zero in on the best company to trade in, or the “MICRO” selection.

It’s always great to find a good target to trade in because positions in single companies can deliver double or even triple returns compared to stock indexes.

That's because the market will pay a far higher implied volatility for a single company than a large basket of companies.

Remember also that you are taking greater risk in trading individual companies. The options market will pay you for that extra risk.

If the earnings come through as expected, everything is hunky-dory. If they don’t, the shares can drop by half in a heartbeat. Large indexes buffer this effect, which is why they have far lower volatility.

Of course, there are gobs of market research about individual companies out there from brokers. Some of it is right, some of it is wrong, but all of it is conflicted. Recommendations are either “BUY” or “HOLD”.

Brokers are loath to issue a “SELL” recommendation for a stock because it will eliminate any chance of that firm obtaining new issue business. Who wants to hire a broker to sell new stock when their analyst has already dissed the company?

And brokerage firms don’t make their bread and butter on those piddling little discount commissions you have been paying them. They make it on new highly lucrative new issues business. In fact, a new issue can earn as much as $100 million from one firm. I know because I’ve done it.

I have been following about 100 companies in the leading market sectors for nearly half a century. Some of the management of these firms have become close friends over the decades. So, I get some really first-class information.

When markets rotate to sectors and companies that I already know, I have a huge advantage. Needless to say, this gives me a massive head start when selecting individual names for options Trade Alerts.

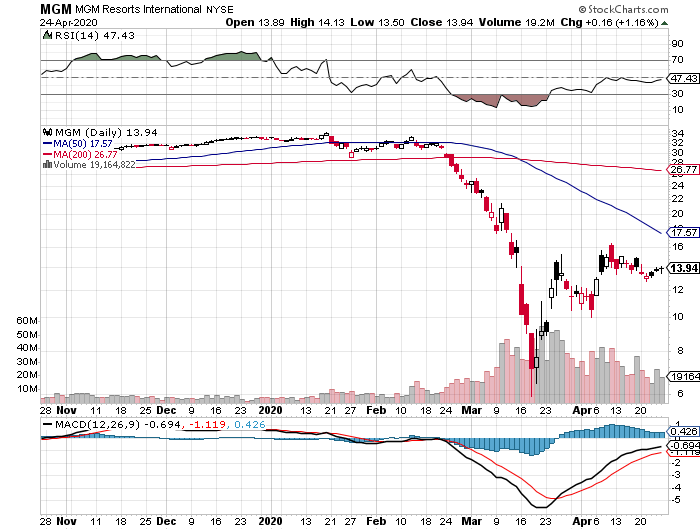

4) The Technicals Line Up

I have never been a huge fan of technical analysis.

Most technical advice boils down to “if it’s gone up, it will go up more” or “If it’s gone down, it will go down more.”

Over time, the recommendations are accurate 50% of the time or about equal with a coin toss.

However, the shorter the time frame, the more useful technical analysis becomes.

If you analyze intraday trading, almost all very short-term movements can be explained in technical terms. This is entirely how day traders make their livings.

It’s a classic case of if enough people believe something, it becomes true no matter how dubious the underlying facts may be.

So it does behoove us to pay some attention to the charts when executing your trades.

Talk to old-time investors and you will find that they use fundamentals for long term stock selection and technicals for short-term order execution.

Talk to them some more and you find out that the best fundamentalists sound like technicians, while savvy technicians refer to underlying fundamentals.

Get the technicals right and you can provide one additional reason for your trade to work.

5) The Calendar is Favorable

There is one more means of assuring your trades turn into winners.

I am a big fan of buying straw hats in the dead of winter and umbrellas in the sizzling heat of the summer.

There IS a method to my madness.

Have you heard of “Sell in May and go away?”

According to the Stock Trader’s Almanac, $10,000 invested at the beginning of May and sold at the end of October every year since 1950 would be showing a loss today.

This is despite the fact that the Dow Average rocketed from $409 to $18,300 during the same time period, a gain of 44.74 times!

Amazingly, $10,000 invested on every November and sold at the end of April would today be worth $702,000, giving you a compound annual return of 7.10%.

It gets better.

Of the 62 years under study, the market was down in 25 of the May to October periods, but negative in only 13 of the November to April periods.

What’s more, the market has been down only three times during the November to April periods in the last 20 years!

There have been just three times when the "good 6 months" have lost more than 10% (1969, 1973 and 2008), but with the "bad six months" time period, there have been 11 losses of 10% or more.

So it’s clear that trading according to the calendar can have a significant impact on your profitability.

Being a long-time student of the American, and indeed, the global economy, I have long had a theory behind the regularity of this cycle. It’s enough to base a pagan religion around, like the once practicing Druids at Stonehenge.

Up until the 1920s, we had an overwhelmingly agricultural economy. Farmers were always at maximum financial distress in the fall when their outlays for seed, fertilizer, and labor were the greatest, but they had yet to earn any income from the sale of their crops.

So they had to borrow all at once, placing a large cash call on the financial system as a whole. This is why we have seen so many stock market crashes in October.

Once the system swallows this lump, it’s nothing but green lights for six months.

After the cycle was set and was easily identifiable by computer algorithms, the trend became a self-fulfilling prophecy.

Yes, it may be disturbing to learn that we ardent stock market practitioners might, in fact, be the high priests of a strange set of beliefs. But hey, some people will do anything to outperform the market.

It is important to remember that this cyclicality is not 100% accurate, and you know the one time you bet the ranch, it won’t work.

So there we have it.

Adopt these five simple disciplines and you will find your success rate on trades jumps from a mere coin toss to 70%, 80%, or even 90%.

In other words, you convert your trading from an endless series of frustrations to a reliable source of income.

If a potential trade meets only four of these five criteria, please do it with your money and not mine. Your chances of making money have just declined.

And I bet a lot of you poor souls execute trades all the time that meet NONE of these criteria. No wonder you’re losing money hand over fist!

Get the tailwinds of the economy, your industrial call, your company pick, the market technicals, and the calendar working for you, and all of a sudden you’re a trading genius.

It only took me a half a century to pull all this together. Hopefully, you can learn a little bit faster than me.

I hope it all works for you.

Quote of the Day

“In a social democracy with a fiat currency, all roads lead to inflation,” said legendary hedge fund manager Bill Fleckenstein.

Decent explanation of the USO ETF in this story.

https://www.cnbc.com/2020/04/23/you...t-even-tracking-the-price-of-oil-anymore.html

https://www.cnbc.com/2020/04/23/you...t-even-tracking-the-price-of-oil-anymore.html

No problem Coach CB .. I'm a little hesitant to give advise in this situation as far as daily moves I'm making..

|

| Global Market Comments April 24, 2020 Fiat Lux Featured Trade: (APRIL 22 BIWEEKLY STRATEGY WEBINAR Q&A), (SPY), (INDU), (GILD), (NEM), (GOLD), (USO), (SOYB), (CORN), (SHOP), (PALL), (AMZN)

|

| � |

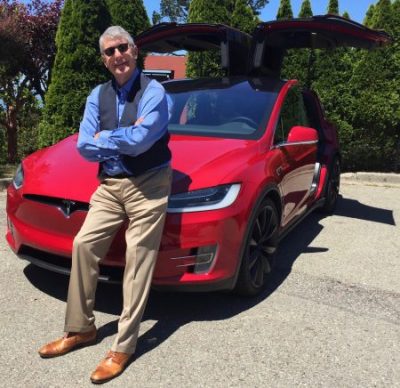

April 22 Biweekly Strategy Webinar Q&A Below please find subscribers’ Q&A for the Mad Hedge Fund Trader April 22 Global Strategy Webinar broadcast from Silicon Valley, CA with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming! Q: Will Trump louse up the recovery by bringing people back to work too soon? A: Absolutely, that’s a risk. Georgia is reopening in a couple of days, which is purely a political decision because all of the scientists have advised against it. If that creates a secondary Corona wave, which we will know in a few weeks, then no one else is going to reopen early and the depression instantly goes from a three-month one to a six or nine-month one. Nobody wants tens of thousands of deaths on their hands. If we do reopen early, it could create a secondary spike in cases and deaths that hit around the Fall, right before the election. That is absolutely what the administration does not want to see, but they’re pursuing a course that will almost guarantee that result, so I wouldn’t be traveling to the Midwest anytime soon. Actually, I'm not going to be traveling anywhere because all the planes are grounded. Trump’s strategy is that Corona will magically go away in the summer, and those are his exact words. Q: What is the Fed's next move? A: I don't think they will go to negative interest rates. The disruptions to the financial system would be too widespread. Nobody is having a problem borrowing money right now unless they are in the housing market and that is totally gridlocked. Probably, the best thing is to expand QE and keep buying more fixed income instruments. They are essentially buying everything now, including mortgage-backed securities, junk bonds, securitized student loan debt, and everything except stocks. Today, we heard that the FHA is now buying defaulted mortgages which account for 6% of all the home mortgages out there, so that should help a lot in bringing the 30-year mortgage rate back in line with the 10-year, which would put it in the mid twos. So, more QE is the most likely thing there. Q: What do you think of Remdesivir from Gilead Sciences (GILD)? Is it a buy at current levels? A: We recommended this six months ago with our Mad Hedge Biotech & Healthcare Letter and got a spectacular result (click here for the link). This is a broad-spectrum antiviral that worked against MERS and SARS. We think it’s one of many possible treatments for the Coronavirus but it is not a vaccine. Buying the stock here is downright scary, up 30% since January. We love biotech for the long term, but this is a terrible entry point for Gilead. If it drops suddenly 10-20% on this selloff, then maybe. Q: You seem very confident we’re going lower again. I’m reminded of the December selloff of 2018 where we saw a very quick recovery and a lot of people were shut out. A: The difference then is that we didn’t have a global pandemic which has killed 47,000 Americans and may kill another 47,000 or more before it's all over. And I think it’s going to take a lot longer for the government to reopen the economy than they think. And corporate share buybacks, the main driver of the bull market of the past decade, are now completely absent. Q: You seem to prefer spreads to LEAPS. Is that the only strategy you use? A: I’m not putting long term LEAPS (Long Term Equity Participation Securities) in the model portfolio because they have two years to expiration, and I don’t want to tie up our entire trading portfolio in a two-year position. So, we are doing front months in the model trading portfolio, but every week I’m sending out lists of LEAPS for people to buy on the dips. Of course, you should go out to 2022 to minimize your risks and you should only buy them on the down 500 or 800-point days. Put a bid in on the bid side of the market (the low side of the market), and if you get a sudden puke out, a margin call, or an algorithm, you will get hit with these things at really good prices. That is the way to do long term LEAPS. Q: Why do you think the true vaccine is a year off? A: If you took Epidemiology 101, which I did in college, you'll learn that when you have a very large number of cases, the mutation rate vastly accelerates. My doctor here in Incline Village tested blood samples he took in northern Nevada in December and found that there were two Coronavirus variants, two different mutations. So, if there are only two, we would be really lucky. The problem is that these diseases mutate very quickly, and by the time you get a vaccine working, the DNA of the virus has moved on and last year’s vaccine doesn’t work anymore. That’s why when you get a flu shot, it includes flu variants from five different outbreaks around the world every year, and I’ve been getting those for 40 years, so I already have the antibodies for 200 different flu variations floating around my system as antibodies. Maybe that’s why I never get sick. They have been trying to get an AIDS vaccine for 40 years, and a cancer vaccine for 100 years, with no success, and it would be a real stretch for us to get a real working vaccine in a year. The best we can hope for is antivirals to treat the symptoms and make the disease more survivable. Q: Long tail risk for long term portfolios? A: The time to buy your long-term tail risk hedges, or the ledges of long term extremely unlikely events, was in January. That’s when they were all incredibly cheap and they were being thrown away with the trash. Now you have to pay enormous amounts for any long-term portfolio hedges. It's kind of like closing the barn door after the horses have bolted, so nice idea, but maybe we’ll try it again in another ten years. Q: Should I buy gold options two months out or through gold LEAPS? A: I would do both. Buying gold two months out will probably make more money faster, but for LEAPS—let’s say you bought a $2,000-$2,100 LEAPS two years out—the return on that could be 500-1000%, so it just depends on how much risk you were willing to take. I would bet that the LEAPS selling just above the all-time highs at $1,927 are probably going really cheaply because people will assume we won't get to new all-time highs for a while and they’ll sell short against that, so that may be your play. You can get even better returns on buying LEAPS on the individual gold stocks like Newmont Mining (NEM) and Barrick Gold (GOLD). Q: How soon until we take a profit on a LEAPS spread? A: Usually if you have 80% of the maximum potential profit, that’s a good idea. You typically have to hang out for a whole year to capture the last 20% and you’re better off buying something else unless you have an idea on how to spend the money first—then you can sell it whenever you have a profit that you are happy with. I know a lot of you who bought the 2-year LEAPS in March on our advice already have enormous profits where you’ve made 500% or more in four weeks. If you bought the 2021 LEAPS, I would roll out of those here and then buy the two-year LEAPs on the next selloff to protect yourself against a second Corona wave. Take some good profits, roll that money into longer two-year LEAPS. Q: There seems to be a real consensus we will retest the lows. Is it possible that the low we recently had was actually a retest of the 2018 lows? A: We actually got well below the 2018 lows, and with all of the stimulus out there now, I don’t see us going back to 18,000 in the Dow (INDU), 2,200 in the SPY, unless things get worse— dramatically worse, like a sudden spike in cases coming out of the Midwest (that’s almost a certainty) and the south. They opened their beaches and essentially created a breeding ground for the virus to then return to all the states from the visiting beachgoers. So, everyone’s got their eyes on this combined $14 trillion of QE and stimulus and they don’t want to sell their stocks now, so I don’t see a retest of the lows in that situation. I would love it if we did, then that would be like LEAPS heaven, loading up on tech LEAPS at the bottom. But even if we go retest the lows, the tech stocks aren’t going back to the lows—too many buyers are under the market. Q: Are you using the 200-day moving average as a top? A: That’s just one of several indicators; it’s almost a coincidence that the 200-day is right around 300 in the (SPY)’s, but also we have earnings multiples at 100-year highs—that’s another good one. And margin requirements have been greatly increasing. Any kind of leverage has been stripped out of the system, you can’t get leverage (even if you’re a well-known hedge fund) because all lenders are gun-shy after the meltdown last month, so you’re not going to be able to get that kind of leverage for a long time. And you can also bet all the money in the world that companies are not buying their stocks back, and that was essentially the largest net buyer of stocks for the last decade in the market, some $7 trillion worth. So, without companies buying back stocks, especially in the airlines, $300 in the (SPY) could be our top for the next month, or for the next six months. Q: With Goldman Sachs forecasting four times the worst case of the 2008 great recession, will stocks not retest the market? A: No. Remember, the total stimulus in 2009 was only $787 billion. We’re already at $6 trillion and $8 trillion in QE so we have more than ten times the stimulus that we had in 2009; so that should offset Goldman’s worst-case scenario. And they’re probably right. Q: Why are you not shorting oil here? A: The (USO) was at $50 three months ago, it’s now at $2. I don’t short things that have just gone from $50 to $2. And even though there’s no storage at this price, you want to be building storage like crazy, and it doesn’t take very long to build a big oil storage tank. Another outlier out there is that the US government could step in and buy 20 million barrels to top up the strategic petroleum reserve (SPR). Buying it for free is probably not a bad idea and then sell it next time we go to $20, $30, or $40 a barrel. The other big thing is that the government is mad not to impose punitive import duties on all foreign oil. Any other administration would have already done that long ago because oil prices are destroying the oil industry. But a certain president seems to have an interest in building hotels in the Middle East, and I think that’s why we don’t have import duties on Saudi oil—pure conflict of interest. Q: Will Coronaviruses be weaker or stronger? A: We just don’t know. This is a virus that has been in existence for less than a year; most diseases have been around for hundreds of years and we’ve been researching them forever, this one we know essentially nothing. Best case is that it goes the route of the Spanish Flu, which mutated into a less virulent form and just went away. The Black Plague from the Middle Ages did the same thing. Q: Thoughts on food inflation going forward? A: Food prices are collapsing and that’s because all of the distribution chains for food are broken. Farmers are having to plow food under in the field, like corn (CORN), soybeans (SOYB), and fruit, because there is no way to get it to the end-user or to the food bank. Food banks are struggling to get a hold of some of this food before it’s destroyed. I know the one in Alameda County, CA is calling farmers all over the west, trying to get truckloads of just raw food sent into the food banks. But those food banks are very poorly funded operations and don't have a lot of money to spend. In California, we have the national guard handing out food at the food banks but there is not enough—they are running out of food. Long term, agriculture is a big user of energy. They should benefit from low oil prices, but it doesn’t do any good if they can’t get their product to the market. Look at any food price and you can see it’s in free fall right now caused by the global deflation and the depression. By the way, the same thing happened in the Great Depression in the 1930s. Q: Would you short Shopify (SHOP)? A: No. Shopify is essentially the mini Amazon (AMZN) and has a great future; they are basically having a Black Friday every day. It’s also too late to buy it unless we have a big dip. Q: Would you include Palladium (PALL) in your precious metals call? A: No. Palladium especially went into this very expensive, and they are dependent on the car industry for catalytic converters, which has just fallen from a 16 million unit per month to 5 million on the way to zero. Don’t go with the alternative white metals at this time. Q: What’s your favorite 10 times return stock? A: Tesla, if you can get it at $500. It’s already delivered me two ten-time returns, and I’m going to go for another tenfold return on a five-year view. Good Luck and Stay Healthy John Thomas CEO & Publisher The Diary of a Mad Hedge Fund Trader

|

Quote of the Day “With valuations rising and fundamentals deteriorating, we are in Looney Tunes Land here. The coyote is running in midair,” said a hedge fund friend of mine about current stock market conditions.

|

Hey Bozzie , love the thread. I purchased a long call, if I let it expire and it's in the money will I get the profits,or do I have to sell it the get it? I see that the bid /ask is .80 difference. Thanks

|

| Global Market Comments April 28, 2020 Fiat Lux Featured Trade: (EIGHT "REOPENING" STOCKS TO BUY AT THE MARKET BOTTOM), (UAL), (DAL), (UNP), (CSX), (WYNN), (MGM), (BRK/A), (BA)

|

| � |

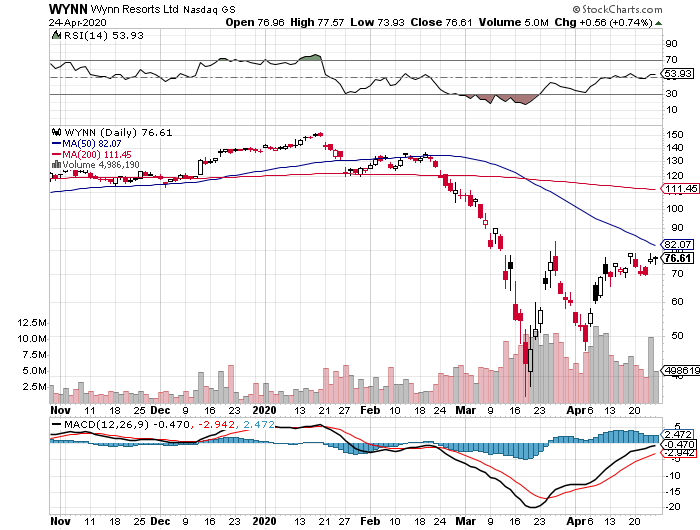

Eight “Reopening” Stocks to Buy at the Market Bottom With the massive technology rally off the March 23 market bottom, the risk/reward for entering new trades has dramatically shifted. Back then. I was begging followers to load the boat with the best big tech and biotech & healthcare names with call options and two-year LEAPS (Long Term Equity Participation Securities). One reader told me he bought Humana (HUM) call options for 70 cents and sold them for a breathtaking $30 for a profit of 4,280%! FedEx showed up with a bottle of single malt Glenfiddich Scotch whiskey the next day. The times have changed. Many tech stocks are now only a few dollars short of new all-time highs, like Microsoft (MSFT) and Apple (AAPL), or are at all tie highs, such as Amazon (AMZN), Teledoc (TDOC), and Zoom (ZM). What a difference 6,000 Dow points make! As a result, it is far more interesting now to pick up stocks that currently look like potential chapter 11 candidates, but will likely prosper once the American economy starts to reopen. Call it my “Reopening Portfolio.” You can buy any of the stocks below outright, sit on them, and probably reap a double over the next two years. However, if you are a much more aggressive kind of trader like me, then you might consider LEAPS, where 500%-%1,000% profits are possible. The advantage of a stock or a two-year LEAPS is that if we get a second Coronavirus wave in the fall, which is highly likely, you can outlast any short term pain and still come out a huge winner. Some of these names we sold short at the market top and made a killing. It is now time to flip to the other side. I am often asked how professional hedge fund traders invest their personal money. They all do the exact same thing. They wait for a market crash like we are seeing now and buy the longest-term LEAPS (Long Term Equity Participation Securities) possible for their favorite names. The reasons are very simple. The risk on LEAPS is limited. You can’t lose any more than you put in. At the same time, they permit enormous amounts of leverage. Two years out, the longest maturity available for most LEAPS, allow plenty of time for the world and the markets to get back on an even keel. Recessions, pandemics, hurricanes, oil shocks, interest rate spikes, and political instability all go away within two years and pave the way for dramatic stock market recoveries. You just put them away and forget about them. Wake me up when it is 2022. I put together this portfolio using the following parameters. I set the strike prices just short of the all-time highs set two weeks ago. I went for the maximum maturity. I used today’s prices. And of course, I picked the names that have the best long-term outlooks. You should only buy LEAPS of the best quality companies with the rosiest growth prospects and rock-solid balance sheets to be certain they will still be around in two years. I’m talking about picking up Cadillacs, Rolls Royces, and even Ferraris at fire-sale prices. Don’t waste your money on speculative low-quality stocks that may never come back. If you buy LEAPS at these prices and the stocks all go to new highs, then you should earn an average 131.8% profit from an average stock price increase of only 17.6%. That is a staggering return 7.7 times greater than the underlying stock gain. And let’s face it. None of the companies below are going to zero, ever. Now you know why hedge fund traders only employ this strategy. There is a smarter way to execute this portfolio. Put in throw away crash bids at levels so low they will only get executed on the next cataclysmic 1,000-point down day in the Dow Average. You can play around with the strike prices all you want. Going farther out of the money increases your returns, but raises your risk as well. Going closer to the money reduces risk and returns, but the gains are still a multiple of the underlying stock. Buying when everyone else is throwing up on their shoes is always the best policy. That way, your return will rise to ten times the move in the underlying stock. If you are unable or unwilling to trade options, then you will do well buying the underlying shares outright. Enjoy. United Airlines (UAL) just raised $1 billion in a new equity issue to tide it over hard times. That is just a drop in the bucket for what it needs. It’s hard to imagine the company coming through the crisis without any government involvement. The most likely is for the feds to offer a big chunk of cash in exchange for a minority ownership. Around 35% might work, which is the portion the US Treasury of General Motors (GM) during the 2008-09 crash. Still, if you’re looking for a double in the shares, that just water off a duck’s back. LEAPS: the January 21 2022 $45-$50 vertical bull call spread at a price of 83 cents delivers a 525% gain with the stock at $50, up 94.5% from the current level. Delta Airlines (DAL) is Warren Buffet’s favorite airline, although he has been selling lately. All of the arguments above apply for this best run of US Airlines. LEAPS: January 21 2022 $40-$45 vertical bull call spread at a price of 83 cents delivers a 502% gain with the stock at $45, up 98.8% from the current level. MGM Resorts (MGM) Yes, Las Vegas is reopening soon, but it certainly won’t resemble the old Vegas. (MGM) is the dominant hotel owner of the strip, owning the Bellagio, Mandalay Bay, Aria Resort, and MGM Grand hotels. It also has a China presence. LEAPS: the January 21 2022 $25-$30 vertical bull call spread at 75 cents delivers 566% gain with the stock at $30, up 95.6% from the current level. Wynn Hotels (WYNN) We killed it on the short side with (WYNN), capturing an eye-popping 90% decline. (WYNN) is poised to lead the upturn. It has a major exposure in Macao, where China will lead any economic recovery. LEAPS: the January 21 2022 $140-$150 vertical bull call spread at 90 cents delivers a 455% gain with the stock at $150, up 81% from the current level. Union Pacific (UNP) The reopening of industrial American means a resurgence of railroad traffic. These are not your father’s railroads. Over the last 30 years, they have evolved into highly efficient operators that offer the cheapest way far to over heavy good and bulk commodities, virtually turning into closet high-tech companies. (UNP) had the additional advantage in that as the country’s dominant East/West road, it stands to benefit the most from a recovery in trade with China. That is a likely outcome of any future administration. LEAPS: the January 21 2022 $180-$185 vertical bull call spread at $1.40 delivers a 257% gain with the stock at $185, up 15.00% from the current level. CSX Corp. (CSX) Same arguments here, except that (CSX) wins on North/South trade, especially with Mexico. With a NAFTA 2 new trade agreement in place, this company benefits from an extra turbocharger. LEAPS: the January 21 2022 $75.00-$77.50 bull call spread at 84 cents delivers a 495% gain with the stock at $77.50, up 16.27% from the current level. Berkshire Hathaway (BRK/A) Yes, they make more than sheets these days. Warren Buffet’s flagship holding company is the poster bot for industrial American. The shares are high priced, but after this 32% pullback, you may finally have a chance to get in. LEAPS: the June 17 2022 $225-$230 vertical bull call spread at $2.61 delivers a 91.5% gain with the stock at $230, up 22.7% from the current level. Boeing Co. (BA) This has been the worst falling knife situation in the market for the last two years, cratering from $450 to $85, or down 81%. The decertification of the 737 MAX started the rot, and the grounding of its major airline customers was the coup de grace. This is another company that may require a government bailout and stock ownership, as it is a strategic national value. You may have to wait until the next administration as its Washington State location is currently politically incorrect. LEAPS: the June 17 2022 $185-$190 bull call spread at $1.25 delivers a 400% gain with the stock at $190, up 47.8% from the current level. Buy all eight of these and if they all work, your average return will be 411.4%. Enjoy!

|

Quote of the Day “I don’t think anyone has made money in the long term by betting against the United States,” said Kevin Bernzott of Bernzott Capital Advisors.

|

Global Market Comments

April 29, 2020

Fiat LuxFeatured Trade:(LEARNING THE ART OF RISK CONTROL)

April 29, 2020

Fiat LuxFeatured Trade:(LEARNING THE ART OF RISK CONTROL)

Learning the Art of Risk Control

Now that you know how to make money in the options market, I’m going to teach you how to hang on to it. There is no point in booking winning trades only to lose the money by making careless mistakes. So today, I am going to talk about risk control.

The first goal of risk control is to conserve whatever capital you have. I tell people that I am too old to start over again as a junior trader if I lose all my money. So, I’m pretty careful when it comes to risk control.

The art of risk control is to make sure your portfolio is profitable, no matter what happens to the market. You want to be a winner, whether the market goes up, down, or sideways.

Remember, we are not trying to beat an index here. Our goal is the make actual dollars at all times, to keep the P&L chart always moving from the lower left to the upper right. You can’t eat relative performance, nor can you use it to pay your bills.

The second goal of a portfolio manager is to make your portfolio bombproof. You never know when a flock of black swans is about to alight on the market, or a geopolitical shock comes out of the blue causing markets to crash.

The biggest mistake I see beginning traders make is that they are in too much of a hurry to get rich. As a result, they lose too much money too soon. I can’t tell you how many times I have heard of first-time traders losing all their money on their first trade, well before they got a handle on the basics.

I’m usually right 80% to 90% of the time. That means I’m wrong 10% to 20% of the time. If you bet the ranch on one of my losing trades, you’ll get taken to the cleaners. Never bet the ranch.

If you do, you are turning calculated risk into random risk. It is akin to buying a lottery ticket. I often tell clients they have gambling addictions. Make sure you’re not one of them. You can’ trade yourself back from zero with no money.

If you can master the skills which I am teaching you, you can make a living at this FOREVER! So, what’s the hurry? As my old trading mentor used to tell me, the Late Barton Biggs of Morgan Stanley, “invest in haste, repent in leisure,” a time-tested nostrum in this business.

I recommend that you use NO real money on your first few trades. Start with paper trading only. All of the online trading platforms offer wonderful tools that allow you to practice trading before you try the real thing. If you lose your “pretend money”, no harm, no foul. They don’t want you to go broke either. Broke customers don’t pay commissions.

The more time you spend learning trading, the more money you will get out of it. Remember, work in, money out. Spend at least an hour or two getting to know your own trading platform well.

Once you start trading with real money, it will become a totally different experience. Your heart rate steps up. Your hands get sweaty. You start checking your watch. It’s a lot like going into combat. In fact, combat veterans make great traders, which is why the military recruits so actively from the military. I think all these instincts trace back to our Neanderthal days when our main concern was being chased by a saber-tooth tiger.

The time to learn a trading discipline is NOW. All of a sudden, your opinions, your ego, and your savings are on the line. It’s crucial for you to always start small when using real money.

That way, making a beginner’s mistake, like confusing “BUY” and “SELL” (I see it every day) will only cost you a cup of coffee at Starbucks, and bet your kids' college education, your house, or your retirement. It won’t take long for you to grow from one contract to thousands, as I have done myself for many years.

It’s all about finding your comfort level and risk tolerance. You never want to have a position that is so large that you can’t sleep at night, or worse, call me in the middle of the night. My answer is always the same. Cut your position in half. If you still can’t sleep, cut it in half again.

I make a bold prediction here. The more experience you gain, the faster your risk tolerance goes up.

I’ll give you one more piece of advice. Take your broker's technical support phone number and paste it to the top of your computer monitor. You don’t want to go looking for it when you can’t figure out how to get out of a position, or your platform breaks. These are machines. It happens. As they teach in flight school, it’s not a matter of if, but when, a machine breaks.

There’s one more thing. When you’re ready to commit real money, don’t forget to take your account off of paper trading. The profits you make can’t be spent.

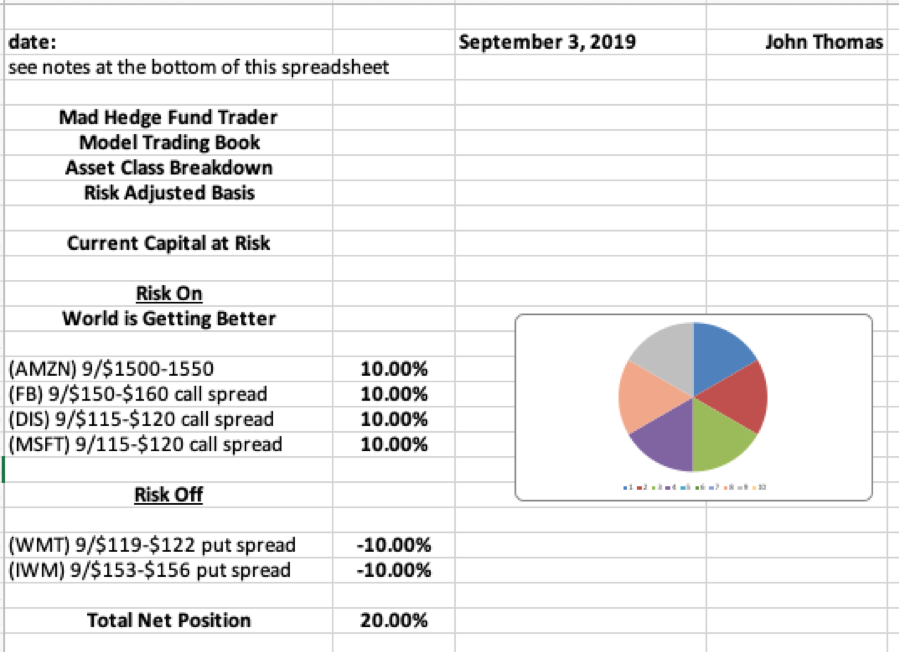

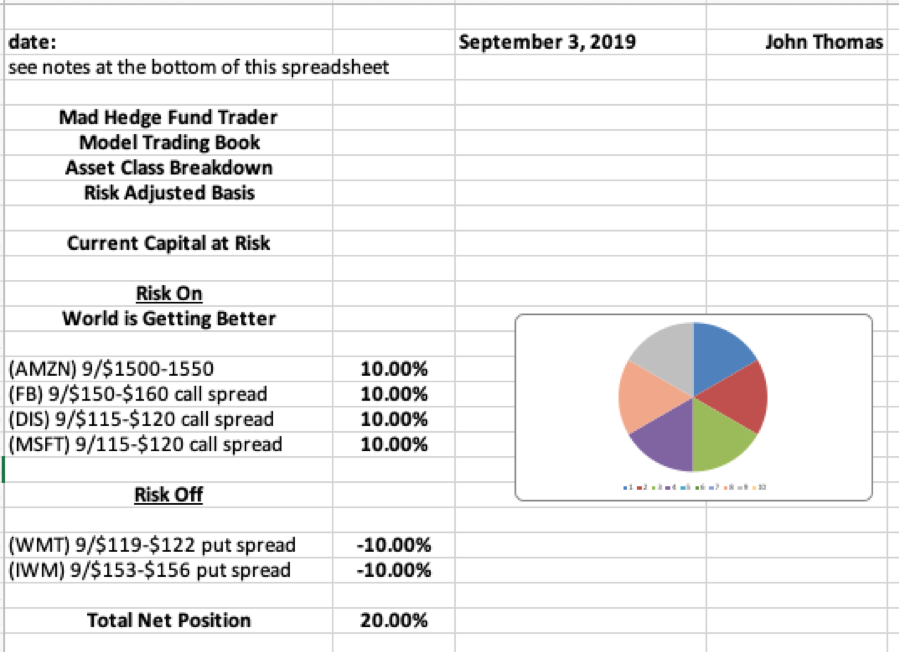

Risk management is an important part of the position sheet I will be sending you every day.

Take a look below at a recent position sheet I sent out during sharply rising markets, which I update every day.

The important thing to look at here is my long/short balance. On the left is the position name and on the right is the position weighting. I usually run 10% positions so I don’t have all my eggs in one basket. Maybe twice a year, I’ll run a 20% position in a single stock, and once a year I’ll have a 30% weighting. Above that, I start to lose sleep.

I have further subdivided the portfolio into “RISK ON” and “RISK OFF.” “RISK ON” means the world is getting better, while “RISK OFF” means the world is getting worse. The long positions have positive numbers, while the short positions have negative ones.

I like to balance “RISK ON” and “RISK OFF” to remove overall market risk from the portfolio. When markets are rising, I tilt positive. When markets are falling, I tilt negative. At the bottom I have my total net exposure. On this particular day, I was running 60% in longs and 20% in shorts, for a total net position of 40% long. This is an aggressively bullish portfolio.

When I’m bullish, the net position is positive. When I’m bearish the net position is negative. When I have no strong views, the net position is zero. That way, if nothing happens you still get to rake the money in.

I have no positions at all only a few days a year. I only play when the risk/reward is overwhelmingly in my favor, and sometimes that is just not possible.

One more warning to the wise. There are literally hundreds of gurus out there, marketing services promising 100% a year, if not a 100% a month, or even 100% a day. They are all fake, created by 20-year-old marketing types who have never worked in the stock market, or even traded. Unfortunately, I work in an industry where almost everyone else is a crook.

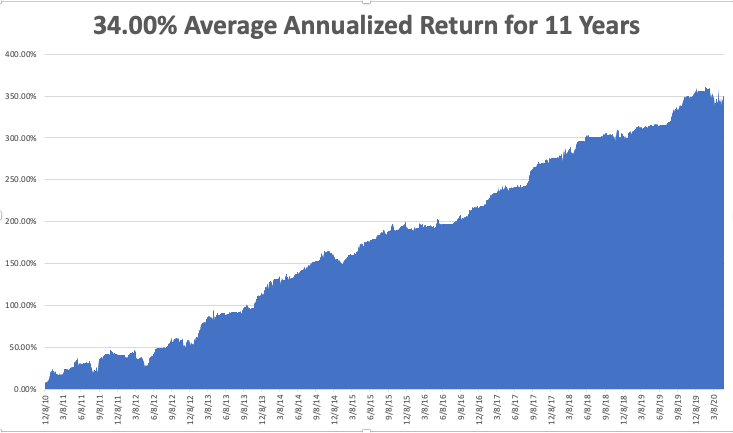

I have worked in the markets for more than 50 years and have seen everything. Ray Dalio is the top-performing hedge fund manager in history and he only averages 35% a year. The number of real traders who are right more than 80% of the time you can almost count on one hand. If returns sound too good to be true, they never are.

I want to offer special caution about naked put-shorting strategies which are promoted by 90% of these letters. This is where a trader sells short a put position without any accompanying hedge, hence the word “naked.” This is an unlimited risk position.

You might take in a $1 of premium with this approach, but if the market turns against you, and implied volatilities go through the roof, your losses could balloon exponentially to $100 or more, wiping you out. The newsletters recommending these have absolutely no idea when or if this is going to happen.

I call this the “picking up the pennies in front of the steamroller strategy.” No professional trader worth his salt will put money into it. It is banned by most investing institutions. And only a few brokers will still let you do this, and then only with 100% margin requirements because when losses exceed 100% of capital, they’re left carrying the bag.

Many of those strategies you see being hawked online look great on paper but can’t actually be executed. In other words, you just paid thousands of dollars for a service that is utterly useless. Sounds like a “No Go” to me.

Stop losses are an important part of any trading strategy. No one is right 100% of the time. If they claim so, they are lying. The best way to avoid a big loss is to take a small one.

There are many possible places to use stop losses. I use 2% of my total capital. If I start to lose more than that, I am out of there. It’s easy for me to do this because 90% of the time, the next trade will be a winner and I’ll make back all the money I just lost.

Others use a 10% decline in the underlying stock as a good arbitrary point to limit loses. Others rely on Fibonacci levels (I’ll get to him later). Many traders rely on key moving averages, like the 50-Day or the 200-day.

The problem with this is that high-frequency traders have access to the same charting data as you do. They’ll program their algorithms to quickly take a stock through your stop loss level, buy your stock for cheap, and then take it right back up again to book a quick profit. You are left with a “SELL” confirmation in your inbox and no position in a rising market. No wonder people think Wall Street is rigged.

Another concept is the “trailing stop”. That’s when after an initial rise, you place a stop-loss order at your cost. That way you CAN’T lose money. This is known as “playing with the house's money.” This approach has one shortfall. You can’t place stop losses in the options market that are executed automatically. The same is true for options spreads.

In this case, you use what is known as a “pocket stop-loss” where you set your own mental level on when to get out. Also, these are not automatic, they do establish a trading discipline. Caution: You can’t execute a pocket stop loss when you’re playing golf or on a one-week cruise in the Caribbean.

So, there you have it. By managing your risk prudently, you can tip the risk/reward balance in your favor.

I hope this helps.

Now that you know how to make money in the options market, I’m going to teach you how to hang on to it. There is no point in booking winning trades only to lose the money by making careless mistakes. So today, I am going to talk about risk control.

The first goal of risk control is to conserve whatever capital you have. I tell people that I am too old to start over again as a junior trader if I lose all my money. So, I’m pretty careful when it comes to risk control.

The art of risk control is to make sure your portfolio is profitable, no matter what happens to the market. You want to be a winner, whether the market goes up, down, or sideways.

Remember, we are not trying to beat an index here. Our goal is the make actual dollars at all times, to keep the P&L chart always moving from the lower left to the upper right. You can’t eat relative performance, nor can you use it to pay your bills.

The second goal of a portfolio manager is to make your portfolio bombproof. You never know when a flock of black swans is about to alight on the market, or a geopolitical shock comes out of the blue causing markets to crash.

The biggest mistake I see beginning traders make is that they are in too much of a hurry to get rich. As a result, they lose too much money too soon. I can’t tell you how many times I have heard of first-time traders losing all their money on their first trade, well before they got a handle on the basics.

I’m usually right 80% to 90% of the time. That means I’m wrong 10% to 20% of the time. If you bet the ranch on one of my losing trades, you’ll get taken to the cleaners. Never bet the ranch.

If you do, you are turning calculated risk into random risk. It is akin to buying a lottery ticket. I often tell clients they have gambling addictions. Make sure you’re not one of them. You can’ trade yourself back from zero with no money.

If you can master the skills which I am teaching you, you can make a living at this FOREVER! So, what’s the hurry? As my old trading mentor used to tell me, the Late Barton Biggs of Morgan Stanley, “invest in haste, repent in leisure,” a time-tested nostrum in this business.

I recommend that you use NO real money on your first few trades. Start with paper trading only. All of the online trading platforms offer wonderful tools that allow you to practice trading before you try the real thing. If you lose your “pretend money”, no harm, no foul. They don’t want you to go broke either. Broke customers don’t pay commissions.

The more time you spend learning trading, the more money you will get out of it. Remember, work in, money out. Spend at least an hour or two getting to know your own trading platform well.

Once you start trading with real money, it will become a totally different experience. Your heart rate steps up. Your hands get sweaty. You start checking your watch. It’s a lot like going into combat. In fact, combat veterans make great traders, which is why the military recruits so actively from the military. I think all these instincts trace back to our Neanderthal days when our main concern was being chased by a saber-tooth tiger.

The time to learn a trading discipline is NOW. All of a sudden, your opinions, your ego, and your savings are on the line. It’s crucial for you to always start small when using real money.

That way, making a beginner’s mistake, like confusing “BUY” and “SELL” (I see it every day) will only cost you a cup of coffee at Starbucks, and bet your kids' college education, your house, or your retirement. It won’t take long for you to grow from one contract to thousands, as I have done myself for many years.

It’s all about finding your comfort level and risk tolerance. You never want to have a position that is so large that you can’t sleep at night, or worse, call me in the middle of the night. My answer is always the same. Cut your position in half. If you still can’t sleep, cut it in half again.

I make a bold prediction here. The more experience you gain, the faster your risk tolerance goes up.

I’ll give you one more piece of advice. Take your broker's technical support phone number and paste it to the top of your computer monitor. You don’t want to go looking for it when you can’t figure out how to get out of a position, or your platform breaks. These are machines. It happens. As they teach in flight school, it’s not a matter of if, but when, a machine breaks.

There’s one more thing. When you’re ready to commit real money, don’t forget to take your account off of paper trading. The profits you make can’t be spent.

Risk management is an important part of the position sheet I will be sending you every day.

Take a look below at a recent position sheet I sent out during sharply rising markets, which I update every day.

I have further subdivided the portfolio into “RISK ON” and “RISK OFF.” “RISK ON” means the world is getting better, while “RISK OFF” means the world is getting worse. The long positions have positive numbers, while the short positions have negative ones.

I like to balance “RISK ON” and “RISK OFF” to remove overall market risk from the portfolio. When markets are rising, I tilt positive. When markets are falling, I tilt negative. At the bottom I have my total net exposure. On this particular day, I was running 60% in longs and 20% in shorts, for a total net position of 40% long. This is an aggressively bullish portfolio.

When I’m bullish, the net position is positive. When I’m bearish the net position is negative. When I have no strong views, the net position is zero. That way, if nothing happens you still get to rake the money in.

I have no positions at all only a few days a year. I only play when the risk/reward is overwhelmingly in my favor, and sometimes that is just not possible.

One more warning to the wise. There are literally hundreds of gurus out there, marketing services promising 100% a year, if not a 100% a month, or even 100% a day. They are all fake, created by 20-year-old marketing types who have never worked in the stock market, or even traded. Unfortunately, I work in an industry where almost everyone else is a crook.

I have worked in the markets for more than 50 years and have seen everything. Ray Dalio is the top-performing hedge fund manager in history and he only averages 35% a year. The number of real traders who are right more than 80% of the time you can almost count on one hand. If returns sound too good to be true, they never are.

I want to offer special caution about naked put-shorting strategies which are promoted by 90% of these letters. This is where a trader sells short a put position without any accompanying hedge, hence the word “naked.” This is an unlimited risk position.

You might take in a $1 of premium with this approach, but if the market turns against you, and implied volatilities go through the roof, your losses could balloon exponentially to $100 or more, wiping you out. The newsletters recommending these have absolutely no idea when or if this is going to happen.

I call this the “picking up the pennies in front of the steamroller strategy.” No professional trader worth his salt will put money into it. It is banned by most investing institutions. And only a few brokers will still let you do this, and then only with 100% margin requirements because when losses exceed 100% of capital, they’re left carrying the bag.

Many of those strategies you see being hawked online look great on paper but can’t actually be executed. In other words, you just paid thousands of dollars for a service that is utterly useless. Sounds like a “No Go” to me.

Stop losses are an important part of any trading strategy. No one is right 100% of the time. If they claim so, they are lying. The best way to avoid a big loss is to take a small one.

There are many possible places to use stop losses. I use 2% of my total capital. If I start to lose more than that, I am out of there. It’s easy for me to do this because 90% of the time, the next trade will be a winner and I’ll make back all the money I just lost.

Others use a 10% decline in the underlying stock as a good arbitrary point to limit loses. Others rely on Fibonacci levels (I’ll get to him later). Many traders rely on key moving averages, like the 50-Day or the 200-day.

The problem with this is that high-frequency traders have access to the same charting data as you do. They’ll program their algorithms to quickly take a stock through your stop loss level, buy your stock for cheap, and then take it right back up again to book a quick profit. You are left with a “SELL” confirmation in your inbox and no position in a rising market. No wonder people think Wall Street is rigged.

Another concept is the “trailing stop”. That’s when after an initial rise, you place a stop-loss order at your cost. That way you CAN’T lose money. This is known as “playing with the house's money.” This approach has one shortfall. You can’t place stop losses in the options market that are executed automatically. The same is true for options spreads.

In this case, you use what is known as a “pocket stop-loss” where you set your own mental level on when to get out. Also, these are not automatic, they do establish a trading discipline. Caution: You can’t execute a pocket stop loss when you’re playing golf or on a one-week cruise in the Caribbean.

So, there you have it. By managing your risk prudently, you can tip the risk/reward balance in your favor.

I hope this helps.

Quote of the Day

"In the US you had ten bad years in a row (during the Great Depression) and it still turned out to be a pretty good century," said Lloyd Blankfein, CEO of Goldman Sachs.

Quick Interesting read.

Stocks have rallied as bond yields have slumped. That could signal trouble ahead.

During several periods over the past year the traditional relationship between equities and credit has broken down, and bonds have recently proven to be ahead of the curve. It’s happening once again.

https://www.barrons.com/articles/st...ignal-trouble-ahead-51588171032?mod=hp_LEAD_3

Stocks have rallied as bond yields have slumped. That could signal trouble ahead.

During several periods over the past year the traditional relationship between equities and credit has broken down, and bonds have recently proven to be ahead of the curve. It’s happening once again.

https://www.barrons.com/articles/st...ignal-trouble-ahead-51588171032?mod=hp_LEAD_3

|

Global Market Comments

April 30, 2020

Fiat Lux

SPECIAL HOUSING ISSUE

Featured Trade:

(WHY A US HOUSING BOOM IS IMMINENT)

(LEN), (KBH), (PHM)

April 30, 2020

Fiat Lux

SPECIAL HOUSING ISSUE

Featured Trade:

(WHY A US HOUSING BOOM IS IMMINENT)

(LEN), (KBH), (PHM)

Why a US Housing Boom is Imminent

Lately, my inbox has been flooded with emails from subscribers asking if the housing market is about to crash as a result of the pandemic and if they should sell their homes.

They have a lot to protect. Since prices hit rock-bottom in 2011 and foreclosures crested, the national real estate market has risen by 50%.

The hottest markets, like those in Seattle, San Francisco, and Reno, are up by more than 125%, and certain neighborhoods of Oakland, CA have shot up by 500%.

Looking at the recent housing statistics, I can understand their concern. The grim tidings are:

*2.9 Million Homes Now in Forbearance, and the number is certainly going to rise from here. Laid off renters are defaulting on payments, depriving owners of meeting debt obligations. It’s just a matter of time before this creates a financial crisis. Avoid the banks for now, no matter how cheap they get.

* Existing Home Sales Collapsed by 15.4%, in March. Realtors expect this figure to drop 40% in the coming months. Open houses are banned, sellers are pulling listings, and buyers low-balling offers. However, price declines in the few deals going through are minimal. When will the zero interest rates come through? Mortgage interest rates are higher now than before the pandemic because 6% of all home loans are now in default.

* Pending Home Sales Down a Staggering 20.8% in March, and off 16.3% YOY. The worst is yet to come. The West, the first into shelter-in-place, was down a monster 26.8%. Prices still aren’t moving because nobody can buy or sell.

*Chinese Buying of West Coast homes has vaporized over trade war fears, and then of the Covid-19 lockdown, which started with a shutdown of all flights from China.

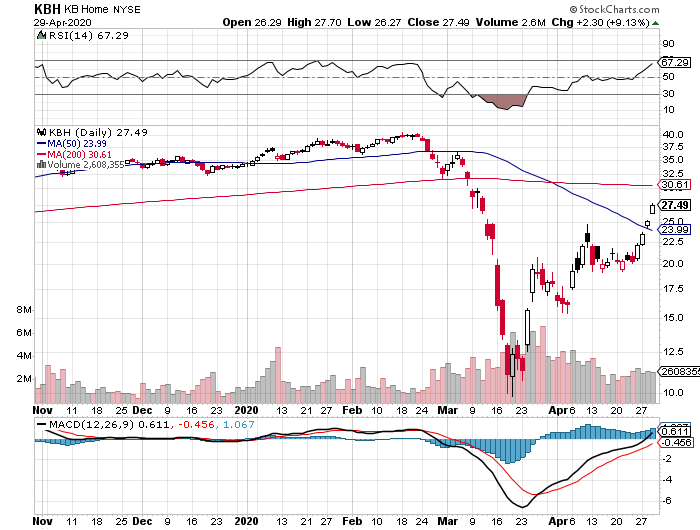

I have a much better indicator of future housing prices than the depressing numbers above. The way homebuilder stocks like Lennar (LEN), KB Homes (KBH), and Pulte Homes (PHM) are trading, I’d say your home will be worth a lot more in a year, and possibly double in another five years. Many of these stocks are up nearly 100% since the March 23 bottom.

What I call “intergenerational arbitrage” will be the principal impetus. The main reason that we are now enduring two “lost decades” of economic growth over the last 20 years is that 85 million baby boomers are retiring to be followed by only 65 million “Gen Xer’s”. When you are losing 20 million consumers, economies don’t grow very fast. For more about millennial investing habits, please click here.

When the majority of the population is in retirement mode, it means that there are fewer buyers of real estate, home appliances, and “RISK ON” assets like equities, and more buyers of assisted living facilities, healthcare, and “RISK OFF” assets like bonds.

The net result of this is slower economic growth, higher budget deficits, a weak currency, and registered investment advisors who have distilled their practices down to only municipal bond sales.

Fast forward to the other side of the pandemic and the reverse happens. The baby boomers will be out of the economy, worried about whether their diapers get changed on time or if their favorite flavor of Ensure is in stock at the nursing home.

That is when you have 65 million Gen Xer’s being chased by 85 million of the “millennial” generation trying to buy their assets!

By then we will not have built new homes in appreciable numbers for 14 years and a severe scarcity of housing hits. Even before the pandemic, new home construction was taking place at half the 2008 peak. Residential real estate prices will naturally soar. Labor shortages will force wage hikes.

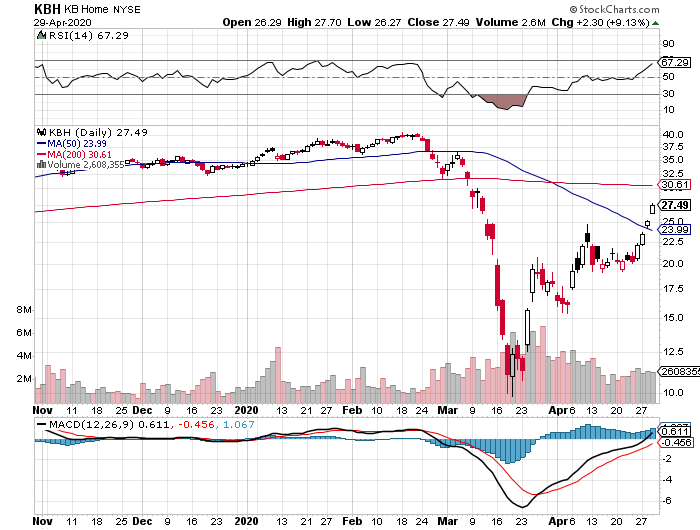

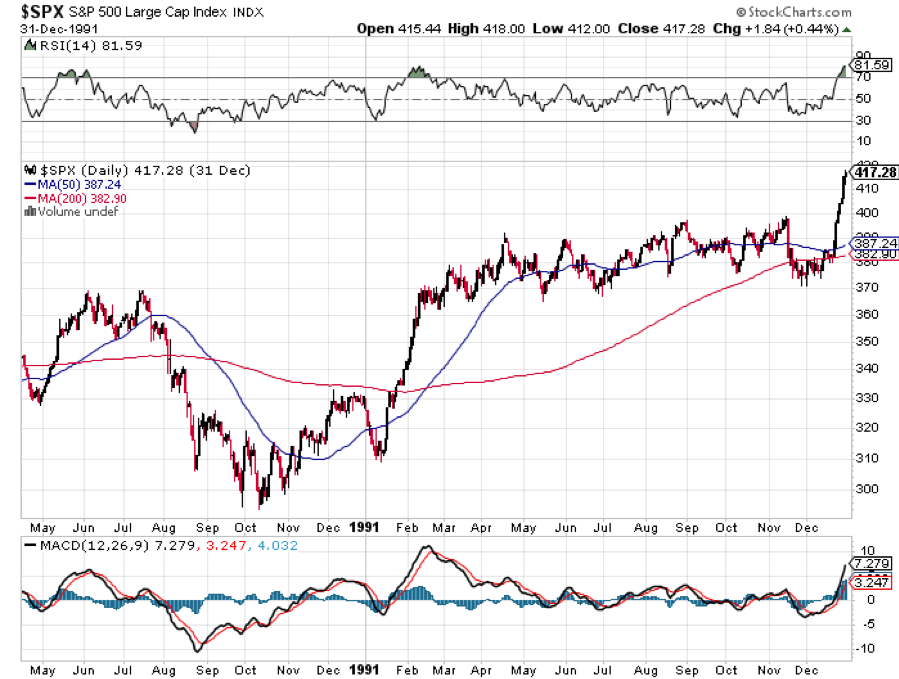

The middle-class standard of living will then reverse a 40-year decline. Annual GDP growth will return from the subdued 2% rate of the past three years to near the torrid 4% seen during the 1990s. It all leads to my “Return of the Roaring Twenties” scenario which you can learn about by clicking here.

It gets better.

It is certain that a future administration will restore tax deductions for state and local real estate taxes (SALT) lost in the 2017 tax bill. The cap on home mortgage interest rate deductions will also rise.

These two events will trigger an immediate 10% increase in the value of your home on an after-tax basis and more on the coasts.

So, if someone approaches you with a discount offer for your home, I would turn around and run a mile the other way.

You should also pile into the stocks, options, and LEAPS of housing stocks in any future market dip.

In Your Future?

In Your Future?

Lately, my inbox has been flooded with emails from subscribers asking if the housing market is about to crash as a result of the pandemic and if they should sell their homes.

They have a lot to protect. Since prices hit rock-bottom in 2011 and foreclosures crested, the national real estate market has risen by 50%.

The hottest markets, like those in Seattle, San Francisco, and Reno, are up by more than 125%, and certain neighborhoods of Oakland, CA have shot up by 500%.

Looking at the recent housing statistics, I can understand their concern. The grim tidings are:

*2.9 Million Homes Now in Forbearance, and the number is certainly going to rise from here. Laid off renters are defaulting on payments, depriving owners of meeting debt obligations. It’s just a matter of time before this creates a financial crisis. Avoid the banks for now, no matter how cheap they get.

* Existing Home Sales Collapsed by 15.4%, in March. Realtors expect this figure to drop 40% in the coming months. Open houses are banned, sellers are pulling listings, and buyers low-balling offers. However, price declines in the few deals going through are minimal. When will the zero interest rates come through? Mortgage interest rates are higher now than before the pandemic because 6% of all home loans are now in default.

* Pending Home Sales Down a Staggering 20.8% in March, and off 16.3% YOY. The worst is yet to come. The West, the first into shelter-in-place, was down a monster 26.8%. Prices still aren’t moving because nobody can buy or sell.

*Chinese Buying of West Coast homes has vaporized over trade war fears, and then of the Covid-19 lockdown, which started with a shutdown of all flights from China.

I have a much better indicator of future housing prices than the depressing numbers above. The way homebuilder stocks like Lennar (LEN), KB Homes (KBH), and Pulte Homes (PHM) are trading, I’d say your home will be worth a lot more in a year, and possibly double in another five years. Many of these stocks are up nearly 100% since the March 23 bottom.

What I call “intergenerational arbitrage” will be the principal impetus. The main reason that we are now enduring two “lost decades” of economic growth over the last 20 years is that 85 million baby boomers are retiring to be followed by only 65 million “Gen Xer’s”. When you are losing 20 million consumers, economies don’t grow very fast. For more about millennial investing habits, please click here.

When the majority of the population is in retirement mode, it means that there are fewer buyers of real estate, home appliances, and “RISK ON” assets like equities, and more buyers of assisted living facilities, healthcare, and “RISK OFF” assets like bonds.

The net result of this is slower economic growth, higher budget deficits, a weak currency, and registered investment advisors who have distilled their practices down to only municipal bond sales.

Fast forward to the other side of the pandemic and the reverse happens. The baby boomers will be out of the economy, worried about whether their diapers get changed on time or if their favorite flavor of Ensure is in stock at the nursing home.

That is when you have 65 million Gen Xer’s being chased by 85 million of the “millennial” generation trying to buy their assets!

By then we will not have built new homes in appreciable numbers for 14 years and a severe scarcity of housing hits. Even before the pandemic, new home construction was taking place at half the 2008 peak. Residential real estate prices will naturally soar. Labor shortages will force wage hikes.

The middle-class standard of living will then reverse a 40-year decline. Annual GDP growth will return from the subdued 2% rate of the past three years to near the torrid 4% seen during the 1990s. It all leads to my “Return of the Roaring Twenties” scenario which you can learn about by clicking here.

It gets better.

It is certain that a future administration will restore tax deductions for state and local real estate taxes (SALT) lost in the 2017 tax bill. The cap on home mortgage interest rate deductions will also rise.

These two events will trigger an immediate 10% increase in the value of your home on an after-tax basis and more on the coasts.

So, if someone approaches you with a discount offer for your home, I would turn around and run a mile the other way.

You should also pile into the stocks, options, and LEAPS of housing stocks in any future market dip.

Oil reports today

Auto glut and Auto/ year outlook article below.

https://www.bloomberg.com/news/arti...in-the-ocean-and-reveal-scope-of-u-s-car-glut

Auto glut and Auto/ year outlook article below.

https://www.bloomberg.com/news/arti...in-the-ocean-and-reveal-scope-of-u-s-car-glut

Global Market Comments

May 1, 2020

Fiat LuxFeatured Trade:(A NOTE ON ASSIGNED OPTIONS, OR OPTIONS CALLED AWAY)

(TRADING THE NEXT KOREAN WAR)

May 1, 2020

Fiat LuxFeatured Trade:(A NOTE ON ASSIGNED OPTIONS, OR OPTIONS CALLED AWAY)

(TRADING THE NEXT KOREAN WAR)

A Note on Assigned Options, or Options Called Away

With the May 15 options expiration only ten trading days away, there is a heightened probability that your short options position gets called away.

We have the good fortune of having a large number of deep in-the-money call and put options spreads about to expire at their maximum profit points, five to be precise.

If that happens, there is only one thing to do: fall down on your knees and thank your lucky stars. You have just made the maximum possible profit for your position with less risk. You just won the lottery, literally.

Most of you have short option positions, although you may not realize it. For when you buy an in-the-money put option spread, it contains two elements: a long put and a short put. The long put you own, but the short put can get assigned, or called away at any time and delivered to its rightful owner.

You have to be careful here because the inexperienced can blow their newfound windfall if they take the wrong action, so here’s how to handle it.

All you have to do was call your broker and instruct him to exercise your long position in your May puts to close out your short position in the May puts.

Puts are a right to sell shares at a fixed price before a fixed date, and one option contract is exercisable into 100 shares.

Sounds like a good trade to me.

Weird stuff like this happens in the run-up to options expirations.

A put owner may need to sell a long stock position right at the close, and exercising his long Put is the only way to execute it.

Ordinary shares may not be available in the market, or maybe a limit order didn’t get done by the stock market close.

There are thousands of algorithms out there which may arrive at some twisted logic that the puts need to be exercised.

Many require a rebalancing of hedges at the close every day which can be achieved through option exercises.

And yes, puts even get exercised by accident. There are still a few humans left in this market to blow it.

And here’s another possible outcome in this process.

Your broker will call you to notify you of an option called away, and then give you the wrong advice on what to do about it.