|

|

If oil keeps getting beat up maybe not. But, this is probably the most unusual period for oil since the early 80's oil embargo.

| Got oil? OPEC and its partners are expected to hold an emergency virtual meeting on April 8-9 in a concerted effort to stabilize markets after the meeting was pushed back from its original date of April 6. All eyes are on if Saudi Arabia, Russia and the U.S. will reach an agreement to take up to 15 million barrels of crude off the market. Heading into next week, Brent crude trades currently at $34.11 a barrel (+14% from Friday) and U.S. West Texas Intermediate stands at $28.34 (+12%) - with oil majors Exxon Mobil (NYSE:XOM), Chevron (NYSE:CVX), Total (NYSE:TOT), BP (NYSE:BP) and Royal Dutch Shell (NYSE:RDS.A) (NYSE:RDS.B) all looking for positive developments to help start a recovery. No great surprise, but jobs are going to be a major focus again next week after 6.6M jobless claims came in. JPMorgan forecasts another 7M unemployment claims are coming down next week and some estimates range even higher. Other economic reports of note include the JOLTS update and a check on consumer prices, while the FOMC will drop the minutes from its latest meeting to the delight of Fed watchers. Earnings spotlight: Simply Good Foods (NASDAQ:SMPL) on April 6; Greenbrier (NYSE:GBX), Revlon (NYSE:REV), Levi Strauss (NYSE:LEVI) and Lindsay (NYSE:LNN) on April 7; PriceSmart (NASDAQ:PSMT) on April 8; and Delta Air Lines (NYSE:DAL), Shaw Communications (NYSE:SJR) and WD-40 (NASDAQ:WDFC) on April 9. Go deeper: See Seeking Alpha's complete list of earnings reporters IPO watch: There are no hints of a company going public next week, but IPO share lockups expire on BioNTech (NASDAQ:BNTX), HBT Financial (NASDAQ:HBT) and Vir Biotechnology (NASDAQ:VIR). Analysts can also start covering Imara (NASDAQ:IMRA). The biotech stock closed at $15.81 on Friday after the IPO was priced at $16 per share. Go deeper: Catch up on all the latest IPO news. M&A tidbits: The tender offer on the Forty Seven (NASDAQ:FTSV)-Gilead Sciences (NASDAQ:GILD) deal expires on April 6. Shareholders vote on the Anixter International (NYSE:AXE)-Wesco International (NYSE:WCC) merger on April 8. Look for more indications that the Caesars Entertainment (NASDAQ:CZR)-Eldorado Resorts (NASDAQ:ERI) deal and Delphi Technologies (NYSE:DLPH)-BorgWarner (NYSE:BWA) combination can make it to finish line. Costco: While traffic at Costco (NASDAQ:COST) stores has finally tailed off just a bit amid social distancing efforts, the retailer's report on March sales has the potential to be a head-turner. As a reminder, Costco saw U.S. comparable sales soar 12% in February as the consumer stockpiling trend first started to take off and the consensus mark for Costco's Q2 comparable sales (U.S., Canada and international) is at a healthy 9.3%. Buckle (NYSE:BKE), Cato (NYSE:CATO) and PriceSmart (PSMT) are also in line to issue monthly sales report. Airline traffic reports: Airline traffic reports will start arriving next week and could include some color on the devastating impact of the pandemic on load factors, earnings and government aid. Late on Friday, JetBlue (NASDAQ:JBLU) warned on a cash crunch, Delta Air Lines (DAL) said it's burning through $60M a day and United Airlines (NASDAQ:UAL) set the high-water for distress by disclosing that it's losing $100M a day. It's likely to be another week of volatile trading for those three carriers as well as American Airlines Group (NASDAQ:AAL), Southwest Airlines (NYSE:LUV), Hawaiian Holdings (NASDAQ:HA), Alaska Air Group (NYSE:ALK), Allegiant Travel (NASDAQ:ALGT), Spirit Airlines (NYSE:SAVE), Mesa Air Group (NASDAQ:MESA) and SkyWest (NASDAQ:SKYW). Business updates: Incyte (NASDAQ:INCY) is scheduled to discuss Phase 3 data on Ruxolitinib Cream for Atopic Dermatitis on April 6. RLH (NYSE:RLH) has a conference call set for April 6 to discuss organizational changes. PAVmed (NASDAQ:PAVM) is hosting a conference call on April 9, with CEO Lishan Aklog expected to provide an overview of the company's near-term milestones and growth strategy. FedEx (NYSE:FDX) is on tap to deliver its monthly economic update and projections on April 10. Voice of the Car Summit: The connect car event on April 7-8 has switched to an online format due to the pandemic. The all-star roster of speakers includes execs from Mercedes-Benz (OTCPK  DAIF), Google (NASDAQ:GOOG) (NASDAQ:GOOGL), iHeartMedia (NASDAQ:OTC:IHRT), LinkedIn (NASDAQ:MSFT), Ford (NYSE:F) and Intel (NASDAQ:INTC). The expected timeline and uses for 5G-based cellular connectivity into cars could be an interesting topic. DAIF), Google (NASDAQ:GOOG) (NASDAQ:GOOGL), iHeartMedia (NASDAQ:OTC:IHRT), LinkedIn (NASDAQ:MSFT), Ford (NYSE:F) and Intel (NASDAQ:INTC). The expected timeline and uses for 5G-based cellular connectivity into cars could be an interesting topic.Restaurants: The restaurant industry will be put to the test again next week as operators continue to look for takeout/delivery workarounds to keep at last some revenue coming in. Analysts expect the industry could look different on the other side of the pandemic. Cowen's Andrew Charles sees Domino's Pizza (NYSE:DPZ) and Papa John's International (NASDAQ:PZZA) nabbing market share from independents and value-minded chains like Red Robin Gourmet Burgers (NASDAQ:RRGB) and Olive Garden (NYSE:DRI) resonating in a harsh economy. The pivot for chains focused in dense urban areas isn't quite so simple. Shake Shack (NYSE:SHAK) isn't standing still, already adding Uber Eats (NYSE:UBER) and DoorDash (DOORD) as delivery options and partnering on cook-at-home burger kits. Short report: The list of short favorites is worth taking a look at amid the wild market swings. While Blue Apron (NYSE:APRN) and Peloton Interactive (NASDAQ:PTON) have defied the market collapse as favorite stay-at-home stock picks, there are plenty of short picks cooperating. Looking ahead to next week, the list of high short interest names includes GameStop (NYSE:GME), Match Group (NASDAQ:MTCH), Gogo (NASDAQ:GOGO), Mallinckrodt (NYSE:MNK), SmileDirectClub (NASDAQ:SDC), Tanger Factory Outlet (NYSE:SKT), Carvana (NYSE:CVNA), AMC Entertainment (NYSE:AMC), Dillard's (NYSE:DDS), Stitch Fix (NASDAQ:SFIX), Wayfair (NYSE:W) and Carvana (CVNA). On a pure dollar basis, Tesla (NASDAQ:TSLA) is also near the top list with short interest standing at over $8B. Then in what would have been a shocking development a few months ago, short interest on Nike (NYSE:NKE), Starbucks (NASDAQ:SBUX) and Home Depot (NYSE:HD) has moved much higher than historic norms. Wells Fargo Biotech Corporate Access Day Virtual Conference Boston 2020: The biotech conference has gone to online presentations, but should still be just as intriguing. Look for updates from uniQure (NASDAQ:QURE), Adaptimmune Therapeutics (NASDAQ:ADAP), Affimed (NASDAQ:AFMD), Akcea Therapeutics (NASDAQ:AKCA), Applied Genetic Technologies (NASDAQ:AGTC), Arena Pharmaceuticals (NASDAQ:ARNA), Autolus Therapeutics (NASDAQ:AUTL), AVROBIO (NASDAQ:AVRO), bluebird bio (NASDAQ:BLUE), Celyad (NASDAQ:CYAD), Crispr Therapeutics (NASDAQ:CRSP), Gritstone Oncology (NASDAQ:GRTS), IMV (NASDAQ:IMV), Infinity Pharmaceuticals (NASDAQ:INFI), Jounce Therapeutics (NASDAQ:JNCE), MEI Pharma (NASDAQ:MEIP), Momenta Pharmaceuticals (NASDAQ:MNTA), MyoKardia (NASDAQ:MYOK) and Voyager Therapeutics (NASDAQ:VYGR). Virtual biotech conferences: The online Goldman Sachs Cell Therapy Day conference will feature presentations from Allogene Therapeutics (NASDAQ:ALLO), TCR2 Therapeutics (NASDAQ:TCRR) and Precision Biosciences (NASDAQ:DTIL). The Canaccord Genuity Horizons in Oncology Conference on April 8 also includes an online presentation by Allogene Therapeutics, along with IGM Biosciences (NASDAQ:IGMS). Videogames check: Analysts seem to be in disagreement on whether the closing of many retail stores will be offset by the boost in digital sales amid the pandemic. On the positive side, there has been an increase in Twitch viewership and Steam users to go along with explosive sales of Nintendo's (OTCPK:NTDOY) Animal Crossing. However, that burst of energy comes against a long streak of monthly declines in videogame sales ahead of the console refresh cycle. The next test of the market could be Activision Blizzard's (NASDAQ:ATVI) release of Call of Duty: Modern Warfare Season 3 on April 8. Annual meetings: Annual meetings on the calendar include Rio Tinto (NYSE:RIO) on April 8, as well as Adobe (NASDAQ:ADBE) and Synopsys (NASDAQ:SNPS) on April 9. Needless to say, those events will be of virtual variety. Furlough Nation: The shock of the massive amount of furloughing of U.S. employees will wear off a little bit next week to leave the question of what does it mean for investors? Analysts say the crisis management skills of top execs and the strength of the underlying businesses will be the critical factors in seeing share prices recover. A partial list of companies that instituted furloughs includes Macy's (NYSE:M), Kohl's (NYSE:KSS), J.C. Penney (NYSE:JCP), Stage Stores (NYSE:SSI), Ross Stores (NASDAQ:ROST), Gap (NYSE:GPS), L Brands (NYSE:LB), Urban Outfitters (NASDAQ:URBN), Simon Property Group (NYSE:SPG), Buckle (BKE), Cato (CATO), Guess (NYSE:GES), Children's Place (NASDAQ:PLCE), Marriott International (NASDAQ:MAR), Tilly's (NYSE:TLYS), Express (NYSE:EXPR), Ascena Retail (NASDAQ:ASNA), Chico's (NYSE:CHS), Movado (NYSE:MOV), Genesco (NYSE:GCO), Caleres (NYSE:CAL), Steven Madden (NASDAQ:SHOO), G-III Apparel (NASDAQ:GIII), Disney (NYSE:DIS), La-Z-Boy (NYSE:LZB), Ethan Allen (NYSE:ETH), Havertys (NYSE:HVT), Casper Sleep (NYSE:CSPR), Five Below (NASDAQ:FIVE), Sysco (NYSE:SYY), Cheesecake Factory (NASDAQ:CAKE), Shake Shack (SHAK), Ruth's Hospitality (NASDAQ:RUTH), SeaWorld Entertainment (NYSE:SEAS), Polaris (NYSE:PII), Caesars Entertainment (CZR), Funko (NASDAQ:FNKO), Gannett (NYSE:GCI), American Eagle Outfitters (NYSE:AEO), and MarineMax (HAZO). Barron's mentions: The tough stretch ahead for the advertising industry is profiled in detail, with spending expected to be down sharply. On the digital side, Facebook (NASDAQ:FB) and Twitter (NYSE:TWTR) have already warned that they will take a hit from the downturn, while Alphabet's Google is also likely to be hurt. Cable players AMC Networks (NASDAQ:AMCX), ViacomCBS (NASDAQ:VIAC) and Discovery (NASDAQ:DISCA) face advertising dollars drying up, subscription services growth and a lack of sports programming in a triple whammy could set the stage for an acceleration in the long-running cord-cutting trend. Sharp revenue drops are also expected for New York Times (NYSE:NYT), News Corp (NASDAQ:NWSA), Meredith (NYSE:MDP), Gannett (GCI), Clear Channel Outdoor Holdings (NYSE:CCO), Outfront Media (NYSE:OUT), iHeartMedia (OTC:IHRT) and Cumulus Media (NASDAQ:CMLS). The largest U.S. media businesses have seen as being better off, but trouble areas are still on the road ahead for Comcast (NASDAQ:CMCSA), AT&T (NYSE:T) and Walt Disney (DIS). The publication also sets out a list of biotechs to own for a post-pandemic world. Gilead Sciences (GILD), Blueprint Medicines (NASDAQ:BPMC), WuXi Biologics (OTC:WXIBF), WuXi Apptec (OTCPK:WUXAY), Invitae (NYSE:NVTA), bluebird bio (BLUE), Fate Therapeutics (NASDAQ:FATE) and Crispr Therapeutics (CRSP) make the cut. Sources: CNBC, Bloomberg, Nikkei Asian Review, Reuters, EDGAR, S3 Partners. |

|

| Global Market Comments April 6, 2020 Fiat Lux Featured Trade: (MARKET OUTLOOK FOR THE WEEK AHEAD, or MAD HEDGE GOES POSITIVE ON THE YEAR) (INDU), (SPY), (VIX), (VXX), (AMZN), (MSFT), (BAC), (JPM)

|

| � |

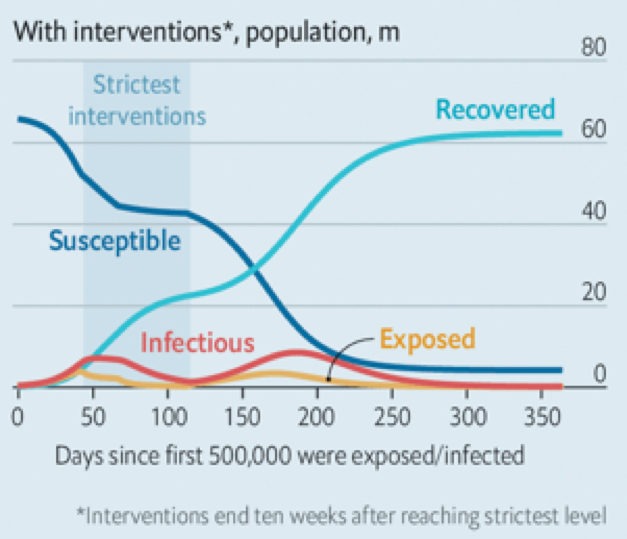

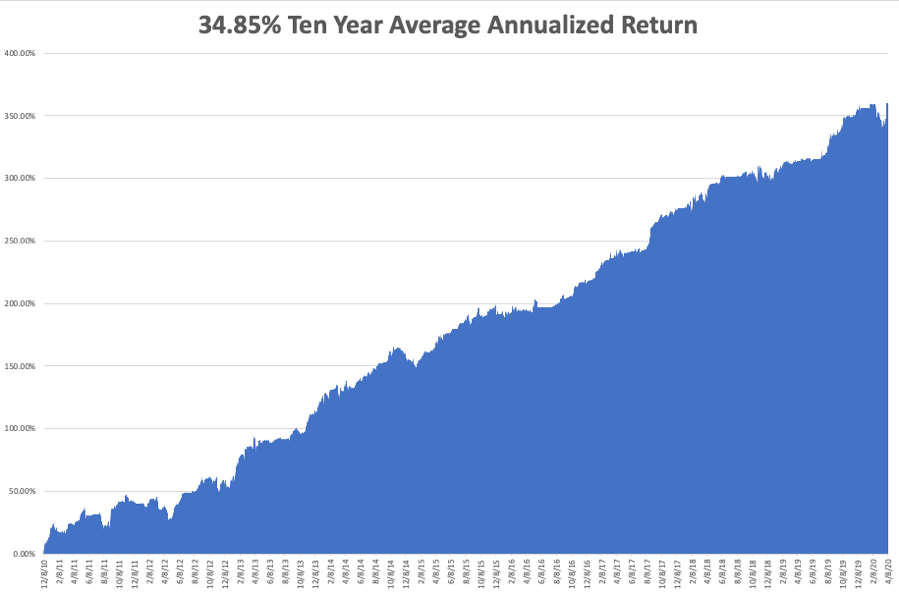

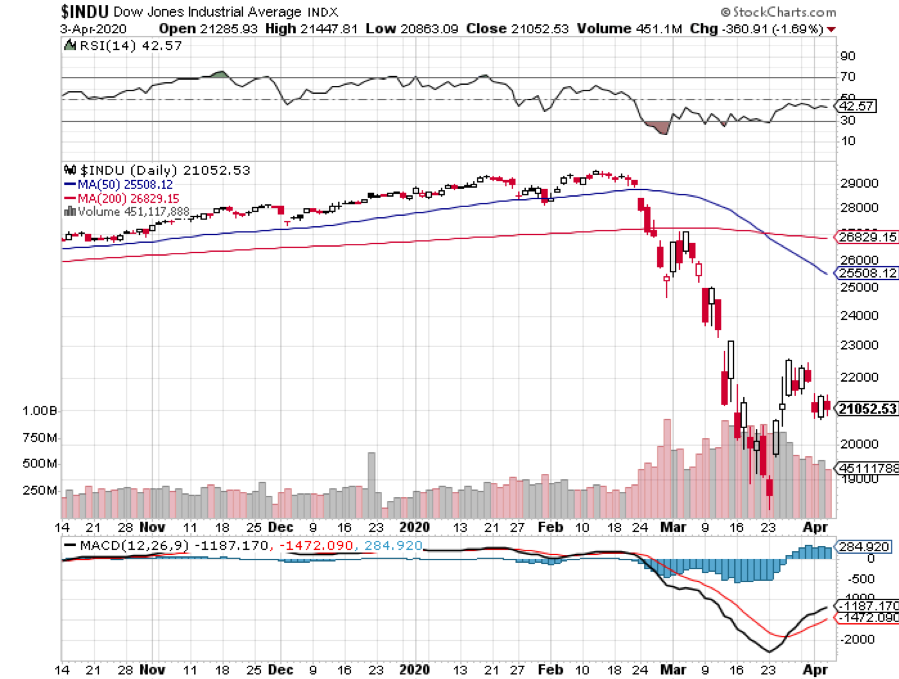

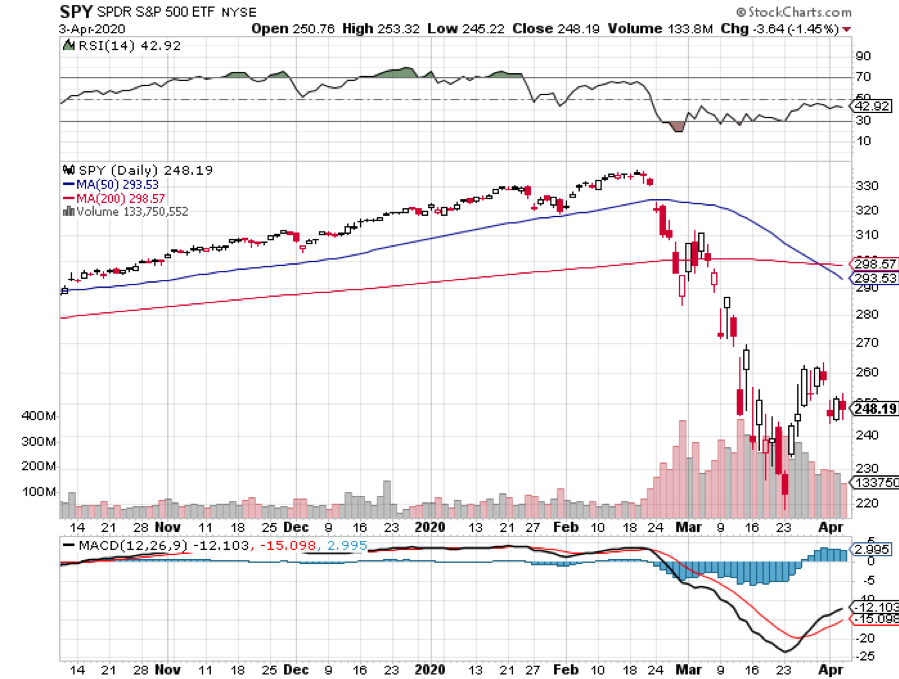

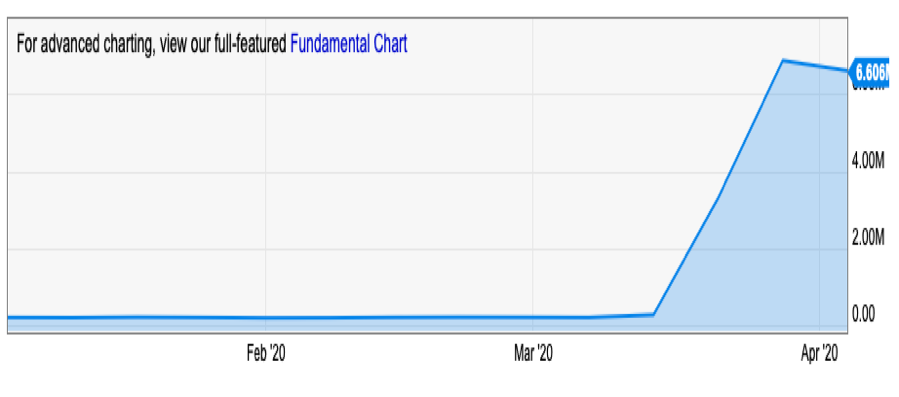

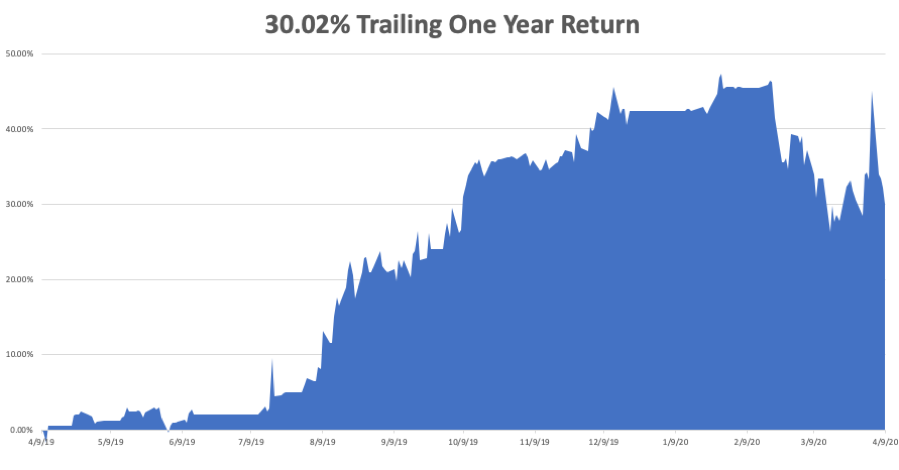

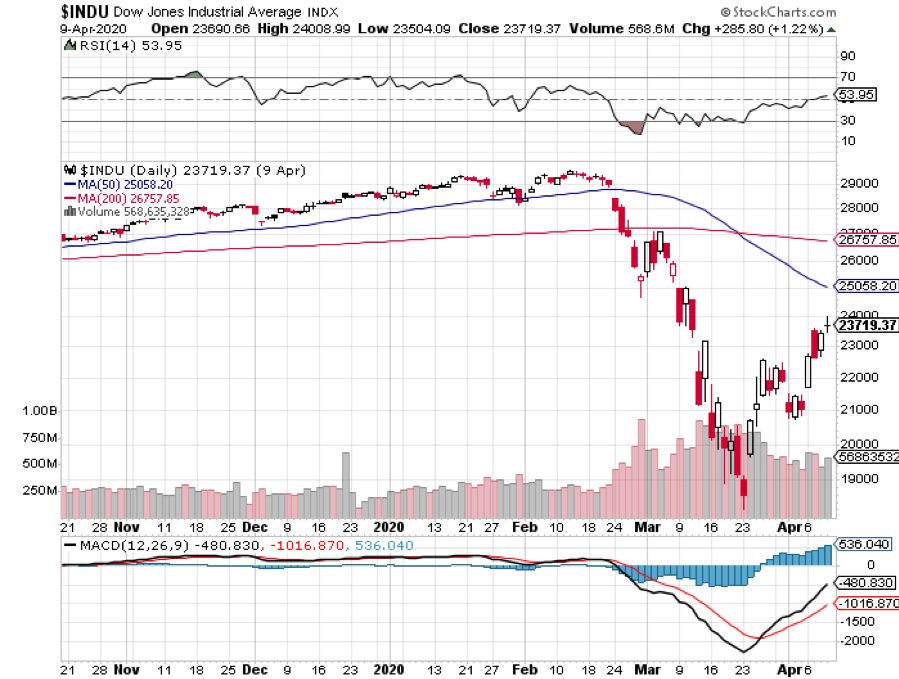

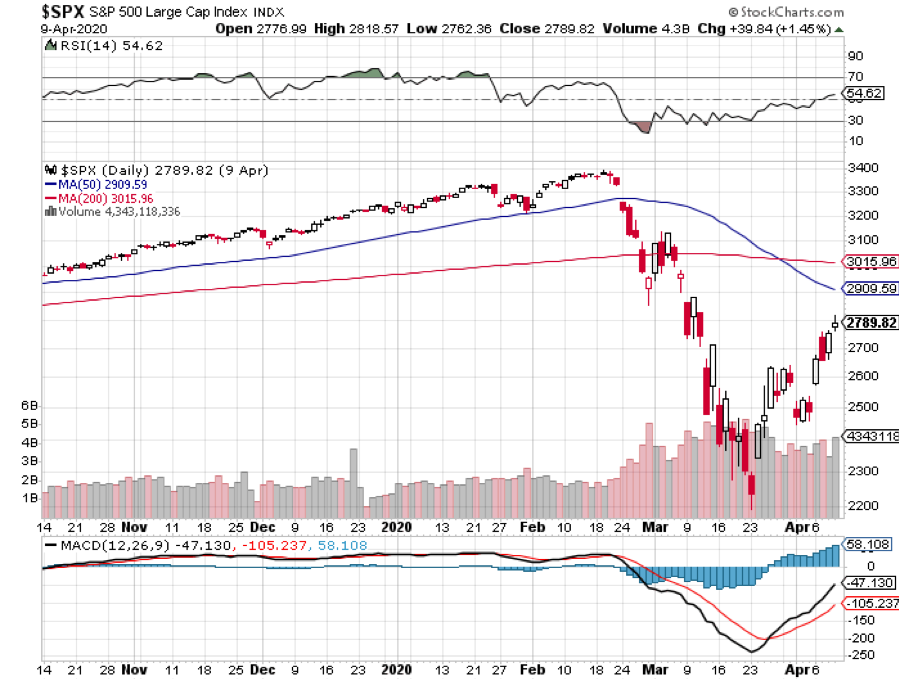

The Market Outlook for the Week Ahead, or Mad Hedge Goes Positive on the Year There is no doubt that the Corona epidemic will be the WWII challenge of our generation. Since we are Americans, we will rise to the task. We all have our jobs to do, being it working as a front-line medical professional, or simply staying at home. We will get through this. I was standing in front of a Reno gun store yesterday waiting my turn to enter. Under Nevada’s strict shelter-in-place rules, only one person is allowed to enter a store at a time. I needed some ammo and black powder for my 1860 Army Colt revolver, which is hard to find in California. I struck up a casual conversion about the epidemic with other waiting customers on a clear, brisk Nevada morning. A blue-collar worker with an AR-15 said he really wasn’t paying attention to it. A hispanic gang member with a heavily tattooed neck and fingers looking for a box a 9mm Glock shells confessed he hadn’t heard about it. A white nationalist with a heavily militarized SUV argued that the whole thing was a left-wing conspiracy meant to discredit Donald Trump. Which can only mean one thing. The worst days of the of the epidemic are ahead of us, as are the consequences for the stock market. Remember, 40% of the country don’t read newspapers or watch the news and be only barely aware of the seriousness of the disease. The White House us currently forecasting 12 million cases and 250,000 deaths. That’s just an optimistic guess. Only one third of the country started their shutdowns early, one third were late, and the last third not at all. This means that the highest death rates will be in southern and midwestern states that are following the presidents advance and dismissing the epidemic out of hand, refusing to wear face masks. So, we are really looking at a potential US 120 million cases and 2.4 million deaths. On that scale the food distribution system will start to break down for shear lack of workers. No one really knows how effective shelter-in-place will be, although the early data is encouraging. We are all living in one giant experimental petri dish right now. And we will be the lucky country. Deaths in the Southern Hemisphere, which is just going into the winter, will be much higher. Anytime I consider adding a long position, I first ask myself how it will stand up against a picture on the front page of the New York Times showing a pile of a thousand bodies outside a local hospital. I saw that sort of thing in Asia a half century ago. Markets will crash. The game we are now in for the coming weeks is to trade an $18,000 to $22,000 range in the Dow Average. The sharp selloff in the Volatility Index (VIX) last week, which we caught with both hands, suggests that the next retest of the $18,000 low will be successful. Further down the road, I’m not so sure. Any prediction beyond tomorrow in this environment is dubious at best. The world is moving on fast-forward now and the unbelievable is happening every day. But here’s a shot. If the $18,000 to $22,000 range doesn’t hold, then we are moving to a $15,000 to $18,000 range. If that fails, then we are looking at $12,000 to $15,000 range. Then we will be looking at Great Depression levels of stock market sell-off, with a total corporate capitalization loss of an eye-popping $17 trillion. The great challenge here is to buy your best stocks and LEAPs as low as possible before an unprecedented $6 trillion in federal stimulus that is coming our way. There will be the $2 trillion in jobs and corporate bailout money already passed, a $2 trillion infrastructure bill coming, and a second jobs and bailout bill that will be needed. On top of that, the Federal Reserve has committed to $8 trillion backstopping of the financial. And here is the problem. Trump has spent the last three years shrinking the government. The pandemic is a very large government event. So, the Feds may simply not have enough bodies in place to spend, or to lend, all the money that has already been authorized. That is your economic and market risk. There is no doubt that the next month will be grim. The U-6 Unemployment Rate published on Friday was 8.9%, indicating the total number of jobless is already at 14.4 million. If the Fed is right and we soon hit 32%, total joblessness will soar to 52 million. During the Great Depression, that unemployment rate peaked at only 25%, throwing 20 million out of work. We could exceed those levels in the coming week! Dr. Fauci predicts 200,000 US deaths. I think that’s a low number, given that 100 million Americans are still not sheltering-in-place. Corona is starting to take its toll on Wall Street, claiming the life of the Jeffries CFO, Peg Broadbent. Every state and city should prepare for a New York-style spike in cases. The Fed is expecting 47 million unlucky individuals to lose jobs. This week, Macy’s (M) chopped 150,000, while Tillman Fertitta laid off 40,000 restaurant workers in place like Morton’s Steakhouse and the Bubba Gump Shrimp Company. Many more are to come. Weekly Jobless Claims have already exploded to 6.64 Million. That is three full recessions worth of job losses in two weeks. The March Nonfarm Payroll Report was a disaster. Here is another number to put in your record book of awful numbers, the report showing 701,000 job losses in March. It’s the first negative number since 2010. Leisure & Hospitality fell by a staggering 459,000. A second Corona wave might arrive in the fall, warns JP Morgan (JPM). We may not have visited the Volatility Index at $80 for the last time. I’m setting up more (VXX) shorts if we do revisit there. Sell all substantial stock market rallies. It’s worse than you think. Brace yourself. Bank of America (BAC) has come out with the first GDP forecast I’ve seen that factors in a second wave of Coronavirus cases in the fall. It is not a pretty picture. They see every quarter of 2020 as coming in negative. These easily takes US GDP back to levels not seen since the Obama administration. The only consolation is that (BAC) has never been that great at forecasting the economy, basically leaving it to a bunch of kids. Here they are: 2020 Q1 -7% 2020 Q2 -30% 2020 Q3 -1% 2020 Q4 -30% Oil rich countries will have to dump $225 billion in stocks, thanks to the collapse of oil to a once impossible $20 a barrel. An 80% plunge in national revenues is forcing asset sales at fire sale prices to avoid a brewing revolutions. They don’t retire former heads of states to golf clubs in the Middle East, they stand them up in front of a firing squads. Oil Hit an 18-year low at $19.30 a barrel and it could get a lot worse. All of the world’s storage is full, so producers might have to PAY wholesalers to take Texas tea off their hands. Yes, negative oil prices are possible. Otherwise, producing wells will be permanently damaged with a total shutdown. Most of the industry has a negative net worth, save the majors. I told you to stay away! China PMIs turn positive, coming in at 52 versus an expected 45indicating a recovering economy. Watch the Middle Kingdom’s economic data more than usual. US PMIs are still in free fall. However, consumers still are staying at home. Their economy went first into the epidemic and will be the first out. There’s hope for us all the quarantine is working. A $2 trillion infrastructure budget is in the works, and the Democrats will support it because the money won’t be spent until they get control of government in 2021. With most of the construction industry closed, the government’s cumbersome bidding process can’t even start until the summer. You wonder how that last $2 trillion rescue package got done in five days? This will take us to Great Depression levels of bailout spending. The Fed balance sheet has exploded from $3.5 trillion to $5 trillion in weeks. I know 10,000 bridges that need to be fixed. When we come out the other side of this, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates at zero, oil at $20 a barrel, and many stocks down by three quarters, there will be no reason not to. The Dow Average will rise by 400% or more in the coming decade. My Global Trading Dispatch performance had a spectacular week, blasting my performance back to positive numbers for the year. That is thanks to the ten-point collapse in the Volatility Index (VIX) on Thursday and Friday, which had a hugely positive effect on all our positions. We are now up an amazing +11.02% for the first three days of April, taking my 2020 YTD return up to +2.60%. We are a mere 68 basis points short of an all-time high. That compares to an incredible loss for the Dow Average of -28.8%, with more to go. My trailing one-year return was recovered to 46.74%. My ten-year average annualized profit recovered to +34.85%. My short volatility positions (VXX) are almost back to cost. I used every rally in the Dow Average to increase my short positions in the (SPY) to almost obscene levels. Now we have time decay working big time in our favor. These will all come good well before their ten-month expiration. I bought two very deep in-the-money, very short-dated call spreads in Amazon (AMZN) and Microsoft (MSFT), the two safest companies in the entire market, betting that we don’t go to new lows in the next nine trading days. At the slightest sign of a break in the pandemic, the economy and shares should come roaring back. Right now, I have a 30% cash position. All economic data points will be out of date and utterly meaningless this week. The only numbers that count for the market are the number of US Coronavirus cases and deaths, which you can find updates at https://coronavirus.jhu.edu. On Monday, April 6 at 6:00 AM, the Consumer Inflation Expectations for March are out. On Tuesday, April 7 at 9:00 AM, the US JOLTS Job Openings Report is published. On Wednesday, April 8, at 2:00 PM, the Fed Minutes for the previous meeting six weeks ago are released. On Thursday, April 9 at 8:30 AM, Weekly Jobless Claims are announced. The number could top 3,000,000 again. On Friday, April 10 at 7:30 AM, the US Core Inflation is released. The Baker Hughes Rig Count follows at 2:00 PM. Expect these figures to crash as well. As for me, I have temporarily moved back to Oakland to retrieve my printer. As I left, my Tahoe neighbors told me I was nuts to go back to a big city. I then drove across an almost totally vacated Golden State, emptied by a pandemic. With my free time, I have planted a victory garden. I managed to obtain tomatoes, eggplants, chili peppers, strawberries, lettuce, and bell peppers from the nearest Home Depot (HD) garden center. In two weeks, I should have something new to eat. Stay healthy. John Thomas CEO & Publisher The Diary of a Mad Hedge Fund Trader

|

Quote of the Day “This is not a time to go to the grocery store or the pharmacy,” said Dr. Deborah Birx, coordinator of the White House Coronavirus task force.

|

| This is not a solicitation to buy or sell securities The Mad Hedge Fund Trader is not an Investment advisor For full disclosures click here at: http://www.madhedgefundtrader.com/disclosures The "Diary of a Mad Hedge Fund Trader"(TM) and the "Mad Hedge Fund Trader" (TM) are protected by the United States Patent and Trademark Office The "Diary of the Mad Hedge Fund Trader" (C) is protected by the United States Copyright Office |

| � |

| Mad Hedge Hot Tips April 6 2020 Fiat Lux The Five Most Important Things That Happened Today (and what to do about them)

|

Stocks Soar on Falling Death Rates. Chinese cases are falling after the border close, Italy and Madrid are going flat, and San Francisco is looking good. There is still a massive, but extremely nervous bid under the market. I’m selling into this rally. We will continue to chop in a (SPY) $218-$265 range for the foreseeable future. |

| � |

| � |

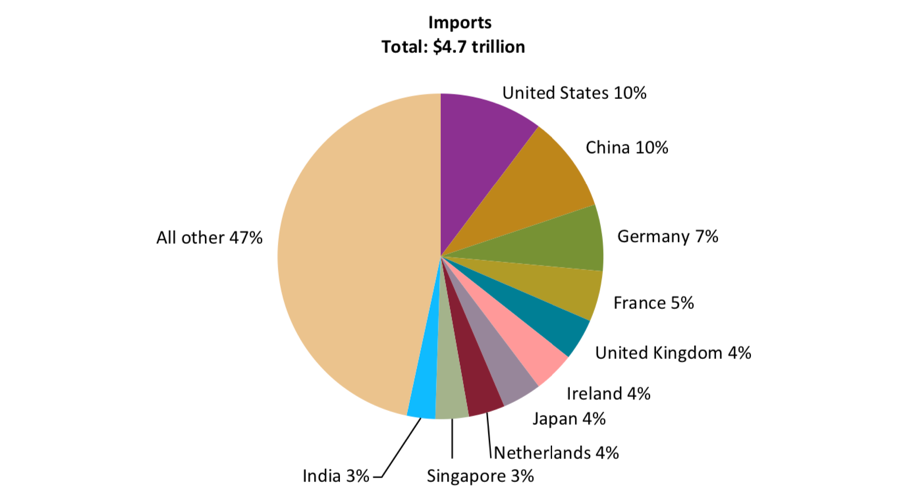

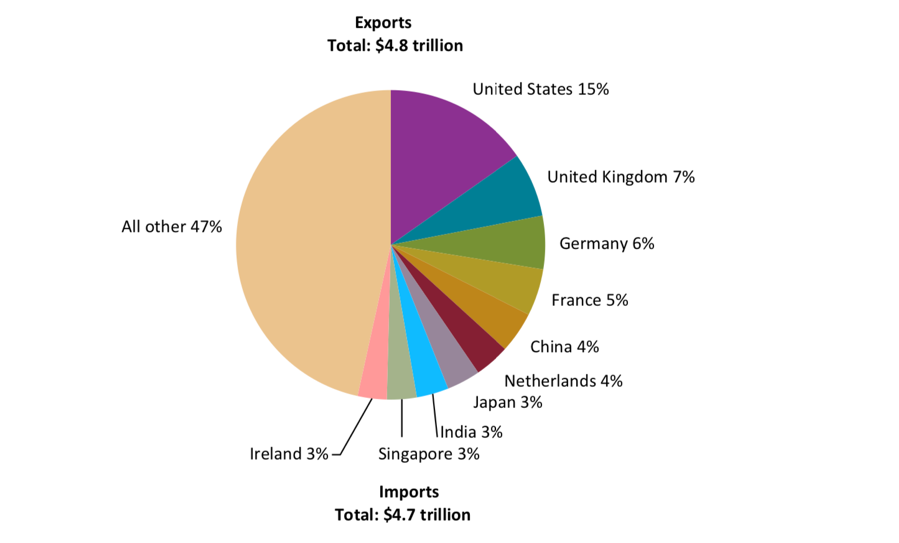

Why Globalization Works I am writing this to you from the Amtrak California Zephyr. I am riding the rails in a first class sleeping compartment from Oakland, CA to Truckee, CA to reposition a car from my Lake Tahoe lakefront estate now that winter is over. Pulling out of the station, I couldn’t help but notice the gigantic cargo ships from China and South Korea unloading containers by the tens of thousands. Mountains of these containers dot the horizon. The cranes used to automatically unload them were the models for George Lucas’s AT walkers in Star Wars. I tell my kids that this year’s Christmas presents are in there somewhere. Having been a vociferous supporter of globalization since its dawn a half century ago, first during a decade spent as a reporter for The Economistmagazine, and then as an investor, I will explain how our international trading system works, and especially why it works for us. There was a polyglot of travelers from all over the world on my train. Large groups of Chinese were led by flag bearing guides. Italian Millennials mobbed the bar. A retired English couple strolled the observation car. There was even the occasional American student backpacker repeating my own adventure from the 1960s. And you know what? This disparate international group shared many things in common. Most of them spent much of the day glued to iPhones or Androids run by US-designed apps. Many were staying in accommodations organized by Airbnb. Like me, they may have made the trip to the train station in an Uber cab. They wore Levi Strauss blue jeans. American pop music pulsed through their ear buds. Probably half of them arrived in America on a Boeing jet financed by the Export-Import Bank of the U.S. In short, they were all sending enormous amounts of money to US companies and shareholders in more ways than they could possible count without realizing it. You never used to see tourists from most countries, like Russia, Spain, Portugal, Italy, or Ireland. They were too poor. Rapidly rising standards of living created by globalization changed all of that, creating an enormous new market for American products, especially technology ones. You can see some of this impact in international balance of trade statistics. In 2018, the US ran a trade deficit with the world of $891.3 billion, an all-time high, with consumer electronics, oil, clothes, and cars our largest imports. There is a more elegant way to describe this trade. We are, in fact, running a massive goods surplus, where foreigners send us $891.3 billion worth of stuff and we give them paper in return, US dollars, which has been steadily depreciating in value for the past 50 years. Who is the big winner here? The US consumer, i.e. you and I. Sounds like a good deal to me. Without this inflow of cheap goods, the US inflation rate would be at least double or triple what it is now. Subtract our $402.8 billion surplus in services, which includes, financial services, education, patents, and other intellectual property, and that brings our current account deficit down by more than half to only $488.5 billion. Some 78.6% of private sector US GDP is now accounted for by services. But that doesn’t tell the whole story. Trade data completely miss the enormous number of products and services that are now given away FOR FREE in exchange for the chance of earning some uncertain revenue at some future date. In a pre-Internet, pre-globalized world, a service like the Diary of a Mad hedge Fund Trader covering so many asset classes and individual stocks real-time might have cost $100,000, if not $1 million. And you know what? It would have been worth it! Multiply this effect on a global scale and you’ll see what I am talking about. Give up your name, email address, and your phone number and you can obtain almost any kind of online service for nothing. And as far as I know, no government agency has any measurement of this whatsoever. Needless to say, the United States is far and away the leader in this immeasurable field. By the way, this might also be the reason why the published productivity data has been so poor despite the fact that US GDP has grown by 20% since 2009. Everywhere I look, productivity is skyrocketing, including my own. It also might be the reason why Amazon continuously sports a nosebleed valuation. Much of what they provide is FREE, and therefore immeasurable. Of course, globalization wrought havoc on your life if you went into it with the wrong job in the wrong industry and an inadequate skill set. Blue collar workers tied to textiles, shoes, toys, and other low value-added manufacturing were toast as their jobs fled offshore. If you didn’t retrain or adapt, you became an angry, mostly white man. As my friend, New York Times columnist Tom Friedman, likes to say, “Average doesn’t cut it anymore.” However, while the jobs are gone, the bulk of the profits stayed here in the US. American companies offshored the $2 an hour jobs (mass assembly), but kept the $150 an hour ones (design and marketing). As my friends in the Chinese government never fail to point out, if they build the iPhone for $100 and we sell it $1,000, we are the big winners, not them. They believe we are perpetuating 19[SUP]th[/SUP] century colonialism by making wage slaves of their workers. They are correct. Globalization enables the US dollar to continue as the world’s reserve currency, as almost all international trade is conducted in the buck. That is one of the greatest free lunches of all time. It enables the US government to indirectly control the global economy through its own monetary policy. Some half of all of the $22 trillion in US government debt is owned by foreigners. When sanctions forced Iran to drop out of the international trading system, what did they get? A Great Depression that cut their GDP by 25%. You can’t run a country of 80 million with oil barter deals, gold, and bitcoins alone. There is also the huge defense benefits that globalization brings us. Back in the early days, the main reason to steer a country into capitalism was to prevent it from going communist, and therefore becoming an enemy. Grow your allies and shrink your enemies, and your defense costs shrink dramatically, raising our friends’ standards of living. That is what has happened on a massive scale. Increased trade also boosted foreign standards of living, therefore creating a growing market for American goods and services. This was the whole point of the World Trade Organization, NAFTA, the Trans-Pacific Partnership. Humans rarely bite the hands that feed them. They are also highly unlikely to set fire to their paycheck or bomb the sources of income. Make a foreigner a millionaire, and you turn him into a pacifist. I have seen this unfold time and again over the past half-century, be it in China, Russia, Vietnam, Cambodia, and most recently in Iran. Create an embedded base of businessmen in any country who are getting rich off of you, and international relations invariably improve. Any system based on greed is guaranteed to succeed. A side benefit of all of this is that stock markets for up forever. Since globalization started in earnest in 1951, the Dow Average has risen from $239 to $21,800, a prodigious gain of some 92-fold. And you wondered why? Globalization is the mechanism through which America is paid the dividend for all of the good deeds it has done and inventions it has created for the past century. I am thinking about the construction of the Panama Canal, Lend Lease, and the Marshall Plan, as well as the transistor, memory chip, microprocessor, personal computer, Windows, the Internet, online commerce, the iPhone, and social media. That is why globalization is a win-win-win for everyone. There are really only two true communist countries left in the world, Cuba and North Korea, which never joined the international trading community. They also happen to have the planet’s lowest standard of livings. And Cuba will become totally capitalist within two years. Just give them a million iPhones, get them talking, and see what happens. Castro will become just another neighborhood in South San Francisco. So why end a trading system from which America and its people have profited so mightily? That is a very good question, one that someone might ask our president.

|

| � |

| Global Market Comments April 9, 2020 Fiat Lux Featured Trade: (TEN LONG TERM LEAPS TO BUY AT THE BOTTOM) (MSFT), (AAPL), (GOOGL), (QCOM), (AMZN), (V), (AXP), (NVDA), (DIS), (TGT)

|

| � |

Ten Long Term LEAPS to Buy at the Bottom I am often asked how professional hedge fund traders invest their personal money. They all do the exact same thing. They wait for a market crash like we are seeing now and buy the longest-term LEAPS (Long Term Equity Participation Securities) possible for their favorite names. The reasons are very simple. The risk on LEAPS is limited. You can’t lose any more than you put in. At the same time, they permit enormous amounts of leverage. Two years out, the longest maturity available for most LEAPS, allow plenty of time for the world and the markets to get back on an even keel. Recessions, pandemics, hurricanes, oil shocks, interest rate spikes, and political instability all go away within two years and pave the way for dramatic stock market recoveries. You just put them away and forget about them. Wake me up when it is 2022. I put together this portfolio using the following parameters. I set the strike prices just short of the all-time highs set two weeks ago. I went for the maximum maturity. I used today’s prices. And of course, I picked the names that have the best long-term outlooks. You should only buy LEAPS of the best quality companies with the rosiest growth prospects and rock-solid balance sheets to be certain they will still be around in two years. I’m talking about picking up Cadillacs, Rolls Royces, and even Ferraris at fire sale prices. Don’t waste your money on speculative low-quality stocks that may never come back. If you buy LEAPS at these prices and the stocks all go to new highs, then you should earn an average 131.8% profit from an average stock price increase of only 17.6%. That is a staggering return 7.7 times greater than the underlying stock gain. And let’s face it. None of the companies below are going to zero, ever. Now you know why hedge fund traders only employ this strategy. There is a smarter way to execute this portfolio. Put in throw-away crash bids at levels so low they will only get executed on the next cataclysmic 1,000-point down day in the Dow Average. You can play around with the strike prices all you want. Going farther out of the money increases your returns, but raises your risk as well. Going closer to the money reduces risk and returns, but the gains are still a multiple of the underlying stock. Buying when everyone else is throwing up on their shoes is always the best policy. That way, your return will rise to ten times the move in the underlying stock. If you are unable or unwilling to trade options, then you will do well buying the underlying shares outright. I expect the list below to rise by 50% or more over the next two years. Enjoy. Microsoft (MSFT) - March 18 2022 $180-$190 bull call spread at $2.67 delivers a 274% gain with the stock at $190, up 16% from the current level. As the global move online vastly accelerates the world is clamoring for more computers and laptops, 90% of which run Microsoft’s Windows operating system. The company’s new cloud present with Azure will also be a big beneficiary. Apple (AAPL) – June 17 2022 $210-$220 bull call spread at $6.47 delivers a 55% gain with the stock at $226, up 14% from the current level. With most of the world’s Apple stores now closed, sales are cratering. That will translate into an explosion of new sales in the second half when they reopen. The company’s online services business is also exploding. Alphabet (GOOGL) – January 21 2022 $1,500-$1,520 bull call spread at $7.80 delivers a 28% gain with the stock at $226, up 14% from the current level. Global online searches are up 30% to 300%, depending on the country. While advertising revenues are flagging now, they will come roaring back QUALCOMM (QCOM) – January 21 2022 $90-$95 bull call spread at $1.55 delivers a 222% gain with the stock at $95, up 23% from the current level. We are on the cusp of a global 5G rollout and almost every cell phone in the world is going to have to use one of QUALCOMM’s proprietary chips. Amazon (AMZN) – January 21 2022 $2,100-$2,150 bull call spread at $17.92 delivers a 179% gain with the stock at $2,150, up 15% from the current level. If you thought Amazon was taking over the world before, they have just been given a turbocharger. Much of the new online business is never going back to brick and mortar. Visa (V) – June 17 2022 $205-$215 bull call spread at $3.75 delivers a 166% gain with the stock at $215, up 16% from the current level. Sales are down for the short term but will benefit enormously from the mass online migration of new business only. They are one of a monopoly of three. American Express (AXP) – June 17 2022 $130-$135 bull call spread at $1.87 delivers a 167% gain with the stock at $135, up 28% from the current level. This is another one of the three credit card processors in the monopoly, except they get to charge much higher fees. NVIDIA (NVDA) – September 16 2022 $290-$310 bull call spread at $6.90 delivers a 189% gain with the stock at $310, up 19% from the current level. They are the world’s leader in graphics card design and manufacturing used on high-end PCs, artificial intelligence, and gaining. They befit from the soaring demand for new computers and the coming shortage of chips everywhere. Walt Disney (DIS) – January 21 2022 $140-$150 bull call spread at $2.55 delivers a 55% gain with the stock at $116, up 31% from the current level. How would you like to be in the theme park, hotel, and cruise line business right now? It’s in the price. Its growing Disney Plus streaming service will make (DIS) the next Netflix. Target (TGT) – June 17 2022 $125-$130 bull call spread at $1.40 delivers a 257% gain with the stock at $130, up 16% from the current level. Some store sales are up 50% month on month and lines are running around the block. Their recent online growth is also saving their bacon.

|

Quote of the Day"Every attempt to make war easy and safe will result in humiliation and disaster," said the Civil War General, William T. Sherman.

|

Visa (V) and Microsoft (MSFT) are on my shopping list for Friday, I don't know Microsoft (MSFT) keeps hitting resistance at 168. this is a 200+ dollar stock.

Market volatility has thrown off all the markets ACCEPTED, time tested approaches to price analysis.I guess everyone is getting a pass right now?

It's going to be interesting to see balance sheets next week, anyone in a cash crunch /Auto/Airlines/Hotels should drag things down a bit.

Visa (V) and Microsoft (MSFT) are on my shopping list for Friday, I don't know Microsoft (MSFT) keeps hitting resistance at 168. this is a 200+ dollar stock.

| Microsoft Corp | MSFT | 5.03% |

| Apple Inc | AAPL | 4.64% |

| Amazon.com Inc | AMZN | 3.19% |

| Facebook Inc A | FB | 1.88% |

| Alphabet Inc A | GOOGL | 1.63% |

| Alphabet Inc Class C | GOOG | 1.63% |

| Berkshire Hathaway Inc B | BRK.B | 1.60% |

| Johnson & Johnson | JNJ | 1.44% |

| JPMorgan Chase & Co | JPM | 1.43% |

| Visa Inc Class A | V | 1.27% |

| � |

The Market Outlook for the Week Ahead, or The Bear Market Rally is Over For the first time in 16 years, I did not have to get up at 6:00 AM to hide Easter eggs. It’s not because my kids don’t believe in the Easter Bunny anymore. They’ll believe in anything that delivers them a free chocolate bunny. It’s because I couldn’t get any eggs. Much of the country’s egg production is being diverted into vaccine production for testing, of which, along with antivirals, there are more than 300 worldwide. Enough of the happy talk. The Bear market rally is over, or at least that’s what Asian stock futures are screaming at us, and the shorts are piling back on….again. It was a classic bear market rally we saw over the past two weeks in every way, retracing 50% of the loss this year. Junk stocks, like hotels, airlines, and cruise lines led, while quality big tech lagged. That’s the exact opposite of what you want to see for a new bull market. At the Friday high, the Dow (IND) was down only 17% from the February all-time high at a two-decade 20X valuation high. The US is now losing 2,000 citizens a day to the Coronavirus. That’s how many we lost at the peak of the Vietnam War in a month. We are suffering another 9/11 every day of the week. More than 16.8 million have lost jobs in three weeks, more than all those gained in six years. Of all American companies with fewer than 500 employees, 54% have closed! JP Morgan (JPM) has just cut its forecast for Q2 GDP from a 25% loss to an end of world 40% decline on an annualized bases. New York is losing 800 people a day and is burying many of them in mass graves. Bread lines have formed in countless major cities. And you think 17% is enough for a discount for stocks, given that a near-total shutdown will continue for another five weeks? Are you out of your freaking mind? Which leads me to believe that another retest in the lows is in the work, no matter how much government money is headed our way. For a start, it will be three months before the Fed handouts show any meaningful impact on the economy. Second, we are due for a second wave of the virus in the fall, once the initial shelter-in-place ends. Markets will likely behave the same. In the meantime, long term analysts of the global economic structure are going dizzy with possible permanent changes. I am in the process of writing a couple of pieces on this if I can only get away from the market long enough to do so. It seems like half the country has lost their jobs, while the other half are now working double time without pay, like myself. The market was stunned by 6.1 million in Weekly Jobless Claims, taking the implied Unemployment Rate to over 14%, more than seen during the 2008-2009 Great Recession. One out of four Americans will lose their jobs or suffer a serious pay cut in the next two months. At this rate, we will top the Great Depression peak of 25 million in two weeks. The Fed launched a second $2.3 trillion rescue program, this time lending to states, local municipalities, and buying oil industry junk bonds. More money was made available to small businesses. Jay Powell is redefining what it means to be a central bank, but no one is complaining. It was worth one 500-point rally in the Dow Average, which we have already given back. At this point, almost the entire country is living on welfare. Stocks soared firefly on falling death rates. Chinese cases are falling after the border closed, Italy and Madrid are going flat, and San Francisco is looking good. There is still a massive, but extremely nervous bid under the market. I’m selling into this rally. We will continue to chop in a (SPX) $2180-$2800 range for the foreseeable future. Trump says there’s a light at the end of the tunnel, but he doesn’t tell you that the light is an oncoming express train. At the very least, the number of deaths will rise at least tenfold from here. That’s how many we lost in the Korean War. It hasn’t even hit the unsheltered states in the Midwest yet. Gold (GLD) is making a run another all-time highs, topping $1,700. Expect everyone’s favorite hedge to go ballistic. QE infinity and zero interest rates will eventually bring hyperinflation and render the US dollar worthless. Gold production is falling due to the virus. Anything else you need to know? Mortgage defaults are up 18-fold. People can’t even get through to their banks to tell them they are not going to pay. This is the next financial crisis. Fannie Mae and Freddie Mac are going to go broke….again. Can the US government spend money fast enough, given that it has been shrinking for three years? I’m not getting my check until September. It’s not easy to spend $2 trillion in a hurry. I can’t even spend a billion in a hurry. It’s darn hard and I’ve tried. It suggests any recovery will be slower and lasts longer. Here’s the bearish view on the economy, with Barclay’s Bank looking for an “L” shaped recovery, which means no recovery at all. I’m looking more for a square root type recovery, which means a sharp bounce back to a lower rate of growth. And there may be two “square roots” back to back. Bond giant PIMCO predicts 30% GDP loss in Q2 on an annualized basis. Everyone staying home doing jigsaw puzzles isn’t doing much for our economic growth. This may end up becoming the most positive forecast out there. When we come out on the other side of this, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates at zero, oil at $20 a barrel, and many stocks down by three quarters, there will be no reason not to. The Dow Average will rise by 400% or more in the coming decade. My Global Trading Dispatch performance had a tough week, destroying my performance back to positive numbers for the year. That is thanks to my piling on the shorts in a steadily rising market. This brings short term pain, but medium-term ecstasy. We are now down -3.99% in April, taking my 2020 YTD return down to -12.41%. That compares to an incredible loss for the Dow Average of -17% from the February top. My trailing one-year return sank to 30.02%. My ten-year average annualized profit was pared back to +33.51%. My short volatility positions (VXX) were hammered even in a rising market, which means no one believes the rally, including me. I took nice profits on two very deep in-the-money, very short dated call spreads in Amazon (AMZN) and Microsoft (MSFT), the two safest companies in the entire market, betting that we don’t go to new lows in the next nine trading days. As the market rose, I continued to add to my short position with the 2X ProShares Ultra Short S&P 500 (SDS). This week, we get the first look at Q1 earnings. All economic data points will be out of date and utterly meaningless this week. The only numbers that count for the market are the number of US Coronavirus cases and deaths, which you can find here. On Monday, April 13, Citigroup (C) and JP Morgan (JPM) report earnings. On Tuesday, April 14 at 11:30 AM, the API Crude Oil Stocks are announced. On Wednesday, April 15 at 2:00 PM, the New York State Manufacturing Index is released. On Thursday, April 16 at 7:30 AM, US Housing Starts for March are published. At 8:30 AM, Weekly Jobless Claims are announced. The number could top 6,000,000 again. On Friday, April 17 at 2:00 PM, the Baker Hughes Rig Count is released. Expect these figures to crash as well. As for me, before the market carnage of the coming week ensues, I shall be sitting down with my kids and touring the National Gallery of Art in Washington DC. Many art museums have now opened up their collections online, for free. There is a special exhibition of “Degas at the Opera.” Please enjoy by clicking here. Next to come will be the Louvre in Paris (click here), and the National Museum of the Marine Corps in Triangle, VA (click here). I have them tracing the dog tags I brought back from Guadalcanal. I bet some of my old weapons are in there. Stay healthy. John Thomas CEO & Publisher The Diary of a Mad Hedge Fund Trader

|

Quote of the Day “This is not a time to go to the grocery store or the pharmacy,” said Dr. Deborah Birx, coordinator of the White House Coronavirus task force.

|

Bozzie thanks for your posts. I especially like reading these posts. They are easy reading, informative and enjoyable.

| ||||||

| ||||||