You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Intersting thoughts

- Thread starter Bozzie

- Start date

LLNW being moved to a sell everywhere. Guess the conference didnt help it at all as its still dropping. Bought a whole lot more USX this morning on the dip.

I haven't seen that move on LLNW but I don't look..I love what they are doing I expect a very positive announcement soon on a partnership.

I'll hold...I like your USX

USX is a really good stock and they have added an All Star board of directors. Thats my one long play right now. Im just holding way to much LL right now as a big negative. I bought it on the dip last week and could have sold it and wanted a little more profit. Next thing it dropped like a rock and now im holding a bag. My fault for not adding a stop on it.

I haven't seen that move on LLNW but I don't look..I love what they are doing I expect a very positive announcement soon on a partnership.

I'll hold...I like your USX

This was posted yesterday SM has been good on his word in the past..He's about to leave the company and doubt he'd go without delivering on the highlighted text below...it's big and will move this...I wonder who downgraded LLNW and Why?

Summary

LLNW's CSO Sajid Malhotra did a video chat with analysts from DA Davidson yesterday (09-09-2020) after the close. Four more presentations are scheduled with firms next week.

Malhotra - former CFO - strongly believed in the mid-pt to high-end of revenue growth of mid teens % given their use of a 70% haircut to the sales funnel/pipeline.

Edge Compute, recently enhanced only days ago, is at a $10MM annual run rate and expected to account for 5% of 15% annual growth, suggesting it will growth 100%-200% annually.

Edge Compute will boost margins and growth, jack up customer spend, and reduce churn due to higher value add to retail subscribers of LLNW's OTT/gaming channel (e.g., AMZN, HBO (T), Peacock (CMCSA), DIS, etc.

Malhotra indicated an outsize customer win - mentioned on the last earnings call - will be announced by their marketing dept. in the future. End use cases for Edge Compute will soon be revealed as they evolve their video focused CDN into the devops world where higher multiple competitors AKAM FSLY have generated radical investor interest. Malhotra found the valuation gap and multiple gap between LLNW and FSLY as curious given LLNW is profitable which high revenue per account, accelerating growth to record levels for the Company, and similar scale whereas FSLY loses money on the botton line. We couldn't agree more - FSLY at $8BN or 30x sales versus LLNW $700MM or 3x sales is an absurd valuation gap. We reiterate our STRONG BUY recommendation and $16 target price, which in this market (and historically) is a more reasonable $2.4BN EV or 10x sales.

[FONT=Yahoo Sans Finance, Helvetica Neue, Arial, sans-serif]Worth watching...They are doing some far out science and the growth is impressive. [/FONT]

[FONT=Yahoo Sans Finance, Helvetica Neue, Arial, sans-serif]Twist Bioscience Corporation (TWST)[/FONT]

[FONT="]62.51[/FONT][FONT="]-0.53 (-0.84%)[/FONT][FONT="]At close: September 11 4:00PM EDT

crazy science,

https://finance.yahoo.com/news/twist-bioscience-synthetic-dna-stores-120000866.html

[/FONT]

[FONT=Yahoo Sans Finance, Helvetica Neue, Arial, sans-serif]Twist Bioscience Corporation (TWST)[/FONT]

[FONT="]62.51[/FONT][FONT="]-0.53 (-0.84%)[/FONT][FONT="]At close: September 11 4:00PM EDT

crazy science,

https://finance.yahoo.com/news/twist-bioscience-synthetic-dna-stores-120000866.html

[/FONT]

[h=1][FONT=Verdana, Arial, Helvetica, sans-serif]The author of this piece has a long position in LLNW. This is developing legs for sure.

[/FONT]

[FONT=Verdana, Arial, Helvetica, sans-serif]Limelight Networks: A True Goldilocks Story Of The CDN Sector[/FONT][/h]Sep. 11, 2020 3:43 PM ET|

63 comments

|

About: Limelight Networks, Inc. (LLNW), Includes: AKAM, AMZN, FSLY, NFLX, SNE

Thomas Cheatham

Growth, long-term horizon, Biotech, small-cap

Summary

Some competitors are growing revenues very quickly and gaining more investor attention because of it, but the cost of revenue growth shouldn't be profitability.

There are multiple approaches to how companies choose to grow, and while one way draws much more market love, the other is much more stable and secure.

We are digging into the numbers and interviewing management to dispel some of the myths in the CDN industry and clear the air.

As a supplement to this article, our team did an interview with Limelight's CSO and CFO. Link posted below for listening. We wanted to thank them both for their time and assistance.

The CDN industry has been under the spotlight the last few months as a strong shift in the digital world gains traction. More and more content providers are turning to streaming solutions to stay ahead of the trend, which is very smart. Linear TV, as in the normal cable and satellite type of content delivery we have come accustomed to, are on a death spiral and the direction for survival is clearly streaming and digital delivery.

We suggest opening positions in the future of digital infrastructure. Specifically in the CDN space and even more specifically in ticker LLNW or possibly AKAM. While both are excellent picks, we think LLNW is the "Goldilocks" of all the CDN competitors in the space and will attempt to show you why.

Source: Image Source

[h=2]The Evolution of Content Delivery[/h]In reality, we've seen this show before. You can easily see the iterations of this evolution from previous moves. Let's bring up VHS to DVD (hopefully we didn't lose anybody on that one that doesn't know what VHS is). For argument's sake, I will completely gloss over Beta Max to VHS.

This should take your mind back to the days of early 2000's when VHS tapes became phased out as DVD's took hold. DVD's were smaller, didn't have to be rewound constantly, held up better in regards to durability, and the video quality was far better. As DVD's got integrated into video store shelving, the VHS section kept getting smaller and smaller. Eventually in 2005, VHS was all but gone from any video store ever. That was a quick turnaround.

Then, we moved to phase 2. When DVD's moved to BluRay discs and streaming at about the same time. BluRay posed a much higher quality content viewing, but kept the same portability and durability as a DVD. Sony's Blue Ray beat out the competitor's HD DVD in the high def disc market. There was a time when you could get either format on the shelves for a short while.

But streaming took it to a whole new level. On Demand wasn't a new concept, but the level of On Demand that took hold was really a stark change. Netflix had done DVD disc delivery via the USPS for a few years. That's when they really started eating Blockbuster's lunch, but it didn't stop there. Blockbuster was actually given a chance to buy into a streaming package with Netflix before it officially launched as a partner before streaming gained steam, and they passed at the chance. We actually used Blockbuster and Netflix as a case study in business school. It truly is one of the stories of stubbornness to adapt to change that will go down as a major example in history of refusing to grasp new trends and move forward to stay relevant as times change.

HBO and Pay Per View had done big events on an On-Demand platform for years, but having a subscription service with essentially unlimited On-Demand options is a true "game changer". That game is still in its evolution today with so many services going to streaming. The premiere of "Mulan" on Disney+ which partnered with several streaming services to help facilitate delivery was a first of its kind. Charging a subscription fee and then an extra $29.99 on top of that to get a first peek at a blockbuster "Mulan" remake before it's released anywhere else. This completely bypassed theaters which that in itself is a huge move to digest. Pre COVID-19, something like that would likely have never been thought of, but times, they are a changin'.

[h=2]So, You Understand the Evolution. Now How Do We Invest in its Future?[/h]Well, you can either invest in the content creation companies themselves, like Disney, Sony, the major networks, or even Netflix which is creating content now. Or.... you can invest in infrastructure. Think of this in parallel with not investing in Walmart or Amazon when they went heavy into online orders, but instead investing in Fed Ex and UPS.

See, if you invest in a CDN, you are essentially investing in the content delivery networks, which is exactly what CDN stands for. It doesn't matter what your clients charge or how they choose to expand their offering to stay competitive, they simply pay you for bandwidth like a toll booth via contracts or even like midstream energy companies. For instance, Amazon has contracts with UPS. UPS doesn't care what Amazon charges for products or how they expand, UPS gets to move those packages around the world regardless. The CDN's do exactly the same thing. They move content around the world through POP servers, Point of Presence, and increase their technology offering to make delivery of content as seamless as possible.

We introduced CDN's in our first article about LLNW. It can be read here .

[h=2]Time to Dig into Some CDN Numbers.[/h]LLNW has chosen the road of profitability with modest growth versus the other road being aggressive growth while sacrificing profitability. Investors today often want to see revenue growth, revenue growth, and even more revenue growth, but don't seem to care about how that growth is achieved. This is a HUGE mistake which I am hoping to help correct now. Revenue growth is in fact great and highly sought after, but that growth has to be HEALTHY growth.

Healthy growth should be described as helping clients expand, and spending some money to expand one's network if the bandwidth loads are reaching critical mass in certain emerging markets. LLNW has done exactly this by expanding POPS heavily into Latin America and India recently. But companies like FSLY are acquiring their growth through acquisitions and fierce sales and marketing efforts. You can't really blame them I suppose, the market has given them an insanely high valuation and thus, capital funding is right at their fingertips as the market gave it to them, they have only to tap it via offerings.

But this type of money isn't actually free. Investors are willing to put their money up if the company keeps putting up huge revenue numbers. But those revenues come at a hefty price and may not be HEALTHY. Let's take a deeper dive. Recently FSLY acquired Signal Sciences for beefing up its security offering on its CDN network. Let's look at the numbers a bit, but it looks like a very expensive acquisition across all metrics and perhaps they bit off more than they could chew here.

Fastly agreed to pay $775 million for the acquisition - a significant amount relative to its scale. Let us also point out, that FSLY paid this amount, which is currently higher than the total market capitalization of LLNW which makes as much as FSLY currently does at time of writing this article. Let that sink in a second.

In addition, it offered $50 million in restricted stock to retain Signal Sciences employees. By comparison, Fastly generated $75 million of revenue during the second quarter, up 62% year over year, and it has yet to become profitable. Also, cash and equivalents amounted to only $384 million at the end of the last quarter.

Including the $50 million retention pool for Signal Sciences employees, the price of the transaction corresponds to nearly 30 times Signal Sciences' $28 million annual recurring revenue at the end of June. That represents a steep price, even in the context of the company's strong growth. Management said Signal Sciences posted a "faster annual revenue growth rate" than Fastly during the second quarter. But in this space, buying a company for 30X run rate seems absurd. Then you look at Limelight Networks trading at 2.4X revenue run rate with solid growth and you have to ask yourself what sounds like the better deal here?

However, Fastly will use its expensive stock to finance a sizable part of the transaction, which is a smart decision that will help offset the deal's high price tag. Consideration will include $200 million of cash and $575 million of Fastly, but that's a hell of a lot of money for a 30X multiple on the backs of investors. FSLY is already trading at its own crazy high valuation of 28.86X revenue run rate at time of writing.

So I have to ask again... a bargain in buying a company trading at 28.86X revenue already that just paid for another company trading at over 30X revenue run rate spending a ton of investor money... for what? Surely they are very profitable right? Wrong again.

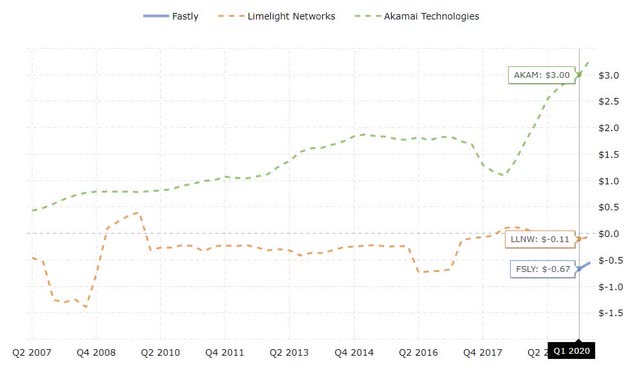

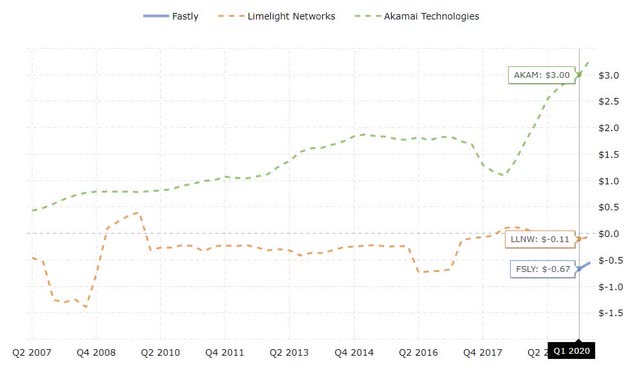

We took the below chart from macrotrends showing trailing EPS growth.

Source: Macrotrends.net EPS Comparison

Source: Macrotrends.net EPS Comparison

You can see from the above chart, the while revenue growth for FSLY is very rapid, their earnings per share are highly negative. They are trending up, but at these profitability levels, there is no way a near 30X revenue run rate is justified here. AKAM's current revenue run rate to market cap puts a valuation of 5.7X revenue run rate at time of writing. AKAM is a beast of a company too, and happens to be the MOST profitable of the 3. It is honestly a very good investment at current prices and given profitability and growth.

But this argument isn't necessarily for AKAM, though it's a very good deal at 5.7X we focus on LLNW. Currently, LLNW has MORE profitability than FSLY but slower growth. Though it has faster growth than AKAM, it has lower profitability. What do I call this? Baby bear. It's not too hard, or too soft, but Baby Bear's bed is JUUUUST right! Being right in the perfect place where profitability and growth intersect is right where one want's to be positioned in this environment in our honest opinion.

Let's put profitability into perspective another way. Company A makes 250 mil a year and so does Company B. Company A banks 20 Mil a year off that 250 and company B loses 20 mil a year off the 250. Does it really matter if company B grows a little faster than company A if they can't keep any of that money as profit? I seem to get this problem... too many others don't. This is so much a disparity in the market place, that Company B IS STILL valued at 15 times MORE than Company A in my scenario. But, I don't think the valuation gap between Company A and Company B lasts too much longer.

[h=2]Valuation Disparity[/h]So I bring it back to reality. How undervalued is LLNW? Well, it currently trades as of today at a measly 2.57X revenue run rate. Less than HALF of AKAM and less than 9% of the valuation given to FSLY. That valuation is ludicrous. Let's go back to Baby Bear this thing. Let's say given its profitability compared to AKAM and FSLY and its growth compared to those two as well, it truly deserves to be somewhere in the middle. If AKAM is 5.8X and FSLY is 29X, it is reasonable to say that LLNW should be trading somewhere around 17.4X revenues, right smack in the middle. But let's be even more conservative and shave off 30% of that just to be on the safe side, that gives you 12.18X revenues. This puts a fair value on LLNW at $2.9 billion or a $24.36 pps stock price.

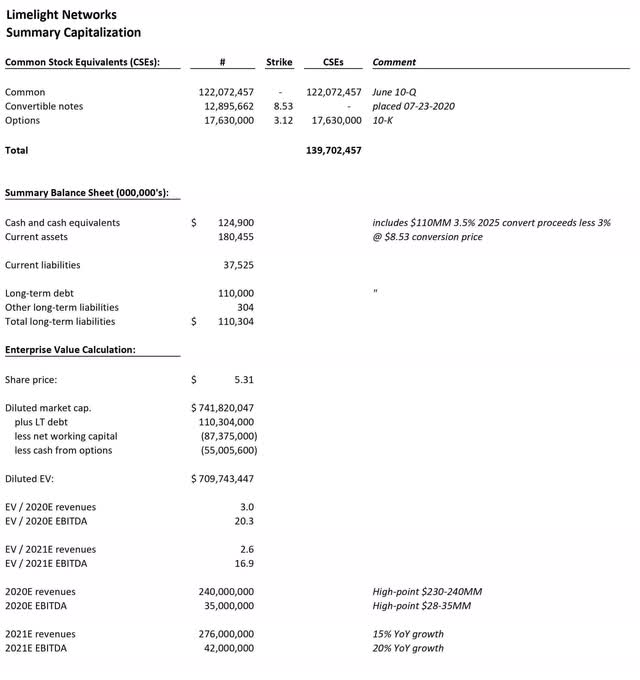

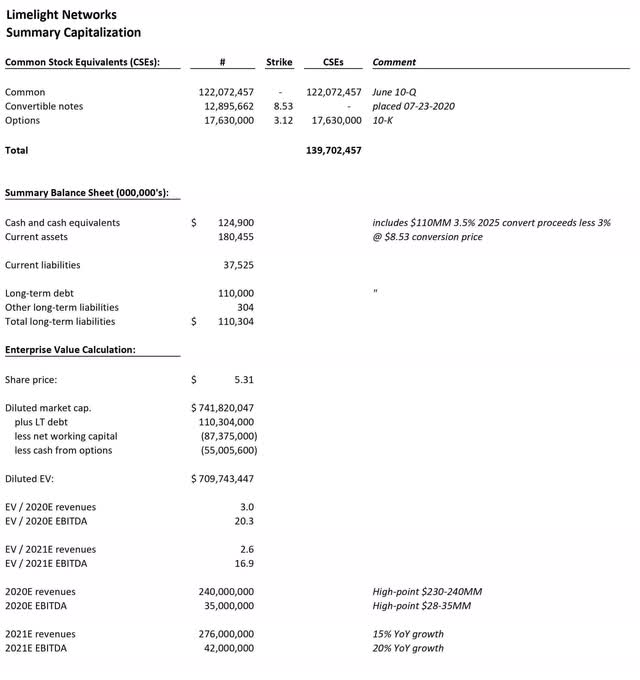

Let's take a quick look at the enterprise values of Limelight Networks with growth numbers plugged in per management's discussion of conservative growth metrics.

Source for the above image: https://seekingalpha.com/instablog/.../5495669-limelight-networks-tortoise-and-hare

[h=2]Conclusion[/h]We were very very conservative and called for $15 to $20 in our last article in the next 12 months. We truly feel the upcoming catalysts will drive shareholder value and the stock price far higher and in short order.

Included in these catalysts are:

We feel that hands down, LLNW provides the absolute best value in the CDN sector today and rate it a STRONG BUY, SCREAMING BUY, or TABLE POUNDER. Pick your poison. We also rate AKAM a MODERATE BUY. While we aren't bullish at all on NET or FSLY, we give them a NEUTRAL rating as we have no idea how long the market will be irrational and inflate their stock prices, but given what we've seen lately in stocks like TSLA, for all we know they could move even higher too.

[/FONT]

[FONT=Verdana, Arial, Helvetica, sans-serif]Limelight Networks: A True Goldilocks Story Of The CDN Sector[/FONT][/h]Sep. 11, 2020 3:43 PM ET|

63 comments

|

About: Limelight Networks, Inc. (LLNW), Includes: AKAM, AMZN, FSLY, NFLX, SNE

Thomas Cheatham

Growth, long-term horizon, Biotech, small-cap

(375 followers)

Summary

Some competitors are growing revenues very quickly and gaining more investor attention because of it, but the cost of revenue growth shouldn't be profitability.

There are multiple approaches to how companies choose to grow, and while one way draws much more market love, the other is much more stable and secure.

We are digging into the numbers and interviewing management to dispel some of the myths in the CDN industry and clear the air.

As a supplement to this article, our team did an interview with Limelight's CSO and CFO. Link posted below for listening. We wanted to thank them both for their time and assistance.

The CDN industry has been under the spotlight the last few months as a strong shift in the digital world gains traction. More and more content providers are turning to streaming solutions to stay ahead of the trend, which is very smart. Linear TV, as in the normal cable and satellite type of content delivery we have come accustomed to, are on a death spiral and the direction for survival is clearly streaming and digital delivery.

We suggest opening positions in the future of digital infrastructure. Specifically in the CDN space and even more specifically in ticker LLNW or possibly AKAM. While both are excellent picks, we think LLNW is the "Goldilocks" of all the CDN competitors in the space and will attempt to show you why.

Source: Image Source

[h=2]The Evolution of Content Delivery[/h]In reality, we've seen this show before. You can easily see the iterations of this evolution from previous moves. Let's bring up VHS to DVD (hopefully we didn't lose anybody on that one that doesn't know what VHS is). For argument's sake, I will completely gloss over Beta Max to VHS.

This should take your mind back to the days of early 2000's when VHS tapes became phased out as DVD's took hold. DVD's were smaller, didn't have to be rewound constantly, held up better in regards to durability, and the video quality was far better. As DVD's got integrated into video store shelving, the VHS section kept getting smaller and smaller. Eventually in 2005, VHS was all but gone from any video store ever. That was a quick turnaround.

Then, we moved to phase 2. When DVD's moved to BluRay discs and streaming at about the same time. BluRay posed a much higher quality content viewing, but kept the same portability and durability as a DVD. Sony's Blue Ray beat out the competitor's HD DVD in the high def disc market. There was a time when you could get either format on the shelves for a short while.

But streaming took it to a whole new level. On Demand wasn't a new concept, but the level of On Demand that took hold was really a stark change. Netflix had done DVD disc delivery via the USPS for a few years. That's when they really started eating Blockbuster's lunch, but it didn't stop there. Blockbuster was actually given a chance to buy into a streaming package with Netflix before it officially launched as a partner before streaming gained steam, and they passed at the chance. We actually used Blockbuster and Netflix as a case study in business school. It truly is one of the stories of stubbornness to adapt to change that will go down as a major example in history of refusing to grasp new trends and move forward to stay relevant as times change.

HBO and Pay Per View had done big events on an On-Demand platform for years, but having a subscription service with essentially unlimited On-Demand options is a true "game changer". That game is still in its evolution today with so many services going to streaming. The premiere of "Mulan" on Disney+ which partnered with several streaming services to help facilitate delivery was a first of its kind. Charging a subscription fee and then an extra $29.99 on top of that to get a first peek at a blockbuster "Mulan" remake before it's released anywhere else. This completely bypassed theaters which that in itself is a huge move to digest. Pre COVID-19, something like that would likely have never been thought of, but times, they are a changin'.

[h=2]So, You Understand the Evolution. Now How Do We Invest in its Future?[/h]Well, you can either invest in the content creation companies themselves, like Disney, Sony, the major networks, or even Netflix which is creating content now. Or.... you can invest in infrastructure. Think of this in parallel with not investing in Walmart or Amazon when they went heavy into online orders, but instead investing in Fed Ex and UPS.

See, if you invest in a CDN, you are essentially investing in the content delivery networks, which is exactly what CDN stands for. It doesn't matter what your clients charge or how they choose to expand their offering to stay competitive, they simply pay you for bandwidth like a toll booth via contracts or even like midstream energy companies. For instance, Amazon has contracts with UPS. UPS doesn't care what Amazon charges for products or how they expand, UPS gets to move those packages around the world regardless. The CDN's do exactly the same thing. They move content around the world through POP servers, Point of Presence, and increase their technology offering to make delivery of content as seamless as possible.

We introduced CDN's in our first article about LLNW. It can be read here .

[h=2]Time to Dig into Some CDN Numbers.[/h]LLNW has chosen the road of profitability with modest growth versus the other road being aggressive growth while sacrificing profitability. Investors today often want to see revenue growth, revenue growth, and even more revenue growth, but don't seem to care about how that growth is achieved. This is a HUGE mistake which I am hoping to help correct now. Revenue growth is in fact great and highly sought after, but that growth has to be HEALTHY growth.

Healthy growth should be described as helping clients expand, and spending some money to expand one's network if the bandwidth loads are reaching critical mass in certain emerging markets. LLNW has done exactly this by expanding POPS heavily into Latin America and India recently. But companies like FSLY are acquiring their growth through acquisitions and fierce sales and marketing efforts. You can't really blame them I suppose, the market has given them an insanely high valuation and thus, capital funding is right at their fingertips as the market gave it to them, they have only to tap it via offerings.

But this type of money isn't actually free. Investors are willing to put their money up if the company keeps putting up huge revenue numbers. But those revenues come at a hefty price and may not be HEALTHY. Let's take a deeper dive. Recently FSLY acquired Signal Sciences for beefing up its security offering on its CDN network. Let's look at the numbers a bit, but it looks like a very expensive acquisition across all metrics and perhaps they bit off more than they could chew here.

Fastly agreed to pay $775 million for the acquisition - a significant amount relative to its scale. Let us also point out, that FSLY paid this amount, which is currently higher than the total market capitalization of LLNW which makes as much as FSLY currently does at time of writing this article. Let that sink in a second.

In addition, it offered $50 million in restricted stock to retain Signal Sciences employees. By comparison, Fastly generated $75 million of revenue during the second quarter, up 62% year over year, and it has yet to become profitable. Also, cash and equivalents amounted to only $384 million at the end of the last quarter.

Including the $50 million retention pool for Signal Sciences employees, the price of the transaction corresponds to nearly 30 times Signal Sciences' $28 million annual recurring revenue at the end of June. That represents a steep price, even in the context of the company's strong growth. Management said Signal Sciences posted a "faster annual revenue growth rate" than Fastly during the second quarter. But in this space, buying a company for 30X run rate seems absurd. Then you look at Limelight Networks trading at 2.4X revenue run rate with solid growth and you have to ask yourself what sounds like the better deal here?

However, Fastly will use its expensive stock to finance a sizable part of the transaction, which is a smart decision that will help offset the deal's high price tag. Consideration will include $200 million of cash and $575 million of Fastly, but that's a hell of a lot of money for a 30X multiple on the backs of investors. FSLY is already trading at its own crazy high valuation of 28.86X revenue run rate at time of writing.

So I have to ask again... a bargain in buying a company trading at 28.86X revenue already that just paid for another company trading at over 30X revenue run rate spending a ton of investor money... for what? Surely they are very profitable right? Wrong again.

We took the below chart from macrotrends showing trailing EPS growth.

Source: Macrotrends.net EPS Comparison

Source: Macrotrends.net EPS ComparisonYou can see from the above chart, the while revenue growth for FSLY is very rapid, their earnings per share are highly negative. They are trending up, but at these profitability levels, there is no way a near 30X revenue run rate is justified here. AKAM's current revenue run rate to market cap puts a valuation of 5.7X revenue run rate at time of writing. AKAM is a beast of a company too, and happens to be the MOST profitable of the 3. It is honestly a very good investment at current prices and given profitability and growth.

But this argument isn't necessarily for AKAM, though it's a very good deal at 5.7X we focus on LLNW. Currently, LLNW has MORE profitability than FSLY but slower growth. Though it has faster growth than AKAM, it has lower profitability. What do I call this? Baby bear. It's not too hard, or too soft, but Baby Bear's bed is JUUUUST right! Being right in the perfect place where profitability and growth intersect is right where one want's to be positioned in this environment in our honest opinion.

Let's put profitability into perspective another way. Company A makes 250 mil a year and so does Company B. Company A banks 20 Mil a year off that 250 and company B loses 20 mil a year off the 250. Does it really matter if company B grows a little faster than company A if they can't keep any of that money as profit? I seem to get this problem... too many others don't. This is so much a disparity in the market place, that Company B IS STILL valued at 15 times MORE than Company A in my scenario. But, I don't think the valuation gap between Company A and Company B lasts too much longer.

[h=2]Valuation Disparity[/h]So I bring it back to reality. How undervalued is LLNW? Well, it currently trades as of today at a measly 2.57X revenue run rate. Less than HALF of AKAM and less than 9% of the valuation given to FSLY. That valuation is ludicrous. Let's go back to Baby Bear this thing. Let's say given its profitability compared to AKAM and FSLY and its growth compared to those two as well, it truly deserves to be somewhere in the middle. If AKAM is 5.8X and FSLY is 29X, it is reasonable to say that LLNW should be trading somewhere around 17.4X revenues, right smack in the middle. But let's be even more conservative and shave off 30% of that just to be on the safe side, that gives you 12.18X revenues. This puts a fair value on LLNW at $2.9 billion or a $24.36 pps stock price.

Let's take a quick look at the enterprise values of Limelight Networks with growth numbers plugged in per management's discussion of conservative growth metrics.

Source for the above image: https://seekingalpha.com/instablog/.../5495669-limelight-networks-tortoise-and-hare

[h=2]Conclusion[/h]We were very very conservative and called for $15 to $20 in our last article in the next 12 months. We truly feel the upcoming catalysts will drive shareholder value and the stock price far higher and in short order.

Included in these catalysts are:

- Return of Sports Streaming: As sports return to screens around the world, the streaming of these will also ramp up very quickly as new streaming contracts are signed for sporting events worldwide via digital content delivery. LLNW has a very deep footprint in this part of the sector and expects revenue to ramp up very quickly with the return of sports.

- Advancement of Sports Streaming: As noted above, sporting content providers are signing more and more streaming contracts. As this change takes hold, bars, restaurants, and venues that have several TV's that show sports will move to streaming contracts as well. That is a whole segment of demand in the commercial streaming space set to expand rapidly to keep pace with the changing environment.

- Large Customer Wins: LLNW has had multiple large new customers in beta testing for months and management has stated those very significant contracts will be announced very soon as these clients launch for Q4 and heavy demand right as competition heats up.

- EdgeFunctions: With the recent official launch of EdgeFunctions, new and existing clients will be able to streamline their media and make it more accessible, enhance the delivery of the media, and control more aspects of how and where the content is delivered.

- Seasonality: Q4 is historically the best quarter for seasonal reasons and this year will be no exception. In fact, with more people bunkering in their home with friends and family for the holidays via small gatherings, gaming and video / movie streaming are going to take center stage.

- Launch of PS5: LLNW has had a contract with Sony for over a decade to do a large part of their gaming downloads. With the release of PS5 this fall, and games moving to digital download formats, the downloads of games, gaming updates, and software upgrades will be practically endless. Limelight Networks is set to get a huge bulk influx of business through all those coming downloads. The content is VERY large for new games with better graphics and more options than ever, the bulk of which all have to be downloaded from massive Sony servers via Limelight Networks.

We feel that hands down, LLNW provides the absolute best value in the CDN sector today and rate it a STRONG BUY, SCREAMING BUY, or TABLE POUNDER. Pick your poison. We also rate AKAM a MODERATE BUY. While we aren't bullish at all on NET or FSLY, we give them a NEUTRAL rating as we have no idea how long the market will be irrational and inflate their stock prices, but given what we've seen lately in stocks like TSLA, for all we know they could move even higher too.

|

| Global Market Comments September 14, 2020 Fiat Lux Featured Trade:(MARKET OUTLOOK FOR THE WEEK AHEAD, or THE 200-DAYS ARE IN PLAY),

($INDU), (SPX), (SPY), (AAPL), (AMZN), (JPM), (C), (BAC), (GLD), (TLT), (TSLA)

|

| � |

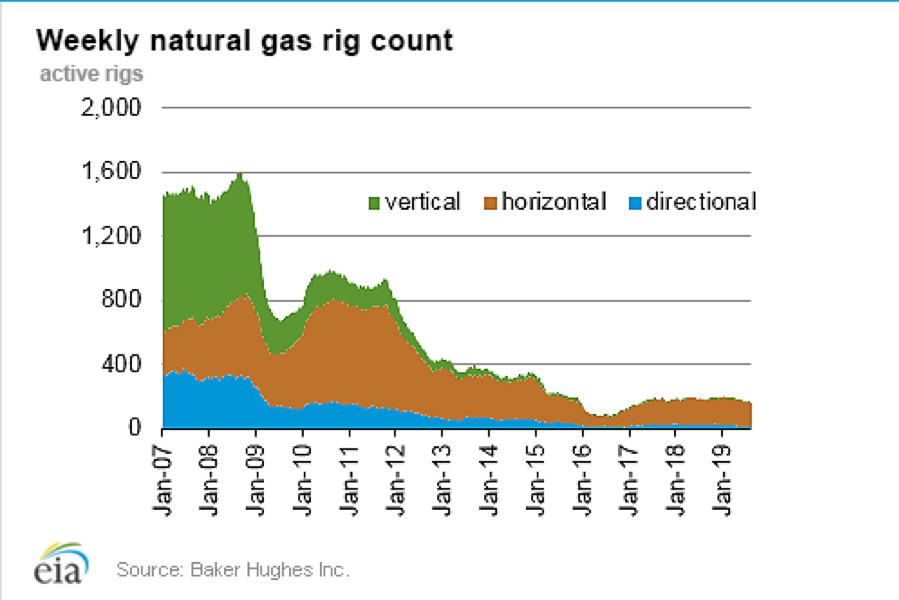

The Market Outlook for the Week Ahead, or the 200-Days are in Play Six months into the quarantine, I feel like I’ve been under house arrest with no visiting privileges. And if I go outside for even a few minutes, I have to inhale the equivalent of a pack of cigarettes as I am surrounded by three monster fires.All I can say is that I’m getting a heck of a lot of work done. We are in the middle of a 20-year move in the Dow Average from 6,500 to 120,000. We have just completed a fourfold move off the 2009 bottom. All that remains is to complete a second fourfold gain by 2030. The move is being driven by hyper-accelerating technology on all fronts. The first half of this move was wrought with constant fear and disbelief. The second half will be viewed as a new “Golden Age” and a second “Roaring Twenties.” The euphoria of July and August were just a foretaste. And here is the dilemma for all investors. The Dow has just pulled back 6.1% from the all-time high of 29,300 to 27,500. Should you be buying here, keeping the eventual 120,000 target in mind? Or should you hold back and wait for 26,000, 25,000, or 24,000? The risk is that if you lean out too far to grab the brass ring, you’ll fall off your horse. By getting too smart attempting to buy the bottom, you might miss the next 93,000 points. And now, I’ll make your choice more complicated. The president has recently whittled away at his deficit in the polls, however slightly, typical of the run-up to the November elections. That increases the uncertainty of the election outcome and increases market volatility (VIX). Ironically, the better Trump does, the lower stocks will fall. So, if you do hang out for the lower numbers you might actually get them, and then more. That puts the 200-day moving averages in play, not only for the major indexes but for single stocks as well. That could take Apple (AAPL) from a high of $137 to $80, a Tesla down from a meteoric $500 to $300. Hey, if this were easy, your cleaning lady would be doing this for a tiny fraction of the pay. Did I just tell you the market may go up, down, or sideways? I sound like a broker. The 200-day moving averages are definitely in play. The 200-day moving average for the Dow Average is 26,298, down an even 10% from the high for the year. The technology-heavy S&P 500 could fall as much as 14% to its 200-day at 3,097. Don’t bet against the Fed as Tuesday’s 700-point rally in the Dow Average sharply reminded traders. Don’t bet against the global scientific community either. That’s why I am fully invested and within spitting distance of a new all-time high. After a pre-election low, the market will soar to new highs. Even if Trump loses the election, quantitative easing and fiscal stimulus will continue as far as the eye can see. The elephant unwinds. Softbank dumped $718 million worth of technology call options deleveraging in a hurry. (NFLX), (FB), and (ADBE) were the targets according to market makers. They still own $1.66 billion worth of long positions in call options. Softbank’s position has grown so large that even my cleaning lady and gardener know about them. The Tesla bubble popped, down a record 22% in one day after traders learned it would NOT be added to the S&P 500. Tesla approached my medium-term downside target of down 40%, or $300 a share. It seems too much of its earnings were coming from non-recurring EV subsidies from the Detroit carmakers. With a peak market cap for an eye-popping $450 billion, it’s probably the largest company ever turned down from the Index. Google ditched Irish office space, putting on ice a plan to rent additional office space for up to 2,000 people in Dublin. The retreat from global office space continues. The company was close to taking 202,000 sq ft (18,766sq m) of space at the Sorting Office building before the virus hit. AstraZeneca halted their vaccine trial after a patient fell ill. It’s not clear if the vaccine killed off the phase 3 trial volunteer, a preexisting condition felled them, or an unrelated illness hit. The company was developing the “Oxford” vaccine, which had been the best hope for developing Covid-19 immunity. It definitely creates a pause for the headline rush to develop a vaccine. Notice the tests are being held in South Africa where patients have little legal recourse. Keep buying (AZN) on dips. “Skinny” failed, tanking the Dow Average by 450 points. A Republican Senate failed to provide even $500 billion to support a COVID-19-ravaged economy. There will be no more stimulus until a new administration takes office. Until then, unemployment will remain in the high single digits, tens of thousands of small businesses will fail, and home foreclosures will explode. The stock market cares about none of this, as it is dominated by large, heavily subsidized companies. Nikola crashed, down 33%, in response to a damning report from a noted short-seller. They don’t have a truck, they lack a claimed hydrogen fuel source, and the founder is milking the company for every penny he can. It’s all hype, thanks to endless quantitative easing. None of the Tesla wannabees are going anywhere. General Motors (GM), which just bought 11% of the company, has egg on its face. With a market cap of $20 billion, Nikola is this year’s Enron. Sell short (NKLA) on rallies. US inflation jumped, with the Consumer Price Index up 1.3% YOY in August, compared to only 1% in July. Soaring used car prices accounted for the bulk of the gain. More proof that the economy lives. Is this the beginning of the end or the end of the beginning? Goldman Sachs moved global stocks to “overweight”. They’re preparing for the post-pandemic world. Cyclical “recovery” stocks like banks will take the lead. It fits in nicely with my view of a monster post-election rally and a Dow 120,000 by 2030. When we come out the other side of this, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. My Global Trading Dispatch clocked its second blockbuster week in a row, thanks to aggressively loading up on stocks at the previous week’s bottom (JPM), (C), (AMZN). My long in gold (GLD) looked shinier than ever. I bet the ranch again on a massive short in the US Treasury bond market (TLT) which paid off big time. My short position in the (SPY) is looking sweet. My only hickey was an ill-fated long in Apple (AAPL), which I stopped out of at close to cost. Notice that I am shifting my longs away from tech and toward domestic recovery plays. You only need 50 years of practice to know when to bet the ranch. That takes our 2020 year-to-date back up to a blistering 35.51%, versus -2.93% for the Dow Average. September stands at a robust 8.96%. That takes my 11-year average annualized performance back to 36.41%. My 11-year total return has reached to another new all-time high at 392.42%. My trailing one year return popped back up to 58.13%. It will be a dull week on the data front, with only the Federal Reserve Open Market Committee Meeting drawing any attention. The only numbers that really count for the market are the number of US Coronavirus cases and deaths, which you can find here. On Monday, September 14 at 11:00 AM US Inflation Expectations are released. On Tuesday, September 15 at 8:30 AM EST, the New York Empire State Manufacturing Index for September is published. A two-day meeting at the Federal Reserve begins. On Wednesday, September 16, at 8:30 AM EST, September Retails Sales are printed. At 10:30 AM EST, the EIA Cushing Crude Oil Stocks are out. At 2:00 the Fed announces its interest rate decision, which will probably bring no change. On Thursday, September 17 at 8:30 AM EST, the Weekly Jobless Claimsare announced. Housing Starts for August are also out. On Friday, September 18, at 8:30 AM EST, the University of Michigan Consumer Sentiment is announced. At 2:00 PM The Bakers Hughes Rig Count is released. As for me, the Boy Scout camporee I was expected to judge and supervise this weekend was cancelled, not because of Covid-19, but smoke. This will certainly go down in history as the year from hell. Stay healthy. John Thomas CEO & Publisher The Diary of a Mad Hedge Fund Trader

|

Quote of the Day “Algorithms know everything about price but nothing about value,” said my old investor and mentor Leon Cooperman of Omega Advisors.

|

re

September 11, 2020 16:35 ET | Source: Avadel Pharmaceuticals plc

DUBLIN, Ireland, Sept. 11, 2020 (GLOBE NEWSWIRE) -- Avadel Pharmaceuticals plc (Nasdaq: AVDL) a company focused on developing FT218, an investigational, once-nightly formulation of sodium oxybate, today announced that its executive team will be presenting at the H.C. Wainwright 22[SUP]nd[/SUP] Annual Global Investment Conference taking place September 14 – 16, 2020.

In addition, management will be participating in one-on-one meetings with investors who are registered to attend the conference.

About Avadel Pharmaceuticals plc:

Avadel Pharmaceuticals plc (Nasdaq: AVDL) is an emerging biopharmaceutical company. The Company’s primary focus is the development and potential FDA approval of FT218, an investigational, once-nightly formulation of sodium oxybate designed to treat excessive daytime sleepiness and cataplexy in patients with narcolepsy. For more information, please visit [url]www.avadel.com[/URL].

About FT218

FT218 is an investigational, once-nightly formulation of Micropump™ controlled-release (CR) sodium oxybate. The Company recently completed the REST-ON study, a pivotal, double-blind, randomized, placebo-controlled Phase 3 trial, to assess the efficacy and safety of FT218 in the treatment of excessive daytime sleepiness and cataplexy in patients suffering from narcolepsy. FT218 has been granted Orphan Drug Designation from the U.S. Food and Drug Administration (FDA) for the treatment of narcolepsy. The designation was granted on the plausible hypothesis that FT218 may be clinically superior to the twice-nightly formulation of sodium oxybate already approved by the FDA for the same indication. In particular, FT218 may be safer due to ramifications associated with the dosing regimen of the previously approved product.

Contacts:

September 11, 2020 16:35 ET | Source: Avadel Pharmaceuticals plc

DUBLIN, Ireland, Sept. 11, 2020 (GLOBE NEWSWIRE) -- Avadel Pharmaceuticals plc (Nasdaq: AVDL) a company focused on developing FT218, an investigational, once-nightly formulation of sodium oxybate, today announced that its executive team will be presenting at the H.C. Wainwright 22[SUP]nd[/SUP] Annual Global Investment Conference taking place September 14 – 16, 2020.

| Presentation details: | � | |

| Date: | Wednesday, September 16, 2020 | |

| Time: | 10:30 a.m. – 10:50 a.m. ET | |

| Webcast: | A live and archived webcast of the presentation will be available at (click here) or on the Company’s website (click here) | |

About Avadel Pharmaceuticals plc:

Avadel Pharmaceuticals plc (Nasdaq: AVDL) is an emerging biopharmaceutical company. The Company’s primary focus is the development and potential FDA approval of FT218, an investigational, once-nightly formulation of sodium oxybate designed to treat excessive daytime sleepiness and cataplexy in patients with narcolepsy. For more information, please visit [url]www.avadel.com[/URL].

About FT218

FT218 is an investigational, once-nightly formulation of Micropump™ controlled-release (CR) sodium oxybate. The Company recently completed the REST-ON study, a pivotal, double-blind, randomized, placebo-controlled Phase 3 trial, to assess the efficacy and safety of FT218 in the treatment of excessive daytime sleepiness and cataplexy in patients suffering from narcolepsy. FT218 has been granted Orphan Drug Designation from the U.S. Food and Drug Administration (FDA) for the treatment of narcolepsy. The designation was granted on the plausible hypothesis that FT218 may be clinically superior to the twice-nightly formulation of sodium oxybate already approved by the FDA for the same indication. In particular, FT218 may be safer due to ramifications associated with the dosing regimen of the previously approved product.

Contacts:

| Investor Contacts Tom McHugh Chief Financial Officer Phone: (636) 449-1843 Email: tmchugh@avadel.com Tim McCarthy LifeSci Advisors, LLC Phone: (212) 915-2564 Email: tim@lifesciadvisors.com Media Contact Patrick Bursey LifeSci Communications, LLC Phone: (646) 970-4688 Email: pbursey@lifescicomms.com |

|

I've started rolling outa the market in a second account.. out by about 10% so far.

Soon I'll be pairing down this trading account as well. A global down turn is inevitable in 2021 optimism is only going to go so far next year.

This looks ugly. I'm fine jumping back in even with a loss in position way later down the line.

Soon I'll be pairing down this trading account as well. A global down turn is inevitable in 2021 optimism is only going to go so far next year.

This looks ugly. I'm fine jumping back in even with a loss in position way later down the line.

|

| Global Market Comments September 15, 2020 Fiat Lux Featured Trade:(THE MAD HEDGE TRADERS & INVESTORS SUMMIT RECORDING IS UP),

(HOW FREE ENERGY WILL POWER THE COMING ROARING TWENTIES), (SPWR), (TSLA)

|

| � |

The Mad Hedge June 4 Traders & Investors Summit Recording is Up For those who missed the June 4 Mad Hedge Traders & Investors Summit, I have posted all 9:15 hours of recordings of every speaker. To find it, please click here.This is a collection of some of the best traders and investors I have stumbled across over the past five decades. They include: 8:45 Meet John Thomas, the Mad Hedge Fund Trader- Summit Welcome and Opening Comments 9:00 Andrew Pancholi - Market Timing Report “Learn How Markets Repeat with Absolute Precision” 10:00 - Fausto Pugliese – Cyber Trading University “The Most important Tape Reading Tactics Every Trader Should Know” 11:00 - Adam Mesh - Adam Mesh Trading “Options Made Easy” 12:00 - Hubert Senters - Trade Thirsty "Investors Miss 95% of Tech Stock Gains -- Here's How You Can Get Them" 1:00 - Charles Hughes – Hughes’ Optioneering - “Simple, Shockingly Successful PowerTrend® Spread Strategy to be Revealed” 2:00 - Steve Reitmeister - Stock News “2020 Stock Market Outlook” 3:00 - Hillary Kramer – Eagle Financial Publications “Accelerated Profit Path: How to Make Money in A Whipsaw Market” 4:00 - Doc Severson – READY SET TRADE “REVISED 2020 Stock Market Outlook” 5:00 Tom Sosnoff- Tastyworks “Tastyworks Platform Demo” I’m sure you will find these speakers educational, if not entertaining. John Thomas CEO & Publisher Mad Hedge Traders & Investors Summit

|

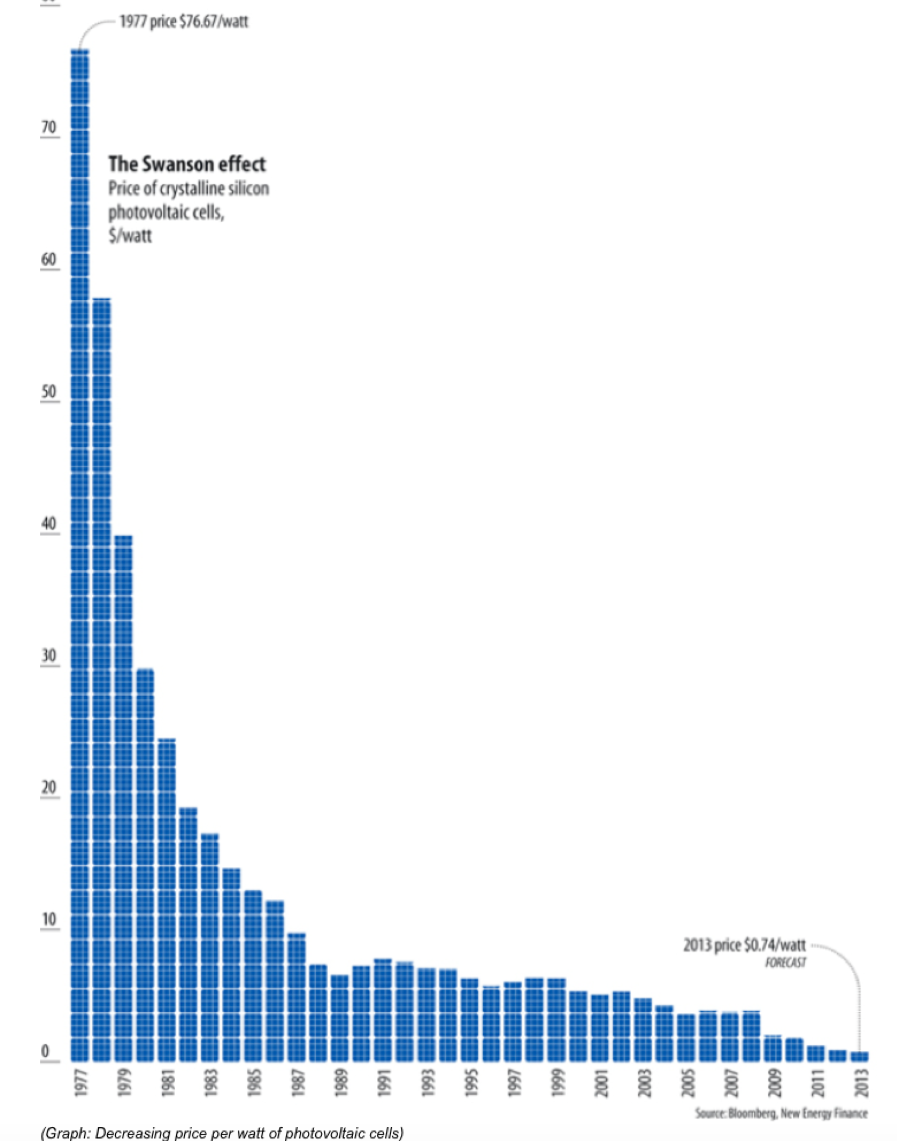

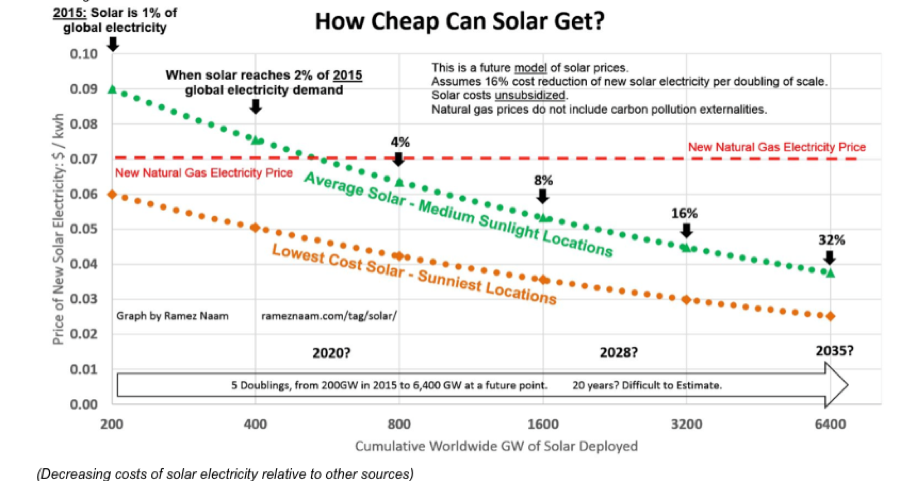

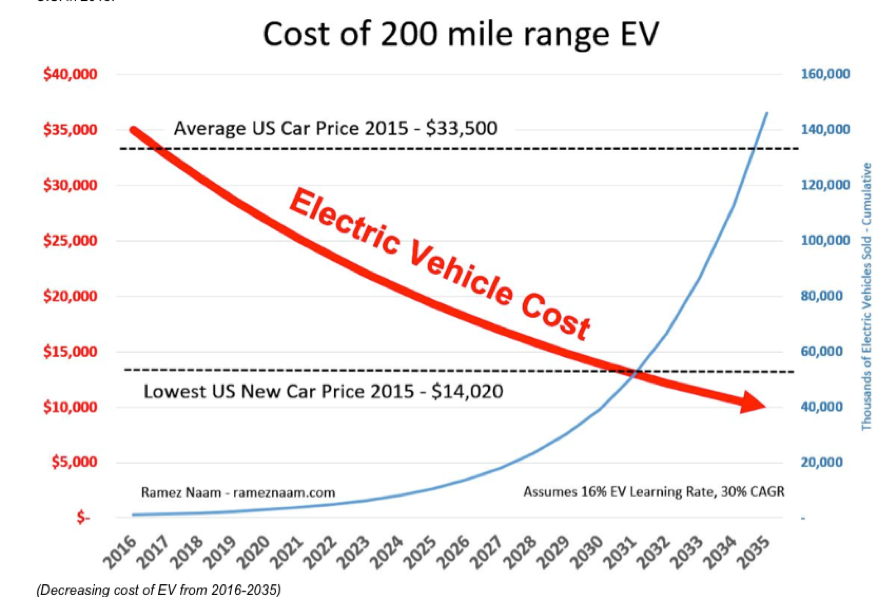

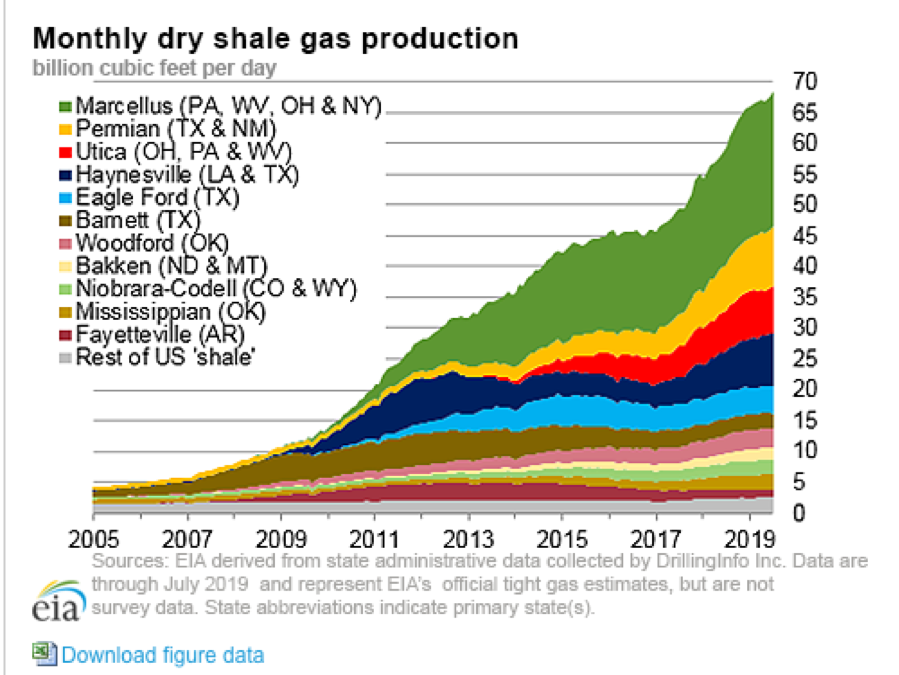

How Free Energy Will Power the Coming Roaring Twenties With the price of Texas tea barely scratching $36 a barrel today, it is time to revisit the doomed future of this ancient energy source.With energy stocks now trading like they’re having a going out of business sale, you have to wonder if the sector will ever come back. The short answer is that it won’t. A key part of my argument for a new Golden Age to take place during the coming Roaring Twenties is that the price of energy is effectively going to zero. It may not actually make it to zero. I’ll settle for down 90%-95%, which is good enough for me. Take a look at the charts below. The first one shows how the price of a watt of solar-generated electricity has plunged by 99.03% since 1977, from $76.67 to $0.74. Just in the past six years, retail prices for completed solar panels dropped by a staggering 80%. That is cheaper than electricity supplies generated by new natural gas plants, which now costs 7 cents per kwh. The potential price declines for natural gas from here are near zero. After all, it’s hard to improve on the near 100% burn rates you get with gas, and many producers are already losing money at current price levels of $2.25 per MM BTU. By the way, gas prices haven’t changed in 20 years. Squeezing efficiencies out of our existing solar technology through improved software, production methods, chemistry, and design are nearly unlimited, are expected to drive solar costs by half down to 3 cents per kwh by 2035. And here is the great shortcoming of all these wonderful predictions. Technology NEVER stays the same. My own SunPower (SPWR) SPR-x20-370 panels with their Maxeon solar cell technology deliver an efficiency of 21.7%, the best on the market. This means that they convert 21.7% of the solar energy they receive into electricity. SunPower is now producing 25.1% efficiency panels in the lab. Another research lab in Germany, Fraunhofer, is getting 44.7%. And my friends at the Defense Department tell me they have functioning solar cells delivering 70% efficiencies which they use in space. Whether they are economic and scalable is anyone’s guess. (Warning: most cheap Chinese made solar cells have only lowly 15% efficiencies, so don’t be tricked by any great “deals”). And this is how most long-term predictions fall short. When I bought the system, I was warned the electricity production would fall 1% a year thanks to the natural degradation of the solar cells. Instead, output has risen by 1% annually. Global warming is the only possible explanation. Not only do they assume that technology doesn’t change, they fail to account for dramatic improvements in other related fields. Electric car technology is a classic example. Battery costs are currently falling off a cliff. When I bought the second Nissan Leaf offered for sale in California in 2010 (the director Francis Ford Coppola got the first one), the battery cost $833 per kilowatt. In 2012, I purchased a high-performance Tesla (TSLA) P85 Model S-1 at $353 per kilowatt. When the Tesla 3 became available in 2017, the 60-watt battery will ran at $250 per kilowatt. Efficiencies gained through the economies of scale from the Sparks, Nevada Gigafactory could take that down to $125. However, that is not the end of the story. The car industry will start to move towards carbon fiber in five years, which has ten times the strength of steel at one-tenth the weight. The only issue now is mass production cost. Some 67% of the weight of a Tesla S-1 is in the body, with the four motors at 13%, and the 1,200-pound lithium-ion battery at 20%. What happens when the body weight falls by 90%, to only 6.7% of total weight? The battery weight, and cost declines by two thirds. That cuts the effective cost of the battery to $66/kilowatt. Add up all of this, and it is easy to see how energy costs can plunge by 90% or more. And it will happen much faster than you expect. This has been the experience with memory costs, processor speeds, and hundreds of other technologies over the past half century I have been following them. The cost of cotton yarn fell by 1,000 times during the 17[SUP]th[/SUP]and 18[SUP]th[/SUP] century. I could go on and on. This is why the State of California has mandated to get 50% of its energy from alternative sources by 2030. Some researchers believe a 100% target could be achieved. And it is doing this while closing its two remaining nuclear power plants. It already hit that target on several days this year when winter filled up all the dams, producing excess hydroelectric power. As a result, the wholesale price of electricity fell to zero on those days. The grid was producing more power than could be consumed. To say that free energy would be a game-changer is a huge understatement. The elimination of energy as a cost has enormous consequences for all companies. You can start with the energy-intensive ones in transportation, steel, and aluminum, and work your way down the list. My bet is that you won’t recognize the car industry in 20 years. At a $66/kilowatt effective battery cost, it will make absolutely no sense to build internal combustion engines in new cars. Too bad Detroit is a decade behind in this technology. Lose transportation, and you lose 50% of US oil consumption, or about 10 million barrels a day. Guess what that does to oil prices? Goodbye Middle East. Go blow yourself up. The profitability and efficiency of the entire economy will take a great leap forward, much like we saw with the mass industrialization that was first made possible by electricity during the 1920s. Share prices of all kinds will go ballistic. Since energy costs will eventually fall effectively to zero, that wipes out the present business model of the entire electric power, coal, oil, and gas industries, about 10% of US GDP. Their business models will be reduced to trying to sell something that is free, like air. Dow 120,000 anyone? For more about the economic rationale behind these prediction, please read my book, “Stocks to Buy for the Coming Roaring Twenties” by clicking here.

|

Quote of the Day “The stock market is not expensive at 0.50% Fed funds and 0.70% government bonds,” said my old investor and mentor Leon Cooperman of Omega Advisors.

|

I've started rolling outa the market in a second account.. out by about 10% so far.

Soon I'll be pairing down this trading account as well. A global down turn is inevitable in 2021 optimism is only going to go so far next year.

This looks ugly. I'm fine jumping back in even with a loss in position way later down the line.

I know very little about the market.

The only things i have right now are:

PASS

SLV

GLD

SQQQ...small position.