You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Intersting thoughts

- Thread starter Bozzie

- Start date

Busy morning ...yep those deals are still alive despite the Chinese threat this weekend.

Bought AVDL again this AM at 6.84 with the intention of selling someplace up the line hopefully.

Sold AVDL @7.32 for a 7% gain but just 1/2 of what I bought this AM..Might add the rest to the core holding depending on the finish today.

This guy. Great info from the conference. Link inside his news letter.

|

| Global Market Comments August 31, 2020 Fiat Lux Featured Trade: (MARKET OUTLOOK FOR THE WEEK AHEAD, or A TALE OF FOUR CHARTS),(NASD), (TLT), (GLD), (JPM), (FB), (AAPL), (AMZN), (TSLA)

|

| � |

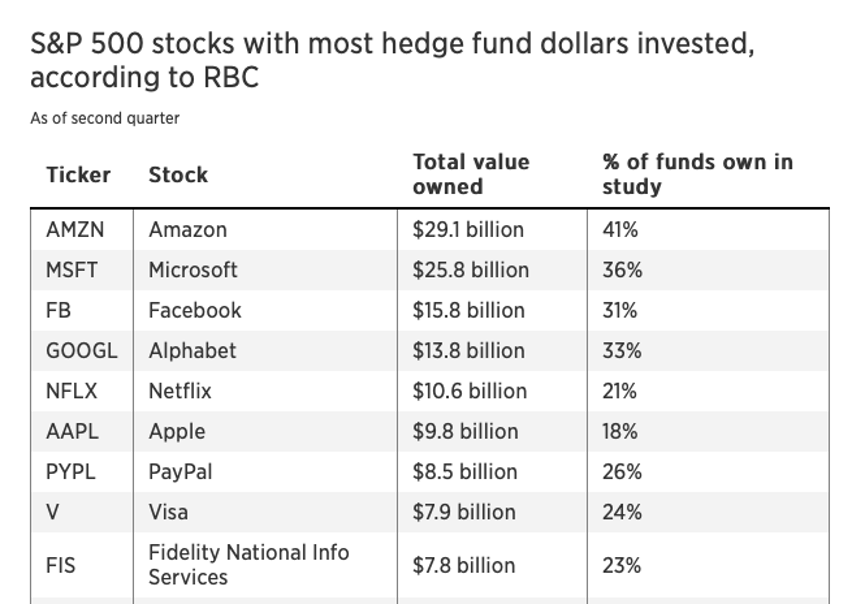

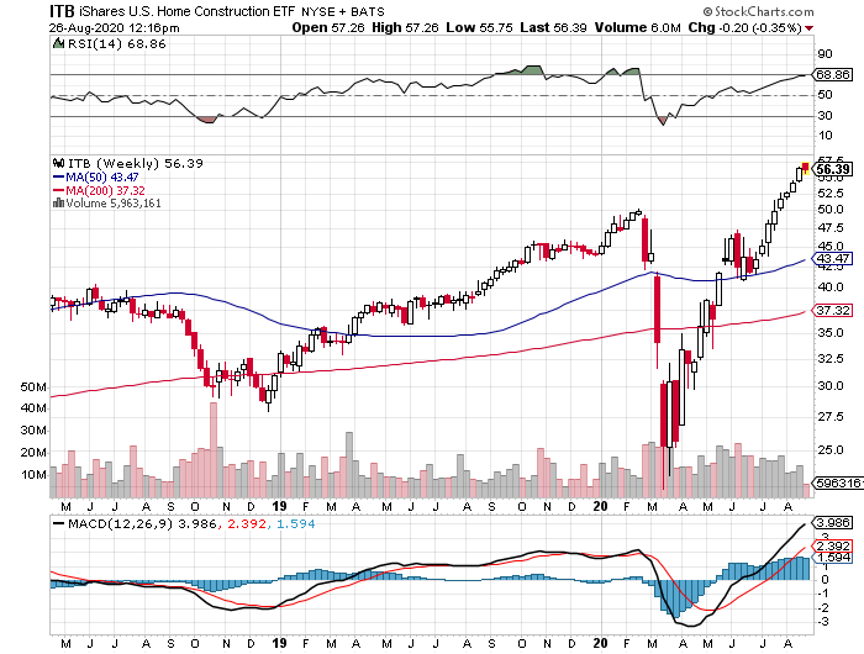

The Market Outlook for the Week Ahead, or a Tale of Four Charts Listening to 27 presentations during the Mad Hedge Traders & Investors Summit last week (click here for the replays), I couldn’t help but notice something very interesting, if not alarming.All the charts are starting to look the same. You would expect all the technology charts to be similar on top of the historic run we have seen since the March 23 bottom. But I wasn’t only looking at technology stocks. Analyzing the long-term charts for stock indexes, bonds, real estate, and gold, it is clear that they ALL entered identical parabolic moves that began during the notorious Christmas bottom in December 2018. With the exception of the pandemic induced February-March hiccup this year, it has been straight up ever since. The best strategy of all for the past three years has been to simply close your eyes and buy EVERYTHING and then forget about it. It really has been the perfect idiot’s market. This isn’t supposed to happen. Stocks, bonds, real estate, and gold are NEVER supposed to be going all in the same direction at the same time. The only time you see this is when the government is flooding the financial system with liquidity to artificially boost asset prices. This latest liquidity wave started when the 2017 Trump tax bill initiated enormous government budget deficits from the get-go. It accelerated when the Federal Reserve backed off of quantitative tightening in mid-2019. Then it really blew up to tidal wave proportions with the Fed liquidity explosion simultaneously on all fronts with the onset of the US Corona epidemic. Asset classes have been going ballistic ever since. From the March 23 bottom, NASDAQ is up an astounding 78%, bonds have gained an unprecedented 30%, the US Homebuilders ETF has rocketed a stagging 187%, and gold has picked up an eye-popping 26%. That’s all well and good if you happen to be long these asset classes, as we have been advising clients for the past several months. So, what happens next? After all, we are in the “What happens next?” business. What if one of the charts starts to go the other way? Is gold a good hedge? Do bonds offer downside protection? Is there safety in home ownership? Nope. They all go down in unison, probably much faster than they went up. If fact, such a reversal may be only weeks or months away. If you live by the sword you die, by the sword. Assets are now so dependent on excess liquidity that any threat to that liquidity could trigger a selloff of Biblical proportion, possibly worse than what we saw during February-March this year. And you wouldn’t need simply a sudden tightening of liquidity to prompt such a debacle. A mere slowdown in the addition of new liquidity could bring Armageddon. The Fed in effect has turned all financial markets into a giant Ponzi scheme. The second they quit buying, they all crash. The Fed and the US Treasury have already started executing this retreat surreptitiously through the back door. Some Treasury emergency loan programs were announced with a lot of fanfare but have yet to be drawn down in size because the standards are too tight. The Fed has similarly shouted from the rooftops that they would be buying equity convertible bonds and ETFs but have yet to do so in any meaningful way. If there is one saving grace for this bull market, it's that it may get a second lease on life with a new Biden administration. Now that the precedent for unlimited deficit spending has been set by Trump, it isn’t going to slow down anytime soon under the Democrats. It will simply get redirected. One of the amazing things about the current administration is that they never launched a massive CCC type jobs program to employ millions in public works as Roosevelt did during the 1930s to end that Great Depression. Instead, they simply mailed out checks. Even my kids got checks, as they file their own tax returns to get a lower tax rate than mine. I think you can count on Biden to move ahead with these kinds of bold, expansionist ideas to the benefit of the nation. We are still enjoying enormously the last round of such spending 85 years ago, the High Sierra trails I hiked weeks ago among them. Stocks soared on plasma hopes. Trumps cited “political” reasons at the FDA for the extended delay. Scientists were holding back approval for fears plasma was either completely useless and would waste huge amounts of money or would kill off thousands of people. At best, plasma marginally reduces death rates for those already infected, but you’re that one it’s worth it. Anything that kills Covid-19 is great for stocks. Existing Home Sales were up the most in history in July, gaining a staggering 24.7% to 5.86 million units. Bidding wars are rampant in the suburbs. Investors are back in too, accounting for 15% of sales. Inventories drop 21% to only 3.1 months. These are bubble type statistics. Can’t hold those Millennials back! This will be a lead sector in the market for the next decade. Buy homebuilders on dips. Goldman said a quarter of job losses are permanent, as the economy is evolving so fast. Many of these jobs were on their way out before the pandemic. That could be good news for investors as those cost cuts are permanent, boosting profits. At least, that’s what stocks believe. Hedge funds still love big tech, even though they are now at the 99[SUP]th[/SUP]percentile of historic valuation ranges. Online financials, banks, and credit card processors also rank highly. Live by the sword, die by the sword.

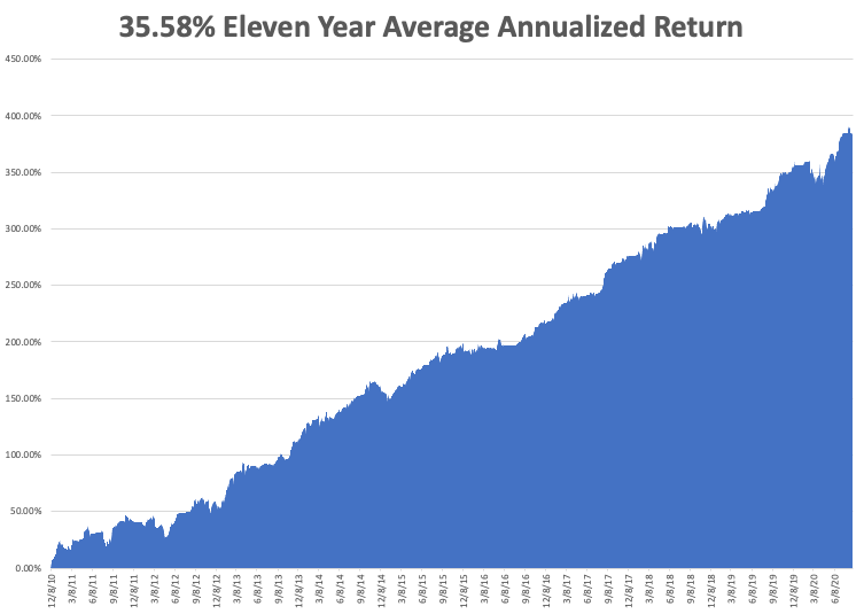

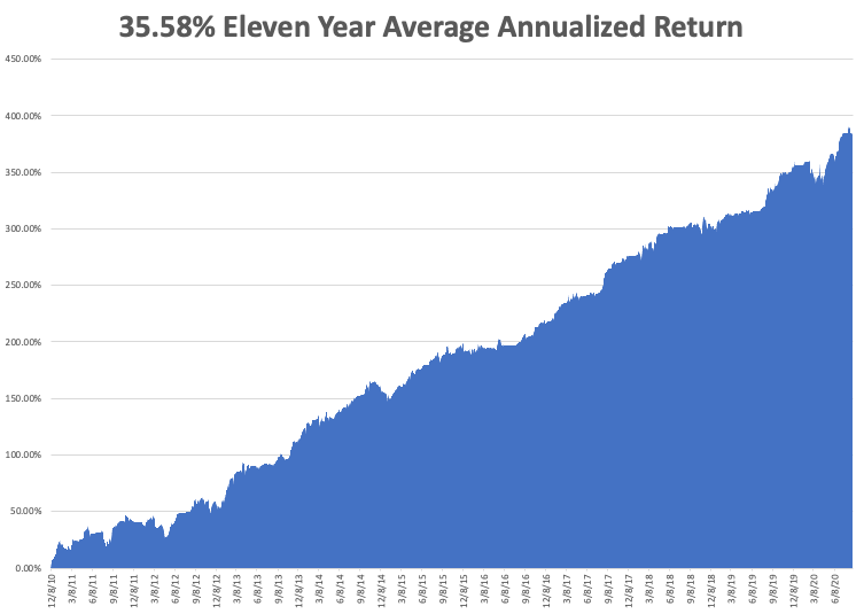

Massive Zoom crash brought the world to a halt for two hours on Monday morning. It looked like a Chinese hack attack intended to delay online school opening of the new academic year. Unfortunately, it also delayed the start of the Mad Hedge Traders & Investors Summit. The Dow Rebalancing is huge. Dow Jones rarely rejiggers the makeup of its famed but outdated index. But changing three names at once is unprecedented. One, Amgen (AMGN) I helped found, working on the team the discovered its original DNA sequencing. All of the founding investors departed yonks ago. The departure of Exxon (XOM) is a recognition that oil is a dying business and that the future is with Salesforce (CRM), whose management I know well. One big victim is Apple (AAPL) whose weighting in the index has shrunk. The end of the airline industry has begun, with American (AAL) announcing 19,000 layoffs in October. That will bring to 40,000 job losses since the pandemic began. The industry will eventually shrink to a handful of government subsidized firms and some niche players. Avoid like a plat in a spiral dive. 30 million to be evicted in the coming months, as an additional stimulus bill stalls in Congress. It will no doubt be rolling evictions that stretch out over the next year. This will be the true cost of failing to deal with the virus. When we come out the other side of this, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. My Global Trading Dispatch suffered one of the worst weeks of the year, giving up most of its substantial August performance. If you trade for 50 years, occasionally you get a week like this. The good news is that it only takes us back to unchanged on the month. Longs in banks (JPM) and gold (GLD) and shorts in Facebook (FB) and bonds (TLT) held up fine, but we paid through the nose with shorts in Apple (AAPL), Amazon (AMZN), and Tesla (TSLA). That takes our 2020 year to date down to 26.56%, versus +0.05% for the Dow Average. That takes my eleven-year average annualized performance back to 35.58%. My 11-year total return retreated to 382.47%. It is jobs week so we can expect a lot of fireworks on the data front. The only numbers that really count for the market are the number of US Coronavirus cases and deaths, which you can find here. On Monday, August 31 at 10:30 AM EST, the Dallas Fed Manufacturing Index for August is released. On Tuesday, September 1 at 9:45 AM EST, the Markit Manufacturing Index for August is published. On Wednesday, September 2, at 8:13 AM EST, the August ADP Employment Change Index for private-sector job is printed. At 10:30 AM EST, the EIA Cushing Crude Oil Stocks are out. On Thursday, September 3 at 8:30 AM EST, the Weekly Jobless Claimsare announced. On Friday, September 4, at 8:30 AM EST, The August Nonfarm Payroll Report is released. At 2:00 PM The Bakers Hughes Rig Count is released. As for me, I’ll be catching up on my sleep after hosting 27 speakers from seven countries and entertaining a global audience of 10,000 from over 50 countries and all 50 US states. We managed to max out Zoom’s global conferencing software, and I am now one of their largest clients. It was great catching up with old trading buddies from decades past to connect with the up-and-coming stars. Questions were coming in hot and heavy from South Africa, Singapore, all five Australian states, the Persian Gulf States, Saudi Arabia, East Africa, and every corner of the United Kingdom. And I was handling it all from my simple $2,000 Apple laptop from nearby Silicon Valley. It is so amazing to have lived to see the future! To selectively listen to videos of any of the many talented speakers, you can click here. See you there. John Thomas CEO & Publisher The Diary of a Mad Hedge Fund Trader

|

| Quote of the Day “Life is too short to hang out with people who aren’t resourceful,” said Jeff Bezos, the founder of Amazon.

|

|

| Global Market Comments September 1, 2020 Fiat Lux Featured Trade: (RIGHTSIZING YOUR TRADING)

|

| � |

Rightsizing Your Trading I can’t tell you how many times I have been woken up in the middle of the night by an investor who was sleepless over a position that was going the wrong way.Gold (GLD) was down $50, the Euro (FXE) was spiking two cents, or the stock market (SPY) was enduring one of its periodic heart attacks. Of course, my answer is always the same. Cut your position in half. If your position is so large that it won’t let you sleep at night on bad days, then you have bitten off more than you can chew. If you still can’t sleep, then cut it in half again. Which brings me to an endlessly recurring question I get when making my rounds calling readers. What is the right size for a single position? How much money should you be pouring into my Trade Alerts? Spoiler alert! The answer is different for everyone. For example, I will not hesitate to pour my entire net worth into a single option position. The only thing that holds me back is the exchange contract limits. But that’s just me. I have been trading this market for more than half a century. I have probably done more research than you ever will (I basically do nothing butresearch all day, even when I’m backpacking in the High Sierras or Alps, by audio book). And I have been taking risks for my entire life, the financial and the other kind, quite successfully so, I might say. So, my taking a risk is not the same as you taking a risk. With the risks I take day by day, a normal person would suddenly die of fright. Taking risks is like drinking a fine Kentucky sipping Bourbon. The more frequently you drink, the more you have to imbibe to get a good buzz. Eventually, you have to quit and start the cycle all over again. Otherwise, you become an alcoholic, and die. So you can understand why it is best to start out small when taking on your first positions. Imagine if the first time you went out to drink with your college dorm roommates and you finished off an entire bottle of Ripple or Thunderbird in one shot? The results would be disastrous and nauseous, as they were for me the first time I did it. So I’ll take you through the drill that I always used to run beginning traders at Morgan Stanley’s institutional equity trading desk. You may be new to investing, new to trading, and find all of this money stuff scary. A lot of people find numbers intimidating. Or you may be wary, entrusting your hard-earned money to advice from a newsletter you foundon the Internet! What if my wife finds out I’m doing this with our money? YIKES! That is totally understandable, given that 99% of the newsletters out there are all fake, written by fresh-faced kids just out of college with degrees in Creative Writing, but without a scintilla of experience in the financial markets. And I know most of the 1% who are real. I constantly hear of new subscribers who are now on their tenth $4,000 a year subscription, and this is the first one they have actually made money with. So, it is totally understandable that you proceed with caution. I always tell new readers to start out paper trading. Virtually all online brokers now have these wonderful paper trading facilities where you can practice the art of trading with pretend money. Don’t know how to use it? They also offer endless hours of free tutorials on how to use their platform. These are great. After all, they want to get you into the market, trading, and paying commission as soon as possible. You can put up any conceivable strategy and they will elegantly chart out the potential profit and loss. Whenever you hit the wrong button and your money all goes “poof” and disappears, you just hit the reset button and start all over again. No harm, no foul. After you have run up a string of two or three consecutive winners, it’s now time to try the real thing. But start with only one single options contract, or a few shares of stock or an ETF. If you completely blow up, you will only be out a few hundred dollars. Again, it’s not the end of the world. Let’s say you hit a few singles with the onesies. It’s now time to ramp up. Trade 2, 3, 4, 5,10, 50, or 100 contracts. Pretty soon, you’ll be one of the BSDs of the marketplace. Then you’ll notice that your broker starts following your trades since you always seem to be right. That is the story of my life. This doesn’t mean that you will enjoy trading nirvana for the rest of your life. You could hit a bad patch, get stopped out of several positions in a row and lose money. Or you could get bitten by a black swan (it hurts!). Those of you who have been following me for ten years have seen this happen to me several times and now know what to expect. I shrink the size, reduce the frequency, and stay small until my mojo comes back. And my mojo always comes back. You can shrink back to trading one contract or quit trading altogether. Use the free time to analyze your mistakes, rethink your assumptions, and figure out where you went wrong. Was I complacent? Was I greedy? Did hubris strike again? Having a 100% cash position can suddenly lift the fog of war and be a refreshingly clarifying experience. We all get complacent and greedy sometimes. To err is human. Then reenter the fray once you feel comfortable again. Start out with a soft pitch. Over time, this will become second nature. You will know automatically when to increase and decrease your size. And you won’t have to wake me in the middle of the night. Good luck and good trading.

|

Quote of the Day “The last few years have been periods of high returns and relatively low volatility. I think with the yield curve inversion and the economy slowing, PMI is in contraction in much of the world ... we’re entering a period that’s the opposite of that. We’re going to have lower returns and substantially higher volatility,” said Ben Kirby of Thornburg Investment Management.

|

|

LLNW with big volume in the last hour yesterday ..300k with an aggressive buyer. good sign

BABA is going to hit 300 much quicker that I thought possible ...Looking for weakness in the next 3 days but I doubt it'll be coming.

Upcoming catalysts, Monday September 7 BABA is included in index funds on the SH market.

ANT is looking at an October IPO offering said to be worth 30 billion..or 10 billion to BABA's line as they own 33% of ANT.

Things look real good here through Oct.. 330 looks doable

BABA is going to hit 300 much quicker that I thought possible ...Looking for weakness in the next 3 days but I doubt it'll be coming.

Upcoming catalysts, Monday September 7 BABA is included in index funds on the SH market.

ANT is looking at an October IPO offering said to be worth 30 billion..or 10 billion to BABA's line as they own 33% of ANT.

Things look real good here through Oct.. 330 looks doable

you see FSLY this AM? down big in the last few min.

https://finance.yahoo.com/quote/FSLY?.tsrc=applewf

https://finance.yahoo.com/quote/FSLY?.tsrc=applewf

LLNW straight down. I may make a buy now

I like it still but I'm cutting some around 7 when it hits it again..with the cycle this has had in the past looks like it's about to break upward. Shorts still covering. This one has been frustrating ..Looking to add more BABA..love the weakness today.

Honestly FSLY wouldn't be a bad short... If Microsoft buys TT its being said they would go with Azure over Fastly for cloud services because of a previous relationship MS has with Azure...But it's just talk.

It's interesting and should have a quick outcome..Thanks for bringing up FSLY..Off my radar lately.

Man I wish I would have shorted this..I looked at the spreads, covering my call on LLNW last week made me shy.

LLNW has to have the worst PR Dept of any Company. Someone needs to be fired before this hits $4. I did just buy a ton of USX. I may look for a swing on that one.

If they've made a deal with anyone it would be up to the other company to announce it..Amazon is gearing up for live TV and they do have a relationship but you wouldn't step in front a company like Amazon or NBC on news. LLNW's 100 million dollar investment in capacity says they have something brewing IMO. I think it comes down to how long you want to hang around with this..I funded my trading account this AM..I want more BABA I like both upcoming catalysts..I would have bought today but the funds need to settle still... hopefully it drifts down tomorrow AM.

|

| it's late Global Market Comments September 2, 2020 Fiat Lux Featured Trade: (HOW THE MAD HEDGE MARKET TIMING ALGORITHM WORKS)

|

| � |

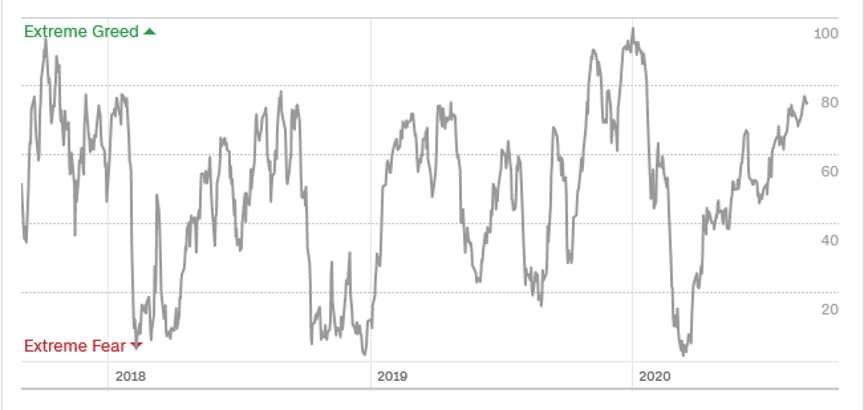

How the Mad Hedge Market Timing Algorithm Works Since we have just taken in a large number of new subscribers from around the world, I will go through the basics of my Mad Hedge Market Timing Index one more time.I have tried to make this as easy to use as possible, even devoid of the thought process. When the index is reading 20 or below, you only consider “BUY” ideas. When it reads over 80, it’s time to “SELL.” Everything in between is a varying shade of grey. Most of the time, the index fluctuates between 20-80, which means that there is absolutely nothing to do. To identify a coming market reversal, it’s good to see the index chop around for at least a few weeks at an extreme reading. Look at the three-year chart of the Mad Hedge Market Timing Index. After three years of battle testing, the algorithm has earned its stripes. I started posting it at the top of every newsletter and Trade Alert two years ago, and will continue to do so in the future. Once I implemented my proprietary Mad Hedge Market Timing Index in October 2016, the average annualized performance of my Trade Alertservice has soared to an eye-popping 34.61%. As a result, new subscribers have been beating down the doors trying to get in. Let me list the highpoints of having a friendly algorithm looking over your shoulder on every trade. *Algorithms have become so dominant in the market, accounting for up to 90% of total trading volume, that you should never trade without one *It does the work of a seasoned 100-man research department in seconds *It runs real-time and optimizes returns with the addition of every new data point far faster than any human can. Imagine a trading strategy that upgrades itself 30 times a day! *It is artificial intelligence-driven and self-learning. *Don’t go to a gunfight with a knife. If you are trading against algos alone, you WILL lose! *Algorithms provide you with a defined systematic trading discipline that will enhance your profits. And here’s the amazing thing. My Mad Hedge Market Timing Indexcorrectly predicted the outcome of the presidential election, while I got it dead wrong. You saw this in stocks like US Steel, which took off like a scalded chimp the week before the election. When my and the Market Timing Index’s views sharply diverge, I go into cash rather than bet against it. Since then, my Trade Alert performance has been on an absolute tear. In 2017, we earned an eye-popping 57.39%. In 2018 I clocked 23.67% while the Dow Average was down 8%, a beat of 31%. So far in 2020, we are up 25.83%. Here are just a handful of some of the elements which the Mad Hedge Market Timing Index analyzes real-time, 24/7. 50 and 200 day moving averages across all markets and industries The Volatility Index (VIX) The junk bond (JNK)/US Treasury bond spread (TLT) Stocks hitting 52 day highs versus 52 day lows McClellan Volume Summation Index 20-day stock bond performance spread 5-day put/call ratio Stocks with rising versus falling volume Relative Strength Indicator 12-month US GDP Trend Case Shiller S&P 500 National Home Price Index Of course, the Trade Alert service is not entirely algorithm-driven. It is just one tool to use among many others. Yes, 50 years of experience trading the markets is still worth quite a lot. I plan to constantly revise and upgrade the algorithm that drives the Mad Hedge Market Timing Index continuously, as new data sets become available.

|

Quote of the Day “I think, it’s very obvious what’s going on. It’s the miracle of free money, zero commissions, and a lot of people getting checks that exceed what they would get if they went to work,” said my former hedge fund investor friend, Leon Cooperman of Omega Family Office.

|

back to the well on BABA @ 285.90 hold through the next month or so on this chunk.

Looking at volatility indexes...as the election nears I believe market volatility will rise.

[FONT="]ProShares VIX Short-Term Futures ETF (VIXY)[/FONT]

Insider buying at AVDL for the second time in a month and a half...looking for weakness.

Looking at volatility indexes...as the election nears I believe market volatility will rise.

[FONT="]ProShares VIX Short-Term Futures ETF (VIXY)[/FONT]

Insider buying at AVDL for the second time in a month and a half...looking for weakness.

|

|

| Global Market Comments September 3, 2020 Fiat Lux Featured Trade: (A HIGH-YIELD PLAY IN A LOW-YIELD WORLD),(JMBS), (SGVAX)

|

| � |

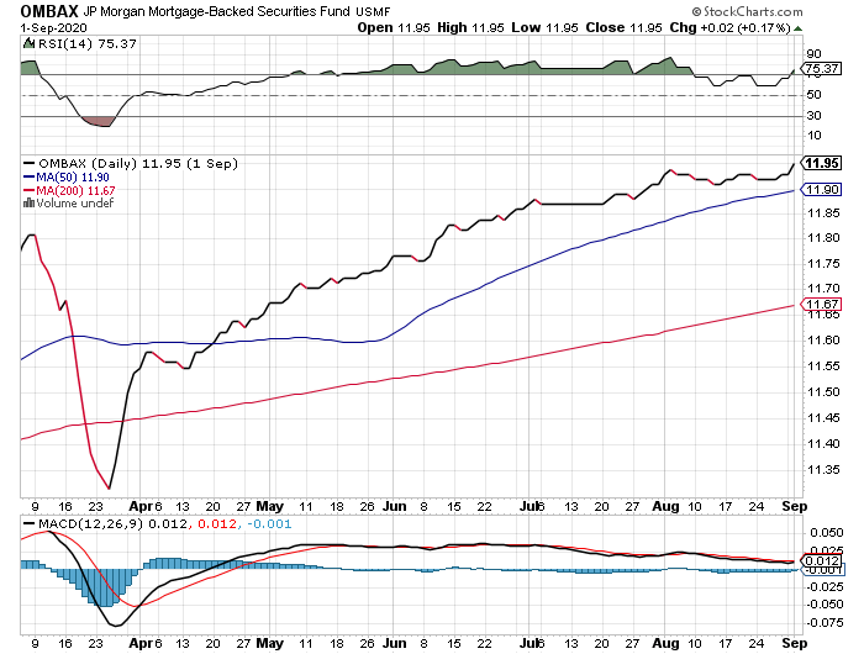

A High-Yield Play in a Low-Yield World I already know what you’re thinking about.Energy Master Limited Partnerships (MLPs), junk bonds, airlines on the verge of bankruptcy? Nope. There are in fact tremendous opportunities in mortgage-backed securities. Mortgage-backed what, you may ask? A Mortgage-Backed Security (MBS) is a type of instrument which is secured by a basket of mortgages. These mortgages are aggregated and sold to banks which then securitize, or package, them together into single securities that investors can buy. MBSs in effect turn banks into middlemen between the individual homeowner and a fixed income end investor. The housing market can’t work without it. The majority of home mortgages in the United States end up in MBS’s one way or the other. MBS’s are further subdivided into residential or commercial ones, depending on whether the underlying assets are home mortgages taken out by borrowers or assets for commercial purposes ranging from office space to multi-dwelling buildings. And here’s the part you want to hear. Some MBSs yield as much as 11%, and high single digits are common. MBSs basically are bonds with a few bells and whistles. They are supposed to trade in line with ten-year US Treasury bonds (TLT). The problem now is that right now they are not. In fact, MBSs are currently trading at the great spread over Treasuries since the 2008-2009 Great Recession. Part of the problem is that MBSs have a terrible history, leading the charge to the downside when the housing market collapsed, some collateral properties dropping as much as 80%. That took the value of most leveraged MBSs to zero. Trillions of dollars were lost. Indeed, vast fortunes were made by hedge funds selling short these securities. Today, these are not your father’s MBSs. In the wake of the 2008-2009 crash, the heavy hand of regulation came down hard. Today, an MBS must be issued by a government-sponsored enterprise (GSE) or a heavily capitalized private financial company. The mortgages must have originated from a regulated and authorized financial institution. And the MBS must have received one of the top two ratings issued by an accredited credit rating agency. As a result, much of the risk has been taken out of these securities. So if these things are so safe now, why are they presenting such astronomical returns? A lot depends on your long term view of these US housing market. There are currently 4 million homes in mortgage “forbearance” meaning that they have a temporary holiday on making their monthly mortgage payments. This government program runs out at the end of 2020. This has crushed the MBS market. If you believe that the majority of these homes are going the default on their loans, you probably should steer clear of MBSs as the market has it right. However, if you think that the majority of these bowers obtained forbearances without actually needing them and will return to regular timely payment once the program ends, plus back payments, then MBSs now offer incredible value and you want to be loading the boat with them. I believe in the latter. There happen to be dozens of publicly listed MBSs which you can buy. I focus on a couple of the highest quality ones. The Janus Henderson Mortgage-Backed Securities ETF (JMBS) is offering a 4.34% yield invests primarily in ten and 30 conventional home mortgages. Click here for more details. The Franklin Templeton Western Asset Mortgage Back Securities Fund (SGVAX) pays a 3.75% yield and invests in a broader range of asset-backed securities. For more details on this fund, please click here. While these yields are attractive, you really need institutional access to get the Holy Grail, the true double-digit return. That will let you soak up the mortgages directly, as hedge funds do. That will let you bypass the hefty management fees and expenses charged by the exchange-traded funds and other middlemen. You may also have to go out on the risk spectrum to get the big numbers, which means investing in more commercial backed securities. It’s no great revelation that people will default on their office or their small business before they do so on the residence.

|

Quote of the Day “Most of the ETF’s today are your dad’s Oldsmobile,” said Lee Kranefuss of Source Advisors, about the outdated irrelevance for most equity indexes.

|

| This is not a solicitation to buy or sell securities The Mad Hedge Fund Trader is not an Investment advisor For full disclosures click here at: http://www.madhedgefundtrader.com/disclosures The "Diary of a Mad Hedge Fund Trader"(TM) and the "Mad Hedge Fund Trader" (TM) are protected by the United States Patent and Trademark Office The "Diary of the Mad Hedge Fund Trader" (C) is protected by the United States Copyright Office Futures trading involves a high degree of risk and may not be suitable for everyone.[FONT="][/FONT] |