You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Intersting thoughts

- Thread starter Bozzie

- Start date

The Vix is having a day X2 the normal volume..Option action is up big.

Pretty interesting look at where money is moving today in ETFs and volumes.

SPY down 12%

https://www.barchart.com/etfs-funds/volume-leaders/daily-leaders

Pretty interesting look at where money is moving today in ETFs and volumes.

SPY down 12%

https://www.barchart.com/etfs-funds/volume-leaders/daily-leaders

Nasdaq down in the pre but its not looking weak enough looking up the curve this AM for vix vehicles.

More chop.. Over all I'm thinking I may sell outa the market slowly as November rolls up on us and flip in to some defensive positions.

Above all the Market hates uncertainty, investor anxiety is on the rise but I don't think you've seen anything yet.

Out for the day..happy flipping fellas.

NYT link

https://www.nytimes.com/2020/09/03/opinion/trump-election-2020.html?referringSource=articleShare

Not All All-Time Highs Are Equal

Sep. 4, 2020 6:19 AM ET

|

Includes: DDM, DIA, DOG, DXD, EEH, EPS, EQL, FEX, HUSV, IVV, IWL, IWM, JHML, JKD, NDX, OTPIX, PSQ, QID, QLD, QQEW, QQQ, QQQE, QQXT, RSP, RWM, RYARX, RYRSX, SCHX, SDOW, SDS, SH, SMLL, SPDN, SPLX, SPUU, SPX, SPXE, SPXL, SPXN, SPXS, SPXT, SPXU, SPXV, SPY, SQQQ, SRTY, SSO, SYE, TNA, TQQQ, TWM, TZA, UDOW, UDPIX, UPRO, URTY, UWM, VFINX, VOO, VTWO, VV

Stuart Allsopp

Long/Short Equity, Research Analyst, Macro, portfolio strategy

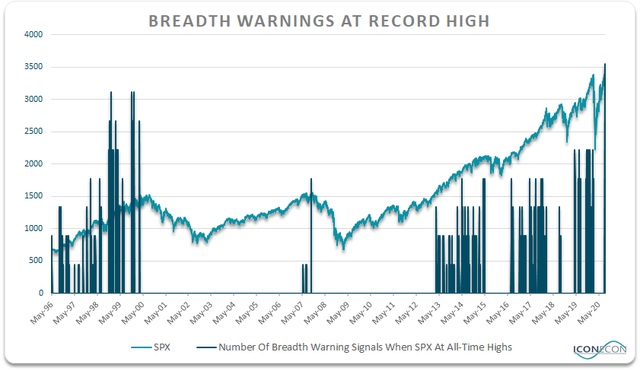

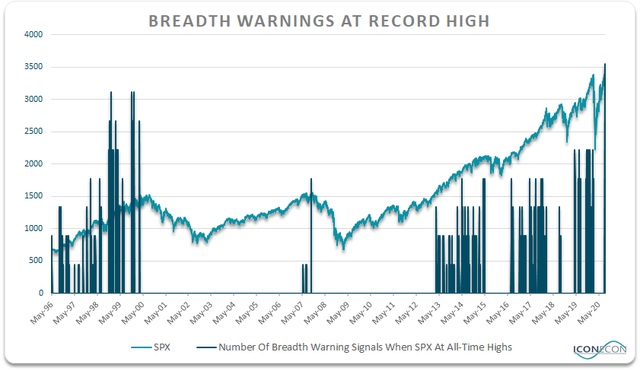

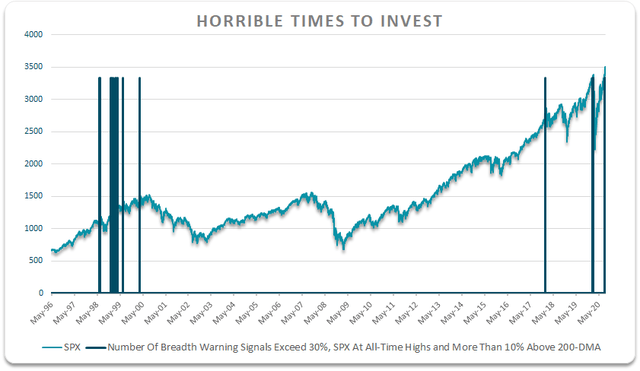

The number of breadth warning signals over the past few weeks has exceeded the number seen even at the height of the 2000 bubble peak, suggesting waning risk appetite.

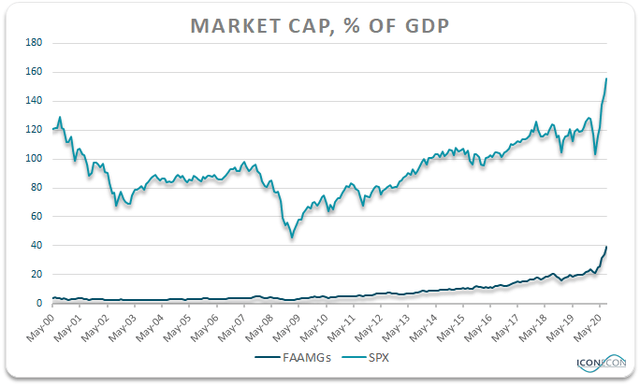

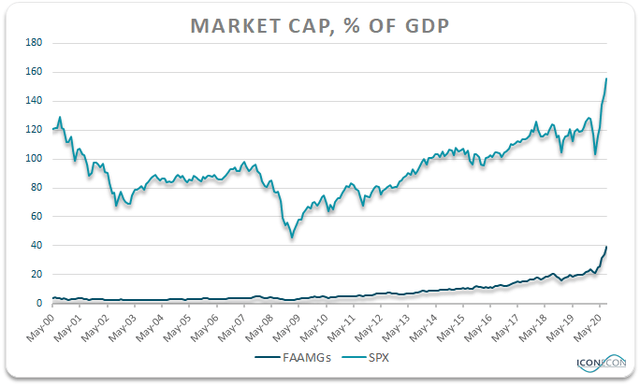

The deterioration in market breadth reflects the performance of the FAAMG stocks which are now valued at almost 40% of GDP, on par with the entire market at the 2009 low.

The widespread belief in the ability of low interest rates to prevent a market crash continues to strike us as completely unfounded.

The difference between all-time market highs that are followed by further gains and all-time highs that turn out to be market tops tends to be the extent to which the highs are reflective of the general appetite for risk. What we currently see is a market that is being driven to new highs by a tiny number of stocks while the majority of stocks are weakening, both in the U.S. and internationally. We are also seeing some upside pressure on implied volatility, signaling a potential shift towards risk aversion.

Market Breadth Reminiscent Of 2000 Peak

There are a number of different measures we look at to determine the internal strength of the SPX and the general appetite towards risk. Specifically, the number of SPX components trading above their 200-dma, the number of SPX components trading at new 52-week highs, the share of stocks rising versus declining on a given day, and the performance of the Dow Transports, the performance of equally-weighted SPX, U.S. Small Caps, the MSCI World Ex-U.S., the MSCI World Emerging Markets, the VIX, and high-yield credit spreads. We have seen all of these metrics flash warning signals over recent weeks.

Source: Bloomberg, Author's calculations

As the chart above shows, the number of warning signals over the past few weeks has exceeded the number seen even at the height of the 2000 bubble peak. We are seeing similar divergences as we saw back then, with the added element of weaker developed market stocks outside the U.S. acting as an additional signal of deteriorating risk appetite. As we saw in the late-1990s, as the market rally has advanced and valuations have become more extreme, gains have been driven by a declining number of stocks while the majority of the market has already begun to show signs of risk aversion.

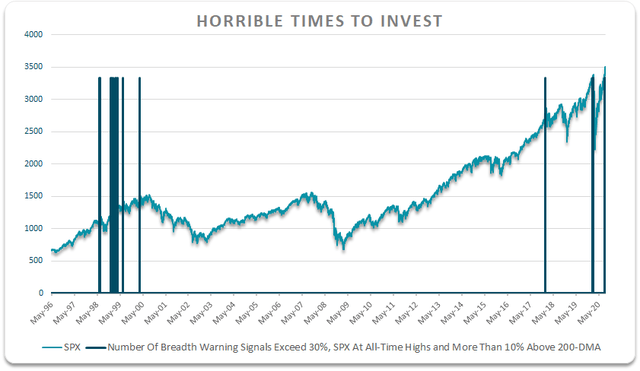

What is particularly rare about the current market advance is the fact that market breadth is deteriorating rapidly even amid a parabolic rise in the major indices. The following chart shows periods where the SPX is trading at new all-time highs, is in excess of 10% above its 200-dma, and more than 30% of our market breadth indicators are showing warning signals. The past three times this has occurred were at the peak of February this year, the January 2018 peak, and the March 2000 peak.

Source: Bloomberg, Author's calculations

The VIX volatility index has been a very useful indicator of impending market weakness, with the index showing a strong tendency to rise steadily alongside the final stages of a market advance. The sharp rise in the VIX over the past few weeks has left it near its highest level on record for any new all-time high in the SPX. The only time we have seen the VIX higher at a new all-time SPX high was in May 1999, just a few months and a few percent from the market's 2000 peak.

FAAMG Stocks Are Flying Too Close To The Sun

The deterioration in market breadth explained above reflects the extent to which the SPX is being driven by the FAAMG stocks (Facebook (NASDAQ:FB), Apple (NASDAQ:AAPL), Amazon (NASDAQ:AMZN), Microsoft (NASDAQ:MSFT), and Google (NASDAQ:GOOG) (NASDAQ:GOOGL)). These stocks are now valued at the equivalent of almost 40% of GDP, on par with the entire stock market's valuation at the March 2009 low. With the bulk of U.S. stocks and risk assets globally showing signs of bull market fatigue, any weakness in these mega-cap tech stocks could result in a major market crash.

Source: Bloomberg, Author's calculations

Low Rate Environment Offers Zero Consolation

The widespread belief in the ability of low interest rates to prevent a market crash continues to strike us as completely unfounded. The speculative mania we are currently seeing is similar in magnitude to the late-1990s bubble which peaked when real interest rates were over 4%, fully 5 percentage points above current levels. If easy monetary policy is such a supportive factor for stocks as many believe, presumably the 20-year period of easing has provided a great deal of support. The problem now is that further declines in real yields from multi-year lows will be harder to come by, and if they are forthcoming they will likely both reflect and result in stagflation, under which stocks have tended to perform particularly poorly.

Disclosure: I am/we are short SPX. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

More chop.. Over all I'm thinking I may sell outa the market slowly as November rolls up on us and flip in to some defensive positions.

Above all the Market hates uncertainty, investor anxiety is on the rise but I don't think you've seen anything yet.

Out for the day..happy flipping fellas.

NYT link

https://www.nytimes.com/2020/09/03/opinion/trump-election-2020.html?referringSource=articleShare

Not All All-Time Highs Are Equal

Sep. 4, 2020 6:19 AM ET

|

Includes: DDM, DIA, DOG, DXD, EEH, EPS, EQL, FEX, HUSV, IVV, IWL, IWM, JHML, JKD, NDX, OTPIX, PSQ, QID, QLD, QQEW, QQQ, QQQE, QQXT, RSP, RWM, RYARX, RYRSX, SCHX, SDOW, SDS, SH, SMLL, SPDN, SPLX, SPUU, SPX, SPXE, SPXL, SPXN, SPXS, SPXT, SPXU, SPXV, SPY, SQQQ, SRTY, SSO, SYE, TNA, TQQQ, TWM, TZA, UDOW, UDPIX, UPRO, URTY, UWM, VFINX, VOO, VTWO, VV

Stuart Allsopp

Long/Short Equity, Research Analyst, Macro, portfolio strategy

Summary

The difference between all-time market highs that are followed by further gains and those that turn into market tops tends to be the general appetite for risk.The number of breadth warning signals over the past few weeks has exceeded the number seen even at the height of the 2000 bubble peak, suggesting waning risk appetite.

The deterioration in market breadth reflects the performance of the FAAMG stocks which are now valued at almost 40% of GDP, on par with the entire market at the 2009 low.

The widespread belief in the ability of low interest rates to prevent a market crash continues to strike us as completely unfounded.

The difference between all-time market highs that are followed by further gains and all-time highs that turn out to be market tops tends to be the extent to which the highs are reflective of the general appetite for risk. What we currently see is a market that is being driven to new highs by a tiny number of stocks while the majority of stocks are weakening, both in the U.S. and internationally. We are also seeing some upside pressure on implied volatility, signaling a potential shift towards risk aversion.

Market Breadth Reminiscent Of 2000 Peak

There are a number of different measures we look at to determine the internal strength of the SPX and the general appetite towards risk. Specifically, the number of SPX components trading above their 200-dma, the number of SPX components trading at new 52-week highs, the share of stocks rising versus declining on a given day, and the performance of the Dow Transports, the performance of equally-weighted SPX, U.S. Small Caps, the MSCI World Ex-U.S., the MSCI World Emerging Markets, the VIX, and high-yield credit spreads. We have seen all of these metrics flash warning signals over recent weeks.

Source: Bloomberg, Author's calculations

As the chart above shows, the number of warning signals over the past few weeks has exceeded the number seen even at the height of the 2000 bubble peak. We are seeing similar divergences as we saw back then, with the added element of weaker developed market stocks outside the U.S. acting as an additional signal of deteriorating risk appetite. As we saw in the late-1990s, as the market rally has advanced and valuations have become more extreme, gains have been driven by a declining number of stocks while the majority of the market has already begun to show signs of risk aversion.

What is particularly rare about the current market advance is the fact that market breadth is deteriorating rapidly even amid a parabolic rise in the major indices. The following chart shows periods where the SPX is trading at new all-time highs, is in excess of 10% above its 200-dma, and more than 30% of our market breadth indicators are showing warning signals. The past three times this has occurred were at the peak of February this year, the January 2018 peak, and the March 2000 peak.

Source: Bloomberg, Author's calculations

The VIX volatility index has been a very useful indicator of impending market weakness, with the index showing a strong tendency to rise steadily alongside the final stages of a market advance. The sharp rise in the VIX over the past few weeks has left it near its highest level on record for any new all-time high in the SPX. The only time we have seen the VIX higher at a new all-time SPX high was in May 1999, just a few months and a few percent from the market's 2000 peak.

FAAMG Stocks Are Flying Too Close To The Sun

The deterioration in market breadth explained above reflects the extent to which the SPX is being driven by the FAAMG stocks (Facebook (NASDAQ:FB), Apple (NASDAQ:AAPL), Amazon (NASDAQ:AMZN), Microsoft (NASDAQ:MSFT), and Google (NASDAQ:GOOG) (NASDAQ:GOOGL)). These stocks are now valued at the equivalent of almost 40% of GDP, on par with the entire stock market's valuation at the March 2009 low. With the bulk of U.S. stocks and risk assets globally showing signs of bull market fatigue, any weakness in these mega-cap tech stocks could result in a major market crash.

Source: Bloomberg, Author's calculations

Low Rate Environment Offers Zero Consolation

The widespread belief in the ability of low interest rates to prevent a market crash continues to strike us as completely unfounded. The speculative mania we are currently seeing is similar in magnitude to the late-1990s bubble which peaked when real interest rates were over 4%, fully 5 percentage points above current levels. If easy monetary policy is such a supportive factor for stocks as many believe, presumably the 20-year period of easing has provided a great deal of support. The problem now is that further declines in real yields from multi-year lows will be harder to come by, and if they are forthcoming they will likely both reflect and result in stagflation, under which stocks have tended to perform particularly poorly.

Disclosure: I am/we are short SPX. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

People just selling out pre labor day. Buying Buying and Buying. Even picked up a lot of LLNW yesterday.

LLNW is driving me nuts...I hate the insider selling last night even though it's part of their 10b5-1 rules...It looks bad from the outside if you don't understand it's mandatory. It's a good company, suddenly analysts are warming up some but the drag here is heavy.

Good luck today pal!

As I said LLNW was hitting $5 before the gaps filled. Everything is still selling off today but next week is another week.

LLNW is driving me nuts...I hate the insider selling last night even though it's part of their 10b5-1 rules...It looks bad from the outside if you don't understand it's mandatory. It's a good company, suddenly analysts are warming up some but the drag here is heavy.

Good luck today pal!

Good one today.

|

| Global Market Comments September 4, 2020 Fiat Lux Featured Trade: (SEPTEMBER 2 BIWEEKLY STRATEGY WEBINAR Q&A),(TSLA), (SPY), (GLD), (GDX), (JPM), (BAC), (C), (WFC), (VIX), (VXX), (TLT), (TBT), (USO), (INDU), (SDS),

|

| � |

September 2 Biweekly Strategy Webinar Q&A Below please find subscribers’ Q&A for the September 2 Mad Hedge Fund TraderGlobal Strategy Webinar broadcast from Silicon Valley, CA with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!Q: Tesla (TSLA) is down 25% today from the Monday high. What are your thoughts? A: Yes, I've been recommending to people all last week that they dump their big leverage positions, like their one- and two-year LEAPS in Tesla and quite a few people got out at the absolute highs near $2,500 just before the new stock issue was announced. People who bought the Tesla convertible bonds ten years ago got an incredible tenfold return, plus interest! Q: Are we at-the-money at the bear put spread in (SPY)? A: Yes, and if we go any higher, you are going to get a stop loss in your inbox because I have good performance this year to protect. I do this automatically without thinking about it. In this kind of crazy market, you cannot run shorts indefinitely. Hope is not a strategy. And it’s easy to stop out of a loser when 90% of the time you know the next one is going to be a winner. Q: Doesn’t gold (GLD) normally go up in falling stock markets? A: Yes, in a normal market that’s what it does. The problem is that all asset classes have produced identical charts in the last 2.5 years, and when they all go up in unison, they all go down in unison. This time around, gold will sell off with the stock market and gold miners (GDX) will go down three times as fast. Remember gold miners are stocks first and gold plays second, so when a big stock dive hits, will see big dives in gold miners as well, as we saw in February and March. Q: Why is JP Morgan (JPM) a good buy? A: JP Morgan is the quality play in the banks. And once inflation starts to kick in and interest rates rise, and you get a positive yield curve and a strengthening economy—that is fantastic news for banks. They are also one of the few underperforming sectors left in the market, so in any stock market selloff banks will rise. And that’s JP Morgan (JPM), Bank of America (BAC), Citigroup (C) that will lead the charge. Avoid Wells Fargo (WFC). It’s still broken. Q: I see iPath Series B S&P 500 VIX Short Term Futures ETN (VXX) starting to move up. Should we buy it? A: Only on dips and only if you expect a dramatic selloff in the stock market very soon, which I do. The (VXX) trade is very high risk. The contango is huge. I tried making money on it a couple of times this year and failed both times; this really is for professional intraday traders in Chicago with an inside look at customer order flows. Retail traders rarely make money on the (VXX) trade—usually, they get killed. Q: Will gold hold up as interest rates rise? A: No, it won’t. Rising interest rates are death for gold and other precious metals. Your gold theory is that interest rates stay lower for longer, which the Fed has essentially already promised us. Q: What do you think of the United States Treasury Bond Fund (TLT)? A: I’m looking to sell shorts in big size as I did in the spring and I’m looking for five-point rallies to sell into. I missed the last one last week because it just rolled over so fast on an opening gap down that you couldn’t get any trade alerts out, and that’s happening more and more. So, if we get going up to $166-$167, that will be a decent short and then you want to be doing something like the $175-$178 vertical bear put spread in October. I don’t think bonds are going to go to 0% interest rates, I think the real range is 50-95 basis points in a 10-year treasury yield. That is your trading range. Q: Do you think big oil (USO) will transform into a low carbon energy industry if Biden wins? A: I’ve been telling big oil that that’s what they’re going to have to do for 20 years. They all read Mad Hedge Fund Trader. And, they always laugh, saying oil will be dominant at least until 2050. Since then, they have become the worst-performing sector of the S&P 500 on a 20-year view, and my thought is that eventually, big oil takes over and buys the entire alternative energy industry, and slowly pulls out of oil. They have the engineering talent to pull it off and they have the cash to make the acquisitions. They will have to reinvent themselves or go out of business, just like everybody else. Q: What could trigger the stock market pullback you mention in your slides? Because the bullish Fed quantitative easing trade is hard to stop. A: It’s like the 2000 top, there was no one thing or even a couple things, that could trigger the top. It’s just the sheer weight of prices and exhaustion of new buyers, and that is impossible to see in advance, so all you can do is watch your charts. One down out of the blue the Dow Average ($INDU) will suddenly drop 1,000 points for no reason. Q: When you say Europe is recovering, which data indicates this? A: Well, when you look at Q2 GDP growth in Europe, they were only down 10% while the US was down 26%. That is purely a result of Europe having a much more aggressive COVID-19 response than the United States. There is no mask debate in Europe, it’s like 100% compliance. Here you have blue states wearing masks and red states not. The result of that, of course, is that the death rate in the red states is about five times higher than it is in blue states, on a per capita basis. That is why the US has the highest infection rate in the world, the highest death rate, and is why we lost an extra 16% of GDP growth in Q2. Q: Will you trade a short Tesla again? A: No, I’ve been hit twice on Tesla shorts in the last six months and we are now in La La land—it’s essentially untradable. I got a lot of people out of Tesla earlier this week, and then they announced their share new $5 billion issue, which they should have done a while ago Q: Is there any way to play the home mortgage refi boom in the stock market with the 30-year mortgages at a record low 2.88%? A: You buy the banks. If you call your bank and ask for a refi quote, it might be a week before they get back to you, they are so busy. Banks are also getting enormous subsidies from all these various lending and stimulus type programs, so money is raining down on them right now. Banks are now the cheapest sector in the market, selling at 6x earnings. It is probably the single greatest sector in the stock market right now to buy. Q: I’ve been holding the ProShares UltraShort 20 year Plus Treasury fund (TBT) and it is moving up and down in the short-range. Should I sell? A: No, I think we have more room to go on the (TBT), I think we could get to $18, which is about a 0.90% yield in the US Treasury bond market. Q: Do you have a target on Tesla? A: Well, my downside target would be its old breakout level. So, divide by five and you get $300. That equates to $1450 in the pre-split price. So, we could have a real monster selloff, like 40%, once this market loses momentum. It’s safe to say don’t buy Tesla up here. Q: Is the ProShares UltraShort S&P 500 ETF (SDS) offering a good entry point here? A: It is as soon as we rollover. In these momentum-driven markets, it’s best to wait for proof of a top before you start getting fancy with short plays. You can see how I got hammered several times in the last month by being too early on my shorts; and fortunately, I was able to hedge out most of those losses. You might not be able to do so. Q: Are you planning on keeping your Fortinet spread? A: Yes, to expiration, which is only 11 days off, unless we get an out-of-the-blue meltdown. Q: Do you like Ali Baba (BABA)? A: Yes; that is essentially a play on a Biden win in the election. If he wins, our war with China will cease and all of the China plays will go ballistic as we return to international trade, which has been powering our economy for the last 70 years. Q: What about cruise lines like Carnival (CCL)? A: I know they’re cheap. They’re selling out their 2021 summer cruises with customers betting that there will be a corona vaccine by then, or simply not caring whether there is a pandemic or not. The dedicated cruisers are desperate to cruise. That’s one reason why these stocks are holding up, but I don’t want to touch them. I think the recovery will take much longer than people realize. Q: When do you buy gold? A: Wait for a bigger dip. Q: Should I be holding gold for the long term? A: Yes; if you don’t want to trade it, just sitting on your position is fine. I think gold eventually goes to 3,000 after hitting an initial target of 2,200. Good Luck and Stay Healthy John Thomas CEO & Publisher The Diary of a Mad Hedge Fund Trader

|

| Quote of the Day “Bonds are now offering return-free risk. I expect a relatively modest return for an extended period of time,” said my former hedge fund investor friend, Leon Cooperman of Omega Family Office.

|

[h=1][FONT=Verdana, Arial, Helvetica, sans-serif]researching a move into the TLT this weekend..This is a flag IMO that the TLT might be primed for a pop.[/FONT]

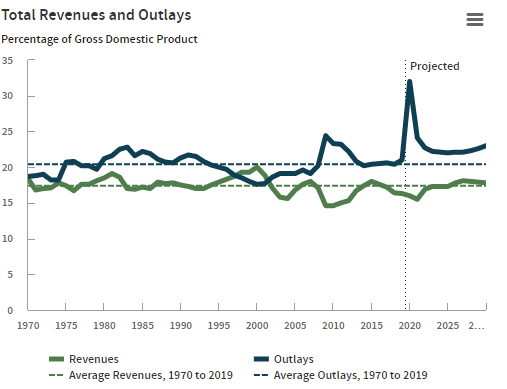

[FONT=Verdana, Arial, Helvetica, sans-serif]CBO budget deficit estimate soars due to economic disruption, pandemic spending[/FONT][/h]Sep. 2, 2020 3:44 PM ET|By: Liz Kiesche, SA News Editor

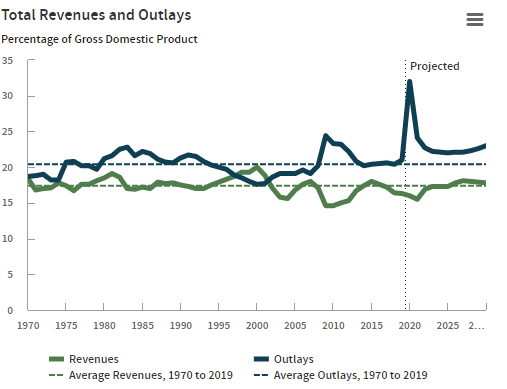

The Congressional Budget Office projects a federal budget deficit of $3.3T in 2020, more than triple that of 2019's shortfall, mostly from the economic disruption caused by COVID-19 pandemic and the ensuing legislative response.

At 16.0% of GDP, the deficit in 2020 would be the largest since 1945. The deficit in 2021 is projected to be 8.6% of GDP.

The deficit estimate for 2020 is $2.2T more than the CBO estimated in March, mostly due to relief legislation enacted in response to the pandemic.

As a result of those deficits, federal debt held by the public is projected to rise to 98% of GDP in 2020 vs. 79% at the end of 2019 and 35% in 2007, before the previous recession started.

CBO's projections put federal debt held by the public over 100% of GDP in 2021 and 107% in 2023, the highest in the U.S.'s history.

The previous peak was in 1946 due to large deficits incurred during WWII. By 2030, CBO sees debt equal to 109% of GDP.

Chart source: CBO.

Dear readers: We recognize that politics often intersects with the financial news of the day, so we invite you to click here to join the separate political discussion.

Previously: CBO sees GDP recovering to pre-pandemic level by mid-2022(July 2)

All PortfoliosBozziePortfolio 1+ Create New Portfolio

Expand Portfolio

U.S. Economy | On the Move

[h=1]Yields erase August's big rise as equities slide[/h]Sep. 3, 2020 11:26 AM ET|About: iShares 20+ Year Treasur... (TLT)|By: Stephen Alpher, SA News Editor

Was it only a week ago when pundits had their eye on a potential breakout in long-dated Treasury yields?

The 10-year Treasury in August had risen from about 0.55% to just shy of 0.8% at the end of last week. It's been falling since, and is down another 3.6 basis point today to 0.611%. TLT +1%, TBT -2%

At the same time, real rates are rising. The 10-year TIPS yield is up 3 basis points to -1.044%. The breakeven inflation spread has now narrowed from 52-week highs around 1.80 to less than 1.66.

The broader iShares U.S. Aggregate Bond ETF (AGG +0.1%).

Today's action comes as some of the speculative fervor lifts from the stock market, with pandemic faves like Apple -7.3%, Tesla -8.6%, Amazon -5%, Microsoft -5.4%, Nvidia -9%.

The Nasdaq at current pixel time is off 4.7% and S&P 500 3.2%.

See all stocks on the move »

[FONT=Verdana, Arial, Helvetica, sans-serif]CBO budget deficit estimate soars due to economic disruption, pandemic spending[/FONT][/h]Sep. 2, 2020 3:44 PM ET|By: Liz Kiesche, SA News Editor

The Congressional Budget Office projects a federal budget deficit of $3.3T in 2020, more than triple that of 2019's shortfall, mostly from the economic disruption caused by COVID-19 pandemic and the ensuing legislative response.

At 16.0% of GDP, the deficit in 2020 would be the largest since 1945. The deficit in 2021 is projected to be 8.6% of GDP.

The deficit estimate for 2020 is $2.2T more than the CBO estimated in March, mostly due to relief legislation enacted in response to the pandemic.

As a result of those deficits, federal debt held by the public is projected to rise to 98% of GDP in 2020 vs. 79% at the end of 2019 and 35% in 2007, before the previous recession started.

CBO's projections put federal debt held by the public over 100% of GDP in 2021 and 107% in 2023, the highest in the U.S.'s history.

The previous peak was in 1946 due to large deficits incurred during WWII. By 2030, CBO sees debt equal to 109% of GDP.

Chart source: CBO.

Dear readers: We recognize that politics often intersects with the financial news of the day, so we invite you to click here to join the separate political discussion.

Previously: CBO sees GDP recovering to pre-pandemic level by mid-2022(July 2)

All PortfoliosBozziePortfolio 1+ Create New Portfolio

Edit

Expand Portfolio

U.S. Economy | On the Move

[h=1]Yields erase August's big rise as equities slide[/h]Sep. 3, 2020 11:26 AM ET|About: iShares 20+ Year Treasur... (TLT)|By: Stephen Alpher, SA News Editor

Was it only a week ago when pundits had their eye on a potential breakout in long-dated Treasury yields?

The 10-year Treasury in August had risen from about 0.55% to just shy of 0.8% at the end of last week. It's been falling since, and is down another 3.6 basis point today to 0.611%. TLT +1%, TBT -2%

At the same time, real rates are rising. The 10-year TIPS yield is up 3 basis points to -1.044%. The breakeven inflation spread has now narrowed from 52-week highs around 1.80 to less than 1.66.

The broader iShares U.S. Aggregate Bond ETF (AGG +0.1%).

Today's action comes as some of the speculative fervor lifts from the stock market, with pandemic faves like Apple -7.3%, Tesla -8.6%, Amazon -5%, Microsoft -5.4%, Nvidia -9%.

The Nasdaq at current pixel time is off 4.7% and S&P 500 3.2%.

See all stocks on the move »

This is the reason the 110 Mill was raised recently..Hold this and you win.

Improving Online Experiences, Workflows and Customized Content Delivery Just Got Easier With Limelight Networks’ New EdgeFunctions

Limelight Networks, Inc. (Nasdaq: LLNW), a leading provider of content delivery network (CDN) and edge cloud services, has expanded its edge capabilities by launching EdgeFunctions, a new serverless compute service which allows developers to tap into the power of the companys global network and gives them the flexibility to deploy and run their own code.

Limelight Networks, Inc. (Nasdaq: LLNW), a leading provider of content delivery network (CDN) and edge cloud services, has expanded its edge capabilities by launching EdgeFunctions, a new serverless compute service which allows developers to tap into the power of the companys global network and gives them the flexibility to deploy and run their own code.

EdgeFunctions provides a customizable environment at the network edge for streamlining content workflows, performing time-sensitive decisions, and customizing user experiences. Providing this environment at the network edge offers Limelights low latency, on-demand scalability and high-performance network to developers. EdgeFunctions is ideal for streaming video and content delivery use cases such as personalized streaming, content protection, dynamic ad insertion, A/B testing, and image manipulation. Functions are globally available in Limelights highly distributed network and run closest to where content requests are received, ensuring Limelights lowest possible latency for code execution and optimal user experiences.

We are thrilled to partner with Limelight to integrate our NexGuard Streaming forensic watermarking technology with EdgeFunctions and safeguard a premium OTT providers content from leaks and piracy, said Jean-Philippe Plantevin, VP Anti-Piracy at NAGRA, a leading provider of content protection and multiscreen TV solutions. Using EdgeFunctions, we were able to quickly deploy our customized solution into Limelights network edge locations and run them on demand, at scale, for both VOD and live OTT watermarking workflows.

EdgeFunctions leverages Limelights global network to put flexibility and power directly into the hands of developers with support for several programming languages including Node.js, Python and Go. Its APIs enable these developers to manage, deploy and run their functions at the network edge and take advantage of Limelights direct peering connections with more than 1,000 ISPs and leading public cloud providers.

Edge technology and solutions are rapidly expanding to meet a diverse set of customer needs. Limelight has an extensive global network with edge locations across the globe, said Dave McCarthy, Research Director, Edge Strategies at IDC. Giving developers more dynamic control over content combined with Limelights extensive global network optimizes the delivery of video at the edge.

EdgeFunctions is Limelights latest innovation in the companys edge compute solutions. These edge compute solutions now include serverless, virtual machine and bare metal solutions, providing edge compute capabilities how and where customers need them. In 2018 Limelight launched its first Edge Compute offering that allowed customers to access a highly connected environment that delivers low latency by combining globally distributed compute power with Limelight’s high-performance network.

Weve evolved beyond high performing online video delivery with new innovative solutions to enhance online experiences and provide real value to our customers in ways that only we can. Now developers have the power to create and run bandwidth-intensive, latency-sensitive applications throughout our network edge, said Bob Lento, CEO at Limelight. Our extensive Edge Compute offering coupled with EdgeFunctions provides one of the most comprehensive content delivery and edge tool sets available today, and we have a robust development pipeline with much more to come. Im thrilled to provide these services to the worlds leading companies.

About Limelight

Limelight Networks, Inc. (NASDAQ: LLNW) is a global leader in delivering the highest quality online video experiences and edge-enabled workflows. Limelight has successfully helped launch and grow the largest video properties in the world and is on the forefront of enabling a new generation of applications that will disrupt markets and change our world.

Press

Stephanie Epstein

SHIFT Communications

Limelight@shiftcomm.com

617-779-1800

Improving Online Experiences, Workflows and Customized Content Delivery Just Got Easier With Limelight Networks’ New EdgeFunctions

EdgeFunctions provides a customizable environment at the network edge for streamlining content workflows, performing time-sensitive decisions, and customizing user experiences. Providing this environment at the network edge offers Limelights low latency, on-demand scalability and high-performance network to developers. EdgeFunctions is ideal for streaming video and content delivery use cases such as personalized streaming, content protection, dynamic ad insertion, A/B testing, and image manipulation. Functions are globally available in Limelights highly distributed network and run closest to where content requests are received, ensuring Limelights lowest possible latency for code execution and optimal user experiences.

We are thrilled to partner with Limelight to integrate our NexGuard Streaming forensic watermarking technology with EdgeFunctions and safeguard a premium OTT providers content from leaks and piracy, said Jean-Philippe Plantevin, VP Anti-Piracy at NAGRA, a leading provider of content protection and multiscreen TV solutions. Using EdgeFunctions, we were able to quickly deploy our customized solution into Limelights network edge locations and run them on demand, at scale, for both VOD and live OTT watermarking workflows.

EdgeFunctions leverages Limelights global network to put flexibility and power directly into the hands of developers with support for several programming languages including Node.js, Python and Go. Its APIs enable these developers to manage, deploy and run their functions at the network edge and take advantage of Limelights direct peering connections with more than 1,000 ISPs and leading public cloud providers.

Edge technology and solutions are rapidly expanding to meet a diverse set of customer needs. Limelight has an extensive global network with edge locations across the globe, said Dave McCarthy, Research Director, Edge Strategies at IDC. Giving developers more dynamic control over content combined with Limelights extensive global network optimizes the delivery of video at the edge.

EdgeFunctions is Limelights latest innovation in the companys edge compute solutions. These edge compute solutions now include serverless, virtual machine and bare metal solutions, providing edge compute capabilities how and where customers need them. In 2018 Limelight launched its first Edge Compute offering that allowed customers to access a highly connected environment that delivers low latency by combining globally distributed compute power with Limelight’s high-performance network.

Weve evolved beyond high performing online video delivery with new innovative solutions to enhance online experiences and provide real value to our customers in ways that only we can. Now developers have the power to create and run bandwidth-intensive, latency-sensitive applications throughout our network edge, said Bob Lento, CEO at Limelight. Our extensive Edge Compute offering coupled with EdgeFunctions provides one of the most comprehensive content delivery and edge tool sets available today, and we have a robust development pipeline with much more to come. Im thrilled to provide these services to the worlds leading companies.

About Limelight

Limelight Networks, Inc. (NASDAQ: LLNW) is a global leader in delivering the highest quality online video experiences and edge-enabled workflows. Limelight has successfully helped launch and grow the largest video properties in the world and is on the forefront of enabling a new generation of applications that will disrupt markets and change our world.

Press

Stephanie Epstein

SHIFT Communications

Limelight@shiftcomm.com

617-779-1800

|

| Global Market Comments September 9, 2020 Fiat Lux Featured Trade: (A VERY BRIGHT SPOT IN REAL ESTATE)

|

| � |

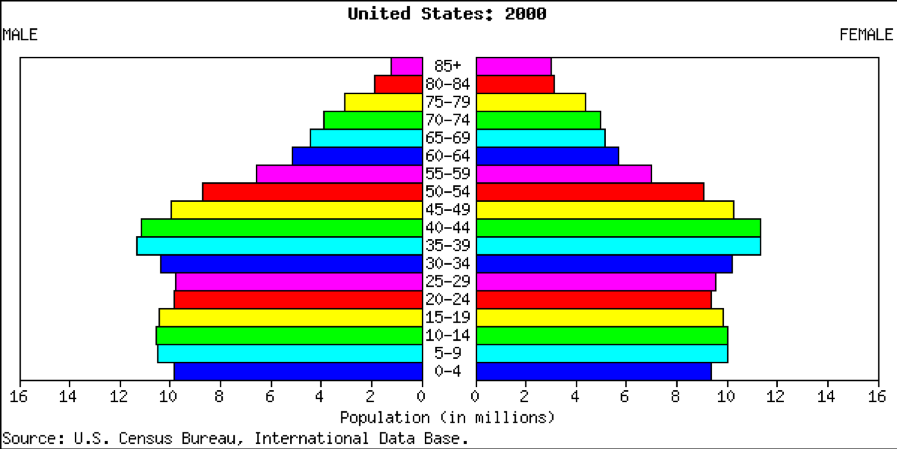

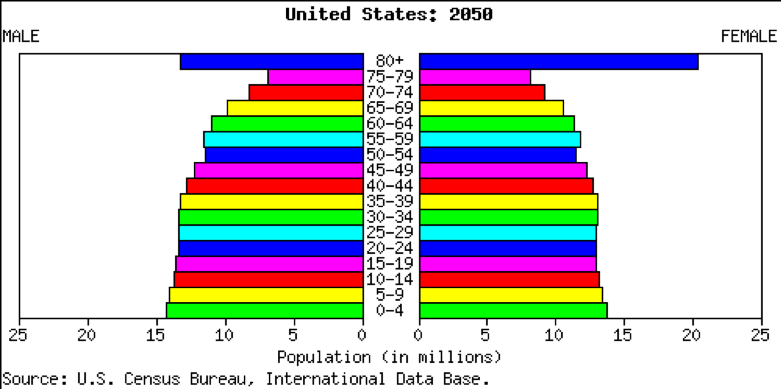

A Very Bright Spot in Real Estate I feel obliged to reveal one corner of this bubbling market that might actually make sense.By 2050 the population of California will soar from 39 million to 50 million, and that of the US from 330 million to 400 million, according to data released by the US Census Bureau and the CIA Fact Book (check out the two population pyramids below). That means enormous demand for the low end of the housing market, apartments in multi-family dwellings. Many of our new citizens will be cash-short immigrants. They will be joined by generational demand for limited rental housing by 65 million Gen Xers and 85 million Millennials enduring a lower standard of living than their parents and grandparents. These people aren't going to be living in cardboard boxes under freeway overpasses. If you have any millennial kids of your own (I have three!), you may have noticed that they are far less acquisitive and materialistic than earlier generations. They would rather save their money for a new iPhone than a mortgage payment. Car ownership is plunging, as the “sharing” economy takes over. This explains why the number of first-time homebuyers, only 32% of the current market now, is near the lowest on record. It’s not like they could buy if they wanted to. Remember that this generation is almost the most indebted in history, with $1.6 trillion in student loans outstanding. They don’t care. Coming of age since the financial crisis, to them, home ownership means falling prices, default, and bankruptcy. Bring on the “renter” generation! The trend towards apartments also fits neatly with the downsizing needs of 85 million retiring Baby Boomers. As they age, boomers are moving from an average home size of 2,500 sq. ft. down to 1,000 sq ft condos and eventually 100 sq. ft. rooms in assisted living facilities. The cumulative shrinkage in demand for housing amounts to about 4 billion sq. ft. a year, the equivalent of a city the size of San Francisco. In the aftermath of the economic collapse, rents are now rising dramatically, and vacancies rates are shrinking, boosting cash flows for apartment building owners. Fannie Mae and Freddie Mac Financing is still abundantly available at the lowest interest rates on record. Institutions combing the landscape for low volatility cash flows and limited risk are starting to pour money in. Run the numbers on the multi-dwelling investment opportunities in your town. You’ll find that the net after-tax yields beat almost anything available in the financial markets.

|

Quote of the Day "The difference between a Tesla and all of its competitors is the difference between an iPod and a cassette player," said Harvard Law fellow Vivek Wadhwa.

|

Limelight Networks - Tortoise And The Hare

Sep. 10, 2020 8:48 AM ET|About: Limelight Networks, Inc. (LLNW), Includes: AKAM, FSLY

Summary

LLNW's CSO Sajid Malhotra did a video chat with analysts from DA Davidson yesterday (09-09-2020) after the close. Four more presentations are scheduled with firms next week.

Malhotra - former CFO - strongly believed in the mid-pt to high-end of revenue growth of mid teens % given their use of a 70% haircut to the sales funnel/pipeline.

Edge Compute, recently enhanced only days ago, is at a $10MM annual run rate and expected to account for 5% of 15% annual growth, suggesting it will growth 100%-200% annually.

Edge Compute will boost margins and growth, jack up customer spend, and reduce churn due to higher value add to retail subscribers of LLNW's OTT/gaming channel (e.g., AMZN, HBO (T), Peacock (CMCSA), DIS, etc.

Malhotra indicated an outsize customer win - mentioned on the last earnings call - will be announced by their marketing dept. in the future. End use cases for Edge Compute will soon be revealed as they evolve their video focused CDN into the devops world where higher multiple competitors AKAM FSLY have generated radical investor interest. Malhotra found the valuation gap and multiple gap between LLNW and FSLY as curious given LLNW is profitable which high revenue per account, accelerating growth to record levels for the Company, and similar scale whereas FSLY loses money on the botton line. We couldn't agree more - FSLY at $8BN or 30x sales versus LLNW $700MM or 3x sales is an absurd valuation gap. We reiterate our STRONG BUY recommendation and $16 target price, which in this market (and historically) is a more reasonable $2.4BN EV or 10x sales.

LLNW DA Davidson Video 09-09-2020

LLNW DA Davidson Video 09-09-2020

DA Davidson 19th Annual Software & Internet Virtual Conference

LLNW Investor Relations Information - Four Presentations Next Week

Home | Limelight Network

LLNW Cap Table @ $5.31 (09-09-2020 close)

LLNW_cap_table.pdf

LLNW Cap Table @ $16 (10x Revenues - > 50% Discount To FSLY Multiple)

Sep. 10, 2020 8:48 AM ET|About: Limelight Networks, Inc. (LLNW), Includes: AKAM, FSLY

Summary

LLNW's CSO Sajid Malhotra did a video chat with analysts from DA Davidson yesterday (09-09-2020) after the close. Four more presentations are scheduled with firms next week.

Malhotra - former CFO - strongly believed in the mid-pt to high-end of revenue growth of mid teens % given their use of a 70% haircut to the sales funnel/pipeline.

Edge Compute, recently enhanced only days ago, is at a $10MM annual run rate and expected to account for 5% of 15% annual growth, suggesting it will growth 100%-200% annually.

Edge Compute will boost margins and growth, jack up customer spend, and reduce churn due to higher value add to retail subscribers of LLNW's OTT/gaming channel (e.g., AMZN, HBO (T), Peacock (CMCSA), DIS, etc.

Malhotra indicated an outsize customer win - mentioned on the last earnings call - will be announced by their marketing dept. in the future. End use cases for Edge Compute will soon be revealed as they evolve their video focused CDN into the devops world where higher multiple competitors AKAM FSLY have generated radical investor interest. Malhotra found the valuation gap and multiple gap between LLNW and FSLY as curious given LLNW is profitable which high revenue per account, accelerating growth to record levels for the Company, and similar scale whereas FSLY loses money on the botton line. We couldn't agree more - FSLY at $8BN or 30x sales versus LLNW $700MM or 3x sales is an absurd valuation gap. We reiterate our STRONG BUY recommendation and $16 target price, which in this market (and historically) is a more reasonable $2.4BN EV or 10x sales.

LLNW DA Davidson Video 09-09-2020

LLNW DA Davidson Video 09-09-2020DA Davidson 19th Annual Software & Internet Virtual Conference

LLNW Investor Relations Information - Four Presentations Next Week

Home | Limelight Network

LLNW Cap Table @ $5.31 (09-09-2020 close)

LLNW_cap_table.pdf

LLNW Cap Table @ $16 (10x Revenues - > 50% Discount To FSLY Multiple)

| � |

|

| Global Market Comments September 10, 2020 Fiat Lux SPECIAL EARLY RETIREMENT ISSUE

Featured Trade: (HOW TO JOIN THE EARLY RETIREMENT STAMPEDE)

|

| � |

How to Join the Early Retirement Stampede There is a new social movement taking place which you probably haven’t heard about.Increasing numbers of people, especially Millennials, are engineering their personal finances to make early retirement possible. I’m not talking about hanging it up at 60, 55, or even 50. I’m talking extreme early retirement, like 45, 40, or even 30! I stumbled across a free app the other day at NerdWallet, and started playing around with a compound interest calculator to see just how much you had to save on a monthly basis to make such incredible early retirements possible. What I discovered was amazing. To check it out, please click here. And here is the big revelation. Assuming that you started saving at the age of 20, you only need to bank $2,150 a month to reach $1 million in retirement savings by the age of 40. If you earn the country’s average wage of $60,000 a year, and you’re paying $1,000 a month in taxes, that means you only have $1,850 a month left to handle housing, health care, education, transportation, and food. Key to becoming a savings hog is to get off the consumer spending treadmill we have all been trained to plod since birth. You don’t have to endlessly upgrade to ever larger McMansions, especially now that the SALT deductions are gone. You don’t have to buy a new $50,000 car every three years either. Just buy a junk heap for $5,000 and run it forever. It’s amazing how much gas, insurance, maintenance, and interest payments can add up. I recommend a Toyota Corolla. They last forever. And what is the most expensive luxury of all? Kids. Raising a child today cost a minimum of $250,000, and that assumes they don’t go to an ivy league college. I know because I have five. A lot of Millennials are downsizing to one child, or none at all, and putting that quarter million towards their early retirement fund. If you live here in the San Francisco Bay Area, this would mean living in a cardboard box under a freeway overpass. However, an increasing number of Millennials are engaging in what I call “income/expense” arbitrage. Earn your income in an expensive city, like San Francisco, San Jose, or New York, but live in a cheap place like Reno, NV, Charlotte, NC, or Cedar Rapids, IA. In that case, banking your $2,150 a month is a piece of cake. Those who work online, about 25% of the bay area population now, have a particular advantage here. With a decent broadband connection, you can work anywhere. Companies are going out of their way to facilitate this trend, requiring office attendance only on Tuesday to Thursday and permitting telecommuting on Monday and Friday. That enables distant, even interstate commutes. I have a Bay Area dentist who commutes from Santa Barbara 300 miles away every week on this schedule. You can even do this at an international level. A couple can live like a king in Budapest, Hungary for $1,000 a month, and in a beachfront home in Albania for $500. With that kind of overhead early retirement become a realistic short-term objective. Once you retire, you will have to live on $60,000 a year, or $5,000 a month, eminently doable in most of the country, not including your social security payments or taxes. And with national healthcare in the US likely over the next 20 years, healthcare costs are about to fall dramatically. Provided you don’t pursue expensive hobbies like my retired friends, such collecting vintage cars, racing horses, joining expensive golf clubs, or flying around in private jets, you should be able to live within these modest means. How about camping? That's almost free! Of course, you can’t live on the coasts for $60,000 a year. But you can do so easily in the heartland. That explains why California and New York home prices have been dead in the water for the last two years, while the Midwest is seeing a renaissance in regional home prices at one third the cost. You don’t have to completely retire either. Instead, you could abandon the pressure cooker that is high tech today and downgrade to a small business, open a restaurant, or turn a hobby into a full-time job. (A laid off FedEx worker I met became a fly-fishing guide and helped me catch that 24 inch trout in Nevada). It goes without saying that if this trend continues, there are major consequences for the economy, markets, and society that boggle the mind. Greatly higher savings rates will drive prices up and yields down on all investments. The US birthrate is already well below the replacement rate at 2.1 per couple. Drive it lower and we could get trapped in the Japan quicksand of an ever-shrinking population. That means fewer consumers and economic stagnation. Reducing working lives from 47 to only 20 years will inevitably create worker shortages, driving up wages an inflation. There are a few problems with the ultra-early retirement strategy. The 6% return available today with relatively low risk investments may not be available in a year or two. That would be the result of global quantitative easing that is taking interest rates down to zero everywhere. This is crushing the investment returns for new retirees. As a result, instead of needing $1 million to generate a $60,000 annual income, you might need $2 million or more. I have been watching this happen to retirees in Japan for nearly 30 years, where interest rates have been near zero since the 1990s. How much do you need to save each month if you want to retire at 30? Better start banking $6,050 a month. It may be time to upgrade your sleeping bag.

|

Quote of the Day If the 2020 election was a math problem, it would read like this. “If you’re going down a river at 20 miles per hour and your canoe loses a wheel, how much pancake mix would it require to re-shingle your roof.”

|

LLNW tweet.

Interesting as they haven't officially announced they'd be streaming this for Amazon.

Till now?

https://twitter.com/llnw/status/1304077767651274752?s=20

Interesting as they haven't officially announced they'd be streaming this for Amazon.

Till now?

https://twitter.com/llnw/status/1304077767651274752?s=20