You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Intersting thoughts

- Thread starter Bozzie

- Start date

LLNW has gone up the day prior to earnings every quarter and drops like a rock the day of earnings.

Yes, that is the long history after earnings..I mentioned this was the case.

I'm not worried.. again 25% growth X3 sales ..just look at the peers in the group.

There is Value here .I'm not doing the volume of trades you are..I like holding for some period of time.

I've been caught doing what you and SM are doing .I've had poor luck day trading.. it's a skill I don't have plus pushing the amounts of money around to make profits on small moves aren't worth it to me..I like what you guys do, seems exciting and smartmoney knows his shit...just not my thing but good luck!

I'm happy to ride it out if I believe in something.

I love doing research but I'm not a chartist in anyway.

Global Market Comments

July 21, 2020

Fiat LuxFeatured Trade:(A REFRESHER COURSE AT SHORT SELLING SCHOOL),

(SH), (SDS), (PSQ), (DOG), (RWM), (SPXU), (AAPL), (TSLA),

(VIX), (VXX), (IPO), (MTUM), (SPHB), (HDGE)

July 21, 2020

Fiat LuxFeatured Trade:(A REFRESHER COURSE AT SHORT SELLING SCHOOL),

(SH), (SDS), (PSQ), (DOG), (RWM), (SPXU), (AAPL), (TSLA),

(VIX), (VXX), (IPO), (MTUM), (SPHB), (HDGE)

Short Selling School 101

$1 trillion is about to hit the stock market if another government stimulus package passes in July. So far, most stimulus has ended up in the stock market, one way or the other.

Perhaps that is why we saw a golden cross in the S&P 500 weeks ago, where the 50-day moving average rose sharply through the 200-day moving average. That is usually a bullish signal.The problem is that everyone knows this, and there are more important issues to consider.

The stock market is now more overpriced than it has been over the last 20 years when the Dotcom Bubble exploded. The (SPY) has risen and an unprecedented 40% in four months.

And the pandemic is triggering a secondary shutdown of much of the economy, trashing the most optimistic “V” shaped recovery scenarios.

We are also solidly into the high risk, low return time of the year from May to November. Historically, the total return for stocks this time of year for the past 70 years is precisely zero.

I, therefore, think it is timely to review how to make money when prices are falling. I call it Short Selling School 101.

I don’t think we are going to crash to new lows from here, maybe drop only 10%-20%. So, some of the most aggressive bearish strategies described below won’t be appropriate.

If you are long stocks in general a low-risk hedge for you might be to sell short the August S&P 500 August 21, 2020, $340 call options for $1.40. If stocks plunge, you have some downside cushion ($1.40 X 100) = $140 in cash. Sell short one call option for every 100 shares of (SPY) you own. If stocks rise and your stock gets called away 6% higher you will think you died and went to heaven. Just buy them back on the next dip.

If the bear move extends you can simply repeat this gesture every month until the cows come home.

If you have big positions in single stocks, like Tesla (TSLA) or Apple (AAPL), you can execute the same kind of strategy. Selling short the Tesla August 21, 2020 $2,000 call option for $70.00 to hedge an existing long in the stock look like the no brainer here. You should sell one option contract for every 100 shares you own to bring in ($70.00 X 100) = $7,000 in cash.

There is nothing worse than closing the barn door after the horses have bolted or hedging after markets have crashed.

No doubt, you will receive a wealth of short selling and hedging ideas from your other research sources and the media right at the next market bottom.

That is always how it seems to play out, great closing the barn doors after the horses have bolted.

So I am going to get you out ahead of the curve, putting you through a refresher course on how to best trade falling markets now, while stock prices are still rich.

I’m not saying that you should sell short the market right here. But there will come a time when you will need to do so.

Watch my Trade Alerts for the best market timing. So here are the best ways to profit from declining stock prices, broken down by security type:

Bear ETFs

Of course, the granddaddy of them all is the ProShares Short S&P 500 Fund (SH), a non-leveraged bear ETF that is supposed to match the fall in the S&P 500 point for point on the downside. Hence, a 10% decline in the (SPY) is supposed to generate a 10% gain in the (SH).

In actual practice, it doesn’t work out like that. The ITF has to pay management operating fees and expenses, which can be substantial. After all, nobody works for free.

There is also the “cost of carry,” whereby owners have to pay the price for borrowing and selling short shares. They are also liable for paying the quarterly dividends for the shares they have borrowed, around 2% a year. And then you have to pay the commissions and spread for buying the ETF.

Still, individuals can protect themselves from downside exposure in their core portfolios through buying the (SH) against it (click here for the prospectus). Short selling is not cheap. But it’s better than watching your gains of the past seven years go up in smoke.

Virtual all equity indexes now have bear ETFs. Some of the favorites include the (PSQ), a short play on the NASDAQ (click here for the prospectus), and the (DOG), which profits from a plunging Dow Average (click here for the prospectus).

My favorite is the (RWM) a short play on the Russell 2000, which falls 1.5X faster than the big cap indexes in bear markets (click here for the prospectus).

Leveraged Bear ETFs

My favorite is the ProShares UltraShort S&P 500 (SDS), a 2X leveraged ETF (click here for the prospectus). A 10% decline in the (SPY) generates a 20% profit, maybe.

Keep in mind that by shorting double the market, you are liable for double the cost of shorting, which can total 5% a year or more. This shows up over time in the tracking error against the underlying index. Therefore, you should date, not marry this ETF, or you might be disappointed.

3X Leveraged Bear ETF

The 3X bear ETFs, like the UltraPro Short S&P 500 (SPXU), are to be avoided like the plague (click here for the prospectus).

First, you have to be pretty good to cover the 8% cost of carry embedded in this fund. They also reset the amount of index they are short at the end of each day, creating an enormous tracking error.

Eventually, they all go to zero and have to be periodically redenominated to keep from doing so. Dealing spreads can be very wide, further added to costs.

Yes, I know the charts can be tempting. Leave these for the professional hedge fund intraday traders for which they are meant.

Buying Put Options

For a small amount of capital, you can buy a ton of downside protection. For example, the April (SPY) $182 puts I bought for $4,872 on Thursday allows me to sell short $145,600 worth of large-cap stocks at $182 (8 X 100 X $6.09).

Go for distant maturities out several months to minimize time decay and damp down daily price volatility. Your market timing better is good with these because when the market goes against you, put options can go poof and disappear pretty quickly.

That’s why you read this newsletter.

Selling Call Options

One of the lowest risk ways to coin it in a market heading south is to engage in “buy writes.” This involves selling short call options against stock you already own but may not want to sell for tax or other reasons.

If the market goes sideways or falls, and the options expire worthless, then the average cost of your shares is effectively lowered. If the shares rise substantially they get called away, but at a higher price so you make more money. Then you just buy them back on the next dip. It is a win-win-win.

Selling Futures

This is what the pros do, as futures contracts trade on countless exchanges around the world for every conceivable stock index or commodity. It is easy to hedge out all of the risks for an entire portfolio of shares by simply selling short futures contracts for a stock index.

For example, let’s say you have a portfolio of predominantly large-cap stocks worth $100,000. If you sell short 1 June 2016 contract for the S&P 500 against it, you will eliminate most of the potential losses for your portfolio in a falling market.

The margin requirement for one contract is only $5,000. However, if you are short the futures and the market rises, then you have a big problem, and the losses can prove ruinous.

But most individuals are not set up to trade futures. The educational, financial, and disclosure requirements are beyond mom-and-pop investing for their retirement fund.

Most 401Ks and IRAs don’t permit the inclusion of futures contracts. Only 25% of the readers of this letter trade the futures market. Regulators do whatever they can to keep the uninitiated and untrained away from this instrument.

That said, get the futures markets right, and it is the quickest way to make a fortune if your market direction is correct.

Buying Volatility

Volatility (VIX) is a mathematical construct derived from how much the S&P 500 moves over the next 30 days. You can gain exposure to it through buying the iPath S&P 500 VIX Short-Term Futures ETN (VXX) or buying call and put options on the (VIX) itself.

If markets fall, volatility rises, and if markets rise, then volatility falls. You can, therefore, protect a stock portfolio from losses through buying the (VIX).

I have written endlessly about the (VIX) and its implications over the years. For my latest in-depth piece with all the bells and whistles, please read “Buy Flood Insurance With the (VIX)” by clicking here.

Selling Short IPOs

Another way to make money in a down market is to sell short recent initial public offerings. These tend to go down much faster than the main market. That’s because many are held by hot hands, known as “flippers,” don’t have a broad institutional shareholder base.

Many of the recent ones don’t make money and are based on an, as yet, unproven business model. These are the ones that take the biggest hits.

Individual IPO stocks can be tough to follow to sell short. But one ETF has done the heavy lifting for you. This is the Renaissance IPO ETF (click here for the prospectus). As you can tell from the chart below, (IPO) was warning that trouble was headed out way since the beginning of March. So far, a 6% drop in the main indexes has generated a 20% fall in (IPO).

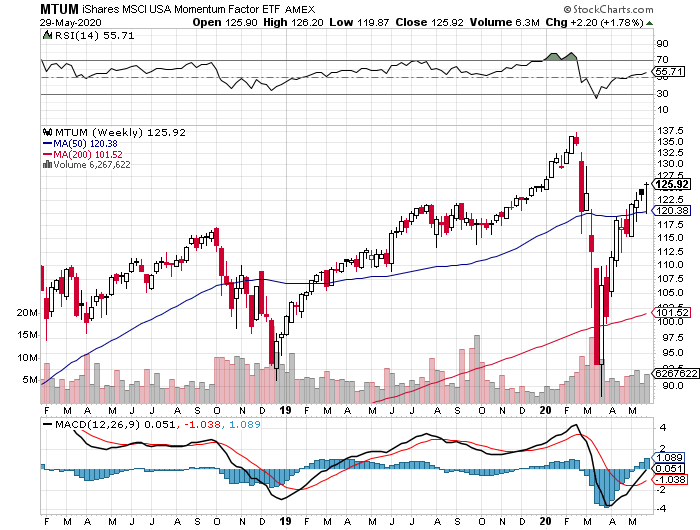

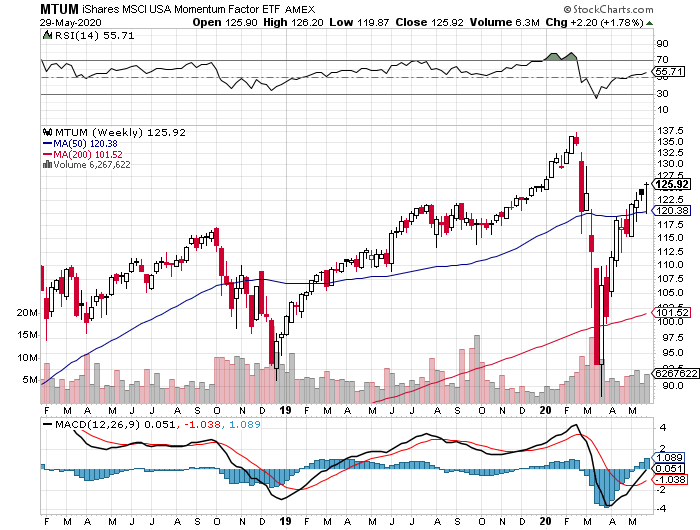

Buying Momentum

This is another mathematical creation based on the number of rising days over falling days. Rising markets bring increasing momentum while falling markets produce falling momentum.

So, selling short momentum produces additional protection during the early stages of a bear market. Blackrock has issued a tailor-made ETF to capture just this kind of move through its iShares MSCI Momentum Factor ETF (MTUM). To learn more, please read the prospectus by clicking here.

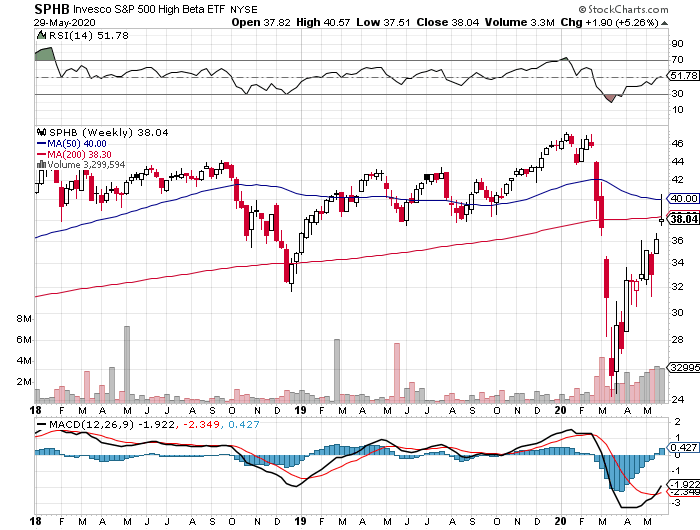

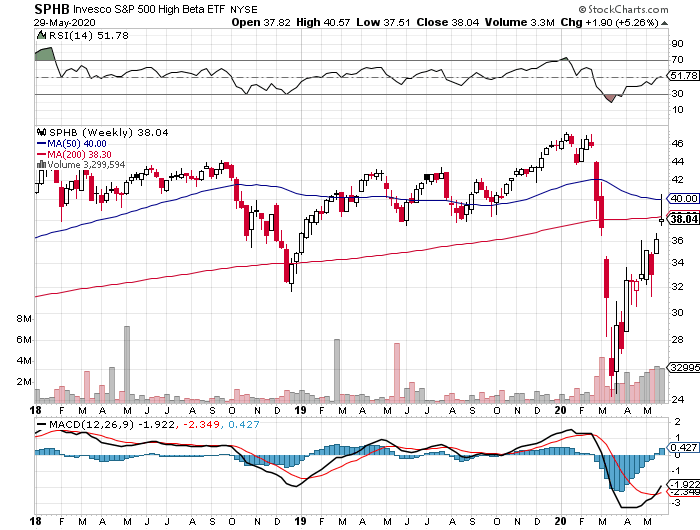

Buying Beta

Beta, or the magnitude of share price movements, also declines in down markets. So, selling short beta provides yet another form of indirect insurance. The PowerShares S&P 500 High Beta Portfolio ETF (SPHB) is another niche product that captures this relationship.

The Index is compiled, maintained and calculated by Standard & Poor's and consists of the 100 stocks from the (SPX) with the highest sensitivity to market movements, or beta, over the past 12 months.

The Fund and the Index are rebalanced and reconstituted quarterly in February, May, August, and November. To learn more, read the prospectus by clicking here.

Buying Bearish Hedge Funds

Another subsector that does well in plunging markets is publicly listed bearish hedge funds. There is a couple of these that are publicly listed and have already started to move.

One is the Advisor Shares Active Bear ETF (HDGE) (click here for the prospectus). Keep in mind that this is an actively managed fund, not an index or mathematical relationship, so the volatility could be large.

[h=2]Oops, Forgot to Hedge[/h]

[h=2]Oops, Forgot to Hedge[/h]

$1 trillion is about to hit the stock market if another government stimulus package passes in July. So far, most stimulus has ended up in the stock market, one way or the other.

Perhaps that is why we saw a golden cross in the S&P 500 weeks ago, where the 50-day moving average rose sharply through the 200-day moving average. That is usually a bullish signal.The problem is that everyone knows this, and there are more important issues to consider.

The stock market is now more overpriced than it has been over the last 20 years when the Dotcom Bubble exploded. The (SPY) has risen and an unprecedented 40% in four months.

And the pandemic is triggering a secondary shutdown of much of the economy, trashing the most optimistic “V” shaped recovery scenarios.

We are also solidly into the high risk, low return time of the year from May to November. Historically, the total return for stocks this time of year for the past 70 years is precisely zero.

I, therefore, think it is timely to review how to make money when prices are falling. I call it Short Selling School 101.

I don’t think we are going to crash to new lows from here, maybe drop only 10%-20%. So, some of the most aggressive bearish strategies described below won’t be appropriate.

If you are long stocks in general a low-risk hedge for you might be to sell short the August S&P 500 August 21, 2020, $340 call options for $1.40. If stocks plunge, you have some downside cushion ($1.40 X 100) = $140 in cash. Sell short one call option for every 100 shares of (SPY) you own. If stocks rise and your stock gets called away 6% higher you will think you died and went to heaven. Just buy them back on the next dip.

If the bear move extends you can simply repeat this gesture every month until the cows come home.

If you have big positions in single stocks, like Tesla (TSLA) or Apple (AAPL), you can execute the same kind of strategy. Selling short the Tesla August 21, 2020 $2,000 call option for $70.00 to hedge an existing long in the stock look like the no brainer here. You should sell one option contract for every 100 shares you own to bring in ($70.00 X 100) = $7,000 in cash.

There is nothing worse than closing the barn door after the horses have bolted or hedging after markets have crashed.

No doubt, you will receive a wealth of short selling and hedging ideas from your other research sources and the media right at the next market bottom.

That is always how it seems to play out, great closing the barn doors after the horses have bolted.

So I am going to get you out ahead of the curve, putting you through a refresher course on how to best trade falling markets now, while stock prices are still rich.

I’m not saying that you should sell short the market right here. But there will come a time when you will need to do so.

Watch my Trade Alerts for the best market timing. So here are the best ways to profit from declining stock prices, broken down by security type:

Bear ETFs

Of course, the granddaddy of them all is the ProShares Short S&P 500 Fund (SH), a non-leveraged bear ETF that is supposed to match the fall in the S&P 500 point for point on the downside. Hence, a 10% decline in the (SPY) is supposed to generate a 10% gain in the (SH).

In actual practice, it doesn’t work out like that. The ITF has to pay management operating fees and expenses, which can be substantial. After all, nobody works for free.

There is also the “cost of carry,” whereby owners have to pay the price for borrowing and selling short shares. They are also liable for paying the quarterly dividends for the shares they have borrowed, around 2% a year. And then you have to pay the commissions and spread for buying the ETF.

Still, individuals can protect themselves from downside exposure in their core portfolios through buying the (SH) against it (click here for the prospectus). Short selling is not cheap. But it’s better than watching your gains of the past seven years go up in smoke.

Virtual all equity indexes now have bear ETFs. Some of the favorites include the (PSQ), a short play on the NASDAQ (click here for the prospectus), and the (DOG), which profits from a plunging Dow Average (click here for the prospectus).

My favorite is the (RWM) a short play on the Russell 2000, which falls 1.5X faster than the big cap indexes in bear markets (click here for the prospectus).

Leveraged Bear ETFs

My favorite is the ProShares UltraShort S&P 500 (SDS), a 2X leveraged ETF (click here for the prospectus). A 10% decline in the (SPY) generates a 20% profit, maybe.

Keep in mind that by shorting double the market, you are liable for double the cost of shorting, which can total 5% a year or more. This shows up over time in the tracking error against the underlying index. Therefore, you should date, not marry this ETF, or you might be disappointed.

3X Leveraged Bear ETF

The 3X bear ETFs, like the UltraPro Short S&P 500 (SPXU), are to be avoided like the plague (click here for the prospectus).

First, you have to be pretty good to cover the 8% cost of carry embedded in this fund. They also reset the amount of index they are short at the end of each day, creating an enormous tracking error.

Eventually, they all go to zero and have to be periodically redenominated to keep from doing so. Dealing spreads can be very wide, further added to costs.

Yes, I know the charts can be tempting. Leave these for the professional hedge fund intraday traders for which they are meant.

Buying Put Options

For a small amount of capital, you can buy a ton of downside protection. For example, the April (SPY) $182 puts I bought for $4,872 on Thursday allows me to sell short $145,600 worth of large-cap stocks at $182 (8 X 100 X $6.09).

Go for distant maturities out several months to minimize time decay and damp down daily price volatility. Your market timing better is good with these because when the market goes against you, put options can go poof and disappear pretty quickly.

That’s why you read this newsletter.

Selling Call Options

One of the lowest risk ways to coin it in a market heading south is to engage in “buy writes.” This involves selling short call options against stock you already own but may not want to sell for tax or other reasons.

If the market goes sideways or falls, and the options expire worthless, then the average cost of your shares is effectively lowered. If the shares rise substantially they get called away, but at a higher price so you make more money. Then you just buy them back on the next dip. It is a win-win-win.

Selling Futures

This is what the pros do, as futures contracts trade on countless exchanges around the world for every conceivable stock index or commodity. It is easy to hedge out all of the risks for an entire portfolio of shares by simply selling short futures contracts for a stock index.

For example, let’s say you have a portfolio of predominantly large-cap stocks worth $100,000. If you sell short 1 June 2016 contract for the S&P 500 against it, you will eliminate most of the potential losses for your portfolio in a falling market.

The margin requirement for one contract is only $5,000. However, if you are short the futures and the market rises, then you have a big problem, and the losses can prove ruinous.

But most individuals are not set up to trade futures. The educational, financial, and disclosure requirements are beyond mom-and-pop investing for their retirement fund.

Most 401Ks and IRAs don’t permit the inclusion of futures contracts. Only 25% of the readers of this letter trade the futures market. Regulators do whatever they can to keep the uninitiated and untrained away from this instrument.

That said, get the futures markets right, and it is the quickest way to make a fortune if your market direction is correct.

Buying Volatility

Volatility (VIX) is a mathematical construct derived from how much the S&P 500 moves over the next 30 days. You can gain exposure to it through buying the iPath S&P 500 VIX Short-Term Futures ETN (VXX) or buying call and put options on the (VIX) itself.

If markets fall, volatility rises, and if markets rise, then volatility falls. You can, therefore, protect a stock portfolio from losses through buying the (VIX).

I have written endlessly about the (VIX) and its implications over the years. For my latest in-depth piece with all the bells and whistles, please read “Buy Flood Insurance With the (VIX)” by clicking here.

Another way to make money in a down market is to sell short recent initial public offerings. These tend to go down much faster than the main market. That’s because many are held by hot hands, known as “flippers,” don’t have a broad institutional shareholder base.

Many of the recent ones don’t make money and are based on an, as yet, unproven business model. These are the ones that take the biggest hits.

Individual IPO stocks can be tough to follow to sell short. But one ETF has done the heavy lifting for you. This is the Renaissance IPO ETF (click here for the prospectus). As you can tell from the chart below, (IPO) was warning that trouble was headed out way since the beginning of March. So far, a 6% drop in the main indexes has generated a 20% fall in (IPO).

Buying Momentum

This is another mathematical creation based on the number of rising days over falling days. Rising markets bring increasing momentum while falling markets produce falling momentum.

So, selling short momentum produces additional protection during the early stages of a bear market. Blackrock has issued a tailor-made ETF to capture just this kind of move through its iShares MSCI Momentum Factor ETF (MTUM). To learn more, please read the prospectus by clicking here.

Buying Beta

Beta, or the magnitude of share price movements, also declines in down markets. So, selling short beta provides yet another form of indirect insurance. The PowerShares S&P 500 High Beta Portfolio ETF (SPHB) is another niche product that captures this relationship.

The Index is compiled, maintained and calculated by Standard & Poor's and consists of the 100 stocks from the (SPX) with the highest sensitivity to market movements, or beta, over the past 12 months.

The Fund and the Index are rebalanced and reconstituted quarterly in February, May, August, and November. To learn more, read the prospectus by clicking here.

Buying Bearish Hedge Funds

Another subsector that does well in plunging markets is publicly listed bearish hedge funds. There is a couple of these that are publicly listed and have already started to move.

One is the Advisor Shares Active Bear ETF (HDGE) (click here for the prospectus). Keep in mind that this is an actively managed fund, not an index or mathematical relationship, so the volatility could be large.

Quote of the Day

“If you’re a retail CEO and the tariff announcement comes, you’re on your front porch looking for a cloud of locusts,” said Charlie O’Shea, a retail debt analyst at Moody’s.

Sold BZUN just now @44.44..I'll but back once it starts ticking up.. Virtually no competition huge upside.

Crazy as it seems I bought ADVL for 7.71...for the "scenario" play.

They have the goods IMO and JAZZ has no choice..if JAZZ isn't the buyer some will be..No doubt in my mind this company pairing down for a suitor who only wants FT218

The gambler in me rears it head ...I'll only hold this till mid august or even late July ..After reading ADVL the transcript this AM it feels like a short term sell plan despite outward projections you see in every transcript ....

Super high risk!..you could easily lose 70% or quickly make somewhere around 100% with a buyout.

Don't do it.

ADVL starting to look like it's getting traction..I just can't see jazz not stepping to this and maybe soon.

up 7% today @ 8.77

Out @9.00 on a % of ADVL

Upgrades today on LLNW off the wire.

Good to see.

* Limelight Networks Inc : Cowen and Company raises PT to $8.75 from $7.50

* Limelight Networks Inc : Craig-Hallum raises target price to $9 from $7

* Limelight Networks Inc : Northland Capital Markets raises PT to $10 from $8

* Limelight Networks Inc : Oppenheimer raises target price to $9 from $7

Upgrades today on LLNW off the wire.

Good to see.

* Limelight Networks Inc : Cowen and Company raises PT to $8.75 from $7.50

* Limelight Networks Inc : Craig-Hallum raises target price to $9 from $7

* Limelight Networks Inc : Northland Capital Markets raises PT to $10 from $8

* Limelight Networks Inc : Oppenheimer raises target price to $9 from $7

[h=1]BREAKING NEWS Instant updates and real-time market news.[/h]

| AVDL, JAZZ08:57 07/21/20 | [h=1]SVB Leerink bullish on Avadel Pharmaceuticals, initiates with an Outperform[/h]As previously reported, SVB Leerink analyst Ami Fadia initiated coverage of Avadel Pharmaceuticals (AVDL) with an Outperform rating and $17 price target. The analyst believes management's filing strategy for FT218 can circumvent a 30-month stay and lead to approval timelines independent of any potential efforts from Jazz Pharmaceuticals (JAZZ) to delay FT218's entry. As such, Fadia thinks FT218 can launch in early 2022, before the entry of Xyrem generics in 2023. The analyst also believes the value proposition of FT218 as a once-nightly version of Jazz's Xyrem is as straightforward as it is attractive for most narcolepsy patients and can capture 25% share of the sodium oxybate market long-term, driving annual revenues of $330M. At a market cap of $475M, she believes the stock reflects a significant discount to the FT218 opportunity, and with potential approval of FT218 in late 2021, she sees it potentially driving meaningful upside to current levels. Fadia also notes that with the recent simplification of the portfolio Avadel could be an attractive acquisition target to companies with an established commercial presence in the sleep or neurology space. AVDL JAZZ |

|

|---|---|---|

AVDLAvadel Pharmaceuticals$8.14 / -0.26 (-3.10%) 06:43 Today SVB LeerinkAvadel Pharmaceuticals initiated with an Outperform at SVB Leerink07/01/20 Piper SandlerAvadel sale of legacy assets 'not a surprise,' says Piper Sandler06/30/20 H.C. WainwrightAvadel Pharmaceuticals initiated with a Buy at H.C. Wainwright05/04/20 Piper SandlerAvadel Pharmaceuticals price target raised to $18 from $14 at Piper Sandler | � |

Turning point on the horizon...I may be hedging again soon.

|

| Global Market Comments July 22, 2020 Fiat Lux Featured Trade: (MY NEWLY UPDATED LONG TERM PORTFOLIO), (PFE), (BMY), (AMGN), (CELG), (CRSP), (FB), (PYPL), (GOOGL), (AAPL), (AMZN), (SQ), (JPM), (BAC), (BABA), (EEM), (FXA), (FCX), (GLD)

|

| � |

My Newly Updated Long Term Portfolio I am really happy with the performance of the Mad Hedge Long Term Portfolio since the last update on October 17, 2019. In fact, not only did we nail the best sectors to go heavily overweight, we completely dodged the bullets in the worst-performing ones, especially in energy.For new subscribers, the Mad Hedge Long Term Portfolio is a “buy and forget” portfolio of stocks and ETFs. If trading is not your thing, these are the investments you can make, and then not touch until you start drawing down your retirement funds at age 70 ½. For some of you, that is not for another 50 years. For others, it was yesterday. There is only one thing you need to do now and that is to rebalance. Buy or sell what you need to reweight every position to its appropriate 5% or 10% weighting. Rebalancing is one of the only free lunches out there and always adds performance over time. You should follow the rules assiduously. Despite the seismic changes that have taken place in the global economy over the past nine months, I only need to make minor changes to the portfolio, which I have highlighted in red. To download the entire portfolio in an excel spreadsheet, please go to www.madhedgefundtrader.com , log in, go to “My Account”, then “Global Trading Dispatch”,then click on the “Long Term Portfolio” button. My 5% holding in Biogen (BIIB) was taken over by Bristol Myers (BMY) at a hefty premium at an all-time high, so I’ll take the win. I am replacing it with Covid-19 vaccine frontrunner Bristol Myers (BMY) itself. I am also taking out healthcare provider Cigna (CI), whose profits have been hammered by the pandemic. A future Biden administration might also move to a national healthcare system that will cap profits. I am replacing it with another Covid-19 vaccine leader Pfizer (PFE). My 30% weighting in technology remains the same. Even though these stocks are 30% more expensive than they were three years ago, I believe they will lead the charge into the 2020s. It’s where the big growth is. These have doubled or more over the past nine months. I am sticking with a 10% weighting in banking. Thanks to trillions in stimulus loans, they are now the most government-subsidized sector of the economy. I also believe that massive bond issuance by the US Treasury will deliver a sharply steepening yield curve, another pro bank development. With my 10% international exposure, I am taking out a 5% weight in slow-growth Japan and replacing it with Chinese Internet giant Alibaba (BABA). The US will most likely dial back its vociferous anti-Chinese stance next year and (BABA) will soar. I am executing another switch in my foreign currency exposure, taking out a long in the Japanese yen (FXY) and a short in the Euro (EUO) and substituting in a double long in the Australian dollar (FXA). Australia will be a leveraged beneficiary of a recovery in the global economy, both through a recovery on commodity prices and gold which has already started, and the post-pandemic return of Chinese tourism and investment. I argue that the Aussie will eventually make it to parity with the US dollar, or 1:1. I’m quite happy with my 10% holding in gold (GLD), which should move to new all-time highs imminently….and then go ballistic. As for energy, I will keep my weighting at zero, no matter how cheap it has gotten. Never confuse “gone down a lot” with “cheap”. I think the bankruptcies have only just started and will stretch on for a decade. Thanks to hyper-accelerating technology, the adoption of electric cars, and less movement overall in the new economy, energy is about to become free. My ten-year assumption for the US and the global economy remains the same. When we come out the other side of this, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. I hope you find this useful and I’ll be sending out another update in six months so you can rebalance once again. Stay healthy. John Thomas CEO & Publisher The Diary of a Mad Hedge Fund Trader

|

| Quote of the Day "I had no idea Amazon would produce this kind of performance. I blew it," confessed Oracle of Omaha Warren Buffett.

|

Any interest in Albertson's (ACI) IPO tomorrow?

Not my thing.

Numerous upgrades on ACI this AM

Price today 15.77

* Albertsons Companies : BMO initiates with outperform rating and $18 PT

* Albertsons Companies : Credit Suisse starts with outperform rating; price $18

* Albertsons Companies : Evercore ISI starts with outperform rating

* Albertsons Companies : Guggenheim starts with buy rating and target of $20

* Albertsons Companies : JP Morgan initiates with overweight rating and $19 PT

* Albertsons Companies : RBC initiates coverage with outperform rating and $19 PT

* Albertsons Companies : Telsey Advisory Group initiates with outperform, $26 PT

* Albertsons Companies :BofA Global Research initiates with buy,$22 price objective

* Albertsons Companies

eutsche Bank initiates coverage with buy rating and $21 PT

eutsche Bank initiates coverage with buy rating and $21 PTsomeone wrote me this AM about China and investments. He was worried about the news and tensions.

This won't be popular and I hate to enter politics in to this thread but this is what a said to him...He's a hard core Trump voter

"I just can’t see them shutting out China…it would crush the US economy American companies like Apple/Nike depend on Chinese hardware.

He’d kill the stock market rally and seriously hurt whatever election chances he still has ..those FANG stocks are keeping this floating.

This is all more bullshit politics to appease the base who want retribution on China for our failed policy dealing with this in a nationally cohesive way.

Honestly, had Trump done put the right measures in early he’d be crushing it in the polls considering the stock market..All I can say is thank god he's discounted science."

This won't be popular and I hate to enter politics in to this thread but this is what a said to him...He's a hard core Trump voter

"I just can’t see them shutting out China…it would crush the US economy American companies like Apple/Nike depend on Chinese hardware.

He’d kill the stock market rally and seriously hurt whatever election chances he still has ..those FANG stocks are keeping this floating.

This is all more bullshit politics to appease the base who want retribution on China for our failed policy dealing with this in a nationally cohesive way.

Honestly, had Trump done put the right measures in early he’d be crushing it in the polls considering the stock market..All I can say is thank god he's discounted science."

trimming some % of ADVL up 20% from my buy..have a sell in at 9.00.

I think it will bust through 9 then pull back...I'll buy back tomorrow on the pull back.. if not I have a good amount still.

Booking profits is my game these days.

AVDL..Highest risk.. Risk From 1 to 10. this is a 12...Don't trade this stock if you can't afford to get your teeth punched out without much pain..

NO joke.

Push back in at 8.36 about a half an hour ago.

CNSL may be a good buy this afternoon for a few $$$$$

why.?

Regional provider and the technology is already in my house basically with another provider..

Am I missing something? It could be I didn't look much past the tech aspect.

Low volume. today but you think it's going to pop? you need big volume to do what you do, don't you?

Just looking to see a bottom out around $6.00. If it does ill buy in. Earnings comes Next week. I do not sell everything instantly lol

why.?

Regional provider and the technology is already in my house basically with another provider..

Am I missing something? It could be I didn't look much past the tech aspect.

Low volume. today but you think it's going to pop? you need big volume to do what you do, don't you?