| Austerity, What Austerity? Europe Desperately Needs "Genuine Austerity" |

Echoing John Maynard Keynes, today's Keynesians insist that times of bust are the right time for the government to indulge in extravagance―and the wrong time to return to sobriety. Indeed, Paul Krugman and his followers go well beyond Keynes: any time is the right time for profligacy and the wrong time for frugality (see also Paul Krugman, Keynes Was Right, The New York Times, 29 December 2011). Krugman and others also allege that, particularly in Europe, the bailouts and other so-called stimulus which panic-stricken policymakers “injected” into the structure of production in 2007-2008 has subsequently been replaced by “austerity,” and that this austerity has scuttled recovery.

The exemplar of austerity-as-poor-policy, they say, is Greece. That country, pressured by the EU in general and Germany in particular, decreased its budget deficit from 10.4% of GDP in 2010 to 9.6% in 2011; other countries, such as Iceland, Italy, Ireland, Portugal, France and Spain, also decreased their deficits relative to GDP from 2010 to 2012. As a consequence of this austerity, Keynesians insist, economic conditions and prospects have worsened.

He’s no fan of Keynesians, yet Paul Roderick Gregory (“Austerity” To Blame? But Where’s the Austerity?Forbes, 26 May 2013) accurately summarises their position:

Die-hard Keynesians bemoan [the fact] that, with a few exceptions, the world’s economies are drowning in the quicksand of austerity. They preach we need more government spending and stimulus, not less. Northern Europe should bail out its less-fortunate neighbours to the South so they can pay their teachers, public employees and continue generous transfers to the poor and unemployed. If not, Europe’s South will remain mired in recession. In America, Keynesians entreat the skinflint Republicans to loosen the purse strings so we can escape sub-par growth. They advise Japan to spend itself out of permanent stagnation and welcome recent steps in this direction.

The stimulationists complain that they have been overwhelmed by the defeatist austerity crowd, [led] by the un-neighbourly Germans and the obstructionist Republicans. If only Germany would shift its economy into high gear while transferring its tax revenues to ailing Southern Europe, and the rascally Republicans drop the sequester cuts, we would be sailing along to a healthy worldwide recovery. We don’t need spending restraint. Instead, we need stimulus, stimulus, and more stimulus to revive economic growth. We’ll deal with the growing deficits later, the stimulation crowd tells us, but we must first get our economies growing again.

The official Keynesian story is that the PIIGS of Europe (Portugal, Italy, Ireland, Greece and Spain) have been devastated by cutbacks in public spending. Austerity has made things worse rather than better―clear proof that Keynesian stimulus is the answer. Keynesians claim the lack of stimulus (of course paid for by someone else) has spawned costly recessions which threaten to spread. In other words, watch out Germany and Scandinavia: If you don’t pony up, you’ll be next.

Keynesians see financial crises and economic busts as largely unpredictable events that governments must prevent at all cost―or, once they occur, move heaven and earth to alleviate. Adherents to the Austrian School of economics, on the other hand, explain crises and busts as the inevitable result of the unsustainable (because it is artificial) boom provoked by government intervention in general and central and fractional-reserve banks’ excessive expansion of credit in particular. Bankers grant the worst loans during the superficially best times. For Austrians, the boom isn’t a blessing; it’s a curse. Moreover, recession isn’t a curse: it’s a cure. The bigger is the preceding artificial boom, the more severe will be the consequent genuine bust. The recession is the hang-over that follows the blinder; it’s the cold-turkey that’s necessary in order to kick the addiction to artificial credit (see in particular Murray Rothbard,Economic Depressions: Their Cause and Cure).(1)

Like the big bushfire that eliminates the underbrush that the government forbade landowners to use small fires to remove, the recession is an inevitable and necessary phase of the business cycle. The bust rids the economy of the detritus, distortions and mal-investments that accumulated during the boom. Resources that have been put to unproductive uses (not least by governments’ perverse incentives, regulations, decrees, etc.) must either be shifted to sectors where genuine demand exists―or be liquidated. Clearly, this clean-up and reorganisation can’t occur overnight; accordingly, some resources must remain idle until entrepreneurs can find a sensible way to deploy them. This means that unemployment will temporarily rise, that plant and equipment will lie partly or fully idle until it can be retooled or scrapped, and that financial resources will be used to repay debt and “parked” in short-term assets instead of invested in long-term projects.

To Austrians, then, recession, unemployment and the like aren’t consequences of austerity; they’re results of the stimulus that kindled the artificial boom. Accordingly, governments mustn’t try to retard, delay or prevent this process of retrenchment, reallocation and recuperation. During the recession caused by stimulus, in other words, they should avoid further “stimulus” like the plague. Keynesian “pump-priming,” “automatic stabilisers,” bailouts and so on vainly sustain the artificial boom, corrupt the necessary bust and thereby delay and weaken any genuine recovery. Stimulus is akin to giving a drunk another bottle of whiskey and an addict another “hit” of heroin. It doesn’t just delay recovery; in sufficiently large doses it will kill the patient.

Stimulus also creates a climate of uncertainty (Robert Higgs calls it “regime uncertainty”) which deters private investment. In short, Keynesians and Austrians recommend diametrically opposite policies to combat financial and economic crisis. Keynesians demand that governments redouble their spending and intervention; Austrians recommend that they slash their expenditures, taxes, legislation and regulation.

What, exactly, is austerity?

Given these diametrically opposite diagnoses and prescriptions, how should we view the current situations in Europe? Has austerity prolonged the crisis, as Keynesians believe? Or, as Austrians maintain, is austerity a necessary condition of recovery? In order to answer these questions, we must define this key term. “Austerity measures,” says The Financial Times Lexicon, “refer to official actions taken by the government, during a period of adverse economic conditions, to reduce its budget deficit using a combination of spending cuts or tax rises.” It adds: “various austerity measures have been announced since the global recession in 2008 and the Eurozone crisis in 2009.”(2)

Given the FT’s conception, a sufficient condition of austerity is the joint occurrence of four things (the first and last of which are necessary conditions). Specifically, austerity is (a) a decrease of the government’s budget deficit which has been caused by either (b) a decrease of government spending or (c) an increase of tax revenues (or both b and c) and which (d) occurs during a period when GDP is stagnant or falling. Most descriptions of and disputes about austerity follow the FT’s conception. They have focussed upon two macroeconomic indicators, both expressed as a percentage of GDP: (1) the government’s budget deficit and (2) debt as a percentage of GDP. The lower the deficit (that is, the higher the surplus) and the more the debt shrinks, the more austere is the policy.

More generally, it seems to me that austerity means not just that the government temper but that it abandon its profligacy. It doesn’t merely tug the fiscal belt slightly: it yanks as hard as necessary in order to live within its means. Austerity means that when a government figuratively stands in the doctor’s surgery and receives an unvarnished diagnosis―namely that it’s bloated and unfit―it doesn’t choose the slack option. It doesn’t borrow in order to buy even bigger trousers: instead, it convincingly resolves immediately to fit into smaller clothes by adopting a strict diet and commencing rigorous training. At a minimum, austerity worthy of the name means that the government eliminates its budget’s deficit; more ambitiously, it means that both its spending and its revenues fall significantly, even drastically, that its expenditures quickly become smaller than its shrunken revenues, and that it uses the resultant budget surplus to repay a significant portion of its debt.

Are governments and households, in at least one key respect, comparable? “What is prudence in the conduct of every private family,” wrote Adam Smith in The Wealth of Nations (1776), “can scarce be folly in that of a great Kingdom.” Here, too, Keynesians and Austrians differ diametrically. Austrians reason from two premises. Firstly, households and businesses cannot live indefinitely beyond their means; secondly, the government confiscates either from households or businesses. From these premises it follows that governments, like the households and businesses that finance them, cannot live indefinitely beyond their means. And because nobody can live indefinitely beyond his means, everybody (including the government) must ultimately live within his means. If he doesn’t, then as a matter of elementary logic he must live within somebody else’s means―whether that somebody else is aware of it or not, and regardless of whether that somebody likes it no not. From the point of view of the Austrian School of economics, then, austerity is moral and rational, and profligacy is immoral and irrational.

Keynesians utterly reject these premises and reasoning, as well as the morality that underlies it. In the words of James K. Galbraith (In Defense of Deficits, The Nation, 4 March 2010:

It may seem like homely wisdom to say that “just like the family, the government can’t live beyond its means.” But it’s not. In these matters the public and private sectors differ on a very basic point. Your family needs income in order to pay its debts. Your government does not … With government, the risk of non-payment does not exist. Government spends money (and pays interest) simply by typing numbers into a computer. Unlike private debtors, government does not need to have cash on hand … No government can ever be forced to default on debts in a currency it controls. Public defaults happen only when governments don’t control the currency in which they owe debts―as Argentina owed dollars or as Greece now (it hasn’t defaulted yet) owes Euros. But for true sovereigns, bankruptcy is an irrelevant concept. When Obama says, even offhand, that the United States is “out of money,” he’s talking nonsense―dangerous nonsense. One wonders if he believes it. Nor is public debt a burden on future generations. It does not have to be repaid, and in practice it will never be repaid.

A question to Galbraith: if you’re right, then why does the government bother to levy taxes? Why doesn’t it simply borrow whatever it pleases, without limit, every year?

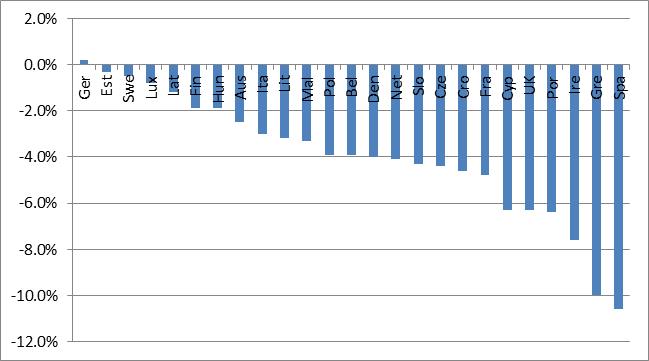

Keeping the broad conception of austerity (i.e., “living roughly within one’s means”) and its morality in mind, it’s worth mentioning that, for members of the EU, austerity or some rough facsimile thereof is a key promise and treaty obligation. It’s also important to repeat: descriptions of and disputes about austerity have focussed upon two macroeconomic indicators, both expressed as a percentage of GDP: (1) the government’s budget deficit and (2) its debt as a percentage of GDP. The Maastricht Treaty of 1992 stipulates that the budget deficit of a country joining the EU must be no greater than 3% of its GDP, and that its level of debt must be no higher than 60% of GDP. These are also “goalposts” for member countries; fortunately for them and unfortunately for people who believe politicians, however, few take these “Maastricht criteria” seriously.

Figure 1: Ratio of Government Budget Surplus or Deficit to GDP (%), EU Members, 2013

Figure 2: Ratio of Government Debt to GDP (%), EU Members, 2013

By these two criteria, in other words―which are not mine but are rather part of the EU’s “architecture”―there is no “austerity” in Europe. Virtually without exception, member states of the EU aren’t honouring their obligations under the Maastricht Treaty. Because they’re not living within their means, according to criteria agreed by treaty more than 20 years ago, they’re not practicing austerity.

Three Varieties of Austerity

Recall from The Financial Times Lexicon that measures of austerity reduce the government’s budget deficit. If the deficit is rising, then by definition there’s no austerity. How to trim a deficit? The government must cut its spending, increase its revenue or adopt some combination of these two things. Generally speaking and regardless of their rhetoric, politicians of all partisan stripes love to increase expenditure and reduce taxes (which rewards their mascots), and they hate to reduce expenditure and to increase taxation (which punishes their followers). Two varieties of austerity, one legitimate and the other bogus, thus follow:

Genuine Austerity

Politicians’ and bureaucrats’ least favoured way to reduce the deficit is to implement genuine austerity, i.e., to cut spending drastically (both in absolute terms and as a percentage of GDP) and to slash taxes considerably. If they do these things (such that the government’s revenues decrease and its expenditures fall even more, thereby turning the budget suddenly and sharply into surplus), and if they use this surplus to trim the debt, they shrink the size of the state; and if they do so whilst GDP is stagnant or falling, then they’re implementing “genuine” austerity.

Not Genuine But Not Completely Fraudulent Austerity

The intermediate (but still relatively unappealing, if you’re a politician or bureaucrat) way to reduce the government’s budget deficit is to (1) halt the growth of spending for a short period of time and (2) greatly increase its revenues (by either increasing the rate of existing taxes, or introducing new taxes, or both) for a long time. These two measures, plus (3) the hope that the growth of GDP resumes quickly enough to remove the pressure to take further unpalatable decisions, may reduce the deficit somewhat as a percentage of GDP, but probably won’t decrease it in absolute terms. And it’ll do nothing to reduce debt; indeed, debt (in absolute terms, if not as a percentage of GDP) may rise; for this reason, the state continues inexorably to grow. This approach, broadly speaking, describes short periods in the 1980s in Britain and the U.S.

Faux austerity

“Faux” (false) austerity entails higher government expenditure, albeit perhaps at a slower pace than during the era before “austerity” commenced. A deceleration of the rate of increase of government expenditure, in other words, underpins faux austerity (in mathematical terms, the second derivative becomes negative, but the first derivative remains positive). So too do either increases of existing taxes or the introduction of new taxes, which increase the government’s revenues more quickly than its expenditure, and thereby reduce its deficit. Unlike genuine austerity, which shrinks the state’s income statement and balance sheet, faux austerity, which is typically financed by borrowing (often at an accelerating pace) produces an ever-bigger state. This, or something roughly like it, occurred in Britain during most of the Thatcher years, most of the Reagan years in the U.S. and during the early Howard years in Australia. As we’ll see shortly, it also characterises the EU and U.S. since 2007. |

| “Have you heard of the Depression of 1920-1921? I thought not. Why not? Probably because, as I detailed in The Evil Princes of Martin Place, it ended so quickly. Why did it end so quickly? The U.S. Government quickly and resolutely implemented genuine austerity.” |

In principle, then, “austerity” of one or another of these varieties can cover many different and otherwise incommensurate situations. Specifically, it can apply just as well to (a) the common situation where the size of the state increases rapidly, (b) the ubiquitous situation where the size of the state rises at a relatively steady pace and (c) the very rare situations where the state suddenly shrinks meaningfully.

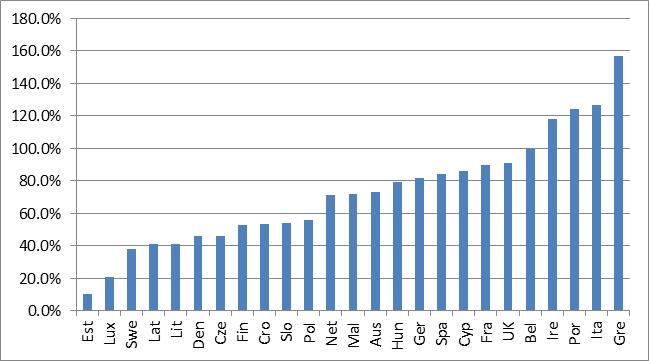

A Textbook Example of Genuine Austerity That Appears in No Mainstream Text

Have you heard of the Depression of 1920-1921? I thought not. Why not? Probably because, as I detailed in The Evil Princes of Martin Place, it ended so quickly. Why did it end so quickly? The U.S. Government quickly and resolutely implemented genuine austerity. Figure 3 plots U.S. GNP during two eight-year periods: 1916-1923 and 1928-1935. To aid comparison of these two intervals, it standardises GNP in the first year of each at 100. (Historical Statistics of the United States is the source of this and subsequent figures that use American data before 1970.)

Figure 3: U.S. GNP (Year 1=100), 1916-1923 and 1928-1935

Figure 3 shows that the decrease of GNP between 1920 and 1921 (a whopping 24%) was far greater than in any single year of the Great Depression. From the peak in 1929 to the trough in 1933, GNP in the U.S. fell by a cumulatively greater amount (46%); but during the first three years of the Great Depression, GNP fell only slightly more (26%) than it did in the single year from 1920 to 1921. Not only was 1920-1921 (to use the phrase of the FT Lexicon) a “period of adverse economic conditions”: it was, economically speaking, America’s single worst interval of the 20th century. Notice, however, that after 1921 GNP rose sharply: from 1921 to 1922 it rose 6.5%; from 1922 to 1923 it soared almost 15%; and thereafter (not shown) it continued to rise strongly. The Depression of 1920-1921 was the severest in America’s 20th century history; it was also the shortest in America’s 20th century history. That latter attribute is perhaps why few Americans remember it.

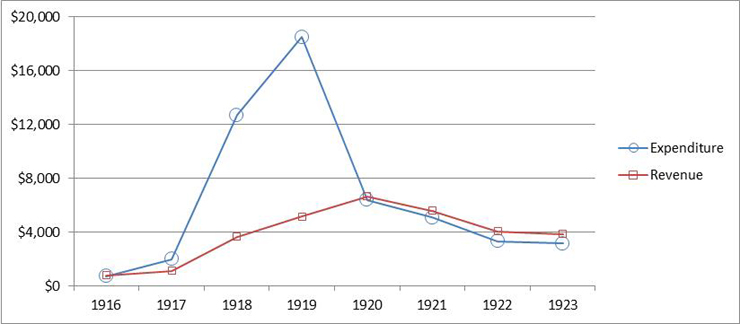

Figure 4: Expenditure and Revenue, U.S. Government ($m), 1916-1923

How did the U.S. Government respond to the Depression of 1920-1921? By drastically slashing both expenditures and revenues, in absolute terms and also as a percentage of GNP; in other words, it did the diametric opposite of what Keynes recommended in 1937 and what Krugman and others demand today.Indeed, slashing its taxing and spending, which the First World War had bloated massively, likely triggered (as opposed to caused) the Depression. (The preceding “stimulus,” in the form of the massive growth of government during the First World War, and the aggressive interventionism of the Federal Reserve, which was formed in 1913, caused the Depression.) Figure 4 shows that the U.S. Government’s expenditure skyrocketed from $713 million in 1916 to $18.5 billion in 1919; spending then plummeted to $6.4 billion in 1920, $5.1 billion in 1921, $3.7 billion in 1922 and $3.5 billion in 1923. That’s no typographical error: from the crest of the wave of spending in 1919 to its trough in 1923, the U.S. Government’s expenditure plunged 81%. Revenue followed a similar but less extreme path: it rose from $761 million in 1916 to $6.6 billion in 1920, and then fell steadily to $3.9 billion in 1923. Also note that from 1920 to 1921, which we saw in Figure 3 was the single worst year in the 20th century, the U.S. Government’s revenue fell 20% (from $6.4 billion in 1920 to $5.6 billion in 1921); from 1920 to 1923, revenue fell 42%.

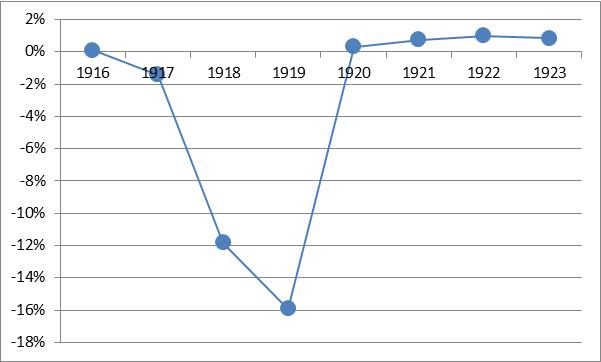

Figure 5 expresses the U.S. Government’s surplus/deficit in each of these years as a percentage of GNP during the relevant year. In 1916, the government roughly balanced its budget; in 1917, as America entered the First World War, it ran a huge deficit (ca. 12% of GNP); and in 1919 (the war ended in November 1918, but the spigot took a bit of time to seal), its deficit was even bigger (ca. 16% of GNP). Notice, however, that within a year the government’s budget returned to surplus (ca. 0.5% of GNP in 1920), and that for the next three years it remained in surplus. Notice, too, that during the Depression of 1920-1921 the U.S. Government’s budget surplus increased. During the worst year of the 20th century, in other words, the government’s spending plunged even more rapidly than its revenue. This, I think, is why Keynesians utterly ignore the Depression of 1920-1921 and attempt to rationalise it when reprobate students bring it to their attention: Keynesians simply cannot explain how the drastic shrinkage of the government’s taxing and spending immediately preceded the strongest recovery of the 20th century. What they cannot explain, they ignore or deny.

Figure 5: the U.S. Government’s Budget Surplus/Deficit, Percentage of GNP, 1916-1923

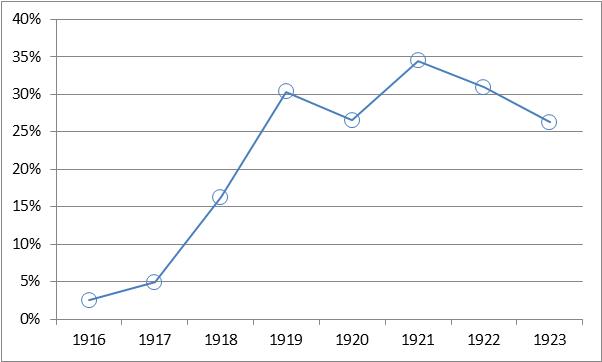

What did the U.S. Government do with the surpluses it generated after 1920? It used them to repay some of the debt which had exploded during the First World War. Figure 6 expresses the U.S. Govern-ment’s debt during a given year as a percentage of GNP during that year. Admittedly, debt rose between 1920 and 1921. This, presumably, was the final installment of a longer series: the First World War caused America’s debt to balloon from ca. 3% of GNP in 1916 to 35% in 1921. By 1923, however, debt was closer to 25% of GNP―a far cry from the level in 1916, to be sure; equally certainly, it was significantly less in 1923 than it was in 1921.

Figure 6: Ratio of Debt to GNP, U.S. 1916-1923

Let’s recapitulate. The Depression of 1920-1921 was the severest in modern American history. Yet the recovery in 1921-1923 was the most robust in that country’s modern history. How do we explain these facts? The Austrian School tells us that the genuine austerity of the U.S. Government, which quickly and thoroughly removed many of the distortions, malinvestments, etc., introduced during the war, had much to do with it. The implication is vital: genuine austerity doesn’t cause misery, it resolves it. Genuine austerity purges the rottenness of the false boom and thereby sets the stage for genuine recovery. Faux austerity and Keynesian-style stimulus, on the other hand, cause misery and indefinitely postpone recovery.

The EU and U.S. since 2005: No genuine austerity but plenty of faux austerity

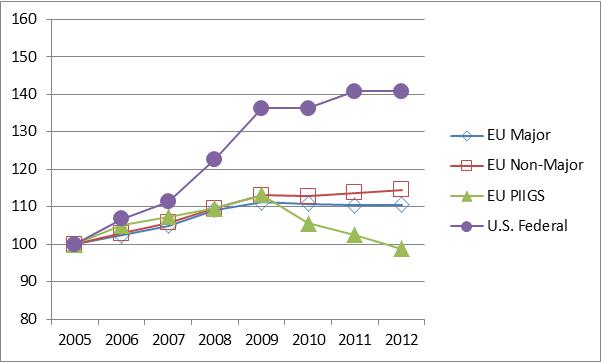

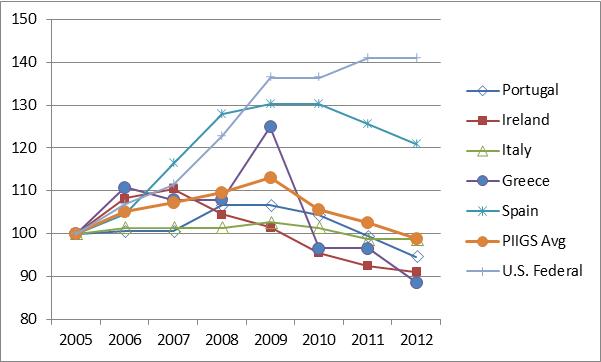

Presently, the critics of austerity take it for granted that governments in the EU (particularly the PIIGS) have drastically their expenditure. It’s also an article of faith among these critics that this alleged austerity (which, they maintain, has also occurred in the U.S.) has shrunk if not eviscerated the state. Do the facts support these assumptions? Figure 7 sorts EU member states into three slightly-overlapping categories: (a) major members (Britain, France, Germany, Italy and Spain), PIIGS (Portugal, Ireland, Italy, Greece and Spain) and non-major members (i.e., all others), and expresses overall government expenditure in each category relative to 2005 (=100).

Figure 7: Government Expenditure, EU and U.S., 2005-2013 (2005=100)

In the U.S., expenditure increase by 40%―that is, at a compound rate of 4.9% per year―between 2005 and 2012. Government expenditure also increased, albeit more slowly, across the EU from 2005 to 2009. It increased by 12-14% and at a compound rate of 2.8-3.3% per year. In 2009-2012, on the other hand, spending changed little in major member states, increased slightly (by a total of ca. 3% and at a compound rate of 0.6% per year) in non-major states, and fell (by a total of 12% and at a compound rate of 4.4%) in the PIIGS.

Figure 8 plots total government expenditure (2005=100) in Portugal, Ireland, Italy, Greece and Spain between 2005 and 2012. It shows that expenditure rose in 2005-2008. On average in these countries, it rose 10% (i.e., at a compound rate of 3.2% per year) during this interval. It rose 28% in Spain (compound rate of 8.9% per year), between 5-10% in Portugal, Ireland and Greece (compound rate of ca. 2.3-2.5% per year) and changed little in Italy. Conversely, in 2008-2012 expenditure fell. It fell 11% in Portugal (at a compound rate of 3.9% per year), 13% in Ireland (4.4% per year) and 17% in Greece (6.3% per year). Does this more recent shrinkage of government expenditure confirm that these three PIIGS, at least, have endured austerity?

Figure 8: Government Expenditure, PIIGS and U.S., 2005-2012 (2005=100)

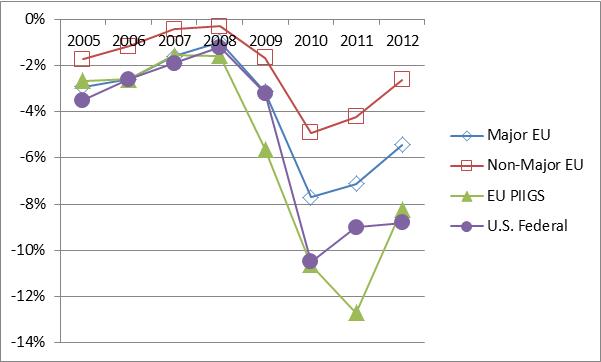

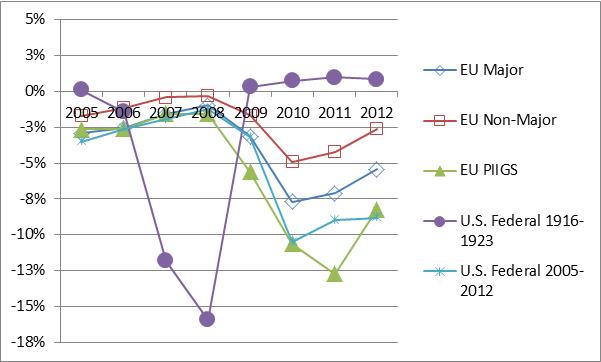

Not really. Figure 9 plots average annual budget deficits (expressed as a percentage of each country’s GDP) in the U.S. these three categories of EU member states. Recall the Financial Times Lexicon: “… various austerity measures have been announced since the global recession in 2008 and the Eurozone crisis in 2009” (italics added). Clearly, however, by and large they haven’t been implemented. A decrease of the government’s budget deficit is a necessary condition of austerity. Without exception, however, budget deficits across the EU have been considerably greater since 2009 than they were before then. But nobody denounced these deficits as “austere” then; so how can Keynesians do so now?

Figure 9: Budget Deficits as a Percentage of GDP, EU and U.S., 2005-2012

It’s true that in 2012 deficits were smaller than they were in 2010 and 2011. The average deficit in major EU countries was smaller in 2012 (-5.4% of GDP) than it was in 2010 (-7.7%); the average deficit in non-major countries was also less in 2012 (-3.6%) than in 2010 (-6.0%); finally, the deficit in the average deficit in PIIGS nation was smaller in 2012 (-8%) than in 2010 (-11%) and 2011 (-13%). The trouble, of course, is that “stimulus” rules: across the EU, as well as in the U.S. budget deficits remain very large―smaller than at their nadir, but nonetheless far greater than before 2009. Whereas Keynesians decry “austerity” in 2012 vis-à-vis 2010, Austrians see “stimulus” after 2009 vis-à-vis the boom until 2007.

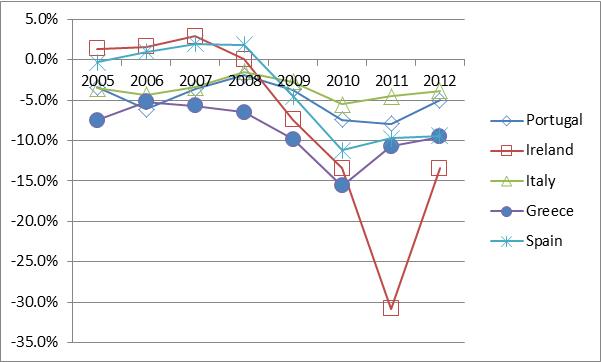

Figure 10: Budget Deficits as a Percentage of GDP, PIIGS Nations, 2005-2012

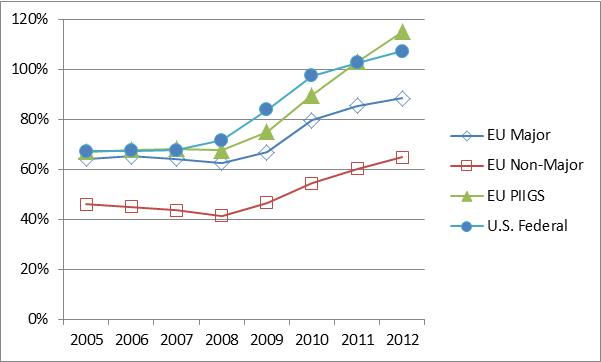

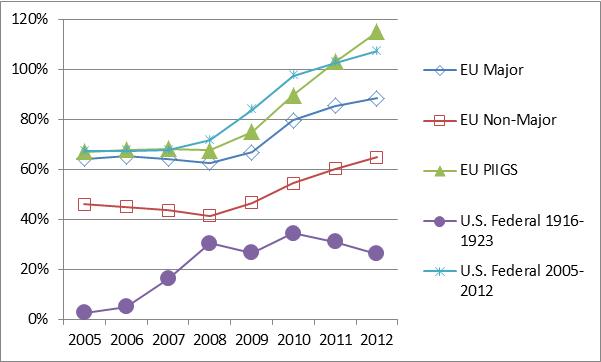

Not only do Figures 7-11 show no compelling evidence of genuine austerity; they demonstrate that the evidence of faux austerity is strongest in the U.S. and PIIGS nations. Although government expenditure in the PIIGS nations has fallen in 2009-2012 (Figure 7), it remains far too high relative to revenues. Accordingly, as their budget deficits have ballooned (Figure 8), governments have borrowed increasingly heavily, and the PIIGS and U.S. Government have borrowed most heavily of all (Figure 10 and 11). As a result, since 2009 the average PIIGS government’s debt as a percentage of GDP has risen from ca. 75% to almost 120%, which is only slightly greater than America’s. That’s evidence of profligacy and an even more bloated state―not of genuine austerity and a leaner and fitter state.

Figure 11: Government Debt to GDP (%), EU and U.S., 2005-2012

Why the “Recovery,” Particularly Among the PIIGS, Has Been So Anaemic

Keynesians in general and Paul Krugman in particular insist that the recovery in the EU and U.S. has been so anaemic because the stimulus and bailouts, etc., in 2007-2009 were too feeble, and because “austerity” (as we’ve seen, faux prosperity is a more accurate description) replaced Keynesian stimulus.They’re demonstrably and diametrically wrong: recovery has been so feeble not because austerity has been much too severe; it’s been so weak because “austerity” has been far too timid.

Figure 12 combines data from the U.S. in 1916-1923 (Figure 5) and from the EU in 2005-2012 (Figure 9).It shows that the faux austerity that Krugman and others decry simply bears no comparison to the genuine austerity that the U.S. Government implemented in the early 1920s. In effect, the welfare-warfare state weights almost as heavily today upon the EU and U.S. today as the First World War did upon the U.S. Government. The inference is clear: whereas the Americans’ genuine austerity quickly and thoroughly put the government’s house into some semblance of order, the PIIGS finances remain in disarray. The Americans’ genuine austerity created the conditions of genuine recovery; in sharp contrast, the PIIGS’ faux austerity has begotten a faux recovery.

Figure 12: Budget Deficits (% of GNP/GDP), 1916-1923 and 2005-2012

Figure 13 combines data from the U.S. in 1916-1923 (Figure 6) and from the EU in 2005-2012 (Figure 10). In the early 1920s, the U.S. Government implemented genuine austerity; as a result, its debt (expressed as a percentage of GNP) fell significantly. By today’s lax standards, in the 1920s the U.S. Government was astonishingly trim; accordingly, it didn’t block the road to economic recovery. In sharp contrast, today in the EU and U.S. debt continues to gallop upwards; as a result, the bloated government has “crowded out” private recovery.

Figure 13: Ratio of Debt to GNP/GDP, 1916-1923 and 2005-2012

Three Conclusions

Never mind Paul Krugman: at no time since 2005 have governments in the EU or U.S. implemented genuine austerity. Instead, they’ve recently championed faux austerity. Accordingly, their “recoveries” from the economic and financial crisis are feeble and artificial; moreover, like Australia they remain vulnerable to renewed economic and financial crisis.

1. Today, Austerity Is Everywhere Except in the Statistics

A researcher at the German Institute for Economic Research, Georg Erber, The Austerity Paradox: I See Austerity Everywhere, But Not in the Statistics, 28 February 2013), examines in much greater detail than I have the EU’s official statistics. Erber writes:… taking a close look at the actual statistics available from Eurostat on the PIIGS-countries plus Cyprus, one finds little empirical evidence that the governments there [or in the EU more generally] have de facto reduced their total public expenditures. This is in stark contrast to the current austerity debate, which seemingly implicitly assumes that austerity has occurred over the past couple of years since the global Great Economic Crisis broke out in 2008.

The PIIGS remind me of the patient whose doctor orders him to lose weight by eating less. The patient responds by doubling his calorie intake. He later cuts back by ten percent and wonders why he is not losing weight. The PIIGS went on a spending binge from which they do not want to retreat. They then blame their problems on austerity and the lack of charity of others.

So much for the scourge of austerity in … Europe. The facts show it simply does not exist. Instead of “where’s the beef?” we should ask “where’s the austerity?” Perhaps economist [Paul] Krugman can find it. But first I would advise him and others like him to consult some facts before they pontificate.

Adam Creighton agrees. In Nothing Austere about Europe’s Fiscal Policies (The Weekend Australian, 11-12 May 2013), he writes:If thought corrupts language, language can also corrupt thought. A bad usage can spread by tradition and imitation even among people who should and do know better. In 1946 George Orwell famously pointed out how politics degraded and abused the English language for the sake of political ends. The same is true in economics. The word austerity, used to describe European and even U.S. fiscal policy, has been a clever ruse by opponents of measures that may cause any reduction in the size of government.

No objective, sane person could describe, in a relative or absolute sense, fiscal policy in Europe or the US as austere, a word stemming from the Greek meaning harsh or severe. … Government budget deficits in Europe are still up to twice as large as they were before the GFC―when no one described them as austere―and are contributing to already vast public debt burdens. Far from the “savage cuts” of [former Treasurer] Wayne Swan’s imagination, European governments have reduced only the rate of growth of public spending. Even in Greece, a country with little population or economic growth in recent years, spending is still greater than it was five years ago.

Yet “mindless austerity” has become a favourite phrase of the Treasurer since [Swan] dumped his promise to restore the budget to surplus this financial year. … The Treasurer is trying to convince Australians that cutting public spending would undermine “jobs and growth.” Whatever is undermining jobs and growth in Europe, it is likelier to be a bizarre fondness for bad economics than spending cuts.

Creighton quotes Alberto Alesina, a professor of economics at Harvard University:[There is] vast evidence showing spending cuts are much less economically costly than tax increases to restore budgets to surplus … Lower spending reduces the expectation of higher taxes in the future, with positive effects on … investors. … Most countries in Europe are actually raising taxes and not cutting expenses; what happens in practice is typically quite different from what is announced (see also Adam Creighton, “Economists Attack Wayne on Austerity/Dons Slam Treasurer on Austerity Stand,” The Weekend Australian, 11-12 May 2013).

2. Keynes was wrong and Krugman is similarly wrong―and the Austrians have been correct all along

“The boom, not the slump, is the right time for austerity at the Treasury,” John Maynard Keynes asserted in 1937. That’s flatly wrong. The greatest slump in the 20th century history of the U.S. occurred in 1920-1921. The Depression of 1920-1921 was the shortest in America’s 20th century history―and the recovery from the Depression of 1920-1921 was the most robust in America’s modern history―precisely because the U.S. Government followed the opposite―and correct―path. It demonstrated that the bust is a correct time for genuine austerity. Krugman, too, is diametrically wrong. The truth is that any time, boom or bust, is the right time for the state to adopt frugality and the wrong time to embrace extravagance.

What’s more, we’ve long known that Keynes and Krugman are wrong. (See the quotes by John Stuart Mill and James Callaghan after the Overview.) Martin Masse (Is “Austerity” Responsible for the Crisis in Europe? Mises Institute, 11 June 2013) adds two final points. Governments in almost all member nations of the EU are now at least as large, and probably larger, than in 2007. If (like The Financial Times Lexicon) we define austerity as measures undertaken which reduce the government’s budget deficit, then faux austerity has deepened the crisis. And if we define genuine austerity as policies which reduce the size of government, then Keynesians―if they are intellectually honest―must exonerate genuine austerity from all blame. Genuine austerity hasn’t deepened the crisis because since 2007 it has never been applied.“Unfortunately,” Masse concludes, “confusion over the meaning of austerity impedes a better understanding of the situation and precludes a more relevant debate over the causes of and solution to the crisis.” He continues:Keynesians will, of course, regret that even larger increases of government borrowing and deficit spending hasn’t occurred. These things, which certainly have marked the state’s finances during the past few years, have been implemented in order to “stimulate” the economy. But, from an Austrian perspective, bloated governments and higher taxes help to explain why, several years after the financial crisis, American and European economies are still in the doldrums.

3. Genuine austerity doesn’t kill―But faux austerity does cause misery

How to respond to claims such as Why Austerity Kills: From Greece to U.S., Crippling Economic Policies Causing Global Health Crisis (Democracy Now! 21 May 2013)? The Depression of 1920-1921 demonstrates that genuine austerity doesn’t cause misery: it removes it. Genuine austerity sets the stage for genuine recovery. Faux austerity, on the other hand, corrupts recovery and thereby causes misery. Not just for material reasons, then, but also on moral grounds, what the world desperately needs is drastically smaller government: not just a much smaller quantity of taxing and spending, but also a vast pruning of legislation and deregulation of capital and labour. These measures will encourage savings, investment and entrepreneurship. They―and not more taxing, spending, legislating and regulating―will thereby set a sound foundation for a return to prosperity.

*This is an adapted and shortened version of a paper presented to the Mises Seminar Emporium Hotel, Brisbane, Queensland, on November 30, 2013.

|

1. Followers of Keynes seldom anticipate recessions, never mind crises, and so these things always surprise them. Followers of Ludwig von Mises, Murray Rothbard and Hans-Hermann Hoppe, on the other hand, usually anticipate downturns, crashes and crises―and are surprised when they (usually) don't occur. To Keynesians, in other words, the glass isn't just full: it's overflowing. Austrians, on the other hand, see a crack in a brittle and mostly-empty vessel. As a result, Keynesians are normally complacent and Austrians fretful.

2. See also “Austerity Europe: Who Faces the Cuts” (The Guardian, 12 June 2010); Brian Wesbury and Robert Stein (“Government Austerity: The Good, Bad and Ugly,” Forbes, 27 July 2010); and Paul Krugman (“The Austerity Agenda,” The New York Times, 31 May 2012). |

|

| From the same author | ▪ The shameful treatment of Ron Paul by the mainstream media

(no 300 – May 15, 2012)▪ The Evil Princes of Martin Place– Introduction

(no 286 – February 15, 2011)

▪ The return of Keynesianism

(no 278 – May 15, 2010)

▪ Why do we have recurrent economic booms and busts?

(no 262 – December 15, 2008)

▪ H. L. Mencken on Governments and Politicians

(no 259 – Sept. 15, 2008)

▪ More... |

| | First written appearance of the word 'liberty,' circa 2300 B.C. |

|