You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

United States Austerity: Government now spending less nominally than Bush

- Thread starter akphidelt

- Start date

The government has been borrowing so much money, that soon, we will not be able to afford even the interest on the loans.

Income tax receipts are roughly $900 billion a year.

Corporate taxes are roughly $200 billion annually.

Our current annual deficits are nearly $1.3 trillion, meaning we’re spending $900 billion + $200 billion + $1.3 trillion = $2.4 trillion.

Even if you doubled tax revenue, we would still be running a deficit!

Even if all U.S. citizens were taxed 100% of their income, it would still not be enough to balance the Federal budget! Tax increases will not even make the smallest dent on the true size of our debt.

There is not a single credible plan, by any political party, to merely end our annual deficits, never mind actually paying back our debts.

Here’s the kicker… the costs of maintaining our debts are about to skyrocket.

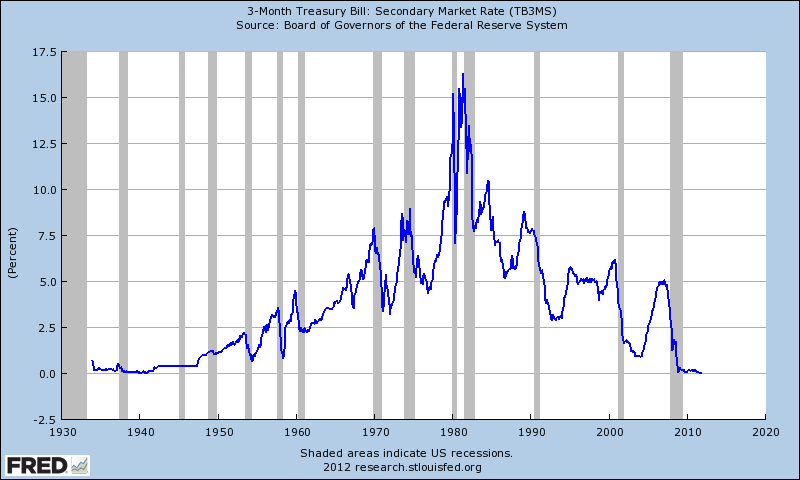

For years, the Federal Reserve has been keeping interest rates very low, to almost zero, and as a result, the interest rate at which the U.S. government borrows money from the Federal Reserve is an incredibly low level. This won’t last forever.

How much interest? Right now we’re paying about 15% of federal tax receipts (about $200 billion a year). If the government had to spend a ‘real’ market-based rate of interest, say 6%, it would cost $840 billion a year on interest (76% of tax receipts), just for what we owe right now, today.

We are trapped. The main-stream-media does not want you to know how precarious our government’s finances really are.

A debt default would be inevitable if not for one anomaly, the thing that has saved the U.S. so far, that is, the country’s ability to simply print more money. The U.S. is the only debtor in the world who can legally print U.S. dollars, and the dollar is the world’s reserve currency.

So, that sounds pretty good, just print more money, what is there to worry about?

The U.S. is the only country in the world that doesn’t have to pay for its imports or its debts in a foreign currency.

Example: A German wants to buy oil from Saudi Arabia – the German cannot pay for the oil in German marks (or Euro’s) because the oil is priced in dollars. You have to buy dollars first, then buy your oil.

The U.S. has been able to consume as much as we want without worrying about acquiring the money to pay for it, because U.S. dollars are accepted everywhere around the world.

As our creditors continue to figure out what’s happening (printing more and more dollars), we’re going to have very BIG problems. The creditors will either begin to refuse payment in dollars, or they will greatly discount the value of these new dollars. It’s already happening.

Most Americans have no clue what the repercussions are of losing the status of world currency.

Yes it can happen here. In fact, the exchange value of the U.S. dollar has fallen about 13% since June 2010. Its rate of decline is accelerating.

As the U.S. dollar continues to lose it’s position as the world’s currency, gas, oil, and other commodities will continue to skyrocket. Almost everything we consume will immediately get more expensive. It’s happening right now. Everything is getting more expensive.

The government says that there is no inflation. How is that even possible? They actually believe that the American public is going to believe them?

It’s only going to get worse, because we can NOT stop printing because we can’t actually afford our existing debts. No one wants you to know this. No one. That’s why, despite the obvious inflation going on all around the world, the Fed continues to say there’s no inflation at all. The government is radically devaluing the dollar and totally lying to everyone about what is really happening.

The Chinese are getting out of the dollar as fast as they can via strategic commodities.

With less demand for the dollar around the globe, interest rates will skyrocket.

Instead of getting a mortgage at today’s low rates of 5%, it may soon cost you 8% or 10% or 15%.

Stock prices will likely plummet by at least 40% in a matter of weeks as a result of this event in the currency markets.

When the U.S. dollar loses its spot as the world’s reserve currency, the brutal downturn will be about 10-times worse than the mortgage crisis of 2008.

When everyone is trying to get rid of their dollars, the government is printing more and more to pay debts, the crisis will reach epic proportions.

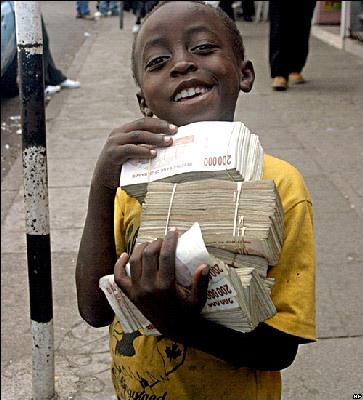

In the past 100 years this type of debt crisis has reared its ugly head in Germany, Russia, Austria, Poland, Argentina, Brazil, Chile, the Ukraine, Japan, and China.

Here’s the thing that most people don’t realize… The U.S. government can only continue printing dollars as long as the dollar remains the world’s reserve currency.

Reported by Robert Fisk (veteran Middle East reporter), last fall, China, Japan, Russia, and France got together for a secret meeting… without the U.S. being present or even knowing about the meeting. It was reported that Gulf Arabs are plotting to end dollar dealings for oil, moving instead to a basket of currencies including the Japanese Yen, Chinese yuan, the euro, gold, and a new unified currency planned for nations in the Gulf including Saudi Arabia, Abu Dhabi, Kuwait, and Qatar.

In February (2011), the IMF has proposed replacing the U.S. dollar with something called ‘Special Drawing Rights’, or SDRs. SDRs will be able to be converted into any currency, based on a weighted basket of international currencies.

The IMF also proposed creating SDR-denominated bonds, which could reduce central banks’ dependence on U.S. Treasuries. They also suggested that certain assets, such as oil and gold, which are traded in U.S. dollars, could be priced using SDRs. (This is a HUGE step to replace the U.S. dollar as the world’s reserve currency)

Russian and China have made an agreement to settle all debts between them in each others currencies without first transferring to dollars.

The U.S. dollar has remained the world’s reserve currency for more than 50 years. It seems as though its days are numbered. Don’t remain in denial

Income tax receipts are roughly $900 billion a year.

Corporate taxes are roughly $200 billion annually.

Our current annual deficits are nearly $1.3 trillion, meaning we’re spending $900 billion + $200 billion + $1.3 trillion = $2.4 trillion.

Even if you doubled tax revenue, we would still be running a deficit!

Even if all U.S. citizens were taxed 100% of their income, it would still not be enough to balance the Federal budget! Tax increases will not even make the smallest dent on the true size of our debt.

There is not a single credible plan, by any political party, to merely end our annual deficits, never mind actually paying back our debts.

Here’s the kicker… the costs of maintaining our debts are about to skyrocket.

For years, the Federal Reserve has been keeping interest rates very low, to almost zero, and as a result, the interest rate at which the U.S. government borrows money from the Federal Reserve is an incredibly low level. This won’t last forever.

How much interest? Right now we’re paying about 15% of federal tax receipts (about $200 billion a year). If the government had to spend a ‘real’ market-based rate of interest, say 6%, it would cost $840 billion a year on interest (76% of tax receipts), just for what we owe right now, today.

We are trapped. The main-stream-media does not want you to know how precarious our government’s finances really are.

A debt default would be inevitable if not for one anomaly, the thing that has saved the U.S. so far, that is, the country’s ability to simply print more money. The U.S. is the only debtor in the world who can legally print U.S. dollars, and the dollar is the world’s reserve currency.

So, that sounds pretty good, just print more money, what is there to worry about?

The U.S. is the only country in the world that doesn’t have to pay for its imports or its debts in a foreign currency.

Example: A German wants to buy oil from Saudi Arabia – the German cannot pay for the oil in German marks (or Euro’s) because the oil is priced in dollars. You have to buy dollars first, then buy your oil.

The U.S. has been able to consume as much as we want without worrying about acquiring the money to pay for it, because U.S. dollars are accepted everywhere around the world.

As our creditors continue to figure out what’s happening (printing more and more dollars), we’re going to have very BIG problems. The creditors will either begin to refuse payment in dollars, or they will greatly discount the value of these new dollars. It’s already happening.

Most Americans have no clue what the repercussions are of losing the status of world currency.

Yes it can happen here. In fact, the exchange value of the U.S. dollar has fallen about 13% since June 2010. Its rate of decline is accelerating.

As the U.S. dollar continues to lose it’s position as the world’s currency, gas, oil, and other commodities will continue to skyrocket. Almost everything we consume will immediately get more expensive. It’s happening right now. Everything is getting more expensive.

The government says that there is no inflation. How is that even possible? They actually believe that the American public is going to believe them?

It’s only going to get worse, because we can NOT stop printing because we can’t actually afford our existing debts. No one wants you to know this. No one. That’s why, despite the obvious inflation going on all around the world, the Fed continues to say there’s no inflation at all. The government is radically devaluing the dollar and totally lying to everyone about what is really happening.

The Chinese are getting out of the dollar as fast as they can via strategic commodities.

With less demand for the dollar around the globe, interest rates will skyrocket.

Instead of getting a mortgage at today’s low rates of 5%, it may soon cost you 8% or 10% or 15%.

Stock prices will likely plummet by at least 40% in a matter of weeks as a result of this event in the currency markets.

When the U.S. dollar loses its spot as the world’s reserve currency, the brutal downturn will be about 10-times worse than the mortgage crisis of 2008.

When everyone is trying to get rid of their dollars, the government is printing more and more to pay debts, the crisis will reach epic proportions.

In the past 100 years this type of debt crisis has reared its ugly head in Germany, Russia, Austria, Poland, Argentina, Brazil, Chile, the Ukraine, Japan, and China.

Here’s the thing that most people don’t realize… The U.S. government can only continue printing dollars as long as the dollar remains the world’s reserve currency.

Reported by Robert Fisk (veteran Middle East reporter), last fall, China, Japan, Russia, and France got together for a secret meeting… without the U.S. being present or even knowing about the meeting. It was reported that Gulf Arabs are plotting to end dollar dealings for oil, moving instead to a basket of currencies including the Japanese Yen, Chinese yuan, the euro, gold, and a new unified currency planned for nations in the Gulf including Saudi Arabia, Abu Dhabi, Kuwait, and Qatar.

In February (2011), the IMF has proposed replacing the U.S. dollar with something called ‘Special Drawing Rights’, or SDRs. SDRs will be able to be converted into any currency, based on a weighted basket of international currencies.

The IMF also proposed creating SDR-denominated bonds, which could reduce central banks’ dependence on U.S. Treasuries. They also suggested that certain assets, such as oil and gold, which are traded in U.S. dollars, could be priced using SDRs. (This is a HUGE step to replace the U.S. dollar as the world’s reserve currency)

Russian and China have made an agreement to settle all debts between them in each others currencies without first transferring to dollars.

The U.S. dollar has remained the world’s reserve currency for more than 50 years. It seems as though its days are numbered. Don’t remain in denial

fratfraud is a militant Keynesian and Keynesians live in denial.

Is the Dollar Dying? Why US Currency Is in Danger

http://www.cnbc.com/id/100461159

"If the dollar loses status as the world's most reliable currency the United States will lose the right to print money to pay its debt. It will be forced to pay this debt," Bove said. "The ratings agencies are already arguing that the government's debt may be too highly rated. Plus, the United States Congress, in both its houses, as well as the president are demonstrating a total lack of fiscal credibility."

This is the stupidest thing I've ever heard...

"If the dollar loses status as the world's most reliable currency the United States will lose the right to print money to pay its debt."

So we are dependent on other countries to print our own currency?

Why do we need to do this? And interest on the loans as a % of GDP is at its lowest point in decades. So not sure what you mean by that comment.The government has been borrowing so much money, that soon, we will not be able to afford even the interest on the loans.

Income tax receipts are roughly $900 billion a year.

Corporate taxes are roughly $200 billion annually.

Our current annual deficits are nearly $1.3 trillion, meaning we’re spending $900 billion + $200 billion + $1.3 trillion = $2.4 trillion.

Even if you doubled tax revenue, we would still be running a deficit!

Even if all U.S. citizens were taxed 100% of their income, it would still not be enough to balance the Federal budget! Tax increases will not even make the smallest dent on the true size of our debt.

There is not a single credible plan, by any political party, to merely end our annual deficits, never mind actually paying back our debts.

If they have kept interest rates low for the last 5 years, why would they just all of a sudden let interest rates get to 6%? Need some cause and effect here, because it makes no sense.Here’s the kicker… the costs of maintaining our debts are about to skyrocket.

For years, the Federal Reserve has been keeping interest rates very low, to almost zero, and as a result, the interest rate at which the U.S. government borrows money from the Federal Reserve is an incredibly low level. This won’t last forever.

How much interest? Right now we’re paying about 15% of federal tax receipts (about $200 billion a year). If the government had to spend a ‘real’ market-based rate of interest, say 6%, it would cost $840 billion a year on interest (76% of tax receipts), just for what we owe right now, today.

We are trapped. The main-stream-media does not want you to know how precarious our government’s finances really are.

Creditors can't refuse payment in dollars and we have no worry about people buying our treasuries since we create the buyers. None of this is remotely true.A debt default would be inevitable if not for one anomaly, the thing that has saved the U.S. so far, that is, the country’s ability to simply print more money. The U.S. is the only debtor in the world who can legally print U.S. dollars, and the dollar is the world’s reserve currency.

So, that sounds pretty good, just print more money, what is there to worry about?

The U.S. is the only country in the world that doesn’t have to pay for its imports or its debts in a foreign currency.

Example: A German wants to buy oil from Saudi Arabia – the German cannot pay for the oil in German marks (or Euro’s) because the oil is priced in dollars. You have to buy dollars first, then buy your oil.

The U.S. has been able to consume as much as we want without worrying about acquiring the money to pay for it, because U.S. dollars are accepted everywhere around the world.

As our creditors continue to figure out what’s happening (printing more and more dollars), we’re going to have very BIG problems. The creditors will either begin to refuse payment in dollars, or they will greatly discount the value of these new dollars. It’s already happening.

The repercussions are not that bad. Oil might be more expensive, but that's it. And you forget that it still hasn't happened and there is no viable currency out there that can replace the USD.Most Americans have no clue what the repercussions are of losing the status of world currency.

Yes it can happen here. In fact, the exchange value of the U.S. dollar has fallen about 13% since June 2010. Its rate of decline is accelerating.

As the U.S. dollar continues to lose it’s position as the world’s currency, gas, oil, and other commodities will continue to skyrocket. Almost everything we consume will immediately get more expensive. It’s happening right now. Everything is getting more expensive.

The government says that there is no inflation. How is that even possible? They actually believe that the American public is going to believe them?

It’s only going to get worse, because we can NOT stop printing because we can’t actually afford our existing debts. No one wants you to know this. No one. That’s why, despite the obvious inflation going on all around the world, the Fed continues to say there’s no inflation at all. The government is radically devaluing the dollar and totally lying to everyone about what is really happening.

The Chinese are getting out of the dollar as fast as they can via strategic commodities.

With less demand for the dollar around the globe, interest rates will skyrocket.

Instead of getting a mortgage at today’s low rates of 5%, it may soon cost you 8% or 10% or 15%.

Stock prices will likely plummet by at least 40% in a matter of weeks as a result of this event in the currency markets.

When the U.S. dollar loses its spot as the world’s reserve currency, the brutal downturn will be about 10-times worse than the mortgage crisis of 2008.

When everyone is trying to get rid of their dollars, the government is printing more and more to pay debts, the crisis will reach epic proportions.

In the past 100 years this type of debt crisis has reared its ugly head in Germany, Russia, Austria, Poland, Argentina, Brazil, Chile, the Ukraine, Japan, and China.

Here’s the thing that most people don’t realize… The U.S. government can only continue printing dollars as long as the dollar remains the world’s reserve currency.

Reported by Robert Fisk (veteran Middle East reporter), last fall, China, Japan, Russia, and France got together for a secret meeting… without the U.S. being present or even knowing about the meeting. It was reported that Gulf Arabs are plotting to end dollar dealings for oil, moving instead to a basket of currencies including the Japanese Yen, Chinese yuan, the euro, gold, and a new unified currency planned for nations in the Gulf including Saudi Arabia, Abu Dhabi, Kuwait, and Qatar.

In February (2011), the IMF has proposed replacing the U.S. dollar with something called ‘Special Drawing Rights’, or SDRs. SDRs will be able to be converted into any currency, based on a weighted basket of international currencies.

The IMF also proposed creating SDR-denominated bonds, which could reduce central banks’ dependence on U.S. Treasuries. They also suggested that certain assets, such as oil and gold, which are traded in U.S. dollars, could be priced using SDRs. (This is a HUGE step to replace the U.S. dollar as the world’s reserve currency)

Russian and China have made an agreement to settle all debts between them in each others currencies without first transferring to dollars.

The U.S. dollar has remained the world’s reserve currency for more than 50 years. It seems as though its days are numbered. Don’t remain in denial

You are just making all kinds of stuff up, lol. China is not getting out of the dollar at all. We still send them $100s of billions of dollars a year.

This is the stupidest thing I've ever heard...

"If the dollar loses status as the world's most reliable currency the United States will lose the right to print money to pay its debt."

So we are dependent on other countries to print our own currency?

You can print as much as you want but that doesn't mean it will be worth anything.

Once again, for the economic illiterates:

PRINTING MONEY ISN'T WEALTH CREATION!

This is the stupidest thing I've ever heard...

"If the dollar loses status as the world's most reliable currency the United States will lose the right to print money to pay its debt."

So we are dependent on other countries to print our own currency?

No it means the DEBT becomes DUE... and will have to pay it with the new WORLD CURRENCY.

for example: You get 1 Yuan for every 1 dollar. When the dollar loses its status, and is no longer the world currency, the value of the dollar (cause of our debt, and ability to just print "free money" lessens the dollar.

So now just to buy 1 Yuan, its going to cost 100 dollars (instead of just 1 for 1).

It losses it value, the treasury bonds become junk, the US would be accountable for all its debt, and countries will refuse to loan.

There are consequences when you spend 100% more then what you make, and you can print "free money" anytime you want. It becomes worthless.

Yeah, Im just making stuff up:

Governmental[edit]

On 16 March 2009, in connection with the April 2009 G20 summit, the Kremlin called for a supranational reserve currency as part of a reform of the global financial system. In a document containing proposals for the G20 meeting, it suggested that the International Monetary Fund (IMF) (or an Ad Hoc Working Group of G20) should be instructed to carry out specific studies to review the following options:

Enlargement (diversification) of the list of currencies used as reserve ones, based on agreed measures to promote the development of major regional financial centers. In this context, we should consider possible establishment of specific regional mechanisms which would contribute to reducing volatility of exchange rates of such reserve currencies.

Introduction of a supra-national reserve currency to be issued by international financial institutions. It seems appropriate to consider the role of IMF in this process and to review the feasibility of and the need for measures to ensure the recognition of SDRs as a "supra-reserve" currency by the whole world community."[9][10]

On 24 March 2009, Zhou Xiaochuan, President of the People's Bank of China, called for "creative reform of the existing international monetary system towards an international reserve currency," believing it would "significantly reduce the risks of a future crisis and enhance crisis management capability."[11] Zhou suggested that the IMF's special drawing rights (a currency basket comprising dollars, euros, yen, and sterling) could serve as a super-sovereign reserve currency, not easily influenced by the policies of individual countries. US President Obama, however, rejected the suggestion stating that "the dollar is extraordinarily strong right now."[12] At the G8 summit in July 2009, the Russian president expressed Russia's desire for a new supranational reserve currency by showing off a coin minted with the words "unity in diversity". The coin, an example of a future world currency, emphasized his call for creating a mix of regional currencies as a way to address the global financial crisis.[13]

On 30 March 2009, at the Second South America-Arab League Summit in Qatar, Venezuelan President Hugo Chavez proposed the creation of a petro-currency. It would be backed by the huge oil reserves of the oil producing countries

http://en.wikipedia.org/wiki/World_currency

Governmental[edit]

On 16 March 2009, in connection with the April 2009 G20 summit, the Kremlin called for a supranational reserve currency as part of a reform of the global financial system. In a document containing proposals for the G20 meeting, it suggested that the International Monetary Fund (IMF) (or an Ad Hoc Working Group of G20) should be instructed to carry out specific studies to review the following options:

Enlargement (diversification) of the list of currencies used as reserve ones, based on agreed measures to promote the development of major regional financial centers. In this context, we should consider possible establishment of specific regional mechanisms which would contribute to reducing volatility of exchange rates of such reserve currencies.

Introduction of a supra-national reserve currency to be issued by international financial institutions. It seems appropriate to consider the role of IMF in this process and to review the feasibility of and the need for measures to ensure the recognition of SDRs as a "supra-reserve" currency by the whole world community."[9][10]

On 24 March 2009, Zhou Xiaochuan, President of the People's Bank of China, called for "creative reform of the existing international monetary system towards an international reserve currency," believing it would "significantly reduce the risks of a future crisis and enhance crisis management capability."[11] Zhou suggested that the IMF's special drawing rights (a currency basket comprising dollars, euros, yen, and sterling) could serve as a super-sovereign reserve currency, not easily influenced by the policies of individual countries. US President Obama, however, rejected the suggestion stating that "the dollar is extraordinarily strong right now."[12] At the G8 summit in July 2009, the Russian president expressed Russia's desire for a new supranational reserve currency by showing off a coin minted with the words "unity in diversity". The coin, an example of a future world currency, emphasized his call for creating a mix of regional currencies as a way to address the global financial crisis.[13]

On 30 March 2009, at the Second South America-Arab League Summit in Qatar, Venezuelan President Hugo Chavez proposed the creation of a petro-currency. It would be backed by the huge oil reserves of the oil producing countries

http://en.wikipedia.org/wiki/World_currency

No it means the DEBT becomes DUE... and will have to pay it with the new WORLD CURRENCY.

for example: You get 1 Yuan for every 1 dollar. When the dollar loses its status, and is no longer the world currency, the value of the dollar (cause of our debt, and ability to just print "free money" lessens the dollar.

So now just to buy 1 Yuan, its going to cost 100 dollars (instead of just 1 for 1).

It losses it value, the treasury bonds become junk, the US would be accountable for all its debt, and countries will refuse to loan.

There are consequences when you spend 100% more then what you make, and you can print "free money" anytime you want. It becomes worthless.

We will never have to pay our debt in another currency. And we will never be dependent on other countries to give us our own made up money to spend. That doesn't even make any logical sense whatsoever. The reason the world reserve currency is significant is because of oil prices.

Looks like the data is not on your side. It's basic mathematics on why we have to continue increasing debt and the money supply. If your theory were even remotely logical this graph would be impossible.

So debt and money supply is wealth????

Memo to Keynesians:

Real markets don't think like you!

face)(*^%

Yeah, Im just making stuff up:

Governmental[edit]

On 16 March 2009, in connection with the April 2009 G20 summit, the Kremlin called for a supranational reserve currency as part of a reform of the global financial system. In a document containing proposals for the G20 meeting, it suggested that the International Monetary Fund (IMF) (or an Ad Hoc Working Group of G20) should be instructed to carry out specific studies to review the following options:

Enlargement (diversification) of the list of currencies used as reserve ones, based on agreed measures to promote the development of major regional financial centers. In this context, we should consider possible establishment of specific regional mechanisms which would contribute to reducing volatility of exchange rates of such reserve currencies.

Introduction of a supra-national reserve currency to be issued by international financial institutions. It seems appropriate to consider the role of IMF in this process and to review the feasibility of and the need for measures to ensure the recognition of SDRs as a "supra-reserve" currency by the whole world community."[9][10]

On 24 March 2009, Zhou Xiaochuan, President of the People's Bank of China, called for "creative reform of the existing international monetary system towards an international reserve currency," believing it would "significantly reduce the risks of a future crisis and enhance crisis management capability."[11] Zhou suggested that the IMF's special drawing rights (a currency basket comprising dollars, euros, yen, and sterling) could serve as a super-sovereign reserve currency, not easily influenced by the policies of individual countries. US President Obama, however, rejected the suggestion stating that "the dollar is extraordinarily strong right now."[12] At the G8 summit in July 2009, the Russian president expressed Russia's desire for a new supranational reserve currency by showing off a coin minted with the words "unity in diversity". The coin, an example of a future world currency, emphasized his call for creating a mix of regional currencies as a way to address the global financial crisis.[13]

On 30 March 2009, at the Second South America-Arab League Summit in Qatar, Venezuelan President Hugo Chavez proposed the creation of a petro-currency. It would be backed by the huge oil reserves of the oil producing countries

http://en.wikipedia.org/wiki/World_currency

You're not making up the fact that other countries are trying to replace the dollar. You're making up the consequences and reasons why it would effect the dollar.

You're not making up the fact that other countries are trying to replace the dollar. You're making up the consequences and reasons why it would effect the dollar.

So, in your world, if the Dollar loses its power as the worlds currency, everything is still going to be Sunshine, Butterflies and flowers?

So what if they agree to go back to the Gold standard? What happens then?

What will happen to all those trillions of dollars that are no longer needed for world trading?

The dollar will continue to be strong on the global market? Or gain value?

I don't think you did any research at all on this, or how much trouble our country is in. Cause if you spend 1-day, just researching and looking at things from outside your little fairy tale land, you would see that we are in for a world of hurt.

There might be some effects but nothing like what you guys are saying.So, in your world, if the Dollar loses its power as the worlds currency, everything is still going to be Sunshine, Butterflies and flowers?

We literally will never do that.So what if they agree to go back to the Gold standard? What happens then?

People trade dollars because we have $17 trillion dollars worth of goods and services backing them. It will still be traded. You act like being a reserve currency is the only way a country can survive. How have all the other countries been able to manage for the past 50 years?What will happen to all those trillions of dollars that are no longer needed for world trading?

The dollar will continue to be strong on the global market? Or gain value?

I've done more research on this than you can ever imagine. I know exactly what I'm talking about. Your arguments are not new. They are soundbites that we have heard for decades. Just a lack of understanding in our monetary system.I don't think you did any research at all on this, or how much trouble our country is in. Cause if you spend 1-day, just researching and looking at things from outside your little fairy tale land, you would see that we are in for a world of hurt.

Why would it not be. Are we all of a sudden not going to be able to produce goods and services because we aren't the world reserve currency? Lol. You guys believe in some weird things.

That's right...if the USD is worth piss, prices skyrocket - especially imports.

Unquestionably, the standard of living would plummet even more than it already has.

As Keynesian Kool Aid drinker, you STILL don't understand why double income families are necessary to maintain the same lifestyle as 50 years ago.

Your Keynesian "simple math" is pure fiction.

Why would it not be. Are we all of a sudden not going to be able to produce goods and services because we aren't the world reserve currency? Lol. You guys believe in some weird things.

Where did I say we wont be able to produce anything?

Now in all your ramblings, insults, and such... now you are just making things up.

No where did I state that.

That's right...if the USD is worth piss, prices skyrocket - especially imports.

Unquestionably, the standard of living would plummet even more than it already has.

As Keynesian Kool Aid drinker, you STILL don't understand why double income families are necessary to maintain the same lifestyle as 50 years ago.

Your Keynesian "simple math" is pure fiction.

Why would the USD be worth piss? We have the wealthiest economy in the history of mankind. Is that all dependent on oil prices? Lol.