You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Dollar Is Extremely Strong, Pushing Down the World

- Thread starter Bozzie

- Start date

a resounding NO. He's the straw that stirs the drink....punished everything in his path, lol..take a look at the reversal on the metals, LOLFOMC tomorrow.....Mr. Powell takes a bite out of the USD? or does the usd go crazy and break its ceiling (i say no to

US Dollar Index Streaming Chart - Investing.com

In this section you'll find a streaming chart for the US Dollar Index.

1 W, candlesticks

look at that, lol....smelling a stale green light, looking for a candle like 2023-03-06....we shall see..........Lagarde, you're up

expiration Friday is tomorrow, XLU sitting at $64.11 with a beauty hammer pattern forming, grant it, its not even 1:00pmadded to utilities, this time on the US exchange. Shortened DTE, too. Done in 2 transactions that amount to the following with XLU

Sept 22, 2023 $64 put @ 1.53...roi : 2.3%, aroi : 19%, yeah with utilities

so sitting pretty here, risk of assignment is there. If assigned then to sell calls which looking at the options chain will pay over 15% easy. however,

one can,also, BTC this position and take home over 85% of the premium if one DIDNT want to take the risk of assignment

the 2 yr weekly

remove the last 2 candles (which are , of course, the last 2 weeks)--look at that BEAUTY green hammer at any area of support.

i chooe to take further action at said point and have this pending (and, no i havent fallen in love with Utility companies, lol)

Sold 5 XLU 12/15/23 63 PUT at 2.05 leaves 0

roi:3.2%

aroi: 12%

utilities are the worst performing sector ytd , down over 7%

.....real estate not too far behind

.....real estate not too far behind(weekly candles)got it 2 weeks ago, just remove the two candles to the far right. SHORT fuse on this for me, 1 ATR from the top of said candle. Short fuse cuase the monthly chart has no red flags , ...yet

US Dollar Index Streaming Chart - Investing.com

In this section you'll find a streaming chart for the US Dollar Index.www.investing.com

1 W, candlesticks

look at that, lol....smelling a stale green light, looking for a candle like 2023-03-06....we shall see..........Lagarde, you're up

+ve-- only about a 17% chance Powell raises in Nov ,

posted somewhere (cant find it, search engine is not up to par) about the potential huge win by BigPharma with the weight loss drugs, well...

LLY, NOVO hit the jackpot. NOVO is Danish,.............. they are likely celebrating in the streets . Literally, they cant keep up with demand

NOVO

decade MONTHLY

lol..........dont ya love charts?

there is a running narrative that these drugs may impact the food industry , its takin consumer staples (so called 'defensive') into a dramatic fall.

i see it as opportunity . XLP (consumer staples, etf) pays garbage for writing puts, so i gotta look under the hood. Not my style , individual stock picking brings much more risk. With that said, marrying the technical oversold/support levels/candlestick entry + fundamentals (including ensuring intrinsic value less than current price) warrants in for me.

notably :MCD, HSY, KO, CAG

LLY, NOVO hit the jackpot. NOVO is Danish,.............. they are likely celebrating in the streets . Literally, they cant keep up with demand

NOVO

decade MONTHLY

lol..........dont ya love charts?

there is a running narrative that these drugs may impact the food industry , its takin consumer staples (so called 'defensive') into a dramatic fall.

i see it as opportunity . XLP (consumer staples, etf) pays garbage for writing puts, so i gotta look under the hood. Not my style , individual stock picking brings much more risk. With that said, marrying the technical oversold/support levels/candlestick entry + fundamentals (including ensuring intrinsic value less than current price) warrants in for me.

notably :MCD, HSY, KO, CAG

...............

Danish drugmaker Novo Nordisk has entered a new chapter in its 100-year history — thanks to its newfound success with two products: Ozempic and Wegovy.

The drugs are once-weekly injectables of a medication called semaglutide, prescribed for Type 2 diabetes and weight loss. Their skyrocketing popularity has boosted Novo Nordisk to new heights.

Novo Nordisk’s share price has more than quadrupled in the past five years, making it Europe’s most valuable company by market cap.

“It’s clear that nobody had expected that it would be taking off this quickly,” said Novo Nordisk CEO Lars Fruergaard Jørgensen in August. “We all along knew that obesity was a serious chronic disease also when most others did not see it like that. So we knew we were onto something big.”

In 2018, the first full year with Ozempic on the market, Novo Nordisk’s net sales were 111.8 billion Danish krone, or $17.7 billion, using an average exchange rate at the time.

In the last three months of 2022, U.S. health-care providers wrote more than 9 million prescriptions for Ozempic, Wegovy and other diabetes and obesity drugs, according to analytics firm Trilliant Health.

Ozempic accounted for more than 65% of total prescriptions as of the end of 2022.

And it was only up from there: In the first six months of 2023, sales of Ozempic and Wegovy rose by 58% and 363%, respectively.

“There has not been any performance near what we’ve seen over the last year or two,” said Jared Holz, health care sector specialist at Mizuho, adding that semaglutide alone could be worth up to $300 billion annually over time.

Semaglutide falls under a drug class called GLP-1 agonists, which mimic GLP-1 receptors in the body and produce more insulin, helping to lower blood sugar levels and decrease appetite.

Novo Nordisk’s treatments are not the only GLP-1 treatments available, but they are the only semaglutide products currently on the U.S. market, as the company holds a patent until 2032.

Eli Lilly has developed its own GLP-1 drug, tirzepatide, marketed as Mounjaro, and other companies, such as Pfizer, are creating their own injectables. Mounjaro was approved by the Food and Drug Administration for Type 2 diabetes in May 2022. It is not yet approved for weight loss

Danish drugmaker Novo Nordisk has entered a new chapter in its 100-year history — thanks to its newfound success with two products: Ozempic and Wegovy.

The drugs are once-weekly injectables of a medication called semaglutide, prescribed for Type 2 diabetes and weight loss. Their skyrocketing popularity has boosted Novo Nordisk to new heights.

Novo Nordisk’s share price has more than quadrupled in the past five years, making it Europe’s most valuable company by market cap.

“It’s clear that nobody had expected that it would be taking off this quickly,” said Novo Nordisk CEO Lars Fruergaard Jørgensen in August. “We all along knew that obesity was a serious chronic disease also when most others did not see it like that. So we knew we were onto something big.”

In 2018, the first full year with Ozempic on the market, Novo Nordisk’s net sales were 111.8 billion Danish krone, or $17.7 billion, using an average exchange rate at the time.

In the last three months of 2022, U.S. health-care providers wrote more than 9 million prescriptions for Ozempic, Wegovy and other diabetes and obesity drugs, according to analytics firm Trilliant Health.

Ozempic accounted for more than 65% of total prescriptions as of the end of 2022.

And it was only up from there: In the first six months of 2023, sales of Ozempic and Wegovy rose by 58% and 363%, respectively.

“There has not been any performance near what we’ve seen over the last year or two,” said Jared Holz, health care sector specialist at Mizuho, adding that semaglutide alone could be worth up to $300 billion annually over time.

Semaglutide falls under a drug class called GLP-1 agonists, which mimic GLP-1 receptors in the body and produce more insulin, helping to lower blood sugar levels and decrease appetite.

Novo Nordisk’s treatments are not the only GLP-1 treatments available, but they are the only semaglutide products currently on the U.S. market, as the company holds a patent until 2032.

Eli Lilly has developed its own GLP-1 drug, tirzepatide, marketed as Mounjaro, and other companies, such as Pfizer, are creating their own injectables. Mounjaro was approved by the Food and Drug Administration for Type 2 diabetes in May 2022. It is not yet approved for weight loss

'still long BTC, no intention of selling until a double top forms ($65,000 ish)-then re-assess. A ceiling is rarely broken on the 1st try. ....that's the plan.......'the best laid plans of mice and men '.....'

long long way to go ......

developments

www.investing.com

www.investing.com

candlestick, 1W (weekly)

clearly has broken the ceiling , (lost that support in April 2023) its 3rd major effort did the trick (see chart)

how this weekly candle closes end of week is significant, imo. If it gives much of this gain all back by end of week (Sat 7pm)? not good, inverted hammer after piercing a ceiling , price manipulation theory calls that a forced top (buy stops triggered then reverse the show). Lets see the close on sat..keep in mind its already at the next resistance level ,..riding uphill , enough gas in the legs?

'Galaxy Investment Partners, in partnership with InvescoIVZ -1.4%, has its own spot bitcoin ETF application lodged with the SEC, a decision on which was delayed along with the other filings in late September.

This week, BlackRockBLK 0.0%, which kicked off the Wall Street bitcoin spot ETF race in June, amended its filing, something that Novogratz said highlighted "the dialogue with the SEC is all heading in the right direction."

"It’s no longer talking about how [bitcoin] works or why it’s important. It’s just a recognized macro asset and that’s a huge psychological shift," Novogratz said.

Coinbase's chief legal officer, Paul Grewal, meanwhile told CNBC the bitcoin and crypto exchange is confident that a U.S. bitcoin spot ETF will be approved by the SEC.

"I’m quite hopeful that these [ETF] applications will be granted, if only because they should be granted under the law," Grewal said. "We are quite excited that there are a number of developments we think that are just around the corner, or underway even as we speak, that will bring back investor and consumer interest in crypto."

long long way to go ......

developments

Bitcoin Price Chart Live - Investing.com

View live Bitcoin price chart and follow real-time Bitcoin price changes.

candlestick, 1W (weekly)

clearly has broken the ceiling , (lost that support in April 2023) its 3rd major effort did the trick (see chart)

how this weekly candle closes end of week is significant, imo. If it gives much of this gain all back by end of week (Sat 7pm)? not good, inverted hammer after piercing a ceiling , price manipulation theory calls that a forced top (buy stops triggered then reverse the show). Lets see the close on sat..keep in mind its already at the next resistance level ,..riding uphill , enough gas in the legs?

'Galaxy Investment Partners, in partnership with InvescoIVZ -1.4%, has its own spot bitcoin ETF application lodged with the SEC, a decision on which was delayed along with the other filings in late September.

This week, BlackRockBLK 0.0%, which kicked off the Wall Street bitcoin spot ETF race in June, amended its filing, something that Novogratz said highlighted "the dialogue with the SEC is all heading in the right direction."

"It’s no longer talking about how [bitcoin] works or why it’s important. It’s just a recognized macro asset and that’s a huge psychological shift," Novogratz said.

Coinbase's chief legal officer, Paul Grewal, meanwhile told CNBC the bitcoin and crypto exchange is confident that a U.S. bitcoin spot ETF will be approved by the SEC.

"I’m quite hopeful that these [ETF] applications will be granted, if only because they should be granted under the law," Grewal said. "We are quite excited that there are a number of developments we think that are just around the corner, or underway even as we speak, that will bring back investor and consumer interest in crypto."

Banks hold a shit load of TLT, sitting on MASSIVE paper losses. Call me crazy - the next sizable move on TLT is up . Im patiently waiting for a technical signal (higher time frame for damn surre!!) ...............no one wants this stuff fellas, lol

'The iShares 20+ Year Treasury Bond ETF has plunged as much as 47% from its 2020 peak, making the collapse worse than the 1981 bond bear market and on par with some of the worst market crashes in history.

"It's the greatest bond bear market in history as stubborn prices and a resilient economy have propelled yields sharply higher," Bank of America said in a Wednesday note.'

1 DECADE monthly chart

look at the volume , red flag-smells of capitulation (that Oct candle will close soon)

'The iShares 20+ Year Treasury Bond ETF has plunged as much as 47% from its 2020 peak, making the collapse worse than the 1981 bond bear market and on par with some of the worst market crashes in history.

"It's the greatest bond bear market in history as stubborn prices and a resilient economy have propelled yields sharply higher," Bank of America said in a Wednesday note.'

1 DECADE monthly chart

look at the volume , red flag-smells of capitulation (that Oct candle will close soon)

have been fiddling with fundamentals , haha ! next stop on the bus might be a HOME..with orchids....

sectors with the greatest # of value plays (intrinsic value lower than market price by more than 20%!):

-numero UNO- healthcare (Biden crushing the sector fellas?....why?...)

-real estate (reits-like utilities they r interest sensitive , ive posted puts on utilities -love the sector to revert to the mean)

-consumer cyclicals

-financials (Powel -DONT kill the banks, all comes crashing down if u do...)

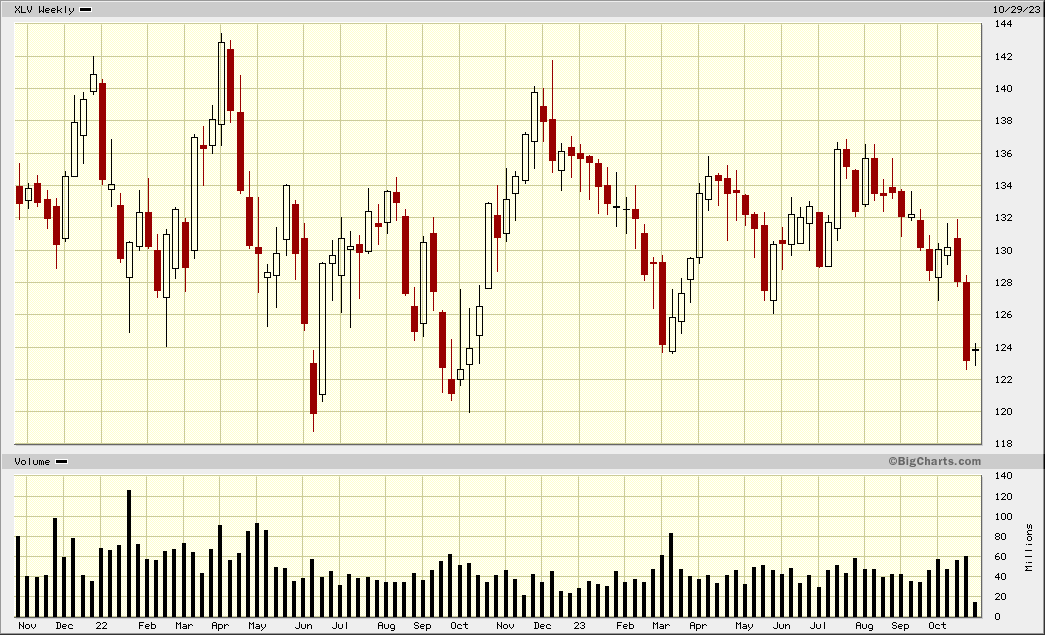

XLV

(healthcare.......everyone ends up in the hospital ...'doc, can u help?')

decade MONTHLY

2 yr weekly

$120 CLEAR as sin level of support...lose that and call 911

sectors with the greatest # of value plays (intrinsic value lower than market price by more than 20%!):

-numero UNO- healthcare (Biden crushing the sector fellas?....why?...)

-real estate (reits-like utilities they r interest sensitive , ive posted puts on utilities -love the sector to revert to the mean)

-consumer cyclicals

-financials (Powel -DONT kill the banks, all comes crashing down if u do...)

XLV

(healthcare.......everyone ends up in the hospital ...'doc, can u help?')

decade MONTHLY

2 yr weekly

$120 CLEAR as sin level of support...lose that and call 911

......IF u think about, its a total shit show.. Its ABOUT FAITH

powell is inadvertently crushing country (he knows this of course , sticking to the mandate doing his job...remember the days when he stated ''inflation is under control' -catastrophic failure , fortunately for him he's not in healthcare lose his license ...no one even cares -- its a GREAT JOB to have !!

'It's an outlook shared by Wall Street, and institutions are raising their expectations on the size of US debt issuance.'

Bank of America revised its deficit expectations higher for coming years, noting that US overspending will grow to $2 trillion by fiscal year 2026 from $1.7 trillion in 2023. A major factor driving this upswing will be higher interest expenses on US borrowing, forcing the Treasury to keep issuing more bonds.

..............

USA cant pay the bills , issue 'bigger wave' of treasuries ...... .....its musical chairs.......... citizenry largely has no idea......

fortunately others r even more garbage, hence the faith

who created BTC? some fuckin' introvert who couldnt sleep at night?

............ raising taxes and /or cutting SS will come ....either that or a further massive bond collapse-- pick ur poison . its MATH. remember someone needs to buy this shit : its largely the fed or internationals

'Get ready for more US debt sticker shock as Wall Street sees a bigger wave of Treasurys flooding the bond market'

powell is inadvertently crushing country (he knows this of course , sticking to the mandate doing his job...remember the days when he stated ''inflation is under control' -catastrophic failure , fortunately for him he's not in healthcare lose his license ...no one even cares -- its a GREAT JOB to have !!

'It's an outlook shared by Wall Street, and institutions are raising their expectations on the size of US debt issuance.'

Bank of America revised its deficit expectations higher for coming years, noting that US overspending will grow to $2 trillion by fiscal year 2026 from $1.7 trillion in 2023. A major factor driving this upswing will be higher interest expenses on US borrowing, forcing the Treasury to keep issuing more bonds.

..............

USA cant pay the bills , issue 'bigger wave' of treasuries ...... .....its musical chairs.......... citizenry largely has no idea......

fortunately others r even more garbage, hence the faith

who created BTC? some fuckin' introvert who couldnt sleep at night?

............ raising taxes and /or cutting SS will come ....either that or a further massive bond collapse-- pick ur poison . its MATH. remember someone needs to buy this shit : its largely the fed or internationals

one of icons of candlesticks charting passed away 2 weeks ago. Stephen Bigalow. PASSIONATE teacher. Wrote books, had his website. Chat forum was awesome. He'd speak every monday/thursday night on a topic, but every day after the close . Lived in Pennsylvania, big Steeler fan..going to miss himBanks hold a shit load of TLT, sitting on MASSIVE paper losses. Call me crazy - the next sizable move on TLT is up . Im patiently waiting for a technical signal (higher time frame for damn surre!!) ...............no one wants this stuff fellas, lol

'The iShares 20+ Year Treasury Bond ETF has plunged as much as 47% from its 2020 peak, making the collapse worse than the 1981 bond bear market and on par with some of the worst market crashes in history.

"It's the greatest bond bear market in history as stubborn prices and a resilient economy have propelled yields sharply higher," Bank of America said in a Wednesday note.'

1 DECADE monthly chart

look at the volume , red flag-smells of capitulation (that Oct candle will close soon)

View attachment 77228

the strongest candlestick signal , in his opinion, is a 'kicker signal' . Happened yesterday on TLT. .....gap up today. Nice call Stephen ,

(im a holder but not trading....the rising interest rate ballgame is coming to an end)

RIP Stephen!!

note- this aint a trade on TLT, its a hold for a significant period of time. I think in 12 mths the probability of price appreciation is significant, and paid that handsome yield while waiting

'The central bank raised its economic assessment, bolstering the case for "higher for longer" rates. But it noted "tighter financial and credit conditions" — a nod to higher Treasury yields — are "likely to weigh on economic activity, hiring and inflation"'

Canada goign to have a fun next two yrs. The housing mess is a runaway train- approx 50% of mortgages come due for renewal within the next 2 yrs. SO..mortgages at 2%ish....and now to renew at 5% ........yikes , what a mess

'The central bank raised its economic assessment, bolstering the case for "higher for longer" rates. But it noted "tighter financial and credit conditions" — a nod to higher Treasury yields — are "likely to weigh on economic activity, hiring and inflation"'

Canada goign to have a fun next two yrs. The housing mess is a runaway train- approx 50% of mortgages come due for renewal within the next 2 yrs. SO..mortgages at 2%ish....and now to renew at 5% ........yikes , what a mess

Banks hold a shit load of TLT, sitting on MASSIVE paper losses. Call me crazy - the next sizable move on TLT is up . Im patiently waiting for a technical signal (higher time frame for damn surre!!) ...............no one wants this stuff fellas, lol

1 DECADE monthly chart

look at the volume , red flag-smells of capitulation (that Oct candle will close soon)

View attachment 77228

Bond-market crash leaves big banks with $650 billion of unrealized losses as the ghost of SVB continues to haunt Wall Street

BlackRock's iShares 20+ Year Treasury fund, which tracks longer-duration debt prices, has plunged 48% since April 2020. Meanwhile, 10-year Treasury yields, which move in the opposite direction to prices, recently spiked above 5% for the first time in 16 years.

As a result of that sell-off, some of the US's biggest banks are now sitting on unrealized, or "paper," losses worth hundreds of billions of dollars. That means the value of their bond holdings has plunged, but they've chosen to hold on rather than offload their investments.

Moody's estimated last month that US financial institutions had racked up $650 billion worth of paper losses on their portfolios by September 30 — up 15% from June 30. The ratings agency's data still doesn't account for a hellish October where the longer-term collapse in bond prices spiraled into one of the worst routs in market history.

"'Higher for longer' is absurd baloney," the market vet Larry McDonald said in a post on X Sunday, referring to the Fed signaling it would hold interest rates at about their current level well into 2024 in a bid to kill off inflation. "A 6% + Fed funds and Bank of America is near insolvency."

..............................

feeling even better now

sweet(weekly candles)got it 2 weeks ago, just remove the two candles to the far right. SHORT fuse on this for me, 1 ATR from the top of said candle. Short fuse cuase the monthly chart has no red flags , ...yet

+ve-- only about a 17% chance Powell raises in Nov ,

USD

US Dollar Index Streaming Chart - Investing.com

In this section you'll find a streaming chart for the US Dollar Index.

click 1W (weekly) ..its at support now, expecting a fight here

again the thesis is the raising rates story is done. Married the technical with the macro. Put a short leash on this as its a play AGAINST the trend--do that enough and great way to go poor (any asset class)

breathtaking action on the capital/forex markets today

bond yields absolutely CRUSHED , lol (as bond yields decrease , bond prices increase). the USD down 1.50%- in one day , more lol

anyone holding variable gic's/cds...may want to lock those . aint going to be paying the same in 12 mths

the russell went nutso today , up over 5% (IWM).....

'

bond yields absolutely CRUSHED , lol (as bond yields decrease , bond prices increase). the USD down 1.50%- in one day , more lol

anyone holding variable gic's/cds...may want to lock those . aint going to be paying the same in 12 mths

the russell went nutso today , up over 5% (IWM).....

'

Toyota throws in the towel

oilprice.com

oilprice.com

In a major milestone in the government-coerced push away from gas-powered vehicles, the best-selling sedan in America will only be available with gas-electric hybrid powertrains starting with the 2025 model year, Toyota revealed in Malibu on Tuesday night.

The 2025 Toyota Camry will feature a 2.5-liter gas engine paired with an electric drive that will deliver more power than the 2024 hybrids. Toyota is already the leading seller of hybrid vehicles, which, depending on the driving scenario, use only electric power, only gasoline, or both. Hybrids recapture energy from the braking system that helps boost the range.

It could be a very risky move for Toyota, considering that combustion models comprise about 85% of Camry's 2024 sales volume. The Camry is king of the sedan market. However, as Americans increasingly prefer crossovers and SUVs, total sedan sales have plummeted from 7.2 million a year in 2012 to just 2.9 million in 2022, notes the Wall Street Journal.

Toyota's radical shift comes in part because of a government gun held to manufacturers' heads. Whether consumers want it or not, the federal government is using regulation to force gas vehicles out of the marketplace by tightening average mileage requirements for manufacturers' fleets. Most recently, the White House proposed a 58 mpg standard for the 2032 model year. The 2022 average was 27 mp

....................

on another note..

oil getting HAMMERED today, and an ugly ugly ugly candle on XLE. The darling of Wall Street a yr ago is reverting to the mean? its DOWN 2.50% ytd

OIL

www.investing.com

www.investing.com

click 1W, candlesticks

headed to a powerful zone of support, i think she holds/bounces off . needs to come down more tho,..chart is clear as day

America’s Best-Selling Sedan Will Be Hybrid-Only by 2025 | OilPrice.com

Starting in 2025, Toyota will only offer the Camry sedan with hybrid powertrains, marking a significant shift towards environmentally friendly vehicles.

America’s Best-Selling Sedan Will Be Hybrid-Only by 2025

In a major milestone in the government-coerced push away from gas-powered vehicles, the best-selling sedan in America will only be available with gas-electric hybrid powertrains starting with the 2025 model year, Toyota revealed in Malibu on Tuesday night.

The 2025 Toyota Camry will feature a 2.5-liter gas engine paired with an electric drive that will deliver more power than the 2024 hybrids. Toyota is already the leading seller of hybrid vehicles, which, depending on the driving scenario, use only electric power, only gasoline, or both. Hybrids recapture energy from the braking system that helps boost the range.

It could be a very risky move for Toyota, considering that combustion models comprise about 85% of Camry's 2024 sales volume. The Camry is king of the sedan market. However, as Americans increasingly prefer crossovers and SUVs, total sedan sales have plummeted from 7.2 million a year in 2012 to just 2.9 million in 2022, notes the Wall Street Journal.

Toyota's radical shift comes in part because of a government gun held to manufacturers' heads. Whether consumers want it or not, the federal government is using regulation to force gas vehicles out of the marketplace by tightening average mileage requirements for manufacturers' fleets. Most recently, the White House proposed a 58 mpg standard for the 2032 model year. The 2022 average was 27 mp

....................

on another note..

oil getting HAMMERED today, and an ugly ugly ugly candle on XLE. The darling of Wall Street a yr ago is reverting to the mean? its DOWN 2.50% ytd

OIL

Crude Oil WTI Futures Chart - Investing.com

Get instant access to a free live streaming Crude Oil WTI Futures chart.

click 1W, candlesticks

headed to a powerful zone of support, i think she holds/bounces off . needs to come down more tho,..chart is clear as day

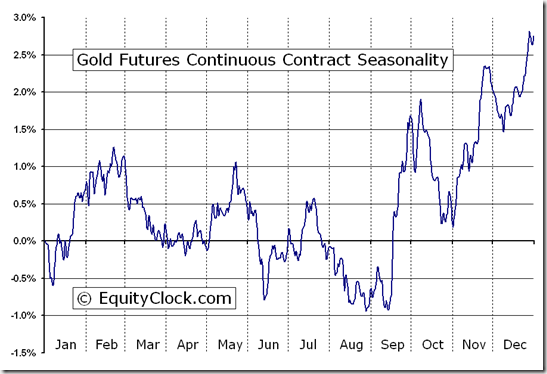

gold is in her seasonality favor zone, see below:

GDX

1 decade monthly

clearly $27 ish a poweful zone of support. Look to write puts , Dec 29th $27 strike price early next week, wouldbe super sweet if the gap @ $27.10 ish is filled, fingers crossed. As of friday close ,those are paying an AROI of 19%

GDX

1 decade monthly

clearly $27 ish a poweful zone of support. Look to write puts , Dec 29th $27 strike price early next week, wouldbe super sweet if the gap @ $27.10 ish is filled, fingers crossed. As of friday close ,those are paying an AROI of 19%