[h=2]Americans are going deeper into debt to buy cars[/h]By Peter Valdes-Dapena July 4, 2017: 10:34 AM ET

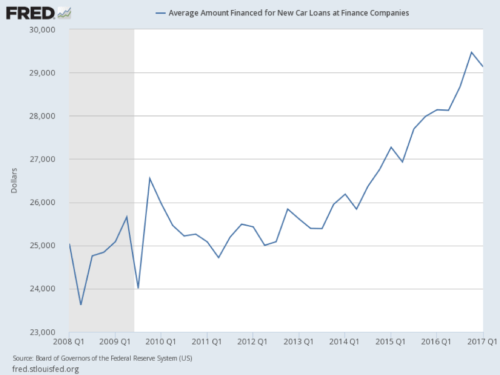

Car buyers are going deeper into debt and for longer periods of time as they reach to buy more expensive new cars.

The average car loan last month stretched out for 69.3 months, or nearly six years, according to Edmunds.com.

That's the longest average loan term ever recorded since Edmunds.com began tracking the statistic in 2002. Based on industry trends, it's very unlikely that it has ever been higher.

The long loans are a sign of consumers' confidence in the economy and their belief they will be able to pay up, Edmunds.com analyst Jessica Caldwell said.

But they're also driven by the allure of crossover SUVs, which cost more than cars, and by all the tempting new technology features cars now offer.

"You can still get a perfectly nice compact car for under $20,000," Caldwell said. Not as many customers want those, though, especially with gasoline prices at historic lows.

Great looking cars on a budget

Last month, car buyers borrowed an average of $31,000 with average monthly payments of $517, the highest so far this year.

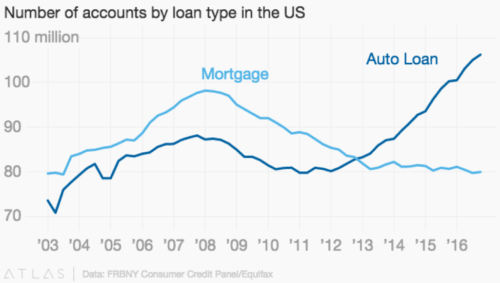

There are serious downsides to long auto loans.

For one thing, since a longer loan is paid off more slowly, borrowers will be "upside down" in the car longer -- meaning they will owe more on the car than what it's actually worth for longer.

Cars buyers end up owing money on about a third of cars that are traded in at dealerships, Caldwell said. That debt then usually gets wrapped up in the new car loan, making for bigger monthly payments and a cycle of expanding debt.

"You hear stories about someone driving a $40,000 Toyota Camry," Caldwell said. "That's where that comes from." A new Camry typically sells for around $30,000.

Consumer Reports Top Pick cars

Even as they are taking out longer loans, they're also putting down bigger down payments. The average down payment in June was $2,453, an increase of over 7% from last year.

These record loan lengths come as auto sales continue to plateau following years of increases.

July 04

NEW YORK

Car buyers are going deeper into debt and for longer periods of time as they reach to buy more expensive new cars.

The average car loan last month stretched out for 69.3 months, or nearly six years, according to Edmunds.com.

That's the longest average loan term ever recorded since Edmunds.com began tracking the statistic in 2002. Based on industry trends, it's very unlikely that it has ever been higher.

But they're also driven by the allure of crossover SUVs, which cost more than cars, and by all the tempting new technology features cars now offer.

"You can still get a perfectly nice compact car for under $20,000," Caldwell said. Not as many customers want those, though, especially with gasoline prices at historic lows.

Great looking cars on a budget

Last month, car buyers borrowed an average of $31,000 with average monthly payments of $517, the highest so far this year.

There are serious downsides to long auto loans.

For one thing, since a longer loan is paid off more slowly, borrowers will be "upside down" in the car longer -- meaning they will owe more on the car than what it's actually worth for longer.

Cars buyers end up owing money on about a third of cars that are traded in at dealerships, Caldwell said. That debt then usually gets wrapped up in the new car loan, making for bigger monthly payments and a cycle of expanding debt.

"You hear stories about someone driving a $40,000 Toyota Camry," Caldwell said. "That's where that comes from." A new Camry typically sells for around $30,000.

Consumer Reports Top Pick cars

Even as they are taking out longer loans, they're also putting down bigger down payments. The average down payment in June was $2,453, an increase of over 7% from last year.

These record loan lengths come as auto sales continue to plateau following years of increases.

July 04

NEW YORK