Still think it is too early to say what will happen.

A lot of House/Senate GOP could block the spending and a lot of Dems might just want to not work with him. Trump is more popular than all of them though and it won't be good for their popularity.

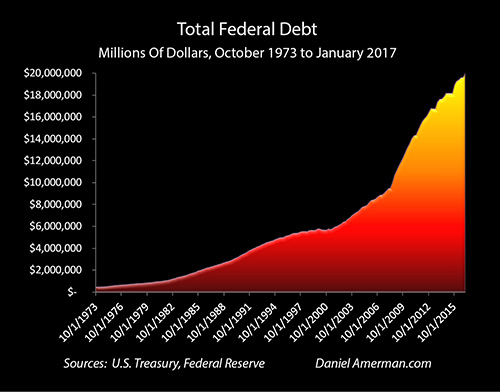

All these guys have the same economic advisors that tell them you have to deficit spend or else there is going to be a contraction though.

The Keynesians always find something to spend on. "Our infrastructure is crumbling" "The soviets are going to kill us" "the war on terror" "We need an ownership society"

Some of these had merit, some didn't. And if the ones that had merit didn't exist, they would've just found other ways to spend.

Going to be an interesting time.

A lot of House/Senate GOP could block the spending and a lot of Dems might just want to not work with him. Trump is more popular than all of them though and it won't be good for their popularity.

All these guys have the same economic advisors that tell them you have to deficit spend or else there is going to be a contraction though.

The Keynesians always find something to spend on. "Our infrastructure is crumbling" "The soviets are going to kill us" "the war on terror" "We need an ownership society"

Some of these had merit, some didn't. And if the ones that had merit didn't exist, they would've just found other ways to spend.

Going to be an interesting time.

up along the way and the libs are simply too chickenshit and too comfy to go there

up along the way and the libs are simply too chickenshit and too comfy to go there