Once you lose that cool appeal it's hard to get it back.. Everybody talks about how "cheap" Apple is.. The reason is obvious their brand is no longer as cool and innovation is nil now.. Samsung leading the market now as far as technology goes.. They an old stale Microsoft now (they will be around and make plenty of money but they are not cool anymore and their high growth days are behind them) .. Microsoft finally on a solid path with nadella now that the rid of ballmer (cook a ballmer)

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

sell! sell! sell!

- Thread starter eek.

- Start date

Yeah, I get Tesla's edge with their brand. People wanna buy a car from a start-up run by the real life Iron Man that also happens to double as the dude building reusable rockets. Compared to old automakers who couldn't even survive without the government bailing them out. Then the media gushes over Tesla because Musk is such a brilliant promoter (similar to Trump in a sense)

You should checkout the Wired piece though. Good read on what GM is doing.

FWIW, even Musk says autonomous is going to be here sooner than people think.

You should checkout the Wired piece though. Good read on what GM is doing.

FWIW, even Musk says autonomous is going to be here sooner than people think.

Also to tie everything together, I do think some of the reason why there are signs we may be coming into a time of accelerating innovation has to do with how messed up everything else is between energy, healthcare, transport, debt at all levels, the climate etc

Necessity is the mother of invention.

Necessity is the mother of invention.

Bolt needs 9 hours to charge vs Tesla has massive charging station network that can charge up in 30 minutes- hour

chevy vs "cool" tesla likely will beat it in the style category too

autopilot program/ be a part of building autonomous network.. No clue what autonomous features if any with bolt..

tesla great customer service

with gas so low don't see bolt selling that well vs tesla .. And for near same price point people who want full electric will wait for model 3 for most part.. Guess we shall see..

tesla forced the big guys hands they will be chasing their tail for a while.. Just brand alone is huge factor..

chevy vs "cool" tesla likely will beat it in the style category too

autopilot program/ be a part of building autonomous network.. No clue what autonomous features if any with bolt..

tesla great customer service

with gas so low don't see bolt selling that well vs tesla .. And for near same price point people who want full electric will wait for model 3 for most part.. Guess we shall see..

tesla forced the big guys hands they will be chasing their tail for a while.. Just brand alone is huge factor..

Yeah, I know they are ahead right now. No doubting that.

Autonomous is coming though. Gov't starting to work with the automakers to make transition smooth. Fleets, charging.....I'm sure the dealerships, suppliers, insurance co and everyone else effected will try to throw their 2 cents in so they can get a piece of the pie without being creatively disrupted but not much they can do.

India/China need it badly but their infrastructure just seems too fucked up for it. You have to constantly break the driving laws and use judgement that only a human could use on those roads in like Shanghai and Mumbia. Unless they program the thing to drive like an NY cabbie or something.

Autonomous is coming though. Gov't starting to work with the automakers to make transition smooth. Fleets, charging.....I'm sure the dealerships, suppliers, insurance co and everyone else effected will try to throw their 2 cents in so they can get a piece of the pie without being creatively disrupted but not much they can do.

India/China need it badly but their infrastructure just seems too fucked up for it. You have to constantly break the driving laws and use judgement that only a human could use on those roads in like Shanghai and Mumbia. Unless they program the thing to drive like an NY cabbie or something.

Unless they program the thing to drive like an NY cabbie or something.

Hehe, And therein lies the problem.

Every town driver in a hurry KNOWS that these things will give way if you drive out in front of them, they are programmed to utterly obey the law, and they won't punch your lights out when you drive like an asshole

Autonomous vehicles will be useful at night, for motorway deliveries etc, but useless for busy daytime stuff

Hehe, And therein lies the problem.

Every town driver in a hurry KNOWS that these things will give way if you drive out in front of them, they are programmed to utterly obey the law, and they won't punch your lights out when you drive like an asshole

Autonomous vehicles will be useful at night, for motorway deliveries etc, but useless for busy daytime stuff

Unless they program the thing to drive like an NY cabbie or something.

Hehe, And therein lies the problem.

Every town driver in a hurry KNOWS that these things will give way if you drive out in front of them, they are programmed to utterly obey the law, and they won't punch your lights out when you drive like an asshole

Autonomous vehicles will be useful at night, for motorway deliveries etc, but useless for busy daytime stuff

That is a minor problem in the grand scheme of things.

There is just way too much improvement for a technology like this to be denied. Yeah there are obstacles but as it improves they will be less and less.

For workers, businesses, retirees, families, really any group you can think of. Paying 10k a year to drive and maintain a car will go the way of the typewriter.

Probably need to build a wall since we won't need as many workers.

http://hussman.net/wmc/wmc160321.htm

The model in policy-maker’s heads

What do policy-makers hope to achieve with all this untethered monetary intervention? Consider the most basic economic model taught in Econ 101.

Output (Y) = Consumption (C) + Investment (I) + Government (G)

Foreign trade is ignored for simplification. Now, if Consumption is assumed to be proportional to output (so C = c*Y where c is the fraction of income that people consume), we have

Y = cY + I + G

or

Y = (I + G) * {1/(1-c)}

Look at the term in brackets. If people spend 75% of their income on consumption, they save (1-c) or 25%. That bracketed term would be {1/(1-.75)} or 4.0. So the model would say that increasing investment or government spending will have a “multiplier effect” on output of $4 of new output for every dollar of new investment or government spending. Alternatively, if you could get people to spend 80% of their income instead of 75%, you could increase the multiplier to 5.0.

While the crude little world above is an extreme abstraction from the real world, imposes no resource constraints whatsoever, and implies “multiplier effects” that are dramatically larger than we observe in practice, this model is essentially how most policy makers think about and justify their actions. Accordingly, what monetary authorities are quietly hoping to do is punish savings so violently, through negative interest rates and the like, that people will consume more (essentially increasing little c), or at least stimulate real investment so that attempts to save more (reductions in c) don’t result in economic contraction.

Unfortunately, we’ve observed in recent years that no amount of punishment actually reduces the desire of people to save. They simply look to save in different forms. This behavior has driven what is now the third equity bubble in 16 years, accompanied by a massive overhang of covenant-lite debt, and an increasing move to alternative forms of money such as precious metals. Meanwhile, aside from a mean-reverting rebound from the 2009 lows, real investment hasn’t responded strongly to low interest rates. Indeed, the growth rate of real U.S. gross domestic investment since 2000 has dropped to nearly one-quarter of the growth rate over the prior 50 years. That’s precisely why productivity and real incomes have stagnated.

Look, there’s one thing we know for certain in economics. The amount of saving in an economy must be precisely equal to the amount of real investment in the economy (factories, buildings, equipment, capital goods, and inventory). That’s not a theory. It’s an accounting identity.

Other things being equal, if people are trying to save a larger fraction of their income, and the level of investment doesn’t respond to low interest rates, income has to fall in order to bring saving and investment into equality. That’s the basic setup that Keynes explored in the General Theory. But if policy-makers really believe that there’s a “savings glut,” punishing savings isn’t the only way out. There are many ways to encourage investment other than manipulating interest rates, and all kinds of spending can function as “investment” even if the GDP accounts classify them as government spending or consumption. That leaves a relatively straightforward road that’s rarely taken, which is to pursue fiscal policies targeted at increasing productive investment at every level of the economy.

Put simply, if people want to save a larger share of their income, and punishing savings doesn’t reduce that desire, and the whole world can’t rely on beggar-thy-neighbor policies to expand their own economies by increasing the trade deficits of others, then the only way to avoid global economic contraction and simultaneously raise the prospects for long-term growth is to expand productive investment at every level of the economy (including infrastructure investment, corporate investment tax incentives, workforce development credits, and other measures ideally tied to the creation of new jobs). Since investment isn’t responding materially to lower interest rates, you can’t do this through monetary policy. The only remaining option is to do it through fiscal means.

The problem with punishing saving in order to encourage more consumption is that it’s ineffective, and also leaves the economy with nothing to show for it. The wealth of a nation consists of its stock of real private investment (e.g. housing, capital goods, factories), real public investment (e.g. infrastructure), intangible intellectual capital (e.g. education, inventions, organizational knowledge and systems), and its endowment of basic resources such as land, energy, water, and the environment. In an open economy, one would include the net claims on foreigners. Everything else cancels out, because every security is an asset of the holder, but a liability of the issuer. If we want greater prosperity, it will come from expanding our productive capacity and defending our natural resources.

Monetary authorities have now become little more than lab rats on a frantic extinction burst. If there are no adults in the room among our policy-makers who are willing to pursue the appropriate substitute behavior - expanding productive investment through fiscal means - we’re going to have a deeper and more concerted global economic downturn than is already likely. I remain convinced that monetary authorities have already ensured a financial collapse in the coming years that is baked-in-the-cake as a result of obscene valuations. That outcome will unfold nearly regardless of economic prospects.

By encouraging acute financial distortions, enabling massive issuance of speculative-grade securities and stock buybacks at near-record valuations, and repeatedly diverting national savings toward speculative malinvestment, the concerted behavior of central banks is increasingly pushing the global economy toward financial crisis and depressed long-term growth. There is no hope for long-term economic prosperity if we place our faith in the monetary policies of deranged bankers and ivory tower college professors. All they can do is to buy interest-earning bonds and replace them with zero-interest paper. How ignorant must we be to believe that financial bubbles will carry us to prosperity without consequences, and how many collapses must we endure before we focus on strengthening our own legs?

The irony of economics is that when we pursue policies that encourage speculative malinvestment and make productive investment scarce, the pie gets smaller but a larger share of it goes to the owners of existing capital. The “rents” are always highest for those resources that are most scarce. If we really want more jobs, higher labor productivity, stronger growth, better real wages, a balanced income distribution, and a return to long-term economic prosperity, only an expansion of real productive investment - at every level of the economy - will do the job. Ever more deranged monetary policy wil not.The foregoing comments represent the general investment analysis and economic views of the Advisor, and are provided solely for the purpose of information, instruction and discourse. Please see periodic remarks on the Fund Notes and Commentary page for discussion relating specifically to the Hussman Funds and the investment positions of the Funds.

The model in policy-maker’s heads

What do policy-makers hope to achieve with all this untethered monetary intervention? Consider the most basic economic model taught in Econ 101.

Output (Y) = Consumption (C) + Investment (I) + Government (G)

Foreign trade is ignored for simplification. Now, if Consumption is assumed to be proportional to output (so C = c*Y where c is the fraction of income that people consume), we have

Y = cY + I + G

or

Y = (I + G) * {1/(1-c)}

Look at the term in brackets. If people spend 75% of their income on consumption, they save (1-c) or 25%. That bracketed term would be {1/(1-.75)} or 4.0. So the model would say that increasing investment or government spending will have a “multiplier effect” on output of $4 of new output for every dollar of new investment or government spending. Alternatively, if you could get people to spend 80% of their income instead of 75%, you could increase the multiplier to 5.0.

While the crude little world above is an extreme abstraction from the real world, imposes no resource constraints whatsoever, and implies “multiplier effects” that are dramatically larger than we observe in practice, this model is essentially how most policy makers think about and justify their actions. Accordingly, what monetary authorities are quietly hoping to do is punish savings so violently, through negative interest rates and the like, that people will consume more (essentially increasing little c), or at least stimulate real investment so that attempts to save more (reductions in c) don’t result in economic contraction.

Unfortunately, we’ve observed in recent years that no amount of punishment actually reduces the desire of people to save. They simply look to save in different forms. This behavior has driven what is now the third equity bubble in 16 years, accompanied by a massive overhang of covenant-lite debt, and an increasing move to alternative forms of money such as precious metals. Meanwhile, aside from a mean-reverting rebound from the 2009 lows, real investment hasn’t responded strongly to low interest rates. Indeed, the growth rate of real U.S. gross domestic investment since 2000 has dropped to nearly one-quarter of the growth rate over the prior 50 years. That’s precisely why productivity and real incomes have stagnated.

Look, there’s one thing we know for certain in economics. The amount of saving in an economy must be precisely equal to the amount of real investment in the economy (factories, buildings, equipment, capital goods, and inventory). That’s not a theory. It’s an accounting identity.

Other things being equal, if people are trying to save a larger fraction of their income, and the level of investment doesn’t respond to low interest rates, income has to fall in order to bring saving and investment into equality. That’s the basic setup that Keynes explored in the General Theory. But if policy-makers really believe that there’s a “savings glut,” punishing savings isn’t the only way out. There are many ways to encourage investment other than manipulating interest rates, and all kinds of spending can function as “investment” even if the GDP accounts classify them as government spending or consumption. That leaves a relatively straightforward road that’s rarely taken, which is to pursue fiscal policies targeted at increasing productive investment at every level of the economy.

Put simply, if people want to save a larger share of their income, and punishing savings doesn’t reduce that desire, and the whole world can’t rely on beggar-thy-neighbor policies to expand their own economies by increasing the trade deficits of others, then the only way to avoid global economic contraction and simultaneously raise the prospects for long-term growth is to expand productive investment at every level of the economy (including infrastructure investment, corporate investment tax incentives, workforce development credits, and other measures ideally tied to the creation of new jobs). Since investment isn’t responding materially to lower interest rates, you can’t do this through monetary policy. The only remaining option is to do it through fiscal means.

The problem with punishing saving in order to encourage more consumption is that it’s ineffective, and also leaves the economy with nothing to show for it. The wealth of a nation consists of its stock of real private investment (e.g. housing, capital goods, factories), real public investment (e.g. infrastructure), intangible intellectual capital (e.g. education, inventions, organizational knowledge and systems), and its endowment of basic resources such as land, energy, water, and the environment. In an open economy, one would include the net claims on foreigners. Everything else cancels out, because every security is an asset of the holder, but a liability of the issuer. If we want greater prosperity, it will come from expanding our productive capacity and defending our natural resources.

Monetary authorities have now become little more than lab rats on a frantic extinction burst. If there are no adults in the room among our policy-makers who are willing to pursue the appropriate substitute behavior - expanding productive investment through fiscal means - we’re going to have a deeper and more concerted global economic downturn than is already likely. I remain convinced that monetary authorities have already ensured a financial collapse in the coming years that is baked-in-the-cake as a result of obscene valuations. That outcome will unfold nearly regardless of economic prospects.

By encouraging acute financial distortions, enabling massive issuance of speculative-grade securities and stock buybacks at near-record valuations, and repeatedly diverting national savings toward speculative malinvestment, the concerted behavior of central banks is increasingly pushing the global economy toward financial crisis and depressed long-term growth. There is no hope for long-term economic prosperity if we place our faith in the monetary policies of deranged bankers and ivory tower college professors. All they can do is to buy interest-earning bonds and replace them with zero-interest paper. How ignorant must we be to believe that financial bubbles will carry us to prosperity without consequences, and how many collapses must we endure before we focus on strengthening our own legs?

The irony of economics is that when we pursue policies that encourage speculative malinvestment and make productive investment scarce, the pie gets smaller but a larger share of it goes to the owners of existing capital. The “rents” are always highest for those resources that are most scarce. If we really want more jobs, higher labor productivity, stronger growth, better real wages, a balanced income distribution, and a return to long-term economic prosperity, only an expansion of real productive investment - at every level of the economy - will do the job. Ever more deranged monetary policy wil not.The foregoing comments represent the general investment analysis and economic views of the Advisor, and are provided solely for the purpose of information, instruction and discourse. Please see periodic remarks on the Fund Notes and Commentary page for discussion relating specifically to the Hussman Funds and the investment positions of the Funds.

I'm shocked .

Finally found an article comcernimg oil from someone who knows why they are talking about .

http://www.valuewalk.com/2016/03/andy-hall-oil-prices/

Here it is.

Basically what I've been saying word for word in this thread the last few months

Finally found an article comcernimg oil from someone who knows why they are talking about .

http://www.valuewalk.com/2016/03/andy-hall-oil-prices/

Here it is.

Basically what I've been saying word for word in this thread the last few months

The lesser of two evils hits a new low.. I'll "waste" my vote and vote 3rd party as usual.. Don't understand how anybody can support either.. We scroomed

Pretty confident historical democrat trump just ran to get billary elected as that's the only way she gets elected..

-----------

That makes Trump and Clinton viewed more unfavorably than any front-runner for either party since 1984, when CBS began polling voters on the question.

On the Republican side, Trump scores a net negative of -33, with a favorable rating of 24% compared to 57% of voters who view him unfavorably. On the Democratic side, Clinton fares only slightly better with a net negative of -21, registering a 31% favorable rating and a 52% unfavorable rating, according to the poll.

http://www.cnn.com/2016/03/22/politics/2016-election-poll-donald-trump-hillary-clinton/index.html

Pretty confident historical democrat trump just ran to get billary elected as that's the only way she gets elected..

-----------

That makes Trump and Clinton viewed more unfavorably than any front-runner for either party since 1984, when CBS began polling voters on the question.

On the Republican side, Trump scores a net negative of -33, with a favorable rating of 24% compared to 57% of voters who view him unfavorably. On the Democratic side, Clinton fares only slightly better with a net negative of -21, registering a 31% favorable rating and a 52% unfavorable rating, according to the poll.

http://www.cnn.com/2016/03/22/politics/2016-election-poll-donald-trump-hillary-clinton/index.html

Bubbles Spread Like a Zombie Virus

The leading academic theory of asset bubbles is that they don’t really exist. When asset prices skyrocket, say mainstream theorists, it might mean that some piece of news makes rational investors realize that fundamental valueslike corporate earnings are going to be a lot higher than anyone had expected. Or perhaps some condition in the economy might make investors suddenly become much more tolerant of risk. But according to mainstream theory, bubbles are not driven by speculative mania, greed, stupidity, herd behavior or any other sort of psychological or irrational phenomenon. Inflating asset values are the normal, healthy functioning of an efficient market.

Naturally, this view has convinced many people in finance that mainstream theorists are quite out of their minds.

The problem is, mainstream theory has proven devilishly hard to disprove. We can’t really observe how investors in the financial markets form their beliefs. So we can’t tell if their views are right or wrong, or whether they’re investing based on expectations or because of changing risk tolerance. Basically, because we can usually only look at the overall market, we can’t get into the nuts and bolts of how people decide what prices to pay.

But what about the housing market? Housing is different from stocks and bonds in at least two big ways. First, because house purchases are not anonymous, we can observe who buys what. Second, housing markets are local, so we can see what is happening around them, and thus have some sort of idea what information they are receiving. These unique features allow us to know much more about the decision-making process of each buyer than we know about investors in the anonymous national financial markets.

In a new paper, economists Patrick Bayer, Kyle Mangum and James Roberts make great use of these features to study the mid-2000s U.S. housing boom. Their landmark results ought to have a major effect on the debate over asset bubbles.

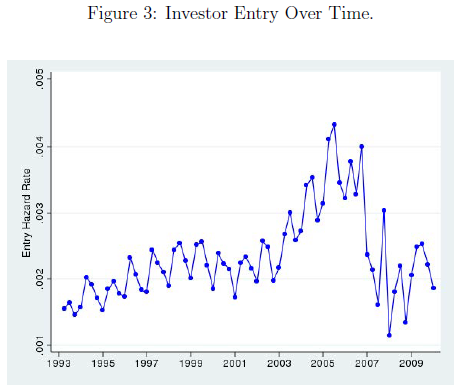

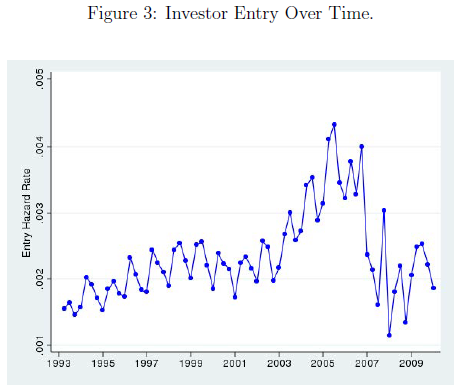

Bayer et al. find that as the market overheated, the frenzy spread like a virus from block to block. They look at the greater Los Angeles area -- a hotbed of bubble activity -- from 1989 through 2012. Since they want to focus on people buying houses as investments (rather than to live in), the authors looked only at people who bought multiple properties, and they tried to exclude primary residences from the sample. They found, unsurprisingly, that the peak years of 2004-2006 saw a huge spike in the number of new investors entering the market. Here is the graph from their paper:

So what was making all these newbie investors start buying houses? The researchers found that one big factor was nearby investment activity. In other words, if lots of people were buying investment properties nearby, it made other people in the area much more likely to buy an investment property. When properties were flipped -- bought and then resold quickly -- it had an even bigger effect in terms of drawing nearby people into the housing market.

This is strong evidence that people were copying their neighbors’ behavior. When people saw other people buying and flipping houses, they started doing it themselves. That stands in stark contrast to the predictions of standard theories of investor behavior, which say that investors only care about the future income that they can earn from their investments. In the case of housing, standard theory says investors just focus on the future rent they can earn on a property, and that all investors have the same information about that future rent. There is absolutely no reason, in standard models, for investors to copy their neighbors’ house-flipping activity. But that is what happened in the bubble.

Even more startlingly, Bayer et al. found that housing investors who mimicked their neighbors ended up performing worse than other investors. That is a good indicator that copycats weren’t learning any new information about the fundamental value of housing.

What were they doing? One possible answer is herd behavior. Economists have studied herding in financial markets, but their theories are generally unwieldy and their results -- until now -- have been inconclusive. Psychological effects, such as greed, or FOMO -- fear of missing out -- are other possibilities. These kinds of effects are regularly cited by financial market participants, but are rarely used in academic finance theory.

The Bayer et al. research may change that. The ability to look into local housing markets, and observe investors and transactions directly, is a bit like the introduction of the microscope in biology -- it opens up a whole new world of evidence. In the past, finance theorists debated back and forth about market data, and what it implied about investor behavior. Now, thanks to the increasing availability of high-quality data, they can look at that behavior directly.

The lesson appears clear: Bubbles exist. Investors aren’t just rational, patient, well-informed, emotionless calculators of risk and return. Now the job is to figure out what really makes them tick.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

To contact the author of this story:

Noah Smith at nsmith150@bloomberg.net

To contact the editor responsible for this story:

James Greiff at jgreiff@bloomberg.net

The leading academic theory of asset bubbles is that they don’t really exist. When asset prices skyrocket, say mainstream theorists, it might mean that some piece of news makes rational investors realize that fundamental valueslike corporate earnings are going to be a lot higher than anyone had expected. Or perhaps some condition in the economy might make investors suddenly become much more tolerant of risk. But according to mainstream theory, bubbles are not driven by speculative mania, greed, stupidity, herd behavior or any other sort of psychological or irrational phenomenon. Inflating asset values are the normal, healthy functioning of an efficient market.

Naturally, this view has convinced many people in finance that mainstream theorists are quite out of their minds.

The problem is, mainstream theory has proven devilishly hard to disprove. We can’t really observe how investors in the financial markets form their beliefs. So we can’t tell if their views are right or wrong, or whether they’re investing based on expectations or because of changing risk tolerance. Basically, because we can usually only look at the overall market, we can’t get into the nuts and bolts of how people decide what prices to pay.

But what about the housing market? Housing is different from stocks and bonds in at least two big ways. First, because house purchases are not anonymous, we can observe who buys what. Second, housing markets are local, so we can see what is happening around them, and thus have some sort of idea what information they are receiving. These unique features allow us to know much more about the decision-making process of each buyer than we know about investors in the anonymous national financial markets.

In a new paper, economists Patrick Bayer, Kyle Mangum and James Roberts make great use of these features to study the mid-2000s U.S. housing boom. Their landmark results ought to have a major effect on the debate over asset bubbles.

Bayer et al. find that as the market overheated, the frenzy spread like a virus from block to block. They look at the greater Los Angeles area -- a hotbed of bubble activity -- from 1989 through 2012. Since they want to focus on people buying houses as investments (rather than to live in), the authors looked only at people who bought multiple properties, and they tried to exclude primary residences from the sample. They found, unsurprisingly, that the peak years of 2004-2006 saw a huge spike in the number of new investors entering the market. Here is the graph from their paper:

So what was making all these newbie investors start buying houses? The researchers found that one big factor was nearby investment activity. In other words, if lots of people were buying investment properties nearby, it made other people in the area much more likely to buy an investment property. When properties were flipped -- bought and then resold quickly -- it had an even bigger effect in terms of drawing nearby people into the housing market.

This is strong evidence that people were copying their neighbors’ behavior. When people saw other people buying and flipping houses, they started doing it themselves. That stands in stark contrast to the predictions of standard theories of investor behavior, which say that investors only care about the future income that they can earn from their investments. In the case of housing, standard theory says investors just focus on the future rent they can earn on a property, and that all investors have the same information about that future rent. There is absolutely no reason, in standard models, for investors to copy their neighbors’ house-flipping activity. But that is what happened in the bubble.

Even more startlingly, Bayer et al. found that housing investors who mimicked their neighbors ended up performing worse than other investors. That is a good indicator that copycats weren’t learning any new information about the fundamental value of housing.

What were they doing? One possible answer is herd behavior. Economists have studied herding in financial markets, but their theories are generally unwieldy and their results -- until now -- have been inconclusive. Psychological effects, such as greed, or FOMO -- fear of missing out -- are other possibilities. These kinds of effects are regularly cited by financial market participants, but are rarely used in academic finance theory.

The Bayer et al. research may change that. The ability to look into local housing markets, and observe investors and transactions directly, is a bit like the introduction of the microscope in biology -- it opens up a whole new world of evidence. In the past, finance theorists debated back and forth about market data, and what it implied about investor behavior. Now, thanks to the increasing availability of high-quality data, they can look at that behavior directly.

The lesson appears clear: Bubbles exist. Investors aren’t just rational, patient, well-informed, emotionless calculators of risk and return. Now the job is to figure out what really makes them tick.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

To contact the author of this story:

Noah Smith at nsmith150@bloomberg.net

To contact the editor responsible for this story:

James Greiff at jgreiff@bloomberg.net

FBI tells Apple we don't need you anymore we hacked ya.. Another hit to the apple brand..

on another note the chances of there being any useful info on that phone is near nil.. The dude destroyed his personal phone.. This phone was owned by the local government..

Just the fascists flexing their muscles as they like to do.. On the Apple side is them trying to protect their reputation.. has nothing to do with support for privacy and all that nonsense cook spouting.. They didn't stand up to Feds till it became a public issue

anywho just funny..

markets are dead as hell.. Feels like the calm before a storm...

on another note the chances of there being any useful info on that phone is near nil.. The dude destroyed his personal phone.. This phone was owned by the local government..

Just the fascists flexing their muscles as they like to do.. On the Apple side is them trying to protect their reputation.. has nothing to do with support for privacy and all that nonsense cook spouting.. They didn't stand up to Feds till it became a public issue

anywho just funny..

markets are dead as hell.. Feels like the calm before a storm...

Trump a false flag to get Hillary elected..

---------------

[h=1]Why Latinos and Muslim Americans should support Trump[/h]Dean Obeidallah, a former attorney, is the host of SiriusXM's weekly program "The Dean Obeidallah Show," a columnist for The Daily Beast and editor of the politics blog The Dean's Report. Follow him on Twitter: @TheDeansreport. The opinions expressed in this commentary are his.

(CNN)I'm Muslim American, and yet I now find myself rooting for Donald Trump to be the GOP presidential nominee. Here's a little secret: Many other Muslim and Latino activists also are cheering for Trump to defeat Ted Cruz for the Republican nod -- even if they won't admit it publicly.

Why? Trump could inspire a record number of Latinos and Muslim Americans to get involved in the 2016 election. But just as Marc Antony didn't come to praise Caesar but to bury him, they won't be doing so to support Trump but to defeat him.

[COLOR=rgba(0, 0, 0, 0.65098)]

[/COLOR]

We have already seen Latinos who have been long-time permanent legal residents of the United States finally apply for citizenship this year for the sole purpose of voting against Trump.

Latino and Muslim college students are now teaming up to protest at Trump rallies, as we saw recently in Chicago. And as someone who has been speaking before Muslim American groups frequently over the past few months, I can tell you that defeating Trump and his dangerously divisive ideology is the No. 1 priority.

A recent New York Times article cited an estimate by Ghazala Salam, head of the American Muslim Democratic Caucus of Florida,that voter registration in that state among Muslim Americans spiked by nearly 20 percent.

[COLOR=rgba(0, 0, 0, 0.65098)] The reality is that Trump's campaign of fear-mongering about Latinos and Muslims is a double-edged sword. On one hand, Trump has effectively ginned up fear of both communities to animate a big chunk of white GOP voters to support him.

The reality is that Trump's campaign of fear-mongering about Latinos and Muslims is a double-edged sword. On one hand, Trump has effectively ginned up fear of both communities to animate a big chunk of white GOP voters to support him.

But what Trump didn't count on (or simply didn't care about) is that this sword could also motivate Latinos and Muslims to get more involved in politics. This is not the 1960s when Alabama Gov. George Wallace could openly demonize blacks to attract white voters with little fear of political repercussions. At that time blacks, thanks to racist laws designed to prevent them from voting, had little political clout.

[COLOR=rgba(0, 0, 0, 0.65098)]

First time voters to cast ballots on behalf of community 03:21

[/COLOR]

The America of 2016, thankfully, is vastly different. There will be approximately 27 million Latinos eligible to vote in 2016. That's 12% of the electorate, up from 10% in 2012.

And while the Muslim population is far smaller at about three to five million, they are concentrated in some key states that could impact the general election such as Virginia, Michigan and Florida.

Yet despite both communities growing in number, neither is fully engaged in American politics.

For example, a poll released just last week by the Institute for Social Policy and Understanding found that only 60% of American Muslims are registered to vote. (In contrast, almost 74% of whites of any religious faith are registered to vote.) And many Muslim Americans, especially immigrants, have all but ignored U.S. politics. They prefer to focus on intracommunity Muslim community activities.

[COLOR=rgba(0, 0, 0, 0.65098)]

[/COLOR]

The Latino community is more active politically, as can be seen by the numerous Latino elected officials but still falls behind other groups in terms of voting. In 2012, 48% of eligible Latino voters cast a ballot. In comparison, white voter turnout in 2012 was 64% and black turnout was 66%.

But that will change big time if Trump is the GOP nominee. The specter of Trump in the White House will inspire and animate both communities to make sure it doesn't happen by engaging in U.S. politics.

Won't Cruz cause the same reaction? No. (Or at least not yet.) Cruz simply doesn't evoke the same passion and fear as Trump.

[COLOR=rgba(0, 0, 0, 0.65098)]

[/COLOR]

True, Cruz is as bad if not worse than Trump when it comes to policies affecting both communities. Cruz has vowed to deport all 11 million undocumented immigrants as well as build a wall on our southern border.

Regarding Muslims, even before Trump's proposed Muslim ban in December, Cruz had called for barring Muslim Syrian refugees and only allowing Christian ones into our country.

And recently Cruz announced he wants the police to patrol Muslim neighborhoods and alarmingly he named as part of his national security team Frank Gaffney, a man described by the Southern Poverty Law center "as one of America's most notorious Islamophobes."

The difference is that Cruz has used a dog whistle to send messages about Latinos and Muslims while Trump has used a bullhorn. And we have heard Trump's words loud and clear.

Trump as the GOP nominee is truly frightening. Yet his legacy may be that he has helped both the Latino and Muslim communities not only to increase their engagement in American politics but also to have the clout to ensure that we never see another presidential nominee who spews the hate of Donald J. Trump.

Join us on Facebook.com/CNNOpinion.

Read CNNOpinion's new Flipboard magazine.

[/COLOR]

---------------

[h=1]Why Latinos and Muslim Americans should support Trump[/h]Dean Obeidallah, a former attorney, is the host of SiriusXM's weekly program "The Dean Obeidallah Show," a columnist for The Daily Beast and editor of the politics blog The Dean's Report. Follow him on Twitter: @TheDeansreport. The opinions expressed in this commentary are his.

(CNN)I'm Muslim American, and yet I now find myself rooting for Donald Trump to be the GOP presidential nominee. Here's a little secret: Many other Muslim and Latino activists also are cheering for Trump to defeat Ted Cruz for the Republican nod -- even if they won't admit it publicly.

Why? Trump could inspire a record number of Latinos and Muslim Americans to get involved in the 2016 election. But just as Marc Antony didn't come to praise Caesar but to bury him, they won't be doing so to support Trump but to defeat him.

[COLOR=rgba(0, 0, 0, 0.65098)]

[/COLOR]

We have already seen Latinos who have been long-time permanent legal residents of the United States finally apply for citizenship this year for the sole purpose of voting against Trump.

Latino and Muslim college students are now teaming up to protest at Trump rallies, as we saw recently in Chicago. And as someone who has been speaking before Muslim American groups frequently over the past few months, I can tell you that defeating Trump and his dangerously divisive ideology is the No. 1 priority.

A recent New York Times article cited an estimate by Ghazala Salam, head of the American Muslim Democratic Caucus of Florida,that voter registration in that state among Muslim Americans spiked by nearly 20 percent.

[COLOR=rgba(0, 0, 0, 0.65098)]

The reality is that Trump's campaign of fear-mongering about Latinos and Muslims is a double-edged sword. On one hand, Trump has effectively ginned up fear of both communities to animate a big chunk of white GOP voters to support him.

The reality is that Trump's campaign of fear-mongering about Latinos and Muslims is a double-edged sword. On one hand, Trump has effectively ginned up fear of both communities to animate a big chunk of white GOP voters to support him.But what Trump didn't count on (or simply didn't care about) is that this sword could also motivate Latinos and Muslims to get more involved in politics. This is not the 1960s when Alabama Gov. George Wallace could openly demonize blacks to attract white voters with little fear of political repercussions. At that time blacks, thanks to racist laws designed to prevent them from voting, had little political clout.

[COLOR=rgba(0, 0, 0, 0.65098)]

First time voters to cast ballots on behalf of community 03:21

[/COLOR]

The America of 2016, thankfully, is vastly different. There will be approximately 27 million Latinos eligible to vote in 2016. That's 12% of the electorate, up from 10% in 2012.

And while the Muslim population is far smaller at about three to five million, they are concentrated in some key states that could impact the general election such as Virginia, Michigan and Florida.

Yet despite both communities growing in number, neither is fully engaged in American politics.

For example, a poll released just last week by the Institute for Social Policy and Understanding found that only 60% of American Muslims are registered to vote. (In contrast, almost 74% of whites of any religious faith are registered to vote.) And many Muslim Americans, especially immigrants, have all but ignored U.S. politics. They prefer to focus on intracommunity Muslim community activities.

[COLOR=rgba(0, 0, 0, 0.65098)]

[/COLOR]

The Latino community is more active politically, as can be seen by the numerous Latino elected officials but still falls behind other groups in terms of voting. In 2012, 48% of eligible Latino voters cast a ballot. In comparison, white voter turnout in 2012 was 64% and black turnout was 66%.

But that will change big time if Trump is the GOP nominee. The specter of Trump in the White House will inspire and animate both communities to make sure it doesn't happen by engaging in U.S. politics.

Won't Cruz cause the same reaction? No. (Or at least not yet.) Cruz simply doesn't evoke the same passion and fear as Trump.

[COLOR=rgba(0, 0, 0, 0.65098)]

[/COLOR]

True, Cruz is as bad if not worse than Trump when it comes to policies affecting both communities. Cruz has vowed to deport all 11 million undocumented immigrants as well as build a wall on our southern border.

Regarding Muslims, even before Trump's proposed Muslim ban in December, Cruz had called for barring Muslim Syrian refugees and only allowing Christian ones into our country.

And recently Cruz announced he wants the police to patrol Muslim neighborhoods and alarmingly he named as part of his national security team Frank Gaffney, a man described by the Southern Poverty Law center "as one of America's most notorious Islamophobes."

The difference is that Cruz has used a dog whistle to send messages about Latinos and Muslims while Trump has used a bullhorn. And we have heard Trump's words loud and clear.

Trump as the GOP nominee is truly frightening. Yet his legacy may be that he has helped both the Latino and Muslim communities not only to increase their engagement in American politics but also to have the clout to ensure that we never see another presidential nominee who spews the hate of Donald J. Trump.

Join us on Facebook.com/CNNOpinion.

Read CNNOpinion's new Flipboard magazine.

[/COLOR]

Market pricing in zero chance of April hike.. July goes sub 50% true value near zero as usual... Kick the old can as far as you can kick it!

What’s notable here is Yellen presenting the tools that will be used if the economy does falter. It’s a familiar one: so-called forward guidance, bond buys and bond swaps. Not in the text: any mention of negative interest rates.

What’s notable here is Yellen presenting the tools that will be used if the economy does falter. It’s a familiar one: so-called forward guidance, bond buys and bond swaps. Not in the text: any mention of negative interest rates.