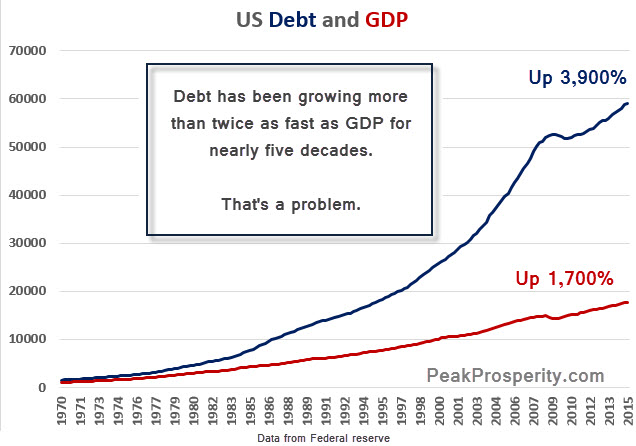

Much much different situation than the 70s.. coming outta QE (never done before) and at zirp for 7+ years..

they mighta done it now since they knew we were on verge of recession anyway... So they can blame that and the lemmings will beg for more zirp and qe.. Beg the sugar daddy to put more punch in the punch bowl..

a measely 1/4 PT Rate hike had nothing to do with coming recession and data already starting to tank.. China slowing down under its own weight etc..

they mighta done it now since they knew we were on verge of recession anyway... So they can blame that and the lemmings will beg for more zirp and qe.. Beg the sugar daddy to put more punch in the punch bowl..

a measely 1/4 PT Rate hike had nothing to do with coming recession and data already starting to tank.. China slowing down under its own weight etc..