It's been worse before...and we are still better off than most of the Western world. Probably a rough recession ahead of us no doubt...but those are normal...it's not the end of the world.

<meta http-equiv="Content-Type" content="text/html; charset=utf-8"><meta name="ProgId" content="Word.Document"><meta name="Generator" content="Microsoft Word 10"><meta name="Originator" content="Microsoft Word 10"><link rel="File-List" href="file:///C:%5CDOCUME%7E1%5CRHSM%5CLOCALS%7E1%5CTemp%5Cmsohtml1%5C01%5Cclip_filelist.xml"><link rel="Edit-Time-Data" href="file:///C:%5CDOCUME%7E1%5CRHSM%5CLOCALS%7E1%5CTemp%5Cmsohtml1%5C01%5Cclip_editdata.mso"><!--[if !mso]> <style> v\:* {behavior:url(#default#VML);} o\:* {behavior:url(#default#VML);} w\:* {behavior:url(#default#VML);} .shape {behavior:url(#default#VML);} </style> <![endif]--><o:smarttagtype namespaceuri="urn:schemas-microsoft-com

ffice:smarttags" name="stockticker"></o:smarttagtype><o:smarttagtype namespaceuri="urn:schemas-microsoft-com

ffice:smarttags" name="country-region"></o:smarttagtype><o:smarttagtype namespaceuri="urn:schemas-microsoft-com

ffice:smarttags" name="place"></o:smarttagtype><!--[if gte mso 9]><xml> <w:WordDocument> <w:View>Normal</w:View> <w:Zoom>0</w:Zoom> <w:Compatibility> <w:BreakWrappedTables/> <w:SnapToGridInCell/> <w:WrapTextWithPunct/> <w:UseAsianBreakRules/> </w:Compatibility> <w:BrowserLevel>MicrosoftInternetExplorer4</w:BrowserLevel> </w:WordDocument> </xml><![endif]--><!--[if !mso]><object classid="clsid:38481807-CA0E-42D2-BF39-B33AF135CC4D" id=ieooui></object> <style> st1\:*{behavior:url(#ieooui) } </style> <![endif]--><style> <!-- /* Style Definitions */ p.MsoNormal, li.MsoNormal, div.MsoNormal {mso-style-parent:""; margin:0in; margin-bottom:.0001pt; mso-pagination:widow-orphan; font-size:12.0pt; font-family:"Times New Roman"; mso-fareast-font-family:"Times New Roman";} @page Section1 {size:8.5in 11.0in; margin:1.0in 1.25in 1.0in 1.25in; mso-header-margin:.5in; mso-footer-margin:.5in; mso-paper-source:0;} div.Section1 {page:Section1;} --> </style><!--[if gte mso 10]> <style> /* Style Definitions */ table.MsoNormalTable {mso-style-name:"Table Normal"; mso-tstyle-rowband-size:0; mso-tstyle-colband-size:0; mso-style-noshow:yes; mso-style-parent:""; mso-padding-alt:0in 5.4pt 0in 5.4pt; mso-para-margin:0in; mso-para-margin-bottom:.0001pt; mso-pagination:widow-orphan; font-size:10.0pt; font-family:"Times New Roman";} </style> <![endif]--> Yes it has been worse before, but during WW2 we had a few things working in our favor. Back then we had a manufacturing base that was basically 33% of the labor force in the Us. Now its down to 12% and losing jobs every month. Back then J6P invested in the debt of the <st1:country-region><st1

lace>US</st1

lace></st1:country-region> and bought its debt, now foreigners are buying up gobs of it at record levels.

<!--[if gte vml 1]><v:shapetype id="_x0000_t75" coordsize="21600,21600" o:spt="75" o

referrelative="t" path="m@4@5l@4@11@9@11@9@5xe" filled="f" stroked="f"> <v:stroke joinstyle="miter"/> <v:formulas> <v:f eqn="if lineDrawn pixelLineWidth 0"/> <v:f eqn="sum @0 1 0"/> <v:f eqn="sum 0 0 @1"/> <v:f eqn="prod @2 1 2"/> <v:f eqn="prod @3 21600 pixelWidth"/> <v:f eqn="prod @3 21600 pixelHeight"/> <v:f eqn="sum @0 0 1"/> <v:f eqn="prod @6 1 2"/> <v:f eqn="prod @7 21600 pixelWidth"/> <v:f eqn="sum @8 21600 0"/> <v:f eqn="prod @7 21600 pixelHeight"/> <v:f eqn="sum @10 21600 0"/> </v:formulas> <v

ath o:extrusionok="f" gradientshapeok="t" o:connecttype="rect"/> <o:lock v:ext="edit" aspectratio="t"/> </v:shapetype><v:shape id="_x0000_i1025" type="#_x0000_t75" alt="" style='width:277.5pt; height:289.5pt'> <v:imagedata src="file:///C:\DOCUME~1\RHSM\LOCALS~1\Temp\msohtml1\01\clip_image001.gif" o:href="http://mwhodges.home.att.net/debt-foreign-share.gif"/> </v:shape><![endif]--><!--[if !vml]-->

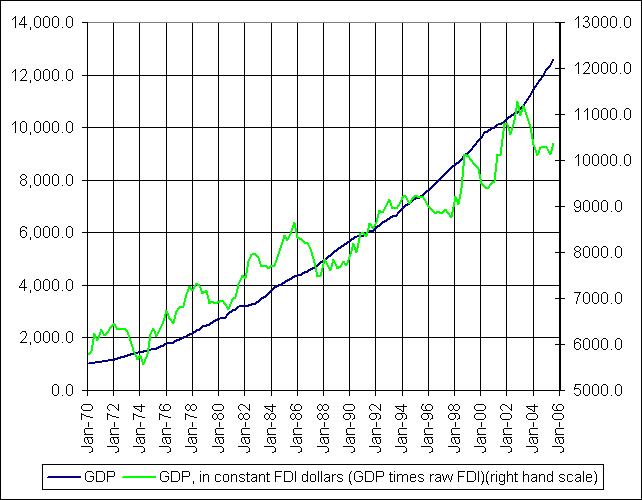

Notice how this foreign investment in debt ramps up correlates perfectly with the three charts above? Those being <st1:stockticker>GDP</st1:stockticker>, money supply and National Debt. So, what’s the common denominator? The only answer and the root of it all…the money supply and the abuse of it. Thus all the wealth you have see wiped off the books on the Dow and what not are just that, gone. Not to someone or some company, just eroded away....because they were never real in the first place.

And for the record we are in a deep recession right now, regardless of what some phony <st1:stockticker>CPI</st1:stockticker> stats state. <st1:stockticker>CPI</st1:stockticker> is calculated in an absolute joking manner. Hell it doesn’t even include Taxation or food and energy prices. Last time i checked those affected my pocket book.

<o

> </o

>

Are we better off then the rest of the world? I would agree MJ, we probably are. But we are running on borrowed time. The world wont end, you are correct good sir, but the world as we know it will surly end, the world as we know it as Americans that is. The fast times are over. The jig is up.

up and defaulting on its debt

up and defaulting on its debt

hno:

hno:

lace>US</st1

lace>US</st1