You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Intersting thoughts

- Thread starter Bozzie

- Start date

Joe Biden, even with that stupid mask on, has a VERY punchable face!!

Punch away..

| Good morning. (Was this newsletter forwarded to you? Sign up here.) |

|

| [h=2]The right to vote[/h] |

| Larry Fink, the C.E.O. of BlackRock, which has nearly $10 trillion in assets, is widely considered to be the world’s most powerful investor. His annual lettersto leaders of the nation’s largest companies are must-reads that change corporate behavior. |

| This year, BlackRock sided with the upstart firm Engine No. 1 in its proxy fight with Exxon, helping the small, climate-focused hedge fund win two seats on Exxon’s board. That shareholder vote followed through on Fink’s promise last year to hold companies accountable if they didn’t have a credible plan to reduce their carbon emissions. |

| Now BlackRock is offering to give up a bit of its power. Starting next year, some of its biggest institutional clients will have the ability to cast their own votes at shareholder meetings instead of BlackRock voting for shares on their behalf. The move could shift responsibility for the votes of as much as $2 trillion in shares held in BlackRock accounts, or about 40 percent of its nearly $5 trillion index fund business. |

| Allowing investors to vote their shares gives BlackRock some cover,especially when it comes to what has become its thorniest issue: its size. In recent years, BlackRock has been simultaneously criticized for having too much power and for not using it to push for more changes at companies in which it invests. “It will allow them to say that they are putting voting power back into the hands of the beneficial asset owners and also deflect some of the criticism that BlackRock has received,” said Douglas Chia, the president of Soundboard Governance. |

| Supporters of more shareholder engagement welcomed the move. “When the biggest asset managers control a sizable chunk of the voting at the biggest companies, shareholder advocates trying to make change can often end up feeling like one David against two Goliaths,” said Matthew Prescott, a senior director at the Humane Society of the United States. “Whatever BlackRock’s motivation, dividing up even part of that power seems like it’ll be a good thing.” |

| [h=3]HERE’S WHAT’S HAPPENING[/h] |

| The Senate passes a short-term increase in the debt ceiling. The legislation to raise the debt limit by $480 billion — which is expected to be enough for the government to continue borrowing through at least Dec. 3 — passed along party lines. The House will take up the bill next week. |

| The I.M.F.’s board will decide the fate of its leader. The tenure of Kristalina Georgieva, the fund’s managing director, is in limbo over claims that she pressured staff members to manipulate a report to placate China when she was at the World Bank. (She has denied the allegations.) At a meeting today, the I.M.F. board will decide whether it still has confidence in her. |

| Ireland joins an international tax deal. The low-tax country that’s a popular base for multinationals had been a holdout in a sweeping tax overhaul focused on imposing a global minimum corporate income tax of 15 percent. A deal could be announced today. |

| Tesla is moving its headquarters to Texas. The electric vehicle maker is the latest big company to move there in recent months. Tesla’s shift makes good on a threat that Elon Musk issued last year, when he was frustrated by lockdown orders at Tesla’s factory in Fremont, Calif. |

| Investment advisers are increasingly nervous about stocks. Domestic stock funds recorded a small loss in the third quarter and strategists aren’t optimistic about the quarters ahead. “We’re not bullish today at all,” David Giroux of T. Rowe Price told The Times. |

| [h=2]What to watch in today’s jobs report[/h] |

| This morning, the government will reveal how many workers employers added in September. August’s number was a disappointment, as rising coronavirus cases forced companies to curtail hiring. Economists expect September to be better. |

| But even if September is strong, given August’s weakness, the average gain over the past two months is still likely to be lower than in the spring and the summer. Here’s what to look for in the report to understand what’s really going on: |

| Hospitality workers: Restaurants and hotels are the most vulnerable to fluctuations in Covid cases. If hiring in these sectors falls short of expectations, it may say more about case counts than the overall economy. |

| Professional services: Hiring in sectors where people can work remotely is a good gauge of demand. In August, the number of new jobs in professional and business services was a relatively high 74,000. A similar or higher number would suggest that the economic recovery is still on track. |

| Labor force: A lack of workers is causing bottlenecks and inflation. The labor force — the number of people who have jobs or who are actively looking for work — grew by 200,000 in August, which was good but not great. Economists are expecting a dip in September’s unemployment rate. The best outcome would be for this rate to fall because fewer people were jobless and because more people formally joined the labor force. |

| Average hours worked: If the overall jobs number disappoints but average hours worked rose, it could indicate that economic activity is still strong, just rising faster than companies can hire. |

| In other labor market news, recruiters are returning to college campuses in a big way. |

| [h=2]“We’re now at a turning point in cryptocurrency. The same technology of freedom could become part of a new technological dystopia.”[/h] |

| — Lane Rettig, an entrepreneur and former senior programmer at the Ethereum Foundation, on El Salvador adopting Bitcoin as legal tender last month. The country’s populist president, Nayib Bukele, pitched the policy — which made all vendors legally obligated to accept the cryptocurrency — as a way to promote financial inclusion. |

|

| [h=2]Renren, SoFi and a $300 million settlement[/h] |

| Last night, the U.S.-listed Chinese social media company Renren agreed to payat least $300 million to minority shareholders who had claimed that company insiders spun off its most valuable assets at less than their fair market value. Among those holdings was a stake in the SoftBank-backed fintech company Social Finance, or SoFi. |

| Some Renren shareholders sued in 2018, and the litigation involved far-flung participants, disputes over tens of thousands of documents in Mandarin, novel jurisdictional issues and 19th-century Cayman Islands law. The litigation created a new precedent for holding foreign companies accountable in U.S. courts, William Reid, the lawyer for the plaintiffs, told DealBook, which is the first to report the settlement. |

| The plaintiffs see the settlement as a big win, and not just for themselves.“This is an important message,” said Peter Halesworth, the founder of Heng Ren Investments, a Boston-based, China-focused asset manager. “U.S. shareholders will fight raw deals of bad actors from China in our stock markets.” The defendants admitted no wrongdoing. |

| U.S. regulators are eying Chinese companies. Last month, the S.E.C. issued a warning to investors in Chinese companies listed in the U.S. after it told Chinese companies hoping to list that they would be subject to additional disclosures. And Chinese companies may soon get delisted if they don’t submit to audit inspections by U.S. regulators. |

| The questions don’t end with this case. Renren’s founder, Joe Chen, was until recently a SoFi board member. The accusations against him in the now-settled lawsuit were brought to the attention of the S.E.C. by Representative Brad Sherman, Democrat of California, after SoFi merged with a SPAC run by the tech investor Chamath Palihapitiya in June. “Given Mr. Chen’s apparent disregard for the shareholders of one public company that he controlled,” the congressman wrote, “it is concerning that the recent SoFi SPAC merger was able to go forward with Mr. Chen as a member of the SoFi board.” |

| Renren, SoFi and SoftBank did not respond to requests for comment. |

|

| [h=2]Weekend reading: Give and take[/h] |

| Many companies are promoting their sustainability goals, particularly their plans to reach net-zero carbon emissions. But Paul Polman, the former C.E.O. of Unilever who became a standard-bearer for corporate social responsibility, is unimpressed. In fact, he argues that having “zero” as a goal reveals a fundamental flaw. |

| Polman’s new book with the sustainable business expert Andrew Winston, “Net Positive: How Courageous Companies Thrive by Giving More Than They Take,” argues that it’s profitable to do business with the goal of making the world better. Polman spoke to DealBook about how to do it. The interview has been edited and condensed. |

| What’s the problem with net zero? |

| Net zero is not enough. Many companies plan to reduce their emissions or are relying on future carbon capture technologies to ensure they take back as much as they put out, but balancing carbon isn’t enough anymore because collectively — globally — we’re showing increased emissions despite reduction commitments. That means we are going to have to do more than reach zero. |

| Can companies make the world better? |

| We’ve already overshot a lot of nature’s boundaries, so it’s not enough to just try to be less bad. Infinite growth on a finite planet isn’t sustainable. We won’t be able to do business at all if this continues. We’re arguing in the book that companies that take ownership of difficult social and environmental justice issues will do very well in the future. |

| How would a company start down this path? |

| You need to think about your purpose. Why are you here? You won’t last long if the world is not better off with you in it, and not attacking issues costs infinitely more in the long term. Now companies have to think about how to drive changes in habits instead of depleting resources and driving more consumption. Producing more stuff doesn’t work. |

| What does it mean to be “net positive”? |

| It means not just being “green” or less bad by minimizing harms, and not just operating sustainably, which means having a neutral effect on the planet. Net positive is restorative, reparative and regenerative. |

| Want to share The New York Times with your friends and family? Invite them to enjoy unlimited digital access to our journalism with this special offer. |

| [h=3]THE SPEED READ[/h] |

| Deals |

|

| Policy |

|

| Best of the rest |

|

| Anna Schaverien contributed reporting. |

| Thanks for reading! We’ll see you tomorrow. |

| We’d like your feedback. Please email thoughts and suggestions to dealbook@nytimes.com. |

|

|

|

|

|

|

| Andrew Ross Sorkin, Founder/Editor-at-Large, New York @andrewrsorkin |

| Jason Karaian, Editor, London @jkaraian |

| Sarah Kessler, Deputy Editor, Chicago @sarahfkessler |

| Stephen Gandel, News Editor, New York @stephengandel |

| Michael J. de la Merced, Reporter, London @m_delamerced |

| Lauren Hirsch, Reporter, New York @LaurenSHirsch |

| Ephrat Livni, Reporter, Washington D.C. @el72champs |

Global Market Comments

October 7, 2021

Fiat LuxFeatured Trade:(A NOTE ON ASSIGNED OPTIONS, OR OPTIONS CALLED AWAY)

(SPY), (TLT)

October 7, 2021

Fiat LuxFeatured Trade:(A NOTE ON ASSIGNED OPTIONS, OR OPTIONS CALLED AWAY)

(SPY), (TLT)

A Note on Assigned Options, or Options Called AwayI know all of this may sound confusing at first. But once you get the hang of it, this is the greatest way to make money since sliced bread.

I still have seven positions left in my model trading portfolio, they are all deep-in-the-money, and about to expire in six trading days. That opens up a set of risks unique to these positions.

I call it the “Screw up risk.”

As long as the markets maintain current levels, ALL of these positions will expire at their maximum profit values.

They include:

(SPY) 10/$410-$420 call spread 10.00%

(GS) 10/$320-$330 call spread 10.00%

(JPM) 10/$130-$140 call spread 10.00%

(BLK) 10/$770-$790 call spread 10.00%

(MS) 10/$85-$90 call spread 10.00%

(BRKB) 10/$255-$265 call spread 10.00%

(C) 10/$62-$65 call spread 10.00%

With the October 15 options expirations upon us, there is a heightened probability that your short position in the options may get called away.

If it happens, there is only one thing to do: fall down on your knees and thank your lucky stars. You have just made the maximum possible profit for your position instantly.

Most of you have short option positions, although you may not realize it. For when you buy an in-the-money vertical option spread, it contains two elements: a long option and a short option.

The short options can get “assigned,” or “called away” at any time, as it is owned by a third party, the one you initially sold the put option to when you initiated the position.

You have to be careful here because the inexperienced can blow their newfound windfall if they take the wrong action, so here’s how to handle it correctly.

Let’s say you get an email from your broker telling you that your call options have been assigned away.

I’ll use the example of the S&P 500 (SPY) $410-$420 in-the-money vertical BULL CALL spread.

For what the broker had done in effect is allow you to get out of your call spread position at the maximum profit point days before the October 15expiration date. In other words, what you bought for $9.00 on September 17 is now worth $10.00, giving you a near-instant profit of $1,111 or 11.11%!

In the case of the S&P 500 (SPY) September 2021 $410-$420 in-the-money vertical BULL CALL, all have to do is call your broker and instruct them to “exercise your long position in your (SPY) October 15 $410 calls to close out your short position in the (SPY) October 15 $420 calls.”

You must do this in person. Brokers are not allowed to exercise options automatically, on their own, without your expressed permission.

This is a perfectly hedged position, with both options having the same name and the same expiration date, so there is no risk. The name, number of shares, and number of contracts are all identical, so you have no exposure at all.

Calls are a right to buy shares at a fixed price before a fixed date, and one options contract is exercisable into 100 shares.

Short positions usually only get called away for dividend-paying stocks or interest-paying ETFs like the (TLT). There are strategies out here that try to capture dividends the day before they are payable. Exercising an option is one way to do that.

Weird stuff like this happens in the run-up to options expirations like we have coming.

A call owner may need to buy a long (SPY) position after the close, and exercising his long (SPY) call is the only way to execute it.

Adequate shares may not be available in the market, or maybe a limit order didn’t get done by the market close.

There are thousands of algorithms out there that may arrive at some twisted logic that the puts need to be exercised.

Many require a rebalancing of hedges at the close every day which can be achieved through option exercises.

And yes, options even get exercised by accident. There are still a few humans left in this market to blow it by writing shoddy algorithms.

And here’s another possible outcome in this process.

Your broker will call you to notify you of an option called away, and then give you the wrong advice on what to do about it.

There is a further annoying complication that leads to a lot of confusion. Lately brokers have resorted to sending you warnings that exercises MIGHT happen to help mitigate their own legal liability.

They do this even when such an exercise has zero probability of happening, such as with a short call option in a LEAPS that has a year or more left until expiration. Just ignore these, or call you broker and ask them to explain.

This generates tons of commissions for the broker but is a terrible thing for the trader to do from a risk point of view, such as generating a loss by the time everything is closed and netted out.

There may not even be an evil motive behind the bad advice. Brokers are not investing a lot in training staff these days. In fact, I think I’m the last one they really did train.

Avarice could have been an explanation here but I think stupidity and poor training and low wages are much more likely.

Brokers have so many ways to steal money legally that they don’t need to resort to the illegal kind.

This exercise process is now fully automated at most brokers but it never hurts to follow up with a phone call if you get an exercise notice. Mistakes do happen.

Some may also send you a link to a video of what to do about all this.

If any of you are the slightest bit worried or confused by all of this, come out of your position RIGHT NOW at a small profit! You should never be worried or confused about any position tying up YOUR money.

Professionals do these things all day long and exercises become second nature, just another cost of doing business.

If you do this long enough, eventually you get hit. I bet you don’t.

[h=2]Calling All Options[/h]

[h=2]Calling All Options[/h]

I still have seven positions left in my model trading portfolio, they are all deep-in-the-money, and about to expire in six trading days. That opens up a set of risks unique to these positions.

I call it the “Screw up risk.”

As long as the markets maintain current levels, ALL of these positions will expire at their maximum profit values.

They include:

(SPY) 10/$410-$420 call spread 10.00%

(GS) 10/$320-$330 call spread 10.00%

(JPM) 10/$130-$140 call spread 10.00%

(BLK) 10/$770-$790 call spread 10.00%

(MS) 10/$85-$90 call spread 10.00%

(BRKB) 10/$255-$265 call spread 10.00%

(C) 10/$62-$65 call spread 10.00%

With the October 15 options expirations upon us, there is a heightened probability that your short position in the options may get called away.

If it happens, there is only one thing to do: fall down on your knees and thank your lucky stars. You have just made the maximum possible profit for your position instantly.

Most of you have short option positions, although you may not realize it. For when you buy an in-the-money vertical option spread, it contains two elements: a long option and a short option.

The short options can get “assigned,” or “called away” at any time, as it is owned by a third party, the one you initially sold the put option to when you initiated the position.

You have to be careful here because the inexperienced can blow their newfound windfall if they take the wrong action, so here’s how to handle it correctly.

Let’s say you get an email from your broker telling you that your call options have been assigned away.

I’ll use the example of the S&P 500 (SPY) $410-$420 in-the-money vertical BULL CALL spread.

For what the broker had done in effect is allow you to get out of your call spread position at the maximum profit point days before the October 15expiration date. In other words, what you bought for $9.00 on September 17 is now worth $10.00, giving you a near-instant profit of $1,111 or 11.11%!

In the case of the S&P 500 (SPY) September 2021 $410-$420 in-the-money vertical BULL CALL, all have to do is call your broker and instruct them to “exercise your long position in your (SPY) October 15 $410 calls to close out your short position in the (SPY) October 15 $420 calls.”

You must do this in person. Brokers are not allowed to exercise options automatically, on their own, without your expressed permission.

This is a perfectly hedged position, with both options having the same name and the same expiration date, so there is no risk. The name, number of shares, and number of contracts are all identical, so you have no exposure at all.

Calls are a right to buy shares at a fixed price before a fixed date, and one options contract is exercisable into 100 shares.

Short positions usually only get called away for dividend-paying stocks or interest-paying ETFs like the (TLT). There are strategies out here that try to capture dividends the day before they are payable. Exercising an option is one way to do that.

Weird stuff like this happens in the run-up to options expirations like we have coming.

A call owner may need to buy a long (SPY) position after the close, and exercising his long (SPY) call is the only way to execute it.

Adequate shares may not be available in the market, or maybe a limit order didn’t get done by the market close.

There are thousands of algorithms out there that may arrive at some twisted logic that the puts need to be exercised.

Many require a rebalancing of hedges at the close every day which can be achieved through option exercises.

And yes, options even get exercised by accident. There are still a few humans left in this market to blow it by writing shoddy algorithms.

And here’s another possible outcome in this process.

Your broker will call you to notify you of an option called away, and then give you the wrong advice on what to do about it.

There is a further annoying complication that leads to a lot of confusion. Lately brokers have resorted to sending you warnings that exercises MIGHT happen to help mitigate their own legal liability.

They do this even when such an exercise has zero probability of happening, such as with a short call option in a LEAPS that has a year or more left until expiration. Just ignore these, or call you broker and ask them to explain.

This generates tons of commissions for the broker but is a terrible thing for the trader to do from a risk point of view, such as generating a loss by the time everything is closed and netted out.

There may not even be an evil motive behind the bad advice. Brokers are not investing a lot in training staff these days. In fact, I think I’m the last one they really did train.

Avarice could have been an explanation here but I think stupidity and poor training and low wages are much more likely.

Brokers have so many ways to steal money legally that they don’t need to resort to the illegal kind.

This exercise process is now fully automated at most brokers but it never hurts to follow up with a phone call if you get an exercise notice. Mistakes do happen.

Some may also send you a link to a video of what to do about all this.

If any of you are the slightest bit worried or confused by all of this, come out of your position RIGHT NOW at a small profit! You should never be worried or confused about any position tying up YOUR money.

Professionals do these things all day long and exercises become second nature, just another cost of doing business.

If you do this long enough, eventually you get hit. I bet you don’t.

Quote of the Day“Stock prices have reached what looks like a permanently high plateau,” said economist Irving Fisher….just before the 1929 stock market crash.

This is not a solicitation to buy or sell securities

The Mad Hedge Fund Trader is not an Investment advisor

For full disclosures click here at:

http://www.madhedgefundtrader.com/disclosures

The "Diary of a Mad Hedge Fund Trader"(TM)

and the "Mad Hedge Fund Trader" (TM)

are protected by the United States Patent and Trademark Office

The "Diary of the Mad Hedge Fund Trader" (C)

is protected by the United States Copyright Office

Futures trading involves a high degree of risk and may not be suitable for ever

| Read in Browser | ||||||||||||||||

| ||||||||||||||||

| ||||||||||||||||

|

Spent no time on the NFL this week

Panthers -3

Bengals +3.5

Cowboys -7

Bills+2.5

Panthers -3

Bengals +3.5

Cowboys -7

Bills+2.5

| � | |||||||||||||||||||||||

| |||||||||||||||||||||||

| |||||||||||||||||||||||

| |||||||||||||||||||||||

Spent no time on the NFL this week

Panthers -3

Bengals +3.5

Cowboys -7

Bills+2.5

3-1 today 13 -7 so far.

| Read in Browser | |||||||||||||||||||||||||||||

| � | |||||||||||||||||||||||||||||

| � | |||||||||||||||||||||||||||||

| � |

| Good morning. |

| We hope you can join us tomorrow for a DealBook Dialogue call on “The Business of Longevity.” We will welcome David Sinclair, a Harvard researcher and biotech founder, to discuss the realities of reversing aging and the implications of extending life. Register here to attend, free of charge, on Tuesday, Oct. 12, at 1 p.m. Eastern. |

| (Was this newsletter forwarded to you? Sign up here.) |

|

| [h=2]Southwest’s bad weekend[/h] |

| Southwest Airlines canceled more than 1,000 flights yesterday, and just over 800 on Saturday, wreaking havoc on weekend travel plans for thousands of passengers. The cancellations accounted for around a quarter of the airline’s scheduled flights this weekend. |

| Since other airlines weren’t affected, the cancellations invited speculation about a link to a court challenge Friday by Southwest’s pilots union to the company’s vaccine mandate. Texas-based Southwest and the union denied any link between the cancellations and the mandate, but it is telling, regardless, that many immediately drew the connection. The union had warned that enforcing the mandate could lead to labor shortages and service disruptions, an argument that is likely to play out elsewhere as vaccination deadlines loom. |

| Southwest blamed weather, limited capacity and air traffic control issues for the cancellations. Although the disruption appeared limited to Southwest, it and others have had similar breakdowns before, as the airline reporter David Slotnick detailed on Twitter. |

| On Friday, Southwest’s pilots union asked a judge to block the company’s vaccine mandate, saying in a legal filing that it “unlawfully imposes new conditions of employment” that had not been negotiated with the union. The company said this month that its workers must be vaccinated against the coronavirus by Dec. 8 to meet rules for federal contractors. Several unions, including those at AT&T, Disney and Tyson Foods, ultimately supported vaccine mandates, after negotiating the terms of the requirements, while pushing for more benefits and protections in the process. |

| Pandemic bailouts of airlines add a layer of political complexity.Representative Chip Roy, Republican of Texas, said yesterday that he was “working on legislation to require all companies that took bailouts to have to pay them back — in full — if they fire any employee for lack of vax.” Last month, Gov. Greg Abbott of Texas said that the state was “working to halt this power grab.” |

| Shortages and disruptions are an increasingly popular talking point for opponents of mandates. Senator Ted Cruz, another Texas Republican, criticized vaccine mandates along these lines this weekend, pointing to Southwest’s problems. While corporate vaccine mandates have largely proveneffective at upping inoculation rates significantly, the risk of being forced to fire employees is a concern for companies in industries facing labor shortages, like airlines. |

| But some employers say that mandates have served as a useful recruiting tool. United Airlines, which was among the first big companies to announce a vaccine requirement, said that it is receiving a much higher ratio of applications per position than before the pandemic. |

| [h=3]HERE’S WHAT’S HAPPENING[/h] |

| The Nobel Prize in economics goes to a trio for their work on unintended experiments. David Card, Joshua Angrist and Guido Imbens were praised by the judges for their study of chance events and policy changes. Card’s work on the labor market showed how increasing the minimum wage does not necessarily lead to fewer jobs, while Angrist and Imbens refined the methodologies that researchers now rely on when analyzing natural experiments. |

| Merck applies for emergency approval of its Covid pill. The pharma company is asking the F.D.A. for authorization of the drug, molnupiravir, for high-risk adults sick with Covid. If approved, it would mark a milestone in the fight against the coronavirus, because the pill could reach many more people than the antibody treatments currently being used. |

| Moderna ships almost all of its Covid vaccine doses to rich nations. An investigation by The Times also found that Moderna is charging poorer nations, like Thailand and Colombia, more money per dose than the U.S. and E.U. Under pressure from the Biden administration, Moderna said that it would ship one billion doses to poorer nations next year. |

| James Bond draws viewers back to the big screens. “No Time to Die” brought in $56 million in its opening weekend in North America, which was less than previous Bond releases, but still one of the best opening weekends in the past year. |

| The I.M.F. chief’s fate remains in limbo. The institution’s board, which met multiple times last week, remains split on whether Kristalina Georgieva should be forced to leave. (It meets again today.) She is accused of overseeing the manipulation of data in a 2018 report to favor China when she was at the World Bank. |

| [h=2]End of an era at K.K.R.[/h] |

| Henry Kravis and George Roberts, the private equity titans who founded K.K.R., are handing over the keys. They founded K.K.R. with Jerome Kohlberg Jr. in 1976 and defined the 1980s leverage buyout boom with the firm’s acquisition of RJR Nabisco. |

| Joe Bae and Scott Nuttall are taking over as co-C.E.O.s, effective immediately, the firm announced today. Kravis and Roberts will remain “actively involved” as executive co-chairmen of the board. |

| Kravis and Roberts are also ceding voting control. Alongside the management moves, K.K.R. is simplifying its corporate governance and will eliminate preferred shares for Kravis and Roberts, moving to one-vote-per-share on all matters — including board elections — by the end of 2026. That is in contrast to rivals like Blackstone, where founder Steve Schwarzman maintains significant control. Apollo said earlier this year that it would move to a one-share-one-vote structure after revelations about its founder Leon Black’s ties to Jeffrey Epstein, which led Black to step down earlier than expected. |

| Other leadership transitions are afoot at buyout groups. Carlyle’s co-founders, David Rubenstein and William Conway, appointed Glenn Youngkin and Kewsong Lee as co-C.E.O.s in 2017. (Youngkin resigned last year and is running for governor of Virginia.) Blackstone’s Schwarzman is still at the helm, with heir apparent Jonathan Gray serving as the firm’s C.O.O. TPG has been reshuffling its ranks in advance of an expected I.P.O. |

| [h=2]“The supply chain is overwhelmed and inundated. It’s not sustainable at this point. Everything is out of whack.”[/h] |

| — Griff Lynch, the executive director of the Georgia Ports Authority, on the traffic jam at the Port of Savannah, a result of larger supply chain problems that show no signs of relenting. |

|

| [h=2]Evergrande’s ticking clock[/h] |

| Evergrande, the teetering Chinese property developer, has three more payments due today on its dollar bonds. It’s been about two weeks since the company, which has $300 billion in liabilities, missed a Sept. 23 bond payment, starting the clock on the 30-day grace period before it formally defaults. |

| Cracks are beginning to appear across China’s real estate industry. Developers have amassed more than $5 trillion (with a “T”) in debt, and buyers are wary of high prices, denting sales and forcing sellers to cut prices. Evergrande isn’t the only developer struggling with its debts; collectively, Chinese real estate companies have more than $28 billion in dollar bond payments due in 2022. |

| Evergrande’s international creditors are beginning to make noise, amid fears that China will prioritize onshore creditors in any potential restructuring. Last week, Moelis and Kirkland & Ellis, the advisers representing a number of offshore bondholders, said they were concerned about a lack of information from China, including details about Evergrande’s potential sale of a stake in one of its divisions. (Trading in the company’s shares has been halted since Oct. 4.) |

| Creditors also questioned whether a deal announced by Evergrande last month to sell a $1.5 billion stake in a bank to help settle debts amounted to preferential treatment that kept offshore creditors out of the loop. Creditors are looking for recourse in Cayman law, which governs Evergrande’s offshore bonds, according to Bloomberg. On Saturday, Evergrande said it had punished six executives who redeemed company investment products early, forcing them to return the funds. |

| [h=2]The week ahead[/h] |

| ► Price check: The government on Wednesday will report how much prices rose in September. The Consumer Price Index rose in August at its fastest pace in 30 years. Economists and White House officials still expect the pandemic-driven spike in inflation to be temporary, but fears that it could drag on could complicate the Fed’s policies and the Biden administration’s spending efforts. |

| ► I.M.F. and World Bank meeting: Finance ministers and central bank governors have plenty of problems to discuss at their weeklong gathering: the pandemic, climate change and inequality are all on the agenda. Finance ministers from the Group of 20 nations are also set to meet to discuss how to sustain the economic recovery, and to endorse a 15 percent global minimum corporate tax. |

| ► Booster shots: Advisers to the F.D.A. will meet on Thursday to discuss emergency authorization of booster shots for people who received the Moderna and Johnson & Johnson coronavirus vaccines. A separate meeting on the use of the Pfizer-BioNTech coronavirus vaccine for children ages 5 to 11 is tentatively scheduled for Oct. 26. The F.D.A. typically issues decisions within a few days of its advisory committee’s meetings. |

|

| From the TimesMachine: 90 years ago this week, the inventor John Logie Baird, known as the “father of television,” made his first visit to the U.S., to expand his company’s offices and ramp up production of TV sets. Baird said there were already around 8,000 working sets in England and he hoped to manufacture one million a year in America, at a cost of $25 each. |

| Want to share The New York Times with your friends and family? Invite them to enjoy unlimited digital access to our journalism with this special offer. |

| [h=3]THE SPEED READ[/h] |

| Deals |

|

| Policy |

|

| Crypto |

|

| Best of the rest |

|

| Anna Schaverien contributed reporting. |

| Thanks for reading! We’ll see you tomorrow. |

| We’d like your feedback. Please email thoughts and suggestions to dealbook@nytimes.com. |

|

|

|

|

|

|

| Andrew Ross Sorkin, Founder/Editor-at-Large, New York @andrewrsorkin |

| Jason Karaian, Editor, London @jkaraian |

| Sarah Kessler, Deputy Editor, Chicago @sarahfkessler |

| Stephen Gandel, News Editor, New York @stephengandel |

| Michael J. de la Merced, Reporter, London @m_delamerced |

| Lauren Hirsch, Reporter, New York @LaurenSHirsch |

| Ephrat Livni, Reporter, Washington D.C. @el72champs |

| � |

| � | |||||||||||||||||||

Read in Browser | |||||||||||||||||||

| |||||||||||||||||||

| |||||||||||||||||||

| |||||||||||||||||||

Nice NFL plays - I avoid betting on the NFL. I've done okay so far this season, but had a really bad weekend taking Bama 1st half and full game. oooof!

BABA has done well the last few sessions....I need it to do REALLY well though!

Thanks dude..I'm horrible betting the college although I'd put parlays together during the bowls.

Tons of big US players have bought in recently..Gotta think it's news outa China the red taping of BABA is over?....it's just strange how suddenly the BABA numbers are too good to ignore in the press..

It's ADVL 's week CB and I'm very nervous.

Bill Gates-backed ESS — which makes giant batteries out of iron, salt and water — starts trading

https://www.cnbc.com/2021/10/11/ess-battery-company-backed-by-bill-gates-softbank-opens-on-nyse.html

9.00 and change today..worth watching?

https://www.cnbc.com/quotes/GWH

https://www.cnbc.com/2021/10/11/ess-battery-company-backed-by-bill-gates-softbank-opens-on-nyse.html

9.00 and change today..worth watching?

https://www.cnbc.com/quotes/GWH

Bill Gates-backed ESS — which makes giant batteries out of iron, salt and water — starts trading

https://www.cnbc.com/2021/10/11/ess-battery-company-backed-by-bill-gates-softbank-opens-on-nyse.html

9.00 and change today..worth watching?

https://www.cnbc.com/quotes/GWH

GHW 16.00 and change this AM!

| Good morning. Join us today at 1 p.m. Eastern for our DealBook Dialogue call on “The Business of Longevity.” More details on that later. |

| (Was this newsletter forwarded to you? Sign up here.) |

|

| [h=2]Exclusive: Harry and Meghan want to make sustainable investing mainstream[/h] |

| Prince Harry and Meghan, the Duchess of Sussex, are getting into the investment business. They are joining Ethic, a fintech asset manager in the fast-growing environmental, social and governance space, as “impact partners” and investors. Ethic has $1.3 billion under management and creates separately managed accounts to invest in social responsibility themes. |

| The couple could attract more attention to sustainable investing. Harry and Meghan can make E.S.G. investing part of pop culture in a way that, say, BlackRock’s Larry Fink can’t. “From the world I come from, you don’t talk about investing, right?” Meghan told DealBook in a joint interview with Harry. “You don’t have the luxury to invest. That sounds so fancy.” |

| “My husband has been saying for years, ‘Gosh, don’t you wish there was a place where if your values were aligned like this, you could put your money to that same sort of thing?’” Meghan said. They were introduced to Ethic by friends, she said. |

| Harry and Meghan said they hoped that their involvement would help democratize investing, making people — especially younger people — more deliberate in their choices and conscious of investing in sustainable companies. “You already have the younger generation voting with their dollars and their pounds, you know, all over the world when it comes to brands they select and choose from,” Harry said, suggesting it was a natural extension to do the same with investments. |

| Ethic was founded in 2015 and has tripled assets under management in the past year, Doug Scott, a founder of the company, told DealBook. Ethic runs screens on companies and sectors based on social responsibility criteria, including racial justice, climate and labor issues. Its user interface has more in common with the likes of Robinhood than traditional financial sites, and it has developed a new platform, “Sustainability for Everyone,” which scores a person’s portfolio along different dimensions. |

| The move is the couple’s latest corporate partnership since relocating to the U.S. Harry and Meghan moved to Los Angeles last year and later gave up official royal family duties. Seeking financial independence, they have signed production deals with Netflix and Spotify. Harry also recently produced a documentary series about mental health for Apple TV+ in connection with Oprah Winfrey and is writing a memoir. |

| [h=3]HERE’S WHAT’S HAPPENING[/h] |

| Texas bans Covid vaccine mandates. An executive order issued by Gov. Greg Abbott yesterday bars virtually any vaccine mandate in the state, including those by private employers. The order will most likely be challenged in court. |

| Oil prices jump. U.S. crude prices have risen above $80 per barrel for the first time in seven years. Some analysts fear that supply shortages will keep oil prices relatively high. |

| The I.M.F. clears Kristalina Georgieva to remain in her post. The fund’s managing director found her position in doubt after an investigation last month concluded that she had manipulated data to placate China when she was at the World Bank. After a series of crisis meetings, the I.M.F.’s executive board yesterday expressed “full confidence” in Georgieva. |

| The Facebook whistle-blower will meet the company’s oversight board.Frances Haugen, the former Facebook product manager who testified before Congress last week and called for stricter regulation of the social media giant, will meet with the panel of experts that reviews the company’s content decisions. |

| HBO removes the “true crime” description from a docuseries that included an episode on WeWork. Lawyers for Adam Neumann, WeWork’s founder and former C.E.O., took a victory lap on the altered text in the show, “Generation Hustle.” WeWork is expected to go public at a $9 billion valuation through a merger with a SPAC this month. |

| [h=2]The stock market’s profit engine may be slowing[/h] |

| The Delta variant of the coronavirus has hurt hiring and made policymakers’ lives more difficult. But investors are taking it in stride, because it appears to have had little effect on corporate profits. |

| Executives, having closed the books on the third quarter, may not be as buoyant as they were earlier in the year, with growing worries about supply chain issues and inflation slowing future profit growth. |

|

| Companies start reporting their third quarter profits this week, beginning with JPMorgan Chase and Delta Air Lines tomorrow. |

| Bottom lines are expected to have risen substantially. Analysts predict that earnings for companies in the S&P 500 rose nearly 28 percent in the third quarter, compared with a year ago, which would be the third-highest increase since 2010. But that’s not necessarily a positive sign for the overall economy. |

| The sectors showing the biggest jumps in earnings are the few that benefit the most from inflation. Companies in the energy and materials sectors — like Exxon and Dow — are expected to report huge jumps in profits for the third quarter. By contrast, companies that are reluctant to pass higher costs onto consumers, like Amazon and General Motors, are expected to have a disappointing quarter. Banks are in the middle, with trading businesses expected to fall short of last year’s windfall but consumer divisions picking up as the economy reopens. |

|

| Shortages and supply-chain issues loom large. On the most recent earnings calls at S&P 500 companies, some 70 percent warned that supply-chain issueswould be a negative factor for sales and profits. “If we had the capacity to meet all of the demand,” Sean Connolly of the packaged food group Conagra told investors last week, “our numbers would likely have been even more impressive.” Expect to hear more of this on third-quarter calls, perhaps unseating inflation as the topic du jour. (Vaccine mandates are also likely to come up.) |

| Optimism is also in shorter supply. FactSet reports that 56 companies in the S&P 500 have issued third-quarter guidance above what analysts expected, which is higher than average but down from 67 in the previous quarter. The number of companies issuing negative guidance rose to 47 from 37 the quarter before. Is this a problem? Analysts expect the S&P 500 index to rise by 15 percent over the coming year. |

| [h=2]“The human brain is a much scarier black box than any machine-learning algorithm.”[/h] |

| — Sabrina Howell of N.Y.U.’s Stern School of Business, on her new researchthat showed Black business owners were more likely to get Paycheck Protection Program loans from online lenders than from banks. |

| [h=2]Acorns hires a chief investment officer[/h] |

| Acorns, the investment app for managing users’ “small change,” has hired its first chief investment officer: Seth Wunder. The appointment, which DealBook is the first to report, comes as the fintech company prepares to go public in a $2 billion SPAC merger. |

| Acorns, which emphasizes index funds and passive investing, will let users dabble in individual stocks and cryptocurrencies. Wunder, who is joining from black-and-white Capital, will help the company introduce these “more sophisticated investment opportunities,” Acorns said. The service will be offered for “higher subscription tiers,” said the company’s C.E.O., Noah Kerner. Acorns has a $3-per-month entry tier and last year introduced a $5-per-month family account. The company will limit how much of a customer’s diversified portfolio can be allocated to crypto and individual stocks. |

| Its investing approach is still more conservative than rivals like Robinhood, whose business model depends more on frequent trading. “One of the things that’s poorly understood in the market today is that when you’re abundantly active in your portfolio, there’s often a lot of unwarranted risk that people really don’t understand or realize that they’re taking,” Wunder said. “Our approach is to offer people the opportunity to invest in lots of different instruments over time, but doing it proportional to what’s a reasonable risk to take.” |

|

| [h=2]China’s property problem, by the numbers[/h] |

| Evergrande isn’t the only Chinese property developer with huge debts it may be unable to pay. Fearing the fallout from policies aimed at cooling China’s costly and dangerously debt-ridden housing market, many are putting off buying homes altogether. With nearly three-quarters of household wealth tied to property, a loss of confidence in the market could drag down the overall economy, The Times’s Alexandra Stevenson and Joy Dong report. Here are three numbers that explain the scope of the problem: |

|

|

| [h=2]Do you want to live forever?[/h] |

| The question brings up all sorts of issues, from the philosophical to the practical. Extending human life has also attracted billions in investment, which raises its own concerns. |

| “Death has never made any sense to me,” Oracle’s Larry Ellison once said. (He has poured millions into longevity research.) Jeff Bezos and Peter Thiel are investors in Unity Biotechnology, which focuses on ways to “slow, halt or reverse diseases of aging.” Google started Calico in 2013, a company that today describes itself as “asking difficult questions about how we age.” |

| Some of those questions include: |

|

| What do you think? Today, at 1 p.m. Eastern, join us for a DealBook Dialogue call on “The Business of Longevity” with David Sinclair, a Harvard researcher and biotech founder. You can submit questions live or when you R.S.V.P. Register here. |

| Want to share The New York Times with your friends and family? Invite them to enjoy unlimited digital access to our journalism with this special offer. |

| [h=3]THE SPEED READ[/h] |

| Deals |

|

| Policy |

|

| Best of the rest |

|

| Anna Schaverien contributed reporting. |

| Thanks for reading! We’ll see you tomorrow. |

| We’d like your feedback. Please email thoughts and suggestions to dealbook@nytimes.com. |

|

|

|

|

|

|

| Andrew Ross Sorkin, Founder/Editor-at-Large, New York @andrewrsorkin |

| Jason Karaian, Editor, London @jkaraian |

| Sarah Kessler, Deputy Editor, Chicago @sarahfkessler |

| Stephen Gandel, News Editor, New York @stephengandel |

| Michael J. de la Merced, Reporter, London @m_delamerced |

| Lauren Hirsch, Reporter, New York @LaurenSHirsch |

| Ephrat Livni, Reporter, Washington D.C. @el72champs |

| � | |||||||||||||||||

| |||||||||||||||||

| |||||||||||||||||

|

|

| Global Market Comments October 11, 2021 Fiat Lux Featured Trade: (THE MAD HEDGE SUMMIT VIDEOS ARE UP), (MARKET OUTLOOK FOR THE WEEK AHEAD, or HAPPY DAYS ARE HERE AGAIN), (GS), (MS), (JPM), (BAC), (C), (BLK), (TLT), (BRKB), (SPY)

|

| � |

The Mad Hedge Summit Videos are UpThe Mad Hedge Summit videos are up from the September 14-16 confab. Listen to 27 speakers opine on the best strategies, tactics, and instruments to use in these volatile markets. It is a true smorgasbord of investment strategies. Find the best one to suit your own goals. The product discounts offered last week are still valid. Start, stop, and pause the videos at your leisure. Best of all, access to the videos is FREE. Access them all by clicking here at www.madhedge.com, click on SEPTEMBER 14-16, 2021 REPLAYS in the upper right-hand corner, and then chose the speaker of your choice.

|

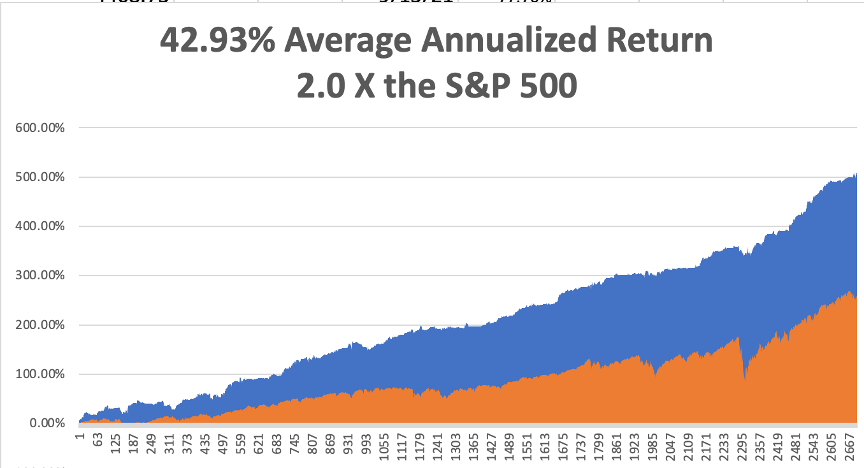

The Market Outlook for the Week Ahead, or Happy Days are Here Again!The yearend rally is on. All it took was another 5% correction and that’s all she wrote. It seems that the stock market has muscle memory. Every time we retreat back to this magical level, the bulls come roaring back. The Shorts are tearing their hair out. The market did this against an increasing wall of worries. Soaring energy prices, rocketing inflation rates, a delayed rescue package in Washington would have defeated a lesser bovine. Not this one. All it took was a few parsed words from Fed governor Jay Powell to completely destroy the bond market, down $11 points in ten days, where we were heavily short. That set financial stocks on fire, where we had been leaning into with every downside test. That left Mad Hedge followers 90% long financials and greatly enriched after last week’s turnaround. The Mad Hedge Bitcoin Letter followers cashed in on a monster 37% rally in Bitcoin with their investment in MicroStrategy (MSTR). It really was a perfect week. It all confirms my theory, relentlessly repeated in these pages, that the wall of money is growing, not shrinking. Except this time, it is happening because of soaring corporate earnings, not because of any government action, that markets fail to fall more than 5%. There are still billions of frustrated dollars trapped on the sidelines dying to get it. The cautious, conservative, and the slow of hand have been severely punished. A Fed threatening to merely take its foot off the accelerator but apply no breaks is not what bear markets are made of. The Friday Nonfarm Payroll Report for September came in at a paltry 194,000 after only 235,000 in August. The numbers are weak not because of any economic weakness but of labor shortages. Somehow, 10 million workers have gone missing, and many of these may NEVER come back. We in fact have suffered a delta and supply chain-generated mini-recession over the summer, which is why stocks went nowhere. That’s if you consider a 7% GDP growth rate slow, compared to a pre-pandemic decade average of only 2.9%. What all this does is delay about 3% a year of growth into future years. That means a bull market that goes higher for longer, possibly until the 2024 election. That totally works for me. Tesla Beats All Estates, delivering 241,300 cars in Q3. That’s about 20,000 more than expected and the company is running at near a 1 million a year rate. Norway now sees 80% of new car sales with EV’s, mostly Tesla’s. (GM) and (F) are suffering a serious sales slump due to the chronic chip shortage. Some 7 million vehicles have gone missing due to the lack of parts, a major drag on the US economy. Bitcoin Pops 10%, and rumors of an SEC-approved crypto ETF percolate. China banning crypto is seen as a positive as it removed an unstable and unpredictable factor from the market. Miners moving to the US and Canada is a major positive. The move up continues as Jay Powell says the Fed has no intention to ban crypto. Defi platform Compound wishes they didn’t have such fat fingers. They accidentally sent out $90 million. Merck’s New Pill Cuts Covid Deaths by 50%. Molnupiravir can be taken in pill form for two weeks. The drug was so successful that phase three trials were ended early. Expect more miracle Covid cures to come. Facebook Gets Slammed on a whistleblower report claiming that the company favors profit over safety. The stock got hammed by 5% and is 15% off its recent high. Imagine! That’s like claiming there is gambling in the casino as Silicon Valley insiders knowingly nod. (FB) led the charge to the downside for all of big tech and could be zeroing in on the 200-day moving average at $315.41. It might light a fire under Congress to ban dual share classes which keep Mark Zuckerberg in control no matter what happens. For good measure, all of (FB)’s apps suffered their biggest global hack ever. OPEC Cuts a Deal with Russia. They maintained the existing quota increases rather than boosting them to take advantage of high prices. Texas Tea soared. My Ten-Year View When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come! My Mad Hedge Global Trading Dispatch saw a heroic +5.94% gain so far in October. My 2021 year-to-date performance soared to 85.54%. The Dow Average was up 13.5% so far in 2021. Figuring that we are either at or close to a market bottom, and being a man of my convictions, I am 90% invested in financial stocks. Those include (MS), (GS), (JPM), (BLK), (BRKB), (BAC), and (C). In for a penny, in for a pound. I am also 10% invested in the (SPY). They all took off like a scalded chimp. A quick trip by the Volatility Index (VIX) to $29 and a rapid 45 basis point leap in ten-year US Treasury bond yields gave us the entry point for all of these positions. That brings my 12-year total return to 508.09%, some 2.00 times the S&P 500 (SPX) over the same period. My 12-year average annualized return now stands at an unbelievable 42.93%, easily the highest in the industry. My trailing one-year return popped back to positively eye-popping 116.72%. I truly have to pinch myself when I see numbers like this. I bet many of you are making the biggest money of your long lives. We need to keep an eye on the number of US Coronavirus cases at 44.5 million and rising quickly and deaths topping 713,000, which you can find here. The coming week will be slow on the data front. On Monday, October 11 at 10:00 AM, the bond market is closed for Columbus Day. Why, I’ll never know. On Tuesday, October 12 at 8:00 AM, the US Consumer Inflation Expectations are out. Fastenal reports earnings. On Wednesday, October 13 at 8:30 AM, US Core Inflation is published. The FOMC Minutes are out at 2:00 PM EST. Bank of America (BAC), (Morgan Stanley), and Citigroup (C) earnings are out, all current Mad Hedge holdings. On Thursday, October 14 at 8:30 AM, Weekly Jobless Claims are announced. We also get the Producer Price Index. On Friday, October 15 at 8:30 AM, we learn Retail Sales for September. Goldman Sachs earnings are out, another Mad Hedge favorite. At 2:00 PM, the Baker Hughes Oil Rig Count is disclosed. As for me, one of the many benefits of being married to a British Airways senior stewardess is that you get to visit some pretty obscure parts of the world. In the 1970s, that meant going first class for free with an open bar, and sometimes in the cockpit jump seat. To extend our 1977 honeymoon, Kyoko agreed to an extra round trip for BA from Hong Kong to Colombo in Sri Lanka. That left me on my own for a week in the former British crown colony of Ceylon. I rented an antiquated left-hand drive stick shift Vauxhall and drove around the island nation counterclockwise. I only drove during the day in army convoys to avoid terrorist attacks from the Tamil Tigers. The scenery included endless verdant tea field, pristine beaches, and wild elephants and monkeys. My eventual destination was the 1,500-year-old Sigiriya Rock Fort in the middle of the island which stood 600 feet above the surrounding jungle. I was nearly at the top when I thought I found a shortcut. I jumped over a wall and suddenly found myself up to my armpits in fresh bat shit. That cut my visit short, and I headed for a nearby river to wash off. But the smell stayed with me for weeks. Before Kyoko took off for Hong Kong in her Vickers Viscount, she asked me if she should bring anything back. I heard that McDonald’s has just opened a stand there, so I asked her to bring back two Big Macs. She dutifully showed up in the hotel restaurant the following week with the telltale paper back in hand. I gave them to the waiter and asked him to heat them up. He returned shortly with the burgers on plates surrounded by some elaborate garnish. It was a real work of art. Suddenly, every hand in the restaurant shot up. They all wanted to order the same dish, even though the nearest stand was 2,494 miles away. We continued our around-the-world honeymoon to a beach vacation in the Seychelles where we just missed a coup d’état, a safari in Kenya, apartheid South Africa, London, San Francisco, and finally back to Tokyo. It was the honeymoon of a lifetime. Kyoko passed away in 2020 from breast cancer at the age of 50, well before her time.

|

Quote of the Day“There is one peculiarity about mass psychology in that when you are in a bubble, you can't see it. Bubbles are invisible when you are inside the bubble,” said the charming Jim Dines of The Dines Letter.

|

| This is not a solicitation to buy or sell securities The Mad Hedge Fund Trader is not an Investment advisor For full disclosures click here at: http://www.madhedgefundtrader.com/disclosures The "Diary of a Mad Hedge Fund Trader"(TM) and the "Mad Hedge Fund Trader" (TM) are protected by the United States Patent and Trademark Office The "Diary of the Mad Hedge Fund Trader" (C) is protected by the United States Copyright Office Futures trading involves a high degree of risk and may not be suitable for everyone.[FONT="][/FONT] |

What a freaking day! +128%Bill Gates-backed ESS — which makes giant batteries out of iron, salt and water — starts trading

https://www.cnbc.com/2021/10/11/ess-battery-company-backed-by-bill-gates-softbank-opens-on-nyse.html

9.00 and change today..worth watching?

https://www.cnbc.com/quotes/GWH

Closed @ 23.80..

Global Market Comments

October 12, 2021

Fiat Lux

October 12, 2021

Fiat Lux

Featured Trade:

(ON THE AIR WITH CASEY STUBBS),

(HOW TO HANDLE THE FRIDAY, OCTOBER 15 OPTIONS EXPIRATION),

(SPY), (GS), (MS), HPM), (BAC), (BLK),

(UNP), (TLT), (C), (BAC), (BRKB)

(HOW TO HANDLE THE FRIDAY, OCTOBER 15 OPTIONS EXPIRATION),

(SPY), (GS), (MS), HPM), (BAC), (BLK),

(UNP), (TLT), (C), (BAC), (BRKB)

On the Air with Casey StubbsI managed to catch up with my buddy, Casey Stubbs, the other day. Casey assembles trading talent from all over the country with his “How to Trade It” podcasts, and my turn was up.

Am I the most interesting person Casey ever met?

Over 30 minutes, we discussed some of my favorite trading tips, investment strategies, and tricks of the trade. I touched upon how I got started in the markets a half-century ago and some of my early trading adventures. He couldn’t resist delving into my long, varied, and iconoclastic past, and I mention some of my greatest trades of all time.

Please enjoy. To access the podcast, please visit this link.

Podcaster Casey Stubbs

Am I the most interesting person Casey ever met?

Over 30 minutes, we discussed some of my favorite trading tips, investment strategies, and tricks of the trade. I touched upon how I got started in the markets a half-century ago and some of my early trading adventures. He couldn’t resist delving into my long, varied, and iconoclastic past, and I mention some of my greatest trades of all time.

Please enjoy. To access the podcast, please visit this link.

Podcaster Casey Stubbs

How to Handle the Friday, October 15 Options ExpirationFollowers of the Mad Hedge Fund Trader alert service have the good fortune to own deep-in-the-money options positions that expire on Friday, October 15, and I just want to explain to the newbies how to best maximize their profits.

These involve the:

(SPY) 10/$410-$420 call spread 10.00%

(GS) 10/$320-$330 call spread 10.00%

(JPM) 10/$130-$140 call spread 10.00%

(BLK) 10/$770-$790 call spread 10.00%

(MS) 10/$85-$90 call spread 10.00%

(BRKB) 10/$255-$265 call spread 10.00%

(C) 10/$62-$65 call spread 10.00%

Provided that we don’t have another 2,000-point move down in the market this week, these positions should expire at their maximum profit points.

So far, so good.

I’ll do the math for you on our deepest in-the-money position, the Goldman Sachs (GS) October 15 $320-$330 vertical bull call spread, which I most certainly will run into expiration. Your profit can be calculated as follows:

Profit: $10.00 expiration value - $8.50 cost = $1.50 net profit

(11 contracts X 100 contracts per option X $1.50 profit per options)

= $1,650 or 17.65% in 24 trading days.

Many of you have already emailed me asking what to do with these winning positions.

The answer is very simple. You take your left hand, grab your right wrist, pull it behind your neck, and pat yourself on the back for a job well done.

You don’t have to do anything.

Your broker (are they still called that?) will automatically use your long position to cover your short position, canceling out the total holdings.

The entire profit will be credited to your account on Monday morning, October 18 and the margin freed up.

Some firms charge you a modest $10 or $15 fee for performing this service.

If you don’t see the cash show up in your account on Monday, get on the blower immediately and find it.

Although the expiration process is now supposed to be fully automated, occasionally machines do make mistakes. Better to sort out any confusion before losses ensue.

If you want to wimp out and close the position before the expiration, it may be expensive to do so. You can probably unload them pennies below their maximum expiration value.

Keep in mind that the liquidity in the options market understandably disappears, and the spreads substantially widen, when a security has only hours, or minutes until expiration on Friday, October 15. So, if you plan to exit, do so well before the final expiration at the Friday market close.

This is known in the trade as the “expiration risk.”

One way or the other, I’m sure you’ll do OK, as long as I am looking over your shoulder, as I will be, always. Think of me as your trading guardian angel.

I am going to hang back and wait for good entry points before jumping back in. It’s all about keeping that “Buy low, sell high” thing going.

I’m looking to cherry-pick my new positions going into the next month-end.

Take your winnings and go out and buy yourself a well-earned dinner. Just make sure it’s take-out. I want you to stick around.

Well done, and on to the next trade.

You Can’t Do Enough Research

You Can’t Do Enough Research

These involve the:

(SPY) 10/$410-$420 call spread 10.00%

(GS) 10/$320-$330 call spread 10.00%

(JPM) 10/$130-$140 call spread 10.00%

(BLK) 10/$770-$790 call spread 10.00%

(MS) 10/$85-$90 call spread 10.00%

(BRKB) 10/$255-$265 call spread 10.00%

(C) 10/$62-$65 call spread 10.00%

Provided that we don’t have another 2,000-point move down in the market this week, these positions should expire at their maximum profit points.

So far, so good.

I’ll do the math for you on our deepest in-the-money position, the Goldman Sachs (GS) October 15 $320-$330 vertical bull call spread, which I most certainly will run into expiration. Your profit can be calculated as follows:

Profit: $10.00 expiration value - $8.50 cost = $1.50 net profit

(11 contracts X 100 contracts per option X $1.50 profit per options)

= $1,650 or 17.65% in 24 trading days.

Many of you have already emailed me asking what to do with these winning positions.

The answer is very simple. You take your left hand, grab your right wrist, pull it behind your neck, and pat yourself on the back for a job well done.

You don’t have to do anything.

Your broker (are they still called that?) will automatically use your long position to cover your short position, canceling out the total holdings.

The entire profit will be credited to your account on Monday morning, October 18 and the margin freed up.

Some firms charge you a modest $10 or $15 fee for performing this service.

If you don’t see the cash show up in your account on Monday, get on the blower immediately and find it.

Although the expiration process is now supposed to be fully automated, occasionally machines do make mistakes. Better to sort out any confusion before losses ensue.

If you want to wimp out and close the position before the expiration, it may be expensive to do so. You can probably unload them pennies below their maximum expiration value.

Keep in mind that the liquidity in the options market understandably disappears, and the spreads substantially widen, when a security has only hours, or minutes until expiration on Friday, October 15. So, if you plan to exit, do so well before the final expiration at the Friday market close.

This is known in the trade as the “expiration risk.”

One way or the other, I’m sure you’ll do OK, as long as I am looking over your shoulder, as I will be, always. Think of me as your trading guardian angel.

I am going to hang back and wait for good entry points before jumping back in. It’s all about keeping that “Buy low, sell high” thing going.

I’m looking to cherry-pick my new positions going into the next month-end.

Take your winnings and go out and buy yourself a well-earned dinner. Just make sure it’s take-out. I want you to stick around.

Well done, and on to the next trade.

Quote of the Day“The stock market is not expensive at 0.25% Fed funds and 1.68% government bonds,” said my old investor and mentor Leon Cooperman of Omega Advisors.

This is not a solicitation to buy or sell securities

The Mad Hedge Fund Trader is not an Investment advisor

For full disclosures click here at:

http://www.madhedgefundtrader.com/disclosures

The "Diary of a Mad Hedge Fund Trader"(TM)

and the "Mad Hedge Fund Trader" (TM)

are protected by the United States Patent and Trademark Office

The "Diary of the Mad Hedge Fund Trader" (C)

is protected by the United States Copyright Office

| Good morning. JPMorgan Chase just kicked off earnings season by beating expectations for quarterly profits, setting an optimistic tone as other companies prepare to open their books. Can they follow suit? (Was this newsletter forwarded to you? Sign up here.) |

|

| [h=2]Vaccine politics[/h] |

| President Biden’s push for large employers to mandate coronavirus vaccinations took another step toward becoming official yesterday: OSHA submitted the initial text of its emergency temporary standard to the Office of Management and Budget. From there, it still needs to go through an interagency review process, which could take weeks. Many companies say they have been waiting for the official OSHA standard to come out before announcing vaccine mandates, despite pressure from the White House to act. |

| In the meantime, vaccine mandates are facing growing resistance in states whose leaders oppose such requirements and other pandemic restrictions. On Monday, Gov. Greg Abbott of Texas issued an executive order banning private employers from mandating coronavirus vaccines. Yesterday in Florida, the state’s health department fined Leon County, which encompasses Tallahassee, for violating a state ban on “vaccine passports.” |

| State-level complications come as companies juggle two sets of federal mandates: the rule requiring all federal contractors to be fully vaccinated by Dec. 8 — the text of which has already been released — and the rule requiring all companies with more than 100 workers to be fully vaccinated or submit to weekly testing, which OSHA has now submitted for approval. |

| Legal experts say that state actions do not override Biden’s order. “Texas has just set itself up for a grand political show, but not a potentially legally sound initiative to stop all vaccine mandates,” James Hodge, the director of the Center for Public Health Law and Policy at Arizona State University, told The Times. That said, for companies wary of vaccine mandates, perhaps because they fear that workers may quit, the Texas order could provide cover to delay an announcement. |

| Several big companies said they would defy the Texas order, including American Airlines and Southwest Airlines, which are based in the state. Boeing, which has offices in Texas, announced a vaccine mandate yesterday. A spokesperson for Shell, which requires offshore workers in the Gulf of Mexico to be vaccinated by January, told DealBook the company was evaluating the governor’s order. |

| “The question for any business leader is: What do you want to do to save more lives in your companies?” Jen Psaki, the White House press secretary, said yesterday at a briefing, emphasizing the Biden administration’s message that vaccine mandates are good for business. “Our intention is to implement and continue to work to implement these requirements across the country,” she said, “including in the states where there are attempts to oppose them.” |

| [h=3]HERE’S WHAT’S HAPPENING[/h] |

| The U.S. opens its borders to Mexico and Canada. Fully vaccinated travelers will be allowed to cross America’s land borders starting in November. The lifting of the ban, imposed in March 2020, will effectively mark the reopening of the United States to tourism, signaling a new phase in the recovery. |

| Policymakers nervously watch inflation data. A key reading on consumer prices today is expected to show that inflation remains historically high, a worry for officials at the Fed and the White House. |

| The global chip shortage takes a bite out of Apple. The tech giant’s production targets for the new iPhone 13 could fall short by as many as 10 million units, according to Bloomberg. Analysts warn that long lead times for semiconductors could persist well into 2022. |

| A big deal in the world of corporate comms. WPP’s Finsbury Glover Hering is buying Sard Verbinnen, combining two of the most well-known M.&A. and crisis communications firms. The new firm will have roughly 1,000 employees and $330 million in revenue. Employees will own about 40 percent of the group, while Sard’s significant minority investor, Golden Gate Capital, will retain a stake. |

| William Shatner heads to space. The actor famous for playing Captain Kirk on “Star Trek” will be a passenger on the second flight by Blue Origin, Jeff Bezos’s space tourism company. Shatner, 90, who has also recorded 10 albums, said he planned to release a song about his trip. |

| [h=2]That ’70s shadow[/h] |

| As the pandemic’s initial economic shock recedes, many worry that the next stage of the recovery could be messy. This week, both the I.M.F. and Goldman Sachs cut their estimates of this year’s economic growth, with the persistence of the coronavirus and supply chain disruptions weighing on the outlook. |

| The biggest worry is a recovery-killing bout of stagflation — the toxic mix of rising prices and sluggish growth that bedeviled the U.S. in the second half of the 1970s, The Times’s Matt Phillips reports. Indeed, some of what’s happening today seems like a flashback: |

|

|

| But the market doesn’t appear to be pricing in a 1970s rerun. Stocks have generally traded at lower valuations during times of rising inflation, like in the latter half of the 1970s. Today, the market’s average price-to-earnings ratio is not far off the levels reached at the height of dot-com mania. Keeping that up relies on continued strong earnings growth. Companies like FedEx, Nike, CarMax and Bed Bath & Beyond saw their shares fall in recent weeks after releasing disappointing quarterly reports. |

| “People are going to be further disappointed,” said Mike Wilson, the chief U.S. equity strategist at Morgan Stanley. “Even if the economy is OK, it may not translate into the kinds of earnings that people are expecting.” |

| [h=2]“You see oil majors feeling the heat. But private equity is quietly picking up the dregs, perpetuating operations of the least desirable assets.”[/h] |

| — Alyssa Giachino of the Private Equity Stakeholder Project, a nonprofit behind a new report that shows private equity firms are among the biggest investors in fossil fuels, despite many of the firms trumpeting their sustainable investments. |

| [h=2]Exclusive: SoftBank bets on Vuori[/h] |

| SoftBank is investing $400 million in the activewear company Vuori, at a valuation of about $4 billion. The move into retail is noteworthy for SoftBank, which is known largely for investing in tech companies. The heady valuation reflects investors’ enthusiasm for direct-to-consumer brands. |

| The athleisure market got a major boost during the pandemic, as consumers bought comfortable clothes during lockdowns. Vuori competes with some formidable rivals in this market, including Lululemon, Outdoor Voices and Sweaty Betty. “One of the things that sets us apart is authenticity with a male demographic,” said Joe Kudla, Vuori’s C.E.O. The company was founded in 2015 and reached profitability two years later, he said. |

| Like other consumer start-ups that were born digital, Vuori is now expanding offline: It has nine retail stores, accounting for about 10 percent of sales. Over the next five years, it’s aiming for around 100 stores. |

| SoftBank’s investment came from a mutual connection. Kudla was introduced to Nagraj Kashyap, a managing partner at SoftBank Investment Advisers, through one of the company’s board members. SoftBank has experience with e-commerce, with investments in companies like Coupang. SoftBank, which invested in the start-up via its Vision Fund 2, saw Vuori as having a “tech mode and a brand mode going forward,” Kashyap said. Vuori is looking to grow in Western Europe and Asia, where Softbank’s connections could help. |

|

| [h=2]Digital design for investors[/h] |

| Our online lives generate loads of data that companies use to nudge us toward doing things. But a prompt to listen to songs that you might like is different from pushing you to invest in a meme-stock frenzy. When it comes to algorithms and recommendation engines, it’s fair to expect more from a finance app than a music program, the S.E.C. chairman Gary Gensler argued in a speech yesterday. |

| “When do these design elements and psychological nudges cross the line and become recommendations?” he asked. The answer “might change the nature of the platform’s obligations under the securities laws,” he said, highlighting the tension that finance firms face in harnessing data collected from users. A finance app’s “legal duties may conflict with such platforms’ ability to optimize for their own revenue,” Gensler said. |

| This isn’t a hypothetical debate. The S.E.C. recently requested comment on the use of new technologies by financial industry firms. In response, the University of Miami School of Law’s Investor Rights Clinic reported “a sharp increase” in clients who suffered losses on digital platforms using gamification, predictive data analytics and behavioral prompts. People “express confusion as to the reason their trusted institution would promote high-risk strategies,” it said. |

| What does Robinhood think? The trading app with more than 20 million customer accounts noted in its response to the S.E.C. that a majority of its users are new to investing. “We believe that this is unequivocally a good thing,” the company wrote, arguing that its digital features help promote financial literacy and don’t explicitly recommend to buying or selling securities. In March, it removed a controversial digital confetti feature that was criticized for gamifying trading. |

| Gensler and Robinhood are on the same page, in part. The regulator said new technologies have broadened access to the markets and brought “a lot of good.” But Gensler said that updates to the commission’s rules may be needed to address the nature of digital nudges on trading platforms. |

| Want to share The New York Times with your friends and family? Invite them to enjoy unlimited digital access to our journalism with this special offer. |

| [h=3]THE SPEED READ[/h] |

| Deals |

|

| Policy |

|

| Best of the rest |

|

| Anna Schaverien contributed reporting. |

| Thanks for reading! We’ll see you tomorrow. |

| We’d like your feedback. Please email thoughts and suggestions to dealbook@nytimes.com. |

|

|

|

|

|

|

| � |

| Read in Browser | |||||||||||||||||

| � | |||||||||||||||||

TOGETHER WITH

| � | |||||||||||||||||

| � |

[FONT=Arial, Helvetica, sans-serif]Global Market Comments

October 13, 2021

Fiat Lux[/FONT]

[/FONT]

[/FONT]

October 13, 2021

Fiat Lux[/FONT]

[FONT=Arial, Helvetica, sans-serif]Featured Trade:[/FONT]

(THE BRAVE NEW WORLD OF ONLINE RETAILING),

(SNAP), (GPRO), (APRN), (SFIX)

[FONT=Arial, Helvetica, sans-serif]

(SNAP), (GPRO), (APRN), (SFIX)

The Brave New World of Online Retailing[FONT=Arial, Helvetica, sans-serif]I was flying on first class flight on Virgin America from New York to San Francisco last year, and all I can say is that you meet the most interesting people in first class.[/FONT]