You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Intersting thoughts

- Thread starter Bozzie

- Start date

LLNW shot up today on the news of a new CEO. Let's see if it can get going!

BABA had another good day as well.

Bob had to go but he did cash out one last time on Tuesday.

Thing is trading x2 ..it's nuts.

Someone should step up and buy these guys, moving the multiple beyond 2.... easy right?

I need to read up on the new guy...Hopefully he's a M&A pro.

Thanks for the link Boz. Ma in serious repair mode , whoa...do not fuck with the Chinese govt . I think Xi made the desired statement, a cool warning to all Chinese billionaires ; dont talk shit about Xi

anyway Ma came out of hiding today, the market loved that . Consecutive gap ups on KWEB, whoa!!!!!

hang in there Jack...

anyway Ma came out of hiding today, the market loved that . Consecutive gap ups on KWEB, whoa!!!!!

hang in there Jack...

LLNW 4.40 today

is LLNW 80% institutionally held and increased over the last quarter.

I'll be buying on the down days till the New CEO gets this going green ..His track record says he will find value for the share holders

He'll bring clients with him from Alert, he'll grow revenue and has 100 million to work with from the jump....he's a great fit.

Hold this for three years and Bob Lyons will bring you X5 or more.

I like him a ton and like the point he's starting from...Trading x2 ...witch is obscene.

[h=1]Limelight Networks, Inc. Appoints Seasoned Growth Executive Bob Lyons as New CEO[/h]

[FONT="]January 20, 2021 01:33 PM Eastern Standard Time

SCOTTSDALE, Ariz.--(BUSINESS WIRE)--Limelight Network, Inc. (Nasdaq: LLNW) and its Board of Directors announced today that Bob Lyons, previously CEO at Alert Logic, has been named President and CEO and will join the company and the board of directors effective February 1, 2021. Bob Lento, President, CEO and Director since 2012, is retiring.

“We are excited to welcome Bob Lyons as we believe he is uniquely qualified to lead Limelight into its next phase of accelerated growth, profitability, and innovation. His passion for the customer and demonstrated track record of building high performing, innovative organizations aligns very well with our strategic objective to build on our current strengths and become a leader in delivering edge-based solutions," said Walt Amaral, Chair of the Limelight Networks Board of Directors. “We are grateful for Bob Lento’s leadership and the many heights reached during his tenure. His success in rebuilding the company, outstanding customer relationships, and creating a dynamic, high-performance culture are some of his most notable accomplishments,” continued Amaral.

"It has been a great privilege to lead Limelight and be a part of this amazing company for eight years. I am enormously proud of what we accomplished and believe Bob Lyons is an excellent choice to lead Limelight in its next phase. He is a seasoned leader with deep experience in scaling technology businesses and creating shareholder value. Most important, his core values strongly align with the Limelight culture to allow for a smooth transition and ability to quickly have an impact,” said Lento.

"I am honored to have the opportunity to join Limelight at a time of unprecedented opportunity. The digital transformation is creating new challenges and big opportunities alike. Limelight’s ability to leverage content, compute, and cybersecurity capabilities at the edge enables us to create a distinctive digital experience and we are uniquely qualified to deliver strategic edge business solutions. I look forward to expanding on Limelight’s strong CDN heritage to build an edge-based solutions company that accelerates growth and profitability," said Lyons.

About Limelight

Limelight Networks, Inc. (NASDAQ: LLNW), a leading provider of digital content delivery and edge services, empowers customers to provide exceptional digital experiences. Limelight’s edge services platform includes a unique combination of global private infrastructure, intelligent software, and expert support services optimized for video workflows. For more information, visit www.limelight.com, follow us on Twitter, Facebook and LinkedIn.

[h=2]Contacts[/h]Investor Relations

Veronica Bracker, (602) 850-5778

ir@llnw.com

[/FONT]

is LLNW 80% institutionally held and increased over the last quarter.

I'll be buying on the down days till the New CEO gets this going green ..His track record says he will find value for the share holders

He'll bring clients with him from Alert, he'll grow revenue and has 100 million to work with from the jump....he's a great fit.

Hold this for three years and Bob Lyons will bring you X5 or more.

I like him a ton and like the point he's starting from...Trading x2 ...witch is obscene.

[h=1]Limelight Networks, Inc. Appoints Seasoned Growth Executive Bob Lyons as New CEO[/h]

[FONT="]January 20, 2021 01:33 PM Eastern Standard Time

SCOTTSDALE, Ariz.--(BUSINESS WIRE)--Limelight Network, Inc. (Nasdaq: LLNW) and its Board of Directors announced today that Bob Lyons, previously CEO at Alert Logic, has been named President and CEO and will join the company and the board of directors effective February 1, 2021. Bob Lento, President, CEO and Director since 2012, is retiring.

“We are grateful for Bob Lento’s leadership and the many heights reached during his tenure. His success in rebuilding the company, outstanding customer relationships, and creating a dynamic, high-performance culture are some of his most notable accomplishments”

Tweet this

Lyons is a proven technology executive with an extraordinary track record of successfully scaling businesses and creating enterprise value through strategic revitalization, improved profitability, and revenue growth. At Alert Logic, he led the company through a multi-year strategic reposition that resulted in becoming a global leader in cybersecurity, specifically in managed threat detection and response. Prior to Alert Logic, Lyons held executive positions at Connexions Loyalty/Affinion Group, Ascend Learning, and Stream Global Services.Tweet this

“We are excited to welcome Bob Lyons as we believe he is uniquely qualified to lead Limelight into its next phase of accelerated growth, profitability, and innovation. His passion for the customer and demonstrated track record of building high performing, innovative organizations aligns very well with our strategic objective to build on our current strengths and become a leader in delivering edge-based solutions," said Walt Amaral, Chair of the Limelight Networks Board of Directors. “We are grateful for Bob Lento’s leadership and the many heights reached during his tenure. His success in rebuilding the company, outstanding customer relationships, and creating a dynamic, high-performance culture are some of his most notable accomplishments,” continued Amaral.

"It has been a great privilege to lead Limelight and be a part of this amazing company for eight years. I am enormously proud of what we accomplished and believe Bob Lyons is an excellent choice to lead Limelight in its next phase. He is a seasoned leader with deep experience in scaling technology businesses and creating shareholder value. Most important, his core values strongly align with the Limelight culture to allow for a smooth transition and ability to quickly have an impact,” said Lento.

"I am honored to have the opportunity to join Limelight at a time of unprecedented opportunity. The digital transformation is creating new challenges and big opportunities alike. Limelight’s ability to leverage content, compute, and cybersecurity capabilities at the edge enables us to create a distinctive digital experience and we are uniquely qualified to deliver strategic edge business solutions. I look forward to expanding on Limelight’s strong CDN heritage to build an edge-based solutions company that accelerates growth and profitability," said Lyons.

About Limelight

Limelight Networks, Inc. (NASDAQ: LLNW), a leading provider of digital content delivery and edge services, empowers customers to provide exceptional digital experiences. Limelight’s edge services platform includes a unique combination of global private infrastructure, intelligent software, and expert support services optimized for video workflows. For more information, visit www.limelight.com, follow us on Twitter, Facebook and LinkedIn.

[h=2]Contacts[/h]Investor Relations

Veronica Bracker, (602) 850-5778

ir@llnw.com

[/FONT]

CCP trying to fuck the way fintech might work in china ..BABA's real growth meter will be the Cloud ..its just becoming profitable and will be the driver over the next few years. It's not going to be ANT the way things look.

Thanks for the link Boz. Ma in serious repair mode , whoa...do not fuck with the Chinese govt . I think Xi made the desired statement, a cool warning to all Chinese billionaires ; dont talk shit about Xi

anyway Ma came out of hiding today, the market loved that . Consecutive gap ups on KWEB, whoa!!!!!

hang in there Jack...

|

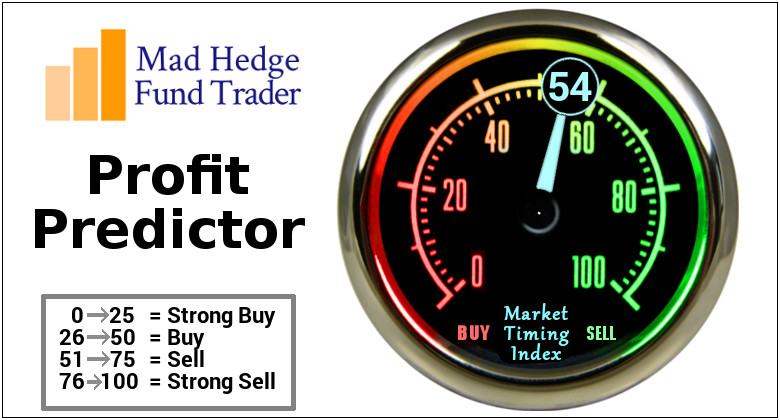

| Global Market Comments January 22, 2021 Fiat Lux Featured Trade: (JANUARY 20 BIWEEKLY STRATEGY WEBINAR Q&A), (QQQ), (IWM), (SPY), (ROM), (BRK/A), (AMZN), NVDA), (MU), (AMD), (UNG), (USO), (SLV), (GLD), ($SOX), CHIX), (BIDU), (BABA), (NFLX), (CHIX), ($INDU), (SPY), (TLT)

|

| � |

January 20 Biweekly Strategy Webinar Q&A Below please find subscribers’ Q&A for the January 20 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Incline Village, NV.Q: What will a significant rise in long term bond yields (TLT) do to PE ratios in general, and high tech specifically? A: Well, the key question here is: what is “significant”. Is “significant” a move in a 10-year from 120 to 150, which may be only months off? I don’t think that will have any impact whatsoever on the stock market. I think to really give us a good scare on interest rates, you need to get the 10-year up to 3.0%, and that might be two years off. We’re also going to be testing some new ground here: how high can bond interest rates go while the Fed keeps overnight rates at 25 basis points? They can go up more, but not enough to hurt the stock market. So, I think we essentially have a free run on stocks for two more years. Q: What about the Shiller price earnings ratio? A: Currently, it’s 34.5X and you want to completely ignore anything from Shiller on stock prices. He’s been bearish on stocks for 6 years now and ignoring him is the best thing you can do for your portfolio. If you had listed to him, you would have missed the last 15,000 Dow ($INDU) points. Someday, he’ll be right, but it may be when the market goes from 50,000 to 40,000, so again, I haven't found the Shiller price earnings ratio to be useful. It’s one of those academic things that looks great on paper but is terrible in practice. Q: Do you see any opportunity in China financials with the change of administration, like the (CHIX)? A: I always avoid financials in China because everyone knows they have massive, defaulted loans on their books that the government refuses to force them to recognize like we do here. So, it’s one of those things where they look good on paper, but you dig deeper and find out why they’re really so cheap. Better to go with the big online companies like Baidu (BIDU) and Alibaba (BABA). Q: Is it too late to enter copper? A: No, the high in the last cycle for Freeport McMoRan (FCX) was $50 dollars and I think we’re only in the mid $ ’20s now, so you could get another double. Remember, these commodity stocks have discounted recovery that hasn’t even started yet. Once you do get an actual recovery, you could get another enormous move and that's what could take the Dow to 120,000. Q: Do you see the FANGs coming back to life with the earnings results? A: I think it'll take more than just Netflix to do that. By the way, Netflix (NFLX) is starting to look like the Tesla of the media industry, so I’d get into Netflix on the next dip. You could get a surprise, out-of-nowhere double out of that anytime. But yes, FANGs will come to life. They've been in a correction for five months now, and we’ll see—it may be the end of the pandemic that causes these stocks to really take off. So that's why I'm running the barbell portfolio and buying the FANGs on weakness. Q: Are you recommending LEAPS on gold (GLD) and silver (SLV)? A: Absolutely yes, go out two years with your maturity, you might buy 120% out of the money. That's where you get your leverage on the LEAPS. Something like a (GLD) January 2023 $210-$220 in-the-money vertical bull call spread and generate a 500% profit by expiration. Q: Do you foresee a cool off for semiconductors ($SOX) even though there's been recent news of shortages? A: No, not really. There are so many people trying to get into these it’s incredible. And again, we may get a time correction where we sideline at the top and then break out again to the upside. This is classic in liquidity-driven markets, which is what we have in spades right now. Thanks to 5G, the number of chips in your everyday devices is about to increase tenfold, and it takes at least two years to build a new chip factory. So, keep buying (NVDA), (MU), and (AMD) on dips. Q: Where are the best LEAPS prospects (Long Term Equity Participation Securities)? A: That would have to be in technology—that's where the earnings growth is. If you go 20% out of the money on just about any big tech LEAPs two years out, to 2023 those will be worth 500% more at expiration. Q: What about SPACs (Special Purpose Acquisition Company) now, as we’re getting up to five new SPACs a day? A: My belief is that a SPAC is a vehicle that allows a manager to take out a 20% a year management fee instead of only 1%. And it's another aspect of the current mania we’re in that a lot of these SPACs are doubling on the first day—especially the electric vehicle-related SPACs. Also, a lot of these SPACs will never invest in anything, but just take the money and give it back to you in two years with no return when they can't find any good investments…. If you’re lucky. There's not a lot of bargains to be found out there by anyone, including SPAC managers. Q: Does natural gas (UNG) fall into the same “avoid energy” narrative as oil? A: Absolutely, yes. The only benefit of natural gas is it produces 50% less carbon dioxide than oil. However, you can't get gas without also getting oil (USO), as the two come out of the pipe at the same time; so I would avoid natural gas also. Gas and oil are also about to lose a large chunk, if not all, of their tax incentives, like the oil depletion allowance, which has basically allowed the entire oil industry to operate tax-free since the 1930s. Q: What about hydrogen cars? A: I don't really believe in the technology myself, and when you burn hydrogen, that also produces CO2. The problem with hydrogen is that it’s not a scalable technology. It’s like gasoline—you have to build stations all over the US to fuel the cars. Of course, it produces far less carbon than gas or natural gas, but it is hard to compete against electric power, which is scalable and there's already a massive electric grid in place. Q: If you inherited $4 million today, would you cost average into (QQQ),(IWM), or (SPY)? A: I would go into the ProShares Ultra Technology ETF (ROM), which is double the (QQQ); and if you really want to be conservative, put half your money into (QQQ) or (ROM), and then half into Berkshire Hathaway (BRK/A), which is basically a call option on the industrial and recovery economy. I know plenty of smart people who are doing exactly that. Q: Is it weird to see oil, as well as green energy stocks, moving up? A: No, that's actually how it works. The higher oil and gas prices go, the more economical it is to switch over to green energy. So, they always move in sync with each other. Q: I heard rumors that Amazon (AMZN) is likely to raise Prime’s annual fee by $10-20 a year in 2021. Will that be a catalyst for the stock to go higher? A: Yes. For every $10 dollars per person in Prime revenue, Amazon makes $2 billion more in net profit. I would say that's a very strong argument for the stock going up and maybe what breaks it out of its current 6-month range. By the way, Amazon is wildly undervalued, and my long-term target is $5,000. Q: Do you think that the spike in Apple (AAPL) MacBook purchases means that computers will overtake iPhones as the revenue driver for Apple in 2021, or is the phone business too big? A: The phone business is too big, and 5G will cause iPhone sales to grow exponentially. Remember, the iPhones themselves are getting better. I just bought the 12G Pro, and the performance over the old phone is incredible. So yeah, iPhones get bigger and better, while laptops only grow to the extent that people need an actual laptop to work on in a fixed office. Is that a supercomputer in your pocket, or are you just glad to see me? Q: Share buybacks dried up because of revenue headwinds; do you think they will come back in a massive wave, giving more life to equities? A: Absolutely, yes. Banks, which have been banned from buybacks for the past year, are about to go back into the share buyback business. Netflix has also announced that they will go buy their shares for the first time in 10 years, and of course, Apple is still plodding away with about $100 or $200 million a year in share buybacks, so all of that accelerates. The only ones you won't see doing buybacks are airlines and Boeing (BA) because they have such a mountain of debt to crawl out from before they can get back into aggressive buybacks. Q: Interest rates are at historic lows; the smartest thing we can do is act big. A: That’s absolutely right; you want to go big now when we’re all suffering so we can go small later and run a balanced budget or even pay down national debt if the economy grows strong enough. The last person to do that was Bill Clinton, who paid down national debt in small quantities in ‘98 and ‘99. Q: What do you think about General Motors (GM)? A: They really seem to be making a big effort to get into electric cars. They said they're going to bring out 25 new electric car models by 2025, and the problem is that GM is your classic “hour late, dollar short” company; always behind the curve because they have this immense bureaucracy which operates as if it is stuck in a barrel of molasses. I don’t see them ever competing against Tesla (TSLA) because the whole business model there seems like it’s stuck in molasses, whereas Tesla is moving forward with new technology at warp speed. I think when Tesla brings out the solid-state battery, which could be in two years, they essentially wipe out the entire global car industry, and everybody will have to either make Tesla cars under license from Tesla—which they said they are happy to do—or go out of business. Having said that, you could get another double in (GM) before everyone figures out what the game is. Q: Will you update the long-term portfolio? A: Yes, I promise to update it next week, as long as you promise me that there won’t be another insurrection next week. It’s strictly a time issue. After last year being the most exhausting year in history, this year is proving to be even more exhausting! Q: Do you see a February pullback? A: Either a small pullback or a time correction sideways. Q: Do you think the Zoom (ZM) selloff will continue, or is it done now that the pandemic is hopefully ending? A: It’s natural for a tech stock to give up one third after a 10X move. It might sell off a little bit more, but like it or not, Zoom is here to stay; it’s now a permanent part of our lives. They’re trying to grow their business as fast as they can, they’re hiring like crazy, so they’re going to be a big factor in our lives. The stock will eventually reflect that. Good Luck and Stay Healthy. John Thomas CEO & Publisher The Diary of a Mad Hedge Fund Trader

|

Quote of the Day“I’m just watching in astonishment at the SPAC market. There are companies that I passed on for $5 billion now selling for $20 billion with 1% gross margins in completely undefendable businesses with competitors eating their lunch,” said investor Barry Sternlicht.

|

CCP trying to fuck the way fintech might work in china ..BABA's real growth meter will be the Cloud ..its just becoming profitable and will be the driver over the next few years. It's not going to be ANT the way things look.

third party mobile payments in China grew from 10% of GDP in 2014 to nearly 250% in 2019 . China is so far ahead of the rest of the world in Fintech, but its only a matter of time until the rest of the world catches up, easy peasy for the younger generation. Estimated that by as early as 2024 there will be 220 million digital wallet users in the US. Upside here is huge.

Fintech is the lifeline of the future digital world, without Fintech there is no digital e-commerce. Covid was a game changer and has accelerated Fintech's acceptance. Spills into everything, zillow in real estate, lending club, sofi in lending .Actually fintech companies have apporx 39% of the unsecured consumer loan market - an astonishing number (not making banks/CC companies very happy) Heck US govt used pypl and square for tranche II of the PPP program.

Wood's insight with the ARK funds is really brillaint. They are of course, actively managed

will be interesting to see the sectors/spaces that are strong during Biden's reign. Large cap tech had a field day during the Trump administration, they were the big winners. Time will tell which are with Biden. Small and mid caps badly underperfomed during the Trump administration, liekly largely hurt with anti-global policies, i'd imagine. They have gone nutso since Nov 7th, Just fuxkin look at this chart!

IWM

5 yr monthly

unreal, great chart...$170 clear beauty entry level with a proper candle , if it were to restrace to that level ...would be 20% hairicut......

I was reacting to new regulations this shouldn't effect BABA up front but the industry is about to have more regulation from the top. Unsecured backing of loans seems to be the big red flag with the CCP as well. 39% unsecured should make more than just US banks worried... who's holds the debt on a default or bankruptcy? is there some sorta insurance for the lender? ..guess not if it's unsecured but someone always ends up holding the bag once the music stops....Who?

Are you invested in any ARK funds?... The Russell has been off the charts for 6 months. UWM too.

https://www.fintechmagazine.com/banking/china-constricts-homegrown-fintechs-through-new-legislation

Are you invested in any ARK funds?... The Russell has been off the charts for 6 months. UWM too.

https://www.fintechmagazine.com/banking/china-constricts-homegrown-fintechs-through-new-legislation

I'll be buying my average price down on LLNW this week...

|

|

I don't understand why WMT has been so stagnant the last few months. They're making good moves, most of the country shops at a Walmart, their online presence is second only to Amazon. I've been adding shares, and slices here and there hoping for a big pop. I'm long on WMT though as I think they're a top bluechip.

I don't understand why WMT has been so stagnant the last few months. They're making good moves, most of the country shops at a Walmart, their online presence is second only to Amazon. I've been adding shares, and slices here and there hoping for a big pop. I'm long on WMT though as I think they're a top bluechip.

It's built a great online machine and is a world wide player.. It's a long hold?

It's built a great online machine and is a world wide player.. It's a long hold?

Definitely a long hold (which I mentioned), but like I said it just seems stagnant. I first bought it around $90, but only 12 shares back then....been adding as it's moved up. It's been sitting idle for the last 5 months or so.

|

Global Market Comments January 25, 2021 Fiat Lux Featured Trade: (MARKET OUTLOOK FOR THE WEEK AHEAD, or HERE COMES THE SUPERHEATED ECONOMY), (SPY), ($INDU), (TLT), (TBT), (TSLA)

|

| � |

The Market Outlook for the Week Ahead, or Here Comes the Superheated Economy The US economy is in the worst condition in a century. The U6 Unemployment rate stands at 20 million a today. Main streets everywhere are boarded up. Millions of businesses have gone under. Some 4,500 people a day are dying from a dreaded virus. All of this means that you should rush out and buy and stocks, as many as possible, with both hands, and by the bucket load. It’s time to take out that home equity loan and pour it into stocks, damn the torpedoes. For things are about to get better for the US economy, a whole lot better, better beyond anyone’s wildest imagination, and for you individually. Speaking to CEOs, fund managers, and hedge fund strategists, it is clear that most are wildly underestimating the strength of the 2021 recovery. People haven’t really added up all the stimulus and quantitative easing that is about the hit, which could reach $20 trillion. The total market value of US stock markets is only $51 trillion. I hate to engage in some simplistic calculations here, but if you increase the amount of capital going into the economy by nearly 50% in two years, stocks just might go up by nearly 50% in two years. It’s no more complicated than that. In fact, economic conditions are about to improve so fast that the Federal Reserve may have to break its promise about not raising interest rates for three years and instead start nudging them up by the end of 2021. Needless to say, this is terrible news for the bond market (TLT), where I am lining up to go from a double to a triple short. You are already starting to see other analysts ratchet up their overcautious yearend S&P 500 target. By November, they may reach my own outsized goal of 4,800, bringing in a total gain in stocks of 35%. All of this explains why stocks just absolutely refuse to go down, even a little bit. Each one-day decline seems to be met with a wall of buying. The memo is out: you absolutely have to get into this market, whether you are an individual, hedge fund, institution, or outright bet the ranch gambler. Of course, if you think I’m so bullish because I made 90% on my money since the April bottom, you’d be right. Just keep your discipline and observe the basic rules of trading: 1) Don’t buy a position that is so big that it can’t handle a normal 10% correction, 2) Don’t accumulate a position that is so big that you can’t sleep at night, 3) No calling John Thomas in the middle of the night and asking “I have a 3X position in this and their trading down in Asia, what should I do?” If you have to ask the question, your position is too big. Biden’s economic plan boosts growth forecasts, according to Goldman Sachs. Prospects have jumped from 6.4% to 6.6%, the highest in a half century, on the back of a massive Covid-19 package. Treasury Secretary Janet Yellen says “GO BIG” or go home to the Senate Finance Committee. She was there to get confirmation and push for Biden’s $1.9 trillion stimulus package. Markets are underestimating the extent of the stimulus headed our way, which could reach $10 trillion in addition to another $10 trillion in quantitative easing. Buy dips. Index Funds are getting trashed, substantially trailing the S&P 500, as single-story stocks dominate the market. It’s become a stock pickers market in the extreme, with no more obvious example that (TSLA), up 1,000% in 9 months. Small caps, IPOs, and cyclicals are getting all the action, leaving the (SPX) in the dust. Tesla delivered its first Chinese Model Y, which will add 250,000 units to sales in 2021. It’s all part of Elon’s quest to take over the global automobile market. He plans to boost sales from 500,000 last year to 20 million in a decade. If so, the stock today still looks cheap. But is the quality the same? Tesla Q4 registrations soar by 63%, in California, its largest market. It’s due to the runaway success of the Model Y small SUV. The stock is taking a long overdue rest with a sideways “time” correction. It’s still true that if you buy the stock, you get the car for free. Weekly Jobless Claims are still sky-high at 900,000. It’s a decline on the week but still horrifically high. The stock market may be starting to notice, with stocks moving sideways for two weeks. Existing Home Sales soared to a 15-year high, up an amazing 22% YOY in December to a seasonally adjusted 6.76 million units. In the meantime, inventories hit all-time lows at only 1.9 months as they can’t build them fast enough. Sales of $1 million plus homes are up an incredible 94%. The hottest markets were in Austin, TX, Tampa, FL, and Phoenix, AZ. New York was the worst, followed by San Francisco. The market is on fire and could continue for another decade. Pending tax breaks from the new tax bill will give home ownership another big push. US Housing Starts jump5.8%, to 1.7 Million units. Single family homes are up 12% YOY, driven by the pandemic. Notice the enormous supply/demand gap which assures that home prices will keep rising for years. Rising mortgage interest rates so far have had no effect. US Manufacturing PMI hits 14-Year high, according to Markit, their index jumping from 57.1 to 59.1. The performance would have been better if it weren’t for rampant parts shortages nationwide. It’s another argument for the long-term bull case. When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% to 120,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 120,000 here we come! My Mad Hedge Global Trading Dispatch shot out of the gate with an immediate 7.25%so far in January. That is net of a 4% loss on a Tesla short which I added one day too soon. Given the great heights of the market, I have trimmed my book to just a long in Tesla and a Short in US Treasury bonds. That brings my eleven-year total return to 430.30% double the S&P 500 over the same period. My 11-year average annualized return now stands at a nosebleed new high of 38.80%. My trailing one-year return exploded to 74.44%, the highest in the 13-year history of the Mad Hedge Fund Trader. We have earned 90% since the March low. The coming week will be a big one for big tech earnings. We also need to keep an eye on the number of US Coronavirus cases at 25 million and deaths 420,000, which you can find here. We are now running at a staggering 4,500 deaths a day. When the market starts to focus on this, we may have a problem. On Monday, January 25 at 9:30 AM EST, we get the Chicago Fed National Activity Index for December. Phillips (PSX) and Kimberly Clark (KMB) report. On Tuesday, January 26 at 10:00 AM, we learned the new S&P Case Shiller National Home Price Index. Microsoft (MSFT), Johnson & Johnson (JNJ), and American Express (AMEX) report. On Wednesday, January 27 at 10:00 AM, US Durable Goods for December are published. Apple (AAPL), Facebook (FB) and Tesla (TSLA) report. On Thursday, January 28 at 9:30 AM, the first look at US GDP for Q4 is announced. McDonald’s (MCD), American Airlines (AA), and Visa (V) report. On Friday, January 29 at 9:30 AM, US Personal Income and Spending for December is published. Ely Lilly (LLY) and Caterpillar (CAT) report.At 2:00 PM, we learn the Baker-Hughes Rig Count. As for me, I have never been big on the “meme” thing, but you have to love the one that has been circulating about Bernie Sanders. Suddenly, he showed up on every transit system in the country. Clearly, the country was dying for a laugh. I include several pictures below. Hopefully, I won’t end up like him someday. Stay healthy. John Thomas CEO & Publisher The Diary of a Mad Hedge Fund Trader

|

Quote of the Day “Sometimes, when you jump off a bridge, you have to grow your wings on the way down,” said author Danielle Steele.

|

|

I got another solar stock I just bought today. SPRQ

I think this could be a home run. If you understand what they do and how they do it you can come to your own decision. Let me give an example. You want to buy a $20,000 solar system for your house. With that there is a 26% federal tax credit which is dollar for dollar or $5,200. Most people finance this purchase. If you have a loan for the amount less the federal tax credit or $14,800 and the interest rate and length are long enough the amount you are paying on the loan is less than the amount you are paying for electricity. Some parts of the country there is more sunshine and higher rates and it just looks better on paper to add solar to the house. So the company is Sunlight Financial. They get solar installers signed up. You can give the client a solar quote and do financing with them and it is a fairly easy yes to the client that wants to go green. This is something they do that is smart. They set up two loans. One for $14,800 and one for $5,200. The $5,200 loan gives the client tome to utilize their $5,200 tax credit and pay it off in 18 months. Then they are left with the $14,800 loan.

What do I think will happen? The vast majority don't have a $5,200 tax credit they can use in one year or they dont take the tax credit an use it to pay the $5,200 loan off. They will use the money for something else and have a loan for $20,000.

Sunlight will go and package these loans and sell them off on wallstreet. I think they have a max of $50,000 or $60,000....something like that. They will have solar installers across the country marketing their financing because it is easy and fast for the consumer to say yes. The loans have different terms and rates. It might be a 15 year loan at 2.99% or 3.99% or 4.99% for example. I think they will go to a 620 credit score. They dont do any income verification it is all stated income. So overall probably not a terrible portfolio of loans to be sold on Wall Street for a profit.

If this sounds good here is the kicker. Lets just say the client wants to 15 years for 3.99% and that is what the solar company shows them. They dont sell the solar system for $20,000 because they have to pay a fee to Sunlight to do the loan. The fee is a big one in my mind. In the example it might be 12% (they might get a 10 to 15% upfront payment.....almost like a huge origination fee if it was a mortgage). So they sell the project for $22,400. Customer still does financing but the loans are now $5,824 and $17,024. The solar company gets paid $22,400 but they have to pay $2,400 to Sunlight. The installer gets to payments. An initial payment and a final payment where the $2,400 is withheld and Sunlight keeps it.

So now they $2,400 cash plus whatever they make selling it on Wallstreet or they could hang onto it and make the spread of what they can borrow $$$ for and the interest rate the client is paying them.

I think this is going to be a cash cow.

I jumped in today. Good Luck to us if anyone else buys it.

Northern Star

I think this could be a home run. If you understand what they do and how they do it you can come to your own decision. Let me give an example. You want to buy a $20,000 solar system for your house. With that there is a 26% federal tax credit which is dollar for dollar or $5,200. Most people finance this purchase. If you have a loan for the amount less the federal tax credit or $14,800 and the interest rate and length are long enough the amount you are paying on the loan is less than the amount you are paying for electricity. Some parts of the country there is more sunshine and higher rates and it just looks better on paper to add solar to the house. So the company is Sunlight Financial. They get solar installers signed up. You can give the client a solar quote and do financing with them and it is a fairly easy yes to the client that wants to go green. This is something they do that is smart. They set up two loans. One for $14,800 and one for $5,200. The $5,200 loan gives the client tome to utilize their $5,200 tax credit and pay it off in 18 months. Then they are left with the $14,800 loan.

What do I think will happen? The vast majority don't have a $5,200 tax credit they can use in one year or they dont take the tax credit an use it to pay the $5,200 loan off. They will use the money for something else and have a loan for $20,000.

Sunlight will go and package these loans and sell them off on wallstreet. I think they have a max of $50,000 or $60,000....something like that. They will have solar installers across the country marketing their financing because it is easy and fast for the consumer to say yes. The loans have different terms and rates. It might be a 15 year loan at 2.99% or 3.99% or 4.99% for example. I think they will go to a 620 credit score. They dont do any income verification it is all stated income. So overall probably not a terrible portfolio of loans to be sold on Wall Street for a profit.

If this sounds good here is the kicker. Lets just say the client wants to 15 years for 3.99% and that is what the solar company shows them. They dont sell the solar system for $20,000 because they have to pay a fee to Sunlight to do the loan. The fee is a big one in my mind. In the example it might be 12% (they might get a 10 to 15% upfront payment.....almost like a huge origination fee if it was a mortgage). So they sell the project for $22,400. Customer still does financing but the loans are now $5,824 and $17,024. The solar company gets paid $22,400 but they have to pay $2,400 to Sunlight. The installer gets to payments. An initial payment and a final payment where the $2,400 is withheld and Sunlight keeps it.

So now they $2,400 cash plus whatever they make selling it on Wallstreet or they could hang onto it and make the spread of what they can borrow $$$ for and the interest rate the client is paying them.

I think this is going to be a cash cow.

I jumped in today. Good Luck to us if anyone else buys it.

Northern Star

I was thinking today would have been the day to buy Enphase.

SPRQ...Very interesting..I'm sorta getting my head around the numbers, you think the multiples are big because the financing makes it easy credit wise to a wide range of scores to qualify?. Are they a segment of a bigger market or are they the main market marker at this point for a loan with this structure when it comes to solar?

I'm interested but don't understand how big those numbers might be.

Great calls Northern star

SPRQ...Very interesting..I'm sorta getting my head around the numbers, you think the multiples are big because the financing makes it easy credit wise to a wide range of scores to qualify?. Are they a segment of a bigger market or are they the main market marker at this point for a loan with this structure when it comes to solar?

I'm interested but don't understand how big those numbers might be.

Great calls Northern star

Very interesting what he says about the real estate market - the beginning of a ten year bull run. I've actually been thinking there's going to be a correction in the next 12-18 months ("correction", not "crash"). I just can't see how prices can keep rising the way they are. The only thing allowing it to happen is the low interest rates and lack of inventory. Once there's an "all-clear" I'm guessing we're going to see a bull run on real estate as the people who were too scared to leave their house during Covid will either be selling or shopping (or both), but this will only last 3 to 6 months (this is my guess). There are super high numbers of people 120 days or more behind on their mortgage and an equal number behind on their rent - so we're going to see evictions and foreclosures after the stimulus protections expire....but when does that happen (i.e. will it get extended again?)?

Very interesting what he says about the real estate market - the beginning of a ten year bull run. I've actually been thinking there's going to be a correction in the next 12-18 months ("correction", not "crash"). I just can't see how prices can keep rising the way they are. The only thing allowing it to happen is the low interest rates and lack of inventory. Once there's an "all-clear" I'm guessing we're going to see a bull run on real estate as the people who were too scared to leave their house during Covid will either be selling or shopping (or both), but this will only last 3 to 6 months (this is my guess). There are super high numbers of people 120 days or more behind on their mortgage and an equal number behind on their rent - so we're going to see evictions and foreclosures after the stimulus protections expire....but when does that happen (i.e. will it get extended again?)?

Real-estate has me mystified right now..We sold two houses before Covid and bought two in Oregon over the past year and a half..

The market here is on fire..Last place we bought had 11 offers we went all cash did the inspections found a few problems and were going to hit them up for a concession ..then found out 5 back up offers nearly equal to ours were behind our excepted offer..we settle without a concession at the price we offered.

It's nuts..... I too wonder how the forbearance will play out starting at the bottom..Home owners and renters.