You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Intersting thoughts

- Thread starter Bozzie

- Start date

Boz, explain what he means about the dollar being weaker for 5-10 years. What are these ETF's (the foreign currency ETFs) he's talking about?

I like that he's positive on BABA.

Debt first then a move to gold by a lot of funds/Individuals have been the main reasons..Doubtful the reserve status is in question but dollars are not in favor as an investment right now...gold,Yuan and crypto.

Those ETFs are a simple way for a retail investor to play currencies markets during regular trading hours. Used to speculate on forex markets mostly single currencies but sometimes a basket of a few, managers can also add short term contracts/derivative contracts/ Debt denomination.. it's used a hedge VS the dollar or that's the way he's looking at it..I think.

I do like the some of the Non currency based Chinese ETFs though.

KraneShares CSI China Internet ETF.(Symbol KWEB )... Up 3+% this week.

Debt first then a move to gold by a lot of funds/Individuals have been the main reasons..Doubtful the reserve status is in question but dollars are not in favor as an investment right now...gold,Yuan and crypto.

Those ETFs are a simple way for a retail investor to play currencies markets during regular trading hours. Used to speculate on forex markets mostly single currencies but sometimes a basket of a few, managers can also add short term contracts/derivative contracts/ Debt denomination.. it's used a hedge VS the dollar or that's the way he's looking at it..I think.

I do like the some of the Non currency based Chinese ETFs though.

KraneShares CSI China Internet ETF.(Symbol KWEB )... Up 3+% this week.

Thanks Boz. What's the expectation for these ETF's? Safe growth? Expect small return, but no losses? (sort of like a low yield savings - when they paid 1-2%)?

I have a question for you about SQQQ. I've lost my ass w/ this (since the market keeps going up). I'm down nearly 40% in the shares I own. What should I do with it? Hold on until there is a market down turn? If I sell now I've lost a few thousand $$.

Thanks Boz. What's the expectation for these ETF's? Safe growth? Expect small return, but no losses? (sort of like a low yield savings - when they paid 1-2%)?

I have a question for you about SQQQ. I've lost my ass w/ this (since the market keeps going up). I'm down nearly 40% in the shares I own. What should I do with it? Hold on until there is a market down turn? If I sell now I've lost a few thousand $$.

Safe growth exposer to the growth markets...Yes... that YTD % is misleading it's up almost 50% YTD and you can find others too..some of the emerging market ETFs sorta interest me as well. EMQQ is a good one.. US based and a basket of investments weighted toward Asian markets but includes other markets as well. up 50% YTD...For an example of the holdings.. https://www.emqqetf.com/emqq-holdings/ ultra pro's run reputable ETFs.. it's a nice stress off investment knowing someone smarter than me is pulling levers someplace else...watch and reading for me,

Million dollar question is what the market going to do..I've sold about 40% outa one account..Maybe I shouldn't have but I did lock profits.

One deal with sqqq is you could just keep losing..it'll split down again and reset if the market keeps going up.. SQQQ can be a black hole for money...I managed to lose (about a grand) on it too only holding it for short times...It's a good question I wish I could answer but I might cut bait this market is insanely hard to figure.. Stimulus is most likely 60 days + away but the market cares not for the populous pains. I really don't know.

This is worth the read..Published in 2015 but still relevant ..Surprised the fund would leave a 6 year old thesis up.

Only 4 pages but places BABA's IOP in an historical sense in the rise of EM's

https://www.emqqetf.com/static/sitepages/org/Data/Sites/29/media/docs/EMQQ_Whitepaper.pdf

Only 4 pages but places BABA's IOP in an historical sense in the rise of EM's

https://www.emqqetf.com/static/sitepages/org/Data/Sites/29/media/docs/EMQQ_Whitepaper.pdf

Thanks fellas. I'll start post the mad hedge more often again.

Started a bit of a gnarly job last week (1 month assignment ) so I've lost momentum here.

Wall Street Breakfast: Mass Vaccination

Dec. 2, 2020 7:01 AM ET|

14 comments

|

Includes: ABNB, AMZN, BA, BNTX, BOX, CRM, FB, HPE, MRNA, NDAQ, PFE, PLTR, TLRD, TSLA, WMT, WORK

Listen on the go! A daily podcast of Wall Street Breakfast will be available by 8:00 a.m. on Seeking Alpha, iTunes, Stitcher and Spotify.

SPONSORED BY

SPONSORED BY

Mass vaccination

The U.K. has become the first country in the world to approve the coronavirus vaccine from Pfizer (NYSE:PFE) and BioNTech (NASDAQ:BNTX), which has been shown to offer up to 95% protection against COVID-19. The first 800,000 doses will be available in the U.K. from next week (another 40M doses are on order), with the jabs being rolled out at hospitals, vaccination centers, and in the community via GPs and pharmacists. Two doses three weeks apart are required for protection and will first be offered to frontline health care workers and nursing home residents, followed by older adults. Other countries aren't far behind: The U.S. and the EU also are vetting the Pfizer shot along with a similar vaccine made by competitor Moderna (NASDAQ:MRNA), and a similar nod by the FDA is expected as early as next week. (22 comments)

Slight pullback

U.S. stock index futures inched down 0.2% overnight after the market's historic rally extended to December and the S&P 500 hit a fresh record high. Sentiment got a boost after a group of lawmakers unveiled a $908B bipartisan stimulus plan, and while Senate Majority Leader Mitch McConnell rejected the proposal, investors are still hopeful for a second stimulus package in the lame-duck period for Congress. It comes after Fed Chair Jerome Powell called the economic outlook "extraordinarily uncertain" on Tuesday when he and Treasury Secretary Steven Mnuchin spoke before Congress as part of mandated updates on CARES Act funding. Powell will speak again today at 10 a.m. ET.

Salesforce shakes hands with Slack

The cash-and-stock deal will see the cloud software company buy the messaging app for nearly $28B. It underpins CEO Marc Benioff’s effort to move Salesforce (NYSE:CRM) beyond its core product, which helps manage customer relationships, to providing the software tools for day-to-day operations. The company shelled out $15.3B on data visualization company Tableau in 2019 and, a year earlier, spent $6.5B to acquire MuleSoft, whose back-end software connects data stored in disparate places. Salesforce shares are off 4.4% premarket and Slack (NYSE:WORK) is down nearly 1%, likely because investors were already expecting the announcement. (162 comments)

Silicon Valley exodus

The coronavirus pandemic has given a number of tech companies an excuse to exit California as many question the high cost of living and the state's hefty taxes amid a broader shift to remote work. Hewlett Packard Enterprise (NYSE:HPE) has become the latest to relocate its headquarters from San Jose, California, to Houston, Texas, following a difficult year that generated a full-year loss. Palantir (NYSE:PLTR) recently moved its headquarters to Denver from Palo Alto, while Silicon Valley electric carmaker Tesla (NASDAQ:TSLA) has long-complained about the state's regulations and is opening a factory in Austin next year. San Jose Mayor Sam Liccardo called HPE's decision "a wake-up call," saying the region needed to "stop demonizing our tech employers, and start working with them to chart a path to a strong recovery."

Airbnb listing could come before Christmas

Airbnb (ABNB) is making some headlines this week as the vacation rental company begins its IPO roadshow. Terms include 51.9M shares at a price range of $44-$50, which would raise as much as $2.6B at a $35B valuation. At one point Airbnb was even leaning towards a direct listing, where it wouldn't sell any new shares, but after the pandemic struck it realized it needed the money. The company then raised $2B in debt to bolster its balance sheet and it's now looking to raise even more. (32 comments)

Walmart+ vs. Amazon Prime

Walmart+ (NYSE:WMT) members will no longer have to spend $35 for next-day or two-day shipping as the service looks to better compete with Amazon Prime (NASDAQ:AMZN) during the coronavirus pandemic. In fact, the number of online-only shoppers across the U.S. jumped 44% over the Thanksgiving holiday weekend, according to the National Retail Federation. The change, effective Friday, only applies to items on Walmart's website like toys, appliances and clothing, though groceries (which are delivered from stores) will still have the $35 minimum. Bigger picture: Walmart+ was launched just over two months ago, and while the retailer hasn't yet shared how many customers have joined, BMO Capital Markets estimates that as many as 19M U.S. households may have signed up based on a survey of about 1,000 U.S. shoppers. Amazon Prime had approximately 126M U.S. subscribers as of October, according to an estimate from Consumer Intelligence Research Partners. Walmart+ is also priced at $98 a year or $12.95 a month compared with Amazon Prime, which costs $119 a year or $12.99 a month.

OPEC+ attempts to mend differences

Diplomatic efforts are currently underway to repair that cracks in the 23-nation OPEC alliance as a dispute over how much crude to pump in 2021 broke into the open. The UAE has grown impatient to use its new production capacity, while also planning to launch a regional oil benchmark contract around its Murban crude variety, which needs the kind of volumes that clash with output limits. However, Saudi Arabia's Energy Minister Prince Abdulaziz Bin Salman signaled his dissatisfaction with the situation on Monday by telling others he may resign as co-chair of a committee that oversees the OPEC+ deal. Members need to hash out a compromise before ministers gather on Thursday, at a meeting that's been postponed because of the impasse. Most other nations support maintaining the existing curbs into the first quarter and deferring the 1.9M-barrel daily supply increase due to take effect in January by three months. "The risks of the OPEC+ alliance failing to reach an agreement are high as a resurgent virus has seen restrictions on travel increase across Europe and the U.S," ANZ analysts said in a note, though others are more skeptical. "OPEC+ often generates drama," declared Helima Croft, chief commodities strategist at RBC. "But we still believe that the group will probably find some face-saving compromise, with a short extension of the current cuts being the most likely outcome."

How would a Biden administration approach China?

Joe Biden won't immediately remove the tariffs that the Trump administration imposed on China, but intends to first review the existing U.S.-China agreement, and develop a "coherent strategy" with traditional allies in Europe and Asia. "The best China strategy, I think, is one which gets every one of our - or at least what used to be our - allies on the same page. It's going to be a major priority for me in the opening weeks of my presidency to try to get us back on the same page with our allies," Biden told NYT opinion columnist Thomas Friedman. While Trump was focused on the trade deficit with China, Biden says his "goal would be to pursue trade policies that actually produce progress on China's abusive practices - that's stealing intellectual property, dumping products, illegal subsidies to corporations" and forcing "tech transfers" from American companies to their Chinese counterparts.

What else is happening...

Nasdaq (NASDAQ:NDAQ) proposes new listing rules to advance board diversity.

Tesla (TSLA) open to talks on auto merger; pushes 'Game of Pennies.'

FAA issues first certificate for Boeing (NYSE:BA) 737 MAX since 2019 grounding.

Facebook's (NASDAQ:FB) Oversight Board chooses its first cases.

Tailored Brands (NYSE:TLRD) emerges from Chapter 11 after restructuring.

Tuesday's Key Earnings

Box (NYSE:BOX) -6.8% AH following a disappointing outlook.

Hewlett Packard Enterprise (HPE) -1.4% AH recording a full-year loss.

Salesforce (CRM) -4.4% AH acquiring Slack for $27.7B.

Slack (WORK) -0.9% AH despite 12K net new paid customers, up 140% Y/Y.

Today's Markets

In Asia, Japan +0.1%. Hong Kong -0.1%. China -0.1%. India -0.1%.

In Europe, at midday, London flat. Paris -0.3%. Frankfurt -0.4%.

Futures at 6:20, Dow -0.3%. S&P -0.2%. Nasdaq -0.2%. Crude -0.8% to $44.18. Gold +0.6% at $1830. Bitcoin -2% to $19119.

Ten-year Treasury Yield -1 bps to 0.92%

Today's Economic Calendar

Auto Sales

7:00 MBA Mortgage Applications

8:15 ADP Jobs Report

9:00 Fed's Quarles: “Financial Regulation”

9:00 Fed's Williams Speech

10:00 Fed's Harker: Economic Outlook

10:00 Powell Testifies Before House Financial Services Committee

10:30 EIA Petroleum Inventories

1:00 PM Fed's Williams Speech

2:00 PM Fed's Beige Book

Started a bit of a gnarly job last week (1 month assignment ) so I've lost momentum here.

Wall Street Breakfast: Mass Vaccination

Dec. 2, 2020 7:01 AM ET|

14 comments

|

Includes: ABNB, AMZN, BA, BNTX, BOX, CRM, FB, HPE, MRNA, NDAQ, PFE, PLTR, TLRD, TSLA, WMT, WORK

Listen on the go! A daily podcast of Wall Street Breakfast will be available by 8:00 a.m. on Seeking Alpha, iTunes, Stitcher and Spotify.

SPONSORED BY

SPONSORED BYMass vaccination

The U.K. has become the first country in the world to approve the coronavirus vaccine from Pfizer (NYSE:PFE) and BioNTech (NASDAQ:BNTX), which has been shown to offer up to 95% protection against COVID-19. The first 800,000 doses will be available in the U.K. from next week (another 40M doses are on order), with the jabs being rolled out at hospitals, vaccination centers, and in the community via GPs and pharmacists. Two doses three weeks apart are required for protection and will first be offered to frontline health care workers and nursing home residents, followed by older adults. Other countries aren't far behind: The U.S. and the EU also are vetting the Pfizer shot along with a similar vaccine made by competitor Moderna (NASDAQ:MRNA), and a similar nod by the FDA is expected as early as next week. (22 comments)

Slight pullback

U.S. stock index futures inched down 0.2% overnight after the market's historic rally extended to December and the S&P 500 hit a fresh record high. Sentiment got a boost after a group of lawmakers unveiled a $908B bipartisan stimulus plan, and while Senate Majority Leader Mitch McConnell rejected the proposal, investors are still hopeful for a second stimulus package in the lame-duck period for Congress. It comes after Fed Chair Jerome Powell called the economic outlook "extraordinarily uncertain" on Tuesday when he and Treasury Secretary Steven Mnuchin spoke before Congress as part of mandated updates on CARES Act funding. Powell will speak again today at 10 a.m. ET.

Salesforce shakes hands with Slack

The cash-and-stock deal will see the cloud software company buy the messaging app for nearly $28B. It underpins CEO Marc Benioff’s effort to move Salesforce (NYSE:CRM) beyond its core product, which helps manage customer relationships, to providing the software tools for day-to-day operations. The company shelled out $15.3B on data visualization company Tableau in 2019 and, a year earlier, spent $6.5B to acquire MuleSoft, whose back-end software connects data stored in disparate places. Salesforce shares are off 4.4% premarket and Slack (NYSE:WORK) is down nearly 1%, likely because investors were already expecting the announcement. (162 comments)

Silicon Valley exodus

The coronavirus pandemic has given a number of tech companies an excuse to exit California as many question the high cost of living and the state's hefty taxes amid a broader shift to remote work. Hewlett Packard Enterprise (NYSE:HPE) has become the latest to relocate its headquarters from San Jose, California, to Houston, Texas, following a difficult year that generated a full-year loss. Palantir (NYSE:PLTR) recently moved its headquarters to Denver from Palo Alto, while Silicon Valley electric carmaker Tesla (NASDAQ:TSLA) has long-complained about the state's regulations and is opening a factory in Austin next year. San Jose Mayor Sam Liccardo called HPE's decision "a wake-up call," saying the region needed to "stop demonizing our tech employers, and start working with them to chart a path to a strong recovery."

Airbnb listing could come before Christmas

Airbnb (ABNB) is making some headlines this week as the vacation rental company begins its IPO roadshow. Terms include 51.9M shares at a price range of $44-$50, which would raise as much as $2.6B at a $35B valuation. At one point Airbnb was even leaning towards a direct listing, where it wouldn't sell any new shares, but after the pandemic struck it realized it needed the money. The company then raised $2B in debt to bolster its balance sheet and it's now looking to raise even more. (32 comments)

Walmart+ vs. Amazon Prime

Walmart+ (NYSE:WMT) members will no longer have to spend $35 for next-day or two-day shipping as the service looks to better compete with Amazon Prime (NASDAQ:AMZN) during the coronavirus pandemic. In fact, the number of online-only shoppers across the U.S. jumped 44% over the Thanksgiving holiday weekend, according to the National Retail Federation. The change, effective Friday, only applies to items on Walmart's website like toys, appliances and clothing, though groceries (which are delivered from stores) will still have the $35 minimum. Bigger picture: Walmart+ was launched just over two months ago, and while the retailer hasn't yet shared how many customers have joined, BMO Capital Markets estimates that as many as 19M U.S. households may have signed up based on a survey of about 1,000 U.S. shoppers. Amazon Prime had approximately 126M U.S. subscribers as of October, according to an estimate from Consumer Intelligence Research Partners. Walmart+ is also priced at $98 a year or $12.95 a month compared with Amazon Prime, which costs $119 a year or $12.99 a month.

OPEC+ attempts to mend differences

Diplomatic efforts are currently underway to repair that cracks in the 23-nation OPEC alliance as a dispute over how much crude to pump in 2021 broke into the open. The UAE has grown impatient to use its new production capacity, while also planning to launch a regional oil benchmark contract around its Murban crude variety, which needs the kind of volumes that clash with output limits. However, Saudi Arabia's Energy Minister Prince Abdulaziz Bin Salman signaled his dissatisfaction with the situation on Monday by telling others he may resign as co-chair of a committee that oversees the OPEC+ deal. Members need to hash out a compromise before ministers gather on Thursday, at a meeting that's been postponed because of the impasse. Most other nations support maintaining the existing curbs into the first quarter and deferring the 1.9M-barrel daily supply increase due to take effect in January by three months. "The risks of the OPEC+ alliance failing to reach an agreement are high as a resurgent virus has seen restrictions on travel increase across Europe and the U.S," ANZ analysts said in a note, though others are more skeptical. "OPEC+ often generates drama," declared Helima Croft, chief commodities strategist at RBC. "But we still believe that the group will probably find some face-saving compromise, with a short extension of the current cuts being the most likely outcome."

How would a Biden administration approach China?

Joe Biden won't immediately remove the tariffs that the Trump administration imposed on China, but intends to first review the existing U.S.-China agreement, and develop a "coherent strategy" with traditional allies in Europe and Asia. "The best China strategy, I think, is one which gets every one of our - or at least what used to be our - allies on the same page. It's going to be a major priority for me in the opening weeks of my presidency to try to get us back on the same page with our allies," Biden told NYT opinion columnist Thomas Friedman. While Trump was focused on the trade deficit with China, Biden says his "goal would be to pursue trade policies that actually produce progress on China's abusive practices - that's stealing intellectual property, dumping products, illegal subsidies to corporations" and forcing "tech transfers" from American companies to their Chinese counterparts.

What else is happening...

Nasdaq (NASDAQ:NDAQ) proposes new listing rules to advance board diversity.

Tesla (TSLA) open to talks on auto merger; pushes 'Game of Pennies.'

FAA issues first certificate for Boeing (NYSE:BA) 737 MAX since 2019 grounding.

Facebook's (NASDAQ:FB) Oversight Board chooses its first cases.

Tailored Brands (NYSE:TLRD) emerges from Chapter 11 after restructuring.

Tuesday's Key Earnings

Box (NYSE:BOX) -6.8% AH following a disappointing outlook.

Hewlett Packard Enterprise (HPE) -1.4% AH recording a full-year loss.

Salesforce (CRM) -4.4% AH acquiring Slack for $27.7B.

Slack (WORK) -0.9% AH despite 12K net new paid customers, up 140% Y/Y.

Today's Markets

In Asia, Japan +0.1%. Hong Kong -0.1%. China -0.1%. India -0.1%.

In Europe, at midday, London flat. Paris -0.3%. Frankfurt -0.4%.

Futures at 6:20, Dow -0.3%. S&P -0.2%. Nasdaq -0.2%. Crude -0.8% to $44.18. Gold +0.6% at $1830. Bitcoin -2% to $19119.

Ten-year Treasury Yield -1 bps to 0.92%

Today's Economic Calendar

Auto Sales

7:00 MBA Mortgage Applications

8:15 ADP Jobs Report

9:00 Fed's Quarles: “Financial Regulation”

9:00 Fed's Williams Speech

10:00 Fed's Harker: Economic Outlook

10:00 Powell Testifies Before House Financial Services Committee

10:30 EIA Petroleum Inventories

1:00 PM Fed's Williams Speech

2:00 PM Fed's Beige Book

yesterdays

|

| Global Market Comments December 1, 2020 Fiat Lux FEATURED TRADE: (THE GOVERNMENT’S WAR ON MONEY) (TESTIMONIAL)

|

| � |

The Government’s War on Money When I lived as a student in West Berlin during the 1960s, I had a nice little side business.I organized weekend walking tours through the Berlin Wall at Checkpoint Charlie to visit East Berlin for American students too afraid to go alone. To pay for it, I smuggled in my boots Ostmarks, the currency of East Germany, which I could buy at a 75% discount to the official price in West Berlin. I then covered lunch and all my other bills very cheaply, booking a nice profit on the day. That would be much more difficult to pull off today as governments around the world have launched a war on cash that will not end until its ultimate demise. The truth is, governments hate cash. This became clearly apparent when the government of India withdrew circulation of its two largest banknotes last year. Some 50% of Indian GDP is thought to take place in the underground economy in cash only. The move caused a financial panic as consumers sold gold (GLD) and other hard assets to meet bills because they were unable to settle accounts with the large denomination notes they had hoarded. As we move towards an all-electronic economy, the few remaining purposes where cash is essential are largely illegal. Waitresses, babysitters, and bookies don’t report income to the IRS. Nor do drug dealers. This is a big deal because eight states legalized marijuana in the last election. Since banks are still banned from handling pot proceeds, this booming business has to take place entirely in cash. Tales about dealers making their runs with gym bags full of $100 bills are rampant. The IRS estimates that $460 billion in tax revenue is lost every year through unreported income which is largely earned in cash. Some half of the entire US paper money supply is held by foreigners where it is used to evade taxes, bribe foreign officials, and finance terrorism. The US government’s war on cash is not a new thing. In 1929, it cut the size of US banknotes by one third to save money on the cost of high-grade paper. In 1970, the US Treasury banned the circulation of the $10,000, $5,000, $1,000, and $500 bills to halt mafia money laundering. Since then, the IRS has been the biggest beneficiary of the move. Large denominations US bills are now solely the domain of collectors. The US government would love to get out of the cash business entirely as it is so expensive to run. It spends about $737.4 million a year just to print American $1, $2, $5, $10, $20, $50, and $100 notes. Paper dollar bills which are actually made of 75% cotton and 25% linen are completely worn out and have to be returned in only 18 months. Coins are even a bigger loser. It costs more than two cents to make a penny. Since the advent of color printers, counterfeiting has exploded. North Korea runs almost its entire economy on fake $100 bills which are said to be the best in the world. Only a handful of specialists at the US Treasury can identify them under a high powered microscope. Today, some 80% of the entire $1.34 trillion M1 notes and coins in circulation in America are in the form of $100 dollar bills. That works out to $4,200 per person. Where has all that money gone? The US is now considering eliminating even this convenient denomination. While $1 million in $100s can fit into a tote bag, that quantity of $10 bills would weigh 220 pounds, a quantity much more difficult to sneak around. An all-electronic economy would certainly pose some privacy problems as it would leave a massive paper trail on everything you do. When you get audited by the IRS, the first thing they do is obtain your past three years of bank and credit card records detailing your every transaction. If the inspection goes criminal, they go back six years. State authorities will pursue phone records to establish your physical presence to verify residency. So how long did you really spend in tax-free Florida last year? It would also pare back illegal immigration as this is another industry that runs entirely on cash. Once here, undocumented workers are often paid in cash in restaurants and on construction sites. There is truly no place to hide. Other countries are already well ahead in the war of cash. In Belgium, some 93% of all financial transactions take place electronically. Sweden has also been pushing hard on this front, taking the M1 money supply there down by 27% over the past two years. Many small businesses there now post signs saying they don’t accept cash. The goal is to move to an all-electronic economy. The preferences of Millennials are also moving us towards the cashless economy. Have you ever been in line at Starbucks and noticed that the kid in front of you just paid $5 for a cup of coffee with his credit card? Or maybe he swiped his Apple Pay account on his iPhone? The last time I handed them a ten-dollar bill they said, “Oh, dinosaur money.” Whatever that means, it is clear that hard cash is about to become extinct, just like the Brontosaurus and the Tyrannosaurus Rex.

|

Testimonial The confidence you have given me to enter the USD:JPY spot positions have returned me in excess of $1,500,000 in the last few weeks.I'll be in California next year. Can't wait to catch up. Dinner is on me, both times! I know you said you aren’t retiring until you’re well into your seventies. Why so soon? You're welcome to use this as a testimonial. Cheers Peter, Australia

|

Quote of the Day "Sometimes we stare so long at a door that is closing that we see too late the one that is open," said Alexander Graham Bell, inventor of the telephone.

|

| This is not a solicitation to buy or sell securities The Mad Hedge Fund Trader is not an Investment advisor For full disclosures click here at: http://www.madhedgefundtrader.com/disclosures The "Diary of a Mad Hedge Fund Trader"(TM) and the "Mad Hedge Fund Trader" (TM) are protected by the United States Patent and Trademark Office The "Diary of the Mad Hedge Fund Trader" (C) is protected by the United States Copyright Office Futures trading involves a high degree of risk and may not be suitable for everyone.[FONT="][/FONT] |

Still holding.. the value here is dumb..Trading X2.5 sales

Limelight Networks - Cult Of Confusion

Dec. 1, 2020 10:01 AM ET|About: Limelight Networks, Inc. (LLNW), Includes: AKAM, AM, CCOI, CMCSA, DIS, FSLY, NET, ROKU

Summary

In another in a series of silly analyst commentaries we see continually issued by "bulge bracket firms", an IB reinstated LLNW yesterday with a HOLD and pinpoint $4.75 target price.

The analyst seems confused as he calls for commoditized margin pressure but models GM% up 2020-2022.

Further, the pundit indicates sales hires will pressure COGS, which any simpleton accounting student knows is incorrect as that expense allocates to SG&A.

LLNW's 3Q19 EBITDA was hurt by a S Korea POP deployment unaccompanied by a major customer porting traffic (200bp). Further, COVID caused capex delays in India (40bp), and R&D and SE Asia circuits hit EBITDA. Normalizing results they were fine in our view and better than LLNW's best comps FSLY and NET which lose money at similar scale.

The analyst incorrectly indicates FSLY NET are not proper comps at 20x-40x sales, and that more mature AKAM at 5x sales is appropriate as a benchmark. Worse, he applies a 50% haircut to AKAM based on scale and margins. He then goes on to use fiber-based bandwidth provider CCOI at 5x sales as a comp, which makes no sense as that is a FTTx Tier-1-Internet-Backbone that bought the old PSINet years ago. LLNW's valuation at 2.3x 2021E sales is a 50%-90% discount to the peer group range populated by AKAM FSLY NET. The Company's business funnel is booming evidenced by ramps at AMZN, DIS, ROKU, SNE, T and more. LLNW's private low latency backbone is perfectly geared for the secular growth of OTT video, gaming and now EDGE computing (where LLNW has been selling for three years). We think the latest confused analyst report has presented a buying opportunity for investors, and "ironically" possibly for that firm's investment banking client(s). We reiterate our STRONG BUY recommendation and $10 target, which represents an EV of $1.38BN or 5x 2021E sales, a steep discount to the peer group mean and median.

LLNW Cap Table @ $4.43

LLNW_cap_table.pdf

LLNW Cap Table @ $10

LLNW_cap_table__10.pdf

Author Comment

We continue to believe LLNW will be acquired if it remains in the single $ digits. You simply cannot have comps at massive premiums to LLNW that can buy the Company in a highly accretive transaction that creates scale and expect the Company to remain independent. LLNW has been strangely quiet issuing no PR while their top customers blow out Fire TV sales, ROKU dongles boom, new movie releases at DIS go DTC with theaters closed, and SNE sells out PS5 consoles worldwide in 12 hours, among other things. Risk/reward strongly favors bullish positions at current levels heading into a seasonally strong 4Q window with conservative guidance after an overreaction to a poorly explained 3Q report. Further, we predict margins will recover far sooner than this analyst firm models, as management has indicated they will either load up the S Korea POP or exit it, while India capex is now on track and prior R&D and circuit investments should diminish and/or scale up 2021 revenues and EBITDA.

Limelight Networks - Cult Of Confusion

Dec. 1, 2020 10:01 AM ET|About: Limelight Networks, Inc. (LLNW), Includes: AKAM, AM, CCOI, CMCSA, DIS, FSLY, NET, ROKU

Summary

In another in a series of silly analyst commentaries we see continually issued by "bulge bracket firms", an IB reinstated LLNW yesterday with a HOLD and pinpoint $4.75 target price.

The analyst seems confused as he calls for commoditized margin pressure but models GM% up 2020-2022.

Further, the pundit indicates sales hires will pressure COGS, which any simpleton accounting student knows is incorrect as that expense allocates to SG&A.

LLNW's 3Q19 EBITDA was hurt by a S Korea POP deployment unaccompanied by a major customer porting traffic (200bp). Further, COVID caused capex delays in India (40bp), and R&D and SE Asia circuits hit EBITDA. Normalizing results they were fine in our view and better than LLNW's best comps FSLY and NET which lose money at similar scale.

The analyst incorrectly indicates FSLY NET are not proper comps at 20x-40x sales, and that more mature AKAM at 5x sales is appropriate as a benchmark. Worse, he applies a 50% haircut to AKAM based on scale and margins. He then goes on to use fiber-based bandwidth provider CCOI at 5x sales as a comp, which makes no sense as that is a FTTx Tier-1-Internet-Backbone that bought the old PSINet years ago. LLNW's valuation at 2.3x 2021E sales is a 50%-90% discount to the peer group range populated by AKAM FSLY NET. The Company's business funnel is booming evidenced by ramps at AMZN, DIS, ROKU, SNE, T and more. LLNW's private low latency backbone is perfectly geared for the secular growth of OTT video, gaming and now EDGE computing (where LLNW has been selling for three years). We think the latest confused analyst report has presented a buying opportunity for investors, and "ironically" possibly for that firm's investment banking client(s). We reiterate our STRONG BUY recommendation and $10 target, which represents an EV of $1.38BN or 5x 2021E sales, a steep discount to the peer group mean and median.

LLNW Cap Table @ $4.43

LLNW_cap_table.pdf

LLNW Cap Table @ $10

LLNW_cap_table__10.pdf

Author Comment

We continue to believe LLNW will be acquired if it remains in the single $ digits. You simply cannot have comps at massive premiums to LLNW that can buy the Company in a highly accretive transaction that creates scale and expect the Company to remain independent. LLNW has been strangely quiet issuing no PR while their top customers blow out Fire TV sales, ROKU dongles boom, new movie releases at DIS go DTC with theaters closed, and SNE sells out PS5 consoles worldwide in 12 hours, among other things. Risk/reward strongly favors bullish positions at current levels heading into a seasonally strong 4Q window with conservative guidance after an overreaction to a poorly explained 3Q report. Further, we predict margins will recover far sooner than this analyst firm models, as management has indicated they will either load up the S Korea POP or exit it, while India capex is now on track and prior R&D and circuit investments should diminish and/or scale up 2021 revenues and EBITDA.

|

| Global Market Comments December 2, 2020 Fiat Lux FEATURED TRADE: (WHAT HAPPENED TO THE DOW?) ($INDU), (EK), (S), (BS), (CVX), (DD), (MMM), (FBHS), (MGDDY), (FL), (GE), (TSLA), (GM)

|

| � |

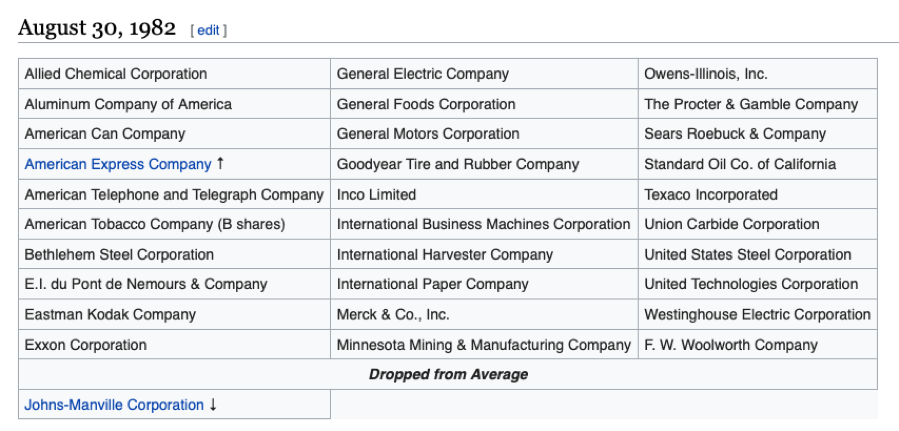

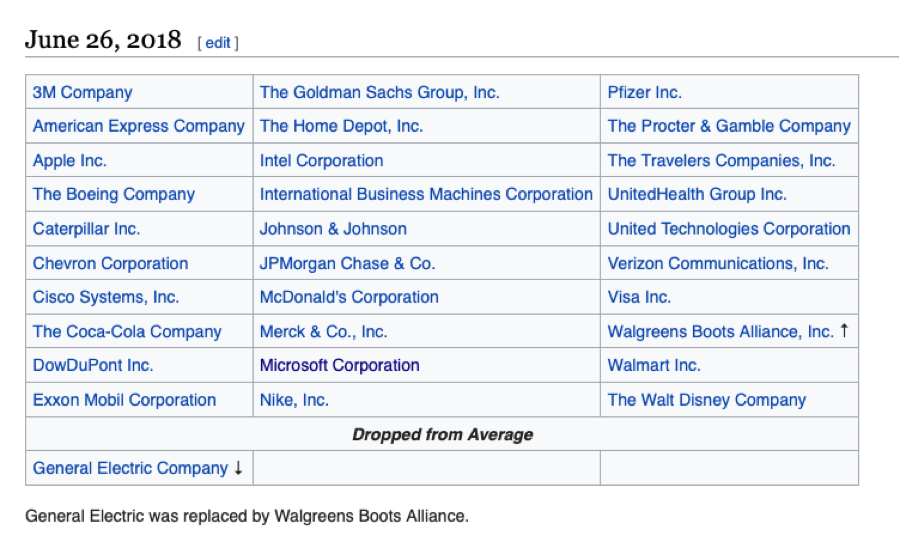

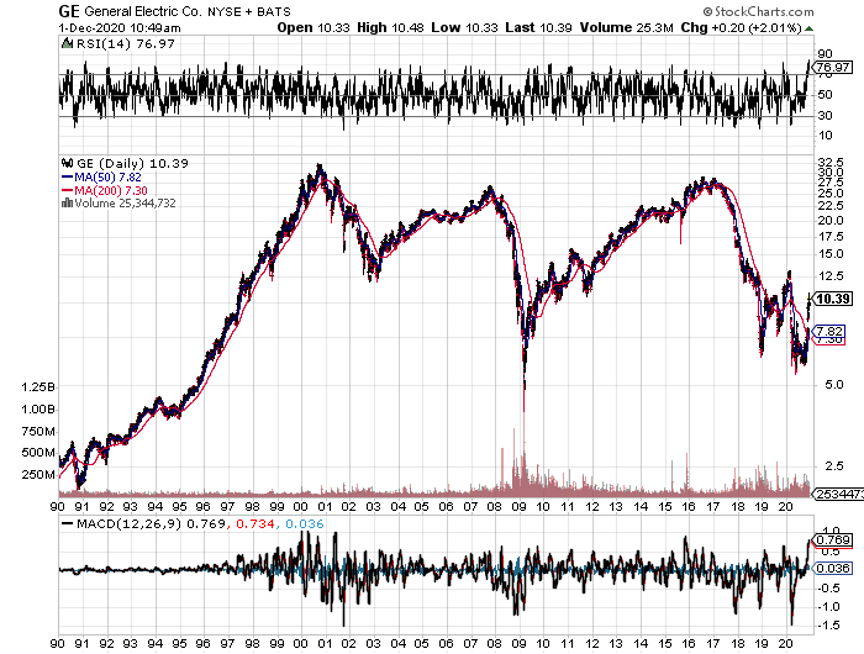

What Happened to the Dow? When I joined Morgan Stanley some 35 years ago, one of the grizzled old veterans took me aside and gave me a piece of sage advice.“Never buy a Dow stock”, he said. “They are a guarantee of failure.” That was quite a bold statement, given that at the time the closely watched index of 30 stocks included such high-flying darlings as ******* Kodak (EK), Sears Roebuck & Company (S), and Bethlehem Steel (BS). It turned out to be excellent advice. Only ten of the Dow stocks of 1983 are still in the index (see tables below), and almost all of the survivors changed names. Standard Oil of California became Chevron (CVX), E.I du Pont de Nemours & Company became DowDuPont, Inc. (DD), and Minnesota Mining & Manufacturing became 3M (MMM). Almost all of the rest went out of business, like Union Carbide Corporation (the Bhopal disaster) and Johns-Manville (asbestos products) or were taken over. A small fragment of the old E.W. Woolworth is known as Foot Locker (FL) today. Charles Dow created his namesake average on May 26, 1896, consisting of 12 names. Almost all were gigantic trusts and monopolies that were broken up only a few years later by the Sherman Antitrust Act. In many ways, the index has evolved to reflect the maturing of the US economy, from an 18[SUP]th[/SUP] century British agricultural colony, to the manufacturing powerhouse of the 20[SUP]th[/SUP] century, to the technology and services-driven economy of today. Of the original Dow stocks, only one, US Leather, vanished without a trace. It was the victim of the leap from horses to automobile transportation and the internal combustion engine. United States Rubber is now part of France’s Michelin Group (MGDDY). American Tobacco reinvented itself as Fortune Brands (FBHS) to ditch the unpopular “tobacco” word. National Lead moved into paints with the Dutch Boy brand. It sold off that division when the prospects for leaded paints dimmed in 1970 (they cause mental illness in children). What was the longest-lived of the original 1896 Dow stocks? General Electric (GE), originally founded by light bulb inventor Thomas Edison. It went down in flames thanks to poor management and was delisted in 2018. It was a 122-year run. Today, it is one of the great turnaround challenges facing American Industry. Which company is the American Leather of today? My bet is that it’s General Motors (GM), which is greatly lagging behind Tesla (TSLA) in the development of electric cars (99% market share versus 1%). With a product development cycle of five years, it simply lacks the DNA to compete in the technology age. What will be the largest Dow stock in a decade? Regular readers of the Mad Hedge Fund Trader already know the answer.

|

Quote of the Day "I only invest in beer-drinking countries, never wine-drinking countries," said Ben Horowitz, co-founder of venture capital firm Andreeson Horowitz.

|

|

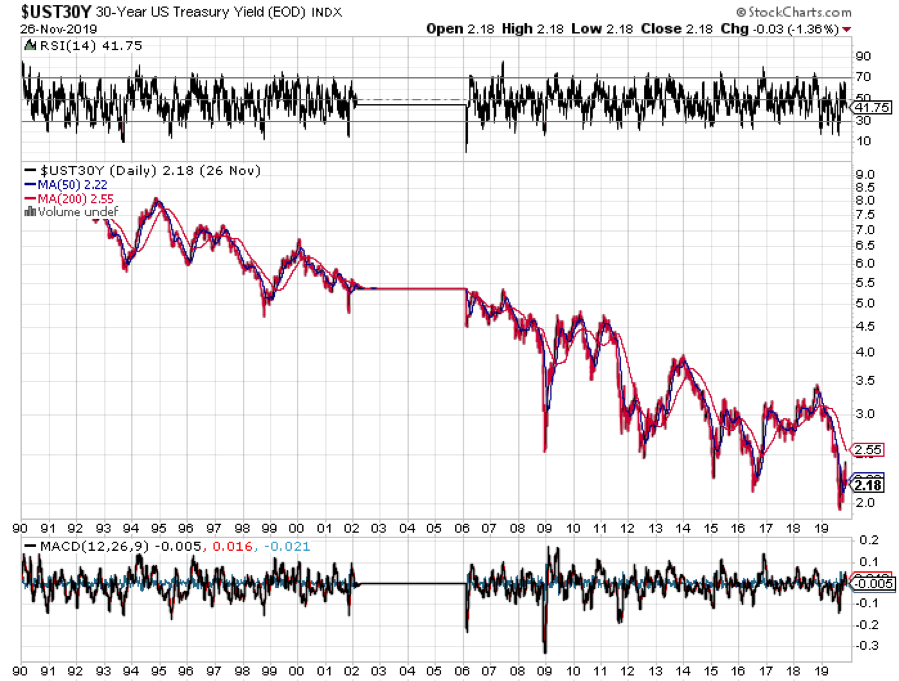

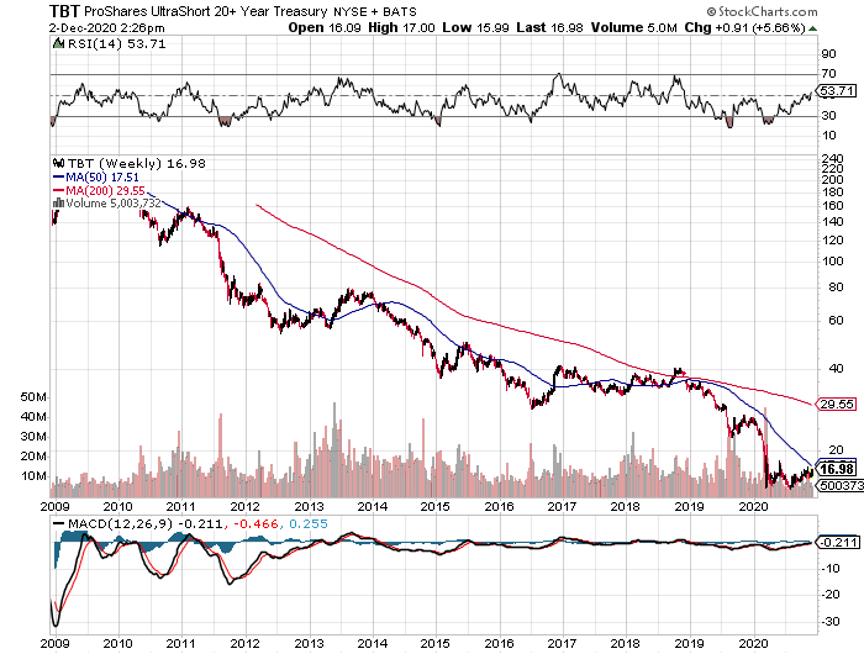

| Global Market Comments December 3, 2020 Fiat Lux FEATURED TRADE: (WHAT EVER HAPPENED TO THE GREAT DEPRESSION DEBT?), ($TNX), (TLT), (TBT),

|

| � |

Whatever Happened to the Great Depression Debt? When I was a little kid during the early 1950s, my grandfather used to endlessly rail against Franklin Delano Roosevelt.The WWI veteran, who was mustard-gassed in the trenches of France and was a lifetime, dyed-in-the-wool Republican, said the former president was a dictator and a traitor to his class, who trampled the constitution with complete disregard. Republican presidential candidates Hoover, Landon, and Dewey would have done much better jobs. What was worse, FDR had run up such enormous debts during the Great Depression that not only would my life be ruined, so would my children’s lives. As a six-year-old, this disturbed me deeply, as it appeared that just out of diapers, my life was already going to be dull, brutish, and pointless. Grandpa continued his ranting until a three-pack a day Lucky Strike non-filter habit finally killed him in 1977. He insisted until the day he died that there was no definitive proof that cigarettes caused lung cancer, even though during his war, they referred to them as “coffin nails.” He was stubborn as a mule to the end. And you wonder whom I got it from? What my grandfather’s comments did do was spark in me a lifetime interest in the government bond market, not only ours, but everyone else’s around the world. So, whatever happened to the despised, future-destroying Roosevelt debt? In short, it went to money heaven. And here I like to use the old movie analogy. Remember, when someone walked into a diner in those old black and white flicks? Check out the prices on the menu on the wall. It says “Coffee: 5 cents, Hamburgers: 10 cents, Steak: 50 cents.” That is where the Roosevelt debt went. By the time the 20 and 30-year Treasury bonds issued in the 1930s came due, WWII, Korea, and Vietnam happened, and the great inflation that followed. The purchasing power of the dollar cratered, falling roughly 90%. Coffee is now $1.00, a hamburger at MacDonald’s is $5.00, and a cheap steak at Outback costs $12.00. The government, in effect, only had to pay back 10 cents on the dollar in terms of current purchasing power on whatever it borrowed in the thirties. Who paid for this free lunch? Bond owners, who received, minimal, and often negative real, inflation-adjusted returns on fixed-income investments for three decades. In the end, it was the risk avoiders who picked up the tab. This is why bonds became known as “certificates of confiscation” during the seventies and eighties. This is not a new thing. About 300 years ago, governments figured out there was easy money to be had by issuing paper money, borrowing massively, stimulating the local economy, creating inflation, and then repaying the debt in devalued future paper money. This is one of the main reasons why we have governments, and why they have grown so big. Unsurprisingly, France was the first, followed by England and every other major country. Ever wonder how the new, impoverished United States paid for the Revolutionary War? It issued paper money by the bale, which dropped in purchasing power by two thirds by the end of the conflict in 1783. The British helped too, by flooding the country with counterfeit paper Continental money. Bondholders can expect to receive a long series of rude awakenings sometime in the future. No wonder Bill Gross, the former head of bond giant, PIMCO, says will get ashes in his stocking for Christmas next year. The scary thing is that eventually, we will enter a new 30-year bear market for bonds that lasts all the way until 2049. However, after last month’s frenetic spike up in bond prices, and down in bond yields, that is looking more like a 2022, than a 2019 position. This is certainly what the demographics are saying, which predicts an inflationary blow off in decades to come that could take short term Treasury yields to a nosebleed 12% high once more. That scenario has the leveraged short Treasury bond ETF (TBT), which has just cratered down to $23, double to $46, and then soaring all the way to $200. If you wonder how yields could get that high in a decade, consider one important fact. The largest buyers of American bonds for the past three decades have been Japan and China. Between them, they have soaked up over $2 trillion worth of our debt, some 12% of the total outstanding. Unfortunately, both countries have already entered very negative demographic pyramids, which will forestall any future large purchases of foreign bonds. They are going to need the money at home to care for burgeoning populations of old age pensioners. So who becomes the buyer of last resort? No one, unless the Federal Reserve comes back with QE IV, V, and VI. QE IV, in fact, has already started. There is a lesson to be learned today from the demise of the Roosevelt debt. It tells us that the government should be borrowing as much as it can right now with the longest maturity possible at these ultra-low interest rates and spending it all. With real, inflation-adjusted 10-year Treasury bonds now posting negative yields, they have a free pass to do so. In effect, the government never has to pay back the money. But they dohave the ability to reap immediate benefits, such as through stimulating the economy with greatly increased infrastructure spending. Heaven knows we need it. If I were king of the world, I would borrow $5 trillion tomorrow and disburse it only in areas that create domestic US jobs. Not a penny should go to new social programs. Long-term capital investments should be the sole target. Here is my shopping list: $1 trillion – new Interstate freeway system $1 trillion – additional infrastructure repairs and maintenance $1 trillion – conversion of our energy system to solar $1 trillion – construction of a rural broadband network $1 trillion – investment in R&D for everything The projects above would create 5 million new jobs quickly. Who would pay for all of this in terms of lost purchasing power? Today’s investors in government bonds, half of whom are foreigners, principally the Chinese and Japanese. Notice that I am not committing a single dollar in spending on any walls. How did my life turn out? Was it ruined, as my grandfather predicted? Actually, I did pretty well for myself, as did the rest of my generation, the baby boomers. My kids did OK too. One son just got a $1 million, two-year package at a new tech startup and he is only 30. Another is deeply involved in the tech industry, and my oldest daughter is working on a PhD at the University of California. My two youngest girls are about to become the first-ever female eagle scouts. Not too shabby. Grandpa was always a better historian than a forecaster. But did have the last laugh. He made a fortune in real estate, betting correctly on the inflation that always follows big borrowing binges. You know the five acres that sits under the Bellagio Hotel in Las Vegas Today? That’s the land he bought in 1945 for $500. He sold it 32 years later for $10 million. Not too shabby either.

|

Quote of the Day "There is no more powerful thing than a free market that changes its mind," said Art Cashin, UBS Director of Floor Operations.

|

is now the time to buy some BABA?

Yes on BABA..I like TWST a ton too but scary as the run has been unreal....reading about DNA storage is mind blowing.

BABA if you buy it's a long hold, I actually don't mind more US over site in relation to the accounting ..protection for the investor is good IMO.

BABA has had so much bad news lately/ No connect status/Ant IPO failure/ the US rhetoric/ Trouble's in India with apps/ given the news the dip from 314 isn't unwarranted..I don't doubt this company can't cross most hurdles ...Long its gold, Cloud growth projections off the charts /ANT IPO eventually but scaled down 2022/Middle class booming in china/ and more than anything inclusion in to the china connect program(southbound$$$)money inflows of at least 4%.

300+ this year is my hope.

TWST with an offering on Dec 2nd.... +$300 million @ $ 110.00 a share 7% dilution.

Closing on the 7th... Nets out to 2.7 million shares

Today 128.90 looking for a pull back..90.00 to 100.00 and I'd go in for more...This company is all over the board from a technology standpoint most of it over my head...I wouldn't buy at this level, I might be a seller on Monday @ this price.

https://flashalert.me/?symbol=TWST&...a3d39d5fb82ebaef1cbf479c25ba/d58079d424b5.htm

Closing on the 7th... Nets out to 2.7 million shares

Today 128.90 looking for a pull back..90.00 to 100.00 and I'd go in for more...This company is all over the board from a technology standpoint most of it over my head...I wouldn't buy at this level, I might be a seller on Monday @ this price.

https://flashalert.me/?symbol=TWST&...a3d39d5fb82ebaef1cbf479c25ba/d58079d424b5.htm

Great news for ANT and BABA.

https://asia.nikkei.com/Business/Finance/Ant-Group-and-Grab-win-Singapore-digital-banking-licenses

https://asia.nikkei.com/Business/Finance/Ant-Group-and-Grab-win-Singapore-digital-banking-licenses

|

| Global Market Comments December 4, 2020 Fiat Lux FEATURED TRADE: (WHY WATER WILL SOON BE WORTH MORE THAN OIL), (CGW), (PHO), (FIW), (VE), (TTEK), (PNR), (BYND), (WHY WARREN BUFFETT HATES GOLD), (GLD), (GDX), (ABX), (GOLD)

|

| � |

Why Water Will Soon Become More Valuable Than Oil If you think that an energy shortage is bad, it will pale in comparison to the next water crisis. So, investment in freshwater infrastructure is going to be a great recurring long-term investment theme.One theory about the endless wars in the Middle East since 1918 is that they have really been over water rights. Although Earth is often referred to as the water planet, only 2.5% is fresh, and three quarters of that is locked up in ice at the North and South poles. In places like China, with a quarter of the world's population, up to 90% of the fresh water is already polluted, some irretrievably so by heavy metals. Some 18% of the world population lacks access to potable water, and demand is expected to rise by 40% in the next 20 years. Aquifers in the US, which took nature millennia to create, are approaching exhaustion especially in Northern India and California’s Central Valley. While membrane osmosis technologies exist to convert seawater into fresh, they use ten times more energy than current treatment processes, a real problem if you don't have any, and will easily double the end cost of water to consumers. While it may take 16 pounds of grain to produce a pound of beef, it takes a staggering 2,416 gallons of water to do the same. Beef exports are really a way of shipping water abroad in highly concentrated form. Hence, the spectacular performance of fake meat producer Beyond Meat (BYND) this year (try one, they’re not so bad). The UN says that $11 billion a year is needed for water infrastructure investment, and $15 billion of the 2008 US stimulus package was similarly spent. It says a lot that when I went to the University of California at Berkeley School of Engineering to research this piece, most of the experts in the field had already been retained by major hedge funds! At the top of the shopping list to participate here should be the Claymore S&P Global Water Index ETF (CGW), which has appreciated by 14% since the October low. You can also visit the PowerShares Water Resource Portfolio (PHO), the First Trust ISE Water Index Fund (FIW), or the individual stocks Veolia Environment (VE), Tetra-Tech (TTEK), and Pentair (PNR). Who has the world's greatest per capita water resources? Siberia, which could become a major exporter of H2O to China in the decades to come.

[h=2]

The New Liquid Gold?[/h] |

Why Warren Buffet Hates Gold After seven years in the penalty box, gold is finally starting to come alive, and the Armageddon crowd is absolutely loving it. Maybe after ten years of rising, stocks are finally expensive on a relative basis?These are the guys who are perennially predicting the collapse of the dollar, the default of the US government, hyperinflation, and the end of the world. Better to keep all your assets in gold and silver, store at least a year’s worth of canned food, and keep your untraceable guns well-oiled and supplied with ammo, preferably in high capacity magazines. If you followed their advice, you lost your shirt. I have broken many of these wayward acolytes of their money-losing habits. But not all of them. There seems to be an endless supply emanating from the hinterlands. The “Oracle of Omaha” Warren Buffet often goes to great lengths to explain why he despises the yellow metal. The sage doesn't really care about the gold, whatever the price. He sees it primarily as a bet on fear. I imagine he feels the same about Bitcoin, the modern tulips of our age. If investors are more afraid in a year than they are today, then you make money on gold. If they aren't, then you lose money. The only problem now is that fear ain’t working. If you took all the gold in the world, it would form a cube 67 feet on a side, worth $5 trillion. For that same amount of money, you could own other assets with far greater productive earning power, including: *All the farmland in the US, about 1 billion acres, which is worth $2.5 trillion. *Two Apples (AAPL), the largest capitalized company in the world at $2.1 trillion. Instead of producing any income or dividends, gold just sits there and shines, making you feel like King Midas. I don't know. With the stock market at an all-time high and oil trading at $45.28/barrel, a bet on fear looks pretty good to me right now. I'm still sticking with my long-term forecast of the old inflation-adjusted high of $2,300/ounce. It is just a matter of time before emerging market central bank buying pushes it up there. And who knows? Fear might make a comeback too.

|

Quote of the Day “Every recession sows the seeds for the next business recovery, and every recovery sows the seeds of the next recession,” said hedge fund manager Leon Cooperman of Omega Advisors.

|

AVDL...great call..Very bullish on this.

you'll need to sign up..hold this and win IMO.

https://wsw.com/webcast/evercore11/...tps://wsw.com/webcast/evercore11/avdl/2343627

MH

you'll need to sign up..hold this and win IMO.

https://wsw.com/webcast/evercore11/...tps://wsw.com/webcast/evercore11/avdl/2343627

MH

|

| Global Market Comments December 7, 2020 Fiat Lux FEATURED TRADE: (MARKET OUTLOOK FOR THE WEEK AHEAD, or A DICEY LANDING) (SPY), (TLT), (AMZN), (TSLA), (CRM), (JPM), (CAT), (BABA), (FCX), (GLD), (SLV), (UUP), (FXE), (FXA), (FXB), (FXY), (FXI), (EWZ), (THD), (EPU)

|

| � |

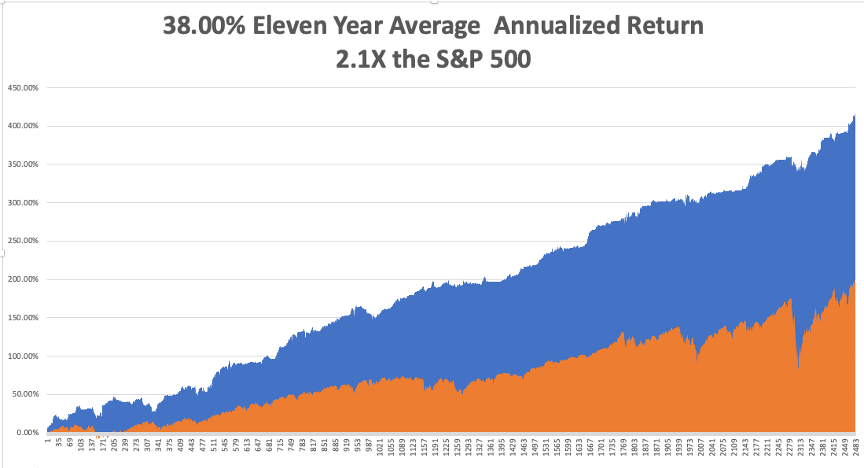

The Market Outlook for the Week Ahead, or a Dicey Landing Landing my 1932 de Havilland Tiger Moth biplane can be dicey.For a start, it has no brakes. That means I can only land on grass fields and hope my tail skid catches before I run out of landing strip. If it doesn’t, the plane will hit the end, nose over, and dump a fractured gas tank on top of me. Bathing in 30 gallons of 100 octane gasoline with sparks flying is definitely NOT a good long term health plan. The stock market is starting to remind me of landing that Tiger Moth. On Friday, all four main stock indexes closed at all-time highs for the first time since pre-pandemic January. A record $115 billion poured into equity mutual funds in November. This has all been the result of multiple expansion, not newfound earnings. Yet, stocks seem hell-bent on closing out 2020 at the highs. And there is a major factor that the market is completely ignoring. What if the Democrats win the Senate in Georgia? If so, Biden will have the weaponry to go bold. The economy goes from zero stimulus to maybe $6 trillion raining down upon it over the next six months. That will go crazy, possibly picking up another 10%, or 3,000 Dow points on top of the post-election 4,000 points we have seen so far. That is definitely NOT in the market. The other big decade-long trend that is only just starting is the weak US dollar. Lower interest rates for longer were reaffirmed by the appointment of my former economics professor Janet Yellen as Treasury Secretary. A feeble dollar brings us a fading bond market, as half the buyers are foreigners. A sickened greenback also provides the launching pad for all non-dollar assets to take off like a rocket, including commodities (FCX), precious metals (GLD), (SLV), Bitcoin, and the currencies (UUP), (FXE), (FXA), (FXB), (FXY), and emerging stock markets like China (FXI), Brazil (EWZ), Thailand (THD), and Peru (EPU). All of this is happening in the face of a US economy that is clearly falling apart. Weekly jobless claims for November came in at 245,000, compared to a robust 638,000 in October, taking the headline unemployment rate down to 6.9%. The real U6 unemployment rate stands at an eye-popping 12.0%, or 20 million. Some 10.7 million remain jobless, 900,000 higher than in February. Transportation and Warehousing were up 140,000, Professional & Business Services by 60,000, and Health Care 46,000. Retail was down 35,000 as stores shut down at a record pace. OPEC cuts a deal, adding 500,000 barrels a day to the global supply. The hopes are that a synchronized global recovery can take additional supply. Texas tea finally busts through a month's long $44 cap, the highest since March. Avoid energy. I’d rather buy more Tesla, the anti-energy. Black Friday was a disaster, with in-store shopping down 52%. Long lines and 25% capacity restrictions kept the crowds at bay. If you don’t have an online presence, you’re dead. In the meantime, online spending surged by 26%. Amazon (AMZN) hires 437,000 in 2020, probably the greatest hiring binge since WWII, and is continuing at the incredible rate of 3,000 a week. That takes its global workforce to 1.2 million. Most are $12 an hour warehouse and delivery positions. The company has been far and away the biggest beneficiary of the pandemic as the world rushed to online commerce. Tesla’s (TSLA) full self-driving software may be out in two weeks, instead of the earlier indicated two years. The current version only works on freeways. The full street to street version could be worth $8,000 a car in upgrades. Another reason to go gaga over Tesla stock. Goldman Sachs raised Tesla target to $780, the Musk increased market share to a growing market. No threat from General Motors yet, just talk. Volkswagen is on the distant horizon. In the meantime, Tesla super bear Jim Chanos announced he is finally cutting back his position. He finally came to the stunning conclusion that Tesla is not being valued as a car company. Go figure. Short interest in Tesla has plunged from a peak of 35% in March to 6% today. It’s learning the hard way. The U.S. manufacturing sector pauses, activity in the U.S. manufacturing sector barely ticked up in November as production and new orders cratered, data from a survey compiled by the Institute for Supply Management showed on Tuesday. The ISM Manufacturing Report on Business PMI for November stood at 57.5, slipping from 59.3 in October. Salesforce (CRM) overpays for workplace app Slack, knocking its stock down 9%. This is worth a buy the dip trade in the short-term and this is still a great tech company which is why the Mad Hedge Tech Letter sent out a tech alert on Salesforce on the dip. Weekly Jobless Claims dive, with Americans applying for unemployment benefits falling last week to 712,000 down from 787,000 the week before. The weakness is unsurprising as we head into seasonal Christmas hiring. The end of the tunnel for Boeing (BA) as they bring to an end an awful 2020. Irish-based airline Ryanair Holdings placed a large order for a set of brand new Boeing 737 MAX aircraft, giving the plane maker a shot in the arm as the single-aisle jet comes off an unprecedented 20-month grounding. Ryanair, Europe’s low-cost carrier, has 135 Boeing 737 MAX jets on order and options to bring the total to 200 or more. Hopefully, they won’t crash this time around. My fingers are crossed. Dollar Hits 2-1/2 Year Low. With global economies recovering, the next big-money move will be out of the greenback and into the Euro (FXE), the Aussie (FXA), the Looney (FXC), the Japanese yen (FXY), the British pound (FXB), and Bitcoin. Keeping interest rates lower for longer will accelerate the downtrend. When we come out the other side of this pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% to 120,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 120,000 here we come! My Global Trading Dispatch catapulted to another new all-time high. December is up 5.34%,taking my 2020 year-to-date up to a new high of 61.78%. That brings my eleven-year total return to 417.69% or double the S&P 500 over the same period. My 11-year average annualized return now stands at a nosebleed new high of 38.00%. My trailing one-year return exploded to 64.56%. I’m running out of superlatives, so there! I managed to catch the 50%, two-week Tesla melt-up with a 5X long position, which is always nice for performance. The coming week will be a slow one on the data front. We also need to keep an eye on the number of US Coronavirus cases at 14.5 million and deaths at 285,000, which you can find here. When the market starts to focus on this, we may have a problem. On Monday, December 7 at 4:00 PM EST, US Consumer Credit is out. On Tuesday, December 8 at 11:00 AM, the NFIB Business Optimism Index is published. On Wednesday, December 9 at 8:00 AM, MBA Mortgage Applications for the previous week are released. On Thursday, December 10 at 8:30 AM, the Weekly Jobless Claims are published. At 9:30 AM, US Core Inflation is printed. On Friday, November 11, at 9:30 AM EST, the US Producer Price Index is announced. At 2:00 PM, we learn the Baker-Hughes Rig Count. As for me, at least there is one positive outcome from the pandemic. Boy Scout Christmas tree sales are absolutely through the roof! We took delivery of 1,300 trees from Oregon for our annual fundraiser expected to sell them in two weeks. We cleared out our entire inventory in a mere six days! We sold trees as fast as we could load them. With the scouts tying the knots, only one fell onto the freeway on the way home. An “all hands on deck” call has gone out to shift the inventory. It turns out that tree sales are booming nationally. The $2 billion a year market places 21 million trees annually at an average price of $8 and are important fundraisers for many non-profit organizations. It seems that people just want something to feel good about this year. Governor Gavin Newsome’s order to go into a one-month lockdown Sunday night inspired the greatest sales effort I have ever seen, and I worked on a Morgan Stanley sales desk! We shifted the last tree hours before the deadline, which was full of mud with broken branches and had clearly been run over by a truck at a well-deserved 50% discount. I can’t wait until next year! Stay healthy. John Thomas CEO & Publisher The Diary of a Mad Hedge Fund Trader

|

| Quote of the Day "Bull markets go everywhere from 1-2 years to five years after the Fed begins tightening. We've got a long way to go before we have to worry about bonds competing against stocks," said Professor Jeremy Siegel of the Wharton School of Business

|