You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Intersting thoughts

- Thread starter Bozzie

- Start date

BABA touched 319 today I have an open limit order @ 300.00 doubtful it fills. early I thought there was shot..Not chasing it up today + $10.00

Dropped my BABA order down to 295 from 300...Love this opportunity

BABA down 9 bucks today

[h=1]Ant Group's Shanghai retail book 872x oversubscribed[/h]Oct. 29, 2020 8:16 AM ETAlibaba Group Holding Limited (BABA)By: Brandy Betz, SA News Editor15 Comments

- In a filing, fintech Ant Group (NYSE:BABA) reveals that the domestic retail book of its record $34.4B dual listing was oversubscribed to the tune of 872x as individual investors scurried to get in on the listing.

- The oversubscription works out to an investment interest of about $596.8B.

- The offering, which is raising about $17.2B in Hong Kong and on Shanghai's STAR Market, surpassed Saudi Arabian Oil's $29.4B listing last year to take the world's IPO record.

- Retired Alibaba chairman Jack Ma holds the majority control of Ant Group. Alibaba held a 32% non-controlling stake and planned to pick up 22% of shares in the IPO.

- Alibaba shares are up 0.8% pre-market to $310.30.

- Previously: Ant Group prices world's largest IPO at $34.5B with $313B market cap (Oct. 26 2020)

- Previously: Strong demand prompts Ant Group to close order book early(Oct. 27 2020)

The earning reports didnt look bad from some of the big boys and the market is still going down. The correction seems to have started.

Not a doubt NS..I think the real volatility is next week.

Everyone beat.. some refused to give guidance moving forward.... that's bad.

Amazon had a huge charge on c19 related costs..

UGLY

LLNW crosses $3.50 then down to $3.00 before elction.

I haven't lost a cent..still holding and will into next year.

It's the way it goes. CDN has consolidation written all over it.. LLNW is beautiful low hanging fruit who's selling CDN at wholesale prices while others still have a retail price point.

Matter of time before 1 of the 5 bigs CDN's start eating each other and why not kill the player with the lowest PE X2 selling the market prices on CDNs down to large players...I assume you listened to that call.

Just a thought. I'm not worried about this.

LLNW crosses $3.50 then down to $3.00 before elction.

If you want to see something strange look at these charts....

Not sure if this will work here but this web site works well for chart comparisons ..LLNW's and FLSY are 100% identical over the past month.

Blue line is FLSY and the orange is LLNW...coincidence? maybe.

https://www.barchart.com/stocks/quotes/LLNW/interactive-chart

You havnt lost a cent buying at $7? lol

Nope....I haven't sold any in to the madness.

Way I've always seen it..keeps the panic down and I've seen it unwind on the + side over and over again and I feel this will too...

Not sure what it is you're looking for..sorry you lost here but I would have never sold 40K or 200,000 worth when you did, our styles are way different when it comes to playing the market.

Good luck GMC

Global Market Comments

November 3, 2020

Fiat Lux

November 3, 2020

Fiat Lux

Featured Trade:

(FIVE REASONS GOLD IS GOING TO A NEW HIGH),

(GLD), (GOLD), (NEM), (GDX)

(GLD), (GOLD), (NEM), (GDX)

5 Reasons Gold is Going to a New High

Gold broke out to a new nine-year high this year. And here’s the good news. It’s only just begun.Cut US dollar interest rates to zero and print $14 trillion more and you render the greenback worthless.

Shunned as the pariah of the financial markets for years, the yellow metal has suddenly become everyone’s favorite hedge.

Now that gold is back in fashion, how high can it really go?

The question begs your rapt attention, as the Coronavirus has suddenly unleashed a plethora of new positive fundamentals for the barbarous relic.

It turns out that gold is THE deflationary asset to own.

Who knew?

I was an unmitigated bear on the price of gold after it peaked in 2011. In recent years, the world has been obsessed with yields, chasing them down to historically low levels across all asset classes.

But now that much of the world already has, or is about to have negative interest rates, a bizarre new kind of mathematics applies to gold ownership.

Gold’s problem used to be that it yielded absolutely nothing, cost you money to store, and carried hefty transactions costs. That asset class didn’t fit anywhere in a yield obsessed universe.

Now we have a horse of a different color.

Europeans wishing to put money in a bank have to pay for the privilege to do so. Place €1 million on deposit on an overnight account, and you will have only 996,000 Euros in a year. You just lost 40 basis points on your -0.40% negative interest rate.

With gold, you still earn zero, an extravagant return in this upside-down world. All of a sudden, zero is a win.

For the first time in human history, that gives you a 40-basis point yield advantage by gold over Euros. Similar numbers now apply to Japanese yen deposits as well.

As a result, the numbers are so compelling that it has sparked a new gold fever among hedge funds and European and Japanese individuals alike.

Websites purveying investment-grade coins and bars crashed multiple times last week, due to overwhelming demand (I occasionally have the same problem). Some retailers have run out of stock.

So I’ll take this opportunity to review a short history of the gold market (GLD) for the young and the uninformed.

Since it last peaked in the summer of 2011 at $1,927 an ounce, the barbarous relic was beaten like the proverbial red-headed stepchild, dragging silver (SLV) down with it. It faced a perfect storm.

Gold was traditionally sought after as an inflation hedge. But with economic growth weak, wages stagnant, and much work still being outsourced abroad, deflation became rampant.

The biggest buyers of gold in the world, the Indians, have seen their purchasing power drop by half, thanks to the collapse of the rupee against the US dollar. The government increased taxes on gold in order to staunch precious capital outflows.

Chart gold against the Shanghai index and the similarity is striking until negative interest rates became widespread in 2016.

In the meantime, gold supply/demand balance was changing dramatically.

While no one was looking, the average price of gold production soared from $5 in 1920 to $1,400 today. Over the last 100 years, the price of producing gold has risen four times faster than the underlying metal.

It’s almost as if the gold mining industry is the only one in the world which sees real inflation since costs soared at a 15% annual rate for the past five years.

This is a function of what I call “peak gold.” They’re not making it anymore. Miners are increasingly being driven to higher risk, more expensive parts of the world to find the stuff.

You know those tires on heavy dump trucks? They now cost $200,000 each, and buyers face a three-year waiting list to buy one.

Barrick Gold (GOLD), the world’s largest gold miner, didn’t try to mine gold at 15,000 feet in the Andes, where freezing water is a major problem because they like the fresh air.

What this means is that when the spot price of gold fell below the cost of production, miners simply shout down their most marginal facilities, drying up supply. That has recently been happening on a large scale.

Barrick Gold, a client of the Mad Hedge Fund Trader, can still operate, as older mines carry costs that go all the way down to $600 an ounce.

No one is going to want to supply the sparkly stuff at a loss. So, supply disappeared.

I am constantly barraged with emails from gold bugs who passionately argue that their beloved metal is trading at a tiny fraction of its true value and that the barbaric relic is really worth $5,000, $10,000, or even $50,000 an ounce (GLD).

They claim the move in the yellow metal we are seeing now is only the beginning of a 30-fold rise in prices, similar to what we saw from 1972 to 1979 when it leaped from $32 to $950.

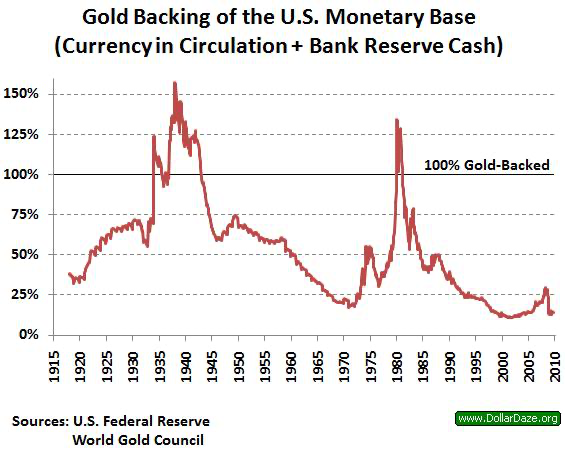

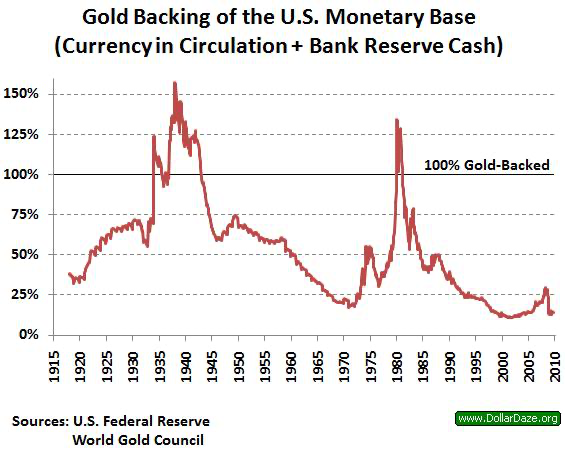

So, when the chart below popped up in my inbox showing the gold backing of the US monetary base, I felt obligated to pass it on to you to illustrate one of the intellectual arguments these people are using.

To match the gain seen since the 1936 monetary value peak of $35 an ounce, when the money supply was collapsing during the Great Depression, and the double top in 1979 when gold futures first tickled $950, this precious metal has to increase in value by 800% from the recent $1,050 low. That would take our barbarous relic friend up to $8,400 an ounce.

To match the move from the $35/ounce, 1972 low to the $950/ounce, 1979 top in absolute dollar terms, we need to see another 27.14 times move to $28,497/ounce.

Have I gotten your attention yet?

I am long term bullish on gold, other precious metals, and virtually all commodities for that matter. But I am not that bullish. These figures make my own $2,300/ounce long-term prediction positively wimp-like by comparison.

The seven-year spike up in prices we saw in the seventies, which found me in a very long line in Johannesburg, South Africa to unload my own Krugerrands in 1979, was triggered by a number of one-off events that will never be repeated.

Some 40 years of unrequited demand was unleashed when Richard Nixon took the US off the gold standard and decriminalized private ownership in 1972. Inflation then peaked around 20%. Newly enriched sellers of oil had a strong historical affinity with gold.

South Africa, the world’s largest gold producer, was then a boycotted international pariah and teetering on the edge of disaster. We are nowhere near the same geopolitical neighborhood today, and hence, my more subdued forecast.

But then again, I could be wrong.

In the end, gold may have to wait for a return of real inflation to resume its push to new highs. The previous bear market in gold lasted 18 years, from 1980 to 1998, so don’t hold your breath.

What should we look for? The surprise that your friends get an out-of-the-blue pay increase, the largest component of the inflation calculation.

This is happening now in technology and is slowly tricking down to minimum wage workers. When I visit open houses in my neighborhood in San Francisco, half the visitors are thirty-somethings wearing hoodies offering to pay cash.

It could be a long wait for real inflation, possibly into the mid-2020s, when shocking wage hikes spread elsewhere.

You may have noticed that I have been playing gold from the long side virtually every month since it bottomed in January. I’ll be back in there again, given a good low risk, high return entry point.

You’ll be the first to know when that happens.

As for the many investment advisor readers who have stayed long gold all along to hedge their clients' other risk assets, good for you.

You’re finally learning!

Gold broke out to a new nine-year high this year. And here’s the good news. It’s only just begun.Cut US dollar interest rates to zero and print $14 trillion more and you render the greenback worthless.

Shunned as the pariah of the financial markets for years, the yellow metal has suddenly become everyone’s favorite hedge.

Now that gold is back in fashion, how high can it really go?

The question begs your rapt attention, as the Coronavirus has suddenly unleashed a plethora of new positive fundamentals for the barbarous relic.

It turns out that gold is THE deflationary asset to own.

Who knew?

I was an unmitigated bear on the price of gold after it peaked in 2011. In recent years, the world has been obsessed with yields, chasing them down to historically low levels across all asset classes.

But now that much of the world already has, or is about to have negative interest rates, a bizarre new kind of mathematics applies to gold ownership.

Gold’s problem used to be that it yielded absolutely nothing, cost you money to store, and carried hefty transactions costs. That asset class didn’t fit anywhere in a yield obsessed universe.

Now we have a horse of a different color.

Europeans wishing to put money in a bank have to pay for the privilege to do so. Place €1 million on deposit on an overnight account, and you will have only 996,000 Euros in a year. You just lost 40 basis points on your -0.40% negative interest rate.

With gold, you still earn zero, an extravagant return in this upside-down world. All of a sudden, zero is a win.

For the first time in human history, that gives you a 40-basis point yield advantage by gold over Euros. Similar numbers now apply to Japanese yen deposits as well.

As a result, the numbers are so compelling that it has sparked a new gold fever among hedge funds and European and Japanese individuals alike.

Websites purveying investment-grade coins and bars crashed multiple times last week, due to overwhelming demand (I occasionally have the same problem). Some retailers have run out of stock.

So I’ll take this opportunity to review a short history of the gold market (GLD) for the young and the uninformed.

Since it last peaked in the summer of 2011 at $1,927 an ounce, the barbarous relic was beaten like the proverbial red-headed stepchild, dragging silver (SLV) down with it. It faced a perfect storm.

Gold was traditionally sought after as an inflation hedge. But with economic growth weak, wages stagnant, and much work still being outsourced abroad, deflation became rampant.

The biggest buyers of gold in the world, the Indians, have seen their purchasing power drop by half, thanks to the collapse of the rupee against the US dollar. The government increased taxes on gold in order to staunch precious capital outflows.

Chart gold against the Shanghai index and the similarity is striking until negative interest rates became widespread in 2016.

In the meantime, gold supply/demand balance was changing dramatically.

While no one was looking, the average price of gold production soared from $5 in 1920 to $1,400 today. Over the last 100 years, the price of producing gold has risen four times faster than the underlying metal.

It’s almost as if the gold mining industry is the only one in the world which sees real inflation since costs soared at a 15% annual rate for the past five years.

This is a function of what I call “peak gold.” They’re not making it anymore. Miners are increasingly being driven to higher risk, more expensive parts of the world to find the stuff.

You know those tires on heavy dump trucks? They now cost $200,000 each, and buyers face a three-year waiting list to buy one.

Barrick Gold (GOLD), the world’s largest gold miner, didn’t try to mine gold at 15,000 feet in the Andes, where freezing water is a major problem because they like the fresh air.

What this means is that when the spot price of gold fell below the cost of production, miners simply shout down their most marginal facilities, drying up supply. That has recently been happening on a large scale.

Barrick Gold, a client of the Mad Hedge Fund Trader, can still operate, as older mines carry costs that go all the way down to $600 an ounce.

No one is going to want to supply the sparkly stuff at a loss. So, supply disappeared.

I am constantly barraged with emails from gold bugs who passionately argue that their beloved metal is trading at a tiny fraction of its true value and that the barbaric relic is really worth $5,000, $10,000, or even $50,000 an ounce (GLD).

They claim the move in the yellow metal we are seeing now is only the beginning of a 30-fold rise in prices, similar to what we saw from 1972 to 1979 when it leaped from $32 to $950.

So, when the chart below popped up in my inbox showing the gold backing of the US monetary base, I felt obligated to pass it on to you to illustrate one of the intellectual arguments these people are using.

To match the gain seen since the 1936 monetary value peak of $35 an ounce, when the money supply was collapsing during the Great Depression, and the double top in 1979 when gold futures first tickled $950, this precious metal has to increase in value by 800% from the recent $1,050 low. That would take our barbarous relic friend up to $8,400 an ounce.

To match the move from the $35/ounce, 1972 low to the $950/ounce, 1979 top in absolute dollar terms, we need to see another 27.14 times move to $28,497/ounce.

Have I gotten your attention yet?

I am long term bullish on gold, other precious metals, and virtually all commodities for that matter. But I am not that bullish. These figures make my own $2,300/ounce long-term prediction positively wimp-like by comparison.

The seven-year spike up in prices we saw in the seventies, which found me in a very long line in Johannesburg, South Africa to unload my own Krugerrands in 1979, was triggered by a number of one-off events that will never be repeated.

Some 40 years of unrequited demand was unleashed when Richard Nixon took the US off the gold standard and decriminalized private ownership in 1972. Inflation then peaked around 20%. Newly enriched sellers of oil had a strong historical affinity with gold.

South Africa, the world’s largest gold producer, was then a boycotted international pariah and teetering on the edge of disaster. We are nowhere near the same geopolitical neighborhood today, and hence, my more subdued forecast.

But then again, I could be wrong.

In the end, gold may have to wait for a return of real inflation to resume its push to new highs. The previous bear market in gold lasted 18 years, from 1980 to 1998, so don’t hold your breath.

What should we look for? The surprise that your friends get an out-of-the-blue pay increase, the largest component of the inflation calculation.

This is happening now in technology and is slowly tricking down to minimum wage workers. When I visit open houses in my neighborhood in San Francisco, half the visitors are thirty-somethings wearing hoodies offering to pay cash.

It could be a long wait for real inflation, possibly into the mid-2020s, when shocking wage hikes spread elsewhere.

You may have noticed that I have been playing gold from the long side virtually every month since it bottomed in January. I’ll be back in there again, given a good low risk, high return entry point.

You’ll be the first to know when that happens.

As for the many investment advisor readers who have stayed long gold all along to hedge their clients' other risk assets, good for you.

You’re finally learning!

Quote of the Day

“There is no vaccine for credit losses….bank provisions will be in the trillions,” said bank analyst Chris Whelan.

Look out if your in BABA ..I bought more on the dip yesterday stupidly.

This could grow in scope as far as regulations go on BABA it's self..MA blew it.

By Keith Zhai, Julie Zhu and Cheng Leng

SINGAPORE/HONG KONG/BEIJING (Reuters) - They say talk is cheap. Tell that to Jack Ma.

Corporate China's shiniest star was just days away from seeing his Ant Group list on the stock market in a record $37 billion deal, when he chose to launch a blistering public attack on the country's financial watchdogs and banks.

The regulatory system was stifling innovation and must be reformed to fuel growth, billionaire Ma told a summit in Shanghai on Oct. 24 attended by the great and the good of China's financial, regulatory and political establishment.

Chinese banks, he said, operated with a "pawnshop" mentality.

It was this speech that set off a chain of events that ultimately torpedoed the listing of Ant, the fintech titan Ma founded, according to interviews with government officials, company executives and investors. They all requested anonymity to disclose confidential details.

Stung by the attack, Chinese regulators and Communist Party officials set about reining in Ma's sprawling financial empire, culminating in the suspension of the IPO on Tuesday, two days before the eagerly awaited market debut in Shanghai and Hong Kong, the sources said.

While Ma might not have realised the impact his words would have, people close to him had been baffled to learn in advance about the tone of the speech he planned to deliver, according to two sources close to Ma.

They suggested the 56-year-old soften his remarks as some of China's most senior financial regulators were due to attend, but he refused to budge, believing he should be able to say what he wanted, the sources said.

"Jack is Jack. He just wanted to speak his mind," said one of the people.

It was a costly miscalculation.

Several senior financial regulatory officials were furious at Ma's criticism, two sources told Reuters, with one source characterising the speech as a "punch in their faces".

State regulators started compiling reports including one on how Ant had used digital financial products like Huabei, a virtual credit card service, to encourage poor and young people to build up debt, according to the two people.

The general office of the State Council compiled a report on public sentiment about Ma's speech and submitted it to senior leaders including President Xi Jinping, the sources said.

Some of the reports indicated public sentiment was negative on Ma and his remarks, the people said.

Top Chinese leaders then became more involved and asked for a thorough investigation of the company's business activities, which eventually led to the halting of the world's biggest IPO, three of the sources said.

The People's Bank of China (PBOC), the China Banking and Insurance Regulatory Commission, China Securities Regulatory Commission, the State Administration of Foreign Exchange,and the State Council Information Office did not immediately reply to Reuters requests for comment.

Ma could not immediately be reached by Reuters for comment and e-commerce group Alibaba, which handles media inquiries for Ma, did not respond to a request for comment on this story from its lead founder.

The chance of the flotation getting back on track in the near-term is slim, according to six of the people, as regulators look to tighten scrutiny of the company. No listing is expected for at least the next few months, two said.

SCRUTINY INTENSIFIES

It was a stunning reversal for Ma, who would have added at least $27 billion to his net worth from the IPO.

In years gone by, most regulators had left the billionaire to his own devices, partly because of his close ties to some senior government officials, according to five of the sources, but also because of national pride in his success.

Ma, a former English teacher, is one of China's internet pioneers, building an e-commerce empire with Alibaba and a fintech giant with Ant.

When the PBOC tried to regulate Ant's payment and wealth management business about five years ago, Ma bypassed the central bank after failing to reach a consensus with regulatory officials and lobbied the central government. The PBOC later dropped those regulation plans.

"Jack Ma did not bypass the customary process of communicating with relevant regulators regarding Ant's payment and wealth management business," Ant's spokeswoman said in an emailed response to Reuters.

But with his Oct. 24 speech, Ma misjudged the shifting priorities of Beijing, according to one senior regulatory source, believing he could challenge the financial establishment yet retain the support of the central leadership.

The bigger picture was that one of the government's main aims this year is to shore up the country's financial sector and tighten regulatory oversight to prevent systemic risks in a pandemic-hit economy, the person said.

Even before Ma's speech, Chinese regulators were gradually increasing their oversight of Ant, which has largely thrived as a technology platform free from costly banking regulations despite its bouquet of financial offerings.

The scrutiny has particularly intensified for the company's rapidly growing online consumer-lending business, a cash cow, which sources demand from retail consumers and small businesses and passes that on to about 100 banks for underwriting.

REGULATORS MAKE MOVE

The Shanghai speech was the trigger for a major escalation, according to half of the dozen people interviewed, prompting senior political officials to ask regulators, including the central bank and China's top banking regulator, for the thorough review of Ant's businesses.

The watchdogs, who had for years wanted to rein in Ma's fintech empire, moved fast after receiving written instructions from officials including Vice Premier Liu He, a trusted economic adviser to President Xi, said two of the people.

The State Council Information Office did not immediately respond to a Reuters request for comment from Liu.

As part of this drive, regulatory officials rushed to publish a consultation paper this Monday to tighten rules for the country's micro-lending business, which directly impacts Ant, said one person with direct knowledge.

The draft requires micro-lenders to fund at least 30% of any loan they fund jointly with banks. Only 2% of the loans Ant had facilitated as of end-June were on its balance sheet, its IPO prospectus showed.

Top Chinese industry players including Ant and Lufax Holding Ltd, an online wealth management platform, were aware of the draft details weeks before its public release, said two of the people.

Lufax, which raised $2.4 billion in a New York IPO last month, had informed investors that regulators had required leading online micro-lenders to provide about 20%-30% of any loan they fund jointly with banks, according to two investors who joined its roadshow.

Lufax declined to comment due to quiet period restrictions following its IPO.

By contrast, Ant's executives did not mention the possible regulatory changes during its two main calls with global investors during its roadshow last week, two other investors said.

Ant's spokeswoman said the company was not aware of the details of the draft online micro-lending rules until they were published on Monday.

HUBRIS AND HUMILITY

After the publication of the micro-lending consultation paper, Ma and the two top Ant executives were summoned to a rare joint meeting with four regulatory bodies.

They were told that the company, notably its consumer-lending business, would face tougher scrutiny over matters including capital adequacy and leverage ratios.

Regulators had been surprised by the scale and risk model of Ant's lending division, details of which were disclosed in the IPO-related filings since late August. The unit, which includes Huabei and short-term consumer loan provider Jiebei, contributed close to 40% of the group's revenue in the first half of the year.

A day later, the Shanghai stock exchange said it had suspended Ant's IPO, citing a "significant change" in the regulatory environment, prompting the company to also freeze the Hong Kong leg of its dual listing.

China's securities industry watchdog said subsequently that recent regulatory changes could have a "major impact" on Ant's business structure and profit model. It said suspending the IPO was a responsible move both for investors and markets.

The suspension marked the nadir of what has been a gradually souring relationship over recent years between Ma's corporate empire and Chinese regulators, from the central bank to the internet and markets watchdogs.

After the announcement, however, Ant released a statement in which it pledged to "embrace" regulation.

"It has no alternative but to do so," Gavekal Research analyst Andrew Batson wrote in a report this week. "Ma's hubris has now morphed into humility."

(Reporting by Keith Zhai in Singapore, Julie Zhu in Hong Kong and Leng Cheng in Beijing; Editing by Sumeet Chatterjee, Pravin Char and Carmel Crimmins)

[FONT="]

[/FONT]

This could grow in scope as far as regulations go on BABA it's self..MA blew it.

By Keith Zhai, Julie Zhu and Cheng Leng

SINGAPORE/HONG KONG/BEIJING (Reuters) - They say talk is cheap. Tell that to Jack Ma.

Corporate China's shiniest star was just days away from seeing his Ant Group list on the stock market in a record $37 billion deal, when he chose to launch a blistering public attack on the country's financial watchdogs and banks.

The regulatory system was stifling innovation and must be reformed to fuel growth, billionaire Ma told a summit in Shanghai on Oct. 24 attended by the great and the good of China's financial, regulatory and political establishment.

It was this speech that set off a chain of events that ultimately torpedoed the listing of Ant, the fintech titan Ma founded, according to interviews with government officials, company executives and investors. They all requested anonymity to disclose confidential details.

Stung by the attack, Chinese regulators and Communist Party officials set about reining in Ma's sprawling financial empire, culminating in the suspension of the IPO on Tuesday, two days before the eagerly awaited market debut in Shanghai and Hong Kong, the sources said.

While Ma might not have realised the impact his words would have, people close to him had been baffled to learn in advance about the tone of the speech he planned to deliver, according to two sources close to Ma.

They suggested the 56-year-old soften his remarks as some of China's most senior financial regulators were due to attend, but he refused to budge, believing he should be able to say what he wanted, the sources said.

"Jack is Jack. He just wanted to speak his mind," said one of the people.

It was a costly miscalculation.

Several senior financial regulatory officials were furious at Ma's criticism, two sources told Reuters, with one source characterising the speech as a "punch in their faces".

State regulators started compiling reports including one on how Ant had used digital financial products like Huabei, a virtual credit card service, to encourage poor and young people to build up debt, according to the two people.

The general office of the State Council compiled a report on public sentiment about Ma's speech and submitted it to senior leaders including President Xi Jinping, the sources said.

Some of the reports indicated public sentiment was negative on Ma and his remarks, the people said.

Top Chinese leaders then became more involved and asked for a thorough investigation of the company's business activities, which eventually led to the halting of the world's biggest IPO, three of the sources said.

The People's Bank of China (PBOC), the China Banking and Insurance Regulatory Commission, China Securities Regulatory Commission, the State Administration of Foreign Exchange,and the State Council Information Office did not immediately reply to Reuters requests for comment.

Ma could not immediately be reached by Reuters for comment and e-commerce group Alibaba, which handles media inquiries for Ma, did not respond to a request for comment on this story from its lead founder.

The chance of the flotation getting back on track in the near-term is slim, according to six of the people, as regulators look to tighten scrutiny of the company. No listing is expected for at least the next few months, two said.

SCRUTINY INTENSIFIES

It was a stunning reversal for Ma, who would have added at least $27 billion to his net worth from the IPO.

In years gone by, most regulators had left the billionaire to his own devices, partly because of his close ties to some senior government officials, according to five of the sources, but also because of national pride in his success.

Ma, a former English teacher, is one of China's internet pioneers, building an e-commerce empire with Alibaba and a fintech giant with Ant.

When the PBOC tried to regulate Ant's payment and wealth management business about five years ago, Ma bypassed the central bank after failing to reach a consensus with regulatory officials and lobbied the central government. The PBOC later dropped those regulation plans.

"Jack Ma did not bypass the customary process of communicating with relevant regulators regarding Ant's payment and wealth management business," Ant's spokeswoman said in an emailed response to Reuters.

But with his Oct. 24 speech, Ma misjudged the shifting priorities of Beijing, according to one senior regulatory source, believing he could challenge the financial establishment yet retain the support of the central leadership.

The bigger picture was that one of the government's main aims this year is to shore up the country's financial sector and tighten regulatory oversight to prevent systemic risks in a pandemic-hit economy, the person said.

Even before Ma's speech, Chinese regulators were gradually increasing their oversight of Ant, which has largely thrived as a technology platform free from costly banking regulations despite its bouquet of financial offerings.

The scrutiny has particularly intensified for the company's rapidly growing online consumer-lending business, a cash cow, which sources demand from retail consumers and small businesses and passes that on to about 100 banks for underwriting.

REGULATORS MAKE MOVE

The Shanghai speech was the trigger for a major escalation, according to half of the dozen people interviewed, prompting senior political officials to ask regulators, including the central bank and China's top banking regulator, for the thorough review of Ant's businesses.

The watchdogs, who had for years wanted to rein in Ma's fintech empire, moved fast after receiving written instructions from officials including Vice Premier Liu He, a trusted economic adviser to President Xi, said two of the people.

The State Council Information Office did not immediately respond to a Reuters request for comment from Liu.

As part of this drive, regulatory officials rushed to publish a consultation paper this Monday to tighten rules for the country's micro-lending business, which directly impacts Ant, said one person with direct knowledge.

The draft requires micro-lenders to fund at least 30% of any loan they fund jointly with banks. Only 2% of the loans Ant had facilitated as of end-June were on its balance sheet, its IPO prospectus showed.

Top Chinese industry players including Ant and Lufax Holding Ltd, an online wealth management platform, were aware of the draft details weeks before its public release, said two of the people.

Lufax, which raised $2.4 billion in a New York IPO last month, had informed investors that regulators had required leading online micro-lenders to provide about 20%-30% of any loan they fund jointly with banks, according to two investors who joined its roadshow.

Lufax declined to comment due to quiet period restrictions following its IPO.

By contrast, Ant's executives did not mention the possible regulatory changes during its two main calls with global investors during its roadshow last week, two other investors said.

Ant's spokeswoman said the company was not aware of the details of the draft online micro-lending rules until they were published on Monday.

HUBRIS AND HUMILITY

After the publication of the micro-lending consultation paper, Ma and the two top Ant executives were summoned to a rare joint meeting with four regulatory bodies.

They were told that the company, notably its consumer-lending business, would face tougher scrutiny over matters including capital adequacy and leverage ratios.

Regulators had been surprised by the scale and risk model of Ant's lending division, details of which were disclosed in the IPO-related filings since late August. The unit, which includes Huabei and short-term consumer loan provider Jiebei, contributed close to 40% of the group's revenue in the first half of the year.

A day later, the Shanghai stock exchange said it had suspended Ant's IPO, citing a "significant change" in the regulatory environment, prompting the company to also freeze the Hong Kong leg of its dual listing.

China's securities industry watchdog said subsequently that recent regulatory changes could have a "major impact" on Ant's business structure and profit model. It said suspending the IPO was a responsible move both for investors and markets.

The suspension marked the nadir of what has been a gradually souring relationship over recent years between Ma's corporate empire and Chinese regulators, from the central bank to the internet and markets watchdogs.

After the announcement, however, Ant released a statement in which it pledged to "embrace" regulation.

"It has no alternative but to do so," Gavekal Research analyst Andrew Batson wrote in a report this week. "Ma's hubris has now morphed into humility."

(Reporting by Keith Zhai in Singapore, Julie Zhu in Hong Kong and Leng Cheng in Beijing; Editing by Sumeet Chatterjee, Pravin Char and Carmel Crimmins)

[FONT="]

[/FONT]

BABA recovering nicely from a good gut punch on the ANT IPO falling apart.....I think it comes back though.

Despite a good kick in the face on LLNW.. I hold and added more lowering my SP still.

This has been my thought all along here with LLNW..Time on this one.

Disclosure ..This guy has a position in LLNW

Limelight Networks: An Absurd Market Cap Should Bring A Suitor

Nov. 6, 2020 8:07 AM ET|

23 comments

|

About: Limelight Networks, Inc. (LLNW), Includes: AKAM, AMZN, DIS, NET, NFLX

Thomas Cheatham

Growth, long-term horizon, Biotech, small-cap

Summary

Sector tailwinds and macro trends have given CDNs a boost this year, but some of that wind has been taken out of the sails via a market pullback.

The fundamentals of the sector have only strengthened as covid keeps forcing shutdowns around the world and shelter-in-place orders.

Content providers are at war to gain market share, and that war is only going to heat up and CDNs will reap the spoils.

We may have been early to the party on LLNW, but our fundamental research is sound, and the current valuation makes a material transaction likely.

Limelight Networks (NASDAQ:LLNW) reported Q3 results that sent shares spiraling lower even on a revenue beat, though a modest one. In a world where almost every tech company is beating earnings, some by a vast margin, and then getting sold off, we can't help but think this is more "the market" than it is directed at LLNW.

However, this argument doesn't hold water when you look at the drop overall, 50% from recent highs, and that likely CAN'T be based solely on the market. We believe the market downturn only exacerbated this drop. Did fellow peers drop? Yes, they did actually. Fastly (NYSE:FSLY) has also dropped over 50% from its recent highs, and oddly enough, it is following LLNW almost identically when looking at technical charts and order flow to the downside. One can argue that the eerie similarities here might be just a sector coincidence, others feel something larger might be at play, but that is all speculation. Akamai (NASDAQ:AKAM) has dropped mildly and so has Cloudflare (NYSE:NET) from recent highs, so the sector IS in fact seeing some pressure.

Regardless of the overall factors at work here, the valuation of Limelight is SO INCREDIBLY CHEAP and ABSURD today, it's a likely target for acquisition, and though of course this is all speculative, we will explain our logic.

Valuation of a CDN

Building out a CDN network to deliver one's content is an ideal approach for a content provider looking to cut long-term costs. One can look at Netflix (NASDAQ:NFLX) and see that it built out its own CDN years ago when it saw the macro trends heading in this direction. The company used to use third-party CDNs, Limelight and Akamai included, but decided to build its own for longevity and cost cutting.

How much does it take to build a CDN? Per some digging I did and speaking to experts in the field, to acquire the ISP contracts all over the geographical locations one wants and to build out POPs or contract data center usage, the process is rather expensive. The estimate is that it takes roughly $500 million to $750 million to build a "no frills" standard CDN. That structure would get your media from point A to point B, while having minor buffering issues, some latency issues, but overall be "acceptable" for most consumer usages.

The owner would still have to pay for bandwidth, but they would get much better deals of course and more control over pricing if they took out the "middleman" of a third-party CDN. Most third-party CDNs, in fact the majority of them, use public networks and strong relationships to do the cost cutting for content providers and make it easy on them to not have to worry about all the supply chain issues. While doing that, they stand to make some decent margins as "middlemen" in this process.

How LONG does it take to build out a CDN? Experts in the field say it takes on average between three and five years to build out the "no frills" CDN. This includes negotiating contracts, acquiring some equipment and setting up POP locations, as well as partnering with data centers globally for delivery. Then, you have to add in the long process of creating software that drives the whole network and has enough features to ensure seamless delivery not to mention security protocols for safeguarding of data and content across public access lines.

Those processes take a very long time and so does applying for and acquiring the global license agreements for governments and municipalities worldwide to approve operations in their respective jurisdictions. This is how long it took NFLX to do it itself. Lucky for the company, it started back 10 years ago working on all this, so of course it stayed ahead of trends. But what about companies that are just accepting the vast changes TODAY?

Fast Forward Back to Today

Today, you have around 47 CDN networks in operation around the world. Of these 47 CDNs, only two have built out their own "private" network. Limelight Networks is one, and a private company is the other to which there is very limited information. What are the benefits of running your own private backbone operations with your CDN?

Why Limelight Networks Is A Huge Target

Being one of the oldest CDNs in the space, Limelight Networks is very well known in the industry. It works with many OTT providers, has ad-supported options, live TV streaming platform, edge computing, edge functionality for optimization and customization as well as a myriad of IP and patents. Again, it is one of the ONLY CDNs with its own private network operating today.

Given today's macro trends, as mentioned earlier, big content providers like Disney (NYSE:DIS) and Amazon (NASDAQ:AMZN) are at war and pushing "all in" on streaming. Both of these giants are currently in a content war with each other buying movie rights and launching "streaming only" blockbusters. Think "Mulan" on the Disney side and Amazon acquiring the rights to "Borat 2" and "Coming to America 2". This war is only heating up, but the funny thing is, while Amazon has its own CDN via AWS, it also uses Limelight HEAVILY and make up for over 30% of Limelight Networks' revenue.

Given its massive use of Limelight Networks platform, it could easily acquire LLNW and use it to enhance the AWS CDN by a multi-use HYBRID CDN with a private network backbone. You can read about the benefits of a private CDN with mixed use public/multi CDN strategy here.

Obviously this approach could save Amazon tens of millions on its CDN costs and create several cost synergies along with strengthening its AWS and CDN offerings for the coming decades. Amazon would also greatly increase its latency and double up on a feature-rich offering of superior quality. But what about Disney?

Disney is not new to the streaming space, but it has come on VERY strong in the last six months. Just a few weeks ago, Disney announced officially it was going "ALL IN" on streaming and completely changing how it will deliver its content in the future with theaters on the outs. Disney is at a disadvantage here forced to use third-party CDNs to deliver its new trajectory business decision, but wait, why not just purchase Limelight Networks, have your very own private CDN with sub-second latency, and grab a huge advantage over any of your competitors by saving four years and a billion dollars of costs by just getting all that done in one swoop of Limelight Networks at an obscene valuation?

Well, the content providers are definitely eyeing up the CDNs to maximize profits, control over their content, and hurt the competition a little, but what about other CDNs? The CDN space is RIPE for consolidation. In the age of streaming, the biggest players are now fighting for accounts, and when they fight each other for accounts, it brings pressure on margins. Dropping prices and pressure from large clients and small clients alike is becoming commonplace in the CDN industry.

When looking at the CDNs in the space, we know that AKAM already tried to buy LLNW years ago, and when that transaction fell through, they sued them instead. Kinda spiteful, but it is what it is. That all got worked out in a settlement that is finally put behind LLNW, but would it be an ideal suitor now? I don't think so. AKAM has done amazing for itself and is chugging right along and is really the one to beat in the space. NET has a very solid offering and is also doing very well for itself. I don't think it would benefit most from an acquisition of LLNW.

That leaves FSLY. I've been eyeing the movement in FSLY as mentioned at the beginning of the article and FSLY has been tracking LLNW almost identically. Very odd. But that made me think of what a transaction might look like. You can look at FSLY's offerings and LLNW's product offerings and make a very distinct observation that they would complement each other VERY well. They seem to have only a few clients that overlap, so no cannibalism of business really. FSLY targets smaller companies and smaller videos and files more than larger streaming like LLNW. Plus, FSLY's network is public and more geared towards higher margins and efficiency than sub-second latency and quality as LLNW's.

Being a public network, FSLY had to pay big for Signal Sciences because on a public network, it needs top-notch security. LLNW doesn't have this problem, and instead focused on helping content providers stop piracy with watermarking and other digital "tricks" for illegal viewing and downloading. Why did it focus on that? Because it is running on a private network not having to worry as much about network hacking and infiltration.

Forming an all-stock transaction where FSLY issues one share for four LLNW shares would lead to something like 25% dilution, but in this type of transaction, FSLY would be buying an 80% revenue boost, a private network with a myriad of powerful tech additions, the ability to run a hybrid private/public network, gain access to LLNW's Chinese delivery licenses, and so many different ways to cut costs and give synergies to improve margins. Not to mention, the profitability of LLNW would pull up FSLY's bottom line while FSLY's raging top-line growth pulls up LLNW's already fantastic growth even higher.

COULD FSLY DO IT? Absolutely it could, and it SHOULD. FSLY has gotten a hold of a very large investment base that it could and should easily tap for rapid growth. Purchasing LLNW at current valuations is 100% an extremely wise investment at this point in time given all the money the market has given FSLY access to and its thirst for wanting to buy cheap revenue and massive growth prospects.

That type of transaction makes so much sense that we feel it would almost be foolish for FSLY NOT to do it. Then, it would give birth to a "major player" in the CDN space with roughly 520 million a year run rate, steady growth, higher margins, and an unbeatable network under FSLY's aggressive management assisted by Limelight's amazing tech focused staff and contact list. We could easily see a union of this nature trading in the $150+ share range within a matter of months given how powerful they would be in unison.

De-Risking In a Major Way

Let's continue to assume the transaction between FSLY and LLNW is a marriage made in heaven and they get off their chairs and do it, does it solve some major issues? Yes, it does. Not only does it solve the issues mentioned above about technology synergies, a hybrid CDN formation, and being able to go toe-to-toe with NET and AKAM, but it also basically solves one of the biggest problems facing BOTH LLNW and FSLY, concentration risk.

Let's take a look at why FSLY dropped when it put out a lowered guidance for Q3. It was specifically aimed at lost revenues from TikTok, its largest customer. Conversely, Amazon is Limelight's largest customer with about 30% of its revenues. In fact, 77% of LLNW's revenues come from 20 clients, and some of this is also seen on the FSLY side of the equation as well.

A merger of these two companies cuts their concentration risk IN HALF and immediately. TikTok would no longer be 18% of FSLY revenues, if these two companies combine, it would drop significantly down to only 9% of revenues. For Limelight, if the merger took hold, Amazon would drop from 30% of revenues down to 15% or just under that number. This gives the combined entity so much more stability and so many more moves for pricing power and competition without the major risks associated with client concentration. It would also bring them power in the CDN space which attracts even more big clients as they become more competitive and stable with a superior combined product offering made much more robust.

Risk Factors

Potential risk factors must always be considered. In this case, the obvious risk factor would be LLNW continuing to go about its business on its own. It is growing revenues, but having pressure on margins in a highly competitive market. A second risk factor to consider, as mentioned above that a merger would clear up for both parties, is concentration risk. That would remain a high risk given current portion of revenues coming from large clients if there was any deterioration with those partnerships. We don't anticipate any deterioration, but it must always be considered.

Conclusion

Looking at Limelight Networks with a market cap of $440 million as of writing and the costs and time associated with building out a similar network, it's easy to see how saving the time and money would be ideal for multiple content providers or other players in the space.

While Limelight Networks stays at these crazy low valuation numbers, it is likely a target unless it pulls itself up on its own before a strategic transaction can occur and gets back towards $6 to $8 where we see it less likely to get acquired. Given a possible valuation of $1 billion to $1.25 billion, a steal for both buyer and target, a buyout in this modest range would be Limelight Networks' valuation between $8.20 and $10.25 pps. It also has no debt and $125 million in cash, or roughly $1 per share in cash as of the end of Q3.

Despite a good kick in the face on LLNW.. I hold and added more lowering my SP still.

This has been my thought all along here with LLNW..Time on this one.

Disclosure ..This guy has a position in LLNW

Limelight Networks: An Absurd Market Cap Should Bring A Suitor

Nov. 6, 2020 8:07 AM ET|

23 comments

|

About: Limelight Networks, Inc. (LLNW), Includes: AKAM, AMZN, DIS, NET, NFLX

Thomas Cheatham

Growth, long-term horizon, Biotech, small-cap

(444 followers)

Summary

Sector tailwinds and macro trends have given CDNs a boost this year, but some of that wind has been taken out of the sails via a market pullback.

The fundamentals of the sector have only strengthened as covid keeps forcing shutdowns around the world and shelter-in-place orders.

Content providers are at war to gain market share, and that war is only going to heat up and CDNs will reap the spoils.

We may have been early to the party on LLNW, but our fundamental research is sound, and the current valuation makes a material transaction likely.

Limelight Networks (NASDAQ:LLNW) reported Q3 results that sent shares spiraling lower even on a revenue beat, though a modest one. In a world where almost every tech company is beating earnings, some by a vast margin, and then getting sold off, we can't help but think this is more "the market" than it is directed at LLNW.

However, this argument doesn't hold water when you look at the drop overall, 50% from recent highs, and that likely CAN'T be based solely on the market. We believe the market downturn only exacerbated this drop. Did fellow peers drop? Yes, they did actually. Fastly (NYSE:FSLY) has also dropped over 50% from its recent highs, and oddly enough, it is following LLNW almost identically when looking at technical charts and order flow to the downside. One can argue that the eerie similarities here might be just a sector coincidence, others feel something larger might be at play, but that is all speculation. Akamai (NASDAQ:AKAM) has dropped mildly and so has Cloudflare (NYSE:NET) from recent highs, so the sector IS in fact seeing some pressure.

Regardless of the overall factors at work here, the valuation of Limelight is SO INCREDIBLY CHEAP and ABSURD today, it's a likely target for acquisition, and though of course this is all speculative, we will explain our logic.

Valuation of a CDN

Building out a CDN network to deliver one's content is an ideal approach for a content provider looking to cut long-term costs. One can look at Netflix (NASDAQ:NFLX) and see that it built out its own CDN years ago when it saw the macro trends heading in this direction. The company used to use third-party CDNs, Limelight and Akamai included, but decided to build its own for longevity and cost cutting.

How much does it take to build a CDN? Per some digging I did and speaking to experts in the field, to acquire the ISP contracts all over the geographical locations one wants and to build out POPs or contract data center usage, the process is rather expensive. The estimate is that it takes roughly $500 million to $750 million to build a "no frills" standard CDN. That structure would get your media from point A to point B, while having minor buffering issues, some latency issues, but overall be "acceptable" for most consumer usages.

The owner would still have to pay for bandwidth, but they would get much better deals of course and more control over pricing if they took out the "middleman" of a third-party CDN. Most third-party CDNs, in fact the majority of them, use public networks and strong relationships to do the cost cutting for content providers and make it easy on them to not have to worry about all the supply chain issues. While doing that, they stand to make some decent margins as "middlemen" in this process.

How LONG does it take to build out a CDN? Experts in the field say it takes on average between three and five years to build out the "no frills" CDN. This includes negotiating contracts, acquiring some equipment and setting up POP locations, as well as partnering with data centers globally for delivery. Then, you have to add in the long process of creating software that drives the whole network and has enough features to ensure seamless delivery not to mention security protocols for safeguarding of data and content across public access lines.

Those processes take a very long time and so does applying for and acquiring the global license agreements for governments and municipalities worldwide to approve operations in their respective jurisdictions. This is how long it took NFLX to do it itself. Lucky for the company, it started back 10 years ago working on all this, so of course it stayed ahead of trends. But what about companies that are just accepting the vast changes TODAY?

Fast Forward Back to Today

Today, you have around 47 CDN networks in operation around the world. Of these 47 CDNs, only two have built out their own "private" network. Limelight Networks is one, and a private company is the other to which there is very limited information. What are the benefits of running your own private backbone operations with your CDN?

- Security - A private network is completely controlled from point A to point B as it doesn't have to travel on any public service. The less public access the data has to travel through, dramatically lower the chances of that data getting tampered with or stolen.

- Control - Using a private network allows the host company to completely control bandwidth and latency packets through their system in a way that public network users cannot. When public CDNs push data through public networks, they can't manage the flow in a scaled down way as a private CDN can. Public CDNs just have to "trust" their partner ISPs deliver it in the most efficient way possible.

- Speed - Using public CDN and public ISP connections means you have to "share" bandwidth with all other networks and traffic users. This can really slow down your content as you can't make it most efficient or maneuver it for best results, you have to trust partners to do it for you and not throttle your content or put theirs in front of yours in the priority chain.

Why Limelight Networks Is A Huge Target

Being one of the oldest CDNs in the space, Limelight Networks is very well known in the industry. It works with many OTT providers, has ad-supported options, live TV streaming platform, edge computing, edge functionality for optimization and customization as well as a myriad of IP and patents. Again, it is one of the ONLY CDNs with its own private network operating today.

Given today's macro trends, as mentioned earlier, big content providers like Disney (NYSE:DIS) and Amazon (NASDAQ:AMZN) are at war and pushing "all in" on streaming. Both of these giants are currently in a content war with each other buying movie rights and launching "streaming only" blockbusters. Think "Mulan" on the Disney side and Amazon acquiring the rights to "Borat 2" and "Coming to America 2". This war is only heating up, but the funny thing is, while Amazon has its own CDN via AWS, it also uses Limelight HEAVILY and make up for over 30% of Limelight Networks' revenue.

Given its massive use of Limelight Networks platform, it could easily acquire LLNW and use it to enhance the AWS CDN by a multi-use HYBRID CDN with a private network backbone. You can read about the benefits of a private CDN with mixed use public/multi CDN strategy here.

Obviously this approach could save Amazon tens of millions on its CDN costs and create several cost synergies along with strengthening its AWS and CDN offerings for the coming decades. Amazon would also greatly increase its latency and double up on a feature-rich offering of superior quality. But what about Disney?

Disney is not new to the streaming space, but it has come on VERY strong in the last six months. Just a few weeks ago, Disney announced officially it was going "ALL IN" on streaming and completely changing how it will deliver its content in the future with theaters on the outs. Disney is at a disadvantage here forced to use third-party CDNs to deliver its new trajectory business decision, but wait, why not just purchase Limelight Networks, have your very own private CDN with sub-second latency, and grab a huge advantage over any of your competitors by saving four years and a billion dollars of costs by just getting all that done in one swoop of Limelight Networks at an obscene valuation?

Well, the content providers are definitely eyeing up the CDNs to maximize profits, control over their content, and hurt the competition a little, but what about other CDNs? The CDN space is RIPE for consolidation. In the age of streaming, the biggest players are now fighting for accounts, and when they fight each other for accounts, it brings pressure on margins. Dropping prices and pressure from large clients and small clients alike is becoming commonplace in the CDN industry.

When looking at the CDNs in the space, we know that AKAM already tried to buy LLNW years ago, and when that transaction fell through, they sued them instead. Kinda spiteful, but it is what it is. That all got worked out in a settlement that is finally put behind LLNW, but would it be an ideal suitor now? I don't think so. AKAM has done amazing for itself and is chugging right along and is really the one to beat in the space. NET has a very solid offering and is also doing very well for itself. I don't think it would benefit most from an acquisition of LLNW.

That leaves FSLY. I've been eyeing the movement in FSLY as mentioned at the beginning of the article and FSLY has been tracking LLNW almost identically. Very odd. But that made me think of what a transaction might look like. You can look at FSLY's offerings and LLNW's product offerings and make a very distinct observation that they would complement each other VERY well. They seem to have only a few clients that overlap, so no cannibalism of business really. FSLY targets smaller companies and smaller videos and files more than larger streaming like LLNW. Plus, FSLY's network is public and more geared towards higher margins and efficiency than sub-second latency and quality as LLNW's.

Being a public network, FSLY had to pay big for Signal Sciences because on a public network, it needs top-notch security. LLNW doesn't have this problem, and instead focused on helping content providers stop piracy with watermarking and other digital "tricks" for illegal viewing and downloading. Why did it focus on that? Because it is running on a private network not having to worry as much about network hacking and infiltration.

Forming an all-stock transaction where FSLY issues one share for four LLNW shares would lead to something like 25% dilution, but in this type of transaction, FSLY would be buying an 80% revenue boost, a private network with a myriad of powerful tech additions, the ability to run a hybrid private/public network, gain access to LLNW's Chinese delivery licenses, and so many different ways to cut costs and give synergies to improve margins. Not to mention, the profitability of LLNW would pull up FSLY's bottom line while FSLY's raging top-line growth pulls up LLNW's already fantastic growth even higher.

COULD FSLY DO IT? Absolutely it could, and it SHOULD. FSLY has gotten a hold of a very large investment base that it could and should easily tap for rapid growth. Purchasing LLNW at current valuations is 100% an extremely wise investment at this point in time given all the money the market has given FSLY access to and its thirst for wanting to buy cheap revenue and massive growth prospects.

That type of transaction makes so much sense that we feel it would almost be foolish for FSLY NOT to do it. Then, it would give birth to a "major player" in the CDN space with roughly 520 million a year run rate, steady growth, higher margins, and an unbeatable network under FSLY's aggressive management assisted by Limelight's amazing tech focused staff and contact list. We could easily see a union of this nature trading in the $150+ share range within a matter of months given how powerful they would be in unison.

De-Risking In a Major Way

Let's continue to assume the transaction between FSLY and LLNW is a marriage made in heaven and they get off their chairs and do it, does it solve some major issues? Yes, it does. Not only does it solve the issues mentioned above about technology synergies, a hybrid CDN formation, and being able to go toe-to-toe with NET and AKAM, but it also basically solves one of the biggest problems facing BOTH LLNW and FSLY, concentration risk.

Let's take a look at why FSLY dropped when it put out a lowered guidance for Q3. It was specifically aimed at lost revenues from TikTok, its largest customer. Conversely, Amazon is Limelight's largest customer with about 30% of its revenues. In fact, 77% of LLNW's revenues come from 20 clients, and some of this is also seen on the FSLY side of the equation as well.

A merger of these two companies cuts their concentration risk IN HALF and immediately. TikTok would no longer be 18% of FSLY revenues, if these two companies combine, it would drop significantly down to only 9% of revenues. For Limelight, if the merger took hold, Amazon would drop from 30% of revenues down to 15% or just under that number. This gives the combined entity so much more stability and so many more moves for pricing power and competition without the major risks associated with client concentration. It would also bring them power in the CDN space which attracts even more big clients as they become more competitive and stable with a superior combined product offering made much more robust.

Risk Factors

Potential risk factors must always be considered. In this case, the obvious risk factor would be LLNW continuing to go about its business on its own. It is growing revenues, but having pressure on margins in a highly competitive market. A second risk factor to consider, as mentioned above that a merger would clear up for both parties, is concentration risk. That would remain a high risk given current portion of revenues coming from large clients if there was any deterioration with those partnerships. We don't anticipate any deterioration, but it must always be considered.

Conclusion

Looking at Limelight Networks with a market cap of $440 million as of writing and the costs and time associated with building out a similar network, it's easy to see how saving the time and money would be ideal for multiple content providers or other players in the space.

While Limelight Networks stays at these crazy low valuation numbers, it is likely a target unless it pulls itself up on its own before a strategic transaction can occur and gets back towards $6 to $8 where we see it less likely to get acquired. Given a possible valuation of $1 billion to $1.25 billion, a steal for both buyer and target, a buyout in this modest range would be Limelight Networks' valuation between $8.20 and $10.25 pps. It also has no debt and $125 million in cash, or roughly $1 per share in cash as of the end of Q3.

Bozzie, I read the same news you did, but I still think baba under 290 was a buy, this decision came from the top and Ma understands he overstepped his bounds, Alibaba is just too ubiquitous right now and not slowing down, they have a piece of everything supported by their payment application. They surpassed IBM cloud storage profits. They are in the largest market that is that is expanding faster than the USA. I think without the aunt group IPO you were getting better value by Baba stock on the pullback. I see it going to 350-400. To have become much more conservative in my stock pinking one the last few months, but baba will be a winner.

Bozzie, I read the same news you did, but I still think baba under 290 was a buy, this decision came from the top and Ma understands he overstepped his bounds, Alibaba is just too ubiquitous right now and not slowing down, they have a piece of everything supported by their payment application. They surpassed IBM cloud storage profits. They are in the largest market that is that is expanding faster than the USA. I think without the aunt group IPO you were getting better value by Baba stock on the pullback. I see it going to 350-400. To have become much more conservative in my stock pinking one the last few months, but baba will be a winner.

In for 100k initially witch makes me nervous at times with the Chinese government watching closely... Although I keep reading party Officials are invested heavily....Skin in the game?.... I bought in the 280's on my second round of buying then again at 284 a few days ago.... For 15k per dip witch isn't much at 280.

My SPA average hasn't been near danger points but I bought in a while back...I feel real good about it long ..it'll split sometime down the road and that ANT IOP will be revived I'd guess.

Hope you're well SM..I'm digging in to green energy lately ..any insight?..Batteries ect?