|

| Welcome to Wall Street Brunch, our preview of stock market events for investors to watch during the upcoming week. You can also catch this article a day early by subscribing to the Stocks to Watch account for Saturday morning delivery. |

|---|

|

|---|

Outlook

Economic reports in the week ahead

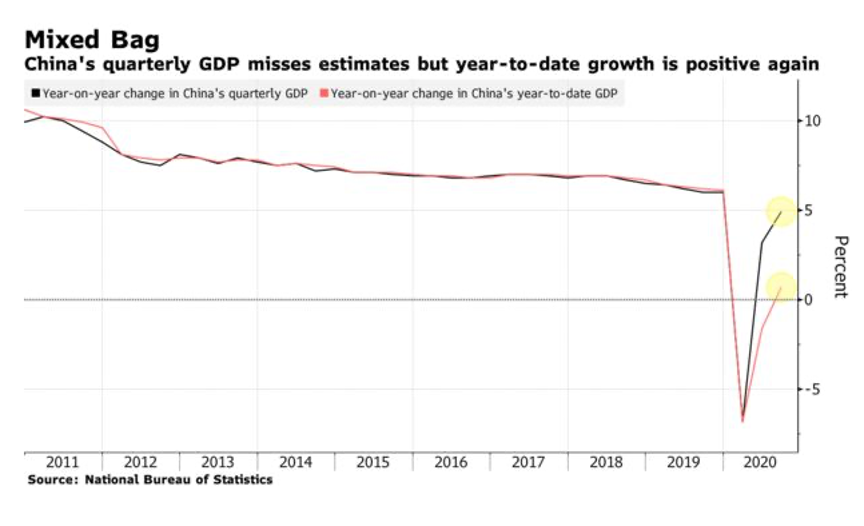

Shutterstock Big tech gets a big test next week when Apple (NASDAQ: AAPL), Facebook (NASDAQ: FB), Amazon (NASDAQ: AMZN) and Google-parent Alphabet (GOOGLE) all step up to the earnings plate after a sizzling run for the sector. Wedbush Securities thinks the reports will fuel up another tech rally into the end of the year, despite the general nervousness over stimulus and the election. Apple is the firm's favorite FAANG name, Microsoft (NASDAQ: MSFT) and Salesforce (NYSE: CRM) are the top cloud software picks and Zscaler (NASDAQ: ZS) is called the cybersecurity standout. There will also be some focus next week on a U.S. Senate hearing on Section 230 immunity, with Twitter's (NYSE: TWTR) Jack Dorsey, Facebook's Mark Zuckerberg and Google's Sundar Pichai all in the firing line. The economic calendar includes updates on new home sales, durable goods and consumer sentiment, as well as what will be an eye-popping Q3 GDP report. A historic 33% Q/Q surge in Q3 GDP is expected to be reported to follow on the 31.4% drop in Q2. Despite the strong bounce in Q3, the Fed's official forecast for this year is for GDP to decline 3.7%, which would mark the biggest single-year drop since at least World War II. Also on the schedule in the week ahead, look for some ideas to be generated out of the Robin Hood conference and SPAC creation Lordstown Motors Corp. ( RIDE) could burn some rubber when it starts trading. | |

|---|

Earnings

Hasbro (NASDAQ: HAS), NXP Semiconductors (NASDAQ: NXPI) and Boyd Gaming (NYSE: BYD) on October 26; Microsoft (NASDAQ: MSFT), BP (NYSE: BP), Caterpillar (NYSE: CAT), JetBlue (NASDAQ: JBLU), Centene (NYSE: CNC), Raytheon ( RTN), Pfizer (NYSE: PFE) and Merck (NYSE: MRK) on October 27; General Electric (NYSE: GE), General Dynamics (NYSE: GD), Mastercard (NYSE: MA), UPS (NYSE: UPS), Boeing (NYSE: BA), Sony (NYSE: SNE), Ford (NYSE: F), Western Digital (NASDAQ: WDC), Amgen (NASDAQ: AMGN), Visa (NYSE: V) and eBay (NASDAQ: EBAY); on October 28; Shopify (NYSE: SHOP), Twitter (NYSE: TWTR), Kraft Heinz (NASDAQ: KHC), Yum Brands (NYSE: YUM), Comcast (NASDAQ: CMCSA), Anheuser-Busch InBev (NYSE: BUD), Amazon (NASDAQ: AMZN), Apple (NASDAQ: AAPL), Google (NASDAQ: GOOG), Facebook (NASDAQ: FB) and Starbucks (NASDAQ: SBUX) on October 29; Exxon Mobil (NYSE: XOM), Chevron (NYSE: CVX), Phillips 66 (NYSE: PSX) and Under Armour (NYSE: UAA) on October 30.

Wedbush says it has seen strong cloud deal activity around Azure in the field during the September quarter with another Street "beat and raise" likely in the cards for Microsoft. "This current work from home environment is further catalyzing more enterprises to make the strategic cloud shift with Microsoft across the board with Azure growth likely in the 50% range. In many cases we are seeing enterprises accelerate their digital transformation and cloud strategy with Microsoft by 6 to 12 months as the prospects of a heavy remote workforce for the foreseeable future now looks in the cards with this COVID-19 backdrop," previews analyst Dan Ives. The firm continues to see MSFT as the core cloud name to play the transformational secular trend.

Investors are expected to key in on whatever details Apple ( AAPL) doles out on how iPhone 12 sales are going more than the Q3 tallies, although service revenue and non-iPhone hardware sales will still be closely watched. Earlier in the week, Morgan Stanley noted that average lead times were running 18.5 days for the iPhone 12 Pro and 10.1 days for the iPhone 12, up from 11.2 days and 0.2 days, respectively, when preorders began on October 1.

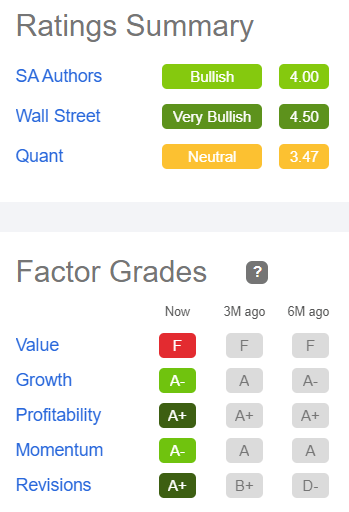

Go Deeper: Compare Seeking Alpha Quant Ratings on systems software stocks. | |

|---|

IPOs

Amerihome ( AHM) expects to price its IPO on October 28. The offering of 14.7M shares is expected to price in a range of $16 to $18. Biodesix ( BDSX) is also slated to price its IPO on October 28, with 4.17M shares due to go off in an expected range of $17 to $19. Other companies that could price IPOs next week include Allegro MicroSystems ( ALGM), Caliber Home Loans ( HOMS), Leslie's ( LESL), Root ( ROOT) and Mavenir ( MVNR). Keep an eye on avocado pure-play Mission Produce (NASDAQ: AVO) with the analyst quiet period expiring following the company's IPO. Shares have shown a modest gain from the IPO pricing level of $12. IPO lockups expire on Sprout Social (NASDAQ: SPT), Lyra Therapeutics (NASDAQ: LYRA) and Zentalis Pharmaceuticals (NASDAQ: ZNTL). Ant Group has secured the final regulatory approval to launch what is shaping up to be the world's largest initial public offering. The Mainland China leg of the IPO will be priced on October 27. Ant has been running a digital IPO roadshow across Asia, Europe and the U.S. to gauge investor interest. Go Deeper: Catch up on all the latest IPO news. | |

|---|

M&A

Shareholders with Jernigan Capital (NYSE: JCAP) are set to vote on the NextPoint deal on October 26. The tender offer for the Wright Medical (NASDAQ: WMGI)-Stryker (NYSE: SYK)combination arrives on October 28. Shareholders with Teladoc (NYSE: TDOC) and Livongo Health (NASDAQ: LVGO) will vote on the upcoming merger on October 29. | |

|---|

Healthcare

A FDA advisory committee meeting is on the calendar for Neovasc's (NASDAQ: NVCN) reducer device on October 27. The FDA action date arrives for Kala Pharmaceuticals' (NASDAQ: KALA) Eysuvis (loteprednol etabonate ophthalmic suspension) 0.25% for dry eye on October 30. The application is the company's second crack at approval. The Allogeneic Cell Therapies Summit 2020 from October 26-28 will feature presentations from Adicet Bio (NASDAQ: ACET), Allogene Therapeutics (NASDAQ: ALLO), Atara Biotherapeutics (NASDAQ: ATRA), bluebird bio(NASDAQ: BLUE), Precision Biosciences (NASDAQ: DTIL), Eli Lilly (NYSE: LLY) and TCR2 Therapeutics (NASDAQ: TCRR). | |

|---|

Events

Fisker: A special meeting of Spartan Energy Acquisition Corp. (NYSE: SPAQ) shareholders will take up a vote on the business combination with Fisker Inc. Following the proposed business combination, EV automaker Fisker will be listed on the New York Stock Exchange under the new ticker symbol FSR. The crazy intersection of electric vehicle stocks and SPAC interest is just getting more crowded, with QuantumScape-Kensington Capital (NYSE: KCAC), Lordstown Motors-DiamondPeak Holdings (NASDAQ: DPHC), Canoo-Hennessy Capital (NASDAQ: HCAC), XL Fleet-Pivotal Investment II (NYSE: PIC) and Romeo Systems-RMG (NYSE: RMG) the new combinations to watch.

Robin Hood Conference: The annual Robin Hood Investors Conference runs from October 28-29 in a virtual format with presentations scheduled from the White House's Lawrence Kudlow, AQR Capital Management's Cliff Asness, Greenlight Capital's David Einhorn, Citadel's Ken Griffin, Eli Lilly (NYSE: LLY) CEO Dave Ricks, Regeneron (NASDAQ: REGN) Co-President George Yancopoulous, Softbank (OTCPK: SFTBY) COO Marcelo Claure and Robinhood's Wes Moore. The Best Idea Blitz on October 27 at 2:30 p.m. ET features short pitches from Lakewood Capital Management, Lone Pine Capital, Saba Capital, Tusk Investment Partners, Sachem Head Capital Management and Glenview Capital Management.

OpenText:OpenText (NASDAQ: OTEX) will hold its OpenText World 2020 event from October 26-29. The conference brings together leading experts together to rethink the challenges facing business and society, with talks from OpenText's CEO, Chief Product Officer and engineering execs. Former Vice President Al Gore will also be a guest speaker.

Talking Cars: CarGurus (NASDAQ: CARG) is holding an event on October 26-27 designed to help educate automotive retail professionals on how to adapt to the rapidly changing landscape their industry has been facing over the past year. Virtual attendees will learn more about inventory acquisition strategies in this new environment and best practices for digital retail as the industry moves towards more online connections. CarGurus is scrapping for more sales after revenue dropped 38% Y/Y in Q2.

Investor meetings and business updates: Bed Bath & Beyond (NASDAQ: BBBY) holds a highly-anticipated investor day event on October 28. Also on the calendar, Veeva Systems (NYSE: VEEV) has an Analyst & Investor Day scheduled for on October 29. Kroger (NYSE: KR) has an investor update call scheduled on October 27. Chairman/CEO Rodney McMullen and CFO Gary Millerchip will provide an investor update to replace the traditional Investor Day event, which has been pushed back to spring 2021. Stitch Fix (NASDAQ: SFIX)President/COO Mike Smith is a speaker at a Barron's Live Event. His talk will delve into the rapid evolution of express delivery amid the pandemic and cover future e-commerce trends.

Go Deeper: See Seeking Alpha's Catalyst Watch for which presentations may stand out. | |

|---|

Barron's mentions

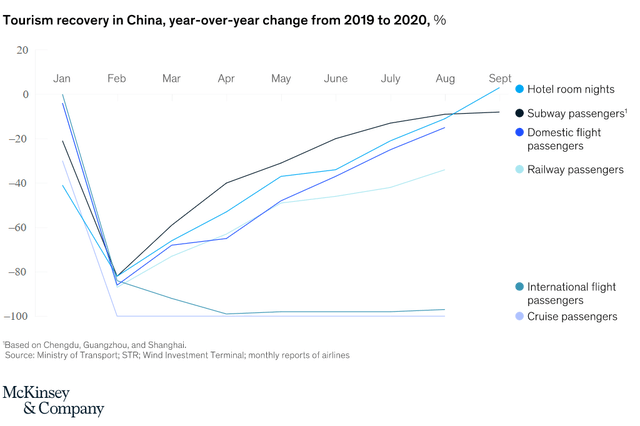

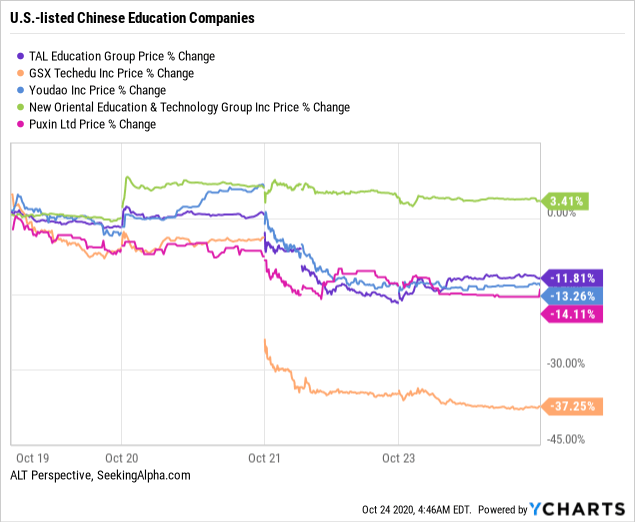

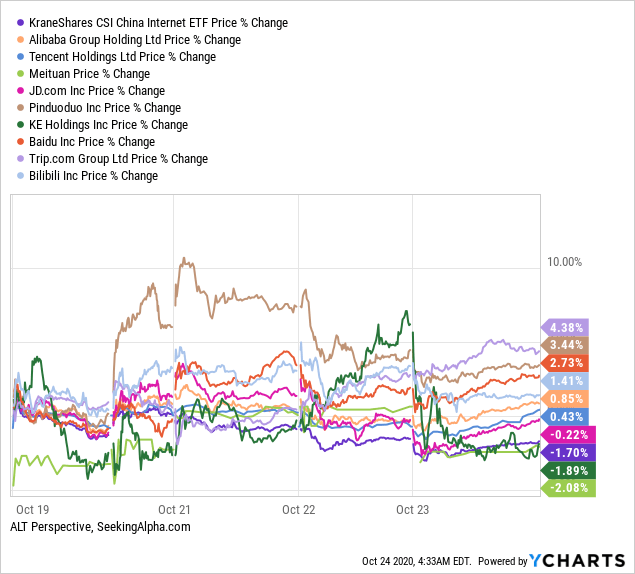

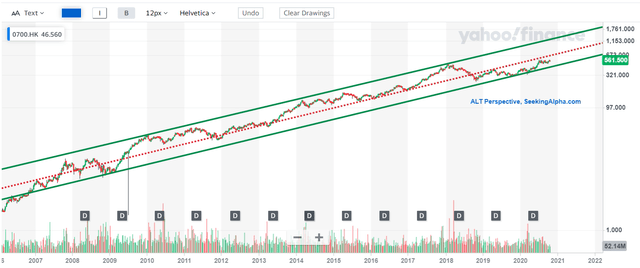

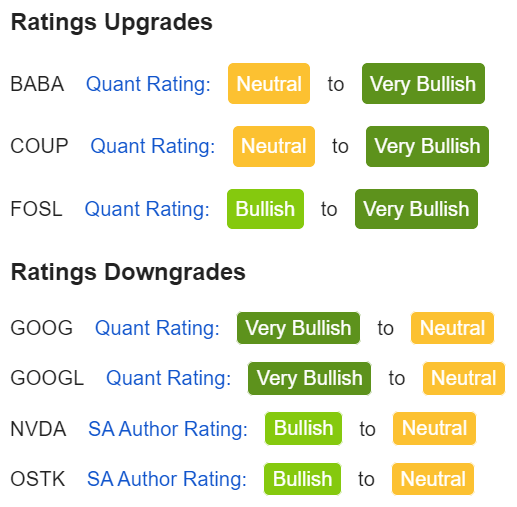

Coca-Cola (NYSE: KO) is profiled as an underappreciated post-pandemic play. The beverage stock is also seen as a hedge against a weaker dollar with 75% of it profit derived from outside the U.S. In the world of REITs, positive trends for medical real estate are seen lifting Community Healthcare Trust (NYSE: CHCT), Physicians Realty Trust (NYSE: DOC) and Healthcare Realty Trust (NYSE: HR). The publication suggests it may be time to look outside U.S. tech giants for future growth. Alibaba (NYSE:BABA), China Tourism Group Duty Free, Huazhu Group (NASDAQ:HTHT), Innovent Biologics (OTCPK:IVBIY), MercadoLibre (NASDAQ:MELI) and Reliance Industries make the list of intriguing ways to play emerging markets.

Sources: EDGAR, Bloomberg, CNBC, Automotive News, Reuters |

|---|

|

|---|

|

|---|

|

|---|

|

|---|

|

|