You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Silver thoughts...

- Thread starter TKE683

- Start date

[FONT="][h=1]SLV Just Broke Out to the Upside[/h]

[/FONT]

[FONT="]

Ken Trester

InvestorPlaceDecember 28, 2018

[/FONT]

https://finance.yahoo.com/news/slv-just-broke-upside-142153889.html

[/FONT]

[FONT="]

Ken Trester

InvestorPlaceDecember 28, 2018

[/FONT]

https://finance.yahoo.com/news/slv-just-broke-upside-142153889.html

[FONT="][h=1]SILVER WILL PAUSE BEFORE GOING HIGHER[/h]

[/FONT]

[FONT="]June 26, 2019[/FONT]

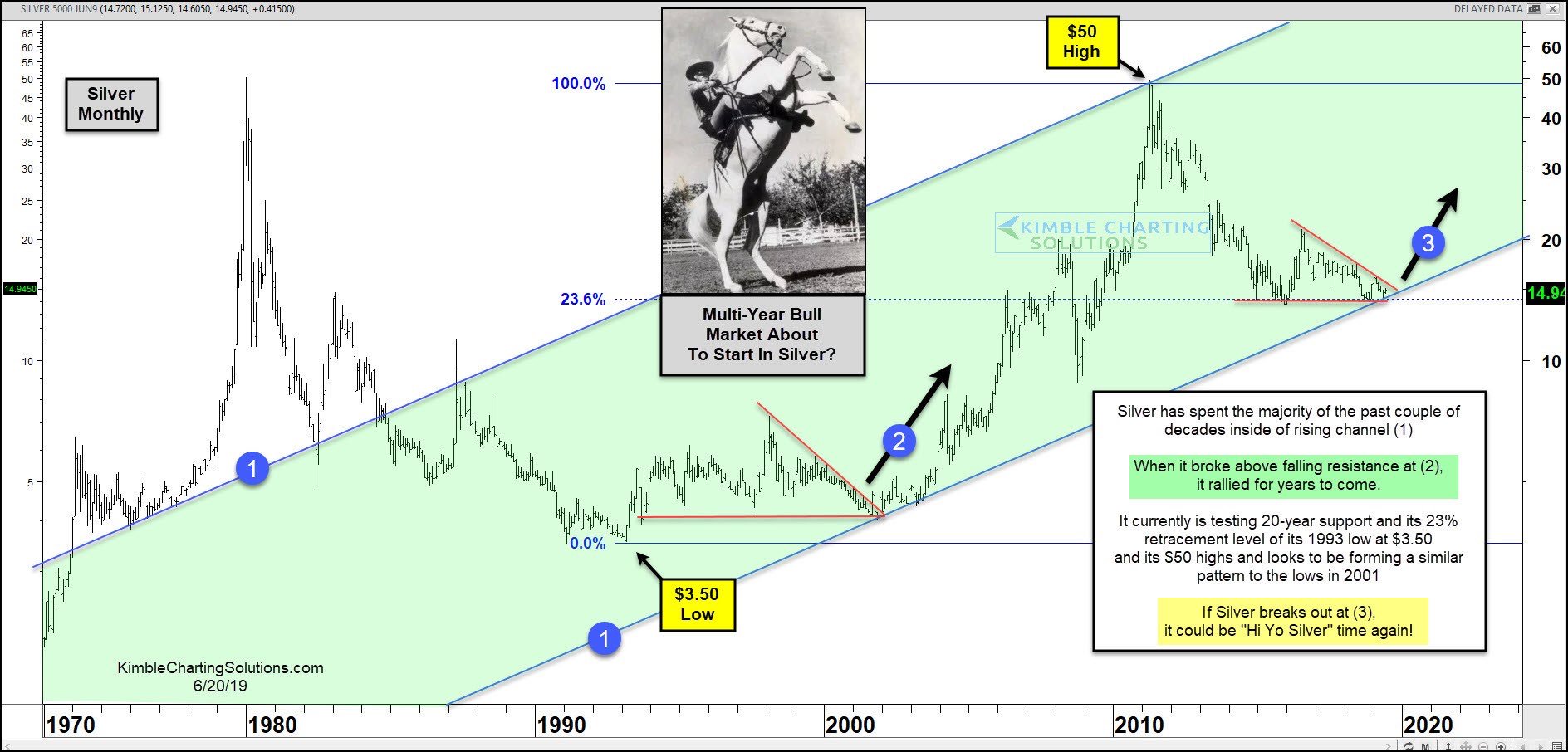

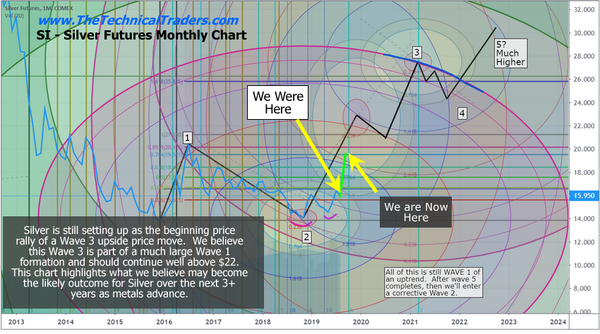

Silver will likely find resistance near $15.60 and move slightly lower before another upside price leg takes place. Both gold and silver have begun incredible price rallies over the past 10+ days and we believe this is just the start of a much bigger price trend.

We believe Silver, to be one of the absolute best potential trades and investment. It will likely pause just below $15.75, near the First Resistance level, rotate a bit lower (possibly towards $15.15), then attempt another rally towards the $16.50 level.

[h=3]DAILY SILVER CHART ANALYSIS[/h]The $15.60 to $15.75 resistance level can be seen on this chart by our RED highlighted price peaks. Additionally, the upper RESISTANCE ZONE between $16.15 and $16.78 is a big range that has historically been a key price channel.

My cycle and trend trading indicators are suggesting this move is far from over, yet we believe this move upward will happen in advancement legs and this first leg is nearing exhaustion. This is why we are issuing this warning to all investors right now. We believe a downward price rotation, a stalling price pattern, will set up where a technical trader will be able to acquire silver below $15.25 again very soon. The next leg higher may start fairly quickly as we don’t expect this rotation to extend out for many weeks.

[h=3]MONTHLY SILVER CHART[/h]This Monthly Silver chart with our proprietary Fibonacci price modeling system suggests upside targets of $17.00 (CYAN), $17.65 (GREEN), and $18.50 (DARK RED). Our RESISTANCE ZONE level on the chart, above, aligns perfectly with these objectives because the price would first have to rally into the RESISTANCE ZONE and break through this level to push to any higher target levels.

Therefore, we believe this upside price move won’t run into any solid resistance until reaching above the $16.30 level and possibly as high as the $16.75 to $17.00 level. At that point, the price of Silver should find real resistance, stall, and set up for the next breakout move higher.

At this point, if you have not been following our research and analysis of the precious metals sector and already positioned your trades for this move, you should get another chance to set up some long trades as this downside price rotation takes place. Remember, wait for silver to fall close to or below $15.25 before targeting your new trade entry. This bottom in silver may only last for a few short trading periods, so when it happens, be ready with your orders.

[h=3]CONCLUDING THOUGHTS:[/h]The next upside leg in Silver should rally for a total of about +6% to +10% targeting the $16.25 to $17.00 price level – the RESISTANCE ZONE. After that price level is reached and price consolidates to likely form another momentum base, another upside price leg should push the price of Silver towards our Monthly Fibonacci price targets – somewhere towards $18.00 to $18.50 before stalling again. !

I can tell you that huge moves are about to start unfolding not only in metals, or stocks but globally and some of these super cycles are going to last years. A gentleman by the name of Brad Matheny goes into great detail with his simple to understand charts and guide about this. His financial market research is one of a kind and a real eye-opener. PDF guide: 2020 Cycles – The Greatest Opportunity Of Your Lifetime

As a technical analysis and trader since 1997, I have been through a few bull/bear market cycles. I believe I have a good pulse on the market and timing key turning points for both short-term swing trading and long-term investment capital. The opportunities are massive/life-changing if handled properly.https://www.thetechnicaltraders.com/silver-will-pause-before-going-higher/

[/FONT]

end of the world shit going down daily on live tv

and what does the price of silver have to do with any of that

and what does the price of silver have to do with any of that

you tell me. why has gold rallied like it has?

these two are generally more correlated and expect to see that gap fill.

anytime you create the amount of money you just did at the push of a button (and leave the option open ended!), people begin to question where that limit is...so the nonstop fear-mongering/ratings-driving drivel exacerbates that to a point where some question what really has any tangible value if it really hits the fan. so I can see some connection there whether direct or not.

Silver, lots a a catching up to do Silver to gold ratio still way to high and I see big moves coming in both

AG , BEST PURE SILVER PLAY , ALSO LIKE FSM , SILV

YTD CHART

email this chart

email this chart

printer-friendly format

printer-friendly format

AG , BEST PURE SILVER PLAY , ALSO LIKE FSM , SILV

YTD CHART