We think Auto Parts Network (PRTS) is a speculative buy here on low valuation, two interesting deals that can possibly act as catalyst. But against that there are pretty intractable problems as well, most notably declining traffic to their websites.

Auto Parts Network appointed a new CEO, Lev Peker at the end of last month. Peker was involved in the company in various roles from 2008 to 2014 when the rot had already set in.

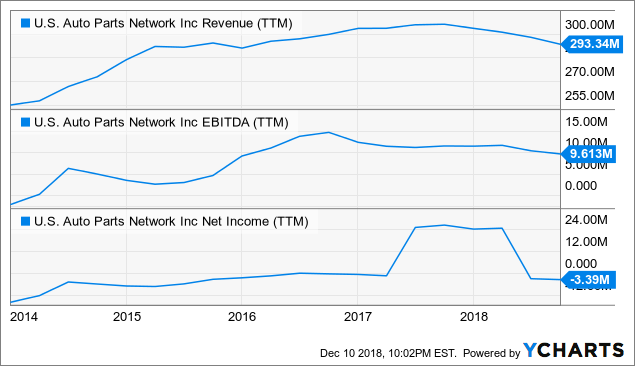

It is clear that something had to change as the fortunes of the company have been rather disappointing. The following is a pretty depressing chart:

Here are the last five years, which shows little progress, basically.

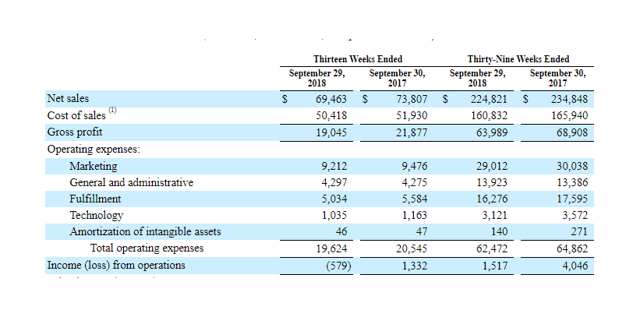

PRTS Revenue (TTM) data by YChartsAnd this quarter wasn't an exception with another decline in revenues, margins and profit:

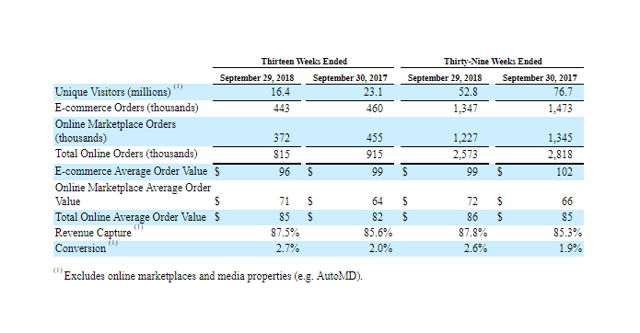

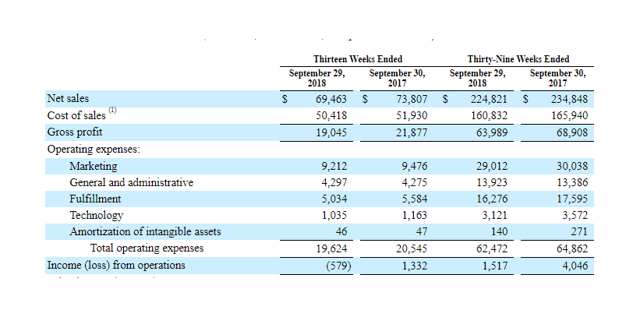

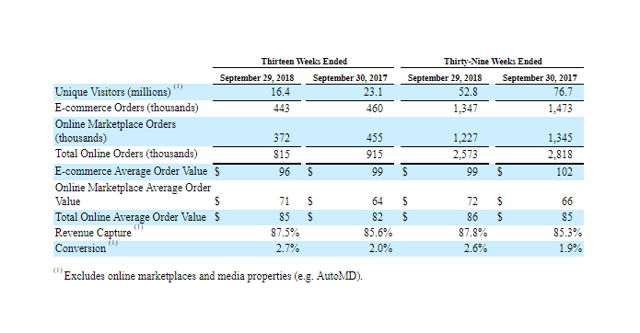

- Net sales were $69.5M compared to $73.8M.

- Total orders declined from 915K to 815K in Q3.

- Gross margin was 27.4% compared to 29.6% a year ago.

- Net income was $0.4M, or $0.01 per share, compared to $0.9M or $0.02 per diluted share.

- Adjusted EBITDA was $2.5M compared to $3.6M.

- E-commerce conversion increased 70 basis points to 2.7%, despite e-commerce orders being down 4% to 443K.

- Customer acquisition cost increased to $7.31 from $6.95 in Q3 last year.

Now, this might not be quite as bad as there were a couple of temporary issues at work, most notably:

- Issues with a channel partner.

- Issues with customs.

On the first, management argues (Q3CC):we also experienced lower marketplace sales with one of our channel partners due to a reduction in search presence on their platform. We've gone through similar cycles in the past, where a marketplace partner makes an update to their platform that adversely affects our business over the short-term and we expect this situation to be no different.

How would that be accomplished, well (Q3CC):In the past, we've responded positively to these changes to improve our presence with them over time. This is accomplished fundamentally with strong titles, images, applications, listing data and tremendous service levels.

The second was discussed in more detail during the Q2CC and involves a lawsuit that the company started against the US Customs and Border Protection for seizing imported automotive grilles on the grounds that they are deemed counterfeit. From the Q2CC:At the time, the court order was granted; Customs was holding approximately 200 of our shipping containers that carried not only the grilles alleged to be counterfeit but many of our other products as well. So although the seized automotive grilles initially accounted for less than 1% of our annual revenue, we began to experience out of stock rates across many other categories due to the backlog of containers which Customs were holding.

We also began to incur significant port and carrier fees resulting from the increased period of time for containers remained at the port.

With respect to the non-grille imports, the issue seems to have been resolved by the end of July but the company has stopped sourcing grilles from outside the US despite their firm belief that what they were importing didn't constitute any trademark infringement.

The company is now able to import freely again but sources grilles from within the US. The affair has cost them (10-Q):Despite the favorable court order, the Company continued to experience issues with product flow arising from CBP's inability to process the Company's shipping containers in an expeditious fashion. As a result, the Company incurred significant port and carrier fees resulting from the increased period of time the Company's containers remained at the port. The fees associated with this unreleased product, as well as the increased legal costs associated with the product seizures and the bonding litigation, aggregated to $1,784 through the third quarter of 2018. As of the end of the third quarter, all product not implicated by the trademark infringement allegations has been released by CBP.

These customs issues are not the only ones they have, the company is also feeling the effects of the trade war with China, most notably the last (third) round of tariffs (Q3CC):The third group was implemented on September 24 and was reported as $200 billion in scope. The third group covers the majority of our industry and impacts 14% of our net sales. As previously discussed, our goal in any tariffs will be to pass the cost along to consumers and maintain our gross profit.

And while these issues might be resolved at some point in the future, there also seem to be more structural issues at work (Q3CC):From a traffic perspective, we continue to see a decline in the third quarter, driven by lower organic traffic and a decline in paid traffic due to unfavorable customer acquisition economics.

There are two potentially much more favorable developments which could give future traffic and sales a considerable boost:

- Walmart.com has become a marketplace partner.

- The company implemented a "direct 1PL" model with Amazon.

These are of course the two behemoths of American retail, so any developments here can quickly move the needle for a company with roughly $300M in sales.

The marketplace agreement with Walmart.com enables the company to sell on Walmart.com and it is in the process of scaling this up.

Amazon is already a marketplace partner and the specifics provided on this direct 1PL model were not given beyond (Q3CC):But only began doing limited tests at the end of last quarter and the beginning of this quarter. So that assortment has been relatively limited, it's a little bit different model. So we wanted to make sure that we're set up success to scale those in the future. So that's very early on.

The word we have to go by is 'direct,' which suggests that they open a direct sales channel on Amazon, rather than competing with other parts providers on the Amazon marketplace.

That could both boost sales, increase margins, and perhaps reduce some of the fears that Amazon would completely take over online autoparts selling, so we take it as a positive. But unless more specifics are forthcoming, it's difficult to assess what the potential is here.

Sales channels

There are several things that can affect results:

- Shift in sales channels

- Shift in sales (branded versus white-label)

To start with the sales channels, here is an overview from the 10-Q:

The company sells:

There is something of a shift towards the latter (10-Q):For example, during the YTD Q3 2018 the online marketplaces sales grew to 36.2% of total sales, compared to 34.7% in the YTD Q3 2017 . Any mix shift in sales to marketplace channels could result in lower gross margins, and as a result, our business and financial results may suffer.

There is another effect as the sales on the marketplaces disproportionally involve branded products (rather than their white label stuff) which carry lower margins.

Fundamental problem

The company should, in principle, be well positioned, from the 10-Q (our emphasis):The U.S. Auto Care Association estimates that overall revenue from online sales of auto parts and accessories is projected to increase to approximately $13.2 billion in 2018 and more than double by 2023. Improved product availability, lower prices and consumers' growing comfort with digital platforms are driving the shift to online sales. We believe that we are well positioned for the shift to online sales due to our history of being a leading source for aftermarket automotive parts through online marketplaces and our network of websites.

Perhaps the inclusion of Walmart as a new channel can revive this, but we have to say the history isn't terribly encouraging. The growth in online sales isn't something new, and so far the company hasn't been able to benefit in a comprehensive way.

It's not so easy to put the finger on the why. The main stylized facts are:

- The website traffic numbers are declining.

- Traffic acquisition cost (mostly paid search) are increasing.

- The conversion of visitors into sales is ticking up of late, that doesn't seem to be the problem.

The most convincing explanation therefore comes from SA contributor Monocle Accounting Research, who argued in April this year:It's amazing to think that PRTS's unique viewers were down by more than 50% from the same quarter in 2011. While some of this decline was intended by the company as it has sought to rationalize the number of websites in its network, we believe the largely forgettable names of the company's remaining flagship websites -

www.autopartswarehouse.com,

www.carparts.com, and

www.jcwhitney.com - are at least partially responsible for the continued evaporation of consumer interest.

We currently have over 55,000 private label SKUs and over 1.5 million branded SKUs in our product selection.

We might also attent you to that article from Monocle, pointing out:

- A potential conflict of interest of a board member arguing for a share buyback when a large fund, OIP, was distributing shares.

- Possibly misleading investors. The company has indeed eliminated its revolver debt, but it has simply substituted it for letters of credit which were not included in all filings.

At least the latter has been remedied in the last 10-Q:The guaranteed total letters of credit balance at September 29, 2018 was $15,246 , of which $11,102 was utilized and included in accounts payable in our consolidated balance sheet.

Guidance

Management now expects 2018 sales to decline by mid-single digits (rather than low single digits)

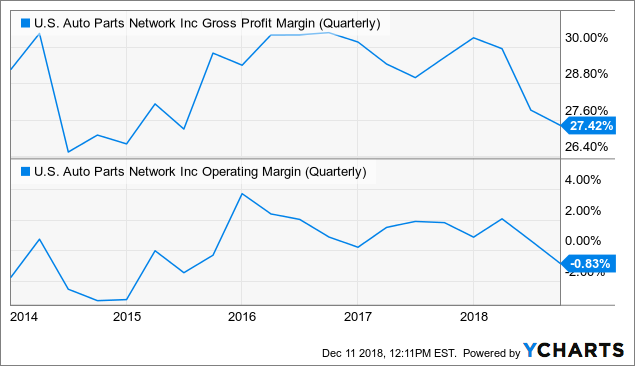

Margins

PRTS Gross Profit Margin (Quarterly) data by YChartsThe decrease in gross margins (from 29.6% last year to 27.4% in Q3) was primarily driven by cost associated with port and carrier fees from the customs issue as well as increased freight costs.

These custom issue is likely to be temporary so there looks to be some room for margin recovery here but not in the coming two quarters (Q3CC):Excluding these fees, gross margin would have been 28.7%. As a result of the amortization treatment of port and carrier fees from the Custom issue, we continue to expect gross margins to remain between 27% to 28% over the next two quarters.

While OpEx decreased $900K in dollar terms, it increased as a percentage of sales from 27.9% last year to 28.3% in Q3. From the 10-Q:

Cash

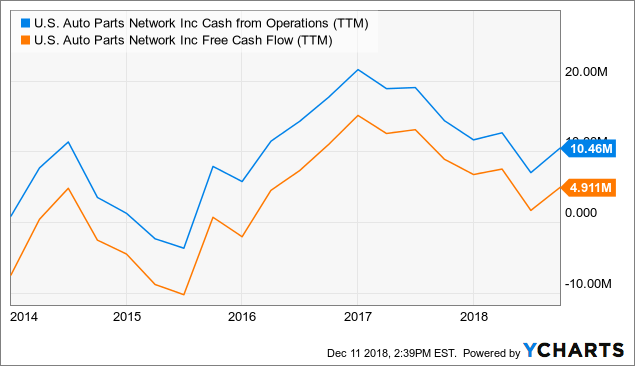

PRTS Cash from Operations (TTM) data by YChartsThe company still generates positive cash flow, but the Q3 figure was somewhat inflated by a (Q3CC):$5.5 million of the cash balance is attributable to the timing of payments with one of our shipping vendors, which we expect will normalize during the fourth quarter.

The company ended the quarter with $8.3M of cash on its books, up from $2.9M nine months ago and no debt.

Valuation

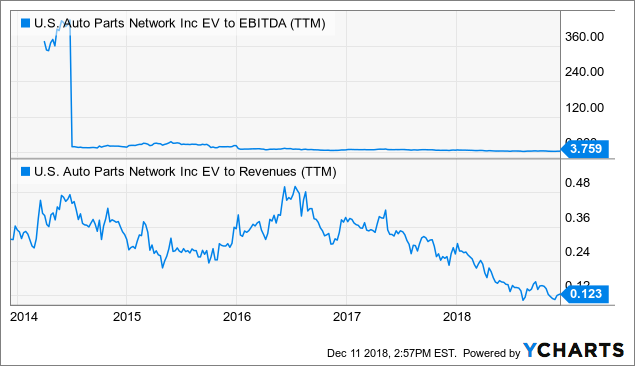

PRTS EV to EBITDA (TTM) data by YChartsValuation metrics have declined, which is no surprise given the company's lack of revenue growth.

Conclusion

The company has a history of disappointing growth against what seems to be a favorable background (the secular growth in online sales). Web traffic is declining. Growth of their high margin private label is declining. Traffic acquisition cost are increasing. It's not a pretty picture.

Against that stand a pretty cheap valuation, two new and potentially very significant deals with market behemoths, increased conversion rates and the potential to do better in the hands of a new CEO.

We would classify this as a speculative buy, with the two new deals and the low valuation as the main factors.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.