Crazy how ENPH has dropped. I got in initially at $54 and sold at $165. I'll wait before I try that name again.

Hey Bill

TWST too rode it to 200.00 now 105.00..I'll get back in for sure.

MH

|

| Global Market Comments March 8, 2021 Fiat Lux Featured Trade: (MARKET OUTLOOK FOR THE WEEK AHEAD, or WHAT’S UP WITH TECH?), (MSFT), (TSLA), (AAPL), (QQQ), (NVDA), (MU), (AMD), (BRKB), (ARRK), (ROM), (VIX), (FCX), (TLT), (BRKB), (TSLA), (JPM), (SPY), (QQQ), (SPX)

|

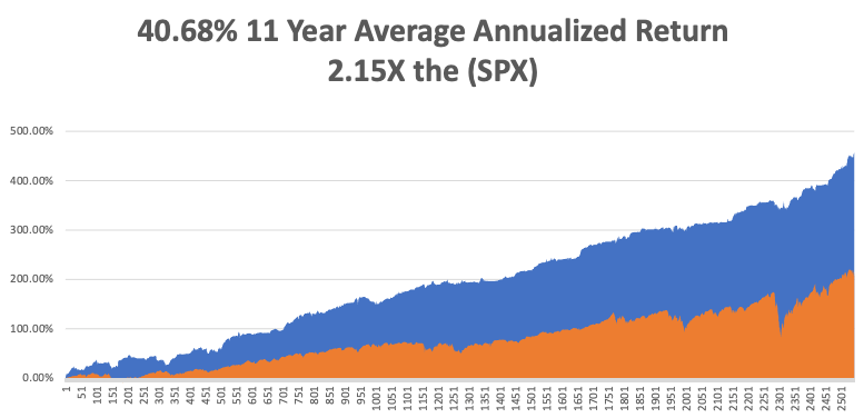

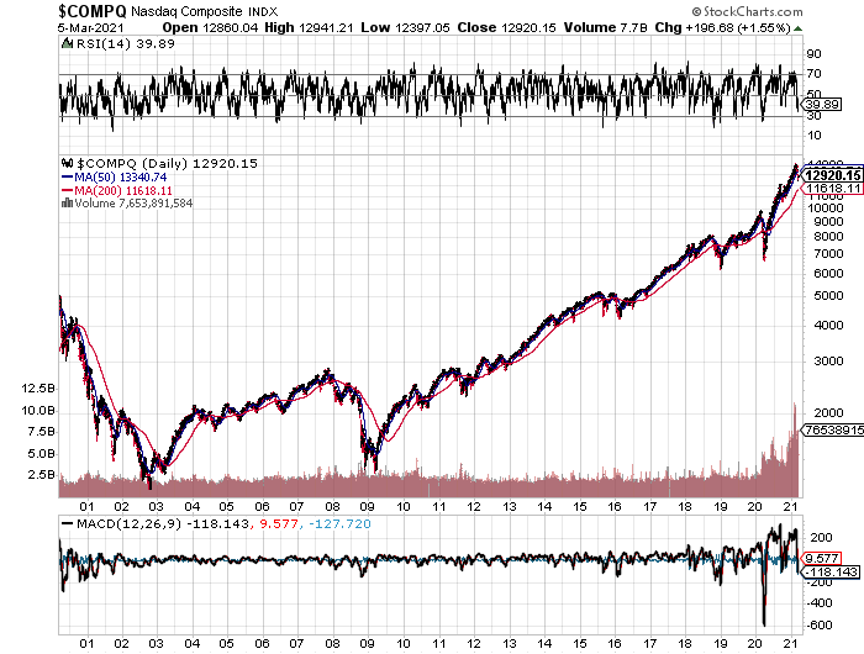

| � |

The Market Outlook for the Week Ahead, or What’s Up with Tech?That great wellspring of personal wealth, technology stocks, has suddenly run dry. The leading stock market sector for the past decade took some major hits last week. More stable stocks like Microsoft (MSFT) only shed 8%. Some of the highest beta stocks, like Tesla (TSLA), took a heart-palpitating 39% haircut in a mere two months. Have tech stocks had it for good? Has the greatest investment miracle of all times ground to a halt? Is it time to panic and sell everything? Fortunately, I have seen this happen many times before. Technology is a sector that is prone to extremes. Most of the time it is a hero, but occasionally it is a goat. When too many short-term traders sit in one end of the canoe, we all end up in the drink. This is one of those times. Technology stocks undeniably need a periodic shaking out. You need to get rid of the day traders, the hot money, the excessively leveraged, and find out who has been swimming without a swimsuit. The sector rotates between being ridiculously cheap to wildly overvalued. We are currently suffering the latter. During the past 12 years, Apple’s (AAPL) price earnings multiple has traded from 9X to 36X. It was a value play for the longest time, all the way up to 2016. Nobody believed in it. It is currently at a 33X multiple. While the stock has gone nowhere since August, its earnings have increased by more than 10%, and better is yet to come. After trading tech stocks for more than 50 years, I can tell you one thing with certainty. They always come back. And this time, they are in position to come back sooner, faster, and bigger than ever before. Remember the Great Dotcom Bust of 2000-2003? It lasted two years and nine months and saw NASDAQ (QQQ) crater by 82%, from 5,000 to 1,000. This time, it’s only dropped by 13%, by 1,850 from 14,250 to 12,400. I don’t see the selloff lasting much longer or lower, no more than another 5%-10% until September. For these are not your father’s technology stocks. There are only three numbers you need to know. Technology now accounts for a mere 2% of the US workforce, but a massive 27% of stock market capitalization and 37% of total us company earnings. A sector with such an impressive earnings output won’t fall for very long, or very far. The pandemic accelerated technological innovation tenfold. Companies now have mountains of cash with which to bring forward their futures. This is no more true than for biotech stocks. The technologies used to create Covid-19 vaccines can be applied to cure all human diseases. And they now have mountains of cash to implement this. So, I’ll be taking my time with tech stocks. But they are setting up the best long side entry point since the March 20, 2020 pandemic low. The biggest call remaining for 2021 is when to take profits and sell domestic recovery value stocks and rotate back into tech. But if you are running the barbell strategy I have been harping about since the presidential election, the work is already being done for you. Nonfarm Payroll comes in at a blockbuster 379,000 in February, far better than expected. It a preview of explosive numbers to comes as the US economy crawls out of the pandemic. That’s with a huge drag from terrible winter weather. The headline Unemployment rate is 6.2%. The U-6“discouraged worker” rate is still a sky-high 11%, those who have been jobless more than six months. Leisure & Hospitality were up an incredible 355,000 and Retail was up 41,000. Government lost 86,000 jobs. We are still 12 million jobs short of the year-ago trend. See what employers are willing to do when they see $20 trillion about to hit the economy? Will US GDP Growth hit 10% this year? That is the sky-high number that is being mooted by the Atlanta Fed for the first three months of 2021. The vaccine is working! They do tend to be high in the home of Gone with the Wind. This Yankee would be happy at 7.5% growth. Manufacturing just hit a three-year high as companies try to front-run imminent explosive growth. The only weak spot is employment, which is still at recessionary highs. Herd Immunity is here or says the latest numbers from Johns Hopkins University. New cases have plunged from 250,000 to 46,000 in a month, the fastest disease rollback in human history. We may be seeing new science at work here, where mass vaccinations combine with mass infections to obliterate the pandemic practically overnight. If true, the Dow has another 8,000 points in it….this year. Buy everything on dips. The economic data is about to get superheated. Warren Buffet’s Berkshire Hathaway blows it away, buying back a staggering $25 billion worth of his own stock in 2020, including $9 billion in the most recent quarter. It’s what I’m always looking for, buying quality at a discount. Warren pulled in $5 billion in profits during the last quarter of 2020, up 13.6% over a year earlier. Net earnings were up 23%. If Buffet, a long time Mad Hedge reader, is buying his stock, you should too. Buy (BRKB) on dips. It's also a great LEAP candidate as the best domestic recovery play out there. Rising rates have yet to hurt Real Estate, as the structural shortage of housing is so severe. Historically speaking, interest rates are still very low, even though the ten-year yield has soared by 82% in two months. Cash is still pouring into REITs coming off the bottom. Home prices always see their fastest moves up at the beginning of a new rate cycle as everyone rushes to beat unaffordable mortgages. The Chip Shortage worsens, with Tesla shutting down its Fremont factory for two days. The Texas deep freeze made matters much worse, where many US fabs are located, like Samsung, NXP Semiconductors, and Infineon Technologies. Buy (NVDA), (MU), and (AMD) on dips. Jay Powell lays an egg at a Wall Street Journal conference. He said it would take some time to return to a normal economy. The speed of the interest rate rise was “notable.” We are unlikely to return to maximum employment in a year. We couldn’t have heard of more dovish speech. But all that traders heard was that inflation was set to return, but will be “temporary.” That was worth a 600-point dive in the stock market and a 5-basis point pop in bond yields. My 10% correction is finally here! Here today, gone tomorrow. Cathie Wood was far and away the best fund manager of 2020. She, value investor Ron Baron, and I, were alone in the darkness four years ago saying that Tesla (TSLA) could rise 100-fold. Cathie’s flagship fund The Ark Innovation ETF (ARKK) rose a staggering 433% off the March 2020 bottom. Alas, it has since given up a gut-punching 30% since the February high, exactly when ten-year US Treasury bonds started to crash. Watch (ARKK) carefully. This is the one you want to own when rates stabilize. It’s like another (ROM). When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% to 120,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 120,000 here we come! It’s amazing how well selling tops and buying bottoms can help your performance. My Mad Hedge Global Trading Dispatch reached a super-hot 11.61% during the first five days in March on the heels of a spectacular 13.28% profit in February. The Dow Average is up a miniscule 4.00% so far in 2021. It was a week of frenetic trading, with the Volatility Index (VIX) all over the map. I took profits in Freeport McMoRan (FCX) and my short in US Treasury bonds (TLT) and buying Berkshire Hathaway (BRKB), Tesla (TSLA), JP Morgan (JPM). I opened new shorts in the S&P 500 (SPY) and the NASDAQ (QQQ). This is my fifth double digit month in a row. My 2021 year-to-date performance soared to 35.10%. That brings my 11-year total return to 457.65%, some 2.12 times the S&P 500 (SPX) over the same period. My 11-year average annualized return now stands at an unbelievable 40.68%. My trailing one-year return exploded to 110.25%, the highest in the 13-year history of the Mad Hedge Fund Trader. We need to keep an eye on the number of US Coronavirus cases at 29 million and deaths topping 525,000, which you can find here. The coming week will be a boring one on the data front. On Monday, March 8, at 11:00 AM EST, Consumer Inflation Expectations for February are out. On Tuesday, March 9, at 7:00 AM, The NFIB Business Optimism Indexfor February is published. On Wednesday, March 10 at 8:30 AM, the US Inflation Rate for February is printed. On Thursday, March 11 at 8:30 AM, Weekly Jobless Claims are out. On Friday, March 12 at 8:30 AM, the Producer Price Index for February is disclosed. At 2:00 PM, we learn the Baker-Hughes Rig Count. As for me, it was with great sadness that I learned of the passing of my old friend, Sheikh Zaki Yamani, the great Saudi Oil Minister. Yamani was a true genius, a self-taught attorney, and one of the most brilliant men of his generation. It was Yamani who triggered the first oil crisis in 1973, raising the price from $3 to $12 a barrel in a matter of weeks. Until then, cheap Saudi oil had been powering the global economy for decades. During the crisis, I relentlessly pestered the Saudi embassy in London for an interview for The Economist magazine. Then, out of the blue, I received a call and was told to report to a nearby Royal Air Force base….and to bring my passport. There on the tarmac was a brand-new Boeing 747 with “Kingdom of Saudi Arabia” emblazoned on the side in bold green lettering. Yamani was the sole passenger, and I was the other. He then gave me an interview that lasted the entire seven-hour flight to Riyadh. We covered every conceivable economic, business, and political subject. It led to me capturing one of the blockbuster scoops of the decade for The Economist. When Yamani debarked from the plane, I asked him “why me.” He said he saw a lot of me in himself and wanted to give me a good push along my career. The plane then turned around and flew me back to London. I was the only passenger on the plane. When the pilot heard I’d recently been flying Pilatus Porters for Air America, he even let me fly it for a few minutes while he slept on the cockpit floor. Yamani later became the head of OPEC. At one point, he was kidnapped by Carlos the Jackal and held for ransom, which the king readily paid. And if you wonder where I acquired my deep knowledge of the oil and energy markets, this is where it started. Today, the Saudis are among the biggest investors in alternative energy in California. We stayed in touch ever since. Stay healthy. John Thomas CEO & Publisher The Diary of a Mad Hedge Fund Trader

|

Quote of the Day“When a business manufactures and distributes a non-essential consumer product, the customer is the boss,” said Oracle of Omaha Warren Buffet.

|