You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Intersting thoughts

- Thread starter Bozzie

- Start date

JAZZ will post earnings after the bell.

Weak earnings support the argument JAZZ needs AVDL.

AVDL @ 8.40

LLNW finally seeing some action..Up 8% over the past two days

Rumors of a deal pending with major partner still swirling.[/QUOTE

JAZZ beats estimates ..a closer looks shows Xyrem with another record in sales up 8% year over year... 1.8 billion run rate.

AVDL has the replacement therapy for Xyrem /FT218 a once nightly therapeutic for narcolepsy. While JAZZ beat earnings the reason is sales of Xyrem exclusively..Again you see JAZZ has a problem if it doesn't move on AVDL...

Jazz is the largest biotechnology company you've never heard of and very aggressive on M&A.

https://www.investopedia.com/articl...m_source=yahoo&utm_medium=referral&yptr=yahoo

4th largest Jazz on the list below.

Jazz Pharmaceuticals PLC (JAZZ)

- Revenue (TTM): $2.2 billion

- Net Income (TTM): $0.5 billion

- Market Cap: $5.4 billion

- 1-Year Trailing Total Return: -30.0%

- Exchange: Nasdaq

Irish biopharmaceutical company Jazz Pharmaceuticals creates and commercializes drug products designed to address issues related to narcolepsy, psychiatry, pain management, and oncology. On March 25, the company announced FDA approval of its drug JZP-258 for the treatment of cataplexy or excessive daytime sleepiness.3

Below is a link to the deal JAZZ made with another company in 2016...JAZZ stepped up to buying a non approved top line phase 3 company mid trial.

Same situation AVDL finds itself in now.

https://www.prnewswire.com/news-rel...ire-celator-for-3025-per-share-300276751.html

who knows but the pieces fit like a glove.

I like how LLNW is building..Sticking with this has been painful but I do think there is good value here.

Todays indirect LLNW development..

Disney with its 100 million subscribers today announced "Mulan" its new streaming service..29.99 a month.

LLNW serves Disneys streaming along with the NBC's new Peacock network.. I'd think the market will take notice.

Up to 6.85 in the after-hours market.

Longish here.

https://www.cnbc.com/2020/08/04/disneys-mulan-coming-to-disney-in-september-for-29point99.html

Todays indirect LLNW development..

Disney with its 100 million subscribers today announced "Mulan" its new streaming service..29.99 a month.

LLNW serves Disneys streaming along with the NBC's new Peacock network.. I'd think the market will take notice.

Up to 6.85 in the after-hours market.

Longish here.

https://www.cnbc.com/2020/08/04/disneys-mulan-coming-to-disney-in-september-for-29point99.html

Just read the 17 page of transcripts from the JAZZ call yesterday the Q and A portion is pretty interesting.

Analysts questions mention AVDL as a coming product that could cut profits on existing therapeutics offered by JAZZ.

https://seekingalpha.com/article/43...2020-results-earnings-call-transcript?page=17

I thought this question was telling...AVDL is a one asset company after seeing off profitable units recently.

Operator

Thank you. And our next question comes from the line of Ken Cacciatore with Cowen & Company. Your line is open.

Ken Cacciatore

Thanks, guys. Bruce I was wondering if I had asked business development question a little bit differently, we're often used to you buying single product assets, I was wondering, would you at all be interested or think of a company that has a portfolio of products instead of a single asset, and maybe a company that you will view as mismanaged spending, so you can take your operating excellence and kind of put it to a company like that. So as we look into the future, could we be thinking about business development a little bit differently or could we expect business development a little bit differently than the past? Thank you.

Bruce Cozadd

Yeah, Ken, really great insightful question. You know, it does so happen that a number of deals over the last few years have been primarily focused around a one asset, in some cases entirely focused around one asset, but we clearly are interested in collaborations and potential acquisitions that would be more portfolio based. You've seen some of our development oriented transactions be around a basket of targets for that reason, but I think you're asking a different question, which is, you know, up to an including a commercial business with multiple assets and absolutely, that is of interest to us as well.

Analysts questions mention AVDL as a coming product that could cut profits on existing therapeutics offered by JAZZ.

https://seekingalpha.com/article/43...2020-results-earnings-call-transcript?page=17

I thought this question was telling...AVDL is a one asset company after seeing off profitable units recently.

Operator

Thank you. And our next question comes from the line of Ken Cacciatore with Cowen & Company. Your line is open.

Ken Cacciatore

Thanks, guys. Bruce I was wondering if I had asked business development question a little bit differently, we're often used to you buying single product assets, I was wondering, would you at all be interested or think of a company that has a portfolio of products instead of a single asset, and maybe a company that you will view as mismanaged spending, so you can take your operating excellence and kind of put it to a company like that. So as we look into the future, could we be thinking about business development a little bit differently or could we expect business development a little bit differently than the past? Thank you.

Bruce Cozadd

Yeah, Ken, really great insightful question. You know, it does so happen that a number of deals over the last few years have been primarily focused around a one asset, in some cases entirely focused around one asset, but we clearly are interested in collaborations and potential acquisitions that would be more portfolio based. You've seen some of our development oriented transactions be around a basket of targets for that reason, but I think you're asking a different question, which is, you know, up to an including a commercial business with multiple assets and absolutely, that is of interest to us as well.

Something sorta interesting was being in Portland yesterday ...that city has been vacated downtown and in ruins.

Around here you can see the desperation in people just getting by, the tip of the damage is just hitting the streets in a visual way.

Lot's of retail locations on the market here suddenly..I haunt loop net religiously.

This isn't going to end well if you're deep in the market right now...I've been wrong about this all along and finally joined in the rally reluctantly.

I'm worried like I haven't been. Again I've been wrong about this but I do think gravity will eventually win.. medium term.

Around here you can see the desperation in people just getting by, the tip of the damage is just hitting the streets in a visual way.

Lot's of retail locations on the market here suddenly..I haunt loop net religiously.

This isn't going to end well if you're deep in the market right now...I've been wrong about this all along and finally joined in the rally reluctantly.

I'm worried like I haven't been. Again I've been wrong about this but I do think gravity will eventually win.. medium term.

I got lucky last week. Flipped from BABA into FSLY on Thursday at $88. Closed at $116 today.

Never had it in the ass before, but this MUST be what it feels like.

Had a stop market order at $103 to protect profits. Closed at $108 then fell off a cliff after hours. My order was executed at $90!!

I'm getting a little fed up with the market lol. Took that money and bought more GLD. It was that or more SLV.

I'm now averaged in at GLD at $177 and SLV at $17.91.

Pass at $47.32 CND.

It's a very difficult to hold profits in this market without selling out and waiting on the right chop to buy back in..I don't like it and I get killed doing it most of the time.

I just trying to hide in some lower PE stocks with potential except BABA ..everything feels 70 on 30/70 line of thinking..(over bought). FSLY was way over bought and got crushed the last time it was over 70...from 102 to 88 a few months ago..man..it's a scary one volatility wise.

I just trying to hide in some lower PE stocks with potential except BABA ..everything feels 70 on 30/70 line of thinking..(over bought). FSLY was way over bought and got crushed the last time it was over 70...from 102 to 88 a few months ago..man..it's a scary one volatility wise.

I got in and out of DDOG and CRWD with profits. Got stupid with FSLY. The $103 stop would have secured some nice profits but I got complacent with what I thought was a safe stop market.

I'm convinced GOLD and SILVER are good for now. Even my offshore bet of over $2000 on gold is soaring again.

I'm convinced GOLD and SILVER are good for now. Even my offshore bet of over $2000 on gold is soaring again.

[h=1]Limelight: Improving And Now Offers Edge Services[/h]Aug. 6, 2020 1:42 PM ET|

10 comments

|

About: Limelight Networks, Inc. (LLNW)

Chetan Woodun

Medium-term horizon, value

Summary

Limelight is a CDN specialist which has experienced increased internet traffic made possible by COVID-19.

Consequently, revenues have increased and this looks to continue throughout this year.

This CDN play had a very low debt level till it raised capital through convertible senior notes.

The company's CDN performance is being improved but most importantly, it already has an edge services offering while Fastly is still developing one.

Valuations are on the low side and Limelight is a buy.

Limelight Networks (LLNW) is benefiting from the work-from-home movement and confinement measures through increased internet traffic including online video.

Streaming is more than half of Limelight's revenue.

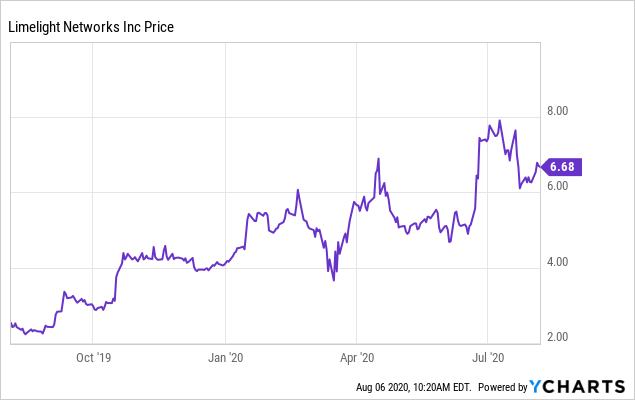

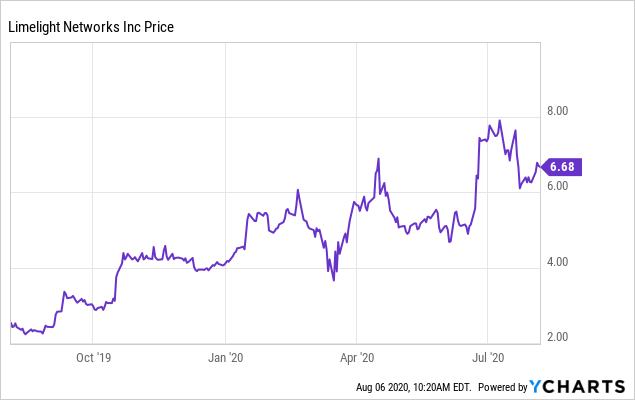

Consequently, the stock price has been on an uptrend since the end of March after successive upgrades by analysts on Wall Street. It is now more than 160% up since August last year, but due to the volatile path, investors are wondering whether there may be more upside.

I am bullish on the stock despite a 4.6% downside following a recent offering to sell $110 million of convertible senior notes due August 2025 in a private offering. I believe that valuations are still on the low side.

Figure 1: Stock price evolution

Data by YChartsI further believe that the company is on its way to be a bigger player not only in the CDN space but also in the newer edge services.

Data by YChartsI further believe that the company is on its way to be a bigger player not only in the CDN space but also in the newer edge services.

I analyze the company's financial capacity to embark on its growth path, being aware that it has deceived investors in the past in terms of revenue objectives.

I also compare with peer Fastly (FSLY) and make sure to cover the challenges as well.

First, I start with providing a view of the market.

[h=2]CDN providers and COVID-19 demand[/h]Internet traffic is exploding driven mainly by video applications like conferencing and movies.

Now CDN providers like Limelight provide higher speed to their customers by copying the content library from the server where it is located to many other dispersed ones closest to the client.

Following the advent of COVID-19, the company has seen a surge in traffic, especially video as people turn to online video for communication, news, entertainment and exercising.

Also, some live events which boost internet traffic are starting to return, albeit under strict health and safety conditions just like British soccer.

Interestingly, traffic levels in the second quarter reached record levels and the executives expect this to continue "much faster than overall Internet growth rates".

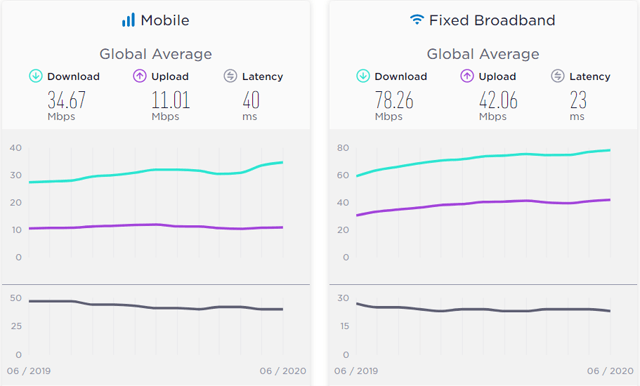

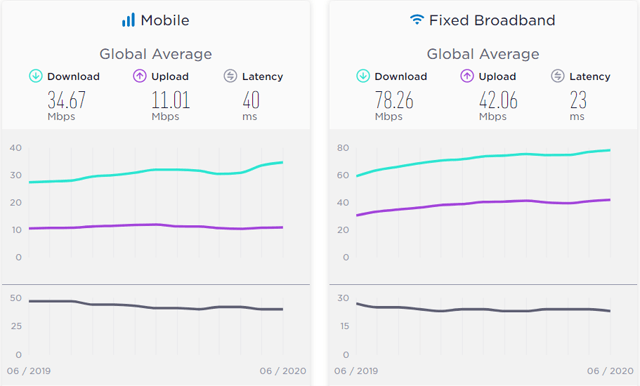

Further research from independent sources also supports the case for internet traffic to be on a steady progression.

Figure 2: Global internet speeds on a steady incremental path

Source: Speedtest.net

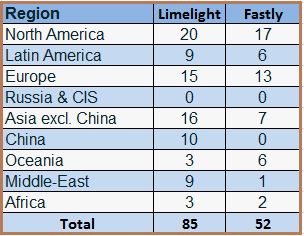

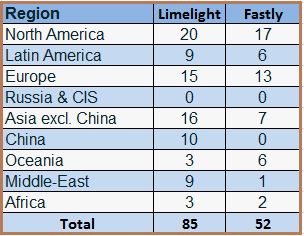

Exploring this further, one of Limelight's strategies is to expanding capacity by rapidly expanding existing POPs (points of presence) throughout the world. Consequently, I checked and found that the company effectively had more network points than peer Fastly.

Figure 3: Number of network points

Source: CDN planet

Normally, more network points mean more traffic and therefore better revenue growth.

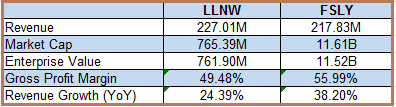

However, this is not the case and Fastly has comparable revenues and superior revenue growth despite an inferior number of network points.

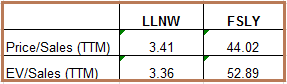

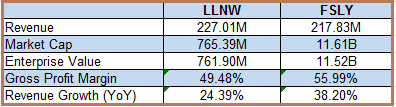

Figure 4: Comparing Limelight and Fastly in terms of some key metrics

Source: Seeking Alpha

This means that Fastly is more efficient at generating revenues.

Additional research in Trustradius which is a technology review website reveals that Fastly offers better performance.

I also confirmed this observation from CDN planet where Fastly has a better "Change propagation delay" specification.

Therefore, my next step was to investigate how Limelight is addressing the issue.

It is indeed doing so, through an optimization and proactive management of the network which are the normal resolution actions for network saturation issues.

More importantly, this is not just a statement by the executives but is backed by a strategic objective of more efficiently managing the increasing traffic loads and thus, delivering higher quality.

Interestingly, to the credit of Limelight this time, reviewers on Trustradius also mention that they had trouble implementing Fastly into the PaaS infrastructures of vendors like AWS or Azure.

This is a point which I explore further in the wider public cloud context.

[h=2]Edge or serverless computing services[/h]With the increasing popularity of public clouds like Azure and AWS, the issue of costly infrastructure spends has been solved or rather been extended to a longer period through the OPEX model.

However, this has not solved the problem of latency at the edge (customer premises), that is where the source of data is located. Here, CDN providers have an important role to play in making the application faster through the development of edge technology which is different from conventional CDN services.

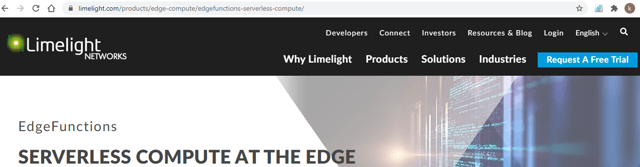

Now, only a handful of CDN companies actually have a functional edge service (also referred to as serverless compute) and Limelight is one of them as I verified from the company's website.

Figure 5: Limelight serverless Compute (live product)

Source: Limelight.com

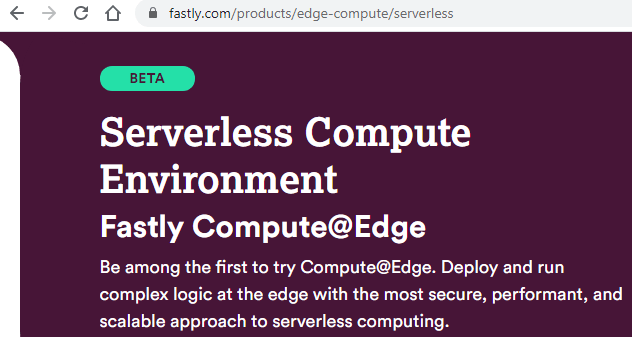

However, upon verification from Fastly's website, I found that the company is still at beta testing phase for its edge services.

Figure 6: Fastly serverless Computing environment (still in Test mode)

Source: Fastly.com

Thinking aloud, demand for Edge services should be growing as more and more businesses migrate to public cloud. In fact, Limelight has already closed a deal with a global OTT provider who will be using both its video delivery CDN and newly-developed edge services.

As per the executives, another large customer is undergoing a proof of concept and one of the preliminary findings is that they have much better performance to access their cloud computing equipment using Limelight's edge solution.

They also expect a contract to be signed soon.

Therefore, going forward, especially in context of the coronavirus speeding up migration of compute workloads to the cloud, I see revenues from edge services start to trickle in 2020 and gradually turn into a flow as from 2021.

For Limelight, this means more income.

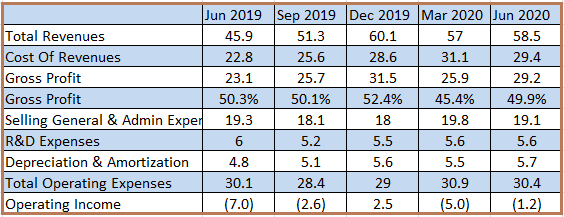

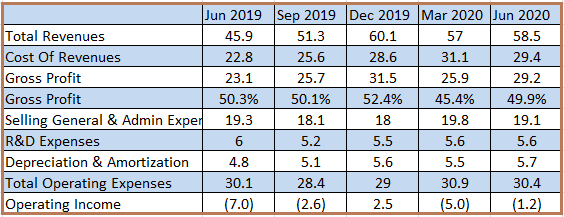

[h=2]Coronavirus-led revenues[/h]First, revenues were up 28% year over year.

Second, gross profits excluding network depreciation costs have also increased compared to the last year driven by improving asset utilization and lower costs for raw materials.

Going forward, I see the setting up of a self-service portal for developers referred to as the Developer Central as bringing more efficiency in terms of human resources.

The reason is that by acting as a one-stop source of documentation and software development kits, the portal will bring more interaction within developers and free up man-hours in the software development department for re-allocation to other tasks.

Figure 7: Statement of income

Source: Seeking Alpha

Moreover, international customers accounted for 38% of total revenue in Q2-2020 with approximately 10% of revenues in non-U.S. dollar-denominated currencies, primarily due to the fluctuation in the GBP (British pound).

Foreign exchange headwinds in the quarter amounted to approximately $100,000. This amount is meaningfully equivalent to the average revenue for one customer.

Now going forward, the pound seems to be on an uptrend and according to Citibank (C), the upside should continue thereby reducing currency headwinds.

Figure 8: GBP/USD trend

Source: Dailyfx.com

Source: Dailyfx.com

On an even more positive note, the company has raised revenue expectations to $235 million (mid-point). As a matter of fact Limelight has already generated $115.5 million and according to me, this guidance reflects more of a prudent approach.

Now, in order to drive a 15% growth, you need capital and therefore capex should be up to account for investments made in infrastructure. However, capex has stayed at the same level indicated for the year 2020 back in December 2019.

This can only be explained by a re-allocation of resource in areas of need and therefore higher efficiency.

With Limelight looking strong, I now dig deeper into the finances.

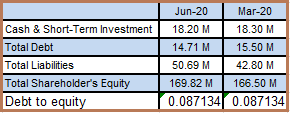

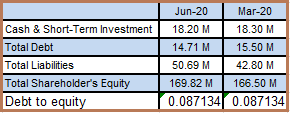

[h=2]Balance sheet[/h]The debt was on the low side as at the end of June with a debt to equity of 0.09.

Figure 9: Some balance sheet metrics.

Source: Seeking Alpha

Now, the convertible unsecured senior notes offering aimed at raising $106 million in terms of net proceeds must have done more than just raised a few eyebrows. This could explain the reason for the minor sell-off, in addition to some profit-taking.

Going deeper, the bulk of the amount raised in the private offering will be used for working capital and other general corporate purposes.

Based on details from the transcripts, I anticipate the cash being used for the following purposes:

As per the SEC filing, concerning the capped call transactions:

"The cap price of the capped call transactions will initially be $13.38 per share of Limelight's common stock, which represents a premium of 100% over the last reported sale price of Limelight's common stock on The Nasdaq Global Select Market of $6.69 per share on July 22, 2020, and is subject to certain adjustments under the terms of the capped call transactions."

Now, the intrinsic value of this call option as at July 22, 2020 was $6.69 (13.38 - 6.69) meaning a 100% premium when taking into consideration that the company was trading at $6.69.

Putting things into perspective for investors focused on liabilities, this is a company which generates $200 million yearly and has availed of a $100 million debt.

For that matter, a convertible note is just another debt instrument which pays interests, but also carries the right to exchange interest/principal cash into an equity interest.

However, looking at the positive side, the debt to equity ratio despite increasing will still be less than 1.

Still, taking into consideration additional debt burden, I look at the risks, bearing in mind that COVID-19 not only comes with opportunities but also with challenges. This is in addition to possible currency headwinds I talked about earlier.

[h=2]Risks[/h]First, Limelight has to set up POPs throughout the world. Therefore, travel and operational restrictions resulting from COVID-19 can be challenging in terms of meeting objectives.

Also, there have been supply-chain challenges resulting from the fact that Limelight uses hardware components from different manufacturers to install its software. However, these have been resolved during the first quarter as the company has already diversified sourcing.

Overall, learning from the first half of the year, when the company managed to add capacity and thus benefit from COVID-19 demand, I am confident that this will be the case for H2-2020 as well.

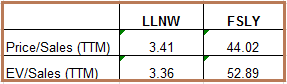

[h=2]Valuations and key takeaways[/h]With a trailing price to sales ratio of 3.4 compared to peer Fastly, Limelight is currently undervalued.

Figure 10: Comparing the valuations

Source: Seeking Alpha

Now, considering that the CDN market will be worth a whopping $50 billion by 2025 and we are still faced with a pandemic which promotes internet usage, not only in the US but throughout the world, revenues should continue to be on an uptrend.

Moreover, due to Limelight improving quality of service, I see the company delivering better performance and winning revenues from the competition.

More importantly, the pipeline now includes edge services to differentiate its product offerings.

Furthermore, the low end of adjusted EBITDA guidance has been revised upwards by the management from $25 million to $28 million.

Also, for risk-averse investors, it is worth noting that the CDN company is not contracting this "debt" for re-financing purposes but predominantly for operational and growth purposes.

At a current price of $6.68, Limelight is a buy. I expect an upside of 100% within the end of this year.

For traders, one important date to bear in mind is the 17th of this month when full-contact practice for the NFL starts.

In this respect, the NFL has hired BioReference Laboratories to perform the entirety of its COVID-19 testing.

10 comments

|

About: Limelight Networks, Inc. (LLNW)

Chetan Woodun

Medium-term horizon, value

(839 followers)

Summary

Limelight is a CDN specialist which has experienced increased internet traffic made possible by COVID-19.

Consequently, revenues have increased and this looks to continue throughout this year.

This CDN play had a very low debt level till it raised capital through convertible senior notes.

The company's CDN performance is being improved but most importantly, it already has an edge services offering while Fastly is still developing one.

Valuations are on the low side and Limelight is a buy.

Limelight Networks (LLNW) is benefiting from the work-from-home movement and confinement measures through increased internet traffic including online video.

Streaming is more than half of Limelight's revenue.

Consequently, the stock price has been on an uptrend since the end of March after successive upgrades by analysts on Wall Street. It is now more than 160% up since August last year, but due to the volatile path, investors are wondering whether there may be more upside.

I am bullish on the stock despite a 4.6% downside following a recent offering to sell $110 million of convertible senior notes due August 2025 in a private offering. I believe that valuations are still on the low side.

Figure 1: Stock price evolution

I analyze the company's financial capacity to embark on its growth path, being aware that it has deceived investors in the past in terms of revenue objectives.

I also compare with peer Fastly (FSLY) and make sure to cover the challenges as well.

First, I start with providing a view of the market.

[h=2]CDN providers and COVID-19 demand[/h]Internet traffic is exploding driven mainly by video applications like conferencing and movies.

Now CDN providers like Limelight provide higher speed to their customers by copying the content library from the server where it is located to many other dispersed ones closest to the client.

Following the advent of COVID-19, the company has seen a surge in traffic, especially video as people turn to online video for communication, news, entertainment and exercising.

Also, some live events which boost internet traffic are starting to return, albeit under strict health and safety conditions just like British soccer.

Interestingly, traffic levels in the second quarter reached record levels and the executives expect this to continue "much faster than overall Internet growth rates".

Further research from independent sources also supports the case for internet traffic to be on a steady progression.

Figure 2: Global internet speeds on a steady incremental path

Source: Speedtest.net

Exploring this further, one of Limelight's strategies is to expanding capacity by rapidly expanding existing POPs (points of presence) throughout the world. Consequently, I checked and found that the company effectively had more network points than peer Fastly.

Figure 3: Number of network points

Source: CDN planet

Normally, more network points mean more traffic and therefore better revenue growth.

However, this is not the case and Fastly has comparable revenues and superior revenue growth despite an inferior number of network points.

Figure 4: Comparing Limelight and Fastly in terms of some key metrics

Source: Seeking Alpha

This means that Fastly is more efficient at generating revenues.

Additional research in Trustradius which is a technology review website reveals that Fastly offers better performance.

I also confirmed this observation from CDN planet where Fastly has a better "Change propagation delay" specification.

Therefore, my next step was to investigate how Limelight is addressing the issue.

It is indeed doing so, through an optimization and proactive management of the network which are the normal resolution actions for network saturation issues.

More importantly, this is not just a statement by the executives but is backed by a strategic objective of more efficiently managing the increasing traffic loads and thus, delivering higher quality.

Interestingly, to the credit of Limelight this time, reviewers on Trustradius also mention that they had trouble implementing Fastly into the PaaS infrastructures of vendors like AWS or Azure.

This is a point which I explore further in the wider public cloud context.

[h=2]Edge or serverless computing services[/h]With the increasing popularity of public clouds like Azure and AWS, the issue of costly infrastructure spends has been solved or rather been extended to a longer period through the OPEX model.

However, this has not solved the problem of latency at the edge (customer premises), that is where the source of data is located. Here, CDN providers have an important role to play in making the application faster through the development of edge technology which is different from conventional CDN services.

Now, only a handful of CDN companies actually have a functional edge service (also referred to as serverless compute) and Limelight is one of them as I verified from the company's website.

Figure 5: Limelight serverless Compute (live product)

Source: Limelight.com

However, upon verification from Fastly's website, I found that the company is still at beta testing phase for its edge services.

Figure 6: Fastly serverless Computing environment (still in Test mode)

Source: Fastly.com

Thinking aloud, demand for Edge services should be growing as more and more businesses migrate to public cloud. In fact, Limelight has already closed a deal with a global OTT provider who will be using both its video delivery CDN and newly-developed edge services.

As per the executives, another large customer is undergoing a proof of concept and one of the preliminary findings is that they have much better performance to access their cloud computing equipment using Limelight's edge solution.

They also expect a contract to be signed soon.

Therefore, going forward, especially in context of the coronavirus speeding up migration of compute workloads to the cloud, I see revenues from edge services start to trickle in 2020 and gradually turn into a flow as from 2021.

For Limelight, this means more income.

[h=2]Coronavirus-led revenues[/h]First, revenues were up 28% year over year.

Second, gross profits excluding network depreciation costs have also increased compared to the last year driven by improving asset utilization and lower costs for raw materials.

Going forward, I see the setting up of a self-service portal for developers referred to as the Developer Central as bringing more efficiency in terms of human resources.

The reason is that by acting as a one-stop source of documentation and software development kits, the portal will bring more interaction within developers and free up man-hours in the software development department for re-allocation to other tasks.

Figure 7: Statement of income

Source: Seeking Alpha

Moreover, international customers accounted for 38% of total revenue in Q2-2020 with approximately 10% of revenues in non-U.S. dollar-denominated currencies, primarily due to the fluctuation in the GBP (British pound).

Foreign exchange headwinds in the quarter amounted to approximately $100,000. This amount is meaningfully equivalent to the average revenue for one customer.

Now going forward, the pound seems to be on an uptrend and according to Citibank (C), the upside should continue thereby reducing currency headwinds.

Figure 8: GBP/USD trend

Source: Dailyfx.com

Source: Dailyfx.comOn an even more positive note, the company has raised revenue expectations to $235 million (mid-point). As a matter of fact Limelight has already generated $115.5 million and according to me, this guidance reflects more of a prudent approach.

Now, in order to drive a 15% growth, you need capital and therefore capex should be up to account for investments made in infrastructure. However, capex has stayed at the same level indicated for the year 2020 back in December 2019.

This can only be explained by a re-allocation of resource in areas of need and therefore higher efficiency.

With Limelight looking strong, I now dig deeper into the finances.

[h=2]Balance sheet[/h]The debt was on the low side as at the end of June with a debt to equity of 0.09.

Figure 9: Some balance sheet metrics.

Source: Seeking Alpha

Now, the convertible unsecured senior notes offering aimed at raising $106 million in terms of net proceeds must have done more than just raised a few eyebrows. This could explain the reason for the minor sell-off, in addition to some profit-taking.

Going deeper, the bulk of the amount raised in the private offering will be used for working capital and other general corporate purposes.

Based on details from the transcripts, I anticipate the cash being used for the following purposes:

- Aggressive expansion of capacity in terms of geographical coverage by having more POPs.

- Promoting edge services through aggressive marketing and possibly acquiring a company already active in the space.

In addition to the organic growth in the CDN space, we believe edge services represents the logical next step in our evolution. We offer an existing globally distributed network that is already connected to over 1,000 ISPs. We have a sales team dedicated to working with existing and new customers to provide ultra-low latency capabilities for a developing and expanding suite of needs. We are working with the growing pipeline of use cases to capitalize on this opportunity over the next several years."

Furthermore, in addition to operational expenses, the company intends to use around $14.4 million to pay the cost of the capped call transactions, which is basically the right to buy the stock of the company at a specific price.

As per the SEC filing, concerning the capped call transactions:

"The cap price of the capped call transactions will initially be $13.38 per share of Limelight's common stock, which represents a premium of 100% over the last reported sale price of Limelight's common stock on The Nasdaq Global Select Market of $6.69 per share on July 22, 2020, and is subject to certain adjustments under the terms of the capped call transactions."

Now, the intrinsic value of this call option as at July 22, 2020 was $6.69 (13.38 - 6.69) meaning a 100% premium when taking into consideration that the company was trading at $6.69.

Putting things into perspective for investors focused on liabilities, this is a company which generates $200 million yearly and has availed of a $100 million debt.

For that matter, a convertible note is just another debt instrument which pays interests, but also carries the right to exchange interest/principal cash into an equity interest.

However, looking at the positive side, the debt to equity ratio despite increasing will still be less than 1.

Still, taking into consideration additional debt burden, I look at the risks, bearing in mind that COVID-19 not only comes with opportunities but also with challenges. This is in addition to possible currency headwinds I talked about earlier.

[h=2]Risks[/h]First, Limelight has to set up POPs throughout the world. Therefore, travel and operational restrictions resulting from COVID-19 can be challenging in terms of meeting objectives.

Also, there have been supply-chain challenges resulting from the fact that Limelight uses hardware components from different manufacturers to install its software. However, these have been resolved during the first quarter as the company has already diversified sourcing.

Overall, learning from the first half of the year, when the company managed to add capacity and thus benefit from COVID-19 demand, I am confident that this will be the case for H2-2020 as well.

[h=2]Valuations and key takeaways[/h]With a trailing price to sales ratio of 3.4 compared to peer Fastly, Limelight is currently undervalued.

Figure 10: Comparing the valuations

Source: Seeking Alpha

Now, considering that the CDN market will be worth a whopping $50 billion by 2025 and we are still faced with a pandemic which promotes internet usage, not only in the US but throughout the world, revenues should continue to be on an uptrend.

Moreover, due to Limelight improving quality of service, I see the company delivering better performance and winning revenues from the competition.

More importantly, the pipeline now includes edge services to differentiate its product offerings.

Furthermore, the low end of adjusted EBITDA guidance has been revised upwards by the management from $25 million to $28 million.

Also, for risk-averse investors, it is worth noting that the CDN company is not contracting this "debt" for re-financing purposes but predominantly for operational and growth purposes.

At a current price of $6.68, Limelight is a buy. I expect an upside of 100% within the end of this year.

For traders, one important date to bear in mind is the 17th of this month when full-contact practice for the NFL starts.

In this respect, the NFL has hired BioReference Laboratories to perform the entirety of its COVID-19 testing.

I got in and out of DDOG and CRWD with profits. Got stupid with FSLY. The $103 stop would have secured some nice profits but I got complacent with what I thought was a safe stop market.

I'm convinced GOLD and SILVER are good for now. Even my offshore bet of over $2000 on gold is soaring again.

Nice work..gold gold gold

Third Point perspective.

Daniel Loebs is someone I've followed for a while I was surprised to find this online already.

Big brained dude...

[h=1]Daniel Loeb's Third Point 2nd-Quarter Investor Letter[/h][h=2]Discussion of markets and holdings[/h]August 06, 2020 | About: BABA -3.04% JD -2.53% AMZN -0.02% DIS -0.62%PCG -0.22% LSE RU -1.25% SPGI -0.58%

RU -1.25% SPGI -0.58%

August 6, 2020

Dear Investor:

During the Second Quarter, Third Point returned 10.8% in the Offshore Fund. Following further gains last month, we have substantially reduced losses incurred during the First Quarter, bringing year‐to‐date losses for the Offshore Fund to ‐3.7% through July 31. Returns for the Second Quarter were divided nearly equally between equity and credit.

Third Point’s successful shift to working from home during the COVID‐19 pandemic was a testament to our robust technological infrastructure and the team’s grit in adapting to this new model. However, we never lose sight of the fact that while some parts of the economy have managed to survive and even thrive over the past few months, the loss of life and livelihoods for some is incalculable. Events of this year have laid bare many inequities in our society. As we have for many years, we will fight for educational opportunity, work diligently to repair our broken criminal justice system, and encourage our employees to find ways to make meaningful differences in their communities. As we discuss the investment environment below, we never forget the human suffering underlying the economic declines and market disruption.

On June 1, Third Point marked 25 years since its founding. I am grateful to our investors and my team, who have been instrumental in achieving this milestone. Third Point’s longevity and growth have been underpinned by a strict adherence to our core values and an ethos of embracing change and evolution. These values include integrity, collaboration, transparency, and constant personal and organizational improvement, or kaizen. While our values are evergreen, our investment style is characterized by flexibility in shifting market conditions. Over the years, we have demonstrated this approach by moving assets between equity and credit as the opportunity set dictates, including by adding structured credit – which quickly became a core strategy – over a decade ago.

On June 1, Third Point marked 25 years since its founding. I am grateful to our investors and my team, who have been instrumental in achieving this milestone. Third Point’s longevity and growth have been underpinned by a strict adherence to our core values and an ethos of embracing change and evolution. These values include integrity, collaboration, transparency, and constant personal and organizational improvement, or kaizen. While our values are evergreen, our investment style is characterized by flexibility in shifting market conditions. Over the years, we have demonstrated this approach by moving assets between equity and credit as the opportunity set dictates, including by adding structured credit – which quickly became a core strategy – over a decade ago.

I believe the Second Quarter was one of many important inflection points over the past 25 years. My disappointment with some elements of recent performance led me to adjust certain parts of our strategy and investment process. One step was to take full control over the portfolio and resume my role as sole CIO. Another was to drive ideas to the team that better reflect the current environment of disruption and dramatic dispersion between winners and losers. These changes to the organization and our process are having the impact I desired: significantly increasing the volume and quality of actionable ideas and thereby creating a more dynamic and diversified portfolio with improved performance.

In 2010, I remember sharing with investors at our annual event the quotation attributed to John Maynard Keynes: “When the facts change, I change my mind. What do you do, sir?” Categories are important and central to how our minds make sense of a complex world by structuring and holding disparate information in our brains. Third Point was founded originally as an “event ‐driven, value‐oriented” strategy1 that specialized in both credit and special situations such as spin‐offs, demutualizations, and post‐reorg equities. Over time, we developed the additional skill of creating our own events through activism. By structuring our funnel of ideas around these categories, we could easily prioritize our research process toward companies that were undergoing or could be catalyzed into making some sort of financial or operational “event”. As markets have changed, I have realized that while event‐

driven is still an essential investment lens (clearly, as our two largest investments, Pacific Gas & Electric and Prudential plc, are both event‐driven situations that together comprise nearly 20% of our exposure), today, quality2 is also an essential screen.

This investment environment is characterized by breakneck technological innovation and sluggish growth which has only been amplified by COVID‐19. Considering this, it is essential to find companies with great leadership and unique products in growing end‐markets in which they are gaining share and achieving high topline growth and strong margins. These factors drive robust earnings and free cash flow growth supported by high returns on existing invested capital. However, when investing in a quality or “compounder” company, it is critical to find an entry point at which an investment is attractive since most of these businesses trade at relatively high multiples.

Interestingly, our most successful activist investments have been in companies that embody these very characteristics, where we were able to find appealing entry points when companies were changing positively in measure of quality. Our investments in Baxter and Nestlé were made at transition points in margin, ROIC and earnings growth. Our investment in Yahoo! was also driven primarily by our interest in buying a high‐quality business, Alibaba, in which Yahoo! held a substantial stake at an extremely attractive price.

Investing in “quality” companies or “compounders” is not a new endeavor for us but a long‐ time category. Some of our most successful investments that have doubled or tripled during the lengthy periods of our ownership including S&P Global, Visa, Danaher, Adobe, Salesforce and Sherwin Williams can rightly be described as such. To be clear, investing in compounders and event‐driven situations are not mutually exclusive activities. It has been our experience that our event‐driven focus provides us with a unique window into the creation or evolution of a quality company, since they are often born out of corporate events or management changes. As we discuss in the equity section below, recent market dislocations have created several unique opportunities for us to acquire more of these kinds of companies at bargain prices. We anticipate selectively adding to this long‐term portfolio when opportunities present themselves.

Equities

In Q2, the equity book returned ~9% on average net exposure of ~56%, with a 15% return in long equities offset by losses from short positions. Equities made up 5.4% of the firm’s 11.4% gain.

Driving the equity portfolio’s gains were a series of well‐timed entries into new positions since the market bottom including in Alibaba and JD.com, Amazon, and Disney, as well as by bounce backs in several core positions including S&P Global and Prudential plc. During the quarter, we also initiated an equity position in Pacific Gas & Electric through a PIPE transaction. We discuss these investments below.

Alibaba & JD.com

During the quarter, we took advantage of jitters about China’s relationships with Hong Kong and the U.S. that created an air pocket in trading of Chinese‐related shares to establish new positions in e‐commerce leaders Alibaba (NYSE:BABA) and JD.com (NASDAQ:JD). As we have articulated in prior letters3, our outlook for Alibaba and the broader Chinese e‐commerce market is bright. We believe online gross merchandise value (“GMV”) will grow at a mid‐teens CAGR over the next five years, propelled by both (1) rising consumption per capita, as the Chinese retail market is equal in size to the U.S. despite four times as many consumers, and (2) increased penetration of retail by online, a trend which we believe has been structurally accelerated by the COVID‐ 19 pandemic.

As the e‐commerce market matures, we believe Alibaba & JD will leverage scale and growing repositories of transaction data to increase monetization of their platforms through targeted advertising to improve revenue yields (revenues as a percentage of GMV) from a starting point of less than 4% today. As a point of comparison, brick‐and‐mortar retail store rent expenses in China are greater than 10% of sales on average, which provides a significant umbrella for online marketplaces to take a greater share of GMV through a combination of commission and advertising spending as online retailer cost structures converge with brick‐ and‐mortar retail.

Finally, we continue to be excited about the latent potential in some of Alibaba’s businesses beyond the core e‐commerce marketplaces – particularly the cloud computing business, Aliyun. China’s cloud computing industry remains nascent but is growing nearly 3x faster than its developed market counterparts through a combination of rising IT intensity, rapid cloud penetration, and a gradual moderation in software piracy. Within that market, Aliyun is increasingly dominant (with nearly 50% market share) and will generate dramatic profit growth as margins expand with scale. As one reference point, Aliyun today resembles Amazon’s AWS business five years ago; this is an encouraging comparison given that today, AWS’ operating profits (and estimated enterprise value) exceed Alibaba’s business in its entirety. Ant Financial – in which Alibaba holds a ~30% stake that is worth roughly $70 billion – has announced its intention to go public later this year. Alibaba shares will benefit further should they become accessible to mainland Chinese investors through inclusion in the Southbound Connect.

Amazon

Historically, Amazon (NASDAQ:AMZN) was a company we admired that traded outside our valuation range. In March, we initiated a 5% position and although shares were flat on the year, we believed they were significantly undervalued due to the acceleration of the adoption of e‐commerce and cloud computing in the pandemic. We saw that e‐commerce penetration as a percent of total retail sales had nearly doubled and that Amazon was fully participating in that growth. Even as shopping patterns normalize, we believe that e‐commerce penetration has structurally ratcheted up and that Amazon’s share gains will be sticky. The COVID‐19 pandemic is also helping to accelerate the adoption of Amazon’s cloud computing services because they are a critical enabler of remote work, a trend that will similarly outlast the virus.

Amazon possesses all the key characteristics of a great “compounder”, including one of the highest cash returns on capital invested (“CROCI”). Shares are up significantly since March, but our attractive entry price enables us to continue to benefit from the company’s compounding of value as the twin engines of e‐commerce and cloud computing are expected to drive strong growth well into the future.

Disney

During Q2, we initiated a long position in The Walt Disney Company (NYSE IS) when shares traded down on fears that closures of theme parks and movie theaters due to the coronavirus pandemic would cripple the company. A slew of sell‐side analysts had recently downgraded the stock but we believed they failed to grasp that the pandemic also provided Disney with an important opportunity – to accelerate a plan to bring its blockbuster content directly to the consumer via streaming, which will further elevate Disney’s position as the world’s pre‐ eminent media company. Streaming is Disney’s biggest market opportunity ever with potentially $500 billion of revenue spread across over a growing market of 750 million current broadband homes globally ex‐China, dwarfing the size of Disney’s current addressable markets (roughly $100 billion between global box offices and theme parks). Disney's dominant position in the global media landscape sets up the company to take a meaningful chunk of the growing DTC streaming market, shown by the early success of Disney+. In less than nine months, Disney+ attained 60 million global subscribers, a milestone that took Netflix over seven years to meet.

IS) when shares traded down on fears that closures of theme parks and movie theaters due to the coronavirus pandemic would cripple the company. A slew of sell‐side analysts had recently downgraded the stock but we believed they failed to grasp that the pandemic also provided Disney with an important opportunity – to accelerate a plan to bring its blockbuster content directly to the consumer via streaming, which will further elevate Disney’s position as the world’s pre‐ eminent media company. Streaming is Disney’s biggest market opportunity ever with potentially $500 billion of revenue spread across over a growing market of 750 million current broadband homes globally ex‐China, dwarfing the size of Disney’s current addressable markets (roughly $100 billion between global box offices and theme parks). Disney's dominant position in the global media landscape sets up the company to take a meaningful chunk of the growing DTC streaming market, shown by the early success of Disney+. In less than nine months, Disney+ attained 60 million global subscribers, a milestone that took Netflix over seven years to meet.

On August 4th, Bob Chapek addressed the market after his first full quarter as Disney’s CEO. We were pleased that he views DTC as Disney’s “top priority” and believe his decision to premiere a tentpole film like Mulan through Disney+ is a defining moment. We encourage Disney to continue leveraging its new digital platforms to further connect fans with their iconic content and brands and, as Mr. Chapek said, “take full advantage of the opportunity” available to Disney today.

Pacific Gas and Electric PIPE

Third Point’s involvement in PG&E (NYSE CG) began in late 2018, when the Company’s bonds traded to distressed levels following the tragic Camp Fire. The Company’s bankruptcy filing was prompted by the need to access liquidity and settle outstanding wildfire claims in an organized manner. We believed PG&E’s core business remained in a strong position reflecting a classic “good business/bad capital structure” restructuring and made it the firm’s largest distressed position. By early 2020, the company reached an agreement to restructure the business and as part of that exit plan, the company needed to raise approximately $26 billion in new capital including $9 billion in new common equity. The exit financing was used to settle insurance and victims’ claims relating to the 2017 and 2018 wildfires, repay some pre ‐and post‐petition creditors, and contribute to the new Wildfire Fund.

CG) began in late 2018, when the Company’s bonds traded to distressed levels following the tragic Camp Fire. The Company’s bankruptcy filing was prompted by the need to access liquidity and settle outstanding wildfire claims in an organized manner. We believed PG&E’s core business remained in a strong position reflecting a classic “good business/bad capital structure” restructuring and made it the firm’s largest distressed position. By early 2020, the company reached an agreement to restructure the business and as part of that exit plan, the company needed to raise approximately $26 billion in new capital including $9 billion in new common equity. The exit financing was used to settle insurance and victims’ claims relating to the 2017 and 2018 wildfires, repay some pre ‐and post‐petition creditors, and contribute to the new Wildfire Fund.

Third Point participated in the common equity offering as a cornerstone PIPE investor. PG&E is the 6 th largest U.S. utility by rate‐base and has no unregulated exposure. The bankruptcy addressed the company’s outstanding legacy liabilities and repositioned the balance sheet for investment and growth. PG&E’s fundamentals position it at the high end of the utility industry, with equity rate base growth of approximately 8% and EPS growth of 8‐12% driven by strong investments in infrastructure to serve customers safely and reliably while also reducing the company’s carbon footprint and providing customers with energy choice. Yet PG&E’s valuation is a fraction of its peers: it trades at under 8x 2022 earnings versus the regulated utility peer set at 18x. The shares have traded poorly (down ~5%) since exiting bankruptcy due primarily to technical factors that are extremely common in these situations. We expect this sharp discount to diminish as the company goes through the normal process of finding an institutional shareholder base, as well as hires a permanent CEO and continues to address prior operational deficiencies.

Alternatively, some attribute the extreme discount to peers to potential wildfire risk but the regulatory regime has substantially changed since PG&E filed for bankruptcy. In addition to restructuring the balance sheet and addressing past liabilities, emergence from bankruptcy allows PG&E to fully access the elements of the enhanced wildfire‐related regulatory framework under AB1054. The largest component of this is the new Wildfire Fund, which provides all investor‐owned utilities in California an insurance policy to address future catastrophic wildfire claims in a timely fashion. Funded to withstand 10+ years of potential wildfire liabilities, the Wildfire Fund provides a three‐year rolling cap on shareholder liability estimated by PG&E at around $2.4 billion, which only applies if the utility fails to act prudently.

Most important, however, is PG&E’s focused commitment to an investment in wildfire safety. The company is spending approximately $3 billion per year to reduce wildfire risk through system hardening, vegetation management, and enhanced inspections. The company has also invested in weather stations and cameras to spot potential fires early and sectionalized the grid to reduce customer disruptions caused by the Public Safety Power Shutoff process. In addition, the company has started to adopt state ‐of‐the‐art technology such as drones provided by Third Point Ventures’ portfolio company PrecisionHawk and is partnering with Palantir to use AI for further risk mitigation and network efficiency. On a positive green note, the company also recently announced a partnership with Tesla to build a lithium‐ion battery storage system. These investments and PG&E’s commitment to ESG best practices should reduce environmental risk over time, while the Wildfire Fund should protect the state’s investor‐owned utilities who act responsibly on climate change.

Prudential plc Update

Prudential plc (LSE RU) stock performed well in the Second Quarter, gaining 18% as concerns over Prudential’s U.S. business, Jackson National, waned and management proved the efficacy of Jackson’s robust hedging program. However, the volatility in the shares over the past few months has confirmed our view that accurate price discovery by the market will prove elusive unless Jackson National is held in a separate corporate entity from Pru Asia.

RU) stock performed well in the Second Quarter, gaining 18% as concerns over Prudential’s U.S. business, Jackson National, waned and management proved the efficacy of Jackson’s robust hedging program. However, the volatility in the shares over the past few months has confirmed our view that accurate price discovery by the market will prove elusive unless Jackson National is held in a separate corporate entity from Pru Asia.

We were pleased by the Board’s recent announcement of a combined equity investment and reinsurance transaction between Jackson and Athene, a leading annuities company affiliated with Apollo Global Management. Athene will reinsure Jackson’s $28 billion fixed and fixed indexed annuities portfolio, as well as make a $500 million anchor equity investment in

Jackson in exchange for an 11.1% economic stake. We believe that this transaction is an important step towards full separation of Jackson and Pru Asia. It increases capital levels at Jackson to be more in‐line with standalone publicly traded peers, a critical consideration for regulators and ratings agencies when evaluating an independent U.S. business. It also puts a floor valuation mark on Jackson equity from a respected market player ahead of a standalone listing.

We continue to advocate for expeditious action in our constructive dialogue with management and the Board. We are confident that an independent Jackson can unlock significant value by closing the still‐large complexity discount in the stock. When Prudential’s fast ‐growing Asia business becomes a pure‐play, investors will better appreciate this high‐quality business, leading to significant multiple expansion. We look forward to an update on the company’s restructuring plans on its August 11 earnings call.

S&P Global Update

Another winner in the quarter was S&P Global (NYSE:SPGI), an investment we initiated four years ago. The company looks forward to decades of growth supported by increasing global debt issuance, data consumption, and the shift from active to passive investing. Over the past few years, we have watched the market react to multiple debt issuance pullbacks including the oil price shock in 2014, the Brexit panic, China slowdown fears, and, most recently, the COVID‐19 crisis and, in each case, these dislocations have all proven fleeting and credit markets have come roaring back. This proved true once again in Q2 2020 with record setting issuance across U.S. investment grade and high yield as well as European investment grade, resulting in S&P Global stock rising +35% in the quarter. We believe that cheaper access to liquidity with near‐zero interest rates, a growing refinancing wall in non‐investment grade credit, and nascent huge opportunities in China will continue to drive demand for S&P Global’s essential services. Management’s stewardship remains excellent, with a focus on cost control, prudent reinvestment, and capital allocation. These elements strengthen our view that S&P Global is a highly defensive, long‐term compounder.

Credit

In Q2, Corporate Credit returned ~16.4% on average exposure and Structured Credit returned ~8.6%. Corporate Credit returns were driven by timely purchases of high‐grade bonds near market lows including in Boeing, Kraft, and Ford. On the non‐performing side, our investment in Pacific Gas & Electric (which we added to near market lows) was also a material contributor, adding 90 bps to fund performance. In Q2, we took profits on some of the investments we made late in Q1 as High‐Yield and Investment‐Grade spreads tightened considerably and we reduced exposure to corporate credit from roughly 23% to 17% of Offshore NAV. I give extra praise to our credit team, who have spent their careers investing in distressed and high yield bonds, for decisively seizing the brief opportunity that we saw in investment grade debt. We expect additional opportunities in credit as the current economic situation disproportionately affects certain industries, offering opportunities for us to facilitate financing and restructurings and allowing companies to make it through this difficult period.

In Structured Credit, many of the investments we made during the panic and forced selling we saw in March appreciated in value during Q2. We are constructive on residential mortgages and consumer assets as interest deferral and forbearance plans are starting to work. Over the coming quarters, we believe opportunities in structured credit will emerge alongside deteriorating fundamentals in commercial real estate and corporate credit. From March through May, we saw a significant dislocation in the secondary markets with new issue securitizations largely on hold. In June, well before TALF was officially launched, the bid for senior portions of the capital structure increased dramatically. We have remained flexible during this period, alternating between investing in securities and loans when a strong funding opportunity presents itself. We are bearish on commercial real estate financials given a confluence of concerns around occupancy and cash flows (e.g. lower rents, required capex, excess capacity, pricing power) potentially impacting asset values. After the forbearance period, we are closely watching potential re‐defaults and liquidity options for many of these properties.

Outlook and Updates

To say that markets have climbed a massive wall of worry since they bottomed on March 23rd is an understatement. There is still plenty to be worried about between a pandemic that seems to have re‐accelerated around the world; diminished prospects for normal school openings in the fall; whole swaths of the economy, especially SMB’s, decimated by the economic fall‐out; a highly volatile November election looming, with many unknown and market‐moving outcomes; and continued tensions with China. The market’s recovery has been more fragile than it appears, led by a few pandemic “winners” urged on by Fed policy, which flooded the market with capital and led to historically low interest rates, ongoing fiscal stimulus, and expectations of a vaccine by year‐end.

As challenging as things seem today, we have spent significant time with scientific experts to better understand evolving treatments and vaccines and have confidence that several will be effective and available later this year, which should lead to the next phase of market recovery in coronavirus‐affected companies. Our equity portfolio is balanced between companies that are doing well now, and later stage recovery names in aerospace, entertainment, and retail which are still trading near their March lows and should benefit when there is a move back into these sectors. Our net exposures reflect not so much a rosy market outlook as an abundance of new ideas that we believe will prosper in our current scenario analyses. But, like Keynes and consistent with our last 25 years in business, we always reserve the right to change our mind as new information presents itself.

Business Updates

I am pleased to announce that Scott Leslie, who will continue in his roles as energy analyst and coordinator of our activist efforts, has also agreed to assist me as Director of Equity Research. In this role, he will also help with talent recruitment and development, drawing on his decade plus of experience working with all teams across the firm.

Jessica Pellegrini joined Third Point in June as a Managing Director of Investor Relations and Marketing. She graduated from Harvard University with a B.A. in Sociology. She was previously Head of Marketing and Investor Relations at Engle Capital, an $800 million long/short equity hedge fund and a Vice President in the Prime Services Division at Barclays. Through her previous roles, she is familiar with many of our investors and will soon connect with those of you she has not yet met during over a decade spent in the hedge fund industry.

Please contact Investor Relations at ir@thirdpoint.com or at 212.715.6707 with questions.

Sincerely,

Daniel S. Loeb

CEO & CIO

While the performances of the Funds have been compared here with the performance of a well-known and widely recognized index, the index has not been selected to represent an appropriate benchmark for the Funds whose holdings, performance and volatility may differ significantly from the securities that comprise the index. Investors cannot invest directly in an index (although one can invest in an index fund designed to closely track such index).

Past performance is not necessarily indicative of future results. All information provided herein is for informational purposes only and should not be deemed as a recommendation to buy or sell securities. All investments involve risk including the loss of principal. This transmission is confidential and may not be redistributed without the express written consent of Third Point LLC and does not constitute an offer to sell or the solicitation of an offer to purchase any security or investment product. Any such offer or solicitation may only be made by means of delivery of an approved confidential offering memorandum.

Specific companies or securities shown in this presentation are meant to demonstrate Third Point’s investment style and the types of industries and instruments in which we invest and are not selected based on past performance. The analyses and conclusions of Third Point contained in this presentation include certain statements, assumptions, estimates and projections that reflect various assumptions by Third Point concerning anticipated results that are inherently subject to significant economic, competitive, and other uncertainties and contingencies and have been included solely for illustrative purposes. No representations express or implied, are made as to the accuracy or completeness of such statements, assumptions, estimates or projections or with respect to any other materials herein. Third Point may buy, sell, cover or otherwise change the nature, form or amount of its investments, including any investments identified in this letter, without further notice and in Third Point’s sole discretion and for any reason. Third Point hereby disclaims any duty to update any information in this letter.

This letter may include performance and other position information relating to once activist positions that are no longer active but for which there remain residual holdings managed in a non-engaged manner. Such holdings may continue to be categorized as activist during such holding period for portfolio management, risk management and investor reporting purposes, among other things.

Information provided herein, or otherwise provided with respect to a potential investment in the Funds, may constitute non-public information regarding Third Point Offshore Investors Limited, a feeder fund listed on the London Stock Exchange, and accordingly dealing or trading in the shares of that fund on the basis of such information may violate securities laws in the United Kingdom and elsewhere.

Daniel Loebs is someone I've followed for a while I was surprised to find this online already.

Big brained dude...

[h=1]Daniel Loeb's Third Point 2nd-Quarter Investor Letter[/h][h=2]Discussion of markets and holdings[/h]August 06, 2020 | About: BABA -3.04% JD -2.53% AMZN -0.02% DIS -0.62%PCG -0.22% LSE

August 6, 2020

Dear Investor:

During the Second Quarter, Third Point returned 10.8% in the Offshore Fund. Following further gains last month, we have substantially reduced losses incurred during the First Quarter, bringing year‐to‐date losses for the Offshore Fund to ‐3.7% through July 31. Returns for the Second Quarter were divided nearly equally between equity and credit.

Third Point’s successful shift to working from home during the COVID‐19 pandemic was a testament to our robust technological infrastructure and the team’s grit in adapting to this new model. However, we never lose sight of the fact that while some parts of the economy have managed to survive and even thrive over the past few months, the loss of life and livelihoods for some is incalculable. Events of this year have laid bare many inequities in our society. As we have for many years, we will fight for educational opportunity, work diligently to repair our broken criminal justice system, and encourage our employees to find ways to make meaningful differences in their communities. As we discuss the investment environment below, we never forget the human suffering underlying the economic declines and market disruption.

- Warning! GuruFocus has detected 4 Warning Signs with BABA. Click here to check it out.

- BABA 30-Year Financial Data

- The intrinsic value of BABA

- Peter Lynch Chart of BABA

I believe the Second Quarter was one of many important inflection points over the past 25 years. My disappointment with some elements of recent performance led me to adjust certain parts of our strategy and investment process. One step was to take full control over the portfolio and resume my role as sole CIO. Another was to drive ideas to the team that better reflect the current environment of disruption and dramatic dispersion between winners and losers. These changes to the organization and our process are having the impact I desired: significantly increasing the volume and quality of actionable ideas and thereby creating a more dynamic and diversified portfolio with improved performance.

In 2010, I remember sharing with investors at our annual event the quotation attributed to John Maynard Keynes: “When the facts change, I change my mind. What do you do, sir?” Categories are important and central to how our minds make sense of a complex world by structuring and holding disparate information in our brains. Third Point was founded originally as an “event ‐driven, value‐oriented” strategy1 that specialized in both credit and special situations such as spin‐offs, demutualizations, and post‐reorg equities. Over time, we developed the additional skill of creating our own events through activism. By structuring our funnel of ideas around these categories, we could easily prioritize our research process toward companies that were undergoing or could be catalyzed into making some sort of financial or operational “event”. As markets have changed, I have realized that while event‐

driven is still an essential investment lens (clearly, as our two largest investments, Pacific Gas & Electric and Prudential plc, are both event‐driven situations that together comprise nearly 20% of our exposure), today, quality2 is also an essential screen.

This investment environment is characterized by breakneck technological innovation and sluggish growth which has only been amplified by COVID‐19. Considering this, it is essential to find companies with great leadership and unique products in growing end‐markets in which they are gaining share and achieving high topline growth and strong margins. These factors drive robust earnings and free cash flow growth supported by high returns on existing invested capital. However, when investing in a quality or “compounder” company, it is critical to find an entry point at which an investment is attractive since most of these businesses trade at relatively high multiples.

Interestingly, our most successful activist investments have been in companies that embody these very characteristics, where we were able to find appealing entry points when companies were changing positively in measure of quality. Our investments in Baxter and Nestlé were made at transition points in margin, ROIC and earnings growth. Our investment in Yahoo! was also driven primarily by our interest in buying a high‐quality business, Alibaba, in which Yahoo! held a substantial stake at an extremely attractive price.

Investing in “quality” companies or “compounders” is not a new endeavor for us but a long‐ time category. Some of our most successful investments that have doubled or tripled during the lengthy periods of our ownership including S&P Global, Visa, Danaher, Adobe, Salesforce and Sherwin Williams can rightly be described as such. To be clear, investing in compounders and event‐driven situations are not mutually exclusive activities. It has been our experience that our event‐driven focus provides us with a unique window into the creation or evolution of a quality company, since they are often born out of corporate events or management changes. As we discuss in the equity section below, recent market dislocations have created several unique opportunities for us to acquire more of these kinds of companies at bargain prices. We anticipate selectively adding to this long‐term portfolio when opportunities present themselves.

Equities

In Q2, the equity book returned ~9% on average net exposure of ~56%, with a 15% return in long equities offset by losses from short positions. Equities made up 5.4% of the firm’s 11.4% gain.

Driving the equity portfolio’s gains were a series of well‐timed entries into new positions since the market bottom including in Alibaba and JD.com, Amazon, and Disney, as well as by bounce backs in several core positions including S&P Global and Prudential plc. During the quarter, we also initiated an equity position in Pacific Gas & Electric through a PIPE transaction. We discuss these investments below.

Alibaba & JD.com

During the quarter, we took advantage of jitters about China’s relationships with Hong Kong and the U.S. that created an air pocket in trading of Chinese‐related shares to establish new positions in e‐commerce leaders Alibaba (NYSE:BABA) and JD.com (NASDAQ:JD). As we have articulated in prior letters3, our outlook for Alibaba and the broader Chinese e‐commerce market is bright. We believe online gross merchandise value (“GMV”) will grow at a mid‐teens CAGR over the next five years, propelled by both (1) rising consumption per capita, as the Chinese retail market is equal in size to the U.S. despite four times as many consumers, and (2) increased penetration of retail by online, a trend which we believe has been structurally accelerated by the COVID‐ 19 pandemic.

As the e‐commerce market matures, we believe Alibaba & JD will leverage scale and growing repositories of transaction data to increase monetization of their platforms through targeted advertising to improve revenue yields (revenues as a percentage of GMV) from a starting point of less than 4% today. As a point of comparison, brick‐and‐mortar retail store rent expenses in China are greater than 10% of sales on average, which provides a significant umbrella for online marketplaces to take a greater share of GMV through a combination of commission and advertising spending as online retailer cost structures converge with brick‐ and‐mortar retail.

Finally, we continue to be excited about the latent potential in some of Alibaba’s businesses beyond the core e‐commerce marketplaces – particularly the cloud computing business, Aliyun. China’s cloud computing industry remains nascent but is growing nearly 3x faster than its developed market counterparts through a combination of rising IT intensity, rapid cloud penetration, and a gradual moderation in software piracy. Within that market, Aliyun is increasingly dominant (with nearly 50% market share) and will generate dramatic profit growth as margins expand with scale. As one reference point, Aliyun today resembles Amazon’s AWS business five years ago; this is an encouraging comparison given that today, AWS’ operating profits (and estimated enterprise value) exceed Alibaba’s business in its entirety. Ant Financial – in which Alibaba holds a ~30% stake that is worth roughly $70 billion – has announced its intention to go public later this year. Alibaba shares will benefit further should they become accessible to mainland Chinese investors through inclusion in the Southbound Connect.

Amazon

Historically, Amazon (NASDAQ:AMZN) was a company we admired that traded outside our valuation range. In March, we initiated a 5% position and although shares were flat on the year, we believed they were significantly undervalued due to the acceleration of the adoption of e‐commerce and cloud computing in the pandemic. We saw that e‐commerce penetration as a percent of total retail sales had nearly doubled and that Amazon was fully participating in that growth. Even as shopping patterns normalize, we believe that e‐commerce penetration has structurally ratcheted up and that Amazon’s share gains will be sticky. The COVID‐19 pandemic is also helping to accelerate the adoption of Amazon’s cloud computing services because they are a critical enabler of remote work, a trend that will similarly outlast the virus.

Amazon possesses all the key characteristics of a great “compounder”, including one of the highest cash returns on capital invested (“CROCI”). Shares are up significantly since March, but our attractive entry price enables us to continue to benefit from the company’s compounding of value as the twin engines of e‐commerce and cloud computing are expected to drive strong growth well into the future.

Disney

During Q2, we initiated a long position in The Walt Disney Company (NYSE

IS) when shares traded down on fears that closures of theme parks and movie theaters due to the coronavirus pandemic would cripple the company. A slew of sell‐side analysts had recently downgraded the stock but we believed they failed to grasp that the pandemic also provided Disney with an important opportunity – to accelerate a plan to bring its blockbuster content directly to the consumer via streaming, which will further elevate Disney’s position as the world’s pre‐ eminent media company. Streaming is Disney’s biggest market opportunity ever with potentially $500 billion of revenue spread across over a growing market of 750 million current broadband homes globally ex‐China, dwarfing the size of Disney’s current addressable markets (roughly $100 billion between global box offices and theme parks). Disney's dominant position in the global media landscape sets up the company to take a meaningful chunk of the growing DTC streaming market, shown by the early success of Disney+. In less than nine months, Disney+ attained 60 million global subscribers, a milestone that took Netflix over seven years to meet.