You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

For gamblers only, any in here ? GRSU

- Thread starter brucefan

- Start date

Unfortunately they did an S-1 registration for financing with a scumbag . Hopefully they withdraw the deal since they shorted stock into the market ahead of the company even drawing down on the credit line .

I paid 65 cents yesterday .

Some notes from the call

Late stage discussion in securing an investment banker, monthly c calls , road shows, and outgoing IR to tell their story, Also noted they meet all criteria for up listing other then stock price

I paid 65 cents yesterday .

Some notes from the call

Late stage discussion in securing an investment banker, monthly c calls , road shows, and outgoing IR to tell their story, Also noted they meet all criteria for up listing other then stock price

FYI

[h=1]Jon Najarian[/h][FONT="]

[/FONT][FONT="][/FONT][FONT="]Co-Founder, Najarian Family Offic[/FONT]

[/FONT][FONT="][/FONT][FONT="]Co-Founder, Najarian Family Offic[/FONT]

Disclosures as of 12/11/18:

Long calls: Activision Blizzard, Albemarle, Alcoa, Amazon,American Airlines, Apple, ArcelorMittal, Autodesk, Axalta Coating, Best Buy, Callon Petroleum, Conagra Brands Inc, Pfizer, Delta Air Lines, Energy Transfer Equity, Fed Ex, Freepoint-McMoRan, Honeywell, Kraft Heinz, Kraneshares TR/CSI China Internet, Las Vegas Sands, Macy's, MGM Resorts, Microsoft, Net Element, Novartis, Nvidia, Procter and Gamble, Republic Services, Sony, SPDR S&P 500 Trust ETF, Target, Tilray, Tesla, TJX, UnitedHealth, Verizon, Visa,Weyland Tech, Williams Comapnies Inc

Long puts: McDermott International, Salesforce.com, SPDR S&P Biotech ETF

Long stock: Apple, Tesla, Tilray, U.S. Auto Parts.

[h=1]Jon Najarian[/h][FONT="]

Disclosures as of 12/11/18:

Long calls: Activision Blizzard, Albemarle, Alcoa, Amazon,American Airlines, Apple, ArcelorMittal, Autodesk, Axalta Coating, Best Buy, Callon Petroleum, Conagra Brands Inc, Pfizer, Delta Air Lines, Energy Transfer Equity, Fed Ex, Freepoint-McMoRan, Honeywell, Kraft Heinz, Kraneshares TR/CSI China Internet, Las Vegas Sands, Macy's, MGM Resorts, Microsoft, Net Element, Novartis, Nvidia, Procter and Gamble, Republic Services, Sony, SPDR S&P 500 Trust ETF, Target, Tilray, Tesla, TJX, UnitedHealth, Verizon, Visa,Weyland Tech, Williams Comapnies Inc

Long puts: McDermott International, Salesforce.com, SPDR S&P Biotech ETF

Long stock: Apple, Tesla, Tilray, U.S. Auto Parts.

Weyland Tech Provides Update On Recent Share Price Decline

GlobeNewswire•December 31, 2018

GlobeNewswire•December 31, 2018

New York, NY, Dec. 31, 2018 (GLOBE NEWSWIRE) -- via NEWMEDIAWIRE -- Weyland Tech Inc. (WEYL) (“Weyland” or the “Company”) discusses the recent share price decline and insight on business operations.

The Company has recently disclosed, among other things, the advancement of its AtoZPay subsidiary business and related stock spin-off as well as a significant increase in year over year revenue and gross margins from 2017 to 2018. Despite these business developments the market price of its common stock is very close to a 52-week low of $0.55. The Company believes that the share price decline is primarily related to shareholders taking advantage of Rule 144 to remove restrictive legends on an unusually large number of shares during the last six months.

These shareholders participated in private placements in 2015, 2016 and early 2017 and, as a result, could have generally removed restrictive legends and deposited their shares in brokerage accounts for sale six months following their respective purchases during 2015, 2016 and 2017. Many of such shares were deposited and sold, however, many of those shareholders, who purchased at prices from a low of .50 and a high of 4.80 during 2015 to 2017, held their shares until recently. As a result, the Company’s average daily volume has increased to 98,810 shares over last 30 days.

Comparatively, during January 2018, our average daily volume was approximately 22,000 shares (and the average closing price during the month was over $5.00 per share). According the to the OTCMarkets’ Annual Market Review for 2017, the average daily volume of companies’ shares listed on the OTCQX during 2017 was 22,500 shares.

As a result, the Company believes that the decline in our stock price is related primarily to an unusually high number of shares becoming available for public sale, and in fact, being sold as evidenced by the anomalistic increase in daily volume. So, the supply of shares on the market has been temporarily higher than the reasonably expected demand for our shares. We expect this market sales pressure to diminish during 2019 as we anticipate fewer shares becoming available for public sale than in 2018, and we expect our daily volume to return to an amount closer to historical levels over the longer term.

We note that Morningstar cites the Company as “undervalued” with a fair value of $1.33 in its December 27, 2018, Quantitative Equity Research Report.

Brent Suen, Chief Executive Officer comments: “I’ve purchased 111,000 shares this year in the open market at prices ranging from $1.15 to a high of $2.40 and these shares are under a Company-imposed two year rolling lock-up. Additionally, the last time our market capitalization was at this level was Q1 2016 when quarterly revenues were around $2.2 million compared to Q3 2018 when the Company reported revenue of $8.3 million. Operationally, the Company is progressing well and the pipeline for new business is better than we’ve seen at any previous point in time. Furthermore, although we are trading on the highest level of the OTC Markets, the OTCQX, we are still not an institutionally driven name in the mobile applications industry sector. That being said, our average daily volume is much higher now than during the past four years of my involvement. Further an uplist to a higher profile market such as the NYSE/MKT or NASDAQ Capital Market remains our stated goal and would open up the visibility for investment in our shares to an entirely new audience of investors unable to buy stocks on Non-Exchange markets.

“Although the recent share price decline has been challenging and frustrating for shareholders both new and from prior years, the business opportunities in the markets where we operate is continuing to grow at a level unprecedented in emerging markets on whole. Our management team has never been more enthused than at this time, and that includes experience through multiple growth industries and technology ‘boom’ cycles.”

The Company operates in a fiercely competitive environment where funding is the key to growth and expansion. To date, that funding has been driven almost exclusively by private placement fundings dating back to mid 2015. Given that legal restrictions on the sale of 144A placements is six months, we believe early investors have exercised patience in holding their shares over the years.

As we progress to a more senior exchange we expect to reduce the reliance on such placements as we focus increasingly on strategic and institutional funding sources. The Company believes strongly that investment in its current projects is timely and further that the combination of organic growth of our PaaS platform as well as the value of current and future ownership stakes in other investments will generate significant shareholder value during 2019.

About Weyland Tech Inc.

Weyland Tech is a global provider of mobile business applications. Its CreateApp platform offers a mobile presence to businesses in emerging markets, with partnerships on 3 continents and growing. This DIY mobile application platform, offered in 14 languages with over 35 integrated modules, enables small and medium sized businesses (“SMB’s”) to create native mobile applications (“apps”) for Apple’s iOS and Google Android without technical knowledge or background, empowering SMB’s to increase sales, reach more customers and promote their products and services in an easy, affordable and efficient manner.

In May 2018, the Company expanded its portfolio to fintech applications with the launch of its AtozPay mobile payments platform. The mobile wallet launched in the worlds 4th most populous country, Indonesia, and is already experiencing rapid growth in transactions taking place on the platform.

The Company has recently disclosed, among other things, the advancement of its AtoZPay subsidiary business and related stock spin-off as well as a significant increase in year over year revenue and gross margins from 2017 to 2018. Despite these business developments the market price of its common stock is very close to a 52-week low of $0.55. The Company believes that the share price decline is primarily related to shareholders taking advantage of Rule 144 to remove restrictive legends on an unusually large number of shares during the last six months.

These shareholders participated in private placements in 2015, 2016 and early 2017 and, as a result, could have generally removed restrictive legends and deposited their shares in brokerage accounts for sale six months following their respective purchases during 2015, 2016 and 2017. Many of such shares were deposited and sold, however, many of those shareholders, who purchased at prices from a low of .50 and a high of 4.80 during 2015 to 2017, held their shares until recently. As a result, the Company’s average daily volume has increased to 98,810 shares over last 30 days.

Comparatively, during January 2018, our average daily volume was approximately 22,000 shares (and the average closing price during the month was over $5.00 per share). According the to the OTCMarkets’ Annual Market Review for 2017, the average daily volume of companies’ shares listed on the OTCQX during 2017 was 22,500 shares.

As a result, the Company believes that the decline in our stock price is related primarily to an unusually high number of shares becoming available for public sale, and in fact, being sold as evidenced by the anomalistic increase in daily volume. So, the supply of shares on the market has been temporarily higher than the reasonably expected demand for our shares. We expect this market sales pressure to diminish during 2019 as we anticipate fewer shares becoming available for public sale than in 2018, and we expect our daily volume to return to an amount closer to historical levels over the longer term.

We note that Morningstar cites the Company as “undervalued” with a fair value of $1.33 in its December 27, 2018, Quantitative Equity Research Report.

Brent Suen, Chief Executive Officer comments: “I’ve purchased 111,000 shares this year in the open market at prices ranging from $1.15 to a high of $2.40 and these shares are under a Company-imposed two year rolling lock-up. Additionally, the last time our market capitalization was at this level was Q1 2016 when quarterly revenues were around $2.2 million compared to Q3 2018 when the Company reported revenue of $8.3 million. Operationally, the Company is progressing well and the pipeline for new business is better than we’ve seen at any previous point in time. Furthermore, although we are trading on the highest level of the OTC Markets, the OTCQX, we are still not an institutionally driven name in the mobile applications industry sector. That being said, our average daily volume is much higher now than during the past four years of my involvement. Further an uplist to a higher profile market such as the NYSE/MKT or NASDAQ Capital Market remains our stated goal and would open up the visibility for investment in our shares to an entirely new audience of investors unable to buy stocks on Non-Exchange markets.

“Although the recent share price decline has been challenging and frustrating for shareholders both new and from prior years, the business opportunities in the markets where we operate is continuing to grow at a level unprecedented in emerging markets on whole. Our management team has never been more enthused than at this time, and that includes experience through multiple growth industries and technology ‘boom’ cycles.”

The Company operates in a fiercely competitive environment where funding is the key to growth and expansion. To date, that funding has been driven almost exclusively by private placement fundings dating back to mid 2015. Given that legal restrictions on the sale of 144A placements is six months, we believe early investors have exercised patience in holding their shares over the years.

As we progress to a more senior exchange we expect to reduce the reliance on such placements as we focus increasingly on strategic and institutional funding sources. The Company believes strongly that investment in its current projects is timely and further that the combination of organic growth of our PaaS platform as well as the value of current and future ownership stakes in other investments will generate significant shareholder value during 2019.

About Weyland Tech Inc.

Weyland Tech is a global provider of mobile business applications. Its CreateApp platform offers a mobile presence to businesses in emerging markets, with partnerships on 3 continents and growing. This DIY mobile application platform, offered in 14 languages with over 35 integrated modules, enables small and medium sized businesses (“SMB’s”) to create native mobile applications (“apps”) for Apple’s iOS and Google Android without technical knowledge or background, empowering SMB’s to increase sales, reach more customers and promote their products and services in an easy, affordable and efficient manner.

In May 2018, the Company expanded its portfolio to fintech applications with the launch of its AtozPay mobile payments platform. The mobile wallet launched in the worlds 4th most populous country, Indonesia, and is already experiencing rapid growth in transactions taking place on the platform.

More Skin in the game by Brent

50K share purchase @ .62 https://ih.advfn.com/stock-market/U...tatement-of-changes-in-beneficial-ownership-4

50K share purchase @ .62 https://ih.advfn.com/stock-market/U...tatement-of-changes-in-beneficial-ownership-4

My name is Wilson Bell. At the behest and expense of a group of WEYL shareholders I travelled to Jakarta, Indonesia to evaluate AtozPay. I am also a WEYL and AtozPay shareholder. I spent over 30 years as a systems and software engineer and am the cofounder and former CTO of Snipp Interactive Inc. Any errors or misunderstandings in this document are mine. Forgive any misspellings and other minor format and grammar issues. I’m doing this on a little chromebook in a cab in Bangkok.

I was met at the airport by Eddie Fong the COO of Weyland Tech. Create App was Eddie’s brainchild and Eddie was responsible for bringing in the key players of AtoZPay including the CEO, Djunaedy Hermawanto, the current CTO Tommy Haryanto and a few others. Djunaedy was out of town but from what I could gather he engenders great loyalty in his employees. Eddie says nothing happens fast in Indonesia so he expected that to be the case with AtozPay as well but he was pleasantly surprised at how efficient and hardworking the team is and credits Djunaedy for that. Eddie also said Djunaedy has lots of connections in the Indonesian Telecom world from previous jobs and, particularly in Indonesia, it’s who you know that counts.

Eddie is an unassuming and really friendly fellow who flew in from Singapore exclusively for my visit. He is passionate about what they are building. We spoke for an hour in the car on the way to the office. At the office, everyone was extremely friendly, They gave me a tour and then Eddie, the CTO Tommy, the General Manager of Marketing and Sales, Samyo Sumarmano, and I went into a conference room for the next 4 plus hours where they answered all my questions. It was a bit of information overload but I will try to put it all down here to the best of my ability, Most of this is from memory and my understanding of what was explained to me. Weyland nor AtozPay can be in no way held responsible for any mistakes in this document.

AtozPay has 65 employees. They have 12 software developers, an operations team that looked to be staffed by 5-7 people, and a sales team. Various other areas like finance etc... are staffed as well. The ops team has a set of real-time monitors on LCD screens in their office. I’ll provide pictures later once I describe the business so they have meaning. Their backend resides in AWS (Amazon Web Services) and takes advantage of all AWS has to offer such auto-scaling and load balancing. It’s the way I would have done it. They do have a server rack in one room that contains a database backup and a GSM server (the purpose of which I will describe later). I’m not sure why that have a database backup on site and don’t just back up in the amazon cloud. I meant to ask but information was coming at me fast.

They have another suite of offices they are just setting up for a new app called AtoZGo which I will describe a bit later.

AtozPay’s main source of revenue is buying discount phone credits from the many telcos in Indonesia. I can’t remember the exact number but there are a bunch of them. It’s automated and they have an algorithm that goes out and finds the best deals and buys them. Phone credits are like a digital currency really. They get bulk discounts or discounts because the credits are near expiry. AtozPay turns them over so fast so expiry is not an issue. They sell these credits back to their customers (top up) at full price at various shops. The users can then use their credits to buy things. The shops that sell credits are called agents. Shops that accept credits are called merchants. A shop can be both. AtozPay makes a 2.5 to 3% (in some cases as much as 5%) margin on these credits. Because of limited capital they have to risk manage their inventory of credits. Eddie says they turn over credits 7 times a month. He thinks with double the inventory they could turn them over 15 times. For example, they put 1 million into the system to purchase and distribute mobile credits. Every 3 days they collect back from the agents the money for all the credits they have sold and put the funds back into the system to repurchase the credits and distribute to agents and sell to users, This happens 7 times a month.

The onsite GSM server I believe is there so that they can make up any short falls in inventory of credits directly from the telcos.

They currently have about 150K users, and a subscriber growth rate of 20% per quarter. They have 14,000 merchants/agents and do 12,000 to 14,000 transactions per day. Rate of transactions is increasing by 20% per month. They are looking to have 50,000 merchants by the end of the year. The benefit to the merchant is fairly obvious: online selling, digital purchase/e-commerce, receive a transaction fee.

The incredible thing to note here is that all of this growth is happening without a marketing budget. AtozPay relies on a bunch of hard charging sales guys riding around on motorcycles signing up merchants and agents. The best salesman of the year wins a motorcycle. Once signed up they may hang an AtozPay banner at the shop but that’s the extent of it. They will also put a QR code display in the shop to speed up transactions. Pretty slick. These same sales guys go collect the money taken in by the agents for the credits they sell users (after the agents take their cut). The salesman goes to the nearest ATM and deposits the money. These sales people are targeting mom and pop stores which I think have a higher probability of having customers with no bank account. A large percentage of the population do not have bank accounts and therefore no access to e-commerce/digital markets. Almost everyone has a cell phone. AtozPay provides these folks access the digital world. However people with bank accounts may find AtozPay to be an easy, efficient cashless experience and adopt it as well. Especially if eventually you can top up directly from your bank account.

Other near term developments:

A government subsidized T1 line provider called Finnet (think internet backbone stuff) approached AtozPay on the reputation of their sales force. Apparently Finnet is not very successful marketing to merchants and asked AtozPay for help. The end result is a network of 7000 Petrol stations and 13400 Alphmarts (7-11 of Indonesia) all accepting AtozPay and 80,000 ATMs where users can top up their credits. I understood that this was about ready to roll out. AtozPay will charge a transaction fee and of course realize more revenue from increase in credit turnover. The thinking is to use Finnet for getting large store chains and franchises to use AtozPay and continue to use the sales force to sell to Mom and Pop merchants.

A deal with REX, a courier service, to accept AtozPay credits for delivery payment and all courier drop stations becoming agents. Currently many deliveries are COD transactions and the delivery people are carrying around too much cash. AtozPay solves this problem and gets a bunch more top up locations. This particular courier does 10000 deliveries per day. This one I believe is ready to go.

AtoZGo a new app for food delivery. The idea is to have a kiosk in an office building where food is delivered from surrounding stalls and restaurants that are within walking distance. Prevents workers in air conditioned offices from going out into the heat to buy lunch. Current markup for food delivered via vehicle is 20-30%. AtozPay would get 10% of the price of the food and eliminate the normal markup. The delivery person would get a cut. They have a restaurant chain with 150 stores signed up but they want to sell to Mom and Pop stalls and other restaurants as well. Of course the new app will accept AtozPay for payment and be integrated.

Indonesia has thousands of mosques and Eddie has a plan to approach the Imams and convince them to use AtozPay for donations. Imagine every Iman telling his congregation to download the app to tithe. This is a devout country. 70% of the television programming is religious. If the Imam says download and use this app, they will download and use it. And not just in the mosque.

They are targeting schools to use AtozPay for school fees.

Eddie says they want to raise money to support growth. Money would be used to expand sales force, create a marketing budget, scale out engineering, and increase credit inventory, With funding they could also clone the system and roll it out in other Asian countries.

Other random items of note:

Users can pay all their utilities with the App, train tickets can be purchased. AtozPay provides the capability to top up other popular e-wallets. They want to be an aggregator not a competitor.

Adding location based marketing in the future. Based on GPS position, paid ads will come up for merchants nearby who accept AtozPay.

There is no AtozPay iPhone app but one is planned. Apple’s footprint in Asia is not nearly as large as Android’s. Android phones are cheaper.

Some of the work they have done with AtozPay and charitable organizations has given them positive visibility with elected officials.

It is my understanding that 49% of AtozPay shares went out in the dividend, Djunaedy and senior staff at AtozPay have another 20%. Weland Tech has an option to aquire the other 31% for a nominal fee.

Eddie’s characterization was that this is a rocket ship ready to take off. Eddie says on fundamentals he thinks the share price of WEYL should be $3-$5

They want to build the business and sell it. Eddie stated that bluntly enough

Eddie demonstrated Create App as well and showed me some applications that were created by it. There are somewhere around 40 components that you can drag, drop and configure. In a couple hours you can create a rich application and publish it to both the Apple Store and Google Play. It’s quite good and I’m not sure why it isn’t being marketed everywhere. AtozPay will soon become one of the configurable components. They have also cloned and licensed it for use within organizations or specific markets.

In summary, there is value here. There is a dynamic team in place developing and improving the software, good leadership and a strong sales force. It looks poised for growth and will clearly very soon become an attractive buyout target in my opinion. And credit to Weyland for their hospitality and transparency.

Operations Room Real-time Monitors

Top: Map depicting merchant and agent locations

Bottom: Tracking of Sales Force

Credit Aquisition from various telecoms

I believe this shows transactions and top twenty selling agents

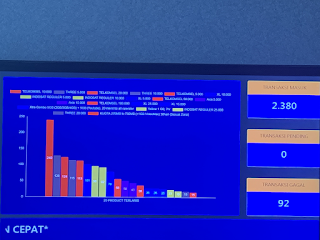

Transaction Rupia Amount and other transaction metrics

I think this is credit aquisition stuff - not sure

Credit Products and Credit Supplier data I think. I was pretty punchy by then

Real-time Transaction data

I’m the ugly white boy. Eddie to my right. The guy is a real sweetheart. Then Samyo and Tommy. Both great guys and all MMA fans like myself!

https://docs.google.com/document/d/1rX0nLx7eIfKCITK3wTUoBIaQ-i7k1zCdNZkXGbVIzMk/mobilebasic

I was met at the airport by Eddie Fong the COO of Weyland Tech. Create App was Eddie’s brainchild and Eddie was responsible for bringing in the key players of AtoZPay including the CEO, Djunaedy Hermawanto, the current CTO Tommy Haryanto and a few others. Djunaedy was out of town but from what I could gather he engenders great loyalty in his employees. Eddie says nothing happens fast in Indonesia so he expected that to be the case with AtozPay as well but he was pleasantly surprised at how efficient and hardworking the team is and credits Djunaedy for that. Eddie also said Djunaedy has lots of connections in the Indonesian Telecom world from previous jobs and, particularly in Indonesia, it’s who you know that counts.

Eddie is an unassuming and really friendly fellow who flew in from Singapore exclusively for my visit. He is passionate about what they are building. We spoke for an hour in the car on the way to the office. At the office, everyone was extremely friendly, They gave me a tour and then Eddie, the CTO Tommy, the General Manager of Marketing and Sales, Samyo Sumarmano, and I went into a conference room for the next 4 plus hours where they answered all my questions. It was a bit of information overload but I will try to put it all down here to the best of my ability, Most of this is from memory and my understanding of what was explained to me. Weyland nor AtozPay can be in no way held responsible for any mistakes in this document.

AtozPay has 65 employees. They have 12 software developers, an operations team that looked to be staffed by 5-7 people, and a sales team. Various other areas like finance etc... are staffed as well. The ops team has a set of real-time monitors on LCD screens in their office. I’ll provide pictures later once I describe the business so they have meaning. Their backend resides in AWS (Amazon Web Services) and takes advantage of all AWS has to offer such auto-scaling and load balancing. It’s the way I would have done it. They do have a server rack in one room that contains a database backup and a GSM server (the purpose of which I will describe later). I’m not sure why that have a database backup on site and don’t just back up in the amazon cloud. I meant to ask but information was coming at me fast.

They have another suite of offices they are just setting up for a new app called AtoZGo which I will describe a bit later.

AtozPay’s main source of revenue is buying discount phone credits from the many telcos in Indonesia. I can’t remember the exact number but there are a bunch of them. It’s automated and they have an algorithm that goes out and finds the best deals and buys them. Phone credits are like a digital currency really. They get bulk discounts or discounts because the credits are near expiry. AtozPay turns them over so fast so expiry is not an issue. They sell these credits back to their customers (top up) at full price at various shops. The users can then use their credits to buy things. The shops that sell credits are called agents. Shops that accept credits are called merchants. A shop can be both. AtozPay makes a 2.5 to 3% (in some cases as much as 5%) margin on these credits. Because of limited capital they have to risk manage their inventory of credits. Eddie says they turn over credits 7 times a month. He thinks with double the inventory they could turn them over 15 times. For example, they put 1 million into the system to purchase and distribute mobile credits. Every 3 days they collect back from the agents the money for all the credits they have sold and put the funds back into the system to repurchase the credits and distribute to agents and sell to users, This happens 7 times a month.

The onsite GSM server I believe is there so that they can make up any short falls in inventory of credits directly from the telcos.

They currently have about 150K users, and a subscriber growth rate of 20% per quarter. They have 14,000 merchants/agents and do 12,000 to 14,000 transactions per day. Rate of transactions is increasing by 20% per month. They are looking to have 50,000 merchants by the end of the year. The benefit to the merchant is fairly obvious: online selling, digital purchase/e-commerce, receive a transaction fee.

The incredible thing to note here is that all of this growth is happening without a marketing budget. AtozPay relies on a bunch of hard charging sales guys riding around on motorcycles signing up merchants and agents. The best salesman of the year wins a motorcycle. Once signed up they may hang an AtozPay banner at the shop but that’s the extent of it. They will also put a QR code display in the shop to speed up transactions. Pretty slick. These same sales guys go collect the money taken in by the agents for the credits they sell users (after the agents take their cut). The salesman goes to the nearest ATM and deposits the money. These sales people are targeting mom and pop stores which I think have a higher probability of having customers with no bank account. A large percentage of the population do not have bank accounts and therefore no access to e-commerce/digital markets. Almost everyone has a cell phone. AtozPay provides these folks access the digital world. However people with bank accounts may find AtozPay to be an easy, efficient cashless experience and adopt it as well. Especially if eventually you can top up directly from your bank account.

Other near term developments:

A government subsidized T1 line provider called Finnet (think internet backbone stuff) approached AtozPay on the reputation of their sales force. Apparently Finnet is not very successful marketing to merchants and asked AtozPay for help. The end result is a network of 7000 Petrol stations and 13400 Alphmarts (7-11 of Indonesia) all accepting AtozPay and 80,000 ATMs where users can top up their credits. I understood that this was about ready to roll out. AtozPay will charge a transaction fee and of course realize more revenue from increase in credit turnover. The thinking is to use Finnet for getting large store chains and franchises to use AtozPay and continue to use the sales force to sell to Mom and Pop merchants.

A deal with REX, a courier service, to accept AtozPay credits for delivery payment and all courier drop stations becoming agents. Currently many deliveries are COD transactions and the delivery people are carrying around too much cash. AtozPay solves this problem and gets a bunch more top up locations. This particular courier does 10000 deliveries per day. This one I believe is ready to go.

AtoZGo a new app for food delivery. The idea is to have a kiosk in an office building where food is delivered from surrounding stalls and restaurants that are within walking distance. Prevents workers in air conditioned offices from going out into the heat to buy lunch. Current markup for food delivered via vehicle is 20-30%. AtozPay would get 10% of the price of the food and eliminate the normal markup. The delivery person would get a cut. They have a restaurant chain with 150 stores signed up but they want to sell to Mom and Pop stalls and other restaurants as well. Of course the new app will accept AtozPay for payment and be integrated.

Indonesia has thousands of mosques and Eddie has a plan to approach the Imams and convince them to use AtozPay for donations. Imagine every Iman telling his congregation to download the app to tithe. This is a devout country. 70% of the television programming is religious. If the Imam says download and use this app, they will download and use it. And not just in the mosque.

They are targeting schools to use AtozPay for school fees.

Eddie says they want to raise money to support growth. Money would be used to expand sales force, create a marketing budget, scale out engineering, and increase credit inventory, With funding they could also clone the system and roll it out in other Asian countries.

Other random items of note:

Users can pay all their utilities with the App, train tickets can be purchased. AtozPay provides the capability to top up other popular e-wallets. They want to be an aggregator not a competitor.

Adding location based marketing in the future. Based on GPS position, paid ads will come up for merchants nearby who accept AtozPay.

There is no AtozPay iPhone app but one is planned. Apple’s footprint in Asia is not nearly as large as Android’s. Android phones are cheaper.

Some of the work they have done with AtozPay and charitable organizations has given them positive visibility with elected officials.

It is my understanding that 49% of AtozPay shares went out in the dividend, Djunaedy and senior staff at AtozPay have another 20%. Weland Tech has an option to aquire the other 31% for a nominal fee.

Eddie’s characterization was that this is a rocket ship ready to take off. Eddie says on fundamentals he thinks the share price of WEYL should be $3-$5

They want to build the business and sell it. Eddie stated that bluntly enough

Eddie demonstrated Create App as well and showed me some applications that were created by it. There are somewhere around 40 components that you can drag, drop and configure. In a couple hours you can create a rich application and publish it to both the Apple Store and Google Play. It’s quite good and I’m not sure why it isn’t being marketed everywhere. AtozPay will soon become one of the configurable components. They have also cloned and licensed it for use within organizations or specific markets.

In summary, there is value here. There is a dynamic team in place developing and improving the software, good leadership and a strong sales force. It looks poised for growth and will clearly very soon become an attractive buyout target in my opinion. And credit to Weyland for their hospitality and transparency.

Operations Room Real-time Monitors

Top: Map depicting merchant and agent locations

Bottom: Tracking of Sales Force

Credit Aquisition from various telecoms

I believe this shows transactions and top twenty selling agents

Transaction Rupia Amount and other transaction metrics

I think this is credit aquisition stuff - not sure

Credit Products and Credit Supplier data I think. I was pretty punchy by then

Real-time Transaction data

I’m the ugly white boy. Eddie to my right. The guy is a real sweetheart. Then Samyo and Tommy. Both great guys and all MMA fans like myself!

https://docs.google.com/document/d/1rX0nLx7eIfKCITK3wTUoBIaQ-i7k1zCdNZkXGbVIzMk/mobilebasic

Weyland Tech Engages Maxim Group for Investment Banking Services

GlobeNewswire•January 17, 2019 New York, NY, Jan. 17, 2019 (GLOBE NEWSWIRE) -- via NEWMEDIAWIRE -- Weyland Tech Inc. (WEYL) announced today that it has engaged Maxim Group LLC (“Maxim”), a leading investment banking, securities and investment management firm, to provide investment banking services to the Company. Maxim will provide its full scope of investment banking services that includes strategic planning, developing strategic partnerships, and introducing the company to the investment community.

Senior Managing Director of Investing Banking at Maxim Group, Ritesh Veera, commented, “We are excited by the opportunity to act as financial advisor to Weyland Tech at such an early stage of its growth cycle. We believe that our full-service investment banking capabilities will complement Weyland Tech’s future efforts. Together we will work to maximize value for the company and shareholders.”

“We are very pleased to have partnered with Maxim Group as we evaluate entry into additional geographic markets, expansion of strategic partnerships and listing on a more senior exchange,” stated Chief Executive Officer Brent Suen of Weyland Tech.

GlobeNewswire•January 17, 2019 New York, NY, Jan. 17, 2019 (GLOBE NEWSWIRE) -- via NEWMEDIAWIRE -- Weyland Tech Inc. (WEYL) announced today that it has engaged Maxim Group LLC (“Maxim”), a leading investment banking, securities and investment management firm, to provide investment banking services to the Company. Maxim will provide its full scope of investment banking services that includes strategic planning, developing strategic partnerships, and introducing the company to the investment community.

Senior Managing Director of Investing Banking at Maxim Group, Ritesh Veera, commented, “We are excited by the opportunity to act as financial advisor to Weyland Tech at such an early stage of its growth cycle. We believe that our full-service investment banking capabilities will complement Weyland Tech’s future efforts. Together we will work to maximize value for the company and shareholders.”

“We are very pleased to have partnered with Maxim Group as we evaluate entry into additional geographic markets, expansion of strategic partnerships and listing on a more senior exchange,” stated Chief Executive Officer Brent Suen of Weyland Tech.

Weyland Tech Inc. Will Host a Conference Call to Discuss the General Overview of the Business and Recent Updates on Strategic and Corporate Initiatives Signed in 2018

GlobeNewswire•January 22, 2019

New York, NY, Jan. 22, 2019 (GLOBE NEWSWIRE) -- via NEWMEDIAWIRE -- Weyland Tech Inc. (WEYL) (“Weyland” or the “Company”) will host a conference call to discuss the general overview of the business and recent updates on strategic and corporate initiatives signed in 2018.

Weyland will host the call at 11:00 A.M. Eastern Time (10:00 A.M. Central Time) on Thursday, January 31, 2019. To participate investors may dial-in on 1 (701) 801-1211 and enter the access code: 873-908-258.

The conference call will also be made available for replay at 1 (701) 801-1218 with the access code: 873-908-258.

The Company will be answering questions provided in advance by shareholders and requests that those be sent by email to: cc@weyland-tech.com

In the interest of time, we will choose the questions asked most frequently and do our best to answer as many as possible. We ask to have them sent by January 28th, 4:00PM EST.

Additionally, callers are asked to join the call promptly at 11:00AM Eastern Time.

About Weyland Tech Inc.

Weyland Tech is a global provider of mobile business applications. The Company operates a Platform-as-a-Service (“PaaS”) software used on mobile ‘smartphones’. The PaaS platform offers a mobile presence to Small-to-Medium-Sized- Businesses (“SMB’s”) in emerging markets, with partnerships on 3 continents and growing. The PaaS platform, offered in 14 languages with over 70 integrated modules, enables SMB’s to create native mobile applications (“apps”) for Apple’s iOS and Google Android without technical knowledge or background, empowering SMB’s to increase sales, reach more customers and promote their products and services in an easy, affordable and efficient manner.

In May 2018, the Company expanded its portfolio to fintech applications with the launch of its AtoZPay mobile payments platform. The mobile wallet launched in the world’s 4th most populous country, Indonesia, and is already experiencing rapid growth in transactions taking place on the platform.

GlobeNewswire•January 22, 2019

New York, NY, Jan. 22, 2019 (GLOBE NEWSWIRE) -- via NEWMEDIAWIRE -- Weyland Tech Inc. (WEYL) (“Weyland” or the “Company”) will host a conference call to discuss the general overview of the business and recent updates on strategic and corporate initiatives signed in 2018.

Weyland will host the call at 11:00 A.M. Eastern Time (10:00 A.M. Central Time) on Thursday, January 31, 2019. To participate investors may dial-in on 1 (701) 801-1211 and enter the access code: 873-908-258.

The conference call will also be made available for replay at 1 (701) 801-1218 with the access code: 873-908-258.

The Company will be answering questions provided in advance by shareholders and requests that those be sent by email to: cc@weyland-tech.com

In the interest of time, we will choose the questions asked most frequently and do our best to answer as many as possible. We ask to have them sent by January 28th, 4:00PM EST.

Additionally, callers are asked to join the call promptly at 11:00AM Eastern Time.

About Weyland Tech Inc.

Weyland Tech is a global provider of mobile business applications. The Company operates a Platform-as-a-Service (“PaaS”) software used on mobile ‘smartphones’. The PaaS platform offers a mobile presence to Small-to-Medium-Sized- Businesses (“SMB’s”) in emerging markets, with partnerships on 3 continents and growing. The PaaS platform, offered in 14 languages with over 70 integrated modules, enables SMB’s to create native mobile applications (“apps”) for Apple’s iOS and Google Android without technical knowledge or background, empowering SMB’s to increase sales, reach more customers and promote their products and services in an easy, affordable and efficient manner.

In May 2018, the Company expanded its portfolio to fintech applications with the launch of its AtoZPay mobile payments platform. The mobile wallet launched in the world’s 4th most populous country, Indonesia, and is already experiencing rapid growth in transactions taking place on the platform.

Weyland Tech Inc. and 'Last-Mile' Delivery Partner, PT Royal Express Indonesia ("REX") Announce Launch Date of Pilot Program

GlobeNewswire•January 31, 2019

New York, Jan. 31, 2019 (GLOBE NEWSWIRE) -- via NEWMEDIAWIRE -- Weyland Tech Inc. (WEYL) (“Weyland” or the “Company”) announces update on its strategic partnership with PT Royal Express Indonesia ("REX") http://www.rex.co.id/id.

REX ships approximately 10,000 packages per day, for thousands of Small-Medium sized Businesses (“SMBs”).

In December 2018, the Company signed an agreement with REX to create a cashless option for REX clients by using the eWallet platform.

Weyland is obligated under the agreement to gradually replace the cash-on-delivery facet of the REX business. Currently, REX deliveries are paid for in cash, which is inefficient, insecure and inconvenient. Weyland Tech’s eWallet, AtozPay, will enable the deliveries to be transacted via the smartphone app eliminating cash. REX has indicated that the addition of the Weyland solution will dramatically improve operational efficiencies and expects to achieve well-above market growth rates once fully implemented.

Weyland’s Indonesian entity, WIP, would receive an average of 15% of each delivery fee, which is equivalent to US$0.45-.50, or potentially $1.6 - 2 million in net revenue annually, if our internal targets are met.

Brent Suen, CEO of Weyland, comments, “Having just spent time with the management of REX, and better understanding their plans for growth, combined with the fact that eCommerce in Indonesia is expected to rise eight-fold within the next five years, there is a tremendous opportunity to both positively impact revenues and also layer in higher margin business for our operations in-country. Furthermore, the ability to take this business model into other Southeast Asian countries is validated by our partnership with a well-recognized logistics provider, PT Royal Express Indonesia.”

“As consumers in the US have witnessed with the dramatic proliferation of Amazon, delivery services or ‘last-mile’ solutions have stretched capacity quite thin with Fedex, UPS and the US Postal Service bearing the brunt of the demand. Amazon has turned to contracting out private individuals to make deliveries and this trend continues. Furthermore, the geography and traffic in countries such as Indonesia almost guarantee the upwards momentum in value provided by last-mile solutions,” Suen comments.

The Companies are implementing a pilot program and will launch March 1st, 2019.

About Weyland Tech Inc.

Weyland Tech is a global provider of mobile business applications. The Company operates a Platform-as-a-Service (“PaaS”) software used on mobile ‘smartphones’. The PaaS platform offers a mobile presence to Small-to-Medium-Sized- Businesses (“SMB’s”) in emerging markets, with partnerships on 3 continents and growing. The PaaS platform, offered in 14 languages with over 70 integrated modules, enables SMB’s to create native mobile applications (“apps”) for Apple’s iOS and Google Android without technical knowledge or background, empowering SMB’s to increase sales, reach more customers and promote their products and services in an easy, affordable and efficient manner.

About WIP/AtoZPay

Weyland Indonesia Perkasa (“WIP”) / AtoZPay is an Indonesian Company that is held by Weyland Tech via both equity and contractual structures which comply with Indonesia’s foreign commercial ownership regulations. AtoZPay, an eWallet solution, is quickly becoming the adopted standard in Indonesia, the world’s 4th most populous nation, with a majority of consumers without bank accounts. A partnership with Finnet, Indonesia’s state-controlled company tasked with building and supporting banking and finance infrastructure nationwide, and a recently achieved banking license, creates the most robust solution for the “unbanked” in Indonesia. Weyland Tech owns 100% the eWallet software platform which powers AtozPay. In a liquidity event or outright exit via an acquisition, Weyland and its sub-holding (WAI) are entitled to 80% economic benefit.

GlobeNewswire•January 31, 2019

New York, Jan. 31, 2019 (GLOBE NEWSWIRE) -- via NEWMEDIAWIRE -- Weyland Tech Inc. (WEYL) (“Weyland” or the “Company”) announces update on its strategic partnership with PT Royal Express Indonesia ("REX") http://www.rex.co.id/id.

REX ships approximately 10,000 packages per day, for thousands of Small-Medium sized Businesses (“SMBs”).

In December 2018, the Company signed an agreement with REX to create a cashless option for REX clients by using the eWallet platform.

Weyland is obligated under the agreement to gradually replace the cash-on-delivery facet of the REX business. Currently, REX deliveries are paid for in cash, which is inefficient, insecure and inconvenient. Weyland Tech’s eWallet, AtozPay, will enable the deliveries to be transacted via the smartphone app eliminating cash. REX has indicated that the addition of the Weyland solution will dramatically improve operational efficiencies and expects to achieve well-above market growth rates once fully implemented.

Weyland’s Indonesian entity, WIP, would receive an average of 15% of each delivery fee, which is equivalent to US$0.45-.50, or potentially $1.6 - 2 million in net revenue annually, if our internal targets are met.

Brent Suen, CEO of Weyland, comments, “Having just spent time with the management of REX, and better understanding their plans for growth, combined with the fact that eCommerce in Indonesia is expected to rise eight-fold within the next five years, there is a tremendous opportunity to both positively impact revenues and also layer in higher margin business for our operations in-country. Furthermore, the ability to take this business model into other Southeast Asian countries is validated by our partnership with a well-recognized logistics provider, PT Royal Express Indonesia.”

“As consumers in the US have witnessed with the dramatic proliferation of Amazon, delivery services or ‘last-mile’ solutions have stretched capacity quite thin with Fedex, UPS and the US Postal Service bearing the brunt of the demand. Amazon has turned to contracting out private individuals to make deliveries and this trend continues. Furthermore, the geography and traffic in countries such as Indonesia almost guarantee the upwards momentum in value provided by last-mile solutions,” Suen comments.

The Companies are implementing a pilot program and will launch March 1st, 2019.

About Weyland Tech Inc.

Weyland Tech is a global provider of mobile business applications. The Company operates a Platform-as-a-Service (“PaaS”) software used on mobile ‘smartphones’. The PaaS platform offers a mobile presence to Small-to-Medium-Sized- Businesses (“SMB’s”) in emerging markets, with partnerships on 3 continents and growing. The PaaS platform, offered in 14 languages with over 70 integrated modules, enables SMB’s to create native mobile applications (“apps”) for Apple’s iOS and Google Android without technical knowledge or background, empowering SMB’s to increase sales, reach more customers and promote their products and services in an easy, affordable and efficient manner.

About WIP/AtoZPay

Weyland Indonesia Perkasa (“WIP”) / AtoZPay is an Indonesian Company that is held by Weyland Tech via both equity and contractual structures which comply with Indonesia’s foreign commercial ownership regulations. AtoZPay, an eWallet solution, is quickly becoming the adopted standard in Indonesia, the world’s 4th most populous nation, with a majority of consumers without bank accounts. A partnership with Finnet, Indonesia’s state-controlled company tasked with building and supporting banking and finance infrastructure nationwide, and a recently achieved banking license, creates the most robust solution for the “unbanked” in Indonesia. Weyland Tech owns 100% the eWallet software platform which powers AtozPay. In a liquidity event or outright exit via an acquisition, Weyland and its sub-holding (WAI) are entitled to 80% economic benefit.

[FONT="][h=1]Conference Call to Discuss the General Overview of Weyland’s Business and Recent Updates on Strategic and Corporate Initiatives, as Well as an Update on its eWallet Business[/h]

GlobeNewswire•March 1, 2019

[/FONT]

[FONT="]

[/FONT]

[FONT="]

[/FONT]

GlobeNewswire•March 1, 2019

[/FONT]

[FONT="]

[/FONT]

[FONT="]

New York, NY, March 01, 2019 (GLOBE NEWSWIRE) -- via NEWMEDIAWIRE -- Weyland Tech Inc. (WEYL) (“Weyland” or the “Company”) will host a conference call to discuss the general overview of the business and recent updates on strategic and corporate initiatives as well as an update on its eWallet business.

Weyland will host the call at 12:00 pm. Eastern Time (11:00 pm. Central Time) on Thursday, March 7, 2019. To participate investors may dial-in on 1 (701) 801-1211 and enter the access code: 873-908-258.

The conference call will also be made available for replay at 1 (701) 801-1218 with the access code: 873-908-258.

The Company will be answering questions provided in advance by shareholders and requests that those be sent by email to: cc@weyland-tech.com.

Additionally, callers are asked to join the call promptly at 12:00 PM Eastern Time.

About Weyland Tech Inc.

Weyland Tech is a global provider of mobile business applications. The Company operates a Platform-as-a-Service (“PaaS”) software used on mobile ‘smartphones’. The PaaS platform offers a mobile presence to Small-to-Medium-Sized- Businesses (“SMB’s”) in emerging markets, with partnerships on 3 continents and growing. The PaaS platform, offered in 14 languages with over 70 integrated modules, enables SMB’s to create native mobile applications (“apps”) for Apple’s iOS and Google Android without technical knowledge or background, empowering SMB’s to increase sales, reach more customers and promote their products and services in an easy, affordable and efficient manner.

In May 2018, the Company expanded its portfolio to fintech applications with the launch of its AtoZPay mobile payments platform. The mobile wallet launched in the world’s 4th most populous country, Indonesia, and is already experiencing rapid growth in transactions taking place on the platform.

Weyland will host the call at 12:00 pm. Eastern Time (11:00 pm. Central Time) on Thursday, March 7, 2019. To participate investors may dial-in on 1 (701) 801-1211 and enter the access code: 873-908-258.

The conference call will also be made available for replay at 1 (701) 801-1218 with the access code: 873-908-258.

The Company will be answering questions provided in advance by shareholders and requests that those be sent by email to: cc@weyland-tech.com.

Additionally, callers are asked to join the call promptly at 12:00 PM Eastern Time.

About Weyland Tech Inc.

Weyland Tech is a global provider of mobile business applications. The Company operates a Platform-as-a-Service (“PaaS”) software used on mobile ‘smartphones’. The PaaS platform offers a mobile presence to Small-to-Medium-Sized- Businesses (“SMB’s”) in emerging markets, with partnerships on 3 continents and growing. The PaaS platform, offered in 14 languages with over 70 integrated modules, enables SMB’s to create native mobile applications (“apps”) for Apple’s iOS and Google Android without technical knowledge or background, empowering SMB’s to increase sales, reach more customers and promote their products and services in an easy, affordable and efficient manner.

In May 2018, the Company expanded its portfolio to fintech applications with the launch of its AtoZPay mobile payments platform. The mobile wallet launched in the world’s 4th most populous country, Indonesia, and is already experiencing rapid growth in transactions taking place on the platform.

[/FONT]

Up to 16,000 shares here at an avg around $1.10.

Would like to see some positives from the CC tomorrow. Crazy to think I had buys in the $3+ range mere months ago. I'm sure you have much higher...

Really hoping this one is a winner. $20M mkt cap seems low given the AtoZPay potential.

Wonder how the legacy business is doing, too...

Would like to see some positives from the CC tomorrow. Crazy to think I had buys in the $3+ range mere months ago. I'm sure you have much higher...

Really hoping this one is a winner. $20M mkt cap seems low given the AtoZPay potential.

Wonder how the legacy business is doing, too...

Up to 16,000 shares here at an avg around $1.10.

Would like to see some positives from the CC tomorrow. Crazy to think I had buys in the $3+ range mere months ago. I'm sure you have much higher...

Really hoping this one is a winner. $20M mkt cap seems low given the AtoZPay potential.

Wonder how the legacy business is doing, too...

It will be . Perfect example of a great company and a screwed up stock . They will sell this company for more then 10 bucks at some point , at least . They have a banker now, they have some capital ( even though it hurt us in the short run) , and I believe some contract announcements should be coming soon.

At least we rode this one down with this some good company .

What does Jon Najarian do when he's not investing? Here's a look in our Halftime Report "Trade Off."

Follow Jon on Twitter: @jonnajarian

Disclosures as of 3/6/19:

Long calls: Albemarle, Alcoa Corp, Axalta Coating, Best Buy, Callon Petroleum, Cardinal Health, Cisco Systems, Crown Castle, D. R. Horton, EBAY, Facebook, Freepoint-McMoRan, Honeywell, Kraft Heinz, Kraneshares TR/CSI China Internet, iShares Silver Trust, Kimberly Clark Corp, Kohl's, Macy's, Melco Resorts & Entertainment, Mellanox Technologies, Micron Technology, MGM Resorts, Microsoft, Net Element, Nio, Nvidia, ******, Procter and Gamble, Republic Services, Roku, Sony, SPDR S&P 500 Trust ETF, Skyworls, Sqaure Inc, SPDR Gold Shares, Target, Tempur Sealy International Inc, Tilray, United Airlines, VanEck VectorsGold Miners ETF, Visa, Western Digital Corp, Weyland Tech, Williams Comapnies Inc, YELP, Zyna Inc

Long stock: Apple, Facebook, Tilray, U.S. Auto Parts.

eyland Tech Inc. Announces Updates Coinciding With Investor Conference Call

Email Print Friendly Share

March 07, 2019 17:01 ET | Source: Weyland Tech, Inc.

New York, March 07, 2019 (GLOBE NEWSWIRE) -- via NEWMEDIAWIRE -- Weyland Tech Inc. (WEYL) (“Weyland” or the “Company”) announces updates coinciding with an investor conference call held on March 7, 2019 at 12 noon EST.

In addition to updates on the Company’s core PaaS business and its eWallet, AtozPay, the following major initiatives and objectives are underway and in various stages:

As announced on September 6, 2018, there has been an increase in private fundings, IPOs and merger and acquisition activity leading to the emergence of large ‘unicorn’ companies competing for marketshare in SE Asia. In February, the Company received an expression of interest in the acquisition of its eWallet business from a regional leader in ride-sharing and delivery. Comparable valuation metrics make this a source of encouragement as we follow through on our mandate at Weyland to build, grow, and sell the businesses that we launch in emerging markets.

Our team in Indonesia continues to build the platform making it attractive to potential acquirers and the landscape continues to improve for a sale.

Management has identified and begun an initiative for entry into our second emerging market in SE Asia. During this process the possibility of a merger with a larger group possessing country licensing and infrastructure needed for rapid expansion has been raised. There have been numerous meetings, calls and terms proposed and should there be a firm agreement, we will pursue it with our Board of Directors and subsequently inform shareholders.

Regarding the current litigation in Singapore and in the US Federal Court in Nevada, over the past two months there has been substantial progress and we remain optimistic that a settlement favorable to shareholders is imminent.

The management team has moved forward re-opening our NASDAQ application and, based upon meetings and discussions with NASDAQ, the Company currently qualifies under most of the criteria for a NASDAQ listing. As we progress, we will inform shareholders.

About Weyland Tech Inc.

Weyland Tech is a global provider of mobile business applications. The Company operates a Platform-as-a-Service (“PaaS”) software used on mobile ‘smartphones’. The PaaS platform offers a mobile presence to Small-to-Medium-Sized- Businesses (“SMB’s”) in emerging markets, with partnerships on 3 continents and growing. The PaaS platform, offered in 14 languages with over 70 integrated modules, enables SMB’s to create native mobile applications (“apps”) for Apple’s iOS and Google Android without technical knowledge or background, empowering SMB’s to increase sales, reach more customers and promote their products and services in an easy, affordable and efficient manner.

About WIP/AtoZPay

Weyland Indonesia Perkasa (“WIP”) / AtoZPay is an Indonesian Company that is held by Weyland Tech via both equity and contractual structures which comply with Indonesia’s foreign commercial ownership regulations. AtoZPay, an eWallet solution, is quickly becoming the adopted standard in Indonesia, the world’s 4th most populous nation, with a majority of consumers without bank accounts. A partnership with Finnet, Indonesia’s state-controlled company tasked with building and supporting banking and finance infrastructure nationwide, and a recently achieved banking license, creates the most robust solution for the “unbanked” in Indonesia. Weyland Tech owns 100% the eWallet software platform which powers AtozPay. In a liquidity event or outright exit via an acquisition, Weyland and its sub-holding (WAI) are entitled to 80% economic benefit.

Email Print Friendly Share

March 07, 2019 17:01 ET | Source: Weyland Tech, Inc.

New York, March 07, 2019 (GLOBE NEWSWIRE) -- via NEWMEDIAWIRE -- Weyland Tech Inc. (WEYL) (“Weyland” or the “Company”) announces updates coinciding with an investor conference call held on March 7, 2019 at 12 noon EST.

In addition to updates on the Company’s core PaaS business and its eWallet, AtozPay, the following major initiatives and objectives are underway and in various stages:

- Expression of Interest for acquisition of the AtozPay business by a large regional tech company

- Update on outstanding litigation in Singapore and US Federal court in Nevada

- Potential for merger and expansion into new emerging market

- Qualification for NASDAQ and re-engagement of application

- Potential for acquisition of the AtozPay business by a large regional tech company

As announced on September 6, 2018, there has been an increase in private fundings, IPOs and merger and acquisition activity leading to the emergence of large ‘unicorn’ companies competing for marketshare in SE Asia. In February, the Company received an expression of interest in the acquisition of its eWallet business from a regional leader in ride-sharing and delivery. Comparable valuation metrics make this a source of encouragement as we follow through on our mandate at Weyland to build, grow, and sell the businesses that we launch in emerging markets.

Our team in Indonesia continues to build the platform making it attractive to potential acquirers and the landscape continues to improve for a sale.

- Potential for merger and expansion into new emerging market

Management has identified and begun an initiative for entry into our second emerging market in SE Asia. During this process the possibility of a merger with a larger group possessing country licensing and infrastructure needed for rapid expansion has been raised. There have been numerous meetings, calls and terms proposed and should there be a firm agreement, we will pursue it with our Board of Directors and subsequently inform shareholders.

- Update on outstanding litigation in Singapore and US Federal court in Nevada

Regarding the current litigation in Singapore and in the US Federal Court in Nevada, over the past two months there has been substantial progress and we remain optimistic that a settlement favorable to shareholders is imminent.

- Qualification for NASDAQ and re-engagement of application

The management team has moved forward re-opening our NASDAQ application and, based upon meetings and discussions with NASDAQ, the Company currently qualifies under most of the criteria for a NASDAQ listing. As we progress, we will inform shareholders.

About Weyland Tech Inc.

Weyland Tech is a global provider of mobile business applications. The Company operates a Platform-as-a-Service (“PaaS”) software used on mobile ‘smartphones’. The PaaS platform offers a mobile presence to Small-to-Medium-Sized- Businesses (“SMB’s”) in emerging markets, with partnerships on 3 continents and growing. The PaaS platform, offered in 14 languages with over 70 integrated modules, enables SMB’s to create native mobile applications (“apps”) for Apple’s iOS and Google Android without technical knowledge or background, empowering SMB’s to increase sales, reach more customers and promote their products and services in an easy, affordable and efficient manner.

About WIP/AtoZPay

Weyland Indonesia Perkasa (“WIP”) / AtoZPay is an Indonesian Company that is held by Weyland Tech via both equity and contractual structures which comply with Indonesia’s foreign commercial ownership regulations. AtoZPay, an eWallet solution, is quickly becoming the adopted standard in Indonesia, the world’s 4th most populous nation, with a majority of consumers without bank accounts. A partnership with Finnet, Indonesia’s state-controlled company tasked with building and supporting banking and finance infrastructure nationwide, and a recently achieved banking license, creates the most robust solution for the “unbanked” in Indonesia. Weyland Tech owns 100% the eWallet software platform which powers AtozPay. In a liquidity event or outright exit via an acquisition, Weyland and its sub-holding (WAI) are entitled to 80% economic benefit.

Well, that didn't take long did it , geeeeeez. Finally put that crap behind us, and we can trade like a real stock

. Up we go STOCK IS BUY!

Weyland Tech Inc. Announces Settlement of Outstanding Litigation

a(79, 79, 84, 0.5)]March 25, 2019

New York, March 25, 2019 (GLOBE NEWSWIRE) -- via NEWMEDIAWIRE -- Weyland Tech Inc. (OTCQX: WEYL) (“Weyland” or the “Company”), a global provider of mobile business applications, announced today that the outstanding litigation between the Company and a group of shareholders in Singapore, regarding ownership of approximately 3,500,000 shares of the Company’s common stock, has been settled. As a result, all outstanding lawsuits and disputes previously reported in the Company’s 10-Q and 10-K filings have been settled and the Company has no further material legal proceedings outstanding.

Brent Suen, Chief Executive Officer of Weyland, stated, “We are pleased to have settled the differences between the Company and a group of shareholders in Singapore, and will endeavor, not only to mitigate outstanding concerns from other shareholders, but also to restore our public profile in Singapore and Southeast Asia that might have been stigmatized by the fact that we were involved in this litigation. Mr. Ravindran Ramasamy, a practicing lawyer and former Member of Singapore’s Parliament, has agreed to work with us, and utilize his extensive network and stature in the region, to assist in this process. We are happy to have him on board and look forward to his involvement.”

In reaction to the settlement, Mr. Ravindran Ramasamy stated, "I am pleased to have resolved our differences and look forward to work with the company to improve our visibility and reputation in the ASEAN investment and business community."

About Weyland Tech Inc.:

Weyland Tech is a global provider of mobile business applications. The Company operates a Platform-as-a-Service (“PaaS”) software used on mobile ‘smartphones’. The PaaS platform offers a mobile presence to Small-to-Medium-Sized- Businesses (“SMB’s”) in emerging markets, with partnerships on 3 continents and growing. The PaaS platform, offered in 14 languages with over 70 integrated modules, enables SMB’s to create native mobile applications (“apps”) for Apple’s iOS and Google Android without technical knowledge or background, empowering SMB’s to increase sales, reach more customers and promote their products and services in an easy, affordable and efficient manner.

About WIP/AtoZPay:

Weyland Indonesia Perkasa (“WIP”) / AtoZPay is an Indonesian Company that is held by Weyland Tech via both equity and contractual structures which comply with Indonesia’s foreign commercial ownership regulations. AtoZPay, an eWallet solution, is quickly becoming the adopted standard in Indonesia, the world’s 4th most populous nation, with a majority of consumers without bank accounts. A partnership with Finnet, Indonesia’s state-controlled company tasked with building and supporting banking and finance infrastructure nationwide, and a recently achieved banking license, creates the most robust solution for the “unbanked” in Indonesia. Weyland Tech owns 100% the eWallet software platform which powers AtozPay. In a liquidity event or outright exit via an acquisition, Weyland and its sub-holding (WAI) are entitled to 80% economic benefit.

Forward-Looking Statements:

This release contains certain “forward-looking statements” relating to the business of the Company. All statements, other than statements of historical fact included herein are “forward-looking statements” including statements regarding: the continued growth of the e-commerce segment and the ability of the Company to continue its expansion into that segment; the ability of the Company to attract customers and partners and generate revenues; the ability of the Company to successfully execute its business plan; the business strategy, plans, and objectives of the Company; and any other statements of non-historical information. These forward-looking statements are often identified by the use of forward-looking terminology such as “believes,” “expects” or similar expressions and involve known and unknown risks and uncertainties. Although the Company believes that the expectations reflected in these forward-looking statements are reasonable, they do involve assumptions, risks, and uncertainties, and these expectations may prove to be incorrect. Investors should not place undue reliance on these forward-looking statements, which speak only as of the date of this news release. The Company’s actual results could differ materially from those anticipated in these forward-looking statements as a result of a variety of factors, including those discussed in the Company’s periodic reports that are filed with the Securities and Exchange Commission and available on its website (http://www.sec.gov). All forward-looking statements attributable to the Company or persons acting on its behalf are expressly qualified in their entirety by these factors. Other than as required under the securities laws, the Company does not assume any duty to update these forward-looking statements.

For further information contact:

Howard Gostfrand

American Capital Ventures, Inc.

President

Office: 305-918-7000

Email: hg@amcapventures.com

www.amcapventures.com

. Up we go STOCK IS BUY!

Weyland Tech Inc. Announces Settlement of Outstanding Litigation

a(79, 79, 84, 0.5)]March 25, 2019

New York, March 25, 2019 (GLOBE NEWSWIRE) -- via NEWMEDIAWIRE -- Weyland Tech Inc. (OTCQX: WEYL) (“Weyland” or the “Company”), a global provider of mobile business applications, announced today that the outstanding litigation between the Company and a group of shareholders in Singapore, regarding ownership of approximately 3,500,000 shares of the Company’s common stock, has been settled. As a result, all outstanding lawsuits and disputes previously reported in the Company’s 10-Q and 10-K filings have been settled and the Company has no further material legal proceedings outstanding.

Brent Suen, Chief Executive Officer of Weyland, stated, “We are pleased to have settled the differences between the Company and a group of shareholders in Singapore, and will endeavor, not only to mitigate outstanding concerns from other shareholders, but also to restore our public profile in Singapore and Southeast Asia that might have been stigmatized by the fact that we were involved in this litigation. Mr. Ravindran Ramasamy, a practicing lawyer and former Member of Singapore’s Parliament, has agreed to work with us, and utilize his extensive network and stature in the region, to assist in this process. We are happy to have him on board and look forward to his involvement.”

In reaction to the settlement, Mr. Ravindran Ramasamy stated, "I am pleased to have resolved our differences and look forward to work with the company to improve our visibility and reputation in the ASEAN investment and business community."

About Weyland Tech Inc.:

Weyland Tech is a global provider of mobile business applications. The Company operates a Platform-as-a-Service (“PaaS”) software used on mobile ‘smartphones’. The PaaS platform offers a mobile presence to Small-to-Medium-Sized- Businesses (“SMB’s”) in emerging markets, with partnerships on 3 continents and growing. The PaaS platform, offered in 14 languages with over 70 integrated modules, enables SMB’s to create native mobile applications (“apps”) for Apple’s iOS and Google Android without technical knowledge or background, empowering SMB’s to increase sales, reach more customers and promote their products and services in an easy, affordable and efficient manner.

About WIP/AtoZPay:

Weyland Indonesia Perkasa (“WIP”) / AtoZPay is an Indonesian Company that is held by Weyland Tech via both equity and contractual structures which comply with Indonesia’s foreign commercial ownership regulations. AtoZPay, an eWallet solution, is quickly becoming the adopted standard in Indonesia, the world’s 4th most populous nation, with a majority of consumers without bank accounts. A partnership with Finnet, Indonesia’s state-controlled company tasked with building and supporting banking and finance infrastructure nationwide, and a recently achieved banking license, creates the most robust solution for the “unbanked” in Indonesia. Weyland Tech owns 100% the eWallet software platform which powers AtozPay. In a liquidity event or outright exit via an acquisition, Weyland and its sub-holding (WAI) are entitled to 80% economic benefit.

Forward-Looking Statements:

This release contains certain “forward-looking statements” relating to the business of the Company. All statements, other than statements of historical fact included herein are “forward-looking statements” including statements regarding: the continued growth of the e-commerce segment and the ability of the Company to continue its expansion into that segment; the ability of the Company to attract customers and partners and generate revenues; the ability of the Company to successfully execute its business plan; the business strategy, plans, and objectives of the Company; and any other statements of non-historical information. These forward-looking statements are often identified by the use of forward-looking terminology such as “believes,” “expects” or similar expressions and involve known and unknown risks and uncertainties. Although the Company believes that the expectations reflected in these forward-looking statements are reasonable, they do involve assumptions, risks, and uncertainties, and these expectations may prove to be incorrect. Investors should not place undue reliance on these forward-looking statements, which speak only as of the date of this news release. The Company’s actual results could differ materially from those anticipated in these forward-looking statements as a result of a variety of factors, including those discussed in the Company’s periodic reports that are filed with the Securities and Exchange Commission and available on its website (http://www.sec.gov). All forward-looking statements attributable to the Company or persons acting on its behalf are expressly qualified in their entirety by these factors. Other than as required under the securities laws, the Company does not assume any duty to update these forward-looking statements.

For further information contact:

Howard Gostfrand

American Capital Ventures, Inc.

President

Office: 305-918-7000

Email: hg@amcapventures.com

www.amcapventures.com

The only thing I’m skeptical about is the wording.

Doesnt say explicitly that the shares will be returned to treasury, just mentions the two sides settled.

Knowing management (S-1), am I cynical to believe we will somehow get screwed by this?

Fingers crossed, my friend! Long and strong. Put all my eggs into this and never got any skin in PRED

Doesnt say explicitly that the shares will be returned to treasury, just mentions the two sides settled.

Knowing management (S-1), am I cynical to believe we will somehow get screwed by this?

Fingers crossed, my friend! Long and strong. Put all my eggs into this and never got any skin in PRED

The only thing I’m skeptical about is the wording.

Doesnt say explicitly that the shares will be returned to treasury, just mentions the two sides settled.

Knowing management (S-1), am I cynical to believe we will somehow get screwed by this?

Fingers crossed, my friend! Long and strong. Put all my eggs into this and never got any skin in PRED

Hope it works out for you Steiner & all the others that are in. I have it on my watch list.....going to see how it goes

The only thing I’m skeptical about is the wording.

Doesnt say explicitly that the shares will be returned to treasury, just mentions the two sides settled.

Knowing management (S-1), am I cynical to believe we will somehow get screwed by this?

Fingers crossed, my friend! Long and strong. Put all my eggs into this and never got any skin in PRED

Expecting a good week next week . Stock tried to get better late in the afternoon . Nice base on which to lift if it starts to go

Buy some PRED . Its far from being to late .

Weyland Tech Inc. Signs Letter of Intent for Strategic Business Alliance in Myanmar

GlobeNewswire•April 9, 2019

GlobeNewswire•April 9, 2019

New York, NY, April 09, 2019 (GLOBE NEWSWIRE) -- via NEWMEDIAWIRE -- Weyland Tech Inc. (WEYL) (“Weyland” or the “Company”), a global provider of mobile business applications, announced today the signing of a non-binding Letter of Intent (“LOI”) with Silver Wave International Pte. Ltd., a holding company organized under the laws of Myanmar (“Silver Wave”), setting forth the proposed terms for a joint venture (“JV”) in Myanmar for the purpose of introducing the Company’s mobile and e-money services through Silver Wave’s merchant channels.

The first step of this JV is expected to be a pilot program of the AtoZpay e-wallet in Myanmar, combining Silver Wave’s financial service licenses and retail presence with Weyland’s AtoZpay and CreateApp/PaaS platform.

Brent Suen, Weyland’s CEO, stated, “We are pleased to announce the proposed joint venture with Silver Wave in SE Asia. This project in Myanmar presents an exciting opportunity for us to expand our e-wallet platform, and a partnership with Silver Wave provides us with key assets to accelerate adoption and growth.”

Suen further noted that a meeting to discuss and sign definitive agreements with the Chairman of Silver Wave is scheduled before the end of April in New York.

The consummation of the transaction remains contingent upon satisfactory completion of due diligence by both parties, completion and agreement on all final terms and conditions of the definitive agreements, obtaining all required consents and approvals, and other customary conditions to closing. Further details shall be made available after the definitive agreements are signed.

About Weyland: