You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Eri

- Thread starter brucefan

- Start date

beast mode

Analyst: Eldorado Resorts not done shopping for casinos

Howard Stutz, CDC Gaming Reports · July 15, 2018 at 7:51 pm

At least one gaming analyst believes the buying spree by Eldorado Resorts is far from over.

Reno-based Eldorado has been an active participant in the current regional gaming consolidation, which will see two operators disappear by the end of the year, swallowed up by larger companies.

Union Gaming Group analyst John DeCree, after hosting a non-deal roadshow with Eldorado Chief Financial Officer Thomas Reeg in Denver, said that there are still “several significant opportunities for incremental (mergers and acquisitions) in the casino sector.”

John DeCree, Union Gaming GroupDeCree said he expects Eldorado to “remain active and disciplined on this front, with a willingness to use a (REIT) partner or off-balance sheet financing.”

John DeCree, Union Gaming GroupDeCree said he expects Eldorado to “remain active and disciplined on this front, with a willingness to use a (REIT) partner or off-balance sheet financing.”

Since completing its game-changing $1.7 billion acquisition of Isle of Capri Casinos in April 2017, which more than doubled the size of the company, Eldorado has remained in growth mode.

In April of this year, the company announced it was partnering with real estate investment trust Gaming and Leisure Partners to acquire seven casinos operated by Tropicana Entertainment at a total cost of $1.85 billion. The transaction includes the Tropicana Resort in Atlantic City and two Nevada casinos, MontBleu in Lake Tahoe and Tropicana Laughlin.

On the same day, Eldorado agreed to purchase Grand Victoria Casino in Illinois for $327.5 million.

Last week, Eldorado CEO Gary Carano called both transactions “highly accretive… (which) further increase the scale of our regional gaming platform and significantly accelerate the company’s free cash flow growth.”

The transactions will give Eldorado nearly 30 casinos in 12 states, making the company the second largest regional casino operator in the U.S. behind Penn National Gaming.

Meanwhile, Eldorado is parting with the Presque Isle Downs & Casino in Erie, Pa., and the management contract for the Lady Luck Nemacolin. Both deals are with Churchill Downs.

DeCree hinted that Eldorado, the dominant casino operator in Reno with three of the Northern Nevada market’s largest resorts, could be eyeballing a location on the Las Vegas Strip. Once the Tropicana purchase closes, the company will operate a casino in every major market in Nevada except the Strip. The Tropicana Las Vegas is owned by Penn National Gaming.

Eldorado’s other major deal, with Maryland-based Cordish Companies, involves the redevelopment of 223 acres surrounding Isle Casino Racing in Pompano Park, Fla., with a mixed-use non-gaming development. That project is not expected to open until 2020.

DeCree said investors don’t understand the worth of the Pompano Park project and that its value is not reflected in the company’s current stock price. On Friday, Eldorado shares closed at $46.25, just shy of its 52-week high of $46.85. DeCree gave Eldorado a price target of $50 a share.

“We believe there is some meaningful present value embedded in the real estate opportunity, though (it will be) difficult to quantify until we have more detail,” DeCree said. “Once Eldorado and (Cordish) announce more definitive plans and designs, we suspect the market will be more willing to begin assigning value to the project.”

More than half the questions at the investor meeting dealt with Eldorado’s plans for the Tropicana Atlantic City. Interest in the market is strong, given last month’s openings of Hard Rock Atlantic City and Oceans Resort and the roll-out of legal sports wagering.

Grand Victoria Riverboat Casino in IllinoisDeCree, however, thought there was too much emphasis on Atlantic City. He noted the investment multiples are stronger across some of the other Tropicana properties Eldorado is acquiring. Gaming revenue at Tropicana Evansville in Indiana has grown 20 percent this year, while St. Louis’ Lumiere Casino operates in a strong market.

Grand Victoria Riverboat Casino in IllinoisDeCree, however, thought there was too much emphasis on Atlantic City. He noted the investment multiples are stronger across some of the other Tropicana properties Eldorado is acquiring. Gaming revenue at Tropicana Evansville in Indiana has grown 20 percent this year, while St. Louis’ Lumiere Casino operates in a strong market.

The hidden gem, DeCree said, could be Grand Victoria. The purchase is expected to close by the end of summer, and DeCree said a riverboat casino would contribute more cash flow to Eldorado than Tropicana Atlantic City.

Over the last 12 months, Grand Victoria has produced $36 million in cash flow, DeCree said.

He added Grand Victoria “could potentially benefit from a hotel,” like the successful partnership the company’s Scioto Downs Racetrack Casino in Ohio has entered into with a nearby Hampton Inn.

The Tropicana Entertainment deal involves GLPI, the gaming industry’s largest REIT, acquiring the land associated with six of the seven properties. DeCree believes Eldorado would rather make additional deals on their own.

“Given the upward trajectory of casino valuations, we expect Eldorado would prefer to own as much casino real estate as possible,” he said.

Howard Stutz is the executive editor of CDC Gaming Reports. He can be reached at hstutz@cdcgamingreports.com. Follow @howardstutz on Twitter.

[/COLOR]

Analyst: Eldorado Resorts not done shopping for casinos

Howard Stutz, CDC Gaming Reports · July 15, 2018 at 7:51 pm

[COLOR=#FFFFFF !important]Save

Share3At least one gaming analyst believes the buying spree by Eldorado Resorts is far from over.

Reno-based Eldorado has been an active participant in the current regional gaming consolidation, which will see two operators disappear by the end of the year, swallowed up by larger companies.

Union Gaming Group analyst John DeCree, after hosting a non-deal roadshow with Eldorado Chief Financial Officer Thomas Reeg in Denver, said that there are still “several significant opportunities for incremental (mergers and acquisitions) in the casino sector.”

John DeCree, Union Gaming GroupDeCree said he expects Eldorado to “remain active and disciplined on this front, with a willingness to use a (REIT) partner or off-balance sheet financing.”

John DeCree, Union Gaming GroupDeCree said he expects Eldorado to “remain active and disciplined on this front, with a willingness to use a (REIT) partner or off-balance sheet financing.”Since completing its game-changing $1.7 billion acquisition of Isle of Capri Casinos in April 2017, which more than doubled the size of the company, Eldorado has remained in growth mode.

In April of this year, the company announced it was partnering with real estate investment trust Gaming and Leisure Partners to acquire seven casinos operated by Tropicana Entertainment at a total cost of $1.85 billion. The transaction includes the Tropicana Resort in Atlantic City and two Nevada casinos, MontBleu in Lake Tahoe and Tropicana Laughlin.

On the same day, Eldorado agreed to purchase Grand Victoria Casino in Illinois for $327.5 million.

Last week, Eldorado CEO Gary Carano called both transactions “highly accretive… (which) further increase the scale of our regional gaming platform and significantly accelerate the company’s free cash flow growth.”

The transactions will give Eldorado nearly 30 casinos in 12 states, making the company the second largest regional casino operator in the U.S. behind Penn National Gaming.

Meanwhile, Eldorado is parting with the Presque Isle Downs & Casino in Erie, Pa., and the management contract for the Lady Luck Nemacolin. Both deals are with Churchill Downs.

DeCree hinted that Eldorado, the dominant casino operator in Reno with three of the Northern Nevada market’s largest resorts, could be eyeballing a location on the Las Vegas Strip. Once the Tropicana purchase closes, the company will operate a casino in every major market in Nevada except the Strip. The Tropicana Las Vegas is owned by Penn National Gaming.

Eldorado’s other major deal, with Maryland-based Cordish Companies, involves the redevelopment of 223 acres surrounding Isle Casino Racing in Pompano Park, Fla., with a mixed-use non-gaming development. That project is not expected to open until 2020.

DeCree said investors don’t understand the worth of the Pompano Park project and that its value is not reflected in the company’s current stock price. On Friday, Eldorado shares closed at $46.25, just shy of its 52-week high of $46.85. DeCree gave Eldorado a price target of $50 a share.

“We believe there is some meaningful present value embedded in the real estate opportunity, though (it will be) difficult to quantify until we have more detail,” DeCree said. “Once Eldorado and (Cordish) announce more definitive plans and designs, we suspect the market will be more willing to begin assigning value to the project.”

More than half the questions at the investor meeting dealt with Eldorado’s plans for the Tropicana Atlantic City. Interest in the market is strong, given last month’s openings of Hard Rock Atlantic City and Oceans Resort and the roll-out of legal sports wagering.

Grand Victoria Riverboat Casino in IllinoisDeCree, however, thought there was too much emphasis on Atlantic City. He noted the investment multiples are stronger across some of the other Tropicana properties Eldorado is acquiring. Gaming revenue at Tropicana Evansville in Indiana has grown 20 percent this year, while St. Louis’ Lumiere Casino operates in a strong market.

Grand Victoria Riverboat Casino in IllinoisDeCree, however, thought there was too much emphasis on Atlantic City. He noted the investment multiples are stronger across some of the other Tropicana properties Eldorado is acquiring. Gaming revenue at Tropicana Evansville in Indiana has grown 20 percent this year, while St. Louis’ Lumiere Casino operates in a strong market.The hidden gem, DeCree said, could be Grand Victoria. The purchase is expected to close by the end of summer, and DeCree said a riverboat casino would contribute more cash flow to Eldorado than Tropicana Atlantic City.

Over the last 12 months, Grand Victoria has produced $36 million in cash flow, DeCree said.

He added Grand Victoria “could potentially benefit from a hotel,” like the successful partnership the company’s Scioto Downs Racetrack Casino in Ohio has entered into with a nearby Hampton Inn.

The Tropicana Entertainment deal involves GLPI, the gaming industry’s largest REIT, acquiring the land associated with six of the seven properties. DeCree believes Eldorado would rather make additional deals on their own.

“Given the upward trajectory of casino valuations, we expect Eldorado would prefer to own as much casino real estate as possible,” he said.

Howard Stutz is the executive editor of CDC Gaming Reports. He can be reached at hstutz@cdcgamingreports.com. Follow @howardstutz on Twitter.

[/COLOR]

[h=1]Eldorado Resorts Reports Second Quarter Net Revenue of $456.8 Million, Operating Income of $77.4 Million and Record Adjusted EBITDA of $118.0 Million[/h]

https://finance.yahoo.com/news/eldorado-resorts-reports-second-quarter-200500497.html

https://finance.yahoo.com/news/eldorado-resorts-reports-second-quarter-200500497.html

Eldorado not done dealing, touts its regional footprint as an attractive sports betting partner

Eldorado Resorts, one of the casino industry’s most active companies on the acquisition front in the past few years, told the market Thursday it wasn’t done buying.

On a conference call with analysts to discuss second quarter results, executives from the Reno-based company said the still have appetite for deals. Eldorado has several large and small asset transactions working their way through the system – including a $1.85 billion acquisition of Tropicana Entertainment in partnership with real estate investment trust Gaming and Leisure Properties.

However, based on “what’s actively being shopped,” Eldorado CEO Gary Carano said the company wouldn’t be buyers. “But we’re poised to take advantage.”

One deal – Eldorado’s $327.5 million acquisition of Grand Victoria Casino in Elgin, Ill., from MGM Resorts International – was approved Thursday by the Illinois Gaming Board. The company expects the deal to close in third quarter.

Eldorado is acquiring the operating assets of seven Tropicana-owned casinos in six states from corporate raider Carl Icahn. The properties include the Tropicana Atlantic City; two casinos in Nevada – Tropicana Laughlin and MontBleu Resort in South Lake Tahoe; Tropicana Evansville in Indiana; Belle of Baton Rouge in Louisiana; Trop Casino Greenville in Mississippi; and Lumière Place in St. Louis. The deal is expected to close by the end of the year.

Adding in the 10 states where Eldorado already operates 20 properties, CFO Thomas Reeg said the company becomes “a very attractive partner” considering the growth of sports wagering.

“What we present to a potential partner is a map a most of the U.S.,” Reeg said.

Eldorado, which has operated sports books in Reno, expects to be operating at its regional properties “where we can by football season.”

Reeg was bullish on sports betting, especially in Atlantic City. He said the activity has been “under-estimated” by the regional markets. Sports betting customers do more than just bet on games and a casino doesn’t need to offer incentives to get them through the door.

“This group of customers come in because there is something on TV,” Reeg said. “This is the kind of customer who shows up to bet, drink, visit your restaurants, plays a bit in the casino and stays in your hotel. The regional markets will really benefit.”

During the second quarter that ended June 30, Eldorado’s net revenue was $456.8 million, 21 percent higher than the same quarter a year ago. The company’s net income of $36.8 million, or 47 cents per share, reversed a net loss from the same quarter of 2017.

Eldorado rebranded its three interconnected flagship Reno casinos – Eldorado, Silver Legacy and Circus Circus – as “The Row,” which covers six city blocks.

“’The Row’ leverages our integrated design and property enhancements and amplifies the convenience, amenities, entertainment and quality (of the three resorts),” Carano said in a statement.

Eldorado is planning a renovation of 400 rooms at the Silver Legacy and will open its Brew Brothers microbrewery restaurant at casinos in Iowa and Missouri. Also, Eldorado will begin a room renovation project to all 402 rooms at the company’s Colorado properties that is expected to be completed in the first quarter of 2019.

Shares of Eldorado, traded on the Nasdaq, closed at $41.40 on Thursday, down 5 cents or 0.12 percent.

Howard Stutz is the executive editor of CDC Gaming Reports. He can be reached at hstutz@cdcgamingreports.com. Follow @howardstutz on Twitter.

Eldorado Resorts, one of the casino industry’s most active companies on the acquisition front in the past few years, told the market Thursday it wasn’t done buying.

On a conference call with analysts to discuss second quarter results, executives from the Reno-based company said the still have appetite for deals. Eldorado has several large and small asset transactions working their way through the system – including a $1.85 billion acquisition of Tropicana Entertainment in partnership with real estate investment trust Gaming and Leisure Properties.

However, based on “what’s actively being shopped,” Eldorado CEO Gary Carano said the company wouldn’t be buyers. “But we’re poised to take advantage.”

One deal – Eldorado’s $327.5 million acquisition of Grand Victoria Casino in Elgin, Ill., from MGM Resorts International – was approved Thursday by the Illinois Gaming Board. The company expects the deal to close in third quarter.

Eldorado is acquiring the operating assets of seven Tropicana-owned casinos in six states from corporate raider Carl Icahn. The properties include the Tropicana Atlantic City; two casinos in Nevada – Tropicana Laughlin and MontBleu Resort in South Lake Tahoe; Tropicana Evansville in Indiana; Belle of Baton Rouge in Louisiana; Trop Casino Greenville in Mississippi; and Lumière Place in St. Louis. The deal is expected to close by the end of the year.

Adding in the 10 states where Eldorado already operates 20 properties, CFO Thomas Reeg said the company becomes “a very attractive partner” considering the growth of sports wagering.

“What we present to a potential partner is a map a most of the U.S.,” Reeg said.

Eldorado, which has operated sports books in Reno, expects to be operating at its regional properties “where we can by football season.”

Reeg was bullish on sports betting, especially in Atlantic City. He said the activity has been “under-estimated” by the regional markets. Sports betting customers do more than just bet on games and a casino doesn’t need to offer incentives to get them through the door.

“This group of customers come in because there is something on TV,” Reeg said. “This is the kind of customer who shows up to bet, drink, visit your restaurants, plays a bit in the casino and stays in your hotel. The regional markets will really benefit.”

During the second quarter that ended June 30, Eldorado’s net revenue was $456.8 million, 21 percent higher than the same quarter a year ago. The company’s net income of $36.8 million, or 47 cents per share, reversed a net loss from the same quarter of 2017.

Eldorado rebranded its three interconnected flagship Reno casinos – Eldorado, Silver Legacy and Circus Circus – as “The Row,” which covers six city blocks.

“’The Row’ leverages our integrated design and property enhancements and amplifies the convenience, amenities, entertainment and quality (of the three resorts),” Carano said in a statement.

Eldorado is planning a renovation of 400 rooms at the Silver Legacy and will open its Brew Brothers microbrewery restaurant at casinos in Iowa and Missouri. Also, Eldorado will begin a room renovation project to all 402 rooms at the company’s Colorado properties that is expected to be completed in the first quarter of 2019.

Shares of Eldorado, traded on the Nasdaq, closed at $41.40 on Thursday, down 5 cents or 0.12 percent.

Howard Stutz is the executive editor of CDC Gaming Reports. He can be reached at hstutz@cdcgamingreports.com. Follow @howardstutz on Twitter.

First post on this was $7.20 They all should be this easy . Nothing in the chart says anything but going higher

Thought I would post these comments though from

Howard Jay Klein

El Dorado Resorts Inc (NASDAQ:ERI). Below the El Dorado flagship in Reno.

As followers of this space on SA have long known, we have been long-time fans of this company and its shares. It has a superb blend of financial discipline and built from the ground excellent customer service know how by the still active Carano family. It also has been on the move.

In the past 18 months it has swallowed four properties from the Carl Icahn portfolio and will lease six others from the GPLI REIT, bought Isle of Capri and was the buyer of MGM’s Grand Victoria. This speedy ramp up outside its long dominant Reno base signals a major departure to expand geography and scale up. We have been bullish on this company and tagged it a buy early on. its current $47.40 trade makes it fully valued at the moment.

There have been some observers who have questioned ERI’s ability to metabolize so much scale in so short a time and therefore warn that further upside may not be taken for granted. I'm a believer in this company’s ability to produce the synergies and earning accretion of these acquisitions.

I don’t think their buying spree is over by any measure. But I do think the stock is fully priced at the moment and see it as a very positive hold.

Thought I would post these comments though from

Howard Jay Klein

El Dorado Resorts Inc (NASDAQ:ERI). Below the El Dorado flagship in Reno.

As followers of this space on SA have long known, we have been long-time fans of this company and its shares. It has a superb blend of financial discipline and built from the ground excellent customer service know how by the still active Carano family. It also has been on the move.

In the past 18 months it has swallowed four properties from the Carl Icahn portfolio and will lease six others from the GPLI REIT, bought Isle of Capri and was the buyer of MGM’s Grand Victoria. This speedy ramp up outside its long dominant Reno base signals a major departure to expand geography and scale up. We have been bullish on this company and tagged it a buy early on. its current $47.40 trade makes it fully valued at the moment.

There have been some observers who have questioned ERI’s ability to metabolize so much scale in so short a time and therefore warn that further upside may not be taken for granted. I'm a believer in this company’s ability to produce the synergies and earning accretion of these acquisitions.

I don’t think their buying spree is over by any measure. But I do think the stock is fully priced at the moment and see it as a very positive hold.

William Hill and Eldorado Resorts enter US partnership

PR Newswire•September 5, 2018

Extends William Hill US' leadership in sports betting through access to Eldorado's leading regional casino portfolio and customer base of 23 million people

William Hill becomes Eldorado's exclusive partner in provision of digital and land-based sports betting and online gaming

Closely aligned partnership to deliver on US opportunity, with William Hill retaining control and strategic flexibility

LONDON, Sept. 5, 2018 /PRNewswire/ -- William Hill PLC (WMH.L) today announces that William Hill US ("William Hill") and Eldorado Resorts, Inc. (ERI) have entered into a nationwide partnership for digital and land-based sports betting and online gaming in the United States.

The partnership combines the leading sports betting company in the US, William Hill, with the extensive market access of Eldorado – a major casino group with 21 properties across 11 states and a customer base of 23 million people. Eldorado'spending acquisition of Tropicana Entertainment Inc. will further extend its reach to 26 properties in 13 states on completion which is expected in the fourth quarter of 2018.

Under the terms of the agreement William Hill becomes Eldorado's exclusive partner in the provision of digital and land-based sports betting services as well as online gaming. As a result, William Hill's reach now extends to 13 states where sports betting is either legal or sports betting bills are tabled.

Within weeks the partners will open William Hill sportsbooks in five properties across three states – The Tropicana in Atlantic City, New Jersey; The Mountaineer Casino Racetrack and Resort in West Virginia, and three casinos in Mississippi – The Lady Luck Casino in Vicksburg, Isle of Capri in Lula and Tropicana Casino in Greenville. Sportsbooks in additional casinos/states as well as digital betting and gaming services will be launched in the months ahead subject to the legislation in each state.

William Hill PLC and Eldorado, who have partnered since 2012 in Nevada, are strongly aligned to grow William Hill US, with the company currently involved in discussions with a number of potential partners.

Commenting on the agreement Philip Bowcock, William Hill PLC Chief Executive Officer, said: "Partnering with Eldorado gives William Hill access to one of the largest and most attractive casino footprints with 23 million customers across multiple states. This partnership provides extensive cross sell and profit growth opportunities to both parties. Together we are positioned to capture the evolving US opportunity – starting with land-based sports betting, and extending to digital sports betting and, in some states, online gaming."

Gary Carano, Chairman and Chief Executive Officer of Eldorado Inc., commented: "Having worked with the company since 2012, we believe William Hill represents the gold standard in global sports betting and we are confident that our expanded partnership will be successful. We look forward to bringing the excitement of sports betting to customers across our growing platform of leading casino resorts, creating value for all shareholders."

Key features of the partnership

The commencement of operations under this agreement are subject to relevant anti-trust and gaming regulatory approvals. Completion is expected following the necessary approvals. The transaction constitutes a class 2 transaction for the purposes of the UK Listing Rules. For the purposes of the LR 10.4.1 R (Notification of class 2 transactions), the value of the gross assets of William Hill US is $68.5 million and William Hill US generated adjusted operating profits of $28.5m in 2017. William Hill PLC has a market capitalisation of £2.1 billion.

As part of the agreement Eldorado will receive initial consideration of $50m in William Hill PLC shares which are subject to an initial 3-5 year lock-up period, as well as a 20% shareholding in William Hill US. This business includes William Hill's operations in Nevada, New Jersey, Delaware, Mississippi, Rhode Island, West Virginia and Iowa as well as its operations in the Bahamas and St Kitts, and all future Eldorado and non-Eldorado US business. Eldorado also has the right to convert its William Hill US shareholding into William Hill PLC shares at market value on the occurrence of certain vesting triggers or during an agreed future exercise window after five years. William Hill has the right to settle the conversion amount due to Eldorado in cash or shares at William Hill's discretion.

As noted above, under the terms of the transaction, William Hill PLC will issue 13,376,135 new Ordinary Shares of 10p each to Eldorado, representing $50m (the Consideration Shares). The Consideration Shares will rank pari passu with the existing ordinary shares of the Company. Applications will be made for the Consideration Shares to be admitted to the premium segment of the Official List and to be admitted to trading on the London Stock Exchange's main market for listed securities (Admission). Admission will occur at the completion of the transaction.

The information contained within this announcement is deemed to constitute inside information as stipulated under the Market Abuse Regulation (EU) No. 596/2014. Upon the publication of this announcement, this inside information is now considered to be in the public domain.

OAM: Inside Information

William Hill LEI: 213800 MDW41W5UZQ1X82

Notes:

1 Following completion of Tropicana acquisition, expected in Q4 2018;

2 Subject to any existing contractual obligations in newly acquired proper

PR Newswire•September 5, 2018

Extends William Hill US' leadership in sports betting through access to Eldorado's leading regional casino portfolio and customer base of 23 million people

William Hill becomes Eldorado's exclusive partner in provision of digital and land-based sports betting and online gaming

Closely aligned partnership to deliver on US opportunity, with William Hill retaining control and strategic flexibility

LONDON, Sept. 5, 2018 /PRNewswire/ -- William Hill PLC (WMH.L) today announces that William Hill US ("William Hill") and Eldorado Resorts, Inc. (ERI) have entered into a nationwide partnership for digital and land-based sports betting and online gaming in the United States.

The partnership combines the leading sports betting company in the US, William Hill, with the extensive market access of Eldorado – a major casino group with 21 properties across 11 states and a customer base of 23 million people. Eldorado'spending acquisition of Tropicana Entertainment Inc. will further extend its reach to 26 properties in 13 states on completion which is expected in the fourth quarter of 2018.

Under the terms of the agreement William Hill becomes Eldorado's exclusive partner in the provision of digital and land-based sports betting services as well as online gaming. As a result, William Hill's reach now extends to 13 states where sports betting is either legal or sports betting bills are tabled.

Within weeks the partners will open William Hill sportsbooks in five properties across three states – The Tropicana in Atlantic City, New Jersey; The Mountaineer Casino Racetrack and Resort in West Virginia, and three casinos in Mississippi – The Lady Luck Casino in Vicksburg, Isle of Capri in Lula and Tropicana Casino in Greenville. Sportsbooks in additional casinos/states as well as digital betting and gaming services will be launched in the months ahead subject to the legislation in each state.

William Hill PLC and Eldorado, who have partnered since 2012 in Nevada, are strongly aligned to grow William Hill US, with the company currently involved in discussions with a number of potential partners.

Commenting on the agreement Philip Bowcock, William Hill PLC Chief Executive Officer, said: "Partnering with Eldorado gives William Hill access to one of the largest and most attractive casino footprints with 23 million customers across multiple states. This partnership provides extensive cross sell and profit growth opportunities to both parties. Together we are positioned to capture the evolving US opportunity – starting with land-based sports betting, and extending to digital sports betting and, in some states, online gaming."

Gary Carano, Chairman and Chief Executive Officer of Eldorado Inc., commented: "Having worked with the company since 2012, we believe William Hill represents the gold standard in global sports betting and we are confident that our expanded partnership will be successful. We look forward to bringing the excitement of sports betting to customers across our growing platform of leading casino resorts, creating value for all shareholders."

Key features of the partnership

- William Hill becomes Eldorado's exclusive partner for digital and retail sports betting. The agreement also covers the provision of online casino.

- The partnership extends the reach of William Hill US and covers Eldorado's 26 properties across 131 states, plus any new properties it may acquire or develop.

- William Hill US retains 80% of the enhanced business, retaining strategic flexibility with both incentivised to grow digital and land-based sports betting in the US.

- Eldorado receives $50m of stock in William Hill PLC (equivalent to circa 1.6% of its market capitalisation), subject to a 3-5 year lock up; a 20% stake in William Hill US and a share of profits attributable to its licenses, closely aligning the two partners' interests.

- Investment in sportsbooks in five existing casino properties set to begin imminently with capital expenditure jointly split between the partners.

- The agreement is for an initial 25-year term.

- Operating in New Jersey at Monmouth Park Racetrack, where it took the first legal bet in that state in June 2018, and at the Ocean Resort Casino in Atlantic City;

- The exclusive risk manager for the sports lottery in Delaware;

- The sportsbook partner in 13 casinos in Mississippi where it expects to be the market leading operator;

- The exclusive partner to IGT in Rhode Island where it supplies sports betting technology and services to the state lottery;

- Taking bets in West Virginia where the first bets were taken on August 30

- Set to open a sportsbook in Pennsylvania in the coming weeks.

The commencement of operations under this agreement are subject to relevant anti-trust and gaming regulatory approvals. Completion is expected following the necessary approvals. The transaction constitutes a class 2 transaction for the purposes of the UK Listing Rules. For the purposes of the LR 10.4.1 R (Notification of class 2 transactions), the value of the gross assets of William Hill US is $68.5 million and William Hill US generated adjusted operating profits of $28.5m in 2017. William Hill PLC has a market capitalisation of £2.1 billion.

As part of the agreement Eldorado will receive initial consideration of $50m in William Hill PLC shares which are subject to an initial 3-5 year lock-up period, as well as a 20% shareholding in William Hill US. This business includes William Hill's operations in Nevada, New Jersey, Delaware, Mississippi, Rhode Island, West Virginia and Iowa as well as its operations in the Bahamas and St Kitts, and all future Eldorado and non-Eldorado US business. Eldorado also has the right to convert its William Hill US shareholding into William Hill PLC shares at market value on the occurrence of certain vesting triggers or during an agreed future exercise window after five years. William Hill has the right to settle the conversion amount due to Eldorado in cash or shares at William Hill's discretion.

As noted above, under the terms of the transaction, William Hill PLC will issue 13,376,135 new Ordinary Shares of 10p each to Eldorado, representing $50m (the Consideration Shares). The Consideration Shares will rank pari passu with the existing ordinary shares of the Company. Applications will be made for the Consideration Shares to be admitted to the premium segment of the Official List and to be admitted to trading on the London Stock Exchange's main market for listed securities (Admission). Admission will occur at the completion of the transaction.

The information contained within this announcement is deemed to constitute inside information as stipulated under the Market Abuse Regulation (EU) No. 596/2014. Upon the publication of this announcement, this inside information is now considered to be in the public domain.

OAM: Inside Information

William Hill LEI: 213800 MDW41W5UZQ1X82

Notes:

1 Following completion of Tropicana acquisition, expected in Q4 2018;

2 Subject to any existing contractual obligations in newly acquired proper

Sports Betting: As The Dust Begins To Settle, These 2 Companies Deliver The Best Upside Odds

Sep. 20, 2018 2:18 PM ET|

9 comments

|

Includes: BYD, ERI

Howard Jay Klein

Summary

The musical chairs game is on with dozens of wannabe operators already shuffling for position for the estimated $150bn illegal sports betting business estimated by the American Gaming Association.

We've picked two stocks we believe, despite higher valuations, still offer solid entry points going forward based on their management moves this early in the game.

Both have moved quickly and smartly and are positioned to achieve quick revenue accretion in sports betting as more states legalize.

This idea was discussed in more depth with members of my private investing community, The House Edge. Start your free trial today »

“The secret to winning is constant, consistent management.” Tom Landry

Part One of Two Articles

This article examines what we believe to be the two best bets in the casino space to achieve the fastest ramp up in sports betting as legalization unfolds. In a subsequent article we will look at the online gaming platforms and equipment space picking among companies we have extensively covered relative to sports betting.

Since the historic US Supreme Court decision May 6 that struck down the PASA law and threw open the flood gates to legalized sports betting, the sector has been engulfed by a game of musical chairs. Dozens of operators from every subsector of gaming and media have weighed in, dancing around the rapidly decreasing line of empty chairs. All have their eye on the fattest potential seat ever to be dangled before the gaming industry since the breaking of the Nevada monopoly on legal casinos in Atlantic City in 1978.

The American Gaming Association estimates that illegal sports gambling is a $150 billion a year business. That assessment is not scientifically demonstrable since there's no realistic way you can count the noses or handle of a representative sample of illegal bookmakers now operating in the US. But you can make an educated guess. And mine is that the AGA number is about as good as there is out there.

To get a grasp on the implications for the business, consider this: A Price Waterhouse Coopers 2012 study projected global casino revenues to rise to $182bn by 2017. The primary regional growth engine is of course Asia, attaining the lead position with 44% of all revenue. Now assume no more than 20% of the presumed illegal $150bn sports wagering play is transformed legally. As US states, one by one, approve sports betting, we think up to 14 states will be legal within three years, and around 30 within the next five to seven years.

Margins on sports betting are slim. On average the house keeps about $3 for every $100 bet. But this is a volume business and one that's consistent. NFL betting, the biggest piñata in the entire space, affords gamblers 16 regular season games to bet on, the playoffs and of course, the mother of all events, the Super Bowl. Also, the imagination of bookmakers over the decades has been dazzling in their creation of dozens of types of exotic bets to entice laydowns by the regulars aimed at building volume of play.

Oddsmaking has become a science, sports information services are abundant, legal bets will now even include the ability to wager during a game. NFL volume leads, followed by college football and the NBA. Much lower on the volume food chain are MLB and NHL. But events also pop volume: The Final Four, The World Cup, World Series, NBA finals and college football championship games. So sports betting is by any measure a consistent, daily business that relies on grind volume. VIPs who can be realistically classified as professional gamblers with big money weekly laydowns comprise a small, but clearly important segment of the market.

All the frenetic jockeying for position, acquisitions and partnerships that have exploded ever since the court decision proves that the race always goes to the swift indeed. The question for investors now is this: Who will be the swiftest, who will have the smartest plan, who is best positioned to glom off the biggest potential market share of sports betting business? In prior posts we have attempted to break down the subsectors and present them to investors. We now share who we think will be sitting prettiest when the music stops.

We’d named a few early favorites right after the court decision. Now that we have a firmer sense of the general strategic landscape in which the business seems to be moving, we can pinpoint our best picks for what a smart, well-balanced sports betting portfolio should contain for the highest and speediest possible return.

Our criteria:

This is not standard security analysis focused entirely on numbers, ratios, etc. That’s part of our boxes to check, but these considerations are industry centric and specific to these shares. We’ve boiled our picks down to the stocks meeting these criteria:

1. Proven management quality and capacity to execute for shareholders over time.

2. Share prices that are either near fully valued that still have run room in our view.

3. Elements that will cohere that the market has yet to fully bake into the trade.

4. Occupation of one of these key sub sectors of gaming: Casino, or online real money wagering platforms. We have not included gaming equipment/tech companies in this portfolio because we will cover them in Part 2 of this review.

5. Geographic scale encompassing a wide and diverse spread across the US’s most potentially lucrative sports betting regions.

The companies included here are few, but in our opinion represent the most well-managed, strongest positioned and savviest companies likely to build a strong market share and the business model most potentially accretive to earnings.

Our Picks

El Dorado Resorts (NASDAQ:ERI)

Price at writing: $48.30

52wk range: $23.95---$50.00

ROE: 17.7% vs. 15.5% for industry.

ERI data by YChartsIn our Nov 2017 we guided strongly bullish on the stock which was trading that day at $25.60. We based our outlook on high conviction over many years that placed ERI management quality and execution far above many peers.

ERI data by YChartsIn our Nov 2017 we guided strongly bullish on the stock which was trading that day at $25.60. We based our outlook on high conviction over many years that placed ERI management quality and execution far above many peers.

The company is moving fast and deftly to expand its geographic reach and immediately dive into sports betting deals.

1.The Carrano family has radiated out of its core Reno home to 21 properties in 13 states. Most recently, it acquired from Carl Icahn his seven-property Tropicana portfolio for $1.85bn which includes its Atlantic City flagship, currently holding second position in gaming revenue in that market. Five of the Icahn properties were quickly lateralled into the Gaming & Leisure Properties REIT (NASDAQ”GLPI).

2. On September 5, ERI announced a partnership deal with William Hill plc (OTC:OTCPK:WIMHY). The deal is among the most elegant in the space. Hill will pay ERI $50m in stock and a 20% stake in its US business for the right to run the entire sportsbook operation in all 21 properties. Five will begin immediately taking action in states where it's already legal.

What this means: ERI gets Hill’s long expertise, tech know how, platform features and mostly its consummate skill in marketing to sports bettors over decades in the UK, as well as its US operations in Nevada and New Jersey. It also opens the possibilities if and when free standing betting shops are legalized that Hill, long in that business, can step up to that potential faster than most. The Hill stock ERI gets has room to run as legalization unfolds in the US. It’s a brilliant, no cash, no debt deal.

3. ERI already is licensed by gaming commissions in all the states in which it owns casinos. This materially short cuts what could be a lengthy licensure process that can last for more than a year for companies without licenses. This means speed to market — a key here.

4.ERI will continue to concentrate on its core casino business, leave the sports betting to Hill and participate in Hill’s success as shareholders outside the ERI portfolio. Hill already has an ongoing business in Nevada and New Jersey at other casinos and racetracks.

Our view: While we believe ERi at $48.30 comes close to be fully valued at the moment, we do see enough upside ahead in both casinos and sports betting to justify consideration of an entry point now. It has nearly doubled since our last recommendation, fulfilling our expectation that it knows how to execute, deliver superior customer service, and keep an eye on costs. With sports betting now a reality we see the company leveraging its enlarged asset base and achieving the kind of scale that will make the business highly accretive to EBITDA over the next three years.

We have included ERI not because we see the stock as cheap now, but because we see it as a solid, imaginative, tightly managed company, which makes consistently savvy asset allocation decisions. Our PT aims at $63 by 2Q of 2019 on ERI, bearing in mind its participation in an upside we see for Hill itself during that period.

It’s a "sleep tight" stock that belongs in a model portfolio skewed with a sports betting upside.

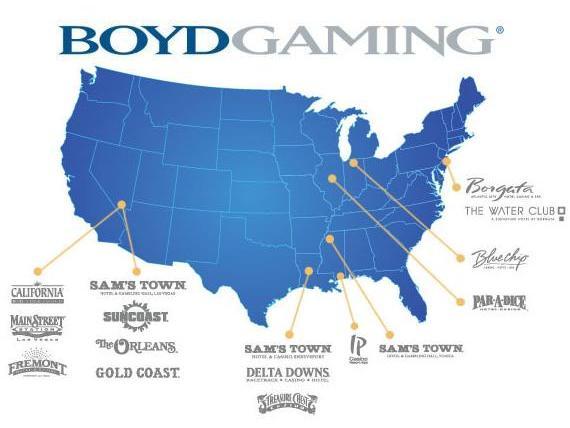

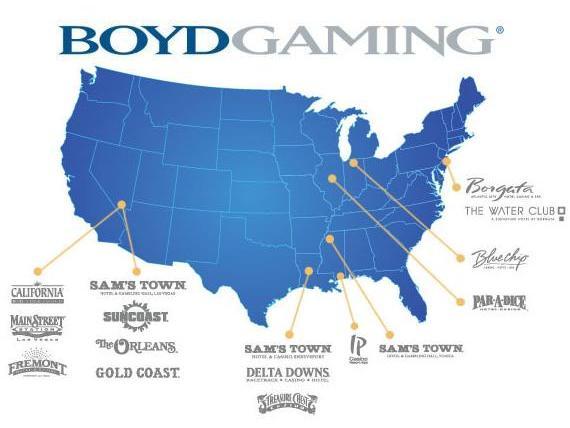

Boyd Gaming Corp. (NYSE:BYD)

Price at writing: $37.97. 52-week range: $24.53--$40.44

BYD data by YCharts

BYD data by YCharts

We have long been fans of BYD as well as ERI fundamentally due to our conviction that like ERI, its management culture was superior to many peers. In 2016 the shares were trading at $19.80. I put a PT on the stock of $26 to $30 and then a short-term hold. I wanted to see how its expectations for its Las Vegas locals business played out. Having liked what I saw, I reiterated my call that this stock had runway. It too has about doubled since my initial call.

We have long been fans of BYD as well as ERI fundamentally due to our conviction that like ERI, its management culture was superior to many peers. In 2016 the shares were trading at $19.80. I put a PT on the stock of $26 to $30 and then a short-term hold. I wanted to see how its expectations for its Las Vegas locals business played out. Having liked what I saw, I reiterated my call that this stock had runway. It too has about doubled since my initial call.

I included it in my best picks in the casino space because like ERI I like the management andtheir savvy response to sports betting. I also like their aggressive move to stay visible on the East Coast even after they sold their 50% of the Atlantic City Borgata to their partner MGM Resorts International (NYSE:MGM) for $900m. The company announced it would use the proceeds to reduce debt and expand its portfolio in a Las Vega locals market. And it has done just that.

Boyd operates 25 properties in eight states with a strong lynchpin in the Vegas locals market. I like that diversity. They increased it most recently by acquiring the Valley Forge, PA, property which sits 20 miles from metro Philadelphia. And here’s the kicker: Sports betting is now a go in that state so BYD can immediately begin ramping up its sports betting palate there.

Here’s the key: The Valley Forge deal dovetails with a partnership BYD signed last month with MGM to jointly develop the entire online gaming space as it becomes legal. It will encompass joint development and operation of platforms in casino, poker and sports betting. BYD will offer the amenity in its properties, and where it has no presence MGM will be the operator. In this way the two companies, which have a positive history in the development and partnership of the Borgata, are once more united in a deal that avoids culture clash. I like that a lot. They will share databases by jurisdictions and jointly market. It leverages the strengths of both companies to build a robust online and mobile presence following legalization as it unfolds.

Our view: Even though it's now trading near its 52-week high, we see upside runway by 2Q next year emanating from the incremental revenue flow from the MGM online partnership. A word of caution: Expectations are that Q3 numbers from the Las Vegas strip are likely to be soft due to high comps from 2017 created by a more robust convention schedule. This could drive some short-term jitters on the Las Vegas gaming space even though BYD is minimally dependent on the strip. But our information now is that Q4 is tracking positive in bookings and that by 1Q19 we expect to get a good sense of how well sports betting is taking hold in Valley Forge with nearly a full season of NFL football behind it. For that reason we think that BYD needs to be in a gaming portfolio because its prospects in the local, regional and sports betting space are very strong. For that reason we’re putting a PT of $55 on the stock by the end of 1Q19.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Sep. 20, 2018 2:18 PM ET|

9 comments

|

Includes: BYD, ERI

Howard Jay Klein

Summary

The musical chairs game is on with dozens of wannabe operators already shuffling for position for the estimated $150bn illegal sports betting business estimated by the American Gaming Association.

We've picked two stocks we believe, despite higher valuations, still offer solid entry points going forward based on their management moves this early in the game.

Both have moved quickly and smartly and are positioned to achieve quick revenue accretion in sports betting as more states legalize.

This idea was discussed in more depth with members of my private investing community, The House Edge. Start your free trial today »

“The secret to winning is constant, consistent management.” Tom Landry

Part One of Two Articles

This article examines what we believe to be the two best bets in the casino space to achieve the fastest ramp up in sports betting as legalization unfolds. In a subsequent article we will look at the online gaming platforms and equipment space picking among companies we have extensively covered relative to sports betting.

Since the historic US Supreme Court decision May 6 that struck down the PASA law and threw open the flood gates to legalized sports betting, the sector has been engulfed by a game of musical chairs. Dozens of operators from every subsector of gaming and media have weighed in, dancing around the rapidly decreasing line of empty chairs. All have their eye on the fattest potential seat ever to be dangled before the gaming industry since the breaking of the Nevada monopoly on legal casinos in Atlantic City in 1978.

The American Gaming Association estimates that illegal sports gambling is a $150 billion a year business. That assessment is not scientifically demonstrable since there's no realistic way you can count the noses or handle of a representative sample of illegal bookmakers now operating in the US. But you can make an educated guess. And mine is that the AGA number is about as good as there is out there.

To get a grasp on the implications for the business, consider this: A Price Waterhouse Coopers 2012 study projected global casino revenues to rise to $182bn by 2017. The primary regional growth engine is of course Asia, attaining the lead position with 44% of all revenue. Now assume no more than 20% of the presumed illegal $150bn sports wagering play is transformed legally. As US states, one by one, approve sports betting, we think up to 14 states will be legal within three years, and around 30 within the next five to seven years.

Margins on sports betting are slim. On average the house keeps about $3 for every $100 bet. But this is a volume business and one that's consistent. NFL betting, the biggest piñata in the entire space, affords gamblers 16 regular season games to bet on, the playoffs and of course, the mother of all events, the Super Bowl. Also, the imagination of bookmakers over the decades has been dazzling in their creation of dozens of types of exotic bets to entice laydowns by the regulars aimed at building volume of play.

Oddsmaking has become a science, sports information services are abundant, legal bets will now even include the ability to wager during a game. NFL volume leads, followed by college football and the NBA. Much lower on the volume food chain are MLB and NHL. But events also pop volume: The Final Four, The World Cup, World Series, NBA finals and college football championship games. So sports betting is by any measure a consistent, daily business that relies on grind volume. VIPs who can be realistically classified as professional gamblers with big money weekly laydowns comprise a small, but clearly important segment of the market.

All the frenetic jockeying for position, acquisitions and partnerships that have exploded ever since the court decision proves that the race always goes to the swift indeed. The question for investors now is this: Who will be the swiftest, who will have the smartest plan, who is best positioned to glom off the biggest potential market share of sports betting business? In prior posts we have attempted to break down the subsectors and present them to investors. We now share who we think will be sitting prettiest when the music stops.

We’d named a few early favorites right after the court decision. Now that we have a firmer sense of the general strategic landscape in which the business seems to be moving, we can pinpoint our best picks for what a smart, well-balanced sports betting portfolio should contain for the highest and speediest possible return.

Our criteria:

This is not standard security analysis focused entirely on numbers, ratios, etc. That’s part of our boxes to check, but these considerations are industry centric and specific to these shares. We’ve boiled our picks down to the stocks meeting these criteria:

1. Proven management quality and capacity to execute for shareholders over time.

2. Share prices that are either near fully valued that still have run room in our view.

3. Elements that will cohere that the market has yet to fully bake into the trade.

4. Occupation of one of these key sub sectors of gaming: Casino, or online real money wagering platforms. We have not included gaming equipment/tech companies in this portfolio because we will cover them in Part 2 of this review.

5. Geographic scale encompassing a wide and diverse spread across the US’s most potentially lucrative sports betting regions.

The companies included here are few, but in our opinion represent the most well-managed, strongest positioned and savviest companies likely to build a strong market share and the business model most potentially accretive to earnings.

Our Picks

El Dorado Resorts (NASDAQ:ERI)

Price at writing: $48.30

52wk range: $23.95---$50.00

ROE: 17.7% vs. 15.5% for industry.

The company is moving fast and deftly to expand its geographic reach and immediately dive into sports betting deals.

1.The Carrano family has radiated out of its core Reno home to 21 properties in 13 states. Most recently, it acquired from Carl Icahn his seven-property Tropicana portfolio for $1.85bn which includes its Atlantic City flagship, currently holding second position in gaming revenue in that market. Five of the Icahn properties were quickly lateralled into the Gaming & Leisure Properties REIT (NASDAQ”GLPI).

2. On September 5, ERI announced a partnership deal with William Hill plc (OTC:OTCPK:WIMHY). The deal is among the most elegant in the space. Hill will pay ERI $50m in stock and a 20% stake in its US business for the right to run the entire sportsbook operation in all 21 properties. Five will begin immediately taking action in states where it's already legal.

What this means: ERI gets Hill’s long expertise, tech know how, platform features and mostly its consummate skill in marketing to sports bettors over decades in the UK, as well as its US operations in Nevada and New Jersey. It also opens the possibilities if and when free standing betting shops are legalized that Hill, long in that business, can step up to that potential faster than most. The Hill stock ERI gets has room to run as legalization unfolds in the US. It’s a brilliant, no cash, no debt deal.

3. ERI already is licensed by gaming commissions in all the states in which it owns casinos. This materially short cuts what could be a lengthy licensure process that can last for more than a year for companies without licenses. This means speed to market — a key here.

4.ERI will continue to concentrate on its core casino business, leave the sports betting to Hill and participate in Hill’s success as shareholders outside the ERI portfolio. Hill already has an ongoing business in Nevada and New Jersey at other casinos and racetracks.

Our view: While we believe ERi at $48.30 comes close to be fully valued at the moment, we do see enough upside ahead in both casinos and sports betting to justify consideration of an entry point now. It has nearly doubled since our last recommendation, fulfilling our expectation that it knows how to execute, deliver superior customer service, and keep an eye on costs. With sports betting now a reality we see the company leveraging its enlarged asset base and achieving the kind of scale that will make the business highly accretive to EBITDA over the next three years.

We have included ERI not because we see the stock as cheap now, but because we see it as a solid, imaginative, tightly managed company, which makes consistently savvy asset allocation decisions. Our PT aims at $63 by 2Q of 2019 on ERI, bearing in mind its participation in an upside we see for Hill itself during that period.

It’s a "sleep tight" stock that belongs in a model portfolio skewed with a sports betting upside.

Boyd Gaming Corp. (NYSE:BYD)

Price at writing: $37.97. 52-week range: $24.53--$40.44

I included it in my best picks in the casino space because like ERI I like the management andtheir savvy response to sports betting. I also like their aggressive move to stay visible on the East Coast even after they sold their 50% of the Atlantic City Borgata to their partner MGM Resorts International (NYSE:MGM) for $900m. The company announced it would use the proceeds to reduce debt and expand its portfolio in a Las Vega locals market. And it has done just that.

Boyd operates 25 properties in eight states with a strong lynchpin in the Vegas locals market. I like that diversity. They increased it most recently by acquiring the Valley Forge, PA, property which sits 20 miles from metro Philadelphia. And here’s the kicker: Sports betting is now a go in that state so BYD can immediately begin ramping up its sports betting palate there.

Here’s the key: The Valley Forge deal dovetails with a partnership BYD signed last month with MGM to jointly develop the entire online gaming space as it becomes legal. It will encompass joint development and operation of platforms in casino, poker and sports betting. BYD will offer the amenity in its properties, and where it has no presence MGM will be the operator. In this way the two companies, which have a positive history in the development and partnership of the Borgata, are once more united in a deal that avoids culture clash. I like that a lot. They will share databases by jurisdictions and jointly market. It leverages the strengths of both companies to build a robust online and mobile presence following legalization as it unfolds.

Our view: Even though it's now trading near its 52-week high, we see upside runway by 2Q next year emanating from the incremental revenue flow from the MGM online partnership. A word of caution: Expectations are that Q3 numbers from the Las Vegas strip are likely to be soft due to high comps from 2017 created by a more robust convention schedule. This could drive some short-term jitters on the Las Vegas gaming space even though BYD is minimally dependent on the strip. But our information now is that Q4 is tracking positive in bookings and that by 1Q19 we expect to get a good sense of how well sports betting is taking hold in Valley Forge with nearly a full season of NFL football behind it. For that reason we think that BYD needs to be in a gaming portfolio because its prospects in the local, regional and sports betting space are very strong. For that reason we’re putting a PT of $55 on the stock by the end of 1Q19.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[FONT="]Boyd, Penn National And Eldorado: A Great Triple Play In Regional Gaming Now[/FONT]

https://seekingalpha.com/article/4222390

https://seekingalpha.com/article/4222390

This growth in Sports Gambling ...

Will make Eldorado's => "20.00%" - Ownership Stakein William Hill => Extremely Valuable

There are very few things in this economy... That will grow this quickly

And will have this many "Zeros" attached to them

REFERENCE LINK:

https://goo.gl/mgoFiH

___________________________

This report from "Gambling Compliance" projects that the U.S. will far and away eclipse

all other countries on planet Earth... In terms of the total dollars wagered on Sports.

In the wake of the US Supreme Court's landmark decision to strike down the federal ban

on Sports Wagering

Sports Wagering now becomes a "States Rights" issue

US States are now free to pass their own laws...

To allow -or- disavow sports wagering within their own States borders

Gambling Compliance now predicts that the Sports Wagering market will rise meteorically to between:

$3.1 Billion -to- $5.2 Billion in total revenue by 2023.... Up from a mere $700 Million in 2019

_______________________________________

REFERENCE LINK:

https://goo.gl/U6Zcci

Will make Eldorado's => "20.00%" - Ownership Stakein William Hill => Extremely Valuable

There are very few things in this economy... That will grow this quickly

And will have this many "Zeros" attached to them

REFERENCE LINK:

https://goo.gl/mgoFiH

___________________________

This report from "Gambling Compliance" projects that the U.S. will far and away eclipse

all other countries on planet Earth... In terms of the total dollars wagered on Sports.

In the wake of the US Supreme Court's landmark decision to strike down the federal ban

on Sports Wagering

Sports Wagering now becomes a "States Rights" issue

US States are now free to pass their own laws...

To allow -or- disavow sports wagering within their own States borders

Gambling Compliance now predicts that the Sports Wagering market will rise meteorically to between:

$3.1 Billion -to- $5.2 Billion in total revenue by 2023.... Up from a mere $700 Million in 2019

_______________________________________

REFERENCE LINK:

https://goo.gl/U6Zcci

Does Golden have a similar deal or anybody else?

https://finance.yahoo.com/news/golden-entertainment-inc-announces-expanded-123000212.html

ERI: Another Way ERI Could Double: BuyCZRIn a June note, we outlined an investment case for $108 per share not requiringadditional acquisition announcements. Below, we argue a separate investmentcase for $104 to $116 per share should ERI purchase Caesar's (CZR-NC)under a reasonable valuation scenario. We do not pretend to know if ERI andCZR are in any deep merger discussions, though the universe of buyers islimited and ERI is best suited to extract full value from CZR assets, in our view.Calculation. Variables of our case for $104 to $116 per share include: a CZR$12 per share base case purchase price or ~$9b utilizing 75% cash and 25%ERI stock consideration (we demonstrate purchase price sensitivity on thefollowing page); $600mm in EBITDA synergies; ~$1.2b of executed lease backcall options from VICI and $5.3b in new debt issuance and; targeted metricmultiples. We also touch on why ERI is likely best suited to maximize CZR

https://roth2.bluematrix.com/sellsi...=Roth2&id=morningcallmin@roth.com&source=mail

https://roth2.bluematrix.com/sellsi...=Roth2&id=morningcallmin@roth.com&source=mail

ELDORADO RESORTS (ERI) @ $46.70 ==> TROPICANA AC … Opens “Massive” Sports Book w/ Huge Bar => Absolute Traffic Driver… Very Impressive !!

http://bit.ly/2XXmUer

The 5,000-square-foot interactive space offers an immersive sports betting experience

with nearly 200 linear feet and 1,654 square feet of video display to show up to

“16” individual games at one time.

The space also features “8” betting windows, including one high-limit window, and 180 seats,

including brand new bar with lounge style seating.

And an elevated “VIP SECTION” is also offered.

Former NFL -QB- and ESPN personality – Ron Jaworski

Helped to Cut the Ribbon .. At ERI’s Newest Attraction

http://bit.ly/2XXmUer

The 5,000-square-foot interactive space offers an immersive sports betting experience

with nearly 200 linear feet and 1,654 square feet of video display to show up to

“16” individual games at one time.

The space also features “8” betting windows, including one high-limit window, and 180 seats,

including brand new bar with lounge style seating.

And an elevated “VIP SECTION” is also offered.

Former NFL -QB- and ESPN personality – Ron Jaworski

Helped to Cut the Ribbon .. At ERI’s Newest Attraction

Isle Casino places a bet that you’re going to love its massive expansion

By DAVID LYONS

A major expansion at Isle Casino Racing Pompano Park would create a thriving city within a city. Shown are card players in this file photo. (robert duyos / Sun Sentinel)

A major expansion at Isle Casino Racing Pompano Park would create a thriving city within a city — transforming it into a village-like enclave that boasts a hotel, office campus, more than 4,000 apartment units and a cinema, shops and restaurants.

Live! Resorts Pompano would be a 100,000-square-foot gambling, dining and entertainment destination, with 750 slots and electronic table games and approximately 30 live-action table games. Plus, there would be nationally recognized restaurants and live entertainment venues.

“It will be a big shot in the arm for southwest Pompano,” the city’s Vice Mayor Barry Moss said Thursday. “The plans are ambitious."

The expansion is the result of a joint venture between Eldorado Resorts and The Cordish Companies, which develops, owns and operates various revitalization projects and entertainment districts across the U.S., many under its Live! brand. The Cordish Cos. have “made a very favorable impression,” Moss said, "principally because of their track record, which is very successful.”

The plans also call for a public park, walking and bike trails, and a “crystal lake” for swimming. Located south of Atlantic Boulevard and bordered on the west by Powerline Road, Isle Casino Pompano Park encompasses 223 acres.

[More business] Trump’s immigration crackdown becomes boon for detention-center company based in Boca »

The entire project is forecast to reel in a local economic impact of $200 million, “with an additional $148 million in economic impact from construction, including approximately 960 direct and indirect construction jobs, plus more than 500 permanent new jobs for local and regional residents,” according to documents filed by Cordish with the city of Pompano Beach.

At a recent public meeting that attracted more than 300 people, most of whom live at the nearby Palm Aire condo development, CEO David Cordish unveiled a preliminary version of what the company intends to do. Pressed for a groundbreaking date, David Cordish reportedly said he’d like to see it take place in the spring of 2020. The project is expected to take close to a decade to complete.

“Their first phase is very bullish. They’re ready to go,” said Broward County Commissioner Lamar Fisher, who was the mayor of Pompano Beach through last year and attended the recent presentation. “The hotel is first. Then the redevelopment of the casino. They’re going to expand the casino and make it even bigger than it is today.”

Neither Cordish nor Eldorado, which announced their joint venture last year, could be reached for comment this week.

Moss, whose district is home to the project, said the proposal was well-received by many residents at the public meeting, but there still are traffic concerns. Moss, who is Pompano’s representative to the Broward Metropolitan Planning Organization, said Cordish is meeting with agencies to assess the project’s impact on neighborhoods. Adding a train stop near the casino is one consideration.

“The Cordish people already have had a few meetings with the MPO staff," Moss said. "They’re hoping they’ll be able to get a Tri-Rail stop at the site.

[More business] Trump’s immigration crackdown becomes boon for detention-center company based in Boca »

“There will be a large residential component to it,” Moss said. "It’s going to be a small city within a larger city, and I think what we hope is the people who choose to live there will also work there. They’re doing their best to keep the vehicular traffic down.”

Founded in 1910, Cordish has created destinations across the country. Live! Casino & Hotel Maryland employs more than 3,400 full-time workers. The company recently announced a project for western Pennsylvania and is developing others in Arlington, Texas, and St. Louis. Previously, it worked on the Seminole Hard Rock Hotel & Casino complexes in Hollywood and Tampa.

Eldorado, a publicly traded company headquartered in Reno, Nevada, acquired the property two years ago when it bought Isle of Capri Casinos and its 13 resorts for $1.7 billion. The company operates 26 gambling-oriented properties in 12 states.

Last year, Fisher told the South Florida Sun Sentinel that he met with Isle Casino’s leaders and was told of plans to tear down the park’s old grandstand building and erect a 400-room hotel. After the first phase, he was told, the site at 777 Isle of Capri Circle was to be developed into a retail, restaurant and office complex.

The fate of the property’s racetrack is unclear. It opened in the 1960s and is the only remaining harness venue operating in the state.

“It does take up a lot of real estate," said Moss, the vice mayor. "It would seem to me that common sense dictates that it’s got to go. I have no idea. I don’t think that racetrack has been financially successful over the last couple of years. I know the Isle Casino has been very successful for Eldorado. Of the non-Indian gaming establishments, they are among the most profitable.”

The companies have a number of local government reviews to go through before any construction can start, Moss said. Zoning and land-use changes at the city and county levels are required.

Moss said he believes that between the Isle Casino project and the Fort Lauderdale soccer venue proposed by a group led by British soccer star David Beckham, northwest Broward will be in for a sizable economic lift.

“All of these things coming together at one time is going to be a big deal," he said, "and one that will benefit those who live here in the northern part of the county.”

David Lyons

South Florida Sun Sentinel

CONTACT

David Lyons is a business writer for the South Florida Sun Sentinel. He is a past editor-in-chief of ALM’s Daily Business Review in Miami and formerly worked for the Miami Herald, Miami News, Fort Lauderdale News, Albany (N.Y.) Times-Union and Schenectady Gazette. He holds a degree in political science from Siena College in Loudonville, N.Y.

By DAVID LYONS

| SOUTH FLORIDA SUN SENTINEL |

MAY 09, 2019 | 8:47 PM

A major expansion at Isle Casino Racing Pompano Park would create a thriving city within a city. Shown are card players in this file photo. (robert duyos / Sun Sentinel)

A major expansion at Isle Casino Racing Pompano Park would create a thriving city within a city — transforming it into a village-like enclave that boasts a hotel, office campus, more than 4,000 apartment units and a cinema, shops and restaurants.

Live! Resorts Pompano would be a 100,000-square-foot gambling, dining and entertainment destination, with 750 slots and electronic table games and approximately 30 live-action table games. Plus, there would be nationally recognized restaurants and live entertainment venues.

“It will be a big shot in the arm for southwest Pompano,” the city’s Vice Mayor Barry Moss said Thursday. “The plans are ambitious."

The expansion is the result of a joint venture between Eldorado Resorts and The Cordish Companies, which develops, owns and operates various revitalization projects and entertainment districts across the U.S., many under its Live! brand. The Cordish Cos. have “made a very favorable impression,” Moss said, "principally because of their track record, which is very successful.”

The plans also call for a public park, walking and bike trails, and a “crystal lake” for swimming. Located south of Atlantic Boulevard and bordered on the west by Powerline Road, Isle Casino Pompano Park encompasses 223 acres.

[More business] Trump’s immigration crackdown becomes boon for detention-center company based in Boca »

The entire project is forecast to reel in a local economic impact of $200 million, “with an additional $148 million in economic impact from construction, including approximately 960 direct and indirect construction jobs, plus more than 500 permanent new jobs for local and regional residents,” according to documents filed by Cordish with the city of Pompano Beach.

At a recent public meeting that attracted more than 300 people, most of whom live at the nearby Palm Aire condo development, CEO David Cordish unveiled a preliminary version of what the company intends to do. Pressed for a groundbreaking date, David Cordish reportedly said he’d like to see it take place in the spring of 2020. The project is expected to take close to a decade to complete.

“Their first phase is very bullish. They’re ready to go,” said Broward County Commissioner Lamar Fisher, who was the mayor of Pompano Beach through last year and attended the recent presentation. “The hotel is first. Then the redevelopment of the casino. They’re going to expand the casino and make it even bigger than it is today.”

Neither Cordish nor Eldorado, which announced their joint venture last year, could be reached for comment this week.

Moss, whose district is home to the project, said the proposal was well-received by many residents at the public meeting, but there still are traffic concerns. Moss, who is Pompano’s representative to the Broward Metropolitan Planning Organization, said Cordish is meeting with agencies to assess the project’s impact on neighborhoods. Adding a train stop near the casino is one consideration.

“The Cordish people already have had a few meetings with the MPO staff," Moss said. "They’re hoping they’ll be able to get a Tri-Rail stop at the site.

[More business] Trump’s immigration crackdown becomes boon for detention-center company based in Boca »

“There will be a large residential component to it,” Moss said. "It’s going to be a small city within a larger city, and I think what we hope is the people who choose to live there will also work there. They’re doing their best to keep the vehicular traffic down.”

Founded in 1910, Cordish has created destinations across the country. Live! Casino & Hotel Maryland employs more than 3,400 full-time workers. The company recently announced a project for western Pennsylvania and is developing others in Arlington, Texas, and St. Louis. Previously, it worked on the Seminole Hard Rock Hotel & Casino complexes in Hollywood and Tampa.

Eldorado, a publicly traded company headquartered in Reno, Nevada, acquired the property two years ago when it bought Isle of Capri Casinos and its 13 resorts for $1.7 billion. The company operates 26 gambling-oriented properties in 12 states.

Last year, Fisher told the South Florida Sun Sentinel that he met with Isle Casino’s leaders and was told of plans to tear down the park’s old grandstand building and erect a 400-room hotel. After the first phase, he was told, the site at 777 Isle of Capri Circle was to be developed into a retail, restaurant and office complex.

The fate of the property’s racetrack is unclear. It opened in the 1960s and is the only remaining harness venue operating in the state.

“It does take up a lot of real estate," said Moss, the vice mayor. "It would seem to me that common sense dictates that it’s got to go. I have no idea. I don’t think that racetrack has been financially successful over the last couple of years. I know the Isle Casino has been very successful for Eldorado. Of the non-Indian gaming establishments, they are among the most profitable.”

The companies have a number of local government reviews to go through before any construction can start, Moss said. Zoning and land-use changes at the city and county levels are required.

Moss said he believes that between the Isle Casino project and the Fort Lauderdale soccer venue proposed by a group led by British soccer star David Beckham, northwest Broward will be in for a sizable economic lift.

“All of these things coming together at one time is going to be a big deal," he said, "and one that will benefit those who live here in the northern part of the county.”

David Lyons

South Florida Sun Sentinel

CONTACT

David Lyons is a business writer for the South Florida Sun Sentinel. He is a past editor-in-chief of ALM’s Daily Business Review in Miami and formerly worked for the Miami Herald, Miami News, Fort Lauderdale News, Albany (N.Y.) Times-Union and Schenectady Gazette. He holds a degree in political science from Siena College in Loudonville, N.Y.