You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Elon Musk takes a 9% stake in Twitter

- Thread starter Michelangelo

- Start date

'Musk is buying Twitter for $44 billion, partly funding the purchase with a $12.5 billion margin loan secured by Tesla shares. If the electric carmaker’s stock falls below $740, which it last did for a brief moment on Feb. 24, Musk may not have enough to cover the full loan, according to Bloomberg calculations. Musk may also need to sell Tesla shares to cover a $21 billion equity commitment he’s made for the purchase.

Shares of Tesla regained some ground Wednesday after slumping 12% on Tuesday to $876.42. About 2.9% of its float is sold short, according to data from S3 Partners.

The Tesla chief executive officer has previously criticized investors with a short position in the electric-vehicle maker, including Burry and Bill Gates, who Musk accused of having a $500 million short against the company in a series of tweets over the weekend.

Short sellers have nothing to do with the success or failure of the underlying company’s business, said Burry, who rose to fame when his successful bets against mortgage securities during the financial crisis were featured in Michael Lewis’s book “The Big Short.”

“If I had pledged the majority of my shareholdings to support personal loans, I might hate short sellers too,” Burry said in the tweet, which was later deleted.'

.........

hmm. selling TSLA shares?

TSLA

3 yr WEEKLY chart

a drop below that curved line would not be good ($850ish) would need to regain it fast. The curved line is still sloping up.. Since Oct '21 playing in a box- $1200 to $790ish. Feb -March came back to test the Oct breakout candle, and held. red flag was 4 candles to the right, has played out . This week's candle is ugly, the week is not done tho

powell speaks next wed

Shares of Tesla regained some ground Wednesday after slumping 12% on Tuesday to $876.42. About 2.9% of its float is sold short, according to data from S3 Partners.

The Tesla chief executive officer has previously criticized investors with a short position in the electric-vehicle maker, including Burry and Bill Gates, who Musk accused of having a $500 million short against the company in a series of tweets over the weekend.

Short sellers have nothing to do with the success or failure of the underlying company’s business, said Burry, who rose to fame when his successful bets against mortgage securities during the financial crisis were featured in Michael Lewis’s book “The Big Short.”

“If I had pledged the majority of my shareholdings to support personal loans, I might hate short sellers too,” Burry said in the tweet, which was later deleted.'

.........

hmm. selling TSLA shares?

TSLA

3 yr WEEKLY chart

a drop below that curved line would not be good ($850ish) would need to regain it fast. The curved line is still sloping up.. Since Oct '21 playing in a box- $1200 to $790ish. Feb -March came back to test the Oct breakout candle, and held. red flag was 4 candles to the right, has played out . This week's candle is ugly, the week is not done tho

powell speaks next wed

Full Orwellian is rolling out globally with only digital currency and social credit scores. They will try to roll it out here if they can figure out how to take our guns.In creating a "Disinformation Governance Board", the Biden administration has gone full Orwellian.

Never go full Orwellian.

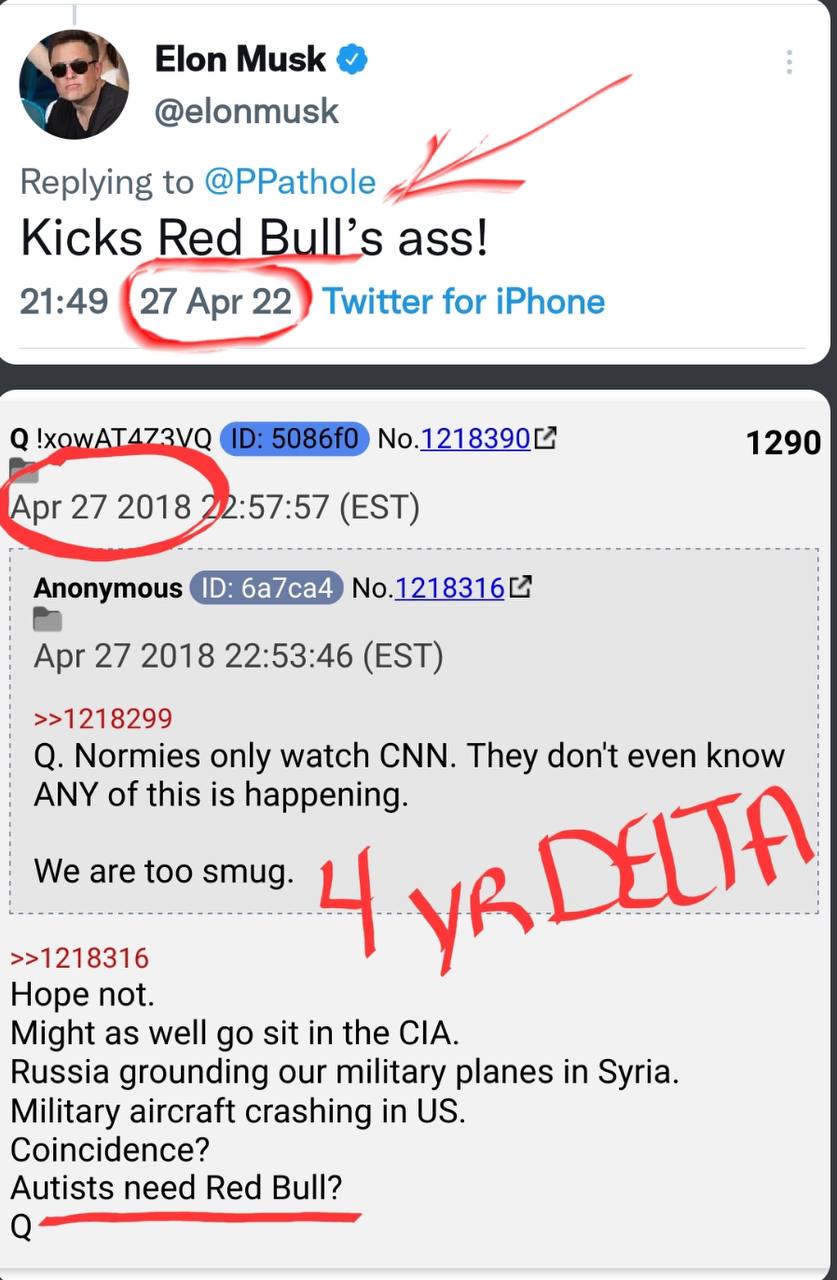

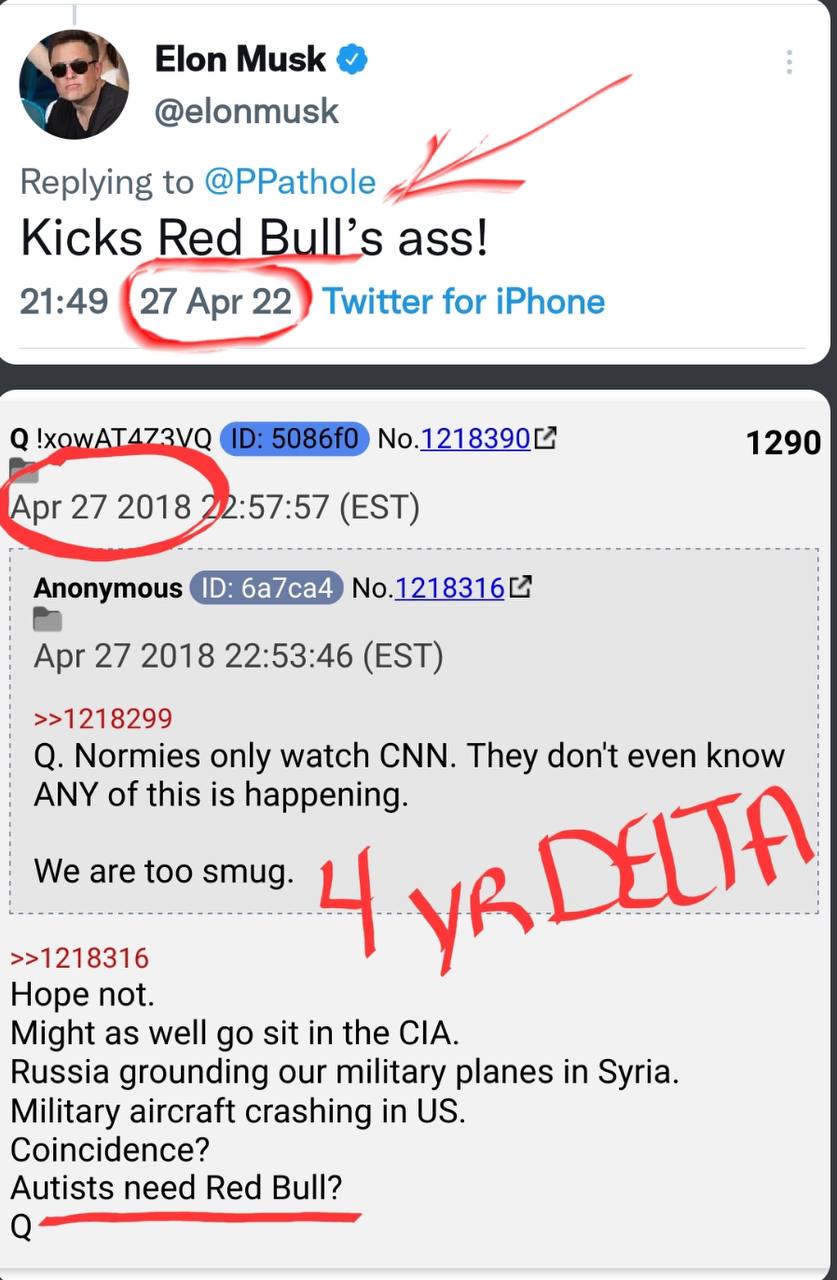

He is either giving signals of working with the good guys or he is trolling the hell out of Q movement

Either way, he continues to refer to Q drops in his messaging....although Im sure the uninitiated still thinks it is all a big coincidence.....but whatever lets just keep and eye on it and see if he continues and more importantly lets watch his ACTIONS over his WORDS........

Either way, he continues to refer to Q drops in his messaging....although Im sure the uninitiated still thinks it is all a big coincidence.....but whatever lets just keep and eye on it and see if he continues and more importantly lets watch his ACTIONS over his WORDS........

7.2 billon allocated for electric car charging stations by the government ...44 billion for twitter.

Let that sink in for a second.

what do I care ? I want to use twitter .. I dont want to drive a cell phone wheels

by the way does your bleeding heart have room, for a reformed prisoner in/near your county that your LIB governor

pardoned, to work for room and bored on your ranch ?

it was only life without parole for murdering a teenage girl via gunshot to the back of the head and rolled into a ditch

but your LGBQTAERIZ governor said he hasn't been arrested for robbery in a long time

im gonna show you another famous case from the ' Pacific FAG West ' just to show you how this worked out last time

in a similar situation and heads rolled

history repeats

but your LGBQTAERIZ governor said he hasn't been arrested for robbery in a long time

im gonna show you another famous case from the ' Pacific FAG West ' just to show you how this worked out last time

in a similar situation and heads rolled

history repeats

Tavares remained imprisoned for killing his mother until 2007 when he was released from state prison despite efforts by State Police and the Department of Correction to keep him behind bars for repeatedly assaulting correction officers.

Tavares’s bail on the assaults on the officers was originally set at $100,000 cash, but Superior Court Judge Kathe M. Tuttman released him on personal recognizance, the Globe reported in 2007.

Tavares fled to Washington, where he shot and killed his neighbors, Beverly and Brian Mauck, on Nov. 17, 2007.

Tavares’s bail on the assaults on the officers was originally set at $100,000 cash, but Superior Court Judge Kathe M. Tuttman released him on personal recognizance, the Globe reported in 2007.

Tavares fled to Washington, where he shot and killed his neighbors, Beverly and Brian Mauck, on Nov. 17, 2007.

How much of a refund will Elon get?

I dont KNOW for a fact about any specifics behind the scenes happening here BUT I bet it would be even more unbelievable than the shit that happens in BILLIONS

Maybe, just maybe one of the reasons the deal doesnt close for 6 months is that in exhange for selling , certain people get some time to clean up their mess and avoid the HAMMER

I dont KNOW for a fact about any specifics behind the scenes happening here BUT I bet it would be even more unbelievable than the shit that happens in BILLIONS

Maybe, just maybe one of the reasons the deal doesnt close for 6 months is that in exhange for selling , certain people get some time to clean up their mess and avoid the HAMMER