You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Coronavirus Stock Market buy off.

- Thread starter RenoChazz

- Start date

MASSIVE print on SPYV

4,600,000 shares went off at $31.45

SPYV- SPY Value ETF. Top holdings include : unh, vz,jnj, pfe, t, csco, bac, wmt, xom

SPYV

6 mth daily, 8 ema

above $32 is bullish , breaks the early June high, it broke its 200 sma two days ago.......cant lose its 8 ema

precious metals taken to the woodshed

4,600,000 shares went off at $31.45

SPYV- SPY Value ETF. Top holdings include : unh, vz,jnj, pfe, t, csco, bac, wmt, xom

SPYV

6 mth daily, 8 ema

above $32 is bullish , breaks the early June high, it broke its 200 sma two days ago.......cant lose its 8 ema

precious metals taken to the woodshed

What do you think that trade means, Ric?

three other huge prints went off during the day :

- ANOTHER massive print on SPYV, no word of a lie, LOL! 3,200,000 shares at $31.44. Holy molly, somethng is up

- SPY: 700,000 shares at $337.16 and another 578,000 at $337.05 (someone getting atta dodge?)

what does it mean (SPLV)? I dont know, can only speculate . Maybe a large buyer(s), sector rotation? QQQ were , as i posted , in severe outlier territory on the high side. Acutally were outside of two-standard deviations of normal price action, reverting of late as they have underperformed . Or maybe its a huge seller. Anyway , we can use it as an alert and of course with the chart. IF it breaks its 8 EMA, danger. Todays candle is a nothing candle , just a red candle in an uptrend. Will see, certaily bullish above $32 (a break of June's high , see chart....let's see tommorrow's candle)

today was RED FLAG day tho-- everyhitng was red - bonds, equities, commodities ... and some BIG BIG prints on SPY ans SPYV

note;

the daily candle forming on GC futures (gold) is a beauty. BUT the day is far from done. Overnight it was beaten, but buyers stepped in and now: long tail , green body. This candle closes at 8 pm. GLD's candle , of course, hasnt even started to form- 9;30am and closes at 4pm

https://www.investing.com/commodities/gold-streaming-chart

click '1D' , you can expand by pressing wide screen

today should be a cracker of day

the daily candle forming on GC futures (gold) is a beauty. BUT the day is far from done. Overnight it was beaten, but buyers stepped in and now: long tail , green body. This candle closes at 8 pm. GLD's candle , of course, hasnt even started to form- 9;30am and closes at 4pm

https://www.investing.com/commodities/gold-streaming-chart

click '1D' , you can expand by pressing wide screen

today should be a cracker of day

note;

the daily candle forming on GC futures (gold) is a beauty. BUT the day is far from done. Overnight it was beaten, but buyers stepped in and now: long tail , green body. This candle closes at 8 pm. GLD's candle , of course, hasnt even started to form- 9;30am and closes at 4pm

https://www.investing.com/commodities/gold-streaming-chart

click '1D' , you can expand by pressing wide screen

today should be a cracker of day

today was fun. market sentiment still bullish, but we're due for a big pullback. big shots say no V-recovery. another major pullback imminent. rotation into banks and travel i think. tech overdue for a rug pull. apple had a decent day today. i've been scalping FDX with some 1-2 day swings, playing off the STMP earnings. JPM and GS paid me yesterday. currently holding only one long swing position on QCOM with an 8/28 exp - see what happens!

nice going man!

something is definetely up- a bunch of large etf prints went out yesterday. I'll post later, and if anything huge today goes off i'll post

ES- line in the sand : 3312. If things start to go the other way, this level needs to hold .note the ES broke the top of the box 3284 (posted a page ago), so if 3312 gets taken out this level liekly 'should hold'. as its now support. ......charts r healthy

something is definetely up- a bunch of large etf prints went out yesterday. I'll post later, and if anything huge today goes off i'll post

ES- line in the sand : 3312. If things start to go the other way, this level needs to hold .note the ES broke the top of the box 3284 (posted a page ago), so if 3312 gets taken out this level liekly 'should hold'. as its now support. ......charts r healthy

guses who's buying a Gold stock?....holy molly!!!!!

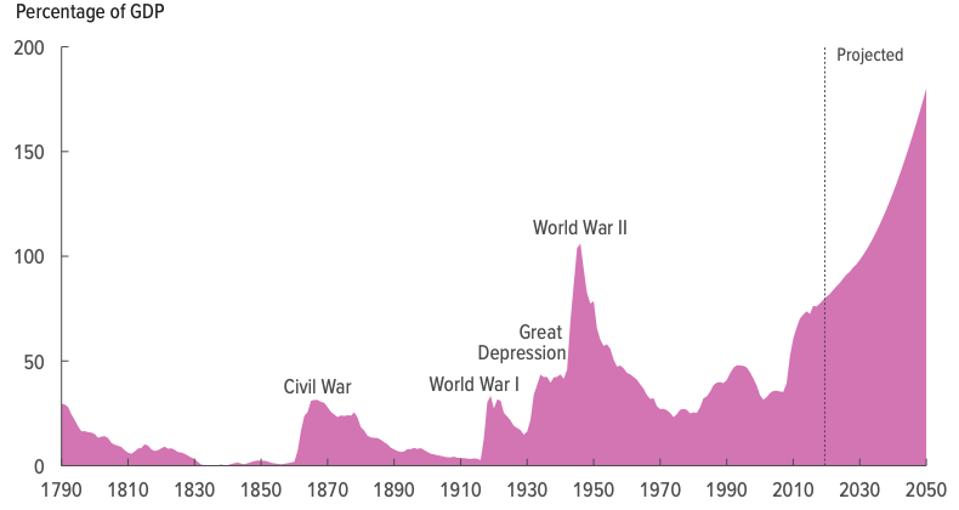

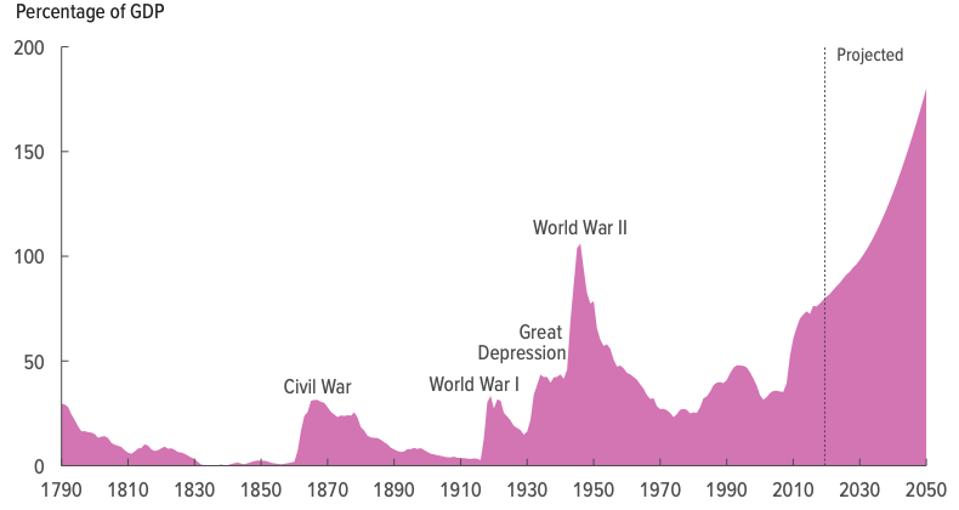

firstly for those unaware the fiscal conservatives r dead, neutered,........ KAPUT . Covid printing has the USD under duress ...... here's Maya , poor soul is barely hangin' on;

Maya MacGuineas, president of the Committee for a Responsible Federal Budget said, “A trillion-dollar deficit is not a milestone to be proud of, nor one to brush aside. Over half of the deficit is due to the choice of policymakers to borrow to fund recent tax cuts and spending increases. CBO’s report confirms that not only are we in uncharted waters, but that we are also leaving future generations with an incredible burden.”

It will only get worse as the CBO projects it could hit 180% of GDP in 2050. The report said, “High and rising federal debt would reduce national saving and income, boost the government’s interest payments, limit policymakers’ ability to respond to unforeseen events, and increase the likelihood of a fiscal crisis.”

Buffett makes bet on Barrick in reversal of earlier stance on gold

:nohead:

Warren Buffett’s Berkshire Hathaway Inc. added Barrick Gold Corp. to its portfolio in the second quarter, sending shares of the the world’s second-largest miner of the metal surging.

Berkshire took a new position in Barrick, buying 20.9 million shares, or 1.2 per cent of the company’s outstanding stock, with a current market value of US$565 million, according to a regulatory filing on Friday.

--he's never had a good thing to say about Gold , and now backs a Gold producer

ABX

6 mth daily , 8 ema

the news of Buffet buying came out Friday, gap up today

firstly for those unaware the fiscal conservatives r dead, neutered,........ KAPUT . Covid printing has the USD under duress ...... here's Maya , poor soul is barely hangin' on;

Maya MacGuineas, president of the Committee for a Responsible Federal Budget said, “A trillion-dollar deficit is not a milestone to be proud of, nor one to brush aside. Over half of the deficit is due to the choice of policymakers to borrow to fund recent tax cuts and spending increases. CBO’s report confirms that not only are we in uncharted waters, but that we are also leaving future generations with an incredible burden.”

It will only get worse as the CBO projects it could hit 180% of GDP in 2050. The report said, “High and rising federal debt would reduce national saving and income, boost the government’s interest payments, limit policymakers’ ability to respond to unforeseen events, and increase the likelihood of a fiscal crisis.”

Buffett makes bet on Barrick in reversal of earlier stance on gold

:nohead:

Warren Buffett’s Berkshire Hathaway Inc. added Barrick Gold Corp. to its portfolio in the second quarter, sending shares of the the world’s second-largest miner of the metal surging.

Berkshire took a new position in Barrick, buying 20.9 million shares, or 1.2 per cent of the company’s outstanding stock, with a current market value of US$565 million, according to a regulatory filing on Friday.

--he's never had a good thing to say about Gold , and now backs a Gold producer

ABX

6 mth daily , 8 ema

the news of Buffet buying came out Friday, gap up today

DIA

6 mth 8 ema

riding the 8 ema - FOUR straight inside bar candles...needs to make a call, a break above the mother bar, 5 candles to the left is BULLISH...a move below, is not danger unless a sell candle that closes below the 8 ema. 270 is an obvious support level (3.5% pullback)...USD hammered before the bell, wow

6 mth 8 ema

riding the 8 ema - FOUR straight inside bar candles...needs to make a call, a break above the mother bar, 5 candles to the left is BULLISH...a move below, is not danger unless a sell candle that closes below the 8 ema. 270 is an obvious support level (3.5% pullback)...USD hammered before the bell, wow

interesting..... ...futures not looking good and set for gap down

...futures not looking good and set for gap down

'ES- line in the sand : 3312. If things start to go the other way, this level needs to hold .note the ES broke the top of the box 3284 (posted a page ago), so if 3312 gets taken out this level liekly 'should hold'. as its now support. ......charts r healthy'

ES is at 3352 comfortably above danger areas, today's print on the ES was a bearish enguling pattern that engulfed two days of action and with highER vol, strongly suggestive of bearish continuation and this is happening with the early today's printing candle. The major indices will need to fight to hold unto their 8 ema's tommorow, specifically the SPY, DIA, IWM. Note IWM is in danger os losing its 200sma tomorrow-not good

let's see tomorrow's candle print the major indices

SPY

6 mth daily 8 ema

ES

https://www.investing.com/indices/us-spx-500-futures-streaming-chart

click 1H , the hourly, then 'widescreen'............. ..its hanging on to a critical support, clear as day..loses it the ES can see 3326.

...futures not looking good and set for gap down

...futures not looking good and set for gap down'ES- line in the sand : 3312. If things start to go the other way, this level needs to hold .note the ES broke the top of the box 3284 (posted a page ago), so if 3312 gets taken out this level liekly 'should hold'. as its now support. ......charts r healthy'

ES is at 3352 comfortably above danger areas, today's print on the ES was a bearish enguling pattern that engulfed two days of action and with highER vol, strongly suggestive of bearish continuation and this is happening with the early today's printing candle. The major indices will need to fight to hold unto their 8 ema's tommorow, specifically the SPY, DIA, IWM. Note IWM is in danger os losing its 200sma tomorrow-not good

let's see tomorrow's candle print the major indices

SPY

6 mth daily 8 ema

ES

https://www.investing.com/indices/us-spx-500-futures-streaming-chart

click 1H , the hourly, then 'widescreen'............. ..its hanging on to a critical support, clear as day..loses it the ES can see 3326.

I called this tiny downtrend last week...my DIA puts are negating the IWO and SPY action.

I’m holding through September more than likely.

My IWO is nov expiration. But SPY is mid sept.

I’m breaking even right now even though the mkt has been down overall ... because... delta, gamma, bs

I’m holding through September more than likely.

My IWO is nov expiration. But SPY is mid sept.

I’m breaking even right now even though the mkt has been down overall ... because... delta, gamma, bs

haha, lost it, violent break....NINE straight red candles on the hourly, not stable

minutes of the fed meeting came out today, led to red candles and a upward spike on the USD that took the metals violently down

Officials at the meeting “agreed that the ongoing public health crisis would weigh heavily on economic activity, employment, and inflation in the near term and was posing considerable risks to the economic outlook over the medium term,” the meeting summary said.

As Chairman Jerome Powell and Fed leaders have emphasized multiple times, the minutes noted a consensus on the need for more fiscal help from Congress, which went into recess without a deal for more rescue funding even as critical elements such as enhanced unemployment insurance remain expired.

The minutes “underscored the need for a fiscal package,” said Quincy Krosby, chief market strategist at Prudential Financial. “Chairman Powell has been adamant that we need to see another package, especially because they see the negative effects of the slowdown.”

........

kaput

those massive etf prints were likely sells , lol

minutes of the fed meeting came out today, led to red candles and a upward spike on the USD that took the metals violently down

Officials at the meeting “agreed that the ongoing public health crisis would weigh heavily on economic activity, employment, and inflation in the near term and was posing considerable risks to the economic outlook over the medium term,” the meeting summary said.

As Chairman Jerome Powell and Fed leaders have emphasized multiple times, the minutes noted a consensus on the need for more fiscal help from Congress, which went into recess without a deal for more rescue funding even as critical elements such as enhanced unemployment insurance remain expired.

The minutes “underscored the need for a fiscal package,” said Quincy Krosby, chief market strategist at Prudential Financial. “Chairman Powell has been adamant that we need to see another package, especially because they see the negative effects of the slowdown.”

........

kaput

those massive etf prints were likely sells , lol

I called this tiny downtrend last week...my DIA puts are negating the IWO and SPY action.

I’m holding through September more than likely.

My IWO is nov expiration. But SPY is mid sept.

I’m breaking even right now even though the mkt has been down overall ... because... delta, gamma, bs

goin' to be some juicy volatility ....i hope

. Charts have not been damaged yet , not even close. 3284 on the ES will be a fun spot...we r far from there.

. Charts have not been damaged yet , not even close. 3284 on the ES will be a fun spot...we r far from there.the new tech boom, or shall we call it the new credit boom?

who wants US Tresuries when Apple's bond yield's are higher?.....HOW cheap is money?...here ya go;

https://ca.finance.yahoo.com/news/apple-joins-tech-borrowing-boom-123033535.html

[h=1]Apple Sells $5.5 Billion of Bonds in Tech Borrowing Boom[/h]

[FONT="](Bloomberg) -- Borrowing costs are so cheap right now that not even Apple Inc. could resist, becoming the latest to join a boom in issuance from the world’s biggest technology companies.[/FONT]

[FONT="]Apple, which hadn’t borrowed in dollars more than once in a calendar year since 2017, tapped the investment-grade market for $5.5 billion in its second trip since May. It was cheap to issue debt then and is even better now, with cash-rich companies like Amazon.com Inc. and Google parent Alphabet Inc. getting in on the action, outdoing each other to set a new floor for yields.[/FONT]

[FONT="]The iPhone maker sold bonds in four parts, according to a person with knowledge of the matter. The longest maturity, a 40-year security, will yield 118 basis points above Treasuries, after initially discussing around 135 basis points, the person said, asking not to be identified as the details are private.[/FONT]

[FONT="]That debt will come cheaper for Apple than it did for Amazon, which priced at 130 basis points over Treasuries, but is still slightly more expensive than Google’s spread of 108 basis points. Outside of tech, Visa Inc. and Chevron Corp. set record low rates on new issues earlier this week, but for bonds that mature sooner.[/FONT]

[FONT="]Unlike the rest of the economy, big tech has thrived in the pandemic, with consumers largely still at home and more reliant on their gadgets and connectivity. Even with cash piles near record highs, the companies are borrowing for next to nothing in a credit boom that has favored corporate America’s biggest companies and left the smaller ones behind.[/FONT]

[FONT="]Apple is coming off a blowout quarter that has helped fuel a stock surge that’s putting its market value close to a historic $2 trillion. Now it’s readying a series of bundles that will let customers subscribe to several of the company’s digital services at a lower monthly price, according to people with knowledge of the effort.[/FONT]

[FONT="]Like almost all of Apple’s bond sales, it will use the money to buy back stock and pay dividends, among other general corporate purposes, the person said. JPMorgan Chase & Co., Barclays Plc and Goldman Sachs Group Inc. managed the offering.[/FONT]

[FONT="]Apple also enlisted minority-owned underwriters Blaylock Van LLC, Loop Capital Markets, CastleOak Securities LP, Siebert Williams Shank & Co. LLC and Samuel A. Ramirez & Co. Inc. to help sell the offering, the person said. Google hired 15 diverse firms on its $10 billion bond sale last week, awarding them a record $4 million in collective fees.[/FONT]

who wants US Tresuries when Apple's bond yield's are higher?.....HOW cheap is money?...here ya go;

https://ca.finance.yahoo.com/news/apple-joins-tech-borrowing-boom-123033535.html

[h=1]Apple Sells $5.5 Billion of Bonds in Tech Borrowing Boom[/h]

[FONT="](Bloomberg) -- Borrowing costs are so cheap right now that not even Apple Inc. could resist, becoming the latest to join a boom in issuance from the world’s biggest technology companies.[/FONT]

[FONT="]Apple, which hadn’t borrowed in dollars more than once in a calendar year since 2017, tapped the investment-grade market for $5.5 billion in its second trip since May. It was cheap to issue debt then and is even better now, with cash-rich companies like Amazon.com Inc. and Google parent Alphabet Inc. getting in on the action, outdoing each other to set a new floor for yields.[/FONT]

[FONT="]The iPhone maker sold bonds in four parts, according to a person with knowledge of the matter. The longest maturity, a 40-year security, will yield 118 basis points above Treasuries, after initially discussing around 135 basis points, the person said, asking not to be identified as the details are private.[/FONT]

[FONT="]That debt will come cheaper for Apple than it did for Amazon, which priced at 130 basis points over Treasuries, but is still slightly more expensive than Google’s spread of 108 basis points. Outside of tech, Visa Inc. and Chevron Corp. set record low rates on new issues earlier this week, but for bonds that mature sooner.[/FONT]

[FONT="]Unlike the rest of the economy, big tech has thrived in the pandemic, with consumers largely still at home and more reliant on their gadgets and connectivity. Even with cash piles near record highs, the companies are borrowing for next to nothing in a credit boom that has favored corporate America’s biggest companies and left the smaller ones behind.[/FONT]

[FONT="]Apple is coming off a blowout quarter that has helped fuel a stock surge that’s putting its market value close to a historic $2 trillion. Now it’s readying a series of bundles that will let customers subscribe to several of the company’s digital services at a lower monthly price, according to people with knowledge of the effort.[/FONT]

[FONT="]Like almost all of Apple’s bond sales, it will use the money to buy back stock and pay dividends, among other general corporate purposes, the person said. JPMorgan Chase & Co., Barclays Plc and Goldman Sachs Group Inc. managed the offering.[/FONT]

[FONT="]Apple also enlisted minority-owned underwriters Blaylock Van LLC, Loop Capital Markets, CastleOak Securities LP, Siebert Williams Shank & Co. LLC and Samuel A. Ramirez & Co. Inc. to help sell the offering, the person said. Google hired 15 diverse firms on its $10 billion bond sale last week, awarding them a record $4 million in collective fees.[/FONT]

here is AAPL's chart

6 mth daily, 8 ema

the long white candles was friday's action and it CARRIED the market. Apple's market cap in ONE DAY rose as much as the entire market cap of most bank companies-- let that sink in for a minute

for investors (not traders), it does bring up interesting debate-- market cap weighted etf Vs equal weighted etf . Obviously, one has significantly outperformed in 2020, at this moment in time

and lastly, on a regression channel-- Apple is OUTSIDE its 2-standard deviation level on the high side, lol

6 mth daily, 8 ema

the long white candles was friday's action and it CARRIED the market. Apple's market cap in ONE DAY rose as much as the entire market cap of most bank companies-- let that sink in for a minute

for investors (not traders), it does bring up interesting debate-- market cap weighted etf Vs equal weighted etf . Obviously, one has significantly outperformed in 2020, at this moment in time

and lastly, on a regression channel-- Apple is OUTSIDE its 2-standard deviation level on the high side, lol

<header class="entry-header" style="margin-top: 0px; color: rgb(119, 119, 119); font-family: "PT Sans", sans-serif;">

Mayor BeBlasio: No Indoor Dining Until Next Year </header>

AUGUST 25, 2020

New York City Mayor Bill de Blasio pledged a final blow to the city’s dying restaurants, promising to keep restrictions prohibiting indoor dining in place until next year.

“If folks miss the theater, if they miss the indoor dining, those things will be back,” de Blasio said, before qualifying, “they’ll be back next year at some point” in response to a question Monday over fears about the mass exodus of wealthy constituents fleeing the city and taking their tax dollars with them.

.................................

best of luck New York

Mayor BeBlasio: No Indoor Dining Until Next Year </header>

AUGUST 25, 2020

New York City Mayor Bill de Blasio pledged a final blow to the city’s dying restaurants, promising to keep restrictions prohibiting indoor dining in place until next year.

“If folks miss the theater, if they miss the indoor dining, those things will be back,” de Blasio said, before qualifying, “they’ll be back next year at some point” in response to a question Monday over fears about the mass exodus of wealthy constituents fleeing the city and taking their tax dollars with them.

.................................

best of luck New York

metals and miners are in pullback mode , For GDX off the lows, just over 10%. NO swing low is confirmed, however, the chart is showing possible signs of life

GDX

6 mth daily, 50 SMA

obviosly the trend is up, she's in an upward trending channel, and is near the bottom of it. 50 SMA defended today. Today's candle is not a high probability buy candle, and its below its 8 ema. The picture improving tho, got her on the radar list. A LOSS of the 50 SMA is all bets are off, get atta dodge . Wuold like to see a few similar candle(s) the next few day(s), another test and hold of the 50 SMA, OR an inside candle ..... then a bullish candle at 3:50 pm. A series of doji's has greater impact on the strength of driection then 1 doji......we shall see

GDX

2 yr weekly

this week's candle is still forming of course. It CANNOT lose the low of the candle formed 2 weeks ago......if this week's candle is ANOTHER inside candle, well its consolidating and will make a decisive break

GDX

6 mth daily, 50 SMA

obviosly the trend is up, she's in an upward trending channel, and is near the bottom of it. 50 SMA defended today. Today's candle is not a high probability buy candle, and its below its 8 ema. The picture improving tho, got her on the radar list. A LOSS of the 50 SMA is all bets are off, get atta dodge . Wuold like to see a few similar candle(s) the next few day(s), another test and hold of the 50 SMA, OR an inside candle ..... then a bullish candle at 3:50 pm. A series of doji's has greater impact on the strength of driection then 1 doji......we shall see

GDX

2 yr weekly

this week's candle is still forming of course. It CANNOT lose the low of the candle formed 2 weeks ago......if this week's candle is ANOTHER inside candle, well its consolidating and will make a decisive break

today we saw some heavy heavy dark pool prints on some of the beasts that are literally CARRYING the market. Havent seen these kinds of prints for awhile. here's what went off;

FB : HOLY SHIT -- 8,500,000 shares @ $281.02- 281,20

:monsters-

GOOG : 400,000 @ $1608

NTFX : 1,200,000 @ $498

MSFT : 1,300,000 @ $215.80

QQQ : 850,000 @ $284,13

INTC : massive collection of prints $49.33-$49.51

AMZN : 177,000 $3348

just a heads up (nothign on AAPL..... LMFAO)

FB : HOLY SHIT -- 8,500,000 shares @ $281.02- 281,20

:monsters-

GOOG : 400,000 @ $1608

NTFX : 1,200,000 @ $498

MSFT : 1,300,000 @ $215.80

QQQ : 850,000 @ $284,13

INTC : massive collection of prints $49.33-$49.51

AMZN : 177,000 $3348

just a heads up (nothign on AAPL..... LMFAO)