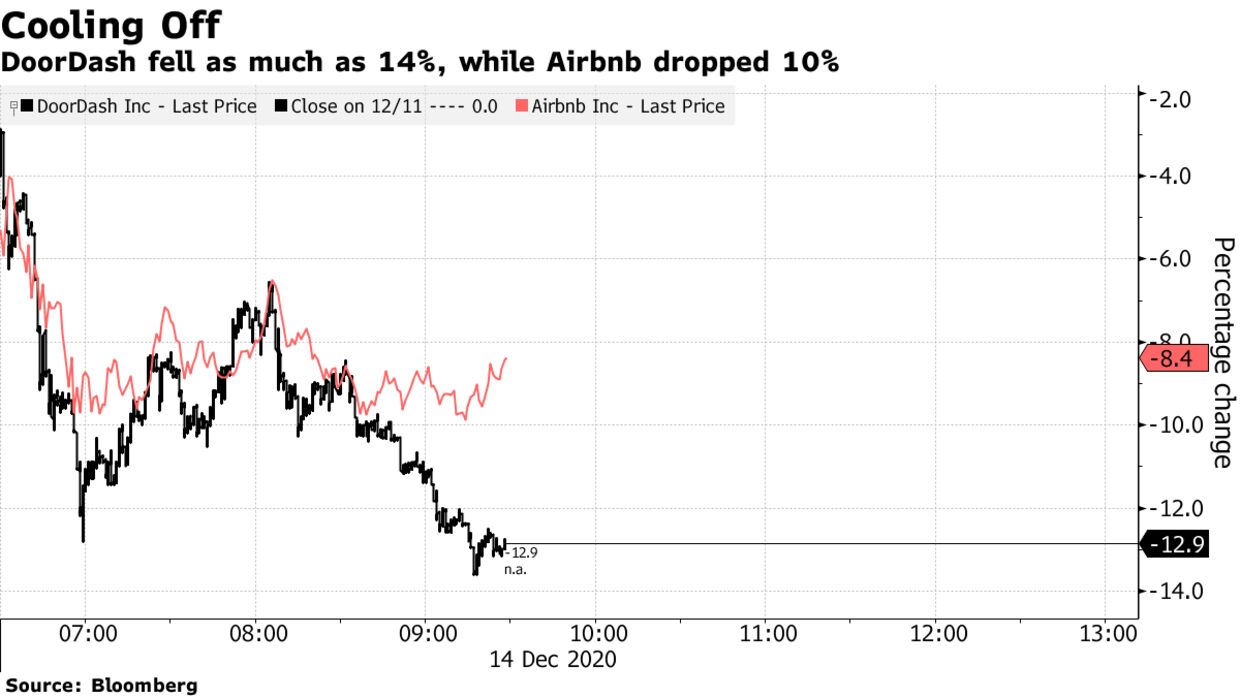

182? 80% over the allotment..Unreal.

Not a fan of this biz in the least..No options yet as a new IPO but I'd short the fuck out this if I could at this price.

Robinhoobders are going to eat poo poo on this one eventually..50% uptick in biz and I'd say the rush back to dining out is going to be massive...Tough biz and I think the model is flawed.

Not a fan of this biz in the least..No options yet as a new IPO but I'd short the fuck out this if I could at this price.

Robinhoobders are going to eat poo poo on this one eventually..50% uptick in biz and I'd say the rush back to dining out is going to be massive...Tough biz and I think the model is flawed.